ROLAND GEORGE INVESTMENTS PROGRAM

STETSON UNIVERSITY

ROLAND GEORGE INVESTMENTS PROGRAM

STETSON UNIVERSITY

MAKING ROLAND GEORGE’S DREAM A REALITY THAT HAS THRIVED FOR 40 YEARS.

After the passing of Roland J. George, Sarah George approached Stetson University determined to bring her late husband’s dream to life. Roland, who had suffered vast investment failures of his own in the market crash of 1929, insisted that the truest way to learn the principles of investing was to learn by doing. He embraced failures and mistakes as a critical part of the learning process. Theory and principles are important in an investor’s learning path, but nothing can replace practical learning experiences. The Georges’ envisioned a program in which students would not only have the traditional classroom experience, but also be given the opportunity to manage a real portfolio – purchasing and selling securities, constantly monitoring the portfolio, and enduring the pressures of generating sufficient income to pay for the program’s expenses.

During his lifetime, Roland endeavored to spread these ideas but was unable to find a sponsor in the academic community for such a program. Offers on his part to assist in creating and financing a “practical” investments course went unaccepted. However, on August 20, 1980, Sarah George transferred assets valuing just under $500,000 to Stetson, accompanied by contributions from President Pope Duncan, Dean David Nylen, H. Douglas Lee, and Professor Kenneth Jackson. Then came a memorandum stating the terms of the new Roland George Investments Program (RGIP), which the school was committed to bringing to life for the approaching spring semester.

Carter Randall, a noted lecturer, writer, and panelist on PBS’s “Wall Street Week,” was selected as the first Distinguished Visiting Professor. Randall proved to be instrumental to the program, as his efforts as a lecturer, advisor, and fund consultant established the ambitious standards RGIP holds itself to today.

From 1982 to 1987, Gerald T. Kennedy assumed this position and introduced the use of computers to scan stocks meeting criteria derived from student research. Students advanced their

research methods through the introduction of services such as Value Line and Dow Jones News Retrieval, in conjunction with data sources such as Zack’s Icarus Services and the O’Neil Reports.

Sarah George passed away in 1988, and in her will, she left a gift of $3.6 million to establish the Roland and Sarah George Investments Institute, where the Roland George Investments Program (RGIP) was born. The Institute provides support for investment education at Stetson to bring investment professionals and academic theorists together and helps provide access to research in investments for the School of Business Administration faculty. The Stetson community greatly appreciates Sarah George’s generosity and vision for investment education. The George endowment has also allowed RGIP to have a full-time resident professor with applied experience.

The RGIP further progressed through its division into a twosemester course. During the first semester, emphasis lies on the Growth Fund and Equity Management techniques. The following semester, focus shifts to managing the Income Fund, which includes bonds and other income-generating securities. Although students monitor both portfolios year-round, this structure allows students to concentrate their efforts in specific areas of investments throughout the year.

Max Zavanelli was selected as the first Roland George Distinguished Visiting Professor of Applied Investments. Since then, Ned Schmidt, Frank Castle, and K.C. Ma have served as visiting professors, with David Mascio currently holding this position. These individuals were selected because they applied investment experience and enthusiasm to effectively convey this knowledge to the students in the program. Their efforts have helped materialize Mr. and Mrs. George’s dream of developing the RGIP into a first-rate organization for applied investment research and investment education.

The RGIP is unique in its concept and design, giving Stetson business students the opportunity to simultaneously learn the theory behind portfolio management and put that learning into practice with a lot more than test grades at stake. While many universities offer courses using computer-simulated programs with “play” money, RGIP students are trusted to invest more than $5 million.

Roland George believed the best way to prepare for a career in investments was through participation in actual investment decisions under the supervision of experienced investment managers. His dream is now a reality, as the program has thrived for the past 40 years and has fundamentally changed the way Stetson University teaches investments.

William Brooks ANALYST

Matthew Cooper

VALUE EQUITY PORTFOLIO MANAGER

Ervin Haris Eminefendic ANALYST

Jonathan Gonzalez

LEAD MATERIALS ANALYST

Jackson Hockenberry

INFORMATION TECHNOLOGY ASSOCIATE

William Hubbard CONSUMER STAPLES ASSOCIATE

Michael Leitelt ANALYST

Max Miller

INDUSTRIALS ASSOCIATE

Robert Isaac Choate

LEAD CONSUMER DISCRETIONARY ANALYST

Erik Eisold ANALYST

Georgia Goering

LEAD CONSUMER STAPLES ANALYST

Edward Hernandez UTILITIES ASSOCIATE

Braden Hill

LEAD INVESTMENT ASSOCIATE, LEAD FINANCIALS & ENERGY ANALYST

Nolan Lappin ANALYST Tyler Lewis ANALYST

Andrew Permenter

COMMUNICATION SERVICES ASSOCIATE

Patrick Pitts

ENERGY ASSOCIATE

Jadyn Prinz

LEAD INDUSTRIALS ANALYST

Sugeeth Sathish

FIXED-INCOME

PORTFOLIO MANAGER

Alec Small

FORMER LEAD

FINANCIALS ANALYST

Alonso Tang

LEAD COMMUNICATION SERVICES ANALYST

Jose Valcourt III

GROWTH EQUITY PORFOLIO MANAGER

Beatriz Vossen

MATERIALS ASSOCIATE

Rachel Zaremba

LEAD HEALTHCARE ANALYST

Stephen Preissler

FINANCIALS ASSOCIATE

Bennett Rossell

HEALTHCARE ASSOCIATE

Devin Shaffer

CHIEF INVESTMENT OFFICER

Cameron Spence

RISK AND COMPLIANCE OFFICER

Isabella Thomsen

LEAD INFORMATION TECHNOLOGY & UTILITIES ANALYST

Steven Vetter

CONSUMER DISCRETIONARY ASSOCIATE

Riley Wiegner ANALYST

Matthew Hurst DIRECTOR

Matthew Hurst DIRECTOR

Reflecting on the events of 2023, the term ‘resilience’ perfectly encapsulates the essence of the year. As global financial markets wrestled with sustained inflation pressures, geopolitical tensions, and shifts in monetary policy, the remarkable resilience of U.S. consumers and the adaptability of investors and institutions stood out. Amidst this significant volatility, the S&P 500’s extraordinary recovery highlighted the enduring strength of the market and the strategic investment decisions that navigated these challenges. Particularly striking was the extensive discourse on the emergence of generative AI, sparking conversations about the transformative impact this technology could have across various sectors of life.

In a year marked by tumultuous market conditions, RGIP’s performance stands as a testament to its exceptional ability to navigate uncertainties and capitalize on opportunities. In this context, the Roland George Investments Program (RGIP) at Stetson University emerges as a beacon of excellence. This was achieved through a strategic asset allocation approach that adeptly minimized systematic risk, allowing RGIP to thrive where others faltered.

The program’s portfolios, a testament to remarkable resilience and strategic foresight, delivered impressive year-to-date

returns by June 30: 29.818% in the Growth portfolio, 17.7% in the Value portfolio, and 7.4% in the Fixed Income portfolio. These outcomes are reflective of RGIP’s sophisticated investment strategies and the analytical prowess of its student investment committee.

A pivotal strategy that set RGIP apart was its decision to limit exposure to cyclical sectors such as Consumer Discretionary and Information Technology within its Equity portfolios. This strategic choice was crucial, given the year’s market dynamics. In the realm of Fixed Income, RGIP’s focus on the short end of the inverted yield curve, particularly as the Federal Reserve continued to hike short-term rates, underscored its nuanced approach to asset allocation. This strategy was instrumental in RGIP’s ability to preserve capital and foster stable capital appreciation amidst ongoing economic turbulence.

Remarkably, RGIP’s growth portfolio realized significant returns without the inclusion of the so-called Magnificent 7 companies. This underscores RGIP’s focus on identifying companies with robust competitive positions, effective growth strategies, significant cash flow generation, and solid balance sheets—factors that bolstered its portfolio performance.

RGIP’s success extended well beyond mere financial metrics. The program earned top honors in prestigious competitions, clinching Florida’s CFA Research Competition for the third consecutive year, and securing a place in the QGAME Portfolio Competition – Fixed Income Category. These accolades speak volumes about the program’s excellence and the high caliber of its participants.

Yet, beyond the portfolio’s impressive performance and the accolades from winning competitions, the most inspiring aspect of RGIP in 2023 was the vibrant culture and spirit exhibited by the students. Their passion, innovation, and commitment were evident in every interaction and event, reflecting a dynamic community that not only excels academically and professionally but also fosters a supportive and enriching environment. This culture of excellence, curiosity, and mutual support is what truly sets RGIP apart, highlighting its role not just as a hub of financial acumen but as a vibrant community shaping the future leaders of the finance world.

In a year marked by tumultuous market conditions, RGIP’s performance stands as a testament to its exceptional ability to navigate uncertainties and capitalize on opportunities. In this context, the Roland George Investments Program (RGIP) at Stetson University emerges as a beacon of excellence.”

David Mascio PROFESSOR

David Mascio PROFESSOR

The financial landscape throughout 2023 continued to be dominated by volatility, attributed to the ongoing adjustments in interest rates aimed at curbing the persistent inflationary pressures that have characterized recent years. Despite the underlying challenges, the S&P 500 Index exhibited resilience, albeit amidst fluctuating market sentiments, and outsized market returns within the Technology sector. Managed futures strategies remained a relative beacon of stability, offering a contrast to the broader market’s unpredictability. The prevailing question as the year unfolded was whether the economy had reached a turning point or if further hurdles were on the horizon.

At the end of 2022, the annual inflation rate, as gauged by the Consumer Price Index (CPI), had moderated to 6.5%, down from the 40-year high of 9.05% reached in mid-2022. This decrease was a direct consequence of the Federal Reserve’s decision to increase the overnight lending rate to 5.25% by the year’s end, and a dramatic

improvement in the global supply chain. Entering 2023, the inflation rate continued to exhibit a downward trend ending the year near 3.5%, reflecting the combined impact of monetary tightening and adjustments in fiscal and energy policies. Despite this progress, inflation remained above the Federal Reserve’s target of 2.0%, emphasizing the ongoing challenge of stabilizing prices without hampering economic growth.

The S&P 500 Index showed signs of recovery in 2023, albeit with modest gains, as investors navigated through the uncertainties of interest rate policies and their implications for economic growth. While the Technology sector outperformed all other sectors of the economy, economically sensitive industries faced challenges.

The bond market once again faced a challenging environment in 2023, continuing the trend from the previous year, though with a slight improvement in performance. The rapid adjustments in short-term interest rates initiated by the Federal Reserve in the prior year had lasting impacts, influencing investment strategies and portfolio allocations. Despite these challenges, the bond market began to show signs of stabilization as investors adjusted to the new interest rate environment.

Looking ahead to 2024, the financial markets appear poised for a period of cautious optimism. The trajectory of inflation and interest rates will remain key determinants of market dynamics. Positive indicators such as resilient corporate earnings, robust consumer spending capacity, and a stable job market provide a foundation for potential growth. However, the path to a more stable and positive market environment hinges on achieving a significant reduction in inflation, ideally to a rate near the Federal Reserve’s target.

As we move into 2024, the experiences and lessons of 2023 will be critical in informing strategies for navigating the

complexities of the global economic landscape. The ability to adapt to changing conditions and leverage insights from the past year will be essential for investors, policymakers, and businesses alike in positioning themselves for success in the evolving economic environment.

As we move into 2024, the experiences and lessons of 2023 will be critical in informing strategies for navigating the complexities of the global economic landscape.”

DEVIN SHAFFER CHIEF INVESTMENT OFFICER

DEVIN SHAFFER CHIEF INVESTMENT OFFICER

RGIP is a program that allows students to discover and transform themselves and enables us to strive for excellence.”

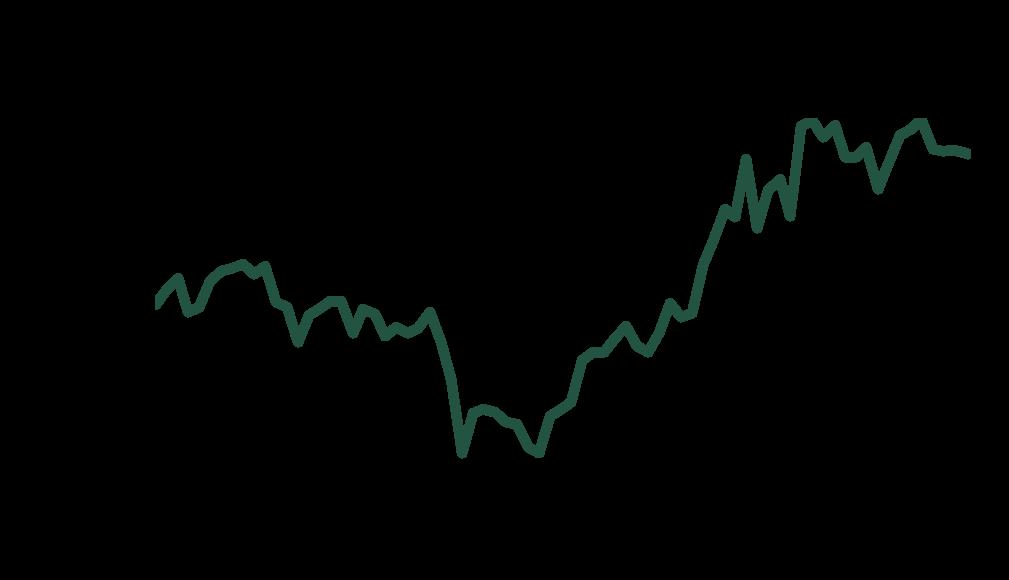

2023 was a year of resilience for the financial markets. The markets were put to the test early as the Federal Reserve continued its tightening campaign, bank failures evoked memories of the Global Financial Crisis, geopolitical tensions escalated, and inflation entered 2023 at a brisk pace. However, decades-low unemployment, buoyant consumer spending, the prospect of peaked interest rates, and AI innovation kept the economy moving. In suit, markets rallied, especially as the year ended. This dynamic environment provided a rich learning ground for students. RGIP saw great successes within our portfolio, academics, and extracurricular pursuits.

Entering 2023, inflation and the Federal Reserve’s aggressive rate-hiking campaign were at the economic forefront, with expectations of a mid-year recession prevalent as the yield curve had been inverted since July 2022. Annual inflation was cooling from its 9.1% peak in mid-2022 but remained well above the Federal Reserve’s 2.0% target, starting the year at a 6.5% pace. After raising the Federal Funds Rate by 400 basis points in 2022, the Federal Reserve pursued three more hikes in 2023, pausing at a 5.5% target rate in September. This marked a reprieve from their rapid series of eleven interest rate hikes that began in March 2022. However, the most aggressive monetary tightening cycle since the 1980s did not pass without negative effects. In the early part of the year, the values of longterm bonds held by financial institutions sharply declined. This caused a market reaction and ultimately resulted in the failures of Silicon Valley Bank and Signature Bank in March, and First Republic Bank in May. Combined, they held more in assets than all the banks that collapsed in the Global Financial Crisis. To prevent a larger crisis, the Federal Reserve established the Bank Term Funding Program to provide liquidity to depository institutions and the U.S. Government vowed that all depositors would be “made whole”, even beyond FDIC insurance limits.

During this tumultuous period, RGIP strategically employed a tactical asset allocation strategy that minimized systematic risk exposure to cyclical sectors, including Consumer Discretionary and Information Technology, in our equity portfolios. For Fixed-Income, our strategy entailed a focus on loading the short end of the inverted yield curve while the Federal Reserve was still raising short-term rates. RGIP’s ability to preserve capital was exemplified as our portfolios held YTD returns through June 30 of 16.1% (Growth), 5.2% (Value), and 2.2%

(Fixed-Income). Moreover, our fundamental approach placed an emphasis on identifying and strategically overweighting companies with strong competitive stances, effective growth strategies, significant cash flow generation, and healthy balance sheets – supporting stable capital appreciation despite the turbulent economic backdrop.

In the summer and fall, investors took notice of a series of labor strikes by millions of workers across industries including healthcare, hospitality, and manufacturing. Concurrently, an escalation in geopolitical tensions emerged as conflict broke out in Gaza between Israel and Hamas, alongside the ongoing Russia-Ukraine war. However, markets began to rally in October as innovations in generative AI displayed its potential and intensified demand, attracting significant investment from major tech companies. The “Magnificent 7” – Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla – rallied to a collective 107% return and drove the S&P 500 Index to a totalyear return of 24.2%. Coincidentally, inflation continued to hold close to 3%. Federal Reserve Chair Jerome Powell adopted a more dovish tone, and market sentiment began to favor the prospect that interest rates may have peaked.

To position our Fixed-Income Portfolio accordingly, we implemented a measured barbell strategy, favoring short-term Treasury Bills while beginning to consider medium-term corporate bonds to lengthen our duration in anticipation of potential rate cuts in 2024. In addition, we strategically adopted a blended tactical asset allocation by continuing to underweight consumer-driven cyclical sectors, such as consumer discretionary, while pivoting to overweight B2Bdriven cyclicals, including Information Technology and Industrials. Combined with our robust security selection standards, these strategic adjustments drove market-beating performance for our Growth and Fixed-Income Portfolios, with the Value Portfolio just narrowly surpassed by its benchmark Index. Ultimately, the Growth Portfolio returned 29.8%, the Value Portfolio returned 17.7%, and the Fixed Income Portfolio returned 7.4% - for a total fund gain of 21.6% in 2023.

The program’s success once again extended beyond our portfolios in 2023. During the year, RGIP students won the Florida Final of the CFA Institute Research Challenge for the

third year in a row, placed third in the GAME Global Portfolio Competition for our Growth Portfolio, and constantly sought new challenges. For the first time in program history, students competed in the Florida Investment Conference Pitch Competition and qualified in the top 10% of more than 500 university teams to compete at the Global Finals of the NIBC Global Investment Banking Competition, further expanding and elevating RGIP’s reputation. Students also passed and began preparing for the CFA Level I exam. Through these pursuits, the quantitative and qualitative skills that RGIP fosters, and with the support of our prolific alumni community, students have secured internships and full-time employment at some of the most competitive buy- and sell-side firms and multinational institutions. We thank those who came before us and continue to give back.

2023 was a further testament that Mr. Roland George’s dream – to offer students the opportunity to learn through partaking in real-world investment decisions and managing real money – brought to life by Mrs. Sarah George, remains alive and flourishing. We’re incredibly grateful for their foresight and generosity, as the program’s structure empowers students to grow, with both their professional skillsets and as individuals. The two-year layout brought forth in 2022, with a student-led Investment Committee and Analyst class, fosters collaboration, peer mentorship, and a growth-oriented culture that connects like-minded individuals and gives everyone a vital role.

Since joining the program, I’ve had the privilege of sharing and enjoying its integral learning environment, uncovering a passion and ambition I never knew I had, and building enriching relationships that will last a lifetime. I’ve thoroughly enjoyed mentoring the analyst class and witnessing their growth. RGIP is a program that allows students to discover and transform themselves and enables us to strive for excellence.

I’m deeply grateful to have had the opportunity to be a part of it. Serving as the Chief Investment Officer has been the highest honor and unequivocally, the pinnacle of my academic career.

To close, I express our sincere gratitude for the immeasurable lessons, guidance, and support from Drs. Matthew Hurst and David Mascio. I am confident in the program’s continued success and excited for the development and achievements of future cohorts.

GROWTH EQUITY

VALUE EQUITY

FIXED-INCOME

Jose Valcourt III

Jose Valcourt III

GROWTH EQUITY PORTFOLIO

MANAGERIn 2023, the Growth Equity Portfolio under the Roland George Investments Program demonstrated resilience and strategic acumen amidst a complex market environment characterized by a mix of domestic macroeconomic factors within the United States. Key among these were high inflation rates and rising interest rates, set against the backdrop of ongoing global concerns such as the war in Ukraine. The Federal Reserve’s efforts to combat inflation through rate hikes led to increased borrowing costs, impacting both consumer spending and business investments. These monetary policy adjustments aimed to temper inflation but also raised concerns about potentially triggering a slowdown in economic growth. Additionally, geopolitical tensions, notably the conflict in Ukraine, added to global economic uncertainties, affecting energy prices and supply chains, further complicating the economic landscape. As the portfolio manager, these challenges were navigated with a focus on long-term growth prospects, leveraging comprehensive equity research and rigorous financial analysis to optimize our asset allocation and sector weightings.

The portfolio delivered a year-over-year return of 29.82%, compared to the benchmark index’s return of 28.31%. This performance is attributable to our strategic selection of highpotential stocks and tactical adjustments to our asset allocation in response to evolving market dynamics:

• Assets Under Management (AUM): $3.26 million

• Return on Investment (ROI): 29.82%

• Alpha: 1.51% (vs the Wilshire 5000 Full Cap Index)

Our portfolio’s sector allocation at the beginning of 2023 was strategically designed to capitalize on growth opportunities while mitigating risks. The table below outlines our initial and year-end weightings across the Global Industry Classification Standard (GICS) sectors.

Our portfolio’s standout performers of 2023 exemplify our ability to identify and invest in sectors with robust growth trajectories. The Communication Services sector showed a remarkable comeback in 2023, with its strong performance being attributed in part to a recovery from the previous year’s declines and excitement over advancements in artificial intelligence (AI). Companies like Meta Platforms and Alphabet saw significant gains, driven by cost-cutting measures and innovative AI applications, respectively. This sector’s rebound demonstrates resilience and a potential for growth as it leverages new technologies to drive earnings and engagement. For the Information Technology sector, the advancements in AI also played a critical role, leading to it being the bestperforming sector of the year. High-profile IT companies made significant strides in integrating AI into their products and services, contributing to their robust performance, and suggesting a promising outlook for the sector moving forward.

Despite our strategic positioning, some investments underperformed relative to our expectations. These instances provide valuable lessons and insights for future investment decisions. Sectors like Utilities struggled, potentially due to less direct benefit from the techdriven growth that buoyed sectors like Communication Services and Information Technology. This could reflect a more traditional operational model and a lesser focus on the high-growth potential of AI and digital transformation.

Looking ahead to 2024, we anticipate a lot of similar trends we saw in 2023 to continue into 2024. Our strategic focus will involve:

1. Adjusting Sector Weightings

We plan to overweight our exposure to Technology, Consumer Staples, Financials, Industrials, and Communication Services sectors, while decreasing our weightings in Consumer Discretionary, Energy, Health Care, Materials, Utilities and Real Estate, aligning with our outlook on global economic and sector-specific trends.

2. Key Investment Themes

Our key investment themes rely on AI momentum and continuous cash inflow into the Technology sector, while finding undervalued opportunities in sectors best positioned to outperform during interest rate cuts.

3. Risk Management

We will continue enhancing our risk management framework to protect against downside risk while capturing upside potential.

In conclusion, our forward-looking strategy is designed to navigate the uncertainties of 2024, leveraging our strengths in equity research and portfolio management to deliver sustainable growth for the Roland George Investments Program. We remain committed to delivering superior performance for our program and for the university, continuously seeking to optimize performance and ensure alignment with our long-term investment objectives.

Matthew Cooper

Matthew Cooper

OBJECTIVE

• Provide an invaluable learning opportunity for student analysts.

• Invest in high-quality and yielding equities to boost the return profile of the value-orientated strategy.

• Sector allocation cannot exceed 150% of the benchmark.

• The entire portfolio may not exceed 65% of the portfolio in conjunction with the fixed-income portfolio.

• Up to 5% of the portfolio may be used for hedging purposes.

• Avoid Funds and ETFs except when used as temporary placeholders to maintain weighting.

• Prohibited from investing in securities that have filed for IPO within the last six months.

• Maintain portfolio beta of 1 +/- .02.

• Single security purchases may not exceed 5% of the portfolio.

2023 was a successful year for the equity markets, but it didn’t come without a few hurdles. The year started with concerns over high interest rates and inflationary pressures and the question of how these factors would impact consumer spending and corporate profitability. That, with the collapse of Silicon Valley Bank and others, sparked fears of a broader financial crisis. However, prompt actions by the Central Bank, Federal Reserve, FDIC, and U.S. Treasury helped stabilize the situation, leading to a somewhat volatile but ultimately positive market performance as inflation began to show signs of easing. Then, as interest rates remained high and inflation moderation slowed, a decline in both stock and bond prices occurred in the third quarter of the year (see Figure 1).

The ongoing conflict in Ukraine and the Middle East posed additional risks to global economic stability and market sentiment. These geopolitical events caused fluctuations in energy prices and impacted global supply chains and investment flows, further complicating the investment landscape.

Towards the end of the year, the Federal Reserve’s signals that lower interest rates were on the horizon boosted the markets and reassured investor confidence. Investors saw an opportunity for growth with a stabilizing inflationary environment and began reallocating capital from conservative investments such as money market and high-yield savings accounts back into the stock market.

The Value portfolio gained 17.66% in 2023 and outperformed most major value equity indexes, beating the iShares Russell 1000 Value Index, the Vanguard Value Index, and the Schwab U.S. Large-Cap Value Index by 6.35%, 8.66%, and 9.07%, respectively. The strong portfolio performance is a product of tactical asset allocation, selecting quality equity investments, and consistently monitoring macroeconomic indicators to make changes to the portfolio holdings. The top three biggest movers in the portfolio were Micron Technology, Inc. (69.43%), Griffon Corp (69.26%), and Costco Wholesale Corp (45.62%).

Two critical changes to sector weightings in the portfolio included shifting to overweight in the Industrial and Information Technology sectors, based on our analysis of market trends and technological advancements, which proved to be a key driver of the portfolio’s growth.

As we enter 2024, the portfolio is well-positioned to capitalize on the evolving market dynamics, continuing to focus on sectors that show strong growth potential. Economic indicators remain optimistic, with consumer spending expected to remain strong as inflation continues to retract and interest rates start to see cuts by the Federal Reserve.

Industrials and Information Technology sectors were strong performers for the portfolio in 2023 and remain areas of interest due to the ongoing implementation of artificial intelligence (AI), machine learning, and neural networks within these companies. Financial institutions are overweighted relative to the S&P 1500 Composite Pure Value Index, with a predicted rebound in the Mergers & Acquisitions market following its relatively slow performance over the last 18 months. Value Consumer Staples companies, such as Procter & Gamble, are expected to continue to perform well, given their continued demand despite the increasing number of credit card delinquencies in the U.S.

Risk management will remain a primary segment of our strategy, with a balanced approach to asset diversification and hedging techniques to navigate market volatilities. The portfolio is underweighted in Energy companies due to exposure to oil companies, Consumer Discretionary is underweighted due to the potential risk of tariff increases from China, Communication Services is underweighted due to a lack of performance of companies implementing 5G in relation to expenditures, and a relatively equal weight to the S&P Composite 1500 Pure Value Index in the remaining sectors. Additionally, the investment committee aims to reduce the amount of ETFs in the portfolio to better allocate towards individual equities.

These strategic adjustments position the Value Portfolio for

stable growth and attractive dividend yields. As the Value Portfolio Manager, I am confident that the current asset allocation remains defensive while allowing for potential appreciation opportunities in the upcoming macroeconomic environment. The Roland George Investments Program continues to strive for improved performance and risk management in the ever-changing market environment.

FIXED-INCOME

PORTFOLIO MANAGER

FIXED-INCOME INVESTMENT POLICY

STATEMENT

OBJECTIVE

• Provide a valuable learning opportunity for the analyst cohort.

• Maximize returns within the 12-month period.

• The Bloomberg US Aggregate Float Adjusted Total Return Index Value Unhedged (LBUFTRUU) serves as the benchmark proxy asset.

• Each sector within the portfolio must not exceed 150% of the target weight.

• A maximum of 5% of the portfolio may be allocated for hedging purposes.

• Investments are restricted from being made in underdeveloped markets or those that have witnessed annual inflation exceeding 20% over the past 12 months.

Amidst heightened inflation and a hawkish interest rate environment, the economy remains resilient with real GDP growing 2.5% in 2023. As the Consumer Price Index begins to cool off and close in on the Federal Reserve’s target rate of 2%, futures now anticipate the Federal Reserve to cut rates by 125150 basis points by December 2024. RGIP’s proprietary federal funds rate model anticipates a much more cautious approach, with three 25 basis point cuts in 2024.

In response to the dynamic macroeconomic landscape, the portfolio adopted a barbell strategy during 2023, allocating investments to short-term treasuries and long-term corporate bonds. This strategic decision involved emphasizing the front end of the yield curve, enabling the portfolio to capitalize on high yields while taking on minimal duration risk.

Moreover, the portfolio’s substantial position in long-duration corporate bonds positioned it favorably, anticipating a peak in rate hikes and potential cuts in 2024. To mitigate credit risk, the portfolio prioritized higher-rated bonds, elevating the average rating from A+/A to AA/AA-. The outcome of this strategy was a portfolio return of 7.38%, surpassing the benchmark’s return by 363 basis points, which stood at 3.75%.

The markets are anticipated to maintain their strength, and the likelihood of a soft landing has become the most probable scenario. While a prudent Federal Reserve approach may result in prolonged elevated interest rates, posing a threat to growth, a resurgence in inflation could negatively impact both the economy and the fixed-income market. Although the peak of interest rates is likely behind us, with expectations of rate cuts in 2024, caution remains regarding the extent of these cuts.

In the face of interest rate uncertainties, the portfolio is strategically transitioning to a ladder strategy. This approach aims to mitigate interest rate risk while capitalizing on our exposure to long-duration bonds poised to benefit from anticipated rate cuts. Additionally, the fund has a mandatory 5% expense ratio to cover program operations. The implementation of the ladder strategy is designed to ensure a steady and predictable cash flow through interest payments and maturing securities.

In the face of interest rate uncertainties, the portfolio is strategically transitioning to a ladder strategy. This approach aims to mitigate interest rate risk while capitalizing on our exposure to long-duration bonds poised to benefit from anticipated rate cuts.”

RISK AND COMPLIANCE

COMMUNICATIONS REPORT

CONSUMER DISCRETIONARY

CONSUMER STAPLES

ENERGY

FINANCIAL

HEALTHCARE

INDUSTRIAL

MATERIALS

TECHNOLOGY

UTILITIES

Cameron Spence RISK & COMPLIANCE OFFICER

Cameron Spence RISK & COMPLIANCE OFFICER

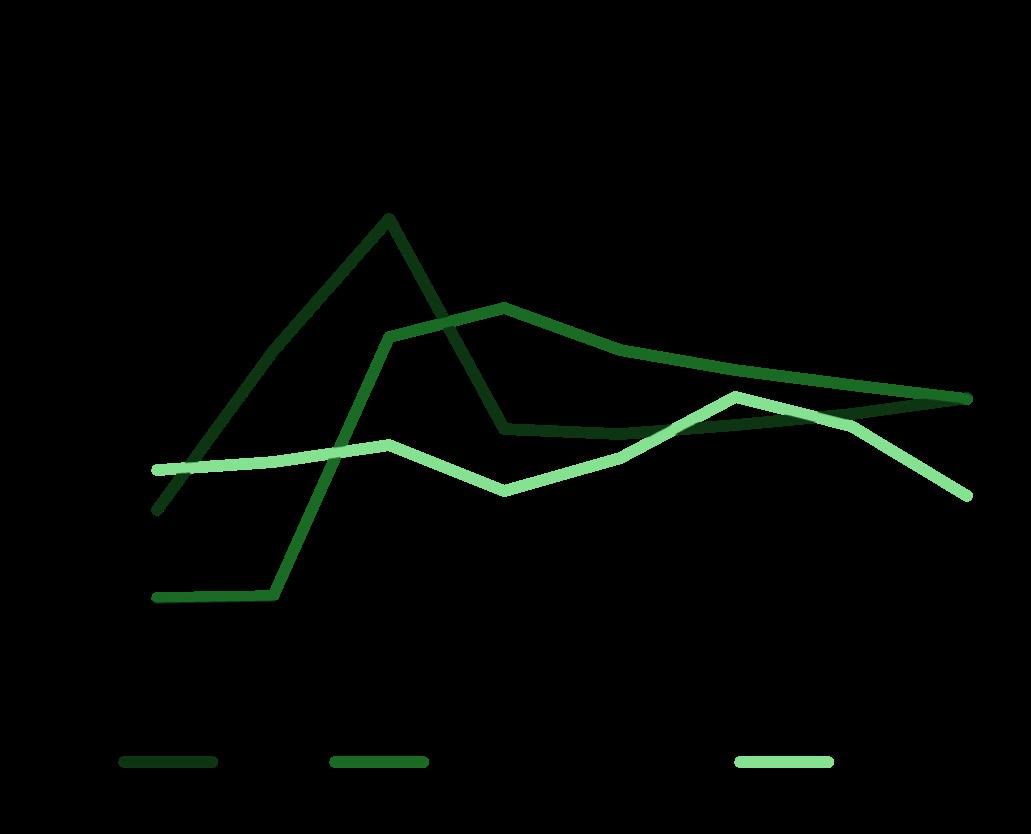

In a year of stellar returns, the overall volatility of the stock market remained low in 2023. The CBOE Volatility Index (VIX) dropped significantly throughout the year (Figure 1) as the S&P 500 raced to near-all-time highs. When the ^VIX is low, it means there is less market fear, more stability, and long-term growth; RGIP capitalized on these trends by overweighting cyclical sectors such as Technology, Industrials, and Energy, while also protecting against downside risk by taking a defensive stance in Discretionary.

The RGIP holds and regularly revises Investment Policy Statements (IPS) for the Growth, Value, and Fixed-Income portfolios. These statements serve as a roadmap for making investment decisions and provide a framework for aligning the portfolio’s investments with the program’s goals and risk tolerance. To ensure fiduciary protection of the portfolio, the Trustees are responsible for monitoring the program’s compliance with the objectives and policies set forth in each Investment Policy Statement.

The IPS includes various measures which aim to maximize the portfolio’s returns while simultaneously mitigating risk. The program’s primary risk parameters that protect the fund from extreme volatility are mandatory and discretionary

trade triggers. Mandatory trade triggers require immediate action and are usually activated by significant deviations from targeted metrics. A discretionary trade trigger warrants action at the judgment of the Director and Investment Committee and is triggered by smaller deviations from benchmarks. These trade triggers monitor portfolio betas, differences in sector weighting and target allocations, individual security returns, and analyst price targets.

Each RGIP portfolio is measured against a benchmark that the program uses to craft target sector allocations. The Investment Committee uses these benchmarks to determine the weight of each sector based on our risk tolerance and the trends that we anticipate. Benchmarks serve as reference points against which the performance of our portfolios can be measured. Additionally, the RGIP holds an average of twelve securities in each portfolio. Each security cannot comprise more than 7.5% of the entire portfolio and sector ETFs are utilized to ensure the program stays within these limitations.

Furthermore, the Investment Committee holds weekly meetings to discuss recent market trends, company-specific news, and portfolio strategies. The Committee also actively seeks the insights of the ten Lead Sector Associates that provide weekly updates on their sector’s performance, company reviews, and sector weighting recommendations. Following exceptional returns, we trimmed our positions in Celsius and Eli Lilly; these trades represent the program’s commitment to the strict adherence to the policies stated in each IPS that allow for the responsible management of the RGIP’s capital.

The Communications Services Sector (GICS) encompasses industries enabling modern communication and information delivery. It comprises two main subsectors: Telecommunication Services, which accounts for over 30% of the sector’s market value, includes companies providing internet access, data services, and telephone and cable services. Many large players in this area have significant operations in one or several countries. The Media & Entertainment subsector, valued at $8.1 trillion, includes multinational companies, video game firms, and interactive media services, representing over 9% of the S&P 500 and about 7% of the Wilshire 5000 indices.

Historically, during the 2010s, the sector’s ETF showed weekly returns similar to the S&P 500, with an adjusted beta of 0.996 and an R-squared of 0.71, indicating near-market cyclicality pre-pandemic. More recent analysis over a 2-year daily return period shows an adjusted beta of 1.10 with an R-squared of 0.75, suggesting increased market cyclicality. Our holdings in this sector include T-Mobile US (TMUS) and Verizon Communications (VZ), with plans to invest in Meta Platforms (META) in 2024.

The Media & Entertainment subsector, featuring companies like Netflix and Spotify that primarily earn through subscriptions, continues to see strong growth by entering new global markets. Post-pandemic, there’s been a rise in consumer demand for subscription services, emphasizing the importance of offering quality services at competitive prices for customer retention. For firms focusing on electronic devices and telecommunication services, internet speed, quality, and reliability offer a competitive edge, alongside service pricing. Consumer concerns about data privacy and security remain constant, despite changing demands. Additionally, the sector is

poised for significant impacts from the rapid growth of 5G and Artificial Intelligence technologies (Figure 1).

Last year, despite high interest rates, investor optimism drove the Communication Services sector, as it made a significant recovery from 2022. The S&P 500 Communication Services Sector index gained 10.2% (Figure 2). Historically sensitive to interest rates and inflation, the sector had its worst return in 2022 at -37.6% during a four-percentage point interest rate hike. Yet, 2023’s fiscal year demonstrated resilience against macroeconomic challenges

T-Mobile, leading in market capitalization at $193.36 billion, has outpaced Verizon and AT&T by $15 billion and $68 billion, respectively, using its “Un-carrier” strategy to address consumer “pain points” and disrupt the industry through direct feedback and aggressive mergers and acquisitions, including acquiring Ka’ena Corp and Octopus Interactive. In Q3 2023, T-Mobile reported a 19.1% year-over-year revenue increase to $20.2 billion and a net income jump to $1.4 billion from $612 million in Q3 2022, indicating strong financial performance and customer growth, especially in the postpaid segment.

Verizon, ranking second in market capitalization, competes closely with T-Mobile in wireless data services and solutions. Despite slight revenue decreases in 2023, Verizon projects 2.5-3% revenue growth for 2024 and beyond. With $37.5 billion in operating cash flows in 2023, up 1% from 2022, and $11 billion in dividend payments, marking the 17th consecutive year of dividend increases at a 6.7% yield, Verizon maintains value for its portfolio.

In the competitive landscape of subscription-based companies, particularly within sports and entertainment, maintaining a competitive edge through unique services or competitive pricing is crucial to avoid negative profit impacts. Diversified companies like Disney and Warner Bros., with revenue streams from theme parks and subscriptions, need to stay vigilant of economic downturns.

The Telecommunication Sector is pivoting towards innovation and efficiency amidst a fragmented market where the top 10 companies account for 47% of revenue. This subsector faces potential regulatory changes related to Artificial Intelligence and connectivity standards. Additionally, the evolving technological landscape heightens the risk of cyberattacks, as evidenced by numerous data breaches among major companies in early 2023. Despite significant layoffs among mediumto-high market value companies within the Telecommunication and Media & Entertainment subsectors in 2023, the industry overall continued to see operational success and profit growth.

Despite Federal Open Market Committee (FOMC) members predicting a decrease in interest rates (Figure 3), economic indicators suggest resilience to the current interest rate environment: the Consumer Price Index (CPI) remains above the 2% target, unemployment rates are low, and the economy has largely withstood the impact of further interest rate increases in 2023.

Should a recession occur, the positive factors mentioned could mitigate potential losses and impacts on profitability for the sector. With 2024 poised to elevate technological innovation, this sector may exhibit robust strength despite economic uncertainties.

Steven Vetter

CONSUMER DISCRETIONARY SECTOR ASSOCIATE

Steven Vetter

CONSUMER DISCRETIONARY SECTOR ASSOCIATE

The Consumer Discretionary sector includes non-essential goods and services, contrasting with consumer staples in purchasing behavior and sensitivity to economic cycles. This sector thrives during economic upturns as disposable income increases, allowing for greater spending on non-essentials. It’s notably affected by changes in consumer preferences, trends, and lifestyle shifts, with businesses focusing on innovation to attract discretionary spending.

Key areas include fashion, entertainment, travel, and leisure, all dependent on consumer sentiment. The sector responds to socio-cultural trends, technological advancements, and global market shifts, necessitating continuous adaptation by companies to remain competitive. The rise of e-commerce and digital platforms highlights the sector’s shift towards online sales and consumer engagement channels. As a gauge of economic health and consumer confidence, the performance of the Consumer Discretionary sector is closely watched by investors and institutions, with its growth signaling economic optimism and contractions potentially indicating downturns.

Despite economic challenges in 2023, consumer sentiment remained resilient, buoyed by low unemployment and real wage growth, as wages adjusted for inflation increased. This resilience was supported by a tight labor market and falling inflation rates by the end of FY23, leading to a rise in consumer spending, though at a slower pace than the previous year. The equities market, including the Consumer Discretionary sector, benefited from these macroeconomic conditions, achieving higher returns despite investor skepticism and high short interest anticipating a price drop. Yet, the S&P 500 Consumer Discretionary index outperformed expectations with a 1-year

return of nearly 21% (Figure 1), surpassing its 3-year, 5-year, and 10-year returns.

The end of the Federal Reserve’s rate-hiking cycle also contributed to a positive outlook, alongside sector-specific growth drivers such as the travel industry’s post-pandemic rebound and the homebuilding sector’s advantage from limited inventories. Many homeowners chose to keep their current homes amidst high prices and mortgage rates, shifting demand to new homes with better inventory levels. Consequently, the sector marked a record-setting year.

After an outstanding year, the consumer discretionary sector appears as an attractive investment for 2024, though expecting returns as high as in FY23 might be too optimistic. Early FY24 sees sustained consumer confidence, driven by increased spending, wage growth, and a halt in interest rate hikes. While the sector shows a positive trajectory in key indicators like revenue growth and profit margins, a potential interest rate resurgence later in the year could pose challenges.

Recent S&P 500 Consumer Discretionary index reports highlight the sector’s significant contribution to market performance, with a notable recovery and over 41% returns

in 2023, indicating a strong rebound from interest rate impacts. CNBC reports anticipate a rise in online retail sales, with technological advances enhancing the sector’s growth prospects for 2024. Companies are boosting R&D spending, rolling out innovative products and services that align with digital economy shifts and consumer interests, promising continued sector growth.

Looking into FY24, the sector benefits from several tailwinds, including undervalued stocks offering appealing investment opportunities. The auto subsector expects a 2024 upturn due to better chip availability and accumulated demand, while the luxury goods market sees growth potential, particularly in Asia. Despite economic uncertainties, consumer expenditure on discretionary goods, driven by desires for relaxation, enjoyment, and self-expression, is likely to stay strong, as affirmed by Fidelity’s Global Equity Outlook, suggesting resilient consumer spending through 2024.

The Global Industry Classification Standard (GICS) categorizes the consumer staples sector as businesses with indispensable goods, such as food, staples retailing, beverages, tobacco, household, and personal products. Recognized for its resilient characteristics, the sector maintains consistent demand for its products, largely unaffected by economic fluctuations or stock market changes. Companies within this realm include agriculture and packaged foods, beverages, and hygiene products. Consequently, even in times of economic decline, consumers persist in buying these essential goods. Although it might not match the growth potential in other sectors, the consumer staples sector offers investors steady income and a degree of stability despite macroeconomic effects (Figure 1).

The consumer staples sector is comprised of six distinct industry categories: food, staples retailing, beverages, tobacco, household, and personal products (Figure 2). Within this sector, beverages, household products, and food and staples retailing are the predominant categories, each accounting for 25% of the sector’s weight. They are followed by food products, tobacco, and personal products in terms of sector weight.

CONSUMER STAPLES

SECTOR ASSOCIATE

Focusing more closely on company-specific influence within this sector, ten companies emerge as key players, collectively holding 75% of the sector’s weight. Leading the pack are Procter & Gamble, Coca-Cola, and PepsiCo, which have historically led the sector and consistently outperformed the market with their returns.

The Consumer Staples sector experienced a period of resilience continuing modest growth with challenging economic conditions, including inflationary pressures and geopolitical uncertainties. The sector was noted as the secondworst performing sector in the S&P 500, facing a reversal from its solid performance in 2022. This was correlated to rising input costs like commodities and transportation, which pressured margins despite attempts to raise prices. Companies in the sector leveraged their strong brand loyalty and essential product offerings to navigate market volatility, with the focus on cost management and operational efficiencies to protect margins. The shift towards e-commerce and directto-consumer channels continued to accelerate, reflecting changing consumer preferences. Organic and sustainable products saw 32% increase in demand from 2022, highlighting the products that are marketed as sustainable grew 2.7 times

faster. Despite facing headwinds from rising commodity prices and supply chain disruptions, firms in the sector managed to deliver a stable performance, underlining the sector’s defensive nature (Figure 3).

The outlook for the consumer staples industry in 2024 is decidedly positive supported by ongoing stability and a significant recovery in sales volume. With projected lower inflation and an increase in consumer spending macroeconomically, the sector is poised for promising upside potential. Although companies in the sector are known for their stability and consistent growth, they may not outpace the rapid growth seen in other sectors. However, there is an inherent demand for consumer staples with the notion that the sector is unaffected by economic fluctuations. This resilience, combined with brand loyalty, enables companies to effectively manage cost increases and sustain dividend payouts. As consumer spending recovers, anticipated lower inflation will diminish cost pressures. Hence positioning the consumer staples sector for a return to its historical pattern of returns in 2024.

The Global Industry Classification Standard (GICS) classifies the energy sector into two primary industries: Energy Equipment & Services and Oil, Gas & Consumable Fuels. The categorization incorporates sub-industries encompassing resource prospecting, excavation, purification, warehousing, conveyance, and commercialization activities. Moreover, enterprises that offer equipment and services to the oil and gas industry are considered constituents of the energy sector. Predominantly, companies in the oil and gas industry can be segmented into three key elements of the supply chain: Upstream, Midstream, and Downstream. Upstream companies focus on exploring and drilling for oil and natural gas, midstream firms handle the storage and transportation of these resources, and downstream entities refine and process raw materials into consumable products like fuels and petrochemicals.

Tight supplies and surging demand maintained higher oil and natural gas prices, driving strong sector performance in 2023 (Figure 1).

Patrick Pitts ENERGY SECTOR ASSOCIATE

Patrick Pitts ENERGY SECTOR ASSOCIATE

The past year witnessed a higher production rebound of refined products and consumable fuels, such as gasoline and diesel, than compared to raw inputs, such as crude oil. Refinery profit margins surged to unprecedented levels during the summer of 2022, which large refining companies used to distribute large dividends in 2023 and invest in growth initiatives. Energy prices declined as supply continued to rebound (Figure 2).

However, energy supply recovery in 2023 resulted in a correction in prices of energy stocks, enabling value stocks to thrive with high dividends and stable prices while most growth companies became more volatile. The rise in renewable energy sources has yet to significantly impact the market, but more legislation could accelerate their prevalence. Although some large funds sold off large portions of renewable energy-focused companies before the end of 2023.

In response to the evolving energy landscape, market participants are increasingly embracing collaborative efforts to drive innovation and sustainability. Governments are

implementing policies to incentivize renewable energy adoption, promote energy efficiency, and mitigate climate risks. Businesses are investing in research and development to enhance renewable energy technologies and optimize energy storage solutions. Moreover, international cooperation is fostering cross-border energy infrastructure projects and knowledge-sharing initiatives to address common challenges and accelerate the transition to cleaner energy sources. As the global community continues to grapple with the complexities of the energy sector, proactive measures aimed at enhancing resilience, reducing emissions, and ensuring equitable access to energy resources remain paramount, although higher interest rates have hampered growth in renewables (Figure 3).

Heading into 2024, despite an election year and potential policy shifts, crude oil and natural gas demand is expected to stabilize after the price spikes of 2022 and 2023. Despite increased investment in production, a global supply lag is anticipated, likely maintaining high energy prices. Companies are reallocating their enhanced cash flows from debt reduction and internal expenses to expanding industrial and drilling operations, predicting strong performance in drilling and production for 2024. Refining capacity will remain constrained due to limited availability and the time needed to expand, suggesting another profitable year for refiners. Energy service firms may see significant earnings growth as investment in exploration and production increases. However, a potential risk is considerable supply weakening. Global geopolitical tensions, domestic inflation, and monetary policy will influence the energy sector’s performance. U.S.-based

Exploration & Production (E&P) companies are expected to return substantial capital to investors through dividends and buybacks. While weather impacts remain, underlying demand for oil and gas is set to grow with ongoing economic expansion, though supplies will be tight. Renewable Energy’s market role is expanding, with major energy firms investing more in this area. Thus, oil and gas producers are poised for strong profitability and stock performance in 2024.

Despite the hiked interest rates, the U.S. economy remained resilient and continued to edge out expectations.”

FINANCIAL SECTOR ASSOCIATE

The Financials sector encompasses various entities like banks, brokerages, insurance firms, consumer finance companies, and other businesses involved in financial assets or transactions. It plays a vital role in the U.S. economy by providing access to capital and liquidity, which are essential for business expansion and stimulating consumer spending. The well-being of the Financials sector often reflects the overall health of the larger economy. Additionally, due to its widespread impact, the Financials sector’s revenue generation significantly exceeds the average of all other sectors in S&P 500 Index (Figure 1). According to the Global Industry Classification Standard (GICS), there are 6000 public firms in this sector, categorized into three main industries: Banks, Diversified Financials, and Insurance. Diversified Financials, with the highest number of firms, engages in activities such as brokering, market making, asset management, and various other financial services. Notable companies in this sector include JPMorgan, Goldman Sachs, American Express, and Evercore.

The Financials sector is consistently in line with the overall health of the economy. Thus, macroeconomic factors such as inflation, interest rates, GDP, and others historically have a significant effect on how the overall Financials sector performs. One of the main drivers of the sector continues to be interest rates, which still increased from the interest rate hike that plagued Financials in Quarter 2 of 2022. The Fed’s decision to keep interest rates steady throughout 2023 and the uncertainty displayed by the FOMC was a primary driver for the Financials sector. This effect can be seen towards the end of 2023 when the Financials sector rose 14.4% in the last 3 months due to increased optimism of numerous interest rate cuts in 2024. Economic health and growth are another steady driver for the sector and the early-to-middle portion of the business cycle is usually the healthiest for the Financials sector. It is cyclically sensitive but to a lesser extent than other sectors, due to a steady demand for financial services.

Entering 2023, uncertainty loomed over the economy, with recessionary fears stemming from an inverted U.S. Treasury yield curve and the Federal Funds rate increasing to 5.25%5.50% in July and remaining elevated. Many investors worried that the Federal Reserve was trying too hard to slow the economy and force a recession to deal with inflation, which remained sticky above their 2% target. Despite the hiked interest rates, the U.S. economy remained resilient and continued to edge out expectations. Key economic indicators such as the unemployment rate and initial jobless claims continued their decline from 2020-2021 levels and remained stable (Figure 2), GDP continued to increase, and consumer

spending thrived, especially in Quarter 4. The Financials sector overall performed well throughout 2023, finishing the year with a YTD return of 9.52% (Figure 2).

The glaring headwind for the sector in 2023 was the banking crisis. Silicon Valley Bank and Signature Bank failed in March, and First Republic Bank failed in May, causing many to panic about the health of the banks. Silicon Valley failed due to selling its Treasury Bond portfolio at a large loss after the steep increase in interest rates, while the other two failed due to large investments in the cryptocurrency market and the popping of the cryptocurrency bubble, as well as risky jumboloans. Between March 6 and March 17, the Financials sector dropped 14.1% and didn’t fully recover to its pre-crisis prices until August. Fears of continually high-interest rates into 2024 and small increases in the CPI drove the sector down again in the mid-to-late portions of the year, but investor optimism and some of Chairman Jerome Powell’s comments fueled a surge to close out the year (Figure 3).

The Financials sector picked up momentum to close out the year and is expected to continue this into the first quarter of 2024, the main drivers of this being expectations of interest rate cuts and a strong and resilient labor market. However, surging economic conditions might cause the Federal Reserve to retract their comments of “early and often” rate cuts starting in early 2024 and instead opt to keep rates as they are. This could cause the Financials sector to begin to slow its momentum from the end of 2023, however, the sector should still benefit from some rate cuts in 2024, even if they come later than expected. In addition, M&A activity, a prominent revenue source for investment banking firms, is expected to rebound in 2024. We’ve seen positive signs as deal-making volumes have increased historically and continued to rebound, suggesting a positive view for the next 12 months (Figure 4).

The Healthcare Sector encompasses various industries, including pharmaceuticals, biotechnology, medical devices, healthcare facilities, and healthcare services (Figure 1). Within this industry, corporations manufacture and distribute a variety of goods, including medical supplies, equipment, medications, vaccines, and alternative therapies. It also provides preventive, remedial, and therapeutic services to patients through collaboration with healthcare providers, government agencies, pharmaceuticals, medical equipment manufacturers, and medical insurance companies.

The healthcare sector is considered extremely defensive as its products and services are a necessity, regardless of how the economy is doing. This sector’s growth largely comes from health crises, government contracts, increasing life expectancy, wars, and innovation. Currently, the RGIP portfolio holds Eli Lilly & Co (LLY), Jazz Pharmaceuticals (JAZZ), Pfizer Inc. (PFE), Becton Dickinson (BDX), Medtronic PLC (MDT), Johnson & Johnson (JNJ), Merck & Co., Inc. (MRK), and Thermo Fisher Scientific Inc. (TMO) (Figure 2).

Bennett RossellHEALTHCARE SECTOR

ASSOCIATE

Healthcare companies had a down year in 2023. The Healthcare SPDR Healthcare ETF (XLV) has seen an annual return of 0.66% compared to S&P 500 ETF Trust (SPY), which had a return of 24.81% (Figure 3). Investors’ favoritism to mega-cap growth stocks, particularly in the artificial intelligence space, may have contributed to the sector’s lagging returns. However, companies within the RGIP portfolio, such as Eli Lilly had a total return of 59.71% in 2023. The financial strain on the healthcare industry in 2022, stemming from labor shortages, inflation, and the ongoing impact of COVID-19, has gradually started to ease in 2023. Furthermore, also posed a threat to small/mid-cap biotech and medical tech companies due to their tendency to be heavily levered. This hindered their access to capital and led to lower share prices overall. However, inadequacies in the healthcare system such as staff shortages are still a concern as the industry continues to adjust to a new reality.

The Russia-Ukraine conflict, with its ensuing economic sanctions, commodity price hikes, and supply chain disruptions, slowed global economic recovery by fueling inflation across various goods and services. In healthcare, trends like telehealth and online meetings are reducing costs and making services more accessible, while the popularity of personalized healthcare, such as precision medicine powered by AI and other technologies, is rising. The demand for healthcare services increased as patients sought treatment for procedures delayed during the pandemic. The Healthcare sector also saw excitement around anti-obesity drugs like Novo Nordisk’s Ozempic and Eli Lilly’s Zepbound, potentially revolutionizing diabetes and obesity treatment, with both companies nearing a combined market capitalization of $1 trillion. However, concerns about how these drugs might reduce the long-term demand for diabetes devices led to losses in some healthcare equipment stocks.

Industries such as biotech and medical devices have seen significant selloffs over the year, with biotech’s third down year in a row despite an influx of R&D. Biopharma companies also face a lot of pressure during 2023 as Medicare price negotiations were going on due to the Inflation Reduction Act. Investment in the industry is likely to remain as a mitigation solution for future pandemics.

Regardless of the direction of the U.S. markets, the Healthcare sector presents a blend of defensive and growth attributes that can be appealing in various market conditions. The likelihood of lowered interest rates will likely generate more activity

for small/midcap securities, as the access to capital becomes cheaper. Furthermore, the potential market for weight loss drugs continues to inspire innovation and a trend within the industry that is likely to continue. As the market begins to understand how these new drugs will enable growth, rather than hinder demand for other segments like diabetes, performance will begin to shift in a positive direction for the sector in the ladder half of 2024. An aging population in America is only going to drive growth and demand upwards for the sector, and investors will gain confidence.

Moreover, the implementation of AI is revolutionizing healthcare, with algorithms assisting in diagnosis, drug discovery, personalized treatment, and more. Machine learning can analyze vast data, improving accuracy and efficiency. Personalized care and cost reduction are potential benefits, alongside increased accessibility for underserved populations.

Overall, the outlook for the Healthcare sector in 2024 is optimistic. AI is beginning to streamline diagnosis, data analytics, and supply chain efficiency, and an aging population will drive demand upwards for the various products and technologies. The dust will begin to settle after the introduction of the weight-loss drugs in 2023 and insurance companies will begin to counter rising costs by raising premiums. Lastly, lower interest rates will begin to drive innovation as access to capital becomes less restrictive and costly.

The Industrials Sector is broken down into three major components: manufacturing/distributing capital goods, providing commercial and professional services, and transportation. Subsectors include aerospace and defense, air freight & logistics, airlines, industrial machinery, industrial conglomerates, commercial services, and supplies, electrical, construction, transportation, and waste management. Current Industrial Securities in the portfolio include CSW Industrials, Inc. (CSWI), Honeywell (HON), L3Harris (LHX), Caterpillar (CAT), Griffon Corporation (GFF), Lockheed Martin (LMT), and SPDR Industrials ETF. Industrial Securities are very cyclical in nature and are notably influenced by prevailing economic conditions and trends, both on a local and global scale. They tend to exhibit positive responsiveness during expansionary periods and rising consumer spending. Conversely, these securities are susceptible to adverse effects during recessionary periods and periods characterized by elevated interest rates.

In 2023, the Industrials Sector exhibited a robust performance, characterized by notable growth and financial resilience. Using the SPDR Industrial Select Sector ETF (XLI) as a performance proxy, the industrials sector exhibited a resilient performance with a year-to-date return of 10%, outperforming the broader market. The sector experienced an increase in revenue, with a year-over-year growth of 8.5%, driven by a combination of favorable global economic conditions and a 12% surge in consumer spending on industrial products and services. Despite periodic challenges associated with a 3.2% recessioninduced contraction and a marginal uptick in interest rates by 1.5%, industrials demonstrated impressive adaptability, showcasing a 5% increase in operational efficiency across

Max Miller INDUSTRIALS SECTOR ASSOCIATEthe sector. Additionally, the industrials sector benefited from ongoing infrastructure developments and the adoption of innovative solutions, contributing to an overall performance in 2023 (Figure 1)

Increased infrastructure spending and heavy investments in innovation with a focus on the development of new technologies are proving a competitive edge for companies within the industrial sector. Since 2016, CAT has seen an average revenue growth rate of 16.8% with a decline in their Cost of Goods Sold (COGS) over the past eight quarters suggesting favorable manufacturing costs and efficiency within their production line. With a 3.46% dividend yield exceeding the S&P 500 average, Caterpillar is expected to continue to grow due to their strong financial performance.

Geopolitical tensions in the Pacific, Middle East, and Eastern Europe is creating pressure for governments to increase their investments in defense products and infrastructure. This boosted the A&D industry in late 2023 (Figure 2)

Considering Lockheed Martin’s (LMT) strong plans for future development in cyber and aeronautics and stable market share in their established segments, revenue is expected to grow modestly in line with industry estimates. With their space segment still considered to be in the embryonic to growth stages yet performing at an operating margin of over 9.2%, they have the ability to increase their profits in this segment substantially.

In 2023, the Machinery industry grew by 7% year-over-year as it has shown strong resilience in the wake of the conflict in Eastern Europe which has caused supply chain problems and commodity price volatility. The machinery industry is expected to continue seeing consistent growth as interest rates eventually decline, stimulating industrial activity (Figure 3).

industry growth as companies move to lower their energy costs. CSW Industrials has multiple subsidiaries that manufacture heat pump HVAC systems and has seen major growth and improved profitability this year. This is slated to continue as the company continues to grow its scalability in 2024.

In 2024, the industrials sector is poised for dynamic growth and transformative changes powered by technological advancements, flexibility, and an increasing demand for sustainability. Supply chain bottlenecks are expected to continue to ease this year as companies continue to scale up on production allowing for beneficial positioning for all industries, but mainly Machinery and Conglomerate. Additionally, HVAC companies such as CSW Industrials are positioned for a big year as the Inflation Reduction Act is fully implemented. The Aerospace & Defense industry is expected to resume its historical growth pattern in 2023 although the industry has been trading at a premium in wake of the conflicts in Ukraine and the Middle East. With the Federal Reserve predicted to decrease interest rates in the upcoming year, industrial companies will take on additional leverage to move toward additional leverage. If labor force shortages continue this year, cost per employee will continue to rise, lowering gross margins.

Growth in the HVAC market has been a major catalyst for

The Materials Sector encompasses five main industries: chemicals, construction materials, containers and packaging, metals and mining, and forestry. The metals and mining sub-sector has seen the most growth among materials and is comprised of a range of minerals and precious metals such as gold and silver, oil, aluminum, and steel. The chemical industry is wide ranging and can be broken down into categories of organic chemical producers, fertilizer industries, refining and petroleum, pesticides, and even heat treatment production. In conjunction, construction materials are also prominent among this sector. These elements either occur naturally such as stone, clay, and lumber or are synthetically made like concrete, steel, or bricks.

Materials is considered a cyclical sector given its performance tendency to rise and fall with global economic trends. Therefore, this sector as a whole may experience downturns during recessions and periods of high inflation and high interest rates. Moreover, geopolitical conflicts greatly influence the performance of the materials sector as forces of international supply and demand dictate its total return. In 2023, the sector logged positive returns but lagged the broader market. Despite its cyclicality, these industries highlight Material’s unique response to the macroeconomic environment through their significant diversification.

In 2023, the Materials Sector constituted 2.07% of the S&P 500 index at year’s end, a decrease from 2.76% at the end of 2022. The sector, tracked by the S&P 500 Materials Index (S5MATR), saw positive returns of 6.7% over the year. However, it faced higher volatility amid economic uncertainties, including fears of a possible recession, high inflation, significant interest

Beatriz Vossen

MATERIALS SECTOR ASSOCIATE

Beatriz Vossen

MATERIALS SECTOR ASSOCIATE

rate hikes, and geopolitical tensions. While the sector didn’t match the S&P 500’s double-digit gains, it’s important to note that the index’s overall performance was largely driven by a few mega-cap growth stocks, especially in the technology and communication services sectors. 2023 saw volatile price performance, and the sector still gained 10.2% in 2023 (Figure 1).

Supply and demand significantly impact the Materials Sector, with its performance closely tied to business cycles and macroeconomic conditions. Industries within the sector, like mining and metals, are highly sensitive to price fluctuations based on consumer demand. The sector’s health reflects global economic trends, acting as a leading indicator for consumer spending and confidence. The housing market is a critical component, influencing demand for construction materials and affecting the timber & forestry industries. The chemical industry is poised for growth, driven by global demand, competition, and the push for products that enhance energy efficiency and reduce dependence on oil. The rise of multinational chemical companies and increasing demand from developing countries are expected to sustain high earnings and sales in the upcoming years.

The United States reaffirms its dedication to advancing the green energy transition, as highlighted in its 2023 progress reports. These efforts include backing electric vehicles and funding clean energy projects to cut net emissions. This shift notably benefits the Materials Sector, especially industries like metals & mining and chemicals, due to clean energy’s dependence on raw materials that are often sourced internationally. The demand for these commodities is expected to rise in the short term, with sustainable innovations ensuring long-term demand. Copper, for example, is essential for renewable energy due to its recyclability and high conductivity, making it crucial for electric vehicles, wind turbines, and renewable energy storage infrastructure. The green energy market is projected to expand at a 9% CAGR through 2030, driven by local and national green incentives (Figure 2) This growth forecasts increased demand and earnings for the sector, presenting a positive future outlook.

Through its various industries, the Materials Sector remains diversified and in demand through international competition and the limited supply of raw materials. This sector has a direct impact on construction, manufacturers, and producers, making its multifaceted character attractive to investors. While material investments favor a bullish market, they can be used to hedge risk, increase exposure, or simply diversify one’s portfolio.

This past year saw recovery and expansion within the Information Technology (IT) sector after a contractionary phase for much of 2022. Improved macroeconomic outlook, increased demand for artificial intelligence (AI) and machine learning (ML), and the recovery of corporate investment in IT infrastructure are the primary catalysts for this shift. Software and semiconductor growth thrived by capitalizing on generative AI and ML potential. Although valuations have now reached high levels due to these drivers, significant innovation and opportunities still exist in cloud computing, IoT, and fintech.

Information Technology outperformed across all sectors and indices—a major recovery after their lowest performance 2022. The S&P 500 Info Tech Index (XLK) generated a 56.39% annual return, more than doubling that of the S&P 500 (Figure 1). Improving macroeconomic conditions in line with slowing inflation and a resilient labor market, paired with industryspecific innovative growth are the major attributes of this overperformance.

TECHNOLOGY

SECTOR ASSOCIATE

Entering 2024, many of the factors that propelled technology into robust growth remain unchanged. The rapid innovation and commercialization of AI and ML continues to be the leading driver of expansion. Tech firms are shifting their focus to incorporate AI and ML into their hardware and software solutions, responding to the escalating demand for smarter and more inventive products and services. The semiconductor and software subsectors have experienced the greatest advantages from the surge in AI and ML, demonstrating significant revenue growth and value creation. (Figure 2).

Subindustries like tech hardware, fintech, and cybersecurity are leveraging the AI transition, complemented by broader industry innovation and a positive macroeconomic outlook. The IT sector, previously weakened in 2022 due to its economic cycle sensitivity, is now experiencing a demand recovery thanks to a stronger-than-expected economy, setting it up for outperformance. With the macroeconomic environment expected to remain favorable, including anticipated Federal Reserve interest rate cuts and sustained demand for AI and

ML innovations, the information technology sector is wellpositioned for growth. Furthermore, areas such as cloud computing, edge computing, IoT, and fintech are poised to capitalize on the increasing need for IT infrastructure, driven by corporate clients looking to boost spending after the cutbacks of 2022 and 2023. These segments not only support the sector’s overall growth with a focus on AI and ML but also offer potential for independent expansion.

Major threats affecting the technology sector include geopolitical and economic tensions affecting global trade, high valuations of tech companies, and supply chain and inventory cyclicality.

The Information Technology sector, particularly in Asian markets like China and Taiwan, is experiencing the impact of geopolitical and economic tensions between the West and competing nations. Increasing sanctions and restrictions on semiconductor, CPU, and GPU chips between China and the United States have become a challenge for multinational tech companies.

The sector has shifted from a discounted valuation in the 2022 bear market to a high valuation compared to recent historical trends. Though this strong upward movement is justified by rapid innovation, high valuations are still a risk to consider. The S&P 500 Info Tech Index currently has a trailing twelve months (LTM) P/E ratio of 38.9x, significantly surpassing the two-year average of 29.0x and exceeding the upper band (two standard deviations) LTM P/E average of 38.2x over the past two years, placing the current market price beyond all historical implied price bands (Figure 3). It’s important to acknowledge that price bands derived from historical P/Es may exhibit a delayed response to movements in the index.

In 2023, attention shifted to the cyclical nature of the supply chain, with a notable impact on semiconductor devices and tech hardware firms. Inventory surpluses, decreased demand, and temporary bottlenecks constrained sales and growth opportunities for some companies. While these surpluses have started to alleviate in 2024, cyclicality remains a potential risk.