The scope, size and investment period applied are as follows:

● Companies listed on the JSE with a minimum market capitalisation of R5bn as at August 31 2024, minimum volume traded value of R20m and a track record of five years trading from September 1 2019 are included.

● Selected companies that meet the aforementioned criteria, but are no longer listed on the JSE or the share is suspended as at August 31 2024 are excluded from the analysis.

● The executive management of Arena have also considered certain subjective qualifying criteria, relating to the Top 100 Companies’ perceived compliance with good governance and ethical conduct.

● The share performance analysis assumes an initial investment of R10,000 at the closing price on August 31 2024 and held for a period of five years from September 1 2019 to August 31 2024.

● The companies are ranked based on the compound annual growth rate over the fiveyear period. This analysis assumes that a fraction of a share can be purchased.

The share price performance is adjusted for corporate actions during the review period as follows:

● Ordinary and special dividends: The gross dividend per share is assumed to be reinvested in the company on the dividend payment date at that date’s closing share price.

● Scrip dividends: Assumed that the cash option was elected and that the gross dividend is reinvested in the company as described above.

● Capitalisation issue: Shares received are held until the end of the review period.

● Unbundling: The shares in “NewCo” received are assumed to be received on the last date to trade and are tracked separately. The compound annual growth rate is calculated based on the basket of shares held at the end of the period as a result of the original R10,000 investment.

● Share split/consolidation: Share price data was adjusted for these corporate events.

● Rights issue: It is assumed that rights are not taken up and lapse, therefore no adjustment made.

The data has been sourced through Bloomberg and the calculations have been verified by Deloitte. PKF.

The Sunday Times Top 100 Companies results were compiled by Valeo Capital. Valeo Capital is a boutique advisory firm, providing independent expert advice on the full spectrum of corporate finance services.

Alphamin Resources

Grindrod

Pan African Resources

Altron-A

Harmony Gold Mining

Aspen Pharmacare

Gold Fields

Raubex Group

AdvTech

Shoprite Holdings

Outsurance Group

Investec

Capitec Bank

DRDGold

Truworths International

Exxaro Resources

Investec Ltd

Glencore

Afrimat

Fairvest

Stadio Holdings

Fortress Real Estate Investments-B

Compagnie Financière Richemont

PSG Financial Services

Alexander Forbes Group

Hudaco Industries

Omnia

BHP Group

Sirius Real Estate

Momentum Group

Motus Holdings

Anglo American

Wilson Bayly Holmes-Ovcon

Clicks Group

Reinet Investments

Lesaka Technologies

Hosken Consolidated Investments

Datatec

Firstrand

African Rainbow Minerals

Bidvest Group

Standard Bank Group

Nedbank Group

British American Tobacco

South32

Fairvest Ltd-B

Mr Price Group

AVI

Quilter

Stor-Age Property REIT

Dis-Chem Pharmacies

Emira Property Fund

Anglogold Ashanti

Southern Sun

Sanlam

SA Corporate Real Estate

Reunert

Santam

Remgro

NEPI Rockcastle

Absa Group

Kumba Iron Ore

Vukile Property Fund

AECI

Bid Corp

Coronation Fund Managers

African Rainbow Capital Investments

Resilient REIT

MAS

Barloworld

Lighthouse Properties

Pepkor Holdings

Northam Platinum

Attacq

Discovery

Woolworths

Mondi Plc

Tiger Brands

Adcock Ingram

JSE

Astral Foods

Oceana Group

Old Mutual

Clientele

Vodacom Group

Naspers

Sappi

Italtile

Impala Platinum

Sun International

Tharisa

TFG

Life Healthcare Group

PPC

Equites Property Fund

Sibanye-Stillwater

Growthpoint Properties

Super Group

MTN Group

Tsogo Sun

16,861 16,614 16,599 16,575 16,449 16,183 16,077 16,036 15,994 15,838 15,835 15,718 15,543 15,515 15,472 15,269 15,259 15,024 14,764 14,543 14,526 14,435 14,386 14,331 14,299 14,223 14,165 13,620 13,477 13,435 13,304 13,269 13,037 12,994 12,866 12,597 11,831 11,741 11,713 11,519 11,064 11,029 10,918 10,903 10,516 10,408 10,358 10,283 10,280 10,224

*Return over five years from September 1 2019 to August 31 2024, on a theoretical R10,000 investment. The results were compiled by Vestra Advisory. The executive management of Arena Holdings have also considered certain subjective qualifying criteria, relating to the Top 100 Companies’ perceived compliance with good governance and ethical conduct. Graphic: Ruby-Gay Martin

1

Share price, daily (cents)

September

R10,000 investment

August2024: R53,077

202120222023 20202024

Graphic: Ruby-Gay Martin

3

Share price, daily (cents)

R10,000 investment

August2024: R35,722

202120222023 20202024

Graphic: Ruby-Gay Martin

5

August2024: R33,762

September 2019: R10,000 investment

202120222023 20202024

Graphic: Ruby-Gay Martin

7

Share price, daily (cents)

August2024: R32,439

202120222023 20202024 September 2019: R10,000 investment

Graphic: Ruby-Gay Martin

9

Share price, daily (cents)

September 2019: R10,000 investment

August2024: R31,577

202120222023 20202024

Graphic: Ruby-Gay Martin

2

August2024: R41,880

202120222023 20202024 September 2019: R10,000 investment

Graphic: Ruby-Gay Martin

4

(cents)

August2024: R35,636

202120222023 20202024 September 2019: R10,000 investment

Graphic: Ruby-Gay Martin

6

August2024: R32,955

202120222023 20202024

Graphic: Ruby-Gay Martin

August2024: R31,653

20202024

(cents) Shoprite

August2024: R31,266

202120222023 20202024 September 2019: R10,000 investment

Graphic: Ruby-Gay Martin

By KHULEKANI MAGUBANE

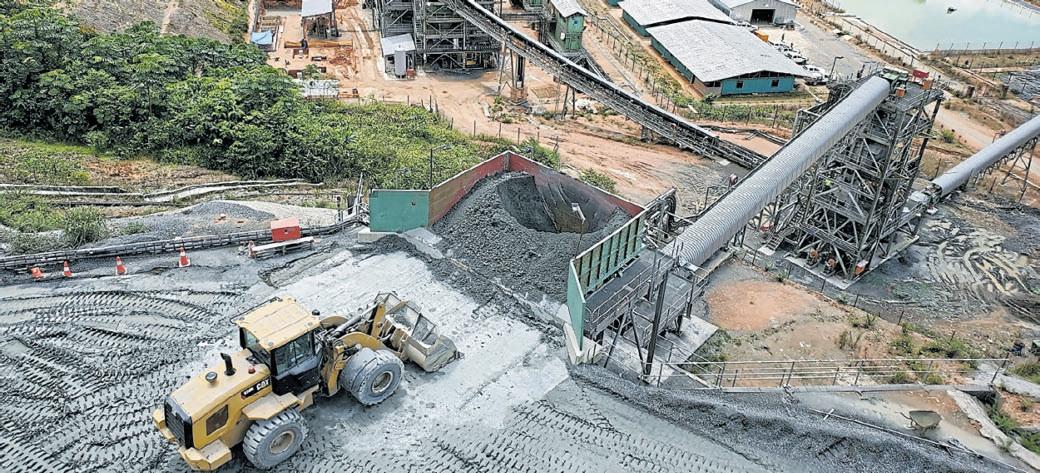

Low-cost tin concentrate producer Alphamin Resources had a blockbuster year in the South African market and on the bourse in 2024. The little-known Alphamin, which has had a secondary listing on the JSE’s Alternative Exchange since 2017, also takes the number one position in this year ’s Sunday Times Top 100 Companies Index. It achieved a trading volume of R209.7m, a compound annual growth rate of 39.6%and a total return of 430.8%.

While it lists its main operations as the high-grade, deposit-rich Mpama North and Mpama South mines in the Democratic Republic of Congo (DRC), the company is headquartered in Mauritius. By last year, Alphamin was having tremendous success, and its Bisie mine in the DRC was already producing 4% of the world ’s tin.

In its 2023 full-year financial results, it reported tin production of 12,568 tonnes, up 1% from the prior year. Ebitda was down 39% to $136m (R2.3bn), negatively affected by a temporary delay in tin sales volumes in the fourth quarter of 2023.

Its latest quarterly performance released in early November shows a record quarterly tin production of 4,917 tonnes for the three months to September, up 22% from the previous quarter.

It also announced third-quarter earnings of $91.6m, up 69% on the prior quarter. Alphamin’s all-in sustaining costs per tonne of tin sold were at $15,728, in line with the previous quarter.

Its share price has risen 34% since the beginning of the year and is now trading at about R15.63, and the company has a market capitalisation of R19bn. Over the past five years, its stock has surged 359%.

In October, upon declaring an interim dividend for the 2024 financial year and an operational update for the quarter ended September 2024, the company said its tin production expansion came against the

By MICHELLE GUMEDE

Displaying nimbleness and agility in adapting to market conditions and clinching important new deals, Grindrod has benefited from sustained strong demand for integrated logistics solutions through its cargo terminal infrastructure footprint and complementary logistics service offerings.

Ranked in the top 10 of the Sunday Times Top 100 Companies Index for 2024, Grindrod facilitates trade in the Southern African region, with its ports and terminals business operating in Durban and Richards Bay, as

South expansion contributing for a full quarter, compared with half of the prior quarter. Ore processed increased by 37% to 229,107 tonnes and the tin grade of the feed ore reduced to 2.9%.” This is in line with expectations as the company targets annual processing volumes of 900,000 tonnes of ore at a tin grade of ~3%.

backdrop of weak global tin supply and producing regions experiencing production challenges.

“Demand for tin in solar installations remains robust, and semiconductor sales, a proxy for tin’s application in electronics, are reportedly improving. Demand in other applications is expected to recover as many large economies enter a lower interest rate cycle and the recently introduced economic stimulus in China takes effect, ” Alphamin said. These dynamics augured well for the tin price while exchange-traded tin stocks were in decline. Contained tin production of 4,917 tonnes for the quarter ended September 2024 was 22% above the prior period.

“This increase is a result of the Mpama

The company also said it was intentional about sustainable tin production. It said the Walikale territory had a difficult history of conflict over minerals.

“This illicit production, which at one point represented about 4% of global tin supply, helped finance conflict in the region and created profound hardship for the miners themselveswho were forced to work in appalling conditions. ”

In its actions to catalyse economic activity around its DRC operations, Alphamin said the Mpama North mine had brought cellular phone connectivity to the mine and its surrounding community.

The company is also a supporter of the Lowa Alliance, a not-for-profit company through which it contributes to community social development. It aims to have a positive impact on the 15,000 households.

The Sunday Times reached out to Alphamin for comment, but the company did not respond.

Alphamin is led by CEO Maritz Smith, who has more than 20 years’ experience in African mining and corporate finance.

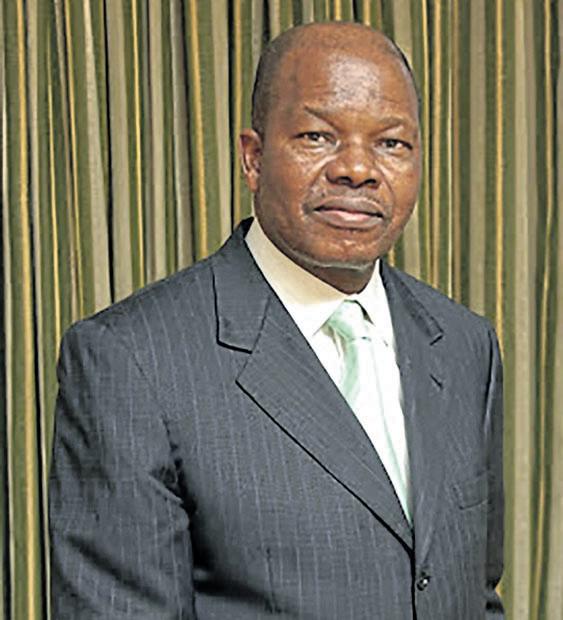

Grindrod CEO Xolani

well as in Namibia and Mozambique, where it holds a 24.7% stake in the Maputo Port Development Company.

Given South African ports’ inefficiencies,

the Maputo port is a convenient entry point to global export markets asits terminal infrastructure accommodates a range of bulk and break-bulk goods, cars and multimodal container packing facilities.

With more than 110 years of experience, Grindrod logistics in its joint venture with Maersk provides reliable end-to-end custom logistics solutionsincluding road and rail transport, that connect major ports with

To Page 7 ➛

➛ From Page 6

inland terminals, warehouses and distribution centres.

Grindrod completed the structural reorganisation of its rail business early this year and has since returned 13 locomotives from Sierra Leone to South Africa as it looks to position itself for Sadc and East African rail opportunities and enable integrated pitto-port solutions.

“We are thrilled to be recognised among the top companies in South Africa, and I extend my heartfelt congratulations to all the other remarkable contenders,” CEO Xolani Mbambo said.

“This achievement reflects the unwavering support of our people, customers and stakeholders, who have worked tirelessly and collaboratively to respond to dynamic conditions that have characterised our operating environment.”

In the half-year to June 2024, strong demand for chrome helped the port of Maputo increase its own handled volumes by 18% to 6.9-million tonnes. About 8.4-million tonnes were handled at all of Grindrod’s drybulk facilities up 3% from the prior period, while volumes from Richards Bay increased 20% over the previous period to 1.6-million tonnes.

During the six months, Grindrod, which is valued at roughly R9.2bn on the JSE, was able to maintain its profitability with core headline earnings of R562m despite difficult market conditions marked by declining commodity prices. Prolonged geopolitical tensions, high interest rates, falling shipping costs, logistical difficulties, supply chain interruptions and overall tepid growth in the local economy exacerbated the operating environment.

“That’s the benefit of running a portfolio of [diverse] assets,” said Mbambo.

“When one asset doesn’t perform, one hopes the other one does, so your performance overall improvesor you are able to sustain it.”

The group’s port volumes have recorded a 22% compound annual growth rate for the first half between 2021 and 2024, while terminal volumes increased 12%. The share price has responded accordingly, rising more than 170% in the period.

The CEO said by executing priorities and growth plans, Grindrod was set to continue to deliver enduring value for all stakeholders.

“Our purpose-driven approach, focusing on making a positive difference in Africa ’s trade with the world and touching the lives of the communities in which we operate, is embedded in Grindrod’s ethos,” said Mbambo.

“It underpins the company ’s strategy and will guide us to a prosperous future.”

By DINEO FAKU

Mid-tier Africa-focused gold producer Pan African Resources is on a winning streak, from being ranked No 9 in the Sunday Times Top 100 Companies a year ago to clinching a spot in the top 3 in 2024.

JSE- and AIM-listed Pan African Resources has evolved from being a single-asset company holding the Barberton Mines underground operations in the early 2010s into a high-margin operator with multiple assets, underscoring its resilience over the past decade.

The group is the best performing gold stock on the JSE in 2024.

CEO Cobus Loots said the combination of a strong gold price and operational improvements had contributed to a strong performance in the year ended June 2024.

“Our performance was certainly assisted by the gold price, both in dollar an ounce and rand per kilogram, while cost management and increased gold production through operational improvements have reduced unit costs, leading to improved profit margins,” said Loots.

Pan African Resources. Picture: Supplied

Pan African’s annual group production well north of 250,000 ounces a year.

At Barberton Mines, Pan African recently announced the increased life-of-mine at the Barberton tailings retreatment plant through constantly improving efficiencies, Loots said. He said in the longer term, it will also bring attractive bulk ore bodies such as Royal Sheba and Western Cross to account.

“The operations have the potential to sustain production of more than 250,000 ounces a year for the group for the foreseeable future.”

The group’s net debt increased to $106.4m in the 2024 financial year from $22m due to capital expenditure for the Mogale Tailings Retreatment (MTR) project and Evander Mines expansionary projects.

Annual group gold production increased by more than 6% to just more than 186,000 ounces in the financial year ended June 2024.

Pan African’s revenue increased by 16.8% to $373.8m for the year ended June 2024, and profit for the year increased by 30.2% to $78.8m up from a restated $60.5m.

It proposed a sector-leading final dividend of R489m in the 2024 financial year, maintaining its track record of sector-leading returns and dividends to shareholders.

Pan African in November announced its expansion into Australia through the $54.2m acquisition of the Tennant Consolidated Mining Group, underscoring its push to acquire low-cost and low-risk assets to complement its portfolio.

Loots said the acquisition will add nearterm, low-cost production of about 50,000 ounces a year within the next seven months in a tier 1 operating jurisdiction, and increase

Loots said MTR adds low-cost, high-margin and long-life production for the group. The $135.1m project was delivered under budget and ahead of schedule.

At Evander, the group invested in developing 24 and 25 levels, which adds 10 years or more to the life of the operation.

To cushion the impact of rising power costs, Pan African commissioned a 10MW solar renewable PV plant at Evander and has recently commissioned its second solar plant at Barberton.

“We also prioritised additional renewable energy projects that will further reduce production costs in the medium and longer term, ensuring Pan African remains internationally competitive. Pan African also has water recycling plants that reduce our municipal water requirements, adding to cost savings as well as overall sustainability of our operations,” he said.

Loots said Pan African invests heavily in its social licence to operate.

“Our operations have a meaningful positive impact in their areas of operation, creating employment and economic opportunity. We work with law enforcement to combat illegal mining and related criminality, and in the case of an operation like Mogale, we rehabilitate the environment and free up land for productive purposes. ”

By THABISO MOCHIKO

Altron has set a target of R1.15bn in operating profit in two years as its businesses record huge financial improvement, with the group planning to pursue international expansion. In the 2024 financial year, its operating profit was R739m. Founded in 1965 by Bill Venter, Altron has gone through a number of changes over the yearsincluding the unbundling of subsidiary Bytes into a separate listed entity and the sale of a few businesses, most recently the ATM unit. The group has also restructured its IT services segment, including merging three businesses, and “we are seeing good leading indicators from that segment which is encouraging for the future” , said CEO Werner Kapp, who has been with the company for over two years.

Altron operates car tracking business Netstar, financial technology unit Altron FinTech, and systems and platforms businesses. It provides a range of software servicesincluding cloud, cybersecurity, systems integration and digital services, and distributes electronic components.

Kapp said that in 2023, “we defined our strategy to become the leading platform and IT services business in our chosen markets. We invested in our core capabilities and made key leadership appointments. After reviewing all our operations we implemented profit improvement strategies and target operating models.”

Altron management also invested in a brand refresh that included a new purpose and corporate narrative to improve the brand. “Our aim was to help our customers and people connect with the brand and better understand what we do. In March 2024we launched our

To Page 9 ➛

By DINEO FAKU

Harmony Gold Mining Company, boasting a portfolio of highquality gold and copper assets in South Africa, Papua New Guinea and Australia, has again ranked in the top 10 of the Sunday Times Top 100 Companies this year.

Despite inflationary pressures, Harmony pulled all the stops to reduce costs with the group’s all-in sustaining cost (AISC) increasing only 1% to R901,550/ kg ($1,500/oz) from R889,766/kg ($1,558/oz) well below inflation and its own guidance of R920,000/kg in 2024.

CEO Peter Steenkamp said Harmony has “drastically” improved the quality of its portfolio over the past few years and this has improved Harmony’s position on the global cost curve and its profitability.

“As a result, we are generating exceptional free cash flows and have a robust and flexible balance sheet which is wellpositioned to take our projects up the value curve. We have an excellent understanding of our ore bodies and continue investing in projects that extend life-of-mine and deliver meaningful returns on capital,” he said.

Total production for 2024 increased by 6% to 1.56Moz mainly due to the robust performance at Mponeng, Hidden Valley and Mine Waste Solutions operations.

Harmony’s cash flow doubled to R12.7bn

in 2024 from a year earlier, marking a record operating free cash flow for the group.

Harmony raised its capital expenditure (capex) by 10% to R8.3bn in the 2024 financial year.

Capex was invested towards the life expansion of Kareerand, helping to further take advantage of the gold price and bringing economic benefit to not only the group but also its surrounding communities. The Kareerand expansion was delivered on time and within budget

The group also made significant

purpose — ‘We use technology to transform today into a simpler, safer and smarter tomorrow’— to the market,” said Kapp.

“Through disciplined execution of this strategy, we’ve transformed Altron into a purpose-driven, customer-obsessed and growth-focused organisation. This has delivered strong, high double-digit profit growth, supported by an emphasis on profitable annuity revenue. Our platforms segment in particular had an excellent first half in the current financial year, driving significant growth during the period.”

In its latest half-year financial results to August, total revenue was down 6% to R5.1bn affected by the sale of the ATM business and a decrease in Altron Nexusrevenue. The Nexus unit is being held for sale.

Earnings before interest tax, depreciation and amortisation tripled to R891m, from R268m. Operating profit was R463m from an operating loss of R118m. Headline earnings per share grew 100% to 74c, with interim dividend up 60% to 40c.

The only information and technology company on the Sunday Times Top 100 list, Altron is ranked fourth. The group grew at a compound annual growth rate of 28.9%. The share price surged just over 100% this year, trading at just over R20 with a market capitalisation of R8bn.

Kapp said Altron invested in its platforms segment Netstar, Altron FinTech and Altron HealthTech and put R330m into growth. “Our platforms segment operates on a positive network effect. Every new customer or partner who joins our ecosystem, enriches our data pool, allowing us to build more accurate models and offer better solutions ... ultimately targeting a greater return on investment for our shareholders.”

The group was actively pursuing international expansion opportunities for its Netstar business as “we believe our solutions can benefit a global market”, said Kapp.

It also saw strong potential for growth in Southeast Asia after a decade in the region. “To drive this expansion, we recently appointed a Singapore-based CFO for Netstar, who brings extensive regional

investments in the Moab Khotsong and Mponeng underground operations in South Africa and the Eva Copper operation in Australia.

Steenkamp said the extension of the lifeof-mine at Mponeng near Carletonville in the west Wits region to 20 years underscored the group’s commitment to South Africa.

“This is already the world’s deepest mine with high recovered grades. The Moab Khotsong mine in the Vaal River region has also been extended to 20 years. It is through these projects that we demonstrate our commitment to South Africa and that gold mining will continue to benefit our country, host communities and our many stakeholders for decades to come,” he said.

Harmony employs over 46,078 people in South Africa, Papua New Guinea and

To Page 12 ➛

telematics expertise,” said Kapp.

Altron would continue “executing our strategy to become the leading platform and IT services business in our chosen markets.

We remain highly cash-generative, which continues to support our strong balance sheet. While our focus remains on organic growth through investments into our platforms, we will also consider strategic acquisitions that align with our overall strategy and enhance our market position” .

On the outlook for the 2025 financial year, Kapp said the group was “dedicated to partnering with our customers on their digital transformation journeys, delivering innovative solutions that address their challenges and drive business growth”

A focus on skills, and bringing talent into the business, was also key. “... initiatives like our graduate recruitment programme and our BEE initiative, Ascent. These programmes ensure we have the skilled workforce needed to drive future success. Driven by the hard work and exceptional talent of our people, we remain focused on executing our strategy.”

Artificial Intelligence (AI) has become a top priority in business, largely on the back of the arrival of Generative Artificial Intelligence solutions that leverage natural language processing (NLP) in tools like ChatGPT, which illustrated how transformative and accessible AI could be. It’s the mix of traditional AI, which includes Machine Learning and modern Generative AI, that serves as a catalyst for digital transformation.

Business leaders immediately wondered how these capabilities could be harnessed to improve business, cut costs and boost productivity – effectively delivering more business value.

The answer to these questions is – AI can indeed be deployed to help transform and reinvent business. BUT: AI becomes truly transformative for business only once the organisation has successfully completed a number of stages of the digital transformation journey, as the efficacy of AI is largely dependent on goodquality data and effective integration into existing business systems and processes.

Where AI fits into digital transformation roadmaps

Organisations starting their digital transformation journey – classed as ‘Pre-digital’ – would not benefit from widespread AI deployment. Because AI’s capabilities depend on access to vast volumes of quality digital data and digitalised processes, an organisation still dependent on manual processes, paper documents and siloed processes will have

limited success with AI implementation. In this instance technologies such as intelligent automation and electronic document and content management can help them progress towards a strong foundation for AI adoption.

As organisations become digitally transformed, they move through stages classed as ‘Digitally Reactive’ and ‘Digitally Purposeful’, with increasingly digitised and automated processes.

Here, analytics and AI begin to deliver value as siloes are broken down and better-quality data becomes available for analysis to drive better decision-making. These are the stages where AI experimentation plays a critical role, identifying viable areas of investment to unlock potential business value.

When organisations near the end of their digital transformation journeys and reach the ‘Digitally Strategic’ stage, analytics and AI are embedded throughout processes to deliver consistent business value through supporting operations, enhancing customer experience, informing decision-making, increasing revenue, decreasing cost and mitigating risk.

When organisational systems are digitised and interconnected, AI and Machine Learning can then be deployed to learn and improve processes across the business, spot trends in massive data volumes, flag anomalies and drive opportunities to become more proactive.

For example, AI could be deployed to analyse decades of historical insurance data to find new indicators of risk or potential fraud. It may connect the previously invisible ‘dots’ linking customer behaviour and churn, or it might analyse IoT readings to learn what tiny variations in performance predict mechanical equipment failure, which can be used to perform preventative maintenance. Using AI to predict outcomes and prescribe actions takes organisations from reactive to proactive.

AI takes on the ‘heavy lifting’ of repetitive manual work, which not only improves accuracy and reduces risk, but also frees up human resources to carry out highervalue strategic and creative problem-solving tasks. This enables organisations to become more innovative and competitive, with improved customer experience and, potentially, also improved employee experience.

BCX has the technology solutions and capabilities to guide organisations through every stage of the digital transformation journey to the end goal: becoming Digitally Strategic. Digitally Strategic businesses use advanced AI-driven analytics platforms, predictive modelling, and machine learning solutions and Generative Artificial Intelligence capabilities to continuously generate business value.

BCX offers end-to-end services that span the entire digital value chain, from business and digital consulting to designing, implementing and managing the crucial

connectivity, data centres, cloud environments, cybersecurity and data-governance frameworks that support the digitally transformed organisation. Because there is no one-size-fits-all roadmap for digital transformation, our consultants have deep sector-specific expertise, and work closely with each organisation to ensure their roadmap suits their environment and unique requirements.

BCX has the expertise to get all the necessary foundations in place to enable organisations to optimise analytics and AI. Our comprehensive data protection and cybersecurity portfolio ensures that value can be extracted from data without risk.

Our data consultancy helps ensure that quality data is consolidated, curated, protected and made accessible through various distribution methods, as well as ready for analysis, reporting, data integration and interoperability.

BCX’s advanced AI and Analytics Solutions then come into play, with AI and GenAI. These technologies enable bespoke, customer-focused solutions that solve specific business challenges and unlock opportunities from organisational data that weren’t previously possible. This enables data-driven decision-making, streamlined operations, improved service delivery and the ability to gain deeper insights into data.

Take data-driven decision-making and business value creation to the next level: transform your organisation and reimagine AI and Data Analytics with BCX.

By KHULEKANI MAGUBANE

In a year in which it announced a 10% increase in revenue as well as the highest six-month normalised earnings in the second half of 2024, Aspen Pharmacare’s financial performance and pharmaceutical ventures have shot the lights out.

The global and multinational speciality pharmaceutical company ranks sixth in the Sunday Times Top 100 Companies Index, with a traded volume of R257.6bn, a 229.6% return and compound annual growth of 26.9%.

Group CEO Stephen Saad said Aspen is arguably South Africa’s most global business, supplying medicines to more than 115 countries and maintaining offices in almost 50 of these. “For the past few years, Aspen has remained focused on executing its strategic priorities, both within its commercial pharma and manufacturing segments.

“The global footprint of the commercial pharma operation, with a particular strength in emerging markets, positions Aspen as a partner of choice for global pharma corporations seeking to partner a company with established capabilities across many regions, particularly in the southern hemisphere.”

When Aspen Pharmacare released its financial results in September, Saad said the group delivered its highest ever six-month normalised earnings before interest, taxes, depreciation and amortisation in the second half of the year, growing 17% over the first half and building momentum for sustainable growth. “Manufacturing revenue grew by 25%, led by finished dose form revenue up by 33% with commercial pharmaceuticals growing 4% after absorbing the impact of volume-based procurement in China.

“Regionally concluded acquisitions in China and Latin America contributed to derisking the base commercial pharma-

6Aspen Pharmacare CEO Stephen Saad

Australia who are directly and indirectly involved in mining operations and support functions.

In April, Harmony signed a five-year wage deal with organised labour for the first time in its 74-year history, paving the way for continued certainty of its fixed labour costs. “This is the first time in our history that we managed to get a five-year wage agreement over the line, with all unions having signed on the same day. This demonstrates our commitment towards our people and ensures we can continue giving back to our host communities and our employees and their families for years to come. ”

ceuticals business which is well poised for future growth. Robust cash generation from earnings was underpinned by sustainably lower working capital investment, assisted by the recently announced change in the operating model of our Heparin business, which released R2.9bn in inventory.”

In March, the company announced that revenue had gone up 10% to R21.1bn in the unaudited interim group financial results for the six months ended December 31 2023. At

Steenkamp said what sets Harmony apart from its peers is that it is the partner of choice in the jurisdictions in which it operates. The group has strong relationships with all stakeholders. “As a result of our investment in safety, in our ore bodies and continually improving operating performance we have demonstrated our ability to not only succeed but be the best at what we do. This has resulted in Harmony consistently meeting or exceeding our guidance, creating value for all its stakeholders, demonstrating mining with purpose in action.”

the time, Saad said, “Great progress has been made in delivering on our ambitious strategy to lay the foundation for strong growth. We have successfully completed the necessary steps to reach the commercialisation stage for the manufacture of mRNA platform products which will augment revenue in the second half of 2024.”

He said that after a 10% increase in revenue and a 44% increase in operating cash flow per share, the company is set for the transition to new toll manufacturing agreements for the Heparin business, which is expected to reduce inventory investment by R3bn by the end of the financial year.

Organic growth complemented by acquisitions is set to drive commercial pharmaceuticals’ revenue in the second half of 2024, up about R1bn over the same period in 2023.

Aspen Pharmacare’s revenue increased 10% from R40.7bn in 2023 to R44.7bn in 2024, according to the group’s financial results for the year ended June 30 2024. Saad said the company’s focus on the commercial pharma business has been on building the product portfolio with recent additions in South Africa and other Sub-Saharan African territories, in Latin America and in China.

“In South Africa and Sub-Saharan Africa, the new products acquired will allow Aspen to provide critical access to insulins used in the treatment of diabetes, to launch a global blockbuster drug used in the treatment of both diabetes and obesity, to supply paediatric vaccines and to introduce novel cancer treatments.”

He said Aspen looked to build on its longestablished record of providing medicines to Africa in the continent’s times of need, most notably in the pioneering of access to

To Page 13 ➛

place to ensure we achieve our goal of zero loss of life,” he said.

The group spent R647m to address illegal mining in its South African mines, through investing in mine closures and security. ➛ From Page 9

Steenkamp said safety remains the group’s priority and a number one risk factor. Seven employees died on duty in 2024. “We have a clear safety strategy in

“We have seen a significant reduction in safety incidents over the past 10 years. Safety is an ongoing process and we are working to ensure all workplaces are safe and our employees return home safely every day.”

Steenkamp said Harmony continues to work with the police,defence force and various security companies to eliminate illegal mining. “We are confident our security controls and processes have removed almost all illegal mining in and around our operations. ”

➛ From Page 12

antiretrovirals for the treatment of HIV/Aids, in producing multi-drug resistance tuberculosis medication and in manufacturing Covid-19 vaccines.

“Aspen has invested more than R10bn over the past few years in building its niche sterile production capacity and is now positioned as a global leader in this area. Over half of this investment has been at Aspen’s flagship manufacturing facility in Gqeberha, which provides medicines locally, into Africaand across the world.

”

Aspen’s investment in pharmaceutical manufacturing in South Africa has improved supply security and infectious disease prevention in Africa, thereby assisting with the AU’s overall objective of solving regional health issues through local capabilities.

Saad added that Aspen’s progress in recent years is evident in the opportunities created and translates into exciting growth prospects for Africa’s leading pharmaceutical company as its strategic plan is further implemented.

By DINEO FAKU

Globally diversified Gold Fields, operating mines in South Africa, Australia, Ghana, Peru and Chile, has secured a spot in the top 10 of the Sunday Times Top 100 Companiesafter clinching the overall competition last year. The company recorded a compound annual growth rate of 26.5%.

Gold Fields, a JSE- and New York Stock Exchange-listed company with a market cap of $13.28bn (R240.23bn), benefited from the wave of the record gold price environment.

shareholders. However, the group had a difficult first half of 2024. It reported two fatalities and its operational performance was affected by lower production levels and higher costs. The delay in ramping up the $1.18bn (R19.9bn) Salares Norte project in Chile’s Atacama province affected operational performance.

Over the past two years the gold price has been a tailwind for the group’s financial performance, helping it generate significant free cash flows and strengthening its balance sheet, paving the way for robust dividends for To Page 16 ➛

Gold Fields’ attributable gold production for

For five decades, Raubex has been driven by the dedication and expertise of our people, building resilient infrastructure across South Africa and beyond. Together, we’re shaping progress – from transformative projects in the SADC region to new initiatives in Western Australia. Our commitment to sustainable growth and community impact is powered by a vision that empowers our teams to reach their full potential, creating lasting value for future generations.

By CAIPHUS KGOSANA

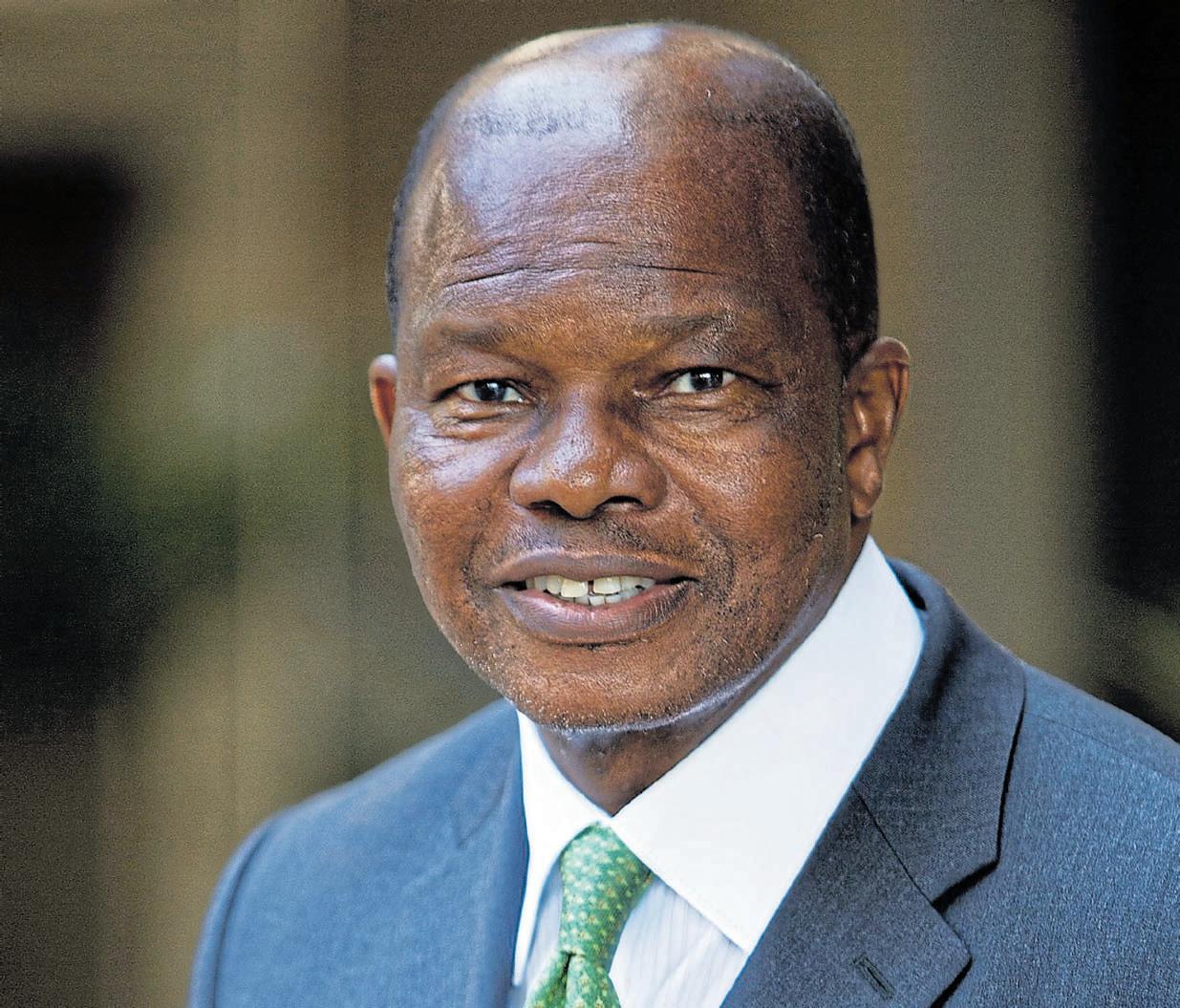

Corporate governance tzar Mervyn King remembers struggling to persuade Reuel Khoza to take over as president of the Institute of Directors of South Africa (IODSA) in 2002 because, eight years into democracy, the institute needed a black person at the helm.

Khoza, then a member of the King committee on corporate governance, was reluctant, arguing he could not be president of IODSA ahead of King himself since it was King who had taught him everything he knew about being a director.

After much persuasion, he assumed the role and the two men worked closely together in crafting guidelines on sustainability reporting which have become integral to corporate governance requirements around the world.

King said Khoza understood right away that as a board director he was the custodian of a company’s assets and business affairs, and that involved accepting greater responsibility for sustainable development. This saw him make a strong contribution towards the crafting of the King 2 report that first proposed making sustainability part of a listed company’s reporting requirements.

“We were the first country in the world to recommend sustainability reporting, which followed the global reporting initiatives guidelines. The JSE adopted that as a listing requirement. They were the first stock exchange to do that, and now next year the whole world will have sustainability reporting as part of the corporate report of companies.”

Still waters run deep

King describes Khoza as a man of integrity who has a deep understanding that business is at the intersection of the three critical dimensions for sustainable development the economy, the environment and society.

He hails the former chair of Nedbank and the Public Investment Corporation as a courageous leader who is not afraid to tackle uncomfortable conversations in the best interests of the country.

“He’s been outspoken over the last few decades over, for example, the incompetence of our government. He’s a man who has got courage, he’s got determination.”

King noted that Khoza has received a number of lifetime achievement awards from organisations and institutions around the world, but this latest one is possibly the most highly deserved.

“What I most admire about him is his consistency. If you are having a meeting about X, he’s done his homework. He’s

If you are having a meeting about X, he’s done his homework, He’s diligent, he ’s informed. When he comes to the boardroom, he actually makes a meaningful and informed contribution

Mervyn King Corporate governance tzar

diligent, he’s informed. When he comes to the boardroom, he actually makes a meaningful and informed contribution to

that meeting.

“That consistency makes him a good director because he’s done his homework.”

Long-time friend Eric Mafuna describes their relationship as a “meeting of the soul” .

“Most people in business circles believe Reuel is my blood brother, but he’s a brother of choice, a brother of necessity,” Mafuna said. “It’s someone who you share things with together; you do things together. We don’t complete one another’s sentences, but we have a competitive and very combative style when it comes to ideas. I love ideas, I’m challenged by ideas. Reuel doesn’t stop at ideas he wants to implement those ideas.”

But while Khoza may be a deeply humble man, he can be assertive when he feels strongly about something or feels undermined by people.

“He’s not timid. He’s like deep, dark waters that are quietly going along. When people stray beyond this façade of humility, he bites, and he bites very big. I heard him the other day lashing out,” Mafuna said.

“Reuel measures people in terms of the depth of their intellectual inquisitiveness. Once he’s made up his mind this person has depth, this is the kind of person he would like to play mental games with.”

Reports by CAIPHUS KGOSANA

Young gifted lawyer makes good

Former CEO Jacko Maree remembers vividly when the Standard Bank Group recruited a 33-year-old lawyer who specialised in structured finance back in 2000, around the time Nedbank had made a hugely publicised bid for Standard Bank. The then finance minister, Trevor Manuel, blocked this move, but the blue bank knew it had to reset to protect itself.

The executive committee and board realised that Africa was where growth was most likely to come, and they moved that young lawyer Sim Tshabalala from his initial post as head of structured finance to take charge of its rest-of-Africa subsidiaries. He grew them from a small unit to a major division contributing 40% of group revenue.

“We quickly put Sim in charge of all our African subsidiaries outside of South Africa. He took over all of them. It was around 15 countries, and he became the CEO of that part of the business. It was a tiny part of our non-South African business. He was instrumental in helping grow [that] part of the business in those very early days,” Maree said.

Some eight years later, at the age of just 43, he was appointed CEO of Standard Bank South Africa.

When Maree retired in 2013, Tshabalala progressed to joint CEO alongside Ben Kruger before assuming leadership of the entire group when the latter also stepped down in 2017.

“He was young when he got given the opportunities and he grabbed them,” Maree remarks.

“For me, he’s living proof that compassionate, approachable, kind and friendly leaders can make it to the top. A lot of people think you need to be tough and nasty to make it through the rat race but he’s proof of the opposite.

“Sim always does the right thing. There’s a lot of pressure when running a bank, from politicians, from difficult clients, et cetera, and Sim would always never get flustered.

“He would always say we are going to stick to the four corners of the law. Then he would respectfully disagree if he thought you were wrong. He wouldn’t be bullied.”

Sim Tshabalala. Picture: Ziphozonke

Lushaba

If you think of Sim’s greatest accomplishments, it would be how he ’s given returns to shareholders

Lincoln Mali

Lesaka Technologies CEO

In awe of how Sim Tshabalala stays calm in the most trying times

Lincoln Mali CEO of Lesaka Technologies has known Sim Tshabalala for 36 years, dating back to their days as law students at Rhodes University.

“We hit it off because we were both student activists. We both loved rugby, and we were both studying law. At the end of that year I became president of the student movement, and he became the general secretary.” Their relationship morphed from best buddies and student leaders to colleagues when Tshabalala recruited Mali to Standard Bank in 2001.

Mali is in awe of how his friend deals with difficult situations by staying calm in even the most trying circumstances.

He was young when he got given the opportunities and he grabbed them

Jacko Maree

Former Standard Bank CEO

Like many who know the Standard Bank Group CEO well and have worked closely with him, Mali takes inspiration from his exceptional leadership and his penchant for continuously acquiring knowledge.

“He’s always learning, he’s always reading. He’s a voracious reader. Sim could be reading the classics, or he could be reading about the future of technology. But he’s able to find a way to linkall these things to what is relevant either to a family environment or to a work environment or to a societal environment. ”

The bank, he says,has transformed into a hugely profitable entity under Tshabalala.

“If you think of Sim’s greatest accomplishments, it would be how he’s given returns to shareholders. The Standard Bank Group has an ROE [return on equity] of 18.5%. The organisation has been performing consistentlyover the10 years he’s been in charge.”

Tshabalala is godfather to Mali’s son, and he is very close to Tshabalala’s family. “So we find time to share our achievements. We find time to share difficulties we’ve gone through.

“I celebrate whenever he’s done well. I admire his achievements. And whenever there’s any difficulty, I’m there as a friend to lend a hand of support. If I look at all my friendships, this has been the deepest, most complex and yet most enduring.”

By MICHELLE GUMEDE

Geographic diversification and forays into new business sectors have sustained the fortunes of Raubex, resulting in double-digit growth and landing it in the eighth spot in the Sunday Times Top 100 Companies Index. With new, lucrative contracts under its belt, its growth momentum is expected to continue.

Supported by its diversified business model, strong leadership and sound balance sheet, the 50-year-old infrastructure development and construction materials supply company’s growth strategy has allowed Raubex to expand through acquisitions and new markets, such as Australia, over the past few years.

JSE-listed Raubex has delivered an impressive three-year compound annual growth rate of 79.8% on headline earnings per share, with its share price climbing more than 32% in the period.

CEO Felicia Msiza said the key to Raubex’s longevity has been its capacity to assess the strategy’s applicability as times change and its in-depth knowledge of the macroeconomics of the markets in which it operates.

This resulted in the deliberate choice to diversify operations into other regions and other activities, which have guaranteed its continued success and reduced significant risks.

“Over the years, we’ve successfully expanded our footprint beyond our borders and the Sadc region, with operations thriving in Western Australia,” said Msiza.

“Looking ahead, we’re excited to take on bigger, more challenging projects while also investing back into our industry to drive sustainable progress.”

Founded in 1974, Raubex has increased its profits over most of the past decade.

“Reaching the top 10 in the Sunday Times Top 100 Companies 2024 is a proud moment for all of us at Raubex, specially as we

in the first half of 2024 was 20% lower year on year due to weather-related events and operational challenges at some operations.

Group CEO Mike Fraser said the group’s operating performance turned around significantly during the third quarter.

“We have made significant improvements in most of our key priority areas during Q3 2024. Most pleasingly, we recorded no fatal or serious injuries during the quarter. Our assets have also reported a material improvement in operating performance during Q3, with production up more than 10% and a decline in costs across the portfolio,” said Fraser.

He expects costs to further improve in the fourth quarter of 2024 with the delivery of higher gold production volumes.

Gold mining costs have been climbing. Fraser said at group level, Gold Fields recorded effective mining inflation of about 5% year to date, with all countries

experiencing continued cost pressures, though there was some easing of input costs, such as oil, compared with 2023. “Australia was again, hit particularly hard as the tight labour market underpinned cost inflation.”

He said longer-term cost management will rely on running the group and mines more efficiently and its asset optimisation programme is one of the key initiatives to achieve this.

The group is aiming to ensure that renewables account for about 70% of its electricity mix by 2030 and 100% by 2050.

Fraser said Gold Fields was striving towards reducing its Scope 1 and 2 emissions by 30% by 2030 and had also added a 10% reduction target in Scope 3 emissions (the emissions created by its suppliers) by 2030. “During 2025 we will assess our performance against these targets with a view of extending them to 2035.”

Gold Fields completed the $1.39bn (R25.15bn) acquisition of Canada’s Osisko Mining in October, giving it 100% ownership

fiscal year 2025. Picture: Supplied

celebrate our 50th anniversary,” Msiza said.

“We’ve always taken pride in the quality and impact of our work, and it’s a privilege to be recognised among the very best companies in the country. This recognition reaffirms the strength of our diversification strategy and the dedication of our incredible team.”

The Centurion-based group managed to deliver a formidable set of results for the 2024 financial year.

It subsequently reported double-digit growth in earnings, operating profits and revenue for the six months to August 2024.

Cash generated by operations was exceptionally strong, up more than 110% compared to the prior period.

Good execution of a strong order book after the award of contracts at the end of the 2024 financial year bolstered the construction materials business and the roads and earthworks division.

Msiza was optimistic about the roads and earthworks division’s outlook for the fiscal

of the Windfall project and its surrounding exploration projects. To expand its portfolio, the group will explore further opportunities in Quebec and other parts of Canada.

Fraser said the group would apply learnings from the Salares Norte project at Osisko. “The key lesson we learnt and one we will apply at Windfall is not to try to start up a processing plant in the middle of winter. The conditions at Salares during the past winter were difficult, with temperatures at record low levels as Chile experienced its worst winter in 70 years.”

He said the delay in bringing Salares Norte into production earlier had been “disappointing” .

“There is no doubting the potential of the project, which once it comes on stream, will markedly improve the production and cost quality of our portfolio.”

Salares Norte’s ramp-up is expected to proceed into the first half of 2025, with commercial levels of production set to be achieved in the second quarter of 2025.

From Page 16

year 2025.

Toll concessionaires, provincial governments, particularly in the Western Cape, and private sector businesses including mines, would be the division’s primary target market in future, said Msiza.

The infrastructure segment’s operating profit climbed 15.9% while its revenue climbed 26.9% to R3.36bn, thanks to new contracts won in South Africa and a strong set of outcomes produced by Western Australia.

Citing a robust balance sheet and high operating cash flow, Msiza said the group was confident it could obtain significant tenders in the future.

Testament to its diversified and robust strategy, Raubex’s order book clocked just over R24bn at the halfway mark, well on its way to match or supersede its recorded R25.55bn at year-end.

Raubex intends to replicate its successful South African integrated strategy by diversifying into surface dressing in Western Australia to take advantage of the infrastructure sector there.

“We are also exploring other opportunities in the mining space, specifically pit dewatering,” said Msiza.

By THABISO MOCHIKO

Over the past five years, ADvTech has recorded an increase in new enrolments at its primary and high schools, amplifying the critical demand for private education by parents for their children.

An increase in enrolments is the fundamental driver of ADvTech’s performance and, in the past five years, the group’s revenue has been growing at a compound annual rate of 12%.

ADvTech operates school, tertiary and resourcing divisions in South Africa and in parts of the rest of the continent. Its private schools which includes brands such as Crawford International, Pinnacle Colleges and Trinityhouse has 32,786 pupils in South Africa, up 5%, while in Botswana and Kenya it has 8,224. In total ADvTech has 113 schools.

ADvTech’stertiary institutions, with 52,718 students, had an increase of 7%. It has a portfolio of eight tertiary brands across 33 campuses including Rosebank College, Varsity College, Vega and Capsicum.

“Our achievements are rooted in the hard work, skills and experience of our people, aligned behind a clear strategy,” said CEO Geoff Whyte. “Through significant investments in our facilities, systems and organisation, we’ve ensured that our well-

To Page 18 ➛

We pride ourselves on being fully invested in our client's corporate journey with forward thinking solution driven advice.

Given our collaboration agreement with Andersen Global, Valeo Capital provides best-in-class local expertise with a global reach.

By THABISO MOCHIKO

Shoprite investors have been smiling all the way to the bank as the retailer maintains a five-year growth streak, outpacing its competitors.

Shoprite has entrenched itself as the leading grocery retailer in South Africa. It is growing at twice the pace of the market, while its Checkers brand, which competes with Woolworths, remains the fastestgrowing grocer in the premium segment.

Mohamed Mitha, investment analyst for Camissa Asset Management, said that in grocery retail, success often leads to further success, and “we see no reason for Shoprite’s immense growth momentum to cease over the short to medium term”

In the 2024 financial year, which ended in September, Shoprite gained market share for the fifth consecutive year, achieving sales and revenue growth at twice the pace of the rest of the market. It maintained a trading margin of 5.6% and consolidated its position as the largest food retailer in Africa.

Group sales increased 12% to R240.7bn, a remarkable annual increase of R25.8bn in sales from an already high base and in a very low-growth economy, “confirming that our customers value what we offer them”, said CEO Pieter Engelbrecht.

This year, the group’s core business, Supermarkets RSA which houses Shoprite, Usave, Checkers, Checkers Hyper and LiquorShop achieved sales growth of 12.3%, contributing 81% to group sales off the back of a 4.5% annual increase in customer visits. “We saw impressive growth at both ends of our targeted market segments,” said Engelbrecht. In the upper-income segment, Checkers remained the fastest-growing premium grocer for a third consecutive year, with sales growth this year of 12.3%.

Key to Shoprite’s strategy was its vast

established portfolio of brands provides ever better quality and value across all the markets we operate in. Our decision to diversify into carefully selected markets on the African continent has also been successful, with our international division now making a meaningful contribution to group earnings.”

ADvTECH ranked 9th in the Sunday Times Top 100 Companies Index continues to expand its schools and colleges. A recent acquisition was the Sandown Conference and Learning Centre.

ADvTECH is preparing its tertiary institutions to gain university status as per the criteria outlined by the department of higher education & training.

footprint, cheaper pricing and stock availability which is an industry-wide challenge for competitors such as Pick n Pay that have suffered the consequences of not having a variety of stock in stores and not being able to replenish on time. Checkers has invested heavily in supply chain across the country, and in technology, which has helped it to respond faster to customer demands and to plan ahead for busy periods.

“Our strategy, at its core, is purposefully customer-centric and as a result it gives our customers what they need (lowest prices, range, availability)while raising the bar in making grocery retail more affordable and more accessible,” said Engelbrecht.

Nandi Qubeka, head of research and fund management at Nedbank Private Wealth, said Shoprite had become a stronger

“Recognition as a university will ultimately benefit our students, who will then rightfully be afforded the same status as their public university peers. We continue to engage with the department to move forward on this issue,” Whyte said.

ADvTECH’s half-year revenue rose 9% to R4.2bn. Its local schools were up 11% to R1.6bn. The rest of Africa also grew 11%, to R214m. The tertiary business recorded 13% growth in revenue to R1.69bn, while the resourcing division which focuses on placement of job candidates reported a 3% decline in revenue to R810m. Total operating profit was up 15% to R865m. The share price has grown 28% this year and is trading at R31. The company has a market capitalisation of R17bn.

On the future, Whyte said the group’s

business due mostly to its “flawless execution, but it has also capitalised on the challenges faced by its peers”

Shoprite is taking over space occupied by some of Pick n Pay’s stores that were closed due to underperformance. Casparus Treurnicht, portfolio manager and research analyst at Gryphon Asset Management, said: “I’m almost inclined to say that Shoprite will make a success out of them.”

Online sales from on-demand delivery platform Checkers Sixty60 surged 58.1%. Shoprite has also expanded into new areas or non-grocery segmentsin a bid to increase total share-of-wallet. It sells its own branded SIM card and its own data and voice packages.

It recently sold its furniture business House & Home to Pepkor.

Shoprite’s share price has recorded some strong gains in the past five years, growing 127% and is trading at about R313, with a market capitalisation of R185bn.

Given its compound growth rate of 25.6% over the years, the general sense is that Shoprite is far ahead and shows no signs of slowing down.

“sound balance sheet, strong cash generation, growing scale and expertise in Africa, and unrelenting focus on extending competitive advantage in both the schools and tertiary divisions, places us in a good position to maintain our growth trajectory and invest with confidence in areas of opportunity”. He said strong demand for quality education persists.

On being in the top 10, Whyte said: “ADvTECH is fortunate to operate in the worlds of education and resourcing where, across our passionate organisation, we are able to make a difference to people’s lives and futures. The whole ADvTECH team feel honoured to be recognised for our work by the Sunday Times and look forward to taking the business to even greater heights over the next few years.”

At Pan African Resources, our success isn’t only measured in ounces of gold; it’s measured by the dedication, innovation, and resilience of our people.

Rated among the Top 3 companies in the Sunday Times Top 100 Awards, we are proof that mining for a future takes more than minerals—it takes exceptional talent, bold ideas, and a shared vision of excellence.

From our Mogale Tailings Retreatment Project, recently commissioned ahead of schedule and under budget, to our commitment to renewable energy and sustainable growth, we know it’s our people who turn these ambitions into reality.

Together, we’re not only creating value but building a sustainable culture of resilience, innovation, and care.