Monday 30th June. This week's headlines:

We are pleased to confirm that the first sprint phase of improvement works has now gone live. In this Sprint

Release the following improvements have been made:

“Previously, sending subsequent Smartr cases over to ConcertHub for existing Clients (eg protection), would result in you seeing Missing Info/Blue List items for fields that you had already filled in previously for the Client record, such as Clients Contact Method. This was because the subsequent case actually overwrote the value you would have entered in the first case for the client - as it isn't captured in Smartr.

Following this change, when sending subsequent cases over to ConcertHub for existing clients, these fields will no longer be overwritten”

The second sprint due for release week commencing July 16 contains the bulk of the improvements work, with a number of fields being mapped to reduce the list further Openwork are also scheduling to include the new Zip File Document upload facility.

More information on Sprint 2 will follow as we get nearer

Every month Smartr365 make further enhancements and improvements as part of their regular release cycle and we are pleased to confirm the following have now been released to the live environment:

Advisers will now receive an immediate email notification when a case is transferred or referred to them.

Triggered instantly upon transfer or referral.

Helps ensure no case handovers go unnoticed.

Never miss a new opportunity again. System Admins, Admin Assistants, and Managers will now receive an email when a new lead is successfully created via:

QR Code submissions

Introducer referrals

Third party integrations (via Lead API)

This ensures the right team members are promptly notified and can take timely action on every potential client.

You can now search filter dropdowns to quickly locate advisers or introducers:

Advisers Filter: Search by adviser name or team name.

Introducers Filter: Search by person name, company name, or location.

We are pleased to confirm details of an exclusive Webinar for Just Mortgages advisors in July, which cover the two biggest time saving features of the system, namely; SmartrConnect & the Client Factfind.

The Fact Find and SmartrConnect are huge time savers within Smartr365. The Editable Fact Find puts the power in your hands. By sending to the Client Portal as much or as little of the factfind to the client, as well as sign off on all the documentation you need for compliance, significant time can be saved.

SmartrConnect will allow you to do DIPs and FMAs with 8 of the biggest lenders, such as Barclays, Halifax, and NatWest, also saving you significant time = no more rekeying!

To learn more about these powerful features, join Smartr365 on either of the below dates simply click on the link below when it is time (formal invite was also sent to you last week)

Tuesday 8 July 10am-11am th Join the meeting

Thursday 10 July 10am-11am th Join the meeting

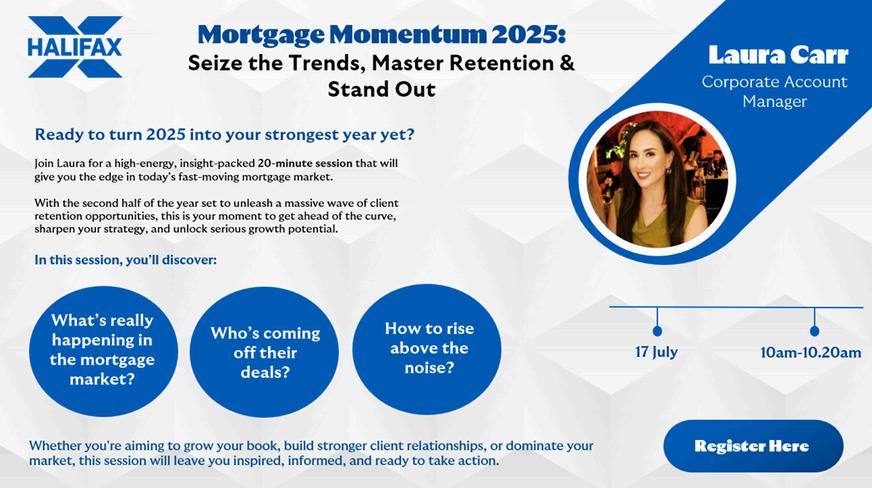

Join Laura Carr, Corporate Account Manager on the 17 July at 10am for a highly informative webinar that th will give you some incredibly useful insights into the huge client retention opportunities in H2 2025

Simply click on the graphic below to register or click HERE

From Thursday 26 June, Nationwide have increased the maximum LTV for those looking to purchase a New Build house or flat. That's for first time buyers and home movers.

Nationwide have increased the maximum LTV for New Build houses to 95% and flats to 85%.

With Helping Hand, first time buyers could borrow up to six times their income.

To give more certainty to your clients, Nationwide will be extending their offer period to 9 months on New Build properties.

g pp

Hodge has developed a dedicated customer support hub with practical guidance and resources to help you provide tailored support to achieve the best outcomes for you clients.

Did you know almost half (49%) of UK adults show at least one sign of vulnerability? Research by MorganAsh found just that, highlighting how vital it is to understand customer vulnerability - and how we as intermediaries and lenders can better support customers in vulnerable circumstances. Vulnerability can arise at any time. That’s why Hodge is committed to helping you support your customers in ways that meet their individual needs.

Hodge has developed a dedicated customer support hub with practical guidance and resources to help you provide tailored support to achieve the best outcomes. The hub includes:

• FCA guidance on vulnerable customers

• Ways Hodge supports both new and existing customers

• Contact for specialist organisations offering support and advice

Find out more by clicking below:

Introducing the Barclays Business Toolkit

Success as a mortgage adviser requires more than just great products, it demands insight, strategy, and professional development.

That’s why, through extensive feedback and focus groups, Barclays created the Business Toolkit, a comprehensive hub designed to support you and your business, every step of the way.

How the Barclays Business Toolkit supports you:

Industry insights – Stay ahead with market updates, regulatory changes, and expert research.

Business guidance – Explore sustainability, AI, and inclusion strategies.

Networking & learning – Join Learning Live discussions and access free, self-paced courses through Barclays Eagle Labs Academy.

Start exploring today by clicking below: Visit The Business Toolkit

As part of Santander’s pledge to improve the product transfer process, with immediate effect, your clients can make an ERC-free overpayment before you submit the product transfer request.

This could allow your client to get a better deal or reduce their monthly payment or term. This won’t impact their ERC-free overpayment allowance.

Santander can only allow an ERC-free overpayment with a product transfer on loans that are eligible to book a new deal. If your client wants to make an overpayment to a loan or loans that aren’t eligible for a product transfer, they can do this in the normal way.

How do you do this? You’ll find an overpayment request form in the ‘Overpayment with a product transfer’ section of our Product transfers page. Once Santander have processed the request, they will send you an email telling you your client can make the overpayment. Once Santander have processed the overpayment, Santander will email you to tell you when you can submit your client’s product transfer request.

To make it easier for your clients to accept their product transfer offer, when they click the link in the acceptance email Santander send them, the OLA reference number will automatically populate directly into the log on screen.

Santander have updated their product transfers page and frequently asked questions to reflect these changes.

th

8 July 10:30am-11:30am

Join Royal London to talk about Family Income Benefit!They have a special guest Shelley Read, who will delve into the main features of family income benefit policies, including term assurance, life or critical illness cover, and the importance of indexing income-based policies.

They will bring the concept to life with real-world scenarios, such as divorced clients, education costs, renters, and families, demonstrating how family income benefit can add value in various situations.

Additionally, they will discuss the benefits of indexation and how it helps maintain the real value of protection over time.

1.Be able to describe the main features of a family income benefit policy

2.Have a clearer understanding of the types of clients who would benefit from a family income benefit policy and how to position it

3.Have a better understanding of the importance of indexing income-based policies

Click HERE when it is time (invite will also be emailed to you on Monday 30 June) th

Whether you’re new to Zurich Life Protection or you’ve been using them for a while, Zurich’s newly developed adviser portal guide might be just what you’re looking for.

Different providers, different portals and completely different ways of working. It can be confusing.

That’s why Zurich have developed their new adviser portal guide.

Continue readin download gu

The Income Protection Task Force (IPTF) exists to raise awareness, provide education and increase understanding and sales of Income Protection (IP). Their mission is simple: to ensure that everyone understands the importance of safeguarding their income in case of illness or injury. They bring together industry professionals, advisers, and affiliates to lead the conversation around financial resilience and practical protection solutions.

In September each year the IPTF run Income Protection Action Week (IPAW), a free to attend online event taking place between 12-1pm each day.

It’s a chance to understand why IP is so important, share top tips on positioning IP and overcoming objections, to learn from peers and challenge your thinking around this vital product. The 2025 programme is packed with brilliant content to help you sell more IP and protect more clients.

22nd September:

This session will provide an overview of the market and the need for IP by way of adviser case studies and expert interviews. It will also include a mindset session for advisers.

Tuesday 23rd September:

This session will consider business protection and small group schemes via a series of expert interviews and panels highlighting the opportunity that exists within the market. We will also be revisiting objection handling with a twist!

Wednesday 24th September:

This session will consider how to make best use of the tools and resources available to advisers to help save time and maximise opportunities for business growth.

25th September:

This session will consider annual reviews in the claims context, learning how having unsuitable cover can impact at claims stage, how reviews can lead to resolving claims before they happen and how to help clients make the most of using value added services.

Friday 26th September: IP - one size doesn’t fit all

This session will consider non-traditional solutions, including ASU and customers who may be considered difficult to cover, uncovering the art of the possible.

Who should attend IPAW?

It’s ideal for both advisers and industry professionals who:

· Are new to IP and want to build confidence

· Have experience and want to refresh their skills & update their knowledge

· Want to learn from peers and understand key IP insights

· Aim to make IP central to client conversations & help improve customers financial resilience

· Are exploring related areas like business protection and Accident Cover and ASU

· Are looking to earn valuable CPD

You’ll also gain insight into who’s buying IP, who’s underserved, and why - helping you spot new opportunities to protect more customers and grow your business.

1.FCA launches mortgage rule review (25 June) – The Financial Conduct Authority issued a discussion paper (DP25/2) to explore updates to rules on responsible lending, later‐life mortgages, consumer information, and flexibility—aimed at boosting home‐ownership while managing risk

2.Interest‐only mortgages gaining traction – FCA and government pressure are prompting lenders to reintroduce interest‐only products and higher loan‐to‐value deals. In Q1 2025, 8.7% of mortgages included interest‐only elements, up from historically low levels. Debates continue around affordability and household debt.

3.Nationwide unveils 5% deposit mortgages – Starting 26 June, Nationwide will offer mortgages with just a 5% deposit for first-time buyers on new builds and reduce deposits on flats—part of wider efforts including a July relaunch of the Government mortgage guarantee scheme – see article above.

4.Market impact: mortgage rate and spending trends –Average two‐year fixed rates hover around 4.9%, while buy‐to‐let sits nearer 5.2% as of 25 June. Consumer spending on rent and mortgages grew 4.6% YoY in May— slowing from April’s 5.2%.