IN THIS ISSUE 01 Indicators of Insolvency

03 Can I Trust my Trust?

Indicators of Insolvency

W

Lisa Isaac - Senior Manager | Melbourne ith COVID-19 related restrictions easing in several states of Australia, many Australian businesses are returning to some sense of normal. That normal may be staff returning to offices, businesses being allowed to re-open or restrictions on capacity limits being lifted.

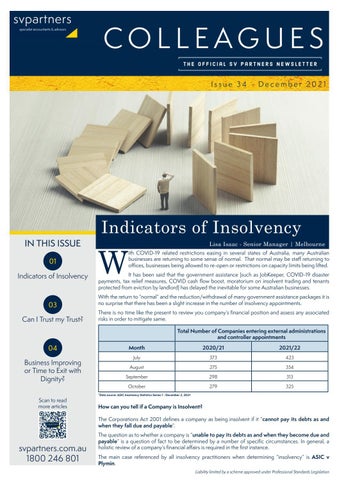

It has been said that the government assistance (such as JobKeeper, COVID-19 disaster payments, tax relief measures, COVID cash flow boost, moratorium on insolvent trading and tenants protected from eviction by landlord) has delayed the inevitable for some Australian businesses. With the return to “normal” and the reduction/withdrawal of many government assistance packages it is no surprise that there has been a slight increase in the number of insolvency appointments. There is no time like the present to review you company’s financial position and assess any associated risks in order to mitigate same. Total Number of Companies entering external administrations and controller appointments

04 Business Improving or Time to Exit with Dignity? Scan to read more articles

Month

2020/21

2021/22

July

373

423

August

275

354

September

298

313

October

279

325

*Data source: ASIC Insolvency Statistics Series 1 - December 2, 2021

How can you tell if a Company is Insolvent? The Corporations Act 2001 defines a company as being insolvent if it “cannot pay its debts as and when they fall due and payable”.

svpartners.com.au 1800 246 801

The question as to whether a company is “unable to pay its debts as and when they become due and payable” is a question of fact to be determined by a number of specific circumstances. In general, a holistic review of a company’s financial affairs is required in the first instance. The main case referenced by all insolvency practitioners when determining “insolvency” is ASIC v Plymin. Liability limited by a scheme approved under Professional Standards Legislation