n this inaugural issue of Stokvels, we explore the transformative impact of stokvels, those remarkable community-driven savings groups reshaping nancial landscapes. As economic challenges persist, stokvels emerge as vital tools for combatting in ation and fostering nancial resilience. We delve into how these groups have evolved from simple support networks to sophisticated investment vehicles, offering a lifeline to many.

Discover how communities leverage collective buying power to tackle rising costs and gain insights into effective money management strategies within stokvels that pave the way for nancial success. Entrepreneurs will nd inspiration in innovative approaches to harnessing communal resources for business growth, tapping into the collective strength of these groups.

We also celebrate the cultural signi cance of stokvels, honouring their role in upholding community spirit through traditional practices such as burial societies. These groups preserve cultural heritage and provide essential support in times of need.

Empowerment is a key theme, particularly in how stokvels open doors for women, fostering leadership and economic independence. We also highlight the role of technology in modernising stokvels with insights from an industry leader, Tshepo Moloi, CEO of StokFella, on how digital advancements are making these groups more accessible and ef cient.

Join us as we journey through the dynamic world of stokvels, where community spirit meets nancial innovation, and discover how these collective efforts drive change and empowerment across diverse communities.

Busani Moyo, Editor

Picasso Headline,

A proud division of Arena Holdings (Pty) Ltd, Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

EDITORIAL

Editor: Busani Moyo

Content Manager: Raina Julies rainaj@picasso.co.za

Contributors: Marchelle Abrahams, Tshepo Moloi, Itumeleng Mogaki, Thando Pato, Lisa Witepski

Copy Editor: Brenda Bryden

Content Co-ordinator: Natasha Maneveldt

Online Editor: Stacey Visser vissers@businessmediamags.co.za

DESIGN

Head of Design: Jayne Macé-Ferguson

Senior Designer: Mfundo Archie Ndzo

Cover Image: @roc_pixel, http://rocpixel.carrd.co

Project Manager: Merryl Klein merrylk@picasso.co.za | +27 21 469 2446

PRODUCTION

Production Editor: Shamiela Brenner

Advertising Co-ordinator: Johan Labuschagne

Subscriptions and Distribution: Fatima Dramat fatimad@picasso.co.za

Printer: CTP Printers, Cape Town

MANAGEMENT

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt General Manager, Magazines: Jocelyne Bayer

In South Africa, where potential and challenge stand in delicate balance, a profound shift is emerging from the social landscape. The NATIONAL STOKVEL ASSOCIATION OF SOUTH AFRICA has embarked on a journey that transcends conventional employment initiatives, creating a generative space where collective intelligence meets purposeful action

The National Stokvel Association of South Africa (NASASA) Youth Employment Programme (NYEP), born from collaboration with the Presidential Youth Employment Intervention through the Industrial Development Corporation (IDC) and strengthened by Old Mutual’s matched funding, has set its sights on empowering 1 000 young South Africans with meaningful employment and skills development, with plans to expand to 5 000 by 2030. This initiative represents more than statistical improvement – it embodies the essence of collective possibility, creating

a container where the future can emerge through the talents and energies of those previously marginalised.

“The NASASA Youth Employment Programme is more than a jobs initiative. It’s a strategic investment in South Africa’s future. By embedding young people within stokvel communities as nancial service agents, we are not only creating sustainable careers, but also reshaping how nancial services reach and serve township and rural economies. It’s about unlocking local talent

“BY EMBEDDING YOUNG PEOPLE WITHIN STOKVEL COMMUNITIES AS FINANCIAL SERVICE AGENTS, WE ARE NOT ONLY CREATING SUSTAINABLE CAREERS, BUT ALSO RESHAPING HOW FINANCIAL SERVICES REACH AND SERVE TOWNSHIP AND RURAL ECONOMIES.” – NSIKA MASONDO

to drive national transformation,” explains Nsika Masondo, chief nancial of cer of NASASA Financial Co-Operative.

The wisdom of stokvels – traditional community savings groups that have sustained South African communities for generations – nds new expression through NASASA’s leadership. As the sole self-regulatory authority of stokvels under the Banks Act, a registered deposit-taking institution under the Co-operative Banks Act, and a licensed nancial services provider, NASASA brings legitimacy and structure to community-based nancial practices. The stokvels themselves represent a profound form of collective intelligence – nancial systems born from necessity and sustained through trust. NASASA elevates this indigenous wisdom, transforming informal

practices into formalised services that reach those most excluded from conventional nancial structures. Through this work, NASASA demonstrates the art of leading from the emerging future, recognising the potential existing at the edges of current systems.

The architecture of change rarely stands on a single pillar. Here, we witness a remarkable con uence of institutional forces, each contributing essential elements to the emerging whole. The presidency provides visionary direction through its Youth Employment Intervention, the IDC ensures resources ow with accountability and purpose, and Old Mutual brings nancial sustainability through matched funding, enabling NASASA to implement its programme. This collaborative structure re ects a microcosm of the system with

“THESE YOUNG PEOPLE AREN’T JUST FINDING JOBS; THEY’RE BECOMING THE VITAL CONNECTION BETWEEN UNDERSERVED COMMUNITIES AND THE FINANCIAL SYSTEMS THAT CAN TRANSFORM THEIR ECONOMIC REALITY.”

– NOMATSHAKA MASEMOLA

diverse stakeholders coming together to sense and realise what wants to emerge. The contours of this initiative are both ambitious and grounded in practical reality. Train and employ 1 000 young South Africans between 18 and 35 years as eld agents and team leaders who will bring nancial services directly to communities where such resources remain scarce. From among these, 250 individuals will pursue the specialised RE5 quali cation, gaining credentials that open pathways to careers within NASASA, other nancial institutions or entrepreneurial ventures. This approach exempli es thoughtful

“OUR YOUTH EMPLOYMENT INITIATIVE PROVIDES YOUNG PEOPLE WITH VALUABLE EXPOSURE TO STOKVEL CULTURE, HELPING THEM UNDERSTAND

– KENIEWE MOOSO

prototyping – creating living examples of what could be, while remaining open to evolution and expansion.

The project extends an invitation to additional partners who might further amplify this work, increasing opportunities for industry quali cation and expanding employment pathways.

South Africa’s youth confront a landscape marked by signi cant obstacles – a 45.5 per cent unemployment rate for those aged 15–34, according to Statistics South Africa’s Q2 2024 data, alongside a nancial services gap that leaves 45 per cent of adults in rural areas and informal settlements without access to nancial services, as reported by FinScope South Africa 2023. These gures represent not just economic challenges, but also profound social disconnection, and this initiative addresses both needs simultaneously.

“In each young eld agent, we’re witnessing the convergence of two critical solutions: continuing to create meaningful employment while simultaneously building bridges to nancial inclusion,” explains Nomatshaka Masemola, chairperson of NASASA’s Education Committee. “These young people aren’t just nding jobs; they’re becoming the vital connection between underserved communities and the nancial systems that can transform their economic reality, thus rendering them economically viable citizens.”

NASASA’s response emerges from a deep listening to this social reality, creating a direct pathway that transforms these challenges into opportunities. By employing young people as eld agents who deliver nancial literacy and services, the initiative simultaneously addresses unemployment while building bridges across the nancial divide. Each eld agent becomes a scout – an individual who crosses boundaries to connect different parts of the system.

“Our youth employment initiative provides young people with valuable exposure to stokvel culture, helping them understand its economic signi cance, historical roots and future potential within communities,” notes Keniewe Mooso, head of training at NASASA.

In Muldersdrift’s Umnotho community, this vision transforms from concept to lived reality. This community serves as the rst of many where NASASA will cultivate change, a living

laboratory where previously unemployed young people step into roles as eld agents and team leaders. Here, in this speci c context, they develop nancial advisory capabilities, formalise stokvels and create ripples of empowerment throughout their neighbourhoods. The impact manifests in the words of those engaged in this work: Florence Sebeko, administrator at Umnotho community, observes: “The programme creates a considerable amount of job opportunities for young people around Muldersdrift to areas such as Cosmo City.

“The on-the job learning approach gives the youth an opportunity to learn and practise what they are learning almost in real-time. Unemployment is a huge challenge in South Africa, and this programme helps increase opportunities in the community and build con dence as well as future employability.”

The Umnotho community, one among several developing communities af liated with NASASA, serves as a prototype and a living example of what becomes possible when institutional support meets community wisdom. This represents the rst step in a journey that will transform social and economic landscapes across South Africa.

This moment calls for collective action. A recognition that the future emerges not from prediction but from participation. For South Africa’s youth, this initiative offers not just employment, but also an invitation to

shape the economic and social landscape of their communities. Those with a passion for community development and eagerness to learn are invited to join the 1 000-strong cohort by registering at www.nasasa.co.za, whether as eld agents, team leaders or aspiring entrepreneurs.

For private and public sector organisations, this presents an opportunity to align with a presidential initiative that delivers tangible impact. By partnering with NASASA, these institutions can help scale this effort, extend its reach to more communities and empower more young people. Such support ampli es a movement that uplifts townships, rural areas and transforms the social fabric of South Africa.

“This youth employment initiative is vital to NASASA’s core mission. It enables our organisation to develop its operational abilities while introducing and empowering young people from the communities we serve. This initiative provides a platform for collaboration between new and experienced team members, allowing all to apply their skills, re ne their expertise and demonstrate their capabilities through meaningful internal and external engagements,” explains Siphumelele Macozoma, chief operations of cer at NASASA.

As the initial phase of a vision, this movement invites all sectors of society to participate in co-creating a South Africa where potential nds purpose.

Join this journey of transformation at www.nasasa.co.za and become part of the emerging future.

SCAN THIS QR CODE TO GO TO THE NASASA WEBSITE

For more information: 087 470 0884 info@nasasa.co.za www.nasasa.co.za

– FLORENCE SEBEKO

“UNEMPLOYMENT IS A HUGE CHALLENGE IN SOUTH AFRICA, AND THIS PROGRAMME HELPS INCREASE OPPORTUNITIES IN THE COMMUNITY AND BUILD CONFIDENCE AS WELL AS FUTURE

Address: 85 Commissioner Street, Johannesburg

According to Sum1 Investments’ Kurhula Baloyi, in the past six months, Sum1 has invested in various businesses, including:

• Esk Meats: a food processing company based in KwaZulu-Natal.

Once rooted in informal savings and community trust, stokvels are undergoing a powerful transformation. With a growing appetite for wealth creation, financial literacy and group economics, stokvels are becoming sophisticated vehicles of collective prosperity – blending tradition with innovation to reshape the future of community finance, writes ITUMELENG MOGAKI

The stokvel, an informal savings pool or syndicate, has been vital to South African society for decades, particularly within black communities.

These community-driven nancial initiatives have a long history, often rooted in a sense of solidarity and mutual support.

However, as nancial literacy increases and the economic landscape evolves, stokvels are increasingly seen as potential vehicles for investment and wealth creation.

Offering her insights into this transformation, Busi Skenjana, founder of Stokvel Academy and author of The Stokvel Voices: The Truth, Illusions and Opportunities, says when we consider the history of stokvels, it’s essential to look at them not just as modern savings groups, but also as manifestations of a deeper

cultural and social need for communal support. The Stokvels Academy connects the private and government sectors with stokvels.

Skenjana explains that stokvels began as informal community support structures, saying even in rural areas, there was a common need to help one another, whether contributing to funeral expenses or supporting a neighbour in distress.

“Historically, stokvels were less about structured savings and more about assisting one another through communal funds. The concept was simple. If someone in the community faced hardship, others would come together to provide nancial help. This could mean pooling resources for funeral costs, medical expenses or even helping a family in economic need,” says Skenjana.

She adds: “As urbanisation progressed, the model of stokvels began to shift. Stokvels took on new forms and, in some instances, became social gatherings, with neighbours and friends

“THE CONCEPT WAS SIMPLE. IF SOMEONE IN THE COMMUNITY FACED HARDSHIP, OTHERS WOULD COME TOGETHER TO PROVIDE FINANCIAL HELP.” – BUSI SKENJANA

• Mebala: a leather manufacturing and retail company in Gauteng.

• Remlo Cosmetics: a health and beauty company in Gauteng.

• Ukuhamba Prosthetics: a 3D printing prosthetics company in Gauteng.

• Estratweni Mobile Foods: a food catering and restaurant business in the Western Cape.

Michele Jennings, CEO of glu Mutual, says: “Turning stokvels into more formal, structured groups is a natural step forward. By setting clear rules, ensuring good management and working together, members can get better benefits such as higher interest rates, safer contributions and more investment options. This is how they can build wealth for future generations.”

glu Mutual is a financial services provider that offers investment, insurance, and healthcare solutions.

Jennings also says successful groups, whether community-based or professionally organised, thrive on good management, transparency and a long-term view.

“The professionalisation of stokvels is a natural and necessary progression. By formalising structures, ensuring good governance, and leveraging scale, members unlock even greater benefits, better interest rates, protection of contributions, stronger investment opportunities and ultimately a pathway to generational wealth.

Adds Jennings: “As stokvels continue to grow and improve, they have the potential to drive economic change. By working together, keeping strong systems in place and sharing the same vision, they can become powerful tools for building wealth, showing that when we invest together, we grow together.”

“THERE HAS BEEN A GRADUAL SHIFT OVER THE YEARS AS STOKVELS MOVE FROM TRIED AND TESTED MODELS OF SAVINGS TO THE MORE UNCHARTED TERRITORY OF INVESTING.”

– KURHULA BALOYI

contributing funds for shared experiences like going out for lunch or improving their homes.”

Skenjana says today it’s no longer just about saving money for stokvels, but about the growing interest in using stokvel funds for investment opportunities.

However, the transition to becoming an investment vehicle is not without its challenges. “There is still a long way to go,” Skenjana acknowledges. “The shift towards pro table investment practices requires more than just the desire to invest; it requires knowledge, particularly nancial literacy.”

She adds: “Without a clear understanding of investment principles, even the best intentions can result in losses. You need nancial literacy to make informed decisions about investments, whether you’re exploring real estate, stocks, or business ventures.”

Investment professional and founder of Sum1 Investments Kurhula Baloyi, says from a Sum1 perspective, they have seen members gradually dip their feet into the investment pool rather than dive in. Sum1 Investments provides stokvel investments and nancial education.

What does it take for a stokvel to successfully transition into a profitable investment vehicle? Busi Skenjana, founder of Stokvel Academy, identifies several key factors:

1. Alignment of goals: the first step is ensuring all members of the stokvel share a common vision. “If members are not aligned on their goals, particularly when it comes to business ventures, it’s going to be a disaster,” she says. “Some members might not be interested in a particular investment opportunity, which can cause friction and disrupt the group’s success.”

2. Knowledge and research: stokvels must conduct thorough research before diving into any investment. Skenjana advises members to take the time to understand the opportunities before committing any funds. “If the stokvel wants to invest in a business, for example, everyone needs to be well-informed about the market, the risks and the growth potential. Just because something is trending or others are doing it, doesn’t mean it’s the right choice for your group.”

3. Financial resources: stokvels need to ensure they have enough capital to make initial investments and weather any challenges that might arise.

“There has been a gradual shift over the years as stokvels move from tried and tested models of savings to the more uncharted territory of investing.”

She adds: “The shift towards investment has been largely in uenced by the growing access to digital nancial tools. The emergence of digital banking, mobile payments and smartphone adoption has spurred the development of technology-driven Stokvel platforms such as Sum1 Investments’ Stokvel Portal.

However, Baloyi acknowledges that challenges remain, particularly with unbanked or underbanked individuals who do not have

Follow: Busi Skenjana @ www.linkedin.com/in/busi-skenjana-17921424a

Kurhula Baloyi @ www.linkedin.com/in/kurhula-baloyi-8001aa123

Michele Jennings @ www.linkedin.com/in/michele-jennings-0b17132b

“It’s essential that stokvels are realistic about the capital they need to sustain an investment long term,” Skenjana advises. This is particularly important when the stokvel decides to pursue more substantial investments, such as real estate or business ventures, which require continuous funding and effort.

4. Risk management: “Investments, like all business ventures, come with risks. Stokvels need to be prepared for those risks and understand that things may not always go as planned,” says Skenjana. “This includes planning for contingencies, having an exit strategy and ensuring members are prepared for the ups and downs of any investment.”

The evolution of stokvels from simple savings clubs to dynamic investment vehicles reflects the growing financial acumen within South African communities. As these groups embrace new opportunities for wealth creation, it’s clear that education, aligned goals and strategic planning will be crucial for their long-term success.

While challenges remain, particularly in digital inclusion and financial literacy, the potential for stokvels to drive economic growth and empower communities is immense. By working together, stokvel members can continue to build wealth and create a lasting impact for themselves and future generations.

smartphones or consistent access to data.

“From our experience, there is still a long way to go, but Sum1 Investments is working on its next technology to include this segment.”

Baloyi says one of the standout features of Sum1 Investments is its commitment to creating a ripple effect of impact in local communities.

“By providing reproductive assets to one small business, we can help create two to three additional jobs, enabling those newly employed individuals to support their families. That’s a ripple effect of impact,” she concludes.

STOKVEL VOICES: THE TRUTH, THE ILLUSIONS AND THE OPPORTUNITIES

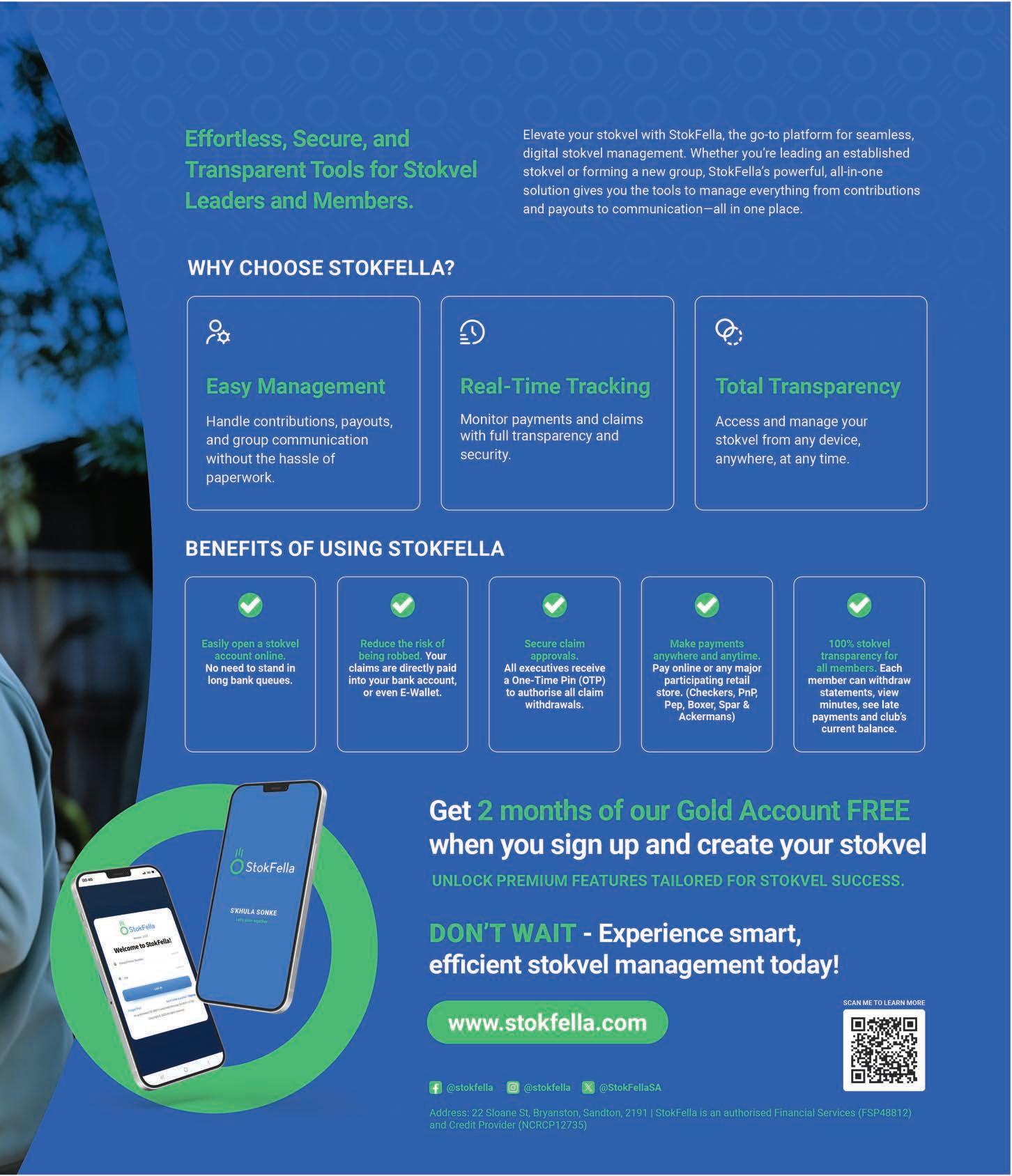

Technology is a key partner in enhancing community trust and financial security while empowering collective growth and inclusion.

By TSHEPO MOLOI, CEO of StokFella

For generations, stokvels have been the cornerstone of communal savings in South Africa, built on trust and community spirit. Traditionally informal, these savings groups have empowered individuals and communities to pool resources, share nancial responsibilities and support one another. Yet, like many sectors, stokvels are now entering the digital age, driven by technological advancements.

At StokFella, we are pioneering this transformation, offering modern tools that allow stokvels to evolve without compromising their core values. Integrating technology into the stokvel system ensures that these communities thrive in a world where ef ciency, transparency and security are paramount.

One of stokvels’ greatest strengths has always been their simplicity: members contribute money into a communal pot and the funds are distributed to members as needed or according to a set schedule. However, as stokvels grow in complexity, traditional methods of tracking contributions and managing funds become increasingly cumbersome. Relying on manual record-keeping and cash management can lead to accuracy, transparency and security challenges.

This is where digital transformation makes a signi cant impact. Platforms such as StokFella offer a secure, user-friendly solution to manage stokvels online. By moving these operations to a digital platform, stokvels can now automate nancial tracking, streamline admin tasks and provide members with real-time updates on their contributions. Importantly, this shift doesn’t remove the community-driven nature of stokvels, but enhances it, making the entire process more ef cient and reliable.

In stokvels, trust is key. Members must believe the person managing their money is doing so accurately and ethically. Unfortunately, relying solely on cash and manual processes opens the door to human error – or worse, mismanagement. With digital stokvel platforms, each transaction is recorded and can be tracked by every member in real-time. This level of transparency builds trust and ensures accountability among members.

Security is another critical advantage of digital stokvels. Handling large sums of cash has always been a risk, both for theft and mismanagement. By digitising stokvel operations, money is kept in secure bank accounts and contributions and withdrawals are tracked electronically. This makes it much safer for stokvel members to manage their funds without the risks associated with physical cash.

Technology streamlines existing processes and opens the door to new opportunities for stokvels. By using digital platforms, stokvels can expand their reach and operate on a much larger scale than ever before. Members who may have struggled with the logistics of cash contributions can now contribute electronically from anywhere, making it easier for stokvels to include members from different regions or countries. Moreover, using ntech tools allows stokvels to grow their collective wealth through strategic investments. Platforms like StokFella offer insights into savings, assets and nancial planning, enabling stokvels to move beyond just saving and into wealth-building. This is a game-changer for communities long underserved by traditional nancial institutions.

stokvels to grow their collective wealth through into

As stokvels embrace digital transformation, they are improving how they function and ensuring their relevance for future generations. Digital platforms enable stokvels to adapt to the fast-paced, technology-driven world while preserving their core values of community, trust and mutual support.

The future of stokvels is one of inclusivity and growth. Digital platforms lower the barriers to entry for people who might have been excluded from traditional stokvels, allowing more individuals to participate in collective saving and investing. In turn, this creates stronger, more resilient communities that are better equipped to tackle the nancial challenges of the future.

At StokFella, we are proud to be part of this transformation, helping stokvels evolve into modern, ef cient and secure nancial communities. The digital age offers stokvels many opportunities and we’re here to ensure they make the most of them.

Stokvels have evolved to the point where entrepreneurs and would-be business owners benefit from their collective power, writes

LISA WITEPSKI

Entrepreneurs who have encountered the common stumbling block of raising capital may nd an attractive alternative to traditional funders in the form of stokvels. Mzingaye Kahla , chief operating of cer of the Riversands I-Hub, a company that provides a physical and virtual ecosystem for small businesses, says stokvels are an ideal option for people who would usually not be considered for mainstream nancial instruments, either because of the informal nature of their businesses or because they are too “early stage”, and do not have a proven track record.

“Stokvels can come to an entrepreneur’s aid by providing affordable loans. This makes them a more viable option than other sources of nance people in the informal sector may typically consider, such as loan sharks, which carry very high interest rates,” Kahla notes. He adds that stokvels can limit risk by initially funding members and individuals within

their ecosystem, which they will have vetted over time.

“Business owners may enjoy other advantages, too. For example, the stokvel’s pooled funds make it possible to buy products in bulk. This reduces input costs, contributing to the pro tability and sustainability of a business. At the same time, stokvels are convenient savings tools. Because they keep entrepreneurs accountable, business owners can use their funds to make the planned capital purchases, which are essential for business growth.” Stokvels are, moreover, an effective investment tool, Kahla says.

“Although this approach is slightly riskier for the stokvel than debt nance, it has a greater upside as the stokvel’s return is tied to the business’s growth over time. Equity nance for entrepreneurs is an ideal instrument as it accelerates that growth through improved cash ows because there are no monthly costs related to debt servicing.”

Motshedisi Mathibe, associate professor/head of business management and entrepreneurship at GIBS, agrees that stokvels offer many bene ts for entrepreneurs. “Members often include people with nancial or business expertise who can provide invaluable networking opportunities or act as mentors, collaborators or even business partners,” she points out.

Follow: Mzingaye Kahla @ www.linkedin.com/in/mzingaye-kahla-755241140

Nonhlanhla Seoe @ www.linkedin.com/in/nonhlanhla-seoe-phd-candidate-a6500598

Professor Motshedisi Mathibe @ www.linkedin.com/in/motshedisi-mathibe-522b1516a

African Response @ www.linkedin.com/company/african-response

On the other hand, there are also potential pitfalls. Because stokvels operate outside formal nancial regulations, members may be exposed to risks such as fraud or mismanagement of funds. Moreover, without proper nancial reporting or auditing, it can be dif cult for members to assess the nancial health and legitimacy of the stokvel. It’s also important to remember that stokvels are not immune to economic uctuations and market risks, which can affect the return on investment.

Due to the potential pitfalls of mismanagement, Nonhlanhla Seoe, deputy director of business tourism for the City of Tshwane and a PhD candidate whose thesis focuses on stokvels, says it is vital for would-be members to conduct thorough research into the stokvel before joining. “Ensure all the correct paperwork is in place because that’s what will protect you in the event of, say, misappropriation of funds.”

Seoe adds that if you want to leverage the stokvel’s collective power to grow your business, it’s a good idea to nd an organisation that focuses on your speci c industry so you can access mentorship and educational platforms – the National Stokvel Association of South Africa is a good example. If no internships are available, consider helping members access nancial education. Mamapudi Nkgadima of market research company African Response says many opportunities fail to come to fruition because members vote against them, due to a lack of understanding. Therefore, all must be aligned and have the same investment goals.

Despite the market for funeral policies, burial societies continue to be popular. THANDO PATO speaks to experts about burial stokvels’ significance

Burial stokvels, also known as burial societies, continue to be popular.

Busi Skenjana, founder of the Stokvel Academy and author of The Stokvel Voices: The Truth, Illusions and Opportunities, says burial societies make up the largest sector of the 11 million stokvel market, ahead of the grocery stokvel.

Skenjana explains: “The rst stokvels were burial stokvels. Community members came together to help each other when a community member or their relative died. It didn’t matter how you knew the person – if they were a family member, a colleague, a neighbour or a friend. People pooled their resources, nancial and otherwise, to help the family bury their loved one. It is referred to as ’masincwabane’, which means ‘let’s bury each other’. The idea behind it is to help the family give their loved one a digni ed funeral.”

The tradition of masincwabane remains at the heart of burial stokvels, which is why many people still opt to join, says Skenjana. “Stokvels are about socialising, community and trust. Stokvel members are friends, family, colleagues or people you know or with whom you are familiar.” She observes that people rarely join a

stokvel of strangers: “You may not know everyone, like two or three people, but the people you know have vouched for them.

“When there is a bereavement, yes, there is the lump sum cash element paid to the person who has been bereaved, but on top of that, stokvel members contribute with ‘izandla’, meaning hands. This involves contributing supplies, groceries or labour – cooking, washing dishes, baking scones, putting up the tent, helping the family with logistics and co-ordination, and so forth.

“Members will also travel long distances to rural areas to attend a funeral so it goes back to community and supporting the family,” she says.

Traditionally, burial societies such as stokvels have members who make regular contributions – usually monthly – on a stipulated date. Upon joining or forming the stokvel, members agree on a lump sum each person will receive in the event of a death.

Skenjana says because of the risk of insolvency associated with this model, group funeral policies, underwritten by a registered nancial services provider, have become a popular alternative option.

“Some burial stokvels have been around for years and have had no problems. However, during COVID-19, many burial stokvels went under because of the volume of deaths and the savings being depleted,” she explains. Follow: AVBOB

STOKVELS

Funeral policies and burial stokvels each have their own structure, benefits and risks. Understanding the differences is key to making an informed decision. Here’s what to know, according to an AVBOB spokesperson.

• A funeral policy is a formal contract between a policyholder (individual or group) and a registered insurance provider.

• The policy is underwritten by a licensed insurer, which assesses the risk and determines premiums based on various factors such as age and the required cover.

• Only an authorised financial services provider (FSP) can sell funeral policies, ensuring legal compliance and consumer protection.

• Insurers must meet strict financial standards, giving policyholders peace of mind that claims will be paid when needed.

• A stokvel is a community-based savings group where members contribute an agreed amount monthly.

• Stokvels don’t operate under a legally recognised regulatory framework and are not underwritten by a formal insurer – unless they opt to take out a group funeral policy with an FSP.

• A traditionally run burial stokvel risks experiencing shortfalls if there are not enough savings.

Stokvels offer thousands of households across South Africa a lifeline to deal with the inflation challenge, writes MARCHELLE ABRAHAMS

In ation rate headlines are commonplace in the current economic landscape. With no reprieve and no relief, consumers are forced to tighten their belts despite low take-home salaries.

The Pietermaritzburg Economic Justice and Dignity Group (PMBEJD) tracks the cost of household food baskets. In its March 2025 Household Affordability Index, the organisation found that Joburg and the greater Gauteng area remain the most expensive places to buy groceries. The average cost of the household food basket is R5 329.36.

Staples, such as maize meal, rice, cake our, white sugar, sugar beans, samp and cooking oil, increased in price in March. “This is problematic as these items take up proportionally the most money in the household purse and are bought rst,” says PMBEJD.

To deal with the in ation challenge, stokvels offer a lifeline for thousands of households across the country.

For journalist and radio commentator Buhle Mbonambi, the communal aspect of his stokvel group makes saving easier. “It’s like being held accountable for your nances in a heartwarming way. Though I have personal savings and investments, I still worry about emergencies. Stokvels bridge that gap,” he says.

Mbonambi has been a member of stokvel groups for ten years and presently belongs to two stokvels: a monthly “lottery-style” savings club where payouts rotate and a year-long savings club where they contribute a set amount.

Working on a traditional savings model, each month they agree on a xed amount to give to one member, who can then use the funds however they choose. “We don’t monitor how the money is spent,” Mbonambi explains. “We only ask that you continue contributing for the next member and stick to the agreed payment dates.”

Like savings groups, grocery stokvels provide nancial relief. Social media manager and mom of two Kim Kay struggled to keep up with all her expenses come December.

“THOUGH I HAVE PERSONAL SAVINGS AND INVESTMENTS, I STILL WORRY ABOUT EMERGENCIES. STOKVELS BRIDGE THAT GAP.”

– BUHLE MBONAMBI

“I wanted to enjoy my holiday season without having to break the bank to make sure there was enough food and drinks,” explains Kay. Joining a grocery stokvel was a no-brainer. “I have been in a luxury hamper group for four years and taking Shoprite stamps for three years.”

Her group operates on the bulk-buy framework. Every month, members contribute their share in cash and decide among themselves which items to purchase in bulk, which are then distributed to group members in December.

When negotiating bulk purchases with stores, Kay says they are not always willing to give discounts, but managers who understand the psychology behind grocery stokvels are more open to bargaining.

Kay’s advice for securing savings is simple: Shop around and don’t settle for the rst store. She adds: “Compare prices, sell-by dates and stock availability. Also, familiarise yourself with the retailer’s return policy on buying in bulk.”

Most importantly, she advises that it is prudent to set a budget. “The rst time we bought in bulk, it was a massive headache. So, avoid overspending. We won’t make that mistake again.”

Follow: Kim Kay @ www.linkedin.com/in/kim-kay-b9916224

Buhle Mbonambi @ www.linkedin.com/in/buhlebonga

THANDO PATO finds out from the experts how and why stokvels have empowered women

Statistics South Africa reports that over 40 per cent of households in South Africa are headed by women, many of whom bear the sole nancial responsibility for their families, sometimes including extended family. The nancial obligations resting on these women’s shoulders include groceries, school fees, childcare, medical costs, clothing, transport, general household expenses, burial costs and housing.

Yet despite this, women face disproportionate exclusion from the nancial sector, particularly those from low-income backgrounds and rural areas.

According to FinScope South Africa’s 2018 survey, 47 per cent of women are nancially excluded from the formal banking and investment sector, compared to 39 per cent of men. This exclusion means that most South African women do not have access to the formal nancial economy – banks, insurance and investments – limiting their prospects of nancial mobility and security.

This crucial factor, mainly due to South Africa’s previous political and economic dispensation, is largely why, for many women, stokvels are a popular savings vehicle.

“For decades, stokvels have provided communities with structured savings vehicles, promoting nancial discipline and inclusion. Stokvels are also popular among women because they offer a reliable and supportive nancial network,” says Babalwa Nonkenge, head of retail investments at Nedbank.

“Besides nancial empowerment, structured savings for speci c goals and access to funds for emergencies or signi cant life events, women who join or start stokvels are often seeking nancial independence, community support and a way to pool resources for mutual bene t. This includes women from diverse backgrounds, particularly those in rural areas with limited access to formal nancial services,” she says.

Busi Skenjana talks about the lack of education around Stokvels.

Busi Skenjana, founder of The Stokvel Academy and author of Stokvel Voices: The Truth, Illusions and Opportunities, says the opportunities stokvels provide women are immeasurable and span generations.

“Stokvels have given women the opportunity to improve their circumstances. Women send children to school and university with their stokvel savings. When we talk about stokvels and women’s empowerment, we also need to include the women whose mothers paid for their education, books or driving lessons with money saved through stokvels. Those women are empowered because of stokvels. Their lives improved because of stokvels.

“Women from all walks of life have bene tted from stokvels. Female hawkers have used their stokvel returns to buy stock so they can increase their volumes and make more money. Stokvels continue to change women’s lives,” she says.

Babalwa Nonkenge

“STOKVELS ARE ALSO POPULAR AMONG WOMEN BECAUSE THEY OFFER A RELIABLE AND SUPPORTIVE FINANCIAL NETWORK.” –BABALWA NONKENGE

For the younger generation of urban women – Gen X, Millennials and Gen Z – who will have experienced greater economic emancipation post-1994 and raised in households where there is a culture of stokvels, stokvels continue to be popular.

The participation of a younger generation in the stokvel market is credited with expanding its sectors. While the traditional and widely prescribed categories of groceries, burials and savings remain popular and account for a large percentage of the estimated 820 000 stokvels in the marketplace, new categories, such as travel, social and investment clubs, are growing in popularity.

“By pooling resources, women can access signi cant capital for investments in education, business ventures or property acquisitions, enhancing their nancial autonomy,” says Tawanda Rumhuma, executive: savings & investments at Absa Everyday Banking, but she cautions that you ensure that you can meet the nancial obligations required.

While Skenjana applauds the new direction stokvels are taking, she cautions women about the skills required for stokvels, which focus on investments and property.

“The nature of stokvels is social and community-based savings. Once you venture into investments and property, the focus shifts to business. I would argue that these stokvels are businesses that require business acumen and skill sets.

“It’s important that stokvels entering this space are clear on their objectives, structures and the investment requirements, and that they are getting the right advice or that within the stokvel they have members with the skill set to navigate this space.

“The stokvel may have the capital for such a venture, but the skills will determine its success. Investments involve risk. What are your appetites for risk? Are they familiar with that terminology? Do they understand there could be losses due to circumstances out of their control? What markets should be considered? What should you stay away from? All these factors need to be considered, and business acumen is required.

“This is a challenge and an opportunity and the reason why I started the Stokvel Academy. Besides the consumer component of stokvels – buying groceries and burial services – there is a business component that involves growing and managing a stokvel. So, what skills are required to take a stokvel to the next level? What skills are needed to start and maintain an investment or property stokvel?

“This is what I address and focus on in my training workshops at the Stokvel Academy. My goal is to train and elevate people’s skills and knowledge base so they can understand or con dently venture into those spaces,” Skenjana explains

Whether you are starting, running or joining a stokvel. Here is what you need to know.

• Define clear objectives: establish your purpose, structure and operations.

• Establish formal agreements: outline membership criteria, contribution amounts, payout schedules and dispute resolution mechanisms.

• Utilise formal banking services: consider a group savings account to reduce risk, increase transparency and enjoy competitive interest rates.

• Research the group’s reputation: investigate history, member experiences and financial practices.

• Understand the rules: acquaint yourself with the constitution, contribution commitments and payout structures.

• Assess financial stability: ensure you can meet the financial obligations required.

Nonkenge says 57 per cent of Nedbank’s stokvel-bank accounts are held by stokvels with a predominantly female membership and leadership base.

At Absa, stokvels with women-only membership make up over 60 per cent of the company’s stokvel account book, says Rumhuma.

With more than 820 000 stokvels estimated to be in operation in South Africa, generating savings of about R50-billion per year, Skenjana estimates 60 per cent of the 12 million people participating in the stokvel economy are women.

Rumhuma says stokvels provide women with nancial security and the opportunity to ex and expand their leadership skills.

“Women often ascend to pivotal roles within stokvels, such as founders, treasurers or decision-makers, gaining invaluable nancial management experience and expanding their professional networks,” he says.

This illustrates why stokvels remain a vital tool for women’s nancial inclusion and empowerment and how they bridge the gap left by traditional nancial institutions. These institutions have realised the power and market share stokvels hold and have started including them in their offerings.

Introducing structure and controls to stokvels that are traditionally characterised by trust and informality may seem overkill, but LISA WITEPSKI writes that they are necessary for success

Over the past 10 years, there has been a move towards greater formalisation among stokvels, driven by the development of new products from banks and nancial institutions. Neo Mohlatlole, founder of Stokvelex, an exhibition targeting stokvels, says new technology apps are further contributing to the change.

This marks an exciting evolution as it sees stokvels move into an era of greater accountability.

One of the rst steps towards optimising the culture of accountability is a discussion around the purpose of the stokvel, its structure, goals and rules, says Tawanda Rumhuma, executive: savings & investments at Absa Everyday Banking and custodian of the annual Absa Stokvel Awards. “It’s vital that members understand their individual responsibilities

and are aware of what their contributions look like, as well as how the withdrawal process works.”

Mohlatlole says this information should be captured in a constitution, adding that a free template is available on the National Stokvel Association of South Africa website. The constitution must be signed by all members and penalties may be imposed for noncompliance.

Rumhuma advises that a trusted leadership team, including a treasurer and a chairperson, be appointed. These roles should be rotated annually to ensure fairness and accountability. It’s equally important to maintain proper nancial records. This is one of the reasons the stokvel should open a bank account in its name, Rumhuma says. It contributes to transparency and ensures funds are less likely to become mixed up with members’ personal funds. A monthly bank statement is a good starting point for keeping track of deposits

Follow: Prudence Mokgotlhao @ www.linkedin.com/in/prudence-mokgotlhoa-27ab4925

Tawanda Rumhuma @ www.linkedin.com/in/tawanda-rumhuma-1028b182

Follow Neo Mohatlole @ www.linkedin.com/in/neo-mohlatlole-327b37a

For a stokvel to establish a bank account, it must adhere to certain rules:

• It must have a constitution.

• There must be at least five members, all of whom have a valid South African identity document.

• Each member must supply proof of residence not older than three months.

• There must be at least three, and at most five, signatories, all of whom must be older than 18.

Source: www.cliffedekkerhofmeyr.com

and withdrawals and is easy to circulate among members so all are informed.

Prudence Mokgotlhoa, Limpopo branch manager at The Financial Specialists (Liberty Life), recommends members meet monthly or, at the very least, every quarter to receive reports and feedback.

Rumhuma agrees and adds that best practices don’t end with strict record-keeping and adherence to good governance. “We encourage stokvel members to implement nancial education so members can increase their nancial literacy. That’s a rst step to driving a savings culture.”

A bank account is the rst and basic vehicle for ensuring stokvels deliver value for members. Rumhuma points out that funds invested in a bank account can earn interest and banks can offer competitive rates.

However, an increasing number of banks are offering products – both savings and investment –specially tailored for small businesses.

Mokgotlhoa says the starting point for any investment is determining its duration. “If you’re looking for long-term growth, we can look at aggressive portfolios. However, portfolio splits are a good idea because a more conservative portfolio will have less equity exposure.”

Rumhuma adds: “There is always a balance between risk and rewards – the higher the risk, the higher the reward. Some stokvels prefer to play it safer with vehicles such as unit trusts while others want to be in the money market space. It’s always a good idea to seek advice from a trusted nancial advisor.”