THE EXPONENTIALLY SMARTER, FASTER, BETTER WAY TO TRANSACT CRE

December 18, 2022

The local mall is changing fast, along with consumer habits that were jolted in the pandemic, as traditional stores make room for nontraditional uses including apartments, warehouse clubs and self-storage spaces.

Adding different types of retail tenants to shopping venues is one way mall owners are trying to drive foot traffic as e-commerce grabs a bigger share of sales. And landlords are seeing more of their tenants try out new concepts to cut costs and drive revenue, such as smaller stores and socalled stores-in-stores, where a specialty retailer opens an outpost in a traditional department store chain.

Industry executives laid out the way the mall is changing in interviews with CoStar News and at panels at this month’s ICSC New York conference at the Javits Center in Manhattan. One area of discussion included one of

the most visible changes after the pandemic-induced retail slowdown: mall landlords either resuming plans to redevelop their properties or announcing plans to do so.

The reimagining of these sites invariably includes the addition of multifamily housing and, in some cases, office and restaurant space. There’s a housing shortage in some parts of the nation, such as New Jersey, and more apartments help fill that void. “Retail follows rooftops,” and malls are adding “rooftops” to provide more customers for their centers, Kristin Mueller, JLL’s president of retail property management, told CoStar News.

There numerous examples of malls being transformed into mixed-use complexes. Earlier this year, global mall landlord Unibail-Rodamco-Westfield announced it had nailed down a partner to work on a massive reimagining of its flagship

Westfield Garden State Plaza in Paramus, New Jersey. That update will include the addition of hundreds of luxury apartment units.

And Unibail has similar plans in Chicago’s suburbs at the Westfield Old Orchard mall in Skokie, Illinois. It will be demolishing a former Bloomingdale’s site and replacing it with multifamily housing.

Traditionally, malls owners would put together somewhat cookie-cutter tenant rosters that included dozens of national chains, with large department stores as their

anchors and a horde of specialty apparel, accessory and footwear sellers occupying the rest of the space. That approach doesn’t cut it anymore in 2022 going into 2023, executives say.

Now, informed by data about their area’s consumers, landlords are being more thoughtful about their tenant mixes, carefully curating them, looking for stores that will prompt frequent visits and will cater to local tastes and preferences, Barrie Scardina, Northeast regional president and head of retail services in the Americas for Cushman & Wakefield, told CoStar News. That could mean executing leases with a boutique fitness chain, such as Orangetheory, a real estate category that’s been booming.

And so-called medtail, which refers to doctor’s offices for people or animals in a retail setting, is opening at shopping centers. In fact, veterinary hospitals, and even vet urgent care centers, are increasingly popping up at retail centers as pet ownership soars. IV drip centers are also debuting at shopping centers nationally. It’s all a balancing act for owners of those properties when it comes to choosing tenants.

Mall landlords are now even welcoming grocery stores and warehouse clubs. Those tenants generate frequent foot traffic, unlike an apparel store, as people often shop

for food every week. A BJ’s Wholesale Club just opened at the Willowbrook Mall in Wayne, New Jersey, and the Stew Leonard’s grocery chain has a flagship at Paramus Park mall in Paramus, New Jersey. They are both in spaces once occupied by Sears.

“A decade ago, I wouldn’t have considered there would come a day when so many of our deals are food-related,” Mike Conway, vice president of national accounts and retail partnerships at retail landlord Phillips Edison & Co., said in a statement. “The name of the game going into 2023 is really about four key categories — grocery, service, restaurant and health/fitness.”

of-the-art life science space, a commercial real estate sector that has seen strong demand in that tech cluster.

“We’re putting more variety in the anchors,” Mueller said.

During a presentation at ICSC’s conference, one speaker raised a provocative question: Is the idea of a traditional mall anchor tenant obsolete?

“Anchors aweigh or anchors away?” Nina Kampler, president of Retail Advisory Group, asked show attendees. She questioned whether malls even need a so-called retail anchors anymore.

The demise of department store chains such as Sears and Lord & Taylor has prompted mall owners to take another look at what retailers they want as anchors. In some cases, former anchor space isn’t being filled by retailers at all but is being transformed for new uses. Apartments are being built in former anchor locations sometimes, or office or research and development facilities are being be created there instead. For example, HBC, owner of the Hudson’s Bay and Saks Fifth Avenue retail chains, is turning three former Lord & Taylor stores in the Boston area into state-

“If the traditional department store anchor is not the anchor, who is the anchor and do we need an anchor?” Kampler said. “And is Apple, with perhaps the most productive per-square-footage in any center ... where you have no outside egress and you have to walk through the mall to get to that door ... is that not our new anchor?”

Her point was supported by recent events at American Dream, the megamall in East Rutherford, New Jersey. An Apple store bowed at that property in early December, and hundreds of people lined up to get a first look at the new store. A video shows Apple employees giving high-fives to shoppers and cheering as they came in.

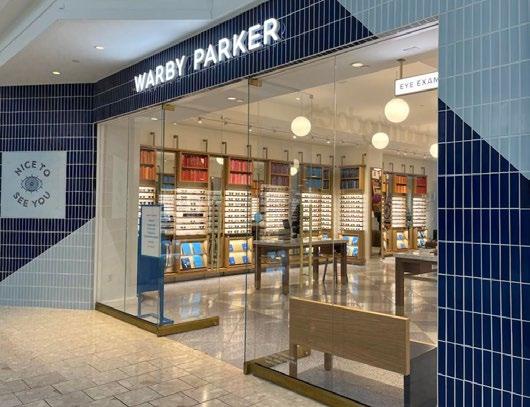

Somewhat ironically, digitally native retailers, those that began as solely online businesses, have evolved into a booming tenant category for malls. Firms such as e-commerce juggernaut Amazon, Warby Parker, UNTUCKit, Allbirds and singer-entrepreneur Rihanna’s lingerie company, Savage X Fenty, have opened brick-and-mortar locations in malls where they are often in the company of traditional tenants such as Macy’s.

Online retailers have found that having what amounts to a billboard at a mall, an actual store, is a smart way to develop a relationship with consumers and drive sales.

Simon Property Group, the nation's largest mall owner, has acknowledged how important digital companies are as potential tenants. Simon recently struck a deal to allow businesses being shepherded by Leap, a startup that helps online brands launch physical spaces, to open locations at some of its mall properties.

"It is our hope that by working together we will continue to both incubate brands through the Leap platform as well as help them expand throughout our portfolio where they can reach hundreds of millions of their target consumers annually," Zachary Beloff, Simon's vice president of leasing, said in a statement when the deal was announced in November.

A wide variety of retailers are opening up smaller-format stores, and each day a new company seems to be added to that list. For some of them, the forays are an attempt to have a brick-and-mortar presence outside of large malls and get closer to customers efficiently and economically. The small stores allow a retailer to put a stake in an area where large square footage may not be available, such as urban downtown business districts, and without having to fork over rent for a large location.

"There's this idea of empowered physical retail that I think we're seeing," Ethan Chernofsky, vice president of marketing at traffic analytics firm Placer.ai, said during an ICSC panel. "It's more brands recognizing that there's more value than just the products they sell. It's the eyeballs you gain. It's the ability to try something on. The CEO of Allbirds said [there's] 150% larger basket [purchase] size online when someone visits a store first. And that's a crazy statistic."

Macy's has gone small with two of its chains, its flagship brand and Bloomingdale's. The company is continuing to roll out off-mall Market By Macy's stores, in at least one case closing one of its mall anchors and replacing it with the new small-format option at another site. And Macy's this year debuted several Bloomie's, the smaller-format version of its luxury chain.

The roster of retailers launching or piloting smaller-format stores also includes Target, BJ's Wholesale Club, Ulta Beauty, Burlington Stores, Nordstrom, Rite Aid and Kohl's.

Nowadays visitors to malls and shopping centers are sometimes essentially getting two retailers at once when they enter a store: It’s the increasingly popular store-instore concept. Usually a larger chain allows a smaller specialty retailer to have branded area, a little shop, that sells its merchandise within the host’s stores.

Macy’s has really pushed into this strategy aggressively. Claire’s, a chain that sells fashion accessories to tweens and teens, recently announced it was opening outposts at about 20 Macy’s flagships. And Macy’s has revitalized Toy R Us by opening store-in-store sites for the toy seller across its department store footprint.

“There’s a lot more optionality to a retailer in the way they want to reach customers, and a lot more channels for them to do so,” Chernofsky said during an ICSC panel where store-in-store initiatives were discussed.

Kohl’s executives say their Sephora outposts are attracting new customers. (Kohl’s)

Macy’s isn’t the only one involved in these partnerships with other retailers.

Struggling Kohl's has reported great success with the Sephora beauty shops that have opened in its department stores. The Sephora outposts are bringing new and younger customers to Kohl's, and they often stop to buy items other than makeup before they leave, according to company officials. Retailers such as Sephora benefit from the arrangement because they are able to expand their physical footprint and reach more shoppers without the expense and trouble of leasing their own additional stores.

Another beauty brand, Ulta Beauty, has rolled out store-instore locations at Target locations.

At Ten-X, we’re empowering the commercial real estate industry to close deals exponentially faster, exponentially better, and with exponentially more certainty.

As part of CoStar Group, we bring together the most expansive pool of investors, unmatched asset intelligence, advanced technology, and the only end-to-end online platform to create an online exchange where brokers, sellers/owners and investors can buy and sell properties in the most efficient and effective way.

Ten-X + LoopNet + CoStar is altogether better business.

The world’s largest online commercial real estate exchange.

LEARN MORE

www.10x.com/M022774-D

Andrew Genova Donohoe (202) 625-8415 andrewg@donohoe.com Lic# DC SP98369980

Matt Weber Donohoe (202) 631-6454 mattwe@donohoe.com Lic# DC SP98378678

LEARN MORE www.10x.com/M022717-D

Nadeem Khan

Sage Street Realty (214) 680-3910 mr.khan@nadeemkhanrealtor.com Lic# TX 0734354

Renae Anderson

Sage Street Realty (469) 497-9196 renae@sagestreetrealty.com Lic# TX 628681

Russ Bono, CCIM

CBRE, Inc.

(616) 799-6629 russ.bono@cbre.com Lic# MI 6501380200

Cameron Timmer

CBRE (616) 485-4131 cameron.timmer@cbre.com Lic# MI 6501378618

Philip Gagnon

Colliers (860) 616-4016

philip.gagnon@colliers.com Lic# CT RES0754831

Scott de Lemos

Coliers (714) 251-2103 scott.delemos@colliers.com Lic# CT REB0792272

Jacklene Chesler Colliers

(973) 299-3083 jacklene.chesler@colliers.com Lic# NJ 9587537

Patrick Norris Colliers (973) 299-3010 patrick.norris@colliers.com Lic# NJ 1646766

Susan Hunt Krygiell

Masterpiece Properties (702) 768-1926 skrygiell@gmail.com Lic# NV B0001925

James Waddy

Ten-X (949) 818-6219 jwaddy@ten-x.com

Harry Chaskalson

N.E.G. Property Services, Inc. (954) 270-6012 harry@negproperty.com Lic# FL SL3261257

Cheri Mascitelli

Ten-X (305) 537-9318 cmascitelli@ten-x.com

LEARN MORE www.10x.com/M022870-D

Al Mirin Cushman & Wakefield (203) 326-5822 al.mirin@cushwake.com Lic# CT REB0793659

Kevin Grace Ten-X (305) 503-2645 kgrace@ten-x.com

LEARN MORE www.10x.com/M022952-D

Alan Cafiero Marcus & Millichap (201) 742-6118 alan.cafiero@marcusmillichap.com Lic# NJ 0791092

John Moroz Investment Associate (201) 742-6131 john.moroz@marcusmillichap.com

Osler Woltz

Atlantic Retail (980) 498-3297 owoltz@atlanticretail.com Lic# NC 297704

Casey Fashouer

Ten-X (619) 330-5124 cfashouer@ten-x.com

Mike Siegel

Corporate Realty (504) 581-5005 msiegel@corp-realty.com Lic# MS 14858

Derek Rudd

Ten-X (949) 398-2589 drudd@ten-x.com

BID ONLINE

Jan 30-Feb 2

Alex Housewright

STARTING

Shop Companies (214) 501-5117 ahousewright@shopcompanies.com Lic# TX 713625

Tommy Tucker

Shop Companies (214) 960-2887 ttucker@shopcompanies.com Lic# TX 543816

BID ONLINE

Jan 24-26

John Martin

Moses Tucker Partners (501) 376-6555

jmartin@mosestucker.com Lic# AR EB00054781

Fletcher Hanson

Moses Tucker Partners (501) 376-6555

fhanson@mosestucker.com Lic# AR PB00042821

325 South Stemmons Fwy Lewisville, TX

LEARN MORE

www.10x.com/M022879-D

Deborah Meehan

TradeMark Properties (919) 333-3914

dhmeehan@trademarkproperties.com Lic# NC 248010

Winston Rathbun

TradeMark Properties (919) 696-0092

wrathbun@trademarkproperties.com Lic# NC 333375

LEARN MORE www.10x.com/M022878-D

Matt Lyman Norris & Stevens, Inc. (503) 507-4880 mattl@norris-stevens.com Lic# OR 200807129

James Waddy Ten-X (949) 818-6219 jwaddy@ten-x.com

BID ONLINE

Jan 23-25

Connie Howard

US Properties (860) 437-0101 chowardusp@gmail.com Lic# CT RES0798067

STARTING

Corey Talley Ten-X (804) 750-5997 ctalley@ten-x.com

BID ONLINE

Jan 24-26

Craig Shames, ESQ

Conway Commercial (508) 982-2333 cshames@jackconway.com Lic# MA 149687

Amanda West Ten-X (804) 750-5875 awest@ten-x.com

101 Water St Norwich, CT

253-257 Roxbury St Boston, MA

2020 W Northwest Hwy

Grapevine, TX

BID ONLINE

Jan 30-Feb 2

STARTING BID $350,000 SIZE 7,649 SF

LEARN MORE www.10x.com/M022936-D

Trina Zais | Champions DFW Commercial Realty (817) 488-4333 | trina@championsdfw.com Lic# TX 748484

Derek Rudd | Ten-X (949) 398-2589 | drudd@ten-x.com

4020 Raintree Rd Chesapeake, VA

BID ONLINE Jan 23-25

STARTING BID $300,000 SIZE 11,258 SF

LEARN MORE www.10x.com/M022868-D

Alex Jacob | ProActive Real Estate Services (703) 907-9562 | alexjacob21@gmail.com Lic# VA 0225242617

Kevin Grace | Ten-X (305) 503-2645 | kgrace@ten-x.com

2000 Beaumont Rd Baytown, TX

BID ONLINE Jan 23-25

STARTING BID $250,000 SIZE 22,076 SF

LEARN MORE www.10x.com/M022895-D

Mart Martindale | EDGE Realty Capital Markets (214) 545-6917 | mmartindale@edge-cm.com Lic# TX 487949

Claire Schmeltekopf | Edge Realty Partners (214) 545-6941 | claire@edge-cm.com Lic# TX 795704

BID ONLINE

Jan 30-Feb 2

STARTING BID $250,000 SIZE 2,143 SF

LEARN MORE www.10x.com/M022902-D

Jaimee Keene | Benchmark Commercial (303) 562-1919 | jaimee@crebenchmark.com Lic# CO FA100078080

Solara Cochran | Benchmark Commercial (720) 275-5061 | solara@crebenchmark.com Lic# CO FA100083743

BID ONLINE

Jan 23-25

STARTING BID $250,000 SIZE 12,868 SF

LEARN MORE www.10x.com/M022850-D

Thomas Bond | Southeast Property Advisor (404) 786-7922 | tpbond49@gmail.com Lic# GA 104302

Christopher Rivera | Ten-X (305) 509-6751 | crivera@ten-x.com

BID ONLINE

Jan 24-26

STARTING BID $200,000 SIZE 3,406 SF

LEARN MORE www.10x.com/M022874-D

Jaimee Keene | Benchmark Commercial (303) 562-1919 | jaimee@crebenchmark.com Lic# CO FA100078080

Tisha Brady | Benchmark Commerial (303) 395-0114 | tish@crebenchmark.com Lic# CO FA100095167

1801 11th St

Lawton, OK

BID ONLINE

Jan 30-Feb 2

STARTING BID $150,000 SIZE 14,650 SF

LEARN MORE www.10x.com/M022923-D

Ted Warkentin | Cummins Setters Commercial (580) 284-0044 | tedw@cscpok.com Lic# OK 157217

Keisha Hartshorn | Ten-X (212) 600-2560 | khartshorn@ten-x.com

150 Lake St Elmira, NY

BID ONLINE Jan 24-26

STARTING BID $125,000 SIZE 45,182 SF

LEARN MORE www.10x.com/M022805-D

Leo F. Jones | Cushman & Wakefield/Pyramid Brokerage Company (607) 754-5990 | ljones@pyramidbrokerage.com Lic# NY 10311208814

Corey Talley | Ten-X (804) 750-5997 | ctalley@ten-x.com

Austin Paul Zeal Property Advisors LLC (417) 389-6638 apaul@zealpropertyadvisors.com Lic# MO 2013032099

Keiten Nuspl Zeal Property Advisors (636) 669-4291 knuspl@zealpropertyadvisors.com

Michael Salvatico

Marcus & Millchap (718) 475-4358 michaelsalvatico@marcusmillichap.com Lic# NY 10301216098

Dawn Helms

Ten-X (804) 807-7872 dhelms@ten-x.com

Sean McNee

Kidder Mathews (858) 369-3093 sean.mcnee@kidder.com Lic# CA 01357657

Brian Brockman

Bang Realty-Texas Inc

Lic# TX 9007017

LEARN MORE www.10x.com/M022956-D

Brian Richardson

Kidder Mathews (425) 450-1123 brian.richardson@kidder.com Lic# WA 78371

Josh Mehlberger

(949) 379-8633

LEARN MORE www.10x.com/M022955-D

Rob Graham Colliers

(407) 362-6152 rob.graham@colliers.com Lic# FL SL3403629

Cheri Mascitelli Ten-X (305) 537-9318 cmascitelli@ten-x.com

BID ONLINE

Jan 24-26

Tommy Lin

B6 Real Estate Advisors LLC (646) 933-2636 tlin@b6realestate.com Lic# NY 10401368552

STARTING

11120 & 11124 Rockaway Beach Blvd Rockaway Park, NY

Amanda West Ten-X (804) 750-5875 awest@ten-x.com

BID ONLINE

Jan 23-25

Joseph Tosi

Oxford Realty Services (412) 261-0200 jtosi@oxfordrealtyservices.com Lic# PA RS289036

STARTING

Taylor Iaboni

Oxford Realty Services (412) 261-0200 tiaboni@oxfordrealtyservices.com Lic# PA RS336715

1400 Riggs Rd South Park, PA

Joseph Tosi

Oxford Realty Services (412) 261-0200 jtosi@oxfordrealtyservices.com Lic# PA RS289036

Taylor Iaboni

Oxford Realty Services (412) 261-0200 tiaboni@oxfordrealtyservices.com Lic# PA RS336715

Mike Henkel

Henkel - The Bravado (989) 404-0000 mikehenkel@ymail.com Lic# MI 6502431250

Christopher Rivera Ten-X (305) 509-6751 crivera@ten-x.com

Tommy Lin

B6 Real Estate Advisors LLC (646) 933-2636 tlin@b6realestate.com Lic# NY 10401368552

Amanda West

Ten-X (804) 750-5875 awest@ten-x.com

4594 3rd St

Ecorse, MI

BID ONLINE

Jan 24-26

STARTING BID $50,000 SIZE 6 Units

LEARN MORE www.10x.com/M022827-D

Andrew Goble | Thomas Duke Company (248) 476-3700 | agoble@thomasduke.com Lic# MI 6501409778

Casey Fashouer | Ten-X (619) 330-5124 | cfashouer@ten-x.com

5 Way St

Binghamton, NY

BID ONLINE

Jan 24-26

STARTING BID $50,000 SIZE 5 Units

LEARN MORE www.10x.com/M022809-D

Scott Warren | Keller Williams Greater Binghamton (607) 722-0722 | scottwarrencre@gmail.com Lic# NY 10301220936

Dawn Helms (804) 807-7872 | dhelms@ten-x.com

Jacklene Chesler Colliers

(973) 299-3083 jacklene.chesler@colliers.com Lic# NJ 9587537

Patrick Norris Colliers (973) 299-3010 patrick.norris@colliers.com Lic# NJ 146766

BID ONLINE

Jan 30-Feb 2

Matthew Leszyk

Marcus & Millichap (201) 742-6171

STARTING

matthew.leszyk@marcusmillichap.com Lic# NY 10301214005

Corey Talley

Ten-X (804) 750-5997 ctalley@ten-x.com

BID ONLINE

Jan 24-26

Holly Jones

Cushman & Wakefield/The Lund Company (402) 548-4038

holly.jones@lundco.com Lic# NE 20050378

Josh Mehlberger

Ten-X (949) 379-8633

jmehlberger@ten-x.com

153 Central Avenue Albany, NY

LEARN MORE www.10x.com/M022908-D

Glen Boehm

KW Commercial (210) 213-6886 glen@glenboehm.com Lic# TX 550654

Tiffany Bottinelli

Keller Williams Realty City (407) 284-8724 tbottinelli@kw.com Lic# TX 783496

LEARN MORE www.10x.com/M022875-D

Roland Loelkes

eXp Commercial (949) 274-6474 roland.loelkes@expcommercial.com Lic# CA 01349994

Josh Mehlberger Ten-X (949) 379-8633 jmehlberger@ten-x.com

BID ONLINE

Jan 24-26

Trip Green

The Woodmont Company (817) 371-1756 tgreen@woodmont.com Lic# TX 572337

Jameson Kuykendall

Ten-X (949) 383-5670 jkuykendall@ten-x.com

BID ONLINE

Jan 24-26

Jim Chaconas

Colliers (734) 769-5005 jim.chaconas@colliers.com Lic# MI 6502358011

Eric Rudland

Colliers (734) 769-5012 eric.rudland@colliers.com Lic# MI 6501438609

LEARN MORE

www.10x.com/M022887-D

Mohammad Ashrif

Global Realty Capital, Inc. (951) 660-7657 mmashrif@gmail.com Lic# CA 01102756

Amjed Manasrah

Global Realty Capital Inc. (951) 893-3749 amjedmanasrah@yahoo.com Lic# CA 02073744

Justin

Jameson Kuykendall Ten-X (949) 383-5670 jkuykendall@ten-x.com

BID ONLINE

Jan 30-Feb 2

Recy Dunn

KW Commercial - Houston

Professionals (281) 444-3900 askrecy@kwcommercial.com Lic# TX 614951

STARTING

Jameson Kuykendall

Ten-X (949) 383-5670 jkuykendall@ten-x.com

BID ONLINE

Jan 30-Feb 2

Daniel McCleary

NAI Farbman (248) 351-4384 mccleary@farbman.com Lic# MI 6506036717

Nathan Casey

NAI Farbman (586) 871-5155 casey@farbman.com Lic# MI 6501410787

14402 Walters Rd Houston, TX

3045 Grange Hall Rd Holly, MI

1801 Highway 72

Huntsville, AL

BID ONLINE

Jan 30-Feb 2

STARTING BID $300,000 SIZE 2,499 SF

LEARN MORE www.10x.com/M022920-D

Drana Mlakic | Marcus & Millichap (949) 419-3200 | drana.mlakic@marcusmillichap.com Lic# CA 02163223

Eddie Greenhalgh | Marcus & Millichap Lic# AL 0000882980

1405 United Flight 93 Blvd Marshall, TX

BID ONLINE Jan 23-25

STARTING BID $300,000 SIZE 4,375 SF

LEARN MORE www.10x.com/M022897-D

Tyler Spain | Matthews Real Estate Investment Services (602) 975-0814 | tyler.spain@matthews.com Lic# AZ SA700296000

Kyle Matthews Lic# TX 9005919

3106 Walden Ave Depew, NY

BID ONLINE

Jan 24-26

STARTING BID $250,000 SIZE 2,481 SF

LEARN MORE www.10x.com/M022822-D

Patti AmecAngelo | CBRE (732) 687-9725 | patti.amecangelo@cbre.com Lic# NY 10401274993

Karly Iacono | CBRE (201) 600-3237 | karly.iacono@cbre.com Lic# NY 10401274993

BID ONLINE

Jan 30-Feb 1

STARTING BID $250,000 SIZE 3,528 SF

LEARN MORE www.10x.com/M022749-D

Patricia A. Grassi | Cushman & Wakefield/Pyramid Brokerage Company (607) 743-4551 | tgrassi@pyramidbrokerage.com Lic# NY 40AC0918684

Corey Talley | Ten-X (804) 750-5997 | ctalley@ten-x.com

BID ONLINE

Jan 30-Feb 2

STARTING BID $250,000 SIZE 29,400 SF

LEARN MORE www.10x.com/M022877-D

Mark Abbo | AQRE Advisors (248) 776-6001 | mabbo@aqreadvisors.com Lic# MI 6501412818

Brian Brockman | Bang Realty Lic# OK 177814

BID ONLINE

Jan 23-25

STARTING BID $250,000 SIZE 6,900 SF

LEARN MORE www.10x.com/M022858-D

Matt Croswell | CBRE (248) 351-2084 | matt.croswell@cbre.com Lic# MI 6505202896

Jake Vorkapich jake.vorkapich@cbre.com

439 Court St Binghamton, NY

551 N Wisconsin St

Port Washington, WI

BID ONLINE

Jan 24-26

STARTING BID $200,000 SIZE 6,630 SF

LEARN MORE www.10x.com/M022819-D

Alexander Reid | Reid Group (847) 791-2420 | alexander@reidgroup.house Lic# WI 8844594

Carlos Silguero (909) 493-2579 | csilguero@ten-x.com

102 11th St

Lawton, OK

BID ONLINE Jan 30-Feb 2

STARTING BID $150,000 SIZE 22,080 SF

LEARN MORE www.10x.com/M022876-D

Mark Abbo | AQRE Advisors (248) 776-6001 | mabbo@aqreadvisors.com Lic# MI 6501412818

Brian Brockman | Bang Realty Lic# OK 177814

BID ONLINE Jan 30-Feb 2

STARTING BID $1 SIZE 1,960 SF

LEARN MORE www.10x.com/M022917-D

TJ Sweatt | Re/Max Southern Realty (910) 331-7713 | tsweatt0@gmail.com Lic# NC 287184

Zac Luckey | Ten-X (949) 790-6441 | zluckey@ten-x.com

Kathleen Reynolds JLL (404) 995-2114 katy.reynolds@am.jll.com Lic# GA 279802

Kami Burnette

Paramount Lodging Advisors (512) 831-5605

kburnette@paramountlodging.com Lic# TX 688841

Mason McDavid

Paramount Lodging Advisors (512) 543-4653

mmcdavid@paramountlodging.com Lic# TX 731557

Corina Swartz

Hotel Brokers of America (661) 910-8003

corina@hotelbrokersinc.com Lic# CA 01905002

Niti Naik

Hotel Brokers of America

Lic# TX 735690

3216

BID ONLINE

Jan 23-25 STARTING

Leonardo Reilly

Marcus & Millichap (305) 510-6755 leo.reilly@marcusmillichap.com Lic# FL SL3490194

Robert Hunter

Marcus & Millichap (954) 245-3473 robert.hunter@marcusmillichap.com Lic# FL SL3241692

BID ONLINE

Patrick Kuhlman

Next Home NWA (479) 877-0184 patrick@nexthomenwa.com Lic# AR SA00074566

Jameson Kuykendall

Ten-X (949) 383-5670 jkuykendall@ten-x.com

LEARN MORE

www.10x.com/M022777-D

Rob Willard

Paramount Lodging Advisors (314) 306-2119

rwillard@paramountlodging.com Lic# MO 2021044070

Andrew Makhlouf

Paramount Lodging Advisors (312) 610-9067

amakhlouf@paramountlodging.com Lic# IL 475185106

LEARN MORE www.10x.com/M022922-D

Kami Burnette

Paramount Lodging Advisors (512) 831-5605

kburnette@paramountlodging.com Lic# TX 688841

Mason McDavid

Paramount Lodging Advisors (512) 543-4653

mmcdavid@paramountlodging.com

Brad Sinclair

Mike George

Avison Young Hotel Group (312) 715-8697 mike.george@avisonyoung.com Lic# IL 475170482

Scott Pickett

Avison

LEARN MORE

www.10x.com/M022872-D

Elliott Fayssoux

Cushman & Wakefield (864) 370-8190 elliott.fayssoux@thalhimer.com Lic# SC 83949

Drew Kirkpatrick

Cushman & Wakefield (803) 306-5767 drew.kirkpatrick@cushwake.com Lic# SC 114537

LEARN MORE www.10x.com/M022840-D

Justin Harris

Cawley Chicago Commercial Real Estate (630) 234-8593 jharris@cawleychicago.com Lic# IL 475175605

Keisha Hartshorn Ten-X (212) 600-2560 khartshorn@ten-x.com

BID ONLINE

Jan 23-25

Brad Margolis

NAI Farbman (248) 351-4367 bmargolis@farbman.com Lic# MI 6501371948

Casey Fashouer

Ten-X (619) 330-5124 cfashouer@ten-x.com

BID ONLINE

Jan 23-25

Matthew Callander

Callander Commercial (269) 349-1000 mcallander@ccmichigan.com Lic# MI 6502431751

Amanda West

Ten-X (804) 750-5875 awest@ten-x.com

3220 Stanton St Springfield, IL

BID ONLINE

Jan 24-26

STARTING BID $200,000 SIZE 45,000 SF

LEARN MORE www.10x.com/M022633-D

Michael Fine | Fine & Company LLC (312) 278-0600 | michael@fineandcompany.com Lic# IL 471009718

Corey Talley | Ten-X (804) 750-5997 | ctalley@ten-x.com

1042 SE 25th St

Oklahoma City, OK

BID ONLINE Jan 24-26

STARTING BID $125,000 SIZE 7,660 SF

LEARN MORE www.10x.com/M022815-D

Sean O'Grady | Caliber Property Group (405) 236-2154 | sean@seanogrady.com Lic# OK 170126

Carlos Silguero | Ten-X (909) 493-2579 | csilguero@ten-x.com

Jason Sasser CBRE (813) 273-8418 jason.sasser@cbre.com Lic# FL SL3230636

Andrea Delgado Ten-X (305) 503-2638 adelgado@ten-x.com

(818) 325-4142 reza.ghobadi@colliers.com Lic# CA 01780045

Nick Lombardi

Frisbie Lombardi

Commercial Real Estate Services (918) 344-9904 nick@frisbielombardi.com Lic# OK 152277

Keisha Hartshorn

Ten-X (212) 600-2560 khartshorn@ten-x.com

Amy Foote

Landqwest Commercial, LLC (407) 451-5171 afoote@lqwest.com Lic# FL SL3172331

Christopher Rivera

Ten-X (305) 509-6751 crivera@ten-x.com

Isle of Palms Perry, FL

BID ONLINE Feb 13-16

STARTING BID $1 SIZE 94 Acres

LEARN MORE www.10x.com/M022954-D

Jason Sasser | CBRE (813) 273-8418 | jason.sasser@cbre.com Lic# FL SL3230636

Andrea Delgado | Ten-X (305) 503-2638 | adelgado@ten-x.com

Office Washington DC 14,655 SF $2,400,000 650 H St NE Jan 24-26 20

Office Greenville SC 143,865 SF $2,250,000 33 & 37 Villa Rd Jan 30-Feb 1 18

Office McKinney TX 16,940 SF $1,600,000 210 N Tennessee St Jan 24-26 20

Office Lansing MI 30,375 SF $1,300,000 200 S Washington Square Jan 24-26 21

Office Southington CT 41,000 SF $1,300,000 29 N Main St & 51 N Main St Jan 30-Feb 2 21

Office Parsippany NJ 30,456 SF $1,200,000 140 Littleton Rd Jan 23-25 22

Office The Woodlands TX 23,405 SF $1,100,000 27312 & 27316 Spectrum Way Jan 30-Feb 2 22

Office Pasadena TX 55,956 SF $1,000,000 213 W Southmore Ave Feb 13-16 19

Office Las Vegas NV 13,000 SF $1,000,000 319 3rd St Feb 13-16 23

Office Fort Lauderdale FL 8,712 SF $950,000 2161 E Commercial Blvd Jan 24-26 23

Office Trumbull CT 66,000 SF $900,000 101 Merritt Blvd Jan 23-25 24

Office Wayne NJ 25,954 SF $875,000 40 Galesi Dr Feb 13-16 24

Office Lexington NC 53,569 SF $750,000 7129 Old US Highway 52 Jan 23-25 25

Office Jackson MS 161,542 SF $750,000 200 E Capitol St Feb 13-16 25

Office St. Peters MO 16,282 SF $650,000 255 Spencer Rd Jan 30-Feb 2 26

Office Southington CT 17,000 SF $650,000 1 Center St & 26 N Main St Jan 30-Feb 2 26

Office Lewisville TX 5,658 SF $400,000 325 South Stemmons Fwy Jan 30-Feb 2 27

Office North Little Rock AR 13,478 SF $400,000 3201 Highway 161 Jan 24-26 27

Office Boston MA 2,068 SF $350,000 253-257 Roxbury St Jan 24-26 29

Office Norwich CT 34,000 SF $350,000 101 Water St Jan 23-25 29

Office Portland OR 6,555 SF $350,000 7025 N Lombard Street Jan 24-26 28

Office Raleigh NC 7,666 SF $350,000 817 New Bern Ave Jan 23-25 28

Office Grapevine TX 7,649 SF $350,000 2020 W Northwest Hwy Jan 30-Feb 2 30

Office Chesapeake VA 11,258 SF $300,000 4020 Raintree Rd Jan 23-25 30

Office Denver CO 2,143 SF $250,000 2373 Central Park Blvd 300 Jan 30-Feb 2 31

Office Baytown TX 22,076 SF $250,000 2000 Beaumont Rd Jan 23-25 30

Office Atlanta GA 12,868 SF $250,000 426 Marietta St NW Jan 23-25 31

Office Louisville CO 3,406 SF $200,000 1849 Cherry St 1 Jan 24-26 31

Office Lawton OK 14,650 SF $150,000 1801 11th St Jan 30-Feb 2 32

Office Elmira NY 45,182 SF $125,000 150 Lake St Jan 24-26 32

Multifamily Blairsville GA 94 Units $2,500,000 168 Stonehenge Dr Jan 30-Feb 1 36

Multifamily Brooklyn NY 9 Units $1,900,000 787 Franklin Ave Jan 30-Feb 2 37

Multifamily Grandview MO 104 Units $1,900,000 12322 3rd St Jan 23-25 38

Multifamily Sierra Vista AZ 69 Units $1,600,000 201 W Fry Blvd Jan 23-25 38

Multifamily New York NY 5 Units $1,500,000 176 Delancey St Jan 24-26 39

Multifamily Bee Cave TX 32 Units $1,100,000 11825 Bee Caves Rd Jan 24-26 39

Multifamily Oak Harbor WA 29 Units $1,000,000 3125 Oak Harbor Rd Feb 13-16 40

Multifamily Orange City FL 15 Units $600,000 244 E Graves Ave Feb 13-16 40

Multifamily Rockaway Park NY 2 Units $550,000 11120 & 11124 Rockaway Beach Blvd Jan 24-26 41

Multifamily South Park PA 64 Units $550,000 1400 Riggs Rd Jan 23-25 41

Multifamily Belle Glade FL 35 Units $400,000 417 6th St Jan 24-26 42

Multifamily Elizabeth PA 51 Units $400,000 145 Broadlawn Dr Jan 23-25 42

Multifamily Mount Pleasant MI 21 Units $400,000 410 W Cherry St Jan 23-25 43

Multifamily Arverne NY 6 Units $150,000 6707 Beach Channel Dr Jan 23-25 43

Multifamily Ecorse MI 6 Units $50,000 4594 3rd St Jan 24-26 44

Multifamily Binghamton NY 5 Units $50,000 5 Way St Jan 24-26 44

Retail Wantage NJ 75,128 SF $2,500,000 455 State Rt 23 Jan 30-Feb 1 48

Retail Amarillo TX 83,422 SF $1,300,000 8275 Amarillo Blvd Jan 30-Feb 2 49

Retail Newark NJ 18,000 SF $1,300,000 660 - 680 Clinton Ave Jan 30-Feb 2 50

Retail Kalamazoo MI 4,300 SF $1,150,000 980 N 9th St Jan 24-26 50

Retail Albany NY 12,300 SF $1,000,000 153 Central Avenue Jan 30-Feb 2 51

Retail Omaha NE 95,590 SF $800,000 8005 Blondo St Jan 24-26 51

Retail Comfort TX 7,556 SF $650,000 220 W FM 473 Jan 23-25 52

Retail Weatherford TX 6,174 SF $500,000 1910 S Main St Jan 24-26 53

Retail Burbank CA 5,720 SF $500,000 1700 N San Fernando Blvd Jan 24-26 52

Retail Adrian MI 6,683 SF $500,000 1329 Main St Jan 24-26 53

Retail Big Bear Lake CA 5,550 SF $450,000 39904 Big Bear Blvd Jan 23-25 54

Retail Alvin TX 7,880 SF $450,000 1509 S Gordon St Feb 13-16 54

Retail Houston TX 1,816 SF $350,000 14402 Walters Rd Jan 30-Feb 2 55

Retail Holly MI 18,307 SF $350,000 3045 Grange Hall Rd Jan 30-Feb 2 55

Retail Huntsville AL 2,499 SF $300,000 1801 Highway 72 Jan 30-Feb 2 56

Retail Marshall TX 4,375 SF $300,000 1405 United Flight 93 Blvd Jan 23-25 56

Retail Lawton OK 29,400 SF $250,000 1511-1513 NW Cache Rd and 1506-1508 NW Lawton Ave Jan 30-Feb 2 57

Retail Binghamton NY 3,528 SF $250,000 439 Court St Jan 30-Feb 1 57

Retail Depew NY 2,481 SF $250,000 3106 Walden Ave Jan 24-26 56

Retail White Lake MI 6,900 SF $250,000 9136 - 9140 Highland Rd Jan 23-25 57

Retail Port Washington WI 6,630 SF $200,000 551 N Wisconsin St Jan 24-26 58

Retail Lawton OK 22,080 SF $150,000 102 11th St Jan 30-Feb 2 58

Retail Ruffin NC 1,960 SF $1 9537 US Highway 29 N Business Jan 30-Feb 2 58

Hotel Myrtle Beach SC 153 Rooms $4,750,000 1304 & 1404 N Ocean Blvd Feb 13-15 62

Hotel Florham Park NJ 219 Rooms $4,500,000 175 Park Ave Jan 23-25 64

Hotel Ames IA 112 Rooms $3,750,000 1325 Dickinson Ave Jan 30-Feb 1 63

Hotel El Paso TX 103 Rooms $3,750,000 7518 Remcon Cir Jan 30-Feb 1 64

Hotel El Paso TX 95 Rooms $3,250,000 7514 Remcon Cir Jan 30-Feb 1 65

Hotel Dallas TX 113 Rooms $3,100,000 11069 Composite Dr Feb 13-16 65

Hotel Rogers AR 96 Rooms $2,100,000 301 45th St Jan 23-25 66

Hotel Lake Charles LA 77 Rooms $2,000,000 1731 Prien Lake Rd Feb 13-16 66

Hotel Tallahassee FL 86 Rooms $1,850,000 3216 Monroe St Jan 23-25 67

Hotel Bentonville AR 76 Rooms $1,200,000 911 Walton Blvd Jan 23-25 67

Hotel Mount Vernon IL 70 Rooms $1,000,000 217 Potomac Blvd Jan 30-Feb 1 68

Hotel Angleton TX 57 Rooms $800,000 2400 Mulberry Street Feb 13-16 68

Hotel Brandon MS 67 Rooms $600,000 215 Dande Drive Feb 13-15 69

Hotel Macedonia OH 121 Rooms $350,000 311 E Highland Rd Jan 30-Feb 2 69

Industrial Huntington Beach CA 23,940 SF $2,000,000 7671 Liberty Dr Jan 23-25 72

Industrial McCormick SC 130,000 SF $700,000 1559 Main St Jan 24-26 74

Industrial Huntley IL 50,281 SF $600,000 11173 - 11193 Dundee Rd Jan 23-25 74

Industrial Long Beach CA 4,500 SF $500,000 1740 W Cowles St Jan 30-Feb 2 73

Industrial Bridgeport MI 41,000 SF $250,000 6817 Dixie Hwy Jan 23-25 75

Industrial Sturgis MI 33,000 SF $200,000 309 Prospect St Jan 23-25 75

Industrial Springfield IL 45,000 SF $200,000 3220 Stanton St Jan 24-26 76

Industrial Oklahoma City OK 7,660 SF $125,000 1042 SE 25th St Jan 24-26 76

Land Lakeland FL 68 Acres $650,000 Carter Rd Jan 23-25 80

Land Loves Park IL 8.07 Acres $100,000 5804-5811 Birkenshaw Dr Jan 23-25 80

Land Tulsa OK 34.6 Acres $75,000 NE Gilcrease Expy Jan 30-Feb 1 81

Land Winter Springs FL 5.6 Acres $1 SR 419 & Edgemon Ave Feb 13-16 81

Land Perry FL 94 Acres $1 Isle of Palms Feb 13-16 82

Retail Huntsville AL 2,499 SF $300,000 1801 Highway 72 Jan 30-Feb 2 56

Hotel Bentonville AR 76 Rooms $1,200,000 911 Walton Blvd Jan 23-25 67

Office North Little Rock AR 13,478 SF $400,000 3201 Highway 161 Jan 24-26 27 Hotel Rogers AR 96 Rooms $2,100,000 301 45th St Jan 23-25 66

Multifamily Sierra Vista AZ 69 Units $1,600,000 201 W Fry Blvd Jan 23-25 38

Retail Big Bear Lake CA 5,550 SF $450,000 39904 Big Bear Blvd Jan 23-25 54

Retail Burbank CA 5,720 SF $500,000 1700 N San Fernando Blvd Jan 24-26 52

Industrial Huntington Beach CA 23,940 SF $2,000,000 7671 Liberty Dr Jan 23-25 72

Industrial Long Beach CA 4,500 SF $500,000 1740 W Cowles St Jan 30-Feb 2 73

Office Denver CO 2,143 SF $250,000 2373 Central Park Blvd 300 Jan 30-Feb 2 31

Office Louisville CO 3,406 SF $200,000 1849 Cherry St 1 Jan 24-26 31

Office Norwich CT 34,000 SF $350,000 101 Water St Jan 23-25 29

Office Southington CT 41,000 SF $1,300,000 29 N Main St & 51 N Main St Jan 30-Feb 2 21

Office Southington CT 17,000 SF $650,000 1 Center St & 26 N Main St Jan 30-Feb 2 26

Office Trumbull CT 66,000 SF $900,000 101 Merritt Blvd Jan 23-25 24

Office Washington DC 14,655 SF $2,400,000 650 H St NE Jan 24-26 20

Multifamily Belle Glade FL 35 Units $400,000 417 6th St Jan 24-26 42

Office Fort Lauderdale FL 8,712 SF $950,000 2161 E Commercial Blvd Jan 24-26 23

Land Lakeland FL 68 Acres $650,000 Carter Rd Jan 23-25 80

Multifamily Orange City FL 15 Units $600,000 244 E Graves Ave Feb 13-16 40

Land Perry FL 94 Acres $1 Isle of Palms Feb 13-16 82

Hotel Tallahassee FL 86 Rooms $1,850,000 3216 Monroe St Jan 23-25 67

Land Winter Springs FL 5.6 Acres $1 SR 419 & Edgemon Ave Feb 13-16 81

Office Atlanta GA 12,868 SF $250,000 426 Marietta St NW Jan 23-25 31

Multifamily Blairsville GA 94 Units $2,500,000 168 Stonehenge Dr Jan 30-Feb 1 36 Hotel Ames IA 112 Rooms $3,750,000 1325 Dickinson Ave Jan 30-Feb 1 63

Industrial Huntley IL 50,281 SF $600,000 11173 - 11193 Dundee Rd Jan 23-25 74

Land Loves Park IL 8.07 Acres $100,000 5804-5811 Birkenshaw Dr Jan 23-25 80

Hotel Mount Vernon IL 70 Rooms $1,000,000 217 Potomac Blvd Jan 30-Feb 1 68

Industrial Springfield IL 45,000 SF $200,000 3220 Stanton St Jan 24-26 76

Hotel Lake Charles LA 77 Rooms $2,000,000 1731 Prien Lake Rd Feb 13-16 66 Office Boston MA 2,068 SF $350,000 253-257 Roxbury St Jan 24-26 29

Retail Adrian MI 6,683 SF $500,000 1329 Main St Jan 24-26 53

Industrial Bridgeport MI 41,000 SF $250,000 6817 Dixie Hwy Jan 23-25 75

Multifamily Ecorse MI 6 Units $50,000 4594 3rd St Jan 24-26 44

Retail Holly MI 18,307 SF $350,000 3045 Grange Hall Rd Jan 30-Feb 2 55

Retail Kalamazoo MI 4,300 SF $1,150,000 980 N 9th St Jan 24-26 50 Office Lansing MI 30,375 SF $1,300,000 200 S Washington Square Jan 24-26 21

Multifamily Mount Pleasant MI 21 Units $400,000 410 W Cherry St Jan 23-25 43

Industrial Sturgis MI 33,000 SF $200,000 309 Prospect St Jan 23-25 75

Retail White Lake MI 6,900 SF $250,000 9136 - 9140 Highland Rd Jan 23-25 57

Multifamily Grandview MO 104 Units $1,900,000 12322 3rd St Jan 23-25 38

Office St. Peters MO 16,282 SF $650,000 255 Spencer Rd Jan 30-Feb 2 26

Hotel Brandon MS 67 Rooms $600,000 215 Dande Drive Feb 13-15 69

Office Jackson MS 161,542 SF $750,000 200 E Capitol St Feb 13-16 25

Office Lexington NC 53,569 SF $750,000 7129 Old US Highway 52 Jan 23-25 25

Office Raleigh NC 7,666 SF $350,000 817 New Bern Ave Jan 23-25 28

Retail Ruffin NC 1,960 SF $1 9537 US Highway 29 N Business Jan 30-Feb 2 58

Retail Omaha NE 95,590 SF $800,000 8005 Blondo St Jan 24-26 51 Hotel Florham Park NJ 219 Rooms $4,500,000 175 Park Ave Jan 23-25 64

Retail Newark NJ 18,000 SF $1,300,000 660 - 680 Clinton Ave Jan 30-Feb 2 50

Office Parsippany NJ 30,456 SF $1,200,000 140 Littleton Rd Jan 23-25 22

Retail Wantage NJ 75,128 SF $2,500,000 455 State Rt 23 Jan 30-Feb 1 48 Office Wayne NJ 25,954 SF $875,000 40 Galesi Dr Feb 13-16 24 Office Las Vegas NV 13,000 SF $1,000,000 319 3rd St Feb 13-16 23

Retail Albany NY 12,300 SF $1,000,000 153 Central Avenue Jan 30-Feb 2 51

Multifamily Arverne NY 6 Units $150,000 6707 Beach Channel Dr Jan 23-25 43

Multifamily Binghamton NY 5 Units $50,000 5 Way St Jan 24-26 44

Retail Binghamton NY 3,528 SF $250,000 439 Court St Jan 30-Feb 1 57

Multifamily Brooklyn NY 9 Units $1,900,000 787 Franklin Ave Jan 30-Feb 2 37

Retail Depew NY 2,481 SF $250,000 3106 Walden Ave Jan 24-26 56

Office Elmira NY 45,182 SF $125,000 150 Lake St Jan 24-26 32

Multifamily New York NY 5 Units $1,500,000 176 Delancey St Jan 24-26 39

Multifamily Rockaway Park NY 2 Units $550,000 11120 & 11124 Rockaway Beach Blvd Jan 24-26 41

Hotel Macedonia OH 121 Rooms $350,000 311 E Highland Rd Jan 30-Feb 2 69 Office Lawton OK 14,650 SF $150,000 1801 11th St Jan 30-Feb 2 32 Retail Lawton OK 29,400 SF $250,000 1511-1513 NW Cache Rd and 1506-1508 NW Lawton Ave Jan 30-Feb 2 57 Retail Lawton OK 22,080 SF $150,000 102 11th St Jan 30-Feb 2 58

Industrial Oklahoma City OK 7,660 SF $125,000 1042 SE 25th St Jan 24-26 76

Land Tulsa OK 34.6 Acres $75,000 NE Gilcrease Expy Jan 30-Feb 1 81

Office Portland OR 6,555 SF $350,000 7025 N Lombard Street Jan 24-26 28

Multifamily Elizabeth PA 51 Units $400,000 145 Broadlawn Dr Jan 23-25 42

Multifamily South Park PA 64 Units $550,000 1400 Riggs Rd Jan 23-25 41

Office Greenville SC 143,865 SF $2,250,000 33 & 37 Villa Rd Jan 30-Feb 1 18

Industrial McCormick SC 130,000 SF $700,000 1559 Main St Jan 24-26 74

Hotel Myrtle Beach SC 153 Rooms $4,750,000 1304 & 1404 N Ocean Blvd Feb 13-15 62

Retail Alvin TX 7,880 SF $450,000 1509 S Gordon St Feb 13-16 54

Retail Amarillo TX 83,422 SF $1,300,000 8275 Amarillo Blvd Jan 30-Feb 2 49

Hotel Angleton TX 57 Rooms $800,000 2400 Mulberry Street Feb 13-16 68

Office Baytown TX 22,076 SF $250,000 2000 Beaumont Rd Jan 23-25 30

Multifamily Bee Cave TX 32 Units $1,100,000 11825 Bee Caves Rd Jan 24-26 39

Retail Comfort TX 7,556 SF $650,000 220 W FM 473 Jan 23-25 52

Hotel Dallas TX 113 Rooms $3,100,000 11069 Composite Dr Feb 13-16 65

Hotel El Paso TX 103 Rooms $3,750,000 7518 Remcon Cir Jan 30-Feb 1 64 Hotel El Paso TX 95 Rooms $3,250,000 7514 Remcon Cir Jan 30-Feb 1 65

Office Grapevine TX 7,649 SF $350,000 2020 W Northwest Hwy Jan 30-Feb 2 30

Retail Houston TX 1,816 SF $350,000 14402 Walters Rd Jan 30-Feb 2 55

Office Lewisville TX 5,658 SF $400,000 325 South Stemmons Fwy Jan 30-Feb 2 27

Retail Marshall TX 4,375 SF $300,000 1405 United Flight 93 Blvd Jan 23-25 56

Office McKinney TX 16,940 SF $1,600,000 210 N Tennessee St Jan 24-26 20

Office Pasadena TX 55,956 SF $1,000,000 213 W Southmore Ave Feb 13-16 19

Office The Woodlands TX 23,405 SF $1,100,000 27312 & 27316 Spectrum Way Jan 30-Feb 2 22

Retail Weatherford TX 6,174 SF $500,000 1910 S Main St Jan 24-26 53

Office Chesapeake VA 11,258 SF $300,000 4020 Raintree Rd Jan 23-25 30

Multifamily Oak Harbor WA 29 Units $1,000,000 3125 Oak Harbor Rd Feb 13-16 40

Retail Port Washington WI 6,630 SF $200,000 551 N Wisconsin St Jan 24-26 58