Keyperson Protection enables you to cover the cost of losing a key individual, either on death or critical illness. It could provide an amount to cover loss of profits, recruitment of a new member of staff and training costs. Can your business afford not to have this?

In a survey, over 59% of small businesses said they would cease trading within one year after the loss of a key person. Source: L&G State of the Nation’s SMEs 2021.

The most valuable assets of a business is its staff, business success or failure can depend on them. They are ofter referred to as ‘key persons’ whether that is because of their knowledge, skills or the contacts they know. These peoples deaths or incapacity could result in the financial performance of the business being widely affected.

Such an event could lead to a significant fall in profits, perhaps to the inability to repay loans or meet other obligations and, in extreme cases, to the collapse of the business.

Just as it is necessary to insure a business against the loss of or damage to physical assets, it is also vital to insure against the loss and/or against the serious illness/disability of a key person.

There are three different covers for Key Person Protection

• Payroll-based approach - when revovery period does not exceed 5 years

• Salary-Based approach - when the aim is to find an equally competent replacement

• Profits based approach - when there are few or only one key persons

Business Loan Protection can help your business pay an outstanding overdraft, loan or commercial mortgage, should a key employee die or be diagnosed with a terminal illness (with a life expectancy of less than 12 months) during the length of the policy. It could also pay out if they’re diagnosed with a specified critical illness (if Critical Illness Cover is chosen at outset for an extra cost) during the length of the policy.

When you take out Business Loan Protection, your cover should reflect the amount your business owes in borrowed money. This can ensure that if you claim for a pay-out, you have sufficient cover in place to repay your business loans.

There can be serious implications for businesses that are unable to pay back loans, so Business Loan Protection can help to give your staff and stakeholders some peace of mind.

Death in service can be offered to employees by an employer. It means they’ll pay out a tax-free lump sum of cash to the claimants family or friends if they die while they’re employed by the business.

Usually, employees will only be eligible for a death in service benefit if they’ve signed up for the relevant pension scheme.

Relevant life cover offers a cost-effective way to provide life insurance with terminal illness cover benefits to employees.

Providing a relevant life policy as part of an overall benefits package can make your company more attractive to potential employees, can help to retain and reward existing employees, and sends out the signal that you are a responsible and caring employer.

Relevant life cover can also help employers reduce their tax liability, and so it can be an affordable way for smaller companies to offer similar benefits to their larger rivals when looking to attract employees.

Premiums are usually classed as a business expense, and so are likely to be an allowable tax deduction. Keeping the plan in trust offers the potential for an employee to plan for inheritance tax if an estate is, or is likely to be, worth more than the current inheritance tax threshold.

Death in service is a cost effective way of providing a very valuable employee benefit that may not be available from the other employers that compete for your staff. Company provided life cover is becoming increasingly more important as personal insurance costs have risen and there is more mortgage debt than ever. Death in Service is therefore an effective tool to boost employee retention, wellbeing, and staff confidence in their employer. Call our Team Today

Our team are here to help create a bespoke business protection plan for you and your business.

For expert guidance from Smith & Pinching call our team today. An initial consultation is at no cost to you, and can be face to face, over the phone or via a video call at a time that works best for you.

• When was the last time you updated your Will?

• Does it still give to the people you want it to? Are you even sure it’s valid?

• Do you have a Will at all?

Lots of people assume that their money will automatically go to the people they want it to, in the way they want it to. This is often far from the case where there is no Will. A Will allows you to leave instructions for those who are handing over your life’s earnings and assets. It’s so important to get this right. Going to a recommended solicitor gives you the peace of mind this has been done properly.

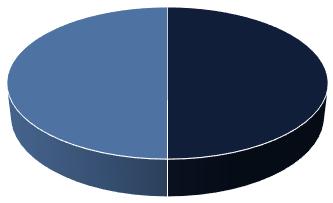

New research from Canada Life has found that 1/2 of UK adults have not written a Will. The survey also mentioned that 1/3 of over 55s say they do not need a will*. There are a lot of decisions to be made if you are a Business owner and we are here to help find the correct solicitor for you, with a large list of local solicitors we can help you get in contact with the firm that suits you the best.

*This information was correct as of 29/03/2023.

• Who is allowed to make decisions for you if you lose mental capacity?

• What happens to the major decisions around your finances, your health, even in your business?

• Did you know that joint assets could be frozen if you lose mental capacity?

Power of Attorney allows someone else to act on your behalf when you are unable to. While people often think of this as being “only if you have dementia” or for later in life, the reality is that this can happen at any time for a number of reasons. Planning ahead can allow those you trust the most to make decisions based on the instructions you leave for them.