MORE FLUID THINKING

The world of water is evolving faster than ever, and every challenge is unique.

We are a fluid-thinking team of engineers, scientists, project designers, and sustainability specialists, committed to protecting our most valuable resources. We deliver tailored flexibility with innovative agility across the ANZ-Pacific water sector.

Whether you’re a local municipality or a global manufacturer, think of us as your performance partner. Here to help you maximise project lifecycle value and drive sustainable change.

Our in-depth hydro expertise, world-leading technology, and carbon-neutral services enable us to achieve exactly this—together.

Discover what more fluid thinking can do for you | hydroflux.nz

WATER WASTEWATER RENEWABLE ENERGY HYDROGEN TRANSITION ENVIRONMENTAL PROTECTION

New Zealand Food & Beverage Industry

Tania Walters Publisher

The food and beverage industry is transforming as manufacturers navigate shifting retail dynamics. Supermarket shelf space is becoming more competitive than ever, private-label brands are expanding, and alternative sales channels are gaining traction. In response, many manufacturers are diversifying their routes to market, exploring opportunities in direct sales, specialty retail, autonomous vending and food service, which is having a resurgence as a key channel for growth, particularly in the hotel, aged care and retirement sectors.

As consumers seek convenience and unique dining experiences, the demand for high-

quality, innovative ingredients and equipment is increasing. Manufacturers and suppliers are adapting to this evolving landscape by building strong partnerships and ensuring they have the right tools and ingredients to meet industry needs. Increasing interest in robotics and AI are also changing the way consumers are adapting to automation.

And this is where the FB Tech Buyers’ Guide comes in. As a trusted industry resource, it connects manufacturers with essential equipment, ingredients, and technology suppliers. Whether businesses are looking for cutting-edge processing solutions, new ingredient formulations, or packaging innovations, the Buyers’ Guide is a valuable

network that helps companies find the right partners to support their growth.

As the industry faces new challenges, collaboration and knowledge-sharing will be more critical than ever. The FB Tech Buyers’ Guide is not just a directory but a community resource designed to support industry professionals in navigating change, seizing new opportunities, and driving innovation in food and beverage manufacturing.

tania@reviewmags.com

PUBLISHER Tania Walters

GENERAL MANAGER Kieran Mitchell

EDITORIAL DIRECTOR Sarah Mitchell

EDITOR Caitlan Mitchell

EDITORIAL ASSOCIATE Jenelle Sequeira, Sam Francks

ADVERTISING SALES info@reviewmags.com

SENIOR DESIGNER Raymund Sarmiento

JUNIOR DESIGNER Raymund Santos

CREDIT:

Italian Tradition

MEETS NZ MANUFACTURING INNOVATION

Granarolo NZ has carved out a unique niche that bridges traditional Italian culinary craftsmanship with New Zealand's innovative manufacturing landscape. Barry O'Neill, the company's CEO, understands that modern food production demands more than ingredients – it requires a comprehensive solution combining quality, flexibility, and authenticity.

"W

e're not just supplying ingredients," O'Neill explains, "we're providing solutions for the evolving food landscape."

The company's parent entity, Granarolo S.p.A., is one of Italy's most respected dairy producers. Its legacy spans traditional farm practices to global market distribution. This connection to authentic Italian quality is the cornerstone of the company's unique value proposition, and its portfolio is a testament to its Italian roots.

From farm to fork, Granarolo brings authentic Italian quality to global markets. Building on this legacy, Granarolo NZ offers local manufacturers direct access to this exceptional quality alongside a curated selection of other premium European products.

Small goods represent another highlight of their offering. Prosciutto, salami, pancetta, and chorizo are available in whole pieces or pre-sliced, demonstrating the company's ability to meet the most specific manufacturing requirements. Cheese options range from entire wheels to individual quick frozen formats, emphasising versatility.

The Unconventional brand represents the company's most forward-thinking initiative. Plant-based products –including burgers, sausages, and nuggets – are available in retailready packaging and bulk formats, showcasing Granarolo NZ's ability to respond to evolving market demands while maintaining Italian authenticity.

Private label options further underscore the company's adaptability. Manufacturers can access a wide

range of products, from bulk supplies to carefully packaged ingredients, all sourced through long-standing relationships with Italian suppliers. This approach allows Granarolo NZ to offer unprecedented customisation and quality.

For food manufacturers seeking a genuine, authentic ingredient experience, Granarolo NZ emerges as a strategic partner. It is the bridge

between culinary heritage and modern production demands – where every ingredient carries the promise of authentic Italian quality.

Granarolo New Zealand Ltd 6 Farmhouse Lane, St Johns, City, Auckland 1072 New Zealand

info@granarolo.co.nz

+64 (0)9 551 7410

EVOLUTION ORRevolution ?

Meeting consumer expectations for active nutrition in 2025

Karsten Smet CEO, ACI Group

The food and beverage industry is highly competitive: categories are becoming blurred, and product democratisation means that items previously aimed at niche consumers and age groups are now available to all.

This, coupled with a rise in savvy and informed shoppers, has resulted in a fundamental change in attitudes and preferences for new products, seeing it shift and expand to functional products that offer not only health and wellness positioning but are backed by science.

Until recently, the food and nutraceutical industry approached a new year by questioning what trends would have the biggest impact. ‘What’s new?’ was the common refrain, rather than ‘What’s changed?’ ‘What’s evolving?’ or ‘What’s redefining itself?’

At ACI, we not only track contemporary trends, but continuously horizon scan to cut through the noise, looking beyond the trend to understand the deeper movements that will drive new formulations in the year ahead.

Functional ingredients: DRIVING A NEW WAVE OF CHANGE

In terms of functional ingredients for active nutrition, we believe that products and formats in the category are well-defined.

Allergen-free, plant and vegetablebased, clean labels are all USPs that have driven the category in the past. While this is still relevant, these attributes must be coupled to functional benefits, for instance, the ability to enhance cardiometabolic health, or solutions aimed at men’s sexual health or the ageing population.

This has prompted us not only to ask what the biggest trends in active nutrition are for the year ahead, but how and where our ingredients and

product solutions can impact most - whether you are developing a new formulation or product or simply reformulating an existing product to enhance bioavailability, texture or flavour.

It’s not always about what is new, but what can we do better to enhance the scope and availability of nutrient-dense and bioavailable products that can make a positive difference to the health and well-being of consumers.

In the past, many brands oversubscribed their product offering –taking a ‘more is better’ approach. This is now shifting with a new dynamic that focuses on creating ‘platforms’ with a select product portfolio. Formulating fewer products but harnessing the unique power of nutraceuticals means that brands can now focus on building a core offering that offers tangible results.

At ACI we believe when it comes to health-supporting supplements and nutraceuticals, staying ahead of consumer trends isn’t simply good business sense – it’s an essential part of what we do.

Our partnership with DolCas Biotech is a prime example. As a leader in clinically researched health ingredients, its branded solutions not only make bold claims but are backed by solid science that can significantly impact active nutrition formats.

In this article, we explore five key areas for new product development growth in 2025. Coupled with selected nutraceutical ingredients, we are confident that these trend snapshots will allow you to enhance your NPD or reformulate existing products – meeting the key requirements of brands and customers.

1. Specialist ingredients: winning the inflammation battle

One of the biggest health concerns facing consumers today is inflammation and its impact on whole-body health. Inflammation has already been identified as a culprit instead of just a side effect in many illnesses and has a role to play in many so-called lifestyle illnesses and

conditions including heart disease, obesity, and metabolic syndrome.1

While inflammation is a natural response to injury, chronic inflammation can cause serious and permanent harm to the body. In this fight, specialised ingredients that target the root causes of the inflammation can be a game changer.

Turmeric and its active compound curcumin have long been viewed as a natural inflammation buster and many offers anti-inflammatory effects in people with chronic inflammatory diseases.2

A study conducted in 2020, is just one of many which found that curcumin could offer positive benefits due to its antimicrobial, antiviral, and antioxidant properties.3

The branded ingredient Curcugen is a next-generation curcumin formula and a clinically researched turmeric extract that boasts a whopping 39 to 52 times more bioavailability than standard curcumin extracts.

It works by utilising turmeric’s natural components to enhance absorption and efficacy, allowing for lower doses with higher results. Not only does it improve overall bioavailability, but it also delivers a less bitter taste and is more food and beverage friendly.

Studies have shown Curcugen’s potential in supporting cardiovascular health and reducing inflammation, making it an excellent addition to supplements aimed at combating chronic inflammation.

2. Health hacks: optimising the gut/brain axis

Categories in active nutrition are often remarkably similar, so it is important that you differentiate your product from competitors.

While personalisation has long been touted as a key trend in new formulations, we are now seeing a shift to high-impact daily essentials that are available to all consumers by integrating

Continued on page 8.

nutrition and lifestyle changes to enhance our health and well-being. Products that offer a health hack, such as those targeted a gut health could have a dual function that impacts cognitive health. This gutbrain axis (GBA) allows bidirectional communication between the central and the enteric nervous system, linking the emotional and cognitive centres of the brain with peripheral intestinal functions. Recent advances in research have described the importance of gut microbiota in influencing these interactions.4

Ginfort® is a concentrated ginger extract and functional ingredient that supports gut health. Up to 26 percent of its bioactive compounds are derived from ginger roots, offering a potent dose of gingerol and shogaol, which are known for their anti-inflammatory and digestive benefits. Its highly bioavailable, patented formula allows it to be effective in extremely low doses, making it an attractive option for formulators seeking to add a gut-brain health hack to their product lines.

3. Ageing populations: targeting sexual health and beauty from within

The active nutrition space is also evolving to meet the needs of specific demographics, particularly the ageing population. One of the areas under scrutiny is how ageing, characterised by physiological, pathological, behavioural, and psychosocial changes, may affect sexual functioning.

While there has been relatively little research into sexuality in old age, available surveys show that some form of sexual activity usually continues until the end of life. For example, in a sample of people aged 80-102, 62 percent of the men and 30 percent of the women were still having sexual intercourse. It is problematic that some clinicians tend to ignore this aspect of the lives of elderly people, who themselves can find sexual problems difficult to talk about. However, it is wrong to assume that little can be done about problems at this stage in life, as many causes are potentially reversible.5

Fortiquin®, a botanical blend inspired by Ayurvedic practices, is designed to address male sexual health and stamina. The branded ingredient is clinically tested and proven to increase stamina fivefold by blending botanicals with amino acids to create a natural but potent solution for male vitality.

The healthy ageing demographic is also invested in beauty from within as consumers recognise the connection between nutrition and overall wellness. Morikol® is a marine collagen tripeptide that taps into the growing trend for whole-body wellness. Its unique tripeptide structure ensures better absorption and utilisation in the body – ideal for consumers seeking natural performance and overall health and wellbeing enhancers.

4. The substance behind the logo: cardiometabolic health Cardiometabolic health remains one of the top concerns for consumers, particularly as heart disease continues to be a leading cause of death globally. It is estimated that cardiovascular diseases are the leading cause of mortality globally with up to 20.5 million CVDrelated deaths reported in 2021.6

Bergacyn®FF offers a unique blend of bergamot citrus and Cynara cardunculus (artichoke leaf) extract, formulated to support liver health, reduce fat storage, and promote healthy weight management.

Bergacyn’s clinical studies demonstrate its effectiveness in lowering liver fat and improving

Continued from page 7.

lipid transport, two critical factors in metabolic health. The combination of polyphenols and other bioactive compounds enhances bioavailability and provides a comprehensive solution for heart and liver wellness, helping to support consumers battling obesity or metabolic syndrome. The ingredient is free-flowing, solvent-free, and offers a clean-label option for formulators – perfect for your next formulation targeting CVD.

5. Performance 2.0: from athletes to everyday fitness

In the past, products targeting performance nutrition was seen for elite athletes, but the category is evolving, now catering to a broader audience of everyday fitness enthusiasts. With performance an everyday lifestyle ambition, the sports nutrition market is expanding to offer products that support or enhance natural performance. Here, NitrateBurst™, a spinach-derived nitrate extract is capitalising on the growing trend of clean-label performance enhancers. As a natural source of nitrates, NitrateBurst supports nitric oxide production, which plays a crucial role in blood flow and endurance during exercise.

For fitness enthusiasts, whether competitive athletes or weekend warriors, NitrateBurst offers an edge in stamina and cardiovascular support. Clinical studies show that it enhances energy levels, improves endurance, and supports healthy blood pressure— all without synthetic additives or stimulants – meeting demand for growing cleaner labels and plant-based performance enhancers.

A dynamic new future in active nutrition

As we look ahead to 2025, it’s clear that the active nutrition market is on a steady upward trajectory. The global demand for functional food and beverages, once the domain of niche health products, is now expanding rapidly. Consumers are not just seeking new products—they are searching for products and ingredients that offer tangible, science-backed benefits that align with their evolving health needs.

From anti-inflammatory supplements to gut health - and from men’s health solutions to performance boosters, the future of active nutrition lies in effective, and scientifically validated ingredients. For brands, the key to success is staying ahead of consumer

The healthy ageing demographic is also invested in beauty from within as consumers recognise the connection between nutrition and overall wellness.

expectations, leveraging innovative ingredients that not only meet health goals but are also easy to incorporate into everyday life.

For more information on ACI’s nutraceutical ingredients, and how it can drive new formulations that target active nutrition, contact our research and development team today.

Molly Shaw Owner & Managing Director Berryworld

But this is an industry that is evolving rapidly, responding to the changing demands of consumers and our workforce. It means many long-held farming traditions are being overhauled.

The classic approach, planting outdoors in the winter for early summer peak berry production, is still practised, but consumers around the world have come to expect berries in the supermarket for 52 weeks a year, and this is also true of New Zealand consumers.

Growing still centres around Auckland and Hamilton both because they are near consumer markets and

NZ StrawberryPRODUCTION CHANGES WITH TIME

Strawberries have been a summer delight for generations of Kiwis, evoking many a family memory of a “pick-your-own” trip to a local patch or the crowning glory at a Christmas feast.

because the North’s mild climate favours early production. But all this is changing.

The classic growing model (in ground-level soil mounds) has been expanded by plants grown in soilless media on “tabletop” structures where fruit is at waist height, - more efficient for harvesters than bending. The tabletops are often covered to protect delicate fruit from rain and to hold in a bit of extra warmth to encourage an early harvest in spring. There are also glasshouse crops and even full indoor ‘vertical growing’.

All these production options create fruit available for nearly every week of the year – it’s great to have quality, local fruit in peak condition for customers.

Varieties are constantly being reviewed for flavour and yield. Growers are often using “ever-bearing” varieties which continue to flower and fruit all through the summer and autumn. Varieties of strawberries from breeding programs around the globe pass through the post-entry quarantine system and get tested for performance in New Zealand growing conditions as growers look for ever more productive and tastier berries that will yield well in both outdoor and covered cropping systems.

Of course, this extended fruiting season comes with its own challenges.

Strawberries are naturally a cool-season plant, and production mid summer under cover can get uncomfortably hot for the plants, leading to a decline in berry size. Insect pests also tend to thrive in hot, dry conditions.

However, growers continue to seek out environmentally sound solutions to these challenges, embracing adaptations, especially towards agroecological pest management, to avoid the use of chemicals.

As much as New Zealanders love strawberries, there are only five million of us. A goal of the strawberry industry is to grow by developing more export markets. There is a long history of exporting strawberries from New Zealand, but the volumes have been declining recently as the requirements of importing countries have become more restrictive.

While this is a challenge, the resulting pest and disease tools, new production methods and improved varieties are benefiting the whole industry. We have a great deal to offer consumers here and across the globe.

Innova Global

FLAVOUR TRENDS

Innova Market Insights has been a specialist in consumerpackaged goods trends for 30 years. The company now uses an AI-enhanced platform to analyse insights and observations and generate reports like its report on global flavour trends.

Innova’s 360 perspective on insights considers many facets of CPG trends, including consumers, categories, packaging, flavours, ingredients, and products. The company takes a top-down and bottom-up approach to identify trends and drivers, including flavour trends. Top-down factors include megatrends and shifts in lifestyle and attitudes. Bottom-up factors incorporate insights from global trend-spotters, as well as category trends. This comprehensive collection of intelligence can be synthesised into reports such as Innova’s

Global Flavour Trend #1 Sensory Therapy

Global flavour trends show that today’s world is highly uncertain, and consumers feel the stress. They look for various paths to mental and emotional wellness, including flavour experiences that can be uplifting or calming.

In fact, consumers participating in global consumer flavour trends research say that the most important feature of

flavours is that they can enhance mood. Innova describes sensory therapy as leading to euphoric wellness.

Flavour trends indicate that manufacturers offer flavour choices to meet consumers’ emotional needs. Flavours can be cheerful, happy, energised, healthy, or relaxed and calm. Familiar flavours and comforting flavours most impact consumer food and beverage choices, with coffee flavours and brown flavours as favourites, especially paired with products that have a creamy or smooth texture.

Global Flavour Trend #2 Authentic and Rooted

Authentic and Rooted is Innova’s #2 global flavour trend for 2025. In global consumer trends research, consumers say that they look for authenticity, connection with others, and comfort through real experiences that are rooted in culture.

Nearly half of the consumers researched globally say that honouring food traditions with food choices

that reflect their heritage is a very to extremely important factor in their diet. Participants in a global consumer trends research report want to see products on supermarket shelves that reflect old and traditional recipes. Furthermore, timeless traditional flavours are nostalgic. A world of flavours is available in all types of products, from ready meals to beverages, snacks, and coffees.

Global Flavour Trend #3 Imaginative Taste Adventures

Innova’s #3 global flavour trend for 2025 – Imaginative Taste Adventures – describes consumer pursuit of experiences with flavour adventures and unique flavour combinations. Taste discoveries provide consumers with enjoyment and pleasure in food and beverages. One example of a global food trend is “swicy,” sweet plus spicy. This food and beverage trend in

food and beverage generates positive buzz in the form of social media mentions and sentiment trends across social media and online platforms. Taste experiences are highly important to consumers, and consumers looking for taste experiences will seek out creative flavours.

Global Flavour Trend #4 Healthier Enjoyment

The #4 Global Flavour Trend, Healthier Enjoyment, stresses the importance of combining health with flavour. By boosting the taste, texture, and healthiness of food and beverage choices, manufacturers make them more enjoyable, as well as satisfying and better for you.

In a global consumer trends survey, participants noted the importance of taste and texture – after price – in food and beverage products that are nutritious. Features that improve nutrition include “light” versions that have less sugar, salt, fat, and/or calories, products that are sugar-free, and products with low or no alcohol claims. Consumers have taste expectations for sustainable products, too. Consumers report that taste and texture are barriers to choosing

sustainable food and beverage products, including plant-based products that they say need better taste and texture.

Global flavour Trend #5 Quality and Enrichment

Consumers globally tell Innova Market Insights that luxurious flavours feel indulgent and enhance a product’s perceived value. While price is important to consumers, the quality of a product relates to its value for money. When consumers were asked about attributes other than price that make a product a good value, premium quality was their top answer. Furthermore, consumers say that they remain brand loyal only if the products are of good quality. flavour is an important conveyor of quality, and indulgent flavours help satisfy consumer cravings. Brands are expected to continue evolving flavour to boost the sensory experience for consumers. AI can help them identify exciting new flavours and flavour combinations. Fermentation technology allows for the production of specialised ingredients. The restaurant trend of molecular gastronomy will heighten the sensory experience around flavour.

Is Net Zero Freezing

YOUR COLD CHAIN?

The journey toward net zero emissions is reshaping industries worldwide and the cold chain is no exception. This critical industry, essential for preserving and ensuring the safety of temperature-sensitive products like food, vaccines, and horticulture, is undergoing significant transformation.

Advancements in technology, shifts to environmentally friendly refrigerants, and the push for improved and compliant processes are at the forefront of these changes. However, achieving true sustainability requires more than technological upgrades, It demands an alignment across people, process and equipment.

The adoption of low global warming potential (GWP) refrigerants, zeroemission technologies, and advanced monitoring systems is essential to meet net zero targets. Yet these advances require significant upfront costs, workforce training, and updated

processes to handle their operational intricacies. Managing the safety and performance of new refrigerants while maintaining cold chain integrity in countries of vast distances and climatic extremes, like Australia, further compounds these challenges.

While new technologies promise substantial benefits, their success hinges on how well they integrate with human processes and how well the industry manages change.

Regular validation of any of these new systems and technologies is equally crucial. Cold chain operators must frequently assess their performance to ensure they meet expectations and identify opportunities for improvement. This approach not only safeguards operational reliability but also maximises the return on investment in these cutting-edge technologies. Refrigeration technology has made

remarkable strides over the past 25 years, with systems now up to 50 percent more energy-efficient than they were at the turn of the century. However, the shift toward sustainability involves more than efficiency, it necessitates a complete overhaul of refrigerants. Traditional options, like R-404A, are being replaced with low GWP alternatives.

These new refrigerants, which could reduce emissions by up to 80 percent over the next decade, bring unique challenges. Many are flammable, operate at higher pressures, or are toxic, requiring more sophisticated equipment, tools and handling procedures. This shift demands comprehensive retraining and certification programs for technicians, adding to operational costs. Despite these upfront investments, the longterm environmental and operational

Addressing these challenges will require measured strategies. Careful planning of routes, appropriate infrastructure development, and ongoing assessment of performance will be key to supporting adoption. By taking incremental steps, businesses can work towards integrating electric and hybrid technologies while ensuring cold chain reliability is not compromised.

benefits are substantial.

The adoption of electric and hybrid trucks and refrigeration units represents a major step forward for the cold chain, offering zero-emission solutions. Although still in their early stages, these technologies hold immense transformative potential. Electric and hybrid trucks provide sustainable alternatives to diesel, reducing emissions and operational costs. However, limitations such as range and charging infrastructure pose challenges, especially for long-haul routes. Similarly, electric and hybrid refrigeration units often deliver lower cooling outputs compared to diesel systems, which can affect performance under demanding conditions.

Addressing these challenges will require measured strategies. Careful planning of routes, appropriate infrastructure development, and ongoing assessment of performance will be key to supporting adoption. By taking incremental steps, businesses can work towards integrating electric and hybrid technologies while ensuring cold chain reliability is not compromised.

Successfully implementing these technologies also requires updating processes throughout the cold chain. This includes training personnel, adopting advanced monitoring systems, and strengthening operational practices to ensure seamless integration. By aligning innovative technologies with optimised processes, businesses can meet both environmental and performance objectives, maintaining a reliable and sustainable cold chain.

The transition to sustainable refrigerants and systems presents an opportunity to rethink the cold chain.

Improved temperature management technologies, such as internet-ofthings (IoT)-enabled monitoring and automated systems, can dramatically reduce spoilage. Tools like route optimisation software and smart warehouse solutions contribute to energy efficiency and resource conservation. These advances align with net zero goals by reducing emissions, conserving resources, and minimising waste.

However, maintaining cold chain compliance can pose significant challenges. For example, inconsistent temperature control, including insufficient refrigeration infrastructure at the source, contributes to an estimated AU$25.6 billion in food waste annually in Australia, equivalent to 5.32 million tonnes, excluding consumer-level waste. This not only impacts food quality and safety but also exacerbates environmental and financial losses. As the industry works to address these inefficiencies, the additional demands of sustainability goals introduce further complexities.

Balancing compliance with sustainability aspirations demands a coordinated approach. By blending technological innovation with robust operational practices, the cold chain can meet current and future demands without compromising reliability. While the journey is complex, the potential rewards of reduced emissions, improved food safety, and enhanced efficiency are transformative.

Net zero is not just about meeting regulations, it’s an opportunity to elevate the cold chain to new levels of performance and world standard compliance.

Eating Green

PLANT-BASED ALTERNATIVE TRENDS

“Plant-based” is set to continue as a major trend in 2025 but unlike the recent crop up of plant-based meat and dairy replacers on the shelves, consumers are seeking foods that are more nutritious, flavorful, and deliver the full experience of the real thing.

Liat Simha CEO & Founder NutriPR

According to Innova Market Insights, one-third of European consumers consistently read ingredient labels on plant-based products to find options that are “nutritionally equivalent to animal-based” products. Purchasing preferences vary by country. For instance, Spanish consumers favor plant-based milk, Germans prefer plant-based butter, while consumers in Germany and the UK are inclined toward plant-based meat. Many consumers want more plant-based meat, dairy, and chocolate options derived from plant protein.

Innovators can answer consumer demands for better-for-you plantbased products by including food

ingredients that provide superior protein and texture, while avoiding artificial ingredients. The growth in this market is motivate by flexitarians who want “the whole package” of flavor, convenience, and affordability without any compromises. The following five points are driving consumer choices in plant-based products in the coming year.

1. Sustainability – US consumers are concerned about the health of the planet. They feel the impact of climate change, according to Innova. Climate change affects a number of factors, including the economy, food security, and health. Examples: Kensing introduced its upcycled Sun E® non-GMO vitamin E at

Fi Europe in Frankfurt. Taking a holistic approach, Sun E is a cleanlabel tocopherol derived from sunflowers that reduces waste and minimizes environmental impact. Novella leveraged proprietary technology to grow nutritious botanical ingredients while leaving the whole plant out of the equation. Addressing the growing demand for botanical micronutrients, the new technology overcomes supply chain disruptions, mitigates climate change, and expands plant life cycles.

2. Affordability – The first generation of plant-based food was expensive. Overall, US consumers worry most about their finances—the cost of

housing, the cost of healthy and nutritious food, the believability of information, and personal safety, reports Innova. Protein trends show that Europeans seek plant-based alternatives that are cheaper and tastier.

Nielsen reports that price sensitivity is one of the most significant challenges. For many consumers, especially in times of economic uncertainty and inflation, this price difference can be a barrier to regular purchases.

Examples of companies meeting these challenges: Cell-cultivated seafood innovator Forsea is on a mission to save eels. This November, the start-up announced its organoid technology reached a record-breaking cell density of more than 300 million cells/ml, and with minimal and precise use of cultured media. This will be bring cultured seafood production to a cost that is actually below the traditional market price. DairyX developed a method to produce casein proteins that can selfassemble into micelles. The start-up creates sustainable dairy proteins that are identical to cow’s milk proteins in structure and function. The company is creating yeast strains that produce exceptionally high casein yields in short timeframes. This approach ensures that DairyX’s ingredients are cost-effective – a crucial factor for adoption by dairy manufacturers.

3. Texture and Flavor – Another standout company at Fi Europe was revyve. This FoodTech company exhibited its plant-based egg replacer based on brewer’s yeast in new texturizers that deliver the meatiness and juicy firmness in meat replacers that cater to consumer desires. These nutritious, wholesome ingredients are, are all-natural and non-GMO.

4. Nutrition – At Brevel’s recent plant opening event, visitors enjoyed tastings of a variety of proteinrich, plant-based cheese analogs demonstrating the company’s ability

to provide nutritional value without compromising flavor or appearance. The extracted microalgae protein is highly nutritious, has sensory appeal, and is in the same price bracket as soy and pea proteins.

NewMoo applies plant molecular farming (PMF) technology to produce casein proteins for making cheese. The scientists at NewMoo discovered a way to express casein proteins in plant seeds that can grow abundantly through traditional agriculture fields. NewMoo can grow proteins that match dairy proteins in nutrition, composition, and function.

5. Better-for-you products – Foodtech start-up Gavan Technologies. developed Fatrix™, a leading-edge alternative fat solution. Fatrix is designed to help food manufacturers reach a higher nutritional score for their product by reducing total fat— especially saturated fat. Using Fatrix as a fat source awards exceptional sensory value while cleaning the label from undesired emulsifiers.

What next

Ingredient and cellular agriculture companies are driving the innovation in plant-based CPGs. They understand consumer demands for sustainable, affordable products and put emphasis on functionality and flavor as well. Plant protein is still the star ingredient, but plant-based fat replacers and texturizers are shifting rapidly to the center of interest as well. Since the population of flexitarians is growing, 2025 will also see more “hybrid” products, using plant-based ingredients in place of a portion or some of the animal-based ingredients, too.

The Year of AI

WHAT IT MEANS FOR BRANDS COMPETING FOR CONSUMER ATTENTION

AI has taken centre stage with innovations that just a few short years ago would have seemed like science fiction. From creating content in seconds to algorithms that predict purchasing behaviour down to an individual level, AI has fundamentally reshaped how businesses operate.

Brands and supermarkets competing in an increasingly saturated market are asking: How can we leverage technology to anticipate and meet consumers’ needs faster and better than ever before?

Here’s a look at some of the major shifts happening in the world of consumer insights and how brands are transforming to not only ‘keep up’ but ‘stay ahead’ of consumer expectations.

SHIFT: From surveys to realtime data: knowing what consumers want right now

Traditionally, brands have relied on detailed (and expensive) surveys and periodic reports to understand consumer preferences. The problem with these is that they report on what has already taken place - often months ago - by which time the market (and

consumer) has moved on.

Today, businesses can access data in real-time, capturing up-to-theminute trends that allow them to adapt instantly. Platforms like Appetise Insights are leading the charge here, providing detailed information about what Kiwis are adding to their festive shopping lists as early as Halloween— months before Christmas arrives.

In short, marketing strategies no longer have to be reactive, missing the mark only to realise too late that consumers aren’t responding. Realtime insights empower brands to finetune their campaigns from the outset, ensuring they align perfectly with consumer sentiment.

This year, for example, data showed a clear shift from turkey to chicken as Kiwis’ go-to holiday protein due to budget constraints and rising food prices. Knowing this, supermarkets could plan targeted advertising

Partnerships can help brands move beyond their own data silos to reveal detailed consumer preferences across specific demographics and regions in an ever-changing market.

campaigns around chicken and other budget-friendly options rather than spending on promoting turkey.

SHIFT: From responding to predicting: forecasting what will sell

Using these advanced, AI-driven insights, brands can move from simply responding to trends to predicting them before they take hold. This shift from historical to predictive data is crucial. It’s no longer about looking back at past holidays to realise that people spent less; brands now have the foresight to recognise these patterns in advance and know that Kiwis will prioritise cost-effective solutions, given the high volume of the search term ‘cost-effective’, supermarkets and suppliers can market their value propositions upfront, competing more effectively in a season when shoppers may be curtailing their budgets. Using a data-backed approach, brands can craft messages that hit home, capturing attention in a timely and relevant way for price-conscious shoppers.

SHIFT: From relying on in-house data to partnering with tech innovators: gaining a holistic view

There has also been a marked shift away from relying on ‘in-house’ data only, with brands realising that tapping into innovative tech platforms to

broaden their consumer insights and gain a more holistic view is the smart cut to success. Rather than piecing together fragmented information, partnerships can help brands move beyond their own data silos to reveal detailed consumer preferences across specific demographics and regions in an ever-changing market.

This collaborative approach is powerful and can highlight essential consumer shifts, such as a growing interest in Asian-inspired meals among Kiwis. Knowing that dishes featuring fresh, bold flavours and ingredients like gochujang and yuzu can help brands refine their product lines, experimenting with flavours that might resonate with consumers looking for something unique yet accessible.

Ultimately, consumer attention is earned by those who can deliver value at the moment and anticipate needs before they even arise. In this AI-powered era, those who leverage the right insights at the right time will come out on top.

For more insights into shifting consumer trends and how brands can respond effectively, stay tuned to Appetise Insights.

The Changing

GROCERY LANDSCAPE

The New Zealand Government and Commerce Commission's scrutiny of the supermarket duopoly is a wake-up call for suppliers. While the answer to the question about competition in the New Zealand grocery scene will take years to evolve, the ongoing discussion about market dominance and limited competition has significant implications.

It affects not only pricing and consumer choice but also the ability of suppliers to get their products on supermarket shelves. The grocery industry is transforming significantly; with a squeeze on shelf space and an increasing number of private-label products, suppliers are exploring alternative sales channels to maintain their market presence.

Major FMCG players are shifting their focus toward higher-margin health, wellness, and beauty categories. Brands are reassessing their strategies and exploring alternative sales channels,

such as direct-to-consumer models, specialty retailers, and food service partnerships.

Fonterra's decision to sell off its consumer brands, including Anchor, Mainland, and Kāpiti, marks a notable retreat from the FMCG space. CEO Miles Hurrell emphasised the importance of focusing on core strengths.

"The key to any good business is knowing what you're good at," said Hurrell.

He noted that while Fonterra's ingredients business has delivered

strong returns, the consumer division has not provided the desired return on capital. By reinvesting in ingredients and food service, Fonterra aims to align with global trends that see food manufacturers exiting low-margin categories.

Unilever is another example of this shift. The company's focus on fewer, larger brands with stronger growth potential reflects an industry-wide move to streamline portfolios. While Unilever is not entirely exiting food, it is prioritising products with higher profitability and scalability.

The supermarket duopoly here makes it increasingly difficult for smaller brands to secure shelf space, and even large players are struggling with the economics of supermarket distribution, prompting them to explore more lucrative alternatives. Private-label

products are gaining traction globally, giving retailers better control over margins and pricing, further squeezing out branded products.

At the same time, subscription models for pet food, personal care, and household products are growing in popularity, providing consumers with convenience and brands with a directto-consumer revenue stream. This raises an important question: if more categories shift to online subscriptions, will supermarkets primarily focus on fresh food and private-label goods?

Where will food and beverage manufacturers sell their products if supermarkets continue to reduce shelf space for branded FMCG products? Will direct-to-consumer models, specialty retailers, food service channels, or exports become the primary routes to market?

Equally, what types of products will be most attractive for manufacturers to produce? With profitability driving decision-making, will we see an increased focus on functional foods, premium offerings, or alternative proteins? As manufacturers shift their strategies, the composition of supermarket shelves and the wider food industry could look very different in the coming years.

Beyond retail, broader global trade dynamics are shifting. HSBC has suggested that globalisation may have peaked in its current form. Geopolitical tensions and US tariffs are influencing supply chains, which could lead to more regionalised trade structures, impacting product availability.

With major brands retreating from traditional FMCG categories and supermarkets expanding their privatelabel ranges, the future of grocery retail is uncertain. If private-label dominance continues, emerging brands may struggle to secure shelf space, raising concerns about long-term consumer choice.

As these shifts unfold, retailers and suppliers must adapt to a rapidly changing environment where traditional retail models may no longer apply.

The complete control solution in Hygienic Design

Beckhoff offers an integrated stainless steel control system with Hygienic Design for the food manufacturing, beverage, pharmaceutical and packaging industries. All stainless steel components meet the stringent requirements of hygiene and cleanroom regulations:

The stainless steel IP65 panels and Panel PCs featuring gap-free housing design and flush-mounted touch screen are available in 12-, 15- or 19-inch display sizes.

The EHEDG-certified AM8800 stainless steel servomotors with IP69K protection are designed for torques between 1 and 16.7 Nm. These motors feature One Cable Technology which combines power and feedback signals in a single standard motor cable, significantly lowering material and commissioning costs as a result.

The stainless steel I/O modules with EtherCAT interface and IP69K protection cover a wide range of applications for all common signal types.

Local

At DTS, we

in

steel engineering solutions for the food, beverage and pharmaceutical industries. Our tank design philosophy is to minimise waste and maximise profit, not only during tank fabrication, but also throughout the tank’s operational

ECO FOOD PACKAGING

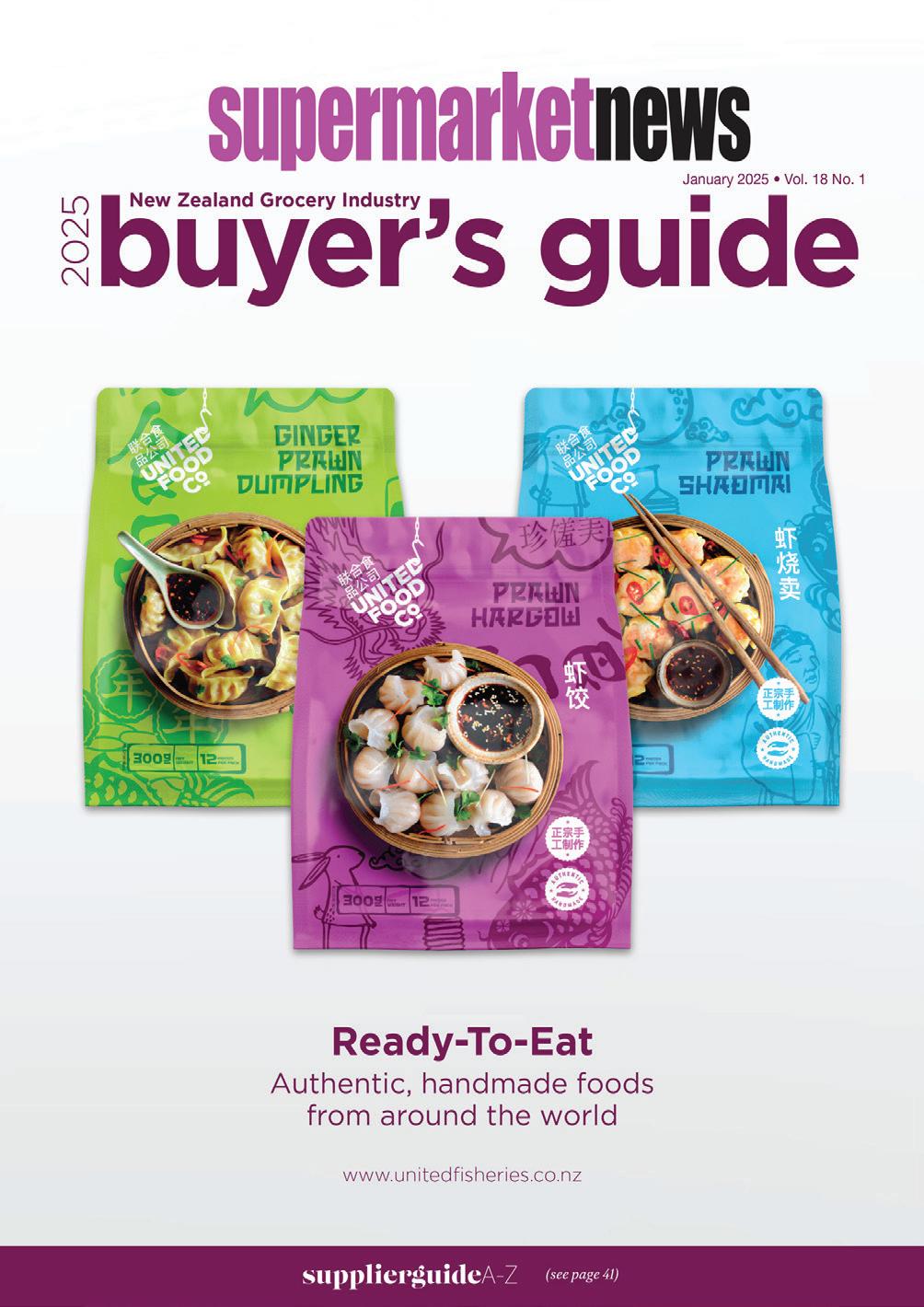

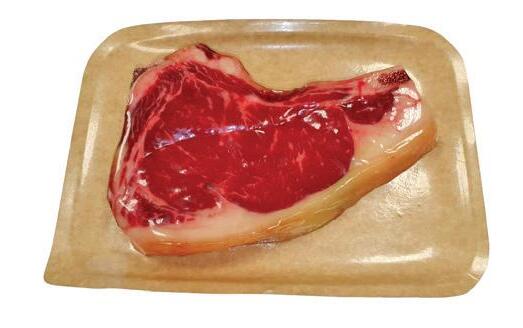

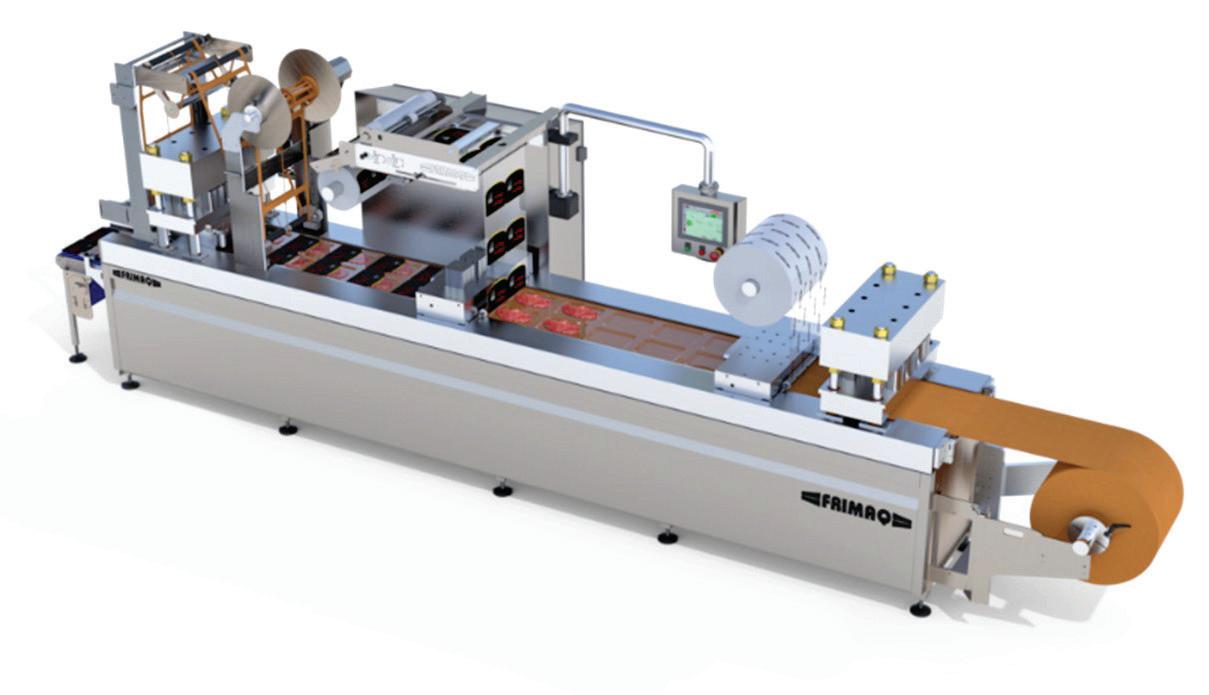

Vacpack is a leading provider of innovative machinery and cardboard base food packaging products to New Zealand, Australia and the Pacific.

Are you looking for eco-friendly packaging that improves the shelf life of your fresh and frozen items? Then, Vacpack’s market leading cardboard base technology is the solution for

you. The systems help reduce plastic by up to 80%, is 100% biodegradable or recyclable and creates an appealing and safe end-product. Call us now to find out more.

Ph: +64(9) 443 6301

Email: info@vacpack.co.nz

www.vacpack.co.nz

4/3 Emirali Road, Silverdale, Auckland

Checkweigher

info@easirecycling.co.nz

www.easirecycling.co.nz

Freephone: 0800 342 3177

Gribbles Scientific providing tailored solutions for all your food, environmental and product testing needs.

Analytical chemistry, nutritional analysis, microbiology testing, shelf-life testing, preservatives, additives & more. Talk to us today. 0800 474 225

www.gribblesscientific.co.nz

Discover the power of

plant-based colours

EXBERRY® Colours are the ideal and future-proof solution for food and drink applications matching the recent plant-based, vegan and vegetarian trends.

MANAGING ENERGY EFFICIENTLY

HRS Heat Exchangers

Pasteurisation

Sterilisation

Aseptic Filling

Direct Steam Injection

Evaporation

CIP Kitchens

Process Skids

Juice Crushing and Remelting

Trusted by brands across New Zealand

NZMS Scientific offers specialised solutions to help ensure your products meet the standards you and your customers expect.

Give us a call today to talk about:

• Pathogen testing

• Allergen testing

• Hygiene testing

• Sterility testing

Processing Solutions for Proteins Since 1987.

SCANZ is a multi-discipline supply company and manufacturers agent, specialising in technology and equipment for the food industry. It’s primary focus is within three market segments, namely fish (including aquaculture), meat and the dairy industry. Recent advances have been made in Impingement and IQF Freezing technologies from OCTOFROST of Sweden, plus an expanded processing role in Petfood.

SCANZ provides solutions to suit all phases of the production process.

Talk to us today, info@scanztech.com or 09-520 2544. www.scanztech.com

Urgent Couriers are specialists in temperature -controlled deliveries of chilled small goods. Fast, reliable, guaranteed sameday services live tracked from despatch all the way to your customer’s door. We provide techforward and innovative solutions to make your life easier.

+64 9 307 3555 P sales@urgent.co.nz E

TC TRANSCONTINENTAL PACKAGING NEW ZEALAND

With over 40 years operating experience in New Zealand, TC Transcontinental Packaging New Zealand (TC NZ) is a leading manufacturer of flexible packaging to the FMCG, horticulture, retail and manufacturing markets

TC NZ is both a reputable manufacturer and trader, supplying all forms of flexible packaging made from traditional plastic films recycled blended films, laminated barrier substrates. TC NZ employs over 90 people in New Zealand with centres in Auckland and Christchurch, home to an ultra-modern food grade packaging manufacturing plant, and supported by our global TC Transcontinental research and technology platform from North America.

TC Transcontinental Packaging brings a distinctive blend of science, technology, and art together to create flexible packaging that preserves our customers’ products and accentuates their brands on the store shelf. Our expertise, resources and conversion technology helps us create packaging that gives our customers a competitive advantage. We utilise a widevariety of printing techniques, laminations and converting styles including pouches that help enhance your brand.

We invest in state of the art technology to offer and invest in a sustainable future and are delighted to be recognised for our high quality packaging that we supply to our customers. Globally TC Transcontinental Packaging is committed to a circular approach to plastic. As global signatories to the Ellen MacArthur Foundation, we are working towards our 2025 goal where 100% of our plastic packaging will be reusable, recyclable or compostable, and 10% of our plastic output to be made from recycled plastic waste.

At the 2022 Pride in Print Awards, TC NZ were awarded Gold Sustainability Award in the Flexible Packaging Category for our significant volumes used into industrial, refuse and hygiene packaging. TC NZ are meeting customer requirements by extruding and converting recycled resins of in-house, postindustrial waste, and post-consumer recycled content , Green PE (PE derived from renewable resources such as waste sugar cane), and has the ability to manufacture flexible packaging with other

ABB

ABB has two manufacturing facilities in New Zealand located in Henderson, Auckland and Napier.

Email: contact.center@nz.abb.com

T: 0800464222

https://campaign.abb.com/Food_and_ Beverage

Contact us for:

• Equipment Regulatory

• Process Control Services

• Events & Education Services

ADM NUTRITION

10A Julius Avenue, Suite 1, Ground Floor, Sydney, 13682, 2113, Australia

Contact: Zona Negri

T: +61 2 8879 4800

E: nutritionanz@adm.com

Contact us for:

• Alternative Proteins

• Bakery & Cereals

• Beverage, Clean Label

• Confectionary

• Dairy

• Emulsifiers & Stabilisers

• Flavours & Colours

• Functional

• IngredientsPrebiotic fibre

• Pro & Post-biotics

• Natural extracts

• Sweeteners

AWS GROUP

43 Maurice Road, Penrose, Auckland 1061, New Zealand

T: 09 622 4601

E: info@awsgroup.co.nz

www.linkedin.com/company/67506277

Contact us for:

• Comprehensive Cleaning and Sanitising Solutions

BRENNTAG NZ LTD

Level 2, Building C, 602 Gt South Road

Ellerslie, Auckland, New Zealand

T: 61 03 9559 8306

E: lisa.gilbert@brenntag-asia.com www.brenntag.com/food-nutrition

Contact us for:

• Bakery & Cereals

• Beverages

• Clean Label

• Confectionery

• Cultures

• Enzymes & Yeasts

• Dairy

• Emulsifiers & Stablisers

• Fats & Oils

• Flavours & Colours

• Functional

• Ingredients

• Ingredients

• Nutrition

• Organic & Free From

CHR HANSEN

49 Barry Street, Bayswater

Victoria, Australia

Contact: Scott Bolch

T: 61 439 355 575

E: aucustomerservice@chr-hansen.com www.chr-hansen.com

Contact us for:

• Alternative Proteins

• Beverages

• Clean Label

• Cultures, Enzymes & Yeasts

• Dairy

• Food Safety

• Ingredients

• Ingredients

• Sustainability & Food Waste

• Testing & Analysis

BROOKE FINE FOODS

9a Apollo Drive, Rosedale

Auckland, New Zealand

T: 64 0800 442 783

E: orders@brookefinefoods.com www.brookehl.co.nz

Contact us for:

• Ingredients

CASPAK PRODUCTS LTD

20 Peters Way, Silverdale

Auckland, New Zealand

T: 64 9 421 9019

E: lane@caspak.co.nz www.caspak.co.nz

Contact us for:

• Labelling

• Materials & Packaging

CONFOIL NZ LTD

3 Piermark Drive, Albany, Auckland, New Zealand

Contact: James Romhany

T: 64 09 415 4580

E: info@confoil.co.nz www.confoil.co.nz

Contact us for:

• Labelling

• Materials & Packaging

COOLTEK LTD.

112A Mays Road, Penrose

Auckland, 1061, New Zealand

Contact: Phillip Cashmore

T: +6496330071

E: cooltek@machinetech.co.nz

Contact us for:

• Equipment

• Cooling Towers

• Water Chillers

D&L PACKAGING + VACPACK

4/3 Emirali Road, Silverdale

Auckland, New Zealand

Contact: Tim Morton

T: 64 09 443 6301

E: info@vacpack.co.nz www.vacpack.co.nz or www.dlpack.co.nz

Contact us for:

• Labelling

• Materials & Packaging

• Equipment

• Food Safety

• Cook Chill

• Sustainability & Food Waste Brands:

• Benison

• Airzero

• EkoPak

• Frimaq

• Regethermic

• Turbovac

• Vacpack

DELMAINE FINE FOODS LTD

5 Reliable Way, Mt Wellington, Auckland

Contact: Customer Service

T: 0800 335 624

E: enquiries@delmaine.com www.delmaine.co.nz

Contact us for:

• Beverage, Toppings & Sauces

• Chilled

• Antipasto Brands:

• Delmaine

• Rosedale

• Pelion

• Longest Drink in Town

• Tuimato

DYNAMIC INSPECTION LTD

17a Cook Street

Cambridge, New Zealand

T: 64 07 823 4111

E: steve@dynamicinspection.co.nz www.dynamicinspection.co.nz

Contact us for:

• Inspection Equipment

EASI RECYCLING NEW ZEALAND LTD

14 Totara Heights Way, Paihia, Paihia, 0200, New Zealand

Contact: Jon Earnshaw

T: 021 053 1730

E: jon@easirecycling.co.nz

Contact us for:

• Sustainability & Food Waste

• Waste Management

EUROTEC LTD

750c Gt South Road, Penrose

Auckland, New Zealand

Contact: Tom Aldridge

T: 64 09 579 1990

E: taldridge@eurotec.co.nz

www.eurotec.co.nz

Contact us for:

• Equipment

• Food Safety

FOODFLO INTERNATIONAL

150 Main Street, Pahiatua 4910

T: 64 6 376 8774

E. info@foodflo.co.nz

W: foodflo.co.nz

Contact us for:

• Ingredients

• Inclusions

GALA SOLUTIONS LTD

3A Joval Place, Wiri, Auckland

New Zealand

Contact: Gavin Carragher

T: 64 09 262 0995

E: support@galas.co.nz

www.galas.co.nz

Contact us for:

• Audits & Certification

• Bakery & Cereals

• Beverage

• Chilled

• Clean Label

• Confectionery

• Dairy

• Equipment

• Food Safety

• Fresh

• Functional

• Inspection & Sanitation

• Labelling

• Materials & Packaging

• Logistics

• Process Control

• Services

Brands:

• Best Code

• Bluhm Systems

• Ijet

• Marroprint

• Print Date

• Printjet

• RN Mark

GNT GROUP

Industrieweg, 26, n/a, Mierlo, 5731HR, Netherlands

Contact: Lorraine Jansen

T: 0407800300

E: info@gnt-group.com

Contact us for:

• Flavours & Colours

GRIBBLES SCIENTIFIC

Invermay Research Centre (Block A), Puddle Alley, Mosgiel, Dunedin, 9053, New Zealand

Contact: Brent Hananeia

T: 03 489 4600

E: sales@gribblescientific.co.nz

Contact us for:

• Product testing / analysis

HANSELLS MASTERTON

160 State Highway 2, RD11, Masterton, 5871, New Zealand

Contact: Alistair Rough

T: 06 370 0200

E: alistairr@hmstn.co.nz

Contact us for:

• Contract Manufacturer

HAWKINS WATTS NZ

43 Maurice Road, Penrose, Auckland 1061

Contact: Stuart Jones

T: 64 9 622 2720

E: sales@hawkinswatts.com

Contact us for:

• Flavours

• Hydrocolloids

• Emulsifiers & Stabilisers

• Health & Nutrition Ingredients

• Probiotics, Prebiotics, Postbiotics

• Colours

• Processing aids

• Antioxidants

• Sweeteners

• Preservatives

• Food ingredients

• Beverage ingredients

• Supplement ingredients

HIBISCUS SOLUTIONS

C/- Kaikaha Building, 70A Business

Parade South Highbrook, Auckland

2013, New Zealand

Contact: Gavin Fantastic

T: 64 218 79301

E: gavinfantastic@hibiscus-solutions.com

Contact us for:

• Alternative Protein

• Bakery & Cereals

• Beverage

• Clean Label

• Confectionery

• Cultures

• Enzymes & Yeasts

• Dairy

• Emulsifiers & Stabilisers

• Equipment

• Fats & Oils

• Flavours & Colours

• Functional

• Ingredients

• Labelling

• Materials & Packaging

• Sugars & Starches

• Supply Chain & Logistics

• Sustainability

HONAR REFRIGERATION

351 Rosebank Rd, Avondale, Auckland, 1026, New Zealand

Contact: John Miller

T: 09 8284180

E: sales@honar.co.nz

Contact us for:

• Equipment

HRS HEAT EXCHANGERS

8/168 Christmas Street, Fairfield

Melbourne, Australia

E: info@au-hrs-he.com

www.hrs-heatexchangers.com.au

Contact us for:

• Equipment

• Processing Technology

INDUSTRIAL TUBE MANUFACTURING

278 Kahikatea Drive, Frankton, Hamilton, 3204, New Zealand

Contact: Jared Knapp

T: 07 8475333

E: sales@industrialtube.co.nz

Contact us for:

• Food Grade Stailess Steel Tubing

• For food processing and hygienic application

INVITA NEW ZEALAND

117 Cryers Road, East Tamaki, Auckland 2013, New Zealand

Contact: Alexis Thorley

T: 61 408 946 264

E: alexis.thorley@invitaanz.com

www.invitaanz.com

Contact us for:

• Alternative Protein

• Bakery & Cereals

• Beverage

• Clean Label

• Confectionery

• Cultures

• Enzymes & Yeasts

• Dairy

• Emulsifiers & Stabilisers

• Fats & Oils

• Flavours & Colours

• Functional

• Ingredients

• Sugars & Starches

Brands:

• dsm-firmenich

• BENEO

• Cargill

• AAK

• Advanced Lipids

• GNT

• Futura

• QHT

• IFF Health

• Ransom Naturals

• Benexia

• OVĀVO

• Totally Natural Solutions

• Coffein Compaigne

• F&C Licorice

• Nigay

• O’Laughlin

• Stabil Nutrition

• PureMalt

• abvickers

• Smart Salt®

• Veramaris® Pets

INSTRUMATICS

19 Beasley Ave, Penrose, Auckland, 1061, New Zealand

Contact: Derek Beckett

T: 0275324474

E: derek@instrumatics.co.nz

Contact us for:

• Equipment

JAMES CRISP LTD

202 Parnell Road

Parnell, Auckland

Contact: Jon McGrinder

T: 64 09 309 0802

E: sales@jamescrisp.co.nz

www.jamescrisp.co.nz

Contact us for:

• Ingredients

LABEL & LITHO LTD

151 Hutt Park Rd, ., Gracefield, Lower Hutt, 5010, New Zealand

Contact: Thomas Kaffes

T: 0800425223

E: info@label.co.nz

Contact us for:

• Labelling

• Materials & Packaging

LANGDON

L2, Building 6/660 Great South Road

Ellerslie, Auckland 1051

New Zealand

Contact: Kenny Pihema

T: +64 9 965 5185

E: kpihema@hjlangdon.com www.hjlangdon.com

Contact us for:

• Alternative Protein

• Clean Label

• Emulsifiers & Stabilisers

• Flavours & Colours

• Functional

• Ingredients

• Sugars & Starches

KIWI SAFFRON LTD

330 Lagoon Creek Road

RD2, Te Anau

New Zealand

Contact: Jo Daley

T: 64 027 856 2867

E: info@kiwisaffron.com

www.kiwisaffron.com

Contact us for:

• Ingredients

MILTEK

Contact: Rod Enoka

3/62 Hillside Road

Glenfield, Auckland

Phone: 09 446 0709

Email: rod@miltek.co.nz

Website: www.miltek.co.nz

PACIFIC TRADE INVEST NZ

Level 3, 5 Short Street, Newmarket, Auckland, 1023, New Zealand

Contact: Alex Stone

T: 022 503 6557

E: alex.stone@pacifictradeinvest.com

Contact us for:

• We support expopters of fine food products from the Blue Pacific to New Zealand

Process know-how

SCANZ TECHNOLOGIES LTD

1/164 Remuera Rd, Auckland 1050

New Zealand

Contact: Tony Rumbold

T: 021992750

E: info@scanztech.com

Contact us for:

• Equipment

SENSIENT TECHNOLOGIES NEW ZEALAND

5 Doraval Place, Mt Wellington, Auckland, 1060, New Zealand

Contact: Nicolas Sawyer

T: +64 9 270 8510

E: salesnz@sensient.com

Contact us for:

• Flavours & Colours

• Organic & Free From

• Sustainability & Food

WasteSpecialty Sauces

SHERRATT INGREDIENTS

1 Workspace Drive, Hobsonville, Auckland, 0618, New Zealand

Contact: Gabriela Garcia-Scholtz

T: 0275053343

E: sales@sherratt.co.nz

Website: www.sherratt.co.nz

Contact us for:

• Bakery & Cereals

• Beverages

• Brines & Cures

• Clean Label

• Dairy

• Emulsifiers & Stabilisers

• Flavoured Seasoning blends

• Flavours & Colours

• Functional and Bespoke Blends

• Hydrocolloids

• Ingredients

• Proteins

• Sugars, Sweeteners & Starches

TC TRANSCONTINENTAL PACKAGING

Address: 42B Tawa Drive, Albany, Auckland

Contact Name: Donald Lee

Phone: 021 481 245

Email: donald.lee@tc.tc www.tctranscontinental.com

TECHSPAN INDUSTRIAL PRINTING SYSTEMS LTD

1 Portage Road

New Lynn, Auckland

New Zealand

T: 64 0800 603 603

E: info@tsclabelprinters.co.nz

www.tsclabelprinters.co.nz

Contact us for:

• Labelling

• Materials & Packaging

TEMPRECORD INTERNATIONAL LIMITED

239D Burswood Drive, Burswood, Auckland, 2013, New Zealand

Contact: BRONWYN ADDINGTON

T: +6492749825

E: info@temprecord.com

Contact us for:

• Equipment

URGENT COURIERS LTD

17 Saleyards Road, Otahuhu, Auckland, 1062, New Zealand

Contact: Catherine George

T: 09 307 3555

E: sales@urgent.co.nz

Contact us for:

• Supply Chain & Logistics

VWORK

Level 10, 120 Albert Street

Auckland, 1010, New Zealand

Contact: Sam Edmond

T: +64272861866

E: sam.edmond@vworkapp.com

Contact us for:

• Job Scheduling and Dispatch Software

FRESH FROM UNITED

we’ve got great products for every occasion, from fresh seafood to crumbed fish and tasty tapas

FRESH FROM UNITED

we’ve got great products for every occasion, from fresh seafood to crumbed fish and tasty tapas.

FRESH FROM UNITED

we’ve got great products for every occasion, from fresh seafood to crumbe fish and tasty tapas