Procurement Update

OCTOBER 2025

AUTHORS

David

Hamilton

SVP, Construction

Procurement Solutions

Doug Allen

Operations and Strategy Associate, STO Building Group

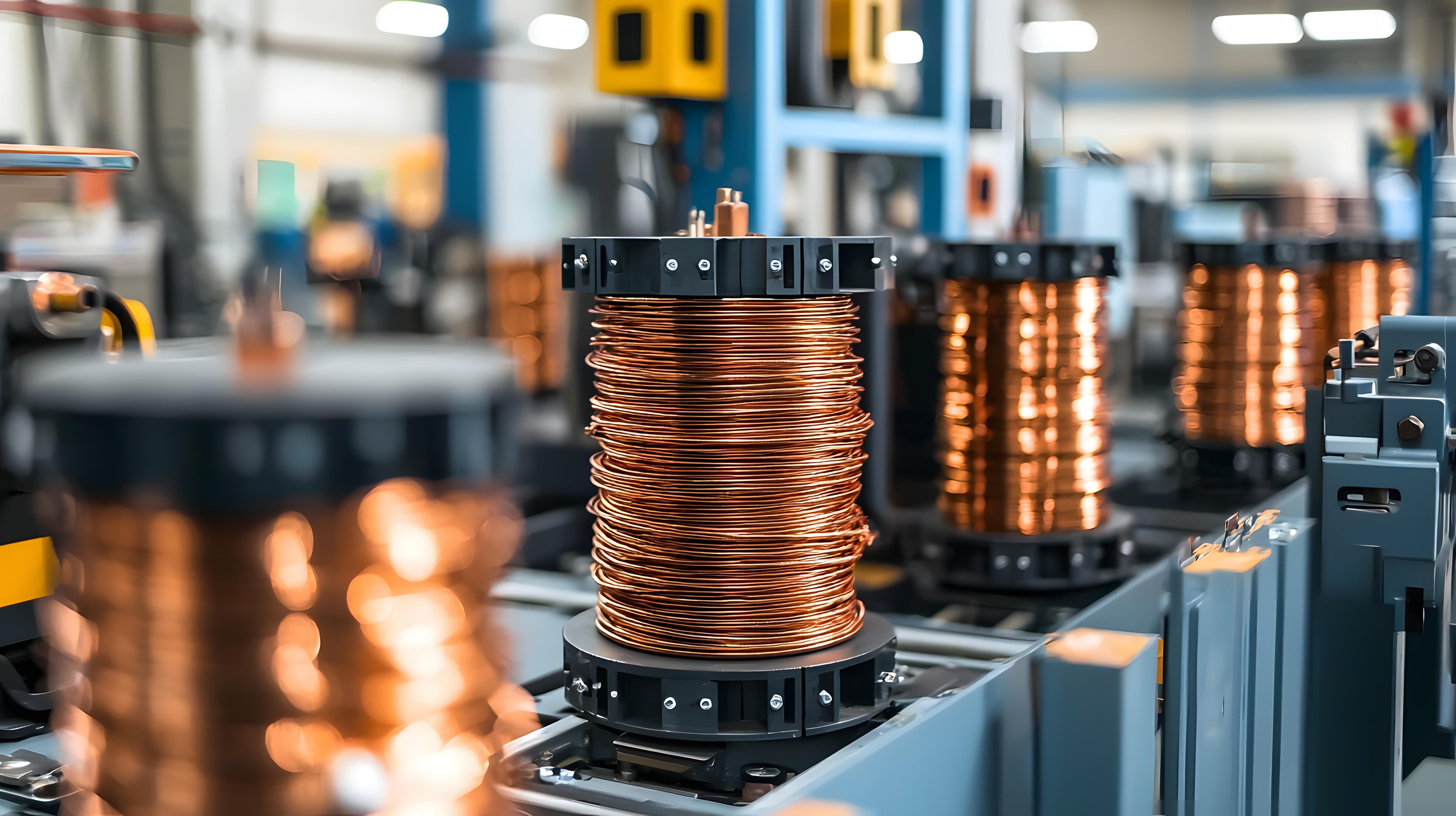

Today’s construction market isn’t defined by a single challenge; it’s simultaneously being influenced in multiple ways. Copper shortages from global supply shocks are pushing costs higher as demand from AI infrastructure, healthcare, and mission-critical projects accelerates. HVAC and electrical systems are among the most time-constrained packages, putting schedules under strain. Subcontractors, meanwhile, are squeezed by thinner margins and tighter credit conditions, heightening concerns around defaults. Yet the industry continues to adapt. Early procurement and diversified sourcing strategies are proving procurement to be a core driver of stability and value. At STO Building Group, and through our affiliate Construction Procurement Solutions, we are committed to anticipating disruption, locking in certainty, and delivering projects that finish strong.

• Inflation Cooling: Price pressures are easing, offering relief from recent highs. The Fed remains cautious about moving rates down too quickly.

• Resilient Economy: Despite geopolitical conflicts, tariffs, and elevated interest rates, the US economy continues to show strength, supporting steady construction demand.

• Capital Costs Improving: The cost of capital is trending lower. High-yield spreads have eased from 2022 peaks, and capital markets are showing healthier signs of recovery.

• Selective Growth Drivers: Demand remains strongest in data centers, healthcare, and infrastructure.

• Balanced Outlook: Global conflicts and policy shifts remain watch points, but cooling inflation, resilient demand, and healthier credit markets offer reasons for cautious optimism.

• Overall: Broadly speaking, we have not seen the anticipated price “hikes” as a result of tariffs. Surcharges have been applied sporadically. Manufacturers claim to be absorbing much of the impact to remain competitive.

• Material Cost Increases: Copper, due to supply chain interruptions. 18.5% increase in futures this year signal pending increases.

• Sourcing/Supply Chain Adjustments: Manufacturers continue to lean on domestic sourcing and multi-supplier strategies. Lead times are generally steady, though specialized HVAC and electrical systems can have 1–2 week slippage. The shift to low-GWP refrigerants is reshaping availability and specifications, forcing some redesigns and new implementation strategies.

• Regulatory and Market Shifts: Policy change is accelerating. Local gas restrictions and state laws blocking such bans are creating planning uncertainty. Roughly 78% of Fortune Global 500 now have quantified carbon targets, raising pressure on manufacturers to adapt faster. Federal HFC phase-downs beginning January 1, 2025, combined with uneven state mandates, complicate procurement strategies and often force region-byregion adjustments.

• Looking Ahead: Moderate price increases remain the baseline, but commodity swings, refrigerant shifts, and uneven regulations raise the risk of sharper cost pressures. Early engagement with Construction Procurement Solutions is key to minimizing impact.

• Margin Compression & Cash Flow Stress: Trade partners are navigating higher material costs, tighter credit, and escalating insurance premiums. Delayed payments and frequent change orders are compounding pressures.

• Rising Default Risk: In the race to remain competitive, subcontractors are cutting margins to unsustainable levels. This increases the probability of midproject failures, making Subcontractor Default Insurance (SDI) an essential safeguard.

• Strategic Advantage: Utilizing direct procurement via Construction Procurement Solutions removes major cost variables from subcontractors’ balance sheets. By relieving them of procurement risk, CPS strengthens subcontractor stability, de-risks schedules, and safeguards client outcomes. CPS’s function shifts from a cost-saver into a systemic risk mitigator, protecting the financial health of trade partners and long-term interests of clients.

• Labor Shortage: Skilled trades in concrete, steel, mechanical, electrical, and framing remain constrained, retirements outpace new entrants and training pipelines unable to close the gap.

• Immigration: Heightened enforcement actions and new visa fees are thinning traveling crews, particularly in laborheavy trades, creating uncertainty for projects.

• Sectors: Mission-critical construction and healthcare facilities continue to absorb specialty labor, leaving commercial and institutional work competing for reduced capacity.

• Regions: The Southeast, Southwest, and Mid-Atlantic are under the greatest strain as megaproject pipelines drive wage escalation.

• Mitigation Tactic: Early subcontractor engagement, modular and prefabricated approaches, and targeted workforce development help reduce exposure to volatility while preserving schedule reliability.

• Copper: Concerns are rising, mainly due to recent supply chain interruptions from an accident at a mine in Indonesia. Electrical component demand driven by the rise in AI, data centers, etc. has pushed copper demand, meaning even the smallest disruption can create large ripple impacts to supply and, especially, pricing. Prices are climbing as supply cushions vanish. A deadly mudslide in Indonesia cut output 35% through 2026 on top of setbacks in Chile and the DRC. Reported the largest deficit since 2004, forecast to hit $10,200–$11,000 a ton by year-end.

• Electrical & HVAC Systems: Large equipment is now bearing the brunt of supply pressures. Rooftop systems, chillers, and other mission-critical HVAC and electrical packages are facing extended lead times, driven less by tariffs and more by surging demand tied to AI growth, data centers, and other critical infrastructure. Smaller components have largely stabilized, but for big-ticket items, the strain is expected to persist, keeping upward pressure on pricing.

• Direct Advantage: As dedicated procurement entity, Construction Procurement Solutions secures HVAC and electrical equipment at scale. CPS brings control and certainty on high-value packages.

• Design-Build: Integrating procurement early in the growing design-build landscape validates that specifications match supply realities, enabling smarter value engineering and faster project execution.

• Early Lock & Strategic Buys: Proactive commitments on steel, switchgear, and aluminum shield projects from volatile markets, while bundling demand across STOBG builders maximizes leverage.

• Domestic & Multi-Source Options: Prioritizing US and near-shore manufacturers, while maintaining multiple qualified sources, protects projects from tariff shocks and global logistics volatility.

• Modular & Prefabricated Systems: Prefabricated electrical rooms, mechanical skids, and structural assemblies can reduce field labor intensity, mitigate schedule risk, and deliver measurable cost efficiencies.