Letter from the Editor | 4

The CSE's Summer 2025 Highlights | 6

Reflecting on a summer filled with fun, community, and giving back

Tune In | 10

Keep your finger on the pulse of the capital markets with CSE’s content hub

HydroGraph Clean Power | 28

A unique approach to ultra-pure production could spur the wider adoption needed for graphene to truly take off

Listed Issuer Updates | 32

Four CSE listed issuers share their current projects, milestones, and what’s next for their companies

Upcoming Events | 36

ME Therapeutics Holdings | 12

A personal mission to reprogram the human immune response to cancer

SNDL | 16

Recent earnings results validate cannabis and alcohol strategy

Bright Minds Biosciences | 20

Epilepsy drug in Phase II trials and peer success combine to fuel a standout year

Sparc Al | 24

A mathematical approach to location assessment finds applications across a wide spectrum

Connect with the CSE at important investment events across North America

The Global Voice for Exchanges: An Exclusive Interview With the World Federation of Exchanges | 37

WFE CEO Nandini Sukumar discusses how exchanges drive sustainability and financial innovation across the globe

Spotlight on Max Cunningham | 40

Meet National Stock Exchange of Australia Managing Director and CEO Max Cunningham

The information contained in this magazine is provided for general information purposes only and should not be construed or relied upon as legal, financial, investment or any other kind of professional advice or opinions. No one should act, or refrain from acting, based solely upon the information provided in this magazine without first seeking appropriate, qualified professional advice. The information is not an invitation to purchase securities listed on CSE. CSE and its affiliates do not endorse or recommend any securities referenced in this magazine. The opinions and views expressed in this magazine do not necessarily reflect the views of the CSE or its affiliates. CSE nor any of its affiliates make no warranties or representations regarding the completeness, reliability, or accuracy of the information. This magazine may contain links to third-party websites or services that are not owned or controlled by CSE or its affiliates. CSE or its affiliates have no control over, and assume no responsibility for, the content, privacy policies, or practices of any third-party websites or services. The inclusion of any links does not imply endorsement by the CSE or its affiliates. We reserve the right to update or change this disclaimer at any time without prior notice. Readers are encouraged to review this disclaimer periodically for any changes.

PUBLISHER

Sparx Publishing Group Inc.

sparxpg.com

For advertising rates and placements, please contact advertising@sparxpg.com

GROUP PUBLISHER

Hamish Khamisa

EDITOR-IN-CHIEF

James Black

EDITORS

Peter Murray Libby Shabada

ART DIRECTOR

Nicole Yeh

WRITERS

Oliver Haill

Ian Lyall

Sean Mason

Peter Murray

Libby Shabada

FREE DIGITAL SUBSCRIPTION

Published by Sparx Publishing Group on behalf of the Canadian Securities Exchange. To receive your complimentary subscription, please visit go.thecse.com/ Magazine and complete the contact form.

To read more about the companies mentioned in this issue, visit blog.thecse.com or proactiveinvestors.com

TERRITORY ACKNOWLEDGEMENT

The Canadian Securities Exchange acknowledges that our work takes place on traditional Indigenous territories.

The global capital markets map is being redrawn in real time. As this issue of Canadian Securities Exchange Magazine goes to press, economies are facing an inflection point: never before has the world been more interconnected through technology and trade; however, geopolitical tensions and economic uncertainties have created new barriers to interoperability.

This Global Issue showcases what happens when innovation refuses to concede to complacency. The CSE listed companies featured in this edition – from Sparc Al's Australian-developed defence technologies to SNDL's multi-jurisdiction cannabis and alcohol operations to ME Therapeutics advancing cancer treatments that could benefit patients worldwide –demonstrate that entrepreneurial vision paired with strategic execution can transcend complex geographic constraints.

This year, the Exchange has embraced our new borderless paradigm with unprecedented momentum. In April, we announced that all CSE listed securities were now eligible for trading on Interactive Brokers' (IBKR) global platform, instantly connecting our issuers with IBKR's approximately 3.6 million client accounts across more than 160 markets worldwide. This enhanced liquidity and price discovery dramatically improves global accessibility for CSE listed issuers as well as investors from abroad.

May marked an even more transformative milestone: the announcement of our

acquisition of the National Stock Exchange of Australia (NSX). With overwhelming shareholder support, this partnership was formally approved in October and opened up a trans-Pacific corridor of opportunities for entrepreneurial companies and investors. Under the continued leadership of NSX's Max Cunningham (also spotlighted in this issue) and his team, we're already seeing companies explore dual-listing opportunities that would have been unimaginable just a year ago.

These developments arrive at a critical moment. As the World Federation of Exchanges' Nandini Sukumar discusses in this issue, exchanges worldwide sit at the centre of global economies and are enabling innovation, sustainability, and responsible investment. Companies like HydroGraph Clean Power, with its innovative graphene production, and Bright Minds Biosciences, advancing precision medicines, exemplify how CSE issuers are addressing global challenges with local ingenuity.

As 2025 draws to a close, we look back on a year that fundamentally transformed what it means to be a Canadian exchange. Though we've grown beyond our borders, we remain deeply rooted in our mission to reduce barriers and lower the cost of capital for growth-stage companies.

The entrepreneurs we serve remind us daily that they’re not simply adapting to a more complex world – they're actively shaping it. Though the world may be more uncertain than ever, we remain "always invested" in providing an agile, innovative, and reliable market for bold visionaries to call home.

Keep your finger on the pulse of what's happening in the capital markets. Join our community of savvy subscribers who tune in to CSE TV for insightful content about developments in the capital markets in Canada and around the world.

Subscribe now: go.thecse.com/CSETV

Listen to a variety of in-depth conversations with thought leaders and innovators on Season 4 of The Exchange for Entrepreneurs Podcast. You can find it on Apple Podcasts, Spotify, YouTube and iHeartRadio.

Tune in: blog.thecse.com/ cse-podcasts FOLLOW US

James Black Editor-in-Chief james.black@thecse.com

Reflecting on a summer filled with fun, community, and giving back

From teeing up fun times with great company at our annual summer golf events in Toronto, Montréal, and Vancouver to donning our cowboy hats at the Calgary Stampede to cycling Toronto’s streets in support of autism research at Bay Street Rides FAR, summer 2025 brought meaningful moments to connect with old friends and new across the country.

Here are our highlights from a memorable summer at the Exchange.

Keep your finger on the pulse of the capital markets with CSE’s content hub

It was an honour to welcome Blue Jays legend José Bautista during this year’s World Series for a special market close in support of The Bautista Impact Fund and SickKids Foundation. Together, Mr. Bautista, along with our friends and cosponsors Urbana Corporation, Caldwell Securities, Sparx Publishing Group, RSM Canada, Norton Rose Fulbright, Gowling WLG, MNP, and ITG, raised $20,000 to help SickKids advance its life-changing work for children and families.

We spoke with Nuclear Vision (CSE:NUKV; OTCQB:GDIGF) CEO Derrick Dao about how the company is advancing uranium exploration in Botswana, one of the world’s top mining jurisdictions, by leveraging proprietary exploration techniques and AI-driven geophysics.

Market Open

The Exchange for Entrepreneurs Podcast

Interview With JJ Hudolin

On a recent episode of The Exchange for Entrepreneurs Podcast, host Anna Serin sat down with DuMoulin Black LLP Advisor JJ Hudolin to unpack the CSE’s newly amended major acquisitions policy and what it means for listed issuers and investors.

As part of the World Federation of Exchanges’ (WFE) annual “Ring the Bell for Financial Literacy” campaign, we proudly joined exchanges around the world, as well as Michael Porto from the CFA Society Toronto, to ring the bell for financial literacy, highlighting the importance of financial education and informed participation in global capital markets.

MORE CONTENT ON CSE TV

Subscribe to our YouTube channel to watch new episodes and replays: youtube.com/CSETV

Don’t miss the world’s premier mineral exploration and mining convention

SEE Browse our exhibitors for investment ideas and ask questions.

HEAR Attend corporate presentations for the full value proposition. Explore insights shared by leading investors.

CONNECT Participate in curated meetings with company management. Join sessions tailored for investors and financial professionals.

By Ian Lyall

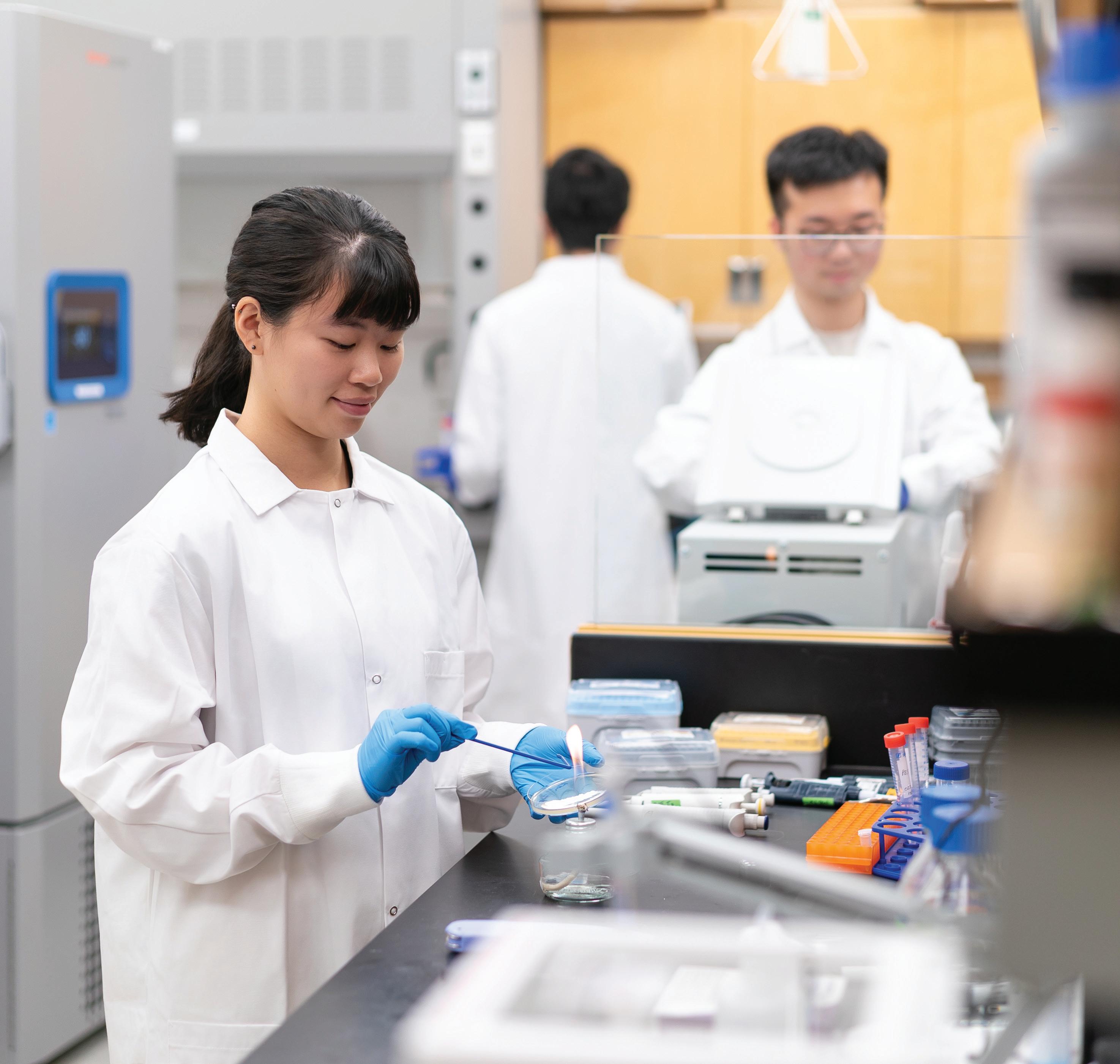

Often when we discuss life sciences, particularly as investors, the human element gets lost. The focus tends to be on the pipeline, clinical and preclinical progress, data, efficacy, cash runway, and addressable market. These and other inputs can be plugged into a model to provide insight into a company’s chance of success.

But this process ignores the point of the business: to help people recover, to fight illness, or in the case of late-stage disease, to add months or perhaps years to life. It also disregards the human sacrifice along the way. This is particularly true in cancer research, where end-of-life patients often volunteer in the hope that the next generation benefits from their experience.

For ME Therapeutics (CSE:METX) Chief Executive Officer Salim Dhanji, the metrics that make the investment case are important but not the real litmus test. Rather, he is driven by a desire to change outcomes for people. Dhanji notes that he is at the stage in life where friends and family are succumbing to the ailments of middle and later years. The determination and passion that drive him are plain to see.

A researcher at heart, he wants a real, human dimension to his team’s work. “To use new technologies, and our knowledge of these technologies to create drugs to treat cancer patients in a

personalized way, is something that really motivates me,” Dhanji tells Canadian Securities Exchange Magazine. “You're starting to see that [in other areas of research], and I think that's the really exciting bit; where you can potentially bring about real change.”

Dhanji earned his Bachelor of Science and PhD at the University of British Columbia and has more than 20 scientific publications and patents relating to cancer, autoimmunity, and inflammation to his credit. ME Therapeutics, founded in 2014, reflects that body of work.

The ME component of the company’s name stands for “myeloid enhancement,” a clue to the science behind its three drug development and discovery programs. Put simply, this involves reprogramming the immune response against cancer. The team is tackling one of oncology’s toughest problems: how cancers hijack the body’s own immune cells to shield themselves from attack.

ME Therapeutics is developing drugs that reprogram so-called myeloid cells. These normally regulate immune responses but in tumors often act as double agents, suppressing cancer-killing T cells and creating a cocoon around malignant tissue. Rather than designing medicines to target a specific mutation, ME Therapeutics is targeting the immune environment itself. That means its drugs could be used across many cancer types, much like today’s blockbuster immunotherapies

Salim Dhanji Chief Executive Officer

such as Merck’s Keytruda or Bristol Myers Squibb’s Opdivo.

The company is working on three fronts. One program delivers synthetic messenger RNA into tumors to coax immune cells into action and turn “cold” tumors into “hot” ones that draw an immune response. A second program engineers in vivo chimeric antigen receptors (CARs) into immune cells directly inside the body, re-tasking both T cells and myeloid cells. A third antibody therapy blocks a protein called granulocyte colony stimulating factor (G-CSF), which fuels immune suppression and drives resistance to vascular endothelial growth factor (VEGF) drugs.

A key partner is NanoVation Therapeutics, co-founded by lipid nanoparticle pioneer Pieter Cullis, whose delivery systems enabled the first Covid-19 vaccines. ME Therapeutics is using NanoVation’s nanoparticles to ferry its mRNA payloads to immune

cells while avoiding the liver, a common stumbling block.

Preclinical work is still early. Studies in mice and non-human primates are scheduled through 2026, with the first regulatory applications expected late that year.

ME Therapeutics’ ambitions are big, but, like most start-ups in the biotechnology space, so are the risks. It is also betting on next-generation technologies, such as in vivo CARs, that have yet to be proven in people. Still, with immuno-oncology drugs now among the industry’s top sellers and combinations extending their reach, investors are watching.

“If you can reprogram the immune environment rather than chase each new tumor mutation, the potential is enormous,” says Dhanji.

The G-CSF antibody program is the most advanced, though whether it or the therapeutic mRNA program reaches the clinic first remains to be seen. There is a case for the latter: the timeline to “spin up” an mRNA drug for a specific cancer is relatively short, as little as six to 12 months, Dhanji explains.

ME Therapeutics’ approach also has transformative potential in CAR therapy, which typically involves genetically engineered T cells trained to hunt and destroy cancer. Used to combat blood cancers such as leukemia, lymphoma, and multiple myeloma, success rates can be upward of 80%. But, the process requires a blood transfusion, which is uncomfortable, and costs between $500,000 and $1 million.

Using ME Therapeutics’ method, Dhanji says, could ultimately pull the price down toward that of traditional gold-standard cancer treatments, as well as leverage myeloid cells in addition to T cells. “There is a lot of potential in some of the work that we're doing in the lab, preclinically right now, and we think we can advance to the clinic very quickly,” he says. “So now, it's really a matter of deciding which program we want to prioritize.”

As with all small-cap biotech, funding is an ever-present requirement. Dhanji says the company’s current runway is long

enough to fund the first candidate to initial meetings with the FDA or Health Canada. After that, further investment will be needed.

An industry partnership with a large drugmaker is possible but uncommon at this stage. Dhanji wants intellectual property patent-protected before any such discussions take place. “I think one of the challenges is that we need to be able to protect our IP before we actually go and have these conversations, as the space is relatively fluid,” he explains.

Dhanji is not without ambition and would like to emulate Genentech, the

founding company of biotechnology. It may be difficult to repeat the San Francisco giant’s success, but it is the pioneer spirit he admires, when budgets were spared to solve real human problems, not the balance sheet metrics that fixate Big Pharma.

Yet Dhanji is also a realist. “I do have to run a business, and I take that responsibility very seriously. But what gets me out of bed in the morning, what motivates me, is the old researcher’s curiosity and the hope our work may make a difference.”

“ There is a lot of potential in some of the work that we're doing in the lab, preclinically right now, and we think we can advance to the clinic very quickly.

— Dhanji

As Managing Editor at Proactive, Ian Lyall oversees an editorial and broadcast team spanning six offices and three continents. Prior to Proactive, he served as News Editor and Investment Editor at the Daily Mail. He also worked as UK Editor for AFX News, and as an equities reporter for Dow Jones Newswires.

By Peter Murray

North America’s legal cannabis industry is still in the early stages of development, shaped by complex regulation, high taxes, and fierce competition – pressures that only the most capable management teams can navigate.

That dynamic is clear when speaking with SNDL (CSE:SNDL) Chief Executive Officer Zachary George, who anticipated how the industry would evolve, the points of differentiation that would matter, and how businesses would need to steer through the turbulence.

George knew the value of a long-term perspective. Inheriting Canada’s largest, but non-competitive, indoor cultivation facility, he worked to reshape a debt-laden, unprofitable business into a retail-forward regulated products model, adding alcohol as a stable cash flow anchor. The move gave his cannabis operations runway to mature, and the results are becoming clear: earlier this year, SNDL posted its first quarter of positive operating and net profit.

Canadian Securities Exchange Magazine spoke with George recently about SNDL’s formative years, his philosophy for the business, and medium-term expansion plans.

SNDL has built a successful cannabis business within a broader overall product portfolio. Where did this idea come from and what were some of the important milestones in the early days?

The business as it stands today was born out of a deep restructuring process. Once we were on

the other side of the restructuring, we sought to build a diversified business model with two strategic pillars.

The first pillar was a vertical cannabis model, the likes of which did not exist in Canada. The second pillar was a financing business that would enable us to, in a compliant manner, invest in U.S. operators by being a passive supplier of credit, without running afoul of the restrictions that exist for Nasdaqlisted companies when it comes to what we call “plant-touching” operations in the United States.

That evolution took a number of twists and turns. Our first foray into retail happened with the acquisition of Spiritleaf in Canada in July of 2021.

Later that year, we were approached by Nova, the company behind discount banner Value Buds, which had quickly become a disruptive force. At the time, Alcanna, Western Canada’s largest private market liquor retailer, owned 63% of Nova. From a sum-of-the-parts perspective, it made more sense to acquire the parent company than to pay a premium for the subsidiary. The deal also gave us access to a leadership team with decades of regulated product retail experience. Many of the same value and convenience themes that drive consumer behaviour in alcohol are directly analogous in cannabis.

The scale that came from the Alcanna acquisition was critical to our model. As an SEC registrant subject to Sarbanes-Oxley Act requirements, we are subject to some of the most stringent financial reporting and internal control requirements on the planet. Given the costs related to these

requirements, playing small was not an option, and we had to do something at scale. The liquor business contributed significant free cash flow to the overall model, which helped to mitigate these costs.

Let’s look at the business portfolio, which is almost evenly balanced between liquor retail and a multi-faceted cannabis business. Can you walk us through the liquor side first and outline its competitive advantages?

SNDL holds significant market share in Alberta and a strong presence in British Columbia. However, each province presents unique regulatory challenges that shape our strategy.

When you talk about competitive advantages on the liquor side, I would point immediately to the success of the Wine and Beyond model. Building a capital-intensive retail model requires strong supply chain management and the ability to seize inventory opportunities in a decisive manner. In our Wine and Beyond locations, consumers can choose from more than 6,000 SKUs, and that breadth has really resonated. Our big box format stands in stark contrast to the consumer experience available in Ontario’s LCBO locations. We are seeing the model materially outperform more limited, convenience-focused formats.

“ The steep and rocky path in the sector will ensure that very few competitors can survive. We are built for the climb.

— George

We are expanding that part of the business and are excited to be opening another two new Wine and Beyond locations in Saskatchewan and a third in Calgary in the coming months.

On the cannabis side, you have a hybrid, vertically integrated model. Tell us about the structure and the thinking behind it.

A couple of observations are important. Canada’s provincial cannabis regulations are inconsistent, with some even contradicting one another. This dynamic creates stubborn supply chain inefficiencies that are anti-business and a disservice to the provinces, operators, and consumers alike.

In certain provinces, retail sales are managed by private operators working within a tightly regulated framework, while in others they are controlled and managed exclusively by the government through crown corporations. Of those provinces permitting private operators, some allow for full vertical integration, while others bar or limit licensed producers (LPs) from retail ownership. In British Columbia’s hybrid framework, private retail operators like us are capped at eight retail locations, while the province competes against us with over 40 of its own, and other operators skirt these regulations with complex

ownership structures. In Ontario, a licensed producer is prohibited from owning more than 20% of a retail operator, while regulations in the Prairies allow for vertically integrated structures. Provincial fiefdoms within crown corporations have preserved inefficiencies while failing to prioritize important public goods such as the optimization of consumption-based tax revenues and consumer safety. At the core of these issues is a question as to whether Canadians believe that their tax dollars should be used by provincial governments to directly manage consumer-facing retail operations.

This is a departure from conventional consumer packaged goods (CPG) where brand awareness, efficient manufacturing, and clear routes to market can drive access to broad growth across a national market. The inherent inefficiencies in Canadian cannabis must be carefully managed. Instead of complaining about poor decision-making and weak enforcement by regulators and government bodies, we are directly involved in lobbying for rational reform. The steep and rocky path in the sector will ensure that very few competitors can survive. We are built for the climb.

Why did you choose a vertical structure?

With a mandate from our board to build a global cannabis business, we observed that in mature markets in the United States, the vertical operators in limited licence markets were by far the most profitable. Further, Health Canada’s restrictions and prohibitions on the marketing of branded products were a clear hindrance to building brand resonance with consumers. In sharp contrast to the regulation applied to alcoholic beverages, even something as simple as the depiction of a mountain on packaging, or the outline of an animal form, can draw fines and demands for the recall of products.

In today’s marketplace, regulated brick-and-mortar retail is the best place to own the consumer relationship. E-commerce solutions have also been stunted by regulation, further reinforcing this dynamic, although we expect this to evolve positively in the future.

Zachary George Chief Executive Officer

In the early years, we saw a proliferation of products where brands themselves were being commoditized. We have the data from tens of millions of consumer transactions and know exactly where repurchase rates are. This data continues to show a strong willingness by the consumer to trial and switch products.

This dynamic created a strong desire to stay out of the fight among producers over whose pre-roll or flower strain was better. My focus was on building a platform that could track and adapt to consumer trends over time. Rather than competing in a sea of sameness with other LPs, I wanted to partner with them, helping to distribute and even manufacture some of their most successful products.

In doing so, we shifted from competing on products to competing on capability – building a platform that could support both our own brands and those of our partners. You will see our owned and co-manufactured brands in competitive retail, and you will see competitive suppliers dominate shelf space in our owned and managed retail network. We have a large B2B or co-manufacturing business building products for other LPs and have built quality products for most of the top 20 LPs in Canada today. We have automated manufacturing capabilities in every relevant product segment, including infused beverages, edibles, pre-rolls, flower, extracts, and vapes.

Let’s talk about performance. The second quarter of 2025 was SNDL’s first profitable quarter. What were some of the highlights?

Understanding the backdrop is really important. I am very proud of our team. Over the past five years, we have been able to grow our revenue base by over 1,500%. We have one of the cleanest

balance sheets in the sector, with no debt and approximately $200 million in unrestricted cash to drive strategic investments. Last year was the first full calendar year that we generated free cash flow. We have hit new milestones and records almost every quarter for the past 14 quarters. In our most recent second quarter, we generated our first quarter of positive operating and net income.

We have announced the acquisition of a 32-door retail portfolio that we are working to close in October and have significant embedded growth coming from our credit investments. Some of those positions are being equitized and may be consolidated in the future.

We have also managed to buck some of the negative trends in alcohol consumption, which is a credit to the strong execution capabilities of our team.

As you look to the near and medium terms, how do you shape strategy given the competitive landscape and the opportunities afforded by your business lines?

We put together a three-year strategic plan supported by our board, and our priorities are clear. Our number one priority is to continue to grow our Canadian retail cannabis and liquor businesses. Second would be the stabilization and investment in U.S. businesses we have exposure to, including operations in Florida, Massachusetts, Texas, and Michigan, all of which have unique and distinct regulatory frameworks. Third would be international. We are excited to be landing finished goods in the U.K. and shipping wholesale flower to several international medical markets. Our segment leaders are focused on delivering profitable growth in our alcohol and cannabis segments in 2026 and beyond.

By Oliver Haill

For three decades, central nervous system (CNS) drug development was a tough space for investors, scarred by failed bets on Alzheimer's disease, plateauing first-generation antidepressants, and setbacks in safety and efficacy.

But advances in receptor-selective chemistry and so-called “biased agonism” – steering toward therapeutic pathways and away from areas that cause side effects – are reviving interest in the field.

Successes such as esketamine for depression or cannabinoids for epilepsy have shown that carefully targeted mechanisms can deliver commercial as well as clinical breakthroughs.

That shift is fuelling a new wave of investment in CNS-focused solutions, with several biotech companies absorbed by larger players in recent years.

One of the companies that illustrates this shift is Bright Minds Biosciences (CSE:DRUG), which is now in Stage II trials for its lead epilepsy drug. The company’s dramatic share performance in the past 12 months, involving appreciation of approximately 5,000%, is why investors come to the biotech space. Bright Minds has certainly delivered.

Ian McDonald Chief Executive Officer

Company

Bright Minds Biosciences

CSE Symbol

DRUG

Listing Date

February 8, 2021

Website brightmindsbio.com

The company was founded seven years ago by former investment banker and current Chief Executive Officer, Ian McDonald, Dr. Alan Kozikowski, a pharmaceutical entrepreneur and one of the most prolific researchers in psychedelic drug discovery, and Dr. Gideon Shapiro, a veteran of CNS drug discovery with senior roles at SandozNovartis and Forum.

Bright Minds is seeking to prove that finely tuned serotonin-targeting drugs can succeed where other compounds have fallen short.

Its lead compound, BMB-101, is being tested with two forms of childhood epilepsy, with data expected around the end of this year.

The scientific premise is straightforward but ambitious: BMB-101 selectively activates the serotonin 5-HT2C receptor, known as 2C, a target known to influence neuronal activity.

Activating that receptor indirectly boosts levels of the neurotransmitter gamma-aminobutyric acid (GABA),

which calms neuronal pathways to aid normal brain function and helps prevent the electrical discharges that result in epilepsy.

Several other medicines also target 2C, but BMB-101 avoids closely related receptors linked to undesirable effects.

Past drugs in this space, including the diet drug fenfluramine, were plagued by serious cardiac and psychedelic side effects because they also activated the 2B and 2A receptors.

Bright Minds’ molecule is designed to bypass those problems and also to avoid the desensitization and tolerance build-up that has undermined many chronic CNS therapies.

“Our compound is an advancement from that – a safer version that doesn’t have the 2A and 2B liabilities,” says McDonald.

BMB-101, which has IP protection out to 2041, is in Phase II studies for two types of epilepsy.

One is developmental epileptic encephalopathies, catastrophic epilepsies which begin in childhood and continue throughout life, with high mortality rates and patients who generally experience a range of problems stemming from the epilepsy.

“We're also looking at a separate population with absence epilepsy, which isn’t very well treated at the moment,” says McDonald.

“Only a couple of therapies have been approved for it, and there's a significant unmet need in that patient population.”

He says these current trials are due to produce results around the end of the year.

An upswing in M&A in recent years suggests that large pharmaceutical groups are willing to pay for validated serotonin 2C assets.

Zogenix, which commercialized fenfluramine, was acquired by Belgium’s UCB for up to US$1.9 billion in 2021; GW Pharmaceuticals was

bought by Jazz Pharmaceuticals for US$7.2 billion in the same year; in October 2024, Denmark’s Lundbeck paid US$2.6 billion for Longboard Pharmaceuticals.

This latter deal was potentially the most relevant for Bright Minds, as Longboard’s compound operates with a similar serotonin 2C mechanism, and it had recently completed its Phase II study when the deal was done.

McDonald believes his lead compound could be superior, with high selectivity and applications in treatment-resistant epilepsy.

“In chronic dosing situations these other compounds often develop tolerance, but our molecule is designed to minimize or eliminate that.”

“

In chronic dosing situations these other compounds often develop tolerance, but our molecule is designed to minimize or eliminate that.

McDonald

Within the serotonin 2C receptor there are different signalling pathways.

BMB-101 works exclusively via the pathway responsible for the therapeutic effect, known as the Gq-protein signalling pathway, and avoids the beta-arrestin pathway, which is responsible for tolerance development.

In earlier tests, the molecule demonstrated efficacy in numerous models of generalized seizures.

While McDonald says it is “potentially a best-in-class drug,” he acknowledges that a lot can go wrong in clinical trials. “The difference here is we know the mechanism works and we know our drug is hitting it.”

The reason Longboard was bought even before it had started Phase III studies, and that Bright Minds shares skyrocketed around 1,500% in the same week as that deal, is that epilepsy trials have strong predictability.

“If you succeed in Phase II, you’re likely to succeed in Phase III,” says McDonald. “Also, fenfluramine was proven to work, and Longboard’s compound was superior. It was lower risk than many other drugs at that stage. Our compound works on the

same mechanism, but we have the biased agonism feature against tolerance development – and ours is more convenient too. Longboard’s compound must be given three times a day and refrigerated throughout. We don’t have those issues.”

While some investors may be crossing their fingers for suitors to swoop after Phase II, the company has a cash runway through to 2027 to take the molecule to the edge of commercialization.

There is also a wider portfolio of intellectual property in the pipeline in neurology and psychiatry, with multiple programs of interest, all built off the strong medicinal chemistry background of its co-founders, with compounds that accentuate the benefits of the mechanism while avoiding negative side effects.

One indication in the same 2C space is a debilitating disease called Prader-Willi syndrome, which impacts around 10,000 patients in the U.S. and starts in childhood, with patients generally having a developmental disability and experiencing some neuropsychiatric symptoms.

Others include BMB-201, a non-hallucinogenic psychoplastogen for treatment-resistant depression. Those additional programs may offer upside optionality, but the company’s value will be determined by whether BMB-101 delivers the pivotal data investors are betting on.

If BMB-101’s data lives up to McDonald’s billing, the company could suddenly find itself on more than a few corporate shopping lists.

Oliver Haill has been writing about companies and markets since the early 2000s, beginning as a financial journalist at Growth Company Investor and later becoming its section editor and head of research. Before joining Proactive, he worked as a freelance reporter contributing to the Financial Times Group, ITV, Press Association, Reuters, and several other high-profile publishers.

By Peter Murray

T

hey were a novelty not that many years ago, but today drones are growing quickly in popularity and importance, used for everything from documentary filmmaking to surveillance and payload delivery on modern battlefields.

For military applications, undermining the effectiveness of a drone by denying it use of critical data and control inputs is something all major armed forces are likely working on. As such, the more independent one can make a drone, the greater its chance to be effective today and in the environments of the future.

Sparc AI (CSE:SPAI; OTCQB:SPAIF) has developed a solution that enables drones to assess object location without the use of GPS, radar, or other inputs that most such devices currently rely on. Its technology is ready to commercialize, and other innovations for drone operator control platforms are just around the corner.

Canadian Securities Exchange Magazine spoke recently with Sparc Al Chief Executive Officer Anoosh Manzoori about the technology’s capabilities, practical applications, and the status of commercialization efforts.

Sparc AI’s technology uses sophisticated algorithms to measure the location and distance to any object on land or water,

with military drones being an important application. How would you define the company’s current objectives?

Our core mission is built around technologies that allow products to work out in the field without GPS.

Interruption to GPS is a real challenge for both defence and commercial applications. There are something like 34 GPS satellites, and you need four of them to record just one location. The receiver connections to these satellites can be compromised, leading to a GPS-denied environment.

Looking at an object that is 5 kilometres away, for example, and determining its geocoordinates and distance without GPS, or any other sensor, is the crux of what we are trying to solve.

That would be our target-acquisition system, and we have another product that is coming that adds intelligence to that platform. It is all operating in a covert environment without GPS.

With drones, weight is an issue, as an operator often wants them to fly long distances or loiter for extended periods. What equipment does Sparc AI attach to drones to facilitate your solution?

Our solution is completely software-based; the telemetry data that is already with the drone is what we use. We need to know the height of the drone. And all drones have a barometer so they can measure air pressure as they move up in the sky. We need to know the angle of the camera pitch in terms of its line of sight. We also need to know the heading or the compass of where the drone is pointing.

What we are doing is mathematically creating a representation of the device in the air relative to the terrain and where it sits. It becomes spatially aware of where it is and where it is pointing, and we can then do a representation of where it is looking and calculate the distance and geolocation.

We don’t use any sensors. We don’t use lasers, lidar, radar, or image recognition software. Although we use the camera, it is already on the drone for the benefit of the operator to see what they are looking at.

We are installed on a Parrot ANAFI drone, a military drone. It is a

500-gram drone, so if we were to put more equipment on it, you would not be able to fly the device.

Because we are software-based and covert, there is no signature emitting from the drone, and nobody knows we are doing any targeting. We save on payloads, weight, and battery.

What is the maximum distance Sparc AI’s technology can measure?

Range really comes down to the ability for the operator to see the target. On the ANAFI drone, for example, the camera enables us to zoom in on a target. We have not seen any limitations on the range and have tested as far as 50 kilometres. We are limited based on how much we can see.

With alternative technologies that might be using a laser system, radar, or lidar, the farther away the object becomes, the less accurate it generally is. Think of a laser beam that becomes more like a cone as it goes farther from its source. These technologies are also detectable and not covert.

“ Because we are software-based and covert, there is no signature emitting from the drone, and nobody knows we are doing any targeting. We save on payloads, weight, and battery.

— Manzoori

Mathematically, there are no limitations in terms of how far the technology would work. It also works on both land and water.

What is the competitive landscape in this market? Technology with military applications is in intense development around the world.

In the military sense, there is a category of products called the target-acquisition system. They typically weigh about 20 kilograms to 25 kilograms and fit a soldier’s backpack. They require a bit of setting up, have to be installed on a tripod, and come with a cable about 25 metres long that connects to a tablet.

The solider needs to install it, position the device, then go and hide somewhere with the tablet to control the system. The reason they need to do that is because the system has a laser – and sometimes radar – on it, so it emits a signature. Basically, when you are looking at your adversary, you then become detectable, and they can

start to look back at you. You start to put yourself at risk the moment you set this up.

The system is also quite expensive and requires a lot of energy, so soldiers typically carry extra battery packs.

The alternative is to put the equipment onto a drone. That means the drone is big, quite expensive, and will send a signature back to the enemy.

The way Sparc AI works, because it is completely software-based, it can be used on any device. The Parrot ANAFI is a drone very much used on the edge of the battlefield, and with Sparc AI you could do your target-acquisition rapidly, without any detection.

The software is installed on the controller, so we are not using any resources of the drone. We have also developed an extension where we are able to navigate the drone autonomously using purely the target-acquisition system to record the location and coordinates for navigation.

Are there other markets in addition to military applications?

Another market is search and rescue, where you identify the location of assets or people during emergencies. The technology was sold to one of the largest telecommunications companies, and it was installed on fixed cameras rather than drones. Think of an old pipeline that requires maintenance that is located in GPS-denied environments.

Sparc AI’s technology is very specialized. Can you discuss your team with us?

We have two people who are ex-military personnel, one of whom had leading roles in special forces here in Australia. So, both have experience in

the defence sector that not only commercially helps open doors but also enables us to better tailor our product for the defence market.

We also have two directors who are very experienced in commerce and finance and dealing with technology companies.

As for myself, I built one of the largest cloud hosting companies in Australia before exiting and have been an active investor for the past 25 years. I’m quite technical and have made significant contributions to our technology and source code.

Where are you in terms of commercialization?

We have a couple of approaches. One is speaking directly to defence departments here in Australia, as well as in Canada and the United States. These are often through referrals and people we know in the industry, and we are conducting regular live demonstrations of the product.

We are in discussions with contractors that supply products directly to defence, and there is an opportunity for Sparc AI to be bundled as part of an existing offering.

We have also been accepted into the Parrot Technology Solutions Program. Parrot sells their drone primarily to defence and first responders. They have an indirect sales model where they sell their product through distributors and resellers around the world, and they have a program where they invite companies integrated into the Parrot platform to provide additional capabilities to plug into that distribution and gain potential customers.

We are also discussing with partners here what they call loitering solutions,

which are solutions on the edge of land and water for surveillance and situational awareness in coastal areas.

Is there anything else you would like to add?

One thing that is quite important for this type of business is capability, so the more capability and intellectual property we build into the product, the closer it brings us to being able to get commercial contracts and build value for the company in terms of possibly being acquired. There is a lot of new capability that we have been working on and will be rolling out soon. We have made some announcements around it already, but there is more coming to elevate the capability of this product.

Anoosh Manzoori Chief Executive Officer

Company Sparc AI

CSE Symbol SPAI

Listing Date December 4, 2020

Website sparcai.co

Peter Murray oversees a national editorial and broadcasting team as President of Proactive Canada. He spent several years managing the English news desk at Nikkei’s head office in Tokyo and has worked with research teams at Asian and European investment banks. Peter is based in Vancouver.

About the Author

A unique approach to ultra-pure production could spur the wider adoption needed for graphene

truly take off

By Sean Mason

Investors are constantly on the hunt for disruptive products that completely change an industry’s dynamics. Disrupting the approach to manufacturing a game-changing product thus seems like taking things to an even higher level.

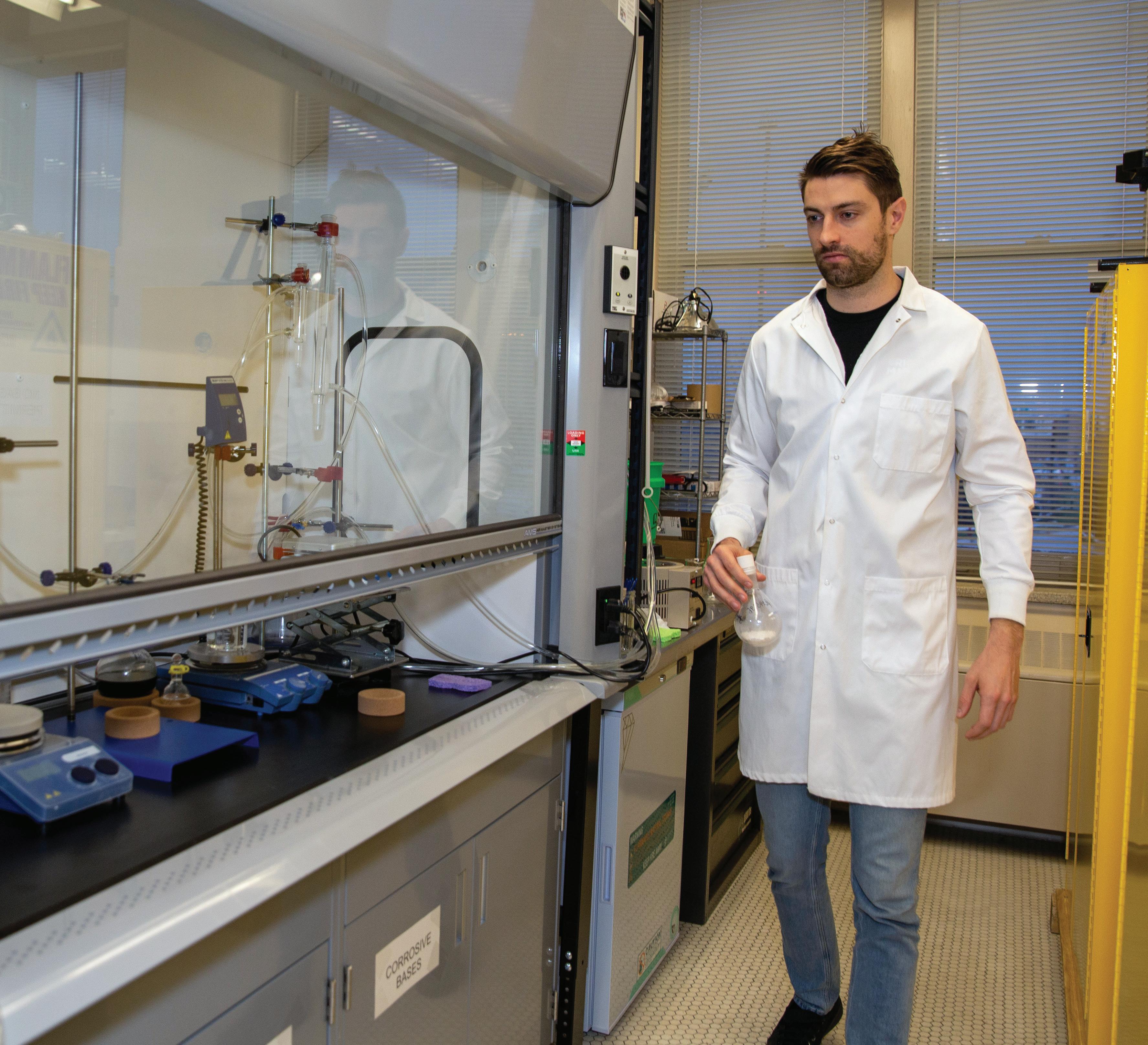

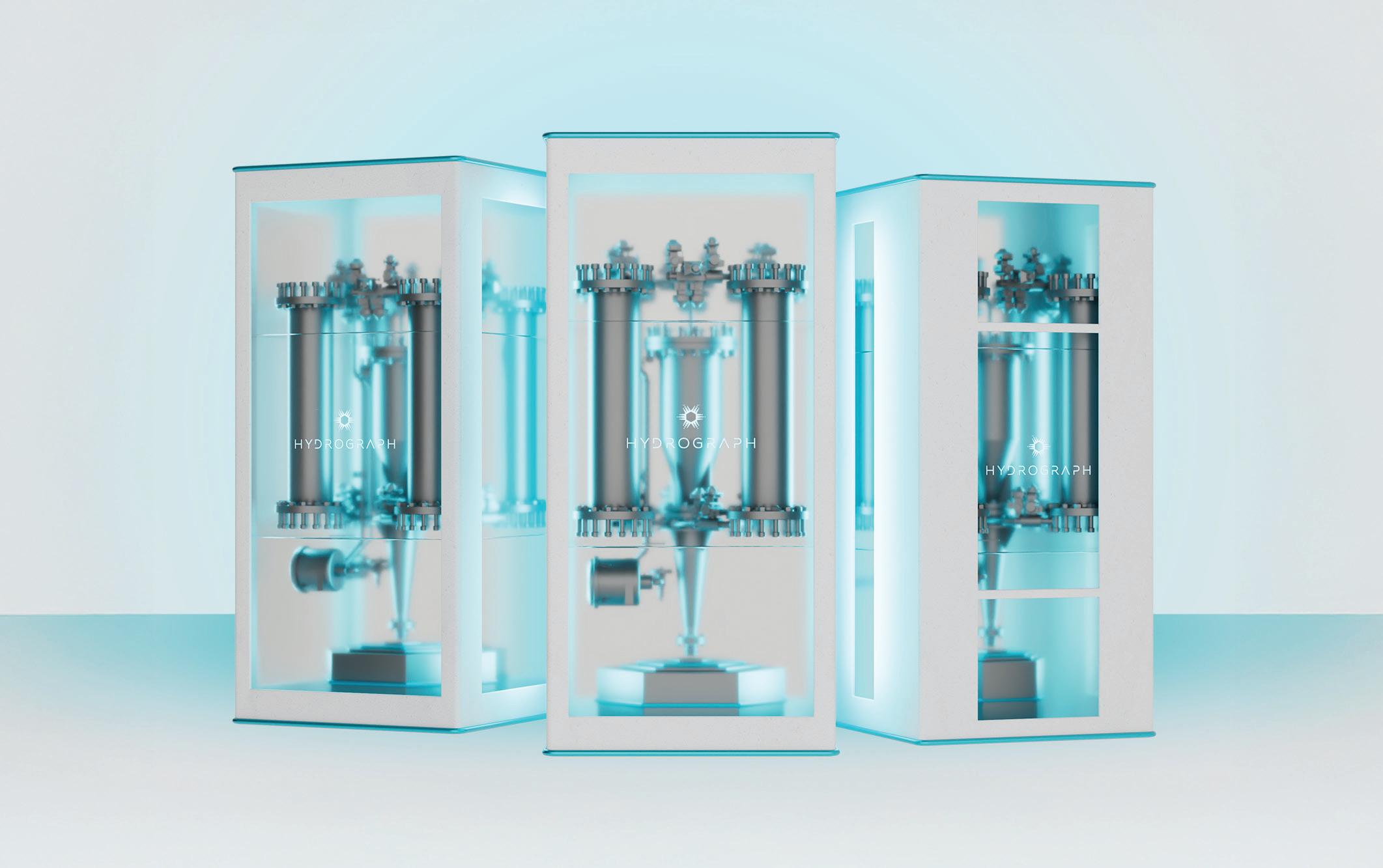

That is what HydroGraph Clean Power (CSE:HG; OTCQB:HGRAF) has been working on since 2017, when the company was formed to pursue the production of graphene in a way that resulted in higher purity, was more cost-effective, and more environmentally friendly than conventional methods.

Fast-forward to 2025 and HydroGraph has reached its objective, with a readily scalable process that yields high-quality graphene while adhering to the founding team’s tenets.

Graphene is perhaps best described as a super-material. Many times stronger than steel, it is also a highly efficient conductor of electricity and heat, impermeable, and very flexible, among other qualities. The process of incorporating it into products can require specialized knowledge, but it still has found a home in a

long list of items, with composites, electronics, and biomedical products among the categories tipped to lead future applications.

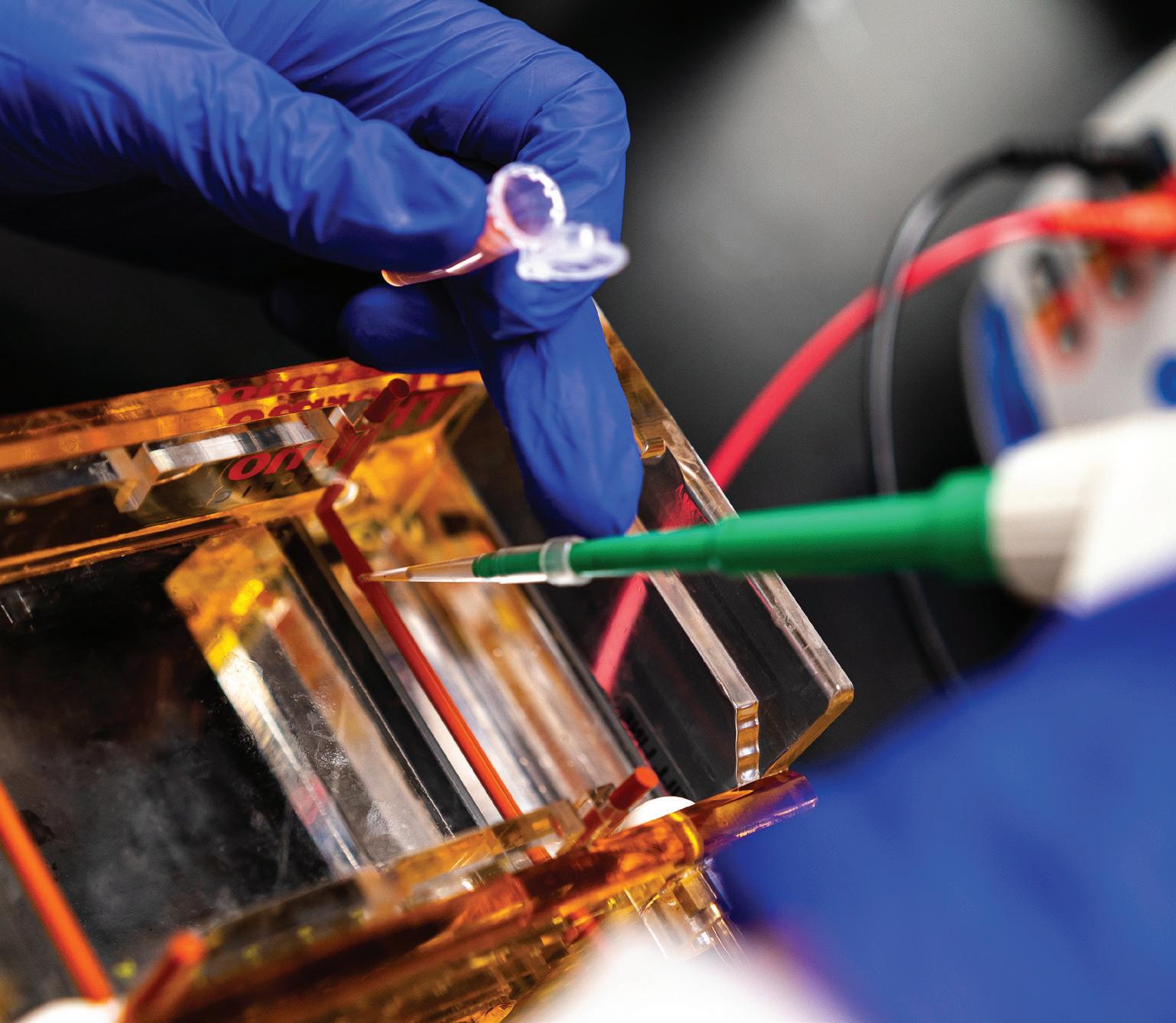

HydroGraph’s core technology is its patented detonation synthesis process, which is quite a departure from methods that begin with graphite from the ground. Instead, HydroGraph detonates hydrocarbon gases using acetylene and oxygen to generate synthetic graphene by turning the gas into a powder.

One aspect of the process that makes it unique, according to the company, is its simplicity. Conducting the detonation process with high-purity feedstock yields graphene with a purity level on the order of 99.8%.

Consistency is another competitive advantage for HydroGraph, as the company has been able to produce a

Kjirstin Breure Chief Executive Officer

Company HydroGraph Clean Power

CSE Symbol HG Listing Date December 2, 2021 Website hydrograph.com

virtually identical product each time it has scaled up output.

And changing the details on the input side can produce different graphene types to meet the particular needs of a given customer.

Technologies like these need protection, and in this regard HydroGraph holds three patents at present, with another eight pending.

“A number of companies have tried to go around our patents and everything has been rejected by the U.S. Patent Office, so we feel strongly about our position in the market,” says HydroGraph Clean Power Chief Executive Officer Kjirstin Breure.

Breure, who joined the company as its Chief Operating Officer in 2020 before becoming CEO in 2024, holds an MSc in Materials Science and Engineering from Arizona State University and has spent over a decade involved with emerging technologies in the commercial sector, including machine learning, data analytics, and blockchain.

Commercialization of HydroGraph’s graphene is already underway, with more than 60 entities in various stages of testing it for potential inclusion in a wide range of products and industries.

One of those, Hawkeye Biomedical, is using HydroGraph’s graphene in its Lung Enzyme Activity Profile (LEAP) lung cancer biosensors. And in late September, HydroGraph announced a letter of intent with SEADAR Technologies, a developer of subsea sensing and surveillance solutions, to integrate HydroGraph’s graphene materials and coating technologies into current and future SEADAR undersea products.

Breure notes that the average development cycle for its customers is about 18 months. First is lab-scale testing, which leads to industrial trials where a potential customer

“ A number of companies have tried to go around our patents and everything has been rejected by the U.S. Patent Office, so we feel strongly about our position in the market.

— Breure

experiments with HydroGraph’s materials. Assuming everything goes well, contract negotiation is the next step.

An important venue for interacting with potential clients in the graphene industry is the Graphene Engineering Innovation Centre (GEIC) at the University of Manchester. HydroGraph has its own laboratory at the GEIC, which has established itself as a hub for companies looking to integrate graphene into their products. With deep expertise on site and all the right equipment, the GEIC is the perfect location for graphene suppliers and users to explore real business relationships.

Current production capacity is 10 tons per year and new production units, in the form of the company’s patented Hyperion detonation chamber, can be built and brought onstream in as little as two to three months.

HydroGraph’s first commercial unit, a 13,000 square foot facility

located in Manhattan, Kansas, started production in 2022. The company’s second production facility will be established in Texas, in part because that state is one of the best places to source the acetylene used in the detonation process.

Scaling up on the revenue generation front could feed quickly to the bottom line, as HydroGraph estimates that an outlay of US$10 million to US$15 million on production can generate more than $100 million in sales.

With the ability to quickly increase production capacity and a healthy pipeline of potential customers, it is reasonable to expect new developments coming to light before long.

“We will be announcing the gas partner that we are working with for a large-scale production facility where we have negotiated pipeline access for acetylene, and we are looking forward to announcing a relationship with the U.S. military,” Breure says.

Breure adds that HydroGraph is planning to provide an update on the

status of its submission to the U.S. Environmental Protection Agency and that contract announcements emerging from the company’s commercial pipeline are likely.

“We have between 10 and 15 clients that are really in that last stage that could convert into revenue within the next year,” Breure says, adding that the company has generated “small amounts” of revenue thus far but expects a more significant revenue stream to be “kicking in next year.”

Sean Mason has been covering North American equity markets for more than 20 years, including for publications such as Investors Digest of Canada. He is a graduate of the University of Toronto and has successfully completed the Canadian Securities Course.

Interviewee

Derrick Dao, CEO

Interview Date

October 22, 2025

Four

Editor’s

CSE Symbol NUKV

Listing Date November 1, 2022

Website nuclearvisionltd.com

We are a uranium mining exploration company with uranium exploration assets in Botswana. […] We have a potentially very large-scale and lowcost resource base, and Botswana is a very favourable mining jurisdiction for us to work in. We have assembled a truly world-class team.

The nice thing about Botswana is that we can work year-round. We are beginning with a ground geophysics program and also using our proprietary exploration technology to help us define drill targets so that we can start drilling in early 2026. Our program will be a combination of traditional geophysics and also accelerated by an AI partnership that we have gone into.

In the West, there's been renewed interest in nuclear, primarily driven by three things. The first – and this applies especially to the United States – is the reshoring of critical manufacturing. […] The second is the electrification of everything: the electrification of vehicles, automation, robotics, etc. that's driving power demand. And number three, which is obviously very topical and also very important, is artificial intelligence (AI).

In order for any country to scale AI, you need to scale power, and nuclear power is the most efficient form of power that you can generate to power AI. And that's why so many companies and so many tech companies are talking about nuclear right now. [And] modern nuclear facilities, these Gen III, Gen IV reactors are very safe.

It’s conceivable, or it is reasonable, to assume that the uranium market and the uranium price will be high enough to incentivize supply to come online, such that uranium won't be the bottleneck for trillions of dollars of AI infrastructure spend.

In order for any country to scale AI, you need to scale power, and nuclear power is the most efficient form of power that you can generate to power AI.

Dao

Interviewee

Brenton Scott, CEO

Interview Date

October 17, 2025

CSE Symbol CTTT

Listing Date February 28, 2023

Website citech.com.au

We've developed a rapidly deployable, fully autonomous communications platform. We're effectively a tower that can go 16 or 20 metres in height. […] Mining companies moving to autonomous vehicles require very high-capacity comms, so they need a system to connect to a fixed tower via microwave, and they require zero sway in the tower.

go.thecse.com/ critical-infrastructuretechnologies

“ The first [tower] that we built, we sold to a large mining company in Western Australia. [...] That's been there for 18 months, and we have not missed a signal once.

Scott

Emergency services is a sector that we're targeting as well. In any natural disaster, you're guaranteed you're going to lose power, and not long after you lose power, you're going to lose communications. Our system can be deployed to be able

to reinstate communications very quickly because we can bring a signal either from the satellite and broadcast that through the antennas.

We moved from that to defence. We were found by the Ukrainian Ministry of Defence. […] They've had over 2,000 telecommunication towers damaged or destroyed, so they need communication systems. From the Ukrainian request for our platforms, we then designed a Nexus 20 that goes 20 metres.

Europe is obviously going to remain very strong. We're talking to a lot of companies in [Poland, Denmark, and Germany]. We recently announced that we've set up a wholly owned subsidiary in Latvia, so we're establishing as our EU headquarters a facility in Latvia that's going to market to the EU.

The first [tower] that we built, we sold to a large mining company in Western Australia. And on that system by microwave, we're connecting to a fixed communications tower 53 kilometres away. When you're going that distance, you've got to take into account the curvature of the Earth. That's been there for 18 months, and we have not missed a signal once.

Alistair Waddell, President & CEO

Interview Date

August 27, 2025

go.thecse.com/ inflection-resources

CSE Symbol AUCU

Listing Date July 16, 2020

Website inflectionresources.com

We are focused on exploring New South Wales, Australia for very large copper-gold porphyry deposits. We're exploring a belt of rocks called the Macquarie Arc, which extends through New South Wales and is hosting some very large mines and big deposits.

This big belt of rocks extends to the north and disappears under a blanket of younger sedimentary cover, masking the underlying geology. And what we set up about seven or eight years ago now is that we started to explore this northern covered extension of this belt.

Recently, we've entered into a large partnership with AngloGold Ashanti, that is fully funding an exploration program to explore under this blanket of sedimentary cover. We've got a large program where we've been doing close to 50,000 metres of drilling over the last couple of years. And more recently, we've had a little bit of success. We've found porphyry, and we're currently at the point where we're drilling to really understand the extent of that porphyry-style mineralization.

In terms of news over the next 12 months, it's really driven mostly by drilling in New South

Wales. This is all fully funded by AngloGold. As I mentioned, we're drilling this target we refer to as Trangie, so we'll be focusing our efforts a little bit on that.

“ We've got a large program where we've been drilling close to 50,000 metres of drilling over the last couple of years.

— Waddell

We've got a number of other projects where AngloGold is funding as well. We've got one called Nyngan, one called Crooked Creek. And these projects are ultimately going to be systematically drill tested by AngloGold. [… And] we've also recently announced a transaction with Newmont Corporation, where we've acquired a large portfolio of exploration assets from Newmont.

Scott Eldridge, Director & CEO

Interview Date

September 26, 2025

go.thecse.com/ military-metals

CSE Symbol MILI

Listing Date June 28, 2022

Website militarymetalscorp.com

Military Metals holds one of the strongest antimony portfolios of any publicly listed company, and we're focused on three different countries, all NATO countries, including Slovakia, Canada, and the U.S. We wanted to put together an investment vehicle that gave investors direct exposure to the rising antimony prices that we've seen for the last 18 months. And that's very important because antimony is not an exchangetraded metal.

“ Antimony is a hidden gem in the periodic table, and it has multiple different demand pillars that differentiate it from other critical minerals.

— Eldridge

[Slovakia] is our flagship asset. It has had a significant amount of money spent on it during the 1980s. And when the Cold War ended in 1992, everyone dropped their shovels and walked away

because the demand for antimony dropped off. But during the 1980s, there were 63 holes drilled into the project, and 1.7 kilometres worth of underground workings developed. We are currently working to transition the historical Soviet-era resource into an NI 43101 resource.

Our West Gore project in Nova Scotia […] has an interesting story. It was a past producer during World War I, where an antimony concentrate was shipped to Wales to support the Allied war efforts at the time. […] We plan to commence a drill program there, probably starting in October [2025].

Our Last Chance property in Nevada […] has a similar story to West Gore, where this was a past producing mine in World War I, and then demand for antimony dropped off. […] We've recently been looking at the structural geology there, and we're now confident that we have drill targets.

Antimony is a hidden gem in the periodic table, and it has multiple different demand pillars that differentiate it from other critical minerals […]. The number one demand for antimony is fire retardants, second would be solar panels, and then third would be the defence sector.

Connect with the CSE at the following key events

Let’s connect! To schedule a meeting with us at an event we’re attending, email the CSE at events@thecse.com

Vancouver, British Columbia January 25-26, 2026

Presented by Jay Martin, President and CEO of Cambridge House International, VRIC brings together thousands of investors and hundreds of junior mining companies to showcase the exploration and production of the world’s most needed critical commodities.

STANY's Annual Conference

New York City, New York April 13, 2026

Back for its 90th year, this renowned event, hosted by the Security Traders Association of New York, provides a platform for leaders in the securities and financial services industry to network, attend fireside chats, and enjoy panels on key industry trends.

Toronto, Ontario | March 1-4, 2026

We’re proud to return to this leading mineral exploration and mining convention, organized by the Prospectors and Developers Association of Canada, which convenes attendees, exhibitors, and expert speakers from across the global mining, mineral exploration, and investment communities for an extensive programming schedule.

Summit on Responsible Investment (SoRI)

Kelowna, British Columbia June 4, 2026

Featuring keynote speakers, thoughtprovoking discussions, and companies leading in CleanTech, Renewable Energy, and Life Sciences, this year’s SoRI will spotlight the latest in ESG trends and investment opportunities.

Québec City, Québec June 2-4, 2026

The CSE is excited to return to this invitation-only, Tier I global mining investment conference that offers unique opportunities to hear from influential thought leaders in the sector and meet with international investors and various mining government authorities.

For more information about these and other events we’re attending across the year, visit go.thecse.com/events

WFE CEO Nandini Sukumar discusses how exchanges drive sustainability and financial innovation across the globe

The World Federation of Exchanges (WFE) is the industry body for exchanges and clearing houses. We represent more than 250 exchanges and central counterparties across the world, including the Canadian Securities Exchange (CSE). The CSE is a very valued member of the WFE. You came into membership last year. We were extremely pleased to welcome you and congratulations. It's a very rigorous assessment process to get into the WFE because we really evaluate your regulation, your regulatory regime, your market structure, all the good stuff that exchanges do that make us the valuable entities at the centre of capital markets.

Exchanges are at the centre of the centre. Markets are the centre of the economy. Exchanges are at the centre of the market because we face onto and support the buy side, the sell side, the issuers, the regulators, government, retail investors, pretty much everyone. One thing that all our members care about is sustainability. Exchanges have been at the frontline of the sustainability effort for the last 20 years, working on sustainability with our stakeholders well before it became as mainstream as it has become today.

There is no sign of decreasing engagement that our industry is bringing to the sustainability debate. Sixty-eight percent of WFE member exchanges who responded to our survey report their own carbon emissions, and 72% of

those cover all three of the GHG scopes. The vast majority of members require issuers to report on sustainability matters, and 82% of respondents offer ESG related products.

At our Singapore conference in June, the focus was on sustainability reporting. There's reporting challenges for SMEs and definitely a topic very close to the CSE's heart. Supply chain reporting and good practices across the industry were also key areas. Exchanges exist to solve problems through product. There's tremendous innovation in transition finance and this emerging trend around transition-focused taxonomies, helping exchanges develop their own transition plans while supporting issuers with theirs.

When you're at the centre of the centre, everybody wants a slice of you. Everybody wants something from you, especially in relation to sustainability. The industry needs to ensure that we come together in agreement because it doesn't work if only one part moves independently of the other. Regulated industries are at the heart of our model, that really distinguishes the exchange industry from other parts of the ecosystem. The WFE believes in the power of public markets such as the CSE. So if you're a company thinking about listing, list.

Editor’s Note: This interview has been edited and condensed from a March 2025 conversation, with minor updates for publication timing. The full interview can be accessed online here: go.thecse.com/ CSE-Podcast-Nandini-Sukumar

Our certifications, recognitions, and partnerships

Tell us a bit about yourself. What was your journey to the NSX?

I’ve been in capital markets for over 30 years. I was a foundation employee when Macquarie Equities opened a retail broking business in Australia in 1994 and was sent to London with Macquarie in 1997 to help build out the U.K. institutional business.

In 2004, I moved to New York to perform a similar role with Goldman Sachs, before returning to Australia to head up Goldman’s capital markets business in 2008. I shifted to ASX and the exchange world in 2013, where we built a strong franchise around tech listings, including achieving great success in the U.S., Israel, and Ireland.

Exchanges play an important role in helping companies raise capital, and I believe that role had been increasingly neglected in Australia. The National Stock Exchange of Australia (NSX) was attractive to me as an underutilized public market with a valuable listings licence. I saw a great opportunity to rebuild the NSX as a competitor in the venture and start-up space, very similar to CSE’s successful execution in Canada.

For those of us who are unfamiliar with the NSX, can you please provide a bit of background on the exchange, as well as some context around the current challenges and opportunities for public companies in the Australian capital markets?

By Libby Shabada

The National Stock Exchange of Australia has been around in various guises for over a century. Part of its history includes the Bendigo Stock Exchange, formed in the 1860s to fund the Victorian gold rush. This century, NSX has led many innovations, including tokenizing wine units in 2002, trading taxi plates in 2006, and, more recently, operating a market for agricultural cooperatives to trade shares.

As CEO, what is your vision for NSX over the next few years? For this partnership?

Our goal is simply to innovate and compete. On the innovation front, we intend to invest in cutting-edge technology to improve trading capability, provide additional services, and expand our listings offering. Competition is something you create as an exchange, and the reality is that small miners, pre-revenue tech, and life sciences companies are increasingly finding it difficult to IPO in Australia, and we can assist with that. The same applies to junior explorers listed in Canada.

Our partnership with CSE will assist on all fronts. It offers experience and expertise in a similar market, provides technology and marketing support, and a great existing network of issuers to call upon. Moreover, Australians and Canadians are natural allies. The NSX and CSE teams have clicked together very well. That’s obviously great for our staff, but it’s also beneficial for our customers and other stakeholders.

The collaboration opens the door for, among other things, dual listings. What

are the benefits for retail investors and public companies in both Australia and Canada?

In reality, we have similar markets and economies, with large pension plans and individual investors looking at opportunities, especially in the mining sector. In my view, Canada and Australia have slightly different investment, risk, and interest rates cycles, with Canada slightly skewed toward the U.S. and Australia toward Asia. This often presents “valuation arbitrage” that companies can potentially benefit from by being listed in both markets. The prospect is exciting.

Looking ahead, how do you expect Australia’s capital markets landscape will evolve, especially as it relates to international opportunities?

Australian pension pools are growing exponentially, and there is a big drive to invest in local tech and keep those businesses local, especially their intellectual property. This combination should see more international opportunities to dual list so as to take advantage of that combo. Indeed, the Australian government has committed AUD$1 trillion of investment in the U.S. over the next decade. There’s no reason why a large part of that can’t be realized through dual listing opportunities.

As I look ahead, I see a dynamic and healthy future.

Tune in to our YouTube channel to watch new episodes and replays.

CSETV