The South Side Weekly is an independent non-profit newspaper by and for the South Side of Chicago. We provide high-quality, critical arts and public interest coverage, and equip and develop journalists, artists, photographers, and mediamakers of all backgrounds.

Volume 12, Issue 12

Editor-in-Chief Jacqueline Serrato

Managing Editor Adam Przybyl

Investigations Editor Jim Daley

Senior Editors Martha Bayne

Christopher Good

Olivia Stovicek

Sam Stecklow

Alma Campos

Jocelyn Martinez-Rosales

Community Builder Chima Ikoro

Public Meetings Editor Scott Pemberton

Interim Lead

Visuals Editor Shane Tolentino

Director of Fact Checking: Ellie Gilbert-Bair Fact Checkers: Isabella Bonito

Patrick Edwards

Kateleen Quiles

Lauren Sheperd

Rubi Valentin

Arieon Whittsey

Layout Editor Tony Zralka

Executive Director Malik Jackson

Office Manager Mary Leonard

Advertising Manager Susan Malone

The Weekly publishes online weekly and in print every other Thursday. We seek contributions from all over the city.

Send submissions, story ideas, comments, or questions to editor@southsideweekly.com or mail to:

South Side Weekly

6100 S. Blackstone Ave. Chicago, IL 60637

For advertising inquiries, please contact: Susan Malone (773) 358-3129 or email: malone@southsideweekly.com

For general inquiries, please call: (773) 643-8533

Cover photo by Paul Goyette

Over the past couple weeks, efforts to defend communities across the country from Immigration and Customs Enforcement (ICE) agents have morphed into mass protests. Sparked by ICE raids on Home Depots and clothing wholesalers in Los Angeles on June 6 and 7, which led to demonstrations in that city that have spread to Chicago, New York, Dallas, and other cities, people have tried various methods at preventing or slowing down ICE activity, from occupying highways to blocking ICE vehicles and surrounding detainment facilities. In Los Angeles, municipal police assisted ICE by shepherding their officers and dispersing crowds, often using tear gas and rubber bullets. The scenes reminded many of the uprisings that occurred five years ago in the wake of George Floyd's murder.

On June 7, President Trump ordered 2,000 National Guardsmen to deploy in Los Angeles to suppress the protests, despite the objections of Los Angeles mayor Karen Bass and California governor Gavin Newsom. Two days later, the Trump administration also ordered 700 Marines to head to the city. As troops outfitted in combat gear and assault rifles filed into the city, Trump and administration officials said they were there to “liberate” Los Angeles from “the Migrant Invasion,” calling protesters “foreign enemies.” On June 16, Trump reaffirmed that carrying out his mass deportation agenda was the top priority of his administration and that he was preparing to send the Guard and military into more sanctuary cities, such as Chicago.

This escalation by the Trump administration has rightly sparked fears about an increasingly authoritarian response to protest and the unprecedented use of military force against American civilians. Trump might be testing out how far he can go with deploying the military to serve his domestic aims; today it's assisting ICE operations against immigrants, tomorrow it might be instituting martial law and election interference. A federal judge ruled on June 12 that Trump’s order was illegal, going against the 10th Amendment, and control of the National Guard in Los Angeles should revert back to California; later that day, that decision had been blocked by the 9th U.S. Circuit Court of Appeals.

In Chicago, people have likewise attempted to block ICE vehicles and operations at offices in the Loop while continuing to lookout for ICE operations through the city and suburbs and spreading the word through local channels. Like in Los Angeles, municipal police—CPD—have apparently coordinated with ICE by protecting their officers and facilitating their operations by holding back or dispersing protesters. These actions raise questions about whether CPD violated the TRUST Act, which prohibits municipal and state police in Illinois from cooperating with federal immigration authorities like ICE. But they also raise questions about the limits of such laws. As mayor Bass said about the LAPD response, “When one branch of law enforcement says they need help, another branch of law enforcement is obligated to respond.”

In this era of increasing authoritarian oppression and resistance, organizers leading the way have emphasized the need to build mass organized political movements. That can start small and local; it might look like participating in a mutual aid network near you, or volunteering in an ICE watch group, or even getting to know your neighbors so that if they—or you—need help, you all have more people to call on.

the rink glides into its 50th year Illinois’ only Black-owned roller rink preserves culture and celebrates community in Chatham.

jasmine barnes ........................................ 4

south side sports roundup

The latest results and other news from the Chicago sports world.

malachi hayes ......................................... 6

who benefits from a snap curfew?

What giving police unchecked powers to detain teens means in authoritarian times.

robert vargas 7

public meetings report

A recap of select open meetings at the local, county, and state level.”

scott pemberton and documenters .... 8 impact of artist visa denials ripples through community

Uncertainty for Mexican artists under the Trump administration led to Miche Fest’s cancellation, which means loss of jobs and income for dozens of local vendors.

jocelyn martinez-rosales 9 no due process: inside ice’s deceptive arrests in chicago

Immigrants complying with monitoring were arrested without warning at a South Loop office.

josé abonce 11 dentro de las detenciones engañosas de ice en chicago

Los inmigrantes que cumplían con los requisitos de supervisión fueron arrestados sin previo aviso en una oficina de South Loop. por josé abonce traducido por alma campos .......................................... 13

chicago joins wave of anti-trump protests

Photos from last Saturday’s ‘No Kings’ protest in the Loop.

paul goyette and jacqueline serrato 14 ‘granny flats’ are illegal to build in most of chicago

Accessory Dwelling Units (ADUs) or “granny flats” are illegal to build in most of Chicago, but a pilot program allowing them in some areas showed promising results.

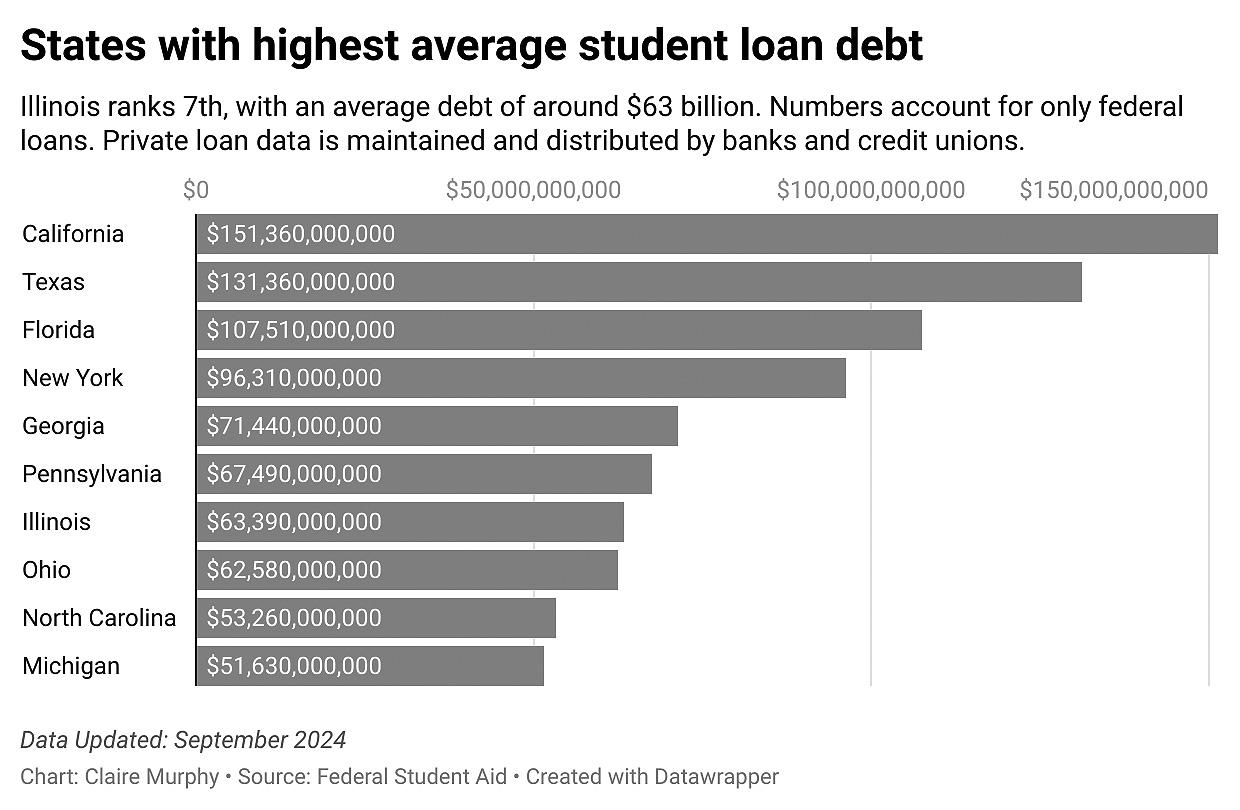

alex nitkin, illinois answers project 16 the graduate’s burden: how illinois is confronting the student loan crisis

With $63 billion in collective student loan debt, new forgiveness programs and innovative solutions aim to help borrowers. But state funding and public awareness remains an obstacle. claire murphy, illinois answers project .................................... 19 cook county medical debt help comes too late

Data shows the majority of medical debt relief was for people who likely should have qualified for free care. binghui huang, illinois answers project .................................... 23 juneteenth calendar Juneteenth events! chima ikoro ........................................... 27

BY JASMINE BARNES

Ramona Pouncy can vividly recall the red and black patent leather skates her mother and father wore when they took her as a child to The Rink’s original location on 89th and Ashland for family skate nights.

“We would skate together,” said Ramona, who is now the co-owner of the roller rink she grew up skating in. For her, The Rink has always been a multigenerational, familial space. It’s played a critical role in her family’s lives and served as a community hub in the Chatham neighborhood for half a century. Her husband and business partner, Curtis Pouncy, remembers coming with friends as a teenager to skate and, at times, frequenting The Rink two or three times per week.

The couple purchased The Rink from the original owners in 2019, navigated a temporary closure during the pandemic, and later completed major renovations and improvements. With that in mind, making it to the Rink’s 50th anniversary in June is both a personal and communal victory.

Since taking over, the Pouncy’s have stayed committed to preserving the best of the past and continuing to invest in innovations meant to serve the holistic well-being of the community.

With the closure of many Illinois skate rinks including Orbit Skate Center Palatine in 2018, Lombard Roller Rink in 2023, and Glenwood Roller Rink this year, The Rink is a staple not just on the South Side but in the region. In fact, The Rink remains the only Black-owned roller rink in the state of Illinois.

On June 7th, beloved Chatham native, Chance the Rapper took to Instagram during the Rink’s 50th anniversary weekend to give a shout out to the space that he calls “a powerhouse in our community.”

While the reality of roller rinks closing across the country remains true, the rise in skating during the isolated days of the COVID-19 pandemic led to a nationwide resurgence in interest, especially among young people.

The entrance to The Rink is easy to miss for anyone who’s not already a regular. As you drive down 87th street, the turn onto a rough gravel driveway leads to a large parking lot behind an industrial building. The roller rink entrance is a small red door with a white sign that reads, “Welcome to The Rink.”

After purchasing a ticket—only $8 on Fridays without a skate rental—a metal detector serves as a threshold between the outside world and the roller rink.

“This is a safe space, and we're going to keep it as a safe space,” said Ramona.

There’s a current of trust that travels throughout the building. New lockers line the wall—an improvement implemented

by the Pouncy’s—but most remain unlocked with some people even leaving bags on top of the lockers.

Young couples venture from the smaller rink for less experienced skaters to the main floor, sheepishly holding hands. A referee in a black and white button-down blows her whistle at rowdy kids. Parents record their children trying new skate tricks. Friends gossip and eat snacks near the concession stands.

The soundtrack of The Rink reflects the many generations present. While older couples skate in slow unison to “Stars” by Kindred the Family Soul and teens perform TikTok dances on skates to “Hellcats SRTs” by Sexyy Red, no one can resist dramatically mouthing the chorus of “Love” by Keyshia Cole.

The smooth moves of JB skating are brought to life by young and senior skaters. The artistic skating style was created by Chicagoans in the 1970s who wanted to mirror the dance moves of James Brown. Skaters show off signature

moves: the “big wheel,” “gangster walk,” “crazy legs,” and “criss-cross.” Dressed casually in hoodies, jeans, and jerseys, skaters balance on one foot, crouch low to the floor, and skate backwards with ease.

When Nate Simpson and Carmen Simpson opened The Rink on June 10, 1975, skating was a central part of Black social life, especially in Chicago. For over forty years the couple owned what became a hub for community celebration; birthdays, graduations, and anniversaries. In 2019, with ticket sales at a low and retirement on the horizon, the Simpsons approached the Pouncy’s, who were already experienced business owners, to see if they were interested in purchasing The Rink and continuing its legacy. At first, the magnitude of the ask was overwhelming.

“We had no intentions of acquiring The Rink,” said Ramona. “We were just skaters like everybody else and we were just trying to help once we heard that it might be closing.”

For months, the Pouncys supported Nate with applying for grants to help offset the cost of repairs and business expenses, but the reality of The Rink’s financial situation and the amount of work needed to remodel was too daunting for the Simpsons to take on. At one point, the Simpons seriously considered selling to a trucking company that would repurpose the skating rink for their corporate offices. Curtis knew that decision would “devastate the community.” The Pouncy’s recognized the importance of the Rink as more than just a place to skate on the weekend.

“We need[ed] to pray about this and count the costs,” said Ramona. “When we decided that this was something that we wanted to do, the deal closed in three weeks.”

In 2019, the Pouncy’s took over ownership of The Rink with the intention

of giving skaters “a place that they can be proud of,” said Curtis.

The first few years were challenging. The COVID-19 pandemic shut down the roller rink for months in 2020, and a much needed remodel closed The Rink for a little under a year starting in 2021. Since its reopening in September 2022, The Rink has boasted new carpeting, flooring and lighting, fresh paint, and repairs to the building’s exterior. Despite all the changes, it’s also sustained a communal culture.

“It's more like a family environment, and we want to be able to to keep it as a family environment and at the same time [are] running it as business,” said Ramona. “There's that corporate, business side, but [there’s] also that emotional side that you develop with your skaters.”

Friday nights feel particularly lively, with the Family Skate welcoming teens and children to take to the floor.

Jasmine Bis, a community member and regular at The Rink, has been bringing her nine-year-old son for Family Skate Nights regularly since October. After attending a birthday party at the roller rink, she noticed his excitement for skating and thought coming more regularly might offer him a healthy social activity outside of school.

In the last five months, they’ve only missed a handful of Friday skate nights. “No matter how tired I am, no matter what's going on, we gotta go skating,” said Bis.

“What can we do to positively impact our community, at large?” said Ramona. This is a question she ponders regularly when thinking about ways to make The Rink a space that serves the many needs of the neighborhood.

Ramona noticed during the pandemic that people weren’t able to see their physicians. When it was safe for folks to gather again in person, she began hosting nutrition classes every week, focusing on diet and exercise as natural remedies to health care issues. Ramona provided cooking demos and tested recipes with class attendees. The fan favorites eventually ended up as healthy alternative options on The Rink’s concession menu including her smoothies, salads and sweet potato nachos.

during the 50th Anniversary Glow In the Dark celebration on June 7. Ramona interviewed the four selected muralists— Jess Patterson, Dreama Dickerson, Araic Anderson, and AJ Brown—on The Rink’s Instagram to shine a light on their artistry.

For parents like Jasmine Bis, observing the youth and their creativity and talent brings her joy during her regular weekend visits to The Rink.

“It warms my heart,” said Bis. “These are kids that probably picked up skating three [or] four years ago. They learn fast and they pick it up really fast, even my son. It's just amazing to see what they can do in such little time.”

“Some of these youth we see are probably doing trends from downtown [teen takeovers], but on Friday night, they’re skating,” said Bis. “It's a safe place, a safe environment, to keep them out of trouble.”

For Ramona, The Rink exists as a space that holds endless possibilities for community care and outreach. As a certified nutritionist, she’s leveraging the recreational space as a way to bring holistic wellness to her community.

“You can still get your pizza [and] your hot wings and all that, but you can have a green drink with it,” she said.

She envisions creating more programs to “uplift our youth” like tutoring to offset the negative toll the COVID-19 pandemic took on students. The Rink recently had an event for Autism Awareness month in April and has been working with a local second chance program that supports previously incarcerated people.

To support the talents and creativity of local artists, The Rink opened a contest for mural ideas that would be featured

A big part of the family feeling at The Rink is the legacy and tradition of JB skating culture that’s been passed down through the generations. The Rink continues to teach and promote the unique skating style by providing affordable skate lessons designed for all ages. As parents like Bis introduce their children to the skating tradition, those unique cultural elements are not only sustained, but grown.

When asked about their dreams for the future of The Rink, the Pouncy’s simply hope it continues to remain open and serve the community with a high quality roller rink experience. It’s especially important that each skater knows how essential their support and use of the space is.

“You support this rink, we're going to be here,” said Curtis. “If you stop coming—you stop supporting this rink— we don't have any customers, we're not going to be here.”

Near the front of the building, a decades-old Wall of Fame featuring the portraits of dozens of skaters hangs above the lockers. The faces of skating regulars from over the years light up under the glowing twinkle lights strung across the photographs.

“This is a magical place,” said Ramona. The magic isn’t in the music, or the skates, but the people whose love for The Rink continues to carry it forward. ¬

Jasmine is a writer, facilitator, and community builder living in Hyde Park. You can learn more about her work at www.jasbarnes.com.

BY MALACHI HAYES

Welcome to the South Side Sports Roundup! Check back every month for the latest news and updates on everything South Side sports fans need to know.

White Sox Show Modest Improvement; Reinsdorf Outlines Future Ownership Plans

The bar is low, but the White Sox have finally shown small signs of life in recent weeks, with performances from several young players offering glimmers of hope despite a league-worst record. They’ve gone 7-6 over their last two homestands after suffering a three-game sweep to the NLleading Cubs at Wrigley Field in mid-May.

Leading the charge has been infielder Chase Meidroth, who ranks in the top five among AL rookies in batting average, hits, walks, and OPS. Acquired as a secondary part in the trade that sent Garrett Crochet to Boston, Meidroth is poised to become a fixture in the Sox infield for the foreseeable future.

Similarly, rookie Shane Smith continues to be the team’s most effective starter in his first big league season. Smith ranks second among AL rookies in ERA (2.37) and strikeouts (64), and third in WHIP. He’s making an excellent case to represent the Sox in July’s All-Star Game.

Speaking of the Crochet trade, the centerpiece of the Sox’ end of the deal is officially in the major leagues, as catcher Kyle Teel made his MLB debut on June 6. Considered one of the top catching prospects in the league, Teel hit .295 with eight home runs in Triple-A Charlotte before receiving the call. He and fellow rookie Edgar Quero will be counted on to hold down the catcher’s spot on the South Side for several years to come.

Of interest off the field, White Sox owner Jerry Reinsdorf announced earlier this month that billionaire investor Justin Ishbia, who purchased a substantial minority stake in the club earlier this year, would be given opportunities to purchase a controlling stake in the team beginning

in 2029 and concluding in 2034. While Reinsdorf has refused to call it such, the move has been widely interpreted as a succession plan for the 89-year-old, who has owned the White Sox since 1981 and NBA’s Chicago Bulls since 1985.

Offseason declarations of progress for the Chicago Sky seem to have been premature. They’ve won just three of their first 10 games of the 2025 season, their first under newly hired head coach Tyler Marsh. Their season opener against the Indiana Fever on May 17th attracted a WNBA-record 2.7 million viewers, but it resulted in a 35-point Sky loss, the first of three defeats of 25+ points through less than a month of play. That’s tied with the 2-8 Connecticut Sun for the most such losses in the league, and certainly not the positive step forward that fans hoped to see early in the season.

“You’ve got to continue to look at the positives for each game,” Marsh told the media after the Sky’s June 10 rematch with the New York Liberty, an 85-66 walloping in front of millions of viewers on ESPN and ABC. “We continue to compete,” he continued. “Once you lose the passion or will to compete, that's the time to worry. We're still putting forth that effort and passion for one another.”

Second-year star Angel Reese notched her first career triple-double against Connecticut last Sunday, a 78-66 win for Chicago. Visible improvements in her playmaking and defense hasn’t quite made up for the regression Reese (10.4 PPG, 11.9 RPG, .357 FG%) has suffered in her overall stats after a record-breaking rookie season, but it is a promising sign nonetheless. Poor team-wide defense has been the primary culprit for the Sky’s struggles, however. The 87 points allowed per game is their worst since 2018, and the offense has been completely disconnected, ranking 12th out of 13 in points scored.

The Sky play at the Wintrust Arena

twice in the coming week, first on Saturday against the Phoenix Mercury, followed by a Tuesday evening bout with the Los Angeles Sparks.

The Chicago Bears revealed their schedule for the 2025 season last month, headlined by a Week 1 Monday Night Football bout with the division-rival Minnesota Vikings to open the year. They’ll also get a Week 5 Monday Night Football rematch with the Washington Commanders a year after a now-infamous last-minute loss sparked a 10-game Bears losing streak that cost head coach Matt Eberflus his job. Rounding out their prime time schedule is a visit to the defending champion Philadelphia Eagles on the Friday after Thanksgiving.

By opponent win percentage, the Bears have the second-toughest schedule of all 32 NFL teams, making a tough hill to climb for ascendant second-year quarterback Caleb Williams. Speaking to the media at this month’s offseason minicamps, Williams reaffirmed his commitment to the Bears after a controversial report emerged detailing his efforts to avoid being drafted by Chicago. Williams and his family reportedly had major concerns about Eberflus and offensive coordinator Shane Waldron, concerns that were ultimately borne out when the pair were dismissed amid an up-and-down campaign for the rookie signal-caller.

“Those are thoughts that go through your head in those situations,” Williams admitted to media members at Bears minicamps earlier this month. “[But] after I came on my visit here, it was a deliberate [and] determined answer that I wanted to come here.”

One challenge that will not be surmounted, however, is the one that involves breaking through the barriers required to build a new stadium on the lakefront. The Bears released a statement last month, originally reported by the Chicago Tribune,

revealing that the team would be shifting their longstanding hunt for a new stadium back to Arlington Heights. They purchased a $200 million tract of land several years ago in the suburb in 2023.

This comes more than a year after Mayor Brandon Johnson championed a proposal from the team for a stadium on Chicago’s lakefront, a proposal that was all but shot down last year amid nearly unified opposition from state lawmakers and lakefront advocacy groups. Johnson acknowledged to the Chicago Sun-Times that the team had informed him of their decision to move on, despite his support. That being said, he added, “the door remains open to Chicago.”

Whether the Bears and state lawmakers—whose approval is required for the public funding the team has asked for— agree with that sentiment remains to be seen.

The Kenwood Broncos took home their second CPS championship in top-division baseball last month with a dramatic, lastsecond 10-9 victory over north siders Lane Tech at UIC’s Curtis Granderson Stadium. Led by Hyde Park-Kenwood Legends youth baseball alumnus Brandon Stinson, who went 5-for-5 and recorded the game-winning hit, it was Kenwood who came out on top this time after falling in heartbreaking fashion to Lane in last year’s championship. Kenwood’s first championship came with a win over Walter Payton in 2023. They’re the second South Side team to capture a championship since the resumption of play following the canceled 2020 season, as the Morgan Park Mustangs took home the title in 2021. Moving forward, other South Sides teams looking for similar athletic success may consider a horse-themed mascot as a potential factor in such victories.

Malachi Hayes is a Bridgeport-based writer and South Side native.

What giving police unchecked powers to detain teens means in authoritarian times.

BY ROBERT VARGAS

As the National Guard and U.S. Marines take up posts in Los Angeles to respond to protests over the Trump administration’s deportation efforts, a dangerous message is spreading from coast to coast: public safety no longer belongs to the public. In Chicago, we are watching this logic take root in a quieter but equally alarming form. A proposed ordinance would give the Chicago Police Department the unilateral authority to impose “snap curfews” on teens, with no oversight and no clear rules.

Supporters of the measure say it’s about public safety and containing chaos. But history—and data—tell us otherwise. The expansion of unchecked police powers, whether through curfews or militarized deployments, rarely serves the public interest. It consolidates authority in ways that reduce accountability and increase the risk of discriminatory enforcement. In Chicago, these dangers are compounded by another, largely invisible threat: the growing influence of private money in policing.

The debate over whether to pass Chicago’s snap curfew ordinance unfolds at a time when an alarming trend is on the rise, namely: private donations to police departments. Through tax-exempt foundations and nonprofit shells, police

departments across the country, including in Chicago, now receive millions of dollars in unregulated private funds each year.

My team’s analysis of national tax records revealed that following the 2020 protests, private donations to police reached a historic high total of $550 million. These donations did not respond to rising crime rates or budget shortfalls. They were in response to protests and, in effect, funded resistance to police reform and abolition efforts. An unregulated system of donations extends police power and incentivizes abuse. It allows police to act unilaterally and without the approval or funds of local governments, all while having a slush fund to pay for lobbyists and pilots of surveillance technologies.

Chicago is no exception. Local corporate sponsors have quietly funded surveillance tech, public relations campaigns, and even equipment purchases. In one case, after 7-Eleven donated to the Chicago Police Foundation, officers made 389 more stops at the convenience store chain’s locations compared to similar businesses the following year. This was not coincidence—it was influence.

If the snap curfew proposal passes, CPD could declare emergency curfews for minors without prior approval from the mayor, City Council, or police

district councils. The potential for harm is enormous: curfews have long been enforced disproportionately against Black and Brown youth, and the new plan offers very minimal transparency.

Worse, we risk combining two threats: expanded policing powers, and growing private influence. What happens when police departments with unregulated donor relationships are granted emergency powers? Who will they serve when a sponsor’s retail hub is under threat from teen loitering? What happens when a donor calls for a crackdown during a protest that challenges their business interests?

These are no longer theoretical concerns. For example, in St. Louis, a police foundation literally pays part of the police chief’s salary. In Arizona and Illinois, billionaire donor Howard Buffett used his philanthropy to obtain a badge, weapons, and real operational authority.

A snap curfew, in this context, is not just a policy—it is an invitation for the wealthy to write a blank check. And in a city like Chicago, with a long history of racialized policing and political corruption, we should be far more cautious about who gets to fill it in.

We’re on the Verge of a Privatized Security State

The events in Los Angeles offer a glimpse of what happens when elected officials reach for armed force first and democratic

processes last. But the militarization of public safety doesn’t always come in fatigues and Humvees. Sometimes it comes dressed as policy, passed through rushed legislation and funded by donors whose names we don’t even know.

Chicago’s proposed snap curfew ordinance is a local version of the same authoritarian drift we’re seeing in cities like Atlanta—one where public institutions and public lands are hollowed out and replaced by private interests seeking favors from police.

If we want policing that truly serves communities, the answer is not curfews or crackdowns. It’s transparency, accountability, and a hard line between public authority and private influence.

We’ve been here before. In the 1920s, Al Capone held significant influence in the Chicago Police Department—not through violence, but through cash. Today, he wouldn’t need to break the law. He’d just start a foundation, lobby the City Council to pass ordinances he could weaponize, and write a check. ¬

Robert Vargas is Professor of Sociology and Director of the UChicago Justice Project.

illustration by Holley Appold/South Side Weekly

A recap of select open meetings at the local, county, and state level.

BY SCOTT PEMBERTON AND DOCUMENTERS

May 21

At its meeting, the Chicago Police District 007 Council—Englewood (covering Gage Park, Auburn Gresham, Chicago Lawn, Englewood, Greater Grand Crossing, West Englewood) heard from Dion McGill, who serves on the nominating committee. He reviewed the Felony Review Bypass Program, which was initiated by the State’s Attorney’s office to reduce roadblocks in connection with low-level gun possession charges. This pilot initiative allows some CPD officers to file certain felony gun possession charges directly without review by a Cook County State’s Attorney. The usual process is for police officers to call prosecutors to alert the office to a potential charge, provide the necessary facts, and then wait for a prosecutor to call back with a yes or no as to whether charges are warranted. This process can take several hours, which can also take officers off the street. District Council Member McGill expressed concern that District 7 Council members were not even aware of this program until a community member circulated a press article about it. “I feel like this is a cut of due process,” he said. An invited speaker from the Chicago Police District Council 2, Alexander Perez, that council’s community engagement member, explained the District Strategic Plan (DSP) and its significance. “How do you know these plans are taking place?” an audience member asked. Perez said that more community input is needed and made two explanatory documents available at the meeting. One is a brochure, “Help Your District Council Improve the Police District Planning Process.” The other is “Community Input Handout on CPD’s Strategic Planning Process.” Twenty-two district councils were created by the Chicago City Council in 2021, according to the committee’s web page.

May 29

Should CPD officers be allowed to make “consent” searches of vehicles they stop? If so, under what circumstances? Conflicting answers to those two questions were debated at a meeting of the Community Commission for Public Safety and Accountability (CCPSA). The answers turn, in part, on interpretation of the Constitution’s Fourth Amendment, which protects individuals from “unreasonable searches and seizures” by the government, noted CCPSA Executive Director Adam Gross. Disagreements existed not only among members of the Commission but also among members and CPD. In certain instances police can search a car without consent, including when they have a search warrant or specific information to suspect a car might contain evidence related to a crime, Gross said. Without a warrant or enough information to justify a search, officers can still conduct a search if they have a driver’s permission— in other words, their “consent.” CPD doesn’t have a policy spelling out when and under what circumstances a consent search may be conducted, Gross said: “If a police

officer pulls over a car, they have a lot of discretion about whether to ask to do a consent search… For example, an officer could ask to do a consent search if they just suspect there’s evidence of criminal activity in the car. They don’t currently need anything more specific.” Some commissioners want a stricter requirement; others want written forms. “Consent searches are essentially a short cut,” said Commissioner Aaron Gottlieb. “They’re a way around having probable cause [and] they have been shown to be incredibly ineffective and inefficient… They’re also among the most racial disparate policing tools that exist. From my perspective, they should be used rarely.” A policy would require sign-off from the Illinois Attorney General and the designated independent monitor, who oversees CPD’s adherence to the department’s federal consent decree, which stipulates reforms to be implemented by CPD.

Chicagoans might not know if their groceries will be taxed in 2026 until after October 1, when the City Council must vote to continue the tax or let it expire. At its meeting, the City Council Committee on Finance: Subcommittee on Revenue reviewed the issues. With the city staring down a one billion-dollar budget deficit next year, the argument is strong to hang onto the eighty million dollars Mayor Brandon Johnson’s budget team expects the tax to bring in. The Council must decide because a statewide one percent grocery tax is to be scrapped as of January 1. But individual towns and cities can keep the tax, and many already have. One argument for cities to retain the tax is that consumers are used to paying it and will not notice any new adverse effects. On the other hand, the tax is regressive and hits lower income households harder than wealthier ones. During the meeting, the subcommittee members discussed the broader issue of taxation policy. Some Council members supported progressive taxation in which wealthier residents are taxed at higher rates. “A lot of the taxes we’re talking about here today are still a burden on working-class people, on poor people, on small businesses,” said newly appointed Council Member Anthony Quezada (35th Ward). “We all have our fair share to pay, but we continue to leverage this burden on working-class people… we should be really examining how we make the wealthiest people in our state pay their fair share.” Right now, the flat rate for all income levels is 4.95 percent. Quezada recalled the failure of an attempt at progressive taxation in 2020, the Fair Tax Amendment. The current one percent tax specifically applies to “food prepared for consumption off the premises where it is sold.” Groceries purchased with SNAP benefits are not taxed.

Chicago’s Uber and Lyft drivers demanding safety standards, a living wage, and decent working conditions dominated the public comment portion of a Chicago City Council Committee on Finance meeting—even though the topic was not on the committee’s agenda. Specifically, public commenters were supporting the Chicago Rideshare Living Wage and Safety Ordinance, which covers many of the drivers’ concerns. The drivers are also seeking more transparency by Lyft and Uber in fares and deactivation processes. The issue falls more directly under the Council’s Workforce Development Committee, chaired by Alderperson Michael Rodriguez (22nd Ward), who sponsored the proposed ordinance in 2023. A vote on the measure by the Workforce Development Committee was anticipated in the near future. If passed by the full Council, the ordinance would also create a public assistance fund and an appeals process for drivers facing suspensions. One commenter, a ride-share driver who said he had ten years of experience including 27,000 rides, said there have been discrepancies with Uber not only with underpaying drivers, but also overcharging passengers.

This information was collected and curated by the Weekly in large part using reporting from City Bureau’s Documenters at documenters.org.

Uncertainty for Mexican artists under the Trump administration led to Miche Fest’s cancellation, which means loss of jobs and income for dozens of local vendors.

BY JOCELYN MARTINEZ-ROSALES

After seven years of the Michelada Festival and its relocation from Pilsen to Oakwood Beach in 2024, the beloved community event had to cancel this year's festivities. In a sudden announcement last month, festival organizers pointed to “uncertainty around artist visas and the shifting political climate” for the cancellation.

The fallout of an up and coming

Chicago music festival underscores how current immigration policies are not only disrupting cultural exchange but also straining local labor and stoking fear within immigrant communities.

“We wanted to be responsible with not only the kind of experience that we give [festival goers], but also their hard earned dollars,” Miche Fest co-founder and owner Fernando Nieto said. “If we’re

going to pull the plug, it’s now, rather than two, three months from now.”

The grassroots South Side festival, which was slated to be held in July, began in Pilsen’s Harrison Park, boasting local mariachi bands and asking attendees for a suggested donation. Last year, the festival moved to Oakwood Beach, upping the scale of the event but still managing to harness community spirit.

Through the years, the lineup has grown to feature artists like Kali Uchis and Junior H while uplifting local talent like Los Kbros and DJs from the likes of Nanoos and Mo Mami. Art installations curated by South Side artists like Sentrock highlighting the vibrancy of Chicago culture became the backdrop for the sounds and smells; at the center of it all, however, always remained the

What happened since Chicago closed 50 public schools in 2013?

Beyond Closure documentary retraces the history of the largest mass school closures in the U.S. history highlighting the inter twined issues of inequity, racism, and injustice. Three closed schools showcase a new pathway - the one of community self-determination. Through the voices of community members on community impact, their setbacks and wins towards redevelopment.

michelada.

“It's a perfect representation of our culture,” Big Mich co-founder Javier Garcia said. “When you're able to make someone a michelada, you're going out of your way to squeeze some limes, put the ice in, rim the glass, make sure the beer is cold, the presentation—it's a sign of love.”

The michelada is a spicy Mexican drink, often made with tomato juice, lime, salt and beer with variations depending on the person’s palate. In recent years, local companies across the city have sprouted by either hosting pop-up events or selling their homemade mixes in jars. For many, Miche Fest was a way to introduce their product to the market.

“[Miche Fest] gave us a springboard. They gave us an opportunity to have a platform for like-minded individuals,” Garcia said.

Garcia founded Big Mich alongside his wife Natalie in 2017, just two years prior to the inaugural Miche Fest. Big Mich has had a stand every year since and has now expanded to sell their products in over 500 retailers across the country. This magnifies the impact that the cancellation of Miche Fest has on the community and the ability it provides for small businesses to expand and grow alongside each other.

“We started as a street festival with four team members, and now we have about twenty independent contractors on our team,” Nieto said. But their influence stretches past the core festival team to the vendors seeking involvement to the people outside festival grounds selling homemade merch out of their trunks.

“We hire small businesses that provide our generators, our sanitation, our security, our tent companies…We hire Latino owned, small, independent companies. And so it was a hard conversation letting them know that, ‘hey, we're not doing the event this year’,” Nieto said.

“We pump a lot of hundreds and hundreds of thousands of dollars into community reinvestments through these contracts,” Nieto added, emphasizing how deeply the festival’s operations are rooted in local economic ecosystems.

The current Trump administration launched an “unprecedented crackdown” on immigration that began on day one.

With the goal of deporting one million immigrants annually, Trump has created a spectacle fueled with fear.

Before Miche Fest was canceled, Los Alegres del Barranco were part of the initial lineup. Within 24 hours of dropping confirmed artists on their social media platforms, festival organizers had to replace the Mexican regional group because their visas were revoked after a performance in Jalisco, Mexico.

At that performance, the group projected the image of a notorious cartel leader mentioned in the song, potentially breaking Mexican laws that have been enacted to combat narco/cartel culture.

“I’m a firm believer in freedom of expression, but that doesn’t mean that expression should be free of consequences,” wrote U.S Deputy Secretary of State Christopher Landau in a post on X.

Mexican regional artist, Julion Alvarez, took to his Instagram account to let his fans know via video that his and his band’s visas were revoked— despite his music being overwhelmingly love songs. Alvarez was due to perform at a sold-out show in Arlington, Texas. Grupo Firme, another Mexican regional talent, had their visas suspended late

Miche Fest organizers created a resource page on their website equipped with information on legal aid, know your rights information and more. “When we say we’re ‘From Chicago, for Chicago,’ we mean it. This isn’t a marketing line for us. It’s what we stand for,” they posted to their official Instagram.

For over four decades, Chicago has been a sanctuary city, with laws that prohibit local law enforcement from cooperating with federal immigration agents, inquiring about immigration status, or detaining individuals based solely on their immigration status.

“It saddens me. Chicago has been very supportive of us being a sanctuary city, and I believe that we have done our part to support all communities, and it's just very unfortunate what we're seeing coming out of Washington, D.C.,” said 4th Ward Alderman Lamont Robinson. The 4th Ward was host to Miche Fest last year.

last month causing them to miss their scheduled performance at La Onda Fest in California.

The administration's policies are trickling down, affecting not only artists' visas but leaving many wondering if ICE raids could be a possibility at community events. Places traditionally protected from ICE raids like churches and schools have now been authorized to be targets for federal immigration authorities.

“We asked the city, and we asked Chicago police, very candidly, what does it look like if ICE shows up at an event that's free versus a hard ticket event that's gated and private,” Nieto said. “And to be quite honest, they really didn't know.”

This uncertainty is being felt in other parts of the country. In South Carolina, the Latino fan base of the Nashville Soccer Club, la Brigada de Oro, posted on social media that they would be canceling their tailgate activities due to recent ICE operations in the area. ICE also showed up at the Santa Fe Springs Swap Meet detaining several people and detained a high school student in Massachusetts on his way to volleyball practice. ICE is not targeting “criminals,” as they claim, but infiltrating all aspects of people’s daily lives.

Robinson also highlighted the financial hit the Chicago Park District is taking due to the two-day festival’s cancellation—a ripple effect that’s now impacting local jobs and the broader economy.

Despite the uncertainty, organizers remain undeterred. Earlier this month, Miche Fest held its first iteration in El Paso, and its parent team continues to build community through events like the Margarita Festival in Pilsen, Michelada 5K and upcoming Mas Flow 5K.

“We're still just South Side kids doing this event at the end of the day,” Nieto said, emphasizing that neither policy nor fear can erase their roots or their mission.

For Garcia and others, the festival may have paused, but the culture behind it hasn’t.

“I don't want to be cheesy, but la gente unida, jamás será vencida,” Garcia said. “Nothing can take us down.” ¬

Jocelyn Martinez-Rosales is a Mexican American independent journalist from Belmont Cragin committed to telling stories from communities of color through a social justice lens. She is also a senior editor at the Weekly.

On June 4, ICE agents arrested a community organizer and mother, Gladis Yolanda Chavez Pineda along with at least nine others in Chicago’s South Loop. A petition urging her release has drawn over 10,000 signatures.

BY JOSÉ ABONCE

On the morning of Wednesday, June 4, immigrants arrived at the Intensive Supervision Appearance Program (ISAP) office in Chicago’s South Loop after they received an unexpected notice to appear for a check-in appointment. Apparently, it was a trap.

These ten people, who had been complying with U.S. Immigration and Customs Enforcement’s surveillance, according to advocates and attorneys, were detained on the spot by ICE officials in what witnesses described as a chaotic scene.

ISAP, an alternative to immigration detention, is managed by private contractors under the oversight of ICE. It requires individuals in deportation proceedings to comply with strict monitoring conditions such as ankle bracelets, phone surveillance, and regular in-person check-ins while people remain in the community as their case progresses.

Attorneys from Beyond Legal Aid and members of Organized Communities Against Deportations (OCAD) who accompanied clients that day said ICE agents broke from usual protocol by denying them entry to provide legal support or interpretation. Individuals arriving for their check-ins were handcuffed without warning, according to witnesses and organizers.

Advocates and elected officials positioned themselves in front of building exits to keep ICE from taking those they detained. Some family members cried as they were separated from their loved ones. Others scrambled to understand what was happening as ICE officers moved quickly to remove those they detained, placing them into unmarked vans and taking them away.

As the crowd of demonstrators grew, the Chicago Police Department was called and conducted crowd control.

Word of the detentions spread fast. Later that week, on June 6, supporters gathered at the Broadview Processing Center, in Broadview Illinois, where immigrants were taken. Activists and family members demanded the release of those taken and to raise awareness about what they call a deceptive and unjust enforcement tactic.

There were no signs, no official markings, nothing to indicate that this was where ICE processed people after an arrest before transferring them to out-ofstate detention centers. Masked men in unmarked white vans and black sedans moved in and out through a barbed-wire gate nearby.

“We are here to demand the liberation of Gladis Yolanda Chavez Pineda,” said Antonio Gutierrez, member of OCAD. “And for the liberation of everyone who has been detained and who are presently in the building behind me,” he said.

Chavez Pineda, a mother and organizer with OCAD, is one of the ten individuals that were detained during routine checkins at the ISAP office on June 4.

According to AJ Johnson Reyes, attorney and part of Cahvez Pineda’s legal team with Beyond Legal Aid, Chavez Pineda received a last minute notice to appear for an appointment the Monday before, June 2, via the ISAP app on her phone that she used to do weekly video calls as part of her ISAP check-ins.

Gutierrez said it was “odd” because she had just shown up at an appointment two weeks ago and had been fully compliant with her check-ins.

Chavez Pineda was detained that day and was not able to be located for two days. According to officers at the processing center, they had not been able to keep up with updating their records because of the number of detentions that had occurred over the span of two days, said Chavez Pineda’s legal team after being let in to see Chavez Pineda.

This new enforcement tactic comes as the Trump administration set goals for ICE to make an increasing number of daily arrests. These heightened enforcement actions that include the deployment of the National Guard in California and threats by the administration to deploy them in Illinois, contributed to sparking mass protests across the country demanding an end to deportations and detentions.

33rd ward Alderperson, Rossana Rodriguez-Sanchez, witnessed the ICE enforcement actions on June 4 and spoke out against ICE’s tactics that resulted in Chavez Pineda, a constituent and neighbor, being detained.

“It’s very important to point out that constitutional rights are being violated right now. We're all watching as constitutional rights are routinely violated, there is no due process and everybody deserves due process under the Constitution,” RodriguezSanchez said.

ICE claimed the ten individuals they detained at ISAP had final orders of removal, meaning an immigration judge has determined a non U.S. citizen must leave the country. However, Xanat Sobrevilla from OCAD said otherwise.

“It’s a lie. The people here are all not in final orders of removal. They are folks that were complying. They are not the people they are trying to paint,” she said.

ICE did not respond to the Weekly’s requests for comment.

Chavez Pineda arrived from Honduras with her daughter ten years ago seeking refuge and has been in the process of seeking asylum for many years.

About two months ago, Chavez Pineda was randomly scheduled for a check-in. Attorneys and a group of about fifteen people came to that appointment in support of Chavez Pineda, thinking she could be detained. She was not detained that day, but an ankle monitor was placed on her.

According to Reyes, Chavez Pineda has no criminal convictions and has complied with her check-in appointments and surveillance requirements since 2017. At the time she was detained during her ISAP check-in, she had an appeal pending. Her lawyers attempted to deliver a copy of the stay of removal issued by the Seventh Circuit Court of Appeals on Thursday to pause her deportation to officials at the processing center as they pushed for her release.

A stay of removal was also submitted to ICE but was still pending. Without ICE’s approval, Chavez Pineda could not be released even though the Seventh Circuit had already granted a stay.

“When making this request today, we were told that the officers at this building no longer have the leeway nor the discretion to release individuals. That all those requests must go through headquarters,” Reyes said. No additional guidance was provided for how to contact headquarters, according to attorneys.

Nadia Singh, a staff attorney at Beyond Legal Aid, said it took about twenty minutes to get let inside the Broadview

processing center after being told to ring a doorbell that they could not find. When they were let in, they were given a moment to see Chavez Pineda.

“We were not allowed to give her a hug. We had to stand at least ten feet back. She was in handcuffs. She wanted to give her appreciation. When she started speaking about her daughter, she started crying,” Singh said.

Lawyers and advocates reported to the media the overcrowded conditions Chavez Pineda and others were experiencing at the ICE processing center, sharing that there were no beds, just chairs.

Chavez Pineda’s legal team believes the order of stay granted by the seventh court, along with the stay filed with ICE that was pending, should have been enough to release Chavez Pineda. However, conversations with officials at the processing center suggested there were additional layers of bureaucracy and backlog processing that may not have made it possible.

Despite that Chavez Pineda has been living in the U.S. for over a decade, has sole custody of her daughter, and has complied with court-related mandates, she was deemed a flight risk, put on an ankle monitor, and subsequently detained, according to Singh.

“A huge part of what's going on is we are not seeing any legality or rationality in ICE's choices of enforcement right now. It's very much just, if we feel like we have some sort of way to deport them, we will,” Singh said.

As the press conference came to a close, advocates and supporters stayed as they received word that ICE was picking people up from the processing center and taking them to an undisclosed location.

Broadview police officers and vehicles patrolled up and down Beach St. and stood in front of the processing center entrance, as well as near the gated fence. When asked by advocates why it appeared that Broadview Police were helping or working with ICE, officers said they were conducting traffic control.

Inside the gated fence, dozens of detained individuals were seen walking out of the processing center, filed in a single line and walking towards unmarked white vans idled in the parking lot.

Supporters outside of the gate shouted, ‘No están solos, aquí estamos!’ (You are not alone, we are here).

About seven to eight vans driven by masked ICE officers, each carrying ten to twelve people, drove out through the gate and onto the clear path Broadview police secured for them. As those unmarked vehicles drove off, more came into the processing center with newly detained people.

The press conference and show of support for Chavez Pineda and others detained at the processing center ended without her release.

”She did have a message to share,” said Reyes. “She wanted to share her thanks and appreciation for all the support for herself and her family and to everyone here today. That's about as much as she was able to give before losing composure.”

After days of uncertainty following last Friday’s rally, ICE updated its locator tool on Monday, confirming that Chavez Pineda is being held at Grayson County Jail in Kentucky.

OCAD organized a call to action and began collecting signatures for a petition to show support for Chavez Pineda and demand her release from ICE custody. The petition has collected over 10,000 signatures since last week.

Since then thousands of Chicagoans and allied organizations have also rallied in demonstrations that continue to demand a stop to ICE detentions and deportations, adding to the country’s growing resistance against the Trump administration.

At least three people were detained by ICE officials on Father’s Day at the ISAP office, following two others who were detained the day before. OCAD members and allied organizations present over the weekend at the Broadview processing center, say that about eighty people who received alerts to check-in over the weekend came out with ankle or wrist bracelets. ¬

José Abonce is the senior program manager for the Chicago Neighborhood Policing Initiative and a freelance reporter who focuses on immigration, public safety, politics, and race. He is an apprentice with The Investigative Project on Race and Equity and a recent New York University Arthur L. Carter School of Journalism graduate.

El 4 de junio, agentes de ICE arrestaron a Gladis Yolanda Chávez Pineda, organizadora comunitaria y madre, junto con al menos otras nueve personas, tras comparecer a una cita de rutina.

En la mañana del miércoles 4 de junio, varios inmigrantes llegaron a la oficina del Programa de Comparecencia con Supervisión Intensiva (ISAP, por sus siglas en inglés) en el South Loop, en el centro de Chicago, después de recibir una notificación inesperada para presentarse a una cita de verificación. Al parecer, todo era una trampa.

Estas diez personas, que habían estado cumpliendo con la supervisión de Inmigración y Control de Aduanas de los Estados Unidos (ICE, por sus siglas en inglés)

fueron detenidas por funcionarios del ICE en lo que testigos describieron como una situación caótica.

El ISAP, una alternativa a la detención de inmigrantes, es administrado por contratistas privados bajo la supervisión de ICE. Requiere que las personas en proceso de deportación cumplan con estrictas condiciones de monitoreo, tales como monitores electrónicos en el tobillo, vigilancia telefónica y presentarse regularmente en persona mientras permanecen en la comunidad en lo que se resuelve su caso.

Los abogados de Beyond Legal Aid y los miembros de Comunidades Organizadas Contra las Deportaciones (OCAD), que acompañaron a los clientes ese día, dijeron que los agentes de ICE violaron el protocolo normal al negarles la entrada al edificio para proporcionar apoyo legal o interpretación. Las personas

que llegaron para registrarse fueron esposadas sin previo aviso, según testigos y organizadores.

Defensores y funcionarios electos se situaron frente a las salidas del edificio para impedir que ICE se llevara a los detenidos. Algunos familiares lloraban al ser separados de sus seres queridos. Otros intentaban comprender qué estaba pasando mientras los agentes de ICE se apresuraban a sacar a los detenidos, los subían a vehículos sin distintivos y se los llevaban.

A medida que el grupo de manifestantes crecía, la Policía de Chicago acudió al lugar y tomó medidas para controlar a la multitud.

La noticia de las detenciones se difundió rápidamente. Más tarde esa misma semana, el 6 de junio, los manifestantes se reunieron en el Centro de Procesamiento de Broadview en Broadview, Illinois, donde habían llevado a los inmigrantes. Los activistas y los familiares exigieron la liberación de los detenidos y trataron de concientizar a la gente sobre lo que consideran una táctica engañosa e injusta. No había letreros, ni marcas oficiales, ni nada que indicara que allí era el lugar donde ICE procesa a las personas tras su detención antes de trasladarlas a centros de detención fuera del estado. Hombres enmascarados en vans blancas y sedanes negros sin distintivos entraban y salían por un portón alambrado.

“Estamos aquí para exigir la liberación de Gladis Yolanda Chávez Pineda”, dijo

Antonio Gutiérrez, miembro de OCAD. “Y por la liberación de todos los que han sido detenidos y que se encuentran actualmente en el edificio detrás de mí”, añadió.

Chávez Pineda, madre y organizadora de OCAD, es una de las diez personas que fueron detenidas durante los controles rutinarios en la oficina del ISAP el 4 de junio.

Según AJ Johnson Reyes, abogado y parte del equipo legal de Chávez Pineda con Beyond Legal Aid, ella recibió un aviso de última hora para presentarse a una cita el lunes anterior, 2 de junio, a través de la aplicación ISAP en su teléfono, que utilizaba para hacer videollamadas semanales como parte de sus controles con ISAP.

Gutiérrez dijo que era “extraño” porque ella había acudido a una cita apenas dos semanas antes y había cumplido plenamente con sus citas.

Chávez Pineda fue detenida ese día y no se supo nada de ella durante dos días. Según los agentes del centro de procesamiento, no habían podido actualizar sus registros debido al número de detenciones que hubo en el transcurso de dos días, dijo el equipo legal después de que se les permitiera verla.

Esta nueva táctica se produce después de que la administración de Trump impusiera a ICE el objetivo de aumentar el número de detenciones diarias. Estas medidas de control más estrictas, que incluyen el despliegue de la Guardia Nacional en California y las amenazas de la administración de desplegarla también en Illinois, contribuyeron a protestas masivas en todo el país para exigir el fin de las deportaciones y las detenciones.

La concejala del distrito 33, Rossana Rodríguez-Sánchez, fue testigo de las acciones de ICE el 4 de junio y se pronunció en contra de las tácticas de ICE que provocaron la detención de Chávez Pineda, vecina y votante de su distrito.

“Es muy importante señalar que en este momento se están violando los derechos constitucionales. Todos estamos viendo cómo se violan sistemáticamente los derechos constitucionales, no hay un proceso justo y todo el mundo tiene derecho a un proceso justo bajo la Constitución”, dijo Rodríguez-Sánchez.

ICE afirmó que las diez personas que detuvieron en el ISAP tenían órdenes finales de expulsión, lo que significa que un juez de inmigración ha determinado

que una persona que no es ciudadana de EE.UU. debe salir del país. Sin embargo, Xanat Sobrevilla, de OCAD, dijo lo contrario.

“Es mentira. Ninguna de las personas que están aquí tiene órdenes finales de expulsión. Son personas que estaban cumpliendo con la ley. No son las personas que están tratando de pintar”, dijo.

El ICE no respondió a las solicitudes de comentarios del Weekly.

Chávez Pineda llegó de Honduras con su hija hace diez años en busca de refugio y lleva muchos años en proceso de solicitud de asilo.

Hace unos dos meses, Chávez Pineda fue citada para una cita al azar. Abogados y un grupo de unas quince personas acudieron a la cita en apoyo a Chávez Pineda, pensando que podría ser detenida. Ese día no fue detenida, pero le colocaron un monitor en el tobillo.

Según Reyes, Chávez Pineda no tiene convicciones penales y ha cumplido con sus citas y los requisitos de vigilancia desde 2017. En el momento en que fue detenida durante su cita con el ISAP, tenía una apelación pendiente.

Sus abogados intentaron entregar una copia de la orden de suspensión de la deportación emitida por la Corte de Apelaciones del Séptimo Circuito el jueves a los funcionarios del centro de procesamiento mientras presionaban por su liberación.

También se presentó una suspensión de su deportación a ICE, pero aún estaba pendiente. Sin la aprobación de ICE, Chávez Pineda no podía ser liberada, a pesar de que el Séptimo Circuito ya había concedido una suspensión.

“Al hacer esta solicitud hoy, se nos dijo que los funcionarios de este edificio ya no tienen la libertad ni la discreción para liberar a las personas. Que todas esas solicitudes deben pasar por la sede”, dijo Reyes.

Según los abogados, no se proporcionó ninguna orientación adicional sobre cómo ponerse en contacto con la oficina central.

Nadia Singh, abogada de Beyond Legal Aid, dijo que tardaron unos veinte minutos en poder entrar al centro de procesamiento de Broadview después de que les dijeran que tocaran un timbre que no podían encontrar. Cuando les dejaron entrar, les dieron un momento para ver a Chávez Pineda.

“No nos permitieron darle un abrazo. Tuvimos que permanecer al menos a tres

metros de distancia. Estaba esposada. Quería expresar su agradecimiento. Cuando empezó a hablar de su hija, se puso a llorar”, dijo Singh.

Abogados y defensores informaron a los medios de comunicación de las condiciones precarias en las que se encontraban Chávez Pineda y otras personas en el centro de procesamiento de ICE, y señalaron que no había camas, solo sillas.

El equipo legal de Chávez Pineda cree que la orden de permanencia otorgada por la Corte del Séptimo Circuito, junto con la suspensión presentada ante ICE que estaba pendiente, deberían haber sido suficientes para su liberación. Sin embargo, las conversaciones con los funcionarios del centro de procesamiento sugirieron que había niveles adicionales de burocracia y retrasos en el procesamiento que pudieron no haberlo hecho posible.

A pesar de que Chávez Pineda ha vivido en los Estados Unidos durante más de una década, tiene la custodia exclusiva de su hija y ha cumplido con los mandatos judiciales, fue considerada un riesgo de fuga, se le colocó un monitor en el tobillo y posteriormente fue detenida, según Singh.

“Una gran parte de lo que está pasando es que no vemos ninguna legalidad ni racionalidad en las decisiones de ICE en este momento. Es como si dijeran: si creemos que tenemos alguna forma de deportarlos, lo haremos”, dijo Singh.

Al finalizar la conferencia de prensa, los defensores y las personas que los apoyaban recibieron la noticia de que ICE estaba recogiendo a personas del centro de procesamiento y las estaba llevando a un lugar desconocido.

Agentes de policía y vehículos de Broadview patrullaban por la calle Beach St. y se situaban frente a la entrada del centro de procesamiento, así como junto a la cerca. Cuando los defensores les preguntaron por qué parecía que la Policía de Broadview estaba ayudando o trabajando con ICE, los agentes respondieron que estaban controlando el tráfico.

Dentro de la cerca, se vio a decenas de detenidos salir del centro de procesamiento, formados en una fila y caminando hacia vans blancas sin distintivos en el estacionamiento.

Las personas que apoyaban a los detenidos gritaban desde fuera de la cerca: ¡”No están solos, aquí estamos!”.

Entre siete y ocho vans conducidas por

agentes de ICE enmascarados, cada una con entre diez y doce personas a bordo, salieron por la cerca y se dirigieron por un camino despejado que la policía de Broadview les había abierto. A medida que los vehículos se alejaban, llegaban más personas recién detenidas al centro de procesamiento. La conferencia de prensa y la muestra de apoyo a Chávez Pineda y a otras personas detenidas en el centro de procesamiento terminaron sin su liberación.

“Ella tenía un mensaje que compartir”, dijo Reyes. “Quería expresar su agradecimiento y aprecio por todo el apoyo que han recibido ella y su familia, y a todos los que están aquí hoy. Eso es todo lo que pudo decir antes de perder la compostura”. Tras días de incertidumbre tras la manifestación del viernes pasado, ICE actualizó su herramienta de localización el lunes, confirmando que Chávez Pineda se encuentra detenida en la Cárcel del Condado de Grayson, en Kentucky.

OCAD organizó un llamado a la acción y comenzó a recolectar firmas para una petición en apoyo a Chávez Pineda y exigiendo su liberación de la custodia de ICE. La petición ha recolectado más de 10,000 firmas desde la semana pasada. Desde entonces, miles de residentes de Chicago y organizaciones aliadas se han unido en manifestaciones que continúan exigiendo un alto a las detenciones y deportaciones de ICE, sumándose a la creciente resistencia en el país contra la administración de Trump. Al menos tres personas fueron detenidas por agentes de ICE el Día del Padre en la oficina de ISAP, luego de otras dos que fueron detenidas el día anterior. Los miembros de OCAD y las organizaciones aliadas presentes durante el fin de semana en el centro de procesamiento de Broadview afirman que algunas ochenta personas que recibieron alertas para acudir a sus citas durante el fin de semana salieron con monitores electrónicos en el tobillo o la muñeca. ¬

José Abonce es el gerente principal de programas de la Iniciativa de Policía Vecinal de Chicago y reportero independiente enfocado en seguridad pública, política, raza y planificación urbana. Es aprendiz del Proyecto de Investigación sobre Raza y Equidad y se graduó recientemente de la Escuela de Periodismo Arthur L. Carter de la Universidad de Nueva York.

BY PAUL GOYETTE AND JACQUELINE SERRATO

An estimated 75,000 people showed up in downtown Chicago on Saturday, June 15, as part of a national wave of protests called “No Kings”—coinciding with Flag Day, President Donald Trump’s birthday, and a D.C. parade honoring the 250th anniversary of the Army.

Families, community groups, activists,

and voters showed up to advocate for a variety of issues, from taxing the rich, to a ceasefire in Gaza, and against the Trump administration's actions that increasingly resemble a dictatorship, such as the deployment of the National Guard and the Marines in Los Angeles against the wishes of city and state officials.

In this and in smaller demonstrations

this month, immigration advocates protested ICE’s fear campaign and detention tactics in Chicago and Cook County. The most recent display of excessive power had ICE agents summoning compliant immigrants wearing ankle monitors to an office in the South Loop and disappearing them for days before confirming they were being

sent to detention centers out of state.

The local No Kings protest was mostly peaceful, with no more than a dozen arrests by Chicago police and no incidents. ¬

A pilot program allowing them in some areas showed promising results. City officials are divided over their full legalization.

BY ALEX NITKIN, ILLINOIS ANSWERS PROJECT

This story was originally published by the Illinois Answers Project as part of their series Making it in Chicago: Detours and Dead Ends on the Path to Opportunity.

For most new parents, finding lastminute childcare usually means an afternoon of frantic phone calls and around $100 dropped on a trusted babysitter.

For Brian and Fiona Peterman, it means walking across their backyard.

In 2021, Fiona’s mother, Louise D’Agostino, was scanning pricey apartments near Brian and Fiona’s Lakeview home so she could live closer to them after she retired—until Brian learned about a new city program that would let the family build a second, smaller house on their own property.

After nearly two years of navigating regulatory red tape and approximately $300,000 in construction costs, D’Agostino was able to move into a 700-square-foot, two-bedroom house on top of Peterman’s garage in 2023.

Nowadays, D’Agostino goes on walks with her 18-month-old granddaughter nearly every day. D’Agostino cooks the toddler recipes from her native Malta that she learned from her own mother, and she’s teaching her to speak Maltese.

D’Agostino pays rent to her daughter, Fiona, and son-in-law, Brian—much less than the cost of the mortgage at her previous home, but still a steady and meaningful source of income for the Petermans to supplement the salaries from their day jobs.

“‘Life-changing’ is probably the cleanest way of saying it,” Brian Peterman said. “By having her there, we always have that backup plan in case something goes awry in our normal lives.”

Homes like D’Agostino’s, typically called coach houses, carriage houses or “granny flats,” are illegal to build in most of Chicago. Their construction was banned in 1957 by city leaders who feared residential overcrowding. Chicago has since lost approximately 800,000 residents.

City officials under three mayors have been pushing for at least six years to unravel the prohibition of so-called accessory dwelling units, or ADUs—a term used to describe both coach houses and unused basement or attic spaces that are converted into apartments. In the legalization campaign, bureaucrats and policy researchers consistently highlight ADUs as a low-risk tool, free to taxpayers, that’s been proven to provide a limited but effective release valve for other cities’ affordable housing crises.

For D’Agostino, it meant finding an affordable home in an affluent neighborhood while providing extra income to offset childcare costs for her daughter and son-in-law while keeping her granddaughter close.

A three-year pilot program that legalized the units in some areas showed that outcomes like the Petermans’ are widely replicable, opening up more housing options in neighborhoods where cheap apartments have become increasingly rare. But the burst of construction seen so far is a pittance compared to the more than 100,000 affordable units experts say it would take to satisfy demand.

“ADUs are our path to economic mobility,” said state Rep. Kam Buckner (D-Chicago), who sponsored legislation that would prohibit Illinois cities from banning the units. “They turn underutilized space into income-generating property, which is a big deal.”

Many City Council members remain

skeptical of ADU legalization, wary of any move that would limit their ability to guide new development in their wards.

That’s one reason why a proposal to legalize the units citywide has been sitting on the shelf for more than a year.

In the meantime, property owners inside the pilot zones, like the Petermans, are straining to build ADUs amid daunting costs and regulatory barriers.

City Hall discussions on how to expand and ease construction are clouded by a political stalemate over how far the program should reach, and by a little-understood federal complaint targeting Chicago’s housing segregation. And policymakers have struggled to craft an ordinance that would encourage ADU construction across the city—not just in wealthy, dense areas, where they’ve overwhelmingly been added during the pilot.

As Chicago leaders sit on their hands, proposals to permit ADU construction across Illinois are gaining support in Springfield, where lawmakers are pushing their own measures. Adding to the momentum is Gov. JB Pritzker, who recently endorsed ADUs as a tool to increase the state’s stock of affordable housing.

“Think about carriage houses,” Pritzker said in an April 30 episode of the Volts podcast after an interviewer asked the governor about his housing agenda. “We’ve got neighborhoods where people are not allowed to have those as separate dwellings—or just the idea that we can, if we make a few tweaks here and there, we can significantly increase the amount of housing with the existing housing stock.”

Chicago planning officials under former Mayor Rahm Emanuel first promoted the idea of legalizing accessory dwelling units in 2018, saying they “can offer relatively affordable housing for tenants and can help moderate income families become homeowners with the additional income.” Researchers had taken note of new construction in Portland following the legalization of ADUs there years earlier, and a 2016 California law had already unlocked an explosion in construction of the relatively low-cost units across that state.

A 2019 study by the AARP found that in seven U.S. cities, ADU rents were hundreds of dollars lower than the rents

of comparable one-bedroom apartments and could provide “a substitute for nursing home care, a means to age in community, an opportunity to live with other family members in multi-generational living arrangements, as well as a source of earning extra income to supplement fixed incomes in their retirement years.”

In 2019, the newly reconstituted Chicago Department of Housing recruited the Chicago-based Urban Land Institute to lead a task force with dozens of developers, architects, affordable housing advocates and lenders to draw up a list of recommendations for how Chicago could legalize ADUs.

The result was a 44-page report, published in May 2020, detailing the challenges of ADU legalization in other cities and ways Chicago could overcome them.

Within a month of the report’s publication, Chicago Mayor Lori Lightfoot had introduced an ordinance legalizing coach house construction and basement unit conversions in Chicago, incorporating some of the task force’s recommendations.

It got a chilly reception in the City Council.

“This will be a blanket approval … it will allow two-flats to become threeflats, three to become four and four to become five,” said then-Ald. Patrick Daley Thompson (11th), who represented the city’s Bridgeport and Chinatown neighborhoods. “If someone wants to change a two-flat to a three-flat, in my ward, we do a community meeting. All of my neighbors—the community comes out and has participation. Not a bureaucrat at City Hall making a decision for my community.”

South Side Ald. David Moore (17th) was more direct.

“I want some aldermanic control over this,” Moore said.

After months of negotiations, the council approved a test ordinance that legalized accessory dwelling ordinance in five “pilot zones”—two on the city’s North Side, one on the West Side and two on the South Side—all in areas represented by alderpeople who supported the initiative. However, the West and South Side zones were established with additional restrictions at local council members’ request, including a requirement that the new units could be built only on owner-occupied properties.

In May 2021, the Chicago Department of Housing began accepting applications for coach houses and basement unit conversions. The ordinance called on city officials to report back to the City Council three years later with data and insights.

Peterman, who had been following the ordinance closely, was among the first in line to apply.

It was a year before his coach house project would break ground.

Peterman became tangled in a weekslong back-and-forth with zoning officials in the city planning department over the dimensions of his porch. Because the city requires homes like his to have at least one parking space, he needed to figure out how to build the coach house on top of his garage. And even after housing and planning officials gave him the go-ahead, he had to get a fresh approval from the Chicago Department of Buildings, which regulates all construction in the city.

“It took us a very long time compared to a normal [housing] permit, which would have been one-tenth of the time if [the ADU] was already part of the zoning code,” he said.

Just as difficult, Peterman said, was financing. It typically takes between $50,000 and $100,000 to build a new unit in a basement or attic, but building a new coach house can run upwards of $250,000. Peterman and his wife had so much difficulty finding a loan package that they ultimately took out a new line of credit on their existing home to pay for the project, he said.

Despite the hurdles, more than 300 accessory dwelling units have been permitted for construction across the five pilot zones since 2021. They overwhelmingly comprised basement unit conversions, as opposed to coach houses— not surprising, observers said, considering how much cheaper it is to renovate than to build a new free-standing structure.