FEBRUARY 2023

THE EXPONENTIALLY SMARTER, FASTER, BETTER WAY TO TRANSACT CRE

FEBRUARY 2023

THE EXPONENTIALLY SMARTER, FASTER, BETTER WAY TO TRANSACT CRE

The world’s largest online commercial real estate exchange.

At Ten-X, we’re empowering the commercial real estate industry to close deals exponentially faster, exponentially better, and with exponentially more certainty.

As part of CoStar Group, we bring together the most expansive pool of investors, unmatched asset intelligence, advanced technology, and the only end-to-end online platform to create an online exchange where brokers, sellers/owners and investors can buy and sell properties in the most efficient and effective way.

Ten-X + LoopNet + CoStar is altogether better business.

*2022 Data

Reprinted With Permission from CoStar

January 10, 2023

Mayor Muriel Bowser has released a “Comeback Plan” outlining Washington, D.C.’s economic development goals for the next five years, including adding 7 million square feet of residential units to the city’s historically office-laden downtown.

The plan, announced Monday, serves as D.C.’s Comprehensive Economic Development Strategy, the city’s economic roadmap that’s created by analyzing economic assets and needs across neighborhoods. The last CEDS was approved in 2010 at the beginning of the last population boom. It allows the city and its stakeholders to apply for federal funding that could support the strategy’s efforts.

Bowser’s plan orbits around D.C.’s population growth, which has slowed during the COVID-19 pandemic after about a decade of rapid growth in the 2010s. The city’s population is at about 671,000, down from almost 690,000 in 2020, according to

the U.S. Census Bureau. One of Bowser’s goals is to bump the population up to 725,000 by 2028, which would be the highest it’s been since the 1970s.

A major part of this population increase will lie in her promise to bring 15,000 residents to downtown D.C., an idea she first floated in her swearing-in speech last week and included in her list of six goals that make up the Comeback Plan. She clarified in Monday’s announcement that she would achieve the downtown benchmark by adding 7 million square feet of residential units downtown. This would most likely involve office conversions, as the central business district has struggled over the past two years with office vacancies due to remote work policies. Bowser has also called on the federal government to assist in either bringing federal workers back into the office full time or ceding underutilized office buildings to become housing.

In addition to increasing overall and downtown populations in D.C., Bowser also set goals to create 35,000 new jobs, increase the share of minorityowned businesses to 33%, eliminate disparities in food, housing and internet access, and lift the median household income of Black residents by $25,000. All six goals are set to be achieved by 2028.

“This is a comeback that is focused on equity,” Bowser wrote in the announcement of her plan,

which was created in collaboration with the Office of the Deputy Mayor for Planning and Economic Development. “This is about making sure we have the revenues to support our world-class city services, our robust network of social programs, and the resources — like our schools and rec centers — that keep people in DC.”

Muriel Bowser Mayor - Washington DC

This is about making sure we have the revenues to support our world-class city services, our robust network of social programs, and the resources — like our schools and rec centers — that keep people in DC.By Chris LeBarton

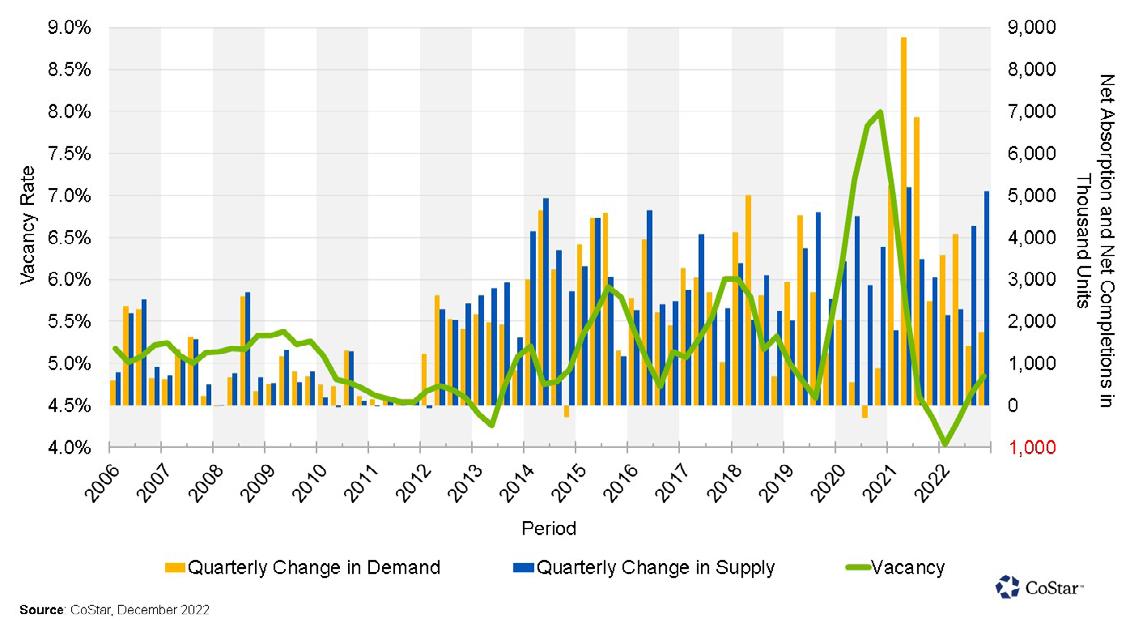

The Washington, D.C., area’s apartment market faces challenges in 2023. Assessing the supplydemand balance — and where vacancy comes out in the wash — can help owners, operators and investors prepare for the new year’s hurdles and unearth opportunities.

Drawing on CoStar’s extensive multifamily data, this analysis highlights macro trends and where supply pressure is highest and lowest among neighborhoods, in addition to a look at two bellwether projects on track for a 2023 completion.

For the 10th straight year, more than 10,000 market-rate apartments opened in the Washington area, and there are still 35,000 more under construction across the region. Nearly 16,000 of those units are slated to be completed in 2023, a number that would surpass 2014 for the highest gross unit total ever in a given year.

Already the nation’s fifth-largest apartment market by units, the Washington area is projected to have the fifth-most gross units completed this year, trailing New York, with 27,000; Austin, Texas, with 19,500; Dallas-Fort Worth, with 19,250; and Atlanta, with 18,500.

Still, there are several factors that could keep the 2014 mark atop the leaderboard, ranging from

zoning delays to continued strains on labor and materials. But even if current estimates fell by 10%, 2023 would still see the third-biggest one-year addition to the area in terms of new apartments coming on line. In 2020, over 14,500 gross units were finished.

Anyone remotely familiar with the Washington apartment market knows that two areas — Southwest-Navy Yard and H Street-NoMa — have been the brightest spots on the development heat map for years. The pair consistently has between 15% and 30% of units under construction compared

to their respective inventories, and together these two neighborhoods house 20% of all units under construction in the area.

Both areas are expected to see a lighter completion schedule this year than in the past two years, but any units add more strain to operators in increasingly competitive landscapes. Vacancy in each area is in the mid-teens and asking rent growth has evaporated in the second half of 2022.

Spotsylvania, Virginia, falls well below both D.C. powerhouses in terms of overall apartment construction, but the far-flung suburb 65 miles southwest of Washington is expanding nearly as quickly. Roughly 600 units were under construction in the final week of 2022 —equivalent to almost 20% of market-rate units in the area today — and all are set to hit the market next year. Pandemic flight trends from major urban centers and remote work accelerated Spotsylvania’s growing popularity as an affordability play at the southern end of the Washington metropolitan area.

The Brightwood and nearby Fort Totten neighborhoods in D.C. have over 1,500 units under construction, as does the Anacostia neighborhood in Southeast. The neighborhoods have relatively large market-rate inventories, but most of the development is skewed to middle- and upper-tier units.

Calls for office-to-residential conversions have never been louder, and the Washington area has one of the more unique projects in that space.

Dubbed Three Collective, a trio of former office towers on Leesburg Pike in Bailey’s Crossroads, Virginia, is being redeveloped into 675 units of

“flexidential” space. Each loft unit is designed to have three different permitted uses at all times: a residence, a loft office or true live-work space. It is also set to feature a collaborative workspace, bowling alley, arcade and recording studio when construction finishes.

Washington’s office market is one of the most troubled in the country — both in terms of leased space and workers utilizing it. Washington began the year with nearly 16% of its 520 million square feet of office space vacant, trailing only Houston, at 19%; Dallas-Fort Worth, at 17.5%; and San Francisco, at 16.7%, among major markets. In theory, converting obsolete or distressed office buildings into multifamily reduces vacancy and increases housing, but it is far easier said than done. Most office buildings weren’t designed in ways that can be easily retrofitted for residential use, and even the ones that do make sense face significant hurdles. Zoning changes and planning components can take years, and construction financing is both difficult to come by and prohibitively expensive for most sponsors.

The joint venture behind Three Collective, The Wolff Co. and Highland Square Holdings, started out with two critical advantages, however: An enviable basis and a proven conversion model to follow.

The three-building campus, previously known as Skyline, saw its assessed value drop from $680 million roughly a decade ago to $300 million in 2018. The joint venture was able to purchase it in 2019 for $215 million. Skyline also provided a similar, albeit larger, opportunity for Highland to follow a conversion roadmap it had capitalized on previously.

In 2017, Highland acquired a 240,000-square-foot building on Ford Avenue in Alexandria, Virginia. A $52 million renovation created what the firm called a revolutionary real estate concept with highly amenitized loft-style spaces that can each be used as either an apartment, office or live-work space. The 200-unit property sold one year later at a 4.75% capitalization rate, or rate of return — 20 basis points higher than 4- and 5-Star buildings in that same quarter.

Not long after, Highland and Wolff joined forces for the first time to run the same playbook on an office building at 5600 Columbia Pike in Falls Church, Virginia. It reopened in 2020 as the Mission Lofts, a

156-unit live-work complex with units that average 900 square feet.

About 50 miles southwest of Washington in Fredericksburg, Virginia, the Factory at Upper Spotsy is a more traditional redevelopment. Still, its lease-up should shine a light on the ongoing renter dislocation from core D.C. areas. Four industrial buildings are being demolished and hundreds of apartments are being returned as part of the Factory project. The first phase has over 250 units, and developers have plans for roughly 300 more in the future. Average rents in Spotsylvania come in at around $1,700 per unit, slightly more than a 15% discount to the D.C. region’s average of $2,025 per unit.

Fredericksburg, an independent city that shares boundaries with Stafford and Spotsylvania counties, was already on a growth trajectory before the pandemic. Its population grew by almost 15% between 2010 and 2020, and the U.S. Census Bureau estimates that the growth pace held again from 2020 to 2021. The Interstate 95 Express Lane expansion is set to finish later this year, and the Virginia Railway Express is set to expand over the next decade as the $3.7 billion Transforming Rail in Virginia TRIV initiative rolls out.

Calls for office-to-residential conversions have never been louder, and the Washington area has one of the more unique projects in that space.

Chris LeBarton - CoStar Analytics

Daniel Dunsmoor Colliers International

(614) 437-4494

daniel.dunsmoor@colliers.com

Lic# OH SAL2008001909

Darlene Johnson Ten-X (512) 439-3543

djohnson1@ten-x.com

Lance Custen Realty.com

(512) 677-9069

lance@realty.com

Lic# FL SL3316486

Jeremy Hakimi Empire Capital Group

Lic# TX 598910

Alan Cafiero

Marcus & Millichap (201) 742-6118

alan.cafiero@marcusmillichap.com

Lic# NJ 0791092

John Moroz

Investment Associate (201) 742-6131

john.moroz@marcusmillichap.com

Jeff Hart

Suntide Commercial Realty (612) 747-7794

jeffhart@suntide.com

Lic# MN 81531

Kevin Peck

Suntide Commercial Realty

(612) 834-2250

kevinpeck@suntide.com

Lic# MN 20587160

msiegel@corp-realty.com Lic# MS

Derek Rudd Ten-X (949) 398-2589

drudd@ten-x.com

emendizabal@bradleyco.com Lic# IN RB21000517

Derek Rudd Ten-X (949) 398-2589

Matthew Ferguson

Premier Commercial Real Estate

(317) 454-7171

mferguson@premiercres.com

Lic# IN RB17000936

Sam Garvin

Premier Commercial Real Estate (317) 454-7171

sgarvin@premiercres.com

David Wiesemann

RE/MAX Heritage

(816) 224-8484

dlwiesemann@gmail.com

Lic# MO 2009020578

Derek Rudd

Ten-X

(949) 398-2589

drudd@ten-x.com

LEARN MORE www.10x.com/M023005-D

Mary Linda Cotten | Coldwell Branker/Walden & Kirkland (229) 347-0953 | marylindacotten@gmail.com Lic# GA 281464

Christopher Rivera | Ten-X (305) 509-6751 | crivera@ten-x.com

LEARN MORE www.10x.com/M023019-D

Jaclyn Blair | Marcus & Millichap (813) 387-4815 | jaclyn.blair@marcusmillichap.com Lic# FL SL3371512

Andrea Delgado | Ten-X (305) 503-2638 | adelgado@ten-x.com

LEARN MORE www.10x.com/M023020-D

Tom Vaught | Victory Commercial Real Estate (405) 757-0470 | tom@victorycre.com Lic# OK 155758

Keisha Hartshorn | Ten-X (949) 818-6210 | khartshorn@ten-x.com

Rob

Colliers (407) 733-5764

rob.graham@colliers.com Lic# FL SL3403629 Cheri Mascitelli Ten-X (305) 537-9318

cmascitelli@ten-x.com

LEARN MORE www.10x.com/M022986-D

Laura Sanchez | Green Lands Realty (305) 503-4121 | laura@lauraisyourrealtor.com Lic# FL 3200886

Jorge Peraza (305) 781-5220 | assistant@lauraisyourrealtor.com Lic# FL 0000

LEARN MORE www.10x.com/M022981-D

Bob Richards | Senior Care Realty (608) 215-2038 | bob@seniorcarerealty.com Lic# WI 5849190

Andrea Delgado | Ten-X (305) 503-2638 | adelgado@ten-x.com

LEARN MORE www.10x.com/M022980-D

Andrew Sfreddo | BluePrint Healthcare (773) 951-4788 | asfreddo@blueprinthcre.com Lic# IL 475147901

Mark Riso | Blueprint Healthcare Real Estate Advisors Lic# FL BK3376059

1125

Quincy, FL

LEARN MORE www.10x.com/M022979-D

Kyle Hallion | Blueprint Healthcare Real Estate Advisors (502) 836-5917 | khallion@blueprinthcre.com Lic# KY 276079

997

Aurora Road Sagamore Hills, OH

Connor Doherty | Blueprint Healthcare Real Estate Advisors (312) 612-9578 | connor@blueprinthcre.com Lic# IL 475147629

Larry Patton | L.D. Patton Realty Lic# OH BRKP0000204458

Houston,

Ann Tran

Compass Real Estate (281) 524-9540

ann.tran@compass.com

Lic# TX 0531375

Derek Rudd

Ten-X (949) 398-2589

drudd@ten-x.com

Alvin,

Justin Miller Marcus & Millichap (713) 452-4287

justin.miller@marcusmillichap.com Lic# TX 551204

Jameson Kuykendall

Ten-X (949) 383-5670

jkuykendall@ten-x.com

LEARN MORE www.10x.com/M022935-D

Recy Dunn | KW Commercial - Houston Professionals (281) 444-3900 | askrecy@kwcommercial.com Lic# TX 614951

Jameson Kuykendall | Ten-X (949) 383-5670 | jkuykendall@ten-x.com

LEARN MORE www.10x.com/M023004-D

Russ Moroz | Marcus & Millichap (916) 724-1310 | russ.moroz@marcusmillichap.com Lic# CA 01807787

Carlos Silguero | Ten-X (909) 493-2579 | csilguero@ten-x.com

LEARN MORE www.10x.com/M023010-D

Michael Gonzalez | Evolve Real Estate (281) 907-6339 | cre@evolve-realestate.com Lic# TX 486448

Keisha Hartshorn | Ten-X (949) 818-6210 | khartshorn@ten-x.com

Mabelle Perez

Berkadia Real Estate Advisors

(786) 208-4795

mabelle.perez@berkadia.com

Lic# FL SL3393845

Gregg Cordaro

Bekadia Real Estate Advisors

Lic# LA BROK47906AACT

Bullhead

Brian Smuckler

CBRE

(602) 735-5688

brian.smuckler@cbre.com

Lic# AZ SA101740000

Josh Mehlberger

Ten-X

(949) 379-8633

jmehlberger@ten-x.com

Michael Fine Fine & Company LLC

(312) 278-0600

michael@fineandcompany.com Lic# IL 471009718

Corey Talley Ten-X (804) 404-2215

ctalley@ten-x.com

Jasmine Golia Pacific Coast Commercial

(619) 469-3600

jasmine@ pacificcoastcommercial.com

Brian Brockman Bang Realty Lic# IL 471020548

Amy Foote Landqwest Commercial, LLC

(407) 451-5171

afoote@lqwest.com Lic# FL SL3172331

Christopher Rivera Ten-X

(305) 509-6751

crivera@ten-x.com

LEARN MORE www.10x.com/M022954-D

Jason Sasser | CBRE (813) 830-8409 | jason.sasser@cbre.com Lic# FL SL3230636

Andrea Delgado | Ten-X (305) 503-2638 | adelgado@ten-x.com