PUBLISHED BY

Picasso Headline, A proud division of Arena Holdings (Pty) Ltd, Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

EDITORIAL

Editor: Lisa Witepski

Content Manager: Raina Julies rainaj@picasso.co.za

Contributors: Carla Collett, Itumeleng Mogaki, Busani Moyo, Thando Pato, Matt Putman, Bernadette Versfeld, Rodney Weidemann, Catherine Wijnberg

Copy Editor: Brenda Bryden

Content Co-ordinator: Natasha Maneveldt

Digital Editor: Stacey Visser vissers@businessmediamags.co.za

DESIGN

Head of Design: Jayne Macé-Ferguson

Senior Designer: Mfundo Archie Ndzo

Designer: Bulelwa Sotashe

Cover Images:istock.com/undefined undefined, istock.com/PeopleImages, istock.com/JLco - Julia Amaral

SALES

Project Manager: Tarin-Lee Watts wattst@arena.africa | +27 87 379 7119 +27 79 504 7729

PRODUCTION

Production Editor: Shamiela Brenner

Advertising Co-ordinator: Johan Labuschagne

Subscriptions and Distribution: Fatima Dramat fatimad@picasso.co.za

Printer: CTP Printers, Cape Town

MANAGEMENT

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt General Manager, Magazines: Jocelyne Bayer

COPYRIGHT: Picasso Headline. No portion of this magazine may be reproduced in any form without written consent of the publisher. The publisher is not responsible for unsolicited material. SMMES is published by Picasso Headline. The opinions expressed are not necessarily those of Picasso Headline. All advertisements/advertorials have been paid for and therefore do not carry any endorsement by the publisher.

By now, most South Africans are keenly aware of the role small, medium and micro enterprises (SMMEs) play in the economy. We understand that it is these small businesses, not established corporates, that are most likely to provide employment and perhaps even stimulate job creation. We know that SMMEs stand a greater chance of fostering inclusion for marginalised groups and may even plant the seeds for new industries to flourish. And we know, from the number of start-ups providing niche products and services that were previously unheard of, that they have the potential to solve social problems.

Sadly, we also know that a small business owner’s journey is a difficult one. Far from dreams of becoming the next Elon Musk, most of South Africa’s SMME owners have more humble goals: how to get that next round of funding? Are there any alternatives to traditional finance houses? What skills do I need to sharpen if I don’t want to fall behind? How can I find out more about enterprise and supplier development – is it the answer to greater market access?

We’ve tried to provide answers to these and other crucial questions in our inaugural edition of SMMEs: Accelerating Growth. The reality is that while SMMEs are all about big-picture thinking, and there is perhaps no other sector as driven by aspiration and ambition, there is also no other sector where these need to be tempered by pragmatic considerations.

Let’s start here.

Lisa Witepski Editor6

Key trends affecting the health and dynamics of South Africa’s SMME sector during 2024.

10

Accessing funding is one of the most notoriously difficult tasks facing business owners, so it helps to know what funders look for in an investment.

11

Gone are the days when the quest for funding began and ended with a bank. The rise of alternate sources is ensuring funding becomes a less complex issue.

18

Your trademark is a sign of quality, a market differentiator and a safeguard of intellectual property.

19 UPSKILLING FOR ENTREPRENEURS

A constantly evolving business landscape requires constantly evolving skills.

20 TECHNOLOGY: HOW HAS INNOVATION CHANGED THE LANDSCAPE?

From AI to Big Data, SMMEs cannot afford to ignore the technologies currently shaping our business environment.

26 PROFILE: IKHOKHA

Committed to supporting small and medium enterprises, this fintech has disbursed over R2-billion in working capital to the small business sector.

27 WHAT ARE ESD LEADERS LOOKING FOR IN SUPPLIERS?

Product quality is just one of several criteria retailers consider for inclusion in an ESD programme.

Addressing challenges, driving growth, building resilience – a spotlight on MTN’s initiatives. By

HAPPY ZONDIIn the rapidly evolving landscape of small- and medium-sized enterprises (SMEs), technological innovations are increasingly pivotal in driving efficiency, growth and resilience. MTN Business, a leading telecommunications company committed to empowering SMEs across South Africa through innovative tech solutions, is at the forefront of this transformation.

Recognising this, MTN Business offers comprehensive solutions tailor-made to address the unique challenges facing SMEs daily. MTN’s GM for SME and indirect channel, Songezo Masiso, says: “Through Microsoft 365 and cloud-based offerings, MTN Business provides SMEs with the tools to streamline operations, collaborate effectively and stay ahead of the curve. By migrating their operations to the cloud, SMEs can enjoy enhanced flexibility, scalability and cost-efficiency, enabling them to focus their resources on core business activities and drive growth.”

With the increasing prevalence of cyberthreats, cybersecurity is a critical concern for SMEs. MTN Business offers cybersecurity services designed to safeguard SMEs’ digital assets and protect them from potential cyberattacks. From threat detection and prevention to data encryption and secure communication channels, MTN Business’ cybersecurity solutions provide SMEs with peace of mind, knowing they can conduct their business operations securely.

In South Africa, load shedding

impacts SMEs’ operations significantly, hindering their growth prospects. MTN Business has partnered with leading ICT company Huawei to offer solar power solutions tailored to the needs of SMEs.

Says Masiso: “These solar power solutions provide SMEs with a reliable energy source, enabling them to continue their business operations uninterrupted. Moreover, MTN offers flexible financing options for SMEs to acquire these solar power solutions, ensuring affordability and accessibility for businesses of all sizes.”

Beyond technology solutions, MTN Business is committed to empowering SMEs through education and support initiatives. Through its SME HUB platform, the company provides SMEs access to valuable resources, including educational content, business tools and networking opportunities. It also offers training programmes and partner collaborations aimed at equipping SMEs with the knowledge and skills to succeed in today’s competitive business environment.

One groundbreaking initiative in partnership with Fintech is the Momo app, which enables SMEs to access digital financial services.

“In addition to enabling online payments and transactions, the Momo app will soon offer SME loans, providing businesses with the capital they need to expand their operations. What sets Momo apart is its flexibility and scalability, allowing SMEs to customise the app to meet their specific needs and requirements,” adds Masiso. Accessibility is key to MTN’s approach to serving SMEs, with the company offering multiple channels for engagement and support.

From physical stores and online platforms to proactive outreach and personalised support, MTN Business ensures that SMEs have access to resources and assistance whenever needed.

Masiso identifies several key trends shaping the future of the SME landscape in South Africa. These include the continued growth of cloud solutions, driven by the increasing demand for online and digital services in the wake of the COVID-19 pandemic.

“Additionally, enhanced connectivity solutions, such as fibre networks, are making it easier for SMEs to access high-speed internet at affordable prices, further fuelling digital transformation and innovation. Cybersecurity and internet of things integration are also on the rise, as SMEs seek to protect their digital assets and leverage emerging technologies to optimise their operations and drive growth,” he explains.

For MTN Business, success is not just about financial metrics, but about delivering tangible value and impact to SMEs. By focusing on customer satisfaction and feedback, MTN Business can assess the effectiveness of its solutions and services in meeting the needs and expectations of SMEs.

“Ultimately, the company’s goal is to empower SMEs with the necessary tools, resources and support to succeed in today’s competitive business environment, driving economic growth and prosperity for businesses across South Africa,” concludes Masiso.

CATHERINE WIJNBERG , CEO of Fetola, provides a comprehensive overview of the challenges and opportunities facing small, medium and micro enterprises in today’s dynamic business landscape

SMME S THAT EMBRACE TECHNOLOGY, INCLUDING ARTIFICIAL INTELLIGENCE, MACHINE LEARNING AND DIGITAL PAYMENT PLATFORMS, HAVE A COMPETITIVE ADVANTAGE OVER THOSE THAT DON’T.

Small, medium and micro enterprises (SMMEs) play a critically important role in driving inclusive growth and development. It’s estimated that SMMEs currently make up more than 90 per cent of registered businesses in South Africa, provide employment to more than half of the labour force and account for more than a third of the gross domestic product, representing one of the most promising opportunities for economic recovery.

However, as the pandemic years clearly illustrated, the SMME sector is also particularly vulnerable to economic downturns and economic shocks. The key trends I see impacting SMME businesses in 2024 include the following:

THE SMME SECTOR IS ALSO PARTICULARLY VULNERABLE TO ECONOMIC DOWNTURNS AND ECONOMIC SHOCKS. AS THE GENERAL ELECTION LATER THIS YEAR LOOMS, SMME S NEED TO BRACE FOR YET ANOTHER UNPREDICTABLE YEAR.

1A LOW-GROWTH ECONOMY AND PERSISTENTLY HIGH UNEMPLOYMENT

The International Monetary Fund (IMF) recently downgraded its growth forecast for South Africa for 2024 to one per cent, citing logistical challenges and energy shortages as a signifi cant constraint to growth. A low-growth economy makes it harder to reduce high unemployment or grow tax revenues. It’s no surprise that in this environment, business confi dence indicators are declining. RMB’s Bureau for Economic Research Business Confi dence Index fell to 31 points in the fourth quarter of 2024 from 33 points in the third quarter.

South Africa’s energy, water and logistics challenges have been well-documented. The continual erosion of municipal services and critical infrastructure poses an additional risk for SMMEs, but is also an opportunity for the private sector to step in to provide these essential services as citizens increasingly look to “state-proof” themselves from the risk of state collapse.

In the energy sector, for example, the shift towards solar is an opportunity for solar installers. Ideally, we need to work on creating a supply chain entirely reliant on green technologies.

The global balance of power is in a precarious position as a result of the conflict in Ukraine and the Middle East. In addition to impacting global supply chains, it’s also having a negative impact on sentiment, and sentiment is ultimately what drives economic growth.

Global sentiment has a knock-on effect on local business confidence levels, which, in turn, impacts SMMEs. Local businesses need to be aware of the potential impact of geo-political risks on their businesses and build flexibility into their risk mitigation strategies.

A focus on sustainability also reflects in supply chains. The rise in geo-political tensions coupled with local port and other logistics constraints means that many businesses will be looking to bring their supply chains closer to home. This presents an opportunity for SMMEs to become part of the supply chains of larger businesses. The African Continental Free Trade Area – which aims to establish a single market for goods and services from the African continent – also offers the potential for increased intra-African trade.

There will be an increased focus on ensuring SMMEs become more resilient to ensure their sustainability and survival. While every small business needs to learn to roll with the punches, they also need to learn how to use their size as an advantage rather than a disadvantage and embrace their ability to be agile and pivot in a new direction when necessary. Having a strategic growth plan in place and the ability to talk the language of investors is critical when they are planning to scale and looking for investors.

SMMEs that embrace technology, including artificial intelligence, machine learning and digital payment platforms, have a competitive advantage over those that don’t.

Personalisation and ease of doing business are also key consumer expectations where technology can assist. As cyber-risks grow, implementing some measure of cybersecurity has become critically important. In an increasingly competitive and complex operating environment, every advantage counts.

Interestingly, we are seeing more and more South Africans choose to leave formal corporate employment once they have gained some experience to establish their entrepreneurial ventures. Our data reveals that the entrepreneurial ventures of these individuals have a high likelihood of succeeding. Less educated individuals, particularly those living in township areas, however, often have a harder time succeeding, which is why they need more support and mentorship to succeed.

There is pressure on businesses globally to incorporate more sustainable models that consider their impact on the environment and society at large, and which emphasise good governance. This trend is also starting to be felt in South Africa. What tends to differentiate South African entrepreneurs from those in more developed countries is their strong social conscience. In my experience, the majority of entrepreneurs are driven to make a positive social impact.

THE CONTINUAL EROSION OF MUNICIPAL SERVICES AND CRITICAL INFRASTRUCTURE POSES AN ADDITIONAL RISK FOR SMME S, BUT IS ALSO AN OPPORTUNITY FOR THE PRIVATE SECTOR TO STEP IN TO PROVIDE THESE ESSENTIAL SERVICES.

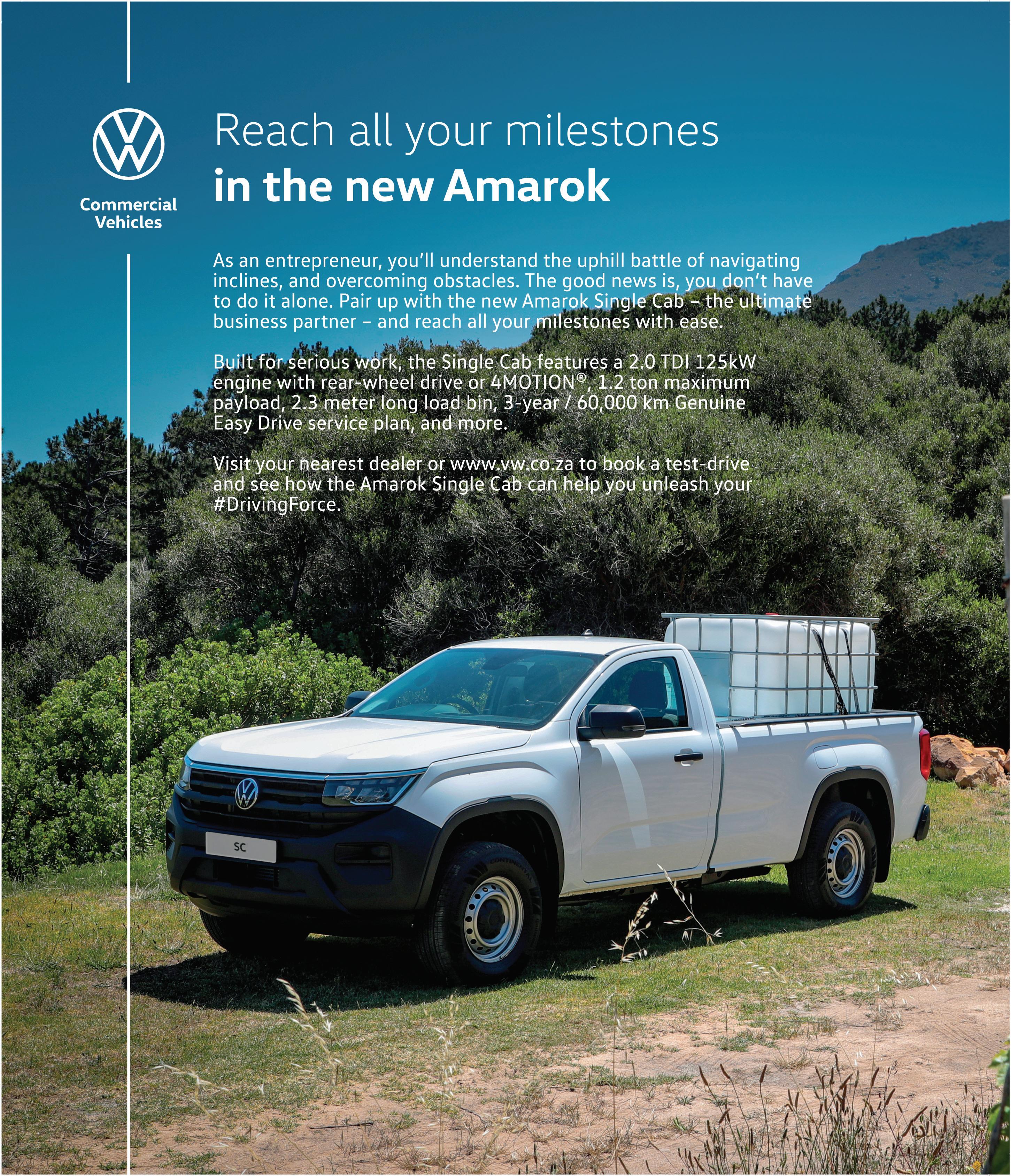

The right products, tools and vehicles are valuable assets in business, writes VOLKSWAGEN COMMERCIAL VEHICLES

In today’s dynamic business landscape, success hinges not only on vision and strategy, but also on the tools at your disposal. Every entrepreneur knows that having the right equipment can make all the difference, transforming daunting challenges into manageable tasks. Among the essential assets for any business is the utility vehicle, a workhorse that serves as the backbone of operations across industries.

Enter the Volkswagen Amarok, a name synonymous with reliability, versatility and performance. In the entrepreneurial journey where adaptability is key the Amarok emerges as a steadfast companion, capable of navigating diverse terrains and overcoming obstacles with ease. Whether you’re a small business owner or managing a fleet for a larger enterprise, the Amarok offers a range of options to suit your needs.

At the heart of the Amarok lineup are the Single Cab and the Double Cab, each designed to meet specific requirements and deliver unmatched performance. Let’s explore how these vehicles can elevate your business to new heights.

The Amarok Single Cab stands as a testament to Volkswagen’s commitment to practicality and innovation. Tailored for those who prioritise function and utility, this model boasts a range of features designed to streamline operations and enhance productivity.

One of the standout attributes of the Single Cab is its robust construction, built to withstand the rigours of daily use in demanding environments. Equipped with a powerful 2.0 TDI engine delivering 125kW of power and 405Nm of torque, this vehicle ensures optimal performance under all conditions. Whether you’re navigating city streets or venturing off-road, the Amarok Single Cab delivers a smooth and responsive driving experience.

But it’s not just about power; the Amarok Single Cab offers a host of intelligent features aimed at simplifying the workday. From the convenience of App-Connect for seamless smartphone integration to the safety of LED headlights and electronic rear differential locking axle, every aspect of this vehicle is designed with the needs of the modern business owner in mind.

With a payload capacity of 1.2 tonnes and a spacious load compartment measuring 2.3 metres long and 1.2 meters wide (between wheelhouses), the Amarok Single Cab offers ample space for transporting goods and equipment. Whether you’re hauling construction materials or delivering goods to clients, you can rely on the Single Cab to get the job done efficiently.

Key Standard Specs

• Engine: 2.0 TDI

• Power: 125kW

• Torque: 405Nm

• 6-speed manual transmission

• Rear-wheel drive or 4MOTION®

• Electronic rear differential locking axle

• Drive profile selection: Normal Eco and Slippery

• 1.2-tonne payload capacity

• 2.3m long x 1.2m wide load compartment

• 800mm maximum wading depth.

For those requiring additional seating capacity without compromising on performance, the Amarok Double Cab emerges as the ideal choice. Combining off-road prowess with ultimate practicality, this model redefines the concept of the utility vehicle, offering a seamless blend of comfort, capability and cutting-edge technology.

Like its Single Cab counterpart, the Amarok Double Cab is powered by a potent 2.0 TDI engine, delivering exceptional performance on any terrain. Whether you’re traversing rugged landscapes or navigating urban streets, you can count on the Double Cab to deliver a superior driving experience.

What sets the Double Cab apart is its versatility, making it equally suitable for business and leisure activities. With a payload capacity of 1.1 tonnes and a spacious load compartment measuring 1.6 metres long and 1.2 meters wide (between wheelhouses), this vehicle offers ample space for both cargo and passengers. Whether you’re transporting a team of workers to a job site or embarking on a weekend adventure with family and friends, the Double Cab ensures a comfortable and enjoyable journey for all.

Key Standard Specs

• Engine: 2.0 TDI

• Power: 125kW

• Torque: 405Nm

• 6-speed manual transmission

• Rear-wheel drive or 4MOTION®

• Electronic rear differential locking axle

• Drive profile selection: Normal Eco and Slippery

• 1.1-tonne payload capacity

• 1.6m long x 1.2m wide load compartment

• 800mm maximum wading depth

• 1900kg rear-axle load limit

• Rear park sensors and reverse camera.

In addition to their impressive performance and versatility, both the Amarok Single Cab and Double Cab come with comprehensive after sales service plans designed to provide peace

THE

of mind and minimise downtime. With a threeyear/60 000km Genuine Easy Drive service plan for the Single Cab and a five-year/100 000km maintenance plan for the Double Cab, you can rest assured knowing your vehicle is covered for routine maintenance and repairs.

These maintenance plans not only save you time and money, but also ensure that your Amarok remains in optimal condition, allowing you to focus on growing your business without worrying about vehicle maintenance.

The Volkswagen Amarok Single Cab and Double Cab represent more than just utility vehicles; they are catalysts for growth and success in the ever-evolving world of business. Whether you’re a sole proprietor or a corporate executive, the Amarok offers the reliability, versatility and performance you need to thrive in today’s competitive marketplace.

By investing in an Amarok, you’re not just purchasing a vehicle; you’re investing in your future and the future of your business. With their unparalleled combination of practicality, performance and peace of mind, the Amarok Single Cab and Double Cab are truly the #DrivingForce behind success.

Take the first step towards transforming your business today. Visit www.vw.co.za to book a test drive to experience the power and performance of the Volkswagen Amarok for yourself and be the #DrivingForce that launches your success.

Experts share how small business owners can increase their chances of securing funding. By THANDO

PATOFor many small, medium and micro enterprises (SMMEs), finding funding is one of the biggest stumbling blocks to growth or getting a business off the ground. Experts Debbie Tagg, COO at Smart Procurement, and René Botha, regional investment manager at Business Partners, share what to avoid and how and where to secure funding.

• In his 2024 State of the Nation Address earlier this year, President Cyril Ramaphosa spoke about government initiatives that would be introduced to help boost small, medium and micro enterprises (SMMEs), which currently contribute over R900-million to the local economy.

• According to Ramphosa’s speech, South Africa currently has 2.4–3.5 million SMMEs that have created and sustained over 30 000 jobs.

• The Banking Association of South Africa (BASA) says SMMEs are one of the key drivers of inclusive growth and development in South Africa.

Sources: BASA website and 2024 SONA

SMMEs must be discerning when seeking funding, says Tagg.

“Grant funding without guidance and support may not foster long-term stability. Traditional banking and finance institutions often offer more than just capital; they provide market access and business development resources that can be invaluable. Don’t overlook the nonfinancial support they bring to the table. Additionally, explore supply chain finance options, especially if your business has secured contracts requiring capital investment.”

Tagg says the South African funding landscape is varied, and it is crucial to research investors and funding models that align with your industry and research.

Botha adds that a business owner should look for an investor with a positive outlook on the SMME market, a desire to make funding available and a willingness to take a risk. “The ideal investor can offer viability-based, flexible funding and will guarantee personal contact and communication and help you build relationships. Try to work with investors offering a quick turnaround time on correspondence, requests and capital.”

Businesses that are attractive to potential investors do the following, says Tagg: “An SMME becomes attractive to potential investors through clear business focus and operational efficiency. Avoiding broad claims and staying fully tax-compliant are key markers of reliability. Timely financial reporting, regardless of the season, significantly boosts investor confidence. Moreover, maintaining discipline by segregating personal and business transactions preserves the company’s value and enhances investor appeal.”

• Government support: institutions, such as the Small Enterprise Finance Agency and the Industrial Development Corporation, offer grants, loans and equity financing tailored to SMMEs, providing vital financial support for growth.

• Traditional banking: commercial banks provide SMMEs with business loans and lines of credit, often coupled with advisory services and financial planning support, helping them navigate the complex financial landscape.

• Angel investors and venture capitalists: early-stage and high-growth SMMEs can attract equity financing from angel investors and venture capitalists who inject capital and also offer valuable expertise and networks to propel business growth.

• Private equity: established SMMEs with promising growth prospects can partner with private equity firms, exchanging equity ownership for capital and strategic guidance to maximise returns and expansion opportunities.

• SMMEs can leverage crowdfunding platforms to raise capital from a wide pool of individual investors through online campaigns, simultaneously generating publicity and community support for their ventures.

• Supplier development programmes offered by large corporations and government entities can provide financing, mentorship and training opportunities for SMMEs aiming to integrate into supply chains.

Botha says when seeking investment, many business owners make the following mistakes: “People sometimes seek out the wrong type of funding and apply indiscriminately, without first assessing their funding needs or analysing whether the business can afford the cost of the funding. Another mistake is having a business model that is not clear or well-thought-through or relying on just a few customers for income. Finally, some business owners apply for funding even if they don’t have a clear credit score.”

Gone are the days when the first “no” from a funder meant that an SMME’s days of operation were over. As the importance of the sector grows, so too do the number of alternate financing options available.

By LISA WITEPSKIErica Nell, head of private debt at Sanlam Investments, notes that small, medium and micro enterprises (SMMES) have traditionally struggled to find funding for a variety of reasons. Limited collateral and credit history, lack of financial literacy, high interest rates on loans and stringent loan requirements all count against them, she says. “Added to this, compliance with regulatory requirements can be burdensome for SMMEs. Often, entrepreneurs are focused on building their businesses and have limited capacity to develop a comprehensive business proposition.”

This is beginning to change, however. Nell points to the awareness of SMMEs’ importance as the backbone of South Africa’s economy as a catalyst in this regard. “If South Africa wants to resolve its high unemployment rate, a sustainable and supportive environment must be created to facilitate small business survival and growth and ensure increased job creation.” Happily, there has been a marked

Around 40 per cent of SMMEs throughout the African continent struggle to access finance, according to a report on Weforum.org

increase in SMME lending, especially since the COVID-19 pandemic, she adds.

At the same time, the advent of data, which makes it possible for SMMEs to keep careful track of transactions, has also played in their favour. Trevor Gosling, CEO and co-founder of Lulalend, points out that this increases their attractiveness to potential lenders. “Traditionally, it has been difficult for merchants that work predominantly with cash to prove they have firm financials. However, we now have the infrastructure to

“MANY OTHER NEW FUNDING MODELS HAVE BEEN DEVELOPED. A GREAT ADVANTAGE OF THESE IS THAT THEY ARE MORE FLEXIBLE, ACCESSIBLE AND TAILORED TO THE SPECIFIC NEEDS OF SMMES.” – ERICA NELL

access accurate data around their businesses, reducing the risk of extending a loan,” he says. Lulalend’s partnerships with companies such as Takealot, Vodacom and Yoco mean that small business owners can now access finance from payment providers or marketplaces – and several other companies are stepping forward to offer similar services.

Nell observes that many other new funding models have been developed. A great advantage of these is that they are more flexible, accessible and tailored to the specific needs of SMMEs. Examples include revenue-based finance, with repayment dependent on the cash flows of the business, and peer-to-peer lending, which bypasses traditional financial institutions. Crowdfunding, invoice discounting and venture debt are also making life easier for business owners, while impact finance (a model that seeks to generate a social or environmental impact alongside financial returns) is another innovative solution.

There is still plenty of room for growth, however. “The International Finance Corporation’s market analysis of the SMME market found that there is a $27-billion credit gap,” informs Gosling.

“Given the potential impact of the sector, we must find ways to plug that gap.” He predicts that data will continue to play a role here, adding that it’s most likely to be the alternate lenders, rather than traditional banks, that step forward – again, largely due to the fact that banks still consider security and assets key when extending a loan, and this sector has a marked lack of both.

Nell agrees that changes are likely afoot –although the solutions that have proved effective overseas won’t necessarily have the same results here. “South Africa can learn from developed countries in various respects, but key focus areas would be capacity-building and business development support for SMMEs and the development of technology and digital platforms for lending products.

“Technology, disintermediation and the rise of alternative funding sources are developing rapidly,” she continues. “There is a shift in investor preference, with an increased focus on impact investing.” It’s likely that this will not only make it easier for SMMEs to obtain funding, but will also change the way SMMEs access finance. “We’ll see funding models evolve to meet the needs of SMMEs at different stages of growth and across various sectors. Tailored financing solutions, which will include more flexible repayment terms, and business development support will become increasingly important,” Nell concludes.

Takealot’s Township Economy Initiative aims to create entrepreneurial opportunities and fuel e-commerce growth in townships countrywide. By TAKEALOT GROUP

In partnership with the Gauteng Provincial Government, Takealot Group’s Township Economy Initiative empowers South African townships by creating jobs, fostering entrepreneurship, and nurturing innovation. Together, we aim to transform labour hubs into vibrant economic centers, unlocking the potential of historically disadvantaged communities. This transformation involves a deliberate effort to introduce manufacturing and industrialisation, thus reshaping these communities into bustling economic activity centers.

WE ARE DEDICATED TO BRIDGING THE GAPS IN UNDERSERVED COMMUNITIES AND EMPOWERING INDIVIDUALS TO PARTICIPATE ACTIVELY IN THEIR DEVELOPMENT.

At the heart of our mission lies a deepseated belief in the immense potential harboured within our townships, particularly in our youth. We envision them as hotbeds of innovation, where creativity flourishes

and new ideas take root. Central to this vision is recognising our youth as catalysts for change, capable of identifying and capitalising on emerging consumer needs. Our commitment extends beyond mere rhetoric; we are steadfast in our resolve to bridge the gaps plaguing underserved communities, empowering individuals to participate in their development actively.

Takealot humbly recognises that our efforts, though earnest, are just a drop in the vast ocean of possibilities. However, our belief in effecting

Takealot Group’S PARTNERSHIP WITH THE GAUTENG PROVINCIAL GOVERNMENT ADDRESSES ECONOMIC CHALLENGES AND CREATES A PLATFORM FOR THE YOUTH TO GROW AND DEVELOP.

change stems from witnessing the impact within our own business. We adhere to the belief, “Never despise the day of small beginnings.”

We do not perceive ourselves as spectators in this transformative journey but as essential collaborators in unlocking townships’ potential. This initiative signifies a groundbreaking milestone within the country’s business landscape. We comprehend the importance of forging strategic partnerships with allies who share our commitment to nurturing programs like the Takealot Township Economy Initiative. Their contributions are invaluable, playing an integral role in our collective success.

Our primary goal is to secure the future of South Africa’s local manufacturing sector, which has seen a significant decline in its contribution to the GDP over the years. The urgency of this situation cannot be overstated. By revitalising local manufacturing, we aim to not only create jobs but also strengthen the nation’s economy. With your support, we can make a significant impact.

While it’s essential to recognise the challenges presented by international e-commerce players, it’s equally vital that we adopt a proactive

approach in empowering our local businesses. Rather than merely expressing concerns, let’s focus on strategies to strengthen and support our local manufacturing sector.

The Gauteng Provincial Government is accelerating the delivery of high-impact projects, specifically focusing on sectors with high labour absorption capacity. To deliver on this vital mandate, the Government is collaborating with the private sector to resolve some structural mismatches in the economy.

• Investing in training to upskill the youth is essential to match their abilities with the requirements of employers in the job market.

• Secondly, the market must provide an adequate platform for absorbing locally manufactured products.

• Thirdly, the inherent inefficiencies in transport and logistics impose a cost premium between township retailers and suppliers. The partnership with Takealot Group addresses economic challenges and creates a youth

growth and development platform. It’s a step towards fueling the growth of e-commerce solutions and positioning the youth to participate in the economy, offering them a promising future.

The government actively empowers the youth, offering pathways to engage meaningfully in the economy. This includes a range of programmes such as training, licensing, testing, and accreditation, all aimed at unleashing their potential and facilitating their success.

The Takealot Township Economy Initiative consists of six programmes focused on creating jobs and supporting small businesses owned by historically disadvantaged persons in underserved communities across South Africa, starting here in Gauteng, including but not limited to

• Mamelodi

• Soweto

• Soshanguve

• Sebokeng

• Tembisa

• Alexandra

• Eldorado Park

• Hammanskraal

We are investing R150 million over the next five years to deliver a social return by creating 20,000 jobs and income-generating opportunities for our fellow South Africans.

We aim to create a virtuous cycle combining the township economy’s unlimited potential and creativity with the digital economy’s scale and reach. With the precise objectives of job creation, entrepreneurship, and skills development, we aim to enable sustainable

economic opportunity for previously underserved communities.

Our initiatives span the holistic e-commerce value chain from production, sales and delivery, enabling individuals at every stage.

WE ARE INVESTING R150-MILLION OVER THE NEXT FIVE YEARS TO DELIVER A SOCIAL RETURN BY CREATING 20 000 JOBS AND INCOME-GENERATING OPPORTUNITIES FOR OUR FELLOW SOUTH AFRICANS.

This programme provides independent restaurants based in township communities a “leg up” with trading benefits to boost sales on the Mr D platform, effectively linking supply and demand within townships. Restaurants will enjoy zero sign-up fees and regular training and guidance from our team. Additionally, they will have access to free advertising credits to the value of R1000 monthly for the first three months of trading to make customers aware of their offering. A monthly dedicated promotion of restaurants owned by historically disadvantaged persons on the platform will further accelerate awareness and growth.

Takealot Marketplace has empowered more than 12,000 small businesses across South Africa, most of which are based in Gauteng—70 in Mamelodi. The Takealot Marketplace Programme uplifts townships by empowering local manufacturers to thrive nationally while fostering community growth. Through our comprehensive support system, we’ll work together to draft a business plan, paving the way for mutual success. Qualifying business owners will receive personalised monthly account management and financial assistance, including waived subscription and Proudly SA membership fees for a year, advertising credits, and a 12-month brand store to amplify their brand visibility and

placement. Additionally, we’ll subsidise fulfilment and success fees, ensuring sustainable growth. With simplified solutions and logistics, we enable businesses to access millions of customers and realise their full potential.

Leaning into the prevailing side-hustle culture, the Personal Shopper programme allows for flexible earning potential with few barriers to entry. Personal shoppers can earn supplemental income by purchasing products on the Takealot platform on behalf of communities, with uncapped earning potential in the form of commissions. We aim to add 5,000 personal shoppers to the programme by 2028, genuinely enabling the virtuous cycle of “by the township for the township through the township”.

Takealot Township Franchise Development Programme

A Takealot franchise is a base for delivering items ordered from the platform. Entrepreneurs

with business experience and knowhow are invited to take advantage of this exciting opportunity to build a futureproof, scalable business. The goal is to develop these entrepreneurs and offer them the chance to expand their business skills, driving local economic growth in underserved areas. We aim to add at least ten franchisees with financial support, technical support and training over the next five years.

This initiative addresses the urgent need for skilled last-mile delivery drivers by training South African citizens interested in working in the on-demand delivery industry. We are committed to adding 2,000 drivers to the Takealot franchise network in the next fi ve years, allowing them to work full- or part-time, receive free training and develop further. OUR AIM IS TO CREATE A VIRTUOUS CYCLE COMBINING THE TOWNSHIP ECONOMY’S UNLIMITED POTENTIAL AND CREATIVITY WITH THE DIGITAL ECONOMY’S SCALE AND REACH.

VERSFELD and CARLA COLLETT, partners at Webber Wentzel, share what small, medium and micro enterprises must consider when creating their brand and securing their trademark

Standing out from the crowd is crucial for businesses, especially small, medium and micro enterprises (SMMEs), if they want to survive in today’s cut-throat market. But what sets you apart from competitors? The answer: your brand. As you build your reputation, you build trust and consumer loyalty. Similarly, as your brand grows, so does the value of your trademark, which is why this is an incredibly important asset for safeguarding your reputation and generating revenue.

A trademark can take the form of a device or logo, name, signature, word, letter, numeral, shape, configuration, pattern, ornamentation, colour or container for goods – anything that makes it easier for consumers to identify your business as its source. Registering your trademark is not just about protecting your brand; it carves a unique space for your business, instantly differentiating you from competitors who cannot use the same or similar brand.

TRADEMARKS

A trademark can only be registered if it is capable of distinguishing your product. Ideally, the trademark you adopt should be an invented word. Some well-known trademarks in South Africa that use word marks include SUNLIGHT, OUTsurance and NIKNAKS. Meanwhile, the Nike swoosh and Facebook’s “f” are recognisable logos. Signatures, such as those of Siya Kolisi and Nelson Mandela, can be trademarks, too. Some brands distinguish themselves through iconic colours, such as Cadbury’s purple and MTN’s yellow.

Using a trademark to distinguish your goods or services from others helps capture your consumer’s attention. In other words, your trademark acts as a badge of origin and an indication of quality, which consumers understand and use to decide which goods or services to trust. Your trademark establishes a loyal client base and increases the goodwill of your business.

Trademarks are one of the most valuable and enduring business assets. They are, furthermore, a critical component of merchandising or franchising agreements, as

they can be licensed to obtain revenue through royalties or put up as security to secure financing. Trademark registration is territorial, so if your business is expanding to territories outside of South Africa, you will need to register the trademark in every country where it will be used. Having a trademark is especially important in the fight against counterfeiting: it plays a role in halting the entry of imported counterfeit goods through our border posts and prevents counterfeiters from using your trademark as a domain name.

In South Africa, unregistered trademarks are protected under our common law. However, enforcing these rights is far more challenging and costly than relying on a registered trademark. If your right to use an unregistered trademark is challenged, you (as the trademark owner) will have to prove that it belongs to the business, has been used consistently and has developed goodwill and reputation to such an extent that the public associates the trademark with the goods or services of your business. Substantial amounts of evidence of use are required – this is often difficult to find.

In contrast, a registered trademark gives you an exclusive right to use the trademark for the goods and services for which it is registered, and you need nothing more than the trademark certificate to prove its existence. This means that there is no need to prove ownership or use of the trademark, and you can prevent competitors (or other third parties) from using or registering the same or similar trademarks for the same or similar goods or services. Unlike a patent or design, once registered, trademark protection can exist in perpetuity, provided that renewal fees are paid every 10 years.

Trademarks are not just brands. They are a means by which consumers identify and choose their preferred business, products and services. Brand strategy and registration, use and enforcement of trademark rights are crucial to protect and increase the value of a business’s brand identity and market position.

TRADEMARK REGISTRATION IS TERRITORIAL, SO IF YOUR BUSINESS IS EXPANDING TO TERRITORIES OUTSIDE OF SOUTH AFRICA, YOU WILL NEED TO REGISTER THE TRADEMARK IN EVERY COUNTRY WHERE IT WILL BE USED.

Within a rapidly changing business environment, BUSANI MOYO identifies some key areas where SMME owners typically need to upgrade their skills

While it’s accepted that business owners cannot be experts in all areas, ignoring critical functions will compromise the business’s growth. Businesses that succeed are generally led by people with basic knowledge across different aspects of business operations. What are the key areas where small, medium and micro enterprise (SMME) owners typically need to upgrade their skills? This article offers a guide to developing those skills while investing time in core operations. It also examines the various options available to small businesses.

Nick Chipangura is the national operations director at Reats Training Services, a skills development company based in Johannesburg. He identifies the main areas owners of small businesses need to direct their focus.

With the proliferation of digital technologies, such as artificial intelligence (AI) and machine learning, it is no surprise that digital literacy is a top skill that SMME owners must focus on when upgrading their skills. Chipangura says: “With the increasing

ENVIRONMENT, SMME OWNERS MUST CONTINUALLY INNOVATE AND ADAPT THEIR BUSINESS MODELS.

digitalisation of business processes, SMME owners need to upgrade their skills in utilising digital tools, online marketing, e-commerce platforms and digital financial management systems.” He adds: “Social media and digital flyers are working better than the traditional issuing of pamphlets at traffic lights. In my industry, all have changed, and we are even doing meetings and training online, so adherence to the wave of technology is needed.”

The smesouthafrica.co.za website, which provides business owners with advice, tools and resources, states: “Financial planning helps with monitoring cash inflows and outflows, allowing small businesses to anticipate potential cash shortages and plan accordingly. This is essential

for paying bills on time and ensuring your business stays in a healthy cash position.” The same site notes that SME owners must always upgrade their skills in this area because “economic conditions can always change, especially when you run a small business”.

“Understanding market trends, customer behaviour and preferences is essential for staying competitive,” says Chipangura. He adds: “SMME owners should focus on upgrading their skills in market research, data analysis and customer relationship management.”

Franklin Kibuacha, who writes for GeoPoll, a provider of remote, mobile-based research solutions, agrees and adds that market research skills are integral to small businesses because they help them make “data-driven decisions that will help them grow and succeed in their industry”.

It is now accepted that things are changing more quickly than ever before. In a rapidly changing business environment, SMME owners must continually innovate and adapt their business models. In relation to this, Chipangura advises: “Upgrading skills in areas such as product development, service innovation and strategic planning can help businesses thrive.”

While it may look like technology will replace human beings, Professor Karim Lakhani of the Harvard Business School, specialising in workplace technology and AI, believes that “AI is not going to replace humans, but humans with AI are going to replace humans without AI”. Therefore, SMME owners need to upgrade their skills in dealing with these human beings with AI. In this regard, Chipangura suggests: “SMME owners may need to upgrade their skills in areas such as employee relations, performance management and conflict resolution.” He adds: “In my experience, this has been a very big problem in South Africa.”

Building a strong network of contacts and partnerships can provide valuable growth opportunities. Chipangura advises: “SMME owners should focus on upgrading their skills in networking, relationship building and collaboration with other businesses and stakeholders.”

Small, medium and micro enterprises that leverage the latest digital technologies and continuously upskill employees can more easily compete with large enterprises, writes

Small, medium and micro enterprises (SMMEs) are regularly touted as the engine that will drive South Africa’s economic recovery. However, to fulfil this role these businesses need to be able to successfully compete with larger corporates, and essentially “punch above their weight”. Technology may well be the enabler that ensures this happens.

Khululwa Mandlendoda, senior specialist for SME marketing at MTN Business, says technology serves as a significant equaliser for SMMEs, empowering them to compete with larger enterprises. “Take cloud computing, for example, a technology that provides cost-effective access to robust computing resources, enabling SMMEs to scale operations without requiring substantial infrastructure investments,” she says.

“In addition, digital marketing tools and platforms facilitate targeted advertising, allowing SMMEs to reach their desired audience precisely, without relying on expensive advertising agencies. The rising prominence of artificial intelligence (AI) resources further aids these companies in becoming more resource-efficient and automated, without incurring significant costs.”

Mandlendoda adds that collaboration tools, such as Microsoft 365, further enhance productivity and streamline workflows, enabling seamless communication and co-operation within the business.

Setlogane Manchidi, head of CSI at Investec, notes that most smaller businesses have embraced social media. “These entities view the likes of Whatsapp, Facebook and similar mediums as amazing

communication, marketing and promotion platforms for their businesses, recognising that these give them a presence far larger than they could otherwise have physically.

“Cloud accounting is also being leveraged by a growing number of emerging entrepreneurs, with most reporting a huge saving in time, effort and, in some cases, money. These tools help them manage their finances effectively, ensuring better control over cash flow and financial decision-making processes.”

The expanding gig economy is also beneficial to SMMEs, says Mandlendoda, noting that access to a flexible workforce enables them to leverage specialised skills on demand, without the overhead costs associated with full-time employees.

“Through freelance marketplaces and task-based apps, SMMEs can swiftly assemble project teams tailored to their precise needs, promoting agility and competitiveness. As with technology, human resources becomes scalable, allowing SMMEs to adjust and expand their workforce as needed, facilitating growth and adaptability,” she explains.

Manchidi agrees that such solutions offer access to highly specialised skills, ability and talent, without having to increase overheads or negatively impact their permanent headcount numbers and associated costs.

“Such freelance arrangements also lighten management and administrative burdens, along with associated costs. This creates breathing space for the emerging entrepreneur while contributing to improved competitiveness.”

Mandlendoda points out that modern digital solutions offer SMMEs numerous opportunities to innovate and distinguish themselves in the market. For example, AI-powered analytics can unveil market trends and customer preferences, providing valuable insights for product development and marketing strategies. Collaborative platforms also play a crucial role in fostering innovation by facilitating knowledge-sharing and idea-generation within the organisation.

“Many of these tools are available for free, allowing SMMEs to experiment and discover the right tools for their business, without committing to significant

“THE AUTOMATION OF BUSINESS PROCESSES AND REDUCTION OF PAPER-BASED DOCUMENTATION, THROUGH DIGITISATION, CAN LEAD TO GREATER EFFICIENCIES.” – SETLOGANE MANCHIDI

licence fees upfront,” continues Mandlendoda.

“Business owners should embrace this opportunity to explore various tools and find those that best suit their unique needs and objectives, without fear of the initial investment. This flexibility will enable SMMEs to adapt and thrive in an everevolving digital landscape.”

Manchidi notes that the challenges and negative impacts resulting from seemingly never-ending rolling blackouts make investment in backup intelligent technologies, such as inverters, a must for all businesses. “On the positive side, the automation of business processes and reduction of paper-based documentation, through digitisation, can lead to greater efficiencies.

“Electronic payment platforms are another smart investment for emerging enterprises, given the massive risk around cash management and transportation in South Africa,” Manchidi adds.

“Among SMMEs’ daily struggles is distinguishing themselves from their peers – how do they ensure that their businesses stand out positively, especially when operating in saturated sectors?” he continues. He suggests that the innovative adoption of solutions may assist here. “SMMEs should look to leverage such solutions in a manner that creates improved brand presence and better customer experiences and differentiates how products and services are promoted and accessed by customers.”

sessions, where small business owners can connect and grow their skills. We also provide access to resources, tools and technologies SMMEs can usually access, thereby accelerating their digital transformation journey.”

He adds that collaborative initiatives, such as incubator or accelerator programmes, can further facilitate partnerships between SMMEs and larger organisations, fostering innovation and growth in the digital ecosystem.

There is little doubt that the growing number of SMMEs joining the e-commerce arena will have a huge impact on the economy, says Pierre Bekker, MD for Quyn International Outsourcing. “This is certainly the direction everything is moving in, so SMMEs that build their internal skills in this space will have an advantage. Such skills provide your business with a unique identity that usually helps attract more customers. Also, such skills ensure you are more in control of the customer experience – it’s crucial to get it right if you’re aiming to develop into a much larger business.

MTN Business suggests that small, medium and micro enterprises should prioritise investment in technologies that streamline operations, enhance customer experience and foster innovation and automation. These may include:

•customer relationship management systems for efficient customer administration;

•e-commerce platforms to expand market reach and facilitate online sales;

•data analytics tools for actionable insights and informed decision-making; and

•automation technologies to streamline repetitive tasks and boost productivity.

“Moreover, the agility and innovation inherent in many SMMEs can drive entrepreneurship, foster creativity and spur economic dynamism, ultimately leading to a more vibrant and resilient economy,” he says.

Acquiring and refining the necessary skills for success in the digital economy is crucial for SMMEs, points out Frederik Zietsman, Takealot Group CEO.

“To this end, Takealot offers and provides extensive support to sellers on its Marketplace, including invaluable business skills development, mentorship and expert-led virtual masterclasses,” he says. “Through Takealot Marketplace, we offer structured onboarding, online training classrooms and knowledge-sharing

“My advice for SMME owners is to search online for free courses. There are many resources available online, and you can find basic training courses easily. Ultimately, once you know your target market and have a unique product or service, leveraging such methods to increase your digital and online skills will allow you to position your business for growth,” states Bekker.

As SMMEs expand their online presence, they create opportunities for job creation across the expected sectors, such as e-commerce, digital marketing, software development and online services, notes Takealot’s Zietsman.

“More importantly, this type of empowerment extends throughout the value chain, from raw materials to manufacturing and logistics, creating job and skills development opportunities. The digital economy enables SMMEs to reach new markets, stimulating economic growth and growing manufacturing output, thereby contributing to increased productivity and competitiveness.

“THROUGH TAKEALOT MARKETPLACE, WE OFFER STRUCTURED ONBOARDING, ONLINE TRAINING CLASSROOMS AND KNOWLEDGE-SHARING SESSIONS, WHERE SMALL BUSINESS OWNERS CAN CONNECT AND GROW THEIR SKILLS.” – FREDERIK ZIETSMAN

Mandlendoda agrees, indicating that SMMEs must prioritise investing in the upskilling of their workforce to harness the full potential of technology. This involves implementing various

THE SOUTH AFRICAN INSTITUTE OF CHARTERED ACCOUNTANTS

writes that its SAICA BIZ Impact Podcast initiative aims to support small businesses to become economically viable

The South African Institute of Chartered Accountants (SAICA) launched the SAICA BIZ Impact Podcast in 2023.

This dynamic platform aims to simplify complex business topics and empower small businesses to thrive. The title, “SAICA BIZ Impact Podcast” signifies the profound difference small businesses can make in driving economies to be catalysts for positive social impact.

Hosted by Luncedo Mtwentwe AGA(SA), managing director at Vantage Advisory, season

one of the debut podcast has 12 episodes featuring SAICA-accredited practitioners who leverage their expertise to help your business thrive, one practical step at a time.

As part of creating positive change and fostering growth for small businesses, each episode features in-depth conversations and actionable advice on key issues

affecting owners of small, medium and micro enterprises (SMMEs).

By creating this podcast series, SAICA aims to bridge the knowledge gap by enabling small businesses to make informed decisions, navigate challenges, and achieve sustainable growth with confidence in their entrepreneurial journeys.

THE GOAL IS TO ENABLE BUSINESSES TO MAKE INFORMED DECISIONS, NAVIGATE CHALLENGES AND DRIVE SUSTAINABLE GROWTH.

SEASON ONE OF THE DEBUT PODCAST HAS 12 EPISODES FEATURING SAICA-ACCREDITED PRACTITIONERS WHO LEVERAGE THEIR EXPERTISE TO HELP YOUR BUSINESS THRIVE, ONE PRACTICAL STEP AT A TIME.

and accounting, managing people, transition to business leadership, sustainable business practices, and many others.

Watch all the episodes from season 1 of the SAICA BIZ Impact Podcast on YouTube and Spotify

Season 2 is due to launch soon and promises to be very informative. It features more SAICA difference-makers and business experts who share valuable information on topics, such as the value of coaching for SMMEs, succession planning, digital marketing for small businesses, and more.

Follow the SAICA Impact Biz Podcast playlist on SAICA’s YouTube channel and subscribe to the podcast on Spotify so you never miss an episode.

The podcast also serves as a platform for SAICA “difference-makers or practitioners” to engage in conversations that echo the ethos of making a difference by having conversations focused on empowering small businesses to not only succeed financially, but also thrive as agents of positive impact.

SMMEs to unlock their potential, navigate challenges and foster sustainable practices that transcend profitability.

It highlights the extensive versatility of SAICA practitioners as professionals whose impact goes beyond traditional accounting and holding finance roles. Through their expertise, SAICA practitioners enable

With the challenges, ranging from rising costs and reduced revenue to securing and managing funds, facing SMMEs, the podcast offers SMMEs an opportunity to gain valuable insight, strategies and advice from experienced SAICA difference-makers. The goal is to enable businesses to make informed decisions, navigate challenges and drive sustainable growth.

Some of the conversations unlocked in the podcast include access to funding, cashflow management, market access barriers, understanding finance

For more information: www.saica.org.za Scan to go to the SAICA website

SAICA is committed to supporting the growth of the accounting profession in South Africa

SAICA Enterprise Development (SAICA ED) and The Hope Factory (THF) work together to provide a platform for SAICA members and other companies to contribute towards their B-BBEE scorecard through Enterprise and Supplier Development (ESD), Socio-Economic Development (SED), and skills development initiatives.

SAICA ED offers:

• strategic ESD programmes and customised projects to grow South Africa’s entrepreneurial sector and;

• expertise in fostering Financial Excellence in entrepreneurs through the Chartered Accountancy profession.

SAICA ED also contributes to the United Nations’ Sustainable Development Goals (SDGs) of creating “Decent Work and Economic Growth” (SDG 8), among other SDGs.The Hope Factory delivers impactful programmes that:

• mobilise economic activity by enabling unemployed Black South Africans (with a key focus on youth and women) to generate their own income;

• contribute to the United Nations’ Sustainable Development Goal of “Eradicating Poverty” (SDG 1), among other SDGs; and

• provide dynamic entrepreneurial initiatives to empower small businesses from start-up to sustainable success.

SAICA ED and THF have a combined 20-plus years of experience in empowering entrepreneurs and driving economic transformation. They offer a wide range of services to help businesses achieve financial excellence, including:

• empowering over 3024 small and medium enterprises/entrepreneurs;

• creating 1 025 additional jobs;

• delivering 2 593 Socio-Economic development interventions; and

• partnering with 147 SAICA small and medium practices.

SAICA ED and THF are committed to providing solutions that meet your B-BBEE scorecard needs. If you’d like to discuss how they can help your business contribute to a more sustainable and prosperous future, contact the investor relations co-ordinator at cherylann@saicaed.co.za.

Don’t miss this chance to invest in your professional growth and contribute to the success of the broader accounting and entrepreneurial community. Get in touch today and become a difference-maker!

Maximise efficiency and unleash your growth potential

This two-day interactive workshop, led by the internationally acclaimed practice management consultant Mark Lloydbottom, is designed to be a game-changer for your practice. Through a dynamic blend of presentations, case studies, group discussions and practical exercises, you’ll gain actionable insights that you can implement immediately.

Lloydbottom is a globally experienced practice management consultant from the United Kingdom and is acknowledged as a futurist specialising in management planning, strategy and profit improvement for accounting firms. His programmes and consulting are based on his over 30 years of experience as a practitioner and consultant. He has worked with professional service firms in 15 countries and has lectured throughout Europe, North America and Africa. Mark has been a regular presenter for AccountingWEB at its annual management conference both in the United States and the United Kingdom. He works extensively

with global accounting firms and many global accounting associations through his IGNITE Practice Management and in-house Margin Mastery workshops.

The results of this last programme have been outstanding, with firm recovery rates increasing by as much as 10 per cent. Mark is co-author of Clients4Life, published by the Institute of Chartered Accountants of Scotland, The South African Institute of Chartered Accountants and the Institute of Chartered Accountants of Australia and New Zealand. He is also the author of Double Your Income, Defining Edge, Deeper, Power UP Your Gross Margin, UPGRADE and Starting In Practice. His firm-wide training programmes include Delivering Outstanding Client Service and Better Billing, Better Collections and Lower Lock Up. Guaranteed.

Here’s what sets this workshop apart

• Learn from a proven master: gain invaluable knowledge and practical strategies.

• Boost team productivity and profitability: discover effective methods to increase team output, streamline processes and maximise your bottom line.

• Reduce debt and attract high-value clients: learn how to improve cash flow, implement

effective client acquisition strategies and win new clients who value your expertise.

• Deliver exceptional client service consistently: develop the skills you need to build stronger, more profitable client relationships and consistently exceed expectations.

• Master the art of overcoming pricing objections: gain the confidence to command your worth and secure the fees you deserve.

• Network with like-minded professionals: connect with other SMPs, share best practices and build a valuable support network

Are you a small or medium practitioner (SMP) feeling the squeeze in today’s competitive landscape? You know that efficiency and growth are no longer optional for sustainable success. But where do you start? SAICA’s Practice Management Workshops offer a powerful solution, equipping you with the tools and strategies you need to become a true difference-maker in your industry. Best of all, this workshop is not limited to SAICA members only – it is open to everyone who owns a small or medium accounting practice.

Don’t miss this opportunity to propel your practice to new heights. Choose the workshop location that best suits you:

• Johannesburg: Monday and Tuesday, 20–21 May at SAICA Offices, Illovo (Book here: [Event: Maximizing Efficiency and Growth: The Practice Management Workshop | JHB | SAICA] )

• Cape Town: Thursday and Friday, 23–24 May at Convention Towers, CTICC (Book here: [Event: Maximizing Effi ciency and Growth: The Practice Management Workshop | CPT | SAICA] ).

The workshops run from 9am to 5pm each day. Space is limited, so register now to secure your spot! Email denisem@saica.co.za for more information.

Scan to go to the SAICA website

For more information: www.saica.org.za

iKhokha, a KwaZulu-Natal-based fintech, is committed to supporting small and medium enterprises, shares iKhokha CEO and co-founder MATT PUTMAN

Our KwaZulu-Natal-based fintech, which recently picked up the MTN Financial App of the Year Award, surpassed the impressive milestone of disbursing more than R2-billion in working capital to our small and medium enterprise (SME) customer base in partnership with Retail Capital, now a division of TymeBank.

In a tough South African economic climate with gloomy daily headlines to have been able to inject R2-billion worth of working capital into the small business sector in South Africa is a really special achievement and milestone for us collectively. Most importantly, to have built a sustainable funding model in this space speaks to the resilience of the small business sector in our country despite all the macro negativity. Our research shows that 80 per cent of these businesses would struggle to access loans through traditional banks, therefore we are stimulating the part of the market that needs it most.

Miguel Da Silva, managing executive at Retail Capital, comments: “This remarkable achievement underscores iKhokha’s extraordinary resilience and commitment to empowering small businesses.

“The accomplishment not only fuels economic growth, but also highlights the value of strong partnerships to provide vital support to entrepreneurs navigating funding challenges in a tough economic landscape.”

In addition to the impact iKhokha is making on the lives of its merchants, there have also been some structural shareholding changes made on the back of iKhokha’s significant growth over the last five years. This includes our shareholder decision to spin the business out of the Adumo group.

“iKhokha has become one of the market leaders in the South African SME payment space, and we believe that the business is better positioned for growth opportunities as a stand-alone business,” says Nic Smalle, MD of iKhokha shareholder Apis Partners.

TO HAVE BUILT A SUSTAINABLE FUNDING MODEL IN THIS SPACE SPEAKS TO THE RESILIENCE OF THE SMALL BUSINESS SECTOR IN OUR COUNTRY DESPITE ALL THE MACRO NEGATIVITY.

“Crossfin, Apis and IFC continue to back the vision of Matt Putman and his team based on their impressive track record.”

iKhokha’s SME-focused financial services platform empowers entrepreneurs to accept both in-person and online payments. The fintech also provides access to working capital and offers easy access to business management tools, including daily sales analytics and the ability to set sales targets and track sales performance.

Dean Sparrow, CEO of Crossfin Holdings, which has invested in iKhokha since its inception in 2012, agrees:

The underserved self-employed sector of South Africa plays a vital role in stimulating our economy and helping to bridge the unemployment gap. Their continued growth is fundamental if we want to see our economy grow. We will continue to help entrepreneurs and SMMEs believe in better business by investing in our SMME-focused financial services platform to expose more local businesses to the digital economy.

THE FINTECH ALSO PROVIDES ACCESS TO WORKING CAPITAL AND OFFERS EASY ACCESS TO BUSINESS MANAGEMENT TOOLS, INCLUDING DAILY SALES ANALYTICS AND THE ABILITY TO SET SALES TARGETS AND TRACK SALES PERFORMANCE.

Enterprise and supplier development holds pivotal significance within the Black Economic Empowerment strategies of numerous companies.

ITUMELENG MOGAKI asks some enterprise and supplier development heads about the criteria they prioritise when selecting suppliers

Many large companies have enterprise and supplier development (ESD) programmes, but for them to be successful and sustainable, says Larisha Naidoo, head of Anglo American’s enterprise development arm Zimele, they must be able to match what the company needs to procure with who can supply the necessary goods and services in any given community.

To make these links, businesses must have deliberate supply chain policies, practices and targets that focus on local procurement. Plus, there must be strong engagement with community businesses to appreciate the issues faced by small business owners and their abilities and skill sets.

“Once you align the community needs with the business imperatives, and corporate supply chains dovetail with development programmes, such as Zimele, you reach a point where supplier development both supports small, medium and micro enterprises and an organisation’s inclusive procurement imperatives,” explains Naidoo.

“It is also vital that these small businesses are created, nurtured and sustained to become valued participants in a supply chain,” she continues. “To create sustainable businesses, an ESD programme must focus equally on mentoring and coaching entrepreneurs, igniting partnerships that create market linkages and assisting with business loan funding.”

“WE LOOK FOR COMPANIES WITH LOCALLY PRODUCED PRODUCTS THAT CAN COMPLEMENT OUR EXISTING STORE OFFERING.” – MARK BANDI

small business head, says: “We always aim to delight customers with innovative products, so we look for companies with locally produced products that can complement our existing store offering. We also look for businesses with which we can develop house brands – those with their own manufacturing facilities whose production lines can accommodate additional products.”

Bandi says the attributes they look for to consider a company for their programme include a quality, innovative product, competitive pricing and sustainability measures, emphasising that those elements play a vital role. “Pick n Pay (PnP) has ambitious sustainability targets, including making all PnP-branded packaging recyclable or reusable by 2025 and reducing carbon emissions to become a net-zero business by 2050.”

Larisha Naidoo

Larisha Naidoo

Explaining what his company looks for when sourcing suppliers, Mark Bandi, Pick n Pay’s

Nothing is without challenges, and Bandi remarks that the most common pitfall PnP encounters when trying to build a database of suppliers is finding a business with products that have been tested for commercial viability with generated sales insights. “This insight is

important as it helps with sales forecasting for both the small business and the retailer.”

Bandi explains how PnP assesses the potential for long-term sustainability and growth within the companies it considers for ESD programmes.

“We initially assess demand for the product by strategically limiting it to a few of our stores. This approach enables us to assess their production capacity to determine the potential to supply and potential product growth for the future. It is very important that a business can grow sustainably with us; this means the supplier must successfully manage its supply capacity to meet current demand.”

Bandi adds that innovation is what sets many businesses apart from any other in the same industry and is a major contributor to developing a unique brand identity and building customer loyalty. “We encourage our suppliers to interact with customers more frequently as this will assist them in improving their products to remain relevant and keep up with ever-changing shopping trends.”

Naidoo says understanding the needs of small businesses will assist corporate South Africa to be impactful in their enterprise and supplier development initiatives.

“To go for impact, we need to understand and define the impact we need to achieve and the scale at which we need to do that, from training and integrating into value chains to investing in infrastructure systems to create jobs and partnering up with other entities to create influence,” Naidoo concludes.

“TO CREATE SUSTAINABLE BUSINESSES, AN ESD PROGRAMME MUST FOCUS EQUALLY ON MENTORING AND COACHING ENTREPRENEURS, IGNITING PARTNERSHIPS THAT CREATE MARKET LINKAGES AND ASSISTING WITH BUSINESS LOAN FUNDING.” – LARISHA NAIDOO