6 minute read

COULD YOUR PERSONAL DATA BE KEPT HOSTAGE FOR RANSOM

itself. I went with the median sale price over the past year, then rounded down a bit to $525,000 for our Bend “starter home”. This seems like a justifiable figure as the sales mode in March 2021 was in the $500,000 to $550,000 range and there were only 15 houses for sale in Bend at $500,000 or below that month.

Second step, we need to know how much that house will cost as a monthly mortgage. Using a 3% fixed mortgage rate and estimating taxes/ insurance I created three different scenarios based on the level of your down payment. If someone could scape together 20% ($105,000) then their monthly mortgage would be $2,320, but the mortgage would be closer to $3,070 with zero down.

Advertisement

Third step, what are the income needs to afford the mortgage on this Bend “starter home”? Before we know how much income you need to afford that mortgage we need to identify a normal or appropriate amount of your household income that would go towards housing. You cannot apply 100% of your wages to housing as that would leave no room for things like food, childcare, or other household expenses. The U.S. Department of Housing and Urban Development (HUD) defines households that spend between 30-50% of their income on housing as being cost burdened. At that level households begin having a difficult time affording other necessities. So I am using an income level that intentionally places the household into a cost burdened state to see who can afford housing when stretched as far as possible. With a 20% down payment you need a household income of around $70,000 to buy that Bend starter house if you are spending 40% of your income on housing. With a lower down payment you will need an annual income of $85,000 to $92,000. Last step, how do those income requirements align with local wage earners and household incomes? The good news is the income requirements to buy the median house with 20% down aligns nearly perfectly with the current median household income. The problem is that very few of our median households have $105,000 for a down payment sitting around in the bank. At 10% down (still a very large down payment) the median household cannot afford this Bend “starter home”. I included a variety of occupational wages for context.

As you can see, most households must rely on multiple wage earners to afford housing in Bend. In fact, according to the U.S. Census Bureau, roughly 66% of the wage earning family households in Deschutes County have more than one wage earner. This analysis has focused exclusively on buying a home in Bend. However, if you are a renter then the household income needs are over $50,000, roughly equivalent to the median wage for all yearround, full-time workers. Housing has been and continues to be difficult to afford for many local wage earners in Bend. The more someone must spend on housing, the less they can spend on other necessities or more discretionary purchases. I won’t get into policy solutions or ideas, but it is important to understand that many hardworking households in our community face the very real question, can I afford to live here?

Could your personal data be kept hostage for ransom?

Just shortly after clearing up the issues caused by ransomware in the national gas pipeline system, ransomware caused stoppages in meatpacking facilities across the country. While major corporations are hustling to ensure tighter security protocols are in place to prevent ransomware, you may be wondering if your computer or home network could be susceptible to this hack. Yes, absolutely. In fact, amateur hackers gain skills by infiltrating individual people’s home networks. Ransomware is a malicious software program that people download to their computers, typically disguised as legitimate links or downloadable items. To reduce your risks, use a malware blocking software program on your devices, keep your operating system and your antivirus software updated, and avoid clicking on links in emails or downloading attachments if you’re uncertain about the sender. If you become the victim of ransomware, immediately contact your local office of the FBI for instructions: https://www.fbi.gov/contact-us/fieldoffices.

by Kale Donnelly Workforce Analyst Crook, Deschutes, Gilliam, Hood River, Jefferson, Sherman, Wasco, and Wheeler counties kale.donnelly@oregon.gov (541) 306-1645

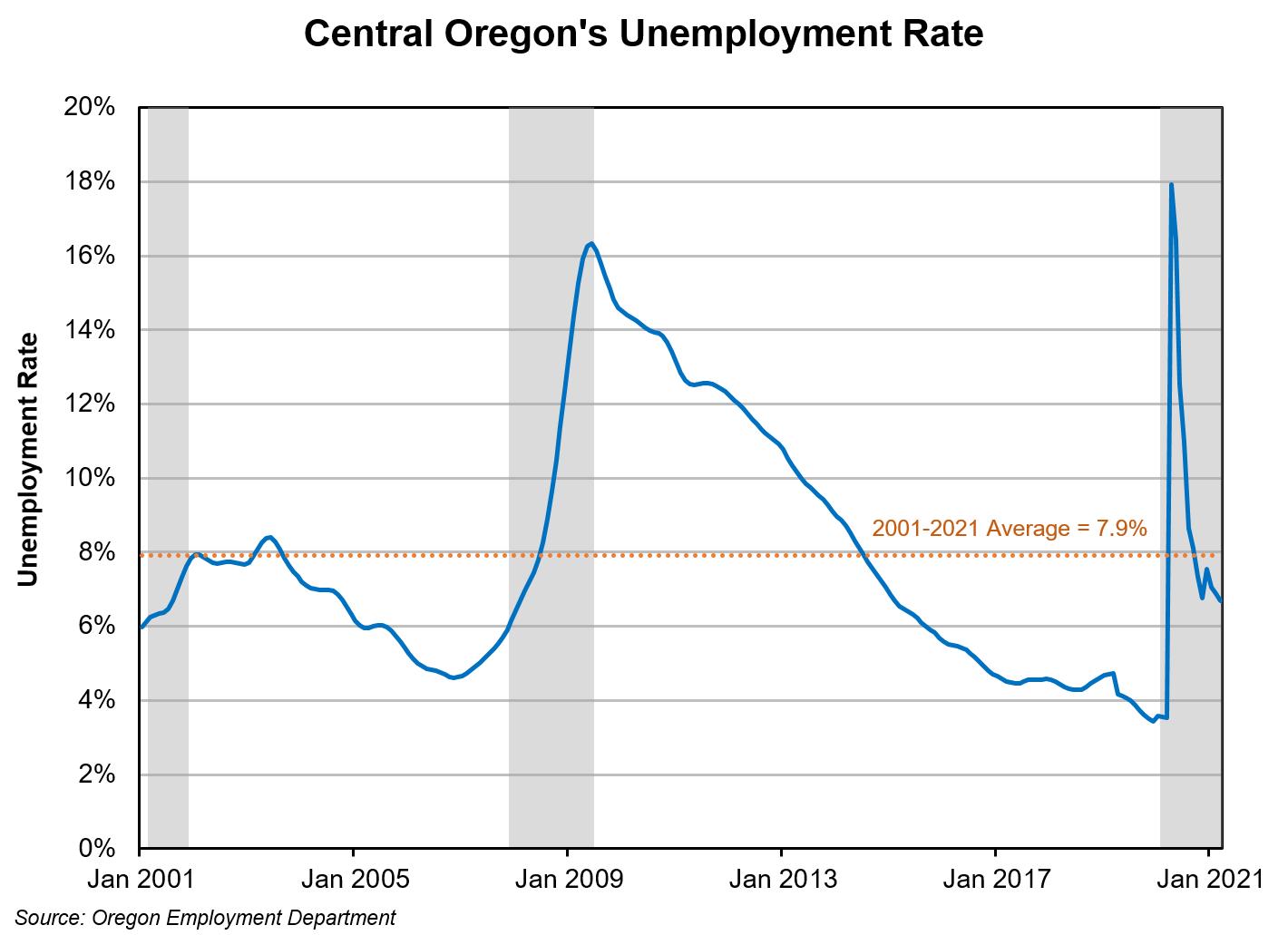

Central Oregon’s Latest Unemployment Levels Lower than Long-Term Average

As local and statewide economic conditions continue to improve, Oregon’s employers are having a difficult time hiring labor in today’s economy when unemployment levels are markedly higher than they were leading up to the pandemic. Typically after an economic downturn, there’s a greater supply of labor to employ as job openings begin to materialize again. This isn’t necessarily the case today, as employers are experiencing difficulty in filling their job vacancies like they were pre-COVID. For a while, the state was posting unemployment rates south of 4.0%, reaching a record low of 3.3% in November 2019. Unemployment shot up to 13.2% in April 2020, as COVID restrictions took effect. Now, the statewide unemployment rate just edged down to 6.0% in March 2021, lower than the long-term average of 6.8%.

Here in Central Oregon, the same narrative plays out: Record low unemployment rates heading into the pandemic, a rapid spike in unemployment once COVID-19 hit,

followed by a steady decline ever since. Still, Crook, Deschutes, and Jefferson counties have noticeably higher unemployment rates than they did leading up to spring of 2020 with 7.3%, 6.6%, and 6.8% unemployment rates in March, respectively. These are significant improvements from Crook and Deschutes counties’ pandemic high of 18.3%, and Jefferson County’s high of 17.0%. In fact, Central Oregon’s unemployment levels are well below their long-term average from 2001 to 2021.

Using a regional average, Central Oregon’s March 2021 unemployment rate of 6.7% is significantly lower than its average rate of 7.9% over that last two decades. While it took 69 months for the region to reach a 6.7% unemployment rate from the Great Recession peak, it has been only 12 months to get to this level since the peak of the COVID-19 Recession. That’s a significant swing in a short amount of time. A pivotal factor to consider when looking at this metric is that over half of the job losses in Oregon today are temporary. Those are folks who expect to be called back to their original place of work, and aren’t necessarily looking to fill another job opening.

Also, while all sectors shed jobs at the onset of COVID-19, many have seen a large number of those jobs (if not all) return over the last year. Depending on the type of job employers are hiring for, there might not be the excess labor pool to fill those positions that might be expected from elevated levels of unemployment. As it turns out, both Oregon and Central Oregon’s labor markets are tighter than you might think, and it’s not due to only one reason. Rather, it’s a combination of unprecedented factors that are hampering the potential supply of labor. This includes limited child care vacancies; working parents’ inability to work remotely; persisting concerns about exposure to the COVID-19 virus at work; and both enhanced unemployment insurance benefits and expanded eligibility. Since it is a combination of these factors for most of Oregon’s unemployed workers, it’s unlikely that the enhanced UI benefits, alone, are keeping a vast number of workers from jumping into these open job vacancies.

It’s important to keep in mind the continued dilemma of today’s situation for many Oregonians. There are still constraints on our personal, social, and professional lives that impact the ability for many individuals to participate in the workforce. Pair that with the fact that half of the job losses are temporary and unemployment rates are well below their long-term average, this all helps provide some context for why our labor market is tighter than expected.