APRIL 11, 2024

Presented by

CA. Niki Darshak Shah

FEMA Advisor | Registered Valuer

Mobile No.-9930547923

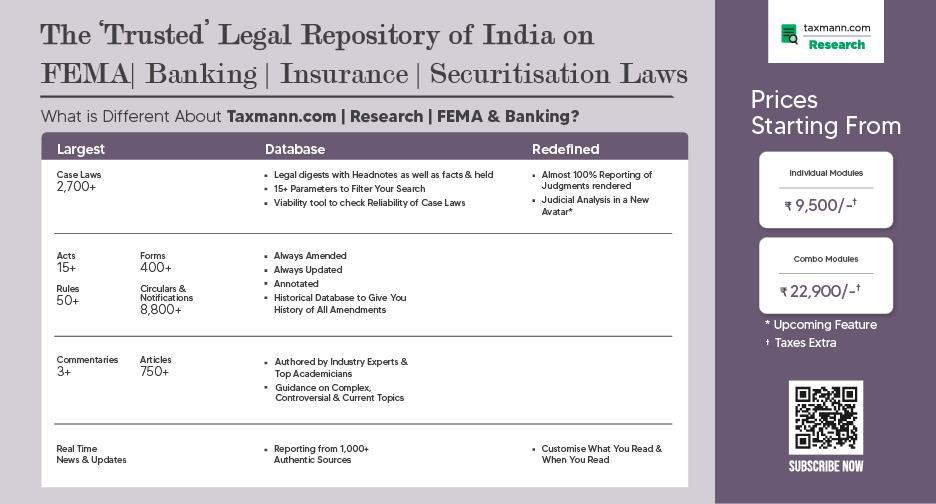

In India, FDI is governed and regulated by:

Master DirectionForeign Investment India

No prior approval from the Government of India is required.

Available for most sectors, except those specifically restricted.

Limits : Sectoral caps/ stipulated sector specific guidelines.

Investors only need to inform the Reserve Bank of India (RBI) within 30 days of investment.

Faster process since it bypasses government scrutiny.

Prior approval from the Government of India is mandatory.

Only for cases other than Automatic Route and those mentioned in sectoral policy.

Investors must obtain permission from the concerned ministry or department before investing.

An entity of a country, sharing land border with India or where the beneficial owner of an investment into India is situated in or is a citizen of any such country (Pakistan)

Mining

IT

Financial services(a)

Insurance (a)

Construction Development

Infrastructure

Manufacturing sector

Note: (a) Sector specific guidelines (b) Subject to certain exceptions

Agriculture (b)

Atomic energy

Lottery, betting and gambling

Chit fund, Nidhi company

Trading in Transferable Development Rights

Cigars & Cigarettes

Limited Liability Partnership Company

Partnership/Proprietary Concern*

Investment Vehicles**

*A NRI or an OCI may invest on a non-repatriation basis

**I.V like REITS, AIFs, etc.

Partly Paid Up: Shall be fully calledup within twelve months of such issue

Fully Paid Up

Eligible equity instruments

Share Warrants are those issued by an Indian company in accordance with the regulations by the SEBI

The mode of payment and attendant conditions are specified by the RBI

Offer made must be in compliance with Companies Act, 2013

Unlisted Company: Rights issue to PROI shall not be at a price less than the one offered to Resident

Investment via Rights and Bonus Issue

Such issue shall not breach the sectoral cap applicable

Listed Company: Rights Issue to PROI shall be at a price determined by the company

• Indian companies can issue ESOs/sweat equity shares to their employees or directors abroad.

• Applies to employees/directors of the company's holding, JV or WOS

• Scheme must comply with SEBI Act, 1992 regulations.

• Alternatively, adherence to the Companies (Share Capital and Debentures) Rules, 2014 is required.

• Prior approval needed if the investment is under the government approval route.

• Mandatory government approval for issues to citizens of Bangladesh or Pakistan.

• Shares acquired via ESOs while being a resident in India must be held on a non-repatriation basis by overseas residents

• Issued shares must adhere to the applicable sectoral investment caps

Issue by company to person resident outside India

Transferred from a person resident in India to a person resident outside India

Price not less than

The rule prescribes that the price must be worked out in accordance with SEBI guidelines.

Transferred by a person resident outside India to a person resident in India

Price not more than

The fair value worked out as per any internationally accepted pricing methodology for valuation on an arm's length basis, duly certified by A Chartered Accountant or A SEBI registered Merchant Banker or A practicing Cost Accountant.

Swap of Equity Instruments

Subscription to MOA

Share Warrants

Irrespective of the amount, valuation involved in the swap arrangement shall have to be made by a Merchant Banker registered with the SEBI or an investment banker outside India registered with the appropriate regulatory authority in the host country

Such investments shall be made at Face Value subject to entry route and sectoral caps

Their pricing and the price or conversion formula shall be determined upfront.

*Note that these pricing guidelines shall not be applicable for investment in equity instruments by a person resident outside India on a non-repatriation basis.

FORM

FC-GPR Indian company issuing capital instruments to a PROI. Also in case of conversion of ECB into equity along with Form ECB-2 (Part V: Annex III).

FLA Return Indian company which has received FDI or an LLP which has received investment by way of capital contribution

FC-TRS For transfer of capital instruments

ESOP Indian company issuing employees’ stock option to PROI

LLP (I) LLP receiving amount of consideration for capital contribution and acquisition of profit shares

LLP (II) Disinvestment/ transfer of capital contribution or profit share of LLP between a resident and a non-resident

LEC (FII) Purchase/ transfer of capital instruments by FPIs on the stock exchanges in India

DI Indian entity or an investment Vehicle making downstream investment in another Indian entity

CN Indian startup company issuing Convertible Notes to a person resident outside India

30 days from the date of issue of capital instruments.

By 15 July of the corresponding year

60 days of transfer or receipt / remittance of funds (which is earlier)

30 days from the date of issue of ESOPs.

30 days from the date of consideration

60 days from the date of receipt of funds

N.A

30 days from the date of allotment of capital instruments

30 days of such issue

Facts of the case:

• An Indian Company was incorporated as a Private Limited on 28.12.2018.

• The company allotted 400 and 6000 equity shares of Face Value Rs. 10 each to the foreign investors ABC Ltd (UK) and XYZ (individual) respectively on 14th August 2019 against subscription to Memorandum of Association against which the company received Inward remittances from them as FDI on 8th September 2019 amounting to Rs. 67,000.

• However, the company had surplus share application money after the shares were allocated. Also, No FEMA compliances were done for FDI received and shares allotted.

Questions:

• What will be the course of action and Compliance required to be done?

Facts of the case:

• Company A, based in India, received an investment from foreign Investors X, Y, and Z against which Equity Shares were allotted.

• Fresh Issue of shares necessitated the filing of Form FC-GPR, for FDI received from foreign Investors.

• However, later on, while filing the Form FC-GPR, a necessary document i.e. 6-pointer KYC of the Foreign Investors could not be obtained as their local bank accounts were dormant.

Questions:

• What would be the appropriate way forward for Company A to ensure compliance with the FEMA regulations while facilitating the fresh issue of shares to foreign investors?

• A Listed company X issued ESOPs to its Resident and Non-Resident Employees under different ESOP Schemes.

• Subsequently, twice the Bonus Shares were also issued to their employees in 2000 and 2006.

• Form FC-GPR was duly filled by the company under the regulatory compliances for the issuance of ESOPs to non-resident employees on a timely basis.

• However, Company X was unaware of the compliance while issuing Bonus Shares to its Non-Resident employees.

Questions:

• What are the immediate regulatory steps the company must take to rectify the non-compliance?

• Mr. A, a Person of Indian origin held shares of M/S XYZ Limited on Non-Repatriable basis.

• He was granted permission by RBI Foreign Exchange department to convert his investment into repatriable basis for transfer to M/S AD Limited (Non-Resident Company).

• However, the FC-TRS forms for these transfers were filed belatedly.

Questions:

• What are corrective measures for compliance with Regulation 10A(b)(i)

• M/S VX Limited incorporated on 31.12.2022, allotted 2,000 equity shares to M/S Dataex (NonResident).

• However, a part of the consideration was received after the allotment by the company.

• The company failed to refund the excess application money beyond the prescribed time limit of 75 days from the date of inward remittance.

Questions:

• What regulations should the company have followed and the way forward?

Facts of the case:

• Mr. X who is Non-Resident transferred equity shares of an Unlisted Company to M/s AB Private Limited (Resident Indian).

• M/s AB Private Limited transferred the Sales consideration to Mr. X’s (Non- Resident) NRO A/c.

Questions:

• Is M/s AB Private Limited is liable for any compliance to be done?

• What are the compliances if the Sales consideration is transferred to NRE A/c?

• M/s XYZ Private Limited incorporated in India received Foreign Investment from Mr. A (NonResident)

• Mr. A who is Non-Resident transferred the Share Application money via the Money Exchanger platform. The company received the Share Application money in INR as a result.

• Since the transaction was not processed under the traditional banking channels, FIRC copy could not be raised.

• Hence, M/s XYZ Private Limited was unable to file Form FC-GPR.

• XE International Money Transfer Payoneer PayPal

Definition

Investment through equity instruments by a PROI in an unlisted Indian company; or in ten per cent or more of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company;

Investments by non-residents in Indian company equity instruments, where the investment is below 10% of the paid-up capital or equity series of a listed company.

Control & Ownership

Implies acquiring a substantial degree of control and ownership in the foreign business entity. The investor often holds a significant stake, usually 10% or more, in the company.

Generally does not result in ownership or significant control over the invested entity.

Purpose

Economic Impact

Generally viewed as more beneficial for the host country’s economy in the long run due to technology transfer, employment generation, and infrastructure development. Often aimed at establishing production facilities, expanding operations, accessing new markets, or obtaining strategic assets in a foreign country.

Brings in capital from foreign investors, which can be used for the development and growth of the country's financial markets. It allows for a wider investor base.

Provides short-term capital for the country’s financial markets, which can help in improving liquidity. However, it can lead to volatility

FDI is allowed in entities like companies, partnerships, and trusts*, subject to certain conditions and guidelines outlined under FEMA.

FPI is allowed mainly in marketable securities like Listed Companies , Government Bonds, Corporate Bonds, Mutual Funds, ETFs.

Pricing Guidelines

Pricing guidelines for issuing and transferring shares are specified under FEMA regulations.

The purchase and sale of shares must comply with the market price for listed companies. For unlisted companies, investment by FPIs is subject to guidelines similar to FDI but mainly focused on debt instruments.

There is no such requirement here. However, there are compliance and reporting requirements under FEMA for entities receiving FDI.

FPIs need to obtain a certificate of registration from SEBI and comply with the conditions prescribed in the SEBI (FPI) Regulations, 2014. The process involves due diligence requirements, adherence to KYC norms, and other regulatory compliances.

• Downstream Investment refers to the investment made by an Indian entity that has received foreign direct investment (FDI) into another Indian company.

• Reporting requirements within 30 days of investment with DIPP/ FIPB introduced

• Indian company making downstream investment not permitted to leverage funds from domestic market

• FI to include all types of foreign investments

• For RIC own and control are cumulative conditions; for NRE these are non-cumulative

• The methodology to apply to every stage of investment at Indian company

If ICO2 & ICO1 owned and controlled by RIC, investment by ICO1 in ICO2 is not indirect FDI 1

If ICO1 is owned or controlled by NRE, investment by ICO1 in ICO2 is considered indirect FDI 2

If ICO1 holds 100% in ICO2, NRE investment in ICO1 is considered indirect FDI in ICO2 3

Greenfield Investment

The parent company creates a new operation in a foreign country from the ground up.

Brownfield Investment

The parent company creates a new operation in a foreign country from the ground up.

'Non-compete' clause shall not be allowed except in special circumstances with the Government approval

Maintain the production level of essential medicines at the highest of the past three years for the next five years.

Keep R&D spending at the highest level of the past three years for the next five years.

Report any technology transfers to the Ministry of Health and Family Welfare or Department of Pharmaceuticals

The Ministry of Health and Family Welfare and other

relevant authorities will monitor compliance with these conditions

• Construction Development: Townships, Housing, Built-up infrastructure

Permissible Activities

1. Development of Townships

2. Construction of Residential/Commercial Premises

3. Roads and Bridges

4. Hotels, Resorts, Hospitals , Educational Institutes

Exit and Repatriation Conditions:

• Exit permitted upon project completion or after developing basic infrastructure (e.g., roads, water supply).

• Foreign investors can exit before project completion after a 3-year lock-in period for each investment tranche, under automatic route.

Transfer of Stake:

• Transfer of stake from one non-resident to another is unrestricted by lock-in periods or government approval, without requiring repatriation of investment.

Project Standards Compliance:

• Projects must meet all applicable norms, standards, and regulatory requirements, including land use and community amenities.

Developed Plots Sales:

• Only plots with completed trunk infrastructure are to be sold as "developed plots.“

Responsibilities of the Indian Investee Company:

• Must secure all necessary approvals and comply with local regulations, including development charges and infrastructure development.

Monitoring of Compliance:

• Local or state government bodies to monitor developer compliance with the conditions.

Prohibited FDI Activities:

• FDI not permitted in real estate business, construction of farmhouses, and trading in transferable development rights (TDRs).

• Real estate business is defined as dealing in land and immovable property for profit, excluding specified development projects.

Lock-in Period Exemptions:

• Lock-in period does not apply to investments in hotels, tourist resorts, hospitals, SEZs, educational institutions, old age homes, and investments by NRIs.

FDI in Completed Projects:

• 100% FDI allowed under automatic route in completed projects for townships, malls, business centres, etc., with a 3year lock-in period per FDI tranche.

• Transfer of ownership/control to non-residents permitted, but immovable property transfers are restricted during the lock-in.

Notes:

The term "real estate business" does not include the development of townships, construction projects, or earning rent/income from property leasing.

Completion of the project is determined according to local regulations