Job opportunities Job opportunities

MAY 9 – 15, 2024

Mary Marlen’s life calling benefits Belleville Memorial Hospital

Sponsored content by

Mary McHugh, Brand Ave. Studios contributing writerMary Marlen has been a nurse for 16 years, but she’s been caring for people since she was a little girl. Putting cool cloths on her siblings’ foreheads when they had a fever and making soup when her mom wasn’t feeling well have evolved into a fulltime career at Belleville Memorial Hospital.

“I’ve always believed that the healthcare field was my calling,” said Marlen, MSN, registered nurse. “As a nurse I’m able to connect with patients and be a part of making a difference during one of the most vulnerable times of their lives, and no matter how big or small that difference is, it just makes me want to work harder and show up for them.”

Even with the years of schooling and clinicals required to become certified as a nurse, Marlen said it’s her patients who continue to teach her day after day.

“Each patient is so different, with very specific needs, and the way you care for them is based on what’s important to them,” she said. “You can always

do more training or have someone mentor you, but I’ve also realized that a lot of learning comes from the patients and their families. To do this job you have

to have a compassionate heart and the ability to individualize how you deliver that care to a patient. Seeing them happy is a validation that I can

make a difference, even if it’s in a small way.” Marlen’s advice for anyone considering the profession is to understand that nursing is more than

just giving medications and assessing patients.

“It’s taking care of the patient as a whole and everyone on the care team, including the nurses, need to have that in their heart,” she said. “The good thing is, there are so many different types of nursing career paths that it’s important for students to really dive into their clinical experience and explore the different departments in a hospital to see what they enjoy the most, because the opportunities are endless.”

She suggests new nurses work a year or two on a medical-surgical or telemetry floor, where they can expect to receive a very well-rounded foundation in patient care, as well as the experience of being part of a highly efficient and collaborative team.

“That experience prepares you for everything,” she said, “especially since today’s nurses are playing a bigger role on the care team. There’s so much more autonomy in nursing

See MARLEN, D7

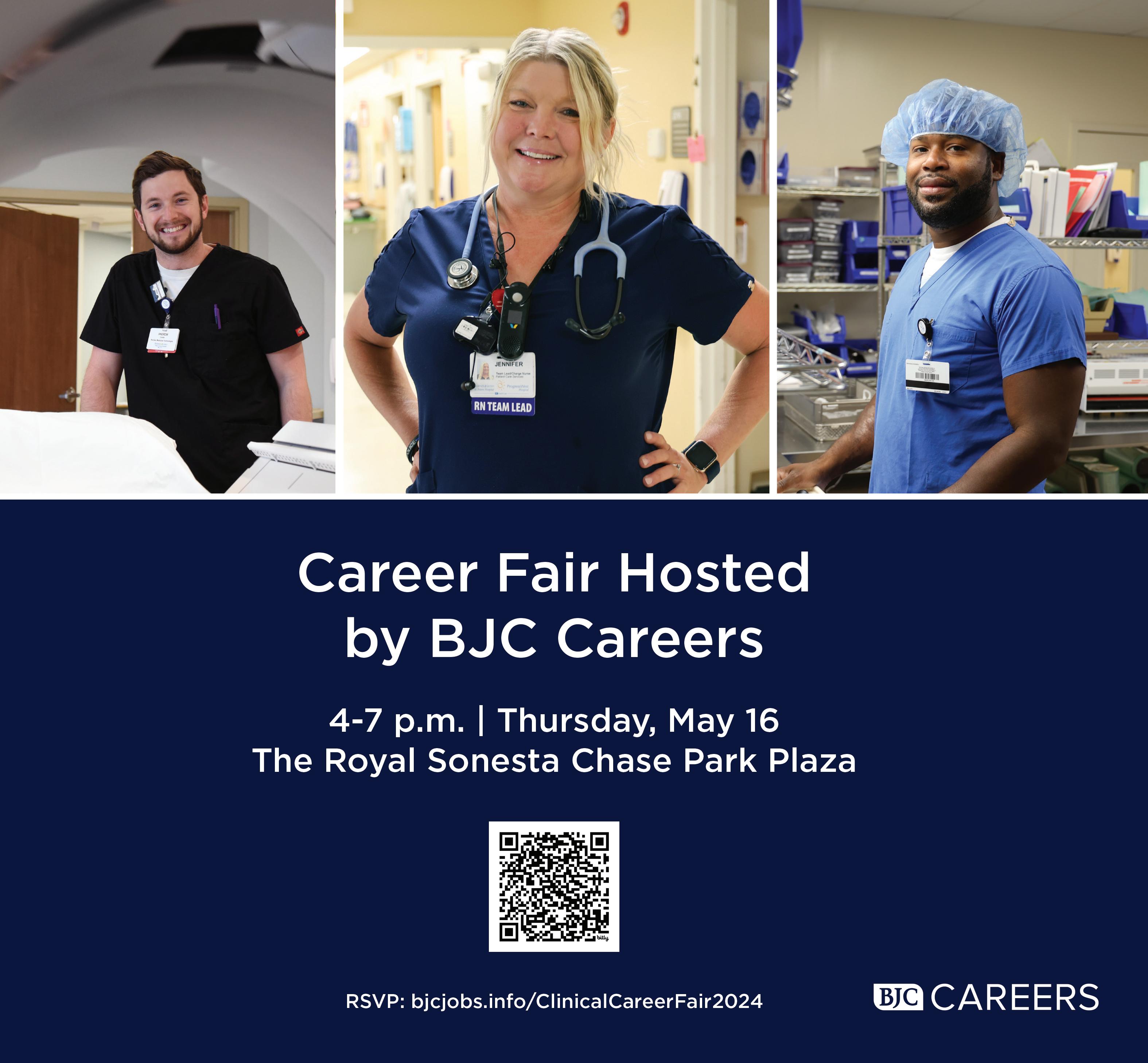

For our nurses, a letter of gratitude

I am honored to celebrate another National Nurses Month — my second in the area — with the nurses of greater St. Louis. I continue to stand in awe of the ways in which every one of you provides extraordinary care to the patients in our communities. I am grateful to be part of a community where I witness this daily, as you give your all and provide care for so many people in the most vulnerable of populations.

My lifelong career as a nurse was always more than a job. It’s a calling — a ministry, even. A club where only those inside understand the privilege of belonging. As nurses, we have a burning desire to help people — not only

by caring for them when they’re sick, but also by educating them so they stay well and advocating for them when they need our voices. It’s sharing knowledge in a way that offers inclusivity to all people and gives them a chance to live their lives to the fullest.

I also know that nursing is not an individual contributor type of job. We work in teams. We collaborate — with each other, with myriad other health care professionals, with patients and their families. We are also mentors to those who are new to the profession or considering joining the profession.

BJC HealthCare is a leader in this regard. We create pathways for aspir-

ing nurses through our Patient Care Technician (PCT) Academy, an accelerated patient care technician training program that allows students to help people while receiving training to begin their health care careers. This is only one way in which we encourage people to join the fold of what, in my opinion, is the best career path in health care.

But we do not have to rely on formal programs alone. We all can play a role in creating pathways for new nurses. Take a moment and think about how you show up in your community as the face of

nursing outside of hospitals and doctors’ offices. I want to challenge all nurses to reach out to nursing schools in your community and be a mentor. By showing the nurses of tomorrow the face of a real caregiver today, they will be able to better picture themselves in the same nursing shoes. There is much gratification in helping newer nurses find their way in the profession.

It’s also critical that we support each other. I would encourage all the nurses belonging to professional organizations in St. Louis to pursue collaborations

across the region. Providing education at scale takes the burden off any one organization and makes it easier to hold conferences and bring health care education to our community of health care workers.

Finally, I’d like to offer my thanks. To my fellow seasoned, practicing nurses who tirelessly and selflessly share their knowledge. To nurses just starting out, for choosing a career of service. And for everyone in between who allowed this path to choose them. And I would be remiss if I didn’t also express gratitude to our team members who support all nurses in providing extraordinary care to our patients. And I want to remind you to take care of your-

selves as you take care of everyone else. While the joys of nursing are immensely rewarding, we know that the demands can take a lot out of us emotionally. Self-care is one of the most important ways you can continue to bring your best selves to our patients and your families. I am grateful for this opportunity during Nurses Month to appreciate all you do as caregivers, advocates and educators, and to express my deepest thanks for every single one of you and the work you do tirelessly, every day.

Tommye Austin, PhD, MBA, RN, NEA-BC, Senior Vice President, Chief Nurse Executive, Eastern Region BJC Health System

Why financial planning is a great career option for women

(StatePoint) Financial planning was once thought of as a male-dominated industry, but that’s quickly changing. The number of women getting their CERTIFIED FINANCIAL PLANNER™ certification is growing year over year — and for good reason: The benefits of entering this field as a woman are numerous. Below are a few to consider.

• It’s lucrative. Financial planners are in high demand and are well-compensated for their expertise. A financial advisor can pull in a generous salary right out of the gate, and earning the right credentials can boost compensation significantly.

The median income for those with CFP® certification and less than 5 years of experience is $100,000 — and that median figure grows to $206,000 with 10

or more years of experience. In general, financial advisors with CFP® certification earn 12% more than those without.

• Being a CFP® professional offers good work-life balance. With the potential to work remotely and create one’s own schedule, financial planning is a career path well-suited to those looking for flexibility and a desirable work-life balance.

• Financial planning can be personally fulfilling. Providing competent, ethical financial advice that helps others achieve their life goals — from sending their children to college to securing a comfortable retirement — can be extremely gratifying.

Research also finds that female CFP® professionals have a unique

dedication to providing holistic financial planning. Working as a financial planner provides opportunities to uplift and empower other women, as well as members of groups

historically given fewer opportunities to accumulate wealth.

• Women who aspire to become CFP® professionals will find support

in many places. CFP Board, for example, has implemented initiatives to recruit women and advance their careers.

Some firms subsidize

the cost of CFP® certification and give employees time away from work to study for the CFP® exam. Additionally, women’s networks and business councils can help build leadership skills and professional confidence, and many firms are even paying their employees’ membership fees.

CFP Board also administers scholarships for individuals underrepresented in the field, along with a mentoring program.

To learn more and get started today on your path to becoming a CFP® professional, visit getCFPcertified.org.

With demand for personal financial advisors expected to grow significantly in the coming years, and the industry making way for more women professionals, it’s worth exploring this rewarding career path.

In-demand careers every new college grad should know about

(StatePoint) So you’ve recently graduated college. The summer ahead is the perfect time to consider a career as a financial planner. At a time when new research reveals that more than half of fouryear college graduates are underemployed a year after they graduate, the financial planning industry is booming.

To give yourself a competitive edge when you’re just starting out, consider earning your CFP® certification. CFP® certification is the standard in financial planning and paves the way for an exceptional career.

Here’s what you need to know about a career as a financial advisor with CFP® certification, also known as a CFP® professional:

• You can gain financial stability: When you’re young, it’s important to pay down any student debt and begin saving for the future as early as possible. That’s difficult to do in industries with low starting wages. While financial planning salaries vary, you can expect to earn $5070K as a starting point. And there’s a lot of room for growth — experienced financial advisors earn $192,000 on average.

• You’ll enjoy job security: Many industries are experiencing widespread layoffs and instability, but financial planning is a career path offering job security and growth. In fact, the Bureau of Labor Statistics predicts that the demand for financial advi-

sors will grow quickly, at a rate of 13% through 2032.

• You’ll use a wide range of skills: Financial planning isn’t just numbers and math. The job requires great communication skills and a high level of emotional intelligence to guide clients through the psychology behind their money management.

• You can forge your own path: Financial advising is not a one-size-fitsall career path. You can choose to specialize in a particular area of finance

or take a holistic approach to your clients’ needs. Where you work is also up to you — you might work at a nationally known financial services firm, a small local firm or even a bank or credit union. Because of the commitment to professional

excellence and high ethical standards it demonstrates, gaining your CFP® certification will unlock even more career opportunities. Many CFP® professionals even start their own business early in their careers.

• You’ll be helping oth-

ers: CFP® professionals build trusted relationships with their clients, helping people achieve their life goals, whether that’s buying a home, paying for their children’s college educations or preparing for retirement.

• You can design your own schedule: After four years of scheduling classes to suit your needs, the idea of rigid working hours may not be appealing. Fortunately, financial advising can come with scheduling flexibility and a good work-life balance.

• You’ll find support along the way: As you work toward CFP® certification, you’ll have many opportunities for ongoing support. An online candidate forum offers opportunities to connect with others on their path to certification. Other resources include a progress tracker, exam preparation tools, financial aid and three mentorship cycles a year that align with the exams offered. Additionally, the CFP Board’s Career Center can help you find your footing after you get certified.

For more information about becoming a financial planner, visit CFP.net.

As you spend the summer months looking back on and celebrating all your hard work over the last four years, don’t forget to make an investment in your future. Pursuing CFP® certification can lead to a rewarding, profitable career as a financial planner.

Three tips to help entrepreneurs stay on track

(StatePoint) May is National Small Business Month, an annual opportunity to support the hard work of small business owners. The backbone of the nation’s economy, small businesses employ 45.9% of the entire U.S. workforce and make up 99.9% of all U.S. businesses, according to the U.S. Small Business Administration. Unfortunately, some small businesses don’t have much in the way of resources, and often struggle to keep their doors open and their cash reserves in the black.

Sometimes though, the difference between suc-

cess and failure is capital, marketing and support. A reliable provider of essential small business services for more than 40 years, The UPS Store can help enable entrepreneurs to actualize their big ideas into success. It’s also the nation’s largest franchise system of retail shipping, postal, print and business service centers, meaning that many local store operators are small business owners themselves. In honor of National Small Business Month, the brand is offering entrepreneurs these three tips:

1. Be top of mind: Maintain a dialogue with

your community and customers. Regularly refresh your social media channels with new content, maintain an e-newsletter, and of course, don’t neglect traditional promotion. Save time by visiting a one-stop shop that can help you design, print and mail your marketing materials.

2. Protect yourself: Data theft is more common than ever as new threats emerge all the time. The Federal Trade Commission offers businesses free resources for improving their cybersecurity awareness. And when it’s time to dispose of physical documents,

be sure to use a trusted solution. You can securely shred unneeded business documents at The UPS Store locations nationwide.

3. Get inspired: Need some inspiration? Look no further than the Small Biz Challenge. This three-phase competition from The UPS Store and Inc. Business Media is a search for the country’s most unstoppable small business owners. Among nearly 6,000 entrants, nine semifinalists were chosen, then paired with a mentor to guide them through the competition. Stemming from a wide variety of skill sets and backgrounds,

the mentors include professional life coaches, brilliant business owners, podcast hosts, creative directors, and bestselling authors. During National Small Business Month, three of the semifinalists will be chosen to compete live in Miami, Florida for a share of the grand prize of up to $35,000 and a feature in “Inc.”

“Each year, this competition presents exhilarating and interactive ways to support and showcase small business owners and entrepreneurs from across the nation,” said Michelle Van Slyke, senior vice president of marketing and sales at The UPS Store,

Inc. “This year’s competition returns even bigger and better to help small business owners grow and hone their skill set and therefore find customized solutions to complex challenges.”

To learn more about the Small Biz Challenge competitors and to cast your vote for this year’s semifinalists, visit theupsstore. com/smallbizchallenge. Being a small business owner within an ever-changing landscape can feel intimidating. But with support and local resources, entrepreneurs can turn their vision into a reality.

Looking for a new career? Become a financial planner

(StatePoint) Becoming a financial planner offers both financial rewards and the chance to help others. Whether you’re a recent graduate exploring your career path or a midcareer professional seeking change, this growing profession may be the right fit for you.

As more Americans recognize the value of partnering with a professional to chart their financial course, the demand for financial advisors is projected to grow by 13% through 2032, according to the Bureau of Labor Statistics. Earning the right credentials, like the Certified Financial Planner certification, can lead to a higher salary, increased job satisfaction and happier clients.

The certification process

The CFP certification program generally takes 18 to 24 months to complete, depending on your time commitment, professional experience and educational background. The process involves completing coursework, passing an exam, accumulating experience and meeting ethics requirements. These rigorous standards make the process challenging. However, during the certification journey, you won’t be alone. CFP Board provides a variety of tools and resources to support your progress, including scholarships, an online forum that allows

you to connect with peers and mentors, and a Career Center, where you can discover internships and jobs.

Benefits of certification

While most financial planners can expect to

pull in a high salary, CFP certification can boost your income by 12%, according to the College for Financial Planning. It can also fast-track your career, enhance your job prospects and help you build a client roster. As a CFP professional, you’ll bring a wealth of education and experience to the table, along with a commitment to CFP Board to act as a fiduciary for your clients. Clients can rest easy knowing you have agreed to put their best interests first.

More than 10,000 firms across the United States employ CFP professionals because they know that the certification inspires trust, confidence and satisfaction with consumers. In fact, 84% of consumers

who work with a CFP professional say they are extremely or very satisfied. Beyond greater job security and income, becoming a CFP professional brings other benefits, including continuing professional development, the flexibility to balance your personal and professional life, and opportunities to give back to the community by providing pro bono services.

For all the reasons above, it’s no surprise that the majority of CFP professionals are happy with the career moves that led them to where they are today. An astounding 93% of CFP professionals say they are very satisfied with their decision to pursue CFP certification,

with most reporting that certification has directly contributed to their success and given them a competitive edge.

Next steps

To get started on your new career today, visit getcfpcertified.org, where you can download a free guide to learn more about your next steps, whether you’re an established advisor seeking a competitive edge, a careerchanger or student still exploring your options.

If helping people create stable financial futures sounds appealing to you, explore a career as a financial planner and find out for yourself about the many benefits the right certification can bring.

Business owners are optimistic as economic conditions improve

(StatePoint) What a difference a year makes. New research finds that small- and mid-sized business owners are increasingly optimistic about economic conditions and the prospects for their own businesses.

According to PNC’s Spring 2024 Economic Outlook Survey, nearly 80% of business owners surveyed feel optimistic about conditions for their business over the next six months -- up from 60% a year ago.

This optimism likely stems from an improving outlook for the economy as a whole as inflation pressures and recession fears appear to be easing. A majority of those surveyed (55%) said they are highly optimistic about the national economy -- a dramatic increase from the 26% who felt that way in the spring of 2023. Even more (63%) said they are highly optimistic about their local economy -more than double the reading from a year ago.

The uptick in optimism for the economy mirrors PNC’s revised outlook for 2024, which shifts away from a predicted recession to a forecast of slow growth. PNC chief economist Gus Faucher said he expects the Federal Reserve will begin cutting interest rates later this year as inflation continues to ease.

“Business owners continue to feel confident that good days are ahead,” Faucher said. “This time around though, the economy is seen as a supporting factor to that optimism instead of a limitation.”

Calming inflation

Easing inflation pres-

Continued from D1

today, with physicians and patients having more respect with regard to what we do.”

Marlen welcomes the increased workload and responsibilities, though. She currently manages more than 80 nurses spread between two floors of the hospital, yet still manages to visit patients and their families every day.

“We are a very patient-centric hospital, and the care teams here are

sures are among the biggest factors reported in the survey. Last spring, 55% of respondents reported that they expected to raise prices in the ensuing six months -- that dropped to 47% this round. Similarly, 40% expect prices from suppliers to increase over the next six months, that’s down from 47% last spring.

Inflation overall has been gradually easing since a mid-2022 high of 9% -- its highest level since the 1980s. By January 2024, inflation

extremely loyal and selfless,” she said. “I am energized by them every day. They are my family.”

And speaking of family, Marlen’s gift of caring has had a powerful influence even beyond the workplace. Her daughter Paula became a nurse four years ago and works in the hospital’s intensive care unit. Their paths cross occasionally.

“I think she saw how happy I was in this career and decided that it was for her,” Marlen said.

“Nursing can be stressful at times, but it’s the reward of the profession that makes the difference.

was reported at 3.1%, with continued easing projected in the months ahead. Still, inflation remains above its pre-pandemic pace and Faucher says more progress is needed before the Fed likely cuts rates later in 2024.

“We’ve come a long way from 2022, as supply chain issues driven by the pandemic have largely dissipated,” Faucher said. “But more progress will probably be necessary before we can expect the Fed to start easing rates.”

And I couldn’t have chosen a better path.”

Belleville Memorial, part of BJC HealthCare, is a 222-bed acute care hospital that provides emergency and critical care services, as well as a full complement of diagnostic and treatment services. Also located on the Belleville campus, the Orthopedic and Neurosciences Center offers a comprehensive rehab program that includes physical, occupational, speech and hand therapy. For more information, please visit memhosp.org

Labor challenges easing One such challenge has been the tight labor

market, which has made hiring difficult for business leaders. Consistent with PNC’s Fall 2023 survey, respondents say the lack of

overall applicants remains their primary hiring issue. Respondents cite lack of experience (22%) and high salary/benefit and flexibility requirements (9%) as other barriers.

The nationwide unemployment rate for January 2024 was 3.7% -- below what is considered “full employment” in the U.S. economy. Faucher said he expects the shortage of available labor to ease as consumer demand softens and the effect of slower job growth across the economy becomes more visible.

Despite the trend across the broader U.S. landscape, few survey respondents anticipate workforce reductions over the next six months. Only 4% report anticipating a reduction, while 74% expect no change to their workforce numbers and 21% project an increase in their workforce over the next half of the year.

“Employers have been under pressure despite the improving conditions because the economy has been at or near full employment for an extended period,” Faucher said. “We expect some slack in the labor market in the coming months, which will likely further ease inflation.”