THE GLOBAL AFRICAN HYDROGEN SUMMIT

ORGANIC WASTE TO BIOGAS PLANTS SKILLS NEEDED TO DRIVE OUR ENERGY TRANSITION

THE BATTERY INDUSTRY

THE GLOBAL AFRICAN HYDROGEN SUMMIT

ORGANIC WASTE TO BIOGAS PLANTS SKILLS NEEDED TO DRIVE OUR ENERGY TRANSITION

THE BATTERY INDUSTRY

From hydrogen to biogas, skills to storage – how Africa is rewriting its energy story in the face of global challenges and local innovation.

BY

Picasso Headline,

A proud division of Arena Holdings (Pty) Ltd, Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

Editor: Anthony Sharpe

Content Manager: Raina Julies rainaj@picasso.co.za

Contributors: Trevor Crighton, Manie de Waal, Tiago Marques, Mark Tiepelt, Irshaad Wadvalla, Rodney Weidemann

Copy Editor: Brenda Bryden

Content Co-ordinator: Natasha Maneveldt

Online Editor: Stacey Visser vissers@businessmediamags.co.za

Head of Design: Jayne Macé-Ferguson

Senior Designer: Mfundo Archie Ndzo

Cover Image: [yourapechkin]/123RF.com

Project Manager: Gavin Payne GavinP@picasso.co.za +27 21 469 2477 | +27 74 031 9774

Sales: Merryl Klein

Production Editor: Shamiela Brenner

Advertising Co-ordinator: Johan Labuschagne

Subscriptions and Distribution: Fatima Dramat, fatimad@picasso.co.za

Printer: CTP Printers, Cape Town

MANAGEMENT

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt General Manager, Magazines: Jocelyne Bayer

It’s no secret that South Africa has abundant potential to generate renewable energy. If you don’t believe me, just go outside on one of these unseasonably warm late summer days we’ve been having and feel the breeze on your face.

What we have lacked until recently, however, is a co-ordinated effort to exploit this potential – and to establish a sound position for South Africa in the renewables value chain. The Cabinet’s recent approval of the South African Renewable Energy Masterplan thus represents an exciting step forward.

Electricity and Energy Deputy Minister Samantha Graham-Maré says that, crucially, the plan is the result of collaboration between civil society, industry role players, labour, government, independent power producers and others, making it holistically aligned with the whole renewable energy ecosystem.

One of the key things the plan addresses is developing the skills South Africa – and indeed most countries worldwide – need to drive our energy transition. From engineers

How the Global African Hydrogen Summit is helping accelerate Africa’s green energy revolution.

and data scientists to environmental impact assessors and welders, there are thousands of jobs that can be created should the various stakeholders across that ecosystem work together.

This is just one of the issues we address in this revamped, and thus inaugural, issue of Renewable Energy Solutions. We also check out the Global African Hydrogen Summit taking place in Windhoek later this year, the potential for biogas development in the country, how we can make those proliferating data centres of ours a bit more sustainable, what the evolution of the battery industry means for a country stocked with crucial minerals, how private trading is transforming the energy market, and just how we’re going to fund the Just Energy Partnership with Donald Trump having withdrawn funding.

If anything illustrates how you can’t plan for everything, it’s that last point. Nevertheless, it still helps to have a plan.

Anthony Sharpe Editor

How do we plug the gap left by America’s funding withdrawal?

The battery industry is transforming rapidly, driven by surging electric vehicle demand and falling costs.

A burgeoning private electricity market represents a step towards a sustainable and inclusive energy future. 26

Unpacking the disconnect between ashy ESG platforms and the real operational data businesses need.

Copyright: Picasso Headline. No portion of this magazine may be reproduced in any form without written consent of the publisher. The publisher is not responsible for unsolicited material. Renewable Energy Solutions is published by Picasso Headline. The opinions expressed are not necessarily those of Picasso Headline. All advertisements/ advertorials have been paid for and therefore do not carry any endorsement by the publisher.

Redirecting organic waste to biogas plants can facilitate sustainable waste management and generate clean energy.

Collaboration between government, industry and educational institutions is needed to drive our energy transition.

The Global African Hydrogen Summit is bringing together a variety of stakeholders to help accelerate Africa’s green energy revolution, writes TIAGO MARQUES , head of content – Africa for dmg events

Energy is at the heart of Africa’s growth story and the cornerstone of Africa’s economic transformation. By harnessing its abundant natural resources, Africa can power its future and sustain its long-term growth trajectory. For investors, the continent offers a unique opportunity to participate in building the infrastructure that will fuel Africa’s development and unlock new domestic, regional and global markets.

Africa is on the brink of an energy transformation that could help to meet the growing electricity demand of its 1.5 billion inhabitants. This transition aims to diversify the continent’s energy mix through the increased adoption of renewable energy, including solar, wind, geothermal, hydropower and nuclear. By increasing renewable energy production capacity and expanding renewable energy infrastructure, Africa can sustainably end energy poverty while unleashing green industrialisation at scale.

A key to fuelling Africa’s green industrial revolution is hydrogen – whether it be green hydrogen, produced by splitting water into hydrogen and oxygen using renewable electricity, pink hydrogen, produced by splitting water molecules using nuclear energy-powered electrolysis, blue hydrogen, produced from natural gas using a process that captures and stores the carbon dioxide produced as a byproduct, or naturally occurring white hydrogen. Africa has huge potential to become a leading player in hydrogen made from renewable and other natural resources.

The second edition of the Global African Hydrogen Summit runs from 9–11 September 2025 in Windhoek, Namibia. It falls under the of cial patronage and is hosted by the Government of Namibia, endorsed by the Ministry of Mines and Energy of Namibia, held in partnership with the Namibia Investment Promotion and Development Board, and supported by the Namibia Green Hydrogen Council and the Namibia Green Hydrogen Programme.

Boasting vast renewable energy resources, such as solar and wind, which can be harnessed for green hydrogen production, Namibia is positioned to become a key player in the global hydrogen economy. The country has initiated pilot projects and aims to develop large-scale hydrogen production to export to international markets.

Namibia is leading Africa’s transition to a low-carbon economy with up to five potential final investment decisions for green hydrogen projects set for 2025. Namibia highlights the vast potential from synthetic fuel production to equipment manufacturing, driving economic growth and cementing its role as a key player in the global energy transformation.

Welcoming over 1 500 global attendees, 700 delegates, 150 exhibitors and 125 speakers, the summit sits at the heart of Africa’s green industrialisation conversation – a leading platform with the power to convene global industry leaders annually in Namibia.

Held under the theme, “Ambition in Action: Fuelling Africa’s Green Industrial Revolution”, the Global African Hydrogen Summit aims to provide a continuity of leadership and dialogue to drive partnerships for, and critical investments and nancing into, bankable green energy and industrial projects of strategic and national importance across Africa.

The summit will host several leadership dialogues and high-level panels for industry leaders and key stakeholders to share critical insights and engage in positive open dialogue enabling countries, governments and businesses to successfully accelerate the momentum across the full spectrum of current and future energy systems with the purpose of investing today in Africa’s energy of tomorrow.

Following two extensive executive committee meetings, the strategic conference programme for this year’s Global African Hydrogen Summit will be announced shortly. Underpinned by six de ning pillars, the programme will shine a light on Africa’s foundational role in the evolving energy system and the role hydrogen and its derivatives will have in building green industries to shape a multifaceted global energy mix.

The dynamic format and structure of the summit harness a sense of community that is fully inclusive. These forums within the summit include:

• Masterclasses for learning.

• Strategic conference for strategic debate.

• High-level interministerial meetings for policy development.

• Leadership roundtables for bilateral signings.

• Project investment roundtables for project incubation.

• International exhibition to showcase product, facilitate meetings and recruitment.

• Youth programme for training.

• Innovation zone for technical capacity building.

• Awards for recognising excellence. Africa’s green energy developments don’t only address energy access, but also contribute to sustainable development, job creation and the ght against climate change. These initiatives position Africa as an emerging hub for renewable energy innovation.

AFRICA HAS HUGE POTENTIAL TO BECOME A LEADING PLAYER IN HYDROGEN MADE FROM RENEWABLE AND OTHER NATURAL RESOURCES.

Follow: Tiago Marques www.linkedin.com/in/tiago-marques-049a34b

The South African biogas industry has yet to reach its full potential, despite the country’s urgent need for sustainable and diversified energy solutions, writes MARK

TIEPELT , MD of Biogas Consulting SA

While solar photovoltaic (PV) and wind energy are widely recognised as key contributors to South Africa’s renewable energy mix, biogas remains largely overlooked. However, South Africa has signi cant potential for biogas development due to its largely untapped organic waste resources.

Many sectors, including agriculture, food processing, abattoirs and municipalities, generate substantial quantities of organic waste. Currently, much of this waste ends up in land lls or dumped into the environment. Redirecting these waste streams to biogas plants would not only facilitate sustainable waste management, but also generate renewable energy. Additionally, the anaerobic digestion process converts organic waste into high-quality organic fertiliser while mitigating carbon emissions by preventing methane from entering the atmosphere.

Despite these bene ts, fewer than 50 industrial-scale biogas plants have been developed in South Africa over the past 15–20 years. The slow development of the biogas sector can be attributed to several key challenges.

For biogas projects to be viable, they must offer attractive returns for investors, project developers and nanciers. However, these projects require high initial capital investment while yielding relatively low returns, with breakeven periods typically ranging from 5–10 years.

Unlike solar and wind projects, which have bene tted from South Africa’s Renewable Energy Independent Power Producer

Procurement Programme (REIPPPP), biogas has been largely excluded. The initial bid window of REIPPPP set a ceiling price of R0.90/kWh for biogas projects, higher than the average cost of generating a kWh of electricity from biogas. By contrast, the ceiling price for solar PV was set at R2.75/kWh, making these projects signi cantly more pro table.

Internationally, successful biogas industries have been supported by incentives such as preferential feed-in tariffs, grants and soft loans. However, no such nancial mechanisms exist in South Africa. Consequently, most biogas projects had to rely primarily on electricity sales for revenue. Given that the average cost of generating electricity from biogas is around R1.50/kWh currently, these projects struggle to compete with Eskom’s tariffs. Higher returns are possible when biogas energy replaces more expensive fuels such as diesel or LPG, but this is not always a viable option.

Moreover, unlike solar and wind energy, which have seen declining costs due to technological advancements, biogas plants remain capital-intensive, making them less attractive to investors.

Biogas projects have faced considerable challenges in achieving long-term operational and nancial success over the past two decades. Many projects were launched with tight pro tability margins, which became dif cult to sustain due to the steep learning curve faced by developers, leading to numerous project failures.

Since biogas technology is relatively new to South Africa, project developers initially

Basic biogas production stages

relied heavily on international expertise. Unfortunately, many overseas biogas technologies were not directly applicable to South African conditions, resulting in costly failures.

As a result, the high number of project failures has contributed to the perception of biogas as a high-risk investment. This has made securing funding increasingly dif cult, with investors demanding stronger guarantees of nancial returns and operational success before committing capital.

Beyond energy production, biogas provides several additional bene ts, including sustainable waste management, carbon mitigation and improved soil health through organic fertilisers. These advantages extend beyond individual projects and could signi cantly bene t the country. However, these bene ts are often overlooked in nancial evaluations and policy discussions, limiting direct support, incentives and funding opportunities.

South Africa’s policy framework for renewable energy has largely favoured solar and wind energy, leaving biogas without clear regulatory support. While biogas plants must comply with existing piped gas regulations, there is a distinct lack of regulations and guidelines speci cally developed for biogas.

The recent promulgation of the National Norms and Standards for the Treatment of Organic Waste has alleviated some regulatory challenges. However, the industry still faces lengthy and costly environmental approval processes. A more streamlined and supportive policy environment is needed to unlock the sector’s full potential.

Over the past two decades, biogas project developers have had to endure long, dif cult and costly learning curves. This often resulted in project failures and many developers shutting down. However, the lessons learned are now being incorporated into the planning, design, nancing and operation of new projects.

With increasing concerns over diminishing land ll space and inef cient waste management, biogas presents a sustainable solution for processing organic waste. Hazardous waste from agriculture (manure), food processing industries and municipalities (municipal solid waste and sludge from wastewater treatment works) can be sustainably processed and converted into energy. This prevents these waste streams from entering land lls or polluting the environment.

For many companies, organic waste disposal comes at a signi cant cost. Investing in a biogas plant allows them to convert waste into a revenue-generating asset, reducing disposal costs while producing electricity and organic fertiliser.

South Africa’s national grid faces ongoing challenges, including frequent load shedding and infrastructure failures. Biogas can provide a reliable and dispatchable source of electricity, reducing dependence on Eskom.

Unlike solar PV and wind, which depend on sunlight and wind availability, biogas can be stored and used to generate electricity as needed, particularly during peak demand periods. Diesel-generated electricity during power outages is costly, whereas biogas provides a more economical and sustainable alternative.

The most ef cient approach to achieving grid independence for projects with access to suf cient quantities of organic waste would be an integrated energy solution combining the grid, biogas, solar PV and wind and diesel generators, optimised with a smart electricity management system.

The agricultural sector can greatly bene t from biogas by converting farm waste into energy and fertiliser, promoting circular and sustainable farming practices. This reduces dependency on synthetic fertilisers and improves soil health.

A recent example is a biogas project currently being commissioned on a farm in northern KwaZulu-Natal. The farm faced frequent power outages due to failing electricity infrastructure and load shedding, which would ultimately threaten their very existence. The farm initially invested in a 350kW solar PV plant but soon realised that solar alone could not provide full grid independence. Exploring biogas, they

Biogas plants prevent methane emissions, making them a valuable tool for reducing greenhouse gas emissions. Countries such as Germany, Denmark and China have recognised this benefit and provided strong financial incentives to develop their biogas sectors.

South Africa has the opportunity to support the development of a large-scale biogas sector as a direct strategy to achieve its carbon mitigation goals. This could be achieved by introducing grants, incentives, rebates and other forms of support for biogas projects.

realised a biogas plant presented them with the opportunity to generate suf cient dispatchable electricity to supplement the solar plant to achieve true grid independence. They could utilise the manure from their piggery, combined with additional organic waste on the farm, as the necessary feedstock for the plant, with the added bene t that these waste streams would be converted into high-value organic fertiliser.

The direct result of developing a biogas project on this farm ultimately ensured a large commercial farming operation remains productive and continues to contribute to the food security of the country, while also ensuring the continued employment of a workforce of more than 200 people.

The biogas industry in South Africa is still in its infancy but holds immense potential for companies, farming operations, municipalities and the country. The industry has undergone a steep learning curve to adapt to local conditions, but most of the challenges faced in the past have now been addressed. As a result, new biogas projects are being developed that meet stakeholder expectations for ef cient waste management, grid independence and attractive returns on investment.

However, continued support from the government, regulators and nancial institutions is essential to create a conducive environment for developers and investors alike.

Follow: Mark Tiepelt www.linkedin.com/in/mark-tiepelt-62544424

Collaboration between government, industry and educational institutions is needed to identify and impart the skills required to drive South Africa’s energy transition, writes ANTHONY SHARPE

South Africa faces energy and employment crises, both exacerbated by a lack of skills to facilitate our energy transition and employ people in this crucial sector. This skills shortage is not unique to the country – multinational corporations worldwide struggle to nd engineers and technicians to build and maintain renewable energy installations, while smaller companies need renewables specialists and auditors to help them incorporate more sustainable energy sources into their operations.

However, the situation in our country requires urgent intervention from government, the private sector and educational institutions to stem the rising tide of unemployment and prevent us from being left behind as the world transitions to greener energy.

The good news is that programmes are in place to develop the higher-level skills, says Dr Sean Kruger, senior lecturer at the University of Pretoria’s Centre for the Future of Work. “This includes skills such as hydrogen energy, energy cell engineering,

mechanical engineering, civil engineering and petrochemical engineering, which all feed into the greater energy ecosystem and are required to build and maintain renewable energy projects. Then, there are also business and project management, accounting and so forth.”

Dr Kruger says higher education is looking at how to develop green talent portfolios for graduates and upskilling those with existing degrees, with support from the Presidential Climate Commission. “We also have strong ties with Germany, the Netherlands and Norway, which all have green hydrogen initiatives.” South Africa’s abundant reserves of platinum – key to making green hydrogen viable – also means there is a high level of expertise in this eld, with a pipeline in place to develop the associated necessary skills.

A study of 18 400 universities across 196 countries by researchers at the Norwegian Institute of International Affairs found that 68 per cent of the world’s energy-related degrees remain focused on fossil fuels. The researchers suggested that universities that have for decades received financial support from governments and oil companies may be effectively locked into continuing to provide fossil fuel-focused education owing to their dependence on this funding – a trend that is more prevalent among public institutions than private ones.

The issue is that, while these skills are undoubtedly valuable, focusing solely on them does not re ect the realities of South Africa’s situation. “Our macroeconomic policies demonstrate a desire to move towards a knowledge economy,” says Dr Kruger. “Although we are moving in that direction, ours is not a knowledge economy; it’s a hybrid, with much of it being resource- and artisan-based.”

Dr Kruger says policies prioritising the development of skills geared towards a knowledge economy, including the scrapping of apprenticeship programmes in the 2000s, have led to people unable to participate in such an economy being left behind. While these skills are increasingly needed, not least to do the actual physical work required to drive our energy transition, they have become stigmatised – from the perspectives of both students and employers.

“Students see technical and vocational education and training (TVET) colleges as lesser institutions offering lesser quali cations, and graduates of these colleges are seen as lesser because they’re doing vocational work,” says Dr Kruger.

This leads us to our current disconnect, says Dr Kruger, who lists the top 10 vocational

“HIGHER EDUCATION IS LOOKING AT HOW TO DEVELOP GREEN TALENT PORTFOLIOS FOR GRADUATES AND UPSKILLING THOSE WITH EXISTING DEGREES, WITH SUPPORT FROM THE PRESIDENTIAL CLIMATE COMMISSION.” – DR SEAN KRUGER

In today’s interconnected and environmentally conscious world, carbon neutrality has evolved into a strategic asset rather than just a moral imperative. For South Africa’s freight industry – a vital pillar of the national economy – embracing environmental, social and governance principles is essential not only for regulatory compliance, but also to drive innovation and growth. By ANNELIE GOVENDER , CHRO and ESG lead at Vector Logistics

Investors and stakeholders are increasingly scrutinising companies on their sustainability commitments. Carbon neutrality now acts as a litmus test, re ecting a company’s long-term vision and resilience while opening up new revenue streams. Despite some criticisms that environmental, social and governance (ESG) initiatives impose additional costs or serve merely as box-ticking exercises, the transformative potential of these practices should not be underestimated. Companies that integrate carbon neutrality into their core operations are not just future-proo ng themselves, but also positioning their brands as leaders in a competitive market.

At Vector Logistics, our commitment to ESG is genuine and strategic. This year, we are proud to introduce our rst fully electric bumper-to-bumper trucks on South African roads, underscoring our dedication to reducing our environmental footprint. Our carbon roadmap sets an ambitious target: a 42 per cent reduction in carbon emissions by 2030 and net zero by 2050. Achieving this goal requires embracing advanced technologies and reimagining traditional logistics models. Globally, the push for decarbonisation is gaining momentum. The launch of the world’s rst carbon-neutral ship, for instance, highlights the innovative spirit permeating the shipping industry. In road freight, a dual

strategy is emerging that combines cleaner fuels and cutting-edge vehicle technologies with systemic changes such as optimised logistics and upgraded infrastructure to reduce emissions. This approach is particularly pertinent for South Africa where the freight sector is under growing pressure to mitigate its environmental impact.

However, the journey towards effective decarbonisation is not without its challenges. Research from McKinsey reveals that many organisations struggle to implement robust sustainability strategies. This gap creates a signi cant opportunity for innovative partners and third-party providers specialising in green logistics. Such collaborations can bridge the divide between lofty ambitions and tangible actions, ensuring decarbonisation efforts are both practical and impactful.

European shareholders and other global stakeholders are increasingly vocal about the need for sustainable practices, in uencing the strategic priorities of companies operating in emerging markets like South Africa. Their insistence on best practices in sustainability re ects an understanding that carbon neutrality is as much about risk management and value creation as it is about environmental stewardship.

Internally, our team’s enthusiasm for this transformative journey further reinforces our commitment. Recognising the potential of a clean energy transition, our employees are eager to be part of a future where pro tability aligns seamlessly with purpose.

Vector Logistics is one of South Africa’s leading cold chain logistics providers, specialising in temperature-controlled warehousing, distribution and end-to-end supply chain solutions. With a national footprint and partnerships with top food brands, it ensures the safe, seamless movement of goods from production to shelf. Driven by sustainability, Vector integrates cutting-edge technology and ESG-focused practices to reduce environmental impact, improve energy efficiency and minimise waste. Its expert teams and expansive network ensure fresh, safe produce reaches customers while advancing responsible supply chains.

South Africa’s freight industry stands at a unique crossroads. With a robust logistics network and strategic regional importance, the sector is ideally placed to lead a green revolution. By adopting cleaner fuels, leveraging digital technologies for optimised routing and fostering innovative partnerships, freight companies can secure a competitive edge while contributing to the global ght against climate change.

For more information: 031 275 4500 vectorcomms@vectorlog.com www.vectorlog.com

skills required as electrical wiring and circuitry, masonry and concrete work, HVAC installation and maintenance, heavy machinery operations, carpentry, roo ng, metal fabrication and welding. “All these plug into advancing agriculture, construction and roads. We want smart cities, but someone needs to build the roads for those cities, do the wiring and circuitry, and we don’t have enough skills on the ground to do that.”

While high-level and vocational hard skills are essential to drive our energy transition, so are soft skills. Simon van Wyk, director for sustainability, climate and equity at Deloitte Africa, believes while South Africa is relatively well equipped on the technical front, softer skills are lacking. “Project management, communication and adaptability are absolutely essential skills for any renewable energy projects to succeed.”

Van Wyk adds that industry engagement is necessary to ensure students are taught applicable skills. “We should bring industry members into the institutions to run curricula on certain hot topics. This will help our universities, technikons and colleges remain relevant, as opposed to using potentially outdated curricula because it’s challenging for these institutions to keep abreast of evolving technologies.”

Van Wyk says industry also needs to leverage the various available forums to share knowledge. “When it comes to generation or distribution in South Africa, you’re invariably dealing with a mix of state-owned enterprises and the private sector. Even independent power producers (IPPs) have to connect with state-owned utilities or municipalities. Say you install cutting-edge wind or solar technology in the Northern Cape, for example. If you have relevant skills at a provincial or municipal level, that can alleviate a lot of friction in the system.”

This sort of knowledge is needed to make renewable energy projects viable in the long term, says van Wyk as, while an IPP might handle the installation, if there are no skilled people to operate and maintain that asset, it tends to fail.

This is a sentiment echoed by Energy and Electricity Deputy Minister Samantha Graham-Maré. “In Limpopo, for example, there isn’t a single municipality that employs an electrical engineer. I understand there are very few such engineers working throughout

the other provinces, and those who do are normally with the metros. One of the reasons there are such issues with electrical infrastructure is that municipalities struggle to attract and keep the skills needed to manage these systems.”

A lack of consistency in the roll-out of renewable energy projects is also hurting skills retention, says Graham-Maré. “For example, there was a surge of activity leading up to Renewable Energy Independent Power Producer Procurement Programme bid window ve, but subsequently there has been no new wind procurement. Consequently, the South African Wind Energy Association says we have been losing people who have been upskilled locally to countries like Australia and Saudi Arabia because there is no work for them here.”

Graham-Maré says that government’s South African Renewable Energy Masterplan (SAREM) is focused on industrialising around renewable energy and developing manufacturing as part of the value chain. “We can’t do this if renewables are not regularly being rolled out. If we wish to build a proper value chain, there needs to be consistency in the roll-out.” This will create predictability around how much of each type of renewable energy will be developed in the coming years, and thus which skills will be required to enable this.

One initiative that hopes to address these issues is the PowerUp Platform, an initiative under SAREM.

“PowerUp is intended to be a hub of skills resources led by demand,” says Graham-Maré. “Businesses and municipalities feed their skills requirements into the system so educational institutions can develop programmes that meet these needs. Skills resource centres have been established countrywide using grant funding, but we want these to be co-ordinated through a central repository.”

To understand the impact of the energy transition on labour markets, the Brazilian National Observatory of Industry developed the Labor Market Foresight Model to predict future workforce needs in industry. The model focuses on identifying new and evolving professions and recommending technological and organisational advancements for training and modernisation in the next 5–10 years.

Through collaboration with industry and academic experts, six key skills for renewable energy workers were identified:

•Quality control analysis.

•Operational analysis.

•Reasoning and decision-making.

•Customer guidance.

•Critical thinking.

•Equipment selection. It also identified abstract abilities workers require to succeed in the evolving energy sector, including creativity, brainstorming, deductive reasoning, mathematical reasoning, leadership, result-oriented focus and analytical thinking.

Graham-Maré says PowerUp has partnered with the Energy and Water Sector Education Training Authority, for example, along with several TVET colleges, to develop training programmes for the practical skills needed to meet our renewable energy demands.

Dr Kruger believes PowerUp can have a positive impact if implemented correctly. “The big issue is not training just for training’s sake; let’s train so we can plug people into careers.”

“PROJECT MANAGEMENT, COMMUNICATION AND ADAPTABILITY ARE ABSOLUTELY ESSENTIAL SKILLS FOR ANY RENEWABLE ENERGY PROJECTS TO SUCCEED.” – SIMON VAN WYK

Follow: Dr Sean Kruger https://www.linkedin.com/in/krugersean

Simon van Wyk www.linkedin.com/in/simonvanwyk77

Samantha Graham-Maré https://x.com/samgrahammare?lang=en

Is America’s withdrawal of over R30-billion in support from South Africa’s Just Energy Transition Partnership a death knell for the country’s transition to greener power, asks TREVOR CRIGHTON

In February 2025, United States (US) President Donald Trump signed an executive order to revoke the United States International Climate Finance Plan, leading to its withdrawal from the Just Energy Transition (JET) Partnership with South Africa, and removed almost R35-billion in grants and commercial funding from South Africa’s JET funding pot.

The United States was one of the founding members of the initial International Partners Group, alongside the European Union, France, Germany and the United Kingdom, that launched the JET Partnership with South Africa on the sidelines of COP in Glasgow in 2021. South Africa subsequently formed the JET Investment Plan and attracted additional international partners Canada, Denmark, the Netherlands, Spain and Switzerland, as well as multilateral institutions such as the World Bank and African Development Bank.

Understanding JET Partnership funding

Jan van Heukelom, a retired associate of the Maastricht-based think tank European Centre for Development Policy Management, has studied South Africa’s energy transition with a special interest in the political economy of its electricity sector and the innovative Just Energy Transition Partnership between South Africa and its donor countries. “What fascinates me in this partnership is that it is a unique form of partnership between some of the biggest donors and a middle-income country around climate nance for a rather comprehensive programme of reforms, policies and measures to green the economy in a way that is fair and just to those communities likely to suffer most from such transition,” he says.

Van Heukelom says America’s withdrawal from the JET Partnership offers a good opportunity to re ect on the weaknesses and

“CO-OPERATION ON A JUST ENERGY TRANSITION HAS BEEN EXTENDED AND INVIGORATED WITH THE PRIVATE SECTOR AND CIVIL SOCIETY AND RECENTLY, THE DEPARTMENTAL LEADERSHIP, AND ELECTRICITY TRANSITION HAS BEEN STRENGTHENED.” –

JAN VAN HEUKELOM

HOW DO WE LEVERAGE AFRICA’S RENEWABLE RESOURCES AGAINST FINANCING THE TRANSITION?

“Africa must move beyond being a raw material exporter and integrate more value-added processing, such as local battery and green hydrogen production,” suggests Professor Roula Inglesi-Lotz of the University of Pretoria. “Countries should negotiate financing arrangements that prioritise local industrialisation, ensuring that renewable resources translate into long-term economic benefits rather than merely supplying external markets.”

South Africa is home to the largest chromite reserves in the world, with annual production measured in local and export sales, making up two-thirds of the world’s total production. Approximately 90 per cent of South Africa’s exports were imported by China, with a GlobalData study indicating that South Africa was the world’s seventh-largest producer of iron ore in 2023.

Speaking at the 2025 Mining Indaba in Cape Town earlier this year, Anglo American CEO Duncan Wanblad said the abundance of minerals required for the transition to low-carbon economies sit under African soil. He told the audience that this offers a major opportunity for Africa to participate – and not be left behind.

strengths of this multicountry partnership around climate nance for South Africa’s just energy transition. “The idea that the US can simply withdraw is an undeniable weakness. Ever since its inception, the JET Partnership has been criticised for its limited resources (an initial estimated R120-billion), the relatively small grant component, the short time horizon and – later – the slowness of spending, with few grants being spent on tangibles in the renewable energy environment or on social programmes.”

A major strength is that, despite heavy weather, the JET Partnership managed to survive and even expand. “On the donor side, more donors have come onboard and the funding commitment has expanded –until the United States’ withdrawal,” says van Heukelom. “On the government side, co-operation on a just energy transition has been extended and invigorated with the private sector and civil society and recently, the departmental leadership, and electricity transition has been strengthened.”

Professor Roula Inglesi-Lotz, leader of the Department of Economics in the Faculty of Economic and Management Sciences at the University of Pretoria, says that while the United States’ withdrawal represents a nancial and political setback, it is not catastrophic. “The impact will depend on whether other partners – European Union, United Kingdom, Germany and France, as well as development nance institutions –step in to ll the gap and whether South Africa can accelerate domestic nancing mechanisms.”

Van Heukelom says to fully appreciate the direction and potential of the JET Partnership, we need to delve a little deeper into the various money sources, the main nancing modalities or characteristics and their use or purpose. “Roughly speaking, the two main sources are public nancing (both South African government and partner countries) and private sector nancing. With South Africa highly indebted, private sector nancing is the most substantial component of nancing for scaling up renewable energy production in solar and wind farms, as well as for investments in the needed expansion of transmission lines, so this is crucial for the country’s energy transition.

“However, as critical as the public spending is for a host of other purposes – including experimentation, research, modelling,

project and policy preparation, community participation and dialogue, skills training, social programmes and more – a substantial part of that public spending derives from the South African budget. When we focus on external public nancing, these are the three aid modalities that matter: grants, concessional nance and technical assistance. Each of these aid modalities has its peculiarities, with different possibilities, constraints, purposes and nalities.”

Much of South Africa’s JET funding is structured as concessional loans, grants or development nance – and in seeking new investment, it is Prof Inglesi-Lotz’s opinion that grants are the most favourable as they do not add to the country’s debt burden. “However, concessional loans with low interest rates and long repayment terms can be viable if structured properly. The key is to optimise the mix: prioritising grants for socially critical investments while leveraging concessional loans and blended nance for infrastructure and market-driven projects.

“Diversifying funding sources means reducing dependence on a few international partners and expanding funding sources to include private sector investment, green bonds, carbon markets and domestic nancial institutions. A stronger role for the private sector and innovative mechanisms, such as sustainability-linked nance, would enhance resilience.”

In terms of local strategies which could be activated quickly – or more ef ciently – to minimise the sudden funding shortfall, Prof Inglesi-Lotz says that strategies such as South Africa’s Integrated Resource Plan, the Renewable Energy Independent Power

Government, through the Department of Environmental Affairs, set up a Green Fund in 2012 to support the JET with an initial allocation of R800-million.

Source: Department of Forestry, Fisheries and the Environment

South Africa is a beneficiary of over R8.1-billion in funding from the Green Climate Fund. This funding benefits nine projects and programmes, including:

•The Water Reuse Programme.

•The Climate Investor Two fund.

•Catalytic Capital for First Private Investment Fund for Adaptation Technologies in Developing Countries.

•Global Subnational Climate Fund

– Equity and Global Subnational Climate Fund – Technical Assistance Facility.

•Blue Action Fund: GCF Ecosystem-based Adaptation Programme in the Western Indian Ocean.

•Embedded Generation Investment Programme.

•The Development Bank of South Africa’s Climate Finance Facility.

•Transforming Financial Systems for Climate.

Source: Green Climate Fund

Producer Procurement Programme, the South African Renewable Energy Masterplan and Eskom’s Just Energy Transition plan already exist but require acceleration. “Quick wins include fast-tracking grid expansion, enabling municipal energy procurement and improving regulatory certainty to unlock private investment,” she says.

“DIVERSIFYING FUNDING SOURCES MEANS REDUCING DEPENDENCE ON A FEW INTERNATIONAL PARTNERS AND EXPANDING FUNDING SOURCES TO INCLUDE PRIVATE SECTOR INVESTMENT, GREEN BONDS, CARBON MARKETS AND DOMESTIC FINANCIAL INSTITUTIONS.”

PROFESSOR ROULA INGLESI-LOTZ

Follow: Jan van Heukelom www.linkedin.com/in/heukelomjvan Professor Roula Inglesi-Lotz www.linkedin.com/in/roula-inglesi-lotz-9201a6b

SAPPI SOUTHERN AFRICA is powering a greener future

We’ve always known the secret to growth: just ask the trees. Sun, rain and a little ingenuity turn saplings into forests and forests into the future. So when it comes to harnessing renewable energy, we don’t just talk about it; we grow with it.

In a landscape where energy uncertainty keeps us on our toes, we’ve turned inward, tapping into smart solutions that fuel not just our operations, but also South Africa’s broader energy transition.

Through strategic investments in clean energy, Sappi is demonstrating how business can drive positive change, helping secure energy stability while advancing environmental and social sustainability goals.

Committed to a just energy transition (JET), Sappi ensures its approach aligns with economic growth and responsible energy use, supporting South Africa’s long-term sustainability ambitions.

One of Sappi’s agship renewable energy projects is its 30 per cent stake in Ngodwana Energy, a 25MW biomass energy plant that has been operational since March 2022. This cutting-edge facility leverages biomass recovered from surrounding plantations and screened waste material from the Ngodwana Mill, producing steam to drive a turbine and generate electricity for the national grid.

By burning up to 35 tonnes of biomass per hour, the plant exempli es circular economy principles: using resources ef ciently while reducing waste. Importantly, all biomass utilised comes from certi ed sustainable sources, ensuring alignment with the principles of the Forest Stewardship Council (FSC) and the Programme for the Endorsement of Forest Certi cation (PEFC).

Recognising the potential of solar energy, Sappi has installed 1 076 photovoltaic (PV) panels at three of its commercial nurseries – Clan, Richmond and Escarpment. These panels generate an impressive 965 000kWh annually, signi cantly reducing dependence on grid power and enhancing sustainability.

At Ngodwana Nursery, an additional 216 thermal panels heat a 300 000-litre insulated reservoir, supplying 50°C water to rooting structures. This zero-carbon solution improves seedling development while reducing reliance on fossil-based fuels such as coal or LPG gas.

Sappi’s dedication to energy ef ciency goes beyond technology; it is deeply rooted in social responsibility. In South Africa, the JET Investment Plan provides a roadmap to decarbonising the economy while ensuring fairness for communities affected by the shift away from fossil fuels.

To support this mission, Sappi collaborates with the National Business Initiative Just Energy Transition Skills for Employment Programme, equipping local workers, particularly women and youth, with renewable energy sector skills. This ensures that economic development and environmental goals are interconnected, fostering long-term sustainability.

ITS

Sappi’s renewable energy expansion took a signi cant leap in May 2024, when it signed a 175GWh per annum Power Purchase Agreement with Enpower Trading. As one of South Africa’s rst private electricity trading companies, Enpower Trading will provide Sappi with renewable power for the next ve years.

The agreement will source power from SolarAfrica Energy’s Sun Central PV project, a 1GW solar farm in the Northern Cape, reducing emissions by six per cent. This milestone marks a groundbreaking shift, setting the stage for utility-scale renewable power solutions in South Africa.

Across its operations, Sappi is deeply committed to climate-smart solutions. Saiccor Mill has reduced its coal and heavy fuel oil consumption by 14.9 per cent year-on-year and 48.9 per cent over ve years, demonstrating continuous improvements in energy ef ciency.

Additionally, Sappi’s partnership in the R80-million Mkomazi Alien Fuels biomass pellet manufacturing plant will

COMMITTED TO A JUST ENERGY TRANSITION, SAPPI ENSURES ITS APPROACH ALIGNS WITH ECONOMIC GROWTH AND RESPONSIBLE ENERGY USE, SUPPORTING SOUTH AFRICA’S LONG-TERM SUSTAINABILITY AMBITIONS.

divert 57 000 tonnes of land ll waste annually, avoiding 322 000 tonnes of CO2 emissions over 10 years. The project will create 68 full-time and 49 part-time jobs, boosting the local economy and reducing environmental impact.

FUTURE-PROOFING SAPPI’S SUSTAINABILITY STRATEGY

Sappi isn’t just adapting to a changing energy landscape; it’s rede ning it. With more than half of its energy already coming from renewable sources, Sappi is proving that sustainability isn’t a check-box exercise; it’s a mindset.

From sun-powered nurseries to biomass-fuelled mills, Sappi is turning nature’s gifts into smart solutions that power not just its operations, but a broader shift towards energy resilience. And, while the road ahead isn’t always smooth, one thing is certain: Sappi will keep pushing, innovating and reimagining a future where sustainability isn’t just the way forward; it’s the only way.

The global battery industry is undergoing rapid transformation, driven by surging electric vehicle demand and falling battery costs.

RODNEY WEIDEMANN finds out what this means for South Africa

Despite the troubles electric vehicle (EV) manufacturer Tesla is experiencing, demand for these cars more generally has been surging in recent months, largely driven by the global battery industry’s rapid transformation and falling battery costs.

Last year it was reported that battery demand exceeded one terawatt-hour, with prices dropping below R1 951 per kilowatt-hour (kWh), demonstrating the increasing cost competitiveness of EVs compared with conventional internal combustion engine (ICE) vehicles.

Lance Dickerson, MD of REVOV SA, says battery costs have been declining due to technological advancements and economies of scale. Innovations in battery chemistry, such as higher energy density designs, have improved ef ciency while reducing material costs.

Additionally, the fall in raw material prices, particularly lithium and cobalt, has contributed signi cantly to cost reductions. Manufacturing processes have also become more streamlined with cell-to-pack designs eliminating unnecessary components, further driving down costs.

“Demand from both the stationary storage and EV sectors has played a crucial role in driving growth, with production volumes increasing steadily,” says Dickerson. “As the market expands, more cell and pack manufacturers are entering the

industry, further accelerating supply chain development and ef ciency.”

Lower battery costs are a game-changer for EV adoption, continues Dickerson. Battery prices are expected to approach R1 560/kWh by 2026, meaning EVs will achieve cost parity with gasoline-fuelled cars, making them more accessible to consumers. “This will accelerate the transition to electric mobility, particularly in markets where affordability has been a barrier. A lower price point also allows the adoption of larger packs and the resultant longer distances between charges, helping to reduce the range anxiety that is still very prevalent.”

The International Energy Agency reports that China produces more than three-quarters of batteries sold globally. Moreover, in 2024, average prices fell by nearly 30 per cent –faster there than anywhere else in the world. Declining battery prices in recent years are a major reason why many EVs in China are now cheaper than their ICE counterparts.

Dickerson notes that China’s supply of such a large percentage of global batteries creates supply chain vulnerabilities. This concentration poses risks such as geopolitical instability, trade restrictions and price manipulation. Diversifying production across multiple regions would enhance supply security, reduce dependency and promote competitive innovation.

The Department of Trade, Industry and Commerce notes that South Africa needs to develop performance and safety testing and certification capabilities as it is currently not possible to certify electric vehicle batteries manufactured in the domestic market for export to the European Union, the United Kingdom or the United States.

Source: Department of Trade, Industry and Competition

However, while it’s important to diversify production, it’s also essential to ensure such production is standardised. “Standardisation is critical for the battery industry,” adds Dickerson. “It enables interoperability, reduces costs and simpli es recycling. A uni ed approach to battery design would make second-life applications more viable, allowing batteries to be repurposed ef ciently. Additionally, standardisation would accelerate mass production, bene tting both manufacturers and consumers.

“There are drawbacks to standardisation as it can potentially slow development. However, this is unlikely in the battery sector as American manufacturers are expected to strongly resist adopting Chinese standards. Additionally, several European factories are currently in development, which will gradually reduce China’s seventy- ve per cent share of global production.”

André Lourens, economist at the Minerals Council South Africa (MCSA), explains that South Africa produces some, but not all, the minerals used in EV batteries. While we mine

Chinese electric vehicle manufacturer BYD recently announced a breakthrough that allows its new batteries to charge in just 5 minutes, adding 400km of driving range.

Source: CarbonCredits.com

manganese, some copper, cobalt and nickel, we do not mine lithium. These minerals form part of an EV battery, but graphite, aluminium, steel and nickel make up approximately 75 per cent of a standard lithium-ion battery’s content.

“South Africa extracts or obtains as byproducts only about thirty-six per cent of the raw materials used in these batteries,” says Lourens. “However, these minerals require highly sophisticated re ning and processing before they can be used in battery production. Nickel and cobalt, for example, are byproducts of platinum group metals mining.

“Currently, South Africa lacks the high-level re ning capacity needed for EV battery production, with most processing taking place abroad. This underscores a key opportunity in mineral exploration.”

Signi cant investment is needed to discover new deposits, says Lourens, including the potential for lithium reserves. Given the expected sustained demand for EVs and energy storage, expanding exploration efforts is a strategic priority for South Africa. “Beyond mining, battery assembly represents another opportunity. While full-scale manufacturing is currently unfeasible, due to the lack of local re ning and other constraints, there is rising domestic demand for lithium-ion and solid-state batteries.

“The growth of South Africa’s EV market, the urgent need for large-scale battery storage amid Eskom’s energy challenges and demand for lithium solar batteries all strengthen the case for establishing local battery assembly. By leveraging the minerals South Africa already produces and by importing re ned components, South Africa can position itself within the global battery assembly value chain.”

Dickerson agrees, suggesting South Africa should pursue mineral bene ciation by producing batteries. Processing raw minerals into higher-value battery components would boost revenue, create skilled jobs and enhance the local supply chain. “With the necessary resources and expertise, the country is well-positioned to establish a competitive battery manufacturing industry, reducing dependence on imports. Government support and incentives will be crucial in driving this

transition, ensuring sustainable growth and global competitiveness,” he says.

However, the MCSA cautions that South Africa is not positioned to compete with countries like China in mineral bene ciation and processing. We lack a comparative advantage in this area due to several factors:

• High electricity tariffs: costs have risen by over 700 per cent in the past two decades, making energy-intensive processing uncompetitive.

• Expensive capital: high borrowing costs/cost of capital make investment in capital-intensive bene ciation less pro table.

• Labour costs: South Africa has relatively high labour costs compared to key competitors.

• Logistical challenges: inef ciencies in transport and infrastructure add to costs and delays.

• Dependence on costly chemical imports: many essential chemical inputs for processing are expensive and sourced from abroad.

“These factors signi cantly weaken South Africa’s global competitiveness, making large-scale bene ciation economically unviable,” says Lourens.

Lourens says developing a manufacturing or industrial base in South Africa to convert the country’s minerals into saleable products needs an alignment of investor-friendly regulations and policies and co-ordination and agreement between government departments and agencies to support industrial hubs.

“The MCSA encourages a market-driven process to develop bene ciation in South Africa, rather than any imposition of export tariffs or restrictions on mineral exports, to force the creation of bene ciation processes.

“The rst step is to encourage and attract investors in the exploration for critical minerals and others needed for evolving

Government policy plays a pivotal role in shaping the electric vehicle (EV) battery industry. Policies should focus on:

•Incentives for local manufacturing to reduce reliance on imports.

•Investment in charging infrastructure to support widespread EV adoption.

•Regulations for sustainable mining of battery minerals.

•Support for research and development to drive innovation.

battery technologies. South Africa’s moribund exploration sector needs urgent revitalisation and regulatory clarity and certainty to improve sentiment to attract local and international investors.”

This, he adds, requires a consistent and cost-competitive supply of electricity, preferably from renewable energy sources, and tax incentives to encourage the development of a battery manufacturing industry from scratch that can compete with established manufacturers. “South African mining needs the fundamentals of investor-friendly regulations, a modern rights processing system, a functional and ef cient regulator and alignment of government departments in the timely processing mineral right applications, if we are to truly participate in the global critical minerals market.”

As for the future of the EV battery market in South Africa, Dickerson believes the local EV battery market will expand rapidly over the next few years. “Among the key trends to look for will be an increase in local battery production initiatives, reducing dependency on imports, growing EV adoption, driven by government incentives and falling battery costs and investment in battery storage solutions, supporting renewable energy integration,” he concludes.

“WITH THE NECESSARY RESOURCES AND EXPERTISE, THE COUNTRY IS WELL-POSITIONED TO ESTABLISH A COMPETITIVE BATTERY MANUFACTURING INDUSTRY, REDUCING DEPENDENCE ON IMPORTS.” – LANCE DICKERSON

Follow: Lance Dickerson www.linkedin.com/in/lance-dickerson-9663b01

André Lourens www.linkedin.com/in/andré-lourens-697311146

A burgeoning private electricity market represents a step towards a sustainable and inclusive energy future, writes IRSHAAD WADVALLA , head of sustainability at Equites Property Fund Limited

South Africa’s energy landscape is undergoing a transformative shift, driven by the urgent need for reliable and sustainable energy amid ongoing power shortages and rising electricity costs. The opening of municipal grids to allow for private electricity trading represents a crucial evolution that could radically reshape how energy is produced, distributed and consumed.

Key legislative reforms have laid the foundation for this transition towards a more decentralised and inclusive energy future. Major change came in August 2021 with the amendment of Schedule 2 of the Electricity Regulation Act 2006, which increased the threshold for embedded generation without requiring a licence from 1MW to 100MW. This enabled businesses, mines and industrial users to invest in more significant self-generation and private energy trading with fewer regulatory hurdles.

Further reforms took place in 2022 when municipalities were permitted to procure energy from independent power producers, opening the door for localised energy markets. Municipal feed-in tariffs for small-scale embedded generation, particularly rooftop solar, emerged, allowing individuals to feed excess electricity back into local grids. It has been reported that the City of Cape Town’s Cash for Power Programme has paid out more than R50-million to businesses and households since 2022 under this initiative.

Additionally, the Electricity Regulation Amendment Act 38 of 2024 paved the way for a more competitive electricity market by facilitating the unbundling of Eskom, encouraging private

sector participation and allowing for a National Transmission System Operator to oversee democratised access to the grid.

The City of Cape Town took strides by opening its grid to energy traders in March 2025, following a year-long wheeling pilot project. Equites Property Fund Limited, a market leader in logistics development and an award winner in sustainability practices, was one of three participants in this pilot and remains a partner to the city in this ongoing initiative. Other municipalities implementing similar models include George Municipality and Nelson Mandela Bay.

A ministerial determination under the Electricity Regulation Act 2006 in March 2025 now provides private sector participation in building transmission infrastructure in key corridors, further stimulating the independent electricity market.

Although a somewhat novel framework locally, several other countries offer valuable lessons. Chile liberalised its energy sector in the 1980s and has a mature solar market wherein private generators trade electricity with consumers.

Germany’s Energiewende programme aimed to transform its energy mix by supporting private power producers. Through power purchase agreements, decentralised trading models empowered consumers to become “prosumers”.

Australia has also embraced private trading using virtual power plants, where rooftop solar and battery systems are aggregated and traded on energy markets. In the United Kingdom, regulatory frameworks have allowed small generators and consumers to trade electricity in real-time using smart grids and smart metering technology.

By encouraging private electricity trading and minimising barriers to entry, for example, through lower use-of-system charges and subsidised grid access, municipalities can stimulate wider participation. Increased investment in renewable energy technologies could create new job opportunities in installation and maintenance, while a more competitive energy market may lower energy costs. With the decentralised nature of private trading, power outages and disruptions can also be minimised, creating a more resilient energy system.

A significant social benefit is the potential for increased access to affordable energy in marginalised communities. Rural areas, townships and informal settlements could also generate their own electricity and participate in local energy markets, driving economic inclusion.

Another aspect is that businesses increasingly have to control their carbon emissions. The wheeling model enables offtakers without the necessary infrastructure to use renewable energy, helping them meet their sustainability goals.

Private electricity trading and open municipal grids represent more than just an energy reform – they are instruments of economic empowerment, sustainability and resilience. Enabled by recent legislative breakthroughs and inspired by global best practices, South Africa is poised to transition from a centralised, monopolistic model to a more dynamic, diversified and decentralised energy future. With continued policy momentum and collaborative governance, this model holds the key to powering South Africa’s next phase of growth – one that is cleaner, fairer and far more inclusive.

ELECTRICITY TRADING AND OPEN MUNICIPAL GRIDS REPRESENT MORE THAN JUST AN ENERGY REFORM – THEY ARE INSTRUMENTS OF ECONOMIC EMPOWERMENT, SUSTAINABILITY AND RESILIENCE.

Data is the buzzword, and the graphs look great. However, do you trust the numbers enough to act?

By MANIE DE WAAL , CEO of Energy Partners

Without data, environmental, social and governance (ESG) reporting, sustainability strategies, investor disclosures and regulatory reports are built on shaky ground. While ESG platforms promise real-time insights and automated reporting, many companies still nd the results underwhelming. The real challenge isn’t the platform; it’s the actual data or the lack thereof.

Many South African companies have invested in local or international ESG platforms that look impressive, but they all assume you already have the data. They assume your operations are metered, your measurements accurate and your systems integrated. For many South African businesses, even the largest corporates, this level of data readiness is not the case.

Accurate ESG reporting relies on comprehensive, reliable and granular operational date from individual equipment to site-level reporting and ultimately to consolidated enterprise and group-level reporting.

Rather than starting with the platform, companies should ask: do we have the right data infrastructure in place?

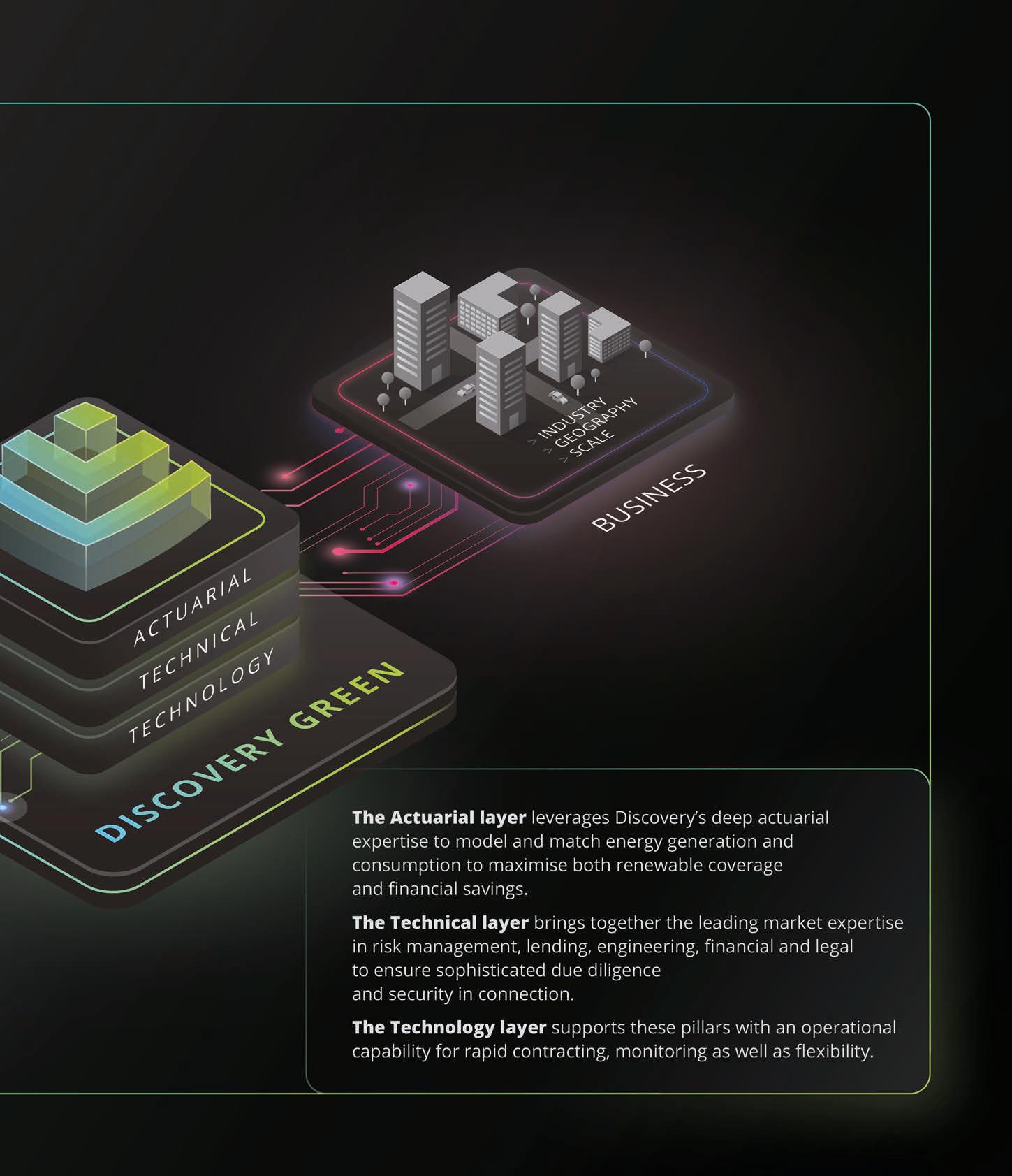

Discovery Green is revolutionising renewable energy procurement for South African businesses. By converting 90 per cent of a business’s electricity demand into affordable, price-certain green energy, we provide complete certainty for executives transitioning their organisations to renewable energy. Powered by South Africa’s largest wind and solar plants, our products maximise financial savings and minimise business emissions, taking care of all your business energy needs in a single, simple transaction. We combine 30 years of Discovery’s actuarial expertise with energy wheeling to maximise financial savings and minimise emissions – our solution will protect your business while fostering a sustainable future. Our mission is to make South Africa a global leader in renewable energy and create employment and investment opportunities.

https://www.discoverygreen.co.za/portal/dgr/home

Yet many companies still lack basic metering for electricity, water, fuel and waste. Site-level data is either missing, estimated or fragmented across systems.

The consequences are signi cant. At worst, incomplete or estimated data means sustainability claims cannot be properly substantiated, leading to regulatory penalties, shareholder action and reputational damage, possibly even accusations of greenwashing. At best, poor data quality means missed opportunities, where companies are unable to identify inef ciencies, reduce resource use or drive operational improvements.

In both cases, the costs are real and rising, with companies facing increasing pressure from investors, regulators and customers to demonstrate credible ESG performance as disclosure expectations climb.

It’s time for businesses to rethink their approach. Engage with data platforms like Syntiro from Energy Partners, which combine boots-on-the-ground metering expertise with an integrated ESG platform designed for roll-up data architecture and seamless reporting. Prioritise getting the physical infrastructure right to capture accurate, site-level data before layering on digital tools to manage and report it.

This requires:

• Auditing facilities to identify existing metering capabilities and gaps.

• Installing and calibrating meters for electricity, water, steam, gas and waste streams.

• Ensuring systems deliver real-time, granular data from site level up.

• Integrating these veri ed inputs into a platform that supports aligned, audit-ready reporting.

The payoff for working with real, measured data is profound. Companies gain granular insights that expose inef ciencies, drive resource optimisation and cut emissions and costs, while also enabling credible reporting aligned with leading standards.

Getting ESG reporting right is no longer just about managing compliance. It’s about investing in accurate, granular data that not only better equips one to meet evolving disclosure requirements, but also reduces operational risks, cuts inef ciencies, unlocks access to capital and sharpens the competitive edge.

The companies that succeed are those with the strongest data infrastructure foundations. That journey starts on the ground, not in the cloud.

PUBLISHER