7 minute read

EMPLOYMENT IN JACKSON COUNTY: APRIL 2021 GAINS IN LEISURE AND HOSPITALITY BOOST PAYROLL EMPLOYMENT

Guy Tauer, Regional Economist Guy.R.Tauer@oregon.gov (541) 816-8396

PHOTO BY ANDREW "DONOVAN" VALDIVIA ON UNSPLASH

Advertisement

Total payroll employment in Jackson County rose by 140 jobs in April with most industries showing small changes over the month. Leisure and hospitality added 110 jobs, 50 of those in the accommodation and food services sector. Professional and business services gained 40 jobs and other services also had a small gain, up by 30 jobs in April. Employment fell in retail trade (-70); health care and social assistance (-50); and manufacturing (-50). Government employment increased by 110 with gains in federal government (+50) and local government education (+50) accounting for most of the rise. Over the past year payroll employment in the Medford MSA (Jackson County) rose by 9,010 jobs, an increase of 11.6%. While that jump is notable, the county is still an estimated 3,400 jobs below the pre-pandemic peak employment in February 2020. Since April 2020, essentially the worst point during the pandemic in terms of job losses, leisure and hospitality showed the largest gain, up by 2,990 jobs. Other industries adding the most jobs since the recession’s nadir included retail trade (+1,790); health care and social assistance (+1,300); construction (+760); professional and business services (+620); manufacturing (+580); and other services (+560). Government employment is still down 120 jobs since April 2020. Local government education fell by 310 jobs over the year while federal (+70) and state government (+50) gained jobs. Local government education has not shown the employment recovery seen in many privatesector industries, in part due to less inperson learning in most educational institutions.

Welcome to Umpqua BroadBand! High Speed Internet for Rural Douglas County.

Rural homes, farms, ranches and businesses now have an option. We have towers strategically located all over the Umpqua Valley. We have hundreds of happy customers that have made the switch to Umpqua Broadband™, replacing their slow DSL or Exede wireless service.

umpquabroadband.com

845 SE Mosher Ave, Roseburg, OR 97470 (541) 672-3793 customercare@umpquabroadband.com

Please SUPPORT YOUR JOURNAL.

If you want to continue seeing news about Southern Oregon Businesses and Oregon News that will impact all of our businesses then please support us.

Be sure to visit SouthernOregonBusiness.com and sign up for FREE emails. We don’t spam and we do not sell your email address. We will send you an email at least once a month to let you know that our newest print version is out and available online.

SouthernOregonBusiness.com

BY DAMON RUNBERG REGIONAL ECONOMIST CROOK, DESCHUTES, JEFFERSON, KLAMATH, AND LAKE COUNTIES DAMON.M.RUNBERG@OREGON.GOV (541) 706-0779

Measuring the Pulse of Oregon Households amidst the COVID-19 Pandemic

The U.S. Census Bureau developed the Household Pulse Survey in order to measure the experiences of households during the COVID-19 pandemic. This experimental data series is a valuable tool for us in understanding how the pandemic is impacting Oregonians at the household level. The U.S. Census Bureau began collecting weekly responses on April 23rd 2020, roughly a month after the onset of the direct impacts from the pandemic, and continued the weekly survey, with a few brief interruptions, through spring 2021. There are a variety of questions asked of respondents to identify the various ways the pandemic has impacted their household, including loss of employment income, food scarcity, housing insecurity, delays in medical care, and impacts on K-12 education. We will work through the results to see how Oregon households are being impacted in these uncertain times.

The last week of April 2021 is the most recent survey data available. One of the more forward looking or leading questions that give us insight into any impending layoff events is the question: “Do you expect someone in your household to lose employment income in the next 4 weeks?” The results from this question have tracked very closely with the broad employment trends through the pandemic. The good news is that the share of adults expecting a loss of employment income by someone in their household is at its lowest levels since the survey began and has been trending down since the end of 2020. Less than 14.5% of adults in Oregon think someone in their household will lose employment income in the next month compared with more than 37% this same time last year.

A loss in employment income doesn’t necessarily mean a permanent layoff. In many instances this can be a reflection of furloughs, hours cut, or temporary layoffs. According to the Small Business Pulse Survey, also developed by the U.S. Census Bureau, roughly one out of 10 businesses reduced the hours worked by paid employees in the middle of April. However, the share of businesses who have reduced their workforce hours has also been trending down aggressively the past several months. In February, at the peak of the winter COVID wave, one out of four businesses had reduced the hours worked by paid employees.

Although an estimated 480,000 Oregonians lived in a house where someone expects to see their employment income decline in the near future, that doesn’t mean these households will necessarily see a net loss in their household income. Many workers have received additional unemployment insurance benefits due to federal legislation that currently adds $300 to the weekly unemployment insurance benefit amount and expanded the program to assist self-employed workers and others not typically covered by unemployment insurance. In many instances this boost to unemployment insurance is likely resulting in near fullwage replacement for households who have lost or expect to lose employment income.

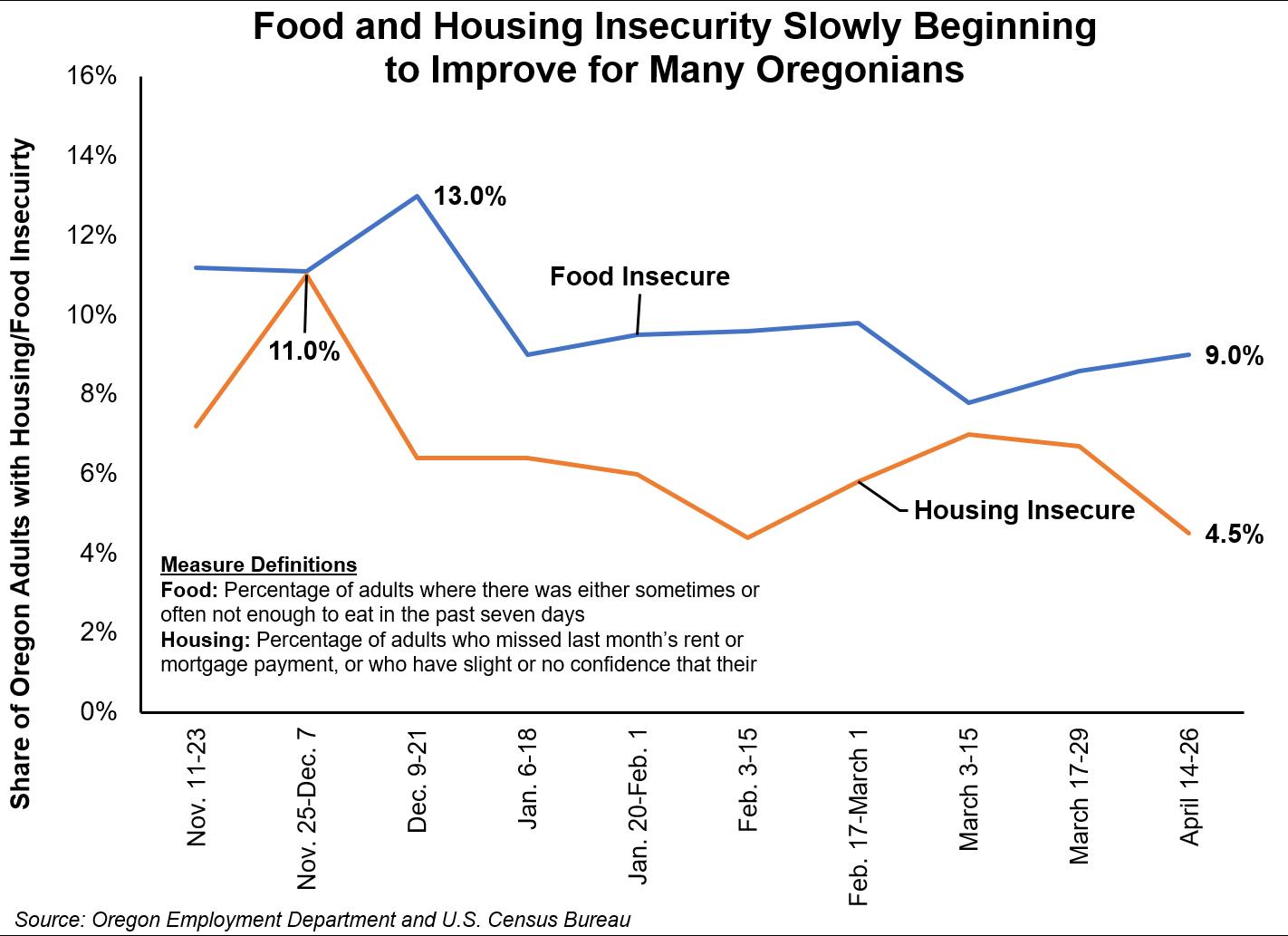

A loss of employment income becomes an increasing financial strain on households and impacts households’ ability to meet basic needs, such as housing or food. Housing insecurity, as captured in the pulse survey, represents the share of adults who live in a household that missed last month’s rent or mortgage payment, or who have slight or no confidence that their household can pay next month’s payment on time. The combination of more generous unemployment insurance benefits, the federal stimulus, and a rapidly recovering economy has drastically reduced the share of Oregon households experiencing these various forms of insecurity.

Housing insecurity has been fairly volatile with the percent of adults living in a household that missed a housing payment and feel like they will likely miss an upcoming payment peaking at 11% last November. As of the end of April the level of housing security had improved to 4.5% of adults in a household that has missed a recent housing payment. The share of mortgage loans that went into forbearance increased dramatically early in the pandemic. According to the Mortgage Bankers Association’s Forbearance and Call Volume Survey, roughly 7.6% of loans across the nation were in forbearance last summer, representing around 3.8 million homeowners. Before the pandemic only around 0.25% of loans were in forbearance. As of the last week of April the share of mortgages in forbearance had dropped considerably to less than 4.5%.

Food insecurity peaked last December at 13% of adults living in a household where there wasn’t enough to eat. The level of food insecurity remains stubbornly high, but has continued to trend down the past few months. There is no great baseline for “normal” levels of pre-pandemic food insecurity to compare these results. According to the 2018 Current Population Survey, around 6.8% of adults in Oregon were food insecure before the pandemic. Much of this scarcity is likely driven by the loss of employment income. However, we are also seeing food scarcity inflated by supply chain and distribution issues that may be limiting access to food, as well as notable increases in costs for many standard grocery items. According to the U.S. Bureau of Labor Statistics’ Consumer Price Index, food prices were up 3.4% in March 2021 compared with the same time last year.

As vaccines become more widespread and the economy reopens we can expect to see these household metrics continue to improve. There are big tailwinds behind us with pent up demand and a large savings rate. Consumers are eager to reengage the economy. This will lead to increased rates of hiring as businesses onboard to meet this increasing demand and workers feel more comfortable reengaging the workforce as the health crisis wanes.