Welcome Home

King County Property Profile

Parcel #: 3262301518

Ref Parcel #: 326230151804

Owner: Alves,Darrin

Co-owner:Gloryvee, Hern

Site: 2612 79th Ave NE

Medina WA 98039-1515

Mail:261279thAveNE Medina WA 98039-1515

Land Use:2 - Single Family(Res Use/Zone)

Census:2030 024200

Zoning:Medina-R-16 - Single Family

Residential

Legal:HERRONS ADD ALL

ASSESSMENT INFORMATIONPROPERTY CHARACTERISTICS

MarketTotal: $5,386,000.00(2024)

Market Land: $2,499,000.00

Market Impr: $2,887,000.00

AssessedTotal: $5,386,000.00(2024)

Exemption:

Taxes: $40,420.07

LevyCode:1836

Levy Rate:7.5011

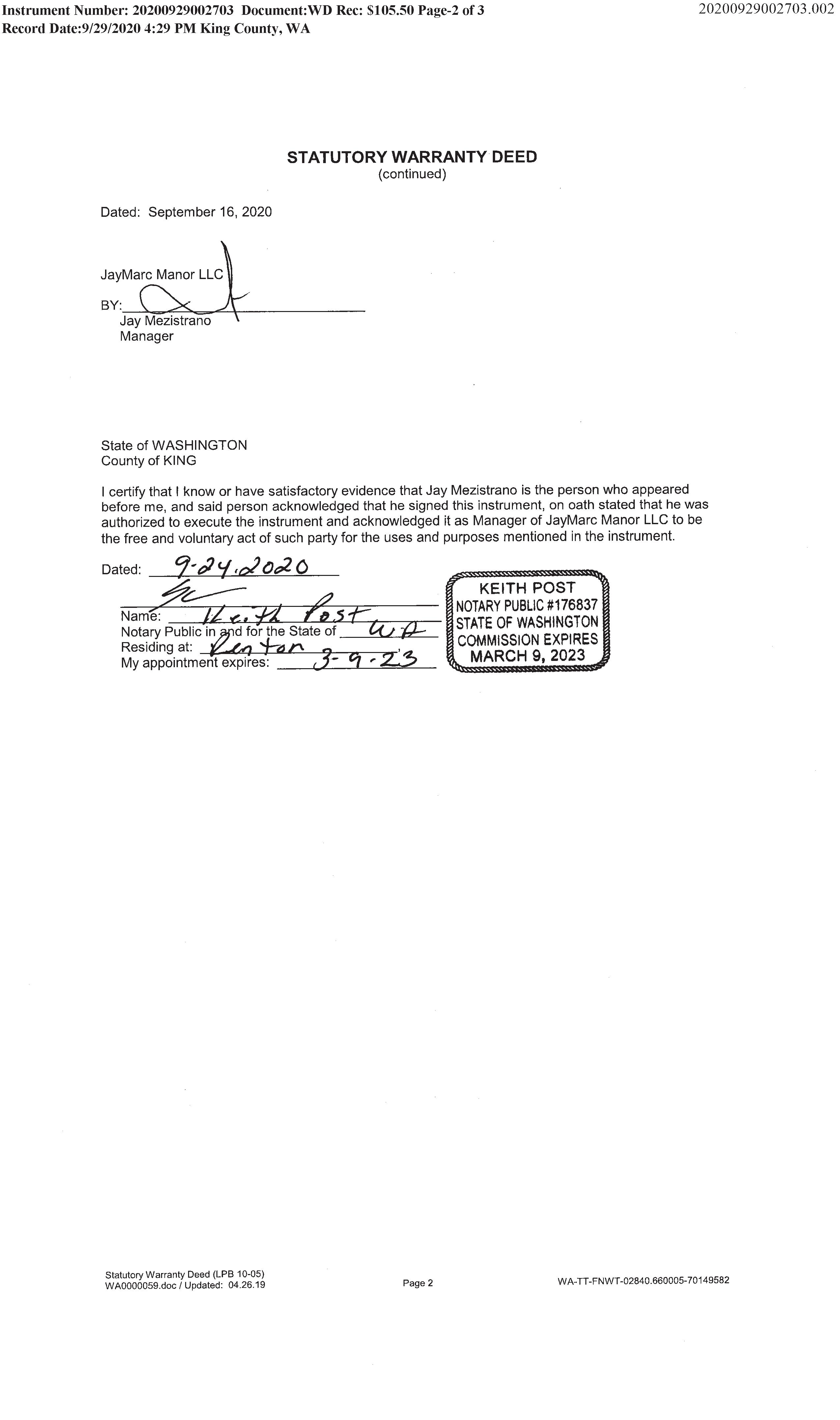

SALE & LOAN INFORMATION

Sale Date:09/29/2020

Sale Amount:$5,500,000.00

Document #:20200929002703

Deed Type:Deed

Loan Amount:$3,575,000.00

Lender:WELLS FARGO BK NA

Loan Type:Conventional

Interest Type:

Title Co:TICOR TITLE

YearBuilt:2019

Remodeled: Bedrooms:5

Bathrooms:4.75

Building Total:7,010 SqFt

Basement Fin:2,480 SqFt

BasementUnfin:

Basement Desc:Daylight, FinGrade 9

Lot Size:0.37 Acres (16,240 SqFt)

Garage:Basement960SqFt

Heating:Gas Forced Air

Fireplace:2

BldgCondition:Average

Neighborhood:33-5

Bldg Count:1

DwellingCount: # of Stories:1

School Dist:405 Bellevue

PrimarySchool:MedinaElementarySchool

Middle School:Chinook Middle School

High School:Bellevue High School

Waterfront: View:

Recreation:

Sentry Dynamics, Inc. and its customers make no representations, warranties or conditions, express or implied, as to the accuracy or completeness of information contained in this report.

ParcelID: 3262301518

Tax Account #: 326230151804

2612 79th Ave NE, Medina WA 98039

This map/plat is being furnished as an aid in locating the herein described land in relation to adjoining streets, natural boundaries and other land, and is not a survey of the land depicted. Except to the extent a policy of title insurance is expressly modified by endorsement, if any, the company does not insure dimensions, distances, location of easements, acreage or other matters shown thereon.

Buyer: ___________

Buyer: ___________

EXHIBIT A

LEGAL DESCRIPTION

**Exhibit A obtained from document recorded under recording number 20200929002703 subject to change upon title examination**

NEIGHBORHOOD REPORT

2612 79thAve NE, Medina, WA98039

Subject Parcel

Owner: Alves, Darrin Gloryvee, Hern

vs

NEIGHBORHOOD REPORT

NEIGHBORHOOD REPORT

Owner: Brennan, Robert Brennan, Cynthia

Owner: Joh, Jung Hyun Joh, Joohee Kim

3.

NE, Medina, WA98039 TaxAcct:

2605 79thAve

2 2609 79thAve NE, Medina, WA98039

2615 79thAve

NEIGHBORHOOD REPORT

4. 2647 79thAve NE, Medina, WA98039

TaxAcct: 326230090002

Owner: Ang, Richard L Ang, Catherine

MailAddr: 2647 79thAve NE Medina, WA98039

Owner: Pneuman, Fred C

MailAddr: 2616 79thAve NE Medina, WA98039

TaxAcct: 326230152000

Owner: Huang,Yong Landi, Shan

MailAddr: 2608 79thAve NE Medina, WA98039

Dt: 07/06/2012

$1,075,000

6. 2608 79thAve NE, Medina, WA98039

NEIGHBORHOOD REPORT

7. 2615 80thAve NE, Medina, WA98039

TaxAcct: 326230157504 Acreage: 0.25

Owner: Ross, KarenA

MailAddr: 2615 80thAve NE Medina, WA98039

4

Dt: 05/15/2009

TaxAcct: 326230158007

Owner: Winquist, Jon Winquist, Marriot

MailAddr: 2633 80thAv NE Medina, WA98039

9. 2629 80thAve NE, Medina, WA98039

TaxAcct:

Owner: Edelstein, Noah B Edelstein, Winegarden

Sq Ft: 10,827

ID: 3262301575 Parcel ID: 3262301580 Parcel ID: 3262301585

8. 2633 80thAve NE, Medina, WA98039

NEIGHBORHOOD REPORT

SUBDIVISION MAP

s & TITLE

PRELIMINARY TITLE COMMITMENT & CCRS

File Number: 2390113

TITLE COMPANY: 2390113

Stewart Title Company 981 Powell Ave SW, Ste 100 Renton, WA 98057

TitleOfficers@stewart.com

ESCROW CONTACT: (Once contract is fully executed and sent to escrow )

The Pope Team

Brenna Pope and Dawn Barry, Escrow Closers/LPO’s

Stewart Title Puget Sound Division

2820 Oakes Ave Ste A Everett, WA 98201

O (425)317-7300| Direct Brenna (425)317-7303| Direct Dawn (425)317-7305

Cell/Text Brenna (206)321-1802 | Cell/Text Dawn (425)903-0542

Brenna Pope LPO #10304

Dawn Barry LPO #10311 Office #728921

FOR THE PROPERTY OWNER:

TITLE INSURACE FAQ’S

Q: What is title insurance?

A: An opinion of the condition of title to real property, backed by an Insurance policy.

Q: Why do I need title insurance?

A: When you buy a home, or a property for that matter, you expect to enjoy certain benefits from ownership. For example, you expect to be able to occupy and use the property as you wish, to be free from debts or obligations not created or agreed to by you, and to be able to freely sell or pledge your property as security for a loan. Title insurance is designed to cover these rights.

Q: What if I have a problem? Do I have to lose my property to make a claim?

A: Not at all At the mere hint of a claim adverse to your title, you should contact your title insurer who issued you policy Title insurance includes coverage for legal expenses which may be necessary to investigate, litigate or settle an adverse claim

Q: What does this cost?

A: The cost varies, depending mainly on the value of your property The important thing to remember is that you only pay once, and then the coverage continues in effect for so long as you have an interest in the covered property If you should die, the coverage automatically continues for the benefit of your heirs. If you sell your property, giving warranties of title to your buyer, your coverage continues. Likewise, if a buyer gives you a mortgage to finance a purchase of covered property from you, your coverage continues to protect your security interest in the property.

Q: If my lender gets title insurance for its mortgage, why do I also need a policy?

A: The lender’s policy covers only the amount of its loan, which is usually not the full property value. In the event of an adverse claim, the lender ordinarily wouldn’t be concerned unless its loan became non-performing and the claim threatened the lender’s ability to foreclose and recover its principal and interest. And, in the event of a claim there is no provision for payment of legal expenses for an uninsured party.

PRELIMINARY TITLE REPORTS:

UNDERSTANDING THE BASICS

The Title Company begins the process of preparing a preliminary report once they have received an order for title services. Our search experts assemble various public records relating to both the property being purchased and the people involved in the transaction

After examining the information gathered, an examiner prepares the preliminary report, which shows current ownership of that specific parcel of land any liens and encumbrances the title company will not cover under the subsequent title policy.

What is the point of the preliminary report?

The preliminary report gives the conditions for The Title Company to issue a particular type of policy. It lists title defects, liens and encumbrances that would not be covered if the title policy were issued as of the date of the report. The preliminary report provides an opportunity to request that actions be taken to remove the objectionable items listed in the report.

If the objectionable items are not eliminated or released prior to the closing and transfer of title, they will be listed as exceptions on the final policy, meaning they will not be covered. For example, the seller could be required to pay a contractor who placed a lien on the property so that the lien would be removed.

Is a preliminary report just another name for the title policy?

No The preliminary report provides the statement of the conditions needing to be addressed in order for a title policy to be issued. The preliminary report offers no representation of the condition of the property’s title. It does not create a contract of liability, which means it provides no protection to the recipient. An actual title policy must be issued in order to provide protection and prevent parties other than the policy recipient from claiming the benefit of owning the property.

(continued on next page)

PRELIMINARY TITLE REPORTS:

UNDERSTANDING THE BASICS

What key points should one look for in a preliminary report?

You will want to pay particular attention to: the extent of ownership rights, including any possible ownership interest on the part of parties other than the seller items listed as being excluded from coverage, including liens, restrictions and interest of others (listed numerically as exceptions) interest of third parties. For example, easements limiting use of the property granted by a prior owner.

A list of standard exceptions and exclusions of items not covered by your title policy may be attached to your report; if so, you should review this as well.

Who can best explain a preliminary report?

Your title agent, your real estate agent or, should you have one, your attorney can help explain the specifics of your preliminary report. Don’t hesitate to ask any one of them to discuss the report with you.

Does the preliminary report contain the complete condition of the property’s title?

It does not. The preliminary report is merely an offer to insure upon the terms and conditions stated therein. It details matters that the title company would exclude from coverage were they to issue a policy at a later date.

CLOSING PROCESS

7 Steps to a Smooth Closing For Buyers

1.Homeowner’s insurance

Prior to closing, please provide us with your choice for homeowners insurance and your insurance agent’s name and phone number.

2.Certified funds

Check to see if your state requires certified funds at closing. If so, your closing cost must be in the form of a cashier’s check, certified check or wired funds.

3.Wired funds

If you wish to wire your closing cost from your account directly to Stewart Title’s escrow account, please inform us prior to the closing, so that we may assist you in making the arrangements.

4.Verify wiring instructions

Before sending any money electronically, verify all wiring instructions with your agent by phone. Don’t rely on emails or other forms of communications. Know that Stewart uses CertifID to protect against wire fraud.

5.Identification

Don’t forget to bring your driver’s license or other U.S. issued form of official picture ID to closing.

6.Reviewing documents

If you wish to examine your loan documents prior to closing, please request that the mortgage company provide them to the title company at least one day early.

7.Reimbursements

All bills for inspections, repairs or other items to be paid at closing must be provided to us prior to closing.

Avoid common closing delays

X If you will not be present at closing to sign documents and intend to use a power of attorney, you must provide the original power of attorney to your closing officer prior to closing for approval and recording of the document. (The lender will also need to approve the power of attorney.) On the day of closing, we will need to contact you and verify that you have not revoked the power of attorney.

Contact me to learn more about the benefits of closing with Stewart Title.

SynapmoC C maeT sseccuS

6 dvlB llaM amocaT S 001 etiu

T 90489

2 niam 6278.077.60

c moc.trawets@s s dnuos-tegup/moc.trawet

X If you are unable to attend the closing and will sign the papers by overnight mail, please provide Stewart Title with the forwarding address, including ZIP code. Also, please provide us with a contact number in case we need to reach you. You will need to sign the papers in front of a notary. Some states can arrange for a mobile notary. We will provide you with a return overnight mail packet. Please send the signed and notarized closing papers back to us the same day you receive them.

You Are in Escrow So Now What?

1. Purchase Agreement is provided to escrow and reviewed by the escrow team.

2. Buyer’s deposit is received. Preliminary report/ title commitment is requested.

3. Preliminary report/title commitment is received, reviewed and distributed.

4. Escrow instructions and documents are prepared and distributed as per local practice.

5. Information and signatures from principal(s) are requested. This includes payoff of underlying loans and Statements of Information from sellers.

6. Demand(s) are requested and received.

7. Data entries are made for payoffs, commissions, etc.

8. If financing is involved, loan approval is received, and loan documents arrive from the lender.

9. Escrow prepares estimated closing statements for buyer and seller review and approval, together with seller’s CD, if required.

10. Buyer’s signing appointment is scheduled, documents are prepped for signing. Escrow paperwork is added. Appointment with seller is made, if required.

11. Funds are requested and received from buyer and seller, if required. Upon receipt of buyer and seller funds as may be required, loan funds are requested from lender.

12. Upon receipt of all funds required to close, recordable documents are forwarded to county recorder’s office with authorization to record.

13. Disbursements are made and closing packages are released.

Home Buying Process

So, you’ve decided to buy a home. Congratulations. However, making the decision to purchase is just the first of many steps. To help you better understand the homebuying process, we’ve listed everything that happens between the time you decide to buy a home and when it’s time to move in.

Prepare to shop

Execute the contract

Compile a list of needs and wants

Prequalify for loan and financing

Find a real estate broker

Visit properties and rank them 1 8 9 2 7 10 3 6 11 4 5

Open an escrow account and send earnest money

Negotiate, if necessary

Make the offer

Sign documents and complete the closing process

Welcome home

Whether it’s your first home or one of many, this is an exciting time, and you can always count on Stewart Title to be here to assist you with your real estate needs, no matter what stage you are in on your home ownership journey.

What happens: Contract to closing

There’s a lot that happens between the time a buyer finds a house and the day they own it. To help you better understand what happens after the Sold sign is posted, we’ve listed the seven basic steps of transferring a land title.

1

Earnest Money

An escrow contract (an agreement to close) starts the process.

2

Title Search

Copies of documents (surveys, deeds, encroachments, restrictions, assessments, liens, wills, divorce settlements, etc.) are gathered from various public records.

3

Examination

Legal owner, debts owed and encumbrances on the land are verified.

4

Nonpublic Record Check

Taxes, assessments, liens, bills and other nonpublic information are reviewed.

Document Preparation

Forms are prepared for settlement and transfer of title.

Please contact me for more information.

2 niam 6278.077.60

c moc.trawets@s

s dnuos-tegup/moc.trawet

5 Settlement or Closing

6

Either an escrow officer or a closer will oversee the closing of the transaction. Seller signs the deed; buyer signs note and new mortgage. Old loan is paid off; new loan is recorded. Seller, real estate agents, attorneys, title company and others are paid. Owner’s and lender’s policies are issued.

7

Recording of Legal Documents

Documents are recorded with the county to show transfer of ownership.

SIX STEPS TO E SC ROW S U CCE SS

In Washington, the Stewart T itle escrow staff is ready to consistently provide you and your customers with the best closing experience possible. For a speedy transaction, we recommend following the six steps below to ensure a successful escrow process.

Step One

Recommend Stewart T itle for your customers’ title insurance and escrow settlement. Ask for their escrow or title reference number to use for all future communications.

Step Two

Read and understand the preliminary report. If there is an item you don’t understand, contact your escrow or title officer.

Step Three

Inform your escrow officer if any changes occur. All changes should be noted in writing. Remember, escrow only acts on mutual instructions except with rare exceptions.

Step Four

2niam 6278.077.60 c moc.trawets@s s dnuos-tegup/moc.trawet onraeleromtuobaeltitT ,ecnarusnehtsyekia s lufsseccuworcsessecorp o ryhwtrawetSeltiTeht r thgieltitynapmocrof,uoy tcatno.yadotc

traweteltiTynapmoCS C maeT sseccuS tneil MyrtnE redrO & ecivreS remotsuC ,regana

6 dvlB llaM amocaT 050 S 001 etiu T90489 ,amoca

It’s important to understand the fiscal tax year, debits, credits, prepaid interest, impounds, due dates and delinquent dates in order to ensure that this information will be easily understood by your client. Familiarize yourself with normal buyer and seller closing costs.

Step Five

Check each signature for accuracy. Review purchase agreement to ensure it is complete and includes buyers’, sellers’, and agents’ phone numbers and email addresses. Make sure all of the required documents are signed and notarized when applicable.

Step Six

Double-check all papers and documents before retur ning them to your escrow officer for verification.

Medina Washington

Parks & Trails

Bellevue Downtown Park is a 21-acre oasis of green in the heart of Bellevue A one-half mile promenade, bordered by a double row of shade trees, and a stepped canal, brings one to the 240-foot wide waterfall that cascades into a reflecting pond. A ten-acre lawn area invites one to pause for a picnic with Bellevue’s skyline and Mount Rainier in the background. The park’s delightful play area and formal gardens add to family enjoyment and serve as a backdrop for community events.

Features:

Restroom

Playground

Tot Lot

Picnic Tables

Pathways

Formal Garden

Public Art

Water Feature

Parking

Public Wi-Fi

https://bellevuewa gov/city-government/departments/parks/parks-and-trails/parks/bellevue-downtown-park

Parks & Trails

Wilburton Hill Park at 105.49 acres large is the largest upland park in the city, encompassing a wide variety of recreational opportunities. The park’s trail is a major link in the Lake to Lake Trail and Greenway System. Active play enthusiasts can take advantage of the one soccer and two ball fields, and the children’s play area, which includes a zip line. Adults can work out on exercise equipment positioned so parents can watch their kids in the play area.

Rentals

Wilburton Hill Park features a large picnic area and ballfields, ideal for company picnics and large gatherings. For field scheduling or picnic reservations, visit the park rental webpage for more information.

Directions

From I-405, take the NE 8th Street exit going east. Turn right onto 124th Avenue NE. The park is on the left at the intersection of 124th and Main Street.

https://bellevuewa gov/city-government/departments/parks/parks-and-trails/parks/wilburton-hill-park

Parks & Trails

This 34+ acre park features a wide array of amenities, including tennis courts, basketball courts, a horse shoe pit, restrooms, a skate bowl, play areas, picnic shelters, and jogging paths. It's also home to the popular Crossroads Water Spray Playground, a full-service community center, a par-3 golf course featuring both golf and foot golf, the Bellevue Youth Theatre, and seasonal community gardens.

Crossroads Park is located in one of the most culturally diverse neighborhoods in Bellevue. Stepping into the park, you will likely hear dozens of languages being spoken, but the common language is play.

Features:

Basketball Court

Meeting Room

Community Center

Electric Vehicle Charging

Farms/P-Patches

Golf

Parking

Pets On Leash

Pickleball

Picnic Tables

Picnic Shelter

Playground

Tot Lot

Restrooms

Skateboarding

Tennis Courts

Walking & Jogging

Water Playground

Public Wi-Fi

https://bellevuewa gov/city-government/departments/parks/parks-and-trails/parks/crossroads-park

Parks & Trails

Swim Area Closure (08/31/2022): The swim area at Meydenbauer Bay Beach Park is closed due to high bacteria count, and will be remain closed until further notice. Visit Bellevue's newest beach park, which includes a viewing terrace, hillside woodland, outdoor classroom, play area, beach house, PPV launch, whaling building update, pedestrian pier, shoreline restoration, daylighted channel, and ravine.

Visitor Moorage

Visitor moorage accommodates 14 boats between Piers 2 and 3 in the Bellevue Marina. Access, moorage and restrooms meet ADA accessibility guidelines. Design of the facility was funded by Washington State's Recreation and Conservation Office (RCO).

Park Amenities

Beach house with restrooms and showers

Curvilinear pedestrian pier and hand-carry boat launch

Natural ravine

99th Street parking lot and marina entrance improvements

Walking paths, picnic areas, pedestrian promenade and children's play area

https://bellevuewa gov/city-government/departments/parks/parks-and-trails/parks/meydenbauer-beach-park

Parks & Trails

Nestled in the heart of Bellevue, the 320-acre Mercer Slough Nature Park offers a tranquil setting for a variety of recreational experiences. The Mercer Slough is Lake Washington’s largest remaining wetland. Containing hundreds of plant species and an abundance of water resources, the park provides diverse habitat for over 170 species of wildlife. Interconnected elevated boardwalks, soft surface trails and asphalt paths transport visitors through this unique urban wetland.

Trails

The Periphery Trail is an asphalt path circling the perimeter of the park. The trail is ideal for jogging, bicycling, and rollerblading. A component of both the Lake Washington Bike Loop and Mountains to Sound Greenway , the path provides connections to Newcastle Beach Park, Seattle, Factoria, Renton and beyond.

The Heritage Trail, located behind the Winters House, meanders past remnants of old greenhouses, through an abandoned rhododendron nursery and parallels the historic blueberry fields to the boardwalk connecting to the Bellefields Trail.

The Bellefields Trailhead, located on the east side of the park, loops through upland forest, scrub-shrub wetland, and open meadow habitats to the edge of the slough channel. Interpretive signs provide information on the history and benefits of the wetland.

The Canoe Trail allows visitors a unique beaver’s-eye view of the Mercer Slough. Canoeists can observe the stark contrast between the soft, ever-changing mosaic of plant communities, and the hard, urban edge of shining glass office buildings along the slough’s edge. The City also offers guided trips on Saturday mornings May through October.

https://bellevuewa

Parks & Trails

This neighborhood park features farm animals, picturesque barns and a historic cabin that are sure to create fond memories

Special uses are permitted with a conditional use permit from the Parks & Community Services Department. These special uses include picnic shelter rentals, filming, photography and commercial uses. Please contact Kelsey Creek Farm staff regarding the permit process at 425-452-7688 or KelseyCreekFarm@bellevuewa.gov.

Features:

Picnic shelter (75 people max. capacity) with 6 tables and 3 grills.

No electricity or water.

Farm animals

Children's play area

Fraser Cabin

Restrooms

https://bellevuewa.gov/city-government/departments/parks/rentals/outdoor-rentals/kelsey-creek-park

Parks & Trails

This waterfront park is suitable for group events or weddings.

Features:

The upland lawn picnic area (125 people max. capacity). Overlooks Lake Washington and is perfect for weddings! No tables or electricity available Water is available at the restrooms.

The lower picnic area (25 people max. capacity) has two secured tables close to play and swimming areas. No electricity available. Water is available at the restrooms. Swimming beach with seasonal lifeguards. See Beach Lifeguard Schedule.

Children’s play area

Restrooms

Non-motorized watercraft may be launched and landed during the non-swimming season only.

https://bellevuewa.gov/city-government/departments/parks/rentals/outdoor-rentals/chism-beach-park

For information on each of these attractions, visit the Travel Washington website at: http://www.travel-in-wa.com

ACTIVITIES & ENTERTAINMENT PUGET SOUND AREA:

Things to Do

The Puget Sound Region is full of dynamic and cosmopolitan cities framed by inspirational lakes, pristine ocean bays and rugged mountains. It is a virtual smorgasbord of possibility, from recreational opportunities in unrivaled natural settings to urban delights in the arts and culture offered in world-class museums, theatres and other venues. An area rich in history, from the Northwest Native American cultures and Alaska Yukon gold rush days, to Seattle’s iconic Space Needle and corporate giants in aviation and the dot-com. Whether you’re looking for fun, excitement, education or romance, this region offers an unrivaled choice of diverse activities.

Experience Washington is the official travel and tourism website for the state. Visit their site to discover and plan things to do in all regions of Washington. You can also contact them at 1-800-544-1800. www.experiencewa.com

For a listing of suggested attractions, coupons and other visitor’s resources check out: The Puget Sound Attractions Council website at: www.seattleattractions.com

The GoNorthwest Online Travel Guide offers a listing by Puget Sound City of attractions, accommodations, visitors information, activities and more. It can be found at: www.gonorthwest.com

WINERIES & BREWERIES

Nationalrank:2ndlargestpremiumwineproducerintheUnitedStates

Numberofwineries:

Numberofwinegrapegrowers: 850+ 350+

Appellations:

ThirteenAmericanViticulturalAreas(AVAs),asrecognizedanddefinedbythe USTreasuryDepartment;Alcohol&TobaccoTaxes&TradeBureau

1.YakimaValley-1983

2.WallaWallaValley-1984

3.ColumbiaValley-1984

4.PugetSound-1995

5.RedMountain-2001

6.ColumbiaGorge-2004

8.WahlukeSlope-2006

9.RattlesnakeHills-2006

10.SnipesMountain-2009

11.LakeChelan-2009

12.NachesHeights-2011

13.AncientLakesof

7.HorseHeavenHills-2005 ColumbiaValley-2012

VisittheWashingtonStateWinewebsiteat:washingtonwine.org

AbouttheWashingtonStateBeerCommission&Industry

TheWashingtonBeerCommissionwasratifiedbytheWashingtonState LegislatureonSeptember6,2006asanAgriculturalCommodityCommission, becomingthefirstcommoditycommissionforcraftbeerintheU.S.Through RCW15.89thestategrantedthecommissiontheopportunitytoproduceup to12beertastingfestivalsperyearandtousetheproceedstopromoteand marketWashington’scraftbreweries.Anassessmentoftencentsperbarrel producedbyeachbrewery(withacapassessmentof$1,000)wasalsoa partofthelegislation.Washingtonstatenowboasts240+breweriesandI sstilltheonlystateinthenationwithabeercommission.

VisittheWABeerCommissionwebsiteat:washingtonbeer.com

DownloadtheWashingtonBeerMobileApp:

10455 NE 5th Pl

Bellevue 13 Coins

900 Bellevue Way NE #100

Bellevue

The Pumphouse Bar & Grill

11802 NE 8th St

Bellevue

Solarium Kitchen & Bar

300 112th Ave SE

Bellevue

The Brief Encounter Cafe

2632 Bellevue Way

Bellevue

900 Bellevue Way NE

Bellevue

Farine Bakery & Cafe 11194 NE 10th St

Bellevue

Bellevue Grill

5500 140th Ave NE

Bellevue

Gilbert’s on Main 10024 Main St

Bellevue

Lil’ Jon Restaurant & Lounge

3080 148th Ave SE, Ste. 201

Bellevue

Chace’s Pancake Corral

1606 Bellevue Way SE

Bellevue

Polaris Restaurant 11200 SE 6th St

Bellevue

California Mexican Food 14620 NE 24th St

Bellevue

Cafe Pogacha 10885 NE 4th St 110

Bellevue

The Brief Encounter Cafe 2632 Bellevue Way

Bellevue

Deli Queen

601 108th Ave NE #130

Bellevue

STK Steakhouse

610 Bellevue Way NE #110

Bellevue

Bellden Cafe 10527 Main St

Bellevue

Duke’s Seafood

500 Bellevue Way NE

Bellevue

Supreme Dumplings 14603 NE 20th St

Bellevue

Bellevue Senior High

School Report

Subject Parcel

SiteAddress 2612 79thAve NE Medina WA98039

Parcel 3262301518

School District 405 Bellevue

Assigned Primary School Medina Elementary School

Assigned Middle School Chinook Middle School

Assigned High School Bellevue High School

School Map

School #1

School District Bellevue School District

School Bellevue High School

Dist From Subject 2 72 miles

SiteAddress 10416 Wolverine Way

City Bellevue Zip 98004

Type 1-Regular school Students 1517

Charter No

Title 1 Elig 2-No

Free/Reduced Lunch 223

Student/Teacher Ratio 21 95

Magnet No

Title 1 6-Not aTitle I school

FTE Teachers Count 69 12

Grade Levels 9th Grade - 12th Grade

Male 792 Female 717

Hispanic 123

568 Black 40

Indian 1 Asian/Pacific Isl. 584

School #2

School District Bellevue School District

School Chinook Middle School

Dist From Subject 1 17 miles

SiteAddress 2001 98thAve NE

City Bellevue Zip 98004

Type 1-Regular school Students 814

Charter No

Title 1 Elig 2-No

Free/Reduced Lunch 171

Student/Teacher Ratio 19 28

Magnet No

Title 1 6-Not aTitle I school

FTE Teachers Count 42 22

Grade Levels 6th Grade - 8th Grade

Male 414 Female 399 Hispanic 96

31

289

Indian 3 Asian/Pacific Isl. 284

School #3

School District Bellevue School District

School Medina Elementary School

Dist From Subject 1 24 miles

SiteAddress 8001 NE 8th St

City Medina Zip 98039

Type 1-Regular school

Charter No

Title 1 Elig 2-No

Free/Reduced Lunch 17

Student/Teacher Ratio 21 92

Male

Students 449

Magnet No

Title 1 6-Not aTitle I school

FTE Teachers Count 20 48

Grade Levels Prekindergarten - 5th Grade

Asian/Pacific Isl. 319

Schools Report

Public School Assignment

School

School

Chinook Middle School

Bellevue High School

Nearby Private Schools

Utilities

(866)928-3123

Electricity/Natural Gas

NorthshoreUtilityDistrict

PugetSoundEnergy

SeattleCityLight

TannerElectricCoop

Water/Sewer

Cedar River Water

City of Bellevue

City of Black Diamond

Bothell

City of Carnation

City of Duvall

City of Enumclaw

City of Issaquah

City of Kent

City of Kirkland

City of Mercer Island

City of Newcastle

City of North Bend

City of Redmond

City of Renton

City of Seattle

(Seattle Public Utilities)

Coal Creek Utilities District

Covington (water only)

Water District

Highline Water District

(425) 398-4400

(888) 225-5773

(206) 684-3000 (425) 888-0623

(425) 255-6370

(425) 452-6932

(360) 886-5700

(425) 486-6250

(425) 333-4192

(425) 788-3434

(360) 825-5541

(425) 837-3000

253) 856-5201

(425) 587-3150

(206) 275-7783

(425) 235-9200

(425) 888-7075

(425) 556-2152

(425) 430-6852

(206) 684-3000

(425) 235-9200

(253) 631-0565

(425) 222-7882

(206) 824-0375

wavebroadband com

(nud net

pse com

seattle gov/light tannerelectric coop

crwsd com

ci bellevue wa us

ci blackdiamond wa us

ci bothell wa us

ci carnation wa us

duvallwa gov

ci enumclaw wa us

ci issaquah wa us

ci kent wa us

ci kirkland wa us

ci mercer-island wa us

ci newcastle wa us

northbendwa gov

ci redmond wa us

rentonwa gov

seattle.gov

ccud org

covingtonwater com

fallcity org

highlinewater.org

SeattlePostIntelligencer

SeattleTimes

USAToday

WallStreetJournal Newspaper

LakeForestParkWaterDist

LakeMargaretWaterSystem

LakehavenUtilityDistrict

MidwaySewer

NESammamishSewer

(206)448-8000 (206)464-2121 (800)872-0001 (800)975-8609

(206)365-3211

(425)844-2193

(253)941-1516

(206)824-4960

425)868-1144

NorthBendWaterDistrict#19

Northshore

RonaldWastewaterDistrict

ShorelineSammamishPlateau

ShorelineWaterDistrict

SkywayWaterandSewerDist

SnoqualmiePassUtilitiesDist.

SoosCreek

SouthwestSuburbanSewer

ValVueSewerDistrict

ValleyWaterDistrict

VashonNorthshoreUtility

VashonSewerDistrict

WoodinvilleWaterDistrict

(206)463-9007

(425)398-4400

(206)546-2494

(425)392-6256

(206)362-8100

(206)772-7343

(425)434-6600

(253)630-9900

(206)244-9575

(206)242-3236

(253)841-9698

(425)398-4400

(206)463-9219

(425)487-4100

seattlepi com

seattletimes com offers usatoday com subscribe wsj com

lfpwd.org lakemargaret org lakehaven org midwaysewer org nesswd org water19 com nud net

ronaldwastewater org ci sammamish wa us

shorelinewater org

skywayws org

snopassutility com

sooscreek com

swssd com

valvue com

valleywaterdistrict com

nud net

woodinvillewater com

10 REASONS WHY

You will make more money. U.S. Housing and Urban Development reports that a staged house sells, on average, 17% higher than a non-staged house

The cost of staging doesn’t cost a dime. A Home Gain Survey of over 2000 Realtors discovered that sellers who spent up to $1,000 staging their home recovered almost 200% of the cost in the sale of their home

Most home sellers cannot view their house objectively. If you can’t see objectively, you can’t “package” effectively. Have a staging professional give you a detailed, step by step, “Action Plan” so you can do the work yourself. Less guesswork and “Do It Yourself”. A professional home stager can manage your projects from start to finish OR give you a detailed enough report based on their extensive knowledge and training to have you “do it yourself”.

Only 10% of homebuyers can visualize the potential of a home. That’s why staging a vacant home is critical! You don’t want the benefits of your beautiful home left up to the buyer’s imagination.

Studies show that the longer your home stays on the market the lower your selling price will be Don’t settle for less and lower your price have your house staged

Staging is designed to differentiate a house. Create emotion, which translates into more offers and more money. Staging is about the creativity, not the money. Staging helps with the vision. Buying a house is largely an emotional decision because people are not just purchasing a home; they are buying a dream...a lifestyle. When it comes to staging a home, the beauty lies not only in the art but in the numbers. Staging can transform a home from ugly duckling to swan. Keep in mind what you’re selling is the home, not its contents. If you remove throw or area rugs, eliminate clutter and collections, and cut down on furniture and accessories, the room will appear to be more airy and spacious. It's all about flow.

HOME DECLUTTERING

By de-cluttering a home, you allow customers to see each space’s best features and full potential. Give customers the space to envision their own dreams within the home. Here are a few tips for staging a home properly with tips on staging mistakes to avoid:

KEYS TO STAGING A HOME PROPERLY¹

• Give the property’s interior a fresh coat of paint to show prospective buyers the home is well kept and alive

• Whether you want to or not, be sure to disclose everything about the property

• Fix all running toilets – the sound of echoing pipes is a sound that could spook off customers

• Show the cozy places in the home, including the outside; if there’s a patio or a porch, show potential customers that the property’s outside is as attractive as the inside

• To get a feel for what spaciousness, simplicity, neutral colors and décor can do for your home sales, visit model homes to see how they do it

• To freshen up the kitchen area, cut one lemon in half and grind it in the garbage disposal

• Display foliage in moderation; be mindful to invest in quality plants that are either silken or easy to maintain

• Ask yourself if all of the decorative items in the home are really needed, or if they can be put away (for example, do you really need three statuettes of turtles on the kitchen counter? Perhaps just clear the counter off completely)

• Listen to the pros and hire an agent to assist you with your real estate needs

STAGING

MISTAKES²

• Leave no section of your home un-staged – be prepared for potential buyers with a critical eye for details, including cleanliness

• If you’re going to add fragrance to the home, use a tad of neutral, fresh-smelling scents such as vanilla or lemon; refrain from using over-powering scents – it could smell like you’re trying to cover an odor

• Do not leave any family photographs, mail, documents or other personal information out on countertops –also, if you keep pictures or personal items tacked on your refrigerator, remove those as well.

• Keep personal items in a hidden, well-protected place; create a non-cluttered, neutral environment in which a potential buyer can picture themselves living there (not the family currently living there)

• Be sure the closet spaces are cleared out – you want your potential buyers to see how much storage space they may find handy

• If a DIY project has been left unfinished, either clean it up or clear it out

• Don’t forget that the yard should be just as neat as the inside of your home

• Not everyone is pet-friendly; when showing a home, please remove your furry friends during a showing

• Be sure the food pantry, laundry room and garage are well-organized and clean; only leave items in those storage spaces that pertain directly to the space itself; all other knickknacks or untidy items should be re-moved

Sources:

1 http://www.hgtv.com/real-estate/top-10-home-staging-dos/index.html

http://www.squidoo.com/homestagingmistakes#module13426482

2 http://www.squidoo.com/homestagingmistakes

http://www.hgtv.com/real-estate/top-10-home-staging-donts/ index.html

Every well-run household has its own unique solutions and quick fixes to keep it humming smoothly

Here are a few favorite and clever pearls of domestic wisdom to add to your collection

• Have you tried baby wipes on carpet stains? They work so well, you’ll be wondering why no one told you sooner!

• Keep candles in the refrigerator for several hours before you use to slow down dripping and make them last longer

• To eliminate cooking odors heat white vinegar in an uncovered pot on the stove. (don’t boil) Remove after 30 minutes. The light vinegar smell dissipates quickly, taking odors with it.

• The best way to attack cooked-on spatters in your microwave: Heat a half-cup of water for two minutes on high The steam will soften the food and the mess will wipe right out

• When run through your coffee grinder, a handful of dried rice will sharpen the blades

• After your next party, share flat, leftover beer with your garden The plants love the yeast

• Ants hate anything spicy Sprinkle ground pepper, cayenne, even cinnamon, in their path, and you’ll stop them in their tracks

• Your chimney will stay clean if you throw a handful of salt on the fire

• Fill nail holes with a paste made of cornstarch and water Works just as well as putty!

• When a wooden door or gate sticks, bring out the hair dryer By blowing hot air directly on the wood where it’s sticking, you’ll remove the moisture and the swelling will go down

• Squeaky doors? For a drip less solution, use petroleum jelly on the hinges instead of oil

• Simmer a sliced apple and a couple of cinnamon sticks in water on the stove. Your whole house will smell like apple pie.

• Place unusable remnants of soap in a ventilated plastic bag and pack it away with seasonal clothes This will keep the moths away, and your clothes will smell much better when you take them out of storage

• Leather needs to breathe, so never hang coats or jackets in plastic Instead, make a dust cover from a pil-lowcase by cutting a hole in the top for a hanger

MOVING DAY

BEFORE MOVING DAY

❑ Pack all family records in a separate box and keep it with you (not in the moving van) when you move Include your family’s medical, dental, school, and financial records Although the moving company is insured, if it loses your irreplaceable records and other valuable, there is nothing they can do to get them back.

❑ Forward your mail. Make “We’re Moving” postcards to send to friends and relatives. Send change-ofaddress forms to magazines, service organizations, DMV/DOL and others Go to the post office and complete a mail forwarding form Also, consider sending electronic change-of-address cards to your friends. Check the Internet for sites that offer these cards for free.

❑ Say goodbye to your neighbors and give them your new address and phone number Hand out “We’re Moving” postcards as you say goodbye.

❑ Call the telephone and utility companies to close or transfer your accounts and let them know your new address Your final bills will arrive there

❑ Be sure that the new tenants (or property manager) have the code for the alarm system.

ON MOVING DAY

❑ Turn off and unplug all appliances. Check the refrigerator, air conditioner, clothes washer, dryer, and other appliances As a courtesy to the new tenants, leave the plugs and their wall sockets in plain view and accessible

❑ Turn off the automatic sprinkling system (or set it to automatic, if appropriate)

❑ Set the thermostat to 55 degrees If it’s winter, this will help ensure that the pipes won’t freeze before the new tenants arrive

❑ Close blinds and draperies and turn off all lights except one or two so that the house doesn’t seem unoccupied.

❑ Secure and lock all doors and gates Remove any locks to which you own a key or combination (or leave the key or combination for the new occupants).

CHANGE OF ADDRESS

Utilities & Services

Electric Gas Water

Garbage

Sewer

Recycle

Telephone/Mobile

Cable/Satellite

Internet

Fuel

Water Delivery/Water Treatment

Pool Services

Lawn/Garden Services

Housecleaning Services

Physicians/Dentists/Veterinarian

Attorney

Real Estate Broker

Lender

Pharmacy/Drug Store

Dry Cleaners

Subscriptions

Newspapers

Magazines

Book and Music Clubs

Family Schools

Children’s Organizations

Clubs (Athletic, misc )

Relatives, Friends, Business Associates

Don’t forget to submit your change of address with the U.S. Post Office online, mail-in form, or at a local branch and set your mail to forward.

Financial & Personal Accounts

Employer/Benefits/401K

Banks

Loan Institutions

Financial Advisor/Investments

Major Credit Card Companies

Department Store Credit Cards

Insurance Agencies (Health, Home/Life & Auto)

Charge Accounts

Pension Plans

Air Miles Rewards Program

Accountant/Tax Consultant

Charities

Professional Memberships/Licensing Boards

Government & Public Offices

Post Office

Veteran Affairs

Income Tax/IRS

Family Support

Social Security

Pension Benefits

Unemployment Insurance

Vehicle Registration

Driving License

Voter’s Registration

HOME MAINTENANCE

Owning a home can be a dream come true. But without regular maintenance, your home can become a nightmare. Here is a handy fall-winter maintenance checklist to use to you can ensure your home remains your haven all winter long.

REMINDERS FOR SPRING:

HOME MAINTENANCE

Show your home’s interior and exterior some much-needed TLC and take spring-cleaning to the next level. Don’t know where to start? this list to help you tackle spring maintenance like a pro.

Advantages Of Owning A Home

The decision to purchase a new home brings a sense of stability. Whether you need a place to make your own, more space for a growing family or an investment opportunity, the home-buying process is an exciting time.

Buying a home often reflects a desire for financial security and can be a sound decision for number of reasons:

Accumulation of Equity

When you buy your house and pay your monthly mortgage, you can gradually accumulate what lenders call equity. Equity is an ownership interest in the property. It can be converted into cash by borrowing against it or by selling your house. Unlike owning a home, renting offers no opportunity to build equity.

Stable Housing Costs

Another advantage to homeownership is that mortgage payments can remain unchanged throughout the life of your mortgage. Renters may face an increase in rent payments year after year. With a fixed-rate mortgage, your monthly payments remain the same over the years as other costs of living increase over time due to inflation. As a homeowner with a fixed-rate mortgage, you have the advantage of knowing what your mortgage payment will be far into the future.

Increased Value

Houses typically increase in value, or appreciate, over time. It’s not unusual to find a house that sold for $150,000 15 years ago valued at a much higher price today. Appreciation is like money in the bank to you as the homeowner.

Tax Benefits

As a homeowner, you will enjoy significant tax breaks that are not available to renters. The most important tax benefit of homeownership is that interest paid on your home mortgage is usually deductible. This fact alone can save you a substantial amount each year in federal income taxes.

Comparing Coverage of ALTA Owner’s Policy and ALTA Homeowner’s Policy

Stewart Title offers our residential customers various levels of coverage for your protection. The coverage provided by the ALTA Owner’s Policy (a standard coverage policy) covers you for defects and liens typically in the Public Records’ history of your title through the date and time your deed is recorded in the Public Records. The ALTA Homeowner’s Policy provides enhanced coverage and protects you from matters appearing in the Public Records and items not appearing in the Public Records, including some that might occur after the policy is issued.

Head-to-head Coverage Comparison

Coverages Included Without Endorsement

Assumes compliance with Stewart Title Guaranty Company’s underwriting requirements for issuance of the applicable policy.

Covered Risks

Title being vested other than as stated in Schedule A of policy

Forgery, fraud, duress, incompetency, incapacity or impersonation

Liens or encumbrances on the title (e.g., prior mortgage or deed of trust, state or federal tax lien, condominium or homeowners’ association lien)

A document affecting title not properly created, executed, sealed, acknowledged or delivered

Defective recording of documents

Defect in title caused by improper remote online notarization, failure to perform those acts necessary to create a document by electronic signature, and repudiation of an invalid electronic signature

Unmarketability of the title

No right of access to and from the land

Restrictive covenants limiting your use of the land

Gap Coverage (extending coverage from the closing to the recording of the deed)

Duration

Coverage continues as long as you own the property

Policy insures anyone who inherits the property from you

Policy insures the trustee of your estate-planning trust who receives a deed from you

Policy insures an affiliate who receives a deed from you

Policy insures residential property only

Policy can only be issued to a natural person or estate planning entity

Extended Coverage

Parties in possession of the property that are not disclosed by the Public Records (e.g., tenants, adverse possessors)

Unrecorded easements affecting the property

Encroachments and boundary line disputes that would be disclosed by a survey

Mechanic’s liens (a lien against the property due to non-payment of work)

Taxes or special assessments that are not shown as liens by the Public Records

*Not included in the coverage

ALTA Owner’s Policy (standard) 2021

ALTA Homeowner’s Policy 2021

Head-to-head Coverage Comparison

Coverages Included Without Endorsement

Assumes compliance with Stewart Title Guaranty Company’s underwriting requirements for issuance of the applicable policy.

Additional Coverages

Actual vehicular and pedestrian access based upon a legal right

Loss of your title resulting from a prior violation of covenant, condition or restriction

A limited amount of coverage is available if you are unable to obtain a building permit due to an existing violation of a subdivision law or regulation or you must correct an existing violation (subject to a deductible)

A limited amount of coverage is available if you must remedy or remove an existing structure because it was built without a proper building permit (subject to a deductible)

A limited amount of coverage is available if you must remedy or remove an existing structure due to an existing violation of a zoning law or zoning regulation (subject to a deductible)

A limited amount of coverage is available if you must remove your existing structures if they encroach into an easement or over a setback line

You cannot use the land as a single-family residence because such use violates an existing zoning law or zoning regulation

You are forced to remove your existing structures because they encroach into an easement or over a setback line

Damage to existing structures due to an exercise of an existing right to use any easement affecting the land

Damage to existing improvements due to an exercise of an existing right to use the surface of the land for the extraction or development of minerals, water or any other substance

Someone else tries to enforce a discriminatory covenant

Supplemental taxes because of prior construction or change of ownership or use

Loss if the residence is not located at the address stated in the policy

Pays substitute rent and relocation expenses, if you cannot use your home because of a claim covered by the policy

Automatic increase in policy amount up to 150% of policy amount over 5 years

Post-Policy Coverages

Forgery or impersonation affecting the title

Unauthorized leases, contracts or options

Ownership claims

Easements affecting your use of the land

Encroachment of neighbor’s buildings onto your land

*Not included in the coverage

Coverages stated above are merely examples. Please refer to the policy for actual coverages related to your transaction. Both policies identified above may contain certain exceptions, exclusions and conditions as set out by Stewart Title Guaranty Company and the American Land Title Association®. If you have any questions regarding your rights under the various policies seek legal, tax or other professional advice.

The information provided is for informational purposes and is subject to change without notice.

Please contact me for more information.

SynapmoC C maeT sseccuS

6 dvlB llaM amocaT S 001 etiu T 90489 ,amoca 2 niam 6278.077.60

c moc.trawets@s s dnuos-tegup/moc.trawet

Flood Insurance vs. Home Insurance

Are You Protected Against Water Damage?

As a homeowner, your property is one of your most valuable assets. That’s why you protect it with homeowner’s insurance. But does your homeowners insurance protect your home against all water damage? By understanding how insurance views water, you can protect yourself financially. Otherwise, you may find yourself drowning in debt.

Where water is concerned, there are two types of water-related insurance claims:

Flooding and water damage.

This first type of water-related claim is flooding, also known as rising water. It’s a very common natural disaster and is only covered through a flood insurance policy.

The second type of water-related claim is water damage. With water damage, your home insurance policy potentially covers four different types. Those are:

X Sudden and Accidental – The kind of damage that occurs when a pipe suddenly bursts.

Please

X Seepage and Leakage – The damage resulting from a slow, continuous water leak over time.

X Water Backup – Water that comes in the home through entry points such as sinks, toilets or bathtubs.

X Foundation water damage – Should one of the three previously mentioned types of water damage occur, resulting in the need to break into your foundation, you’ll want to have foundation water damage coverage.

Keep in mind that not all home insurance policies cover all four types of water damage. Verify your coverage with your insurance agent.

Let Stewart Insurance help you build an insurance plan you’re confident in.

Call Stewart Insurance at 866-798-2827 today.

SELLING A HOME Checklist for Repairs and Cleaning

A home that is clean and tidy, and maximizes space will sell faster and at a higher price. Keep in mind that a small investment in time and money could make your home much more attractive to buyers.

Exterior

Does the house need fresh paint?

Are holes and cracks visible?

Are sidewalks, porches and decks swept and in good shape?

Is it inviting?

Do the windows and door screens need to be replaced?

Does the house trim need repair or paint?

Are gutters and downspouts secure and clean?

Landscape

Are shrubs and trees trimmed?

Is the lawn fertilized?

Are flowers planted?

Is the lawn mowed and edged?

Has the lawn been weeded?

Kitchen

Are the appliances clean and working?

Are cabinets neat and in good condition?

Are countertops clean and uncluttered?

Does the tile need regrouting?

Does the sink need recaulking, chips repaired or stains removed?

Do the faucets leak?

Is the oven clean?

Is the gas igniter working properly? (Be sure to leave the key.)

Bathroom

Do the faucets leak?

Does the tub need recaulking?

Do the shower tiles need new grout?

Are the shower doors clean?

Is the floor in good condition?

Roof

Are there any leaks or unlevel areas?

Are shingles or tiles missing?

Does the roof have any unlevel areas?

OK As Is Needs Work

OK As Is Needs Work

OK As Is Needs Work

OK As Is Needs Work

OK As Is Needs Work

Garage OK As IsNeeds Work

Are the floors swept and stain-free?

Are all items stacked against walls to maximize floor space?

Is the garage door opener operating correctly?

Is the garage organized, neat and well lit?

Attic OK As IsNeeds Work

Is the attic organized and clean?

Are the stairs in good condition?

Is the attic well lit?

Are there any signs of insects or rodents?

Overall OK As IsNeeds Work

Can items be removed in order to make the home appear larger?

Do the walls and woodwork need new paint?

Do the walls have holes or cracks?

Does the wallpaper need replacing?

Are both sides of the windows clean?

Are the floors clean and polished?

Are there any stains or damage from water leaks?

Is the carpet clean, flat and stain-free?

Are the window treatments clean and properly working?

Do squeaky hinges need oil?

Are the ceiling fans and vents clean?

Do the windows open and close easily?

Has the house been deep cleaned?

Do any of the doors stick?

Do all the locks work properly and have keys?

Do the doors seal properly?

Are all lights working?

Please contact me for more

TIPS FOR MOVING

Moving can be stressful, but you can make it easier by starting your preparations early. The first step is to hire a mover. Here are few tips for choosing the right one:

x Get referrals from friends, online review sites and organizations like the Better Business Bureau®

x Find a balance between the lowest cost, the most experience and the right equipment.

x Inquire about discounts related to organizations you may belong to.

x Confirm mover credentials. Movers should be licensed and bonded, and employees should have workers’ compensation insurance.

x Ask for references.

x Get estimates in writing.

Please

Protecting Yourself From Real Estate Cyber-fraud

Sensitive information plays a critical role in your real estate transaction, and it’s imperative that this information remains safe and protected. Stewart Title strives to provide consumers with peace of mind in knowing that their personal, non-public sensitive information is protected through Stewart Title’s data security and email encryption. But, as a consumer, there are steps you can take to protect yourself from cyber-fraud, too.

Recently, there has been a wave of cyber-fraud. Cybercriminals hack into the email accounts of real estate agents or other persons involved in real estate transactions. These “hackers” are patient; they sit and wait until they discover useful information to assist in the scam and trick you into sending money through a wire transfer to a bank account that appears to be legitimately owned by a party involved in the transaction (but is not). The hackers send an email that appears to be from an individual involved in the transaction (a practice called spoofing).

At first glance, these spoofing email addresses appear legitimate but often have one additional letter or some other minor variation from the actual email address.

Example: msmith@stewartttitle.com instead of msmith@stewarttitle.com

These spoofing emails advise the recipient (often the buyer) that there has been a last-minute change to the wiring instructions and request that funds be sent to the new account information provided. By following these instructions, the funds are inadvertently wired to the hacker’s account and, most often, lost forever.

Please contact me for more information.

Recognize common indicators of cyber-fraud:

X Emails requesting last-minute changes to wiring information (e.g., particularly changes in the beneficiary and/or receiving bank)

X Requests for wire transfers late in the day or week or outside of business hours

X Emails with poor grammar and/or typographical errors

X Slight, typically unnoticeable-at-first-glance changes in the email address

Suggested best practices for transmitting and receiving sensitive information:

X Send emails with sensitive, personal information, through encrypted email only.

X Verify requests to change wiring instructions through a trusted method (like a phone number previously verified); never use the phone number in the email.

X Verify wire transfer requests to locations outside normal business areas.

X Never click on any links in an unverified or unexpected email.

X Always question attachments and links that are sent unencrypted.

What to do if you believe you are a victim of cyber-fraud:

X If money was wired in response to fraudulent wiring instructions, immediately call all banks and financial institutions that could put a stop to the wire or your funds.

X Contact your local police or local municipalities’ real estate fraud division.

X Contact any other parties who may have been exposed to the cyber-fraud so that appropriate action may be taken.

X Change all usernames and passwords associated with any account that you believe may have been compromised.

X Report any cybercrime activity to the Federal Bureau of Investigation Internet Crime Complaint Center www.ic3.gov/complaint/default.aspx.

What is Title Insurance?

So, you’re buying a house. It’s an exciting time. It can also be a bit confusing. Things feel like they’re happening pretty fast and, often, some important things can go unexplained – like title insurance. To help you understand the purpose and importance of title insurance, Stewart Title has put together this helpful overview.

What is title?

Simply stated, the title to a piece of property is the evidence that the owner is in lawful possession of that property.

What is title insurance?

Title insurance protects real estate owners and lenders against any property loss or damage they might experience because of liens, encumbrances or the defects in the title to the property. Each title insurance policy is subject to specific terms, conditions and exclusions.

How does title insurance differ from other insurance?

Insurance such as car, life, health, etc., protects against potential future events and is paid for with monthly or annual premiums. A title policy insures against events that occurred in the past of the real property and the people who owned it, for a one-time premium paid at the close of the escrow.

What does it cover?

Title insurance protects against claims from defects. Defects are things such as another person claiming an ownership interest, improperly recorded documents, fraud, forgery, liens, encroachments, easements and other items that are specified in the actual policy.

Who needs it?

Home buyers and lenders need title insurance in order to be insured against various possible title defects. The buyer, seller and lender all benefit from the issuance of title insurance.

How is a title policy created?

The creation of a title policy begins by searching the public records for defects, such as liens or legal judgments, which could interfere with the transfer of the property’s title. Once the title is deemed free and clear of defects, the prospective new owner receives a preliminary report for review and approval. If the prospective buyer approves the “prelim,” the escrow officer will record the document after closing and settlement, and the title policy will be created.

What is escrow?

Escrow refers to the process in which the funds of a transaction (such as the sale of a house) are held by a third party, often the title company or an attorney in the case of real estate, pending the fulfillment of the transaction.

What are the policy types?

A standard policy insures the new owner/home buyer, and a lender’s policy insures the priority of the lender’s security interest.

Stewart Home Warranty

We’ve Got You Covered

Coverage That Gives You Real-Life Assurance

Stewart Home Warranty, powered by HWA** , is a nationwide leader in the home warranty industry with over two decades of experience helping homeowners stay safe and feel comfortable when buying, selling or just living in their homes.

How Does a Home Warranty Protect You?

You’re covered for life’s big emergencies — fire, theft, severe weather damage — by your homeowners insurance policy. But can you relax when it comes to everyday disasters? Your appliances and plumbing, electrical and heating/ cooling systems have limited lifespans due to normal wear and tear. A Stewart Home Warranty plan helps reduce your out-of-pocket repair and replacement costs for essential home systems — and gives you peace of mind.

Why HWA?

When you choose Stewart Home Warranty, you’re choosing:

X 13 months of initial coverage

X A fully customizable plan that meets your unique needs

X Easy-access customer service via phone, email, chat or web

X Coverage of more than 120 items

X Protection against unknown pre-existing conditions

X FREE Seller’s Coverage on active listings for up to 180 days ($1,500 limit)

X No age restrictions on your home

Getting started is easy. Visit HWAHomeWarranty.com or call 888.492.7359 for full information.

X Multiyear plans

X Newly enhanced claims process

X Coverage for townhomes, condos and investment properties and new construction plans

X Dependable service from a national network of independent qualified service technicians*

MOVING TIMETABLE

TIPS FOR MOVING

8

Weeks Before the Move

x Select your mover and get everything in writing.

x Decide how much of your current furniture you will be using. You can save on moving costs by getting rid of unwanted furniture prior to your move.

x Determine which unwanted pieces will be given to charity and which will be sold. This can save you money on your move – and put money in your pocket.

6

Weeks Before the Move

x If you are moving yourself, determine how many boxes you will need, then determine the size of the truck required by calculating the cubic feet of the boxes, plus that of large furniture pieces.

x If you’re moving to a new community or city, get copies of records from service providers such as doctors, dentists, lawyers and utility companies.

x Make arrangements to transfer your children’s school records.

4

Weeks Before the Move

x Clean or repair furniture, curtains or carpets, if needed.

x Hold a garage sale.

x Arrange for storage, if needed.

x Make any necessary travel and hotel reservations.

x Determine if you need to transfer local bank accounts or cancel direct deposits. Coordinate with your bank(s).

3

Weeks Before the Move

x If movers are not doing your packing, begin gathering packing materials:

° Boxes

° Bubble wrap

° Old newspapers

° Felt-tip markers

° Furniture pads

° Large self-stick labels

° Nylon packing string

° Packing peanuts

° Packing tape

° Rope

° Scissors

° Utility knife

x Begin packing items you won’t need between now and your move.

x Arrange to cancel utilities and services at your old home after you’ve moved, and make sure you have electricity and water turned on at your new home by the time you move in.

Weeks Before the Move

x Make any special arrangements to move pets.

x Have your car checked and serviced for the trip if you’re moving far away.

x Fill out a change-of-address form with the U.S. Postal Service.

x Send a change-of-address notice to your friends and family.

x Review your online accounts and update your address in your profile.

x Transfer any prescriptions to a pharmacy near your new home and return any library books.

x Arrange for a babysitter on moving day if you have small children.

Moving Day

x Pick up the truck early if you’re moving yourself.

x Make a list of every item and box loaded into the truck.

x Give your contact information to the mover.

x Read the terms and conditions in your mover’s agreement before signing. Keep the agreement in a safe place until your goods are delivered, charges are paid and any claims are settled.

x Check that no leave-behind appliances are still connected in your old house.

x Inspect the attic and garage, and lock all doors and windows.

elivery Day

x Check off all boxes and items as they come off the moving truck (if applicable).

x Make sure utilities are connected and new locks are installed.

x Be on hand to answer questions, pay the driver, take care of last-minute problems and examine your goods.

Days Before the Move

x Defrost your refrigerator and freezer.

x Set aside valuables and legal documents to take with you.

x Pack clothing, toiletries and other first-day essentials to go with you.

x Have your movers begin packing.

x Arrange payment for the driver on moving day if you’re using a mover.

traweteltiTynapmoCS

C maeT sseccuS tneil

6 dvlB llaM amocaT 050

S 001 etiu

T90489 ,amoca

2niam 6278.077.60

c moc.trawets@s s dnuos-tegup/moc.trawet