ARGUING that there is good reason to stick together can be tricky. We all like to forge our own path and that has been a successful recipe for many businesses. But there are times when it helps. The traditional/cynical view is that we’ve not, as an industry, necessarily been the best at sticking together in our common interest. Unfair? Characteristic of an uber critical industry to say that about itself? Either way, we’ve seen some winning examples of the industry sticking together lately. No, really.

The industry may not have universally been against that potential shake up to eBikes proposed last year (amending the maximum continuous power output of eBike electric motors from 250 watts to 500 watt), though certainly there were a lack of voices in favour of it, with the majority fearful of its implications (registration plates, compulsory helmets, insurance, etc). But industry voices combined, the Government listened and closed down its proposal and reiterated you don’t need taxation, insurance, etc to ride an eBike. A victory!

Then there’s the current plight of Welsh mountain bike trails, which are facing an uncertain future thanks to central government cost-cutting. Here the industry appears to be coming together with, we hope, similarly positive results, though that remains to be seen (page 10).

As this magazine goes to press, the news has hit that the UK will be ditching antidumping on (non-folding) eBikes from China. With huge potential implications for the UK trade, that’s further indication that market disruption is the new norm.

This issue of CIN mentions some of the above and also includes some unflinching examination of the UK market. Is Britain an attractive proposition for some overseas brands right now? What is the future for the UK/EU relationship and what are the implications for the bike trade? Inevitably, there’s controversy here, but not for the sake of it. Like those bike and P&A brands that want to make riders’ lives better, we’re trying to do the same for the industry (albeit in a more woolly, indirect way). By all means shake your fist (from a distance) and send us a strongly worded email, but before you do that, let us thank you for reading and encourage some more focused ‘working together as an industry’ projects as we face various collective challenges.

Head of Produc tion Luke Wikner production@cyclingindustr y.news

Head of Marketing Shona Hayes shona@cyclingindustr y.news

Jonathon Harker

jon@cyclingindustr y.news

If you are interested in the spending priorities of the UK’s bike shops – and if you’re in the trade then you probably are – take a look at some of the investment trends we have gleaned through years of Cycling Industry News’ Market Data reports…

Continuing our traipse through the CIN Market Data archives, this time around we look at the kinds of things that bike shops intend to part with their (increasingly) hard earned cash on. There are some notremotely-surprising findings (stock levels) as well as some slightly more left field discoveries. This time we directly compare and contrast the answers given by bike shops and workshops when we asked “What are your investment priorities into the coming year?” in 2018 and 2024.

No surprises here, but a sharp indication of the current difficulties facing the trade and tough news for distributors and importers. All know that the industry is over stocked, but these stats illustrate how pointed the situation is for independent shops – a downward shift from the highs of 2018, plunging well into the negative. Based on those numbers there’s little surprise that some parties who supply shops have dipped their toe into D2C transactions to help clear stock. Conversely, that won’t have helped the situation as a whole – in fact it will likely have held back some shops from clearing stock,

but it might have added some liquidity for suppliers and helped prevent some (supplier) insolvencies. A far from optimum situation, all parties will agree.

The $64,000 question is undoubtedly: “When will these numbers shift back into the positives, with shops

looking to invest in new stocks?

Clearly these numbers are not telling the whole story – the detail shows that shops are investing more in certain categories (eg urban and gravel – see CIN Issue 1 2025). But certainly the broad strokes are grim.

It’s perhaps been understated just how much online cycle retail has changed in recent years. Wiggle CRC went into administration in mid-2023 (three years post-Brexit implementation), throwing the proverbial hand grenade into an already disrupted UK cycle industry (not least for UK suppliers selling through Wiggle CRC to non-UK customers).

It’s not so long since former Frasers Group boss and director Mike Ashley was advocating a tax on online retailers doing more than 20% business online (2018) included his (then) own Sports Direct. Since then (March 2024), Frasers bought the ailing Wiggle CRC brand… and that’s just a broad overview of cycling’s biggest online player in recent times. Lower down the leagues, it seems the nation’s independent retailers have been investing more in their

websites and ecommerce capabilities, with a marked upturn in investment in recent times. How much that has to do with the wild ride that Wiggle CRC has been on is debateable, perhaps it’s more to do with that oft-noted boost to online retail that was the lockdown.

Bricks and mortar retail has, in truth, had a hugely disrupted decade or two and – as Mike Ashley once said – that’s almost entirely due to the internet and technology. It seems a betting certainty

that current spend will be maintained or increased on websites and ecommerce in the coming years, with the caveat that bicycle retail (and indeed workshops) are better protected from online retail than some other sectors eg video games – now almost entirely sold via download, and books – the vanishing prospect of buying a book on the high street currently being exacerbated by WH Smith’s proposal to sell its high street stores.

2018: +32%

2024: +12%

A potential surprise for you here. Shops are investing less in merchandising in recent times than they were pre-Covid. You might have expected embattled retailers to bring in more POS and merchandising to shift gear during difficult trading, or perhaps it has been dispensed with if felt costly or encroaching on space for stock. Maybe there hasn’t been quite as much merchandising available or offered by suppliers as belts are tightened throughout the supply chain. Neverthetheless the numbers are a bit of a surprise here, particularly as merchandising is often seen as ‘an extra salesperson’ in a shop.

2018: +7.51%

2024: -5%

Purveyors of additional warehouse space be warned, these are not positive stats. From the heady days of the lockdown boom, when everyone was banging down the door to rent out your handily located warehouse while suppliers and importers purposefully built up stocks to avoid being caught out with any further potential spikes in demand like those seen in the Covid aftermath, now the phone is rarely ringing.

And pity the landlords of the UK, not only contending with more home working in recent times leading to an overstock (if you will) of office space looking

for tenants, and now there’s also less demand for additional retail premises. Statistics from elsewhere indicate a solid shift when it comes to retail. Retail closures are being hardest felt in the high street, while retail parks appear to be weathering the storm better with retail openings actually increasing in these out-of-town plots. There’s a finer point about these retail parks being tailored to customers arriving by car. It would be interesting to see whether bike shops are following the trend and growing more in retail parks than in the high street.

NOTE: For brevity, some of the results have been summarised: We arrived at these figures by subtracting the percentage of shops decreasing their investment in that particular area from the number increasing in the same area. We omitted the percentage which were maintaining their investment in that area.

Taipei Cycle Show

The trade show season is in full swing, with the internationally important Taipei Cycle Show running in Q1…

4,000

CIRCA 4,000 VISITORS ATTENDED TAIPEI CYCLE 2024

THE TOP FIVE BUYER COUNTRIES AT THE SHOW ARE JAPAN, CHINA (INCLUDING HONG KONG), THE USA, SOUTH KOREA AND SINGAPORE

1988

TAIPEI CYCLE SHOW HAS BEEN RUNNING 37 YEARS

23%

THIS ASIAN SHOW SEES 23% OF ITS VISITORS ARRIVE FROM EUROPE

80

ATTENDEES FROM 80 COUNTRIES ATTENDED THE MOST RECENT TAIPEI CYCLE

TAIPEI CYCLE WILL BE HELD FROM 26-29 MARCH AT TAINEX HALLS 1 AND 2

3,500

THE NUMBER OF BOOTHS PLANNED FOR THE SHOW THIS MARCH

250

THE CYCLE MEDIA IS WELL REPRESENTED, WITH 250 SHOWING UP

bob-elliot.co.uk

bob-elliot.co.uk/twitter

bob-elliot.co.uk/facebook

bobelliot-online

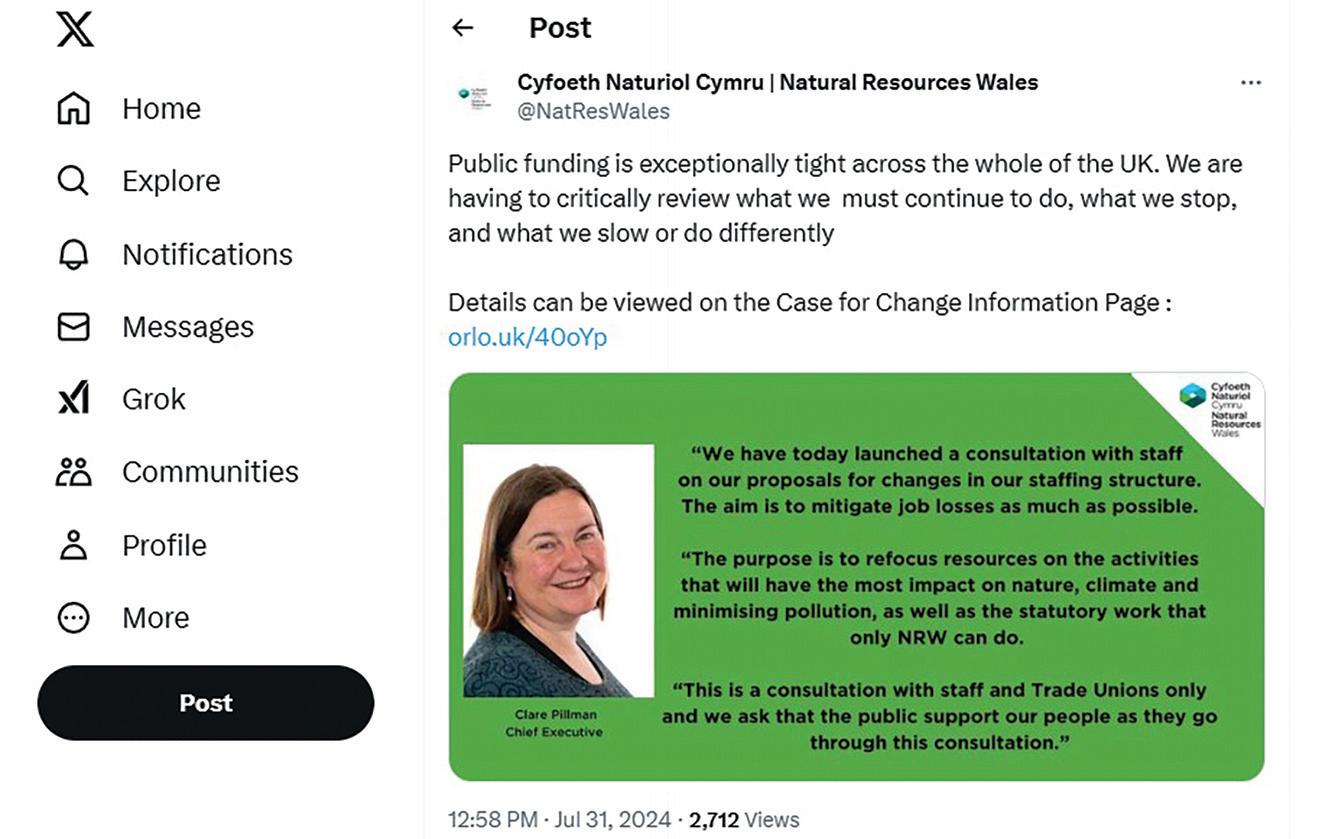

How much is a single mountain bike trail worth to the economy? What happens if a combination of budget cuts and storms puts an entire mountainside, or more at risk? Wales is facing exactly this problem and already local businesses are reeling. Cycling Industry News speaks to the locals to learn more…

The lifeblood of the UK cycling industry has an artery where a stream of rich red blood, or perhaps slick brown mud, powers our progress. Where Europe leads on urban trends, the UK mountain bike scene has generally been far more advanced for decades. Why? We would argue it's down to the hard graft breeding creativity. Where Europeans have an abundance of big mountains on

which trails naturally form, those of us on this side of the channel have had to pick up a shovel and create to get airborne. We are an island where the imagination of the mountain biking scene flourished in spite of our climate, in spite of our generally more mellow terrain and, as our well-established gravel bike scene will attest, also because after a while of riding on often hostile roads in much of the UK

“THE NRW PLAN TO SAVE £12 MILLION PRIORITISES THINGS OTHER THAN RECREATIONAL ACTIVITIES. THAT LEAVES US VERY CONCERNED ABOUT THE FUTURE OF WELSH MOUNTAIN BIKE TRAILS. THERE IS NO SUGGESTION THAT THEY ARE GOING TO PROACTIVELY CLOSE TRAILS, BUT OF COURSE THEY WILL DETERIORATE AND QUICKLY BE FORCED TO CLOSE."

the woodland trails and fire roads pull like a magnet.

Nowhere is this trend more established than in Wales. It’s the destination bored Brits in much of the south to mid-section of England head to in droves to really get the adrenaline going. The trails to the west are just better, bigger, bolder in their design, and as a result, they’re a massive boon to Welsh tourism. Cafes, bike coaches, hotels, bike shops, and many more businesses are all beneficiaries of the steady stream of bike riders headed for the bike parks and trail networks of Wales. But these businesses now have a major headache in the form of budget cuts from Natural Resources Wales, widely reported to have a budgetary black hole of around £13 million, though some estimates have run as high as £20 million.

Natural Resources Wales has significant control of all outdoor visitor sites in the country and with this budget

shortfall, there exists significant concern that the thriving Welsh mountain bike scene is at great risk. That’s the risk of visitor centres closing, the risk of trail networks quickly falling into disrepair and of course, there have been job losses galore.

One source Cycling Industry News spoke with suggests says that 250 roles are on the chopping block with most notified in November 2024. At least 150 of these were existing roles, with the remainder made up of culled vacancies.

The carnage is unlikely to stop there, with the aforementioned economic beneficiaries of the cycle tourism now facing a shortfall in potential customers as word gets round that the trails are falling into disrepair.

Robin Grant is the Founder and Chair of the UK MTB Trail Alliance and a Trustee and Director with Cycling UK. He has found himself a coordinating member of a multiorganisation fightback that has

already gone to the Senedd with a call to make sure budgets for mountain bike trails do not suffer a full-scale cut.

He explains: “The NRW plan is to save £12 million in the budget for this financial year and so they have outlined a plan to prioritise things other than recreational activities and focus largely on core activities. That leaves us very concerned about the future of Welsh mountain bike trails. There is no suggestion that they are going to proactively close trails, but of course they will deteriorate and quickly be forced closed. We are already seeing this happen in lower footfall areas of what is an approximately 550km network of signposted trails in the country. Afan is already seeing entire sections closed, in theory temporarily, but little is forthcoming about timescales for reopening. Mountain biking trails seem to have ended up far down the list of priorities.”

A few record-breaking storms blowing through the region at the end of 2024 and start of 2025 have greatly exacerbated the decline of the network and with trees littering trails and erosion washing away routes there is already a severe dent in the riding appeal of Wales with only uncertainty about a timeline for revival. Naturally, passionate riders want to get on with the job themselves, but this is not a solution the authorities are happy to progress.

Grant says this is a symptom of heeldragging on the issue: “We have seen examples now in Brechfa forest where the NRW have discovered the public using their own kit to clear dead trees, but this is only happening because they are dragging their feet on the

required work. We don’t encourage people to take matters into their own hands, of course, but it does happen. Why is it happening and what is the root cause? This is the question. We would love to get rid of the internal red tape that stops volunteer groups working on trails, which would be to the Government’s benefit. The Trail Collective in North Wales has for last two and a half years sought an agreement with the NRW to bypass red tape and take on maintenance. I’ve only seen success on this front in Brechfa Forest to date.”

Politicians have apparently taken some interest where high footfall locations have posed questions. A debate in the Welsh Senedd in January was pitched as a challenge to the apparent NRW trail maintenance cuts, but ended up focusing instead on the closures of visitor centres. This, feels Grant, has hijacked the news cycle and taken the focus off the broader network.

Another local bike industry insider and cycling advocate, who in this case did not wish to be named for concern of souring the chances of building bridges to a solution told CIN: “31 March sees staff out of work and the visitor centres closed indefinitely. The claim is that NRW are working with local service providers to take over the running of the sites, but as yet there is no proof of this and the one local community group I spoke to claims NRW are simply not engaging with them. The wider concern is what about the trails? NRW claims to still be maintaining them, but at what level of priority? How important will some random MTB trail be to them when there is no money to be made for them at that site? The fear is that this is the beginning of

“THE WIDER ISSUES FOR THE INDUSTRY ARE MUCH MORE THAN FEWER RIDERS EQUATING TO FEWER BIKE AND KIT SALES. IT’S LOCAL CAMPSITES, B&Bs, CAFES, EVENTS. RUN COED Y BRENIN CANCELLING ALL 2025 EVENTS HAS REALLY BROUGHT THIS FACT HOME.”

the end for Welsh trail centres.”

A stark warning and one that the bike industry hardly would wish to hear in the current climate, but galvanising support behind the pushback at this stage is exactly what this local hopes for. There are, after all, numerous organisations fighting against the cuts and seeking a solution. Among these are Cycling UK, Beicio Cymru (formerly Welsh Cycling), the UK MTB Trail Alliance, Mountain Bike Wales and the Wales Adventure Tourism Organisation (WATO), along with over 90 other groups, organisations and businesses. Add to that over 90 bike shops, a tally that the collective would love to see grow with the support of readers here.

Challenges have persisted in driving progress, so says our source, who adds: “Beicio Cymru and MB Wales set up a mountain bike steering committee last summer. The resultant committee has been deafening by its silence. The MTB industry gathered to kick it off and I, like many I have spoken with, now feel we wasted our time at that meeting as nothing has come of it. The closures should have propelled that group into representing the industry but instead, we’ve seen nor heard a thing from them.”

As before, this is an issue that has become everyone’s problem. That is

everyone with an interest in the economy surrounding cycle tourism. “The wider issues for the industry are much more than fewer riders equating to fewer bike and kit sales. It’s local campsites, B&Bs, cafes, ride leaders, training groups, and event organisers. All in the dark. Run Coed y Brenin cancelling all 2025 events has really brought this fact home. This, as I understand it, was purely as he (the organiser) has no way of knowing what trail access or facilities he can offer beyond the end of March.”

Will business go elsewhere? Our source said that in reviewing their own schedule the answer has already become clear. “I have recently been planning my 2025 ride and run event calendar and it shocked me when I

realised that 90% of them were in Scotland. I went back to look for more in Wales and there are very few left. Coincidence? Not in my opinion, whatever that is worth.”

WANT TO LEND YOUR SUPPORT TO THE EFFORTS TO KEEP WALES MOUNTAIN BIKE SCENE ALIVE? Those wanting to pitch in should sign up to the newsletter at www.ukmtb.org to be kept abrest of developments and calls to action. If you do business in Wales, or live locally, it is asked that you also write to your member of the Senedd expressing concerns about the defunding of the trail network. Furthermore, a crowdfunding effort can be pitch into at wwww.gofundme.com/f/helpus-to-protect-your-trails

www.cambriantyresb2b.co.uk

www.lyonequipment.com

goodyearbike

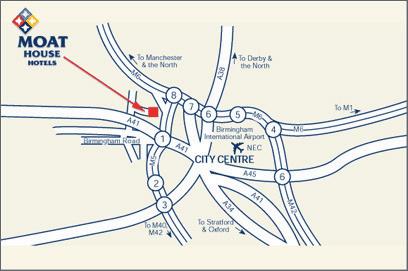

Enjoy sharing ideas and experiences with colleagues from the trade over a drink and a bite to eat. Pop over for the day or come for the full overnight experience and see how a proper distributor looks after its customers!

Learn about Oxford’s latest technological developments, direct from the product designers themselves. Get exclusive early access to - and be first to market with - all our new and innovative products!

EXPLORE OUR HUGE PRODUCT CATALOGUE

View all 480 pages of parts and accessories from Oxford and our world class distribution brands at our website: oxfordproducts.com

Chat with representatives from our partner brands and get the low-down direct from the horse’s mouth. Jump the queue and be the first to receive all the new models and latest tech!

OXFORD ARE PROUD DISTRIBUTORS OF

RSVP TODAY. LIMITED SPACES. Contact your area sales manager or info@oxprod.com

In the noise around the BBC’s Panorama programme, which purported to be about eBikes, Cycling Industry News caught sight of an overseas business leader’s view on why Britain has become a less enticing investment prospect to the European. Here, Upway CEO Toussaint Wattine explains and prays for the record to change…

Toussaint Wattine lived, studied and cycled the UK, having moved eagerly in 2016 to take up the opportunity to lead Uber Eats’ Northern European operations. Having been schooled in Kent as a teenager and worked with several businesses as an adult his appreciation for the UK was punctuated by a long goodbye; a cycling trip, lasting a month, alongside his wife traversing the country.

Thereafter he returned to France to set up what is now one of Europe’s most interesting young businesses, the leading refurbished bike platform Upway.

Nowadays Upway, over the course of only three years, has sold over 50,000 refurbished eBikes across eight countries, including France, Germany and the USA, helping people embrace more sustainable ways of getting around.

Toussaint explains his motivation as “giving second lives to electric bikes, reducing both costs for consumers and the carbon emission impact of

manufacturing new eBikes.”

It's a vision he desperately wants to deploy much wider. After all, he’s already reached North America. So, why as a neighbouring country did Upway veer right around the UK? Having spotted Toussaint offer a candid reply to the controversy around the BBC’s Panorama segment on electric bikes, or more precisely e-things, he explained to Cycling Industry News that, from the perspective of the foreign investor looking in there have been more than a few reasons to pause progress, some obvious, some that we Brits may not yet have even considered.

Starting with the media’s profiling of cycling and electric bikes in particular, this has not escaped the attention of Europeans looking over the Channel.

Toussaint says: “Media coverage about cycling and e-mobility has been a lot more balanced in France than what I tend to see in the UK. Over the last ten years, there has been a wide

recognition that eBikes can replace a large share of the 50% of car trips travelling less than five miles, which in turn leads to better air quality, less congestion, regained public space from parking slots, improved health, fewer road accidents, lots of local job creations and major economic upside. There are lots of positives that journalists have found worthy of attention.”

The BBC’s programme travelled, we’re told, catching the eye of Europeans bemused by its portrayal of electric bike culture, something we all felt in the UK, but have become all too accustomed to. Toussaint explains: “This kind of coverage would seem absurd to a German citizen!”

He adds: “Perhaps there is a lack of public perception that eBikes are part of the future of mobility in England, a problem which coverage like Panorama only worsens by insisting on the negatives without showing how impactful eBikes can be, for the better.”

“THE UK IS 10X LESS PENETRATED THAN GERMANY AT ONLY 2.2 NEW EBIKES SOLD PER YEAR, PER 1,000 INHABITANTS. THIS IS EVEN BEHIND THE USA. THE GOOD NEWS IS THAT THIS ISN’T INEVITABLE. THE UK IS WHERE SPAIN WAS SEVEN YEARS AGO, THERE IS STILL TIME TO SEE AN ACCELERATION.”

consignments do

seem

Meanwhile, France has been successful not necessarily in controlling the narrative, but in backing politicians to make bold and sometimes unpopular decisions to tear up roads and give them back to people power. This is highlighted by Paris Mayor Anne Hidalgo, in particular, but where success has been seen the positive mood around cycling has spread further.

“Naturally it’s not a one-sided picture and there’s occasional media focus on potential challenges. But I’ve never been concerned by the general perception and coverage of light electric mobility in continental Europe and its impact on general adoption like I currently feel about the UK.”

What’s perhaps interesting, given the mention of Upway launching in the USA is the quite obvious point that America has one of the world’s most prominent car cultures. Toussaint reminds us here that The Netherlands, despite being considered the most

cycling-friendly place on earth, was in the 1970s also car-centric until such time the oil crisis and public outrage at increasing road fatalities turned the public mood toward support for cycle lanes and alternate mobility solutions. “The fact that the Netherlands is dense and flat made cycling an obvious choice at the time. Plus, you don’t need a two-tonne metal box that will cost you fuel and parking tickets to travel five miles for some groceries,” he says, which given the rate of urban expansion here may give pause for thought. So, what weight is given to safe cycling lane miles versus other factors businesses will be watching before going live?

Toussaint says: “Government support to cyclists and the bike industry plays an important, yet indirect role in our decision to launch a market. Ultimately our primary criteria remains whether we are seeing a meaningful share of the population purchase and own an eBike. We know that infrastructure and purchase support (whether through consumer subsidies or tax benefits through programs like the Cycle to Work scheme) play a major role in driving such adoption. We hope to see this translate into an exciting adoption trajectory in order to make a launch decision.”

The numbers govern the decision, however, and Toussaint says that “one data point we like to look at is the number of eBikes sold per thousand inhabitants. For comparison, the Dutch and German markets sell around 25 new eBikes per year for every thousand inhabitants. The UK is 10 times less penetrated at only 2.2

new eBikes sold per year and per 1,000 inhabitants. This is even behind the USA, which is currently at 3.3 per 1,000. The good news is that this isn’t inevitable. The UK is where Spain was seven years ago, there is still time to see an acceleration. I hope to see over 200,000 new eBikes get sold in the UK in 2025 or 2026, which would be a signal that the trajectory is starting, and would encourage us to come and play our role in building a path to a million e-bikes sold per year.”

That would require a 50,000 unit or 33% leap in the market volume, which to anyone who lives and works in the UK bicycle industry at present may feel like some going, but it can be done. Toussaint knows only too well as an inhabitant of France that the touchpaper being lit can come in a few forms, be that the aforementioned commitment to infrastructure, or perhaps a Government subsidy. Though France has now halted its popular eBike subsidy, when it launched it propelled the market from 150,000 units and alignment with the UK, to 750,000 units in just over five years.

So, despite an overall hesitant view of the market at present, what factors are being watched beyond unit sales as signals of a turnaround? We ask to what degree Europeans look to our broader politics for signals of the country’s mentality.

“I haven’t followed the UK’s latest policy changes very closely, but I do hope that the Labour Government will bring the development of light electric mobility higher up in the national agenda,” he says, adding “The Nether-

Is the penetration of eBikes in the UK being hit by media coverage which would be deemed “absurd to a German citizen”? Is that encouraging would-be brands and services away from the UK?

lands and German examples suggest that the most effective way to start a more positive trend that attracts traders and brands is to build a longterm political vision with meaningful infrastructure investment. In short, if the UK can commit to a long-term plan that encourages national and local cycle lane investments around the country, I’m confident we will see wider adoption which will attract more companies to invest in the market.”

By this stage, you might be feeling an elephant in the room and we’d be remiss not to ask for a European’s assessment of Brexit and how that overshadows any decisions to invest.

As readers of this magazine have told us in our Market Data reports, trading with Europe has, according to the stats, declined with 9 in 10 businesses.

So, let us have it, Toussaint. “Brexit has certainly added complexity. The increased costs and logistics challenges tied to importing goods, coupled with regulatory uncertainty, made the UK a less attractive market compared to the rest of Europe and even the USA. A UK launch will require a more costly, fully independent Upway operation capable of buying, refurbishing and reselling ebikes at scale from day one. That said,

and as outlined above, the reason why we haven’t entered the UK market is a combination of factors that includes operational complexity, market maturity, and public perception.”

With a Labour Government seemingly warmer in its sentiment toward active travel than all Governments as far back as Boris Johnson’s premiership, and arguably beyond, Toussaint says that Europeans will at least be curious again.

“I would say that the political shifts we’ve seen in the UK in recent years have increased uncertainty for businesses. Experiencing rapid changes in public policies makes long-term business planning more difficult and I think even more so in sectors like mobility, and in our case eBikes, where government support plays a crucial role in accelerating change in deeply ingrained mobility behaviours around cars. There also seems to be a lack of dedicated political support for eBikes that would make a transition to lighter, eco-friendly mobility a priority in the political agenda like the “Contrat de Filière” does in France, for example. I’m curious to see whether a Labour government will change this.”

Looking closer to home, it’s perhaps simple to understand why Upway has made hay where the sun is shining. The

UK still sells fewer new eBikes than Belgium at 290,000, Austria at 220,000, or Switzerland at 172,000 for less than 9 million inhabitants. With a very keen eye on market data, Toussaint reminds us that the UK’s tally has been declining for two consecutive years now. He says, based on population sizes that “the UK should be competing with France’s most recent 700,000, or even Germany at over 2 million!”

His is as robust a call to action as you’ll get from an overseas investor for the UK Government to shoot at the open goal for health, congestion and pollution that electric bikes could represent. With a £100 billion per year annual bill to the NHS for obesity-related illness alone, following through with the idea of prescribing eBikes for health reasons alone could be quite revolutionary and stimulate an industry, plus offer significant job creation. Toussaint concludes: “At every step of this rapid expansion, a UK opening has been on the table. But to my personal disappointment, the hard truth was that the business case did not add up so far. I sincerely hope we can collectively turn this around in the next five to 10 years.”

en.upway.be

The stagnating economy, mounting debts – and global stock markets breaking one record after another – how does that add up? Looking at Europe, the economic powerhouse Germany – facing three years of stalled reforms and an economic downturn – suffered the most significant decline. At the same time 2024 was one of the most successful years in the 36-year history of the German DAX share index. Comprising Germany’s 40 largest and most liquid companies, it surpassed the 20,000-points barrier for the first time in history. In this story CIN is trying to figure out why only a little more than a third of the stock-listed company in our global bicycle chart benefited from last year’s boom – and why it also bypassed almost two thirds of them. Jo Beckendorff writes…

Regardless of a geopolitical environment characterised by wars, global crises and a collectively gloomy mood, the global stock market only knew one direction in 2024 –namely, upward.

One reason for this is the monetary policy of the central banks. They fought the economic slump by lowering interest rates. As interest rates fall, credit become more affordable. If credit become cheaper, companies should – according to the prospective rationale – invest more. Because the future is traded on the stock market, it benefits from the measures taken by these central banks.

DAX turbo in the economic crisis

However, the interest rate cuts were not the sole trigger for last year’s stock market boom. Let’s take a closer look at the DAX. At a time when the governing political coalition has failed and bankruptcies are almost an everyday occurrence, the 40 largest and most liquid German DAX companies generate 80% of their sales and profits abroad – which means that a large proportion of their added value is also generated abroad. This is also where around two thirds of the assets, such as factories and machinery, are located. In other

words, the DAX is not a national affair.

Today, around 87% of the DAX shares are held by foreign investors. Investors from North America and the UK, in particular, continue to place their trust in Germany. However, they do not invest in all DAX companies. Above all, there are six magnificent heavyweights (Allianz, Munich Re, SAP, Siemens, Siemens Energy, Telekom) whom they trust. Last year, they pushed the DAX up by 22%. The main losers in the DAX were companies from the chemical and automotive industries.

Upheaval in the automotive industry in times of uncertainty

The ailing German automotive industry is facing a major upheaval. Nobody really knows what will happen next. So far, domestic car makers have not succeeded in making the transition from pure automotive manufacturers to a sustainable mobility provider. The entry of some listed automotive parts suppliers into the bicycle and, above all, eBike sector has not come close to offsetting the losses from the much larger automotive business.

This becomes clear, for example, when looking at German chart members and automotive parts makers hGears AG or NCTE AG. In 2024, both share prices

ended with double-digit losses. However, this is not the only reason last year’s Bicycle Stock Chart is weaker than the general 2024 stock market. Not only the European and North American car industry, but also the bicycle industry is struggling – even on a global basis.

Global bicycle industry overstock persists

The ongoing challenges in the bicycle market are generally due to the booming sales years in the Covid era. Products were in short supply, delivery problems increased, production was ramped up – and met finally with an abrupt drop in demand (caused also by inflation and the like) in the post-corona days. As a result, inventories are still bulging and liquidity bottlenecks have caused problems from some industry and trade participants. Last year’s takeover and concentration process in the bicycle industry will continue. Nevertheless, in the long-term, sustainable mobility products such as bicycles and eBikes will continue to be seen as a growth market. Therefore it remains attractive for investors.

Two chart members out, three in Before we go into our listed bicycle

* Source: Bloomberg, Corporate Information & Yahoo Finance.

** Allegion is an Irish-based spin-off of Ingersoll-Rand and traded at NYSE (hence US$).

*** Shares of HL Corporation from Taiwan is traded on the Chinese stock exchange in Shenzhen (hence CNY).

**** Shares of South-African Protection Wear supplier Leatt are traded OTC (Over-The-Counter) in USA (hence US$).

***** Shares of Chinese Shanghai Phoenix Enterprise and Zhonglu are taken from the US stock exchange (hence US$).

Composed by Jo Beckendorff (no liability assumed)

stocks, we want to point out that we have removed two chart members and added three.

First, we removed Hong Kong-listed Anta Sports Products Limited. After going public in the US, Anta’s Finnish subsidiary Amer Sports exited the bicycle sector altogether with the sale of US carbon wheel and frame manufacturer Enve Components.

In the middle of the year, the inter-

national marketplace BikeExchange Ltd., founded in Australia, voluntarily withdrew from the stock exchange. According to the Board, the low trading volume had a negative impact on the share price. It was already dropped towards a penny stock. The delisting allows the management to spend “more time on other value-enhancing measures for the benefit of the company and its shareholders”.

Meanwhile, we have added the Chinese producer Ananda Drive Techniques (Shanghai) Co., Ltd. to the chart. The maker of eBike drivetrain units celebrated its Shanghai stock market debut last June.

Also newly included (but already listed for some time): Taiwan’s electronics giant Darfon Electronics Corp. With its eBike drivetrains, its evergrowing Darfon E-Mobility division is

serving OEM- as well as ODMcustomers. This division is also strategically expanding the business of its own eBike brand BESV. In addition, Darfon acquired a majority stake in the German wholesaler and importer Grofa Action Sports last year. Not to mention the majority stakes the electronics giant holds already into the bicycle compatriots Kenstone Metal and Astro Tech. Furthermore, the Taiwanese company has opened its own European production facility for eBikes and batteries in the Czech Republic. Darfon Electronics Czech s.r.o. was founded at the end of 2023. The company produces close to the market for its own eBike brand BESV, as well as for European OEM-customers.

In November 27, outdoor supplier Revelyst Inc., which has been founded after the split of Vista Outdoor Inc.’s business and is also active in the bicycle business, celebrated its stock market debut. More on this below.

The top 3 winners

As a result, at the end of last year our bicycle stock chart included a total of 43 selected companies. Of these, on 1 January (and compared with 1 January 2023) 16 (= 37.2%) were on the plus and 27 (= 62.8 %) were on the loss side.

The respective increases and decreases in value naturally also have an impact on the company values. We have corrected them accordingly (and in comparison) to the previous year.

As for the winners, eleven of the 16 chart members achieved double-digit (year-on-year) share price increases and five single-digit (year-on-year) share price increases. The aforementioned chart newcomer Ananda Drive Techniques achieved the biggest share value jump. Since its IPO in July – in just six months – share price skyrocketed by 77.5 percent.

Right behind is Japanese rim manufacturer Araya Industrial Co., Ltd., which operates in three business areas (steel tube, bicycle business, real estate rental). Share price jumped 76.6% up. Above all its steel tube, bicycle rim and wheel business benefited from the weak yen exchange rate. This means that the product prices of Nippon’s oldest rim manufacturer remain competitive again on the world market.

Vista Outdoor Inc’s share price saw the third-largest price jump in 2024. After a long bidding war, the US

“TODAY, AROUND 87% OF THE DAX SHARES ARE HELD BY FOREIGN INVESTORS. INVESTORS FROM NORTH AMERICA AND THE UK, IN PARTICULAR, CONTINUE TO PLACE THEIR TRUST IN GERMANY.”

supplier officially confirmed on 4 October that it would be split up and sold in parts to two separate buyers for a total of USD 3.35 billion.

With the entry of the Czech industrial and defence holding Czechoslovak Group (CSG), Vista Outdoor’s ammunition and hunting portfolio was merged into the new independent The Kinetic Group. In turn, the US investment company Strategic Value Partners, LLC (SVP) acquired Vista Outdoor’s outdoor portfolio (brands Bell, Blackburn, Camelbak, Fox Racing, Giro, QuietKat, etc.), which also appeals to the bicycle market. Since 27 November, it has been listed on the US stock exchange under the name Revelyst Inc. The initial price at the IPO was USD 22.75 (December 31: USD 20.08 = down 11.7%).

Before the company split, Vista Outdoor Group’s share price rose to new heights. Stock market experts expect the split to generate new profit potential. With the completion of the SVP transaction to acquire the outdoor business, with has been schedule by the end of January 2025, the shares of Vista Outdoor Inc. will be transferred to Revelyst (and thus be in our bike stock chart for the last time).

Some post-corona losers turned around in 2024

Notably, the stocks of chart members whose share prices had fallen significantly at double-digit in 2022 and 2023, the years following Covid, were on the road of recovery in 2024. One example is helmet technology expert MIPS AB. The Swedish company successfully reduced its over-stocked inventories. After sales picked up again, the share price rose last year by 29.1%.

The same applies to MIPS-compatriot and transportation systems supplier Thule Group AB. Here, too, last year’s share price managed to rise again by 24.4%.

Even the shares of our former chart winner Peloton Interactive Inc., which shot up to unhealthy heights during the corona pandemic (395.8% increase in 2020 alone!) and then crashed, seem to have regained their footing. After the US-based connected indoor sport platform averted its final demise and is currently undergoing a tough restructuring course, the share price rose again for the first time last year. It achieved an impressive double-digit increase of 42.9%. Here the worst seems to be over.

The top 3 losers

27 of our all in all 43 listed bike share companies recorded a loss in the stock market boom year of 2024. Only six of them got off lightly with a single-digit share price drop. What is more trou-

blesome is the double-digit share price decline of the remaining 21 stocks.

Not surprising, however, is the plunge in the shares of Austria’s twowheeler giant Pierer Mobility AG. With a 2024 share price slide of 60.4%, the company became the top loser in our last year’s chart. Even if, according to the company itself, “economically volatile and difficult conditions” led to a negative result, the respective preliminary forecasts had to be gradually corrected downwards, and they had to further tighten their belts. On 29 November, Pierer Mobility’s motorcycle business, operating under the name KTM AG, had to file for reorganisation proceedings with self-administration. The proceedings filed at the local court in Ried im Innkreis also affect KTM AG’s subsidiaries KTM Components GmbH and KTM F&E GmbH.

In this context again the note that KTM AG has nothing to do with the bicycle and eBike manufacturer KTM Fahrrad GmbH. KTM Fahrrad is an independent and autonomous company. They have nothing but their history in common. KTM-branded bicycles and eBikes are in the hand of KTM Fahrrad.

It is no secret that aside its motorcycle subsidiary KTM AG its parent company Pierer Mobility’s bicycle and eBike business (brands Felt Bicycles, GasGas Bicycles and Husqvarna EBicycles) is currently also suffering.

But it is also a fact that KTM AG’s motorcycle business generated more than 95% of Pierer Mobility’s revenue until 30 June 2024. The Austrian bicycle and eBike business is more of a “distant second”.

With a share price drop of 56.7%, Chinese e-drive drivetrain producer Bafang Electric (Suzhou) Co. Ltd. is the second-biggest loser in our 2024 Bike stock chart. A brief look back: in 2019, the company celebrated opening its own European e-bike drivetrain production facility in Poland. The aim was to gain a slice of the European eBike market. Thanks to the subsequent share price speculation, Bafang shares recorded double-digit growth in 2021. In 2022 and 2023, after the Covid crisis, it fell at a double-digit rate. Due to the current precarious situation in the bicycle industry, this downturn could not be stopped in 2024.

The US suspension expert Fox Factory Holding Corp. is the thirdbiggest loser in our 2024 chart. While

“IN THESE DIFFICULT TENSE TIMES, SUSTAINABILITY MOBILITY MAY NOT PLAY THE ROLE IT SHOULD. LET'S HOPE THE AVERAGE CONSUMERS WILL AT LEAST CONTINUE TO EMBRACE USING BICYCLES AND EBIKES FOR HEALTH REASONS.”

the bicycle segment being managed under the name Specialty Sports Group (SSG – brands Easton Cycling, Fox, Marucci Sports including Lizard Skins and Oury, Marzocchi, Race Face, Ride Concepts) saw double-digit revenue growth compared to 2023, this is partly (but not only) due to the acquisition of Marucci Sports (including Lizard Skins and Oury). Fox Factory’s other two divisions Powered Vehicles Group (PVG) and Aftermarket Applications Group (AAG) experienced problems. The revenue decline in these divisions could not offset by the revenue increase from SSG. As a result, the Fox Factory’s share price fell by 55.1 % in 2024.

When looking at the economic slump and last year’s stock market boom, not only ‘Joe Cool’ but also some stock market observers are getting seriously nervous. How long can this development last? And with this development, is it any wonder that ‘Joe Cools’ – aka the average consumer – see the financial market as a casino run by gamblers?

In retrospect, we can say that `Joe Cool’s’ stock market blues has come to nothing. But what awaits us in 2025 (after last year’s extraordinary outstanding stock market boom in 2024) is indeed a matter of looking into a crystal ball.

At the time of writing, Donald Trump’s – cue trade barriers – had not yet taken fully control. There is no question that he will change the financial markets in one direction or another. In Europe, the focus will be on the govern-

ment elections in Germany and France. These government changes also entail noticeable uncertainties on the stock markets, which, according to insiders, are unlikely to be overcome before the second half of 2025. Whoever wins these elections and whichever coalition governs – it won’t be a walk in the park.

Optimists assume that the stock market has already priced in all current problems such as wars, economic downturns and looming political risks. They see a bright future ahead.

Stock market pessimists tend to believe things will not go as they are. For the latter, 2025 will be an extremely difficult year on the stock market. Not to mention international debt. It is so high that, at some point, a certain limit will be reached where it simply cannot go on.

Looking at current climate policy, we can also guess sustainable mobility’s role. In these difficult, tense times, it will not play the role it should. Let’s hope that the average consumers –particularly the financially strong baby boomer generation – will at least continue to embrace using bicycles and eBikes for health reasons.

Industry observers assume the bicycle industry will have a bright future once the current (hardware) inventory overhang is eliminated. And when that happens, the stock prices of our bicycle stock chart members will certainly rise again. Whether that happens already in 2025 or 2026 will probably be decided in the first few months of the current year (keywords Trump and tariffs).

Text & chart: Jo Beckendorff

courtyard marquee

Too soon? Are we able yet to have an open and frank conversation about the UK leaving the EU? CIN has (perhaps unwisely) thrown caution to the wind with Mark Sutton examining some of the core topics and bringing in some trade opinions on the future relationship of the EU and UK…

“Because no party is offering a vision of hope for the future, is it any wonder people long for a vision of the distant past?”

I was vaguely listening to a podcast while working away lately and that line just jumped right out at me. Undoubtedly different generations may interpret it differently, but for most of us there’s probably meaning. It’s natural to be nostalgic. Sometimes our memories serve us well, other times they deceive us, but most of us remember how a time made us feel regardless. I don’t know about you, but I don’t remember feeling with such concern for the future prior to 2016. Maybe I was younger, more carefree, actually still able to ride BMX bikes at the weekend and not instead crippled by mid-life back pain.

So I’ll come right out with it, the subject of the latest column in this series: It’s Brexit. Has it been long enough now to mention it? To examine it? To question it?

Lately, it seems that with all the geopolitical disruption we’ve been experiencing and the current government’s need for growth at all costs, now might be a good time to speak openly again on the subject. A recent YouGov study had just 12% of Brits now saying Brexit has gone well and 6 in 10 say it’s gone very badly.

We now know that the economic cost of leaving has already, many years

ago, surpassed the entire history of membership costs to our neighbouring trading bloc. It’s getting awkward. We should have an open and frank conversation about it now that the ‘special relationship’ with the USA looks uncertain.

According to the LSE, 16,400 businesses stopped exporting to the EU altogether when Brexit trade rules hit. Combined with declining trade, overall that meant a £27 billion drop in goods exports to the EU in 2022. A 15% long-term hit to UK trade is the result, so says the OBR.

Back in 2022, when I was the Editor of this trade title and thus in charge of the annual Market Data service that Cycling Industry News produces, all with the help of you, the esteemed readers, we asked as the dust of Brexit was settling whether businesses were doing more or less trade with Europe since before the vote. Naturally, as domestic retailers, many did not do any business at all, yet nonetheless, we got feedback from 22 retailers who did. 21 of them stated, “I’m now selling less product into the EU than previously.”

One apparently more.

Thereafter the anecdotal became very quickly a cascade of evidence that Brexit’s effects were now compounding against the backside of the Covid spike. When the unthinkable happened and Wiggle CRC collapsed it was punctuated

by the administrators citing the economic fallout of this international business suddenly having far less profitable trading conditions. In the August before its downfall, it revealed a £97 million pre-tax loss which it blamed in large part on Brexit and moving its business out of Northern Ireland. Just prior, 38% of the firm’s trade was exports, worth £252 million in revenue.

The Office for Budget Responsibility studies on the ongoing impact indicate that the replacement Trade and Cooperation Agreement effective since 2021 and replacing our membership deal returns a 4% annual productivity loss compared to being a member. Add to that, it reveals that both exports and imports are around 15% lower than had we remained. Those are deficitplugging numbers.

Whether you were large or small, the impact was far-reaching. A recent closure in the e-mobility trade, the pioneering Swiftly Scooters – the only firm to deliver an approved UK road legal e-scooter – blamed Brexit for the failure of its business in part down to the shake up of its EU sales channel, but also blaming the “chronic lack of leadership” in Government during its prime trading years.

Ever the enthusiast of what’s going on in Europe, in January I took a day trip out to Velofollies in Belgium in January. Less than two hours on the

Bspoke Cycles is a thriving, family-run business located in Peebles, Tweed Valley, Scottish Borders, with over 30 years of history in the area. We provide a welcoming environment for families and offer a range of services, including bike servicing, sales, rentals, clothing, and accessories. With a customer base exceeding 2,000, we also attract many drop-in visitors to the Tweed Valley. As the only bike shop in Peebles, we face minimal competition and benefit from our prime high street location, just 45 minutes from Edinburgh, along the 7Staines Route and in a highly desirable area.

The business is currently based upon a fulltime mechanic and a sales/administration member. Over the past five years, the business has consistently grown, achieving a turnover of over £200,000+ (based on a five-day working week and taking an annual month’s holiday). All accounts are current through the end of the financial year in March 2024. The landlord is supportive and enthusiastic about cycling. The business benefits from low rent, minimal overheads, and is currently zero-rated for tax.

Bspoke is well-regarded in the long-distance bike packing and racing communities, supporting visitors participating in events like LeJog through various organisations. We have contributed to local events, including Tweedlove, Muck n Mac Fest, Tour O the Borders, and the Enduro World Series. Additionally, we maintain strong ties with local youth clubs and hold Bikeability Approval, as well as membership of the Association of Cycle Traders.

• Family-run business

• Established 30 years

• High street location

• 2,000+ customer base

• £200,000 turnover

• Expansion potential

There is significant untapped growth potential, particularly since we do not currently engage in e-commerce and have only a basic presence on Facebook and Instagram. Our rental potential is not fully realised; we currently only offer a limited selection of basic hardtail mountain bikes and a couple of gravel bikes. Expanding the rental options to include hybrid and e-bikes could attract more visitors interested in riding the Tweed Valley Railway Path to Innerleithen, Walkerburn and Eddleston and potentially further as it expands.

The shop features a fully equipped workshop with a comprehensive selection of tools and components, including a bio parts washer. We are an approved Bosch Centre and also work with Mahle and TQ. Our subscribed cycle to work schemes include Vivup, Cycle Scheme, and Green Commute Initiative, and we hold active trade accounts with most major UK distributors. The premises are equipped with CCTV and an alarm system linked directly to the police and a designated contact.

There is further potential for building expansion when the neighbouring business owner retires, as the landlord owns that section as well.

We are now looking to sell the business as a going concern, since we plan to return home to Kenya to support our family.

“I HAD SOME REALLY POSITIVE ENGAGEMENTS WITH EUROPEAN BRANDS WHO SEEMED GLAD THAT A BRIT WOULD TAKE THE TIME.”

Eurostar and we were in France and another short hop over the border by train and in the halls we were in time for a continental breakfast. This show, dubbed by others in the press as a Eurobike challenger, was refreshingly busy with European consumers who looked ready to part with cash.

To back this feeling up, I asked around a handful of brands how the European consumer was holding up and which markets were starting to spend again. Germany, naturally, with its 2 million eBike sales per year came up. The home turf, Belgium, with its progressive cycle to work perks and leasing models was again spending freely, albeit with some assistance from their employers.

“Where are you from?” I was asked a handful of times. “Ohhhh, the UK.” Said as if the sentence needed punctuating with a question mark. Now this isn’t necessarily a new phenomenon, I’ve been in the trade press attending international shows for the best part of

20 years now, so you can take a temperature year-to-year, but nowadays we’re moving past a sense that Brexit just complicated the trading picture toward a view that feels like that moment where a door-to-door seller is trying to sell you fresh produce on the spot. You know it’d be nice, probably beneficial for you, but you know it’s going to cost more and you really wish you hadn’t answered the door.

Nonetheless, I had some really positive engagements with European brands who seemed glad that a Brit would take the time. Many were very much open to signing up dealers but didn’t know how to make the approach. So, after the show, I looked at the dealer locator maps of four to five mid-to-large-sized brands that I had encountered on the show floor but not had the time to chat with. Each had some really sharp product that could do very well here, if consumer spending returns. What I found was astonishing: pins dotted all over

Europe, densely and then us, off out at sea. A blank. Some had been here previously, but no longer.

The phenomenon has permeated my work as a consumer journalist a number of times this year. “Please note, this model will not be available in the UK” press releases have noted on many occasions. Why not? I’ve pondered, having had my suspicions I’ve already had the answer at hand. Quite simply, the sales prospects and chances to clear stock have been greater in countries that have no trade barriers, pristine infrastructure, subsidies and cycle culture.

Physically back in the UK, but curious for further insight from those over the pond I spoke with second-hand marketplace Upway Founder Toussaint Wattinne on the back of an insightful comment against one of my LinkedIn posts about the UK market as it stands.

He said specifically on the tradehampering effect of Brexit: “Brexit has certainly added complexity. The

“THE CYCLING LOBBY HAS BEEN PLAYING DEFENCE FOR A DECADE OR MORE AND, YES, IT’S TIME WE SWITCHED TO ATTACK.”

increased costs and logistics challenges tied to importing goods, coupled with regulatory uncertainty, made the UK a less attractive market compared to the rest of Europe and even the US. Experiencing rapid changes in public policies make longterm business planning more difficult and I think even more so in sectors like mobility.” And so his business has prioritised other markets as part of what has been a rapid expansion in just a few years.

Dominic Langan of Madison and Sportline told us: “I still think Brexit was the single biggest act of self harm the country has made this century. The latest figures as published by the BBC further prove it with export of goods (not services) down and immigration up. I don’t see it being reversed unfortunately and I worry about our standards diverging which will make it even harder to export or sell our goods within the EU.

“I have already increased costs by

setting up an EU business which has cost jobs in the UK and reduced tax revenue to the Exchequer and benefitted the Republic of Ireland. Rejoining the single market would be a positive step.”

Harder fought progress?

Now we’re not here to bash the UK, it has always been and hopefully always will be in my interests, as it is yours, that things improve. It’s a no-brainer that, no matter your political leaning that this is a common goal, even if you dislike the current occupants of Downing Street more or at least the same amount as the last.

The very same podcast that got me started on this note expressed something else that caught my ear. The idea that the left has surrendered the right to be publicly proud of our country, assuming that if such things are said it'll come off a bit… Brexity. I think we’re now at a junction where both sides should quit the moaning, look at the indisputable facts and realise once

more that we’re all in it together, regardless of who’s in power.

That means getting our houses in order and working out why the past few decades’ work has been relatively ineffective on the lobbying front, despite what should be a compelling proposition given our product’s positive externalities.

It's undoubtedly unfair to say the UK cycling lobby has failed since it has not only progressed but also constantly fought off fires along the way. It’s a thankless task with a new headwind arriving with each passing week at times. The cycling lobby has been playing defence for a decade or more and, yes, it’s time we switched to attack. Yet clearly our increased physical and cultural separation from mainland Europe has not done us any favours. What progress has come is harderfought than ever and frustratingly difficult to keep consistent, again as a result of our inconsistent market foundation and the fact that marketing budgets are

the first thing to be cut in a crisis. This was unfortunately the case with the temporarily brilliant industry collaboration around the #BikeIsBest campaign; funding simply dried up when the market turned, despite it cutting through in a new way.

So, the fact remains that we do not yet have critical mass as our neighbours do, instead, we have critical press and critical politicians, of which it takes only one to block progress for an entire area.

Yet in the background of the industry workings I can see signs of unity. Of common goals and logic forming. Shared ideas and evolution that could set the stage for a change of fortunes. Tucked within the now public response to the declined bid to explore upping the eBike’s continuous motor power limit to 500W were statements from business groups that outlined diverging in this way is an isolationist idea and that this has never been a smart move. Despite a fair argument

from heavy goods cargo bike operators in the pro 500W camp, outside of this many would agree that this was an unnecessary consultation and certainly something that would make those European brands selling into our market further question their sanity.

Outside of our bubble, the country has a decision to make. The government desperately desires growth, so much so that it is considering expanding multiple airports in a climate crisis. We certainly need shelter from an increasingly volatile world. Job creation could certainly do with a shot in the arm and, in my view, a supported bike industry could pay societal dividends with only a small investment from the Government. If we again borrowed ideas from France, as we did during Covid with the bike repair scheme vouchers, we could subsidise eBike uptake and completely change the fortunes of the sector.

Copying your neighbour's homework is easier if you’re in the room and

“LOOK UP THE EUROPEAN DECLARATION ON CYCLING, IT’S A THING OF UTTER BEAUTY.”

not locked outside, of course. Legislative work in the EU has now laid out a framework for EU countries that seeks to mandate cycling infrastructure, and improve building regulations around bike parking and eBike charging. Look up the European Declaration on Cycling, it’s a thing of utter beauty. It would be game-changing to mirror these policy recommendations. Perhaps we don’t need to rejoin to do this, but it is just another reason to take pause and reflect on whether we have made more or less progress outside of the trading bloc.

The EU has of late struck a welcoming tone. The bridges still exist, it seems. Joining the Single Market, something that even Brexiters said in 2016 we would never leave, would not mean any great betrayal of Leave voters. It’s harder still to argue against the economic lift such a thing would offer.

Is this a point that we in the bike industry can now agree on, not only for our own good but for the country’s?

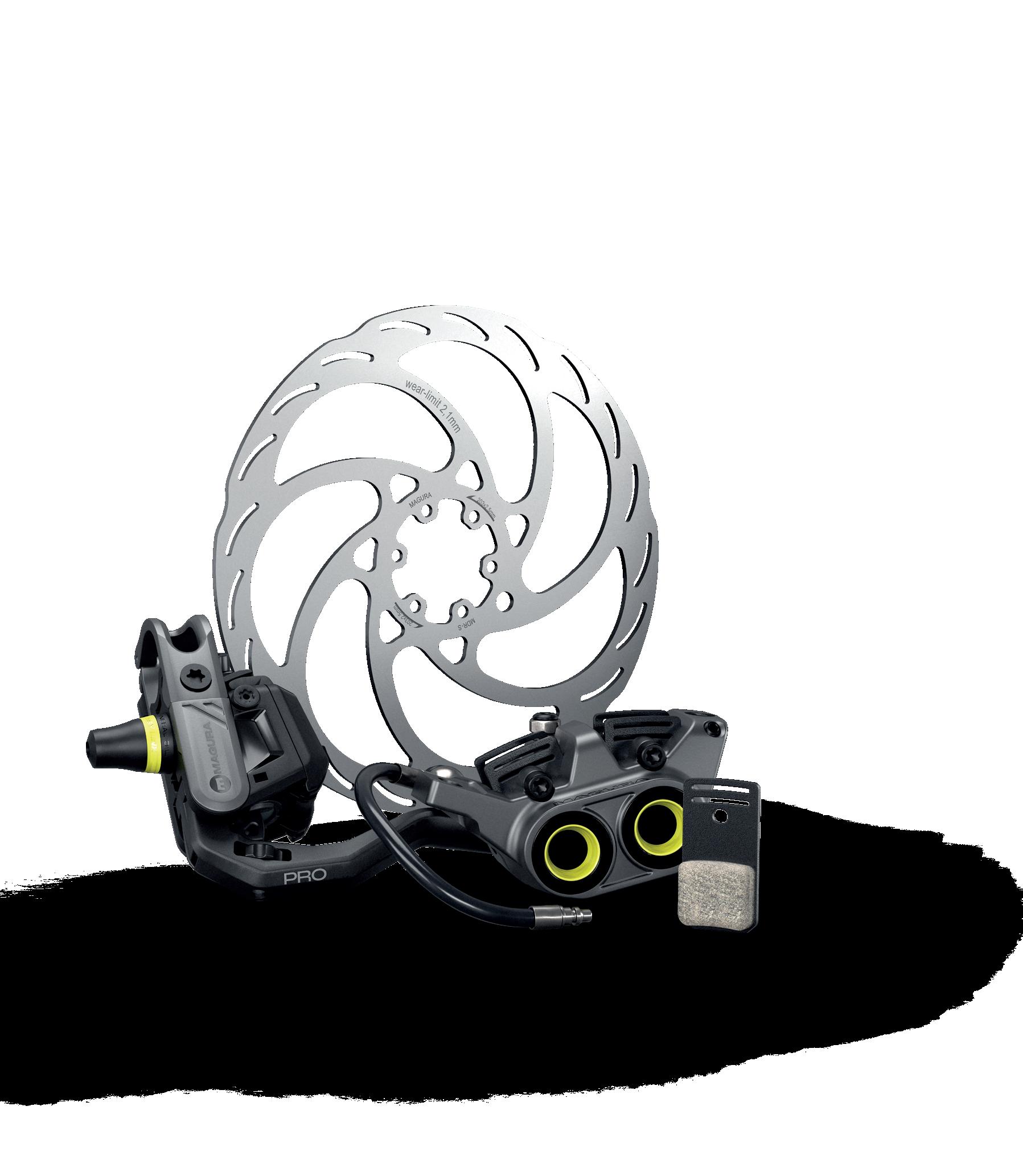

With 2.5 mm thick rotors and 40 % more pad volume for consistent performance from summit to valley, MAGURA is opening a new era of bicycle brakes. The new GUSTAV PRO combines stability, power and modulation like no other brake. Consistent performance from the summit to the valley. But it is so much more than raw power.

CHECK IT OUT AT THE COREBIKE SHOW IN ROOM MONACO

Not only is Core hitting its 20th anniversary, but one of the founding six – Upgrade Bikes – is this year celebrating its 30th year of business. CIN checks in with Upgrade’s Head of Marketing Mark Noble to get a steer on some of the attractions that are awaiting visitors…

“This will be another big year for Upgrade at COREbike Show, and this time we probably have more new products and new brands to show than ever before. We can’t bring our entire catalogue to Core as it’d be impossible trying to fit 4,000 bike products into a room at Whittlebury, so we bring our latest and greatest, the products that really helps dealers and riders alike. My advice would be to sign in at the front desk, grab your badge and turn right into our Upgrade room to find out what we have in store. Even better yet, try and book a timeslot with your contact at Upgrade just to be sure.

“Core Bike is our most important show by some margin – we also expo at various consumer shows and events, and we support and sponsor multiple races and contests throughout the year, but Core is where we get to spend quality time with our bike shops and our dealers. Everyone, from the stand-alone mechanics and IBDs who are often the beating heart of their local bike scene, to the chain

stores and e-commerce giants – it’s great to spend time, catch up, showcase our new products we’re launching, and help bike shop learn about the products that sell.

“We’ve been working with bike shops for three decades and we’re not showing any signs of stopping yet. In fact, we’re adding to our brand range, developing new products with DMR and Kinesis Bikes, and growing – obviously the bike industry is challenging, but we have solid brands and products that sell, and we’re very easy to do business with, which is what bike shops deserve. They need support and the right products for their customers, and that’s what we’re here to take care of. It’s also DMR Bikes’ 30th anniversary – and we’ll be celebrating this throughout the year ahead, with new product, brand collabs, video projects, events and more. We kicked off the new year with an all-new website, and the feedback on that has been awesome so far. DMR is definitely on a roll.

RANGE HIGHLIGHTS (AND GOOD COFFEE)

“We’ll have good coffee for COREbike visitors for sure! Come a grab a cup, and we’ll take you through some of the new highlights:

1. DMR BIKES – Celebrating 30 Years of DMR with new product reveals – new bars, new stems, new dirt jump frames, new grips, new pedals, new graphics and more sneak previews. Plus, check out the whole DMR bike range on show, from our Sidekick balance bikes to pro-spec dirt jump completes.

2. LEZYNE – Full range focus and tech advice from Lezyne EU Brand Manager Mark Robinson...

3. STAN’S – No longer just making the best sealant on the market – Stan’s is now launching the all-new WPL range of lubes and bike care which is entirely bio-based.

4. ABUS – Check out the new shop-inshop display units – these are proving amazing for key retailers, with proven returns and marked lift in sales.

5. MOTUL – New bike care products for workshop and home use – the new Bike Care range is used by top teams, the World Cup DH series, and is as-seen on Tour de France. Motul means business.

6. KINESIS – New bikes and new framesets – including the new G2 gravel frameset, 4S all-road bikes and framesets, and more.

7. HKT – New bike protection kits – a new brand for Upgrade! HKT is made in the UK, a simple upsell for any new mountain bike, so these are a muststock for any bike shop. Come and

Some of the established and new brands from Upgrade

“CORE BIKE IS OUR MOST IMPORTANT SHOW BY SOME MARGIN – WE GET TO SPEND QUALITY TIME WITH OUR BIKE SHOPS AND OUR DEALERS.”

meet Davi from HKT and see if your shop can also do customs.

8. CHALLENGE – The best tyres for road, gravel, and cyclo-cross – the Champs’ choice.

9. STYRKR – The fastest-growing nutrition brand in cycling – come and find out how well Strykr will sit in your bike shop.

10. PLUS! SKF Bearings, ISM Saddles, DexShell, Tektro, TRP, Praxis, Fazua, and more vital brands and products for your customers... all on show right here.

11. PLUS – SEA SUCKER! Upgrade will launch the new Sea Sucker range – as we are now the exclusive UK distributors for Sea Sucker, the best range of bike racks available.”

we still have a long way to go.”

www.upgradebikes.co.uk

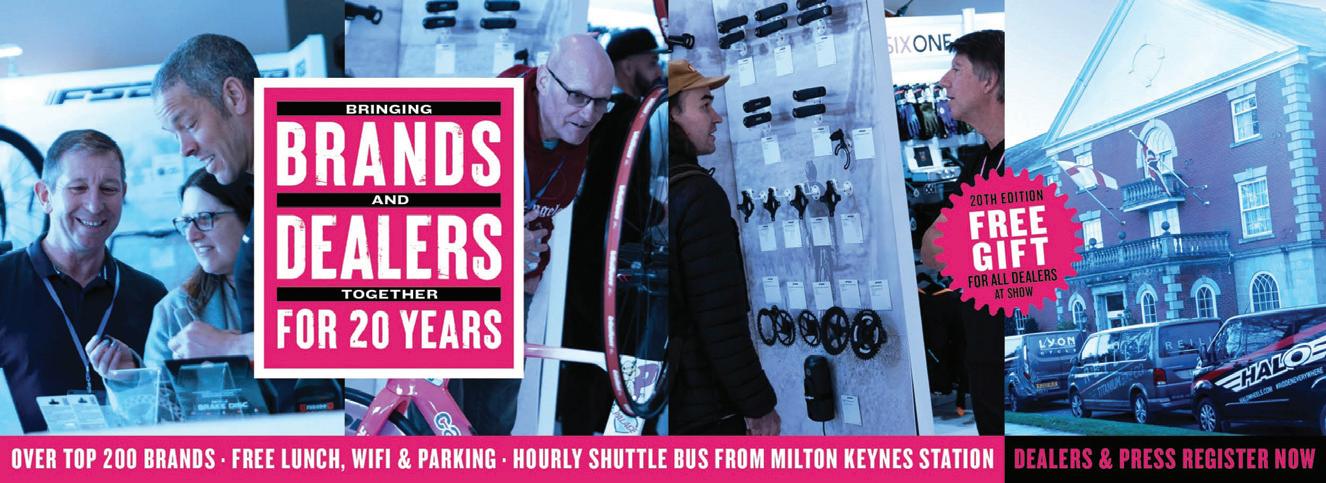

It’s a run that any show would be proud of, COREbike has defied all expectations and this year hits its 20th edition. We speak to the organisers for their take on this special edition of the show…

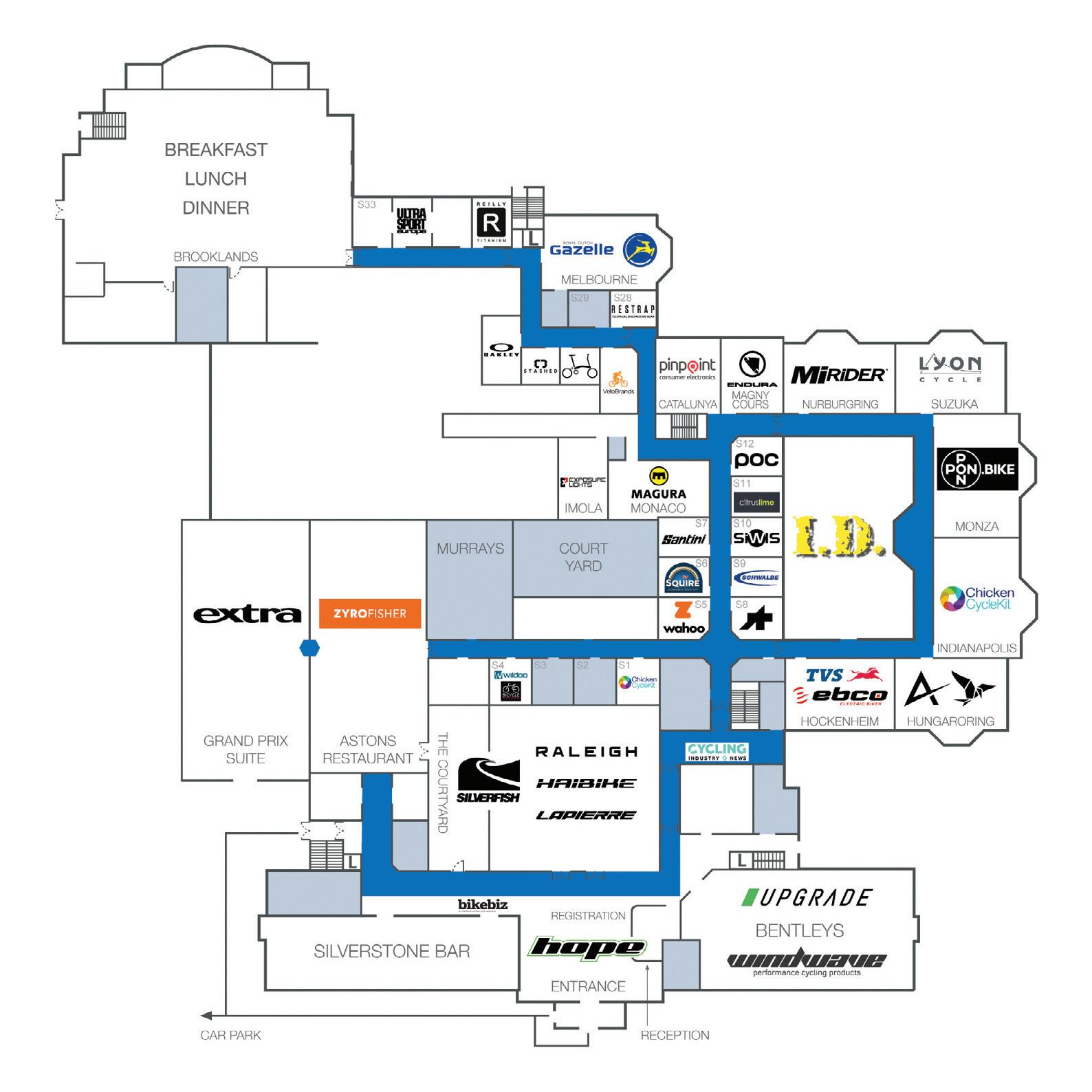

The COREbike line-up of exhibitors has, appropriately enough, expanded for this special 20th show, including a number of first timers: Adaptive DCS, Brompton, MiRiDER, Restrap, Stashed and Raleigh (along with Haibike and Lapierre). Returning additions for 2025 include POC, Tern Bicycles and Velobrands who return to the CORE line up. No doubt to accommodate that long list, the Chequers Courtyard marquee has been re-instated for 2025, along with several more of the smaller rooms added in to the mix, giving the show its largest ever footprint.

There’s going to be a bunch of 20th anniversary celebrations as part of the show, not least that all dealers and press attending the show will also receive a special 20th edition gift on arrival.

CIN quizzed the organisers for their thoughts on the big 2-0…

“THE EVENTS THAT CONTINUE TO FLOURISH ALL SEEM TO OFFER SOMETHING A BIT OUT OF THE ORDINARY.”

20 years is a long time for any event –COREbike has surely exceeded all initial expectations. Can you share your thoughts on the reasons for its continued appeal?

Given how many other bike events have fallen by the wayside recently, for CORE to make it to its 20th edition is quite an achievement. The events that continue to flourish all seem to offer something a bit out of the ordinary, be that demo experiences at Sea Otter or a strong family focus at the Malverns. The hotel format of CORE has meant it’s always been a great place to meet and talk business in a relaxed environment. Not just the ability for dealer to be face-to-face with brand owners and experts, but also shops do seem to like being able to meet other dealers to have a catch up and that adds an important element too.

There was record attendance last year – looking to top that again for this 20th edition of the show?

The show has enjoyed a steady increase in attendance for the last five editions and with more distributors and brands at this year’s CORE it should prove be very popular again. At some point the attendance might well level out, but CORE does seem to provide a service that dealers and press find beneficial each year so we’ll keep on making it as useful for their businesses as we possibly can.

This year you’re going to run a courtesy bus to Milton Keynes station to help dealers make the trip – have you had much reaction to that? Is that some thing you’ll hope to run for future years? Feedback on the shuttle so far has been really positive, and we’ll monitor how popular it is on the first day. It should certainly help to take some pressure off the car park which does get over subscribed on Sunday and Monday, so that’s another good reason to keep on doing it.

Many of us are old timers and have visit ed CORE many times over the years. Do you have a view on how the show is received by new blood/new visitors? It’s absolutely critical for new businesses to attend. The quality and the number of brands at CORE and the breadth of products on show make Whittlebury a unique one-stop shop for new dealers looking to add to their shop offerings. It is a very special event and not one to be missed.

www.corebike.co.uk

Back in 2004, you were likely updating your MySpace page, while thumbing through the Da Vinci Code novel and listening to assorted tracks from Eminem and Destiny’s Child while travelling to West Brom Moat House (in the days before the CORE team settled on Whittlebury Hall). No? Well maybe you’ll remember the first COREbike ticket which the organisers kindly dug out of their archive (right). CORE was launched by six companies in 2005: Extra UK, Hope Technology, ISON Distribution, Silverfish, Upgrade Bikes and Windwave. DO YOU REMEMBER THE FIRST TIME?

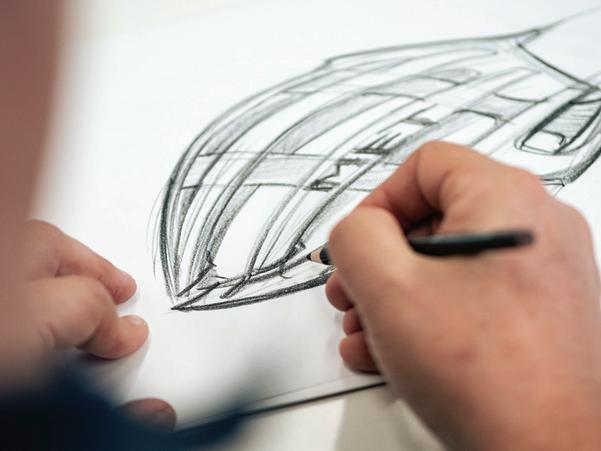

Approaching 40 years in the business, MET Helmets are used by some of the best pro teams and has forged a reputation for innovation – not least with its recently established world first of an aerodynamic and thermal wind tunnel centre for cycling helmets, called the TUBE...

MET Helmets’ aerodynamic and thermal wind tunnel centre, called the TUBE, is thought to be the only facility of its kind in the world specifically for cycling helmets

"MET WAS ONE OF THE FIRST COMPANIES TO INTRODUCE IN-MOULDING, IMPROVING IMPACT RESISTANCE AND REDUCING HELMET WEIGHT."

Founded in 1987, MET Helmets is an Italian family-owned company based in the heart of the Alps. For over three decades, MET has created iconic helmets to inspire confidence, enhance the sport of cycling and promote safer and more sustainable mobility. In a market where many brands choose to diversify their offerings, MET has always maintained a clear focus: the safety of cyclists. This specialisation has allowed the company to develop specific know-how, helping it become among the benchmarks in the industry.

Expertise and in-house production

Tech pioneer MET Helmets has consistently invested in innovation, introducing revolutionary technologies that has helped redefine protection in cycling, including:

• In-Moulding Technology: MET was one of the first companies to introduce this technique, which allows the outer shell to be fused with the inner EPS material, improving impact resistance and reducing helmet weight.

...testing also includes more common impact simulations

MET boasts enviable experience in the production of cycling helmets, with over 25 years of in-house manufacturing. Even though production has now been outsourced, MET maintains full control over every phase of the process, ensuring the highest quality standards. Attention to detail and the use of cutting-edge technologies help guarantee products that meet the needs of the most demanding cyclists, from professionals to amateurs.

Specialisation in cycling helmets

While other brands explore various sectors of sports equipment, MET is exclusively dedicated to cycling helmets. This strategic choice allows the company to focus all its resources on R&D, designing increasingly advanced solutions. The result is a range of innovative products capable of offering the best in aerodynamics, ventilation and safety.

• FEM (Finite Element Method) Analysis: The use of digital simulation enables the optimisation of helmet structures, ensuring maximum protection with minimal weight.

• 3D Prototyping: This technology allows new models to be developed and tested in reduced timeframes, accelerating the innovation process.

• Wide-Body Design for Time-Trial Helmets: MET has invented the innovative wide-body aerodynamic shape that reduces air resistance, improving athletes’ performance in time trials.

Top-level safety: Crash tests and internal laboratory

Safety is a top priority for MET Helmets. To ensure the highest reliability of its products, the company has developed an advanced internal crash test laboratory, where helmets undergo rigorous impact testing. The tests evaluate both linear and rotational impacts, replicating real-world fall conditions. For MET, certification standards are never a final goal in the

“MET HAS ALWAYS BUILT BUSINESS RELATIONSHIPS ON THE SPORTING VALUES OF HONESTY, LOYALTY, AND FAIRNESS, EARNING A STRONG REPUTATION FOR RELIABILITY.”

design or testing phase but instead a starting point for achieving new milestones in energy dissipation by the helmet.

The first wind tunnel for cycling helmets

One of MET Helmets’ latest achievements is the creation of an aerodynamic and thermal wind tunnel centre called the TUBE. It is the only facility in the world specifically designed for testing cycling helmets. Thanks to this laboratory, MET can precisely analyse helmet performance in various wind and temperature conditions, optimising designs to provide maximum aerodynamic efficiency and the best thermal comfort. This innovation represents a unique competitive advantage in the industry.

Partner of the best teams in the world MET helmets are trusted by some of the most prestigious professional teams. The

company is an official partner of the UAE Team Emirates and UAE Team ADQ World Tour teams, two of the strongest squads on the international scene. Recent successes speak for themselves: in 2024, Tadej Pogačar and his team mates equipped with MET helmets won the Giro d’Italia, the Tour de France and the World Championship.

Proudly based in Italy, with a flair for aesthetics and a deep passion for cycling, MET has always built business relationships on the sporting values of honesty, loyalty, and fairness, earning a strong reputation for reliability.

MET is distributed in the UK and Ireland by Extra UK (and its Irish subsidiary Cyclex) who offer great stock availability and innovative POS solutions.

www.extrauk.co.uk

Our exciting new range of KX Wheels are produced right here at Bob Elliot HQ Utilising our specialist machinery, we prepare the hubs using reliable, economical, high quality componentry and lace the wheels before finishing them to precise tolerances with the use of a robot which are then quality checked to deliver the perfect wheel every time. Competitively priced replacement wheels offering a wide selection for 700C and all MTB disciplines.

Built here at Bob Elliot HQ IN THE UK

All wheels FInished to exacting tolerances Comprehensive range, PRICED competitively

Quality componentry from all around the World

Over 50 years combined wheel building experience

Next day delivery available

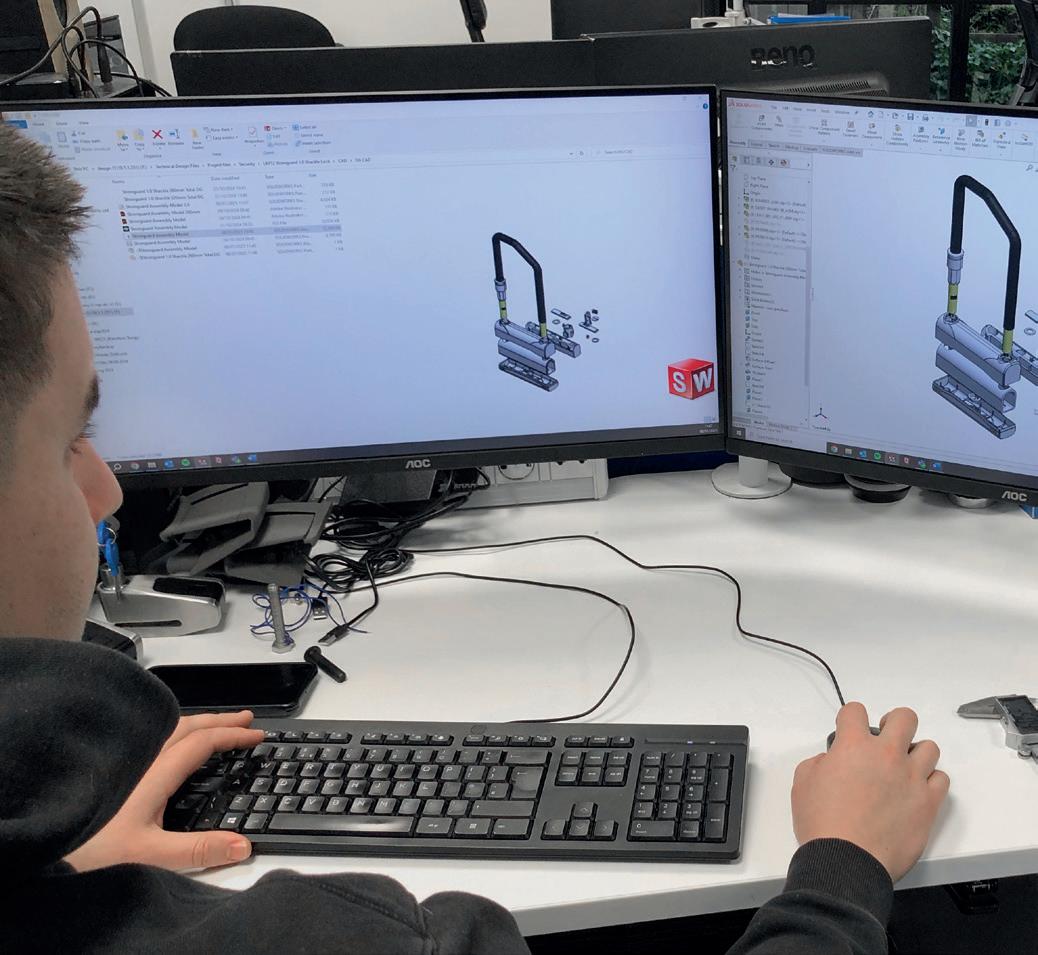

This year celebrating some key anniversaries, USE and Exposure have forged a reputation in the bike market with their high-end technology. The R&D-led business, intent on delivering rideimproving products, is increasingly being sought out by other industries and isn’t afraid to shake up its internal thinking with outside expertise. CIN visits the South Downs HQ to speak with Founder Roger Sparrow and Head of Sales and Marketing Mark Swift

In hindsight, Ultimate Sports Engineering (USE) set out its stall from the beginning back in 1990 with the launch of the world’s first suspension seat post. Developing innovative technology that is designed to make the life of riders easier has been the rationale from the start and has stayed consistent through its 35 years, including the launch of the Exposure Lights brand (which is also celebrating a big anniversary of 20 years).

That commitment to innovation, with significant levels of profit ploughed back into R&D, has seen this Sussex-set business become an established technology hub not just for the

cycling industry but one increasingly sought out by other sectors, including the medical and marine markets.

The beginning

After an uncomfortable hard tail MTB ride, USE founder Roger Sparrow was inspired to engineer a suspension seatpost – the story goes that one of those cushioned office chairs helped spark off that train of thought. The product launched to wide acclaim and the firm’s path of improving the ride was established. Mark Swift picks up the point: “We’re all riders here, so we’re keen to make the ride better for us too. It’s about real rider benefits and the

technology is genuinely beneficial, not just there for the sake of it.”