Routt County Assessor's O�ce, Property Search

Routt County Assessor's O�ce, Property Search

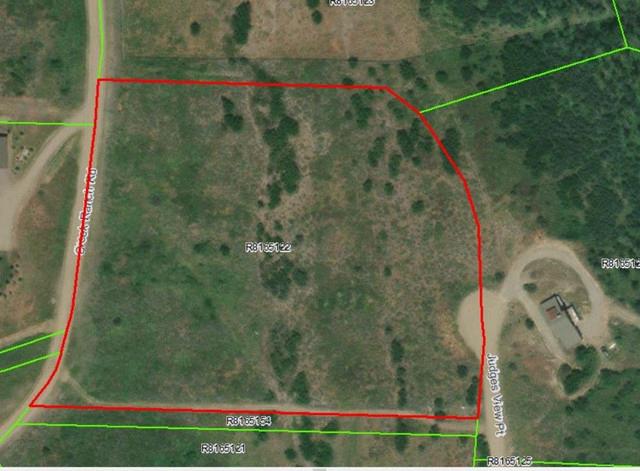

R8165122 -

Owner: CABELL, CHRISTOPHER H & HUGHES, LINDSEY S (JT) PO BOX 774586

STEAMBOAT SPRINGS, CO 80477

Account # R8165122

Tax Area 19 - *RE2* MID-ROUTT (County Rds 179 & 29 north of SH131)

Aggregate Mill Levy 52.857

Neighborhood -

Subdivision CREEK RANCH

Legal Desc LOT 14 CREEK RANCH LPS

Property Use VACANT LAND

Total Acres 7 56

Owner CABELL, CHRISTOPHER H & HUGHES, LINDSEY S (JT)

Situs AddressesTotal Area SqFtBusiness Name -

Value $400,000

Contact the Treasurer's O�ce @ 970-870-5555 for exact amount due Figures above do not re�ect any processing fees, Senior/Vet exemptions, late penalties, interest or liens due Please con�rm all balances with the Treasurer prior to submitting payment, as short payments will be rejected

REMARKS

REMARK

LAND DETAILS

Property Code - Economic Area 10 MILE

Super Neighborhood 131 NORTH TO WHITEWOOD SUBDV

Land Code CREEK RANCH

Zoning AF

Road GRAVEL

Neighborhood CREEK RANCH

Land Use PRIME SITE

Site Access YEAR-ROUND

Site View GOOD

Topography SLOPING Slope SLIGHT

Wetness NOT AFFECTED Water

Utilities PROP AND ELEC Sewer PRIVATE

Acres 7 56

BUILDINGS

EXTRA FEATURES / OUTBUILDINGS

No data to display

TRANSFER HISTORY LAND

Description -

Appraiser Public Remarks -

Grantor KLINE, DONALD RICHARD JR & BONNIE JEAN

Grantee CABELL, CHRISTOPHER H & HUGHES, LINDSEY S (JT)

+ 06/12/2023 846126 -

Appraiser Public Remarks -

Grantor BRAUCH, TOM & SUZETTE

Grantee KLINE, DONALD RICHARD JR & BONNIE JEAN (JT) + 09/14/2020 813754 - -

Appraiser Public Remarks -

Grantor SILLERUD, JONATHAN D & NORA K A

Grantee BRAUCH, TOM & SUZETTE (JT)

+ 10/18/2005 627574 -

Appraiser Public Remarks -

Grantor HAYES, DIANE KAMPSCHUUR

Grantee SILLERUD, JONATHAN D & NORA K A (JT) + 08/13/2004 606281 - -

Appraiser Public Remarks -

Grantor HAYES, DENNIS JAMES

Grantee HAYES, DIANE KAMPSCHUUR

+ 11/01/2000 535808 -

Appraiser Public Remarks BY BRENT A ROMICK, PRESIDENT

Grantor CREEK RANCH, LLP

Grantee HAYES, DENNIS JAMES &

COMMON AREAS

TAX AUTHORITIES

$315,000

Contact the Treasurer's O�ce for current property tax amount due Do not use the �gures above to pay outstanding property taxes

* 2024 assessment values reported above represent the assessor ' s appraised value less any Legislative discounts applied for SB24-233 & SB24B-1001 - Typically a $55,000 Residential Actual Value credit and/or a $30,000 Commercial Improvement Actual Value credit depending on the classi�cation of the property The 2023 values listed were subject to the same discounts under Legislative bills SB22-238 & SB23B-001

Data last updated: 06/25/2025