Playbooks for growth from the smartest people in startups, PR, and sales.

32 The 50 Startup Mistakes to Avoid Lessons learned from a serial entrepreneur.

46 The Growth Rules Have Changed What works now, from LegalZoom and ShoeDazzle’s cofounder.

48 I’m in PR. Don’t Hire Me! Here’s a better, cheaper way to tell your story.

52 Close the Sale (Even if They Say No) Tips from the world’s best door-to-door salesman.

7 Start Here!

Yes, you can afford a franchise. We’ll show you how.

8 Trust Equals Sales

How this mom-and-daughter duo earn customer loyalty.

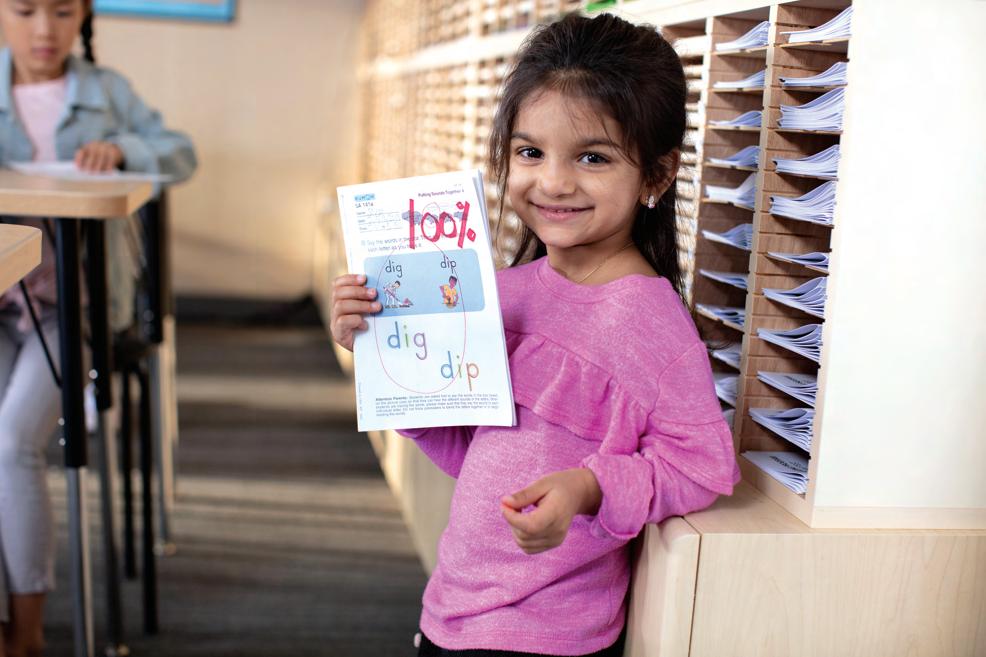

10 His Schools Drove

$7.5 Million in a Year

And he has no background in education!

12 ‘My Greatest Marketing Spend Ever’

How franchisees spent wisely, and drove sales as a result.

20 She Went From Franchisee to CEO

A big lesson in speaking up.

Guy

22 Now ThisGuy Knows Restaurants! He owns many of them. Here’s how he spots a successful concept.

24 How to Build Your Money Machine

The process for making your franchise very profitable.

58 Top Franchises For Any Budget (Even Under $50K)

Browse 300 amazing brands that you can buy for thousands, tens of thousands, and more.

This is Padgett Business Services, a franchise you can start for between $14,450-$100,675. P.12

$245,051* $1,252,496*

*Based on the top Jeff's Bagel Run affiliate-operated store open and operating for a full fiscal year as of 12/31/24. There were two Jeff's Bagel Run affiliate-operated stores open and operating for a full fiscal year as of 12/31/24. The store with the lowest Sales was $841,884 and the lowest Net Profit was $49,991. “Sales” include all revenues, except tips and taxes. “Net Profit” is Sales minus the cost of goods sold, payroll, rent, store-level office and general operating expenses, utilities, merchant fees, local advertising and imputed 2% marketing fund contribution, and imputed 6% royalty, but with no deduction for amortization or depreciation. Additional information can be obtained from JBR Franchise Co's Franchise Disclosure Document. This advertisement is not an offering. An offering can only be made by prospectus filed first with the Department of Law of the State of New York. Such filing does not constitute approval by the Department of Law. MN – 11233. JBR Franchise Co, 4190 Millenia Blvd., Orlando, FL 32839

EDITOR IN CHIEF Jason Feifer

CREATIVE DIRECTOR Paul Scirecalabrisotto

DEPUTY EDITOR Frances Dodds

MANAGING EDITOR Monica Im

SPECIAL PROJECTS EDITOR Tracy Stapp Herold

COPY CHIEF Jessica Levy

RESEARCH Andre Carter, Eric White

SPECIAL PROJECTS COORDINATOR Jordan Hall

CONTRIBUTING EDITOR Liz Brody

CONTRIBUTING WRITERS Jon Bier, Ryan Frankel, Kim Kavin, Mark Siebert, Sam Taggart, Nir Zicherman

ENTREPRENEUR.COM

EXECUTIVE EDITOR Brittany Robins

DEPUTY DIGITAL EDITOR Melissa Malamut

SENIOR DIGITAL CONTENT DIRECTOR Jessica Thomas

ENTREPRENEUR STUDIO DIRECTOR Brad Gage

VIDEO PRODUCER Jeremy Belanger

SENIOR BUSINESS EDITOR Carl Stoffers

EDITOR, CONTRIBUTOR NETWORK Maria Bailey

SUBSCRIPTIONS EDITOR Mark Klekas

SENIOR FEATURES WRITER Amanda Breen

NEWS REPORTER Sherin Shibu

ASSOCIATE EDITORS, CONTRIBUTOR NETWORK

Chelsea Brown, Kara McIntyre, Micah Zimmerman

VP, DATA & OPERATIONS Michael Frazier

AD OPERATIONS COORDINATOR Daniel Belyaks

CHIEF TECHNOLOGY OFFICER Jake Hudson

VP, OPERATIONS Shannon Humphries

PROJECT MANAGERS June Munoz, Julianne Page

SENIOR ENGINEER Jace Poirier-Pinto

ENGINEERS Angel Cool Gongora, Michael Flach, Abel Trotter

FRONT-END ENGINEERS Lorena Brito, John Himmelman

QUALITY ASSURANCE TECHNICIAN Jesse Lopez

ART DIRECTOR Christian Zamorano

SENIOR DESIGNER Jayla Buie

GRAPHIC DESIGNER Andrew Chang

DIGITAL MEDIA DESIGNER Monica Dipres

DIGITAL PHOTO EDITOR Karis Doerner

CEO Ryan Shea

PRESIDENT Bill Shaw

CHIEF OPERATING OFFICER Michael Le Du

ASSOCIATE PUBLISHER/MARKETING Lucy Gekchyan

VP, SPECIAL PROJECTS Dan Bova

PRODUCTION COORDINATOR Mackenzie Truman

VP, NATIVE CONTENT Jason Fell

SENIOR INTEGRATED MARKETING MANAGER Wendy Narez

INTEGRATED MARKETING ASSOCIATE Ashleigh Dennis

SVP, INNOVATION Deepa Shah

PRODUCT MARKETING MANAGER Arnab Mitra

MARKETING COORDINATOR Chris Desrosiers

SENIOR MARKETING MANAGER Hilary Kelley

SENIOR DIGITAL ACCOUNT MANAGER Jillian Swisher

DIGITAL ACCOUNT MANAGER Michelle Gaudy

VP, BUSINESS DEVELOPMENT Charles Muselli

GM, CONTENT SYNDICATION Matt Goldstein

BUSINESS DEVELOPMENT ASSOCIATE Michelle Buzga

ENTREPRENEUR BOOKS

VP, ENTREPRENEUR BOOKS Sean Strain

DIRECTOR OFAUDIENCE DEVELOPMENT & MONETIZATION Anthony Del Conte

SOCIAL MEDIA SENIOR MANAGER Kennadi McCoy

CUSTOMER SERVICE entrepreneur.com/customerservice

SUBSCRIPTIONS subscribe@entrepreneur.com

REPRINTS

PARS International Corp. (212) 221-9595, EntrepreneurReprints.com

ADVERTISING AND EDITORIAL Entrepreneur Media LLC 1651 East Fourth Street, Suite 125, Santa Ana, CA 92701 (949) 261-2325, fax: (949) 752-1180

ENTREPRENEUR.COM Printed in the USA GST File #r129677027

ENTREPRENEUR MEDIA NATIONAL ADVERTISING SALES OFFICES

SVP, NATIONAL SALES Brian Speranzini

ACCOUNT DIRECTOR Krissy Cirello

LOS ANGELES

VP, WEST COAST ADVERTISING Mike Lindsay CHICAGO

MIDWEST DIRECTOR, STRATEGIC PARTNERSHIPS Steven Newman

DETROIT

MIDWEST DIRECTOR OF SALES Dave Woodruff

ATLANTA

SOUTHERN ADVERTISING DIRECTOR Kelly Hediger

NATIONAL ADVERTISING DIRECTOR Hilary Kelley

FRANCHISE AND BUSINESS OPPORTUNITIES

VP, FRANCHISE SALES Brent Davis

PRODUCTS AND SERVICES ADVERTISING

Direct Action Media, Tom Emerson (800) 938-4660

ADVERTISING PRODUCTION MANAGER Mona Rifkin

EXECUTIVE STAFF

CFO Chris Damore

DIRECTOR OF FINANCE Tim Miller

FINANCE SUPPORT Jennifer Herbert

CORPORATE COUNSEL Ronald L. Young

ASSOCIATE COUNSEL Brittany Ortiz

LEGAL ASSISTANT Cheyenne Young

On the following pages, we’ll show you how.

Have you ever thought about business ownership? Worried that it might be too expensive?

After reading the next few pages, you might change your mind.

On page 58, you’ll find our list of the top franchises that can be started for less than $50,000, less than $100,000, and less than $150,000. They include brands that can be started for less than $3,000 (like Dream Vacations) or $13,000 (like Estrella Insurance), and nearly 300 more than can fit any budget.

Between this page and that list, we’ll share stories of how to succeed in franchising—and make that investment worthwhile! You’ll meet a franchise school owner who drove $7.5 million in revenue last year, a restaurant franchisee who’s become a master of evaluating average unit volume (AUV), and even a franchisee who became her brand’s CEO. You’ll also learn how to turn your franchise into a “money machine,” from one of the top industry consultants in the business.

And now, let’s put the money where our mouth is: We’re listing every franchise brand we write about in this issue—and the range of their initial investments. Just look to the right. As you’ll see, the cost range is wide...and so are the opportunities.

things onto the website, how we do things with our consignors.

GABRIELLE: I had to learn all of the names of the leathers, the types of handbags, more about the luxury aspect of it, and all of the history behind the luxury items and luxury brands. We have a very savvy customer base.

How do you build trust with those savvy customers?

People will reach out to us via DMs. One bought a $2,000 bag from us and asked us for a video on how to change the strap. Another one asked us to take a photo of something in a bag. We’re very personal with our customers and our consignors on so many levels. We will take that video for them.

You really lean on that personal connection.

by KIM KAVIN

Dianne, why did you decide to open this franchise?

our items are pre-owned,” Gabrielle says. “Our customers must trust us and our level of transparency. We treat them like we would treat our friends. We would never steer them in the wrong direction.”

The Melillos are franchisees

chise Association’s Franchisees of the Year, they opened a second territory in northern New Jersey—making them Season 2 Consign’s first multiunit owners. Here, they share what they’ve learned building a trust-based business.

companies’ websites. I’m 31, and wanted to start my own business as well.

Was it hard getting started?

DIANNE: The technical part was a big learning curve. We use software for everything: loading

GABRIELLE: Our customers aren’t just our followers. We constantly get comments thanking us for helping them. And because Gabrielle is my daughter, we have insane trust between us. We have the same goals for this business, and we work so hard. It’s such an incredible labor of love.

Do you ever meet your customers in person?

Yes, when we do pop-up shops—at a country club, a boutique, and some spas. Most of the women who get Botox and spa treatments are ready and willing to buy luxury items.

That sounds like a target-rich environment for refilling your stock too.

DIANNE: Some of these women have such big collections; they’re giving up their bags that they don’t use anymore. That’s basically where we get our inventory. Those events—some of them have been really amazing for us.

Jason Skidmore didn’t have an education degree. Here’s how he thrived as an education franchisee anyway.

by CARL STOFFERS

When Celebree School CEO Richard Huffman talks to prospective franchisees, he often hears the same misconception: People think they need a degree in education to run a school. But it’s not true. Huffman himself doesn’t have an education degree! Instead, he believes that franchisees just need to be great operators—so they can hire great educators.

Jason Skidmore is a perfect example. Skidmore’s background is in healthcare; he grew an ambulance service from a single ambulance into a multimillion-dollar operation with more than 130 vehicles and 350 employees. Then in 2019, he became a franchisee for Celebree, an early-education franchise with more than 50 units open. Now Skidmore owns four units, with five more in development, and brought in $7.5 million in revenue in 2024—making him the brand’s top performer.

SO, HOW DID A NON-EDUCATOR BECOME THE TOP FRANCHISEE OF AN EDUCATION BUSINESS?

HE FOLLOWED THESE THREE RULES:

1 ▶ Demonstrate leadership through engagement. When you run a school, your customers (parents!) expect a great experience and curriculum—but they’ll judge you equally on your communication. That’s why Skidmore doubles down on it. “Make sure parents always have a voice at the table,” he says, “and build a leadership team that wants to listen and understands the importance of listening.”

2 ▶ Build scalable systems.

If you’re a franchise owner, you can’t just add a second (or third) unit and run things the same. Your systems must adapt. “It’s looking at what those requirements are, building the team, and then constantly reassessing the gaps and opportunities and processes, then building measurables to review with the team every week,” he says.

3 ▶ Remember what matters.

Skidmore may not be an educator by training, but he connects personally to his brand’s mission—to support children, teachers, and families. When you build a culture around your mission, he says, your team’s actions will follow. “It’s knowing and understanding how many lives we touch every day.”

FIND YOUR SCALABLE TALENT. Skidmore proves it: You really don’t need an education degree to run a successful education franchise. But that’s not to say your background isn’t useful—you just need to think about your skills more broadly. According to Celebree CEO Richard Huffman, prospective franchisees often bring a lot of relevant experience as leaders. “Jason [Skidmore] already knew how to build teams and get results through others,” Huffman says. If you’re unsure if you fit into a franchise, consider what skills of yours are transferable across industries. Your versatility could surprise you!

As a trusted leader in tutoring & test prep for nearly five decades, our commitment to shaping students’ bright futures has earned us the reputation of excellence — year after year. Make an impact in your community as a Huntington franchise owner — because our mission “to give every student the best education possible” stands the test of time.

• Over 45% higher average revenue than our closest competitor

• Low initial investment starting at $163,521

• $5 billion industry and projected to grow to $18 billion by 2028 (Source: Grand View Research)

• Close to 50 years as an industry leader in tutoring and test prep

Great marketing doesn’t require huge budgets. We asked franchisees and franchisors to share their best marketing ROI—and their stories (on the following pages) will inspire you.

“Our Saturday morning pizza workshops have had a huge impact on our reputation in the community. The workshops start with a full restaurant tour, followed by a guided class on how to make your own pizza. Kids don aprons and chef hats to learn tips, tricks, and hands-on skills from our team. Once their pizza is built and cooked, they get to eat their masterpiece. Recently, on Valentine’s Day, we offered a heart-shaped pizza workshop for parents and their kids. All of this has resulted in back-toback workshops selling out, and multiple bookings for private workshops, parties, and field trips.” —Jessie and Jason Parker, franchisees of Crust Pizza Co. in Louisiana

“The best money we ever spent on marketing wasn’t for ads or influencers; it was for coffee. We believe our team members are the true powerhouse behind community awareness, so we created a Slack channel where our team can upload anything that captures the spirit of our studio: selfies, ‘usies,’ quick videos, artsy shots, silly moments, teacher tips, member celebrations, memes, or fails. For every image or video we use in our social campaigns, the contributor gets a Starbucks or Peet’s Coffee gift card—in surprise amounts. What started as a fun way to gather content has transformed into a vibrant culture of sharing and collaboration.”

3

Commission a photo shoot of yourself on the job.

—Toni King and Audrey Ryder, franchisees of YogaSix in California and Nevada

owner of Always Yours Bakery Cafe, and we found a professional photographer through the local Chamber of Commerce directory to capture our partnership in action. Just $500 and an hour of time resulted in stunning images that replaced generic stock images on our website, social media channels, and Google Business Profile. They became the centerpiece of a client success story highlighting Natalie’s entrepreneurial journey, and elevated corporate marketing efforts, adding a layer of authenticity to brochures, presentations, and digital campaigns.”

—Shinji Taniguchi, franchisee of Padgett Business Services in California

“Recently, I reached out to DonutNV corporate to partner on disaster relief efforts for communities in my territory of St. Pete, Florida, following Hurricanes Milton and Helene. DonutNV jumped at the chance, and I was supported with enough product to serve over 4,000 residents of the St. Pete area. Cofounder Alex Gingold actually joined me on night one of the give-back efforts. The response to this initiative was overwhelming, and we continued to provide donations to local schools, communities, and businesses over the following weeks. We just wanted to brighten the day of those who lost everything in these hurricanes, and we are proud to continue these efforts in 2025.”—Eric Koroknay, franchisee of DonutNV in Florida

“We try to have a presence at local events, setting up a welcoming MaidPro table and tent at every opportunity. Kids and adults alike are delighted by our popcorn machine, and we also offer toys for children. We even include fuzzy friends by making dog treats and a water dish available. One of the highlights of our setup is the spinning wheel, where attendees can win exciting prizes, including a free cleaning service and various swag items. This not only promotes my business but also fosters a sense of community spirit. The marketing spend is close to minimal and usually only includes the cost of entry, but the connection we make with our local community is priceless.”—Julie

Sollinger,

franchisee of MaidPro in Massachusetts

“Direct mail continues to be a key driver of success. In June, I received a call from a mom as her son entered his senior year, saying she’d received our mailer and took it as a sign to give test prep one last try. Her son’s scores improved, and he’s been accepted into his dream school. I believe consistency is key—vibrant, colorful postcards with clear messaging go out monthly. The content includes validated insights from reputable sources, emphasizing how standardized test prep improves college acceptance odds. In today’s digital age, physical mail stands out as a tangible way to connect with parents often overwhelmed by online clutter.”—Cara Murray, franchisee of Huntington Learning Center in New Jersey

Looking for a business opportunity with recurring income, flexibility, and long-term potential?

Join Goosehead Insurance and step into a $400 billion industry ready for disruption. Legacy players are outdated—Goosehead is built for today. Customers demand choice, and our franchise model thrives in a fast-changing world.

Why this opportunity stands out:

Create an asset that you can pass down or sell.

Seamless operations for faster business growth.

Grow your business with ultimate flexibility.

Scalable, recurring revenue built to grow.

No insurance experience? No problem. We want motivated entrepreneurs ready to lead and build relationships.

Take control of your future and pave the way to financial freedom with Goosehead!

goosehead.com choice, and our franchise model thrives in a world.

7 ▶ Get a memorable

“Ivy the Owl has proven to be a fantastic tool for Ivybrook Academy franchisees. This lovable mascot serves many purposes, making it one of the best investments for boosting the brand’s visibility. As an educator assistant, Ivy the Owl brings joy and excitement to the classrooms, helping children feel more at ease and engaged. Ivy helps make important announcements at events and provides a playful, attention-grabbing presence for promotional campaigns. Ivy visits new locations to take photos and builds anticipation for school openings, as well as representing us at events like graduations and community fairs. Students can even travel with Flat Ivy, a portable version of Ivy the Owl that families can take to different locations.Ó—Jamie Smith Flatow,

chief marketing officer of Ivybrook Academy

“Claudia Coffey, a local TV personality, was a customer at our locations, so we proposed creating a signature drink inspired by her. This resulted in the Claudia Coffee, a triple espresso frappé with almond milk and chocolate syrup. Claudia launched the drink on her TV show, discussing her busy lifestyle and indirectly endorsing Clean Eatz, while also promoting it on her social media. While Clean Eatz paid for three on-air spots—one on location and two in-studio, totaling $1,000—Claudia’s personal promotion was an extra, valuable boost. Claudia’s target demographic aligns perfectly with ours—female, educated, 30 to 50 years old—making her endorsement even more impactful.”—Matt Hall, franchisee of Clean Eatz in Kentucky

“In the lead-up to the Grand Opening of my location in Knoxville, I was talking to a friend who had just won a World Series title, and jokingly asked him, ‘Why don’t you bring the trophy to the event?’ I was surprised when he replied, ‘What time?’ As an Olympian myself, I wanted the event to celebrate excellence in all forms, so we also brought in another Olympian to sign autographs. These star-studded appearances generated incredible buzz. I learned not to be too shy to ask—and more importantly, that having something concrete to market around is key. It is much easier to generate traction with your digital marketing effort if there is a unique aspect to your event.”—Davis Tarwater, franchisee of SafeSplash Swim School in Tennessee and South Carolina

...unless you speak up and tell them! That’s how this franchisee became a CEO, and then transformed herself into a true leader. by CARL STOFFERS

In 2020, Just Between Friends was facing a crisis. It’s an events-based business, which means it was hit especially hard by COVID. Meanwhile, the husband of one of its founders became seriously ill, so she needed to step back from day-today operations.

The company began looking for a president to take over—and Tracy Panase was sure she’d be considered. She was the brand’s top franchisee, after

all. Three of her four locations were among the company’s top 10 earners nationwide. She’d be a perfect president, she thought. But they never called her.

Panase stewed over this. Then she talked it over with her husband.

“Did you raise your hand?” he asked her.

“No, I didn’t,” she realized. She assumed that her hard work and success would speak

to step up and express it. You have to raise your hand. So she did. She reached out to the company’s cofounder, Shannon Wilburn. What followed was an 18-month conversation about how Panase could do even more than become president. Instead, she was able to buy the entire company and become CEO. Franchises are often sold to private equity firms or investors, not franchisees. But this move fit the brand well. Just Between Friends is community-oriented: Its franchisees host local consignment sales, where they invite neighbors to sell their used clothing. It works because communities band together. So shouldn’t the Just Between Friends brand be

between friends too?

In 2022, Panase officially took over. But when she began, she made the same mistake as before: She thought that because she had been a franchisee, her brand’s franchisees would immediately trust her to be CEO. Instead, franchisees had questions and concerns. Panase realized she’d need to speak up once again.

“The first thing I did was I visited 10 different major metropolitan areas all around the country,” she says, “where we had casual but intentional conversations about franchisees’ concerns, and that was awesome.”

She called it a “Better Together” roadshow, meeting face-to-face with franchisees and listening to their concerns. It was so successful that she did it again last year, but with a focus on small-market franchises. “I’ll continue to do it on an annual basis, because that’s the number-one thing in franchising—establishing those relationships and having that trust with the franchisees.”

Now she’s thinking ahead. Just Between Friends has 150 locations, and she wants to grow it to over 200 across all 50 states. But she knows that she won’t achieve this goal through her efforts alone—it will require every franchisee to take initiative and contribute to the larger mission. That means she needs every franchisee to raise their hand, speak up, and share what’s on their minds. Success isn’t just about working hard, after all. It’s about knowing when to step up and say, “I’m ready.”

“I think it’s an excellent reminder for all of us that you’ve got to verbalize what you want,” Panase says.

It’s the one-stop-shop Creative Education Destination for the whole family! Music, Art, Theatre, Film, & Writing classes and productions serve all ages in skill-based instruction. Our popular, proprietary curriculums retain motivated students for years in the life-changing community that is Encore.

In an era of changing educational needs, Encore Creative Center has emerged as a solution to revitalize collaborative, creative development. Founder-Director Danika Starrharrt shares, “Creativity is about opening the mind to what-if’s, letting expectations go, and finding success in doing what only you can do. Being creative is more than an extracurricular activity; it’s a force, and it’s our whole business model.”

A bustling hub for lessons and classes, Encore serves homeschool students during daytime hours and provides evening classes for all ages. Skill-based learning and year-round programming make consistent revenue possible for franchise owners. The model is unique in its cross-collaboration across departments, resulting in impressive productions from students and staff.

“Encore changed my life,” says 17-yearold Gabe Carson, a student of film and writing, “The qualified teachers and welcoming atmosphere truly makes Encore special. I’m honored to be part and in turn

help change others’ lives.”

Employees find similar fulfillment. “It’s more than a career; it’s a community of magic makers keeping art alive and thriving,” says Megan Owen, an Encore manager. Instructor Laurie Avey notes, “I was having a hard time starting my own studio until I came to Encore. Here, my students are motivated.” Creatives flock to Encore so they can do what they love while earning stable income – no “starving artist” to be had.

The Encore franchise model allows creativity for its owners, while making powerful business simple through personal training, rich media resources, and ongoing support for owners and instructors alike.

As creativity diminishes in traditional education, Encore’s

franchising model offers entrepreneurs an opportunity to fill a need while building sustainable businesses that transform lives.

As writer-musician Kate Haderlie notes, “The fact that Encore is providing a place for ALL creative expression – it fills a much-needed void in the community.”

There are a lot of franchise restaurants. So how do you know which ones are worth buying? This restaurant veteran says it’s all about average unit volume— and here’s why. by KIM KAVIN

If you want to work in restaurants, look at the business through Sonu Chandi’s eyes. His life has been shaped by this business, but he also knows it’s a game of numbers.

In 2000, at the age of 16, he moved to America from his small Indian village—then learned English while working at a restaurant his dad managed. In 2003, his dad and two partners opened a restaurant, and Chandi got involved with the front-ofhouse. “That’s how I learned how the restaurant world

works,” he says. Then he got into the business himself. He bought an existing Mountain Mike’s Pizza franchise in 2007. And now Chandi Hospitality Group, a company he founded with his brothers, runs 17 Mountain Mike’s, is opening 10 units of Guy Fieri’s Chicken Guy! and owns a few independent restaurants too. You might think this makes him sentimental about restaurants, but in truth, it makes him an analytical number cruncher. What makes a good restaurant, in his eyes? “AUV,” he says.

Average unit volume. Here’s how this restaurant man evaluates a tasty opportunity.

How do you choose the brands you work with?

We’re really strategic about looking at their AUV—the average unit volume. It’s the average sales for each location. When you have a high AUV, that gives you the bandwidth to do more things. Our strategy is finding concepts with a high AUV and possibility of a good profit margin and a territory that we have experienced.

Guy Fieri’s Chicken Guy! concept is newer; the brand launched in 2018. Is there a trick to evaluating AUV with a newer brand?

Chicken Guy! doesn’t have enough units to give it actual volume from those units, but we’ve seen comparable competitors do really well in that segment. We know Guy has national brand awareness. We really think that’s

going to drive the traffic. But as a franchisee, you have to make sure you do your operations well. They have the brand awareness and the product, and we have the systems as a franchisee.

Why do you think AUV is so critical?

Revenue is crucial. You can do everything right, and if your concept is limited to only $700,000 top-line revenue, you’re going to have a hard time. If you have a potential unit that can do more than $2.5 million, like some of the competing chicken concept brands are doing—some of them are doing more than $3 million in average unit volume— that’s important. If you’re doing research as a franchisee, look at that top line.

Do you look only at the top line? Franchisors will say, “The top 25% are doing $1.5 million.” Well, what about the bottom 25%? What are they doing? I think it’s important to know that, and then it comes down to whether you have systems to manage the daily labor, the daily food costs.

How do you keep costs down? In the past year, we invested in a back-office team in India. We’re three brothers in the business, and my youngest brother moved to India to operate that back office of nearly 40 people. With that team, we are able to put way more into our customer experience. We can focus on every little detail without taking anything away from our local workforce, but we can enhance that workforce with things like handling phone calls and better practices on accounting.

It sounds like you have even bigger plans on the horizon. We will definitely grow into being a franchisor in the future.

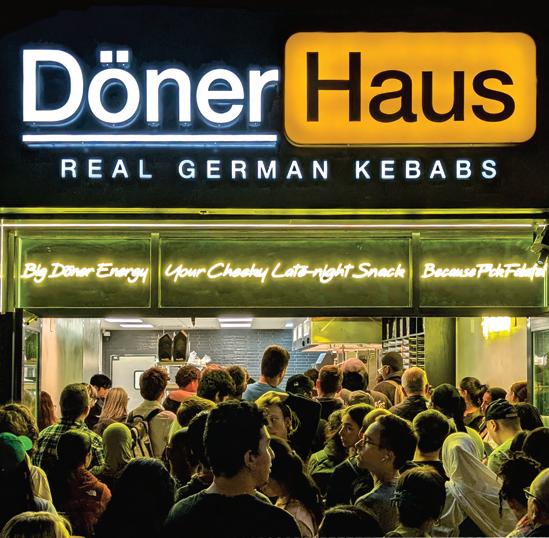

Döner Haus is redefining QSR with a takeout-focused concept bringing authentic German-style Döner Kebabs to the U.S. Founded in 2023, it serves 100% filler-free, Zabiha halal meats in fresh Turkish pide bread. With a tech-driven, efficient model, Döner Haus delivers bold flavors at speed and scale.

Döner Haus does one thing & does it rightserving authentic German-style Döner Kebabs

Döner Kebabs are the next big thing in food, coming over from Europe and set to take the US by storm

Döner Haus offers efficient, streamlined operations with a very focused menu primarily for takeout and delivery

Extremely fair 3% royalty rate and 2% brand development fund to allow franchisees to grow with the company

Delicious, portable, and a staple of European street food culture, authentic Döner Kebabs from Germany are ready to take the U.S. by storm. Döner Haus is leading the way with 21 franchised locations committed and more on the horizon. With a steadfast commitment to quality and nationwide distribution already in place, Döner Haus offers franchisees a ground floor opportunity to introduce this iconic food at half the franchise fees of competitors.

Döner Haus has a simple mission: do one thing and do it right. Their commitment to authenticity and quality sets them apart, from 100% filler-free, organic halal meat to custommade pide bread made just like in Germany. Every step of the process is designed to deliver the bold, authentic flavors that have made Döner Kebabs a staple across Europe. With a focused menu offering Döner

Kebabs in a sandwich, wrap, or box, Döner Haus stays true to what it does best. The result is a healthy, delicious, and truly authentic Döner experience, bringing a taste of Germany to the U.S. market.

Döner Kebabs are Europe’s number one street food and a $6 billion industry in Germany alone. Launched in 2023 in New York City, Döner Haus has quickly proven its success, with annual revenues exceeding $1.9 million at its initial launch. The company has built a 50 state distribution system to ensure consistency across all its stores, with robust proprietary technology to back it up. And with a focus on take-away and delivery, Döner Haus stores have reduced footprints and overhead that allow franchisees to secure prime real estate in high-traffic areas other concepts cannot afford.

Döner Haus provides a streamlined, turnkey franchise model with fees set at half the industry standard. The concept is designed for efficiency, eliminating unnecessary overhead while maintaining high operational standards. Franchisees receive support with location selection, staff training, branding, and day-to-day operations, ensuring a smooth launch and sustained success as you enter an untapped street food market.

A franchise isn’t just a franchise. It should be a Money Machine, creating profit even while you’re out of the office. Here’s how. by

MARK SIEBERT, founder and CEO, iFranchise Group

When I first met the founders of Buffalo Wild Wings, it was 1991 and they had about six locations. They wanted me to try everything on the menu, so we went to the biggest table in the house and began ordering. The wings were hot. But the business potential was hotter.

I’m a franchise consultant. My job is to help turn brands into franchises, and turn franchises into giant franchises. So when I meet with a potential client, I want to know: Are they ready?

Jim Disbrow and Scott Lowery, the founders of Buffalo Wild Wings, were clearly ready. Their unit-level financials were great. They were eager learners. We had a good growth strategy.

But here’s what really sold me: They understood what they were building. It wasn’t just a great brand. It was a Money Machine. I have consulted with literally thousands of businesses, and not everyone understands this, or is willing to do the work required. But I am telling you: The most successful entrepreneurs I’ve ever worked with all understood that a business is ultimately just a Money Machine.

So what is a Money Machine? Good question.

It’s something that provides a reasonable return on investment (ROI) to you as its owner, regardless of whether you have ever even set foot in an individual operation. You can pay yourself dividends or reinvest in your future growth. But ulti-

mately, your Money Machine should provide you with an ROI that is commensurate with the risk you are taking by going into that business.

Franchisors and franchisees both build Money Machines— because even though their businesses are different, the same principles apply. So let’s make sure you’re building your Money Machine the right way.

There is no universal model of business success. But there are commonalities. I call this the “small business success cycle”— which is in the chart.

Start at the 12 o’clock position, where the chart says “Ongoing consumer desire or need.” If you’re not solving someone’s desire or need, you have no business—so you must

do that, and do it sustainably and repeatably. Then you need ways to convince prospective buyers why you are a better choice than your competitors. Keep going around the cycle. As you do so, you need to fulfill your brand promise at a price and margin that provides you with adequate profit. You must also maintain a relationship with your clients or customers

Franchisees benefit from proprietary software, available robotic cleaning equipment, and a scalable business model in a high-demand industry.

Low-Cost Investment: Image One offers one of the most affordable franchise opportunities, with low startup costs and no need for a physical storefront.

Recurring Revenue Model: Commercial cleaning is an essential service with longterm contracts, ensuring steady income and business growth.

Advanced Technology & Support:

Franchisees benefit from proprietary software, and comprehensive training to streamline operations and maximize efficiency.

Starting a business can feel overwhelming—especially with the high costs of many franchise opportunities. But what if you could step into business ownership with low upfront investment, built-in support, and a proven model? That’s exactly what Image One Facility Solutions offers.

Most franchises require six-figure investments, and some exceed $1 million. Image One eliminates that barrier, offering one of the most affordable franchise opportunities across all industries. With low startup costs and no need for a physical storefront, franchisees can start earning without a heavy financial burden.

Image One franchisees benefit from proprietary software that simplifies

scheduling, customer communication, and invoicing—giving them a competitive advantage. Robotic cleaning equipment is also changing the industry, boosting efficiency, reducing labor costs, and improving service quality. effective cleaning solutions.

Commercial cleaning isn’t a trend—it’s an essential service. Offices, medical facilities, and retail spaces require professional cleaning regularly, creating consistent revenue. Even during economic downturns, the need for sanitized workplaces never disappears.

No prior experience? No problem. Image One provides step-by-step training on operations, customer acquisition, and

business management. With ongoing coaching, marketing tools, and tech support, franchisees have everything they need to succeed and scale.

If you want an affordable, scalable franchise in a high-demand industry, now is the time to explore Image One.

Want to learn more? Visit https:// imageonefranchise.com to see if you qualify!

through communication, and then use their feedback to continuously improve.

These ideas may sound simple, but their execution is complex. Each step requires its own systems and measurements. So before we go further, we should pause on the two most important measurements of all: ROI and Key Performance Indicators (KPIs).

First, ROI. If you go into business, you’re investing money and time—and hoping for a good return. It should be that simple. Ideally, you want that return to be north of 20% annualized (plus a market-rate salary if you plan to work in the business)—although, with many small businesses, you may not be able to achieve that kind of ROI in the first couple of years. You should adjust that number up or down based on the perceived risk associated with your desired startup. For example, if your Money Machine required a sizable capital investment in an unproven business model, your risk would be substantially higher, and thus your required ROI should also be higher.

Next, KPIs. Think of these as the inputs into your business’s system. Each of them has target ranges that, if achieved and combined successfully, will allow you to manufacture the output of profitability.

KPIs vary substantially depending on your industry, so you need to understand yours. For restaurants, a few of the many important KPI measurements include your sales-to-investment ratio, your food costs, your labor costs, your average ticket, your table turns, and your occupancy costs. If you are in the hotel business, some important KPIs include your overall occupancy rate and your average

revenue per occupied room.

Moreover, the target numbers for each of these KPIs will likely be different even within the same industry. For example, in the restaurant industry, a steakhouse might aim for food costs in the range of 35%, while for a pizza restaurant that number might be closer to 30%.

If you change your KPIs and target ranges, those decisions will ripple out into other areas of your business. For example, let’s consider a restaurant: The logical assumption is that we want to keep our food costs down. After all, each percentage point saved on food costs, all else being equal, will translate to a significant increase in profitability. But everything is not always equal. If you can reduce your food costs by eliminating waste, improving portion or inventory controls, or establishing better systems for pricing or purchasing, that could improve your Money Machine. On the other hand, if you had to sacrifice quality, raise prices unreasonably high, or make your portions so small that your customers are left dissatisfied, then your reduced food costs KPI could have a severe negative impact on your overall profitability. After all, anyone can decrease food costs to 2% if they charge $50 for a burger. But how many burgers could one sell at that price?

Likewise, you could reduce your labor costs in your restaurant simply by hiring fewer people. But if that results in poor service and unhappy customers, you may have missed the point of the exercise. So as you start identifying the KPIs and target numbers that will ultimately drive your business, consider the consequences of valuing or adjusting them.

The KPIs for a franchise or

small business can usually be grouped into several major categories: marketing metrics, sales metrics, production and financial metrics, and client satisfaction metrics. These KPIs generally occur in that order. Marketing drives sales. Sales drive production. Production drives client satisfaction. And client satisfaction (and the word-of-mouth it delivers) drives repeat and new business.

To create your Money Machine, think about your business as if it were a car going down the assembly line. Some things happen first, then others later. Different inputs occur at each step of the process. You must make the right moves at each step to end up with the best possible result.

So what parts are you assembling? Let’s start with the most basic one: your customers

Knowing your customers is the first step toward building any business. You must determine who they are, what they need, and what message will drive them to your door. You also need to figure out how to find them in the most cost-efficient way—and at an acquisition cost that will allow you to make money.

Here’s the next piece to assemble: your price. What will customers pay for your product or service, and how can you differentiate from your competitors enough to capture some of those customers? Essentially, you need to create a reason for your customers to buy from you (and not someone else) at a price point that allows you to make a profit. And like all aspects of your system, you want that customer acquisition element of your process to be simple (so you do not have to do it yourself) and repeatable (as

much as possible in today’s rapidly changing world).

Here’s the final piece to assemble: How you’ll produce your product or service at a cost that allows you to make a profit while making your customers happy. Do that, and you are well on your way to creating your Money Machine.

Of course, this simple, sequential process will be much messier in the real world. Entrepreneurs often start with the product or service they plan to provide, believing they have found that better mousetrap. But if you fail to think about your business holistically and sequentially, you may build a business that cannot be replicated.

So far, we’ve talked about the fundamentals of business— whom you serve, how you serve them, and how you make it financially sustainable. You could call this your business paradigm; it’s the set of assumptions, models, or beliefs that ideally guide you to success.

Every business is different, which means every business will need a slightly different paradigm. The purpose of this paradigm is to provide you with a simple set of analytical tools that will give you performance benchmarks. So here’s a piece of cautionary advice: Don’t overcomplicate it.

Your paradigm should be simple. If your business model paradigm looks like the schematics for building a 747, you will never be able to use the many data points in your analysis to course-correct.

Essentially, your business paradigm needs to be actionable—which means that you will want to limit it to only the data you need to alert you

when you start to go off course. Your primary KPIs will be lead generation, sales, production, and client satisfaction. Under each of those broad categories, you will probably want three to five more granular KPIs to monitor. This will leave you with a maximum of perhaps 20 different measurements to monitor on a regular basis. Some of these KPIs can be found in your profit and loss (P&L) statement, the standard accounting document that measures revenue, expenses, and profits. But many of these KPIs will be measurements you need to create yourself, based on your own needs.

Beyond that, of course, this can’t just be about numbers. It has to be about understanding what changes those numbers. If you cannot glance at your P&L statement and understand how you are performing, you do not fully grasp the nature of your business. Likewise, if you do not fully understand your KPIs, you are more likely to find yourself mired in an unanticipated crisis.

One of the key qualities of a machine is that it is not dependent on one specific individual to operate it. While there may be particular skills needed to run it, no engineer would take the trouble and expense to design a machine that only worked for one person.

The same is true for a Money Machine. If you are integral to the performance of your business, you have not built a Money Machine. You built a job.

When entrepreneurs come to me looking to franchise, one of the telltale signs that they may not be ready is their inability to break away from their work, even for a day. They are often so tied up in their business that

simply scheduling a 90-minute phone call is a challenge. And when it comes to implementing their expansion plans, their primary concern is often their ability to devote the time and effort to the program—and an unwillingness to delegate to others.

One of the most difficult lessons for many entrepreneurs to learn is that if they want to grow, they need to give up control. If they can’t, they will usually fail. Expansion requires you to create systems, and then recruit and trust talented people to implement them.

Once your Money Machine works without you, you can turn it on and watch it print money. It can run while you are on vacation, at your children’s athletic events, or on the golf course. You can even take the money and reinvest it in a second Money Machine. The formula for growth should become relatively easy to predict, barring an unexpected disaster.

Use systems to create a duplicable Money Machine, measure its performance, and harvest the returns. Reinvest those returns in another Money Machine, continue to monitor performance, and harvest the returns. Reinvest in another Money Machine. Lather. Rinse. Repeat. That’s the Multiplier Model.

Like I said earlier: This applies to both franchisors and franchisees. Franchisors are building systems that repeat. Franchisees are buying units that could eventually run without them. Both can do more. Both can multiply.

Let’s assume that your Money Machine requires an investment of $180,000 in equipment, buildout, and signage. Let’s further assume that you need another $90,000 in working capital until you break even at the end of the

Entrepreneurs often start with the or service to But if you fail to think about your business and you may build a business that cannot be

Entrepreneurs often start with the product or service they plan to provide. But if you fail to think about your business holistically and sequentially, you may build a business that cannot be replicated.

first year. And let’s assume that at the end of year two, your Money Machine will generate revenue of $600,000 and will generate a profit, after paying the salaries of everyone involved, of 20% (maybe 15% after taxes), giving you $90,000 in returns. Let’s further assume that you can live off the manager’s salary while you build the business and can reinvest all the profits in growth.

If you were to reinvest all your profits, you could open a second Money Machine in year four. And at the end of year four, you would have two Money Machines, generating 15% returns on $1.2 million in revenue. Your timeline now gets cut in half, although at some point you will need to add overhead. In year six, you have enough capital to build a third Money Machine.

Here is where it starts to get interesting. In year eight, you could open a fourth unit, a fifth in year nine, a sixth in year 10, and two more in year 11. By year 20, if you had the fortitude to continue reinvesting at that pace, you would have 65 units in operation, $39 million in revenue, and nearly $5 million in annual profits, with 17 additional locations scheduled to open the following year.

Of course, that does not account for your need for incremental overhead to support

your growth. And it assumes that the business model does not change or evolve over the years (unlikely) or that there are no major recessions or other setbacks along the way (fingers crossed). So there is some optimism baked in here.

Then again, my example also did not account for any bank financing or tenant improvement allowances that might have been granted. It did not account for any purchasing economies that might have improved margins, or increased buying power on advertising, or stronger name recognition that might have driven higher revenue. And it did not account for faster growth strategies, such as franchising, that would allow for more aggressive market penetration.

You can’t predict everything. But the point remains the same: If you build a successful business model that works without your direct involvement, duplicating that business model over time will multiply those profits substantially.

Then, as your Money Machine grows, so does your money.

This is an excerpt of Mark Siebert’s book The Multiplier Model, published by Entrepreneur Press. Find it at entrepreneur.com/bookstore.

MAXIMIZE YOUR PROFITS IN 2025

The path forward is hard, so learn from where others have fallen. This is a list of very hard-won lessons.

by NIR ZICHERMAN

I’ve seen many startups succeed, and many fail. I’ve conin

of them. My previous startup, Anchor, its own and missteps; we were fortunate to survive them, and the company in 2019.

I’ve seen many startups succeed, and many fail. I’ve consulted for and invested in lots of them. My previous startup, Anchor, navigated its own challenges and missteps; we were fortunate to survive them, and ultimately Spotify acquired the company in 2019.

My favorite piece of advice for startup founders: You’ll be 90% wrong about your assumptions. The problem is that you don’t know which 90%. Therefore, do everything you can to challenge your convictions, and be willing to shed them or tweak them as needed. Rapid iteration and an open mind are two necessary ingredients for a successful startup journey.

Over the years, I’ve come to think of startups as a game of Minesweeper. Remember that game from early PCs? You’d start with a grid of clickable squares, with cartoon mines hidden throughout. Your job was to take a few guesses, gain some information about where the mines were, and logic your way through finding them all. Similarly, startup founders start with an empty board. And although nobody can know their locations, the mines are guaranteed to be there—and certain types of mines are common to every kind of business. A founder can save a lot of time, money, and energy if they know how to avoid these pitfalls from the very start.

Over the years, I’ve come to think of startups as a game of Remember that game from early PCs? You’d start with a of clickable squares, with cartoon mines hidden Your was to take a few guesses, gain some information about where the mines were, and logic your way through finding them all. startup founders start with an empty board. And can know their locations, the mines are to be there—and certain types of mines are common to every kind of business. A founder can save a lot of time, money, and energy if know how to avoid these from the very start.

After many years of navigating mines, I’ve identified the 50 most common ones. share lessons like this in my newsletter— which you can find at my website,

After many years of navigating mines, I’ve identified the 50 most common ones. (I share lessons like this regularly in my newsletter— which you can find at my website, zaxis.page.) To be clear, this list is far from exhaustive. And while there are certainly exceptions, it can be a great shortcut for anyone leading a new initiative, at any sized company.

To be this list is far from exhaustive. And while there are exceptions, it can be a great shortcut for anyone leading a new initiative, at any sized company. to find your mines? Here are.

Ready to find your mines? Here they are.

Meaningful long-term change takes time, be it learning new skills, obtaining new customers, or establishing a brand. The most underrated way to drive improvement is through incremental steps that compound over time. Einstein apocryphally called compound interest the “eighth wonder of the world.” Tiny changes each day multiply to astronomical gains, so long as you’re consistent and committed.

Any action a user or customer needs to take is considered the top of a “conversion funnel.” The goal is to get them to the bottom. One of the easiest ways to lose someone along that journey (a phenomenon known as churn) is to require them to go through too many steps. I call this the “Law of Funnels.” It states: “The more steps a user has to go through to do something, the less likely they are to complete it.”

Startups have very little time and resources to focus on the wrong thing, but it’s impossible to predict what they will need to focus on. So don’t waste energy and precious hires on what a person has done in the past. It’s 97% irrelevant to what they will be doing in the future. Instead of hiring for relevant experience, hire people who are adaptable and good problem-solvers.

(SEE FIG. 1)

Many startups overengineer and future-proof in the early days, which is almost certain to result in a tremendous waste of energy. At the start of the journey, there are very few knowns (see mistake No. 1). But one thing that is known is that there is a fundamental difference between the friction that prevents a product from taking off and the friction that prevents it from scaling.

In my favorite brainteaser of all time, 100 prisoners wear different colored hats and strategize ways to identify their own hat colors. A startup often has far fewer than 100 employees, but often has far more than 100 hats. Context-switching carries a real cost, and early-stage employees who fail to delegate responsibility often end up performing all tasks poorly. Find people you can trust to take some of those hats off your head, and bring them in early.

One of the easiest ways to get discouraged while running the startup marathon is to compare your rough drafts and works-in-progress to polished success stories. All difficult tasks (be they entrepreneurial, creative, educational, etc.) require iteration and more iteration, revision and more revision. The mistakes along the way are countless, sure, but they are also priceless. Comparing a work-in-progress to the finished products we see every day is not only demotivating—it’s also disingenuous. It’s comparing a sapling to a fully grown tree.

The line of demarcation is known as product-market fit. Prior to that line, all of a company’s energy should be directed to reaching it. Being overly concerned with what happens afterward is an exercise in futility.

To be solved effectively and efficiently, problems must be segmented and bounded. First, split your intractable problems into small, digestible challenges with a single goal in mind for each. Second, ensure that their solution is bounded to a finite solution space. Not realizing this is almost always a recipe for wasted resources and disappointing outcomes.

Founders are often scared to take on powerful incumbents, believing those paths to be dead ends. This is a mistake. Taking on a monopoly is often a missed opportunity with enormous upside, and with lower costs than you think. There are four main reasons: Monopolies have already proven the industry is viable and lucrative. They refuse to cannibalize their own dominance. They’ve institutionalized their inefficiencies. And perhaps most importantly, they have the most to lose from making mistakes. Startups, by contrast, have the most to gain.

For most startups, there are only two viable outcomes. In the unlikely case, they will be a big success. In the more likely scenario, they will fail. Don’t stick to early product or strategy decisions that raise the likelihood of the latter. If your startup fails, the value of all your decisions will be zero—so do everything you can to maximize the likelihood of success. If that requires pivoting from what you know and are comfortable with, so be it.

Passionate and creative thinkers often believe that in order to succeed, they need to be the first mover. This is wrong. Being the first mover is often a tremendous disadvantage. What matters is not being first but having consumers think you were first, all while benefitting from the courses charted by your forerunners.

FIG. 2)

Your existing users or customers are critically important; you wouldn’t have a business without them. But focusing too much on their needs necessarily comes at the expense of the audience you haven’t yet reached, and for whom you’re still struggling to showcase value. Catering to those who have reached the bottom of your funnel prevents you from serving the needs of those higher in the funnel, whose needs have not yet been served. This is the push and pull of product development, and there is a flip side to it. That’s the next mistake…

(SEE FIG. 2)

The danger outlined in mistake No. 12 swings the other way too. Neglecting to serve the needs of your existing users runs the risk of causing unnecessary churn. The cost of retaining customers you have already converted is substantially lower than the cost of obtaining new ones. Don’t be overly protective of the users you have, but don’t be overly dismissive either.

Your employees are motivated by different things, and failing to recognize their different styles often leads to poor management as well as to employee dissatisfaction. I categorize people into a “Climber, Hiker, Runner” framework: Climbers are driven by the prospect of unlocking future opportunities. Hikers prefer to take on new challenges and learn new things. And Runners are happy when they can dive deep into what they’re good at. Approaching motivation this way has made me a better manager, and has helped me identify effective ways to keep employees happy.

Successfully growing a startup is a marathon (see mistake No. 2). Shortterm wins offer little beyond dopamine hits and the stroking of egos. In long-term success stories, accomplishing tough goals takes time but yields meaningful and lasting benefits. While it takes many short-term wins to get to the finish line, don’t miss the forest for the trees. Those incremental achievements are not the true goal. They are the means to an end.

DON’T BE OVERLY PROTECTIVE OR DISMISSIVE OF YOUR CUSTOMERS.

Your life is divided into two parts: that which occurs before you have the awkward, unpleasant, or emotionally taxing conversation you’re putting off, and that which occurs after. Which would you rather extend? If it’s the latter, why not do everything in your power to cross the boundary right now?

Power laws govern everything you do. Most of the work you put into your startup will yield little clear benefit. Most of the success you see will come from a handful of bets. Internalizing this phenomenon leads to better decision making, less emotional turbulence, and healthier, more sustainable businesses.

Get started with CRM now — with simple setup and guidance. Unify your data and use trusted AI to make smarter decisions, automate processes, and grow revenue.

See how Salesforce can help you do more with less.

Have a brilliant idea and an NDA preventing anyone from peeking at it? You’re likely not doing yourself any favors. Truly successful companies win with superior execution, not superior ideas (see mistake No. 11). And by overprotecting your idea from being prodded and challenged, you’re weakening its probability of ever coming to fruition. Often, those individuals who frighten you as potential competitors are those whose feedback is most valuable. And if you fear them stealing the idea, be comforted in knowing that there is no shortage of great ideas in the world. There is, however, a dire shortage of people who know what to do with them.

When lost in the hustle and bustle of the early stages of a company, it’s important to remember that most stressful things don’t actually matter in the long term. They will do little to affect the eventual outcome, but they will heavily drain you in the near term. Please take regular moments to stop yourself, look at your small stressors, and ask if this really matters in life. It probably doesn’t.

Nearly everything I’ve needed to learn to become a technical cofounder, I taught myself (with the guidance of great mentors). You live in an age of wonders, where anyone can learn anything with incredible efficiency. Do not allow the search for a technical cofounder to prevent you from pursuing your dream. Become the technical cofounder yourself.

For instance: Are you interested in AI but think you’ll never understand how it works? Think again.

Whether in person or remote, the value of having your team “break the ice” cannot be overstated. I mean that in two ways. First, it’s of course good for your colleagues to get to know one another (and hopefully like one another), which leads to happier employees and higher productivity. Second, when people let loose, it “breaks the ice” of the day-to-day mayhem of startup life—or what I like to call “a necessary thawing period.”

Goals without metrics are unbounded (see mistake No. 8). This makes them harder to achieve—and how will you know when you do achieve them? How will you hold yourself accountable when you’ve veered too far off course? Particularly when working as part of a team, quantifiable and measurable goals are of paramount importance to achieve any level of alignment.

Often, problems that seem intractable have elegant and simple solutions. We are trained to look for complexity, and to value those perspectives that overcomplicate the world. Ignore that instinct! The greatest insights I had as a founder came from light-bulb moments when I realized things were simpler than I’d assumed, not more complicated.

(SEE FIG. 3)

There is a big difference between being at a local minimum and being at a global one. Yet from a day-today vantage point, they look the same. Any change in any direction means more work, more stress, and more risk. We must zoom out and look at the entirety of our options. Sometimes the best paths or strategies lie just beyond a hill we’re scared to climb.

While other people’s success stories can motivate and inspire you, they can also be dangerous. Everyone’s path is unique, and often meandering. Anyone who says that your journey to success must follow a single trajectory has never built a company of their own; they’ve merely studied other people’s.

Most day-to-day problems are just noise. Sometimes it’s angry employees or customers. Sometimes it’s a deal gone bad or failing servers. Successful leaders adopt what I call a low-pass mentality. Just as low-pass filters in engineering absorb short-term shocks by filtering out the high-frequency ups and downs, a startup founder must filter out the noise and focus on solving long-term, systemic issues that will have a high impact.

As shown in mistake No. 1, you’ll be wrong about pretty much all your assumptions. So why risk your business on a single bet? Of course, it’s important to have convictions—but that doesn’t preclude you from simultaneously having other convictions, particularly at the very early stages. If the primary goal of a startup is to reach product-market fit quickly (see mistake No. 5), the risk of being wrong about your one big bet would be extremely costly.

Just as it is dangerous to wear too many hats (see mistake No. 6), it is similarly dangerous to tackle too many strategies at once. Successful leaders prioritize ruthlessly; that means tackling “critical” tasks before ones that are only “very important.” It means committing to seeing strategies through before expending energy on other ones. And it means rallying the whole team around a single milestone or goal, rather than splitting their attention and making everyone worse off because of it.

Most of the key turning points in my business career came through the strength of relationships fostered over many years. Small decisions to help others, to build trust, and to keep in touch can have a tremendous impact on your future in unpredictable ways. The worst-case scenario? Some wasted social energy. The best-case scenario? You open doors you never knew were there.

Despite all the unpredictable noise in business, there is an often-overlooked consistency between market cycles and the players within them. While it’s dangerous to place too much emphasis on individual success stories (see mistake No. 25), it is even more dangerous to overlook the cyclical nature of market dynamics. Human psychology is notoriously predictable—and notoriously forgetful.

As a founder myself, I overlooked the learned experience of other founders. There is so much guidance buried in their success stories. There is even more to take away from their failures. As I said at the top of this article, startups are like a game of Minesweeper. You can tackle a blank board and start clicking away, or you can put aside your ego and get help from those who have played that board before. If you choose the latter, the likelihood of success can skyrocket.

There is a reason they are called vanity metrics. Hitting them is the kind of shortterm gain I advised you to disregard in mistake No. 15. Why achieve goals that look good but aren’t strategically important? Why care about the number of users if those users are a poor fit and don’t stick around? Why focus on time spent using your product if that number is only high because your product is hard to use (see mistake No. 3)? Identify your desired outcomes, and then find the metrics that actually map to those outcomes.

In computer science, there is a fundamental limitation on how database systems can be built. One can never achieve more than two of the following three goals: consistency, availability, and partition tolerance (or “CAP”). The same is true of companies, which will inevitably see a decline in one of these as they invest in the other two. For instance, when ensuring all teams can talk to each other (availability) and that there is always an individual who can be the “source of truth” for others (consistency), your ability to manage when an employee leaves or communication channels go offline (partition tolerance) drops considerably.

Arbitrary deadlines are a tool. Like most tools, they can be good or bad, depending on who’s using them and for what. Yet while there are many times a team needs the space to think, build, and iterate without undue pressure, there are just as many instances that benefit from the structure and direction provided by arbitrary deadlines. Importantly, arbitrary deadlines should be recognized as arbitrary, and they should be adjusted if needed. But that doesn’t diminish their power in aligning a team and incentivizing productivity. In the right circumstances, I’ve seen them work wonders.

Early-stage entrepreneurship, as in quantum physics, presents an inescapable tradeoff. Resources (time, money, etc.) can be spent on investing in a specific strategy or on keeping open optionality; they cannot do both. I call this phenomenon the “Startup Uncertainty Principle.” It shows that the more you focus on the present, the less you’re able to prep for the future. And the more you prep for the future, the less effective you’ll be now. Companies that attempt to do both at once are fighting a losing battle.

As shown in mistake No. 28, successful companies prioritize ruthlessly. When companies spread themselves and their employees too thin, they hurt productivity and morale. Of course, there is value in investing in longer-term projects with higher costs and higher rewards. Yet it is also critical to regularly prioritize easy wins and short-term opportunities that move the needle incrementally. In addition to laying the foundation for compounding improvements (see mistake No. 2), it will also reengage your teammates and keep morale high.

As founders and dollars race to build in competitive, high-growth markets, opportunities often exist in “hidden layers” of industry. Companies that focus there can ride waves of market growth while avoiding fierce competition, by turning potential competitors into actual customers. Some of the most valuable companies in the world have taken this approach (including the two most valuable) and it has paid dividends (literally).

New technological solutions to longstanding problems can be attractive. But the hidden downsides can surface much too late—often when you’re already dependent. New technologies can break, can go out of business, or can have unexpected side effects. By contrast, longstanding problems tend to have proven longstanding solutions. While not as exciting to use, they work, and that’s what matters most.

Managers sometimes believe that when things get hard—and they inevitably will, many times over—bad news is better delivered indirectly or with a positive spin. This is an innate human desire. But employees are smart. Being disingenuous about the state of the business or the rationale for business decisions will hurt your company over the long term. This applies to everything from layoffs to pivots to cutting perks. Your employees will see through the euphemisms, rendering your sugarcoating fruitless, and they will respect you less for your lack of directness.

It’s a law of the universe that everything trends toward disorder. Knowledge and control are no different. No matter what, eventually you’ll be wrong. Your convictions will need to adapt as the world in which they exist evolves. The stable parts of your business will suffer from unexpected market dynamics, new competition, and shifting consumer attitudes. Those who succeed in the long term embrace entropy as a fact of life, and they know that they cannot hold anything too sacred for too long.

With limited time and limited resources, only so much can get done. A startup has every disadvantage relative to more well-funded incumbents, and only one advantage: speed. Leverage this. Big players are slow to move and slow to turn, like giant cruise ships. Startups are small and nimble sailboats that can race faster and turn on a dime when it matters.

A dollar is a dollar is a dollar. Every single dollar spent—no matter how it’s accounted for—is money not spent on something else. This is all the more reason to prioritize ruthlessly (see mistake No. 28). Resources have a habit of disappearing faster than you’d expect.

(SEE FIG. 4)

Companies that overinvest in aligning their team members do so at the expense of productivity. Those that focus on productivity do so at the expense of alignment. The optimal balance depends on the company, its size, and its unique journey. But the important takeaway is that you are making this trade-off whether you explicitly choose the balance or not—so you might as well choose it.

The “birthday paradox” shows that if you put 23 people in a room together, there is a 50% chance two will share the same birthday. By the same mathematical logic, if any conversation has even a 0.3% chance of being life-changing, then putting a few dozen people in a room together is virtually guaranteed to lead to some life-changing conversations. The takeaway? Meet more people.

Startup stress can seep across any boundaries you’ve set. To drive both productivity and better mental health, don’t work exclusively from where you sleep and spend time with family. I say “exclusively” because I have seen startups achieve great success in a fully remote setup. Still, the early days of startups rely critically on serendipitous conversations and ideations—and that can only happen when employees are colocated. Get the team together now and then.

Most founders I know get their best ideas when they’re not at work. There’s something about the change of scenery, the connections between unrelated neurons, and the exposure of a problem or challenge to a new environment. Whereas mistake No.

45 showcases why it’s important to sometimes bring your team together, this one recognizes that it’s equally important to take them out of their comfort zones and get them to interact in brand-new places and brand-new ways.

When things get difficult (and they will), it’s important to reflect on the things that helped motivate you to start in the first place. Have it readily accessible—be it a movie or a podcast episode or a book or a soundtrack—and revisit it when you feel the morale drop. For me in my Anchor days, it was Daft Punk’s Random Access Memories. To this day, if I need a jumpstart in motivational energy, I just put on that album and get to work.

You’re going to miss the early days. You’ll wish they were better documented. If things end up working out, you’ll look at those moments in time and say, “Wow, look how far we’ve come.” And if things don’t, you’ll say, “Wow, look how hard we worked. If I did that, I can handle anything.”

49 ▶

Product-market fit is the elusive transition point at which you realize who your customers are and what value you’re providing for them. Hardly anyone reaches this point without considerable effort, and the easiest way for a brand-new enterprise to fail is to assume they have reached this point when they have not. There are only two ways—talking to customers and looking at data—that can verify the milestone has been hit. Once there, things get considerably easier.

I suppose I’m guilty of this one right now. No list of startup advice is exhaustive. Every new entrepreneurial journey is bound to uncover unique challenges. Yet that’s also part of the fun of the startup journey: You never know what’ll happen next.

Nir Zicherman is the CEO of Oboe and shares advice like this weekly in his newsletter, Z-Axis. Subscribe at zaxis.page.

Local Engagement, National Reach

As a CMIT Solutions franchise owner, you’ll lead a team that helps businesses thrive with top-tier IT solutions—all with the backing of a proven system.

Join an elite network of business leaders and start your journey with CMIT Solutions today!

www.cmitfranchise.com

‘ONLY

Brian Lee cofounded companies like LegalZoom and ShoeDazzle—and he believes a lot of conventional business wisdom is backward. Sure, it’s harder to raise capital. But it’s actually cheaper than ever to start a company.

by JASON FEIFER

Want to think big? Think like Brian Lee.

He’s the cofounder of LegalZoom, ShoeDazzle, and The Honest Company—each of which were transformative inside of crowded spaces. And here’s how he spotted his most recent opportunity. He looked at the primary trading-card industry, which he says is “relatively small” at just a couple billion dollars. The secondary market for trading and selling those cards is more interesting to him, at maybe $25 billion. There are a lot of players in this space—manufacturers, auction houses, grading companies, and so on. So where would he fit in?

“The reason I’m so excited,” he says, “is because that secondary market doesn’t really have a brand name. So there’s some very large players in the industry, but none of them are household names.” Now he’s building what he hopes will become that household name; it’s called Arena Club, which helps people grade, collect, invest in, sell, and trade cards.

Lee now also invests in startups through his early-stage fund, BAM Ventures. Most startups he sees aren’t built for success, he says—but the reasons may surprise you. He explains in this conversation.

You’re no stranger to business problems. In fact, LegalZoom came close to insolvency a few times. What did that teach you?

LegalZoom started as a direct-to-consumer (DTC) legal services company. However, a few years in, we noticed this gentleman in Florida ordering a divorce package probably every week. So after about 12 or 13 divorce orders, we were like, “Wow, this guy’s getting married and divorced a lot!”

So I decided to reach out and just make sure he’s OK. Then I found out that he was a divorce attorney, and he was just using us almost as a back-end paralegal to create his documents. And of course, the light bulbs went off for us at LegalZoom. We were like, “My

goodness, we’re not just DTC. We could be a B2B business too!”

This happens so often, right? Entrepreneurs see how customers use their products, and new opportunities emerge.

Yeah. But not always.

After talking to this divorce attorney, we were like, “OK, why don’t we start a B2B platform as well?” So we decided to make a more robust, professional version of LegalZoom and sell it to lawyers. We took all of our best resources, our best designers, our best engineers, and our best marketers, and put them into an offshoot company we called ProxyLaw. Then we realized that ProxyLaw was a very different business. The sales channel was different. We’d have to knock on doors of small law firms and convince them to switch over to us, and so forth.

Meanwhile, LegalZoom had been profitable—but now it was slowly becoming unprofitable. ProxyLaw never took off, and we were days away from bankruptcy. So we had to shut it down and refocus our energy on LegalZoom.

That story didn’t go where I expected it to! You discovered a new opportunity, but it harmed the existing opportunity.

It became a lesson I’ve always remembered: You have to focus. Every day, you’ll see new opportunities. But guess what? You can’t do it all. You have to build a very, very strong foundation first, and make sure that you’re as solid as you can be before you start extending. Now, on anything I’m doing, I make sure to go deep, deep, deep—and start with a position of strength before extending.

You invest in founders. Is this something you look for in them—a deep ability to focus?

Yeah, we look for entrepreneurs that have to make it work. They almost have no other choice but to make this

work, and they’re all in. By contrast, we don’t think side hustles work. Side hustles are OK if you’re just making a few bucks here and there, but if you’re going to really start a business, you’ve got to be all in.

We also prefer teams to be together, in person. I have yet to see a company that starts with a fully dispersed team, with dispersed founders from all over the place, grow a multibillion-dollar business via Slack.

often say that remote work allows