By GRACE BARLOW & KENNEDy SAMUEL, DTU INTERNS

This week, Atlanta residents face dangerous heat conditions that can pose serious health risks.

On Tuesday, June 24, a heat advisory was in effect from 1 p.m. through 8 p.m. the following night, with every county on alert. Local fire departments are preparing to see a surge in emergency 911 calls as temperatures continue to rise.

According to the American Red Cross of Georgia, extreme heat is deadly and kills more people than any other weather event. The organization urges everyone to take three critical actions to stay safe: stay hydrated, cool, and connected by checking in on neighbors and friends. That particularly includes children and the elderly.

According to the Atlanta-based Centers for Disease Control, “Georgia reported 27 heat-related deaths in 2023, ranking 11th highest in the nation.” Experts stress that heat-related illnesses can develop rapidly, especially for those working or spending extended time outdoors.

The warning signs of heat exhaustion can come very quickly. Symptoms can include

weakness, dizziness, vomiting, and a general feeling of illness. Immediate action is necessary when these signs appear to prevent more severe complications like heat stroke.

Firefighters also warn about the dangers of leaving children or pets in parked vehicles.

Community members are urged to stay indoors during peak heat hours if possible, stay hydrated, and check on vulnerable neighbors. As Atlanta battles rising temperatures, awareness and caution are critical in protecting lives and preventing another deadly summer.

As record-high temperatures scorch the Atlanta area, organizations like Frontline Response are stepping in to offer vital support to help residents stay cool and safe. At their Dekalb County location on Gresham Rd., staff say their efforts go far beyond offering air conditioning.

“This is way more than a cooling center,” said Terry Tucker, national chief executive officer at Frontline Response. “Anybody can walk up and say, ‘Hey, I’m hungry.’ We don’t turn people away.

The center not only provides cold water and a cool, safe place to reset, but also offers meals, hygiene products, and referrals to

long-term services. Many of the individuals who visit the facility are unhoused or lack consistent access to air conditioning, making even short stays critical to their health.

Tyana Mizel, director of hospitality operations at Frontline Responses DeKalb County location, works closely with the guests and said the space has profoundly impacted

those who stop by. “Some of them told us just having this has been good for their health and wellbeing,” she said.

A DeKalb County native, Mizel, reflected on how essential community resources shaped her own life. “Being a mom at the age of fifteen, I knew if I didn’t have those resources in Decatur, no telling where I would’ve been,” she said. “For me, it’s just paying it forward.”

As temperatures continue to rise, Frontline Response plans to keep its cooling centers open through Sunday, June 29. The organization also offers transportation to the center from several locations, including the Decatur Library, the Chamblee Library, and the First United Methodist Church of Tucker.

The City of Atlanta has also begun offering cooling station services around the city, including in the historic Sweet Auburn District at Selena S. Butler Park. Inside the park’s small rec center, there is an air-conditioned room for sitting.

“We have room for more people here as well,” said Kecia Lymon, an employee with the City’s Parks & Recreation Department. Lymon pointed to another larger room next door.

BY DONNELL SUGGS & GRACE BARLOW, DTU INTERN

Affordable housing feels more like a buzz term these days, as metro Atlanta municipalities have followed current Atlanta Mayor Andre Dickens’ mission of providing residents affordable housing (there’s that term again). The cost of living in metro Atlanta remains among the highest in the country. The average rent in Atlanta, which includes the northern and southern suburbs of metro Atlanta, is $2,045 per month, according to Zillow.

According to Rent Cafe’s residential data, that’s above the average rent for an apartment in the United States, which is $1,761. Something has got to change if everyday working citizens in metro Atlanta are going to be able to afford decent living accommodations at an affordable price.

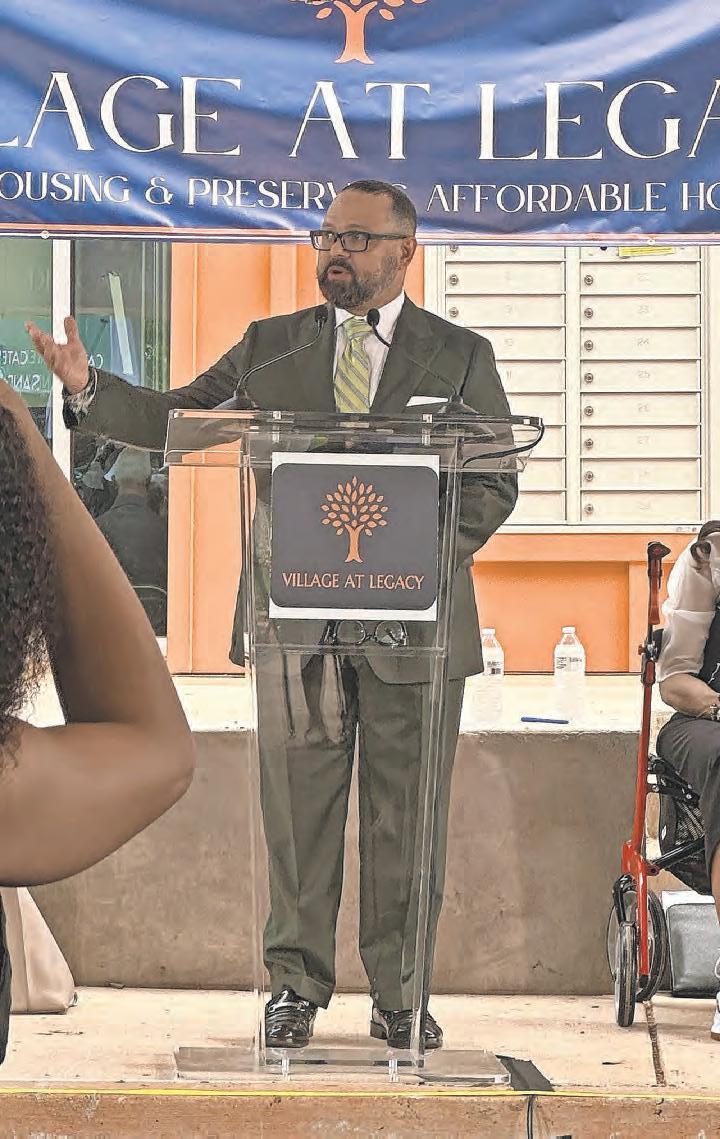

Marking the gravity of the moment, Larry H. Padilla, chief executive officer of the Decatur Housing Authority, emphasized that the ribbon-cutting was a renewed commitment to the authority’s mission of creating affordable housing. “Today is a celebration, yes. But it must also be a call to action,” he said. Building on his message, Padilla concluded,

“Let it be the beginning, not a capstone.”

When phases one and two of construction are completed, the Village at Legacy complex will have 132 one- and two-bedroom units available for rent. With prices ranging from $1,000 to $2,000 per month, Village at Legacy will have some of the most affordable new housing units in the City of Decatur, according to management staff. That is the purpose of this particular apartment complex, according to Padilla, a native of Brooklyn, New York.

“There hasn’t been any new multi-family construction here in quite some time,” he said. “This is the first one that is brand new.”

Padilla told The Atlanta Voice that the City of Decatur bought the 77-acre property on which Village at Legacy is currently being built in 2017. The project is still months away from being completed in part, but the construction is taking place, and affordable housing will be a reality much sooner than later.

“This is a wonderful opportunity for the community to have housing units built that embrace the institution of family,” Rev. Dr. Victor Aloyo, Jr., the president at Columbia Theological Seminary, said.

Aloyo described the City of Decatur’s decision to use what he described as prime real estate—Village at Legacy is off Columbia Drive—for

affordable housing as “critical.”

Village at Legacy manager Candace Evans referred to the apartments as “necessary and attainable.”

During a ribbon-cutting ceremony at Village at Legacy, Padilla took a moment to use baseball salary disparities as an example of the salary disparities among everyday people in the City of Decatur. He spoke about employees in his office having to drive two hours one way to get to work because they can’t afford to live in the city where they work.

“This is more than just bricks, beams, and blueprints,” Padilla said. “There is a housing affordability crisis in our country, right here in our backyard.”

Longtime resident and property caretaker Dorsey Nobles, a local celebrity due to his familiarity with the area, has given the apartments his stamp of approval.

“You’re helping people,” he said of the affordable units. “We need to help as many people as we can, but let’s be real about it.”

Asked if he thought local home openers in surrounding subdivisions are happy about the affordable housing and the traffic a huge apartment complex can bring, Dorsey said he speaks to residents all the time.

“I believe they are happy that housing is here,” Dorsey said.

By CHARLENE CROWELL

According to the National Association of Home Builders, nearly 75 percent of families – 100.6 million households – cannot afford a median priced new home in 2025. With a price tag of $459,826 and an accompanying 30-year mortgage rate of about 6.5 percent, it’s no surprise that both families and government are challenged like never before when it comes to securing affordable housing. For much of Black America, affording a home is even harder due to pernicious and persistent income and wealth inequality. A February analysis of Census Bureau data by Lending Tree found that:

• Black households earned a median income of $56,490 in 2023-- 33 percent less than the $84,630 earned by white households;

• Black Americans hold 3.4 percent of the nation’s wealth, although they make up 13.7 percent of the population, while white Americans hold 84.2 percent of national wealth, while making up 58.4 percent of the population; and

• Black workers earned a median of $962 weekly in the third quarter of 2024, versus $1,184 among white workers.

Despite these disturbing figures, the proposed fiscal year (FY) 2026 budget for the Department of Housing and Urban Development (HUD) would walk away from affordable housing concerns. The proposed budget reductions will eliminate long-standing programs and further reduce HUD staffing, while giving states block grants to craft their own versions of programs and funding priorities.

“President Trump’s bold budget proposes a reimagining of how the federal government addresses affordable housing and community development,” said HUD Secretary Scott Turner in a written statement. “Importantly, it furthers our mission-minded approach at HUD of taking inventory of our programs

and processes to address the size and scope of the federal government, which has become too bloated and bureaucratic to efficiently function.”

Where the administration envisions “requiring states and localities to have skin in the game,” this proposal sidesteps large concerns that would affect every state: the capacity, expertise, and additional funding to design, deliver, and sustain affordable housing services. HUD programs funded this year at $89.1 billion, would drop to $43.5 billion in FY 2026.

Popular programs slated for elimination include:

• Community Development Block Grants (CDBG) - $3.3 billion in formula grants to over 1,200 state and local governments for a wide range of community and economic development activities;

• HOME Investment Partnerships Program - another $1.25 billion formula grant that provides state and local governments with funding to expand local housing; and

• Fair Housing Initiatives Program (FHIP)$56 million in competitive grants to public and private fair housing organizations to advocate against single family neighborhoods and promote equity policies.

As recently reported by Bloomberg News, an internal report estimates that HUD will have lost the majority of legal managers at its field offices, including half of the managing attorneys in its Chicago, San Francisco and Seattle offices, by September 30. Other planned HUD staff reductions will eliminate 75 percent of its managers in Boston, and all of its managers in Denver. Many remaining staff would be asked to relocate – at their own expense – to avoid future staff reductions.

Housing stakeholders strongly oppose these cuts.

For example, the National Council of State Housing Agencies (NCSHA) has been an affordable housing advocacy organization for 50 years. This nonprofit, nonpartisan group draws upon the knowledge

and expertise of the nation’s state Housing Finance Agencies and their more than 350 affiliate members who together partner to provide affordable housing.

“Overall, the changes proposed in the FY26 budget envision a dramatic reduction in federal support for affordable housing and a major restructuring of how the remaining federal assistance is delivered,” wrote Robert Henson, NCSHA’s Senior Housing Policy Specialist. “In total, the budget requests $43.5 billion in discretionary budget authority for HUD in FY26, as compared to $89.1 billion in FY25, representing a 51 percent decrease year over year.”

The DC-based Urban Institute expressed similar concerns about the so-called “skinny budget” proposal.

“Because states, unlike the federal government, must balance their budgets each year, major shifts in federal housing development funding would hinder states’ abilities to continue funding programs and projects, including efforts to increase affordable housing,” wrote the Urban Institute’s Kathryn Reynolds, its Principal Policy Associate and Gabriella Garriga, Research Analyst.

With Congress yet to decide the fate of FY 2026 agency budgets, there is still time for communities, advocates, and others to stand up in support of affordable housing. A strong showing of broad and diverse support for housing and urban development is needed now like never before.

As California Congresswoman Maxine Waters recently said, “At a time when homelessness is surging, with over 771,000 people experiencing homelessness on any given night, President Trump is proposing the wholesale destruction of our federal housing safety net... Housing costs are going up, not down and this budget will ensure that homelessness goes up as well.”

Charlene Crowell is a senior fellow with the Center for Responsible Lending. She can be reached at Charlene.crowell@responsiblelending.org.

FOUNDED

May 11, 1966

FOUNDER/EDITOR

Ed Clayton Immortalis Memoria

PUBLISHER/EDITOR

J. Lowell Ware

Immortalis Memoria

The Atlanta Voice honors the life of J. Lowell Ware.

PUBLISHER

Janis Ware

PRESIDENT/

GENERAL MANAGER

James A. Washington 2018-2024

EXECUTIVE ASSISTANT TO PUBLISHER

Chia Suggs csuggs@theatlantavoice.com

EDITOR IN CHIEF Donnell Suggs editor@theatlantavoice.com

GENERAL ASSIGNMENT REPORTERS Isaiah Singleton isingleton@theatlantavoice.com Laura Nwogu lnwogu@theatlantavoice.com

EDITOR AT LARGE Stan Washington swashington@theatlantavoice.com

MANAGING EDITOR, DIGITAL Itoro Umontuen iumontuen@theatlantavoice.com

ADVERTISING, SALES & CIRCULATION

ADVERTISING ADMINISTRATOR

Chia Suggs advertising@theatlantavoice.com

SALES

RDW Jackson rdwadman@gmail.com

CIRCULATION MANAGER Terry Milliner SUBMISSIONS editor@theatlantavoice.com

DIRECTOR OF PUBLIC RELATIONS

Martel Sharpe msharpe@theatlantavoice.com

CONTACT INFORMATION

633 Pryor Street, S.W. Atlanta, GA 30312 Office: 404-524-6426 info@theatlantavoice.com

BY JAMES A. WASHINGTON

The Atlanta Voice

There’s something to be said about hunger for the Word of God. I do something I’d only heard about from several close friends. I think they called it“ church hopping.” So, for the past few weeks, I’ve discovered quite a few churches, ministers, and associate pastors who deliver a very powerful message. From Oak Cliff Bible Fellowship to Trinity Valley Missionary Baptist, from Friendship West Baptist Church to maybe Warren United Methodist, we live in an area filled with houses of worship and men, gifted men and women called to preach. Each is unique, and each has a loyal following. I guess I’m fortunate, as we all are, to know one’s spiritual hunger can be satisfied on any given Sunday. I used to believe that the pulpit was simply a place for hypocrites to shine and generate false praise from members more interested in looking good than working for the Lord. I must admit that this belief was probably the single biggest reason I didn’t go to church. I had intellectualized myself out of the kingdom of God, and for the most part, I had convinced myself that I could stay connected without being

The Word of God shows up in all kinds of places from all types of people and certainly under countless circumstances if you are open to it.

connected. Satan had won this battle and used my unsaved spirit to take me down. Once I got past the pulpit and into the Word, my life changed and continues to evolve. The Word of God shows up in all kinds of places from all types of people and certainly under countless circumstances if you are open to it. I am sometimes amazed at how confused I was to believe that the message would be given by a perfect person, heard by perfect people in a perfect congregation. Underneath it all, my arrogance and pride had somehow allowed me to believe maybe I was better than some, a cut above others, and certainly smarter

“YOUR VOICE”

than most. When I think about that now, it makes me sick. No wonder the devil felt like his job had been done. The good news today is I’m saved in the knowledge that I am better than no one and more flawed than many. I am no more worthy of the sacrifice of Jesus Christ than I am of the love of God the Almighty. I’m just thankful to be in the family. As such, I’ve enjoyed the last few weeks and believe the spiritual community in our small part of God’s kingdom is poised to do great things in His name. Take the top ten churches in the area and look beyond the numbers in their congregations. You’ll find program after program designed to feed the hungry, help the poor, deliver to the downtrodden, and teach the children. When you investigate and seek out God’s Word, you find whole communities of ordinary people doing extraordinary things. The key is you’ve got to open your eyes and look. At the moment you do this, God shows up. He did in my case by illuminating my sin-filled soul and letting me know, despite it all, all of His blessings are my unconditional birthright. Now I realize the power inherent in the truth.

“Now that you have purified yourselves

by obeying the truth so that you sincerely love your brothers, love one another deeply, from the heart, for you have been born again, not of perishable seed, but of imperishable through the living and enduring God. For ‘ all men are like grass, and all their glory is like the flowers of the field; the grass withers and the flowers fall…but the word of the Lord stands forever.” 1 Peter 22-25. The simplicity of this has now become transparent to me. God’s goodness and grace are everywhere. The view is merely clouded because we tend to try to see these things from the inside looking out, rather than from God’s point of view, looking from the outside in. May God bless and keep you always.

This column is from James Washington’s Spiritually Speaking: Reflections for and from a New Christian. You can purchase this enlightening book on Amazon and start your journey toward spiritual enlightenment.

In the wake of all the protests against Trump’s deportations, what should Black Americans do? Do we have a dog in this fight?

INDIGO A. Riverdale DIZZY U. South Atlanta

“I think that during this time, it’s very important for the black community to lean more into each other and host more community building and community events so that we can foster these relationships with our neighbors rather than trying to rely on the government to solve our problems or fight for us because they’ve shown us time and time again that they’re not willing to do that and I think that there’s just power in our community and our love for each other.”

“For black people, they’re going to say that we are not supposed to be here anyway. They will find any reason for us not to be on this land. I don’t think we should ignore everything happening, hands down. So, we shouldn’t be sticking our heads in the sand. We should always have our eyes open because we will be affected. It doesn’t matter what it is. We will be affected, harshly too.”

ALAMAMY

KAMARA South Fulton

“My response to what’s going on with the situation with ICE and what’s going on in the world, as far as black people, we should support them anyway, because I feel like it’s like a big family and the government is trying to take a part of us away and that’s not right so, if we could do anything to help them. That will help all black people in the world.”

“I feel like everybody should be helping each other, but where were the others when we needed help? They want us to come out and help protest. But when Trump makes his racist comments against black folks, do they have any say in it? I probably would protest, if it’s not violent, I would do it. So, it should be a learning curve for everybody when they need help. Others should help them, and then vice versa.”

“I do not think black people should be involved in the immigration protests... I think it’s unfortunate, but a lot of these brown people voted for Trump statistically, and so they must deal with the immigration policy... I think, as black people, we need to be minding our own business, literally creating our businesses, especially with how tough the economy is... But at the end of the day, my grandmother made a good point. Who’s going to pick your food? Because she’s like, I don’t see you working in the fields.”

“I believe we as black people have a dog in this fight. What happens after the illegal immigrants are deported? Are we going to be next?”

By ISAIAH SINGLETON

In partnership with South Fulton Arts, Atlanta native Dalyla Nicole is hosted a launch party for HTD & Company, a onestop creative resource hub and network for creatives and entrepreneurs, on Juneteenth, June 19, 2025.

Raised as a theatre-maker (performer, poet, playwright, director, dramaturg, and overall story lover), Nicole says cultural anthropology combined with a natural zeal for developing community through stories has aided in finding cadence in the theatre-making process.

During her professional ventures nationally and abroad in Haiti, Holland, and Australia, Nicole’s work always returns to the love of the global community, curious compassion, and a delightful story.

In addition to her work as a multi-disciplinary artist, she leads sister company legs: HTD Consulting Group and Ebony Taylor Theatre Company as well as serving on the boards of Working Title Playwrights and Atlanta Green Theatre Alliance.

As the launch party drew near, Nicole told The Atlanta Voice that she was nervous but felt grateful for the opportunity.

“I feel like I’m running around like a chicken with its head cut off, but I’m incredibly grateful at the end of it. The idea started off solo, but it’s formed such a community,” she said. “I’m grateful.”

Peps! Cola B-tch

The launch party also displayed its first production, which was written by Nicole, Peps! Cola B-tch (PCB), a play about heteronormativity and beverage bias.

With the official launch aligning with Juneteenth, Pride, and Caribbean Heritage month, the event invites the audience to “taste” the story through a multimedia experience across stage (the play); screen (the documentary); sound (the album); and interactive play (the video game).

Rooted in the freedom of Juneteenth and the rebellious joy of J’ouvert, this multidimensional debut honors the past while launching stories of the future. J’ouvert, Nicole says, is a Caribbean Street festival that precedes the more formal Carnival parade, and is known for its unconventional costumes, revelry, and the use of mud, oil, or powder.

“We’ve had the company growing and having a grassroots initiative for the past few years, so we’re officially launching all three departments and letting folks know about a few opportunities opening up to the community,” she said.

PCB started as an idea on Nicole’s voice notes while she was driving home shortly after the pandemic, and later became an idea from HTD productions, where they wanted to look at how to make storytelling more accessible across genres, Nicole says.

“Atlanta is like a feast of creativity of all sorts and genres. As I started to produce and had development opportunities with the story, I started finding different collaborators of diverse types,” she said. “I ran into Mia Jones, who is

our game developer and helps with social media and all of these other creatives, and together we have built a community to be able to tell a single story in four different ways.”

PCB is also the first project of Nicole’s where she dove into her personal experience at the intersections of being Black or femme-presenting, queer, and a millennial, and really leaned into that language to translate it into written form.

Largely inspired by Suzan-Lori Parks, Nicole says it was the way Parks defines what style is and how to define your own style of writing and your own vocabulary.

“I hadn’t seen a play for someone like me at those intersections, and that’s what I wanted to create,” she said.

The premise of Peps! Cola B-tch, Nicole says, is about the idea of battling heteronormativity we live and everything that comes with it, whether it’s through the analogy of beverage bias or the idea of a Pepsi versus a Coca Cola drinker.

“I always felt bizarre drinking Pepsi in Atlanta and at Emory, there used to be a joke around saying, ‘You can’t drink Pepsi on this campus’, so a lot of this, on the lighter end of it, is mostly sourced from my reflections on that,” she said.

Additionally, Nicole says PCB also came about in her own journey and figuring out her sexuality and who she was through the pandemic due to the huge amount of reflection time. Nicole said her family is from the Midwest and Milwaukee, but she was burned and raised in Atlanta where Coca Cola is the way to go.

“Drinking Pepsi became a curse word to my family, so I was secretly drinking it. One day I was driving home drinking Pepsi, and I

remember making a voice note, which became a key cornerstone monologue in the play about what is it like being in Atlanta as a Pepsi drinker,” she said.

This unfolded into a full story, which began integrating many complex layers of various sexualities, experiences, and backgrounds, she said.

“We tie in a lot of J’ouvert, Trinidad, and Carnival culture heritage into the play as the protagonist’s journey of homecoming and being able to be comfortable with herself against all these battles,” she said.

Nicole describes PCB as “very Atlanta, very Black, very Queer”, and says she hopes everyone who watches it feels seen.

Nicole says she knew there was something important around liberation and how crucial it was to host her launch party during Juneteenth, Pride, and Caribbean Heritage month.

“I knew it was liberating to do, especially in Atlanta being such a Black city and Black cultural cornerstone,” she said. “In a time where to be a creative, entrepreneur, queer, and to own your blackness is a rebellious thing, it just felt like the right time to celebrate homecoming, to celebrate pride, and what it means to honor yourself.”

Alongside the launch of the production company, Nicole also announces they will be launching a fully Black woman led theater company. Other plans include a swim school, a therapeutic artist resources community, and helping artists and creatives figure out how to get their own projects off the ground.

For advice to entrepreneurs and creatives

alike, Nicole says to “just do it.”

“That has been my go-to thing, but it’s also because I’m a perfectionist and things have to be very right before we get it to a place, whether it’s this company, the story, or all the opportunities and partnerships including South Fulton Arts that came about to make any of these things possible,” she said.

Nicole also wants people to feel confident in themselves and even if they’re afraid, they should know they don’t have to do it alone.

Also, each part of the immersive experience will be available for everyone the day of launch and if you’re able to attend the launch party, there will be a special announcement they’re expanding on for the next round of projects coming soon, according to Nicole.

The video game will be accessed online as of right now and it allows the user to play along with the story.

Nicole also will be launching their Vanguard Awards, where each year they will be acknowledging three different vanguards in our communities to shed light and celebrate across the community.

Furthermore, Nicole shouts out the support from South Fulton Arts which has been in partnership with her through the conversation series, with the launch party being the third and final part.

“All of their support exemplifies what it means to partner in community in Atlanta. They’re a nonprofit organization through their CREATE program that takes creatives and the community and partners with them for resources and tools,” she said. “Also, big shoutout to the Academy Theater, who hosted us on Juneteenth.”

By STAFF REPORT

Atlanta, the birthplace of public housing, hosted leaders from across the country June 11-13 for critical discussions on the future of public housing nationwide.

“We are incredibly excited to not only showcase Atlanta but also to continue one of the most important conversations we could have right now – the urgent need for affordable housing,” said Terri Lee, president and CEO of Atlanta Housing.

Members of the Council of Large Public Housing Authorities (CLPHA), representing more than 80 cities from Los Angeles to New York, gathered in Atlanta for the organization’s three-day summer meeting.

CLPHA members own and manage nearly 40% of the nation’s public housing stock and provide vital services to over 1 million low-income households.

The conference began with a guided bus tour of Atlanta Housing’s current and upcoming developments, showcasing one of the most ambitious public housing pipelines in the country.

In 2023, Atlanta Housing committed to creating or preserving 10,000 affordable housing units by the end of 2027.

“I’m proud to report we are two-thirds of the way toward achieving our goal, with more than 6,700 units created or preserved, thanks to our dedicated staff and partners who share the belief that housing is foundational to community growth,” Lee said at the conference’s welcome reception.

Lee, who serves on CLPHA’s board of directors, introduced attendees to Atlanta’s significant public housing history.

“Atlanta’s leadership in housing dates back nearly a century,” Lee said. “In 1936,

Techwood Homes opened as the nation’s first federally funded public housing project, establishing affordable, safe, and dignified living conditions as a public responsibility. That same year, University Homes became the first federally funded public housing community specifically built for Black Americans.”

In 1992, Atlanta revolutionized public housing policy with HOPE VI – a transformative initiative that replaced distressed housing projects with vibrant, mixed-income communities. This program set the national standard, creating pathways for economic mobility and self-sufficiency.

“Today, we remain committed to that legacy, grounded in progress and driven by innovation,” Lee said.

The conference emphasized innovation in public housing through various sessions led by the organization’s executive team. Key topics included:

• Innovative housing designs addressing homelessness.

• Creative funding structures for affordable housing development.

• Housing as a pathway to economic independence.

• The significance of public-private collaboration.

• The positive economic impact of affordable housing.

• Opportunities offered by federally funded Choice Neighborhood Grants.

For Lee, hosting the conference provided Atlanta another chance to influence national conversations about public housing.

“We’re here to advance the dialogue—not just about how public housing affects Atlanta, but how it impacts our nation. Bringing together visionary leaders helps us find solutions and continue setting standards,” Lee said.

SPONSORED

By ASHANI O’MARD

ANDP Senior Vice President for Strategic Housing Investments

According to a recent Gallup survey, 68 percent of non-homeowners cite lack of affordability—particularly the inability to cover the down payment—as the top barrier to homeownership. That number has risen significantly from 45 percent in 2013, reflecting the growing pressure on renters aspiring to buy in today’s housing market. But many potential buyers may not realize that help is available. Across the country and right here in Metro Atlanta, down payment assistance programs offered by local governments, nonprofits, and financial institutions are making a real difference in helping individuals and families bridge the gap to homeownership.

Since 2010, Atlanta Neighborhood Development Partnership (ANDP) and its partners have sold nearly 830 homes to low- and moderate-income households in Metro Atlanta. A key factor in making these homes truly affordable has been the strategic use

Start building equity and stability for your family today.

Nothing changes a family’s future like owning a home. If you’re ready to take that step, ANDP Homes is here to guide the way. Since 2010, we’ve helped more than 825 families become homeowners— building an average of $190,000 in family wealth.

We partner with trusted developers to offer quality renovated and newly built homes—priced affordably for low- and moderate-income buyers. With over 30 homes available now, our average price is $283,000. Many homes also qualify for down payment assistance.

New listings are added regularly, so there’s no better time to start your search. Explore listings on our website. Ready to buy? Have your agent connect with our listing agents and make an offer today!

www.andphomes.org

of down payment assistance. ANDP has leveraged federal, local, and institutional resources—including the Neighborhood Stabilization Program, HUD’s HOME Investment Partnerships Program, and most recently, its membership with the Federal Home Loan Bank of Atlanta—to provide more than $17 million in down payment assistance. These funds have helped aspiring homebuyers overcome the financial barriers to purchasing a home and, just as importantly, stay in those homes long-term. But does down payment assistance really make a difference? The data says yes.

Depending on the program, down payment assistance can be used for more than just meeting the minimum down payment requirement—which is 3.5% for an FHA loan and up to 20% for a conventional mortgage. In many cases, the funds can also help cover closing costs, reduce the principal balance of the loan, and even “buy down” the mortgage interest rate—lowering monthly payments and making the loan more manageable over time. These added benefits significantly ease the financial burden for first-time and lower-income buyers.

At ANDP, more than 70 percent of homebuyers receive some form of down payment assistance, either directly from ANDP or through other available programs. A soon-to-be-released report tracking nearly 800 ANDP homebuyers offers compelling evidence of down payment assistance’s long-term impact.

According to the study, 77.5 percent of these buyers are still in their homes after seven years—a strong indicator of stability and sustainability. An additional 21.25 percent have resold their homes after an average of 5.7 years. Among buyers who have owned their homes for five years or more, the average wealth gain through home equity is a remarkable $191,000.

“This data shows us that providing an affordably priced home in combination with down payment assistance creates truly affordable and sustainable homeownership while building wealth for future generations,” said Ashani O’Mard, ANDP Senior Vice President for Strategic Housing Investments. “At present, ANDP homebuyers have generated $104.5 million in homeownership wealth creation.”

ANDP’s consumer sales website— www.ANDPHomes.org—currently lists over 30 homes for sale, with prices ranging from $209,000 to $339,900 and a median sales price of $282,991. In the past

year, ANDP’s average sales price was $289,350, while the average first mortgage was just $251,212. The difference— typically covered by down payment assistance—highlights the program’s role in making these homes attainable for working families.

What are your next steps?

If you’re ready to explore homeownership, start by educating yourself on available resources. Websites like www. DownPaymentResource.com offer a comprehensive listing of local, state, and national down payment assistance and affordable mortgage programs. You should also check with your city or county government. For instance, the City of Atlanta offers two down payment assistance programs—through Invest Atlanta and Atlanta Housing—that can be combined to provide up to $45,000 in support for eligible buyers.

If you’re interested in purchasing an ANDP home, visit www.ANDPHomes. org to explore current listings, check which homes qualify for down payment assistance, and take the first step toward owning a home—and building a more secure financial future.

What better time to get on top of your finances and start planning for your future?

SPONSORED CONTENT

Provided By United Bankshares

It’s June 2025, and we are exactly halfway through the year. As with any midyear wellness check-up, now is also the time to assess your financial health.

The Certified Financial Planner (CFP) Board of Standards’ annual Debt and New Year’s Resolutions Report found that almost half of all Americans (45%) said that saving more money was their top New Year’s resolution for 2025. As we reach the halfway point of the year, now is a great time to look back and track your progress towards your goals. Have you met with a financial advisor to iron out a plan for your money and get serious about saving this year? Have you stayed committed to your goal and set yourself up for success for the latter half of the year? Or did your saving streak end not too long after it started? Regardless of where things currently stand in your financial wellness journey, it’s never too late to get on track with your money. Financial planning is an understandably intimidating undertaking to handle on your own, but it’s for the people who want to make smarter decisions with their money, and working with a financial advisor will definitely help ease the burden. Financial planning allows you to take control of your financial future, avoid common mistakes, and be prepared for life’s uncertainties. With a solid plan, you have a clear roadmap for your money, which helps you make smarter decisions and stay on track to reach your goals.

I’m here to say that anyone can benefit from planning ahead, regardless of age and income, so long as they’re ready and willing to start planning for their future. Here’s what you need to know to set yourself up for financial success for the rest of 2025 and beyond.

What is financial planning?

The traditional definition of financial planning is the process of developing a strategy for your money. It covers things like saving, investing, budgeting, planning for retirement, handling taxes, and estate planning. The goal is to build a solid foundation for financial security and independence.

But if I had to break this down into easy-to-understand terms, financial planning is planning for the future. This could be the near-term or long-term future, and you might have different objectives based on that time frame and the risk tolerance you’re comfortable with.

Financial advisors and planners play an important role in this process. We help you

Robinson, MBA, CRC® Financial Advisor, Vice President United Brokerage Services, Inc.

manage your investments to achieve your financial goals. We assess your entire financial picture, including income, expenses, liquidity needs, and future plans, and provide advice in areas such as saving, investing, and retirement planning. Creating a financial plan is a great first step, but if you really want to make the most of your money, speaking with a professional will really help you go the extra mile.

Why should you begin financial planning?

As a financial advisor, I’ve heard several reasons why people put off financial planning, from believing they don’t make enough money to warrant planning to thinking they’re too young to start now and that they can worry about that later in life. Sometimes it just comes down to their exposure to financial planning. Many people are intimidated by the idea if they aren’t educated enough, so they decide to simply stick with traditional banking services. It’s also possible that their family didn’t plan, so they don’t see the need to plan themselves. But the fact is that financial planning is more crucial now than ever before. It just is not sustainable to live paycheck to paycheck, and traditional savings and retirement funds are not stretching as far as they once did. People are living longer, health care costs are rising, and Social Security may no longer be enough to cover retirement needs.

I’ve seen clients spend years accumulating wealth, just to have it quickly diminish once long-term care costs arise. We account for our financial needs in life such as major purchases,

life moments, bills, and the costs to keep our home running. But not many people intuitively consider what happens when we need additional care later in life or when unexpected financial challenges arise. What it all comes down to is if you want to live comfortably long past retirement – or even reach that savings threshold that allows retirement – it is important to start making strategic money moves sooner rather than later.

What are the key steps to financial planning?

Sit down and write things out. Take time to document your current assets, liabilities, monthly income, and monthly expenses. Then, you’ll know how much money you have left to invest.

Have an emergency fund. Save six months’ worth of living expenses in an easily accessible account to cover any unexpected expenses. Create a budget and begin saving and investing as early as possible. Once you know how much you spend on fixed and necessary expenses and you’ve set money aside in an emergency fund, take 30% of your remaining income and invest it into your 401K and regular brokerage account. Diversify your investments as much as possible to allow maximum opportunities for returns.

Take advantage of employer-sponsored plans. Set up regular monthly contributions to a retirement plan – especially those where employers match contributions and offer tax benefits – and other non-retirement investments such as mutual funds or managed portfolios.

Plan for taxes. Work with an accountant to take advantage of tax-efficient investing, such as traditional IRAs, Roth IRAs, college savings plans, and HSAs. A good tax strategy can save you money in the long run.

Review and adjust your plan. Your life and goals will change, and so should your financial plan. Do regular financial check-ups and make small changes where necessary to keep you on track to reach your goals.

How should you approach planning for the future?

There’s no one-size-fits-all planning strategy. It depends on your age and current needs. If you are in college or a recent grad with student loans, you might want to focus on reducing

your debt balance and putting yourself in a position to buy your first property.

If you’re recently married, you’ll definitely want to start going to financial meetings together to discuss what your long-term goals are. Too often, I see young couples who are not on the same page financially. So, one spends more on things that the other does not agree with, which might cause delays in the couple making financial progress in their life. The older they get, the more long-term planning they should do.

But overall, you should have both short-term and long-term goals. Planning for the next five years is important for immediate goals like paying off debt (or retiring if you’re close to retirement age), while planning for 20-30 years ahead ensures you’re on track for retirement and future financial security (and making sure you won’t outlive your savings).

But if you do nothing else, everyone should create a budget and stick to it. Without a clear understanding of how much money is coming in and where it’s going, it’s hard to achieve long-term financial goals. I firmly believe that if you start with being transparent, you can take control of your finances.

Anyone looking to learn more about financial planning can check out resources like the CFP Board website, financial blogs, or even talking to a financial planner or financial advisor. There are many tools and guides available online to get you started. We have a lot of great resources on BankWithUnited.com, from helpful articles and calculators to tips for investing and economic snapshots. You can also fill out a form there to be connected with a financial advisor who can best help you with your planning needs.

Ebony Robinson is a financial advisor at United Brokerage Services, Inc., a premier full-service brokerage and investment advisory firm and a wholly owned subsidiary of United Bankshares, Inc. Based in Atlanta, Georgia, Ebony covers the Atlanta metro region. She has a Master of Business Administration and has worked in financial services since 2004. She holds the following licenses: Series 6, Series 7, Series 63, and Life & Health Insurance.

SPONSORED CONTENT

Provided by SouthState Bank

Buying a home is one of the biggest financial decisions most people will ever make – and for many, it can also be one of the most intimidating. Between rising home prices, fluctuating interest rates, and upfront costs like down payments and closing fees, it’s easy to feel overwhelmed before you even start the process. But what if there was a way to make that path a little smoother?

At SouthState Bank, we believe homeownership should feel possible, not impossible. That’s why we created

the Buyer’s Advantage program.

Whether you’re a first-time buyer or just need a little extra support to make you[KO1] r next move, this exclusive program is designed to help reduce barriers, ease the financial strain, and make it easier to step into the home that’s right for you.

In this article, we’ll walk you through what Buyer’s Advantage is, who it’s for, and how it could be the game-changing tool you need to make homeownership a reality.

The Buyer’s Advantage Program is a SouthState-exclusive[KO2] mortgage solution designed to help more people become homeowners, especially those who might need extra support navigating the homebuying process. With this program, eligible buyers can access flexible financing options and reduce [KO3] upfront costs that make purchasing a home more attainable.

Unlike traditional loan programs, Buyer’s Advantage offers expanded guidelines and tailored benefits to meet buyers where they are. Whether you’re working with a smaller down payment,

navigating credit challenges, or just looking for a smoother path to homeownership, this program is built to remove some of the common roadblocks.

Backed by SouthState’s local expertise and relationship-driven approach, Buyer’s Advantage isn’t just a loan, it’s a strategic tool to help you buy with more confidence and less stress.

The Buyer’s Advantage program is more than just a mortgage: it’s a way to make homeownership more accessible and affordable. Here are some of the standout benefits that set it apart:

• Many buyers struggle to save for a large down payment. Buyer’s Advantage offers more flexible down payment requirements, helping you get into a home sooner without drawing from your savings. In fact, you could qualify for a down payment as low as 0% down. The Buyer’s Advantage mortgage provides up to 100% financing based on the purchase price or a bank-accepted appraisal, whichever is lower. Plus, Private Mortgage Insurance

(PMI) isn’t required for a Buyer’s Advantage mortgage, which is typically required when a down payment less than 20% is made.

• Not everyone has a perfect credit score, and that shouldn’t stand in the way of owning a home. This program offers more lenient credit requirements, giving buyers with a minimum 640 credit score a real opportunity to qualify.

• Because this mortgage program is offered directly through SouthState, you get the added benefit of working with a local, experienced Mortgage Banker who understands your [KO4]community and is with you every step of the way.

One of the best parts about the Buyer’s Advantage program is that it’s designed to open more doors to homeownership. To qualify, you’ll need to meet just one of the following criteria:

• The area has at least a 50% minority population, OR[KO6]

• Your income is at or below 80% of the area’s average income level. Not sure where your income or property stands? Don’t worry, your SouthState Mortgage Banker can help check the details for you using census data tools. The goal is to make qualifying straightforward and transparent, so you can focus on finding the right home, not stressing over fine print.

If you think Buyer’s Advantage might be a good fit for you, or even if you’re just curious about what you might qualify for, the next step is easy. Connect with a local SouthState Mortgage Banker who can walk you through the program, check your eligibility, and explain how it fits into your bigger homebuying goals. Want to learn more? Start your journey today by visiting SouthStateBank. com/AtlantaVoice.

• The home is located in a neighborhood with low-to-moderate income levels, OR[KO5]

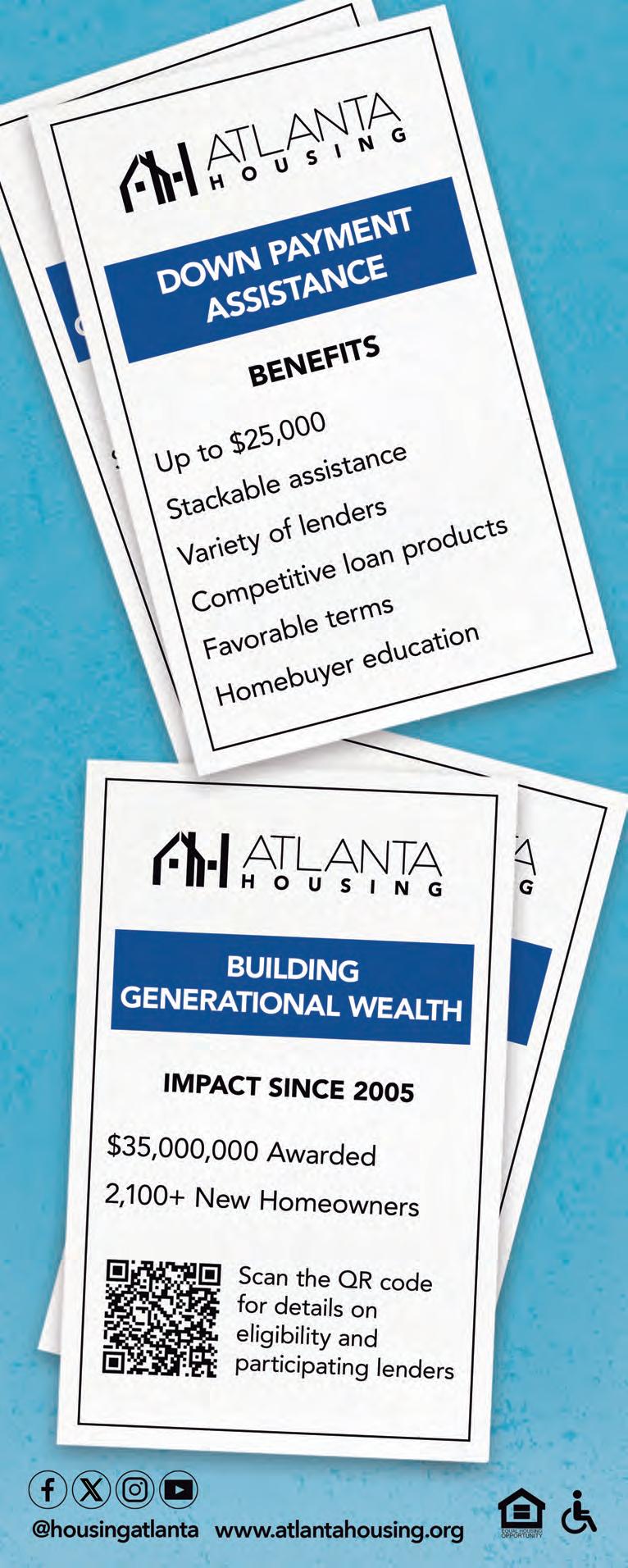

Provided By Atlanta Housing

In Atlanta, today the dream of homeownership feels like it’s slipping further out of reach for many first-time buyers—especially Black residents. Once-affordable neighborhoods have been transformed into high-demand markets. Rent is rising, inventory is low, and home prices continue to climb. For first-time homebuyers, the barriers—limited savings, rising interest rates, and fierce competition—can feel insurmountable.

Atlanta Housing is working to change that. Through our Down Payment Assistance (DPA) program, we have invested more than $35 million since 2005 to help 2,100+ firsttime buyers transition from renting to owning. The goal: to create pathways to generational wealth and housing stability.

The DPA program provides up to $20,000 in assistance—or $25,000 for eligible public service workers, veterans, and voucher participants. It’s designed to help moderate-income buyers overcome one of the biggest hurdles to homeownership: the upfront cost. These funds can be used toward down payments and closing costs, and the assistance is often structured as a forgivable loan, provided the buyer remains in the home for a set period.

One such success story is Brion, a Georgia native who recently purchased her first home with help from the DPA program. Her journey reflects the challenges—and the possibilities—facing young Black professionals in Atlanta today.

Atlanta Housing: Tell us a little about your background and what brought you here?

Brion: I was born and raised in Gwinnett County. Growing up in the suburbs was great, but I wanted more for myself. Going to Georgia State University was the first time I really saw myself in Atlanta and started to envision who I could truly be.

Atlanta Housing: What made you decide to pursue homeownership?

Brion: At 25, I decided I wanted to become a homeowner. I was seeing rent prices go up all around Atlanta, and I knew I needed something more sustainable and affordable. I didn’t want to keep throwing money away—I wanted to invest in myself and my future.

Atlanta Housing: How did you prepare for that step?

Brion: I took the initiative to educate myself. I enrolled in classes to learn about the homebuying process, how to build my credit, and everything else I’d need to be successful. It wasn’t easy, but I knew it was necessary.

Atlanta Housing: How did you find out about our DPA program?

Brion: I first learned about Atlanta Housing’s programs through the classes I was taking. Once I understood what Atlanta Housing offered, I realized it could be the key to making my dream a reality.

Atlanta Housing: What kind of impact did the program have?

Brion: Atlanta Housing made my dreams possible. They gave me the confidence to know that I deserve homeownership and prosperity in Atlanta—just like everyone else. This isn’t a handout. It’s a hand up. It gave me the boost I needed to close the deal. Now, I am looking forward giving back to others in the future.

Atlanta Housing: What does owning a home mean to you now?

Brion: It means stability. It means I have a place that’s mine, where I can grow and build. It’s not just about having a roof over

my head—it’s about building generational wealth and creating a future I can be proud of.

Atlanta Housing: What would you say to others who are in the same position you were in?

Brion: Believe in yourself. Take the steps. Educate yourself, build your credit, and don’t be afraid to ask for help. Programs like Atlanta Housing’s DPA are here for a reason. They’re here to help people like us succeed.

Atlanta Housing: Any final thoughts?

Brion: Just gratitude. I’m forever thankful for the opportunity. Atlanta Housing opened doors for me—literally and figuratively. And now, I’m walking through them with pride.

You Could Be Next

Brion’s story reminds us that with the right support, homeownership is possible—even in a challenging market. Atlanta Housing’s DPA program is a commitment to fairness, access, and the belief that everyone deserves

a chance to build a future in the city they call home.

For many Atlantans, especially those from historically marginalized communities, the DPA program is a bridge to stability and long-term wealth. It’s not just about buying a house—it’s about claiming a stake in the city’s future.

If you’re a first-time buyer wondering whether homeownership is within reach, Brion’s message is clear: you deserve it—and you’re not alone.

See page 18 for more details!

By JPMorganChase

Homeownerships is one of the largest investments consumers will make in their lives –and one of the most exciting.

But, the housing market has experienced a lot of highs and lows over the past few years, and many buyers are sitting on the sidelines wondering if now is the right time for them to buy.

In this Q&A, Chase Community Home Lending Advisor Dameion Normal based in Atlanta takes you through a few questions and considerations to determine where you are in your homebuying journey and your next steps to securing the keys to your new home.

When is the right time to buy?

The market is ever-changing, and there’s a lot you can’t control. So focus on what you can control, which is your financial readiness, because the best time to buy is when you’re financially prepared to. Rates aren’t the only thing impacting housing affordability, and educating yourself on the homebuying process and making informed decisions may help you find additional areas to save.

If buyers are concerned about daily rate fluctuations, consumers might be able to lock in today’s rate while they shop around. For instance, Chase’s Homebuyer Advantage with Lock and Shop program allows borrowers who are eligible to lock in their rate for 90 days while they begin the homebuying process. They also may be eligible for a one time option to lower their rate if rates improve.

How do I know if I am financially ready for homeownership?

Homeownership is a dream for many, but most people don’t know that their dreams may be within reach. Here are some signs you may be ready to take on homeownership:

1. Your financial health is sound . This might look like having a regular, dependable source of income, having a good credit score— lenders typically look for a score of 620 and above—and having a low debt-to-income ratio. This allows lenders to better gauge how much you may be able to afford.

2. You understand the true cost of homeownership: This might look like understanding not only your borrowing

capacity but also the monthly payment. You’re also prepared for the additional costs of buying a home, such as closing costs, property taxes, homeowners association fees, among other costs, as well as ongoing maintenance or repairs. Look for financial tools like the Chase affordability calculator to help determine buying power, based on income, and preferred monthly loan payments.

3. Your personal goals and timelines match up: Think about your upcoming life events and whether it makes sense to own a home, such as retiring, relocating or a growing family.

What else can I do to save on the costs of homeownership?

A big misconception is that you have to put 20% of the total purchase price of the home down, but some loan types offer low down payment options—such as FHA and VA loans. For example, Chase’s DreamMaker Mortgage has flexible credit guidelines and down payments as low as 3%.

Find local assistance programs to help reduce items like closing costs, down payments or interest rates. There are assistance programs at the local, state, and national levels to support homebuyers on their path to homeownership. You can checkout tools like the Homebuyer Assistance Finder that helps you research and find additional assistance programs you may qualify for, such as Chase’s Homebuyer Grant which offers up to $5,000 in qualifying neighborhoods, including eligible neighborhoods in the Atlanta area.

Also, don’t be shy to shop around for your

loan -- make lenders compete for your business. Check in with more than one lender and compare and contrast terms to get the best deal possible.

For more information to prepare you for your homebuying journey, visit chase.com/afford or connect with a local a mortgage professional who can help make recommendations based on your unique financial picture and goals.

For informational/educational purposes only: Views and strategies described in this article or provided via links may not be appropriate for everyone and are not intended as specific advice/recommendation for any business. Information has been obtained from sources believed to be reliable, but JPMorgan Chase & Co. or its affiliates and/or subsidiaries do not warrant its completeness or accuracy. The material is not intended to provide legal, tax, or financial advice or to indicate the availability or suitability of any JPMorgan Chase Bank, N.A. product or service. You should carefully consider your needs and objectives before making any decisions and consult the appropriate professional(s). Outlooks and past performance are not guarantees of future results. JPMorgan Chase & Co. and its affiliates are not responsible for, and do not provide or endorse third party products, services, or other content.

Deposit products provided by JPMorgan Chase Bank, N.A. Member FDIC. Equal Opportunity Lender.

© 2025 JPMorgan Chase & Co.

Provided

By Southern First Bank

Purchasing a home is much more than putting a roof over your head. It is one of the most impactful and wealth-building events in a person’s life and can help you reap personal, financial, and even social benefits. Let’s take a closer look at what homeownership could mean for you and how to take the next step.

When you rent, you are paying your landlord’s mortgage. When you own a home, each mortgage payment builds your own equity and serves as an investment in your future. While rent payments can increase every year, with a fixed-rate mortgage, your

principal and interest payment stay the same year after year. Homeownership also comes with tax advantages, like deductions on mortgage interest and property taxes.

Owning a home gives you greater control over your living situation. It allows you to customize your space to fit your personality and lifestyle with any decorations, renovations, or landscaping you see fit. It also gives you the potential to build generational wealth, as real estate tends to grow in value over time. In the long term, homeownership allows you to pass down property, financial security, and community roots to the next generation.

Typically, homeowners stay in one place longer than renters, which gives them a stronger connection to their area. Homeowners are also more likely to develop relationships with their neighbors, get involved in community activities, and influence the development of their neighborhoods. At Southern First, our mortgage experts are committed to providing you with access to information and loan programs to fit your needs. We offer competitive rates and a variety of products with low down payment options

such as FHA, VA, and USDA loans as well as the Dream Mortgage,* which is serviced by Southern First and offers up to 100% financing with no down payment and no mortgage insurance required.

If you’d like to learn more about taking the next step to your dream home, please don’t hesitate to reach out to our team of experts at 877679-9646 or southernfirst. com/mortgage. We would be honored to help you achieve your homeownership dreams.

*Southern First Bank PO Box 17465 Greenville, SC 29606- 8465 (NMLS #754127).

Member FDIC and Equal Housing Lender. The Dream Mortgage Program is a Special Purpose Credit Program designed to expand access to credit for underserved borrowers (low to moderate income and minorities) or locations, which are subject to change without notification. Applications are subject to underwriting and credit approval; additional terms and conditions may apply. Not all applicants will qualify. Southern First Bank makes no representations or warranty and does not guarantee specific results or outcomes implied, nor any claims, costs, or damages that arise. It is for advertisement and informational purposes only and shall not constitute as legal advice, subject to change without notice.

Take your next step to home sweet home

Choose from no or low down payment options with competitive interest rates and terms

Multiple loan options to choose from including conventional, FHA, VA, and USDA loans

Providing personalized guidance to help you find the right mortgage to fit your budget * *

*Loan originations are subject to underwriting and credit approval. Other terms, conditions and certain fees may apply.

Scan to get started

I’m from Stone Mountain, Georgia— born and raised in the metro Atlanta area. I’ve lived here my whole life, went to school in DeKalb County, graduated from Chamblee High. So, when I say I’m from Atlanta, I mean it. I know the city, the suburbs, the back roads, the traffic. I’ve always loved being close to everything—close to the culture, the people, the energy. But what really makes Atlanta feel like home to me is the nature. The trees, the forests, the green that surrounds you even when you’re stuck in traffic. That’s what grounds me.

As a teacher, I’ve seen how hard it is for people in my profession to live near where they work. I used to live in Cobb County and commute to Gwinnett. I know teachers who live in Henry County but work in DeKalb. The commutes are long, the traffic is brutal, and the cost of living near your school? Nearly impossible. That’s why owning a home close to my job—just 25 minutes away, with or without traffic—has been life-changing.

I started my homebuying journey through the NACA program, which eventually connected me to Atlanta Housing. That’s when everything changed. The market was wild— post-COVID interest rates, unpredictable approvals, and home prices that seemed to

jump by $10,000 overnight. I was looking at fixer-uppers that needed new HVAC systems, roofs, everything. It was overwhelming.

But with Atlanta Housing’s Down Payment Assistance, I didn’t have to settle. I didn’t have to choose between affordability and livability. I was able to buy a home that was move-in ready, a place I could actually see myself in for the next 5 to 10 years. That support made the difference between just getting by and truly thriving.

Renting had always felt like a cycle I couldn’t break. Every month, I was paying $1,500 to $1,600 and getting nothing back. No equity, no stability—just a roof over my head. Now, every payment I make is an investment in my future. My name is on the mortgage. This is my home. And no one can take that away from me.

There’s a confidence that comes with homeownership that I didn’t expect. It’s not just about having a place to live—it’s about knowing that I’m building something. I’m not just spending money to survive; I’m investing in my future, in my community, in my peace of mind. I can walk my dog through the neighborhood and wave to my neighbors. I may not know all their names, but we look out for each other. That’s what community means to

me—trust, connection, and the kind of support that reminds you you’re not alone.

The biggest obstacle I faced when looking for a home was affordability. The difference of $5,000 or $10,000 in a listing price could completely change what I had access to. I’d find a home that was perfect, only to realize it was just out of reach. Sellers weren’t budging on prices, and I was stuck. Atlanta Housing’s support helped close that gap. It helped me move from “almost” to “yes.”

Being able to afford my house through Atlanta Housing’s down payment assistance was life-changing. It gave me the freedom to choose a home I actually wanted—not just one I could barely afford. It gave me peace of mind. It gave me a future.

To anyone out there—especially young people—who think homeownership is out of reach: look into your resources. Yes, the process is tedious. But it’s tedious for a reason. It prepares you to be a better homeowner, to be financially ready, to be a lasting part of your community. Atlanta Housing and NACA worked together to help me find my home. Sometimes they coordinated things without me even needing to step in. That kind of partnership is rare—and powerful. My advice? Don’t stop at one resource. Ask

questions. Ask how else they can help. There are people and programs out there that want to see you succeed. You just have to be willing to do the work and trust the process.

Home is opportunity. Home is security. Home is self-sufficiency. And for me, home is safety.

Chris’s story reminds us that with the right support, homeownership is possible—even in a challenging market. Atlanta Housing’s DPA program is a commitment to fairness, access, and the belief that everyone deserves a chance to build a future in the city they call home.

For many Atlantans, especially those from historically marginalized communities, the DPA program is a bridge to stability and long-term wealth. It’s not just about buying a house—it’s about claiming a stake in the city’s future.

If you’re a first-time buyer wondering whether homeownership is within reach, Chris’s message is clear: you can do this! See page 9 for more details!

By NOAH WASHINGTON

Lauren Ward never expected her first job out of college to become the foundation for a thriving career coaching business. But three years after leaving Meta, the Detroit native has helped more than 300 job seekers land roles at major tech companies through her firm, Lomentum Careers.

Ward, who holds a Bachelor of Business Administration from the University of Michigan Ross School of Business and a master’s degree in Integrated Design, Business, and Technology from USC, started at Facebook in 2019 when she was fresh out of college. Her family’s roots in Detroit trace back to the Great Migration, when they moved north from the South after World War II.

“When I was at university, I was doing senior recruiting, and I only really had one other offer at a consulting firm based in Detroit,” said Ward, 28. “When I saw the opportunity at Meta arise, I couldn’t say no. It was the best offer from the best company that I had available.”

Ward worked in many spaces during her time at Meta, including quality work on Facebook Stories, prepping Facebook Reels to launch in North America, and performing parity development work on Instagram Reels. In starting her career, she noticed that her experience revealed a common misconception about the tech giant.

“The biggest misconception is that everybody assumes because Meta is this multi-billion dollar company that everything runs according to plan, so everything is smooth and efficient,” Ward explained. “It’s actually more like a startup culture with so many products and verticals that each one essentially acts like its own company.”

She noted that this decentralized structure means decisions are made at the product level,

Ward’s insider perspective revealed what she considers the most critical factor for success: strategic alignment with company priorities.

“Having very strong strategic alignment, understanding the company, what they value at the moment, where they’re dedicating resources for upcoming quarters, and being able to speak to that in your interview answers is really helpful,” she said.

She emphasizes that successful candidates must balance granular analysis with big-picture thinking, adapting quickly to changing circumstances that are common in fast-paced tech environments, and particularly product.

internal referrals, which she considers essential given the volume of applications major tech companies receive.

Advice for Non-Traditional Backgrounds Ward encourages candidates from non-traditional tech backgrounds, noting that major companies value diverse perspectives and critical thinking skills developed outside computer science.

“Big tech loves non-traditional backgrounds because they want employees equipped to frame experiences and solve hard problems through not only technology and computer science, but how you think critically,” she said.

with little crossover between departments. It is essentially “a group of mini companies all within a big conglomerate.”

Ward’s transition from Meta employee to entrepreneur began while she was still at the company, serving on interview panels. She recognized a gap in the market for specialized coaching tailored to big tech interviews.

“Given my experience interviewing potential employees, I realized I could offer useful insight to candidates that they may not necessarily get from a recruiter,” she said. “With product management interviews, there’s a very specific way that you have to prepare specific frameworks, outlines, and delivery are what interviewers are looking for.”

Ward moved to Atlanta in August 2022, and started Lomentum Careers six months later. Ward has focused exclusively on product management roles, developing frameworks for product sense questions, questions requiring analytical notating, and leadership assessments.

One of Ward’s most rewarding coaching experiences involved a client who landed a $300,000 offer as a Level 6 product manager at Meta after starting with no interview experience.

“He came in with low self-confidence, and confidence is a big piece in acing these interviews,” Ward recalled. “I started him from scratch, and because we had practiced so much and I prepped him in all the right areas, he was able to land that offer.”

Ward stresses that interview performance directly impacts compensation, making proper preparation crucial for maximizing earning potential.

The career coach has observed significant changes in the hiring process, particularly regarding artificial intelligence. Companies now screen for AI-generated application materials, automatically rejecting candidates who use such tools.

“They have screens for that now and they’ll just toss you out if anything feels like it was AI, or if there’s any invisible watermark that says AI,” Ward warned.

She advises candidates to avoid AI resume generators and instead focus on networking and

Her recommendations include developing side projects in target areas of interest, working with industry professionals for insights, and writing cover letters that clearly explain career pivot motivations.

Despite AI’s growing influence in hiring, Ward believes human expertise remains irreplaceable. She views AI as a tool that enhances rather than replaces human capabilities in both job seeking and recruitment.

“AI is going to be a tool that helps us do our jobs but not necessarily replace them,” she said. “I would take the same approach across the board, even as it relates to hiring and job seeking.” Ward even owns her own AI firm ,Buildhouse.ai, a secondary business venture that connects customers to AI builders who optimize, build, and implement AI solutions for small and medium-sized businesses in Atlanta. Recently the company led a workshop at this year’s Atlanta Tech Week, teaching junior and associate product managers how to apply AI in their daily workflows.

Ward continues to update her knowledge of hiring practices through client feedback, recruiter insights, and industry networks, ensuring her coaching methods remain current with evolving tech industry standards.

By ITORO N. UMONTUEN

The 92% of Black Women that voted for former Vice President Kamala Harris in the 2024 Presidential Election had high hopes heading to election night. Upon hearing the news of the twice-impeached and 34-time convicted felon, Donald J. Trump, winning the election, scores of Black women proclaimed they would reclaim their time. They proclaimed they would prioritize themselves and their overall community. Concurrently, it became clear that most Black women will not cheerfully, happily and/or willingly participate in the battles that were looming on the horizon. Why? The art of saying ‘no’ is a form of self-care.

Twelve days after the election, Georgia State Rep. Dar’shun Kendrick assembled nearly two dozen women at her home to discuss next steps. The gathering included county leaders, concerned members of the community, business leaders, and activists. They discussed how they felt after the election while Kendrick guided the group on how to best advocate for Black women in all levels of government. And with that, Black Women Act was created.

“What next [After This Election]? And, I am sorry but not really—we don’t mean ‘How are Black women going to rise up and save America?’ We tried that. We’re done. We‘re tired,” Kendrick explained on social media. “The question instead is ‘How do we organize and act to support the interests of … Black

women?’ Because apparently, we have to focus on saving ourselves versus other groups that don’t want help.”

The Mission of Black Women Act (BWA) is to advocate strategically for policies affecting Black women through a unified voice, clear public messaging, civic education, and collaboration with aligned organizations. Their vision is as follows:

• To become an active voice in local, state and federal policy decision making;

• To educate members and the public about the rules of policy making;

• To support Black women in policy decision making positions that support our mission;

• To effectively message our mission and vision to the masses be leveraging the media

While the No Kings Protests took place in Atlanta, BWA held a meeting nearby. They discussed ways to add new members and grow the organization. Their top three issues are economic prosperity, infant/maternal mortality, plus voting rights and representation. While the storms have arrived, this group of Black women are poised to take the next steps, together. They are leveraging technologies, resources, while engaging other Black women and the voting public and Gen Z to drive their agenda forward.

“It’s simple for me. I can make moves or I can make excuses, but I can’t do both.” Kendrick said. “And I promise, if you’re committed enough to something, you will find a way.”

By CLAyTON GUTZMORE

The American Black Film Festival (ABFF) partnered with the National Alliance of Mental Illness (NAMI) to host Reel Healing, a discussion on how Mental Health is depicted on film and television. The organizers are aware of the influence these mediums have, and they want to utilize the festival time to discuss normalizing mental wellness within the Black Community. NAMI and ABFF gathered medical professionals and popular stars to share why we need to remove the stigma around mental health. The group aims for attendees to leave with a greater appreciation for their mental well-being and not to underestimate the importance of mental wellness.

“I think the mind is everything. I just want people to understand the power of the mind and don’t casually go about your life thinking that your mind is not as important as it may be perceived to be,” said Da Vinci, star of BMF

The Reel Healing discussion occurred on Saturday, June 14, at the Truist Hall in the New World Center on Miami Beach. ABFF is the largest gathering of Black filmmakers in the industry. Da’Vinchi, Spider-Man Across

the Spider-Verse star Shameik Moore, and NAMI associate medical director Christine M. Crawford sat on a panel in front of ABFF attendees to discuss the topic. NAMI CEO Daniel Gillison Jr. moderated the discussion.

“It’s powerful being here at ABFF, meeting the talent, and talking with them and the audience. It’s a force multiplier that amplifies what needs to occur when we talk about full health and mental health,” said Gillison Jr.

The conversation dove into the mental toll Hollywood takes on actors and actresses. Moore and Da’Vinchi shared how they limit their social media use. Passionate fans frequently contacted them online to share their love and criticism of the actors’ work. Some negative comments have crossed boundaries, and both must remain silent, so they don’t end up on the news and appear to be the bad guys.

“I try to guard my mind and stay rooted in truth while not exposing it too much online. I try to keep myself in a state of learning. One author mentioned in a book that we must train our minds the same way athletes train their bodies for optimal performance. Anything that is not in alignment with that, I try to keep away,” Da’Vinchi said to the crowd.

Gillison Jr. explains how fans often

overlook the actor’s current status. He explains that fans watch the latest projects of actors and actresses but are unaware of how long ago they were made. Most of the time, they are looking for their next role, and possibly, their livelihood depends on it.

“The stress that many of our actors navigate in terms of being able to continue to work, and some can pay their bills and other family members’ bills, and some of them can’t pay their bills. So, the stress is pretty real, “ said Gillison Jr.

The conversation shifted to how Moore and Da’Vinchi accept roles with mental health challenges. Da’Vinchi explains that his life experiences have allowed him to adapt to the roles in his career. He said that roles have spirits in them, and if he feels that a Character’s role is something he doesn’t feel comfortable with spiritually, he will pass on it.

Moore’s explanation of the roles he chooses is tied to his personal connection with the character. He elaborates that he is a method actor who finds himself in the roles. When he received more serious, darker roles, he would listen to dark rap to tap into that version of himself for the character. He believes this is a necessary step and a way to preserve one’s

identity.