HOUSING

Revisiting “Who Can A ord Housing in Bend?”

by Damon Runberg Regional Economist Crook, Deschutes, Jefferson, Klamath, and Lake counties damon.m.runberg@oregon.gov (541) 706-0779

S

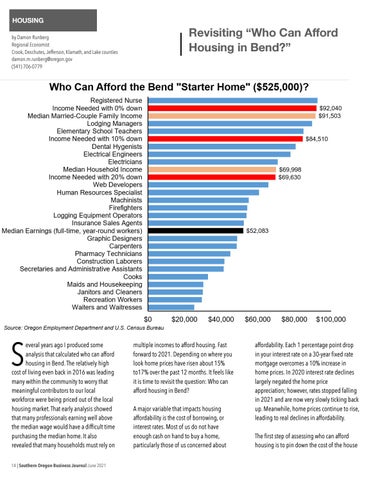

everal years ago I produced some analysis that calculated who can afford housing in Bend. The relatively high cost of living even back in 2016 was leading many within the community to worry that meaningful contributors to our local workforce were being priced out of the local housing market. That early analysis showed that many professionals earning well above the median wage would have a dif cult time purchasing the median home. It also revealed that many households must rely on

multiple incomes to afford housing. Fast forward to 2021. Depending on where you look home prices have risen about 15% to17% over the past 12 months. It feels like it is time to revisit the question: Who can afford housing in Bend? A major variable that impacts housing affordability is the cost of borrowing, or interest rates. Most of us do not have enough cash on hand to buy a home, particularly those of us concerned about

ff

fi

fi

fi

14 | Southern Oregon Business Journal June 2021

affordability. Each 1 percentage point drop in your interest rate on a 30-year xed rate mortgage overcomes a 10% increase in home prices. In 2020 interest rate declines largely negated the home price appreciation; however, rates stopped falling in 2021 and are now very slowly ticking back up. Meanwhile, home prices continue to rise, leading to real declines in affordability. The rst step of assessing who can afford housing is to pin down the cost of the house