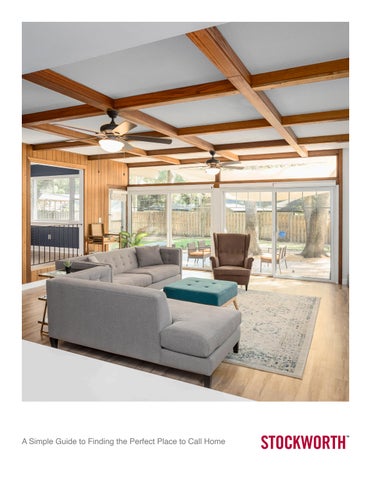

A Simple Guide to Finding the Perfect Place to Call Home

MEET LISA

Lisa Holaday brings 27 years of sales executive experience to Stockworth Realty Group. As a Concierge Realty Advisor, Lisa’s areas of expertise are Downtown Orlando, Dr. Phillips and Windermere areas.

Lisa grew up in Orlando and is a local graduate of Boone High School and the University of Florida. She started her professional career “selling Orlando” with the Orlando/Orange County Convention & Visitors Bureau, now called Visit Orlando.

Lisa obtained her real estate license in 1999 and has worked with residential buyers and sellers in Orange, Lake, Seminole and Osceola Counties. In 2011, she decided to switch gears and try her hand at commercial real estate with Brixmor Property Group. Lisa had the ability to gain extensive experience in both office and retail leasing, rounding out her real estate career.

While Lisa enjoyed commercial real estate, her passion is advising families on making great choices when it comes to buying, selling, or renting their home. Lisa is a dedicated Mom to her grown sons, Russell and Dylan, and her black lab, Marley.

Lisa Holaday-Weiss Professional Real Estate Advisor 407.376.1000 Lisa@Stockworth.com @HoladayLisa Lisa

Holaday Weiss

Leadership & Creative Team

EXPERIENCE THE DIFFERENCE

Stockworth advocates for our clients, guiding them through the real estate transaction with extraordinary service, uncompromising ethics, and exceptional knowledge. Our group of outstanding practitioners and their support team have a strong commitment to service, integrity, and professionalism. We build lifelong relationships by providing unparalleled experiences for our clients.

Jared Eslick Creative Director

Melissa Koepplinger Director of Relocation

Jason Schmidt, CCIM President, Broker

Mark Hayes, CCIM Owner

Jodi Hayes COO

Sara Presser Social Media Manager

Ryan Ashworth Video Producer & Editor

Josue Quiceno Video Editor & Colorist

Meghan Garcia Video Editor & Colorist

Evan Caulfield Property Management

Fransheska Nunez Web Developer

Will Rizzo Real Estate Photographer

Jared Eslick Creative Director

Melissa Koepplinger Director of Relocation

Jason Schmidt, CCIM President, Broker

Mark Hayes, CCIM Owner

Jodi Hayes COO

Sara Presser Social Media Manager

Ryan Ashworth Video Producer & Editor

Josue Quiceno Video Editor & Colorist

Meghan Garcia Video Editor & Colorist

Evan Caulfield Property Management

Fransheska Nunez Web Developer

Will Rizzo Real Estate Photographer

Let’s Find Your Dream Home

What we will do to help you through the home buying process...

• We will work with you through the mortgage pre-approved process.

• Provide immediate access to any new listing that meets your search

criteria.

• Provide a comprehensive market valuation of all properties you

• Offer step by step communication of all processes leading to the

• Provide consultation and recommendations of the written offer to

Sellers and their agents know that a pre-approved buyer is serious and prepared to close. choose to make an offer on. transaction closing. purchase, with terms approved by you.

• Negotiate the right deal for you.

No matter where you find homes that attract your attention...

• In a local real estate magazine

• Via the Internet

• Other agents FOR SALE sign

• Other agents OPEN HOUSE

• From a friend

• A “For Sale by Owner” sign

• Other agents exclusive listing

I can sell any of them to you!

Most importantly, I can negotiate any offer for you. If you see a sign, an open house, or even hear about a property, call me first and I will provide you with all of the necessary property information and make all the arrangements for viewing.

Shopping for a Lender

A very important part of purchasing a home is finding the right lender. Below are some characteristics you should look for when choosing a lender.

Questions to ask while shopping for your lender

• What is his/her reputation within the community?

• How many loans do they close each year?

• Is the company well known in the area?

• How long has the company been in business?

• Does the lender have access to a wide variety of loan packages?

• Can the interest rates be locked in and for how long?

• Does the lender offer your loan product (FHA, VA, Specialty, etc.)

Things to be aware of when shopping for a lender…

Quoted rates over the phone are rarely locked prices. Rates can be subjected to change unless they are predetermined for a specific period of time.

Interest rates can change daily. A quote you receive today may not be the quote you receive tomorrow.

The interest rate you are quoted over the phone may not be a program that will fit your needs or situation.

Many lenders will discount their posted rates for well qualified customers.

Getting Pre-Qualified

It is recommend that home buyers are pre-qualified with a lender before selecting a home to purchase. This way you will be ready, willing and able to make an offer on your desired home.

Reasons to get pre-qualified…

With pre-qualification, you can determine which loan program best fits your need and which programs you qualify for.

You will know exactly how much you are qualified for. It’s no fun to find your ideal home and then realize that you can’t afford it.

Your monthly payment will be estimated. This will allow you to begin outlining your budget.

It estimates what your down payment and closing costs will be.

If you are a first-time buyer, you may be able to qualify for a special firsttime buyer program.

Required Loan Documentation

• Photo ID

• Social Security Number

• Date of Birth

• Home addresses lived at as a primary residence for the past two years

• Addresses for any rental properties including mortgage statements and

• Work address, phone numbers and employment position for the past two years

• Checking and savings account statements for the past two months (6

home owners association bill months for child support/alimony)

• 401K/IRA statement last quarter

• Four most recent pay stubs. If you have received a recent raise please let

the lender know

• Federal income tax returns for the past two years for both personal and

business (if applicable)

• Divorce settlement papers if receiving child support, alimony, or if

ex-spouse pays a debt help cover the purchase costs

• Gift letters if you are using gifts from parents, relatives or organizations to

• Social Security/Disability Award Letter

• Pension Letter from Employer

• Home Owners Insurance binder when a contract for purchase is fully executed

Stepping Through the Loan Process

Pre-qualification / Interview

Application interview

Lender obtains all pertinent documentation

Order Documents

Credit report, appraisal on property, verification of employment

Loan Submission

The loan package is assembled and submitted to the underwriter for approval

Documentation

Supporting documents arrive

Lender verifies all information is correct

Request for any additional items are made

Loan Approval

Parties are notified of approval

Documents Are Drawn

Loan documents are completed & sent to the closing agent

Borrowers are prepared for final signatures

Funding

Lender reviews the loan package

Funds are transferred by wire

Showings

• Many homeowners prefer 24 hours notice prior to showings

• No more than 5 properties in 1 day

Writing a Contract

• Understanding contract options

• Confirming financing options

• Understanding your deposit requirements

• Understanding inspection rights

• Establish closing timeline

Moving Checklist

Send Change of Address Cards to Post Office

Charge Accounts

Subscriptions

Friends / Relatives

Bank

Other loan holders

Disconnect/Reconnect Utilities

Water

Electric

Gas

Telephone

Cable Television

Other

Cancel Deliveries

Newspaper

Other Miscellaneous

Arrangements with moving company

Obtain school records for children

Have drug prescriptions refilled

Notify Insurance Companies

Health

Life

Auto

Homeowners (if applicable)

Obtain Medical Records

General Practitioner

Dentist

Optometrist

Other doctors

© 2023 Stockworth Realty Group LLC. All Rights Reserved. Stockworth™ is a registered trademark licensed to Stockworth Realty Group LLC An Equal Opportunity Company. Equal Housing Opportunity. Lisa Holaday-Weiss 407.376.1000 Lisa@Stockworth.com The True Market Disruptors. We approach real estate differently than your average real estate company.

Jared Eslick Creative Director

Melissa Koepplinger Director of Relocation

Jason Schmidt, CCIM President, Broker

Mark Hayes, CCIM Owner

Jodi Hayes COO

Sara Presser Social Media Manager

Ryan Ashworth Video Producer & Editor

Josue Quiceno Video Editor & Colorist

Meghan Garcia Video Editor & Colorist

Evan Caulfield Property Management

Fransheska Nunez Web Developer

Will Rizzo Real Estate Photographer

Jared Eslick Creative Director

Melissa Koepplinger Director of Relocation

Jason Schmidt, CCIM President, Broker

Mark Hayes, CCIM Owner

Jodi Hayes COO

Sara Presser Social Media Manager

Ryan Ashworth Video Producer & Editor

Josue Quiceno Video Editor & Colorist

Meghan Garcia Video Editor & Colorist

Evan Caulfield Property Management

Fransheska Nunez Web Developer

Will Rizzo Real Estate Photographer