2025 IN REVIEWFROM THE SUNSHINE COAST, QUEENSLAND

Jason Cronan (Director) and Daniel Luckman (Associate Director) | Sunshine Coast

Welcome to our final newsletter for 2025.

Following on from last year’s recap from the Sunshine Coast, Queensland, we share with you our industry experiences for 2025.

Merry Christmas and happy holiday season to our friends and valued colleagues. Thank you again for your support.

1. ATO Debt Collection Continues to Soar!

• The ATO continues to aggressively pursue unpaid taxation debts, reported to be in excess of $101 billion, the largest it has ever been!

• The feedback we are receiving is that ATO payment arrangements are becoming more difficult to obtain.

• ATO debt collection continues to drive a high level of insolvencies.

• Whilst there has been more of a focus on collecting company and business-related debts, collection of individual debts (including sole traders) has increased.

• Court appointed Liquidations have increased substantially compared to previous financial years; signalling stronger and more proactive action from creditors (especially the ATO) to chase debts through legal action. Court Liquidations exceed the number of SBRs for the financial year to date.

• Over 84,000 Director Penalty Notices (DPNs) were issued during the 2025 financial year, to make directors personally liable for unpaid company tax and superannuation.

• Garnishee notices continue to be issued to recover funds (especially from bank accounts, accounts receivable, income of individuals) Credit defaults (for business debts in excess of $100,000) are still being reported to credit agencies by the ATO, which adversely impacts credit scores (and the potential ability to borrow money) and can impact the continuity of trade supplier terms / accounts.

2. Small Business Restructures (SBRs) on the decline

• SBR appointments have slowed in the financial year to date, down 40% on the same period last year.

• The acceptance rate for SBRs is also down –from 79% last year to 63% this year.

• The ATO is still the major creditor in SBR appointments.

• Whilst it depends on each case, the ATO are seeking higher returns than previously.

• The ATO are rejecting some SBR proposals in

situations where there are large, related party debts owed to the Company (eg Director / Division 7A loans), historical non-compliance in relation to lodgements and lack of payments historically (especially where there has been little to no payments to the ATO over the previous years).

• We do a lot of work at the start to

► Maximise the prospects of success;

► Provide a better outcome than a liquidation; and

► Consider the viability of the Company’s business – it is often a catalyst for a review of the company’s financial performance and to improve and tighten up areas (eg improve compliance, review revenue and costs, etc).

• SBRs are still a viable restructuring process for building companies in Queensland, as the event does not result in the automatic loss of a building licence for a company (the QBCC will still consider other compliance issues).

• The feedback from the ATO is:

► Lump sum up front payment/s are viewed favourably.

► The shorter the payment period, the better (2 years or less is preferred).

► Director loan accounts (even for drawings) and related party loans are not an automatic reason to reject a SBR proposal, some repayment of the loan under the SBR, and future repayment of the balance of the loans, is viewed more favourably.

► Related party creditors should not claim in the SBR – to maximise the ATO dividend.

► Cash flow forecasts and financial statements need to be realistic and justifiable – and the ATO will review this against historical financial information for reasonableness.

• Remember, SBRs are only for companies (not available for individual debts – the Bankruptcy Act deals with this)

3. Voluntary Administrations (VAs) continue to have a place

• SBRs are still more popular than VAs as the preferred method to compromise Company debts.

• VAs are the fourth highest type of external administration appointment for the financial year, behind CVLs, Court Liquidations and SBRs.

• VA appointments remain relatively steady over the last few quarters.

• VAs still have a place when:

► Corporate structures are complex, and greater flexibility is required for a compromise.

► If debts exceed $1million.

► Where employee entitlements (including superannuation) are owed.

► Related party debts wish to claim and participate in voting.

► Other eligibility criteria for SBRs are not met.

4. Director and Shareholder Disputes on the Rise?

• There continues to be an increase in director and shareholder disputes, especially with increased financial pressure and stress on businesses.

• Shareholder disputes can often lead to litigation and an insolvency appointment.

• We still do not see many Shareholder Agreements in place, which could assist with resolving disputes.

5. Individual / Personal Debts Owed

• Personal insolvencies remain lower than pre-Covid numbers; however, they have increased by over 6% compared to last financial year and are on the rise again.

• The ATO continue to issue DPNs to Directors to make them personally liable for Company debt.

• Some important factors to consider are:

► DPN liability can arise due to late lodgements, and they can become locked down, i.e., can only be avoided if the debt is paid or a valid defence is available.

► ATO debts are not statute barred so there is no time limit on collection (unlike other debts).

► The ATO can retain tax refunds to apply against debts owed –even if the debt was previously classified “non-pursuit”.

► The ATO can chase these debts at a future date, which can result in the loss of assets acquired later, including interests in deceased estates!

6. Members’ Voluntary Liquidations (MVLs) are still a useful tool to save tax!

• MVLs (solvent liquidations) are still being utilised to wind up companies to save tax.

• MVLs are also beneficial when shareholders can’t resolve disputes, and the Company is solvent – they can appoint an independent

THE TAX MAN COMETH

David Stimpson - QLD Executive Director | Brisbane

party to wind-up the company.

7. The Main Industries facing Insolvency are (still)…

• Construction, Hospitality and Retail Trade for corporate insolvencies.

• Construction, Health Care and Social Assistance for personal insolvencies.

• Economic pressures and consumer spending continue to impact small businesses.

• We also see a lack of business acumen and planning with Companies that enter insolvency appointments, often due to not seeking and obtaining appropriately qualified advice.

8. Safe Harbour – Protection for Directors from Insolvent Trading

• As noted last year, Safe Harbour was introduced in 2017 to provide protection for Directors from insolvent trading, whilst engaging a professional (such as SV Partners) to assist in implementing a plan to provide a better outcome than a liquidation.

• Whilst the number of appointments is not reported to ASIC, our experience is that there has been limited use of the regime, especially in the SME market.

• It provides a viable process for directors concerned about insolvent trading, where there is potential to save a Company and avoid a formal external administration.

9. Voluntary Liquidations (CVLs) are still the most common form of insolvency

• Voluntary liquidations for insolvent companies are still the most prevalent type of insolvency appointment - there have been 2,480 appointments for the financial year to the end of November 2025.

• ATO debt continues to be a main driving factor for liquidations.

• Whilst liquidations are often difficult on directors, shareholders, employees, creditors and other stakeholders, it can provide relief from stress, some closure and minimise further incurring of debts.

• We always encourage early intervention, and we are available to discuss:

► The options available and the implications.

► Alternative actions that may assist the business to continue, survive and maximise returns to creditors.

► An exit strategy and plan for the future if the Company is not financially viable to continue.

Thank you again for your support in 2025. We will continue to provide relevant and useful information in 2026.

October 31 was an exciting day indeed. On that day, the ATO issued its annual report, 313 pages of jaw dropping “tax facts” for FY25, such as:

• There are 21,493 employees at the ATO, compared to 21,663 last year.

• The ATO's social media following has grown to 684,821 followers – an increase of 11% from the previous year.

• The minimum salary at the ATO is $31,512 pa, paid to “cadets while undertaking study”. The maximum wage at the ATO is $413,142 per annum paid to SES3 level employees (SES being a “Senior Executive Service”).

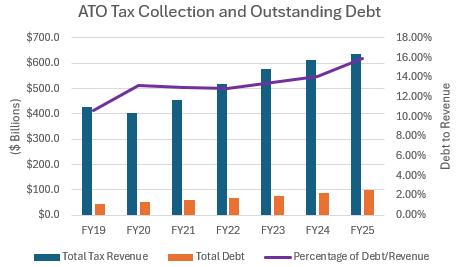

But the most interesting tidbits extracted from the report is that the ATO collected $636 billion in tax revenue in FY25, an increase in revenue of 4.09% from the previous year.

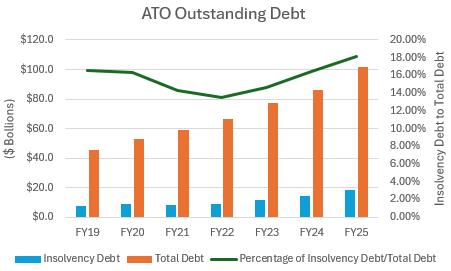

Even more interesting is the fact that the ATO has cracked the tonne for the first time, with total outstanding debt of $101 billion. This is up from $45 billion in FY19.

Whilst $77 billion of this is collectable or subject to appeal, nearly $25 billion is basically uncollectable, and includes two very interesting items (to me at least):

1. Insolvency debt of $18 billion, up $4 billion from last year. Given we’re experiencing record high numbers of insolvencies at the moment, it makes perfect sense that the level of ATO insolvency debt is at record highs, and

2. A new category included in the annual report this year is “non-pursued uneconomical” debt which is currently $6 billion. The report notes that in previous years this category was “n/a”. Most of the $6 billion non-pursued uneconomical debt is owing by either individuals or small business.

This little development makes one wonder whether the ATO has relaxed its public interest/level playing field mentality by writing off material amounts of debt in instances where there is no formal insolvency. An interesting item to keep an eye on in future years. If it escalates, the financial community would be within its rights to ask “who’s getting the free ride?”.

We all know that the ATO is cracking down on non-complying taxpayers for the first time really since Covid and that between 2020 and 2024 no real proactive collection activities were undertaken. This has clearly changed, and we are seeing more DPN’s, statutory demands and garnishees now then we have for five years.

The graphs below tell the story.

The first graph shows that since FY19, the percentage of debt to total revenue has increased from around 10% to around 16% in FY25. Although, bad debts of $25 billion on a turnover of $636 billion is not bad at all.

3.87% in fact; I’d take that. Government – what a great business model!

The second table demonstrates how the percentage of insolvency debt to total debt dipped during the Covid years but now is on a steady incline reaching around 18% currently.

The telling stat in my view is that tax debt is now 16% of total revenue (the purple line in Table 1), a percentage the government would clearly like to reduce. If the ATO focuses on those growing debt levels, we liquidators will be busy for a few more years yet.

The full annual report can be accessed on the ATO's website.

CHRISTMAS HEALTH CHECK

Hillary Orr - Consultant | Adelaide

As the festive season approaches it is an opportunity to do a mid-year health check for clients. Some of the risks that clients may be exposed to are more obvious than others.

There has been much activity in the insolvency arena around Small Business Restructuring (SBR). It has been an opportunity for businesses in financial difficulty (whilst meeting the relevant criteria) to put a proposal to their creditors for a compromise of their debts. Often these debts are predominantly owing to the ATO and the ATO has recently updated its website to set out what it requires when reviewing an SBR and the circumstances as to when they will approve a proposal.

We understand that there has been a slowing in the number of SBR appointments nationally, which may reflect the closer scrutiny applied by the ATO when reviewing SBR proposal. As noted on their website, the ATO closely scrutinises the compliance and payment history of the company when assessing the SBR proposal.

Early action is always recommended to provide a company with the best possible chance of successfully undertaking an SBR.

We also note that the ATO have increased their enforcement of outstanding debts by being the

petitioning creditor in a large number of recent Court appointed liquidations. Once the ATO files winding up proceedings, the company’s options are limited and therefore we recommend directors act before any such action occurs.

Christmas time is also a good time to review whether the company’s lodgements have been completed especially the Business Activity Statements (BAS) to the end of September 2025. The ATO have continued issuing a large number of Director Penalty Notices, and where the BAS is lodged outside of 3 months of its due date, the director will be personally liable for the debts incurred on that BAS and no formal appointment for the company will remove the director’s personal liability.

Cash flow problems at this time of year with businesses facing holiday downtime, coupled with holiday pay pressure, may also highlight the need for a check on the overall financial viability of a business and its directors/proprietors.

Although tax debt is a significant issue in relation to a business’ operations there are other exposures to both corporate and personal liability that can arise from changes in an individual’s circumstance. Some of these are discussed below.

Newly Appointed Director

If your client has recently consented to be a director of a company without seeking financial advice they may have inadvertently signed up for unexpected liabilities in the form of tax liabilities or even potential exposure to insolvent trading. If the appointment has just occurred and the director has realised the adverse financial position, it may be possible for the director to avoid personal liability if they take action which results in the tax being paid or a formal insolvency appointment within 30 days from inception.

Appointment following Bankruptcy of Spouse

It is not uncommon for a company director facing bankruptcy to appoint their spouse as a replacement director. This pre-empts the disqualification of the individual, following bankruptcy, from being a director under the provisions of the Corporations Act 2001.

The spouse, who may not have been active in the business prior to appointment, may not be aware of the risks and responsibilities of being a director.

Cessation as a Director

Resigning as a director may seem like the end

of an involvement with a company but it is easy for a retiring director to overlook liabilities that were incurred while they were a director. Similarly, they may have entered into agreements with financiers, leasing companies and landlords that leave them exposed despite their retirement. If a company has been operating for a number of years, directors may have forgotten what personal guarantees they gave to suppliers, often given many years ago. Action will be required to eliminate or reduce the exposure

Separation

and Divorce

While many separations may start off with the parties intending to resolve their financial affairs amicably, circumstances can often change over time.

LEGAL CASE

We have seen a number of instances where one spouse has been unaware that debts have been incurred in their name or they may be ignorant of their entitlements under complex trust arrangements. At the very least a credit check may identify debts, defaults or enquiries from third parties.

While the discussion above has centred around companies and directors, similar considerations apply to partnerships.

At SV Partners we are often asked to investigate the personal circumstances of an individual in circumstances where they are facing potential exposure. Should you have any questions in this area please do not hesitate to contact us.

UPDATE: SIGNIFICANT DEVELOPMENTS IN THE BANKRUPTCY ADMINISRTATION OF THE SECOND ESTATE OF KATHERINE JACKSON

Gillian Wright - Manager | Melbourne

Final orders were made recently in Federal Court proceedings brought on behalf of Fabian Micheletto and Michael Carrafa (SV Partners Directors | Victoria), the replacement trustees of the second bankrupt estate of former Health Services Union official Katherine Jackson. The orders mark a major milestone in a long-running matter involving serious misconduct by former registered trustee Paul Leroy.

Background to the Jackson Estate (No.2)

Katherine Jackson, once a senior HSU official, was found liable to repay compensation for breaches of workplace legislation. Facing significant judgments for interest and costs, she filed a debtor’s petition, appointing Paul Leroy— then a Sydney-based sole practitioner—as her trustee in bankruptcy. Further claims by the HSU forced Ms Jackson to lodge a second bankrupt estate, with Leroy again appointed as trustee.

During the administration, Ms Jackson became entitled to a share of the deceased estate of the late David Rofe QC. Once her entitlement was confirmed, the inheritance was paid to Leroy in his capacity as trustee. Instead of administering the funds for the benefit of creditors, Leroy misappropriated the money, withdrawing it from the estate’s account before fleeing Australia.

Federal Court Orders Against Leroy

With funding support from the Australian Financial Security Authority (AFSA) under s 305 of the Bankruptcy Act 1966, Micheletto and Carrafa pursued claims against Leroy for breach

of duty. The Federal Court has now made orders to the effect that Leroy:

• Breached his duties and obligations to the second bankrupt estate;

• Must repay the misappropriated inheritance, all remuneration taken from the estate (even amounts previously approved by creditors), interest, and indemnity costs.

Written reasons will be published in due course.

Cases of such blatant misconduct by a registered trustee are rare. This is one of the clearest examples in which breach of duty entirely disentitles a trustee to remuneration.

Australian Financial Security Authority (AFSA) Commences Broader Regulatory Action

In addition to the Jackson estate litigation, the Inspector-General in Bankruptcy has commenced separate proceedings in the Federal Court against Paul Leroy—an unprecedented regulatory action.

Following extensive investigations, AFSA alleges that Leroy misappropriated more than $4 million across at least five bankrupt estates between 2021 and 2023. AFSA is seeking wide-ranging relief, including:

• Declarations that Leroy breached his statutory and fiduciary duties

• A declaration that he is not fit and proper

ADAM KERSEY'S 20TH ANNIVERSARY!

We proudly recognise a remarkable achievement: Adam Kersey's 20th year at SV Partners.

Adam started with SV Partners as a graduate in 2005 and from the very beginning has been a constant source of leadership, expertise and calm problemsolving.

to act as a bankruptcy trustee

• An order prohibiting any application for re-registration for 15 years

• Repayment of allegedly misappropriated funds to estates now administered by the Official Trustee and to an individual whose bankruptcy has been annulled

• Orders requiring Mackay Goodwin, Leroy’s former firm, to account for and potentially repay remuneration received in connection with the relevant estates

This is the first application of its kind by the Inspector-General and reflects AFSA’s strengthened regulatory stance.

Close Coordination With Trustees of the Jackson Estate

AFSA’s regulatory proceedings complement the trustees’ own recovery actions regarding the Jackson estate (No. 2). AFSA has supported those investigations through:

• Section 305 funding;

• Commissioning forensic accounting work to trace misappropriated funds; and

• Ongoing coordination with government regulators and law enforcement.

Together, the Court’s orders in the Jackson estate and AFSA’s broader action against Leroy represent a significant step toward recovering misappropriated funds and strengthening regulatory protections for creditors and stakeholders.

His contribution to our practice has shaped not only the work we do, but the people we grow and the culture we try to exemplify at all times.

Adam, thank you for your dedication, professionalism, and the impact you’ve made on colleagues, clients and SV Partners.