New Zealand’s best stories often start local and grow onto the world stage. This year’s Local to Global edition of SupermarketNews reflects exactly that: a local view with a global focus.

Our food and fibre sectors continue to stand tall internationally, driving both value and reputation. Dairy remains the backbone of our export story, underpinning the strength of our economy and reminding us that quality and consistency will always find demand abroad. Wine, meanwhile, has carved out a position of prestige. New Zealand bottles carry with them the weight of regional

identity and sustainability, ensuring they command recognition and respect across competitive global markets.

Red meat producers are navigating changing demand with agility, strengthening ties with traditional partners while exploring new opportunities. It is this adaptability that secures New Zealand’s place as a trusted source of premium protein, even as global conditions shift. Honey, particularly mānuka, shows another side of our export capability: winning not on volume, but on uniqueness and story. Each jar carries a sense of place and authenticity that continues to resonate strongly with international consumers.

Beyond these established giants, smaller players are also seizing global opportunities.

Fix & Fogg’s growth in the United States and Forty Thieves’ expansion into Asia show that innovation, branding, and determination can take even a niche category like nut butters far beyond our shores. These businesses embody the

entrepreneurial spirit that keeps New Zealand’s food and beverage sector dynamic and forward-looking.

Local to Global is more than just a theme; it is a mindset. It is about recognising that our small domestic market should never be seen as a limitation, but rather as a launch pad. With the right blend of innovation, resilience, and authenticity, New Zealand brands are proving that they can compete, and win, on the world stage.

This edition celebrates those businesses: from the household names continuing to define excellence, to the challengers creating new space for New Zealand in international aisles. Together, they tell a powerful story of a country whose products carry quality, character, and confidence wherever they go. n

The Food and Grocery Council is an industry association for grocery suppliers providing members networking, events, industry information and strong advocacy. Contact us for information on the benefits of membership: raewyn.bleakley@fgc.org.nz

• Networking • Industry Updates

• Conference and Events

• Education and Training

• Advocacy and Law Reform

The second Annual Grocery Report has shown progress in the sector, but identified key issues that continue to stifle competition improvement.

In a first for New Zealand’s horticulture sector, the country’s avocado exporters have joined forces to secure a collective FernMark Licence

Complex and outdated labelling regulations cause unnecessary costs and frustrations throughout the economy.

While major strides have been made to elevate and invest in women’s sport in New Zealand, one basic barrier continues to sideline emerging stars - access to period products.

FreshChoice has announced the opening of its brand new store in Tinwald, located at 124 McMurdo Street.

The government's move to review New Zealand's product labelling system has been a welcome move for BusinessNZ.

A new chilled and frozen distribution centre in Mangere will futureproof supply chain demands for Foodstuffs North Island.

Yili Group-owned dairy companies operating in New Zealand are on track for strong revenue growth in 2025 after recording significant year-on-year growth for the first half of the year.

Foodstuffs North Island has officially opened the doors to New World Point Chevalier, adding more shopping choices for locals and creating 120 new jobs in the Auckland suburb.

New Zealand’s economic turnaround continues, slowly but surely.

Pic’s Peanut Butter, the country’s best-selling peanut butter brand, has sold a majority stake to Australian food ingredient supplier Scalzo Foods in a multimillion-dollar deal. The move signals a new chapter for the Nelson-founded business, which has grown from a humble market stall into an international brand recognised for its natural, no-nonsense spreads.

Aimee McCammon, Chief Executive Officer of Pic’s, said Pic’s would still be in control following the deal, and she would stay on to lead the company.

Scalzo Foods will own 51 percent of the Pic’s brand, from which it will provide investment in the brand’s business plan and five-year growth plan.

“Scalzo won’t be taking full ownership of Pic’s at this stage. However, we can’t wait to benefit from their market expertise and growing plan for the company,” said McCammon.

She added that it has been tricky to find the right business partner; however, there were strong similarities between Pic’s and Scalzo.

McCammon, a second-generation member of the Pic’s team, said it was fitting that Scalzo is also a family-owned company.

“Through this partnership, we are able to share our connections are elevate the Pic’s brand. We have previously worked with Scalzo for our peanut supply, and they have the ability to find the best ingredients we need.”

The story of Pic’s began in 2007 when founder Bruce ‘Pic’ Picot bought a jar of supermarket peanut butter and was dismayed to find it packed with sugar. Armed with a few kilos of peanuts, he set about making his own. The homemade spread quickly won fans at the Nelson Market, and word-of-mouth demand turned it into a household name.

“Kiwis have always supported our product, but most importantly, have been connected to our company’s story from the beginning,” added McCammon.

Growth led to a second Nelson site and then the opening of Pic’s Peanut Butter World, which now anchors operations, employs around 50 staff and draws thousands of visitors each year. Tours reinforce transparency around roasting and grinding, and help the brand function as a Nelson Tasman food destination as well as a pantry staple.

Early international recognition helped Pic's to expand offshore. Great Taste Awards in the UK boosted credibility, and distribution followed, including placement in hundreds of Tesco stores and at Partridges

of Kensington. The brand has also moved from online to bricks-and-mortar in China. These steps built the platform for broader Asia, UK and US sales.

Innovation has stayed close to the core: classic smooth and crunchy, with or without salt, plus nut butters and peanut oil. Convenience formats like the single-serve Slug brought new use occasions. Pic’s has also sparked conversation with launches such as KidsCan-supporting “Smunchy” that blended smooth and crunchy, glow-in-the-dark Space Explorer labels, limited runs like Peanut & Chocolate Butter with Whittaker’s, and seasonal plays with New World’s hot cross buns kept the brand relevant to New Zealand consumers.

Pic’s often ties launches to community or waste-reduction stories. A 2022 collaboration with Cathedral Cove Naturals upcycled surplus boysenberries after a local processor closed, preventing hundreds of kilograms of fruit from going to waste. The company has also explored trials with Northland growers to evaluate a homegrown peanut industry, signalling long-term interest in local supply resilience.

Today, Pic’s is firmly established as New Zealand’s leading peanut butter. Its range includes crunchy and smooth peanut butters, with or without salt, as well as almond and cashew butters, peanut oil, and the convenient single-serve “Slug” packs. All products are gluten-free, carry a five-star Health Star rating, and are made using premium peanuts from Kingaroy, Queensland.

Expansion has been a consistent part

of the business journey. A second Nelson factory was opened to meet increasing demand, doubling production capacity and providing more local jobs. Limited-edition products, such as commemorative drinking glass jars, have added to the brand’s appeal.

“Following this deal, we hope Pic’s will be a better-funded and more accelerated brand. It will allow us to welcome more members to our team, and introduce new equipment to our factory,” said McCammon.

She added that innovation within this space was essential to staying on top.

Pic’s products are stocked in supermarkets

throughout New Zealand and Australia, as well as in markets across Asia, the UK, and the US, with mail-order customers worldwide. It has been on Australian shelves for 13 years and looks to expand its foothold on the Australian market through its partnership with Scalzo.

Picot has long described his vision as creating a world-recognised premium peanut butter brand. The new partnership with Scalzo Foods is expected to strengthen Pic’s growth trajectory and support its ambition to take New Zealand’s favourite peanut butter to even more global shelves. n

As a heavily tourist-based economy, Fiji is skewed towards international liquor brands in resorts, hospitality, and retail stores.

Pacific Island Beverages saw an opportunity for something new and better. The brainchild of two colleagues who, having previously worked together, set out to develop a locally made and locally owned product.

Establishing the business from scratch is not for the faint-hearted. Enlisting Onfire Design to help guide the development, the project started to take shape. Naming, identity design and marketing were completed in tandem with the physical build of the premises in Nadi. The owners recognised that the first brand and range of products from the fledgling business needed to establish a presence in local retail. With a

list of NPD planned out, the first one to hit the market was a range of RTD beverages.

The range consists of dark and light cocktails formulated with a distinct Fijian flair. In large 500ml cans, perfect for sharing, the classic mixes called out for a strong identity. Inspired by the new business’s founding partners, friends first – and Fiji’s deep-rooted culture of kinship – the name FORGED was given the go-ahead.

Onfire Creative Director, Matt Grantham, recalled, “The name also speaks to strength, loyalty, and something made to last. The oversized cans selected were the result of an investigation into how these drinks are consumed and shared among

friends and family, where one can might be enjoyed by a group.”

While a forge is best known as somewhere a blacksmith works, the parallels with packaging design aren’t lost on Grantham.

“Getting the best result not only requires a degree of skill, but also extreme focussometimes combined with a bit of blood, sweat and tears. And you have to come up with the goods when the heat is on.”

Visually, the brand uses dark colour palettes and craft cues but adds a modern twist with oversized typography and strong use of pop colours. The FORGED wordmark is bold, heavy, and proud with soft serifs that nod to knowledge and craft. Retail boxes amplify this language, using typography size and colour contrast to maximise impact.

Launched with four bold flavours, FORGED has rapidly carved out a place in Fiji’s competitive RTD market. In just a short time, it’s secured distribution in all major supermarkets nationwide and 80 percent of liquor outlets, offering

consumers a proud local alternative to the global heavyweights. With strong retail momentum, the brand is now turning its attention to making inroads into the hospitality sector.

"Working with Onfire Design has been an exceptional journey. Their creativity, strategic vision, and design expertise have been pivotal in shaping FORGED into the success story it is today,” added Pacific Island Beverages.

To forge ahead with Onfire Design, visit weareonfire.co.nz or contact its Founder, Sam Allan, on 09 480 2036.

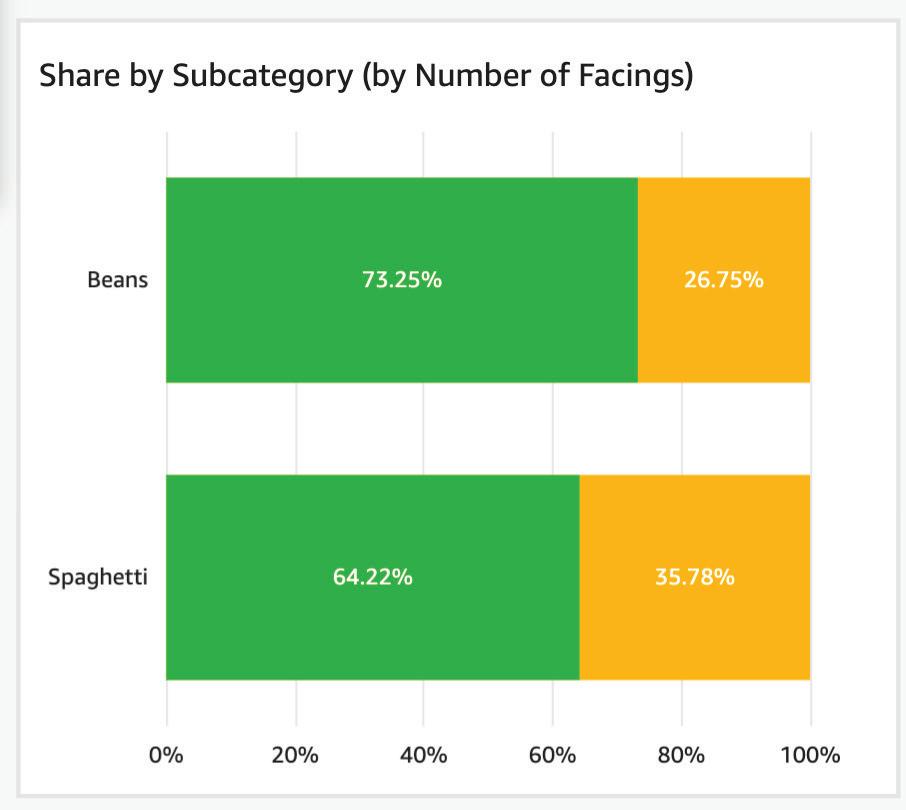

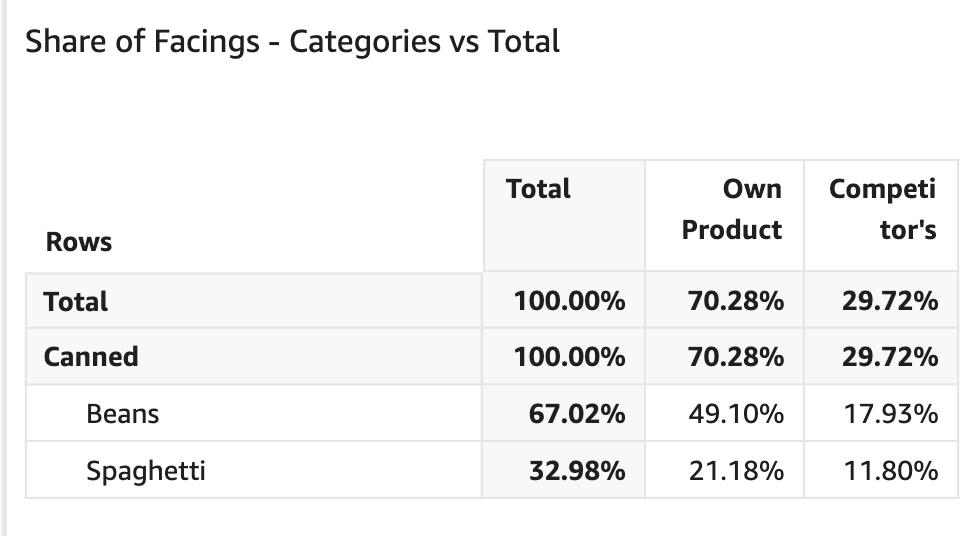

The battle for shelf space in New Zealand supermarkets has always been fierce, but the tools to win it are evolving rapidly. While image recognition technology for retail auditing isn't new, what's happening now represents a fundamental shift in how suppliers can engage with retailers, particularly in the complex Foodstuffs ecosystem.

Ten years ago, when Insightful. Mobi first ventured into visual shelf scanning through thirdparty partnerships; the technology was promising, but cumbersome. Training models required thousands of images per SKU, and deployment could take weeks. Today, using proprietary in-house developed visual recognition models leveraging the latest AI advances, that same process takes just 48 hours with minimal product images required.

This speed matters enormously in the fastmoving grocery sector, where new products launch weekly and packaging changes constantly. But the real breakthrough isn't just technical; it's strategic.

The Foodstuffs Challenge

Despite Foodstuffs' recent shift to head office-only ranging for new products, individual store owners still maintain significant autonomy over their planograms. Walk into five different Pak'nSave stores, and you'll likely see five different shelf layouts for the same category. This creates a massive challenge for suppliers: key SKUs can be completely absent from the aisle in some stores, putting both the retailer and supplier at a disadvantage.

One launch customer of Insightful.Mobi's latest platform discovered exactly this problem. Their field reps were spending 15 minutes per store manually auditing shelves, only to find wildly inconsistent execution

across the Foodstuffs network. High-velocity products were out of stock, planogram compliance sat at just 65 percent, and facing counts bore little resemblance to what head office had agreed.

Armed with iPads running Insightful. Mobi's platform, those same reps now capture shelf images in under a minute. The AI instantly identifies not just what's there, but what's missing, calculating both physical share of shelf and precise facing counts. More importantly, it tracks these metrics over time, building a picture of persistent compliance issues versus one-off problems.

The results speak volumes. Within three months, the launch customer achieved 96 percent on-shelf availability (up from 82 percent), 92 percent planogram compliance (up from 65 percent), and an 8 percent sales uplift in trial stores. Time spent on manual audits dropped by 93 percent, freeing reps to focus on actually fixing problems rather than just documenting them.

Where this technology becomes truly powerful is in its integration with DunnHumby and Quantium data. Suddenly, an out-of-stock isn't just an empty shelf; it's a quantifiable loss of high-value shoppers who specifically seek that product. A compliance issue isn't just untidy; it's costing the store measurable basket value from disappointed customers.

This fusion of shelf reality with shopper science transforms conversations between suppliers and store owners. Instead of vague complaints about execution, suppliers can

present concrete business cases: "This SKU's 20 percent out-of-stock rate last week cost your store an estimated NZD 2,000, and those shoppers have 30 percent larger baskets than average."

For suppliers aspiring to category captain status, this capability is invaluable. They're no longer just monitoring their own products but can provide retailers with objective, data-driven insights about the entire category's performance. They become the single source of truth, helping retailers navigate the gap between planned and actual shelf execution.

In New Zealand's concentrated grocery market, where supplier-retailer relationships often feel adversarial, this positions

progressive suppliers as indispensable partners rather than mere vendors. They're not asking for better shelf space; they're showing exactly how to grow the entire category.

The technology has matured. The data ecosystems are in place. For suppliers ready to move beyond clipboards and gut feel, the tools to master the final metre of retail have never been more accessible or more powerful.

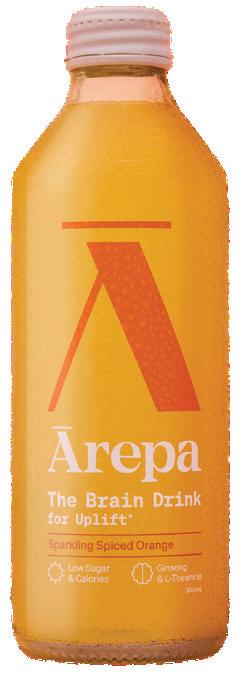

Crafted as the ultimate 3 pm slump saviour, Ārepa’s new Spiced Orange flavour is a zesty neuro-nostalgic pick-me-up to support clarity and keep you energised, without caffeine or sugar crashes.

Formulated by worldrenowned neuroscientists and backed by clinical research, this 300ml sparkling 97 percent sugar-free, low-calorie drink contains 200mg of American Ginseng, 200mg L-Theanine and Vitamins B5 & B6.

Spiced Orange brings a warming, citrusy twist to the Uplift family. Available exclusively at Farro and New World/Foodstuffs.

Alliance Trading

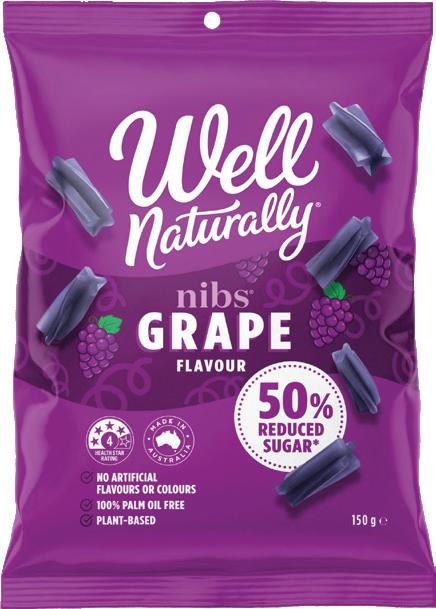

Sweet tooths rejoice - grape is officially back, and there’s only one place to get your fix.

Well Naturally Grape Flavour Nibs are the only grape liquoricestyle snack on shelves right now, and they’re worth the wait.

With 50% less sugar than regular jelly lollies, these juicy, bite-sized nibs deliver nostalgic flavour without the guilt. Made from plant-based ingredients, with no artificial colours or flavours, they’re the ultimate modern twist on a classic sweet.

Each 150g pack serves up six portions of purple perfection, only

88 calories per serve and packed with dietary fibre. Proudly made in Australia and 100% palm oil free.

Grape lovers, your moment has arrived.

For orders, contact your local Alliance Marketing Territory Manager or Account Manager Nick Cleaver (021 986 769) on email: ncleaver@alliancemarketing.co.nz

Arepa

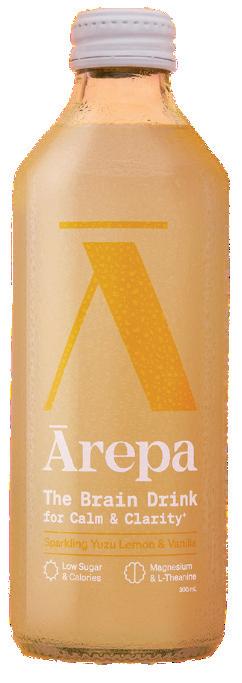

Newly crafted with magnesium in direct response to customer demand, this Lemon Yuzu & Vanilla flavour expands Ārepa’s Calm & Clarity range with a refreshing and elevated new option.

Designed to help you unwind, de-stress and take a mindful pause, the 300ml sparkling drink offers a smooth, lightly citrus profile. What makes this release truly innovative is the advanced functional formulation. For

the first time in an Ārepa Brain Drink, it blends 138mg of elemental Magnesium, supporting a healthy nervous system, muscle relaxation, reduced fatigue, and psychological balance, plus 200mg of L-Theanine per serve. Available exclusively at Farro and New World/Foodstuffs.

Alliance Trading

Well Naturally’s beloved 90g Milk Chocolate has a fresh new look - bold, modern, and designed to highlight what matters most to health-conscious chocolate lovers.

The updated packaging is easier to spot and proudly displays key benefits: “No Added Sugar,” “No Artificial Flavours or Colours,” and “100% Real Chocolate.”

Smooth, creamy, and melt-in-your-mouth, this milk chocolate contains 80% less sugar than regular milk chocolate and is naturally sweetened with erythritol and stevia.

Made in Australia with quality ingredients, including 34% cocoa solids, each 90g block offers three 15g servingsjust 65 calories and 1.6g of naturally derived sugar per serve. It’s the ideal guilt-free treat for those who want indulgence without compromise. Same smooth taste. Smarter packaging. For orders, contact your local Alliance Marketing Territory Manager or Account Manager Nick Cleaver (021 986 769) on email: ncleaver@alliancemarketing.co.nz

Sorbent

Sorbent is bringing fresh style to shelves this season with the launch of its limited edition Winter 2025 packaging designs, inspired by the latest interior design trends to look great in any room of the house. Available in Sorbent Silky White boxes of 224 and 90 tissues, these eye-catching designs offer a premium

look to complement the brand’s trusted softness and strength.

Sorbent Silky White 224s continue to lead the category as New Zealand Grocery’s #1 selling facial tissue since 2020.* Check out the new designs instore now.

*Circana TKA, unit sales, years 2020 until MAT 03/08/25.

Rockit™ apple

Share the joy with every bite. Rockit has gone big with its miniature apples and launched a new Small Family Pack into global markets to meet strong consumer demand for everyday sharing occasions.

Just like the iconic Rockit Daily Pack, the Small Family Pack features a resealable lid keeping each Rockit™ apple in peak, ready-

to-eat condition, and a grab-andgo handle made for sharing during all of life’s little moments.

Rockit’s new Small Family Pack is now available in stores across Greater China, South-East Asia, the Middle East and New Zealand.

The perfect snack for every moment - at home, on the go, or in the lunchbox.

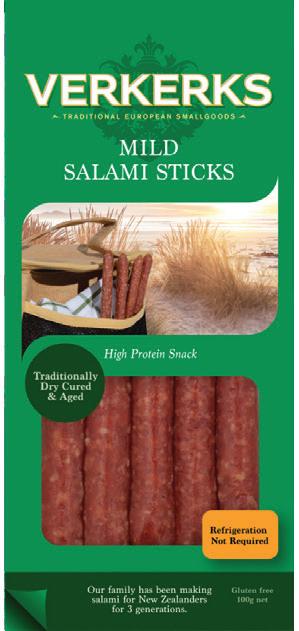

Verkerks

New Zealand’s appetite for convenient, nutritious snacks is booming. Verkerks are excited to launch our new Ambient Salami Sticks range. These shelf-stable (refrigeration not required) salami sticks are packed with 28g of protein per 100g, perfect for on-the-go snacking, multi-day tramps, long road trips or getting protein into the lunchbox.

Crafted with authentic, traditionally dry-cured and aged recipes, they come in three delicious flavours: Mild, Peppered and Garlic. Fuel your day by grabbing Verkerks Ambient Salami Sticks from the Meat Snacks aisle at your local supermarket.

*Only available at South Island New World’s & Pak’nSave’s

Navpreet Kaur Sandhu and Gurjant Singh Sandhu are the new franchisees of Night ‘n Day Taradale Road, bringing fresh energy and dedication to a brand well-known across New Zealand for convenience, consistency, and excellent customer service.

They were drawn to Night ‘n Day’s strong reputation and proven business model, which combines nationwide support with a modern retail approach. The variety of products, ranging from fresh food to groceries, offers a broad appeal that creates multiple revenue streams, a crucial factor for new business owners.

“The support from the Night ‘n Day team has been exceptional,” said the Sandhus.

“Training, systems setup, and ongoing operations have been areas where we’ve felt confident, knowing we are part of a wellestablished brand.”

While there has been a learning curve, the experience so far has been both

exciting and rewarding, with plenty of growth on the horizon.

Team culture is a priority for the Sandhus. They have created an environment founded on mutual respect, open communication, and a shared commitment to delivering exceptional customer service. Continuous learning is encouraged, with regular training designed to develop skills and maintain high standards.

“We lead by example, being hands-on and approachable, always available to support the team.”

Fresh and ready-to-go food offerings stand out in their store, with customers especially enjoying the hot food, barista coffee, and desserts. Presentation, freshness, and speedy

We take pride in being a friendly, reliable, and convenient stop for the neighbourhood, whether people are grabbing lunch, essentials, or a treat.

service have been key to winning the local community’s approval.

Personalising the store to suit local needs has also been important, keeping shelves well-stocked, maintaining cleanliness, and nurturing the popular Milkbar section.

“We take pride in being a friendly, reliable, and convenient stop for the neighbourhood, whether people are grabbing lunch, essentials, or a treat.”

Being part of the Night ‘n Day family has been a rewarding journey, though not without its challenges. The first few months have presented a steep learning curve, encompassing everything from dayto-day operations to team building and customer engagement.

The Sandhus value the support from Night ‘n Day’s head office, which has helped keep them on track and confident in their decisions.

“One of the best parts has been becoming part of the local community and the joy of seeing familiar faces return regularly.”

Their pride in representing Night ‘n Day is evident as they look ahead to continued growth and improvement.

Nicky Gibbs, Business Manager, offered her insight into the rebuild process. The

project began in November 2023 with architectural designs and engineering consultations, moving from concept to complete building plans.

Construction officially started in July 2024 and was completed by early December 2024, a tight schedule achieved through teamwork and dedication.

“A-Grade Construction led the main build and supported the internal fit-out,” said Gibbs.

“Max, Phil, and the team worked late nights and weekends to keep us on schedule.”

Morgan Projects managed day-today operations smoothly, while Evolve Electrical and Karlsson Plumbing ensured all electrical and plumbing needs were met with long hours of work. Their combined efforts resulted in a fantastic space ready to serve customers.

The Taradale location itself carries significance. Originally home to Night ‘n Day before a devastating fire in June 2023, the site has remained a favourite with customers. The longstanding partnership with Gull further cemented the decision to rebuild here.

“It was always our intention to bring Night ‘n Day back to Napier.” n

Reckitt is expanding its over-the-counter analgesics range with the launch of Nurofen Zavance Mini Liquid Capsules –the brand’s smallest liquid capsule to date.

The new format responds to a common consumer concern: difficulty swallowing pain relief products. Recent research shows that 57% of consumers under 30 struggle to swallow pain relief products, and 36% prefer the smallest tablet or capsule available.

At 20% smaller than standard Nurofen Zavance Liquid Capsules, the new mini format offers the same effective pain relief as Nurofen Zavance Liquid Capsules in a more compact size. It is designed to support those who find it challenging to swallow larger capsules.

“We know that ease of use is a key driver of purchase decisions in the pain relief category,” says Dan Amza, Head of Category, Trade Strategy & Activation at Reckitt. “With Nurofen Zavance Mini Liquid Capsules, we’re supporting a clear consumer need while giving retailers a compelling opportunity to grow the category. The smaller liquid capsule size, combined with portability, makes it an easy recommendation for shoppers seeking fast, effective pain relief.”

This launch strengthens Nurofen’s fast relief portfolio, broadening the range of formats available to consumers. While Nurofen Zavance Tablets and Caplets are

absorbed up to twice as fast as standard Nurofen, and Nurofen Quickzorb delivers rapid relief in a tablet format, Nurofen Zavance Liquid Capsules are known for “unleashing the speed of liquid” – using a liquid form of ibuprofen in a soft gelatin shell that dissolves quickly in the stomach.

The Mini Liquid Capsules bring that same effectiveness as Nurofen Zavance Liquid Capsules in a smaller size. Ideal for consumers who value both fast relief and convenience, the new smaller format offers effective relief from a wide range of pain conditions – including pain associated with cold and flu symptoms, headaches and migraines, period pain, back and joint pain, and dental pain.

Another key advantage is that over-thecounter ibuprofen can be taken without food – a benefit for people on the go.

As the health and wellness category continues to grow across supermarkets and pharmacies, this launch presents a strategic growth opportunity for retailers. With consumer-driven innovation, trusted efficacy, and wide therapeutic relevance, this product is a high-potential addition to the analgesics aisle.

Available in 8s and 16s pack sizes in supermarkets, and 32s and 64s in pharmacies, the capsules cater to a range

The Mini Liquid Capsules bring that same effectiveness as Nurofen Zavance Liquid Capsules in a smaller size. Ideal for consumers who value both fast relief and convenience, the new smaller format offers effective relief from a wide range of pain conditions,

of needs and price points. The launch will be supported by a comprehensive retail program including in-store visibility, staff education, and targeted marketing to drive awareness and trial.

With strong consumer appeal and a format designed for ease and effectiveness, Nurofen Zavance Mini Liquid Capsules are set to become a valuable addition to the everyday pain relief aisle.

For the temporary relief from pain and inflammation. Always read the label and follow the directions for use. Incorrect use could be harmful. Do not use if you have a stomach ulcer. If symptoms persist see your healthcare professional. Reckitt, Auckland. TAPS NP23149

The world of sausages has undergone a flavourful revolution, with the market witnessing a blend of tradition and innovation. As consumers seek new experiences and culinary adventures, the sausage market has redefined the way consumers savour this timeless delight.

Anew report, Savouring Innovation: Trends Transforming the Sausages Market, highlighted that key drivers of innovation within the sausage industry included the rising demand for convenient food options as well as the global emphasis on health and wellness trends.

Sausage products that are pre-cooked, prepackaged and heat-and-eat are designed to meet the needs of consumers who are looking for instant and hassle-free meal alternatives that do not sacrifice flavour. This trend is in line with the lifestyle of current customers, who are constantly on the move.

“Consumers today have less time to cook and want a rapid cooking process, and the products stocked are reflecting this,” said Marise Richards, Office Manager, Christchurch Vegan Society.

In terms of trends, producers have been experimenting with global flavours, infusing sausages with spices, herbs, and flavours from diverse cuisines. Whether it's a chorizo with Asian spices or a bratwurst with Mediterranean herbs, this trend has enticed taste buds and expanded the traditional sausage palate.

“Consumer demand for sausages in New Zealand has changed notably in recent years, with shoppers seeking greater choice and quality,” said Retail Meat New Zealand spokesperson.

“While traditional favourites remain popular, there is increasing interest in artisanal-style products that showcase premium cuts, bold flavours, and innovative ingredients.”

Manufacturers have been focusing on using high-quality, natural ingredients, reducing additives, and offering sausages with lower fat and sodium content. In response to the growing emphasis on health and wellness, a notable trend is the rise of health-conscious sausage options with clean labelling.

According to the Retail Meat New Zealand spokesperson, industry initiatives such as the Dunninghams Great New Zealand Sausage Competition, which features 13 categories from traditional to gourmet and alternative options, have helped drive this evolution by encouraging butchers and producers to continually raise the bar.

“The result is a broader and more exciting

Continued from pg. 23

sausage range now available to Kiwi consumers.”

They also mentioned that seasonality played a key role in the sausage category, with barbecues being an essential part of Kiwi summers. The Great New Zealand Sausage Competition is well-timed to reflect this, with awards announced in late October ahead of Labour Weekend and the traditional start of the barbecue season.

At the same time, Jade Jones, Marketing Manager at Dunninghams, added that there has been a shift in sausage consumption, with consumers enjoying it beyond summer BBQs, especially with the rise in gourmet, natural ingredients, as well as gluten-free options.

With regards to sustainability, the Retail Meat New Zealand spokesperson highlighted that the approach to animal welfare and traceability in sausage production depended on the meat used.

They said that in the case of beef and lamb, New Zealand has clear advantages as most animals are free range and pastureraised, with the temperate climate allowing them to roam outdoors year-round.

“The sector is internationally recognised for its low environmental impact, with research showing the carbon footprint of New Zealand beef and lamb is about half the global average. Since 1990, gross greenhouse gas emissions have fallen by more than 32 percent, with further offsets achieved through carbon sequestration on sheep and beef farms.”

However, innovations in food technology have continued and led to the creation of sausages made from ingredients like soy, peas, and mushrooms, offering a savoury and sustainable choice for vegetarian and

Innovations in food technology have led to the creation of sausages made from ingredients like soy, peas, and mushrooms, offering a savoury and sustainable choice for vegetarian and flexitarian consumers.

flexitarian consumers.

“Vegan sausages are increasingly popular. When I went vegan in the 2008 era in Invercargill, options were slender. Fast forward to 2025, where vegan cafes can be found in all major cities, and many provincial areas too, like Murchison, or Ashburton,” said Jordan Wyatt, member of Christchurch Vegan Society.

“One factor drawing greater market share is simply awareness of what farmed animals go through. As I became aware of vegan options, plant-based sausages, I became a regular consumer.”

According to FMI’s Plant-Based Sausages Market Outlook from 2025 to 2035, plantbased pork sausages are projected to hold the largest plant-based sausages market share, due to their ability to mimic the taste and texture of pork sausages closely made using conventional methods.

At the same time, plant-based beef sausage production has been focused on mimicking the texture and taste of traditional beef sausage using ingredients such as pea protein and beet juice for colour and juiciness. Rising consumption of plantbased beef substitutes at fast-food chains and in supermarkets has also aggravated

demand for these items. Still, Marise Richards, Office Manager, Christchurch Vegan Society, mentioned that there was also a lack of reliability in the availability of products on the shelf.

“I was very sad to see Sundfed Meats stop production and supply to supermarkets. For many, this was a New Zealand company product that was gluten-free and cooked well. I now have to buy more overseas brands to fill in this ‘gap’.”

Richards added that tofu had become hard to source in New Zealand lately and that supermarkets have been dropping vegan products and bringing in more processed flavour-type products, in particular drinks and sauces.

By source, plant-based sausages made from soy are expected to hold the largest share of the plant-based sausages market by 2035. Soy protein has been a mainstay in the plant-based food space as it is rich in protein, has all the essential amino acids and is functional with good texture and mouthfeel in meat substitutes.

As the market continues to grow, further development of the sausage market to meet the evolving needs of global consumers will drive growth. n

Get ready for BBQ season as warmer weather arrives. Verkerks Cheese Kransky 280g are delicious and versatile, with a great smoky cheese flavour. Our Kransky’s are gluten-free, and perfect for grilling on the BBQ, or make a wonderful addition to a pasta bake.

Whether you’re firing up the grill or creating a comforting family meal, Verkerks delivers great-tasting Kransky’s for the family to enjoy. For three generations, Verkerks has been making salami and small goods for New Zealanders, blending traditional European craftsmanship with local tastes.

Available at supermarkets nationwide, grab Verkerks Cheese Kransky 280g from your local store and elevate your summer feasts.

For more information, visit https://www.verkerks.co.nz/

Beard Brothers premium precooked beef & chicken sausages are made from beef and real chicken, that’s right, as much real beef and chicken as we can pack into a sausage, with the least amount of processing possible to really get the texture and flavour to stand on its own.

We add some key seasoning to complement the meat. It’s the meat we want you to taste, old-school as. These bangers are made with natural hog casings for the best natural flavour, which allows flavours and textures to shine.

With no fillers, no added MSG, no Gluten, and only the best quality minimal seasonings, these oldschool, precooked bangers are the real deal.

For more information, visit www.beardbrothers.co.nz/

Dunninghams aim to empower butchers and processors to delight shoppers, bringing fresh thinking to a Kiwi staple.

New flavours are developed through market research, culinary trend tracking, and feedback from butchers. Recipes are trialled in-house for texture, flavour, and balance, then tested with customers before launch.

Popular recent releases include Smokey Jalapeño GF, Smokey Bacon & Maple GF, and Spanish Chorizo GF, reflecting demand for bold yet familiar flavours inspired by casual dining.

At the same time, Dunninghams has balanced local New Zealand classics like Old English and Lamb Mint with on-trend flavours and products like Rubs used with low and slow BBQ cooking.

Jade Jones, Marketing Manager at Dunninghams, said that there has been a shift in sausage consumption, with consumers enjoying it beyond summer BBQs, especially with the rise in gourmet, natural ingredients, as well as gluten-free options.

“Seasonal launches are often limited runs,” said Jade Jones, Marketing Manager at Dunninghams.

“We align with Summer BBQs, Easter, or winter, creating staples and small-run, limited production product blends so retailers can test interest before scaling.”

Looking ahead, Jones said growth opportunities were in gourmet global blends, functional health benefits, and convenience formats, low and slow BBQ, ready-to-eat meals, dry rubs, smoked spices, and natural local flavours supported by Dunninghams’ complete supply-chain insight and innovation.

For more information, contact 0800 363 1921 or visit dunninghams.co.nz

Make tonight a Vegie Delight! Vegie Delights offers a tasty range of plant-based products designed for easy, nutritious meals the whole family will love.

With decades of experience in creating delicious meat-free foods, we know it all comes down to what you choose to eat. Our products are high in protein, with added Iron, B12 and Zinc, so you can enjoy the health benefits without compromising on flavour.

From quick weekday dinners to crowd-pleasing party favourites, our plant-based Hot Dogs deliver 18.8g of protein per serve and taste

amazing in a classic hot dog bun or transformed into sausage rolls.

Look for Vegie Delights in the chilled section of your local supermarket and make every meal a plant-based delight!

For more information, contact us on 0800 100 257, or visit https://vegiedelights.co.nz/

NEW FLAVOURS ARE DEVELOPED THROUGH MARKET RESEARCH, CULINARY TREND TRACKING, AND FEEDBACK FROM BUTCHERS.

Recipes are trialled in-house for texture, flavour, and balance, then tested with customers before launch. Popular recent releases include Smokey Jalapeño GF, Smokey Bacon & Maple GF, and Spanish Chorizo GF, reflecting demand for bold yet familiar flavours inspired by casual dining. We balance NZ classics like Old English and Lamb Mint with global profiles such as Mediterranean

herbs and South American spices. Seasonal launches align with BBQs, Easter, or winter, often as limited runs. Trends show more gourmet, natural, gluten-free sausages eaten beyond summer BBQs. Growth opportunities lie in gourmet global blends, functional health benefits, and convenience formats, supported by our full supply-chain insight and innovation.

The Australian Laundry Detergent Market was valued at USD 1.03 billion in 2024, and is expected to reach USD 1.35 billion by 2030, rising at a CAGR of 4.67 percent.

Growth has been driven by increased consumer focus on hygiene, sustainability, and convenience. Environmentally conscious consumers are increasingly opting for eco-friendly, plant-based, and biodegradable products, fueling demand for green alternatives.

The market has also evolved with the introduction of concentrated liquid detergents, pods, and hypoallergenic formulas that cater to specific skin sensitivities.

A shift toward premium and specialised products - such as fragrance-free or dermatologically approved variants - reflects rising expectations for both performance and safety.

At the same time, evolving laundry habits, particularly among younger and urban populations, are influencing product format preferences and driving innovation in the detergent category.

Heightened hygiene awareness, particularly following the COVID-19 pandemic, has become a major catalyst for growth in the Australian laundry detergent market. Consumers are prioritising cleanliness and fabric care, increasing the demand for products that offer deep cleaning and antibacterial protection.

This trend is particularly strong in households with children, elderly members, or individuals with sensitive skin, where the preference leans toward gentle, dermatologically tested formulas. Labels

highlighting properties such as "suitable for sensitive skin" or "antibacterial" are gaining consumer trust. The overall shift toward health-focused product choices is reinforcing the need for effective yet safe laundry solutions across all demographics.

The Australian laundry detergent market is highly competitive, with major global players, leading to continuous price wars, promotional offers, and the proliferation of private-label products from retailers like Woolworths and Coles.

Many consumers remain cost-conscious, especially in light of inflationary pressures, leading them to prioritise affordability over brand loyalty or eco-credentials. This puts pressure on manufacturers to offer innovation without significant cost increases, posing a challenge to the widespread adoption of premium or sustainable alternatives in a price-sensitive market.

A notable trend in the Australian laundry detergent market has been the growing shift from powder to liquid detergents and premeasured pods. These formats are perceived as more convenient, user-friendly, and compatible with modern washing machines, particularly high-efficiency front-loaders. Pods, in particular, are gaining traction for their ease of use, precise dosing, and reduced mess. These attributes resonate with time-pressed consumers and families looking for a streamlined laundry routine.

Additionally, the sleek packaging and concentrated formulations of pods often align with premium positioning, further enhancing their appeal among younger and urban consumers seeking efficiency without sacrificing performance.

Probiotics are changing the cleaning aisle, with formulations that go beyond surface shine, offering deeper, longer cleaning.

Unilever’s investment in probiotic technology for cleaning has seen the launch of probiotic variants for several of its brands: Wipol in Indonesia, Vim in India and Sunlight in Vietnam.

With the launch of the probiotic-powered Home Care range, Hindustan Unilever (HUL) has taken a definitive step towards redefining household cleaning.

Take Vim’s UltraPro Floor Cleaner, for example, a powerful, probiotic-infused solution that not only removes dirt and grime effectively but also ensures that surfaces remain clean for extended periods. The revolutionary formula, backed by

science, has been developed to deliver effective and long-lasting cleaning solutions for consumers.

Vim leveraged Unilever’s cutting-edge, UltraPro technology with probiotics to transform home cleaning. Its floor cleaner integrates these 100 percent natural, ‘friendly’ bacteria safely and reliably into its formula to prevent a buildup of dirt, making cleaning easier and delightfully convenient.

In addition to probiotics, Vim UltraPro also harnessed the benefits of Surface Modification technology. Upon use, this enables the formation of a dirt-repelling layer, giving consumers a spotless, shiny floor.

Vim UltraPro effectively and efficiently

Cif’s new versatile multi-purpose spray was specifically formulated to provide a longer-lasting clean on surfaces ranging from home electronics and worktops to sofas, soft toys and pet beds, long after its application.

removes all types of stains, ranging from food, cosmetics and rust, to footprints, garden soil, limescale, engine oil, and many more. Its versatility renders it a suitable cleaning solution that can be used across the entire home.

And while superior cleaning is one of its key benefits, this floor cleaner also releases soothing natural fragrances that elevate the essence of living spaces. Crafted with essential oils, VIM UltraPro Floor Cleaner is available in variants such as Sparkling Lemon, French Lavender with Sage, and Refreshing Lemongrass with Salt.

In India, the household cleaners’ market has experienced significant growth, driven by the need for more effective cleaning solutions. In keeping with this need, HUL has continued to lead with innovative offerings that blend sustainable packaging,

science, and consumer-centric design.

At the same time, in the UK and Europe, the New Cif Infinite Clean spray has used pioneering bioscience technology and probiotics to transform home cleaning.

Cif Infinite Clean, a new all-in-one spray, uses cutting-edge microbiome technology and probiotics to keep surfaces clean long after application naturally.

In a survey of home care insights, 70 percent of cleaner users said they “would like products to be longer lasting so I didn’t have to clean so often”.

Cif’s new versatile multi-purpose spray was specifically formulated to provide a longerlasting clean on surfaces ranging from home electronics and worktops to sofas, soft toys and pet beds, long after its application.

It also uses a unique ‘continuous mist technology’ trigger system that delivers

a superior cleaning experience across all surfaces. This makes the most of the probiotic bacteria’s ability to live on hard and soft surfaces for up to three days, providing consumers with a versatile, multi-purpose cleaner. They can also get into crevices, making hard-to-reach surfaces far cleaner, too.

“We’re challenging traditional cleaning norms and how people think about cleaning their homes by creating a disruptive cleaning product that harnesses the potency of nature’s probiotics, not just to clean our homes but also to provide a longer-lasting clean,” said Eduardo Campanella, Business Group President of Unilever Home Care.

With the market for probiotics currently worth EUR 70.12 billion and increasing consumer trends for cleaning products with natural ingredients, the global market for probiotics cleaners is expected to grow. n

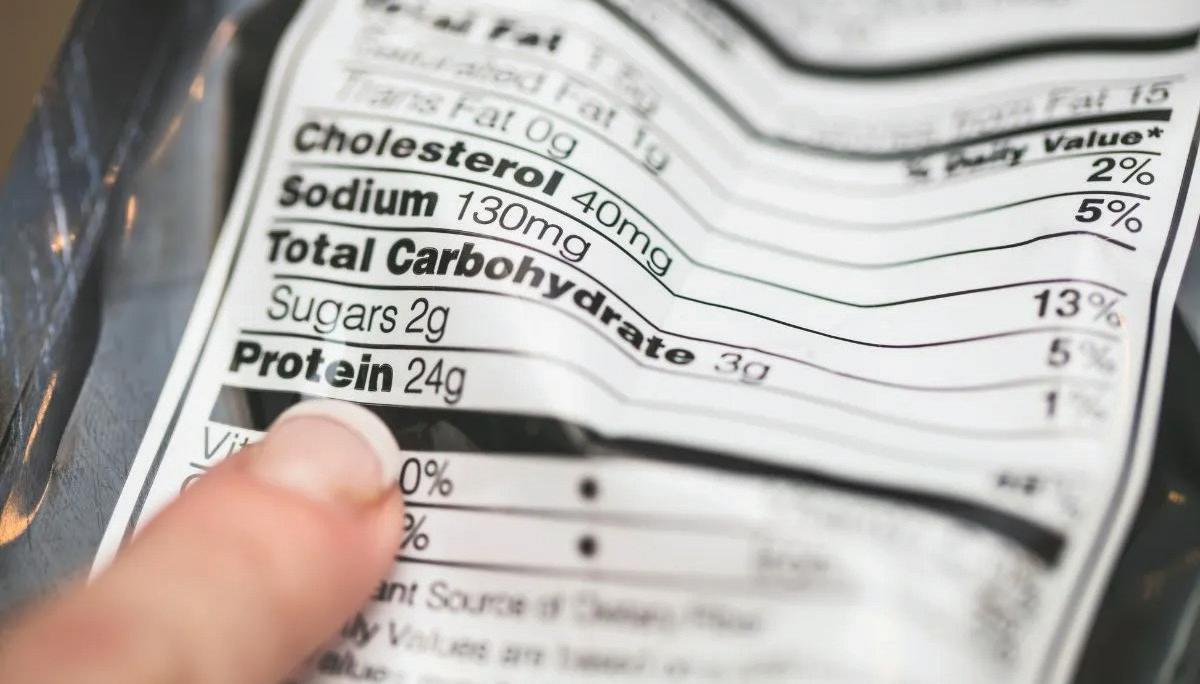

Walk into a supermarket and grab any product off the shelf. Turn it around and you’ll see the same thing every time: a label bursting with information. Ingredients, nutrition tables, allergy warnings, recycling logos - all squeezed into whatever space is left on the pack. It’s useful, but it’s crowded. And sometimes, it’s hard to find the details that matter to “you” the most.

Now picture this instead: you scan a small code with your phone and instantly see everything you need to know, from allergens to expiry dates, sustainability credentials to recycling instructions, all clear, simple, and always up to date. But that same QR still goes ‘beep’ at the checkout.

This is digital labelling - and it is not just an idea for the future - it is already underway in New Zealand.

What is digital labelling?

Digital labelling uses technology to provide product information in a way that complements the physical label. Instead of cramming every piece of information onto packaging, a product can carry a digital access point, most often a scannable code like a GS1 QR code - that links consumers, retailers, and regulators to up-to-date, detailed product information.

Think of it as the next chapter in labelling: a world where labels are not just printed but live, dynamic, and accessible to anyone with a smartphone or scanner.

Why digital labelling matters

The shift isn’t just about being techsavvy - it’s about solving real problems for consumers, brand owners, and retailers:

• For consumers: Digital labelling means more transparency. Shoppers can scan and instantly see allergen information, expiry dates, recipe ideas, recycling instructions, sustainability credentials - virtually anything. It makes product information more accessible, especially for those with low vision or language barriers.

• For brand owners: Packaging design will become simpler and cleaner. No need to overload labels with compliance fine print - that can live digitally. Product information can also be updated in real time, reducing admin burdens and costly reprints. Information that changes more frequently can be taken off pack and provided digitally.

• For retailers: Faster, smarter supply chains. Digital labelling can link directly to stock, logistics, and product recall systems, making it easier to trace, replenish or withdraw/recall items. When needed this can now be done at the batch or lot level far more efficiently than today.

Globally, the benefits are being recognised. Markets like the European Union, China, and South Korea are already modernising their regulations to enable digital labelling. Locally, the benefits of digital labelling are being explored.

How digital labelling works

Unlike traditional GS1 barcodes that only carry a number, digital labels utilise the QR code and can store a rich array of information. The combination of QR codes with new globally adopted GS1 standards means they can “beep” at the checkout just like regular barcodes while being scannable by consumers with their smartphones. It's important to remember QR codes without the GS1 Standard will not beep at the checkout, and GS1 New Zealand can assist you with this if required.

Retailers like Woolworths New Zealand are already trialing in store, and the transition is underway across the food and grocery sector. Globally, GS1 - the not-forprofit standards organisation best known for the barcode - has set 2027 as the target year for retail businesses to be ready to scan digital labels at point of sale.

Why now?

The timing couldn’t be better for digital labelling to be rolling out in New Zealand. Product recalls can be more precisely managed at the batch level rather than the whole SKU reducing waste, increasingly shoppers want more transparency, export markets are demanding new compliance requirements, and packaging is under pressure to do more with less.

What’s next for New Zealand?

Rolling out digital labelling in NZ is a journey but momentum is building. GS1 New Zealand and major retailers are already working with industry to test, pilot, and scale digital labelling initiatives. The government’s review of product labelling - due to conclude in late 2025 - presents a golden opportunity to set the rules of the game for the future of labelling in New Zealand.

How to get started

For businesses, the first step is simple: explore piloting digital labels. Start with one product line and see how a digital label can add business value and consumer value. GS1 New Zealand is here to help - we’ve supported thousands of Kiwi businesses with barcoding for decades, and we’re leading the transition to digital labelling. If you’re ready to pilot or just curious about what this means for your business, then get in touch.

The future of labelling isn’t just on the pack - it’s in the palm of your hand.

For more information contact GS1 New Zealand. 0800 10 23 56 | www.gs1nz.org

Start implementing next generation QR codes with GS1

Make your existing barcodes and marketing QR codes work harder for you!

GS1 QR Codes will transform the way Kiwi organisations do business. Unlike standard ‘QR codes’, GS1 QR Codes ‘beep’ at point of sale like a traditional barcode while delivering personalised brand experiences with a simple scan using your smartphone.

Working with retailers, product manufacturers and brand owners GS1 New Zealand is aiming for all retail point-of-sale systems in New Zealand to be able to scan GS1 QR Codes by the end of 2027.

DISCOVER MORE

Book a FREE consultation with GS1 NZ.

• 30-minute overview of GS1 QR codes

• Practical next steps for your business

• FREE GS1 QR code verification on your first product.

GET STARTED

Book a Starter Workshop to plan a pilot.

• Identify benefits and opportunities

• Lay the groundwork for your pilot

• Receive a high-level roadmap for your business.

Failing to comply with the requirements of the Australia and New Zealand Food Standards Code (Code) and the Fair Trading Act 1986 (FTA ) can attract the attention of regulatory bodies, like the Ministry for Primary Industries and the Commerce Commission.

These bodies have wide-ranging powers, from requiring product recalls and sending warning letters to carrying out prosecutions. This is a situation any business wants to avoid, not only for the stress and potential loss of income involved, but also for the possible reputational damage.

Key legal requirements that food and beverage businesses in New Zealand must consider when creating a product labelling panel are set out in the Code.

Labels must also be part of, or attached

to, the package, easy to read and in English. It is also important that food and beverage businesses comply with the FTA regarding labels on their products.

This means that all labels and claims must not contain information that is misleading regarding the food or beverage product, and any claims made about the product must be substantiated, which means the claims must be supported by evidence, such as a scientific study. Note that the Code also contains special rules relating to health claims made about food.

The Weights and Measures Act 1987 is also relevant for stating the correct weight, quantity, or volume of food or beverage using the metric system's weights and measures. This relates to the label only; there is other legislation, such as the Food Act 2014, which helps ensure that food sold in New Zealand is safe and suitable to eat.

The Food Standards Authority for Australia and New Zealand (FSANZ) has recently proposed a new definition of what constitutes genetically modified food. This new definition, if adopted, stipulates that food is considered genetically modified if it contains foreign DNA in the final product.

This means that if a food has been geneedited, but contains no “novel DNA,” then it will no longer need to be labelled as genetically modified. The final decision on whether to adopt this definition is expected within the next few weeks.

“The most common mistakes we see are that labels lack the required level of detail and that claims made or implied on the packaging aren’t substantiated with reputable evidence. It usually comes down to finding a balance between meeting legal obligations regarding labelling and the aesthetic of the packaging, so that the food or beverage is appealing to consumers,” said Kathryn Wallace, Practice Leader, at Legal Vision.

Although each aspect of food labelling is relatively detailed and complex, the key points Wallace highlighted were:

Two types of health claims can be madegeneral-level and high-level. Food must meet specific nutrition requirements to carry a health claim. General health claims can be made based on a pre-approved food-health relationship as outlined in the Code, or self-substantiated with scientific evidence per the Code's requirements.

High-level health claims can only be made using a pre-approved food-health claim in the Code.

The nutrition information panel must contain the following information:

• Serving size for the food/beverage.

• Quantity per 100g/100ml of each nutrient

• Energy/kjs of the food/beverage

• The amount of each of the proteins, fats, carbohydrates, sugars, fibre, and salt in the product.

• Required allergen names must be used on a label. For example, if the product contains nuts, the type of nut must be specified.

• Allergens must be in bold font in the ingredients list, and there must also be a “contains” statement listing the allergens in bold.

Wallace’s advice to emerging businesses was to do everything by the book and ensure compliance with all requirements.

“This means you won’t be subject to recalls based on labelling (which is seen often in the Ministry for Primary Industries food recalls list, where allergens have not been declared on the label as required by the rules) and therefore damage to reputation,” added Wallace.

“This means you start from day one as a brand that shows it knows what it is doing and is across the requirements. This establishes you as a trusted label/brand. Whilst taste and nutrition are important, people often buy products from brands they trust.”

Barcodes have played a significant role in improving efficiency for FMCG over the past 50 years. Most retailers will not stock products that are not barcoded, as their systems are largely automated. Barcodes are essential for stock control and pricing.

Using the correct format and dimensions is crucial, especially for the large FMCG retailers. Each product variation ( size, colour and flavour) needs its own barcode number so retailers know precisely how many of each product they have in stock.

“We know how busy small food manufacturers are, so we keep things simple, fast and affordable. Clients can order and receive their barcodes in five minutes via our automated website ordering system,” said Moya Cutts, Barcodes Limited.

“Barcode terminology can be confusing. Some formats are used in different regions, i.e. UPC is more common in North America, whereas the rest of the world uses the EAN format. GTIN is just a newer term for barcode. It refers to the barcode number or Global Trade Item Number (GTIN).”

In New Zealand, there are only two food

retailers that have particular requirements requiring barcodes only from GS1, Foodstuffs and Costco.

"This anti-competitive behaviour results in higher costs for New Zealand food manufacturers and consumers," said Cutts.

Cutts also mentioned common mistakes startups make when it comes to barcodes. These include poor quality printing, poor positioning on the packaging, and underestimating the number of barcodes they need. For instance, not buying enough barcodes. We recommend clients buy in bulk to get cheaper rates. Then they can keep spare barcodes on hand for future products.

Her advice was that since barcodes are crucial for the supply chain, allow time and space to ensure their accuracy. Cutts added that some clients have their products copied after listing their products on major

international platforms, so patenting is worthwhile if applicable; however, this may not be such an issue for food products.

Getting ‘Made in New Zealand’ or ‘Product of New Zealand' on products is also valuable for export. As barcodes do not identify the origin of the product, it can be worthwhile getting the Fern Mark accreditation.

Many small businesses have also become concerned about the change to QR codes. Cutts reassured that this change is gradual (2027 onwards) and that they can still use the same GTIN.

“The format will change from linear barcodes to 2D digital link QR codes. Some European countries and Australian food distributors have already been using 2D Digital link QR codes, so New Zealand food businesses should start researching the move to QR codes.” n

Labelling requirements in the Australia New Zealand Food Standards Code (the Code) are designed to protect public health and safety, help consumers make informed choices, and prevent misleading and deceptive conduct.

Chapter 1 of the Code includes general labelling standards that apply to all foods, with specific requirements depending on the context, such as food for retail sale or catering. Chapter 2 includes additional labelling and information requirements that are specific to certain foods. More information is available here - Labelling | Food Standards Australia New Zealand.

“While we set the standards in the Code, we do not enforce them. This is the responsibility of the New Zealand Ministry for Primary Industries (MPI), Australian state and territory food regulatory agencies, and the Department of Agriculture, Fisheries and Forestry at the Australian border, under the Imported Food Inspection Scheme,” said a FSANZ spokesperson. Cathy McArdle B.Tech (Food Tech),

NZCS (Chem), Food Labelling Consultant and Managing Director of McFoodies Ltd, said that startups and small businesses often do not realise there are strict rules in Australia and New Zealand about what ingredients can be added to food and drinks, and that these are often different to other countries.

There are also particular and detailed rules about the format for compliance content, such as nutrition information panels, ingredient listings, allergen statements, net quantity statements or country of origin declarations.

“We have some complicated rules to navigate when determining which standard applies if wanting to include a specific ingredient, or if making a claim, or even if using a particular product name. It's easy to get it wrong and have the expense of fixing it later,” said McArdle.

“When preparing ingredient listings, make sure you look for all hidden ingredients that need to be declared. Saying that, you can ignore processing aids (like oil used on raisins to prevent sticking in production) as long as they are not allergens and include the percentage after any ingredients highlighted in graphics or words on the pack.”

She added that mislabelling allergens can be life-threatening; therefore, it was essential to include them all. With recent changes to legislation in this area, they also need to be declared in multiple places, including with the slightly confusing rule that the (allergen) summary statements must be 'directly next to', but also 'distinctly separated from' the statement of ingredients.

For small businesses trying to balance creative branding with meeting strict compliance requirements, McArdle’s advice was to be creative with the brand and product images, colours, and font types, but when a technical member asks for bolding or a space or a particular font size, listen to them.

“They are trying to save a whole lot of drama if the packaging is printed and a competitor, auditor, retailer, or regulatory enforcement agency (including at the border) picks up an issue, a few months after you started selling thousands of units of the product.” n

A recent Coeliac New Zealand member survey confirmed that 68 percent of respondents actively choose products that are Crossed Grain Logo accredited when they shop for gluten-free products.

The Crossed Grain symbol is nationally and internationally recognised by those who follow a gluten-free diet. The logo gives consumers confidence and is a quick reference point when shopping and faced with uncertainty about the genuine glutenfree status of a product.

Products displaying the logo are subject to accredited laboratory testing and random audit testing and meet the Food Standards of Australia and New Zealand (FSANZ) glutenfree standard of ‘no detectable gluten’.

The Crossed Grain Logo (CGL) symbol

is a certified trademark owned by Coeliac New Zealand for the certification of products produced and licensed in New Zealand and sold in the territories of New Zealand and Australia.

Manufacturers who use the logo programme have been licensed to use the logo on certified product packaging and marketing material. The use of the CGL is operated via a licence agreement, renewable every year. The licence fee varies according to the total glutenfree gross annual sales turnover of the certified products you wish to license.

Dana Alexander, Sales and Marketing

Manager, Coeliac New Zealand, mentioned that startups face several hurdles when navigating gluten-free labelling compliance in New Zealand.

“There is still a knowledge gap among startups and small food producers when it comes to compliance with allergen declaration requirements, but it is getting better.”

The FSANZ code has one of the strictest definitions globally, prohibiting even trace amounts of gluten and banning ingredients like oats or processed gluten-containing cereals – but there are exclusions.

Every ingredient, including additives and processing aids, must be verified as glutenfree, but supplier documentation is not always adequate, and there’s a constant risk of cross-contamination. “May contain” statements aren’t permitted on gluten-free products, and misleading claims can lead

to complaints or recalls.

While independent lab testing isn’t mandatory for gluten-free products, accreditation like the CGL offers a recognised standard that elevates your product but adds cost. With a highly informed coeliac community, one compliance breach can cause lasting brand damage.

Alexander said common packaging errors included misusing the “gluten-free” claim, contradictory allergen statements, missing or incorrect allergen declarations under PEAL rules, vague ingredient naming that hides gluten sources, unsubstantiated claims of suitability or certification, and combining gluten-free claims with unauthorised health benefits.

FSANZ approved a new Plain English Allergen Labelling (PEAL) standard in 2021 with a three-year transition. Packaging produced from 25 February 2024 must comply to the new rules, while pre-existing labels may be sold until 25 February 2026.

The gluten-free market is growing - and so is consumer awareness. Coeliac NZ’s Crossed Grain Logo isn’t just a mark of

transparency. Licensing with the CGL shows your brand is committed to safety and integrity - qualities that resonate with consumers and retailers alike.

• Download MPI’s plain-English allergen labelling guidebook and checklist to help you navigate ingredient declarations, as the deadline for compliance has now passed.

• Learn about the Crossed Grain Logo accreditation programme from Coeliac New Zealand at coeliac.org.nz. This globally recognised certification mark assures people with coeliac disease and those on a strict gluten-free diet that a product is safe and meets strict gluten-free standards. The logo is only granted after a thorough review of the product, including ingredient integrity and checking that product testing meets FSANZ standards of ‘nil detected.’

• Coeliac New Zealand also provides gluten-free food safety training, covering best practices for risk reduction, compliance requirements, and building staff confidence in gluten-free handling and communication.

• For routine gluten testing, use AsureQuality or other accredited laboratories. CGL licensees receive an

New Zealand’s Homegrown Juice Company has quite the presence in our supermarket fridges and shelves thanks to a wide range of juices, fruit and vege blends, smoothies and shots.

Disappearing off the shelves pretty smartly are products like Lemon Honey Ginger, Immunity, Pro Bio Mango Smoothies, Berry Anti Ox and the 100% Pure OJ - all are popular staples of Kiwi households and all can proudly proclaim “great taste – great health”.

Homegrown Juice Company’s National Sales Manager Russell Holt said the company’s goal is to produce the best tasting, healthiest juices and smoothies possible for New Zealanders. In fulfilling that aim, Homegrown uses a “cold pasteurisation” process that sets them apart and has added a new benchmark in the NZ juice market.

While almost all other juices in NZ are pasteurised using heat, this process is rejected by the Homegrown team who believe it compromises vitamins, minerals and flavour. Instead, they favour a cold pasteurisation process, for which they have earned the trust of many a NZ consumer.

“We use High Pressure Processing (HPP) Cold Pasteurisation to maintain the natural taste and nutritional goodness of our fruit. RAW juice is put under extreme pressure to deactivate naturally occurring bacteria, yeast and moulds with miniscule changes to the vitamins, minerals and flavour,” said Holt Russell.

“In short, Homegrown juice remains committed to producing the freshest tasting, cold-pressed, HPP-protected juice that tastes as close to nature as possible.”

Sales would indicate that taste is pretty good. Homegrown Juice can boast market leadership as the company holds 60 per cent of New Zealand’s chilled juice market. The remaining 40 per cent is made up of the heat-treated (thermal processed) juices mentioned above, including some imported from Australia.

The company is called Homegrown for a reason. In fulfilling its “best tasting, healthiest juices and smoothies possible” motto, The Homegrown Juice Company grows its own oranges and, wherever possible, sources NZ ingredients to control quality and deliver the best, every time.

“Most orange juices in NZ are made from imported orange juice – some of which is even bottled overseas. This goes against our philosophy. We believe you can’t make great-tasting, nutritious juice when it has been shipped halfway around the world.

“So, we did something about it and increased our plantings to the point where we now have the largest plantings of orange orchards in NZ,” he said.

It helps enable the company to declare that its RAW Cold Pasteurised Fruit and Veggie Juices are made from predominantly

local and only some imported ingredients. The orange orchards are located in Gisborne and Hawke's Bay. In fact, it all started in Hawke’s Bay, when the Brownlie family first planted their orange orchard in that sunny fruit bowl of NZ back in 1969. Steve Brownlie continues this legacy under the Homegrown Brand.

It’s not just about oranges, however. The likes of grapefruit, lime, apple, kale and raw fruit smoothies and vege juices are all in the mix, along with treasures like turmeric, with combinations available in 400ml, 1 litre and 1475ml bottles (plus shot sizes of some).

Holt added that while there’s already a wide product range to please, the Homegrown NPD team is always looking for new and innovative healthy products, in line with global trends, to develop for their growing local customer base.

NPD and distribution are both ticking boxes. The company is proud of its robust distribution network that ensures direct delivery of its chilled juices and smoothies. And the full product range reaches retail and foodservice customers on time all year round. How good is all that!

Homegrown Juice Company is a member

of the New Zealand Beverage Council (NZBC). The NZBC is the industry association for New Zealand's nonalcoholic beverage sector. Members are the brand owners, manufacturers, bottlers and suppliers of New Zealand’s juice, carbonated drinks, flavoured-dairy and bottled water brands. Membership is made up of a wide range of companies operating in New Zealand, ranging from large multinational brands, local New Zealand producers, to those companies that provide a wide range of goods and services to the industry. www. nzbeveragecouncil.org.nz

Nourishing, home-made soups are a popular choice as the seasons shift, and Kiwi shoppers are on the lookout for top-quality produce to sauté, simmer, and blend into the perfect bowl.

Highlighting key soup ingredients in store like potatoes, onions, kūmara, carrots, parsnip, broccoli and cauliflower, will not only inspire shoppers to get creative with their soup combinations but also help boost our vegetable intake.

Consider displaying soup vegetables together in your produce department along with eye-catching imagery and recipe suggestions. The 5+ A Day website (www.5aday.co.nz/recipes) currently features 30 great soup recipes which retailers can leverage to help influence purchasing decisions.

People often stick with their tried and true soup favourites, but there are endless flavour combinations to explore – think roasted cauliflower, broccoli and kale soup; pear, kūmara and ginger soup; or roasted parsnip and garlic soup.

Organise a creative ‘soup’ display and surround your hero produce with complementary ingredients such as fresh herbs, dried lentils, coconut milk, spices (cumin, nutmeg, turmeric and chilli flakes are popular), ramen noodles and vegetable

stock. An attractive display where fresh produce is frequently topped up and rotated, will help drive sales and raise consumer awareness about different soup ingredients they could combine.

Many soups require minimal effort. Just throw the ingredients into a slow cooker for a few hours, or simmer gently in a pot for 20 minutes and blend.

Silky smooth soups are a great way to serve up a host of nutritional benefits. People often turn to citrus fruit to boost their immunity, but brassicas like broccoli and cauliflower are in fact a very good source of vitamin C. Eating one cup of broccoli or cauliflower (which is easy to achieve in a soup) will provide more than your recommended daily intake.

Meanwhile, root vegetables like potatoes, kūmara, carrots and parsnips all provide complex carbohydrates to boost energy levels and are a source of dietary fibre. This helps support healthy digestion and bowel movements, and can help keep you feeling fuller for longer.

The 5+ A Day Charitable Trust recommends adults eat at least five servings

Root vegetables like potatoes, kumara, carrots and parsnips all provide complex carbohydrates to boost energy levels and are a source of dietary fibre. This helps support healthy digestion and bowel movements, and can help keep you feeling fuller for longer.

of vegetables and two servings of fruit every day to stay as healthy as possible.

Soups are an ideal way to achieve this –colourful ingredients can easily be combined to deliver a wide range of antioxidants, vitamins and minerals, and create a delicious and hearty meal.

The 5+ A Day website (www.5aday.co.nz) is also a great resource to check what’s in season and find recipes and nutrition information that consumers might find useful.

If you want to enter the New Zealand FMCG market and don’t know where to start. Start here.

Storelink provides winning insights led strategy, national scale, speed to market, NPD acceleration, sales velocity and profit enhancement. Our services range from importing, customer services, order management, key account management, field sales and merchandising. Aside from our incredible team, what makes us different?

• Ability to contribute to, and execute strategy.

• Industry connections and cross category experience.

• A culture of getting things done.

Our partner relationships are constructive, collaborative and transparent. Plug straight into our established importing and logistics networks across both Islands to reduce cost.

Distribution expertise designed for the nuances of NZ's retail environment. Flexible import models that suit your brand - We can shift your brands your way.

Our Storelink360 program informed by StorelinkIQ market insights is designed to build, execute activity and provide fast feedback in real time. We have the national infrastructure, speed, and smarts needed to succeed. Connect with us to find out more.

Engine

New

Storelink is one of New Zealand’s largest full-service retail execution specialists. For over 35 years, we’ve helped ambitious FMCG brands get seen, sold, and scaled — everywhere that matters.

From sales and merchandising to data insights, logistics, and strategy, we move fast, act smart, and get results.

New Zealand snack-sized apple brand, Rockit, has expanded its offerings with its miniature apples and launched a new Small Family Pack into global markets to meet strong consumer demand for everyday sharing occasions.

This formed part of its occasionbased marketing strategy, which included new product categories, such as a Snack Pack for impulse purchases, a Daily Pack for high frequency consumption, Family Packs for sharing moments and Gift Packs for festivals and always-on gifting moments.

Julian Smith, Rockit General Manager Global Marketing, said that the company has always looked for new ways to innovate and satisfy its consumers’ latest needs.

“Creating a pack that locks in the goodness on a big scale took innovation and

ingenuity. During the development, our research team spoke to 12,000 household shoppers to find out what they value most,” said Smith.

Off the back of this, Rockit responded with the Large Family Pack, a unique container designed to deliver its premium quality apples in a quantity that met the needs of busy family consumption occasions, such as weekend sharing moments.

Consumer feedback following the launch of the Large Family Pack indicated that an additional smaller pack would meet the requirements of smaller households or those with limited storage space. The result, aka the Small Family Pack, has proved to be a hit.

The Small Family Pack is a practical bucket-like pack with a resealable lid to lock in freshness and a strong handle for easy transport. The resealable lid keeps each Rockit apple in peak, ready-toeat condition, providing a controlled environment that extends shelf life and minimises food waste. The carry handle means that the Small Family Pack can be enjoyed and shared by consumers during all of life’s little adventures, anytime, anywhere.

Focusing on sharing special moments, Rockit tailored its Small Family Pack campaign with localised activity that resonated with each global audience. This included ‘Buy and Win’ promotions in Singapore and Malaysia, where consumers

can go in the draw to win theme park passes or movie tickets by scanning the QR code on the pack, and a colouring book gift with purchase featuring our cheeky brand character, Rocki, in Vietnam, Indonesia and the Middle East.

Smith mentioned that the Small Family Pack has arrived just in time for the peak Back to School season in the Middle East, where it is the hero product in Rockit’s omnichannel campaign. He added that globally, influencers and KOLs have become an essential part of the digital marketing mix.

“We leverage them both to build awareness and brand love with new audiences, and to drive tangible actions such as traffic to events or competition entries. They help humanise the Rockit brand while creating authentic, engaging content that resonates with customers.”