→ BUGGIN’ OUT

Some people hate bugs. Jeff Neal made crickets his side hustle—and earns $30,000 a year breeding them.

8 What You Can Do Now

An entrepreneur’s path is never simple or easy—but you have more opportunities than you think.

by JASON FEIFER

11 Huge Economics

The cofounder of Zillow and Hotwire explains how to build (and fund) ambitious companies. by

NICOLE LAPIN

18 When Harder Is Better

Sometimes, adding friction to a process makes it run smoother. So how do you know when to do it? And how do you do it well? by ROBERT

I. SUTTON and

HAYAGREEVA “HUGGY” RAO

22 The Lessons Worth $25 Million

How one entrepreneur learned from her mistakes—and built a thriving company as a result. by LIZ

BRODY

24 How a Brand Looks

Every brand needs an aesthetic. Here are six ways to create yours.

28 How to Sell the

Secrets from a guy who turns unexciting products into humorous, top-selling brands. by LIZ BRODY 34 Work Faster!

Five new gadgets that’ll help you meet and beat deadlines. by MARIO ARMSTRONG

82 Why These Brands Are in Our ‘Hall of Fame’

Looking to buy a long-lasting, trustworthy brand? Check out the companies on this list.

96 The Midlife Leap

Why this woman bought a franchise in her 50s. by

KIM KAVIN

98 People Problems

This brand used to just clean up huge messes. Then they started addressing another kind of turmoil.

by KIM KAVIN

100 How He Opened 8 Franchises in 8 Years

Secrets of a top franchisee. by KIM

KAVIN

103 The Fastest-Growing Franchises of 2024

These brands are growing the quickest right now—and could be the rocket ship you’re looking for.

by TRACY STAPP HEROLD

124 What Inspires Me

How a tragic loss helped me realize my company’s true mission.

by JON B. BECKER

March-April 2024

→ PITCH OUR INVESTORS TO BE ON ENTREPRENEUR ELEVATOR PITCH

We welcome founders who have scalable products or services that are ready for investment, and who have a specific plan for how that investment can help them grow. APPLY TO BE ON THE NEXT SEASON: ENTM.AG/EEPAPPLY

→ FULL HUSTLE

Blake Geffen created a luxury rental business on the side—then raised $60 million for it. P.44

EDITOR IN CHIEF Jason Feifer

CREATIVE DIRECTOR Paul Scirecalabrisotto

DEPUTY EDITOR Frances Dodds

PHOTO DIRECTOR Judith Puckett-Rinella

MANAGING EDITOR Monica Im

SPECIAL PROJECTS EDITOR Tracy Stapp Herold

COPY CHIEF Jessica Levy

RESEARCH Andre Carter, Eric White

SPECIAL PROJECTS COORDINATOR Jordan Hall

INTERN Andrew Robinson

CONTRIBUTING EDITOR Liz Brody

CONTRIBUTING WRITERS Mario Armstrong, Jon B. Becker, Rachel Davies, Kim Kavin, Nicole Lapin, Hayagreeva “Huggy” Rao, Robert I. Sutton, Sal Vaglica

EXECUTIVE EDITOR Brittany Robins

DEPUTY DIGITAL EDITOR Melissa Malamut

SENIOR DIGITAL CONTENT DIRECTOR Jessica Thomas

ENTREPRENEUR STUDIO DIRECTOR Brad Gage

DIRECTOR OF EDITORIAL SUBSCRIPTIONS Caroline Olney

SENIOR BUSINESS EDITOR Carl Stoffers

EDITOR, CONTRIBUTOR NETWORK Maria Bailey

SUBSCRIPTIONS EDITOR Mark Klekas

SENIOR NEWS WRITER Emily Rella

FEATURES WRITER Amanda Breen

ASSOCIATE EDITORS, CONTRIBUTOR NETWORK

Chelsea Brown, Kara McIntyre, Micah Zimmerman

AD OPERATIONS DIRECTOR Michael Frazier

AD OPERATIONS COORDINATOR Daniel Belyaks

CHIEF TECHNOLOGY OFFICER Jake Hudson

VP, OPERATIONS Shannon Humphries

PROJECT MANAGERS June Munoz, Julianne Page

SENIOR ENGINEERS Jace Poirier-Pinto, Geoff Winner

ENGINEERS Angel Cool Gongora, Michael Flach, Abel Trotter

FRONT-END ENGINEERS Lorena Brito, John Himmelman

QUALITY ASSURANCE TECHNICIAN Jesse Lopez

ART DIRECTOR Christian Zamorano

SENIOR DESIGNER Jayla Buie

GRAPHIC DESIGNERS Andrew Chang, Isaac Contreras

DIGITAL MEDIA DESIGNER Monica Dipres

DIGITAL PHOTO EDITOR Karis Doerner

CEO Ryan Shea

PRESIDENT Bill Shaw

CHIEF OPERATING OFFICER Michael Le Du

ASSOCIATE PUBLISHER/MARKETING Lucy Gekchyan VP, SPECIAL PROJECTS Dan Bova

PRODUCTION COORDINATOR Mackenzie Truman VP, NATIVE CONTENT Jason Fell

SENIOR INTEGRATED MARKETING MANAGER Wendy Narez

INTEGRATED MARKETING ASSOCIATE Ashleigh Dennis

SVP, INNOVATION Deepa Shah

PRODUCT MARKETING MANAGER Arnab Mitra

MARKETING COORDINATOR Chris Desrosiers

SENIOR MARKETING MANAGER Hilary Kelley

SENIOR DIGITAL ACCOUNT MANAGER Jillian Swisher

DIGITAL ACCOUNT MANAGER Michelle Gaudy

BUSINESS DEVELOPMENT

VP, BUSINESS DEVELOPMENT Charles Muselli

GM, CONTENT SYNDICATION Matt Goldstein

BUSINESS DEVELOPMENT ASSOCIATE Michelle Buzga

ENTREPRENEUR BOOKS

VP, ENTREPRENEUR BOOKS Sean Strain

SOCIAL MEDIA

VP, SOCIAL Sana Ali

SOCIAL MEDIA SENIOR MANAGER Kennadi McCoy

CUSTOMER SERVICE entrepreneur.com/customerservice

SUBSCRIPTIONS subscribe@entrepreneur.com

REPRINTS

PARS International Corp. (212) 221-9595, EntrepreneurReprints.com

ADVERTISING AND EDITORIAL Entrepreneur Media Inc. 1651 East Fourth Street, Suite 125, Santa Ana, CA 92701 (949) 261-2325, fax: (949) 752-1180

ENTREPRENEUR.COM Printed in the USA GST File #r129677027

ENTREPRENEUR MEDIA NATIONAL ADVERTISING SALES OFFICES

SVP, NATIONAL SALES Brian Speranzini

VP, NATIONAL PRINT SALES James Clauss

NORTHEAST SENIOR ACCOUNT DIRECTOR Rikki Paribello

ACCOUNT DIRECTOR Krissy Cirello

CHICAGO

MIDWEST DIRECTOR, STRATEGIC PARTNERSHIPS Steven Newman

DETROIT

MIDWEST DIRECTOR OF SALES Dave Woodruff

ATLANTA

SOUTHERN ADVERTISING DIRECTOR Kelly Hediger

LOS ANGELES

WEST COAST ADVERTISING DIRECTOR Mike Lindsay

GREEN ENTREPRENEUR & ENTREPRENEUR, NATIONAL ACCOUNT DIRECTOR

Hilary Kelley

FRANCHISE AND BUSINESS OPPORTUNITIES

VP, FRANCHISE SALES Brent Davis

DIRECTORS, FRANCHISE SALES

Cassidy Ford, Casey Lamm

PRODUCTS AND SERVICES ADVERTISING Direct Action Media, Tom Emerson (800) 938-4660

ADVERTISING PRODUCTION MANAGER Mona Rifkin

EXECUTIVE STAFF CFO Chris Damore

DIRECTOR OF FINANCE Tim Miller

FINANCE SUPPORT Jennifer Herbert

CORPORATE COUNSEL Ronald L. Young

LEGAL ASSISTANT Cheyenne Young

Vol. 52, No. 2. Entrepreneur (ISSN 0163-3341) is published bimonthly by Entrepreneur Media Inc., 1651 East Fourth Street, Suite 125, Santa Ana, CA 92701. Periodical postage paid at Irvine, CA, and at additional mailing offices. POSTMASTER: Send address changes to Entrepreneur, P.O. Box 6136, Harlan, IA, 51593-1636. One-year subscription rates in U.S.: $19.97; in Canada: $39.97; all other countries: $49.97; payable in U.S. funds only. For customer service go to entrepreneur.com/customerservice or mail subscription orders and changes to Entrepreneur, Subscription Department, P.O. Box 6136, Harlan, IA, 51593-1636. For change of address, please give both old and new addresses and include most recent mailing label. Entrepreneur considers its sources reliable and verifies as much data as possible, although reporting inaccuracies can occur; consequently, readers using this information do so at their own risk. Each business opportunity and/or investment inherently contains certain risks, and it is suggested that the prospective investors consult their attorneys and/or financial professionals. Entrepreneur is sold with the understanding that the publisher is not rendering legal services or financial advice. Although

nor

Entrepreneur will be treated as unconditionally assigned for publication,copyright purposes and use in any publication or brochure,and are subject to Entrepreneur’s unrestricted right to edit and comment.

ENTREPRENEUR.COM / March-April 2024

An entrepreneur’s path is never simple or easy— but you have more opportunities than you think.

YOU’VE HIT a wall. Maybe it’s an idea that won’t work. A pursuit you were rejected from. An effort that failed. Now you feel stuck and frustrated.

I’ve felt it too—but I learned four simple words that help me move past it. I think they can help you too.

To appreciate them, I’m going to take you back in time. The year is 2005. Kara Goldin and her husband Theo were making a lightly flavored, all-natural beverage in their kitchen. They called it Hint Water, and they thought it had potential.

But when they tried to mass-produce the drink, they hit a problem. Kara writes about this in her book, called Undaunted. Her husband tried to find a manufacturer for the drink, but everyone said it was impossible: They couldn’t make the drink without preservatives or other chemicals, because it wouldn’t have the shelf life for national distribution.

“Well, what can we do?” Kara asked Theo.

“We can have a product with a very short shelf life that we deliver locally out of our Jeep in a limited area in San Francisco,” Theo replied.

“Perfect, that’s what we’ll do,” Kara said. “We’ll find out what people think of the product and if it’s worth trying to solve this problem.”

This little scene made a big impact on me. I loved Kara’s

reaction. Theo tells her what they can’t do, and Kara asks what they can do.

I’ve since gotten to know Kara, and we’ve talked about this. That question—What can we do? become a mantra of hers. She calls upon it when hitting a wall, or when someone says something is impossible.

I wondered: Why is this such a powerful reframe? Then I realized: It’s because when we want something, we almost immediately limit our imaginations.

Think of something you want right now. Maybe it’s a certain kind of growth. Or a particular job. Maybe it’s being recognized for an achievement, or connecting deeply with another person.

I bet you have an idea of how to get that—first I’ll do this, then that, and so on. That’s your action-oriented, entrepreneurial self at work. But there’s a problem: When we imagine how we’ll get something, we start to think that’s the only way to get it.

question to help my wife!

My wife, Jennifer Miller, is a journalist and author of five books (including one with me).

If our original idea doesn’t work out, we assume we’re out of luck. Our way became the only way, and now the only way is no way.

The antidote to that is Kara’s question: “What can we do?”

No matter the challenge you’re facing, there is an answer to that question. You can do something. It doesn’t mean you’ll always reach your goal exactly as you defined it, but it does mean you can find some action to take—a way to move forward, or

A few years ago, she met a former inmate with an incredible story—a captivating, true-crime tale, that was also a powerful story of redemption. She spent years earning this person’s and their family’s trust, wrote a book proposal, shopped it around to all the major publishers, and…nobody wanted it.

Jen was crushed. The rejection stung, of course, but she was also in a kind of mourning: If she couldn’t sell the book, she figured, then she could never tell this story.

But as we talked about it, Kara’s words came to me. OK,

in podcasting, but she liked the idea. She threw herself into learning the market and meeting the players—and after a year of hard work, she just signed a contract with a major production company and one of the world’s largest podcast distributors.

Now she’s making the thing many people said she couldn’t make. Because they were wrong. There is always something you can do.

Jason Feifer jfeifer@entrepreneur.com @heyfeifer subscribe: entm.ag/subscribe

Spencer Rascoff cofounded Hotwire and Zillow. Now he’s an investor and serial startup founder. Here’s his advice for funding and growing a giant, ambitious idea. by

NICOLE LAPIN

Want to start, fund, and sell a major company? Spencer Rascoff has some advice on that— because he’s seen it from all sides.

As a founder, he first cofounded the travel-booking site Hotwire, which he sold to Expedia. He then cofounded Zillow, which helped reshape nothing smaller than the real-estate market, and served as its CEO for nearly a decade. Now he’s a serial board member, an investor (including as general partner at the venture fund 75 & Sunny), and a continual startup founder—including building social platforms for sharing intel on food (Recon Food, which he started with his teenage daughter) or what’s best to binge-watch (Queue), saving creatives from the endless emails they face as they chase down business leads (heyLibby.ai), and simplifying the market for co-owning a second home (Pacaso).

“I find problems that I have in my life and feel passionate about, and I try to solve them by starting companies,” he says. But actually funding, growing, and selling those companies? That’s about great ideas—and also cold, hard numbers. Here, he explains.

You’ve said that Zillow didn’t start with the idea— it started with the team. Can you tell that story? Actually, this is true of a couple of my startups. I had sold my company Hotwire to Expedia. I had been at Expedia for about a year, and decided it was time to do something more entrepreneurial. So I left with two other folks, who were actually the founders of Expedia; then we added one or two more folks. And we sat in a conference room for,

Our credibility and longevity are unmatched. With more than 65 years of experience and over 26,000 centers worldwide, we know what it takes to help franchisees succeed.

• High Demand for Education Enrichment

• Industry-Low Franchise Fee of $2,000

• Extremely Affordable Startup Costs

• Comprehensive Training & Support Programs

• Generous Incentives Package Ranked on the Franchise 500 for 27 Years Straight #1 in Category for 23 Consecutive Years

gosh, maybe three months or more—just talking and kind of shooting the shit about: What’s important to you? What services do you love? What are you doing in your life right now? And all three of us were buying houses, all at the same time. We quickly realized that here we were in 2005, and the internet was more than 10 years old, and there still was no category-defining company that empowered the real-estate consumer, not the industry. So Zillow was born.

You often tell startup founders to look for businesses with a big TAM, low NPS. Can you break down those terms?

“TAM” is a Total Addressable Market. A big TAM means there’s lots of money spent in the category. “NPS” is Net Promoter Score. It’s a measure of how much people like a product or an industry. Generally speaking, it’s calculated by asking people, “Would you refer this service to a friend?” A low NPS means people are dissatisfied.

Real estate has a big TAM: something like 15% of the economy is in real estate. And it has a low NPS. Everybody finds it to be a pain in the neck. Nobody likes their real-estate agent. Nobody likes homeshopping. Definitely nobody likes home-selling. It’s just, it’s a very unpleasant thing. So that makes it ripe for startups. But entrepreneurs also need to know the difference between TAM and “SAM”: the Serviceable Addressable Market.

Because every investor pitch starts with something like, “This is a trillion-dollar opportunity,” right? How do you feel about those claims? They create skepticism for a

good investor. So I think it’s useful for founder pitches to cop to the SAM. Basically, say, “Look, I understand that this market’s massive”—TAM—“but realistically, this is how much of it I, and my startup, and my idea, and my team, can truly go after”—which is SAM. And even if that’s a much smaller number, at least it’s more realistic and therefore credible.

about exits? What should that look like?

So, if you’re raising institutional venture capital, you should not be focused on an M&A (mergers and acquisitions) exit. You should believe that the idea and opportunity is big enough that it could be a publicly traded company, which means it could be worth over $1 billion. Generally, that’s a threshold above which you can go public. So to get to a $1 billion-plus valuation, you probably need at least $100 million of revenue.

to invest in companies that they think do have that potential.

If you have an idea that’s smaller than that, then bootstrap it or raise “friends-and-family” capital from noninstitutional investors, because VCs are not going to fund you.

Institutional investors are kind of like a nesting doll, right? They have investors themselves.

I’m glad you brought that up. I think this is misunderstood or just not well known among founders: When you get a check from a VC firm, where is that money coming from? The fact is, it’s not sitting there in their checking account.

Let’s say a VC has a billiondollar fund, and they put $10 million into your startup. They’re not going to their checking account and taking $10 million out of the $1 billion. Instead, the general partner— the person who founders meet

lot to say about how the general partners invest.

Everyone has a boss. Even when you’re raising money. I’ll tell you a quick story. Maveron is a top venture capital firm that has invested in a couple of my companies. I’m also an LP there. They had a couple of their LPs attend a meeting a few months ago where they spoke to the CEOs of Maveron’s portfolio companies. The LPs were a children’s hospital and a university endowment and, I think, an environmental organization—so, these huge nonprofits that each have $5 million, $10 million, $25 million in the Maveron fund as limited partners. It was so interesting to hear them talk. They were like, “Look, if this fund that has invested in all of your startups is a 5x fund, then I, at the hospital, will be able to add another 25 beds to our intensive care unit.” And then

IT’S USEFUL FOR FOUNDER PITCHES TO BASICALLY SAY, ‘LOOK, I UNDERSTAND THAT THIS MARKET’S MASSIVE, BUT REALISTICALLY, THIS IS HOW MUCH OF IT I, AND MY STARTUP, AND MY IDEA, AND MY TEAM, CAN TRULY GO AFTER.”

Now, there are plenty of great ideas and plenty of good companies that should be started—and will be successful— that have a smaller opportunity than that. Just realize that you’re not going to be able to raise institutional venture capital, because the VC business model is predicated on spreading a lot of chips out on the roulette table: They will accept a lot of zeros, but two or three of their roulette bets are going to pay off big—100x, 1,000x, 10,000x. So they’re only going

with to try to convince them to invest in their company—issues a “capital call” to the VC’s limited partners (LPs).

LPs are, say, a university endowment fund or a firefighters’ pension fund or a highnet-worth individual. They’ll each have a commitment to the VC’s fund, and they’ll get a capital call that says, “OK, we just invested $10 million in this new startup. Send us your piece.” And then the VC passes it on to you as a startup. And those limited partners have a

the environmental organization LP says, “You know, if this is a 5x fund versus a 3x fund, that’s the difference between us protecting another million acres of the rainforest in South America versus only a hundred thousand acres.” It was eye-opening for the portfolio company CEOs to understand what actually happens when we create an exit for the VCs.

To hear more of this conversation, listen to Nicole Lapin’s podcast, Money Rehab.

adding friction to a process makes it run smoother.

how do you know when to do it? And how do you do it well?

by ROBERT I. SUTTON and HAYAGREEVA

“HUGGY” RAO

Everyone knows the exasperation of unnecessary friction.

We’ve all navigated systems that create maddening ordeals rather than give us simple answers, services, or refunds. We’ve sat through endless meetings with blabbermouths and ill-defined agendas. We’ve pulled our

hair out over rules, procedures, traditions, and technologies that once made sense, but are now antiquated, pointless, and inefficient. These are all soul-crushing forms of organizational friction that make it difficult to do simple things. And as professors at Stanford’s School of Engineering and Graduate School of Business, we spent the last seven years

researching the causes and cures for these problems.

But one of our biggest discoveries surprised us. It turns out that friction isn’t always a problem. In fact, sometimes it can be a solution.

For example: We may love how simple it is to order a ride on Lyft or Uber, or rent a place on Airbnb—but when a sixyear-old asks Alexa to get her a

dollhouse, and a $162 KidKraft Sparkle Mansion arrives the next day, her parents aren’t so enthused. That process could have used some friction.

Here’s another example: Unfettered, overconfident leaders can rush their half-baked creations to market, burning a lot of cash along the way. That process, also, needs friction. Piles of studies show that to do creative work right, teams need to slow down, struggle, and develop a lot of bad ideas in order to find a rare good one.

The value of friction is all around us—as are the downsides of removing it. Technologies like Slack and Zoom can make communication frictionless, but they can also make it easy for clueless leaders to inflict long and convoluted communications on colleagues and customers. Product innovation can make delivery and setup nearly frictionless—but studies on everything from military boot camps to assembling Ikea products show that “labor leads to love.” The harder we work at something, and the more we suffer, the more we come to value it.

Ultimately, our research showed that friction must be taken seriously—and nobody should make snap judgments about what ought to be easier. Instead, leaders should hit pause and question their assumptions to figure out what to make easy, hard, or impossible. When and where you want friction requires weighing an organization’s goals, values, talents, and constraints—including money, traditions, rules, laws, and power dynamics.

We call this the art and science of “friction forensics,” and we’ve developed eight diagnostic questions to help guide you through such decisions.

If you’re figuring out whether to make a process easier or harder, here’s what to ask:

1/ Is adding (or removing) friction the right—or wrong—thing for you to do?

2/ Do you have enough skill and will to do it well? Or do you need to learn how to do it? Or crank up your motivation?

3/ Is failure cheap, safe, reversible, and instructive?

4/ Is delay wasteful, cruel, or downright dangerous?

5/ Are people already overloaded, exhausted, and burned out? Or do they have the bandwidth to add more to their plates?

6/ Does it require people to work alone or with one another? To do it well, how much do different people, teams, and organizations need to coordinate (work together) and cooperate (be willing to work together)?

7/ Will reducing or eliminating friction for some people result in it being heaped on others? Are you making things easier and harder in the right places? Is the redistribution of friction ethical and fair? Or is it heartless, destructive, exploitative, and cruel?

8/ Are the commitment, learning, and social bonds that can result from hard work, frustration, suffering, and struggle worthwhile given the human and financial toll?

AFTER FIGURING OUT your answers to the first two questions—what the right (or wrong) thing is to do, and if people have enough will and skill to do it well—then you can debate the six additional questions to decide whether to make something easy, hard, or impossible.

As an example, consider a simple obstacle that Laszlo Bock imposed when he headed People Operations at Google.

Google cofounder Larry Page believed that hiring people who fit Google’s quirky culture and had strong leadership potential was essential for scaling the company, so he imposed a tradition of seemingly endless rounds of interviews with job candidates. Page knew he was making enemies among candidates because Google interviewed them 10 times or more and still rejected most—but he believed it was worth it.

As Google grew, however, this practice devolved into a sacred cow that was unnecessary for most job searches. It drove away

1/ Bock had good reason to believe that endless interviews were a big problem, and this obstacle would be effective—or at least worth a try.

2

/ The rule was so simple that his HR team had no trouble implementing it, and Google interviewers had no trouble learning it.

3/ The rule was cheap to implement, and easy to modify or reverse.

4/ The rule reduced frustration and delay for eager candidates and for Google teams that wanted to hire them.

5/ Most Google interviewers were already busy; burnout and exhaustion were problems in

BOCK’S RULE is elegant and instructive, and—except for the possible dimming of the “labor leads to love” effect—appeared to help everyone affected. This is a good example of why policies that make use of friction should be evaluated over time. Page may have originally viewed the strikingly high number of interviews as some necessary friction in the hiring process, to ensure the most ideal candidates make it to the end. But as the company grew, that particular bit of friction became obstructive, and a new type of friction was needed to clear the path forward.

ULTIMATELY, OUR RESEARCH SHOWED THAT FRICTION MUST BE TAKEN SERIOUSLY—AND NOBODY SHOULD MAKE SNAP JUDGMENTS ABOUT WHAT OUGHT TO BE EASIER. INSTEAD, LEADERS SHOULD HIT PAUSE AND QUESTION THEIR ASSUMPTIONS.

ABOUT WHAT OUGHT TO BE EASIER. SHOULD HIT PAUSE AND THEIR ASSUMPTIONS.

top talent, and burdened the six, eight, 10, 12, or 15 Googlers who interviewed, evaluated, and discussed each candidate. Sometimes it was even worse. Bock told us, “People had up to 25[!] interviews before being rejected.” So he made a simple rule: If more than four interviews were to be conducted with a candidate, Bock needed to personally approve an exception. This didn’t forbid more interviews, but it added friction to the process. Most Googlers were hesitant to ask an executive vice president like Bock for an exception, so the ordeal disappeared for most job candidates. “It was one of my first lessons in the power of hierarchy to actually do some good,” Bock told us.

Let’s assess Bock’s simple hiring rule by returning to our eight questions:

many corners of the company. This change reduced rather than increased the burden on these beleaguered people.

6/ Implementing the change required little coordination or collaboration; it was simply announced, and (for the most part) Googlers gently pressed one another to follow the new rule. Coordination and collaboration were still essential for writing job descriptions, selecting and interviewing promising candidates, and deciding whom to hire. But involving fewer people reduced such burdens.

7/ The obstacle created by this rule wasn’t exploitative or cruel, as it added friction in the right places and reduced it in the wrong places.

8/ The old practice of endless interviews did have “labor leads to love” effects, increasing commitment and social bonds among the interviewers and candidates who survived the gauntlet. This is a potential negative effect of the rule.

Ultimately, the wrong kinds of friction can squander the zeal, damage the health, and throttle the creativity and productivity of good people—while burning through company cash and other precious resources. All organizations, even the most successful, can make the right things too hard and the wrong things too easy. If a process at your company is gobbling up time and resources, maybe it’s time to ask: Could I make this easier by making something about it harder?

This essay was adapted from The Friction Project: How Smart Leaders Make the Right Things Easier and the Wrong Things Harder by Robert I. Sutton and Huggy Rao. Copyright © 2024 by the authors and reprinted by permission of St. Martin’s Publishing Group.

Take charge of your entrepreneurial journey with PuroClean, a proven franchise system. With our comprehensive training programs and unwavering support, you can confidently expand your business empire and achieve remarkable success.

WANT TO KNOW MORE? Scan the QR Code to learn more about your investment opportunity

It’s an old cliché: Failures make you stronger. But how, exactly? Here’s the way one entrepreneur put them to good use—and now drives $25 million in annual sales. by

LIZ BRODY

→ THE STARTUP CURE

Shizu Okusa built success with Apothékary by remedying what ailed her first company.

When Shizu Okusa decided to start a new business, she knew where to find the best guidance. “I wanted to reverse engineer everything I did wrong in my last company,” she says.

Raised on a farm in Vancouver by Japanese immigrants, she’d founded a cold-pressed juice brand called JRINK after feeling burned out at Goldman Sachs. It had nine shops and sold in two Whole Foods stores. But it was hard to make a lot of money. So in 2020, Okusa took all the lessons she learned and created Apothékary—an herbal remedy

business that’s now profitable, and drove roughly $25 million in revenue last year. Here’s what Okusa saw go wrong, and how she made it right.

DON'T Give it a short shelf life.

DO Make it scalable.

JRINK launched when cold-pressed juices were in demand, but the product’s three-day shelf life made it nearly impossible to grow beyond a local business. In her next company, she chose a product built for scale. “I wanted very high gross margins, a shelf life of 18 months or more, and a category-defining opportunity,” she says.

DON'T Move fast and grab any investors you can.

DO Move slow and find the right investors.

With JRINK, Okusa took whatever investors she could—only to discover that some were not so helpful. “People don’t talk about this,” she says, “but once you have an investor, you can’t just get rid of them—and it can be very expensive or sometimes impossible to buy one out who turns out not to be a good fit.” This time around, she’s looking for relationships, not just dollars. “We’ve raised roughly $13 million, but mostly from angels and family offices that share a more patient, long-term view. We’ve

also looked for founder funders who have operational experience and relationships to offer.”

Go all in on one

sales channel.

Try everything!

Okusa focused on foot traffic to drive business at JRINK—using pop-ups in gyms and yoga studios to increase brand awareness, so people would buy more at their local store. “But that’s a very capped audience,” she says. With Apothékary, she’s trying everything she can think of: affiliate, social media, paid advertising, free consultations, pop-ups. “Recently, we partnered with Truemed to get our products qualified so people can buy them with their HSA and FSA funds. We’ve seen so many new customers come in with very large ticket sizes.”

DON'T Keep trying to make it work.

DO Pivot fast.

“JRINK was an eight-year journey that I should have ended sooner,” she admits. “With Apothékary, my whole team is constantly thinking ahead.” They saw the rise of “sober curiosity” coming and in 2023, did a major rebrand including new refillable jars and tincture products, which she estimates will be 70% to 80% of its business this year. The rebrand also added phone consultations—a new sales tool with a 50% conversion rate. “Consumers want to be taken with the company ahead of the game,” she says.

Your next gig is waiting on Florida’s Cultural Coast ® .

Here, creativity, culture & arts, and the nation’s best beaches combine to ensure a healthy quality of life. Entrepreneurs welcome, or discover your next role.

Every brand needs a look—but how do you create an eye-catching design that’s true to your company’s purpose? Here, six business leaders explain how they did it.

“The food delivery space is extremely crowded, and our competitors have raised over $20 million each, while we’ve never raised a Series A. So we couldn’t rely on huge media budgets or celebrity endorsements. Instead, we focused on the aesthetics of our experience, so that photos or videos of our food would grab people’s attention on their Instagram feeds. Our meals are packaged in reusable glass jars with millennial-pink lids, and reusable oval, pastel bento bowls that look like Easter eggs.”

—JULIE NGUYEN, cofounder and CEO, Methodology

“Because we intended for our pots and pans to be sold globally, we wanted to use shapes that felt familiar—yet new—in the East as well as the West. So we took our favorite elements of Japanese design and mashed it up with mid-century Scandinavian design, and added a contemporary perspective on colors and finishes. We wound up with a product that was a little retro, a little futuristic, a little minimalist, and a little maximalist. And when pitching the products to retailers, I’ve realized they really want to know the stories behind the design.”

—MJ TRUONG, head of brand, Meyer Cookware

and Cookware

3/ Design that amplifies your purpose

“In 2023, we did a brand refresh to capture the wide range of emotions inherent to eating-disorder recovery. Our curving line represents the nonlinear recovery journey that is universal to treatment, and our new color palette is brightened and more modern. We added a pop of peach for warmth and compassion, modernized our navy to a more youthful periwinkle, and added colors like lime and bright teal for a jolt of energy. Our website also now showcases a wide range of photography to honor the unique identities of those who struggle with eating disorders.”

—LAUREN GERBER, head of brand and communications, Equip

5/ Design that scales with you

“With cereal, we knew we were entering the most colorful aisle in the supermarket. We joined the color explosion, but in a monochromatic, simpler way, to read healthier. We also wanted to visualize each flavor, but real food photography looked too corporate. Our big unlock was what we call ‘delicious illustrations.’ However, as we grew outside the natural grocery channel, and researched consumer insights from mainstream grocers, we gave our boxes a facelift with brighter hues, more prominent messaging, and more of a focus on flavor.”

—IAN WISHINGRAD, cofounder and CMO, Three Wishes

4/ Design that mirrors the product

“When a customer takes a box of our mochi out of the freezer, we want them to know they’re getting a premium product. Early on, we leaned heavily into sophisticated aesthetics, but found that our product was suited for a gentler nod to luxury. That means rainbow color palettes that are elegant but still fun, inspired by our flavors and ingredients. This is contrasted by navy and sandstone on the exterior packaging. It all emulates our mochi: simple on the outside, but a world of imagination inside.”

—CHRISTOPHER WONG, cofounder, Mochidoki

Design that welcomes people in

Bring your team and America’s Finest City will deliver the ‘wow factor.’

Networking. Brainstorming. Planning. Problem solving. These are all elements of a productive business meeting. As the leader of your team, setting goals and charting a course for the future are critical. But so is a meeting’s “wow factor.” The more your employees and clients have fun and engage in new experiences while talking shop, the more memorable and effective your business meeting will be.

No other meetings destination offers an inspiring mix of stunning venues, breathtaking views, vibrant nightlife, rich culture, exciting attractions, and enviable outdoor lifestyle like San Diego. Things like positivity, innovative thinking, and team synergy come naturally thanks to 70+ miles of wide-open coast and a downtown area that’s buzzing with excitement.

San Diego’s downtown is pleasantly walkable and its close, convenient proximity to the San Diego International Airport makes America’s Finest City an ideal location to host a national sales meeting, a planof-action meeting (POA), or conference. When it comes to delivering that “wow factor,” San Diego doesn’t disappoint.

Revel in hands-on competition with a touch of elegance. There’s arguably no better way to relax and unwind (while engaging in a little competitive fun) than by hitting the links. And there’s no more breathtaking golf course than Torrey Pines. Located in San Diego’s La Jolla region, the course boasts two picturesque championship 18-hole courses, both situated atop cliffs that tower over the Pacific Ocean.

Once your team finishes a round and taking in the spectacular view, head next door to The Lodge at Torrey Pines, an award-winning luxury resort. Whether you’re there for the spa, fresh regional cuisine, or a delicious beverage served on the outdoor terrace, you may never want to leave.

Sometimes a business meeting needs a dash of luxury, and you’ll find it at the Fairmont Grand Del Mar. A grand Mediterranean estate nestled amidst San Diego’s Los Peñasquitos Canyon, this is where business meets elegance, offering a variety of luxury accommodations and gorgeous outdoor spots with sweeping lawns and views.

Enjoy some thrilling sports action.

Want to get employees amped up? Why not treat them to a thrilling sporting event? That’s where Petco Park comes in. This architecturally magnificent ballpark is home to Major League Baseball’s Padres baseball team. It’s located downtown, steps from the Gaslamp Quarter and Convention Center, where there is ample variety of sensational venues for meetings of all sizes.

If baseball isn’t for you, then a trip to Snapdragon Stadium may be more your speed. Located in Mission Valley, the stadium is home to the San Diego Wave soccer team and hosts exciting events and entertainment all year round.

Just minutes away from the San Diego International Airport and within easy reach of all that San Diego has to offer, Mission Valley and Old Town are conveniently located in the center of San Diego County within a 10-minute drive of numerous attractions, museums, and experiences.

Bask in the sunshine and get out by the water.

Nothing brings the “wow” factor quite like a business meeting right on the water. Take your team to San Diego’s Mission Bay and Beaches.

One of the area’s prime event venues is Belmont Park Coaster Terrace. Overlooking the ocean and sitting just steps from the historic Giant Dipper Roller Coaster, this is a 4,000-square-foot venue that can accommodate up to 300 guests. With an indoor space and outside area, this beautiful rooftop retreat is a front-row seat to Mission Beach beauty. A company event in San Diego is one your team won’t soon forget.

Ready to plan a business meeting everyone will remember? Learn about all San Diego has to offer at sandiego.org/meetings

Funded In Part With City Of San Diego Tourism Marketing District Assessment Funds

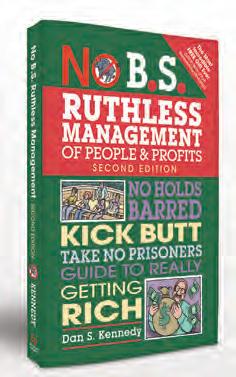

Some product categories are truly dull, but that doesn’t mean their brands have to be. Tom Rinks knows that better than almost anyone. by LIZ BRODY

I→ TIME TO BRUSH, KIDS!

This new toothpaste line did $5.5 million in sales in nine months.

n 2021, when Tom Rinks was asked to rebrand an oral care company, he had a few thoughts: The name sucked, for one. The market looked impenetrable. And the product was boring as hell. It was right up his alley. Rinks is an unusual guy, with an even more unusual skill set.

Intense and given to obsession, he studiously maintains an in-

visible profile online and wears his lucky Tupac socks to every important meeting. He’s also developed a reputation as a brand savant—with a specialty in turning unexciting things into fun, cool merch.

His largest hit was Sun Bum, which he cofounded and sold for around $400 million. And he’s credited with popularizing the chihuahua—the dog once

just seen as an ugly, annoying rodent—by turning it into a countercultural clothing brand and inspiring the iconic Taco Bell campaign (although, it’s complicated; we’ll get to that).

All of this is to say, Rinks was a good match for Spotlight, the oral care company. Three dentists, including two sisters from Ireland, had poured their hearts and

was looking for: Great brands start on the inside. An athlete and track coach started Nike. Computer geeks started Apple. Bikers started Harley-Davidson. But Crest and Colgate came out of giant corporations. So Rinks renamed Spotlight for its founders: “Made By Dentists.”

“If someone’s partner goes, ‘Why did you buy this toothpaste?’ they can say, ‘Because it’s made by dentists—I thought it would work better!’”

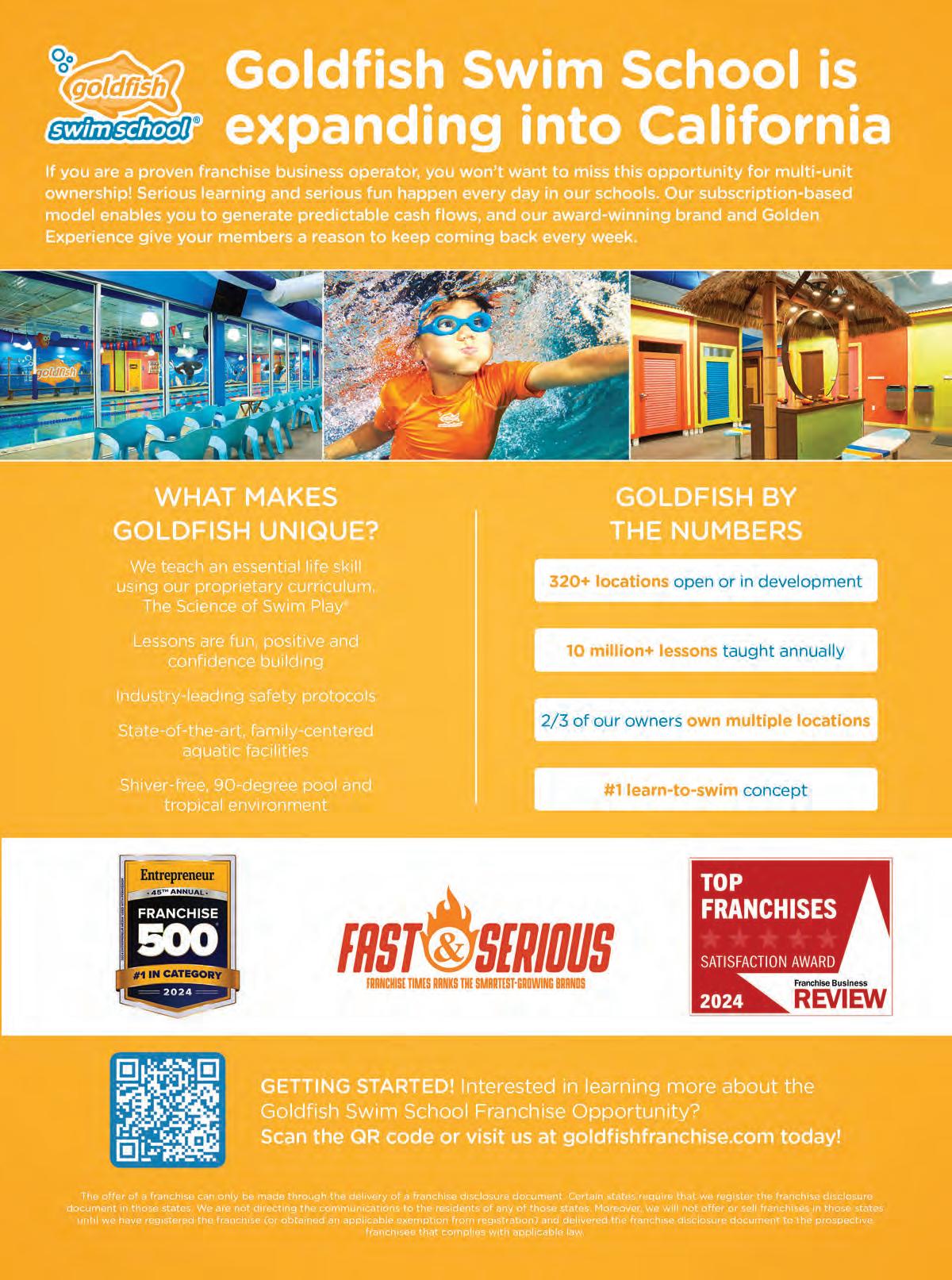

$1,024,602 SYSTEM-WIDE AUV*

He designed the packaging to feel like a prescription from a doctor, and the new look launched in March 2023.

UNFORTUNATELY, after all of that aisle stalking, early sales were disappointing. “I missed it,” Rinks says.

He wasn’t the type to sit around and hope things worked out, so he began ruminating on his past work, searching for what he’d done wrong. The first thing he realized was that the brand had no humor— the very skill that had launched his entire career.

He’d been 26 and working at a furniture store in Grand Rapids when one day, he stood on the shore of Lake Michigan and saw surfers. As a Southern California native, he couldn’t believe his eyes. Surfers. On a lake? He went home and drew

an old Castaways-style dude sitting on his longboard in the middle of the calm water.

He printed the cartoon on a shirt with the words “Waiting for the big one.” Then he called Meijer, the Midwest supercenter chain, and pretended to be a surfwear rep. It got him a meeting. When Vivian Dryer, a buyer there, walked into the room, she found Rinks in a suit with a single shirt and some artwork to show. Even so, it struck her as incredibly fresh.

“Let’s do it,” she said, and put in an order for 1,800 shirts. It was the beginning of a thriving apparel business.

That taught him something valuable: Underwhelming things can be flipped into valuable ones, especially if you poke some fun at them. In 1994, he saw a similar opportunity. He’d been reading a

→ SURF’S DOWN ...but sales were up! Rinks turned this cartoon into his first true business.

magazine, and saw a photo of Madonna with a chihuahua. “At that time, it was all about big dogs and top dogs and No Fear brands,” he says. “There was no Legally Blonde. No Paris Hilton with an accessory chihuahua. People hated them. But Madonna is now holding a chihuahua—a rat dog? I thought that’s just in itself gonna make it cool.”

Rinks partnered with cartoonist Joe Shields, who drew a raggedy cartoon dog character they called Psycho Chihuahua. When accompanied by captions like “Bite Me!” it became a new hit on T-shirts. From there, Rinks and Shields allege a direct line to the famous “Yo quiero Taco Bell” campaign that was out by early 1998. They filed a lawsuit over it. In court documents, a Taco Bell employee admitted that he saw the Psycho Chihuahua character at a trade show and asked Rinks to develop promotional ideas around it, which led to months of work together. But the actual chihuahua campaign came from the ad agency TBWA\Chiat\Day, which said it conceived the idea independently. After lots of legal back and forth, the case was settled in 2005.

Rinks doesn’t love talking about it. But it taught him a lesson: “If you’re trying to create brands,” he says, “you really need to understand people’s feelings.” And people love a funny underdog.

THAT FED into the second major insight of Rinks’ career: A company shouldn’t just have char-

acter; it should be a character. “You’re creating a person that other people like,” he says. “Not a brand that people like.”

This was the guiding principle behind Sun Bum. In 2010, Rinks and his business partner René Canetti had a branding agency, when a client asked: Could they create something new in the sunscreen aisle? It was a tough category. Nobody enjoys wearing sunscreen, and brand loyalty was scarce.

Like a novelist imagining his protagonist, Rinks drummed up a detailed persona for Sun Bum. It was Tommy Lee from Mötley Crüe—edgy, tatted, and bad-boy sexy—but this Tommy was also the best dad ever and volunteered at the soup kitchen. This Tommy had the cool of an idiot at the beach who might get tangled up in their boogie board cord and is unbothered by it all—the type to say, “Hey, come hang with us at the bonfire.”

“He was what I want people to think a Sun Bum guy was like,” says Rinks. “And so they go, ‘OK, I like that guy. And if I like that guy, I like the brand.’”

Of course, they couldn’t actually use Tommy Lee from Mötley Crüe. So Rinks and Canetti created a mascot named Sonny: He was an ape wearing shades and exuding an amiable chill, who appeared in ads that said things like, “We don’t care if you use ours. Just use sunscreen.” The packaging was a “mash-up style”–of ’60s surf culture, Japanese street art, and the wood grain of an Eames lounge chair—to bring everyone together at that metaphorical bonfire. “No one was doing anything fun and disruptive like this,” says Lisa Motzko Hamilton, a merchandising exec at Ulta Beauty when

JUST LIKE CHIHUAHUAS AND SUNSCREEN, NOBODY LIKES THE DENTIST. “I LEARNED THIS LONG AGO,” RINKS SAYS. “IF YOU CAN HIT ON THE TRUTH OF SOMETHING WHERE PEOPLE GO, ‘YEAH, I AGREE,’ YOU’RE GETTING THEM THAT MUCH CLOSER TO BUYING.”

Rinks brought the brand there. Eric Carl, who was at Target for 13 years, agrees. He remembers taking meetings with Rinks back then, and being in awe at how large his thinking was. “Brand people think very transactionally,” Carl says. But not Rinks. For example, Sun Bum expanded with a kids’ line—“and Tom’s there ready to create Nickelodeon shows around his Baby Bum characters,” Carl recalls. “He’s going on, out of left field. And the buyer’s like, ‘Wait, so which SKU is going to go on the shelf?’”

SO THAT’S what Rinks missed

with Made By Dentists: It had no humor or character. He began to fix the problem by designing a new kids’ line for the toothpaste, which looked like a mash-up of Creepy Crawlers, graffiti, Vans checkerboard, and skater streetwear. He drew an alien character and a great white shark, and offered flavors like “eyeball juice” and “monster slime.” He posted zany videos on Instagram called “In-Sink Entertainment,” with little characters and funny, snarky plots. It all had a knowing nod to parents—as if to say, “Anything to make the kid

brush, right?”

In the first nine months, the kids’ line crushed, doing $5.5 million in sales. But the adult line lagged with $3.3 million— not the traction he wanted.

Rinks knew what he needed to do, but not how—until finally, one night at 2 a.m., he got an idea. He was in bed scrolling through eBay when he came upon a clone of a 1962 Ben Casey doll from Hong Kong. “He just looked at me like a villain from a James Bond movie,” Rinks recalls. “And I said, ‘Man, who is this guy?’”

Then he knew: It looked like “the dentist everyone loves to

→ CAVITY COMEDY

Scenes from a new Made By Dentists ad, featuring a very unlucky dentist and a sharp new rebrand.

hate.” This would be the humorous muse of Made By Dentists. He outbid himself all night to win the thing.

On his first attempt, Rinks realized, he played it too safe. He had tried to show people why they should care about toothpaste by making it an official, dentist-approved thing. But he should have done the opposite—and made the dentist the bad guy! Just like chihuahuas and sunscreen, nobody likes the dentist. “I learned this long ago,” he says. “If you can hit on the truth of something where people go, ‘Yeah, I agree,’ you’re getting them that much closer to buying. Because you’re not changing anybody’s mind. You’re connecting with all the people who already think like you. And then you show that, ‘Hey, we’re vulnerable enough to poke fun at ourselves,’ and they’re with you.”

With that vibe in hand, Rinks did a second rebrand. Will the new dentist scheme work? We’re about to find out—it launches in stores this March.

In the meantime, Rinks prepares himself, thinking about a tattoo he has on his chest. It says “37,” Paul Newman’s prison number in Cool Hand Luke. There’s a poker scene in the movie, where Newman’s character gets dealt a terrible hand— but bluffs his way into winning. “Sometimes nothin’ can be a real cool hand,” he tells the group. For Rinks, with his product résumé of unexciting cards, that resonates. “I’ve always told people it’s not the hand you’re dealt, it’s how you play it,” he says. “Same goes for brands.”

The International Franchise Show

April 12-13 | London, England

Partnership event with MFV NSE

FRANCHISE EXPO WEST

April 12-13 | Los Angeles, CA

Partnership event with MFV Expositions/Comexposium

LEGAL SYMPOSIUM

May 5-7 | Washington, DC

IBA/IFA JOINT CONFERENCE

May 7-8 | Washington, DC

INTERNATIONAL FRANCHISE EXPO

May 30 – June 1 | New York, NY

Partnership event with MFV Expositions/Comexposium

FRANCHISE CUSTOMER EXPERIENCE CONFERENCE

June 18-20 | Atlanta, GA

Partnership event with Franchise Update Media.

Franchise Expo South

September 6-7 | Ft. Lauderdale, FL

Partnership event with MFV Expositions/Comexposium

IFA ADVOCACY SUMMIT

September 9-11 | Washington, DC

FRANCHISE LEADERSHIP AND DEVELOPMENT CONFERENCE

October 16-18 | Atlanta, GA

Partnership event with Franchise Update Media

FRANCHISE EXPO AUSTIN

November 15-16 | Austin, TX

Partnership event with MFV Expositions/Comexposium

EMERGING FRANCHISOR CONFERENCE

November 18-20 | Austin, TX

Mario Armstrong, gear expert and two-time Emmy Award winner, recommends tech solutions that keep up with you wherever, and however, you work.

1/ A smartphone stand that follows you.

Tired of doing video selfie-style? The Belkin Auto-Tracking Stand Pro with DockKit [$180; belkin .com] acts as your personal cameraman. On video calls with Zoom, TikTok, FaceTime, and others, the dock holds an iPhone magnetically while charging it, while you dial in the perfect tilt position. Content creators can use the iPhone’s Apple DockKit tracking feature to rotate and tilt the Belkin, keeping your face focused in the frame automatically, whether in portrait or landscape mode.

3/ The go-anywhere desktop.

4/ A straight-shooting tripod.

Want to record a conversation and transcribe it? You usually need a recording device, and to then send the audio file somewhere. But not with the Plaud Note [$159 plus $10/month subscription; plaud.ai], which is a credit-card-size recorder that automatically transcribes whatever you capture (and summarizes it in a companion app with a subscription). The battery records up to 30 hours of meetings and the 64GB memory holds about 480 hours of conversations—and it can even capture calls on your phone.

HP Envy Move All-in- Stand Pro

Laptops and tablets were the only mobile computers—but the HP Envy Move All-inOne [from $900; hp.com] now brings big-screen performance wherever you can carry the 9.04-pound desktop. Work in front of the 23.8-inch touch screen while typing on the keyboard and trackpad for up to four hours using the rechargeable battery. A pair of feet spin into position when you set the screen down, keeping it upright, then rotate out of the way when you yank the Envy up by its built-in handle.

Tripods hold cameras, but it’s a lot of fuss to get your shot leveled. The Edelkrone Tripod X [$2,599; edelkrone .com] fixes that automatically, thanks to a gyroscope accelerometer and motors. Splay open the feet, and the tripod moves at nearly 50 inches a minute—even when topped with 66 pounds of camera equipment—to level itself on uneven ground at the push of a button. Control how slowly the tripod moves and connect a shuttertrigger cable for silky video and stop-motion shots.

Clicks [from $139; clicks.tech] makes the old new again, adding a BlackBerrystyle physical keyboard to iPhones 14Pro and newer. The rubbery case slips around the smartphone, creating a fourrow keyboard with clicking buttons—which not only feels great, but returns valuable screen space otherwise occupied by the virtual keyboard. The case supports wireless and corded charging, backlights the keys, and includes a few iOS keyboard shortcuts— like Command-H taking you to the home screen.

If you’ve been hearing a lot about side hustles lately, you’re not alone. The term has slipped into our common consciousness in recent years—so much so that Merriam-Webster added it to its dictionary in 2022.

“Side-hustle is a word on the move,” the entry says. “Although the precise definition of this term is still in a bit of flux, it appears to be centering on ‘work performed for income supplementary to one’s primary job.’”

“In a bit of flux” is right. As you’ll see on the following pages, having a side hustle means many things to many people. Some rely on the extra cash to pay their bills, others want a fun hobby that makes a little money, and still others want to build an entirely new business or career. A 2023 Bankrate survey found that nearly 2 in 5 of all American adults now have side hustles, and more than half of all Gen Zers and millennials. Among these younger side-hustlers, 1 in 5 Gen Zers and 1 in 4 millennials hope to one day make their side gig their full-time job.

Factors like the normalization of remote work and a general sense of economic instability have surely fueled this trend, but one thing is clear: It’s not slowing down. As one side-hustler, Justin Cambra, told us: “In today’s world, stability is from multiple sources of income. I’m trying to generate as many revenue streams as possible.” Hopefully, the stories here will help you do just that.

When people talk about side hustles, they usually think of gig work for the likes of Uber or DoorDash, or starting a company in their off-hours and growing it into a full-blown business. But we found people making thousands of dollars on all sorts of weird, wonderful side hustles that fall somewhere in the middle. Peruse their ventures, and get inspired!

by FRANCES DODDS and AMANDA BREEN

makes thousands of dollars on all sorts

If you don’t get squirmy around creepy-crawlies, try breeding insects! Crickets, Dubia roaches, and mealworms are all easy to cultivate, and lizard-owners never stop needing to feed their reptiles. learned this in 2016, when he bought his daughter a bearded dragon. He was shocked by how expensive crickets were, so he researched how to breed them himself. “It was really easy, because crickets are rampant breeders,” he says. So rampant, in fact, that he had a surplus to sell. Neal created a site on Shopify and promoted it on reptile-owner forums.

There were challenges—keeping crickets alive during shipping is tricky. But when the pandemic arrived, “It seemed everyone bought a bearded dragon,” Neal says. “All the local pet shops were closed, so everyone went online looking for live insects.” These days, he earns about $30,000 a year from his crickets. “It’s profitable and gives me something to do with the kids.”

Some furniture-lovers scour Facebook Marketplace for those rare perfect finds. But what if you pounced on imperfect pieces instead? There’s money to be made refurbishing and selling old stuff.

Lilly Skjoldahl discovered this in 2022, when she got hit with a $10,000 dentist bill—almost a quarter of her annual income as a program manager in public health. She needed cash, and fast. She started spending weekends and after-work hours searching for and refinishing furniture. Her first item was a $50-ish nightstand, which she sanded, stained, and transformed into a liquor cabinet. She sold it for about $195. “I really enjoyed the process and loved the cash, plus I had leftover supplies,” she says, “so I decided to keep going.”

In early 2023, Skjoldahl was able to quit her day job. By the end of the year, she’d earned over $235,000 from furniture flipping and related streams of income, like brand deals and social media content.

Teach a class online. Just like this retiree making

If you’ve used Eventbrite, it was probably to buy a ticket to an in-person event. But the platform actually hosts all kinds of events— including virtual courses (as do other platforms like Teachable, LinkedIn Learning, and more). So what’s it like to teach? A retiree Bill Reichman tried it out, and now makes about $250 per class.

Reichman always loved to bake, and after retiring, he started teaching at a local cooking school—“like a date-night function.” During the pandemic, he offered a free class for kids on Zoom, which he advertised on Eventbrite. Later, he began teaching classes for adults at $25 a ticket. “Once I attached my checking account to the [Eventbrite] system,” he says, “the money just flowed automatically.”

Reichman prefers Zoom classes of 10 or less, so he can see what everyone is doing. “I use recipes to teach the science of baking,” Reichman says. “So you’ll know what’s going on in your bowl and in your oven.”

Maybe you have an idea for a simple product that could be improved. You don’t want to start a full-blown company, but you’d happily sell something in your spare time. That’s Barry Farris started making $80,000 a year selling cat

Barry worked as a pharmaceutical rep, but always had an innovative streak. After retiring, he wanted to invent something. “That’s when he came up with the idea for the cat fountain,” Patricia says. “He’d lost a number of cats to kidney disease, which is related to cats not drinking enough water.”

Cats prefer chilled, flowing water. So in 2009, Glacier Point Pet Fountains was born. Today, there are hundreds of cheap pet fountains on sites like Amazon. But the Farrises source nontoxic, pharmaceuticalgrade materials like high-fire ceramic with antimicrobial tubings and fittings, and assemble the fountains at home. They sell 300 to 400 a year for $120 to $340 apiece.

If you spend hours online browsing and screenshotting things you can’t justify someone should because they’re so cute, or funny, or nifty—you could turn your mindless scrolling into pocket money. did this after retiring in 2019. “I was incredibly bored,” she says, “so I started a blog of unique gifts for those who have everything.” She named it Gifter World, and scoured the internet for items to delight and surprise. Then she started monetizing with affiliate partnerships— where a website links to a product, and earns a commission if someone clicks and buys. Torrey joined the Amazon Associates Program and affiliate networks like Awin, Skimlinks, and ShareASale, which offer access to thousands of retail websites.

“At first it was just a hobby,” Torrey says, “but now I make about $1,500 per week with Gifter World, and during the holidays, it goes up to around $3,000.”

If you have a creative itch, a love for thrifting, and an eye for potential, then revamping old apparel could be a lucrative—and environmentally responsible—venture. Many shoppers are looking for alternatives to fast fashion and are thrilled to find a one-of-a-kind item. Maddy Clements realized this when she was studying fashion design in school, and using thrifted clothing for her projects instead of spending money on new fabric. “I enjoyed taking something old and drab and figuring out ways to make it new and exciting,” she says. She didn’t know if it would go anywhere, but she began posting about her creations on TikTok under an account called Junk Gold. She worried that, at almost 30, she was “ancient to the Gen Z crowd”— but after two of her videos got a million views, she was bombarded with customers. Within three months, sales soared from $500 to $10,000, and by the end of that year, she made $50,000.

Rent

Have some extra space? An app called Neighbor lets users rent parking spots, basements, attics, and garages to others looking to store personal items or vehicles.

Justin Cambra, an investor who recently left his job at Amazon, is making over $1,300 a month doing this. He lives in Seattle, where he had an unused, paved lot on his property. One of his first Neighbor customers was going to the Philippines for eight months. “Airport parking is about $10 a day, so that’s $300 a month, and I was half that at $150,” Cambra says. “It’s only a $20 Uber to the airport from my place, which saves you a lot of money. So I get people like him who are long-termers, and then I get people who are taking an extended trip and need parking for two to four weeks at a time.”

With 20 spots, he’s experimenting with prices. He started at $200 a month, and then dropped incrementally to his current rate of $125. “Now I’m getting more traction,” he says, “so I may even drop it to $100.”

Just like this retiree making $1,000 a

Maybe you’ve considered driving for Uber or Lyft—but aren’t crazy about chauffeuring strangers in your own car. Well, you might be interested in Alto, a high-end ride-sharing app that makes drivers actual employees, with training and hourly pay—and gives them all-white Buick Enclaves to drive on their shifts. Alto is currently operating in Dallas, Houston, Los Angeles, Miami, and Washington, D.C., and is swiftly expanding.

Larry Mack lives in Dallas, where he’s retired. The idea of driving appealed to him, but the one time he tried Uber, someone threw up in his car, and he was stuck with the bill. So when he heard about Alto in 2019, “It seemed like a no-brainer,” he says. He drives 20 to 30 hours a week, which comes out to about $1,000 a month. “I’m an explorer, and driving for Alto has allowed me to see places in the DFW area that I didn’t know existed. It doesn’t even feel like work!”

out your pool.

Just like this couple making $84,000 a year

If you’re fortunate enough to have a swimming pool at your house, you may be looking at a liquid cash opportunity. The online marketplace Swimply lets people rent out their pool—or other private recreational spaces like tennis, pickleball, and basketball courts—by the hour.

When Stuart Doty heard about this, he knew he had the perfect setup. He works in healthcare and lives with his wife in Portland, Oregon, where they have an indoor pool and a tennis court. In December 2020, after hearing about Swimply, Doty says, “I entered my pool’s info quickly and arbitrarily named it the Mad Men Pool. The bookings started rolling in.” On weekends, they charge $80 an hour for access to the pool and $40 an hour for the tennis court, and offer a 20% discount on both during the week. Because the pool is indoors, groups book the space all year round. The income varies by month, but in their first year, Doty and his wife made $84,000.

Do you know a lot about something? Your knowledge is valuable. The site JustAnswer hosts more than 12,000 experts across 150 categories, who are paid a dollar amount per question based on their category and quality rating on the site. JustAnswer says the average expert makes $2,000 to $7,000 per month, with the biggest earners hitting as high as $20,000 per month. (Other sites serve more targeted niches, like Paperial, where you can answer students’ questions.)

Jennifer Sheffer, a New England-based antiques dealer, has been working as an appraisals expert on JustAnswer since 2012. She makes $10,000 to $20,000 a month, and typically puts in 40 hours a week. “The great thing is that JustAnswer treats the experts equally, whether they work a lot or just here and there,” she says. To become an expert, the platform has you fill out an online application.

If you have a teaching background or a passion for kids, there’s never been more need—or methods— to connect with students. Outschool is a platform that offers live, online classes on everything from core subjects to fun after-school activities.

Elementary school teacher Tara Laczynski was laid off during the pandemic, so she started teaching math on Outschool. “The biggest challenge is getting ‘seen’ in the search engine,” she says. “Most of my early students were friends, family, and classmates of other early students. Social media is also a great way for families to find you. You can create tips to share as reels.”

Early on, Laczynski put a lot of time into her curriculum, but now works about 32 hours a week—27 teaching, plus another five on administrative work, content creation, and meetings—and makes an average of $12,600 a month. “In the traditional classroom, I worked 40-to-50-hour weeks.”

Calling all extroverts! If you want to build your own schedule and meet new people, then representing brands at events like festivals, sports games, conventions, and conferences could be the perfect side hustle for you.

A decade ago, Tremont Turner was in college, working at Chipotle and Panera, when he heard that being a brand ambassador paid double his hourly wage. The work involves stuff like handing out products (say, samples of Aperol Spritz at a music festival), taking pictures with fans, and getting people to download an app or follow a brand on social media. “Probably my favorite jobs are summits where CEOs get together to network,” Turner says. “Our job is to facilitate them meeting each other and having a good time.”

Turner says groups on Facebook are the best place to find these jobs (search “brand ambassador” in your city, or “promotional models”). And once you’ve worked for a brand, you’ll get on their email blasts.

If you have a hobby—say, word games, knitting, meal planning, or anything that can be rendered in templates—your pastime could translate to passive income. Put your best ideas down on paper, and sell them as “printables” on sites like Etsy and Shopify. started doing in 2017. As a full-time middle-school teacher, she wanted a side hustle, so she began designing printable games for kids that teachers could use in their lesson plans or parents could print off on rainy days. Fink tried to create the experience of an “escape room” on the page, with reading passages, ciphers, and comprehension questions. She sold her creations for $4 to $5 on her own website, ThinkTankTeacher, as well as Etsy and Shopify. Sales trickled in at first. But within six months, she was making five figures a month. “The best part about printables is that the income is passive,” she says. “One single lesson can sell over and over again.”

Do you have a car and some time to kill? You’ve got what it takes to become a loan-signing agent. They guide people through the process of signing paperwork, mostly on real estate transactions—everything from reverse mortgages to home equity loans. Barbara Hill became a loan-signing agent while working a full-time software sales job. But after being laid off at 62, she upped her loan-signing game, and now makes about $66,000 a year. Signings pay between $50 and $175 for beginners, and $100 and $250 for agents with experience.

The first step is getting commissioned by your state as a notary public. (Find instructions on your state’s Department of Revenue website.) Then, educate yourself a bit. “I came across this guy, Mark Wills,” Hill says. “His course ‘Loan Signing System’ taught me, step by step, everything I needed to do and all about the documents, and where and how to get work.”

Find a way to make AI tools useful. Just like this financial analyst making $4,000 a month

We’re still in the early days of figuing out how to use AI in our lives, so pay attention if you notice an application that would come in handy.

Soon after ChatGPT launched, financial Dhanvin Sriram observed that “ChatGPT is only as good as the prompts you give it, and there was no database where you could find these prompts. So I was like, Let me build something very simple and see what happens.” He compiled prompts from Twitter and Reddit threads, and created a simple website called PromptVibes, where users can search for prompts by category, or explain their “task” to a chatbot that helps to identify a prompt. Within a few months, the site had gotten 100,000 organic visitors, so Sriram started sending a newsletter on ChatGPT prompts five days a week. He began selling ad spots in the newsletter: a big one for $300 and a small one for $70. He now has 19,000 subscribers, and makes about $4,000 a month in ad sales.

Some side hustles just earn you extra cash. Others are the seeds of full-fledged businesses. Here are three tactics to build long-lasting companies, from three founders who turned their side hustles into full-time operations.

by AMANDA BREEN

If you have marketable skills, but you aren’t sure how to spin them into a business, try teaming up with someone from an entirely different industry. Together, you could pinpoint opportunities for innovation. That’s what Gene Caballero did. Back in 2012, he worked in sales at a Fortune 500 company, and started talking with a childhood friend who’d built a landscaping business. They came up with an idea—a platform to connect homeowners with lawn care professionals. Caballero would run sales, while his friend navigated the industry. They called their company GreenPal. “We devoted countless hours to cold-calling vendors to join our platform,” Caballero says. “We even set up a kiosk in the mall.” At last, in 2017, GreenPal started making consistent income, and in 2021, surpassed what Caballero made at his full-time job. Now, in peak season, earnings exceed $3 million a month. “Hold onto your primary job as long as possible,” Caballero advises. “It’s the financial backbone for your side hustle during those early, uncertain days.”

TACTIC NO. 2/

Treat your day job like industry research.

If you’re working a full-time job, you have an inside look at how your industry operates—and its unmet needs. Plus, you already have connections. International trade specialist Wendy Wang realized this when she was working for a textiles company and noticed something strange: “The covers for outdoor furniture available in the market were either exorbitantly priced or subpar quality,” she says. She wondered why that was— and whether she could make high-quality covers at lower costs. “I did in-depth research to understand the nuances of the market, and spent a considerable amount of time sourcing high-quality materials,” she says. “Then I set up an e-commerce platform to facilitate easy transactions.” She called the brand F&J Outdoors, and it launched in 2018.

About a year in, the business started generating monthly income. Two years in, it surpassed her salary from her day job, so she quit. Now, she says, F&J Outdoors makes a monthly average of $66,000 in revenue.

A person identifies a need in their own life, creates a solution, and then turns it into a business. It’s maybe the most tried-andtrue business origin story—and also a great kickoff for a side hustle.

Publicist Blake Geffen discovered this when she was planning her wedding in 2017. She wanted high-end accessories, but didn’t want to splurge on expensive pieces she’d wear once. “That’s when I realized there was a hugely untapped market for borrowed luxury accessories,” she says. She told her soon-to-be husband about her idea, and the newlyweds spent their honeymoon fleshing out a business plan.

Geffen returned to her day job, but continued developing the idea for what would become Vivrelle. “On weekends, we were pitching potential investors and garnering relationships with vendors and partners to help us create a website, help with marketing, etc.,” she says. They launched with a modest goal of 50 subscribers in the first month, but “far surpassed” that. Since then, they’ve raised more than $60 million.

Maybe! A startup called OpenStore gives Shopify store owners two interesting options: Sell and walk away with a generous payout, or take a vacation while they grow your business for you.

by RACHEL DAVIES

Stefan Gehrig’s side hustle was doing well—and that became a dilemma.

The Melbourne, Australia-based entrepreneur had started a gym bag brand called Knkg, also known as King Kong Apparel, in 2011. It began as a side hustle that scratched an entrepreneurial itch untouched by his academic day job, then grew into his full-time business. But by 2021, he’d hit a wall: To scale up, he needed resources that he didn’t have.

Meanwhile, in Miami, investor and former PayPal executive Keith Rabois had just helped found a startup called OpenStore, which acquires Shopify stores with growth potential. Gehrig heard about OpenStore, but wasn’t interested in selling Knkg. Then, in 2023, the startup launched another offering called OpenStore Drive, which lets Shopify owners retain ownership while handing off operations to OpenStore. That interested Gehrig a lot more.

Here’s how it works: For one year, OpenStore Drive offers Shopify brand owners monthly payments comparable to what they were making before starting the program, while Drive scales the brand and keeps any revenue beyond that monthly payment. At the end of the year, owners have the choice to sign up for another year, sell to OpenStore if they make an offer, or take the company back. For Gehrig, this arrangement had basically no downsides. “Signing up for Drive was not just about having more time for myself, but about putting Knkg in better hands,” he says. “I’m still a full owner of the brand, but they’re kicking goals on my behalf.”

For both acquisition and Drive, OpenStore looks for brands that do the majority of their business on Shopify, have at least $500,000 in net sales, and sell primarily to U.S.-based customers. “Where it becomes more of an art than a science is when we project whether a store has significant upside under our operation,” says OpenStore’s

head of sourcing, Frank Kosarek. “Knkg was really the golden situation. We saw very strong potential and realized we absolutely needed to work with this brand to take it to the next level.”

The road to getting noticed by OpenStore is straightforward. To be considered for both acquisition and Drive, entrepreneurs upload their financials to the OpenStore website and connect their Shopify and ad accounts. Within a business day, business owners can expect to receive an estimate of how much OpenStore would pay to buy them out (acquisition deals typically fall between $500,000 and $10 million) or how much they would receive in monthly payments.

From sign-up to sale, the process generally takes under a month, with the majority of time spent in due diligence after an offer is accepted. Once that hurdle is crossed, a transition phase allows the OpenStore team to learn more about the intricacies of the brand. As Gehrig was considering Drive, his main concern was whether the customer experience would change. After visiting the OpenStore team at their Miami office, he was convinced that they would operate the brand with care and were invested in the Knkg brand guidelines he’d established.

OpenStore has many success stories to show off. Jack Archer, a brand that was acquired in 2022 with a revenue of $1 million, reached $10 million after just nine months with OpenStore. Regen Health, a Drive brand, saw new customers grow 50% month over month after just a few months on Drive. “Whether we’re driving a store or acquiring a store, we’re treating it with the same growth playbook that we’ve developed to scale any new Shopify brand,” says Kosarek.

These days, Gehrig is a few months into his time on Drive—and still not sure what he’ll do at the end of the year. But he does know this: Having more time has allowed him to spend more time with his kids, go golfing more often, and, true to the entrepreneurial spirit, work on developing a new brand. “If I do take Knkg back, I’ll get a much better brand than I left,” Gehrig says.

Nick Loper is the founder of Side Hustle Nation, where enabling other people’s side hustles to thrive is his full-time job. Here, he shares his top insights for right now.

by RACHEL DAVIES

Nick Loper doesn’t just teach the art of side hustling—he’s a side-hustler himself. In 2006, while working a full-time gig at Ford Motor Company, he launched a website that recommended footwear through affiliate links. After six years and about $10 million in sales, he turned his attention to another side hustle: an education company called Side Hustle Nation, which teaches others how to build and run—you guessed it—side hustles. Here, he answers users’ most common questions.

Side hustles take a lot of time and work. What’s the key to staying motivated?

First, choose one you’re excited to take action on. But also, when I ask this question to guests on my podcast, they often say, “I was afraid to stay where I was. It pained me to ask my boss for time off.” You hear these deep-rooted motivations of, “I needed to get out, I needed to be in charge of my own thing.” So connecting with your “why” is super important. You almost have to hit rock bottom.

Are there certain side hustles you’re seeing that are really lucrative right now?

I see a lot of opportunity in blue-collar services—everything from window washing to mobile car cleaning to pooper-scooper businesses. Fewer people are going into the trades, so there’s a shrinking supply and a growing demand from millennial homeowners, like me, who aren’t very handy. Plus, a lot of the competition is still not digitally savvy with their marketing.

There’s also demand for niche online agencies, where you’re not even selling your own expertise—but going out and playing matchmaker between the people who do have the expertise For example, a virtual assistant company called Belay has gotten really big by tapping into the talent pool of stay-at-home professionals, and putting a layer of unique branding and management on top of that.

There are similar opportunities in graphic design, web design, content writing, or video editing. Like, there are agencies

that say, “We’ll make TikTok videos for you, we’ll turn your longform content into short form and slice it up, we’re the pros at that.”

How do you know when to go all in on your side hustle?

My typical rule of thumb is to have profits from that business—going back three, six, or 12 months, depending on your comfort level—that at least cover your monthly expenses. I don’t want you to dip into savings or take on additional debt.