Table of Contents

1. SMBC Overview

2. Facebook

3. Pre-Program Tips Sheet

4. Desk Overviews

1. SMBC Overview

2. Facebook

3. Pre-Program Tips Sheet

4. Desk Overviews

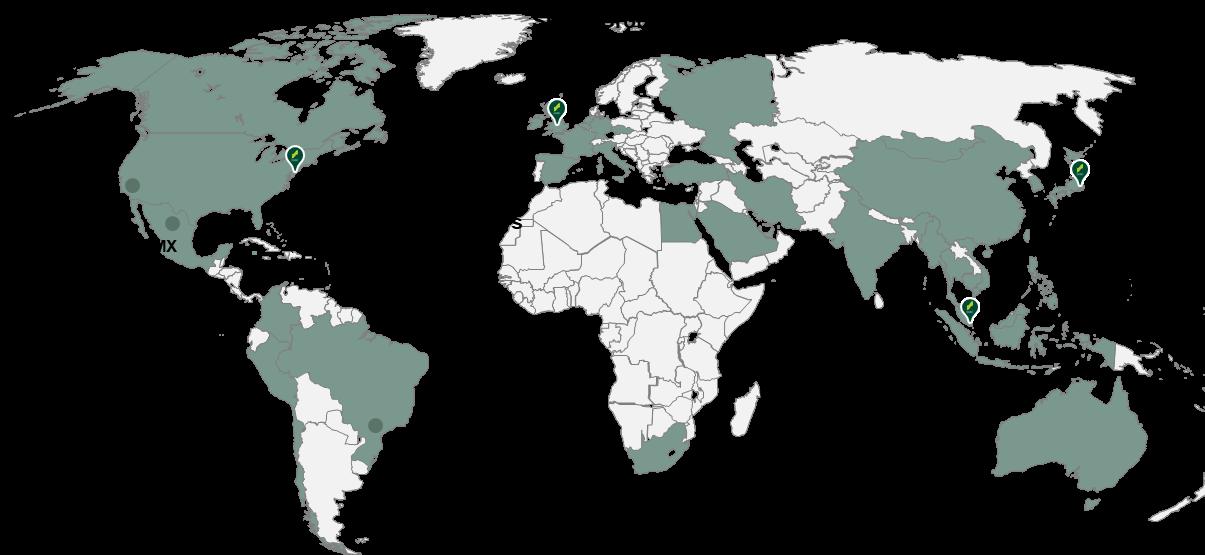

SMBC Group, a global financial group headquartered in Tokyo, offers a wide range of products and services, including banking, leasing, securities, credit cards, and consumer finance.

$1.99 trillion Total Assets¹ $6.26 billion Net Income²

$54.65 billion Market Capitalization¹ 14.78% Tier 1 Ratio

Note:

(1) Translated into USD December 2022 period-end exchange rate of USD 1 = JPY 132.71

(2) Translated into USD at March 2022 period-end exchange rate of USD 1 = JPY 122.41

(3) SMBC, SMBC Nikko Securities, SMBC Trust Bank, and all branches, excluding Japan as of June 30, 2022.

(*) Includes: SMBC Capital Markets, Inc.; SMBC Nikko Securities America, Inc.; SMBC Leasing and Finance, Inc.; SMBC Americas Holdings, Inc.

We are expanding our franchise to provide more comprehensive solutions to help our clients achieve their financial goals.

Asset-Based Lending

Global Trade Finance

Lease Finance

Lender Finance

Leveraged Finance

Municipal Finance

Private Placements

Railcar Leasing

Structured and Project Finance

Subscription and Fund Finance

Sustainable Finance

We are active throughout the region with a presence in Brazil, Canada, Chile, Colombia, Mexico, Peru, and the U.S.

Auto, Transportation, and Mobility

Consumer, Retail and Environmental

Energy

Financial Institutions

Healthcare

Industrials

Media and Communications

Real Estate, Gaming, and Leisure

Technology

Utilities and Power

North America

New York, New York

Los Angeles, California (2)

San Francisco, California

Toronto, Canada

Grand Cayman, Cayman Islands

Houston, Texas

Dallas, Texas

Chicago, Illinois

Silicon Valley, California

Mexico City, Mexico (2)

León, Mexico

South America

Bogotá, Colombia

Lima, Peru

Santiago, Chile

São Paulo, Brazil

Europe

Amsterdam, Netherlands

Brussels, Belgium

Dublin, Ireland

Düsseldorf, Germany

Frankfurt, Germany

London, United Kingdom

SMBC CM London Abu Dhabi Branch

Madrid, Spain

Milan, Italy

Moscow, Russia

Paris, France

SMBC EU Paris

Prague, Czech Republic

Note: Major overseas offices, as of June 2022.

Middle East

Abu Dhabi, UAE

Doha, Qatar

Dubai, UAE

Istanbul, Turkey

Manama, Bahrain

Riyadh, Saudi Arabia

Tehran, Iran

Africa

Cairo, Egypt

Johannesburg, South Africa

China

Beijing, China

Changshu, China

Chongqing, China

Dalian, China

Guangzhou, China

Hangzhou, China

Hong Kong SAR, China

Kunshan, China

Shanghai, China

Shenyang, China

Shenzhen, China

Suzhou, China

Tianjin, China

Southeast Asia

Bangkok, Thailand

Chonburi, Thailand

Hanoi, Vietnam

Ho Chi Minh City, Vietnam

Jakarta, Indonesia

Kuala Lumpur, Malaysia

Labuan, Malaysia

Manila, Philippines

Phnom Penh, Cambodia

Singapore, Singapore

Thilawa Front Office, Myanmar

Ulaanbaatar, Mongolia

Yangon, Myanmar

South Asia

Chennai, India

Mumbai, India

New Delhi, India

East Asia

Seoul, South Korea

Taipei, Taiwan

Oceania

Perth, Australia

Sydney, Australia

Interaction With Senior Executives

Work Across Business Lines & Across Borders

International Travel to EMEA, Asia, Japan Projects That Make a Difference

Highly Diverse Teams Grow, Stretch, and Progress Toward Your Best Potential

Make New Friends and Get to Know Great Colleagues

Appreciated and Recognized for Contributions

To foster professional development and leadership competencies and increase opportunities for personal, professional, company, and community achievement with a focus on the recruitment, development, and advancement of Black employees at the firm

To provide a platform that strives to promote the advancement, development, retention, and recruitment of talented individuals of Latin American or Hispanic heritage across the organization while raising cultural awareness and supporting local communities

To raise awareness about Asian cultures and promote a welcoming and inclusive work environment of mutual understanding, cultural awareness and respect

To focus on promoting a greater understanding and acceptance of mental health challenges, neurodiversity, and visible and invisible disabilities through resources, education and advocacy

To empower career-driven professionals to impact innovative thinking and establish relationships to mentor, lead, and network while cultivating a new generation of leaders

To embrace our proud community of employee veterans who support and encourage each other through shared experiences, career development, professional growth, veteran recruitment and retention, and other external engagement activities

To create a welcoming, safe, and supportive work environment for all LGBTQ+ employees in partnership with our allies

To promote and champion the growth, development, and success of women across the organization so they can achieve their full potential and emerge as true leaders, both personally and professionally

Christopher Bodine

(914)262-6574

Chrisbolax@gmail .com

McGill University

I go to school in Canada.

Elif Canbulat (781)600-1203

elifcanbulat2002 @gmail.com

University of California, Berkeley

I have a twin bother!

Ansh Oberoi (512)619-6961

ansho0531@gmai l.com

University of Texas at Austin

I once competed in a pie eating contest and won.

Jack Rottler (949)943-4733

jackrottler1@gmai l.com

Fordham University

Ex-Div 1 Football Player.

Matthew Vaughan (973)876-4343

mc462002@gmail .com

Stevens Institute of Technology

I play middle blocker for my college club volleyball team.

James Amell (860)249-3589

jmamell2@icloud. com

Connecticut College

I studied abroad in Scotland this past fall.

Jessica Tian (781)860-2969

tianjessica112002 @gmail.com

Vanderbilt University

I love dance, gymnastics, and going hiking!

Kathy Lin (917)660-4207

kathy.lin318@gm ail.com

Baruch College

I have a dog.

Philip Hahm (201)708-3159

phil.hahm01@gm ail.com

University of Virginia

I am from New Jersey.

Tyler Lis (908)246-2138

tylerlis41@gmail.c om

Pennsylvania State University

I have a twin brother.

Madison Dodson (832)358-5337

madison.dodson1 0@gmail.com

University of Alabama I enjoy skiing.

Varun Mallampati (847)902-5232

varun.chicago@g mail.com

Indiana University

I speak four languages: English, Spanish, Telugu and French.

Andrew Alikakos

(610) 620-4785

AndrewAlikakos23 @gmail.com

Lehigh University

I hit a hole in one in Wii Golf!

Christian Byrne

(516) 497-6022

ctbyrne17@yahoo .com

Hamilton College

I studied abroad in Prague last semester.

Sebastian Kaczor (516) 528-6698

sebikaczor@gmail .com

New York University

I'm currently studying abroad in Italy.

Alejandro Gonzalez Salinas (713) 259-3152

alegonzalezsalina s@gmail.com

University of Houston

My favorite activities are cycling and swimming.

Curtis Hu (949) 633-9025

curtislbj@gmail.co m

University of California, Irvine

I love to sing and play basketball!

Alexander (Sasha) Zaytsev (818) 210-6054

alexmzaytsev02@ gmail.com

University of California, San Diego

Dylan Yadegar (310) 980-1618

dylanyadegar02@ gmail.com

University of Southern California

I can drive a stick car.

Brandon Kim (678) 209-6240

brandonkim2002 @yahoo.com

Georgia Institute of Technology

I love watching Formula 1 and my favorite driver is Pierre Gasly

Emma Kravetz (203) 780-1242

emmakravetz@g mail.com

University of WisconsinMadison

I'm currently studying abroad in Barcelona!

Gavin Anderson

(801) 214-5906

Gavinski.anderso n@gmail.com

University of Utah

I am an avid skier.

Georgia Sgouros (845) 490-4583

gsgouros@me.co m

Indiana University

I have visited over 30 countries!

Hayden McGrory (302) 357-8586 haydenmcgrory65 @gmail.com

University of Delaware

I'm left-handed!

Jackson Brace (360) 823-7477

jacksonbrace@ho tmail.com

University of Southern California

One day I was added to a group me of over 2000 other people all named Jack.

Kevin Weng (917) 595-6858

Wengkevin90@g mail.com

Williams College

I recently studied abroad in Kyoto for art history.

Michael Kim

(626) 380-5401

2014michael123 @gmail.com

Emory University

I competed in shot put for all four years in high school!

Mina Turkyolu (570) 730-3070

mturkyoluu@gmai l.com

Lehigh University

I’ve travelled to 10 countries over 3 months!

Raj Talukdar (210) 334-1618

rajtalukdar7@gma il.com

Duke University

I like working out and playing basketball.

Shaukat Ibrahim (319) 419-8053

shaukat.ibrahim@ outlook.com

Furman University

i have lived in a boarding school/been away from home for 9 years!

Siddharth Kotecha

(832) 692-6078

sidkotecha01@g mail.com

University of Houston

I can play a bunch of different musical instruments.

William Heller (860) 331-9608

willheller07@gmai l.com

Colgate University

I am forklift certified.

Daniel Greenstein

(914) 260-3789

dgreenstein221@i cloud.com

Cornell University

I am currently studying abroad in Copenhagen, Denmark!

Yiqing (Abby) Wang (201) 851-1007

ywabbycova@gm ail.com

Rutgers University

I am a snowboarder.

Delaney Michaelson

(213) 210-9518

del.m@hotmail.co m

Barnard College

I drove in President Joe Biden's motorcade in 2020.

Anoushka Aggarwal

(908) 500-2097

anouaggarwal@g mail.com

Cornell University

I'm double-jointed.

Gracie Iwersen

(860) 993-4518

gracie.iwersen@g mail.com

St. John's University

I was born in South Korea!

Maura O'Connor

(330) 696-8477

mauraeoconnor18 @gmail.com

The Ohio State University

I love film photography and have been taking photos on my camera since high school.

Sadie Feighan

(914) 462-8118

Sadiefay26@gmai l.com

Lehigh University

I used to be a child actress.

Venkata Panchumarthy

(540) 519-2778

sujithp2002@gma il.com

University of Virginia

I went skydiving last summer!

Victoria Mui

(917) 282-2756

victoriaimui@gmai l.com

University of WisconsinMadison

I am a huge foodie!

Katelynn Lewallen

(480) 334-4223

katelynnlewallen1 @gmail.com

Vanderbilt University

I am double jointed in my shoulders!

Sarah Anderson

(813) 992-8216

sarah_a3@icloud. com

Vanderbilt University

I play club volleyball!

Hana Krcic

(917) 353-5296

hana.krcic@gmail .com

Baruch College

I traveled to Croatia last summer!

Vania Cheung

(626) 466-5034

nvaniacheung@g mail.com

New York University

I worked as a tailor for a year.

Virginia Lee

(201) 889-0457

virginiahmlee48@ gmail.com

Mount Holyoke College

I've visited Whiteface Mountain at least three times.

Chanakya Medimpudi

(571)919-9068

cmedimpu@gmu. edu

George Mason University

I went to Iceland over winter break.

Jonah Ismael Fernandez

(321)578-0954

fernandezjonah98 @gmail.com

University of Central Florida

I share the same birthday as my uncle and my great grandmother.

Nikol Kovacevic (858)752-9517

nk.nikol.kovacevic @gmail.com

Wellesley College

I can speak Bosnian.

Ashley Kim

(404)992-9743

Ashleykim844@g mail.com

Georgia State University

I am bilingual, I can speak English and Korean both fluently!

Alexander Cowell

(908)523-7547

alexander.cowell9 8@gmail.com

The University of Tampa

I am a lover of fiction.

Ellen Wei

(424)407-5251

ellenw0112@gmai l.com

University of California, Los Angeles

I grew up in Vancouver and Toronto, Canada!

Matthew Man

(908)399-8136

matthewman125 @gmail.com Stevens Institute of Technology

I am allergic to apples.

Alexia Balentine

(914)874-7092

a.balentine8@gm ail.com

Connecticut College

My family has goats!

Ethan Taylor (425)387-6788

ethaij@yahoo.co m

Western Governors University I like pigs.

Ethan Yuen

(609)819-2020

yuenethanw@gm ail.com

Grinnell College

I build keyboards for fun!

Evelyn Zhang

(949)308-5930

ev.thezhangs@g mail.com

University of California, Los Angeles

I have a blue birthmark!

Hao Lin

(646)578-5168

haolin1010@gmai l.com

Columbia University

I grew up in NYC.

Jeongyun (Amy) Lee

(201)655-8954

aamylay@gmail.c om

Rutgers University

I can’t ride a bike.

Kalsang Dedon (347)681-5465 kdon1115@gmail. com

Rutgers University

I went to the Himalayas once.

Matthew Bartchak (267)893-0980

Matthewbartchak@g mail.com

Lehigh University

I can solve a Rubik’s cube.

Nathan Tesfaye (571)247-5982

nathan041902@gmai l.com

George Mason University

I really enjoy traveling, Japan is my dream travel location.

Lauren Moulaison (603)702-5862

Laurenmmoulaiso n@gmail.com

Roger Williams University

I enjoy staying active by lifting weights!

Pavitra Patel (732)476-9086 pavs.network7@gmai l.com

Rutgers University

I can cook a nice vegetarian meal for a large amount of people.

Srihitha Kariveda

(848)667-3078

srihitha.kariveda @gmail.com

University of California, Berkeley

I love watching reality TV (Selling Sunset and Love is Blind are my favorites)!

Raymond Daniel Javier

(732)278-1777

rddjavier@gmail.co m

Rutgers University

I enjoy street photography!

VennelaChatla

(667)228-9042

vennela.chatla@gm ail.com

University of Arizona

Sahil Malhotra (408)893-4672

sahil.ma12@gmail.co m

University of California, Berkeley

I know how to count cards!

Samir Joshi (801)906-3687

sbjoshi616@gmail.co m

Washington University at St. Louis

I play bass (but I dont play in a band unfortunetly).

Christopher Hier (616) 970-5029

cjhier545@gmail.c om

University of Michigan

I am studying in Prague this semester.

Fatima Verona (305) 922-8081

fatimacverona@g mail.com

Florida State University

I went on a universitysponsored gap year to Costa Rica!

Emily Corcoran (732) 864-5540

emilycor7@gmail. com

New Jersey Institute of Technology

I have doublejointed thumbs!

Khaled Taima (917) 379-6141

khaled.taima@outlo ok.com

Washington University at St. Louis

An allergy test once reported that I was highly allergic to dust, but I have no abnormal reaction to dust.

Riley Stanley (508) 614-8371

riley19stanley@g mail.com

Pennsylvania State University

I have never been on a plane before.

Jeremy Bertolet (631) 495-4824

jeremybertolet@gm ail.com

Williams College

I can put my foot behind my head.

SachiDieker (703) 899-6489

sachidieker@gmail.c om

University of California, Los Angeles

I grew up in 5 countries around the world!

Scott Cook

(973) 432-5560

scottmcook316@ gmail.com

University of Richmond

I am an avid New York Giants fan.

Joy Mahoney (781) 366-1128

joy.mahoney2024 @gmail.com

Smith College

I was in a Netflix production during COVID.

Yanni Bills (571) 308-4154

yannibills6@gmail.co m

University of California, Los Angeles

I am bilingual.

Andrew He (346) 331-0634

andrew_helium@ yahoo.com

Stevens Institute of Technology

I failed my driving test twice before passing!

Aniket Devarakonda

(908) 227-6884

aniketdevarakond a@gmail.com University of North Carolina

I am ambidextrous (can write with both my right and left hands equally well).

Conner Smith (203) 554-7030

cpsmith594@gma il.com

Boston College

I am a big New York sports fan.

David Peng (917) 640-7306

davidykpeng01@ gmail.com

Boston University

I can speak four languages: English, Chinese, Cantonese, and Hakka.

Dillon Jones (702) 823-8809

dillonj8809@gmail .com

Seton Hall University

I played in the little league world series.

Emily Saad (610) 739-1489

emilysa023@gmai l.com

Syracuse University

I am a lefty.

Keila Seeley (201) 280-2120

kgseeley16@gmai l.com

Lehigh University

I have three siblings.

Steven Devery (631) 880-9027

devsteven19@gm ail.com

Marist College

I am Icelandic.

Victor Isidro (908) 922-6107

victorantonio.isidr o@gmail.com

Boston College

I've met the pope.

Andrew Patrick (414)722-6469

Ajpatrick38@gmai l.com

Stanford University

I’ve eaten sushi in 20 countries!

Beata Knecht

(973)337-0513

beatamknecht@g mail.com

Smith College

I studied abroad in Denmark!

Carla Candido da Silva (914)393-0560

carla.candido4@g mail.com

Smith College

I love to cook.

Daniel Sola (785)979-2228

d.sola9@gmail.co m

University of Kansas

I have an adopted donkey named Manolo. He lives in Antequera, Spain.

Emma Strauss (203)856-2344

emmastrauss6@gm ail.com

University of Richmond

I studied abroad in Copenhagen!

Garrin Avaloz (612)412-6369

garrinavaloz@yah oo.com

University of WisconsinMadison

I'm really good at staring contests.

Jacob Schaffer (716)783-4526

Schaffer.jake23@ gmail.com

Yale University

I have 5 brothers!

Jose Roberto Avelar Nava (760)997-6069

joseravelar111@g mail.com

New York University

I crossed the border every day for four years from Mexicali, MX to Calexico, CA to attend High School!

Marihah Abdullah (614)448-6369

marihah18@gmail .com

University of Denver

I am a dual AmericanCanadian citizen!

Noah Miller (610)955-1772

noahbmiller10@g mail.com

Pennsylvania State University

I have competed in semi professional pickleball tournaments.

Rafael Perez (321)586-6039

peloterocruz026@ hotmail.com

University of Central Florida

I am the only lefty in my family.

Anita Lau

(510) 505-4280

deyu5678@gmail. com

Wellesley College

I prefer noodles over rice.

Katelyn Kasko

(804) 855-7985

kate.kasko@gmail .com

University of Virginia

I play club rugby at my university!

Eleanor Bomberg

(617) 895-6275

ebomberg@me.c om Southern Methodist University

I have a puppy named Cindy Lou Who.

Joanne Lee

(781) 392-7590

leethebookworm @gmail.com

Boston College

I love to do cross stitch embroidery.

Samarth Kadaba

(805) 444-5691

samkadaba@yah oo.com

Stanford University

I am on my school's bhangra (Indian dance) team!

Alexander Grahor

(412) 660-1931

alexgrahor@mailc .net

Loyola University

I won the vacation item contest at the keep in touch event with a cool shell, I also play guitar and piano, am forklift certified, and a D1 swimmer.

Kevin Herbst

(631) 260-4594

kevherbst7@gmai l.com

Stevens Institute of Technology

I play on the men's volleyball team at Stevens Institute of Technology.

Olivia Boccia

(914) 602-3330

Oliviaboccia14@g mail.com

Tulane University

I can solve a Rubik's Cube.

Albano Gozzarelli (702) 480-6090

agozzarelli99@g mail.com

University of California, Los Angeles

I’m originally from Las Vegas, NV and moved to LA when I was 18.

Melissa Romano (347) 612-7609

mromano142002 @gmail.com

University of Albany

I was born on Valentine's day.

Daniel Nassif (239) 571-9360

danieljnassif@gm ail.com

Villanova University

I studied abroad in Milan, Italy last semester!

Alejandro Vazquez

(619) 948-5861

alexvazquez489@ gmail.com

University of California, San Diego

Nell Melton (804) 928-2003

nelliehmelton@g mail.com

University of Virginia

I am studying abroad in London this spring semester!

Claire Brundage (315) 730-2843

clairebrundage@v erizon.net

Bucknell University

I love to both snow ski and water ski!

Evan Chu (917) 886-5918

evanchu1254@g mail.com

Northeastern University

I am a foodie.

Emma Wang (617) 784-0281

emmawang1121 @gmail.com

Brandeis Univesity

I am the only grandchild from both sides.

Isaac Abraham Espinal

(817) 372-4540

isaaccspinal128@ gmail.com

University of Texas at Arlington

I am MexicanHonduran.

Ethan Skelly (781) 234-8737

eskelly61.0@gmai l.com

University of Richmond

I love to ski.

Katheryn Uetz (585) 667-1826

kuetz33@gmail.c om

Case Western Reserve University

I did competitive gymnastics growing up.

Kyle Pave (215) 501-9002

kylebp12@gmail.c om

Pennsylvania State University

I’ve driven tanks before.

Logan O'Neill (201) 753-1976

loganaoneill@gm ail.com

Fordham University

I am studying abroad in London.

Matthew Meyer (516) 417-6349

meyermatt23@g mail.com

Binghamton University

I love to snowboard, and I also love to DJ.

Michael Kalbfleisch (925) 348-7490

kalbfleisch.michae l@yahoo.com

University of California - Santa Barbara

I’m Indonesian.

Sarah Austin (562) 386-8804

ssaustin02@gmail .com

University of Southern California

I've summited Mt. Kilimanjaro during my senior year in high school!

Mick Hashimoto (720) 508-9994

hashimotomick@gm ail.com

University of California, Davis

I like to snowboard.

Mohammad Hasan

(312) 956-5450

moakramhasan@ gmail.com

University of Pennsylvania

I'm a twin and trilingual.

Sean Kirk (609) 410-8001

seanrkirk08057@ gmail.com

New York University

I love to play tennis.

Shane Heskett

(973) 975-5102

sheskett418@gm ail.com

Marquette University

I enjoy skiing in the winter.

Timothy Prister (203) 673-9337

timmyprister@gm ail.com

Colby College

I have two older sisters.

Serena Migdal (760) 697-2266

serenamigdal@g mail.com

Stevens Institute of Technology

I have a twin brother.

XiaonaGuo (646) 427-7410

guoxiaona7@gma il.com

University of Virginia

I enjoy hiking and photograph!

Aidan Treutel

(207)798-0197

aidantreutel1@gm ail.com

Fordham University

I recently tried Escargot for the first time while in Paris.

Anna Shin

(714)724-4558

annashin882@gm ail.com

Emory University

I have lived in three different countries.

Derek Shen

(425)559-0657

derekshen24@hot mail.com

Bates College

My mom, brother and I were all born on the 24th of different years!

Reach out to your desk contact and mentor and introduce yourself

Ask for reading material that will prepare you for your new role

Familiarize yourself with the financial products that the team supports and research relevant terminology (reference the attached desk overviews)

Connect with your fellow classmates on LinkedIn (reference the attached Facebook)

Check to see if your university provides free access to The New York Times and/or The Wall Street Journal

Review the attached desk overviews to familiarize yourself with the business areas you and your classmates will be working in this summer

You should always keep your PC camera on when attending virtual meetings

Come to meetings and our speaker series with prepared questions

Forbes-10 Tips To Successfully Manage Up In A Virtual World

Indeed-28 Tips for Working Virtually

SMBC expects employees who have contact with clients to present a professional image in their dress and grooming. Employees who are not expected to have contact with clients are permitted to wear business casual attire.

When working from home, you are still expected to present yourself in appropriate, professional attire. As such, all aspects of this policy related to dress extend to participation in video conferences while working from home.

Outlook

Beginner’s Guide to Microsoft Outlook - YouTube

MS Teams

Microsoft Teams 101

PowerPoint

PowerPoint Hacks for Investment

Banking

Excel

Excel Shortcuts: Quick Tips

The 100+ Excel Shortcuts You Need to Know

Bloomberg Surveillance

Bloomberg Masters in Business

CNBC Fast Money

FREE FINANCIAL NEWSLETTERS

The Morning Brew

Axios by Mike Allen

We encourage you to check out these resources to help you be prepared for your time with us this summer.

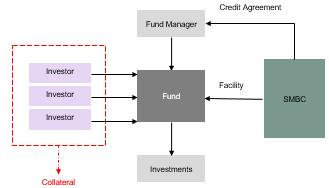

SMBC typically hires into the following business areas for our Summer Intern and Full-Time Analyst Programs.

Front & Middle Office Groups

Corporate Banking (North America and Latin America)

Debt Capital Markets

Derivatives

Equities Execution

Fund Finance

Financial Institutions Group

Fixed Income Sales & Trading

Investment Banking Advisory

Loan Syndications

Leveraged Finance Acquisition

Latin America Corporate Finance

Project Finance (North America and Latin America)

Private Placement

Real Estate Finance

Sponsor Finance

SMBC Leasing & Finance

Structured Finance

Quantitative Strategy

Infrastructure Groups

Audit

Compliance

Finance

Operations

Risk Groups

Capital Markets – Risk

Credit Risk

Risk Management

Technology Groups

Data Strategy

Information Security

Information Technology

Corporate Solutions Group

1 2 3

The Corporate Solutions Group (CSG) is growing and looking for premier junior talent that is eager to learn and take on responsibility. Our goal is to recruit and invest in the next generation of bankers, preparing them to best serve both SMBC’s clients and the firm

CSG augments our client coverage efforts by generating timely and relevant ideas that provide SMBC’s clients with best-in-class advice and solutions regarding capital structure, ratings, liquidity, debt capacity, M&A finance, sustainable finance, and more using a product agnostic approach

A career in CSG is one that offers a high level of interaction with key client decision makers, as well as with colleagues throughout the bank in various product groups including loan, debt & equity capital markets, derivatives and investment banking as well as client & product teams in Tokyo, London, and Singapore

Sustainable Finance

Strategic corporate actions: impact analysis (mergers & acquisitions, spin-offs, disposals, IPO’s, etc.)

Acquisition finance: structuring & execution considerations

Capital structure: optimal debt quantum & instruments; debt / equity mix; cost of capital; liquidity needs

Capital allocation strategies

Debt capacity: balance sheet flexibility as measured against credit rating agency parameters

First-time ratings: provide guidance on methodology and estimate of potential ratings outcome

Advisory: analyze ESG risks & opportunities and formulate bespoke financing solutions; extend client workbench

Deal Execution: documentation review; investor marketing

Market insights & ESG investor feedback

Gateway to Japan / Asia: buyside / sell side opportunities; strategic investors

Shareholder analysis

Financial risk advisory

Capital markets insights & market intelligence

Overview

The Corporate & Investment Bank Coverage (“CIBC”) is the first point of contact for SMBC for many of the largest companies in the U.S. through our industry verticals

CIBC closely collaborates with all the product areas to deliver the entire platform and build trusted advisor relationships

CIBC protects the bank’s balance sheet as the first line of defense against any credit event at our clients

Cash Management

Structured Finance

Debt Capital Markets

Asset Securitization

M&A Advisory

Equity Capital Markets

FX / Derivative / Options

Loan Capital Markets

• Technology

• Auto, Transportation & Mobility

• Real Estate, Gaming & Leisure

• Communications & Media

• Healthcare

• Power

• Natural Resources

• Public & Infrastructure

• Latin America Project and Corporate Finance

• Asia ECA Liaison

Advisory & Analysis Project Finance

• New York

• Los Angeles

• San Francisco

• Houston

• Dallas

• Other countries

• Leveraged Finance

• Middle Market Banking

• Sponsor Finance

● Direct Deposit/ACH

● Cash Pooling

● Electronic Funds Transfer

● Online Services

Corporate & Investment Banking Coverage

• Oil & Gas, Utility & Power

• Diversified Industrials

• Consumer & Retail

Japanese & Asian Corporate

Strategic Credit Products

Cash Management

• Equity and Debt Capital Markets Issuance

• Equity and Fixed Income Sales and Trading

• US Research

• Structured Finance

• Investment Banking

• Trade Finance

• Export & Agency Finance

• Commodity Finance

• Corporate Trade

• Tax & Non-Tax Leases

• Leasebacks

• Operating Leases

• Construction Financing

• Real Estate, Transport, Power & IT Equipment Leases

• Swap & Options

- Interest Rate

- Currency

• Swap Structures

• Money Markets

• Foreign Exchange

• Cash Management

SMBC is committed to the Auto sector on a global basis with a leading capital markets platform, proven execution capabilities, significant capital commitments and a recently hired team with deep industry experience.

Experienced Team of Auto Experts

Stephanie Bowker

Managing Director, Sector Head

Corporate & Investment Banking – Auto, Transportation & Mobility

Joined SMBC in February 2020. 13-year Citi veteran, serving as MD within the Corporate & Investment Bank, where she was the primary banker for a portfolio of auto and related companies and responsible for global auto credit portfolio.

Sam Smith

Managing Director

Corporate & Investment Banking – Auto, Transportation & Mobility

Joined SMBC in November 2022. Previously served as Director of Strategy at Ford Motor Company, responsible for global new business strategy. 19-year Ford veteran, with previous positions including Assistant Treasurer & Director of Debt Capital Markets.

Kelli Kandow

Executive Director

Corporate & Investment Banking – Auto, Transportation & Mobility

Joined SMBC in August 2020. 11-year Citi veteran, serving as a relationship manager within the Corporate & Investment Bank, where she was responsible for US subsidiaries of non-US clients, predominantly in the automotive and industrial industry.

Noah

Executive Director

Corporate & Investment Banking – Auto, Transportation & Mobility

Joined SMBC in November 2011 and is responsible for US clients and their global subsidiaries. Began career at Regions Financial, where he was accepted into the Management Associate program and worked as a commercial credit underwriter.

Source: Dealogic

Note: (1) League tables only consider CIB Auto, Transport and Mobility client base.

Broad Spectrum of Corporate Relationships

Original Equipment Manufacturers (OEMs)

Aftermarket

Suppliers

Engineering & Construction (E&C)

Transportation

Cruise Liners

SMBC has a global strategy to deepen dialogue with clients by providing market-leading support on responding to the dynamic risks and opportunities arising from emerging sustainability and ESG challenges

Supporting Clients Across Sustainability Strategy Considerations

Sustainable Finance

Well-resourced platform to support structuring and advising on sustainable finance transactions, including use of proceeds formats (green bonds, etc.) and sustainability-linked formats (sustainability-linked loans, etc.)

Providing independent analysis and recommendations to clients across a range of hot topics in sustainability and ESG strategy

Connecting clients with market intelligence and companies offering leading edge solutions to key sustainability-related challenges

In 2022, formed strategic with Marathon Capital, with expertise in tax equity structuring, M&A of sustainability-related businesses and power purchase offtake consulting

Supporting clients in responding to ESG challenges and climate transition strategy

ESG Regulatory Concerns

Renewable Power Markets

Emissions-Driven Lending Restraints

ESG Target Setting and Peer Benchmarking

Transition Risk Policy and Carbon Pricing

Environmental/Social Shareholder Activism

Advising on implementing sustainability strategy through business matching and M&A

- Strategic partnership with leading decarbonization solution providers such as Persefoniand Sustana

Supporting incorporation of sustainability in client financing and making targeted equity investments

- Connecting across our global footprint

- M&A, debt and equity capital raise

- Launched in April 2022 a “Sustainability Investment Fund” to drive innovative and catalytic technologies and market infrastructure

- Strategic investments in leading global impact funds such as TPG Rise Climate and Ares Climate Infrastructure funds

SMBC supports clients to demystify and respond to complex ESG trends, topics and developments, with apolitical, concise and practical guidance tailored to each client’s priorities

Recent Discussion Topics

Topic Content Overview

1) Shareholder Activism on Environmental and Social Topics

Update on trends and potential impacts of shareholder activism in the U.S. related to environmental and social topics and of outline sustainable finance as a way to proactively mitigate potential shareholder actions

Overview and update of financial institution financed emissions targets and the potential impact of such targets on lending and investment practices for various sectors

Overview of current trends in renewable power procurement and options to increase renewable power utilization while materially reducing scope 2 GHG emissions

Overview of external and internal carbon pricing use and practice and outline of a baseline framework to begin establishing an internal carbon price

4) Carbon Pricing for Corporates

Also contains tailored indicative internal carbon price ranges based on clients latest reported GHG emissions and peer internal carbon price benchmarking

5) U.S. Inflation Reduction Act

Key takeaways from the U.S. Inflation Reduction Act and an overview of new tax credit architecture, new and expanded credits, and new options for the monetization of credits

6)

7)

Overview of the SEC’s proposed climate change disclosure rules and the potential impact of the proposal on reporting requirements including the substantially expanded scope and cost

Insight into key sustainable finance topics and trends heading into 2023 to help clients identify potential risks and opportunities

The Lending Management Group sits within the Corporate and Investment Bank Group and is primarily responsible for credit underwriting, deal documentation and closing and ongoing portfolio management. We support the Marketing Group within CIBC by driving transaction execution.

Lending Management Group

1 2 3

LMG analysts will develop a solid understanding of the deal life cycle, from origination to closing and get a foundation in credit analysis to help to facilitate client execution, including financial statement analysis as well as industry vertical reviews.

In order to most effectively provide the best execution to our clients, LMG analysts are assigned to a specific industry vertical. With in depth industry knowledge, CIBC is more able to effectively help clients to navigate market trends and regulatory developments.

As an analyst in LMG, you will be exposed to many financial products and services offered by SMBC. Acting as the primary point of contact in the front office for risk management, analysts must also be well versed in the risks associated with the products offered by the bank..

Who will do well in our group? We’d like to see someone with the following:

• Extremely detailed oriented with strong critical thinking

• A desire to perform an analytical function

• Excellent verbal and written communication skills

• An ability to work effectively in a deadline driven and time pressure environment

The Debt Capital Markets group is a clientfacing division of SMBC Nikko Securities America Inc., and is responsible for delivering the full spectrum of financing solutions for the bank’s clients via the bond market, including:

Advising on structure, pricing, and strategy for primary market debt offerings, often part of broader multiproduct pitches

Gathering investor orders for primary market issuances and ultimately allocating those debt securities appropriately

Connecting issuers and investors

Advising on debt portfolio optimization via liability management exercises

Helping clients understand key market developments across the macroeconomic and fixed-income space

Bonds to invest in; interest income

Capital to use for debt refinancing, M&A, dividends, stock repurchases, CapEx, working capital, etc.

General Motors Financial (GMF) is General Motors’ captive finance arm and was formed in 2010 via the acquisition of AmeriCredit GM and GMF have a support agreement that requires GM to own 100% of GMF as long as it has unsecured debt outstanding

Equity futures were mixed Monday morning, while Treasury yields were 4-7bps higher than where they closed Friday Credit spreads were unchanged to 1 basis-point tighter the morning of the offering Markets were digesting an unexpected announcement that OPEC+ would cut oil production by more than 1 million barrels The week prior to the transaction saw an improvement in tone as markets continued to recover from banking turmoil that saw Silicon Valley Bank’s collapse and the acquisition of Credit Suisse by UBS

The Friday before the transaction, Moody’s upgraded the senior unsecured notes of General Motors Company and General Motors Financial to Baa2 from Baa3 GMF spreads tightened as a result of the announcement and tightening continued Monday morning

General Motors Financial announced a $Benchmark three-part offering just before 9:00AM EDT The Company announced a 3-Year FRN tranche and 3- and 7-Year fixed tranches Five other issuers announced transactions on Monday, including one direct competitor Despite the presence of a peer, the Underwriters felt confident moving forward given GMF’s higher credit ratings and differences in announced tenors

GMF was able to build a peak orderbook of $9 6 Billion (4 3x oversubscribed), skewed towards the 7-Year tranche. The Company dropped its floating-rate tranche due to lack of demand The orderbook was comprised of several real-money accounts with triple-digit orders, which allowed the Company to release guidance at T+170# and T+240#

Orderbook attrition was minimal, and the Underwriters were able to skip the Launch call and move straight to pricing General Motors Financial was ultimately able to price $2 25 Billion at T+170bps and T+240bps on 3-Year Fixed and 7-Year Fixed tranches, respectively

Source: SMBC, Bloomberg, Ipreo

Note: *Other Includes: SSA, Corporations, Broker/Dealers, Etc.

Ford Motor Credit Company, “FMCC”, offers a wide variety of automotive financing products to and through automotive dealers throughout the world FMCC’s primary business is the financing of vehicles and supporting Ford’s dealers

Equity futures were mixed Monday morning, Treasury yields were 4-7bps higher from Friday’s close. Credit spreads were unchanged to 1bp tighter. Markets were digesting an unexpected announcement that OPEC+ would cut oil production by more than 1 million barrels, stoking concerns around an inflation rebound

The Company initially engaged the Underwriters in early March but stood down for multiple weeks as a result of banking turmoil that saw Silicon Valley Bank’s collapse and the CS-UBS merger. The market found its footing in the week preceding the offering, driving spread compression that afforded FMCC attractive all-in yields relative to early March The Company moved quickly to take advantage of the constructive conditions and on the Friday before the transaction re-engaged the Underwriters for an offering as soon as Monday morning

Just after 9:00am EDT, Ford Motor Credit Company announced a $Benchmark 5-Year offering Initial Price Talk on the offering was set at 7 125% – 7 250% Five other issuers, including one direct competitor, were in the market alongside FMCC The Syndicate was comfortable moving forward with the transaction, specifically given that the peer was of a different credit profile and did not announce a 5-Year tranche

Ford Motor Credit Company’s transaction was able to build a peak orderbook of $5 0 Billion (3 3x oversubscribed) The sizeable orderbook gave the Syndicate confidence to be aggressive with Guidance, which was released at 6 800% the #

The high-quality orderbook held in well and the Company was able to launch the transaction with a size of $1 5 Billion, significantly larger than the whispered target size of $1 Billion Ultimately, Ford Motor Credit Company was able to price $1 5 Billion of 5-Year notes at 6 800%

Source: SMBC, Bloomberg, Ipreo

Note: *Other Includes: SSA, Corporations, Broker/Dealers, Etc.

Waste

Ratings Baa1 / A- / BBB+ (Stable/Stable/Stable)

Waste Management, based in Houston, Texas, is the leading provider of comprehensive waste management environmental services in North America Through its subsidiaries, the company provides collection, transfer, disposal services, and recycling and resource recovery It is also a leading developer, operator and owner of landfill gas-to-energy facilities in the United States The company’s customers include residential, commercial, industrial, and municipal customers throughout North America

Wednesday morning opened with relative stability in equity and credit markets following a recent FOMC rate decision and pending CPI print The primary market saw ~$28 billion of supply from the previous two trading sessions which included the largest deal in 2023 thus far Waste Management opted to proceed with their first offering of the year at 8:45am EST, announcing a $Benchmark 7-Year and 10-Year financing with Initial Price Talk set at T+105 Area, and T+115 Area, respectively

With Waste Management being the only IG corporate borrower in the market, the Company was able to build a peak orderbook of just over $3.1 billion (2.5x oversubscribed). Guidance on the new 7-Year and 10-Year was released at T+90# and T+100#, respectively. The Syndicate opted for an “at the #” strategy to solve for the size split between the two tranches

After manageable orderbook attrition, the Company Launched and Priced the offering at T+90 bps and T+100 bps with a skew in size towards the 7-Year tenor

In determining fair value on the new 7-Year and 10-Year notes, the most relevant data points would be the trading levels of WM’s 2 00% 2029s at T+79 bps (G+84 bps) and 4 15% 2032s at T+88 bps (G+86 bps) After applying the relevant curve adjustments and considering comparable 7-Year and 10-Year paper from similar companies, the deal priced with 5-10 bps of new issue concession

KEY TRANSACTION HIGHLIGHTS

Source: SMBC, Bloomberg, Ipreo

Note: *Other Includes: SSA, Corporations, Broker/Dealers, Etc.

Executing New Issue Bonds Advice & Solutions

Client-Focused

Industry Coverage Verticals

Managing Relationships Business Travel

After establishing our Broker-Dealer license in 2013, SMBC’s DCM platform has grown exponentially, developing from nonexistent to an origination powerhouse, leading transactions across USD, EUR, JPY, AUD, etc.

SMBC’s DCM desk has expanded rapidly in underwriting volume and number of deals led

Corporate Strategy

Capital

Raising

Sophisticated

Corporate Clients

Global Markets Focus

Capital Structure Risk Management

As the DCM platform continues to flourish, SMBC works hand-in-hand with C-Suites and Treasury teams at some of the world’s largest companies, advising them through the capital raising process

The investment grade bond market offers an exceptional career opportunity

Investment Grade Issuance has Grown Dramatically SMBC’s Platform Growth Has Well Outpaced The Market

As one of the key revenuegenerating areas of the firm, we strive for attracting top junior talent to help our team’s rapid growth continue

Strong Communicators

Client-Facing Types

Analytical

Creative

Responsible

Detail-Oriented

Organized

Compelling Presentation Skills

Ambitious

Hard-Working

Quantitative

Passionate

Fun-loving!

Interested? Get in touch!

Our desk is a client-facing division of SMBC Nikko America’s Investment Banking business, responsible for delivering the full front-toback spectrum of advisory services including mergers & acquisitions, capital raising, and strategic advisory solutions to our client base of global corporations within the Consumer & Retail, Industrials, Power, Energy & Infrastructure (“PEI”) and Technology, Media & Telecom (“TMT”) sectors, as well as Financial Sponsors of a wide spectrum of investment strategies

As a group, we are a collection of dedicated and collaborative individuals

– we thrive in a dynamic, challenging, and professional work environment that is supported through open communication and a collective commitment to driving investment banking business by providing bespoke, value-maximizing solutions on complex corporate finance transactions to our clients across the world

Dedicated, coverage team with deep industry expertise, providing best-in-class advice with a full suite of services to support our global corporate client needs

● Industry Advisory Groups: Consumer & Retail, Industrials, Power, Energy & Infrastructure and Technology, Media & Telecom

● Advisory services:

Corporate Acquisitions & Divestitures

Leveraged & Management Buyouts

Debt Capital Markets Transactions

Strategic Advisory

Restructuring & Distressed Transactions

Valuations & Fairness Opinions

Joint Ventures & Strategic Alliances

Equity Capital Markets Transactions

Structured Finance Products

M&A execution capabilities spanning all industry verticals, often across multiple geographic jurisdictions

● Combining resources of a global financial institution with local market expertise, we provide the highest level of client service in sell-side and buy-side advisory engagements

● International scope of our services allows us to provide industry insights in critical sectors of the global economy, access to the global market of buyers and sellers combined with local market coverage

● Frequent collaboration between SMBC & SMBC Nikko’s industry coverage and product groups to provide full-suite of advisory services to clients

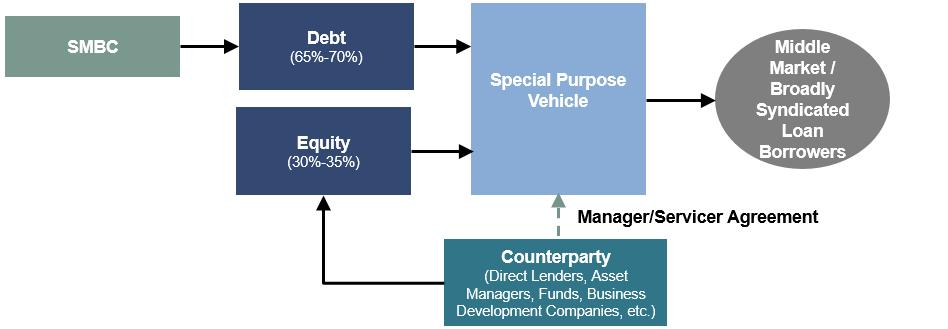

Our desk is a client-facing division of SMBC Nikko, responsible for providing services across securitization, including securitization lending, term ABS and CLOs

Our group is comprised of several different groups within securitization. Analysts and associates are given the opportunity to experience across all products and asset classes and eventually fine-tune skills in areas in which they are most interested

Term ABS is most similar to traditional banking, when you consider investment banks acting in an advisory capacity. A group (or sometimes a single) investment bank is hired to advise a client on a portfolio of assets and how best to structure them into a bond. The banks are also tasked with finding interested investors, preparing marketing materials and selling those bonds

Securitization lending is similar to Term ABS in that the investment bank still has to analyze the portfolio and put together a structure that packages together the cashflows of the underlying assets. However, in this case, the investment bank is the investor. The investment bank is taking the right to the payments of the underlying assets and providing a line of credit to the client backed by those assets

We also work closely with other groups at the organization.

Securitizations typically need to have a diversified portfolio of underlying customers as the programs are structured using a pool based analysis

Typical program commitment sizes are $50 million to $1+ billion

Companies with high customer diversity tend to have higher advance rates than those with lower customer diversity

Securitizations are designed to be bankruptcy remote in nature

Assets included in a securitization would be isolated from the bankruptcy estate of the company allowing lenders to avoid stay risk and get repaid quickly

As such, securitization facilities are generally viewed as separate exposure from the underlying corporate servicing entity

Securitizations are underwritten based on the quality of the underlying customer pool and asset performance and not to the individual customers

Companies with underlying assets that have strong performance have higher advance rates than those with underlying assets with less strong performance

Current Relationships

Target Relationships

Auto Loan and Leases

Auto Floorplan

Credit Cards (Private Label & Bank Card)

Telecom Receivables

Equipment Loans, Leases, and Floorplan

Trade Receivables

Other Asset Class Experience & Target Relationships Include

Aircraft Loans and Leases

Airline Ticket Receivables

Container Related Receivables

Data Center

Fleet Leases

Future Flow Receivables

Solar Loan/Lease

Unsecured Consumer

Utility/Rate Recovery

Student Loan

Other

Reason 1

Group Name

1 2

An evolving market: ABS is growing quickly, and across many new asset classes. While the more “vanilla” asset classes (called on-the-run) such as autos and equipment still command a large portion of the market, “off-the-run” asset classes including many surprising ones (like rate recovery bonds or music royalties) keep ABS bankers always learning

Reason 2

Safety and security: ABS is one of, if not the cheapest, form of funding. In times of market stress, investors may be unwilling to fund companies via other markets, but because ABS is secured, ABS is better able to weather turbulent markets

Reason 3

3

A dynamic, growing and exciting work environment: Our team is close knit, and always working together. We often have events, going out for drinks or team building events

Who will do well in our group? We’d like to see someone with the following

While experience in ABS is not necessary, a strong grasp of macro economic concerns as well as the ability to think quickly and deeply would be helpful for a new team member

The ability to juggle multiple projects while working with different people without any loss to quality of work is important; attention to detail is key

The world of ABS is always evolving, and so an inquisitive personality, one that is always looking to learn, read and develop skills

Ability to comfortably interact and communicate with both clients and internal stakeholders across the firm in a professional and mature manner

Our work is often dictated based on strict timelines, the ability to know how to prioritize work and complete it in a timely manner

Strong intellectual curiosity, ethics, integrity and judgment

Comfort in and commitment to team-oriented environment

Excellent technology skills with superior Excel and PowerPoint skills and ability to quickly learn new software applications

Our desk is a client-facing division of SMBC Nikko Americas, Inc. focusing on secondary market (public) execution of single stock, program trading, and electronic orders under the best execution mandate

As a group, our clients include passive investors, active investors (hedge funds, long only), corporate clients, and internal clients

We work closely together as a team and with research sales, corporate access, equity capital markets, to create revenue opportunities. Utilize our execution expertise and execution tools for clients’ trading needs

Utilize equity execution toolkit, market knowledge, fundamental stock information, technical analysis, and client relationships, to receive trades and execute across execution venues

Provide Japanese market expertise to North American clients during US market hours, bridging the geographic and time zone gap between US and Asia

Coordinate with Equity Capital Markets (ECM) and coverage bankers to pitch transactions to corporate clients

Equity Execution Services Group (EESG)

1 2 3

Unique viewpoint into secondary market trading on behalf of institutional and corporate clients trading in US and Japan equity markets. Glean insights on the sales and trading side of the business from the perspective of long-term experienced traders with global backgrounds and multi-product, multimarket expertise

Our job is to make sure our institutional and corporate clients have best-in-class equity execution experience. A career in EESG is one that offers direct exposure to clients, to trading, and involves working closely with other departments, to execute transactions in the secondary public markets. The role includes a combination of skill sets including sales, technical expertise, and understanding of markets

North American investors manage one of the largest AUM globally, and the US stock market is the most dynamic equity market, with a breadth and depth unrivalled by other equity markets. SMBC Nikko America, Inc.’s platform with Japan-listed megabank SMFG as the parent company, and with our relationships with corporates around the globe, offers unique opportunities

Who will do well in our group? We’d like to see someone with the following:

Proactive self-starter personality with interest in learning about stocks, markets, executing institutional orders, and understanding capital markets transactions

Teamwork-oriented collaborative individual with strong verbal and written communication skills for both internal and external clients

Adaptable to constantly changing market conditions and changing regulatory landscape

Strong analytical and reasoning skills with the ability to connect the dots on seemingly disparate sources of information

Acute attention to detail even under the most high-pressure, fast-paced situations

Embracing and adopting key concepts in risk management and compliance as it pertains to trading and execution

Excellent technology expertise (both hardware and software) and programming skills or quantitative background are highly positive skills

● The Global Financial Institutions Group offers comprehensive banking solutions and financial advisory to our clients by leveraging the strength of SMBC Group, our products and services, and our global platform.

● We work closely with product partners across the firm, serving as the primary point of contact for our clients to connect them to the broader SMBC Group, while acting as an advisor to our clients and recommending the best financial products for their needs.

• Established strategic coverage and long relationships with global, regional, and local banks

• Leading market position in 1940 Act open and closed-end fund financing Multi-product asset managers and alternative investment firms

• Serve key clients across the industry, including life, property and casualty, reinsurance and runoff

Market leader in private credit coverage - #1 in BDC DCM league table for three years in a row Growing NBFI coverage

GFIG bankers work closely with CEOs, CFOs, Treasurers, Portfolio Managers, and other senior management at some of the world’s most renowned financial institutions.

1 2 3

Our FIG team is a rising market leader, covering funds, sponsors, and various specialty finance companies, offering analysts a top tier experience working with some of the largest and most successful companies in the industry.

Given our coverage role, GFIG has the unique opportunity of interacting with various other SMBC bank groups, including DCM, ECM, Derivatives, ABS, Leveraged Finance, Project Finance, Structured Finance and Subscription Finance. Our analysts rotate across sectors as they progress in their careers and gain indepth exposure to various financial verticals and product offerings of corporate investment banks. Rarely do analysts get this level of experience at a bank.

GFIG is a cooperative tight knit group where analysts have the ability to be impactful from the start. GFIG is one of the few global teams, meaning analysts have the unique opportunity to travel to other GFIG teams in Europe, Asia, and Australia. From preparing for meetings with top executives of financial institutions, to working on live deals with fellow team members and bank groups, GFIG offers an unparalleled experience for young analysts.

• SMBC Capital Markets, Inc. (SMBC CM) provides market liquidity and customized derivative solutions to corporate and institutional clients around the globe. In addition, SMBC offers regional fixed-income and foreign-exchange expertise through 70+ offices in over 40 countries.

• Through our New York, London, and Hong Kong trading centers, SMBC Capital Markets, Inc. delivers custom, tailored derivative solutions to corporate and institutional clients to help manage interest-rate and foreign-exchange exposures as they relate to debt financing, M&A activity, or plans around long-term capital structure.

• We work in close collaboration with various relationship management partners and other product specialists to provide integrated financing and risk management solutions to help our clients achieve their objectives.

• We are a growing group of dedicated and driven individuals who always strive to obtain the best outcome for our clients. We believe in close collaboration, leveraging knowledge among the team and other partners to develop value-added ideas and analysis.

• Interest-rate swaps

• Treasury locks

• Basis swaps

• Caps, floors, collars

• Swaptions

• Asset swaps

• Structured fixed-rate products

• Deal-contingent hedges

• FX forwards in 30+ different currencies

• Non-deliverable forwards

• Cross-currency swaps

• FX options

• Structured FX products

• eFX execution and STP via FXALL, 360T, and Bloomberg FXGO

We work closely with other groups across the organization.

• Optimal fixed/float analysis

• Currency management efficiency

• Fixed income, FX, and crosscurrency basis markets research and commentary

• Macroeconomic reviews and forecasts

• In-depth country risk analysis

• Leading liquidity provider of option products in the U.S.

• Leading dealer in USDJPY basis swaps and other APAC currencies

• Onshore Brazil presence

• Structured cross-border solutions

• Select access to SMBC Derivative Products LP, rated Aa1/AASMBC

With ever-evolving financial markets, derivative strategies that address risks and solve problems are vital for our clients. A successful candidate has a passion for both the capital markets and the complexities of derivative products.

It’s our job to ensure all clients are receiving timely analysis and professional insight into market-moving events. Our analysts have the opportunity to interact with market experts and product specialists to deliver best-in-class solutions to our clients.

Incoming analysts are given a high degree of responsibility in preparing client materials, providing relevant market commentary, and working closely with members of the sales and trading teams across all seniority levels to assist in closing derivative transactions.

• Through its New York, London, and Hong Kong trading centers, SMBC CM provides market liquidity and customized derivative solutions to corporate and institutional clients around the globe.

• In addition, SMBC offers regional fixed-income and foreign-exchange expertise through 70+ offices in over 40 countries.

SMBC CM provides 24-hour trading coverage and competitive market-making capabilities across 30 different currencies.

Location: London

Headcount: 25 sales & trading staff

Profile: Regulated by the Financial Conduct Authority

Coverage: Serving clients in the UK, Europe, Africa, and Middle East regions

Location: New York

Headcount: 30 sales & trading staff

Profile: CFTC provisionally registered U.S. Swap Dealer. Member of National Futures Association

Coverage: Serving clients in the U.S., Canada, and Latin America regions

Rate Derivative Capabilities

• Interest-rate swaps

• Treasury locks

• Basis swaps

• Caps, floors, collars

• Swaptions

• Asset swaps

• Structured fixed-rate products

• Deal-contingent hedges

SMBC CM is a wholly owned, fully guaranteed subsidiary of Sumitomo Mitsui Banking Corporation with long-term credit ratings of: A1 (stable) / A (positive)

Location: Hong Kong

Headcount: 10 sales & trading staff

Profile: Licensed by the Hong Kong Securities and Futures Commission. Acts as agent for SMBC Capital Markets, Inc. and SMBC Nikko Capital Markets Ltd.

Coverage: Serving clients in Asia and the Pacific Rim regions

FX Derivative Capabilities Unique Strengths

• FX forwards in 30+ different currencies

• Non-deliverable forwards

• Cross-currency swaps

• FX options

• Structured FX products

• eFX execution and STP via FXALL, 360T, & Bloomberg FXGO

Strategic Analysis and Research

• Optimal fixed/float analysis

• Currency management efficiency

• Fixed income, FX, and crosscurrency basis markets research and commentary

• Macroeconomic reviews and forecasts

• In-depth country risk analysis

• Capacity, tenor, and XVA pricing

• Leading liquidity provider of option products in the U.S.

• Leading dealer in USDJPY basis swaps and other APAC currencies

• Structured cross-border solutions

• Select access to SMBC Derivative Products LP, rated Aa1/AA-

1 2 3

Our derivative franchise is growing—we are looking for smart, hungry, personable junior talent to invest time and money in. Given that we are small to begin with, it is a great opportunity to learn about a wide range of products.

We hire in three areas trading, marketing and risk to provide service to clients around the globe. It is exciting to learn and develop skills that are needed to service clients from various regions with different needs across our three areas.

The work environment is friendly and at the same time fast-paced. Our work environment allows for a balanced work -life commitment that is helpful in the long run.

Who will do well in our group? We’d like to see someone with the following:

• Excellent written and oral communication skills with a demonstrated ability to articulate concepts and ideas concisely and defend their validity and rationale

• Experience with financial modeling and eagerness to learn complex modeling

• The ability to comfortably interact and communicate with both clients and internal collaborators across the firm in a professional and mature manner

• The ability to work in a fast-paced environment and prioritize effectively in order to meet strict deadlines

• Exceptional attention to detail, self-motivation and a commitment to delivering top-quality work products

• Strong intellectual curiosity, ethics, integrity and judgment

• Comfort in and commitment to a team -oriented environment

• Excellent technology skills with superior Excel and PowerPoint expertise and the ability to quickly learn new software applications

SMBC’s Global platform extends across North America, Europe, Japan and Asia Pacific, with over 200 professionals providing financing and advisory solutions to our clients and their portfolio companies

75 professionals

London

Paris

5 professionals

New York

70 professionals

21+ years track record through multiple credit and business cycles; 11+ years in U.S. middle market

Organically developed business with ~$4Bn assets to ~160 borrowers*** Cover 125+ sponsors sourcing ~350+ opportunities per year

Frankfurt

10 professionals

50 professionals Tokyo

Hong Kong

Singapore

10 professionals

9 professionals

Sydney

6 professionals

50+ professionals including 10+ MDs with average 25+ years experience***

Middle Market Expertise – deep knowledge of middle market sector through multi-pronged approach involving leveraged finance and market-leading asset management financing business

Robust Governance – operate under SMBC’s strict risk appetite framework, which is supported by disciplined “credit first” culture

(*) Includes: SMBC Capital Markets, Inc.; SMBC Nikko Securities America, Inc.; SMBC Leasing and Finance, Inc.; SMBC Americas Holdings, Inc. For more information, please visit www.smfg.co.jp/english/investor

(**) As of Nov. 1, 2022

(***) Only includes Leverage Finance and Portfolio Management

Highly successful middle market and large cap Leveraged Finance platform consisting of comprehensive product offerings and dedicated sector coverage

Originates, structures, underwrites and executes financings for LBOs, add-on acquisitions and recapitalizations

Over 70 professionals supported by additional middle / back-office functions

Integrated operating model across leveraged finance, coverage, execution, syndication and portfolio management

Focused on lead and joint-lead underwritten debt financings

~$4 billion committed to Sponsor backed portfolio companies in the US

Partnership with private credit platform to enhance term loan holds

Proven ability to underwrite complex transactions and credit stories across both middle market and large corporate businesses

Unrated and rated-institutional term loans (Term Loan B)

Senior bank term loans

Second lien credit facilities

Asset-based loans and securitization facilities

High Yield Securities

Dedicated HY capital markets team

Capable of providing bridge financing

Other

Derivatives Products (rates and f/x)

Subscription Lines, CLO Warehousing

Equity Capital Markets

Equity Research in select sectors (oil & gas, technology, life sciences)

LP investments in PE funds

Industrials

Diversified Industrials

Paper & Packaging

A&D / Gov’t Services

Chemicals & Materials

Agriculture

ESG

Power, Energy & Infrastructure

Consumer & Retail

Food & Beverage

Beauty & Healthy Living

Auto / Transportation

TMT & Software

Streamlined approval process involves key decision makers at early stages providing enhanced speed and certainty

Leveraged Finance

1 2 3

Leveraged Finance is a well established and rapidly growing platform in the U.S. which offers firsthand experience within the private equity financing space. Candidates will contribute directly to the processes of underwriting and structuring transactions across various industries.

An opportunity to learn through participation in deal diligence, modeling, credit evaluation and structuring of highly complex and challenging financing arrangements.

An opportunity to experience a transaction-oriented environment on the front line, working closely with originations, structuring and capital markets professionals through each phase of the deal process.

Who will do well in our group? We’d like to see someone with the following:

• Combination of academic aptitude, quantitative skills, and strategic and creative thinking

• Excellent written and oral communication skills with a demonstrated ability to articulate concepts and ideas concisely and defend their validity and rationale

• Ability to comfortably interact and communicate with both clients and internal collaborators across the firm in a professional and mature manner

• Ability to work in a fast-paced environment and prioritize effectively in order to meet strict deadlines

• Exceptional attention to detail, self-motivation and commitment to delivering top-quality work products

• Strong intellectual curiosity, ethics, integrity and judgment

• Excellent technology skills with superior Excel and PowerPoint expertise and the ability to quickly learn new software applications

• The Leveraged & Acquisition Finance Group of SMBC is a dynamic and fast-growing team that is responsible for delivering capital structure advice and debt financing solutions for our non-investment grade corporate and private equity clients

• We pitch, structure, and execute LBO, acquisition, and refinancing transactions for sponsors and companies globally

• We leverage the size and strength of the SMBC balance sheet to put ourselves in a strong position to win client mandates and economics on deals

• The group covers clients across both corporate and sponsor groups as well as across all sectors (i.e., Energy, Consumer, Media, Tech, Telecom, Industrials, Healthcare, Real Estate, Gaming, Automotive, and Transportation)

• The team includes some of the most visible senior leadership at SMBC who are responsible for driving growth across the bank and broker-dealer

• Given the often complex capital structure solutions that are needed for our clients, the group collaborates with other product and coverage teams across the bank in the U.S. and globally daily, which provides great visibility for members on the team

• The ideal candidates are:

o Highly motivated self-starters

o Possess strong analytical and written/oral communication skills

o Experienced in MS Excel, PowerPoint

o Interested in debt capital markets and the global economy

• We are a group of hard-working individuals who love working in a team setting and sharing our diverse knowledge, backgrounds and experiences. “Work hard, play hard” is our motto and the success we’ve accomplished to date is a direct reflection of this

• A line of credit that is like a credit card used for working capital purposes

• Customers draw down on the revolver and repay the outstanding balance with accrued interest. If a revolver is unused, it accrues a commitment fee

• A loan that is typically 3-7 years in tenor used for acquisitions, refinancings, and general corporate purposes

• Repayment occurs in regular intervals during the tenor of the facility with a lump sum at maturity

• A fixed-rate instrument with a tenor typically of 5-10 years for acquisitions, refinancings, and general corporate purposes

• Balloon repayment at maturity; however, these instruments can have embedded options to call/refinance the bonds prior to their maturity

• Unsecured loan or bond that ranks below senior loans or securities in the capital structure

• Non-amortizing and typically can only be repaid after senior obligations are satisfied

• Likely the most expensive debt in the capital structure

1

Our Leveraged & Acquisition Finance franchise is growing we are looking for smart, hungry, and personable junior talent in whom to invest our time and money. Our goal is to recruit the next generation of leveraged capital markets originators for our dynamic Leveraged Loan & High Yield Capital Markets platform.

2 3

It’s our job to ensure internal and external clients experience seamless coverage, globally. A career in Leveraged & Acquisition Finance is one that offers nonstop interaction with colleagues covering private equity and non-investment grade corporate clients in the Americas as well as geographic mobility and coordination with our counterparts in London, Tokyo, and Singapore.

In 2022, our team utilized our vast experience and skillset in the leveraged finance field to successfully navigate a historical downturn in the M&A and LBO market. Our deal pipeline continues to expand as we pitch, structure, and position ourselves to lead leveraged loan and high yield bond transactions across our client base in the Americas and globally.

Our desk is a client-facing group responsible for product-agnostic client coverage

We originate and execute corporate finance solutions for our clients in Latin America

We are the entry point to the bank for clients in Latin America, managing existing client relationships and fostering new ones

The New York sector teams provide industry insight

The Latin America bankers have client proximity and local expertise

The Corporate Finance bankers are based in New York or in Latin America (Mexico, Colombia, Peru, Chile, Brazil)

The Advisory and Solutions team in charge of supporting cross-product marketing and executing most complex credit deals for corporate clients or financial sponsors

The Credit Management team oversees portfolio monitoring

We work very closely with other groups: syndicated loans; debt capital markets; private placements; trade finance; export credit agency finance; project finance; investment banking; risk solutions

Term loans, revolving credit facilities, bridge loans, private placement, bonds, etc.

Financing solutions from simple (e.g., general corporate purposes) to more complex/structured (e.g., acquisitions)

Growing Group

1 2 3

Our Latin America Corporate Finance team is growing

We want to recruit highly motivated and intellectually curious junior talent for our expanding group

Multi-Sector Coverage

Latin America Corporate Finance offers you the opportunity to have exposure to many sectors, from diversified industrials to power, natural resources, financial institutions and consumer retail among others

Multi-Product Interaction

A role in the Latin America Corporate Finance provides exposure to the whole LatAm product platform

Who will do well in our group? We’d like to see someone with the following

Excellent written and verbal communication

Ability to comfortably interact and communicate with internal collaborators across the firm in a professional and mature manner

Ability to work in a fast-paced environment and prioritize effectively in order to meet strict deadlines

Attention to detail, self -motivation and commitment to delivering top-quality work product

Strong intellectual curiosity, ethics, integrity and judgment

Comfort in and commitment to team-oriented environment

Interest in Latin America region and in learning about different industries and companies

Fluency in Spanish & Portuguese is a plus

We have over 40 professionals dedicated to Latin America Project and Structured Finance with exceptional expertise and deep local knowledge.

Mexico City, Mexico

Representative Office reopened in 2009 and SOFOM opened in 2014

Client coverage

Project Finance origination

New York, U.S.

SMBC Headquarters in Americas

Client coverage (coverage of countries without regional office)

Corporate Finance, Project Finance, Export & Agency Finance, and Trade Finance origination, structuring and execution

Work together with SMBC Capital Markets & Securities teams Bogotá, Colombia

Office opened in September 2010

Client coverage

Project Finance origination

Alliance with Financiera de Desarrollo Nacional (Colombian financial institution that specializes in infrastructure project finance)

Lima, Peru

Office opened in September 2012

Client coverage

Project Finance origination

São Paulo, Brazil

Office opened in 1959

Client coverage

Corporate Finance, Project Finance, Export & Agency Finance and Trade Finance origination

Santiago, Chile

Office opened in September 2013

Client coverage

Project Finance origination

Largest Project Finance team in the Region (28+ professionals in New York plus 12+ locally)

Offices and Project Finance origination in the five main Latin American countries (Mexico, Brazil, Colombia, Chile and Peru)

Sector coverage and specialization in Project Finance sectors: Infrastructure & Telecom Power & Renewable New Energies & Natural Resources