CONSTRUCTION COST REPORT STOBG GLOBAL SERVICES

Commercial

Regional

Trade-Specific

Conclusion

ABSTRACT

ABOUT STOBG GLOBAL SERVICES

STOBG Global Services reimagines the construction experience for enterprise clients with delivery models focused on collaboration, measurable impact, and predictable results. We thrive in repeat client work across multiple geographies.

We leverage data-driven insights and a national network to streamline execution, enhance efficiency, and ensure consistent outcomes.

Our flexible approach fosters lasting partnerships, helping clients achieve sustainable growth and maximize value.

STOBG actively engages with regional construction professionals to monitor cost and construction trends as they develop and seek to inform and connect with others in the commercial real estate industry so that we may all better understand the daily reality of our markets.

Through our global network of operating companies and Strategic Alliance Partners, STOBG collects and analyzes data from actual projects across our geographic platform to generate timely reports that represent the market as it stands.

This pricing data is captured from a variety of actual projects and not standardized benchmarks; it is intended only to inform and advise and not for specific planning purposes. For a deep dive, our global team is here to support you.

Stephen Dennis

Account Executive

Global

Services

Stephen.Dennis@STOBuildingGroup.com

Beth Moore Senior Vice President Global Services

Beth.Moore@STOBuildingGroup.com

STOBG US OFFICE LOCATIONS

Atlanta, GA

Augusta, GA

Austin, TX

Bala Cynwyd, PA

Boise, ID

Boston, MA

Charleston, SC

Columbia, SC

Dallas, TX

Denver, CO (2)

Fairfield, NJ

Fort Myers, FL

Gainesville, FL

Greensville, SC

Honolulu, HI

Houston, TX

Irvine, CA

Jacksonville, FL

Lihue, HI

Los Angeles, CA

Mountain View, CA

Nashville, TN

New Haven, CT

New York, NY

Orlando, FL (2)

Pasadena, CA

Philadelphia, PA

Phoenix, AZ

Sacramento, CA

Salt Lake City, UT

San Antonio, TX

San Diego, CA

San Francisco, CA

San Jose, CA

Sarasota, FL

Seattle, WA

Stamford, CT

Tacoma, WA

Tallahassee, FL

Tampa, FL

West Palm Beach, FL

Windham, NH

Woodbridge, NJ

STOBG INTERNATIONAL OFFICE LOCATIONS

Calgary, Canada

Edmonton, Canada

Kitchener, Canada

Ottawa, Canada Toronto, Canada Vancouver, Canada Amsterdam, Netherlands Dublin, Ireland London, United Kingdom

METHODOLOGY

The following data represents median construction costs from actual projects under construction as well as recently procured interior fit-out projects spanning between Q1 and Q2 2025 by our family of builders within these specific locales. The data is normalized to an assumed 30,000 USF commercial interiors project in a central business district.

‘High End’ values are assumed as Class A buildings with all MEPS run from a building core and include finishes such as stone flooring, specialty lighting, and veneer casework.

‘Medium End’ projects are assumed to be Class A/ Class B new interiors within existing buildings, reuse existing perimeter heating, and more accurately reflect region median construction values.

‘Low End’ projects are based on building standard spec suites, Class B buildings, or projects that include higher levels of reuse of prior finishes, partitions, and MEPS.

All pricing includes General Contractor fees and staffing and assumes a Q3-2025 construction start (no escalation is included). Pricing does not include: design or consultant fees, commercial kitchen equipment, FF&E, Security, AV and other Low-Voltage infrastructure, or any work outside of tenant interior space such as site work, foundations, roofing, fenestration, or building superstructure.

STOBG understands that office design is an extension of an organization’s brand, values, and culture and that the spectrum of possible materials and inspiration changes and grows every day. Our indexing deliberately excludes ‘Showcase’ and other significantly high-value spaces to prevent the skewing of average values.

We hope this bulletin helps you understand the current cost trends and strategically plan your company’s growth into the upcoming quarters.

Corporate Interiors Market Data presented in this report reflects information collected as of August 15, 2025.

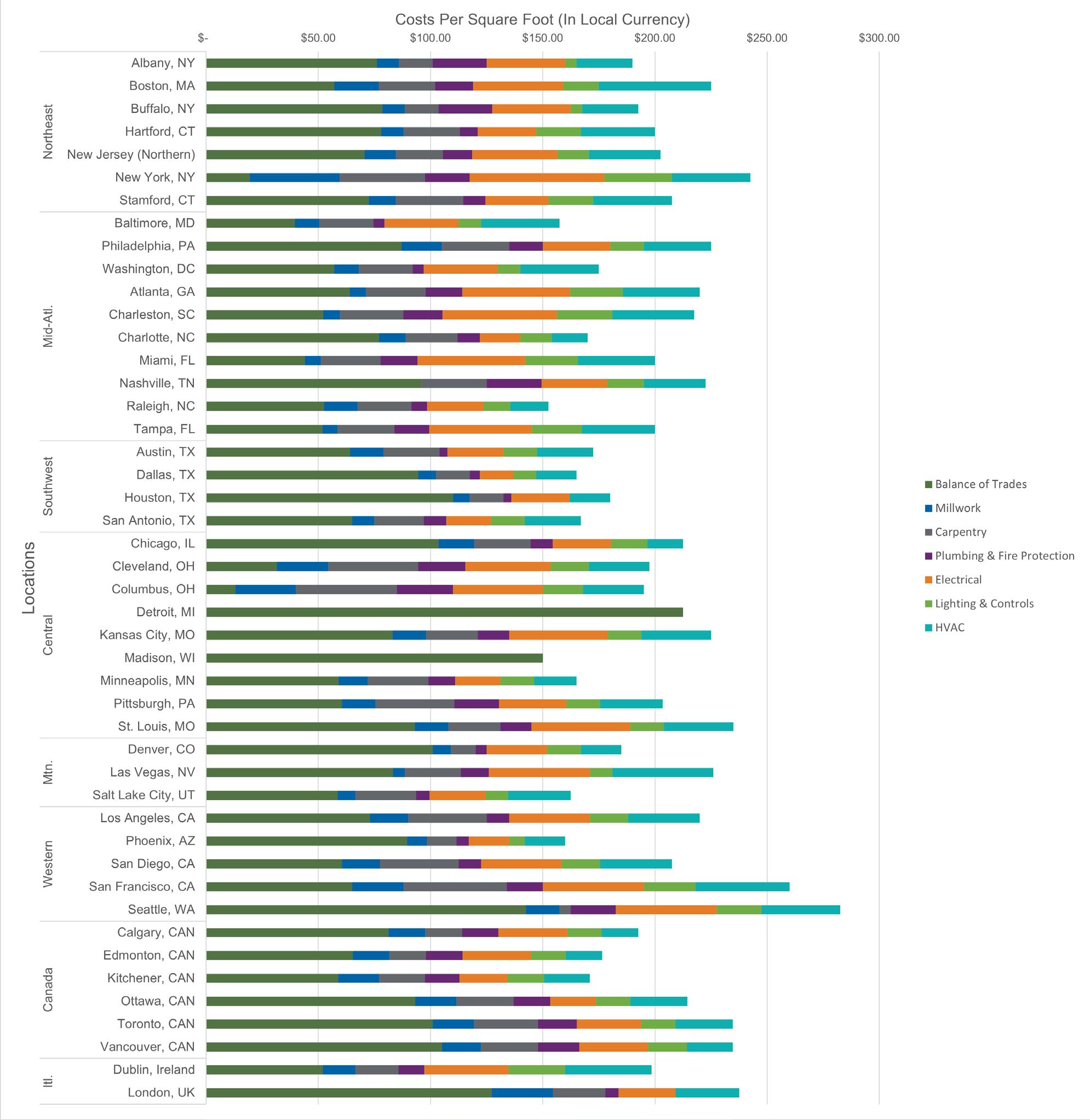

KEY TRADE COST BREAKDOWNS

1:

The graph above represents average key trade cost breakdowns across major markets in the United States, Canada, London, and Dublin through Q2-2025.

81% of surveyed locations stated the availability of skilled labor is a significant driver of project cost and early procurement and subcontractor engagement is key to managing a project’s budget.

The subcontractor market’s desire to maintain backlog and tight competition for desirable projects has kept trade costs largely consistent through Q1 and Q2.

FIGURE

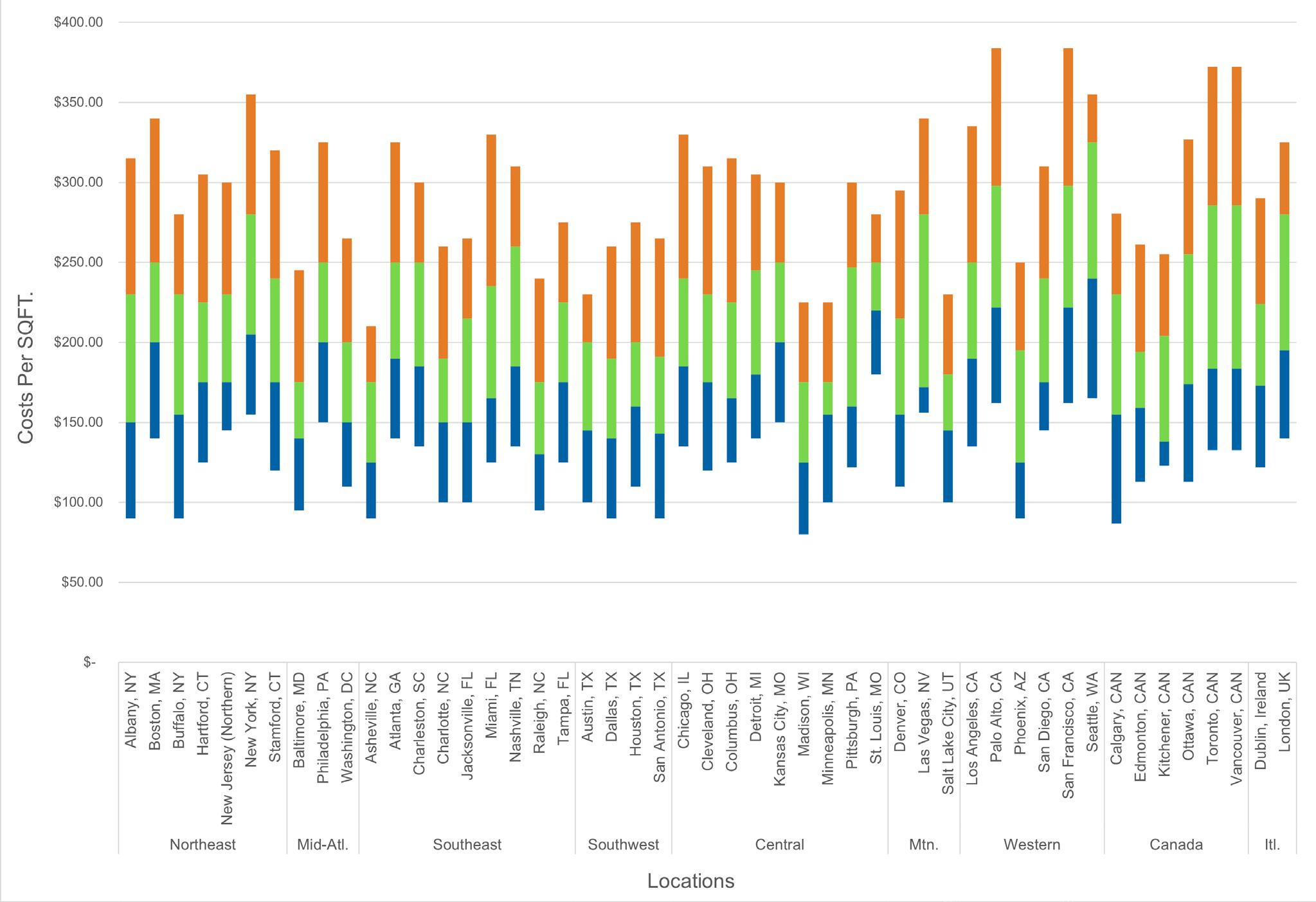

COMMERCIAL INTERIOR RENOVATION CONSTRUCTION COSTS

FIGURE 2:

The graph above represents the typical range of costs for commercial tenant interior construction across major cities in North America, as well as select international markets, spanning Q1-Q2 2025.

2025 has thus far maintained 2024’s modest escalation with commercial interiors costs mirroring the broader national rate. In hotbeds of industrial, medical, and mission critical construction, the skilled labor pool is further limited, increasing project cost and negatively impacting construction schedules.

STOBG continues to maintain close attention to the availability of materials and the impact that the proposed tariffs may have on the construction industry.

65% of surveyed locations have agreed that tariffs have impacted commercial interior construction pricing in Q1-Q2 of 2025.

In 2025, commercial interiors costs echo last year’s rise, while labor shortages in key sectors drive up expenses and impact schedules.

REGIONAL COST BREAKDOWNS

TRADE-SPECIFIC BREAKOUT COSTS

CONCLUSION

Throughout the US, Canada, London, and Dublin, the corporate interiors industry has maintained the positive momentum and outlook that it experienced in 2024. General Contractors and Subcontractors alike are in fierce competition to secure work for 2026 and procure long-lead materials in the uncertainty of ongoing trade negotiations. While most markets have sufficient labor to manage demand, regions with less robust labor pools, or highly active manufacturing, medical, or mission critical construction industries, are continuing to see costs rise due to a mixture of pursuit selectivity by subcontractors and longer schedule durations.

2025 has also been a time of confidence for real estate planners and managers to solidify their long-term vision of the corporate built environment. The latest spaces are embracing a Return-to-Office approach that balances technologically sophisticated collaboration areas with warm, comfortable, and home-like focused work environments. These design trends have influenced broader palettes of materiality with many finishes playing multiple roles, being both aesthetically pleasing as well as sound-absorptive and eco-friendly.

Looking ahead to 2026, the commercial interiors industry remains optimistic and resilient, as well as cautious of economic uncertainties including variations in the cost of lending, ongoing global trade negotiations, and the availability of raw materials.

STOBG is committed to working with our clients to collect and analyze market data and disruptions, and we continue to advise ongoing and robust due diligence in sourcing and vetting capable, qualified, and reliable trade partners. STOBG has pioneered and rigorously upheld an industry-leading prequalification process which remains our primary tool to help our clients manage risk and uncertainty.