THE PACKAGING INDUSTRY

Management buyout signals new chapter

Nampak Liquid Cartons deal unlocks significant value and growth potential, writes Lynette Dicey

RMB Corvest and its partner, Dlondlobala Capital, have successfully facilitated a management buyout of Nampak Liquid Cartons, marking a new era for the business.

The division, which includes operations in SA, Zambia and Malawi, will now operate as a standalone, privately owned entity under the name Diversified Liquid Packaging Group (Pty) Ltd (DLP Group). The current management and staff have been retained, ensuring continuity and stability.

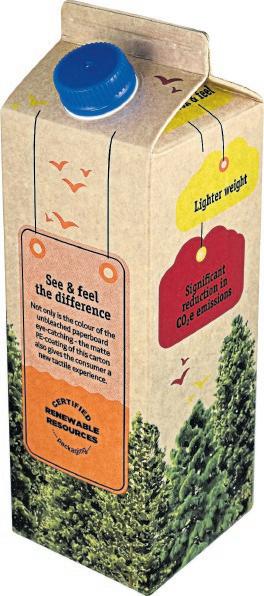

The DLP Group offers a fully integrated packaging solution, including filling equipment and technical services to improve packaging efficiencies for clients. The business strives to provide cost-effective, environmentally friendly solutions.

According to Menzi Khoza, executive at RMB Corvest, the investment was particularly appealing due to the strong management team leading the buyout.

We re excited that the business is predominantly a paper packaging manufacturer, offering more sustainable, environmentally friendly packaging in line with consumer expectations, he says.

RMB-Corvest backed management buy-outs enjoy a high success rate. Melanie Pillay, an executive at RMB Corvest, says the team is confident the transaction will achieve steady growth with good returns.

Derek Perryman, shareholder and group CEO of the DLP Group, says the management buyout is an opportunity to drive a well-positioned business

with a good client base that can thrive as a smaller standalone privately owned group.

“We believe we can continue to grow the business, but also further consolidate our position outside SA, he says.

Fundiswa Roji-Nodolo, CEO of Dlondlobala Capital, says the deal unlocks significant value and growth potential, especially given the business s current blue chip customer base.

Offering a cost-effective and customer focused approach, DLP Group provides manufacturing, technical services and equipment maintenance. The shift to a standalone, privately owned group has streamlined decision-making for the

Local industry striving to align with EU regulations

The European Union’s Packaging and Packaging Waste Regulation (PPWR) is more than just a new set of rules; it’s a global wake-up call for the plastics industry. The regulations, which came into effect in February 2025, have created significant ripple effects for countries that export to the EU, including SA.

The new mandates are pushing for a circular economy, where plastic is seen as a valuable resource to be reused and recycled, rather than a single-use product destined for a landfill. For SA s plastics and packaging sectors, this presents both challenges and an opportunity to lead in sustainable innovation and secure their place in the international market.

The PPWR mandates that all packaging must be recyclable by design and in practice by 2030. Fortunately, many South African packaging manufacturers, especially those with an eye on export, are already well on their way to meeting these standards.

Anton Hanekom, executive director at Plastics SA, says the local industry has made positive strides in designing for recyclability with designers, brand owners and retailers now consciously creating products with their end-oflife in mind. Significant investments in technology and infrastructure are allowing South African companies to successfully export plastic packaging that complies with global standards. This proactive engagement is not just about

Achieving a truly circular economy requires concerted collaboration

meeting a deadline, it's about building a more sustainable and competitive industry from the ground up.

A core component of the new regulations is the gradual increase of post-consumer recycled (PCR) content in plastic packaging. SA has made progress here, particularly with PET bottles, which are already being successfully recycled back into new bottles, trays and punnets for food contact. However, scaling up the production of foodgrade PCR and expanding recycling capabilities remains a challenge. Scaling up, says Hanekom, requires further investment in research and development (R&D) to broaden the use of PCR across various packaging types. This isn t just a technical hurdle; it s an economic one which also requires a fundamental shift in how waste is collected and processed, ensuring that highquality, recyclable materials are consistently available for manufacturers.

A significant challenge for SA, distinct from its European counterparts, is the state of its waste management system.

Having packaging that is 100% recyclable is useless if it's not collected,” says Hanekom.

While European nations often have efficient curbside collection and waste-to-energy programmes, SA has a manual collection and mechanical recycling system, which also creates much-needed jobs. This different context means that advocacy is key.

Plastics SA is engaging with government bodies to improve waste management infrastructure and collection services, recognising that a well-functioning system is the backbone of any circular economy. Without it, even the most innovative recyclable designs will end up in a landfill, undermining all other sustainability efforts,” says Hanekom.

The PPWR also introduces eco-modulated extended producer responsibility (EPR) fees, a polluter pays model that financially rewards sustainable design and penalises noncompliance. SA’s own EPR system is already beginning to show its benefits. Under this system, producer responsibility organisations (PROs) manage funds to enhance collection and recycling efforts.

Hanekom says EPR has led to an increase in recycling and has grown consumer awareness. Its financial mechanism acts as a driver for change, encouraging producers to invest in better design and more recycled content. It aligns economic interests with environmental goals, creating a win-win scenario where both profitability and sustainability can coexist.

Both the EU’s PPWR and SA’s EPR regulations are driving innovation and the development of circular economy solutions.

Achieving a truly circular economy requires concerted collaboration among industry bodies, government and academia. By working together, they can accelerate progress and position SA not just as a compliant partner, but as a leader in sustainable packaging solutions. If SA can use this moment to lead the way in advanced recycling technologies, mono-material packaging and recyclable designs it will forge a more sustainable and prosperous future, says Hanekom.

group, removing unnecessary layers or bottlenecks and enabling quicker response times. Perryman says this structure allows the company to focus on its core business.

The first year of the buyout, he says, has been focused on building a strong foundation emphasising four principal business pillars including building a team based on respect, recognition and teamwork; clearing clutter in finance, IT and operations to improve efficiency; concentrating on core products, suppliers and customers; and striving to be a lean and efficient manufacturer.

While the South African market remains extremely fragile with declining volumes, Perryman says the company s cross-border markets in Zambia and Malawi have seen an increase in volumes, offsetting the local decline. He believes the packaging sector, which responds quickly to positive sentiment, is an ideal area for investment.

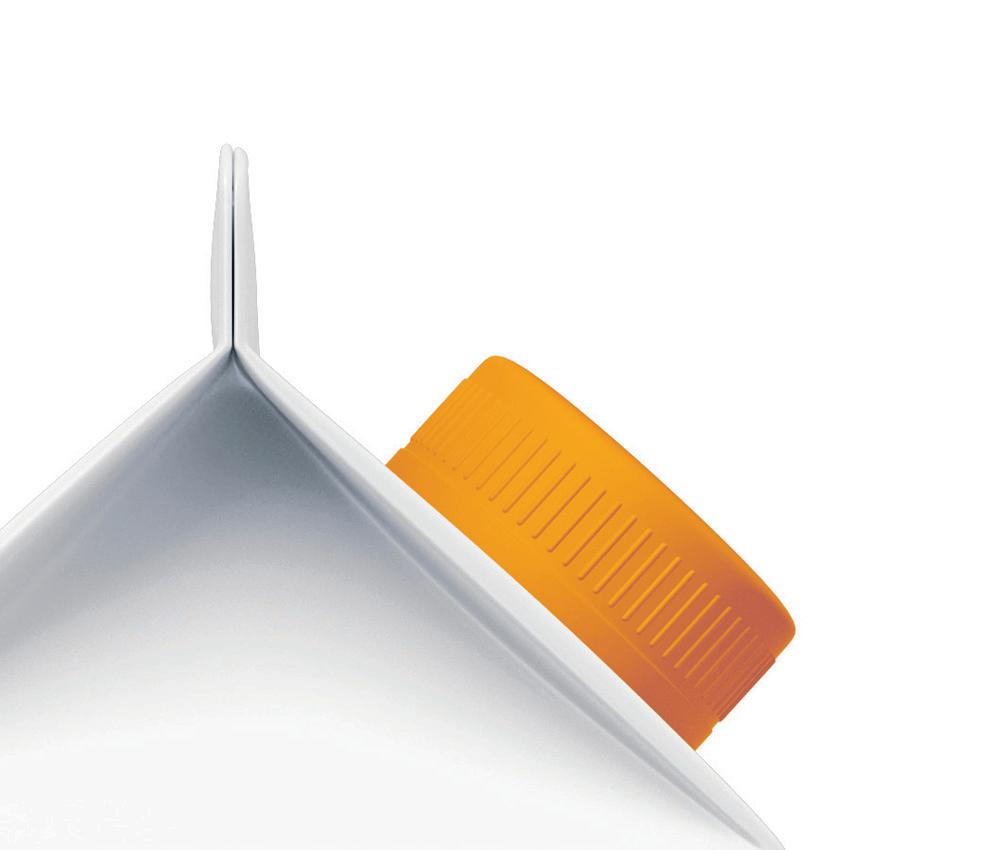

DLP Group s paper packaging is a key competitive advantage. Supplied in flat form and taking up little space, it benefits customers in terms of distribution, storage and cost.

Cartons are an almost perfect packaging medium. We estimate that it would take nine times as many trucks to deliver the same quantity of blown 500ml bottles as it would 500ml gabletop cartons. This significantly reduces the carbon footprint, making it a more environmentally friendly solution, says Perryman.

The company s commitment to sustainability extends to its active membership in Fibre Circle, a

producer responsibility organisation for the paper and packaging sector. Through this membership, the DLP Group has contributed to projects that use recycled cartons for new purposes, such as roofing for animal shelters and materials for pit latrines at rural schools. Innovation is a constant focus, driven by technology, consumer demands and customer needs. Perryman says that while price reduction is a key driver, other factors such as stronger, lighter materials, tamper-evident features and ergonomics are also important. The group’s integrated packaging solutions provide a one-stop shop for customers, ensuring smooth operations and a competitive edge.

Bespoke conical carton

The business has developed a bespoke conical carton for traditional beer, producing more than 20-billion cartons at the last count. The traditional beer conical carton is a good example of a fit-for-purpose pack, says Perryman, adding that once sealed the carton cannot be manipulated, ensuring consumer safety. Carton packaging, he says, is becoming increasingly popular in many industries, including the wine industry, with growing demand for ecofriendly, renewable packaging.

One of the biggest challenges facing the business locally is sluggish consumer spending as a result of a high unemployment rate. The business doesn t face the same challenge in its Zambian or Malawian market where volume is growing.

Paper packaging most popular choice, says survey

Paper-based packaging remains SA’s preferred sustainable packaging choice.

According to the Paper Manufacturers Association of SA (Pamsa), the South African findings of the 2025 Two Sides Trend Tracker a global survey on the print and paper industry reveals that consumers value paper-based packaging for its recyclability, biodegradability or compostability, lower environmental impact, affordability, safety and its ability to display clear product information.

The packaging sector is under pressure to reduce plastic waste and cut carbon footprints.

Paper-based packaging has emerged as a positive solution as it s made from renewable wood fibre from sustainably managed planted forests or recycled paper fibre.

Consumers rated packaging materials based on 15 environmental, visual and physical attributes. Glass was in second place, followed by plastic and metal standing, which were on equal footing.

In this year s survey, 64% of people said they prefer products ordered online to arrive in paper packaging, up from 58% in 2023. Additionally, 58% are actively taking steps to increase their use of paper packaging, while 80% expressed a preference for their online orders to be delivered in fit-for-size packaging.

“Right-sizing is not always possible for online retailers. The good thing about cardboard boxes is that they are fully recyclable regardless of their size and welcomed by informal collectors and recycling companies, says Samantha Choles, communication manager at Pamsa, the industry body for SA’s pulp, paper, board and tissue sector.

When it comes to being home compostable

and biodegradable, 75% of respondents chose paper or cardboard. Glass ranked the highest in reusability, lookand-feel and brand image, with plastic being the easiest to store. Metal packaging outstripped the other materials in terms of its strength and robustness.

Acknowledging that paper packaging may not always fulfil the same function as other materials, Choles says that in today s world, there is still a place for all packaging materials, provided they are responsibly produced and disposed of.

“The local and global forest products sector has for years been exploring ways to use renewable materials such as wood, cellulose and process by-products such as lignin to substitute materials that have a high environmental impact, she says. Virgin fibre from farmed trees grown in responsibly managed and certified plantations are considered renewable resources, with only 7%10% of 850,000 trees harvested annually and new trees planted in their place within a year.

SA's tissue and packaging manufacturers make use of recycled fibre, recovered from used paper and packaging. More than half of respondents said paper products should only be made using recycled paper. In reality, this is not possible, says Choles. Paper fibres can only be recycled around seven times, each time shortening and weakening. Without new wood fibre from trees, the paper cycle cannot be maintained.” In the context of reducing the consumption of nonrecyclable single-use packaging, most respondents concur this responsibility should be shared by governments, local authorities, brands, retailers and supermarkets. About 46% acknowledge consumers bear the least responsibility in this regard. Two-thirds of local respondents say nonrecyclable packaging should be discouraged through taxation, while more than half would consider avoiding using retailers not actively trying to reduce nonrecyclable packaging. Interestingly, 62% feel that brands, retailers and supermarkets are introducing more sustainable packaging, up from 54% in 2023, says Choles, adding that local extended producer responsibility legislation is encouraging improved production design and recycling initiatives.