Pratik Kamdar CEO and Co-Founder

Energy

E-Mobility+ publications, distributed pan-India, sets a new standard in EMobiliy+ energy media. With over 200+ and a growing list of advertisers, we work with who's who in the industry across our platforms from print magazines to social media platforms put their brands first and ensure the best delivery of the marketing needs.

Customizable Product Layout Highest Circulation & Readership Well Researched Editorial Content Most

Ensures best delivery of the marketing needs Get

Minister of State for Heavy Industries, Shri Bhupathiraju Srinivasa Varma, informed the Lok Sabha that ₹2,000 crore has been allocated under the PM E-DRIVE Scheme to establish EV public charging stations, including in Tier-2 cities of Tamil Nadu. As of April 1, 2025, 4,625 stations are operational Additionally, ₹873 50 crore under FAME-II supports 8,932 stations by IOCL, BPCL, and HPCL

Bharatsure, one of India’s Insurtech companies offering Infrastructure-as-a-Service (IaaS) solutions, has successfully raised ₹6 crore in a funding round led by Inflection Point Ventures (IPV), with participation from Capital A and Atrium Angels The fresh capital will bolster the company’s mission to deepen insurance penetration and enhance financial security for underserved segments in the country

distribution and on-ground partnerships, and invest heavily in technology, R&D, and strategic hiring across sales, marketing, and operations

Vinfast India Partners With HDFC Bank To Offer End-To-End EV Financing Solutions Ahead Of Launch

VinFast Auto India has entered into a strategic partnership with HDFC Bank to provide comprehensive financing solutions for customers and dealers ahead of its official market debut The MoU, VinFast’s first tie-up with a banking institution in India, will deliver tailored credit offerings such as attractive interest rates, flexible repayment plans, 100% on-road funding, exclusive benefits, and priority services across the company’s full EV lineup Dedicated HDFC Bank representatives will be stationed at all VinFast showrooms to provide on-thespot assistance, making electric mobility more accessible to a broader consumer base

Mufin Green Finance Secures ₹54 4 Crore From U S Impact Investor DWM To Boost EV And Green Energy Financing In India

Citroën India has entered into a strategic partnership with HDFC Bank, India’s largest private sector bank, to provide best-in-class retail and dealer finance solutions, making HDFC Bank the exclusive preferred financier for all Stellantis brands in India including Jeep, Maserati, and now Citroën

Mufin Green Finance, a leading NBFC in green finance, has raised ₹54 4 crore (USD 6 5 million) via private placement of NCDs from U S -based Developing World Markets (DWM) The 36-month funds will be disbursed in two tranches to expand loans for productive-use EVs, batteries, charging infrastructure, and solar installations MD Kapil Garg emphasized the impact on Tier 2 and 3 regions, while CFO Gunjan Jain highlighted growth and risk discipline DWM sees this as a strategic step into India’s climate finance landscape.

Ministry Of Heavy Industries Amends PM E-DRIVE Scheme To Strengthen Local Manufacturing Of EV Charging Stations

On July 18, 2025, the Ministry of Heavy Industries issued an amendment (S.O. 3318(E)) to the PM E-DRIVE Scheme, modifying the original notification of September 29, 2024 The amendment replaces Annexure-6, updating the Phased Manufacturing Programme (PMP) for Electric Vehicle Public Charging Stations (EVPCS) It specifies indigenization timelines for components like charger enclosures, wiring harnesses, connectors, software, meters, switchgear, charging guns, controllers, power supplies, and power modules, with deadlines from December 2021 to December 2025 EVPCS must meet PMP requirements, follow IS:17017 standards, and undergo testing Import of PMP components in CKD form is restricted The notification was signed by Dr Hanif Qureshi

Ministry Of Heavy Industries Expands PM E-DRIVE Scheme To Include ETrucks With Revised Incentive Guidelines

The Ministry of Heavy Industries has amended the PM EDRIVE Scheme, expanding coverage to e-trucks under N2 and N3 categories (3 5–55 tonnes) Certification validity must now be renewed with each new Phased Manufacturing Programme milestone E-trucks must carry warranties of five years or 5,00,000 km for batteries, and five years or 2,50,000 km for motors and vehicles Incentives are capped at the lowest of ₹5,000/kWh, 10% of ex-factory price, or ₹2.7–9.6 lakh based on GVW. Around 5,643 e-trucks, including 1,100 in Delhi, will benefit, supported by ₹100 crore Scrapping an ICE truck is mandatory to claim incentives

Ministry Of Road Transport And Highways Releases New Guidelines 2025To Streamline And Secure India’s Shared Mobility Sector

The Ministry of Road Transport and Highways has issued the Motor Vehicle Aggregator Guidelines 2025, replacing the 2020 framework to regulate India’s growing mobility sector Aggregators must obtain a five-year license via a central portal (or states until then), paying ₹5 lakh for new applications and deposits of ₹10–50 lakh Conditions include 40-hour driver training, insurance coverage, annual refreshers, and safety compliance Vehicles must be under eight years old, certified, insured, and fitted with tracking and panic systems. Apps must ensure safety, data protection, and multilingual support Fare rules guarantee drivers 80% earnings Strict penalties enforce compliance, safety, and inclusivity

India’s Road To Net Zero: Government Releases Landmark Report Charting Battery Electric Truck Adoption To Decarbonize Freight Sector By Mid-Century

The Office of the Principal Scientific Adviser released a landmark report, “ZET Adoption in India and Its Impact on Emission and Energy” (June 2025), highlighting Battery Electric Trucks (BETs) as the future of zeroemission freight transport With Medium and Heavy-Duty Trucks handling 70% of freight and consuming 40% of fuel, electrification is vital for Net Zero 2070 The report calls for fiscal incentives, innovation, and charging infrastructure to accelerate adoption, reduce emissions, and enhance energy security, ensuring a sustainable logistics ecosystem

TDK Ventures Invests In Ultraviolette To Drive Next-Gen Electric Two-Wheeler Innovation

In a major boost to India’s performance electric two-wheeler (E2W) sector, TDK Ventures, the corporate venture capital arm of TDK Corporation, has invested in Ultraviolette Automotive as part of a $21 million funding round. The round also saw continued backing from existing investors, including Zoho Corporation and Lingotto (formerly Exor Capital)

The Ministry of Heavy Industries has amended the PM E-DRIVE Scheme through a notification on August 7, 2025, with effect from publication Originally notified in September 2024, the scheme now has a ₹10,900 crore outlay and will run from October 1, 2024, to March 31, 2028, merging EMPS-2024 It supports EV adoption, charging infrastructure, and domestic manufacturing Benefits for e-2Ws, e-rickshaws, e-carts, and L5 e3Ws will end on March 31, 2026 As a fund-limited program, it will close early if allocations are exhausted. Signed by Dr. Hanif Qureshi, the amendment reinforces efficient fund use and faster EV ecosystem development

NITI Aayog, in partnership with WRI India, launched the India Electric Mobility Index (IEMI) 2024 on August 4, 2025, at Vigyan Bhawan, New Delhi This global-first subnational index assesses EV maturity across States and UTs through 16 indicators under three pillars Transport Electrification Progress (50%), Charging Infrastructure Readiness (30%), and EV R&D and Innovation (20%). Delhi, Maharashtra, and Chandigarh lead overall rankings, while Karnataka, Haryana, and Tamil Nadu stand out in specific areas Updated quarterly, IEMI highlights best practices like Delhi’s scrappage incentives and Chandigarh’s fleet roadmap By benchmarking outcomes and enablers, IEMI aims to accelerate India’s target of 30% EV penetration by 2030 and Net Zero 2070

The global Electric Vehicle Supply Equipment (EVSE) market is projected to soar to $20 84 billion by 2030, growing at a CAGR of 25 9% from $2 12 billion in 2020, according to Allied Market Research. Growth is driven by rising EV adoption, supportive policies like India’s FAME-II, and technologies such as wireless charging and Vehicle-to-Grid systems Asia-Pacific, led by China, dominates the market, with Europe and North America following While high infrastructure costs pose challenges, innovations like ABB’s ultra-fast chargers highlight opportunities Residential charging led revenue in 2020, while commercial charging is set for rapid growth Key players include ABB, Tesla, Siemens, Schneider Electric, and ChargePoint

DPIIT Signs Mou With Ather Energy To Boost EV Startups Under ‘Build In Bharat’ Initiative

The Department for Promotion of Industry and Internal Trade (DPIIT), under the Ministry of Commerce and Industry, has signed a Memorandum of Understanding (MoU) with Ather Energy, a leading Indian electric vehicle manufacturer The collaboration falls under the ambit of the Build in Bharat initiative, led by the Startup Policy Forum (SPF), a coalition of over 50 innovation-focused startups. The MoU aims to accelerate the growth of deep-tech and hardware startups in the EV and manufacturing sectors.

2,000 AI-Powered BeiGo EV Pickup Trikes

Elektrik Express has announced a landmark partnership with electric vehicle innovator iGowise Mobility Together, they plan to roll out 2,000 AI-integrated BeiGo 2 5-Wheeler EV Pickup Trikes The phased deployment will kick off with a pilot in Mumbai, Pune, Bengaluru, and Hyderabad, and expand over 24 months to Tier 1 and Tier 2 cities across India, before entering Global South markets including Southeast Asia, Africa, and Latin America

Bike Bazaar EV Rentals organized a Rider Safety and Customer Engagement Meet at its Bengaluru yard The event brought together over 100 EV riders, senior officials from the Transport and Police Departments, and top executives from Bike Bazaar and electric twowheeler manufacturer E-Sprinto

VinFast Auto India, the Indian subsidiary of global EV manufacturer VinFast, has announced a strategic partnership with RoadGrid, a leading provider of EV charging and aftersales solutions in India This collaboration marks a significant step in VinFast’s journey toward building a robust EV ecosystem in the country ahead of its highly anticipated product launch

CleanMax has entered into a long-term strategic partnership with Toyota Tsusho India Private Limited (TTIPL), the Indian arm of Toyota Tsusho Corporation, Japan The collaboration aims to develop and operate 300 MW of renewable energy projects by March 2028, specifically tailored for the Commercial and Industrial (C&I) sector The newly formed partnership platform will focus on delivering customized renewable energy solutions to corporates in India, especially Japanese firms, including those under the Toyota Group umbrella.

Indian Railways has partnered with Indofast Energy to establish a network of battery swapping stations across key railway stations in the Hyderabad and Secunderabad divisions This collaboration marks a significant milestone in India’s clean energy transition, aligning with the national goal of boosting electric mobility infrastructure Indofast Energy, a 50:50 joint venture between IndianOil and SUN Mobility, has successfully installed 80 swap stations across 25 railway stations with 56 located under the Secunderabad division and 24 under Hyderabad

Emobi And Electricfish Partner To Deliver GridIndependent Ultra-Fast EV Charging Across North America

Emobi, North America’s largest EV charging roaming and JustPlug infrastructure provider, has announced a strategic partnership with ElectricFish, a California-based distributed energy innovator, to accelerate the deployment of ultra-fast, grid-independent charging solutions for both public and fleet users The collaboration integrates Emobi’s patented JustPlug technology with ElectricFish’s 350Squared microgrid-scale battery storage and charging systems, addressing two of the biggest barriers to EV adoption: charging speed and grid upgrade delays

Hindustan Zinc Strengthens Ties With Greenline Mobility To Accelerate EV And LNG Truck Deployment For Sustainable Logistics

Hindustan Zinc Limited has partnered with GreenLine Mobility Solutions, an Essar venture, to drive one of India’s largest green logistics transitions With a ₹400 crore investment, 100 EV trucks and 100 additional LNG trucks will be deployed, supported by India’s first commercialscale battery swapping infrastructure with three highcapacity stations.

Stanford And Cambridge Academics Visit Thunderplus To Study India’s EV Evolution

ThunderPlus, India’s fastest-growing electric vehicle (EV) charging network, recently hosted a high-level academic delegation from Stanford University, USA, and the University of Cambridge, UK The delegation’s visit focused on studying India’s evolving EV ecosystem and the role of startups and enterprises in advancing clean mobility

MOL, Tradewaltz, And Suzuki Join Forces To Strengthen India–Africa Automobile Trade

In a major step toward building a stronger automobile supply chain between India and Africa, Mitsui O S K Lines, Ltd (MOL), TradeWaltz Inc , and Suzuki Motor Corporation signed a Memorandum of Understanding (MoU) during the 9th Tokyo International Conference on African Development (TICAD 9)

EKA Mobility & Chartered Speed To Deploy 1,135 Electric Buses Under PM E-Bus Sewa Scheme

EKA Mobility and Chartered Speed will deploy 1,135 electric buses under the PM e-Bus Sewa Scheme, with 235 newly confirmed Serving 3 6 lakh passengers daily, the project will generate 2,500+ jobs Chartered Speed will operate fleets across Madhya Pradesh, Odisha, Chhattisgarh, and Meghalaya, boosting India’s sustainable public transport network.

Partners With Sun Electro Devices To Fast-Track 2 5-Wheeler EV Production, Redefining Manufacturing Playbook

iGo, an emerging innovator in the electric mobility space, has announced a strategic manufacturing partnership with Pune-based veteran Sun Electro Devices to accelerate the rollout of its unique 2.5-wheeler smart EVs.

Vinfast Completes Tamil Nadu EV Plant In Record 17 Months, Establishing India’s Fastest

VinFast has inaugurated its new 400-acre EV assembly plant in Tamil Nadu, completed in just 17 months a record pace for foreign carmakers in India From groundbreaking in February 2024 to launch in August 2025, the facility outpaced the typical 24–36-month timeline for large auto plants

Jitendra New EV Tech Pvt Ltd (JNEVTPL) has signed an MoU with MET’s Institute of Engineering, Nashik, to strengthen academia-industry collaboration in electric mobility The partnership focuses on research, product development, consultancy, and technical problem-solving Students will benefit from internships, plant visits, and live projects, gaining practical EV exposure while fostering innovation and talent development in sustainable mobility

Convergence Energy Services Limited (CESL) has invited online bids for selecting operators for 10,900 electric buses under the PM E-Drive scheme, including civil and electric infrastructure on a Gross Cost Contracting basis The tender, issued on 27th June 2025, follows a single-stage, two-envelope process Tender documents are available until 12th August 2025, 14:00 IST, with bid submission by 14:30 IST Bidders must pay a ₹25,000 fee and city-wise EMD Prebid conference is on 10th July 2025. CESL may cancel without notice.

Iadoption of electric vehicles has created a growing demand for reliable and widespread charging infrastructure Building this backbone is not just a matter of convenience for EV owners but a critical step in shaping the future of sustainable transport As sales of electric two-wheelers, cars, and buses continue to rise, India must ensure that charging points are available, accessible, and affordable across urban and rural areas

The government has taken several measures to accelerate the growth of EV charging Policies such as the FAME-II scheme, state EV policies, and guidelines from the Ministry of Power have provided direction and financial support Public sector enterprises like NTPC and Indian Oil have also entered the EV charging space, alongside private companies such as Tata Power, Statiq, and ChargeZone. This mix of public and private participation is essential for scaling up quickly Still, the current numbers show that India has only around 20,000 public charging stations, far below the requirement projected for the next decade Estimates suggest that at least one million public chargers will be needed by 2030 to match the pace of EV growth.

g ground for two-wheelers and three-wheelers, where time efficiency is vital Companies like Sun Mobility and Ola Electric are experimenting with different models to suit India’s unique market needs. However, standardization of connectors, payment systems, and protocols remains a major gap. Without common standards, interoperability will remain a challenge, discouraging users and investors alike

The financial aspect cannot be ignored either Setting up charging stations involves a high upfront investment and uncertain returns in the early years Innovative business models, such as pay-per-use, subscription plans, and partnerships with malls, offices, and fuel stations, are emerging to address this issue Additionally, integration with renewable energy and battery storage can make EV charging greener and more cost-efficient With India aiming for net zero by 2070, ensuring that EV charging is powered by clean energy will make the transition truly sustainable.

A key challenge lies in the uneven distribution of charging points Metro cities like Delhi, Mumbai, and Bengaluru are seeing faster rollout, while smaller towns and highways remain underserved For EV adoption to spread beyond early users, it is important to focus on intercity corridors, semi-urban regions, and rural areas Highway charging networks will play a crucial role in easing range anxiety and making long-distance EV travel possible The National Highways Authority of India has already announced plans to set up charging stations at regular intervals on key routes, but the progress needs to be much faster.

Another critical factor is the type of charging Slow AC charging can meet the needs of home and workplace users, while fast DC charging is necessary for public stations and fleet operators Battery swapping is

The role of technology and digital solutions is also becoming important Smart charging, real-time data on station availability, mobile apps, and digital payments are improving the user experience At the same time, grid readiness is a pressing concern With millions of EVs expected in the coming years, the electricity distribution network must be upgraded to handle the load Utilities will need to invest in smart grids, load balancing, and renewable integration to avoid bottlenecks

India’s EV charging story is still in its early chapters, but the direction is clear The coming years will decide whether the country can move beyond pilot projects to create a nationwide, reliable, and user-friendly network. The task is enormous, but so is the opportunity. A strong charging backbone will not only drive EV adoption but also strengthen India’s position as a leader in the global clean mobility revolution.

The electric vehicle (EV) revolution in India is no longer just about green mobility or technology innovation It is rapidly transforming into a robust business opportunity, especially in the EV charging sector With India’s ambitious targets to achieve net-zero emissions and increase EV adoption, the EV charging infrastructure market is poised for exponential growth, offering exciting prospects for entrepreneurs, investors, and established energy companies alike The journey “from kilowatts to profits” in EV charging hinges on understanding the evolving business dynamics, regulatory environment, and consumer behavior The Indian government has been playing a proactive role by announcing policies and incentives that encourage the installation of charging stations across the country Programs like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme provide subsidies for EVs and charging infrastructure, reducing entry barriers for new players

From a business perspective, the charging ecosystem presents multiple revenue streams Public charging stations, especially fast chargers located in urban and highway corridors, are gaining traction due to the growing number of EVs These stations earn revenue through pay-per-use models and subscription plans. Fleet operators, e-commerce companies, and ride-sharing platforms are increasingly partnering with charging providers to manage their electric fleets efficiently, creating bulk and recurring revenue opportunities

chains, and charging companies create strategic locations that attract foot traffic and provide convenience Additionally, bundling charging with other services like car maintenance or retail discounts enhances customer experience and loyalty.

Another promising avenue is the integration of smart charging solutions that optimize energy consumption based on grid demand and electricity tariffs By leveraging IoT and data analytics, charging service providers can reduce operational costs and offer value-added services such as demand response and vehicle-to-grid (V2G) technologies This opens doors for partnerships with utilities and renewable energy companies to balance load and generate additional income

Challenges remain, however The upfront capital investment for setting up charging stations, especially fast chargers, is significant Site acquisition, power availability, and grid connectivity often involve complex negotiations and regulatory clearances. Moreover, consumer confidence and convenience are critical; lack of standardization in charging plugs and payment systems can deter users

To overcome these hurdles, many players are adopting innovative business models Shared infrastructure and franchising approaches reduce capital risks Collaborations between real estate owners, retail

Investment trends also reflect growing confidence in the sector Venture capitalists and private equity firms are increasingly funding EV charging startups, attracted by the scalable business models and the potential for long-term recurring revenues Large energy conglomerates and oil companies, traditionally focused on fossil fuels, are diversifying portfolios to include EV charging to stay relevant in the energy transition

Looking ahead, technological advancements such as ultra-fast chargers and wireless charging will further enhance profitability by reducing charging time and improving user convenience Coupled with rising EV adoption driven by affordable vehicles and improved battery technology, the demand for charging infrastructure will soar The business of EV charging in India is evolving rapidly from a niche market to a mainstream, profitable sector Success will depend on navigating regulatory frameworks, adopting customer-centric solutions, and leveraging technology innovations For businesses willing to invest wisely and innovate continuously, the journey from kilowatts to profits promises a sustainable and rewarding future

India’s electric vehicle sector is evolving rapidly, and the country’s charging infrastructure is becoming smarter, faster, and more sustainable with the integration of Artificial Intelligence (AI), the Internet of Things (IoT), and solar energy. These advanced technologies are not only improving the efficiency of EV charging stations but also making them more reliable, cost-effective, and environmentally friendly As the number of EVs on Indian roads grows, the demand for intelligent charging solutions is creating opportunities for technology-driven innovation

AI is playing a crucial role in optimizing charging operations By analyzing real-time data on energy demand, battery levels, and grid conditions, AI systems can manage when and how vehicles are charged This helps balance electricity loads, avoid grid stress, and lower charging costs for consumers AI-powered predictive maintenance also ensures that charging stations remain operational by detecting faults before they become critical Additionally, AI algorithms are enabling smart scheduling, where EV owners can be guided to the nearest available charger or book a charging slot in advance through mobile apps

IoT is another key enabler in the smart charging ecosystem With IoT connectivity, charging stations can communicate with each other, the power grid, and even the EVs themselves Sensors and connected devices monitor parameters like voltage, temperature, and charging speed, providing operators with valuable insights to improve service IoT platforms also allow remote monitoring and control, making it easier to diagnose issues, update software, or adjust charging rates without on-site intervention. For EV users, IoT integration offers a seamless charging experience, enabling cashless payments, usage tracking, and real-time availability updates

Solar energy is adding a sustainable edge to India’s EV charging network Solar-powered charging stations reduce dependence on the conventional grid and cut carbon emissions In locations with abundant sunlight, solar panels integrated with battery storage systems can supply renewable electricity even during non-sunny hours This approach not only supports India’s clean energy goals but also makes charging more resilient in areas with unreliable grid supply. For rural and semi-urban regions, solar charging can help bridge infrastructure gaps, enabling EV adoption beyond major cities

The combination of AI, IoT, and solar is transforming the EV charging ecosystem into a dynamic, intelligent network AI-driven demand forecasting ensures that solar energy is used efficiently, IoT-enabled systems provide the connectivity needed for smooth operations, and renewable energy reduces the environmental footprint This synergy is particularly important in a country like India, where the need for clean transportation must align with energy security and costeffectiveness

Several startups and established companies are already deploying such smart charging solutions across India. From highway charging hubs equipped with solar canopies to AI-enabled city charging grids that adapt to usage patterns, the shift is underway As policy support, private investment, and consumer adoption grow, the integration of these technologies will be key to scaling the network

With the right mix of innovation and infrastructure, India can build a future-ready EV charging system that is fast, green, and intelligent, supporting the country’s journey toward a cleaner and more connected mobility landscape

India’s electric vehicle (EV) charging infrastructure is rapidly evolving, driven by a combination of innovative technologies and increasing investments As the country pushes towards ambitious climate goals and a cleaner transport future, the demand for reliable and widespread EV charging networks is growing exponentially.

Recent policy measures from the government have played a critical role in accelerating this growth Incentives for setting up charging stations, streamlined regulations, and support for private sector participation have encouraged many startups and established companies to invest in charging solutions The government’s Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme continues to provide subsidies for EV purchases and infrastructure development, further boosting market confidence

Technological innovation is another key factor shaping India’s EV charging revolution. Companies are deploying faster and smarter chargers, including DC fast chargers capable of delivering significant power within minutes Integration of renewable energy sources like solar panels with charging stations is becoming more common, ensuring greener and more sustainable operations. Additionally, smart charging solutions that optimize energy use based on grid demand and vehicle needs are gaining traction, helping reduce costs and enhance efficiency

Investment flows into the EV charging sector have surged, with venture capital, private equity, and corporate funding fueling expansion Collaborations between energy companies, automakers, and technology providers are creating a robust ecosystem This financial backing is enabling rapid scaling of infrastructure not only in metropolitan areas but also along highways and in smaller towns, addressing range anxiety and improving accessibility

The rise of interoperable charging networks, allowing users to access multiple stations with a single app or card, is also improving user convenience and adoption rates As India’s EV market matures, the synergy between innovation, policy support, and investment will be crucial to building a reliable and efficient charging ecosystem.

With these combined efforts, India is well on track to meet its EV adoption targets while promoting sustainable transportation and energy usage. The charging revolution is gaining momentum, transforming the way the country moves towards a cleaner, greener future

India’s electric vehicle adoption is accelerating, but the availability of charging infrastructure remains uneven, with most facilities concentrated in metro cities For EV growth to be truly inclusive and nationwide, the focus must now shift to last-mile charging solutions that extend beyond urban centers into smaller towns, highways, and rural areas Expanding this network will not only support existing EV users but also encourage new buyers who may hesitate due to charging access concerns

The concept of last-mile charging goes beyond traditional highcapacity urban stations. It focuses on strategically placing chargers in semi-urban and rural locations, village clusters, transport hubs, and along state and national highways Such infrastructure ensures that EV owners can travel long distances without worrying about running out of charge. This approach is particularly vital in India, where the diversity of terrain, driving patterns, and energy access requires a flexible and localized strategy

One of the main drivers for last-mile charging expansion is the rapid penetration of electric two-wheelers and three-wheelers in nonmetro areas These vehicles are used for personal transport, last-mile deliveries, and shared mobility services, making reliable charging access essential for economic activity. Smaller, low-cost charging solutions, including battery-swapping stations and slow chargers that can operate from standard electricity connections, can meet the needs of such vehicles effectively

Public-private partnerships are emerging as a key enabler in this expansion Government policies like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, along with state EV policies, are incentivizing the installation of chargers in non-urban areas. At the same time, private companies, startups, and energy utilities are investing in modular, mobile, and solar-powered charging units that can be deployed quickly without heavy infrastructure costs

Technology also plays a crucial role in enabling last-mile charging. Mobile applications can help EV users in smaller towns locate the nearest charger, check availability, and even book charging slots Digital payment systems make transactions seamless, while IoTenabled chargers allow remote monitoring and maintenance, reducing operational costs in far-flung locations For areas with unstable grid supply, hybrid systems combining solar power with battery storage ensure continuous service.

Another important aspect is integrating last-mile charging into existing public and commercial spaces For example, installing chargers at petrol pumps, bus depots, retail outlets, and community centers can bring charging closer to where people live and work This not only increases convenience but also reduces the perceived risk of EV ownership. In rural areas, where EV adoption is still emerging, pilot projects and awareness campaigns can help build trust in the technology

As India moves toward its electrification targets, the success of the EV transition will depend on bridging the infrastructure gap between metros and the rest of the country. Last-mile charging is the link that will make EVs a practical choice for every segment of society, regardless of location By combining policy support, innovative business models, and scalable technology solutions, India can create an inclusive charging network that fuels the next wave of EV adoption and ensures that the electric mobility revolution truly reaches every corner of the nation.

India’s electric vehicle (EV) market is accelerating rapidly, and at the heart of this transformation lies the critical need for robust charging infrastructure Investors across the globe are increasingly turning their attention to India’s EV charging ecosystem, recognizing it as a fertile ground for long-term growth and lucrative returns. The reasons behind this surge in investment interest are rooted in the country’s ambitious climate goals, rising EV adoption, government support, and evolving business models that promise profitability

India aims to have electric vehicles constitute a significant share of its total vehicle population by 2030 This ambitious target is supported by the government’s aggressive push through policies such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, state-level EV policies, and the National Electric Mobility Mission Plan These frameworks not only provide subsidies and incentives but also lay out clear roadmaps for scaling up charging infrastructure nationwide For investors, this regulatory clarity and government backing reduce risks and create a predictable environment for capital deployment

Another key driver attracting investors is the diversification of revenue streams within the EV charging space. Beyond simple payper-charge models, companies are exploring subscription services, fleet management solutions, smart charging with grid integration, and value-added services like advertising and retail partnerships These diversified offerings enhance profitability and customer stickiness, making the sector more appealing to investors looking for recurring revenue opportunities.

The rising number of EVs on Indian roads is creating an urgent demand for accessible, reliable, and efficient charging networks. Urban centers, highways, commercial hubs, and fleet depots all need strategically placed charging points This demand is fueling a wave of investments in both public and private charging infrastructure Private players, including startups and traditional energy companies, are innovating to create scalable models that address range anxiety and charging convenience, which are critical for consumer acceptance

The financial community is also encouraged by the entrance of global players and strategic partnerships that bring both capital and expertise Major energy conglomerates, automobile manufacturers, and technology firms are investing heavily in joint ventures and acquisitions, signaling confidence in the market’s potential Furthermore, international development agencies and green funds are providing grants and concessional financing to support infrastructure projects, underscoring the sector’s environmental and social importance

Challenges such as high initial capital expenditure, power supply constraints, and the need for standardization remain. However, ongoing technological advancements in fast-charging, battery swapping, and vehicle-to-grid integration are steadily mitigating these issues, improving operational efficiency, and expanding business viability Investors are keenly watching these innovations as catalysts for accelerated growth and enhanced returns

India’s EV charging infrastructure presents a compelling investment outlook The convergence of supportive policies, growing market demand, innovative business models, and strategic collaborations creates a robust foundation for sustainable growth As the nation charges ahead on its electric mobility journey, investors betting big on EV infrastructure are positioning themselves at the forefront of one of India’s most promising green revolutions.

In a fast-evolving EV market, what strategies help you stay ahead?

Targeting top three position in India’s electric commercial vehicle market

Expanding to 100 cities with stronger sales and service network

Wants to deepen the leadership in the electric commercial vehicle space by strengthening presence across both three-wheeler and four-wheeler cargo categories

At Euler Motors, we believe the future of electric mobility isn’t just about vehicles It’s about solving real-world challenges for fleet operators and businesses That’s where our edge lies We’re not just building EVs, we’re delivering a complete electric commercial mobility solution: one that combines reliable vehicles, robust aftersales service, and data-driven fleet management, all designed to deliver lower total cost of ownership and maximise uptime

Our EVs are built ground-up for Indian conditions, matching or even outperforming traditional ICE vehicles. Whether it’s high payload capacity, high ground clearance, industry-first features like ADAS and fastcharging, or warranties of up to seven years, we’re making sure our customers get both performance and peace of mind.

But we know product alone isn’t enough That’s why we’re scaling fast In just a few years, we’ve grown our market share in the 3W cargo segment from 4% to nearly 12%. And with our 4W commercial EV, StormEV, launched in 2024, we’re already eyeing a 20 to 30 percent share in key cities With plans to expand to 300 to 400 touchpoints nationwide, we’re working to make Euler Motors a top three EV player and, more importantly, a trusted partner in India’s transition to electric

What are your top expansion priorities over the next 12–18 months?

Over the next 12 to 18 months, our priority is to scale Euler Motors across three fronts –production, geography, and operations – to power our next phase of growth

We plan to expand our presence from 50 cities to over 100, with a strong push into tier-2 markets that are showing increasing appetite for EV adoption, while continuing to grow in key metro cities

To enable this, we’re building out a stronger sales and service network This includes adding more service centres and growing our onground teams to deliver a seamless customer experience across regions.

On the manufacturing front, around 15 to 20 percent of the ₹638 crore recently raised – with Hero MotoCorp and British International Investment as lead investors is being directed towards increasing production capacity, boosting R&D, and accelerating product development to cater to diverse market needs

All of this is aimed at driving 100 percent revenue growth while cementing our leadership in the electric light commercial vehicle space

How does the Hero MotoCorp partnership drive your growth roadmap and milestones?

Our partnership with Hero MotoCorp is a big leap forward in our growth journey Hero MotoCorp isn’t just bringing capital to the table, they bring decades of experience in manufacturing, a strong distribution network, and a deep understanding of how the EV ecosystem is evolving in India That kind of strategic value is hard to match.

This collaboration is already helping us strengthen our supply chain, expand into new markets, and tap into shared strengths that will allow us to scale faster and more efficiently It also sends a strong signal to the ecosystem from investors to partners that we have the right backing and execution muscle.

Together, we're aiming to double our revenue and build a business that’s not only growing fast but also grounded in strong unit economics Our goal is to reach overall profitability within the next three to four years, while expanding from tier-1 cities into tier-2 markets where the next wave of EV adoption is set to happen

What is Euler Motors’ outlook and which segments will drive revenue?

We’re building for long-term growth with a sharp focus on reaching profitability in the next three to four years Our electric three-wheeler business continues to be the main revenue driver – it’s where we’ve grown our market share from 4 percent in 2021 to around 11 to 12 percent last year

In January 2025, we began scaling our electric four-wheeler, the StormEV While it’s still early

days, this segment holds significant potential and is expected to contribute 30 to 40 percent of our revenue by 2030

On the financial side, we’re targeting predictable sales growth, stronger gross margins, and EBITDA neutrality We’re also consciously reducing our reliance on subsidies by investing in R&D, manufacturing, and a strong sales and service ecosystem As we expand both product lines, our goal is to be among the top three players in India’s electric commercial vehicle market with a business that’s not just growing but built to last

How is Euler Motors aligning its roadmap and scale-up to meet FY26 targets?

Our focus right now is clear, we want to deepen our leadership in the electric commercial vehicle space by strengthening our presence across both three-wheeler and four-wheeler cargo categories. These will continue to be our mainstay product lines over the next few years, and we’re building on them with specific variants for different markets, like longer-range models for metro cities and more cost-effective options for smaller towns.

To keep up with rising demand, we’re significantly ramping up our manufacturing capacity and extending our reach beyond the 50 cities we're currently in Over the next 12 to 15 months, we plan to be in 90-100 cities That means more sales and service touchpoints, stronger charging infrastructure, and a more localised supply chain to ensure faster delivery and better after-sales support About 15 to 20 percent of our recent funding is going into R&D, product innovation, and plant expansion investments that will start showing returns over the next two to three years

We're being very deliberate about where we go next Our strategy is to prioritise high-impact segments and regions, especially tier-2 cities where EV adoption is picking up rapidly. We've seen strong traction in metros like Delhi, Chennai, and Hyderabad, and we’re confident about replicating that success in newer markets This will help us maintain a steady sales trajectory, aim for 100 percent revenue growth in the short term, and stay firmly on track to meet our FY26 goals

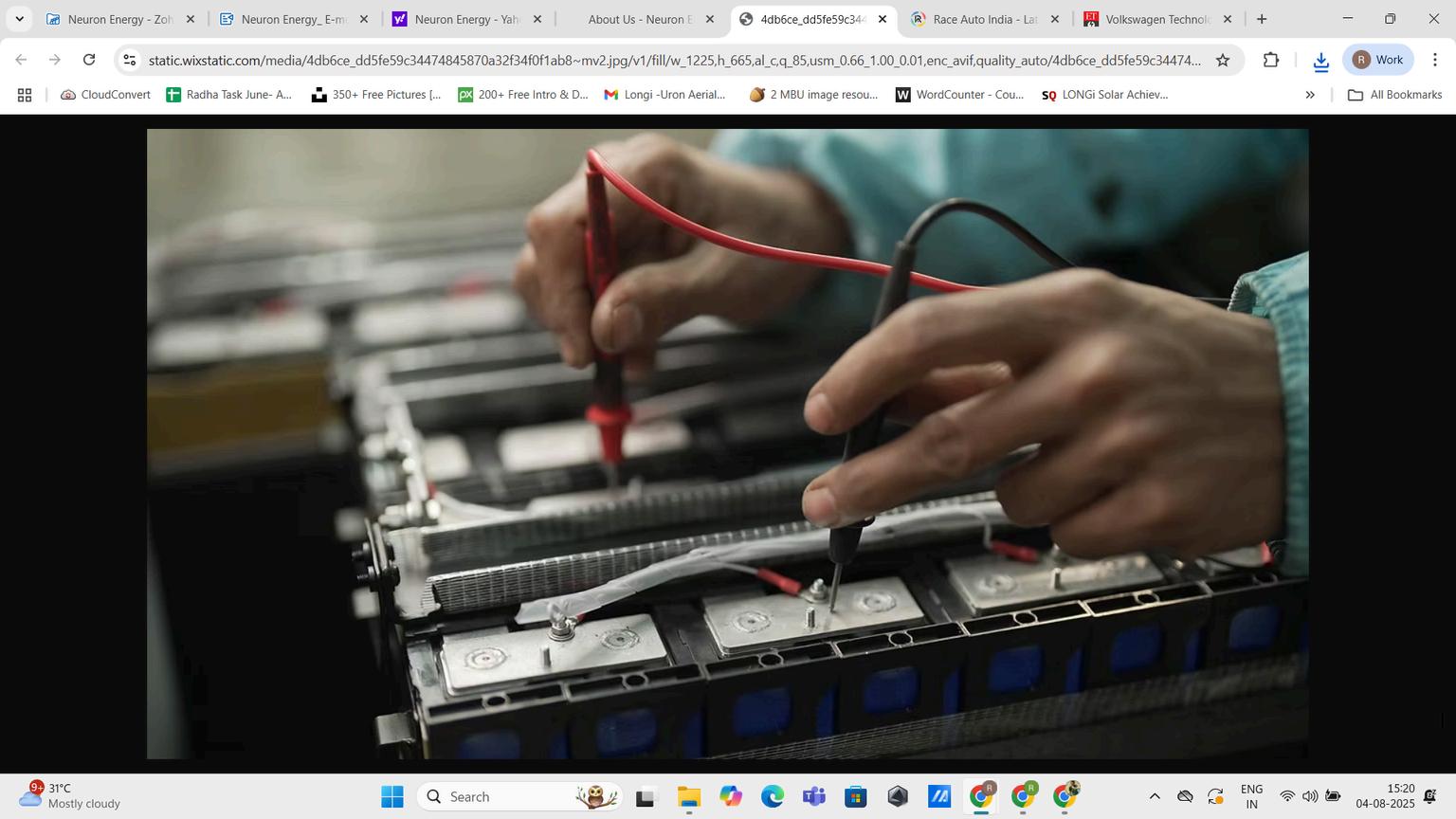

India’s electric revolution isn’t on the horizon, it’s already on the road And as it accelerates, it’s becoming clear that the true engine of this shift isn’t the vehicle, but the battery From powering e-rickshaws in Tier 2 towns to enabling solar backups in rural homes, batteries are no longer just energy carriers , they’re lifelines

But here’s the catch: while many batteries are built for test tracks, India’s real roads tell a different story From 45°C summers to broken roads, overloaded hauls, and patchy charging infrastructure , it’s in these conditions where battery performance is truly tested And that’s exactly where Battery-as-a-Service (BaaS) comes in as a gamechanger

Traditionally, buying an electric vehicle also meant bearing the brunt of battery ownership , which can account for up to 40% of the vehicle’s cost For gig workers, delivery agents, and small businesses, this upfront investment has long been a barrier BaaS flips this model.

By converting batteries from high-cost assets into pay-per-use or subscription-based services, BaaS unlocks accessibility. But cost savings aren’t the only benefit. Users no longer have to worry about battery degradation, replacements, or performance losses over time , the service model covers it all.

More importantly, with the rise of battery-swapping stations, downtime is reduced to minutes A discharged battery can be replaced with a fully charged one, keeping two- and three-wheeler users , the true foot soldiers of India’s EV growth , on the move

However, the success of BaaS doesn’t depend only on financial models It hinges on how batteries perform under pressure, heat, humidity, rough usage, and high load The heartland of India, often treated as an exception in product design, is actually the core market for EV adoption And that requires batteries that are heatresistant, load-validated, mileage-optimized, and capable of lasting beyond the warranty period

In a sector obsessed with spec sheets, what truly matters is what happens after the sale Reliability, servicing, and reparability are the real differentiators Batteries that can be maintained instead of discarded are essential , not just for sustainability, but for trust

The promise of BaaS extends beyond vehicles The same battery systems are powering homes during outages, replacing noisy generators, and providing grid resilience In rural India especially, they’re proving to be compact, durable, and low-maintenance , making them an ideal backup for fluctuating power supply

According to Battery Service Market Report 2025, Battery as a Service Market, valued at USD 2 68B in 2025, is projected to reach USD 4 52B by 2029, growing at a 13 9% CAGR As adoption increases, energy and automotive companies are forming alliances to build scalable battery-swapping ecosystems, opening up recurring revenue streams and bridging the last-mile power gap

In a space where batteries are often treated as interchangeable, there’s a quiet reckoning underway A few forward-looking energy players are choosing not to follow benchmarks , but to rewrite them They’re stepping away from the commodity mindset and focusing on engineering batteries that perform in real-world conditions, not just labs

Because the future of energy in India, mobile or stationary, isn’t built on short-term cost-cutting. It’s built on trust, durability, and a deep understanding of the people and roads that power the movement.

Battery-as-a-Service, when powered by this mindset, doesn’t just unlock access. It can build resilience, and that’s the foundation of a truly electrified India.

charging in India, and which segments lead the demand?

The EV charging market is expanding rapidly as EV adoption moves beyond early adopters to mass-market users Two key factors are fueling this growth: rising EV sales and policy support

Two- and three-wheelers remain the biggest demand drivers Their massive presence in urban commuting, last-mile delivery, and shared mobility creates a constant need for affordable, high-availability charging and swapping options. With 1.14million electric two-wheelers and 0 7million e-three-wheelers sold last year, most of the current charging demand is concentrated in this segment [1]

Passenger cars are also creating a different kind of demand fast-charging Fleet operators in logistics and ride-hailing are also driving investments in high-capacity chargers to maximise uptime

Supported by FAME-II incentives, a stable 5% GST, and PLI-led local manufacturing, automakers and energy companies are scaling networks with “mega-chargers ” Together, these trends are driving a dual push two- and three-wheelers lead on volume, whle cars and fleets are driving fast-charging infrastructure growth

How do charging challenges differ in urban and rural areas, and how are they being tackled?

The challenges are very different in cities and rural areas In urban areas, the biggest issue is space most people live in apartments without private parking, and public chargers often get

Two- and three-wheelers lead EV charging demand across urban and rural India

FAME-II and state EV policies boost investments and expand charging infrastructure

Battery swapping and private charging networks ensure high uptime for fleet operations

overcrowded There’s also heavy pressure on power grids, which can cause delays at charging points To address this, cities are adding fastcharging hubs in commercial zones, using smart grid systems to manage power loads, and encouraging private investments to improve access.

Rural areas face the opposite problem, such as fewer chargers, long stretches without charging points, and unreliable grid supply That creates “range anxiety” for drivers and limits high-speed charging options The solutions here are more decentralised, such as solar-powered standalone chargers, mobile charging vans, and government-backed highway charging stations

So, while cities are solving for efficiency and grid management, rural areas are focusing on accessibility and reliability Both are equally important if India wants EV adoption to grow beyond major cities and truly become inclusive.

How have FAME-II and state EV policies impacted investments in charging infrastructure?

FAME-II has laid the foundation for India’s charging network The ₹1,000crore allocation for public charging helped set up nearly 2,900 chargers across 68 cities, and subsidies covering up to 80% of upstream costs encouraged Oil Marketing Companies to expand fast-charger deployment to 7,432 units

State EV policies have taken this further by attracting private players Maharashtra, Delhi, Gujarat, Haryana, and Kerala, for instance, offer capital subsidies, GST reimbursements, and even mandate EV-ready buildings and highways These initiatives reduce investment risk and make commercial viability stronger

That said, the EV-to-charger ratio is still high around 235 EVs per public charger which means alternate models are critical At Neuron Energy, we’re using this policy momentum to expand battery leasing and swapping networks, particularly in Tier 2 and 3 cities, where traditional charging is still catching up. These models ensure high uptime and predictable costs for fleets, which is key to driving adoption in these markets

What’s the future role of public vs. private charging networks in India’s EV landscape?

Both public and private networks will play equally important but different roles Public charging, supported by FAME-II and state policies, is crucial for long-distance travel and reducing range anxiety As of mid-2025, India has over 12,000 public charging stations,[1] and expansions along highways and key urban clusters are already planned

Private networks, on the other hand, will define the daily charging experience. OEMs are teaming up with private operators to set up fastcharging stations, and residential and workplace charging is expanding through partnerships with RWAs and builders For twoand three-wheelers, battery swapping is scaling rapidly because it saves time and keeps operations running smoothly

At Neuron Energy, we see private networks and swapping models as critical for high-uptime fleet operations, while public infrastructure ensures geographic inclusivity Going forward, interoperability and unified payment systems will be key to making this ecosystem seamless and user-friendly

Which new business models in EV charging are gaining traction in India, and why?

The EV charging business is evolving quickly, with newer models focused on flexibility, affordability, and uptime Revenue-sharing partnerships, where landowners provide space and electricity, and operators manage installation, are helping expand networks across commercial and residential spaces Payper-use and subscription-based options are also gaining popularity, giving users and fleet owners cost flexibility

What’s growing fastest, especially for two- and three-wheelers, is Battery-as-a-Service At Neuron Energy, we’ve seen strong demand for battery leasing combined with IoT-enabled diagnostics and performance tracking This gives fleet operators predictable costs, high uptime, and minimal downtime something that’s especially valuable in Tier 2 and 3 cities, where grid-connected charging is still limited

Public-private partnerships, solar-powered charging hubs, and app-based platforms for real-time booking and payments are also making the user experience smoother. These models work because they reduce upfront costs, improve infrastructure density, and make EV adoption more accessible across the country

where vehicles are parked for hours. They cost less to install and maintain, but the ROI is slower and depends a lot on consistent daily use

We also look closely at grid capacity, incentives, and user behaviour before deciding what goes where At Neuron, we rely heavily on IoT-based monitoring to track usage patterns and manage energy flow, which directly impacts profitability.

sustainability Our Always On charging network, ensures 24X7 availability, high asset utilization of over 50%, thereby, maximizing efficiency With JBM’s ‘India First’ focus towards building a resilient supply chain, we prioritize the TIP approach i e Technology, Innovation and People for operational excellence. JBM ECOFUEL’s sustainable infrastructure with a minimum 12-year lifespan provides efficient, reliable and seamless user experience

In EV charging, how can ESG move beyond compliance to drive real value for businesses and communities?

At JBM ECOFUEL, ESG is not just about compliance, it is a core design and planning principle True value creation comes when ESG is embedded into the DNA of the business model We are working towards incorporating new age solutions by deploying solar-ready infrastructure, integrating battery energy storage to reduce peak load These measures will not only lower the carbon footprint across the asset lifecycle but will also optimise operating costs for our partners

From a social perspective, we aim to position our network as a platform for inclusion. We have created over 500 direct jobs in operations & maintenance in Tier 2 & 3 cities where green employment opportunities are limited

From the governance perspective, we strive to maintain transparency in asset inventory, uptime metrics and safety audits including operating data available on ECOFUEL digital platform for charging network operation management. These build trust with users, partners and regulators, especially in a sector where adoption depends on confidence, trust itself becomes a competitive

M ECOFUEL ensures 24x7 reliable fast-charging with optimum asset utilization, ximizing efficiency and user trust

h solar-ready infrastructure, BESS integration, and green employment in Tier 2 & 3 es, ESG is embedded into every stage of operations

m megawatt-level bus depots to AI-driven energy management and V2G readiness, M is building India’s EV charging backbone for 2030 and beyond

ge Moreover, when ESG becomes to the business, the benefits compound translating to lower lifecycle costs, brand equity, faster regulatory approvals e resilient community relationships

ll high-powered, interoperable ng drive EV adoption in India, and JBM ECOFUEL responding?

wered, interoperable and grid-friendly s are the bridge between early adoption and true mass adoption of EVs in India. The faster we can charge, the more confidence drivers and fleet operators have in replacing ICE vehicles and the more efficiently we can use grid resources, the lower the total cost of ownership becomes

High-power mobility hubs to support 60-360

kW DC Fast Charging

Megawatt-level electric bus depot readiness based on dynamic load sharing principle to address peak load charging demand for managing large scale fleet operation

Smart load management and dynamic power sharing, ensuring multiple vehicles charging simultaneously without oversizing the grid connection

Collaboration with discom for integration of Battery Energy storage systems and solar readiness to reduce peak demand and enable cleaner charging with green tariff plan

AI-based site selection and utilisation analytics to ensure that ECOFUEL chargers are operationalized to deliver maximum impact

By providing fast charging solutions that are universally compatible and grid-sympathetic, we are not just addressing today’s challenges, but we are building the infrastructure backbone that can handle the EV volumes of 2030 and beyond

Which policy and regulatory shifts are most critical to accelerate India’s EV charging rollout over the next five years? India’s EV charging infra expansion is anchored on two strategic pillars, the PM E-DRIVE scheme and the Ministry of Power - Technical guidelines

for charging Infrastructure building Together, they are forging both the financial and technical foundations needed for a resilient, scalable network This dual approach incorporating both, policy and regulatory support are most critical for the rapid rollout of EV charging infra in India over the next 5 years With these initiatives bringing in financial incentives and technical clarity, this will encourage robust private-sector participation at scale Moreover, common standards and subsidized deployment will avoid fragmentation and stranded infrastructure. Together, these efforts towards streamlining approvals, technical standardization, subsidy clarity and digital enablement have laid the groundwork for a nationwide, reliable and userfriendly EV charging ecosystem deployment.

What top three tech trends will shape India’s EV charging evolution, and how is JBM ECOFUEL preparing?

JBM ECOFUEL is the leading smart EV charging infra solutions provider, having proven expertise in the electric bus depot electrification domain, having electrified over 50 depots across various states pan India. Our technological edge stems out of the following:

JBM ECOFUEL has been one of the early adopters of AI-driven energy management, V2G infrastructure and ultra-fast charging We deployed our first 120 kW charger in 2018 and have deployed Megawatt Charging Solutions in 2024

In collaboration with DISCOM, JBM ECOFUEL has undertaken a grid integration POC for Battery Energy Storage Systems (BESS).

Our V2G and solar readiness plan is designed to reduce peak demand and enable cleaner charging with a green tariff plan

ECOFUEL’s Software as a Service (SaaS) platform supports various charging operations. It includes Network Operation Centre (NOC) monitoring, AI-driven energy management, charging operations, and asset lifecycle management

India’s transition to electric mobility is shaping up as a tale of two Indias In one, we see the steady rise of electric vehicles in metro cities like Delhi, Bengaluru, and Mumbai supported by dense charging networks and premium EV offerings In the other, tier 2 cities, small towns, and rural areas, once left out of the EV conversation, are now making strong progress and changing how adoption is understood

Global Benchmarks vs India: A Stark Contrast

Around the world, countries leading the EV shift have set high standards for public charging networks. China has about 1 public charger for every 7 EVs, and the United States has about 1 for every 20 These numbers show a clear focus on making charging easy, reliable, and available at scale

With just 1 public charger for every 156 EVs, India is lagging nearly 22 times behind China and over 7 times behind the U.S. on this key metric. But the bigger concern lies in the internal divide,the growing gap between urban and rural regions

In Indian cities, where most of the EV chargers are located, the charger-tovehicle ratio is somewhat better though still not enough But in rural and semi-urban areas, the ratio stretches beyond 1 charger for every 400 EVs

Even though rural areas have more space and a growing interest in EVs, they are still not getting enough attention. More than 70% of India’s 30,000 public charging stations are installed in metro cities or along highways, leaving smaller towns and inner regions with very limited support

New approaches like solar-powered charging kiosks are starting to show potential. If India’s EV journey is to be inclusive, infrastructure must shift from metro-centric to mobility-centric designed to serve the emerging wave of users who are not just willing but waiting

Even with fewer chargers, smaller cities are showing strong growth Surat, Jaipur, and Lucknow have seen EV usage more than double from 4 16% in FY2022 to 10 67% in FY2025 Tier 3 cities have grown even faster from 1.69% to 8.68% during the same time. These are not small changes. They show a real shift in how people are thinking about mobility

In many states, smaller cities are doing better than their capital cities Surat now accounts for 25 17% of Gujarat’s EV sales, ahead of Ahmedabad’s 21.28%. Ranchi makes up over a quarter of Jharkhand’s EV numbers, much higher than expected In Uttar Pradesh, it’s not just Lucknow leading the way Cities like Gorakhpur and Bareilly are also showing strong adoption, driven by practical needs and increasing awareness

This data challenges old assumptions: the EV future isn’t being written only in metro cities, it's being shaped by smaller cities and rural areas too

in homes or offices, the decision to buy is easier But in smaller towns and rural areas where public chargers are rare and people may not understand home charging the hesitation is much higher

A strong, reliable charging network builds more than just convenience. It gives buyers the confidence to switch, helps improve resale value, supports businesses that rely on EVs, and removes the fear of running out of charge It turns EVs from something only a few people can use into something useful for everyone Without charging, the EV push slows down. With it, the market grows quickly.

India’s villages and nearby small towns are set to become the next big market for EVs Rural India already makes up 55% of national twowheeler sales making it ideal for affordable electric models And rural homes often have what urban ones don’t: space to park, access to power during off-peak times, and room for overnight charging

Electric vehicles in the ₹60,000–₹80,000 price range are becoming popular, especially in areas where community-based solar charging is starting to develop. With the right information and easy financing, rural areas can skip over older systems and move directly to cleaner, more affordable electric transport

What’s driving this rapid growth in non-metro areas? The answer is simple: economics EVs especially two- and three-wheelers have low running costs, need less maintenance, and work well for local travel For buyers who use their vehicles to earn a living, saving money over time is a strong reason to switch

Also, shorter daily travel, fewer traffic issues, and simpler roads make smaller towns a great match for electric vehicles It’s no surprise that 71% of EV sales in Tier 3 cities are electric two-wheelers

India’s electric vehicle movement cannot be measured by what’s happening in its biggest cities alone Real success means bringing clean mobility to small towns, villages, and every place in between. The growth is already visible The numbers are encouraging But without fair infrastructure, access to loans, and local support systems, the shift to EVs may remain uneven

India’s EV future will only be complete when every region, urban or rural is part of the journey.

For many potential EV buyers across India, the biggest concern isn’t the vehicle, it's whether they’ll be able to charge it If charging stations are far away, unreliable, or missing altogether, even the best EV feels like a risky bet In metros, where chargers are often available

GLIDA is seen as one of India’s most user-centric EV charging networks. What principles and innovations like “Charge-Thru” are shaping your approach to building a seamless and inclusive ecosystem?

GLIDA’s mission is to create a barrier-free, user-centric EV charging network across India Guided by principles of customercentricity, sustainability, scalability, and innovation, GLIDA ensures charging is intuitive and accessible. Innovations like Charge-Thru (QR-based, app-less charging) and an interoperable RuPay prepaid card simplify user experience With 985+ charging points across 17 states, GLIDA’s inclusive approach supports individual users and fleets alike. Strategic partnerships and future-ready hubs in malls and airports further enhance accessibility, while renewable integration and safety remain core to its expansion

With experience spanning both public and private sectors, how has this blend influenced your leadership and strategy in India’s EV charging journey?

As Executive Director of GLIDA, my threedecade journey across public and private sectors has profoundly influenced how I lead and make strategic decisions This diverse background has equipped me with a unique blend of pragmatism, adaptability, and a deep-rooted commitment to the public good qualities essential for building a seamless, inclusive, and sustainable EV charging ecosystem in India

My public sector experience taught me the importance of aligning diverse stakeholder interests At GLIDA, I foster co-creation with

rector

er-friendly charging with Charge-Thru and prepaid cards

nds public-private experience for sustainable growth

ble, green infrastructure and supportive policies

industry partners, encouraging innovation that serves a wide spectrum of EV users from individual drivers to large fleets

Large-scale public projects instilled in me the patience to navigate complexity and the foresight to prioritize sustainable outcomes These lessons shape GLIDA’s expansion strategy, ensuring our network not only meets current demands but is also future-ready. We aim to support India’s EV goals with infrastructure that is scalable, reliable, and environmentally responsible

My tenure in government roles provided deep insight into regulatory frameworks Today, I actively engage with policymakers to advocate for EV-friendly reforms from grid reliability to urban planning This ensures GLIDA’s growth is aligned with national mobility objectives while addressing realworld challenges Our vision is not just about deploying chargers; it’s about shaping a resilient ecosystem that supports India’s transition to clean mobility

How do you assess the current EV policy and regulatory landscape, and what reforms do you believe are critical for faster infrastructure rollout?

GLIDA’s journey from 20kW chargers to 200kW+ hubs reflects India’s evolving EV landscape. However, policy gaps persist. Key reforms include:

Raising LT connection limits (e g , Gujarat’s 150kW model)

Allowing multiple connections per site

Creating a dedicated EV infrastructure category

Shifting grid upgrade costs to shared models

Clarifying VCB norms to reduce costs

GLIDA also advocates for stronger CAFE norm enforcement and a dedicated Emissions Regulator to push OEMs toward zero-emission fleets Infrastructure must be demand-driven, not subsidydependent, with technology-neutral policies focused on emission outcomes

As India advances towards mass EV adoption, how can the industry balance rapid infrastructure growth with longterm sustainability, and what role should players like GLIDA take?

GLIDA emphasizes a balanced approach to infrastructure growth:

Modular, scalable stations for quick deployment and future upgrades

Smart charging systems to manage grid load and reduce costs

Renewable energy integration for lower emissions and energy independence

Consumer awareness campaigns to drive adoption

Policy alignment via CAFE norms to ensure predictable demand GLIDA’s role includes thoughtful expansion, techdriven solutions, and policy advocacy Its “All Lights Green” vision supports a resilient, eco-friendly EV ecosystem that meets both immediate and long-term goals.

India's automotive sector is undergoing a seismic shift, propelled by a growing emphasis on sustainability and environmental responsibility. As the world's third-largest automobile market, the nation is at a crucial juncture in its journey toward widespread electric vehicle (EV) adoption. Recognizing the pivotal role a robust charging infrastructure plays, India is aggressively pursuing a multipronged strategy to establish a comprehensive and inclusive EV charging ecosystem, a prerequisite for achieving its ambitious climate and economic objectives The government's target of 30% EV penetration by 2030 is not just a policy statement, but a rallying cry to build a network that caters to the diverse charging needs of private EV owners in bustling urban centers to commercial fleet operators traversing national highways and underserved communities scattered throughout rural India

The statistics paint a compelling picture of both progress and the challenges that lie ahead The Indian EV market has demonstrated impressive growth, with sales surging by over 45% in 2024, indicative of rising consumer confidence However, the current EVto-public-charger ratio of 135:1 underscores a pressing need for infrastructure augmentation This metric highlights the gap between EV adoption and charger availability, requiring strategic interventions to close the divide and alleviate range anxiety among potential EV buyers Significant progress is already underway in scaling India's EV charging infrastructure Initiatives such as the Faster Adoption and Manufacturing of Hybrid & Electric Vehicles (FAME) scheme and the PM Electric Drive Revolution are driving development, supported by a budgetary allocation, which includes a dedicated Rs 20 billion for EV public charging stations (EVPCSs) Further solidifying this progress, the Ministry of Power has issued the Guidelines for Installation and Operation of Electric Vehicles However, when compared to the global average, which hovers around a more manageable 6 to 20 EVs per charger, it becomes abundantly clear that India must make significant strides in expanding its public charging infrastructure to effectively support and sustain the burgeoning EV ecosystem

To address this challenge, India's EV charging vision rests on several strategic pillars: scalability, inclusivity, and strategic partnerships. Scalability is paramount: the network must be designed to support a rapidly growing EV fleet, encompassing everything from nimble twowheelers to heavy-duty commercial vehicles. This necessitates a well-planned deployment of charging points along highways, in urban centers, residential complexes, and workplaces, offering a mix of slow and fast charging options to cater to varying user needs Moreover, the integration of renewable energy sources into charging stations, leveraging India’s abundant solar and wind resources, can minimize the carbon footprint of EV charging, aligning with India’s broader climate commitments

A successful EV transition will require a well-defined strategy that instils confidence among charge-point operators, fleet managers, and investors This involves proactively identifying prime charging locations, considering the types of chargers needed (fast vs slow), and understanding grid upgrade requirements Furthermore, governments must rely on data and engage with the private sector to navigate demand uncertainties and account for the unique charging requirements of various transportation modes, from two-wheelers to heavy-duty commercial vehicles A well-informed package deal backed by reliable data, available infra (land, grid, etc) and favourable eco-system (ease of doing business including financing) will attract more private sector players as well promote technological interventions both in urban and rural pockets

India's journey toward a scalable and inclusive EV charging infrastructure presents both a significant challenge and a unique opportunity to become a global leader in electric mobility Prioritizing technological standards, policy reforms, financial innovation, and community engagement will ensure a resilient network that supports climate and economic goals while democratizing clean mobility The future of transportation depends on powering this transition and paving the way for a sustainable and equitable mobility ecosystem

India is undergoing a major shift in the way mobility is powered, and electric vehicles are at the center of this transformation The development of charging infrastructure is one of the most important parts of this journey, as it will decide how quickly people adopt electric mobility in the coming years At present, the EV market in India is growing at an impressive rate, driven by government policies, falling battery costs, and rising consumer interest in clean transport But the availability of charging stations remains a critical issue that needs immediate attention

According to official data from the Bureau of Energy Efficiency, India has more than 12,000 public charging stations installed across the country, with a large part concentrated in major cities like Delhi, Mumbai, Bengaluru, and Hyderabad. However, this number is very small when compared to the growing base of EVs India has already crossed 3 million registered EVs, most of them two- and three-wheelers, which means that the ratio of vehicles to chargers is still heavily unbalanced For mass adoption of EVs, the ratio needs to be closer to one charger for every 10–15 vehicles, whereas in India, it is currently far behind this mark.

The government has been actively pushing for expansion Under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, support has been given for thousands of new charging stations to be set up across highways, cities, and rural areas. Energy companies like NTPC, Indian Oil, and private players such as Tata Power, Statiq, and ChargeZone are investing heavily in building networks Recently, the Ministry of Heavy Industries sanctioned nearly 7,500 new charging stations under the FAME-II program, covering major highways and urban areas to ensure that range anxiety is reduced for EV users

land at concessional rates, capital subsidies, and electricity tariff discounts for charging operators This has encouraged local entrepreneurs and startups to enter the sector, creating a competitive and fast-evolving ecosystem

The focus has also shifted to fast charging technologies, especially DC chargers, which can recharge a car in less than one hour While most existing stations use AC slow chargers, which are suitable for two-wheelers and overnight charging, the future growth depends on the rapid expansion of DC fast charging stations along highways and intercity routes Battery swapping is another model being explored for two- and three-wheelers, as it saves time and reduces dependence on fixed charging points.

The economics of charging infrastructure are also improving with innovations in solar-powered charging, grid integration, and partnerships between utilities and private firms Many state governments have also announced policies with incentives such as

Looking at the future, the potential is enormous NITI Aayog has estimated that by 2030, India could need over 2 million public charging stations to support its EV target of 30% of all new vehicle sales With declining costs of batteries, better technology, and clear policy support, the EV charging market could become one of the most dynamic sectors in India’s clean energy journey The pace of infrastructure development will be a key factor in shaping the success of the country’s electric mobility goals

India has made good progress in building its EV charging base, but a lot more is required to match the speed of EV adoption. The coming years will likely see rapid expansion, innovative business models, and greater collaboration between government and industry, making EV charging a strong pillar of India’s green transport future.

SOURCE: VAHAN DASHBOARD

SOURCE:

SOURCE: VAHAN DASHBOARD

Smart Manufacturing Company of the Year

Jendamark India Pvt. Ltd.

Powertrain Manufacturing Excellence Award

Compage Automation Systems Pvt Ltd

Commercial EV Manufacturer of the Year - 3W

Sustainable Manufacturing Excellence Award

3ev Industries Pvt. Ltd.

R&D Excellence Award (Advanced Power Electronics Innovation)

Innovative EV Components Manufacturer of the Year (Critical EV Sub-systems)

Uno Minda EV Systems Pvt Ltd

Best Connected Vehicle & Telematics Solution

Gravton GOTAC by Gravton Motors Pvt. Ltd.

PorVent®

R&D Excellence Award (Battery Safety & Venting Innovation) ISIEINDIA

Best EV LAB and EV Skill Ecosystem Development Award

Quality Assurance & Testing Innovation Award

3ev Industries Pvt. Ltd.

Battery Technology Breakthrough Award

Lixir Energy

2 0 2 5

TATA Starbus Urban 9X12

Electric Bus by TATA Motors Ltd. Urban Commuter Award (E Bus)

Urban Commuter Award (3W Passnger)

Piaggio Apé E-City MAX by Piaggio Vehicles Pvt Ltd

Farm to Future Award

OORJA EV C220EE by Cygnus Motors LLP

Value Leader Award –Innovation & Safety

Ace Pro EV by TATA Motors Ltd.

Range Runner Award (3W)

Apé E-City by Piaggio Vehicles Pvt Ltd

Urban Delivery Champion (2W)

E-Luna by Kinetic Green Energy & Power Solution Ltd.

Urban Delivery Champion (3W Cargo)

Apé E-Xtra MAX by Piaggio Vehicles Pvt Ltd

Urban Delivery Champion (LCV)

TATA ACE EV by TATA Motors Ltd.

Efficiency Expert Award

Apé E-City Ultra by Piaggio Vehicles Pvt Ltd

Public Transport Pioneer

Ultra Urban 9X9 Electric Bus by TATA Motors Ltd.

Emerging Leader of the Year –EV Manufacturing

KARAN KADABA

Director 3ev Industries Pvt Ltd

EV Supply Chain Leader of the Year

SOURABH SHARMA

Vice President Uno Minda Limited - Controller Division

Visionary Leader of the Year –EV Manufacturing

SULAJJA FIRODIA MOTWANI

Founder & CEO

Kinetic Green Energy & Power Solution Ltd

"INDIA'S