LITIGATION FORUMS AND STRATEGIES

Session – IV November 25, 2022

1

2 CONTENTS 01 | TRADITIONAL FORUMS 02 | ADJUDICATION 03 | APPELLATE PROCEEDINGS 04 | LIMITATION 05 | PRE-DEPOSIT 06 | WRIT JURISDICTION 07 | ALTERNATE FORUM 08 | BEST PRACTICES

TRADITIONAL FOURMS

1

3

4 POINTS TO BE DISCUSSED AUDIT & INVESTIGATION ADJUDICATION PROCEEDINGS APPELLATE PROCEEDINGS WRIT JURISDICTION

AUDIT vs.

AUDIT and INVESTIGATION tend to be referred interchangeably, although these are not one and the same Audit and Investigation proceed to Adjudication. The demarcation is carved by the issuance of SCN

5

INVESTIGATION

Investigation • Undertaken in case of suspicion • An Ad-hoc action • Usually brings in an element of surprise • Investigation Authority includes SIIB, DGGI Audit • Conducted as a matter of routine • Pre-determined periodicity • Precedes with advance Notice • Co-operative demeaner

6 POLL

B C D

QUESTION 1 A

ADJUDICATION

2

7

ADJUDICATION PROCEEDINGS…

8 Fact

the

law Department

It is necessary

Department Strong research and drafting skills required for fair

the Assessee Quasi Judicial Forum – [Summary proceedings without requirement

to the

finding of

matter and application of

is most of the time biased about the revenue with respect to customs duties

for strong representation of the matter before the

procedure of

of following Code of Criminal Procedure and Civil Procedure Code] The officer shall issue the SCN within two years from the relevant date

person chargeable with duty or interest

Key Aspects of Adjudication involve the following

ADJUDICATION PROCEEDINGS

Points to be considered

- Issuance of SCN triggers adjudication

- Reply against the SCN is to be filed within 30 days subject to Principles of Natural Justice

- Prior to drafting reply it shall be checked if SCN is issued with proper authority

- It ought to be ensured that SCN is not time barred or vague

- SCN must preceed with clear allegations and relevant facts

- In case, incorrect facts are mentioned or relevant facts are missed out in SCN the same shall be highlighted to the Authorities

- Reliance placed on inappropriate judgements should be distinguished in the reply

- Taxpayer to present relevant evidences during adjudication

- Taxpayer should also exercise its right of personal hearing to explain its case better Taxpayer should ensure that the Principal of Natural Justice is followed, and he has been heard and given an opportunity of being heard

9 …

3 APPELLATE PROCEEDINGS 10

11 POLL

B C D

QUESTION 2 A

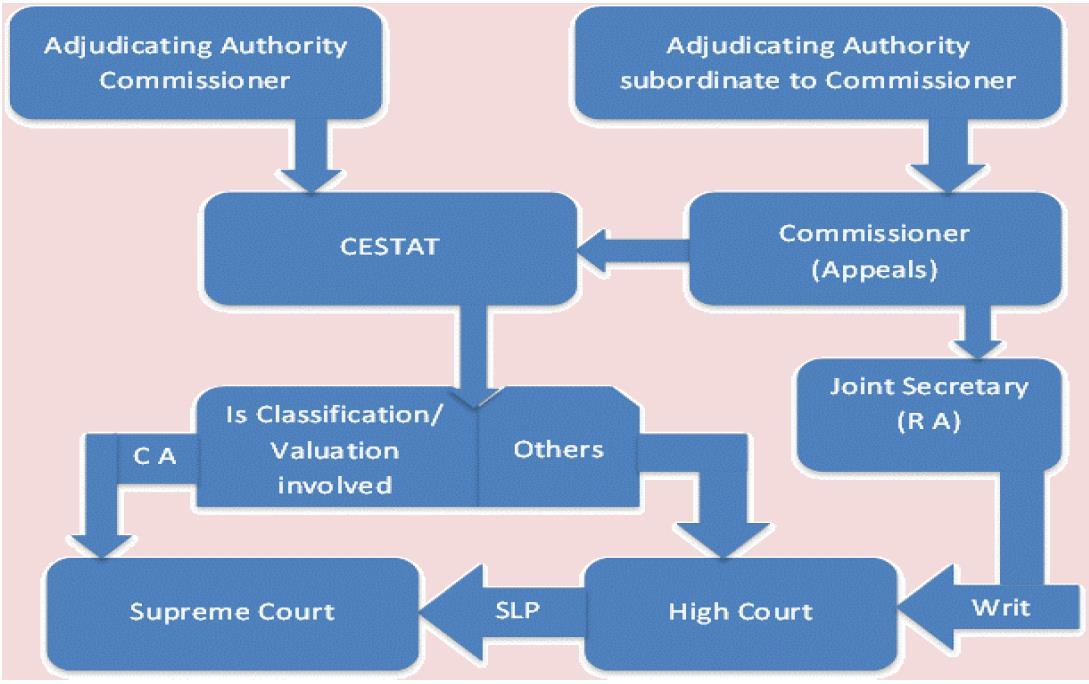

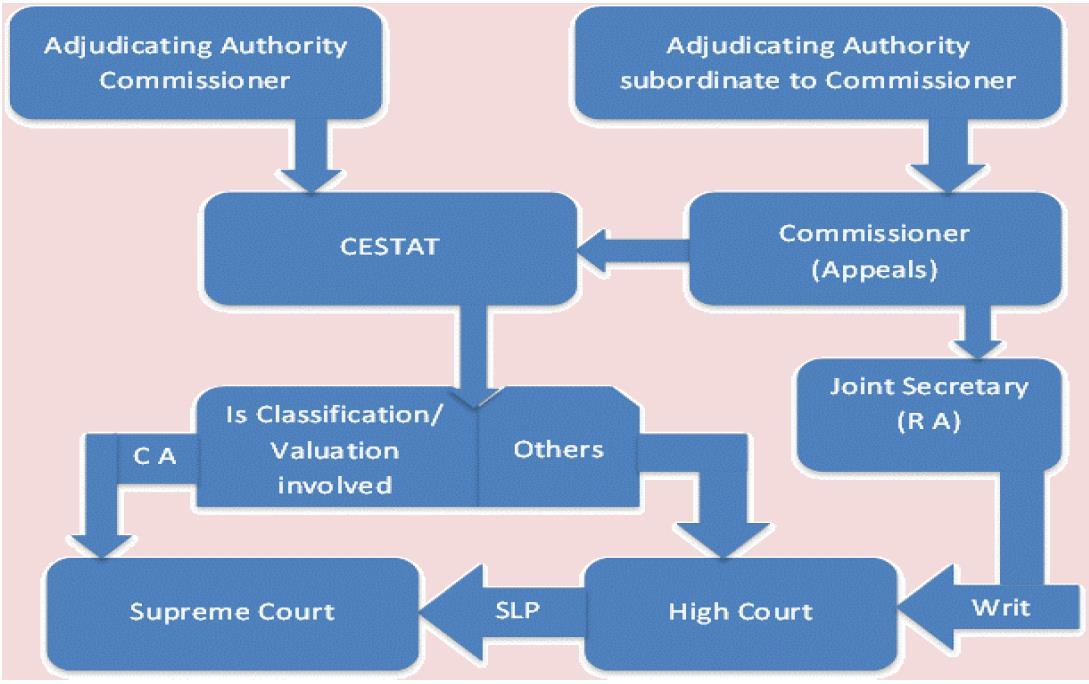

APPELLATE FORUM

12

•

Other

Commissioner (Appeals)

Assistant Commissioner Deputy Commissioner CESTAT

Commissioner Principal Chief Commissioner of Customs

Chief Commissioner of Customs

appropriate authority Order passed by: Additional Commissioner Order passed by: Appeal to lie before the below Appellate Authority if the orders are passed by the authorities mentioned below:

APPELATE FORUMS

Commissioner (Appeals)

Section 128 and Section 128A of the Customs Act, 1962 defines the appellate jurisdiction of the Commissioner (Appeals) and the procedure for filing appeals

Appellate Tribunal

Section 129 of the Customs Act, 1962 defines the appellate jurisdiction of CESTAT

Appellate Tribunal is the final factfinding adjudicating authority under the Customs Act

High Court

Section 130 of the Customs Act, 1962 gives power to the High Court for hearing appeals against the CESTATE order

Supreme Court

Against the order of the High Court, appeal can be made to the Supreme Court by way of Civil Appeal under Section 130E(a) of the Customs Act, 1962 or a Special Leave Petition under article 136 of the Constitution of India

03 04 01 02 13

APPELLATE PROCEEDINGS

14

LIMITATION

4

15

TIME LIMIT FOR FILING APPEALS UNDER CUSTOMS ACT, 1962

01

02

Section 128 Commissioner Appeals

Appeal to be filed within 60 days from the date of communication of the order

Section 129A

CESTAT

Appeals to be filed within 3 months from the date of communication of the order

Condonation of Delay period – 30 Days

Based on sufficient cause, delay maybe condoned

03

04

Section 130A

High Court

Appeal to be filed within 180 days from the date of communication of the order

Based on sufficient cause, delay maybe condoned

Supreme Court

Appeal to be filed within 60 days from the date of communication of CESTAT order and 90 Days from the High Court’s Order

Based on sufficient cause, delay maybe condoned

16

PRE-DEPOSIT

5

17

18 POLL

B C D

QUESTION 3 A

19

Section 129E of the Customs Act, 1962 provides for mandatory pre-deposit • When duty or duty, interest and penalty are in dispute, pre-deposit is a percentage of duty • When penalty or interest and penalty are in dispute, pre-deposit is a percentage of penalty Sr. No Appellate Forums Percentage of Pre-Deposit 1 Commissioner (Appeals) • 7.5% 2 CESTAT • 7.5% (If Appeal is filed against the order of Commissioner) • 10% (If Appeal is filed against the order of Commissioner(Appeals) u/s 128A) 3 High Court/ Supreme Court • No such requirement

PRE-DEPOSIT UNDER CUSTOMS ACT, 1962

WRIT PETITION

6

20

21 POLL

B C D

QUESTION 4 A

WRIT PETITION

Article 32 and Article 226 of the Constitution of India had vested powers on the Hon’ble Supreme Court and High Court for Writ Jurisdiction;

TYPES OF WRITS

HABEAS CORPUS

Literal meaning –‘present the body’ Writ is issued when:

• Detention is unlawful;

• Detention is not issued by competent authority; Writ cannot be issued when:

• When detention is for contempt of court or legislation by the person

MANDAMUS

Literal meaning – ‘We Command’

• This Writ is issued to order the public official who has failed to perform his duty or refused to do his duty

• This Writ can be issued against public body, corporation, inferior court, tribunal or government

CERTIORARI

• Literal meaning –

To be informed

• This Writ is issued in case of excess or lack of jurisdiction

• This Writ is issued by a higher Court to lower Court or tribunal ordering them to transfer a case pending with them or quash their order

PROHIBITION

• Literal meaning –

To forbid

• This Writ is issued by Higher Court to lower court to prevent them from exceeding its jurisdiction

QUO WARRANTO

Literal meaning – By what authority or warrant

Hon’ble Supreme Court or High Court issues this Writ to prevent illegal usurpation of a public office by a person

22

This remedy can be invoked only in absence of an alternate efficacious remedy

ALTERNATE FORUMS

7

23

24

FOR ADVANCE RULING Duty Drawback Scheme during the period of transition to GST regime w.e.f. July 1, 2017 to September 30, 2017 Import of Telecom Equipment, Mobile/Cellular Phone Parts and Aircraft Parts Anti-Dumping Duty on Auto/Vehicle Parts-Radiators, Axle for trailers, Alloy Wheel etc. (Notification No. 20/2017-Cus. dated May 12, 2017) Misclassification of Radiators & parts of automobiles with a view to avoiding Anti-Dumping Duty: Undue benefit of BCD under Sr. No. 530A of the Notification No. 50/2017-Cus dated June 30, 2017: Related party transaction value cases handled by SVB Cells at major Customs Houses SIGNIFICANT ISSUES WITH RESPECT TO ADVANCE RULING AUTHORITY ‘Advance Ruling’ means a written decision on any of the questions referred to in section 28H of the Customs Act, 1962 raised by the applicant in his application in respect of any goods prior to its importation or exportation Clarity in advance with respect to transaction undertaken/proposed transaction Advance Ruling is binding only on the Applicant and jurisdictional authority Carries persuasive value for identical transaction of other assessee Possibility of bias towards revenue by Advance Ruling officers Long pendency: Over a year. The pendency only aggravated due to lockdown measures Equalizer or a tool to settle revenue neutral transactions

AUTHORITY

25

RELAXATION COMMITTEE Duty Drawback Scheme during the period of transition to GST regime w.e.f. July 1, 2017 to September 30, 2017 Import of Telecom Equipment, Mobile/Cellular Phone Parts and Aircraft Parts Anti-Dumping Duty on Auto/Vehicle Parts-Radiators, Axle for trailers, Alloy Wheel etc. (Notification No. 20/2017-Cus. dated May 12, 2017) Misclassification of Radiators & parts of automobiles with a view to avoiding Anti-Dumping Duty: Undue benefit of BCD under Sr. No. 530A of the Notification No. 50/2017-Cus dated June 30, 2017: Related party transaction value cases handled by SVB Cells at major Customs Houses AIM OF POLICY RELAXATION COMMITTEE Paragraph 2.58 of Foreign Trade Policy (‘FTP’) provides for the relaxation of Policy and Procedures on grounds of genuine hardship and adverse impact on trade. A Policy Relaxation Committee (PRC) is accordingly constituted under para 2.58 of the FTP TO SEEK RELAXATIONS IN MATTERS OF FTP RELAXATION OF EXPORT OBLIGATION AND EXTENSION OF EXPORT OBLIGATION PERIOD TO BE APPROACHED ONLY IF UNFORESEEN DIFFICULTIES FACED IN GENUINE CASES CAN BE APPROACHED TO MITIGATE PROCEDURAL LAPSES THAT THREATEN SUBSTANTIAL BENEFIT

POLICY

SETTLEMENT COMMISSION

AIMS

OBJECTIVES

• An option to acknowledge the lapse after knowing allegations in SCN and to request waiver from penal consequences

• Provides waiver of Penalty and Prosecution if bona fide is established the

• No relaxation in duty demand and interest: to be approached only when merits of the case are weak

• Time Limit: after issuance of SCN but prior to adjudication Order

• To provide an alternate channel for dispute resolution

• To reduce litigation

• An opportunity to come clean after realizing the lapse is statutory obligation

• Settlement subject to complete disclosure of duty liability

• Quick settlement of disputes and save the business from the worries of prosecution

26

AMNESTY SCHEMES

•Amnesty Schemes are effective mechanism to close long pending cases

•It is critical to assess merits of the case prior to opting for redressal through amnesty scheme

•Concession in penalties, interest and even party of duty payment maybe granted depending upon the circumstances

•To expedite realization of revenue locked in disputes

27

8 BEST

28

PRACTICES

Facts

29

BEST PRACTICES

DRAFTING

• Backbone of pleadings. • Clarity of facts strengthens control on law point • ‘All and Only’ relevant facts!

• Ratio decidendi vs Obiter dicta • Referred vs Relied upon vs Distinguished

of

• Understanding the grievance in the matter • Interpretation of statute according to the rules and regulations prescribed under law

• Draftsman to function as a ‘teacher’ • Flow – to be concise and self-explanatory • Proof reading • Print copies

Research

Point

law

Ancillaries

30

More Information, Visit: https://taxmann.com/

For