By STAFF REPORT

Atlanta, the birthplace of public housing, hosted leaders from across the country June 11-13 for critical discussions on the future of public housing nationwide.

“We are incredibly excited to not only showcase Atlanta but also to continue one of the most important conversations we could have right now – the urgent need for affordable housing,” said Terri Lee, president and CEO of Atlanta Housing.

Members of the Council of Large Public Housing Authorities (CLPHA), representing more than 80 cities from Los Angeles to New York, gathered in Atlanta for the organization’s three-day summer meeting.

CLPHA members own and manage nearly 40% of the nation’s public housing stock and provide vital services to over 1 million low-income households.

The conference began with a guided bus tour of Atlanta Housing’s current and upcoming developments, showcasing one of the most ambitious public housing pipelines in the country.

In 2023, Atlanta Housing committed to creating or preserving 10,000 affordable housing units by the end of 2027.

“I’m proud to report we are two-thirds of the way toward achieving our goal, with more than 6,700 units created or preserved, thanks to our dedicated staff and partners who share the belief that housing is foundational to community growth,” Lee said at the conference’s welcome reception.

Lee, who serves on CLPHA’s board of directors, introduced attendees to Atlanta’s significant public housing history.

“Atlanta’s leadership in housing dates back nearly a century,” Lee said. “In 1936,

Techwood Homes opened as the nation’s first federally funded public housing project, establishing affordable, safe, and dignified living conditions as a public responsibility. That same year, University Homes became the first federally funded public housing community specifically built for Black Americans.”

In 1992, Atlanta revolutionized public housing policy with HOPE VI – a transformative initiative that replaced distressed housing projects with vibrant, mixed-income communities. This program set the national standard, creating pathways for economic mobility and self-sufficiency.

“Today, we remain committed to that legacy, grounded in progress and driven by innovation,” Lee said.

The conference emphasized innovation in public housing through various sessions led by the organization’s executive team. Key topics included:

• Innovative housing designs addressing homelessness.

• Creative funding structures for affordable housing development.

• Housing as a pathway to economic independence.

• The significance of public-private collaboration.

• The positive economic impact of affordable housing.

• Opportunities offered by federally funded Choice Neighborhood Grants.

For Lee, hosting the conference provided Atlanta another chance to influence national conversations about public housing.

“We’re here to advance the dialogue—not just about how public housing affects Atlanta, but how it impacts our nation. Bringing together visionary leaders helps us find solutions and continue setting standards,” Lee said.

SPONSORED

By ASHANI O’MARD

ANDP Senior Vice President for Strategic Housing Investments

According to a recent Gallup survey, 68 percent of non-homeowners cite lack of affordability—particularly the inability to cover the down payment—as the top barrier to homeownership. That number has risen significantly from 45 percent in 2013, reflecting the growing pressure on renters aspiring to buy in today’s housing market. But many potential buyers may not realize that help is available. Across the country and right here in Metro Atlanta, down payment assistance programs offered by local governments, nonprofits, and financial institutions are making a real difference in helping individuals and families bridge the gap to homeownership.

Since 2010, Atlanta Neighborhood Development Partnership (ANDP) and its partners have sold nearly 830 homes to low- and moderate-income households in Metro Atlanta. A key factor in making these homes truly affordable has been the strategic use

Start building equity and stability for your family today.

Nothing changes a family’s future like owning a home. If you’re ready to take that step, ANDP Homes is here to guide the way. Since 2010, we’ve helped more than 825 families become homeowners— building an average of $190,000 in family wealth.

We partner with trusted developers to offer quality renovated and newly built homes—priced affordably for low- and moderate-income buyers. With over 30 homes available now, our average price is $283,000. Many homes also qualify for down payment assistance.

New listings are added regularly, so there’s no better time to start your search. Explore listings on our website. Ready to buy? Have your agent connect with our listing agents and make an offer today!

www.andphomes.org

of down payment assistance. ANDP has leveraged federal, local, and institutional resources—including the Neighborhood Stabilization Program, HUD’s HOME Investment Partnerships Program, and most recently, its membership with the Federal Home Loan Bank of Atlanta—to provide more than $17 million in down payment assistance. These funds have helped aspiring homebuyers overcome the financial barriers to purchasing a home and, just as importantly, stay in those homes long-term. But does down payment assistance really make a difference? The data says yes.

Depending on the program, down payment assistance can be used for more than just meeting the minimum down payment requirement—which is 3.5% for an FHA loan and up to 20% for a conventional mortgage. In many cases, the funds can also help cover closing costs, reduce the principal balance of the loan, and even “buy down” the mortgage interest rate—lowering monthly payments and making the loan more manageable over time. These added benefits significantly ease the financial burden for first-time and lower-income buyers.

At ANDP, more than 70 percent of homebuyers receive some form of down payment assistance, either directly from ANDP or through other available programs. A soon-to-be-released report tracking nearly 800 ANDP homebuyers offers compelling evidence of down payment assistance’s long-term impact. According to the study, 77.5 percent of these buyers are still in their homes after seven years—a strong indicator of stability and sustainability. An additional 21.25 percent have resold their homes after an average of 5.7 years. Among buyers who have owned their homes for five years or more, the average wealth gain through home equity is a remarkable $191,000.

“This data shows us that providing an affordably priced home in combination with down payment assistance creates truly affordable and sustainable homeownership while building wealth for future generations,” said Ashani O’Mard, ANDP Senior Vice President for Strategic Housing Investments. “At present, ANDP homebuyers have generated $104.5 million in homeownership wealth creation.”

ANDP’s consumer sales website— www.ANDPHomes.org—currently lists over 30 homes for sale, with prices ranging from $209,000 to $339,900 and a median sales price of $282,991. In the past

year, ANDP’s average sales price was $289,350, while the average first mortgage was just $251,212. The difference— typically covered by down payment assistance—highlights the program’s role in making these homes attainable for working families.

What are your next steps?

If you’re ready to explore homeownership, start by educating yourself on available resources. Websites like www. DownPaymentResource.com offer a comprehensive listing of local, state, and national down payment assistance and affordable mortgage programs. You should also check with your city or county government. For instance, the City of Atlanta offers two down payment assistance programs—through Invest Atlanta and Atlanta Housing—that can be combined to provide up to $45,000 in support for eligible buyers.

If you’re interested in purchasing an ANDP home, visit www.ANDPHomes. org to explore current listings, check which homes qualify for down payment assistance, and take the first step toward owning a home—and building a more secure financial future.

What better time to get on top of your finances and start planning for your future?

SPONSORED CONTENT

Provided By United Bankshares

It’s June 2025, and we are exactly halfway through the year. As with any midyear wellness check-up, now is also the time to assess your financial health.

The Certified Financial Planner (CFP) Board of Standards’ annual Debt and New Year’s Resolutions Report found that almost half of all Americans (45%) said that saving more money was their top New Year’s resolution for 2025. As we reach the halfway point of the year, now is a great time to look back and track your progress towards your goals. Have you met with a financial advisor to iron out a plan for your money and get serious about saving this year? Have you stayed committed to your goal and set yourself up for success for the latter half of the year? Or did your saving streak end not too long after it started? Regardless of where things currently stand in your financial wellness journey, it’s never too late to get on track with your money. Financial planning is an understandably intimidating undertaking to handle on your own, but it’s for the people who want to make smarter decisions with their money, and working with a financial advisor will definitely help ease the burden. Financial planning allows you to take control of your financial future, avoid common mistakes, and be prepared for life’s uncertainties. With a solid plan, you have a clear roadmap for your money, which helps you make smarter decisions and stay on track to reach your goals.

I’m here to say that anyone can benefit from planning ahead, regardless of age and income, so long as they’re ready and willing to start planning for their future. Here’s what you need to know to set yourself up for financial success for the rest of 2025 and beyond.

What is financial planning?

The traditional definition of financial planning is the process of developing a strategy for your money. It covers things like saving, investing, budgeting, planning for retirement, handling taxes, and estate planning. The goal is to build a solid foundation for financial security and independence.

But if I had to break this down into easy-to-understand terms, financial planning is planning for the future. This could be the near-term or long-term future, and you might have different objectives based on that time frame and the risk tolerance you’re comfortable with.

Financial advisors and planners play an important role in this process. We help you

Robinson, MBA, CRC® Financial Advisor, Vice President United Brokerage Services, Inc.

manage your investments to achieve your financial goals. We assess your entire financial picture, including income, expenses, liquidity needs, and future plans, and provide advice in areas such as saving, investing, and retirement planning. Creating a financial plan is a great first step, but if you really want to make the most of your money, speaking with a professional will really help you go the extra mile.

Why should you begin financial planning?

As a financial advisor, I’ve heard several reasons why people put off financial planning, from believing they don’t make enough money to warrant planning to thinking they’re too young to start now and that they can worry about that later in life. Sometimes it just comes down to their exposure to financial planning. Many people are intimidated by the idea if they aren’t educated enough, so they decide to simply stick with traditional banking services. It’s also possible that their family didn’t plan, so they don’t see the need to plan themselves. But the fact is that financial planning is more crucial now than ever before. It just is not sustainable to live paycheck to paycheck, and traditional savings and retirement funds are not stretching as far as they once did. People are living longer, health care costs are rising, and Social Security may no longer be enough to cover retirement needs.

I’ve seen clients spend years accumulating wealth, just to have it quickly diminish once long-term care costs arise. We account for our financial needs in life such as major purchases,

life moments, bills, and the costs to keep our home running. But not many people intuitively consider what happens when we need additional care later in life or when unexpected financial challenges arise. What it all comes down to is if you want to live comfortably long past retirement – or even reach that savings threshold that allows retirement – it is important to start making strategic money moves sooner rather than later.

What are the key steps to financial planning?

Sit down and write things out. Take time to document your current assets, liabilities, monthly income, and monthly expenses. Then, you’ll know how much money you have left to invest.

Have an emergency fund. Save six months’ worth of living expenses in an easily accessible account to cover any unexpected expenses. Create a budget and begin saving and investing as early as possible. Once you know how much you spend on fixed and necessary expenses and you’ve set money aside in an emergency fund, take 30% of your remaining income and invest it into your 401K and regular brokerage account. Diversify your investments as much as possible to allow maximum opportunities for returns.

Take advantage of employer-sponsored plans. Set up regular monthly contributions to a retirement plan – especially those where employers match contributions and offer tax benefits – and other non-retirement investments such as mutual funds or managed portfolios.

Plan for taxes. Work with an accountant to take advantage of tax-efficient investing, such as traditional IRAs, Roth IRAs, college savings plans, and HSAs. A good tax strategy can save you money in the long run.

Review and adjust your plan. Your life and goals will change, and so should your financial plan. Do regular financial check-ups and make small changes where necessary to keep you on track to reach your goals.

How should you approach planning for the future?

There’s no one-size-fits-all planning strategy. It depends on your age and current needs. If you are in college or a recent grad with student loans, you might want to focus on reducing

your debt balance and putting yourself in a position to buy your first property.

If you’re recently married, you’ll definitely want to start going to financial meetings together to discuss what your long-term goals are. Too often, I see young couples who are not on the same page financially. So, one spends more on things that the other does not agree with, which might cause delays in the couple making financial progress in their life. The older they get, the more long-term planning they should do.

But overall, you should have both short-term and long-term goals. Planning for the next five years is important for immediate goals like paying off debt (or retiring if you’re close to retirement age), while planning for 20-30 years ahead ensures you’re on track for retirement and future financial security (and making sure you won’t outlive your savings).

But if you do nothing else, everyone should create a budget and stick to it. Without a clear understanding of how much money is coming in and where it’s going, it’s hard to achieve long-term financial goals. I firmly believe that if you start with being transparent, you can take control of your finances.

Anyone looking to learn more about financial planning can check out resources like the CFP Board website, financial blogs, or even talking to a financial planner or financial advisor. There are many tools and guides available online to get you started. We have a lot of great resources on BankWithUnited.com, from helpful articles and calculators to tips for investing and economic snapshots. You can also fill out a form there to be connected with a financial advisor who can best help you with your planning needs.

Ebony Robinson is a financial advisor at United Brokerage Services, Inc., a premier full-service brokerage and investment advisory firm and a wholly owned subsidiary of United Bankshares, Inc. Based in Atlanta, Georgia, Ebony covers the Atlanta metro region. She has a Master of Business Administration and has worked in financial services since 2004. She holds the following licenses: Series 6, Series 7, Series 63, and Life & Health Insurance.

SPONSORED CONTENT

Provided by SouthState Bank

Buying a home is one of the biggest financial decisions most people will ever make – and for many, it can also be one of the most intimidating. Between rising home prices, fluctuating interest rates, and upfront costs like down payments and closing fees, it’s easy to feel overwhelmed before you even start the process. But what if there was a way to make that path a little smoother?

At SouthState Bank, we believe homeownership should feel possible, not impossible. That’s why we created

the Buyer’s Advantage program.

Whether you’re a first-time buyer or just need a little extra support to make you[KO1] r next move, this exclusive program is designed to help reduce barriers, ease the financial strain, and make it easier to step into the home that’s right for you.

In this article, we’ll walk you through what Buyer’s Advantage is, who it’s for, and how it could be the game-changing tool you need to make homeownership a reality.

The Buyer’s Advantage Program is a SouthState-exclusive[KO2] mortgage solution designed to help more people become homeowners, especially those who might need extra support navigating the homebuying process. With this program, eligible buyers can access flexible financing options and reduce [KO3] upfront costs that make purchasing a home more attainable.

Unlike traditional loan programs, Buyer’s Advantage offers expanded guidelines and tailored benefits to meet buyers where they are. Whether you’re working with a smaller down payment,

navigating credit challenges, or just looking for a smoother path to homeownership, this program is built to remove some of the common roadblocks.

Backed by SouthState’s local expertise and relationship-driven approach, Buyer’s Advantage isn’t just a loan, it’s a strategic tool to help you buy with more confidence and less stress.

The Buyer’s Advantage program is more than just a mortgage: it’s a way to make homeownership more accessible and affordable. Here are some of the standout benefits that set it apart:

• Many buyers struggle to save for a large down payment. Buyer’s Advantage offers more flexible down payment requirements, helping you get into a home sooner without drawing from your savings. In fact, you could qualify for a down payment as low as 0% down. The Buyer’s Advantage mortgage provides up to 100% financing based on the purchase price or a bank-accepted appraisal, whichever is lower. Plus, Private Mortgage Insurance

(PMI) isn’t required for a Buyer’s Advantage mortgage, which is typically required when a down payment less than 20% is made.

• Not everyone has a perfect credit score, and that shouldn’t stand in the way of owning a home. This program offers more lenient credit requirements, giving buyers with a minimum 640 credit score a real opportunity to qualify.

• Because this mortgage program is offered directly through SouthState, you get the added benefit of working with a local, experienced Mortgage Banker who understands your [KO4]community and is with you every step of the way.

One of the best parts about the Buyer’s Advantage program is that it’s designed to open more doors to homeownership. To qualify, you’ll need to meet just one of the following criteria:

• The area has at least a 50% minority population, OR[KO6]

• Your income is at or below 80% of the area’s average income level. Not sure where your income or property stands? Don’t worry, your SouthState Mortgage Banker can help check the details for you using census data tools. The goal is to make qualifying straightforward and transparent, so you can focus on finding the right home, not stressing over fine print.

If you think Buyer’s Advantage might be a good fit for you, or even if you’re just curious about what you might qualify for, the next step is easy. Connect with a local SouthState Mortgage Banker who can walk you through the program, check your eligibility, and explain how it fits into your bigger homebuying goals. Want to learn more? Start your journey today by visiting SouthStateBank. com/AtlantaVoice.

• The home is located in a neighborhood with low-to-moderate income levels, OR[KO5]

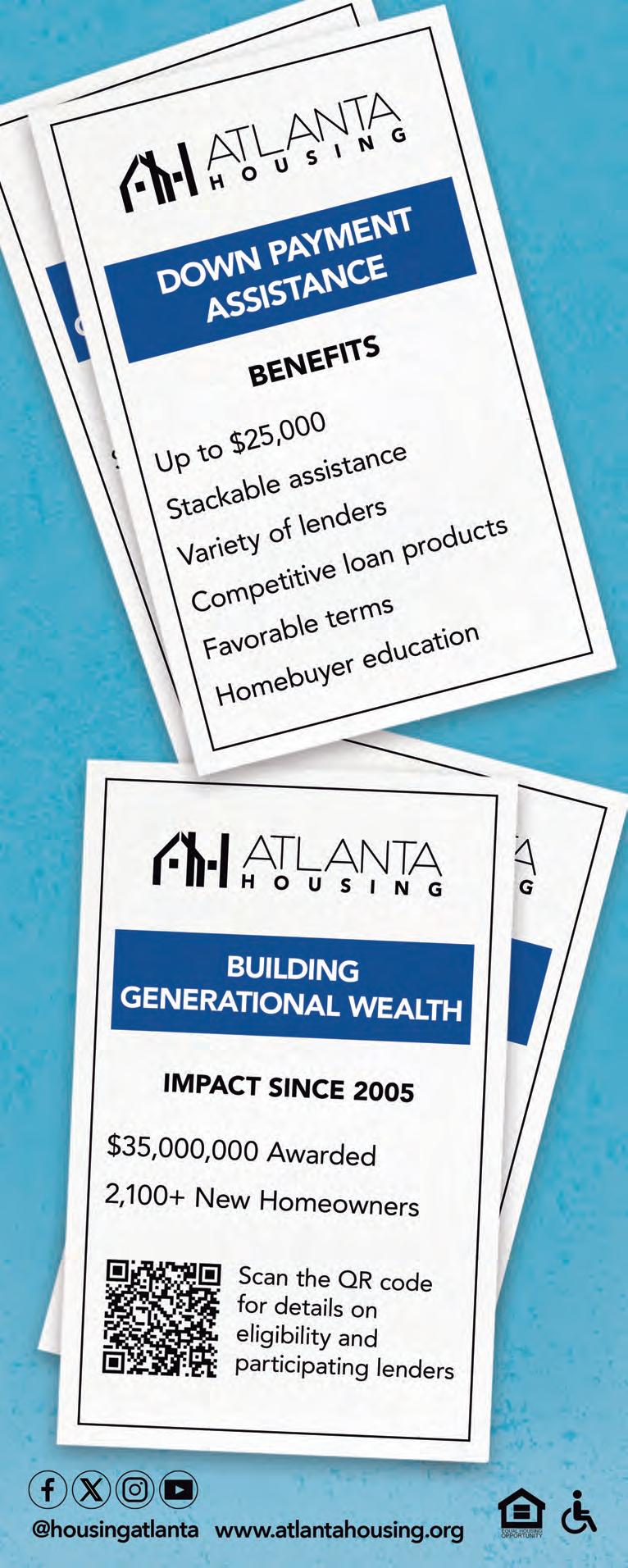

Provided By Atlanta Housing

In Atlanta, today the dream of homeownership feels like it’s slipping further out of reach for many first-time buyers—especially Black residents. Once-affordable neighborhoods have been transformed into high-demand markets. Rent is rising, inventory is low, and home prices continue to climb. For first-time homebuyers, the barriers—limited savings, rising interest rates, and fierce competition—can feel insurmountable.

Atlanta Housing is working to change that. Through our Down Payment Assistance (DPA) program, we have invested more than $35 million since 2005 to help 2,100+ firsttime buyers transition from renting to owning. The goal: to create pathways to generational wealth and housing stability.

The DPA program provides up to $20,000 in assistance—or $25,000 for eligible public service workers, veterans, and voucher participants. It’s designed to help moderate-income buyers overcome one of the biggest hurdles to homeownership: the upfront cost. These funds can be used toward down payments and closing costs, and the assistance is often structured as a forgivable loan, provided the buyer remains in the home for a set period.

One such success story is Brion, a Georgia native who recently purchased her first home with help from the DPA program. Her journey reflects the challenges—and the possibilities—facing young Black professionals in Atlanta today.

Atlanta Housing: Tell us a little about your background and what brought you here?

Brion: I was born and raised in Gwinnett County. Growing up in the suburbs was great, but I wanted more for myself. Going to Georgia State University was the first time I really saw myself in Atlanta and started to envision who I could truly be.

Atlanta Housing: What made you decide to pursue homeownership?

Brion: At 25, I decided I wanted to become a homeowner. I was seeing rent prices go up all around Atlanta, and I knew I needed something more sustainable and affordable. I didn’t want to keep throwing money away—I wanted to invest in myself and my future.

Atlanta Housing: How did you prepare for that step?

Brion: I took the initiative to educate myself. I enrolled in classes to learn about the homebuying process, how to build my credit, and everything else I’d need to be successful. It wasn’t easy, but I knew it was necessary.

Atlanta Housing: How did you find out about our DPA program?

Brion: I first learned about Atlanta Housing’s programs through the classes I was taking. Once I understood what Atlanta Housing offered, I realized it could be the key to making my dream a reality.

Atlanta Housing: What kind of impact did the program have?

Brion: Atlanta Housing made my dreams possible. They gave me the confidence to know that I deserve homeownership and prosperity in Atlanta—just like everyone else. This isn’t a handout. It’s a hand up. It gave me the boost I needed to close the deal. Now, I am looking forward giving back to others in the future.

Atlanta Housing: What does owning a home mean to you now?

Brion: It means stability. It means I have a place that’s mine, where I can grow and build. It’s not just about having a roof over

my head—it’s about building generational wealth and creating a future I can be proud of.

Atlanta Housing: What would you say to others who are in the same position you were in?

Brion: Believe in yourself. Take the steps. Educate yourself, build your credit, and don’t be afraid to ask for help. Programs like Atlanta Housing’s DPA are here for a reason. They’re here to help people like us succeed.

Atlanta Housing: Any final thoughts?

Brion: Just gratitude. I’m forever thankful for the opportunity. Atlanta Housing opened doors for me—literally and figuratively. And now, I’m walking through them with pride.

You Could Be Next

Brion’s story reminds us that with the right support, homeownership is possible—even in a challenging market. Atlanta Housing’s DPA program is a commitment to fairness, access, and the belief that everyone deserves

a chance to build a future in the city they call home.

For many Atlantans, especially those from historically marginalized communities, the DPA program is a bridge to stability and long-term wealth. It’s not just about buying a house—it’s about claiming a stake in the city’s future.

If you’re a first-time buyer wondering whether homeownership is within reach, Brion’s message is clear: you deserve it—and you’re not alone.

See page 18 for more details!

By JPMorganChase

Homeownerships is one of the largest investments consumers will make in their lives –and one of the most exciting.

But, the housing market has experienced a lot of highs and lows over the past few years, and many buyers are sitting on the sidelines wondering if now is the right time for them to buy.

In this Q&A, Chase Community Home Lending Advisor Dameion Normal based in Atlanta takes you through a few questions and considerations to determine where you are in your homebuying journey and your next steps to securing the keys to your new home.

When is the right time to buy?

The market is ever-changing, and there’s a lot you can’t control. So focus on what you can control, which is your financial readiness, because the best time to buy is when you’re financially prepared to. Rates aren’t the only thing impacting housing affordability, and educating yourself on the homebuying process and making informed decisions may help you find additional areas to save.

If buyers are concerned about daily rate fluctuations, consumers might be able to lock in today’s rate while they shop around. For instance, Chase’s Homebuyer Advantage with Lock and Shop program allows borrowers who are eligible to lock in their rate for 90 days while they begin the homebuying process. They also may be eligible for a one time option to lower their rate if rates improve.

How do I know if I am financially ready for homeownership?

Homeownership is a dream for many, but most people don’t know that their dreams may be within reach. Here are some signs you may be ready to take on homeownership:

1. Your financial health is sound . This might look like having a regular, dependable source of income, having a good credit score— lenders typically look for a score of 620 and above—and having a low debt-to-income ratio. This allows lenders to better gauge how much you may be able to afford.

2. You understand the true cost of homeownership: This might look like understanding not only your borrowing

capacity but also the monthly payment. You’re also prepared for the additional costs of buying a home, such as closing costs, property taxes, homeowners association fees, among other costs, as well as ongoing maintenance or repairs. Look for financial tools like the Chase affordability calculator to help determine buying power, based on income, and preferred monthly loan payments.

3. Your personal goals and timelines match up: Think about your upcoming life events and whether it makes sense to own a home, such as retiring, relocating or a growing family.

What else can I do to save on the costs of homeownership?

A big misconception is that you have to put 20% of the total purchase price of the home down, but some loan types offer low down payment options—such as FHA and VA loans. For example, Chase’s DreamMaker Mortgage has flexible credit guidelines and down payments as low as 3%.

Find local assistance programs to help reduce items like closing costs, down payments or interest rates. There are assistance programs at the local, state, and national levels to support homebuyers on their path to homeownership. You can checkout tools like the Homebuyer Assistance Finder that helps you research and find additional assistance programs you may qualify for, such as Chase’s Homebuyer Grant which offers up to $5,000 in qualifying neighborhoods, including eligible neighborhoods in the Atlanta area.

Also, don’t be shy to shop around for your

loan -- make lenders compete for your business. Check in with more than one lender and compare and contrast terms to get the best deal possible.

For more information to prepare you for your homebuying journey, visit chase.com/afford or connect with a local a mortgage professional who can help make recommendations based on your unique financial picture and goals.

For informational/educational purposes only: Views and strategies described in this article or provided via links may not be appropriate for everyone and are not intended as specific advice/recommendation for any business. Information has been obtained from sources believed to be reliable, but JPMorgan Chase & Co. or its affiliates and/or subsidiaries do not warrant its completeness or accuracy. The material is not intended to provide legal, tax, or financial advice or to indicate the availability or suitability of any JPMorgan Chase Bank, N.A. product or service. You should carefully consider your needs and objectives before making any decisions and consult the appropriate professional(s). Outlooks and past performance are not guarantees of future results. JPMorgan Chase & Co. and its affiliates are not responsible for, and do not provide or endorse third party products, services, or other content.

Deposit products provided by JPMorgan Chase Bank, N.A. Member FDIC. Equal Opportunity Lender.

© 2025 JPMorgan Chase & Co.

Provided

By Southern First Bank

Purchasing a home is much more than putting a roof over your head. It is one of the most impactful and wealth-building events in a person’s life and can help you reap personal, financial, and even social benefits. Let’s take a closer look at what homeownership could mean for you and how to take the next step.

When you rent, you are paying your landlord’s mortgage. When you own a home, each mortgage payment builds your own equity and serves as an investment in your future. While rent payments can increase every year, with a fixed-rate mortgage, your

principal and interest payment stay the same year after year. Homeownership also comes with tax advantages, like deductions on mortgage interest and property taxes.

Owning a home gives you greater control over your living situation. It allows you to customize your space to fit your personality and lifestyle with any decorations, renovations, or landscaping you see fit. It also gives you the potential to build generational wealth, as real estate tends to grow in value over time. In the long term, homeownership allows you to pass down property, financial security, and community roots to the next generation.

Typically, homeowners stay in one place longer than renters, which gives them a stronger connection to their area. Homeowners are also more likely to develop relationships with their neighbors, get involved in community activities, and influence the development of their neighborhoods. At Southern First, our mortgage experts are committed to providing you with access to information and loan programs to fit your needs. We offer competitive rates and a variety of products with low down payment options

such as FHA, VA, and USDA loans as well as the Dream Mortgage,* which is serviced by Southern First and offers up to 100% financing with no down payment and no mortgage insurance required.

If you’d like to learn more about taking the next step to your dream home, please don’t hesitate to reach out to our team of experts at 877679-9646 or southernfirst. com/mortgage. We would be honored to help you achieve your homeownership dreams.

*Southern First Bank PO Box 17465 Greenville, SC 29606- 8465 (NMLS #754127).

Member FDIC and Equal Housing Lender. The Dream Mortgage Program is a Special Purpose Credit Program designed to expand access to credit for underserved borrowers (low to moderate income and minorities) or locations, which are subject to change without notification. Applications are subject to underwriting and credit approval; additional terms and conditions may apply. Not all applicants will qualify. Southern First Bank makes no representations or warranty and does not guarantee specific results or outcomes implied, nor any claims, costs, or damages that arise. It is for advertisement and informational purposes only and shall not constitute as legal advice, subject to change without notice.

Take your next step to home sweet home

Choose from no or low down payment options with competitive interest rates and terms

Multiple loan options to choose from including conventional, FHA, VA, and USDA loans

Providing personalized guidance to help you find the right mortgage to fit your budget * *

*Loan originations are subject to underwriting and credit approval. Other terms, conditions and certain fees may apply.

Scan to get started

I’m from Stone Mountain, Georgia— born and raised in the metro Atlanta area. I’ve lived here my whole life, went to school in DeKalb County, graduated from Chamblee High. So, when I say I’m from Atlanta, I mean it. I know the city, the suburbs, the back roads, the traffic. I’ve always loved being close to everything—close to the culture, the people, the energy. But what really makes Atlanta feel like home to me is the nature. The trees, the forests, the green that surrounds you even when you’re stuck in traffic. That’s what grounds me.

As a teacher, I’ve seen how hard it is for people in my profession to live near where they work. I used to live in Cobb County and commute to Gwinnett. I know teachers who live in Henry County but work in DeKalb. The commutes are long, the traffic is brutal, and the cost of living near your school? Nearly impossible. That’s why owning a home close to my job—just 25 minutes away, with or without traffic—has been life-changing.

I started my homebuying journey through the NACA program, which eventually connected me to Atlanta Housing. That’s when everything changed. The market was wild— post-COVID interest rates, unpredictable approvals, and home prices that seemed to

jump by $10,000 overnight. I was looking at fixer-uppers that needed new HVAC systems, roofs, everything. It was overwhelming.

But with Atlanta Housing’s Down Payment Assistance, I didn’t have to settle. I didn’t have to choose between affordability and livability. I was able to buy a home that was move-in ready, a place I could actually see myself in for the next 5 to 10 years. That support made the difference between just getting by and truly thriving.

Renting had always felt like a cycle I couldn’t break. Every month, I was paying $1,500 to $1,600 and getting nothing back. No equity, no stability—just a roof over my head. Now, every payment I make is an investment in my future. My name is on the mortgage. This is my home. And no one can take that away from me.

There’s a confidence that comes with homeownership that I didn’t expect. It’s not just about having a place to live—it’s about knowing that I’m building something. I’m not just spending money to survive; I’m investing in my future, in my community, in my peace of mind. I can walk my dog through the neighborhood and wave to my neighbors. I may not know all their names, but we look out for each other. That’s what community means to

me—trust, connection, and the kind of support that reminds you you’re not alone.

The biggest obstacle I faced when looking for a home was affordability. The difference of $5,000 or $10,000 in a listing price could completely change what I had access to. I’d find a home that was perfect, only to realize it was just out of reach. Sellers weren’t budging on prices, and I was stuck. Atlanta Housing’s support helped close that gap. It helped me move from “almost” to “yes.”

Being able to afford my house through Atlanta Housing’s down payment assistance was life-changing. It gave me the freedom to choose a home I actually wanted—not just one I could barely afford. It gave me peace of mind. It gave me a future.

To anyone out there—especially young people—who think homeownership is out of reach: look into your resources. Yes, the process is tedious. But it’s tedious for a reason. It prepares you to be a better homeowner, to be financially ready, to be a lasting part of your community. Atlanta Housing and NACA worked together to help me find my home. Sometimes they coordinated things without me even needing to step in. That kind of partnership is rare—and powerful. My advice? Don’t stop at one resource. Ask

questions. Ask how else they can help. There are people and programs out there that want to see you succeed. You just have to be willing to do the work and trust the process.

Home is opportunity. Home is security. Home is self-sufficiency. And for me, home is safety.

Chris’s story reminds us that with the right support, homeownership is possible—even in a challenging market. Atlanta Housing’s DPA program is a commitment to fairness, access, and the belief that everyone deserves a chance to build a future in the city they call home.

For many Atlantans, especially those from historically marginalized communities, the DPA program is a bridge to stability and long-term wealth. It’s not just about buying a house—it’s about claiming a stake in the city’s future.

If you’re a first-time buyer wondering whether homeownership is within reach, Chris’s message is clear: you can do this! See page 9 for more details!