10 minute read

Consumer trends

from SPN April 2021

by spnews.com

Balancing act

Consumer trends and advancing technology are continuously shaping packaging sustainability. In order to achieve this whilst outsourcing can prove a delicate balancing act. The BCMPA explains why and makes some very interesting observations.

Advertisement

Rodney Steel, CEO, told SPN that pressures throughout the supply chain, in addition to growing consumer demand, means that sustainability has become a hot topic within the packaging industry. Whereas a few years ago sustainability might have been ‘nice to have’, there is now an expectation for products and their packaging to minimise their impact on the environment as an integral part of their offering. Today, whether it is food and drink, personal care, household or medical and pharmaceutical goods, sustainability is no longer just an option.

The current anti-plastic backlash that is still being felt following the broadcast of David Attenborough’s Blue Planet, has undoubtedly brought the sustainability debate centre stage, particularly for the packaging sector, but in reality, it is a topic that companies were addressing long before this. Certainly, this is the case for many BCMPA members.

Portion Solutions, a provider of effective portion solutions across the foodservice, wholesale and custom pack market, has been working constantly towards offering its customers more sustainable options for the last five years.

“Our business has been on a successful journey looking to reduce plastic and paper across our product range,” explains Simon Nicholson, Portion Solutions’ commercial director. “For example, reducing the size of sachets not only ensures effective use of materials it also delivers additional benefits such as allowing more items per box, which in turn maximises efficiencies in the supply chain by reducing packaging and transportation costs.”

Rodney Steel - CEO

One of the key challenges in developing any sustainable pack solution is that it has to complement the many other benefits that packaging needs to deliver. This can be something of a balancing act, matching sustainability with the required levels of product protection and preservation, while also delivering functionality and convenience for the end-user. In addition, external factors can also have an influence, as demonstrated by how the Covid pandemic has impacted on the pack styles for some products.

One example is the closure of food outlets during lockdown, which has had a marked effect on businesses supplying the foodservice industry, as Angus Campbell, co-packing business development manager at contract food manufacturer and packer Alexir, explains: “The huge shift away from foodservice resulted in massive growth in retail and e-commerce, and the sector is now looking at retail pack formats and supplying direct to the public. Manufacturers with a high level of foodservice business have come to us to explore smaller packs formats and new markets into retail and Business to Consumer (B2C).”

The increased interest from consumers in home cooking during the pandemic has also created significant demand for packaged ingredients and meal kits. “Our business with the ready meal and soup manufacturers has gone down, with consumers more likely to make these at home now, but our sales of sachets and pots into the meal kit companies have grown exponentially,” says Phil Moran, sales & marketing director at savoury ingredient manufacturer Jardox. Such instances demonstrate how creating a ‘sustainable’ pack solution is not always clear cut. On the one hand, it could be argued that smaller pack sizes go against the trend for less packaging; however, their portion control abilities have a significant role to play in reducing food waste, which has become an ever - growing environmental problem. In 2018, over 70% of food waste in the UK – some 7.7 million tonnes - came from households; smaller sizes and single-serve packs have been an important way to combat this.

For this reason, building in sustainability to the operational mix, is vital to the success of the packaging industry and is best made at the very start of the development process.

For the full report please visit: www.bcmpa.com

Top of the Pops

Nestlé and Unilever are top of the biggest and most popular FMCG giants when it comes to their commitment to sustainability, this is according to an Ethical Corporation analysis. However, even the slow-coaches are upping their game.

Sustainability at big consumer goods companies once meant little more than coming up with some form of recyclable packaging and putting money into meaningful philanthropy. No longer. As Will Hailer, head of consumer goods at OC&C Strategy Consultants points out, the goal posts have moved and these days such efforts don’t make the grade. At a time of growing realisation of the toll our voracious consumption patterns are taking on our resource-constrained planet – coffee, for example, is now the most valuable commodity after oil - consumers want to know that the companies that produce their favourite brands are making serious efforts to address their impacts in their manufacturing practices and supply chains.

And companies have every reason to listen. A 2015 Global Sustainability Report from the US consumer research agency Nielson found that 66% of consumers were willing to pay more for a sustainable brand, up from 55% in 2014. Among millennials, 73% were willing to pay a sustainability premium.

But failure to step up to its social and environmental responsibilities has far more serious implications than losing market share to a greener competitor. Former BP CEO John Browne argued in his book Connect: How Companies Succeed by Engaging Radically with Society that a company could lose up to 30% of its value if it doesn’t get its relationship with society right – translating into around £5.6bn for a typical FTSE100 company.

So how are the biggest fast moving consumer goods (FMCG) companies, the ones that have the greatest potential to wreck environmental and social damage through sheer size, doing on this increasingly important metric? We decided to assess the progress of the world’s top 10 FMCG companies by turnover. In declining order of size they are: Nestlé, Procter & Gamble, PepsiCo, Unilever, JBS, AB InBev, Coca-Cola, Tyson Foods, Mondeléz, and Archer Daniels Midland.

While it is relatively easy to assess consumer companies on their financial sustainability, it is much trickier to do so on their social, environmental, and good governance goals and actions. Though most companies start by internally setting goals to reduce greenhouse gas emissions, water usage and waste, there is no universally accepted set of sustainability metrics and how to report them in order to make easy comparisons.

To get an idea of the leading sustainability performers in our top 10, Ethical Corporation looked at their sustainability reports and the companies’ inclusion in leading sustainability indexes; we also viewed sustainability news items emanating from our 10. Interesting patterns and indicators emerge, and while this assessment is subjective, it helps to show best practice among the biggest FMCG players. What we found is that the leaders are the leaders because they started early and have stayed a course – and the laggards are following their examples as they pursue the sustainability journey.

Leading the field

Clearly, Nestlé and Unilever are the sustainability leaders. For one thing, they’ve been around longer than those that that are the result of many mergers and acquisitions, such as Mondeléz, and have been more consistent than the likes of Brazil’s JBS, the global beef conglomerate, which have produced sustainability goals, reports, and efforts less consistently and for fewer years. When it comes to collaboration and partnerships with other companies and non-profits, supply chain issues, and action around climate change, Nestlé and Unilever predominate.

Unilever, and to a certain degree Nestlé, also seem to have embraced a holistic sustainability definition and have begun embedding it into their business models. This means they are beginning to take “breakthrough” goals, which are highly aspirational and beyond stretch goals. Unilever global vice-president for sustainable business Karen Hamilton, distils her company’s sustainability work into three big goals. “By 2020 we will improve the health and well-being of more than a billion people, halve the environmental impact of our products, and enhance the livelihood of millions working across our value chain,” Hamilton says.

Waste, water and climate

How have the big boys performed. Let’s look at three different metrics – Zero waste sites, Water use, and Climate change action, in order to see. Unilever in February announced that it had reached an “industryleading” achievement of eliminating non-hazardous waste to landfill at more than 600 of its manufacturing, office and warehouse sites in 70 countries (though it did not say what percentage of sites this represented) while Nestlé, which had a 2015 goal of zero waste at 10% of factories, achieved this at 22% of sites.

At Unilever sites in Egypt, trash is sent to local entrepreneurs, who sort for recycling and use plastics in upcycled fishermen’s bags; in Africa some waste is turned into low-cost building materials; in Ivory Coast waste fires cement kilns. Unilever’s ultimate goal is a “zero-waste value chain” and it is collaborating with the Closed Loop initiative to build better recycling facilities as well as with non-profit 2degrees to share its best practice with other companies.

Paul Polman - CEO at Unilever

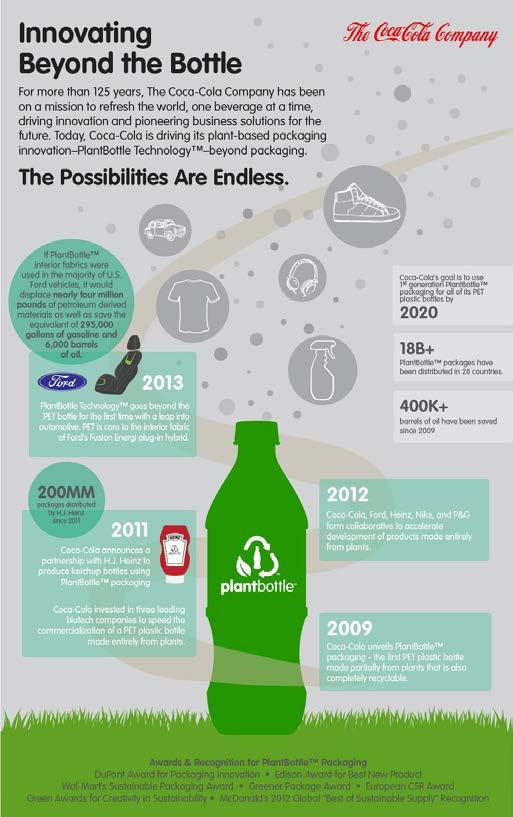

Coca-Cola’s PlantBottle is made from 30% plant-based plastic

On water, Unilever is lauded by Oxfam’s Behind the Brands report for getting suppliers to report water management practices, though Oxfam says Nestlé has the most specific guidelines for suppliers on water management. Oxfam praises both Unilever and Coca-Cola for adopting the idea of water neutrality for internal operations, a great case of best practice. However, none of these brands has yet set value-chain water-use reduction goals, which Oxfam sees as a necessary next step.

On climate, Unilever is the only company to get a score of nine out of 10 from Oxfam. Oxfam says Unilever has strong policies on deforestation and palm oil and strong guidelines for suppliers, and is involved in many partnerships to push the Paris agreements beyond promise to actions. Other companies, Oxfam says, haven’t stretched themselves enough in their emissions-reductions ambitions.

The middle ground

Coca-Cola, PepsiCo, Mondeléz and P&G form the middle tranche in terms of sustainability leadership among our 10 FMCG firms. Oxfam in particular gives Coca-Cola kudos for its land rights policy, and Coca-Cola also gets top marks from Canada’s Corporate Knights and from Germany’s Oekom Research. Coca-Cola views three of its recent actions as breakthrough in terms of sustainability leadership, says communications director Serena Levy. “Three actions we view as having great potential well into the future are our water replenish work, 5by20 programme, and our PlantBottle innovation.”

The 5by20 initiative, which has a goal of empowering 5 million women entrepreneurs across the value chain by 2020, has already reached 1.2 million women. Andy Krumholz of Escama Studio, a social enterprise that employs women to make fashionable purses and handbags out of recycled pull tabs from drinks tins, says Coca-Cola’s long-term support has been key. “Coca-Cola has helped source the raw materials to create our products and purchased our finished products for sale in their branded shops,” Krumholz says. “Without their consistent support over the years our venture would not have been able to sustain the livelihood of 65 artisans at a fair living wage.

”PlantBottle (made from 30% plant-based plastic) attracted some negative attention for claiming too much green goodness, but has helped Coke reduce CO2 emissions by 315,000 tonnes. Last July the company debuted a PET recyclable bottle made entirely from plant plastic.

With the giants of the FMCG industry continuing to support smaller companies with the sourcing of their raw materials and sustainable technology, SPN believes that today the outlook for the planet is looking much brighter.