Smartr365/Concert Hub Integration | Survey

WiththefinalphaseoftheSmartr365/ConcertHubintegrationimprovementsnow complete,bothOpenworkandJustMortgagesarekeentounderstandtheimpact thesechangesarehavingforyou.

Yourfeedbackisreallyimportant,itwill notonlyhelpusmeasurethesuccessof theimprovements,butalsoshapeany futureenhancements.

Thesurveyisjust10shortquestions andshouldtakenomorethan2–3 minutestocomplete:

Thankyouinadvancefortakingthetime toshareyourthoughts.Yourinput genuinelywillmakeadifference.

Take Survey

Joinusforournextroundofwebinartraining,whetheryou arenewtothesystemorneedarefresh,thesesessionsare ideal.Spacesarenowverylimited,sobookintoday!

Smartr365 – Tasks, Notes & Workflows

Areyoustrugglingwithmanagingyourtasks?Doyouknowwhatisgoingonwithall yourcasesandwhenclientsneedtobecontacted?Iftheanswerisno,oryouwould liketomovefromapaperdiarysystemtomanagingonyourCRM,thenthisisthe workshopforyou!Thiswebinarwilltakeyouthroughthebasicsofhowtousetasks, notes,andworkflowssoyouareabletoeasilybeontopofclientcommunication.

Wednesday17 September,09:30am-10:30am th

Smartr365 & Concert Hub – System Trouble Shooting

Whydon'tmycasesgothroughtoConcert?WhathappensifIsendtoConcerttoo manytimes?HowdoINPWacaseinConcert?WhyhasthewrongLenderpulled throughtoConcert?Theseandotherquestionswillbeansweredinthistrouble shootingwebinar.

Wednesday17 September,11:30am-12:30pm th

Smartr365 – Client Portal

BringanewlevelofprofessionalismtoyourservicesasanAdviserbyusingtheSmartr 365Portal.Cutdownontimeenteringdata,andupthetimespentonqualityadvice. Thiswebinarwilltakeyouthroughthebasicsofhowtousetheclientportal,fromboth theperspectiveoftheAdviserandtheclient.

Wednesday17 September,1:30pm-2:30pm th

Hodge introduces specialist 95% LTV mortgage range

Gettingonto,ormovingup,thepropertyladderhasneverbeenmorechallenging.To helpyourclientstakethesteptheyneed,Hodgehastakenitscommitmentonestep furtherbyadding95%loan-to-value(LTV)mortgageoptionsacrossitsHodgeResi andHodgeResiRetireranges.

ForHodge,it’snotjustaboutalowerdeposit,it’saboutpairingthatextra affordabilitywiththetailoredflexibilityitsalreadyknownfor,helpingmoreclients securetherighthomefortheirfuture.Theseenhancementsgivebrokersmoreways tohelptheseclients,whetherthey’refirst-timebuyers,second-steppersorhigh earningprofessionalswithlimiteddepositsornavigatingmajorlifechangeslike divorce.

Hodge’s95%LTVmortgagesareavailableto:

· Customersaged21upto95

· Borrowersontermsofupto40years

· Applicantswithcomplexincomes,includingselfemployed

· Thosewhere100%ofallincomewillbeconsidered

· Clientswho’llbenefitfrommanualunderwriting

Thisflexibilityremovesunnecessarylimitationsand allowsforamorepersonalisedapproachtoaffordability.

Whynow?

TheselatestenhancementsalignwithHodge’sshift towards“lifelonglending”,bringingtogethercore residentialandretirementpropositionswherelendingis basedonacustomer’saspirationsratherthantheirage

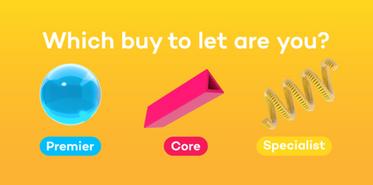

LandbayisgivingyouthechancetowinaniPadtocelebratethereleaseoftheir redesignedBuytoLetrange! Thethreesimplifiedproductsetsprovidesolutionsfor everytypeoflandlord:

Premier–thesimpleBTL

Competitiveratesforstraightforwardcases

Standardproductsforlandlordswithupto15propertiesinlimitedcompanySPVs

Core–theprofessionalBTL

Smartsolutionsforportfoliolandlords

OptionsforalllimitedcompanystructuresplusaccesstoourAVMproducts

Specialist–thecomplexBTL

Flexibilityformorespecialisedproperties

Includingholidaylets,HMOs,MUFBsandtradingcompanies

SowhicheverBTLyouandyourclientare,Landbayistheretohelp.

SolveLandbay'snewproductsetclueforachancetowinaniPad!

Click here for clues and find out more

Precise | Bridging in action.

Howhelpfulwoulditbetofindallthebridging infoyouneedinoneplace?Withreal-lifecase examples,informationandguides?

Well,Precisehavesomegreatnews….

Introducingbridginginsights.Everythingyou needtohelpyourcustomersgetthefunding theyneed.

Visitthebridginginsightssectionoftheir websiteto(Takealook):

Enhanceyourbridgingknowledge

Viewour‘QuickStartGuide’ifyou’renew tobridging

Identifynicheopportunities–likerefurbsor time-criticalcases

Understandhowwepackagecasestomeet theobjectives

Seeourteaminactionwithourreal-life casestudies

ICYMI: Protection Proposition overview webinars

OurregularProviderPropositionoverview webinarsrunthismonthonTuesday23and Wednesday24September.

Thesesessionsareperfectforeveryone,from newadviserswantingtounderstandeach provider’spropositiontomoreexperienced adviserslookingtokeeptheirknowledgeupto date.Eachsessionisjust30minuteslongand qualifiesforCPD(Self-serveviainsight).

Aswellasallourprotectionpanelproviders, wehavesessionsfrom:

PaymentshieldcoveringtheirGI proposition.

Curalookingathowtheycanhelpwith clientswithadverserisks.

UsayCompareexploringopportunitiesin thePMImarketandhowtheycanhelp.

CoopLegalServicesexplainingtheir propositionandhowtheycanhelpclients, startingwithafreelegalreview.

Join or register below:

·Tuesday23September: ·Aviva:23September9am (registrationrequired)

·Vitality:23September10am (registrationrequired)

·MetLife:23September11am

·Paymentshield:23September 1pm

·Legal&General:23September 2pm(registrationrequired) Cura:23September4pm

·Wednesday24September: ·Zurich:24September9am

·TheExeter:24September11am (registrationrequired)

·UsayCompare:24September 12pm

·RoyalLondon:24September1pm

·LV=:24September2pm (registrationrequired)

·Guardian:24September3pm

·CoopLegalServices:24 September4pm

Income

IIncomeProtectionActionWeekaimstohelp advisersensureclientsunderstandtheimportance ofsafeguardingtheirincomeincaseofillnessor injury.Theweekbringstogetherindustry professionals,advisers,andaffiliatestoleadthe conversationaroundfinancialresilienceand practicalprotectionsolutionsandfeaturesfree onlineeventseachdaybetween12pmand1pm.

Register here for Income Protection Action Week 2025

Housepricedevelopments

HalifaxreportedUKhousepricesrose0.3%inAugust,takingannualgrowthto about2.2%,andpushingtheaveragehomevaluetoarecord£299,330.

Meanwhile,NationwidesawaslightmonthlydropinAugust( 0.1%),withyear-onyeargrowthslowingto~2 1%,indicatingdivergenceamonghouse-priceindexes

Mortgageapprovals&marketactivity

MortgageapprovalsforhousepurchasesinJulyrosetotheirhighestlevelinsix months:~65,400approvedmortgages.

Yet,inspiteofthat,securedlending(i.e.theactualamountslent)droppedtoa two-monthlow,suggestingthatwhilemorepeoplearebeingapproved,theymay beborrowinglessonaverage.

Rates,lender/borrowersidepressures

Choiceoflow-depositmortgages(90%-95%LTV)hassurgedtoa17-yearhigh. ThesehighLTVproductsnowmakeupabout19%ofresidentialmortgagedeals.