End of the 2022-23 School Year

E-Learning Days

● 5 Days Built into the Calendar

● Do not need to be made up by Students

● Teachers are working from home supporting student learning

● Support staff may earn lost working hours by electing to work additional hours at the end of the year

● All 5 Days Used

Snow Days

● No built into the calendar

● Added to the end of the school year

● 2 Snow Days Used

● Make Up Days = May 30th and 31st

● Support Staff Optional Days = June 1, 2, 5, 6, 7 (survey will come out in May)

EMPLOYEE BENEFITS REVIEW

APRIL 2023

What is Open Enrollment?

During this time benefit eligible employees are allowed to make changes to their benefits. This is the only time of year where changes can be made without a qualified life event. Any changes that are made go into effect July 1, 2023.

April 12 - May 5

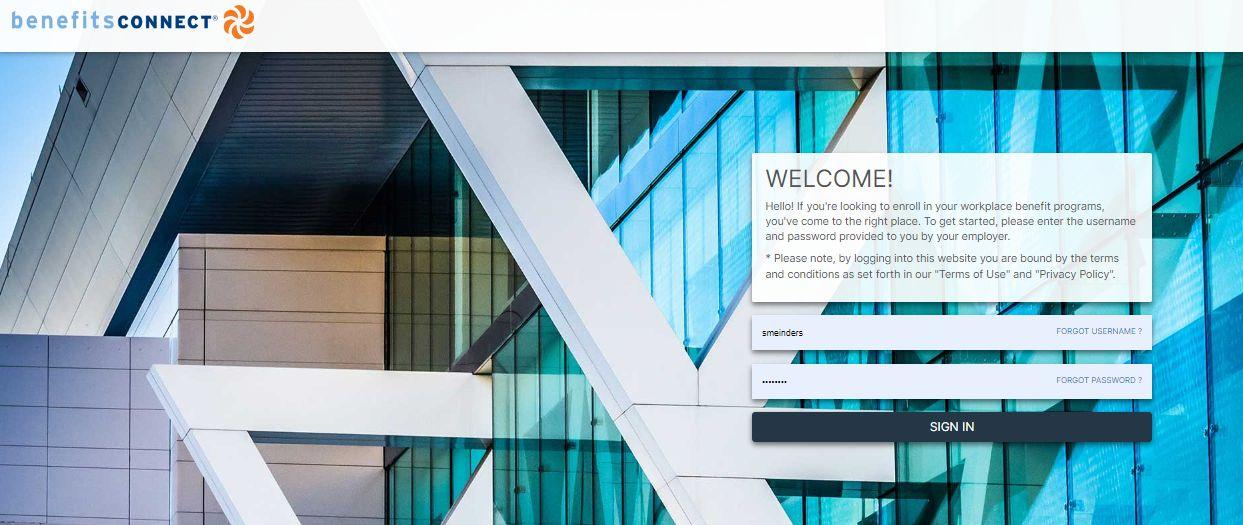

Enrollment updates will be made online this year via Benefits Connects.

FULL TIME EMPLOYEES ARE OFFERED: FULL TIME = WORKING MORE THAN 30 HOURS PER WEEK

● Medical Insurance for self and/or family towards one of the following three plans:

○ $500 Deductible (partial self funded (PSF) from $5000) for employee with options to add one dependent or family. District pays for 100% of Single PSF Plan.

○ High deductible health plan (HDHP) with a $2500 deductible and the district contributes the savings in premium to the employee’s health savings account (HSA). This plan will not be a partially self funded plan.

○ High deductible health plan (HDHP) with a $5000 deductible and the district contributes the savings in premium to the employee’s health savings account (HSA).

● Dental Insurance

○ Delta Dental Plan for employee with options to add one dependent or family. District pays for 100% of single plan.

OTHER BENEFITS TO FULL TIME EMPLOYEES ARE:

The following benefits are called “voluntary” benefits meaning there is no district financial support for them but offered if needed by the employee at their own cost and deducted from monthly paychecks.

● Avesis Vision Insurance

○ Coverage for vision exams, lenses, frames and contact lenses.

● Long Term Disability (LTD) via UNUM

○ You never expect a serious illness or accident to happen, but when it does, it can interrupt your ability to work for months. LTD can give you the financial support you need to manage your disability and your household.

● 403b Retirement Plan (also called a Tax Sheltered Annuity or TSA)

○ Designed to supplement your pension and social security benefits at retirement. You choose how much of your current income to save pretax, through automatic salary reductions.

OTHER EMPLOYEE BENEFITS

● Iowa Public Employer Retirement System (IPERS)

○ All regular (ongoing) employees of the Forest City Schools are eligible for IPERS and often substitute employees as well once they “qualify”.

○ Contribution Rates: Employee Share = 6.29%, Employer Share = 9.44%

● Cafeteria Plan (Flex Medical Account)

○ Enrollment into Cafeteria Plan is in August each year.

● Employee Assistance Program (EAP)

○ Call for confidential access to a Licensed Professional Counselor who can help you with:

• Stress, depression, anxiety

• Relationship issues, divorce

• Job stress, work conflicts

• Family and parenting problems

• Anger, grief and loss

• And more . You can also reach out to a specialist for help with balancing work and life issues.

WHAT IS A DEDUCTIBLE?

● A specified amount of money that the insured must pay before an insurance company will pay a claim. Once you meet the deductible, then coinsurance applies until you meet the out of pocket limit.

PSF Plan = $500 (Wellmark = $5,000, Advantage pays to $500)

PSF $2500 HDHP = $2,500 (Wellmark = $5,000, Advantage pays to $2,500)

$5000 HDHP = $5,000

● On PSF Plan, if you go to the hospital, they can only see/verify the Wellmark amount ($5,000) and may ask you to make a down payment. You can call Advantage Administrators to help as they recommend you do NOT make a down payment.

ARE THERE SERVICES COVERED BEFORE YOU MEET YOUR DEDUCTIBLE?

A copayment or coinsurance may apply instead on $500 PSF (not HDHP)

● Well-Child Care

● Telehealth Services (Doctor-on-Demand)

● Office Services/Outpatient Services

● Urgent Care

● Preventative Care (routine vision exam, colonoscopy, mammogram, etc)

● Drug Card = $50 per person deductible, then tier pay applies for Rx (per calendar year)

WHAT IS THE OUT-OF-POCKET LIMIT?

The out-of-pocket limit is the most you could pay in a year for covered services.

● $500 PSF Health = $1,000 per person per calendar year

and/or $500 PSF Drug Rx = $1,000 per person per calendar year

■ Deductible and out-of-pocket maximum amounts you pay for covered prescription drugs under Blue Rx Value Plus apply toward the Alliance Select medical deductible and out-of-pocket maximum. Likewise, deductible and out-of-pocket maximum amounts you pay for covered medical services under Alliance Select also apply toward the Blue Rx Value Plus deductible and out-of-pocket maximum.

● $2500 PSF HDHP = $2,500 per person per calendar year

● $5000 HDHP = $5,000 per person per calendar year

WHAT IS PARTIAL SELF FUNDING (PSF)?

● The District purchases a lower premium, higher deductible health plan.

● The District then partial self-funds the account to a lower deductible plan.

● The District receives a savings on the premium vs. a regularly priced plan at the same benefit level.

● Savings are then used to cover employee’s medical expenses via a third party administrator (Advantage Administrators).

● Employee’s should ONLY PAY after Advantage Administrators has determined their coverage (see the end of this presentation).

WHAT IS HDHP AND HSA?

● HDHP = High Deductible Health Plan

○ A plan with a higher deductible than a traditional insurance plan. The monthly premium is usually lower, but you pay more health care costs yourself before the insurance company starts to pay its share (your deductible). A high deductible plan (HDHP) can be combined with a health savings account (HSA), allowing you to pay for certain medical expenses with money free from federal taxes.

●

HSA = Health Savings Account

○ An HSA is an account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses, as defined in the tax law.

○ By using pre-tax dollars in an HSA to pay for deductibles, copayments, coinsurance, and other qualified expenses, including some dental, drug, and vision expenses, you can lower your overall health care costs.

○ You can contribute to an HSA only if you have an HSA-eligible HDHP.

WHY CHOOSE A HDHP?

One way to manage your health care expenses is by enrolling in a High Deductible Health Plan (HDHP) in combination with opening a Health Savings Account (HSA).

● If you enroll in an HDHP, you may pay a lower monthly premium but have a higher deductible (meaning you pay for more of your health care items and services before the insurance plan pays).

● If you combine your HDHP with an HSA, you can pay that deductible, plus other qualified medical expenses, using money you set aside in your tax-free HSA.

● So if you have an HDHP and don’t need many health care items and services, you may benefit from a lower monthly premium. If you need more care, you’ll save by using the tax-free money in your HSA to pay for it.

● Your HSA balance rolls over year to year, so you can build up reserves to pay for health care items and services you need later.

PEG IS HAVING A BABY (9 MONTHS OF IN-NETWORK PRE-NATAL CARE AND A HOSPITAL DELIVERY)

This EXAMPLE event includes services like:

• Specialist Office Visits (Prenatal Care)

• Childbirth/Delivery Professional Services

• Childbirth/Delivery Facility Services

• Diagnostic Tests (Ultrasounds and Blood Work)

• Specialist Visit (Anesthesia)

MANAGING JOES' TYPE 2 DIABETES

(A YEAR OF ROUTINE IN-NETWORK CARE OF A WELL-CONTROLLED CONDITION)

This EXAMPLE event includes services like:

• Primary care physician visits (including disease education)

• Diagnostic Tests (Blood Work)

• Prescription Drugs

• Durable Medical Equipment (Glucose Meter)

MIA’S SIMPLE FRACTURE

(IN-NETWORK EMERGENCY ROOM VISIT AND FOLLOW UP CARE)

This EXAMPLE event includes services like:

• Emergency room care (including medical supplies)

• Diagnostic test (x-ray)

• Durable medical equipment (crutches)

• Rehabilitation services (physical therapy)

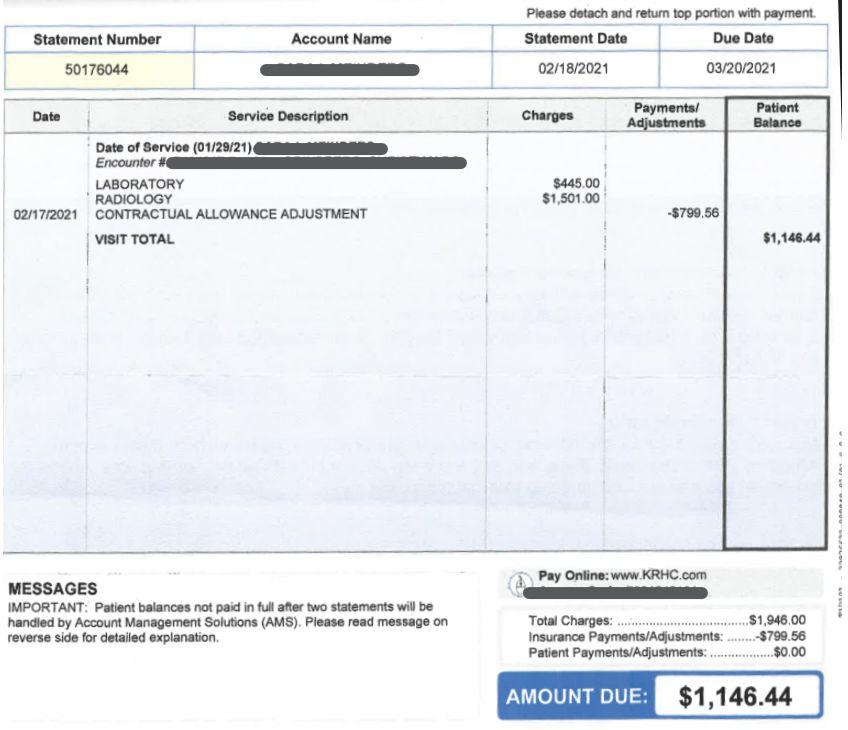

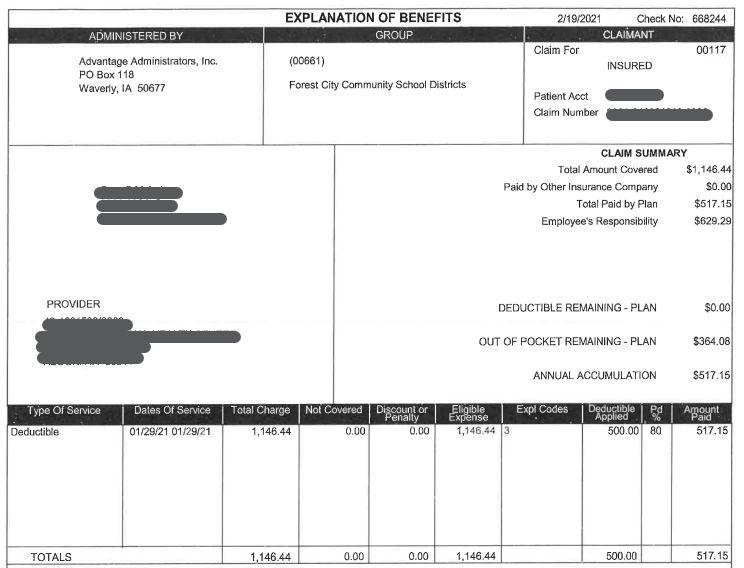

PARTIAL SELF FUNDING (PSF) WITH ADVANTAGE ADMINISTRATORS

• 1/29/21

• CAT Scan, total cost $1,946.00

• 2/18/21

• Billed by KCRH $1,146.40

• Wellmark paying $799.56

PARTIAL SELF FUNDING (PSF) WITH ADVANTAGE ADMINISTRATORS

1/29/21 CAT Scan, $1,946.00

2/18/21 Billed by Hospital $1,146.44

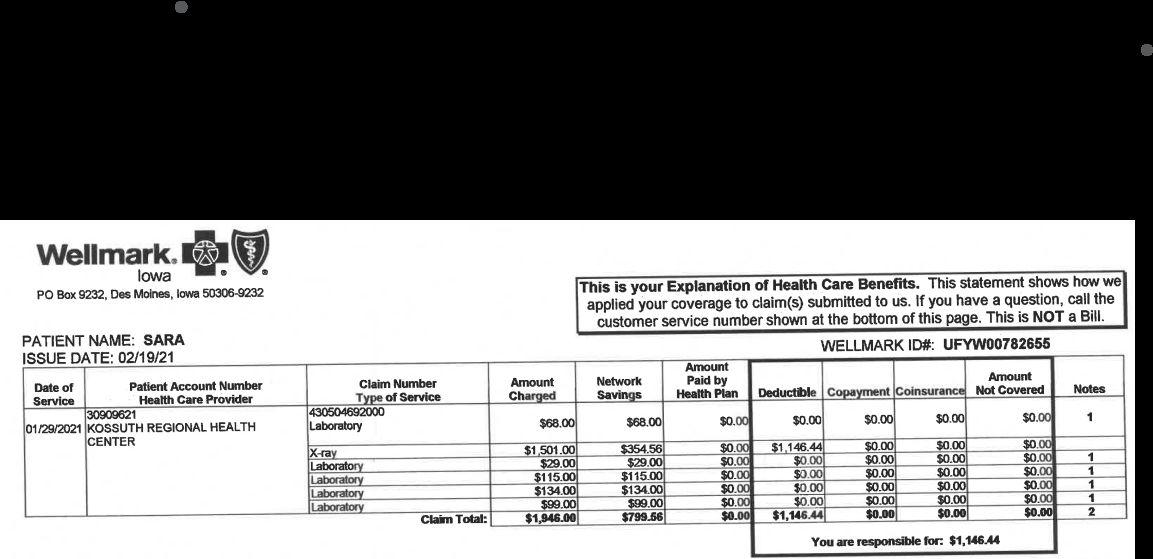

2/19/21 Wellmark EOB showing payment of $799.56 (same as statement from Hospital)

PARTIAL SELF FUNDING (PSF) WITH ADVANTAGE ADMINISTRATORS

1/29/21 CAT Scan, $1,946.00

2/18/21 Billed by Hospital $1,146.44

2/19/21 Wellmark EOB showing payment of $799.56 (same as statement from Hospital)

2/19/21 Advantage Administrators EOB showing payment of $517.15 to Hospital.

Balance Due = $629.29 (not $1,146.44)

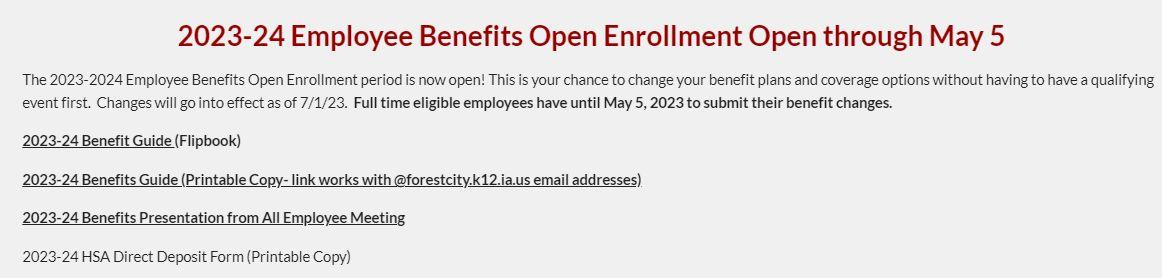

WHERE CAN I FIND ANSWERS TO MY QUESTIONS?

Questions on your Health Plan Coverage?

1. If PSF, Call Advantage Administrators to help at 800-383-1623 or login to the patient portal account at www.advantageadmin.com

2. Call the Toll Free Number on the back of your Wellmark Insurance Card

3. Look for an answer in the plan booklet which can be found on School Website under “Employment” and “Staff Resources”

4. Contact Secretary Meinders

New!! Benefits Guide

Benefits guide will be emailed later today. This will help guide you through the new enrollment process as well as answer many questions you may have.

2023-2024 Employee Benefits Guide

Benefits Connect

Staff Resources