Hub Integration

Wearepleasedtoconfirmthatourfinal beenreleasedtothesystem.But,theev extremelyexcitingroadmapofimprovem including: Smartr/Concert

FullyIntegratedElectronicIDVvia YOTI

HomebuyerAppcompletelyreengineered,tobetterfacilitateany deviceaccessforclients

IntegrationsoffurtherAitoolsto supportyouradviceandcompliance journey

MoreFMAlendersbeingaddedto SmartrConnect Plus,lotsmore!

Systemoverwriteremoved(onrevisitingCHprioritwouldcleardownfields)

Defaultvaluesaddedtoanumberofdropdowns

BulkDocumentUploadFacility

CreditCommitments–nointerestraterequired(unlessDebtCon)

ProtectionValidationsremovedfor Mortgagecasesubmissions

OccupationCodeMapping

CountryofDomicileMapping

NINumberMapping

ProductCodeUpdate

Mandatingofcirca12fieldsinSmartr365–removesmissing“bluelinks”inCH

ICYMI:JoinHSBCfortheirlatestCybercrimeawarenesswebinars

JoinHSBCUK’sSeniorCorporateAccountManager,TracieBurton,asshehostsa panelofHSBCcybersecurityexperts,whowillbeexploringthelatestcyberthreats targetingthemortgageindustryanddiscussingstrategiesformitigatingrisk. Theexpertpanelbringawealthofknowledgeandexperience,andinclude:

J.R.Manes,GlobalHeadofCyberIntelligenceandThreatAnalysis(formerF.B.I.agent) LucieUsher,LeadStrategicCyberIntelligenceAnalyst(formerMetropolitanPoliceand NationalCrimeAgency)

TimKolk,HeadofStrategicCyberIntelligence(formerF.B.I.agent).

Thesewebinarsaimtoequipmortgageprofessionalswiththeknowledgeandtoolsneeded tostayaheadofcyberthreatsandhelpprotectyourbusinessfromfinancialand reputationaldamage.

TopicsHSBCwillbecoveringinclude:

Whatiscybercrime

Emergingthreatsandtrendsincybercrime

Bestpracticesforprotectingsensitivecustomerdata

Real-worldcasestudiesandlessonslearned

Implementingeffectivecybersecuritymeasures tosafeguardyourorganisation

Whattodoifyoufallvictim

Monday15thSeptember–11:00am-12:00pm

Friday19 September2025 -11:00am-12:00pm th

Accordhasmadetwocriteriachanges tohelpyousupportmoreclients:

IncreasedLTVto90%availableforsingle orjointapplicationswherenoapplicant hasindefiniteleavetoremain(commonly referredtoasforeignnationalcriteria). UniversalCreditisnowacceptedasan incometypeforaffordability assessments.

ThesepositivechangesreflectAccord’s commitmenttocommonsenselendingand makeiteasierforyoutosupportmoreclients -whetherthey’rebuyingtheirfirsthome, movingupthepropertyladder,need additionallendingorremortgaging

View criteria

Clydesdale Bank and Virgin Money’s Product Transfer windows are changing

Followingareviewofitsproducttransfer proposition,ClydesdaleBankandVirginMoney arechangingtheapplicationwindowfromsix monthstofourmonths.Astherateenvironment hasbecomemorestable,mostcustomersnow applywithinthelastfourmonthsoftheir outgoingproduct.

A4-monthwindowstillgivesyourclientstimeto secureanewdealaheadofproductmaturity,and VirginMoneyisconfidentthiswillallowyouto continuesupportingtheirneeds.

If you’ve got any questions about product transfers, or have a new case you'd like to discuss, please contact your BDM

With immediate effect HSBC will be making the following changes to their residential lending policy.

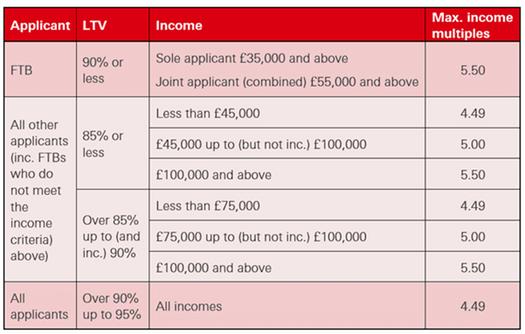

IntroducingLoantoIncome(LTI)multiplesfor FirstTimeBuyers(FTB)

TosupportFTBs,HSBChaveintroducednewLTI multiplestohelpthemtaketheirfirststepsinto homeownership.Ahigherincomemultipleis nowavailablesubjecttomeetingthefollowing criteria:

Applicant(s)mustbeaFTB

Soleapplicant–aminimumincomeof £35,000

Jointapplicants–acombinedminimum incomeof£55,000

Changestonon-FTBLTIs

HSBChaveincreasedthemaximumLTIfornonFTBcustomerswithanincomeof£45,000upto (butnotinc )£100,000from4 75to5 00x income,whereLTVislessthanorequalto85%.

Thetablebelowsummarisesthesechanges:

ChangestoInterestOnlylendingpolicy

HSBChavechangedhowtheyassess InterestOnlyapplicationstohelpmore customerswiththeirmortgageneeds:

IncreasedthemaximumtermforPart& Partapplications–theCapital Repaymentelementcannowbetakenup toamaximumof40years.Pleasenote, theInterestOnlypartwillstillbelimited toamaximumof25years

IncreasedthemaximumageforPart& Partapplications–theCapital Repaymentelementcannowbetakenup totheapplicant’s80thbirthday.

Anyelementoftheapplicationon InterestOnlymustnotexceedtheoldest applicants70thbirthdayoranticipated retirementageifsooner

AllInterestOnlyapplicationswillnowbe assessedforaffordabilityonaCapital Repaymentbasis. Needanyhelp?

Use‘Chatwithus‘orcalltheBroker SupportTeamon03456005847 (MondaytoFriday,9amto5pm)or contactyourlocalBDM.

lending criteria

Followingastrategicreviewofits

Self-Employedproposition,Skiptonhas implementedchangestoitslendingcriteria

MinimumSubmissionRequirement–BusinessBankStatement

Skiptonwillonlyrequire1month’s businessbankstatements (previously3months).

ConstructionIndustryScheme(CIS)workers

ForCISworkers,incomewillbeassessed ona12-monthperiod(previously3 months)usingthegrossamount (deductinganymaterials/subcontracts).

Evidencedby1yearsummaryof paymentsfromemployer/accountantor 1-yearSA302s.

DayRateContractors

AllDayRateContractorswillbe assessedinthesamewayofdayrate x5x46weeks(previously48weeks). Skiptonisremovingthetwo-tiered incomeassessmentforDayRate Contractors(>=£50,000/<£50,000).

Skiptonnowrequireaminimumof12 monthshistoryofcontracting (previously6monthsminimum).

Skiptonwillacceptonegapofa maximumof4weekswithinthepast 12months.Skiptoncanconsider morethanone4-weekgapin contractswiththeincomebeingprorata'daccordingly.

Wherelessthan3monthsis remainingonthecurrentcontract thenacopyofthenextcontractor confirmationletterofthenext contractisrequired(previously1 month).

Locum/Medical(includingbanknurses),ZeroHours

Contracts,andAgencyWorkers

Skiptonnowrequireaminimumof12-months experienceinthefield(previously24months). Incomewillbeassessedona12-monthperiod (previously3months)

Skiptonwillcalculateincomeusingthelowest annualizedYTDfigureonthelatestpaysliporP60.

FixedTermContractors

Incomewillbecalculatedoncontractincome backedupbythelatestpayslip.

Wherelessthan3monthsisremainingonthe currentcontractthenacopyofthenext contractorconfirmationletterofthenext contractisrequired(previously1month).

SelfEmployed–LimitedCompany–Applicant usingShareofNetProfit&Remuneration

Tobeeligibletouseshareofnetprofit& remunerationforincome,thecompany musthavemadeaprofitacrossthewhole accountingperiod(bothofprevioustwo years)

You can find further details of Skipton’s lending criteria for Self-Employed clients on the website.

Please note applications submitted up to and including 31st August will be assessed using the previous lending criteria.

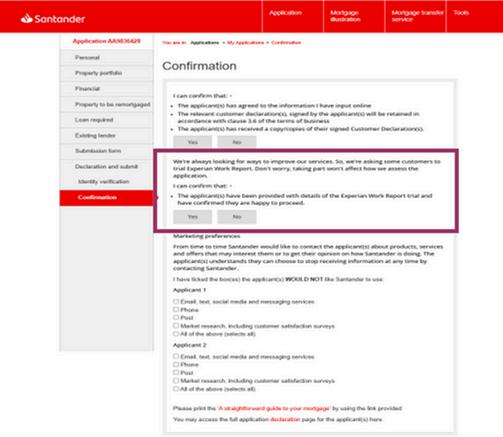

TheExperianworkreportisaquick,simpleandsecurewayforSantandertoverify incomeandemploymentinformationbysupplyingyourclient’spersonal information.ThisservicecouldhelpSantanderremovetheneedforpayslipsinthe futureforsomeofyourclients.

BenefitsofExperianworkreport:

· Verifiesincome,employmentstatusandemployername.

· Providesthemostuptodateandaccurateincomedata.

· Confirmsgrossandnetincome.

· Helpspreventfraud.

Whatdoesthismeanforyou?

Duringthetrialperiodthere’llbeno changetotheapplicationjourney. You’llstillneedtoprovideyourclient’s payslipsonallmortgageapplications. SantanderwilluseExperianwork reportserviceaswelltoverifythe information.

Onceyouhaveyourclient’sconsent, youcanoptthemintothetrialby selecting‘Yes’ontheirbehalfonthe confirmationpageinIntroducer Internet:

Please note, this won’t affect their marketing preferences, and your client can opt out at any time if they change their mind. Santander would just need you to email them at workreportpilot@santander.co.uk to let them know.

Protection Proposition overview webinars

OurregularProviderPropositionoverview webinarsrunlaterthismonthonTuesday 23andWednesday24September. Thesesessionsareperfectforeveryone, fromnewadviserswantingtounderstand eachprovider’spropositiontomore experiencedadviserslookingtokeeptheir knowledgeuptodate.Eachsessionisjust 30minuteslongandqualifiesforCPD(Selfserveviainsight).

Aswellasallourprotectionpanelproviders, wehavesessionsfrom:

PaymentshieldcoveringtheirGI proposition.

Curalookingathowtheycanhelpwith clientswithadverserisks.

UsayCompareexploringopportunitiesin thePMImarketandhowtheycanhelp. CoopLegalServicesexplainingtheir propositionandhowtheycanhelp clients,startingwithafreelegalreview.

Join or register below:

·Tuesday23September:

·Aviva:23September9am (registrationrequired)

·Vitality:23September10am (registrationrequired)

·MetLife:23September11am

·Paymentshield:23September1pm

·Legal&General:23September 2pm(registrationrequired)

·Cura:23September4pm

·Wednesday24September: ·Zurich:24September9am

·TheExeter:24September11am (registrationrequired)

·UsayCompare:24September 12pm

·RoyalLondon:24September1pm

·LV=:24September2pm (registrationrequired)

·Guardian:24September3pm

·CoopLegalServices:24 September4pm

Income Protection Action Week - 22 to 26 September 2024

IncomeProtectionActionWeekaimstohelp advisersensureclientsunderstandthe importanceofsafeguardingtheirincomein caseofillnessorinjury.Theweekbrings togetherindustryprofessionals,advisers,and affiliatestoleadtheconversationaround financialresilienceandpracticalprotection solutionsandfeaturesfreeonlineeventseach daybetween12pmand1pm.

RegisterhereforIncomeProtection ActionWeek2025

Royal London IP webinars – Cover that keeps the lights on

AspartofIncomeProtectionActionWeek, RoyalLondonarerunningaseriesofshort, focusedwebinarsdesignedtohelpadvisers havemoremeaningfulconversationsabout incomeprotectionandtheroleitplaysin safeguardingclients’futures.

They’rerunningthesame30-minute webinaratdifferenttimeseveryday,so youcanpickthesessionthatworksbest foryou. Pick a session & book in

Thesessionwill:

ExploreinsightsfromRoyalLondon’s FinancialResilienceReportandhow financialchallengesarereshaping clientneeds.

Showhowincomeprotection(IP)can helpclientsstayontrackwiththeir goals,evenwhenlifetakesan unexpectedturn.

Helpyouidentifythedifferenttypes ofIPcoverandwhentouseeach one.

Breakdowncommonjargon associatedwithIPproducts Sharepracticaltipstohelpyoutalk aboutIPwithyourclients.

ShowhowtheteamatRoyalLondon cansupportyouinthismarket.

Housepricesdipamidhighborrowingcosts:Nationwidereportedasurprise0.1% monthlyfallinAugusttoanaverageof£271,079,withannualgrowthslowingto 2.1%.Elevatedmortgageratesaround4.96%fortwo-yearand5.0%forfive-year fixesaresqueezingaffordability,pushingtypicalfirst-timebuyerpaymentsto35% oftake-homepay,abovethelong-runaverageof30%

Mortgageapprovalsreachsix-monthhigh:TheBankofEnglandconfirmedthatUK lendersapproved65,352purchasemortgagesinJuly,thehighestsinceJanuaryand theeffectiveinterestrateonnewmortgageseasedto4.28%,downfrom4.34%in June

Greenmortgagemarketshrinks:Sustainablemortgageofferingsdroppedto11% ofproductsinAugust,downfrom16%inAugust2023.Despitetypicallyoffering ratesabout0.65%belowmarketaverage,lowdemandandpatchysupportare limitinguptake.