STAY UP TO DATE ALL YEAR LONG

As we reflect on 2022, Slifer Smith & Frampton has a lot to celebrate, including our 60th anniversary and the growth of our family of brokers in the Front Range

In the Roaring Fork Valley limited inventory continues to be the top concern and in 2023 we anticipate inventory will be even more limited Limited inventory coupled with the Aspen experience as an outdoor, shopping and restaurant mecca means that home values are holding ? if not increasing ? as is price per square foot Interestingly, we are seeing that nearly 50% of transactions are being done off-market meaning that relationships and local connections in the market matter more than ever.

Fortunately, we continue to be the No 1independent brokerage firm in the Roaring Fork Valley and continue to grow our market share. In the past year, we also continued to grow our team and opened a office in Woody Creek Plaza

One thing that continues to set us apart is our commitment to our local communities In 2022, we supported innumerable nonprofit organizations and events across the Roaring Fork Valley including being a sponsor for Aspen Gay Ski Week. In addition, we provided a $30,000 matching contribution for this year?s Lucky Chances Luncheon

It gives us great pride to have been invested in and committed to Colorado communities since 1962 A second major milestone was welcoming Colorado Landmark Realtors, a pioneer in the Boulder Valley Real Estate market that has been operating there for 45 years, into the Slifer Smith & Frampton family This expansion not only led to our designation as the No 1 Independent Real Estate Brokerage in Colorado but allowed us to expand our Front Range presence adding three Boulder Valley offices to our two Downtown Denver offices

As we look into 2023, and the celebration of our 60th anniversary, we reaffirm our commitment to being stewards of our Colorado communities and look forward to bringing the same vision and innovation to our next 60 years.

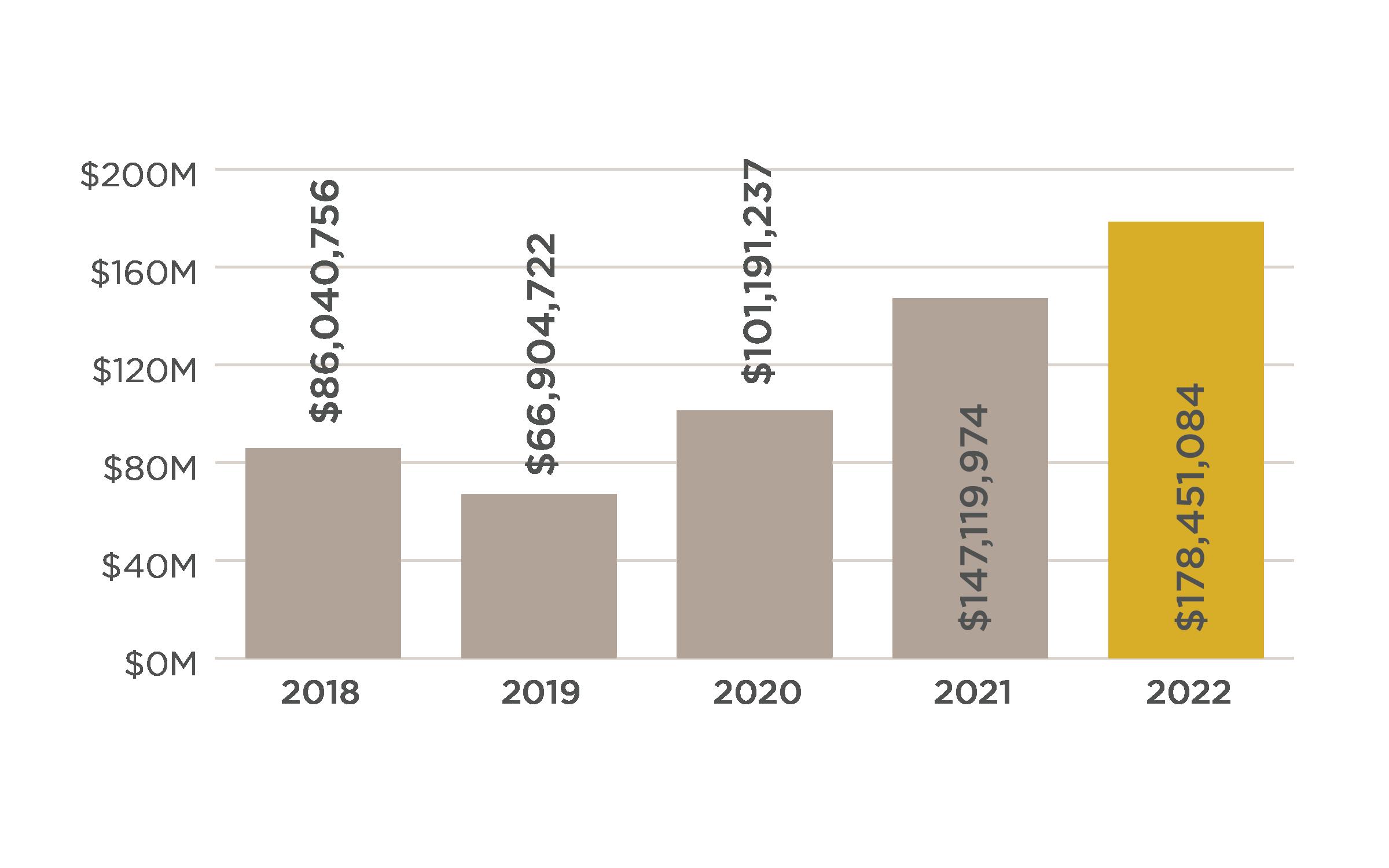

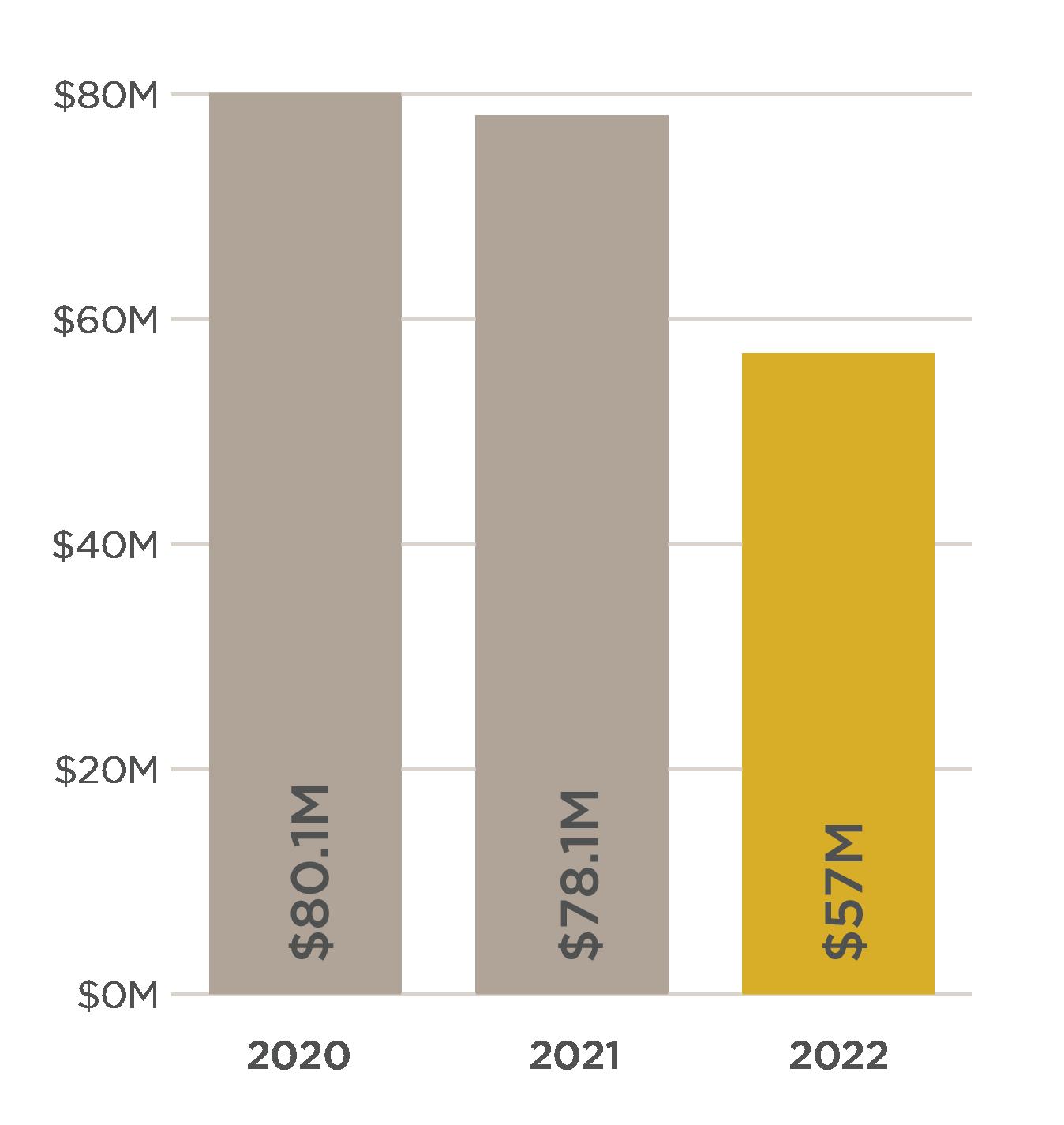

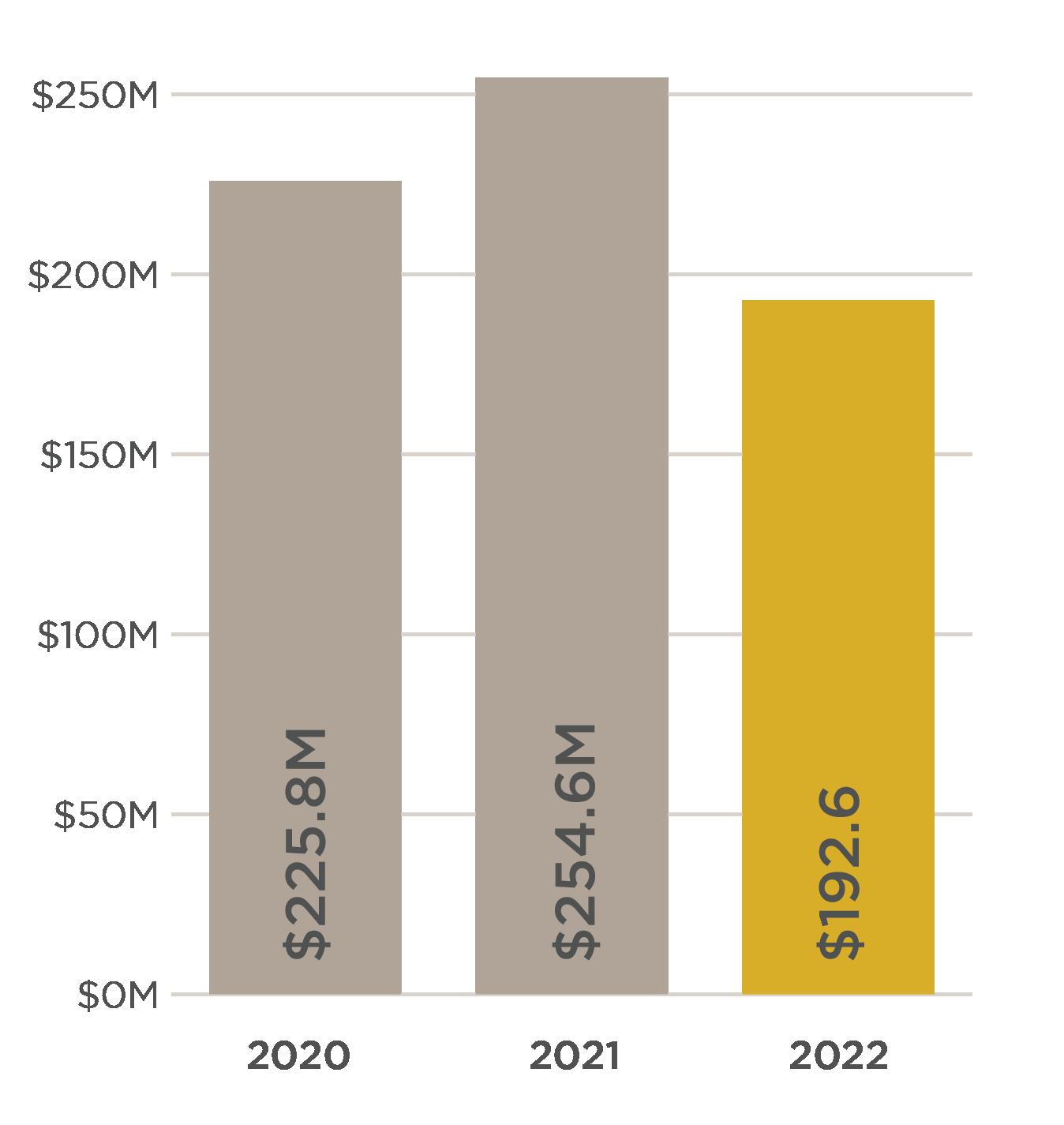

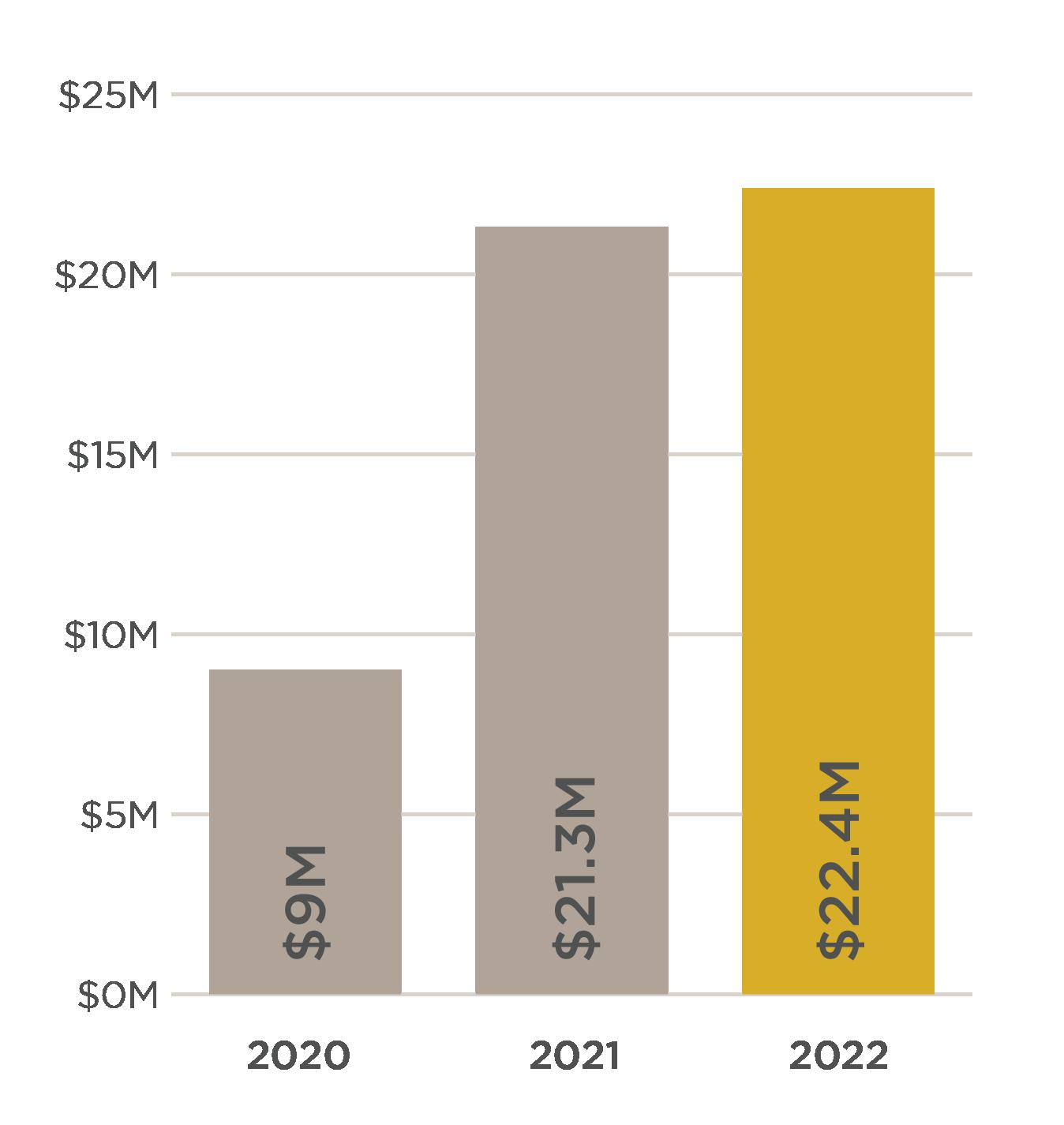

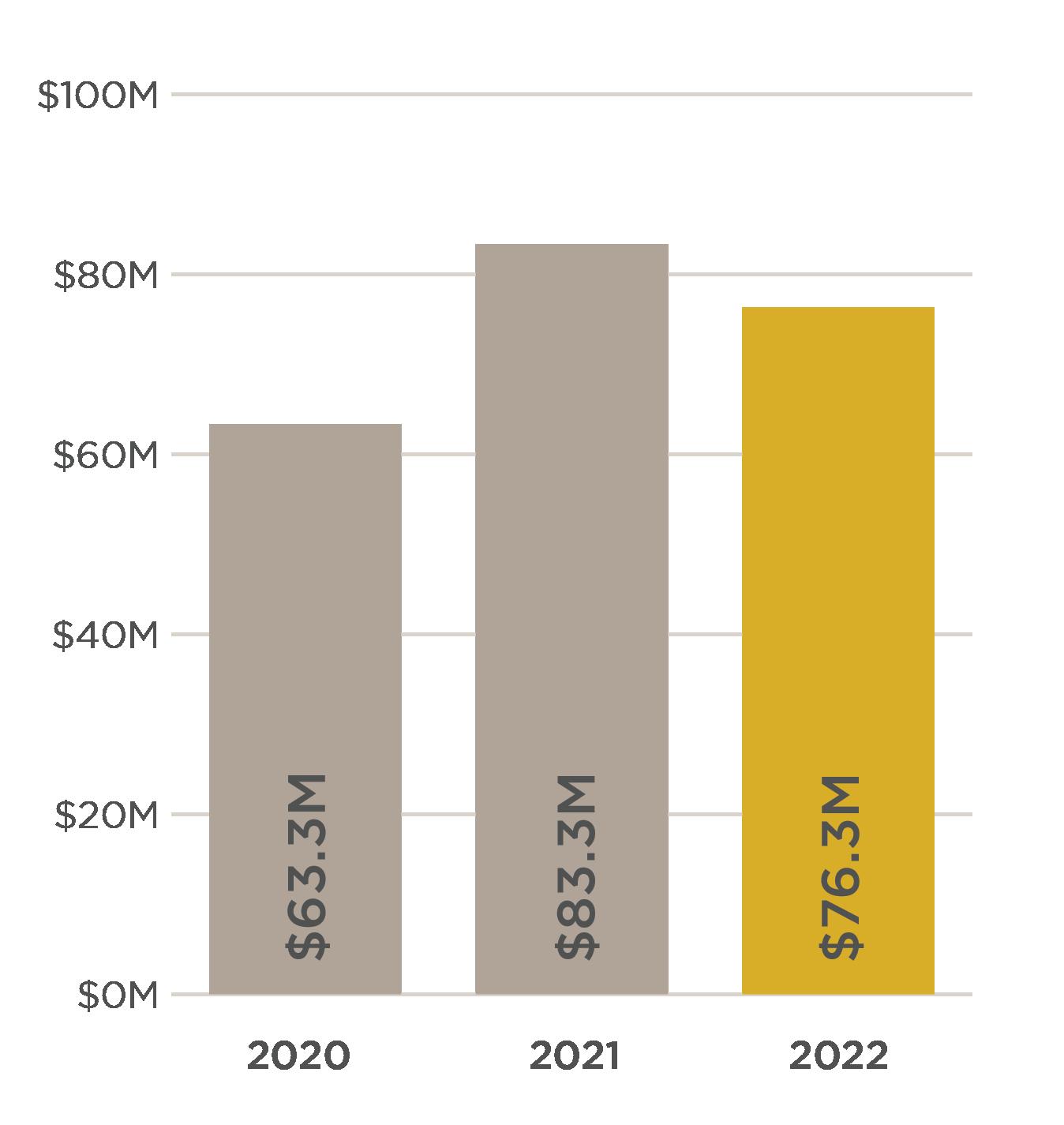

SALES VOLUME

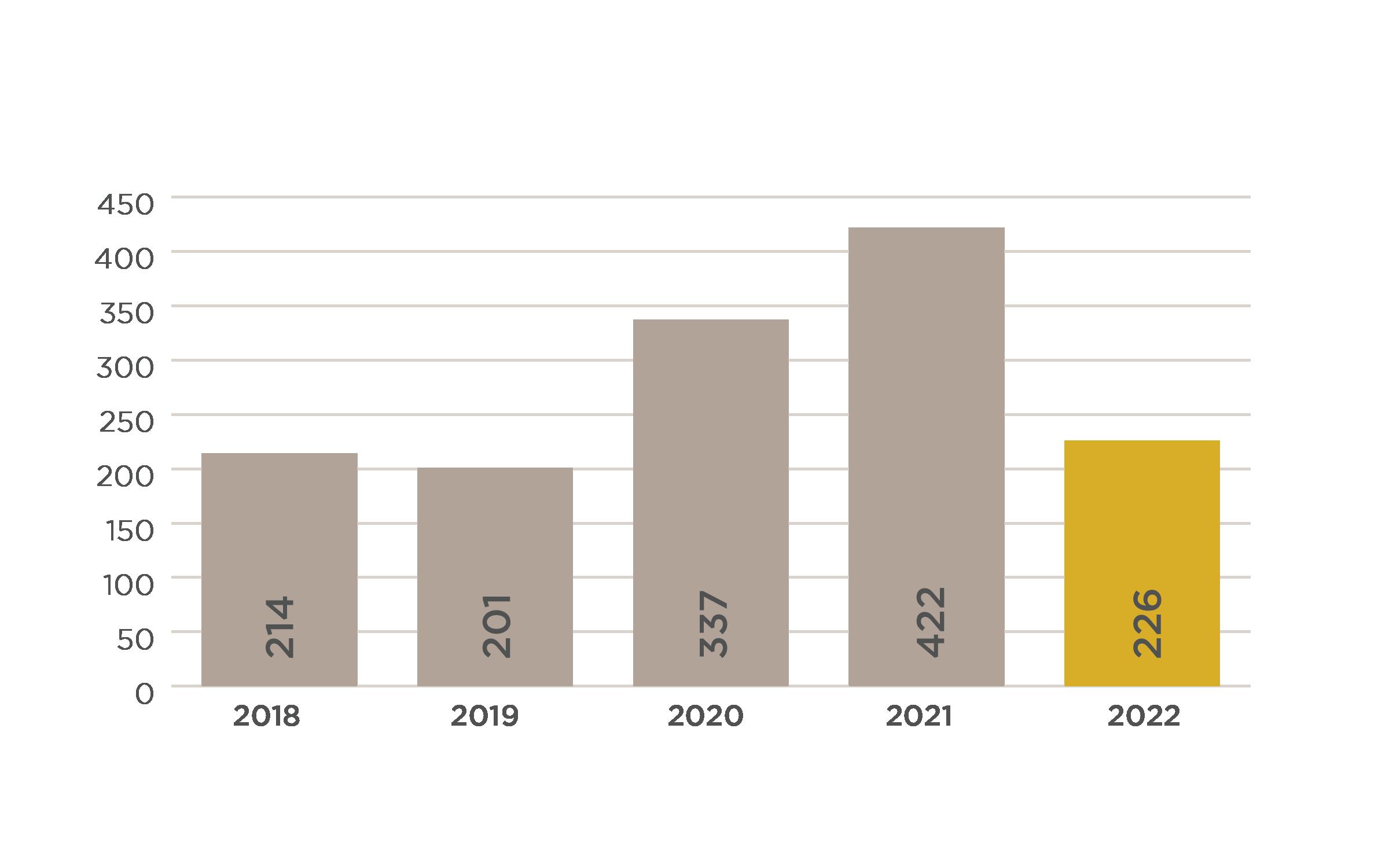

NO OF SALES AVG DAYS ON MARKET AVG SALE AVG PRICE/ SF

2018 $494,323,752 75 294 $6,590,983 $1,463 2019 $675,447,609 89 303 $7,589,299 $1,481 2020 $1,810,627,218 162 312 $11,176,711 $1,855 2021 $1,852,306,685 143 239 $12,953,194 $2,198 2022 $1,317,135,952 71 163 $18,551,211 $3,048

SALES VOLUME NO OF SALES AVG DAYS ON MARKET AVG SALE AVG PRICE/ SF

2018 $376,112,104 141 289 $2,667,462 $1,520 2019 $331,464,341 141 237 $2,350,811 $1,573 2020 $691,603,182 185 252 $3,738,396 $1,899 2021 $780,448,584 245 153 $3,185,504 $2,110 2022 $1,033,664,795 614 104 $1,683,493 $1,090

SALES VOLUME NO OF SALES AVG DAYS ON MARKET AVG SALE AVG PRICE/ SF

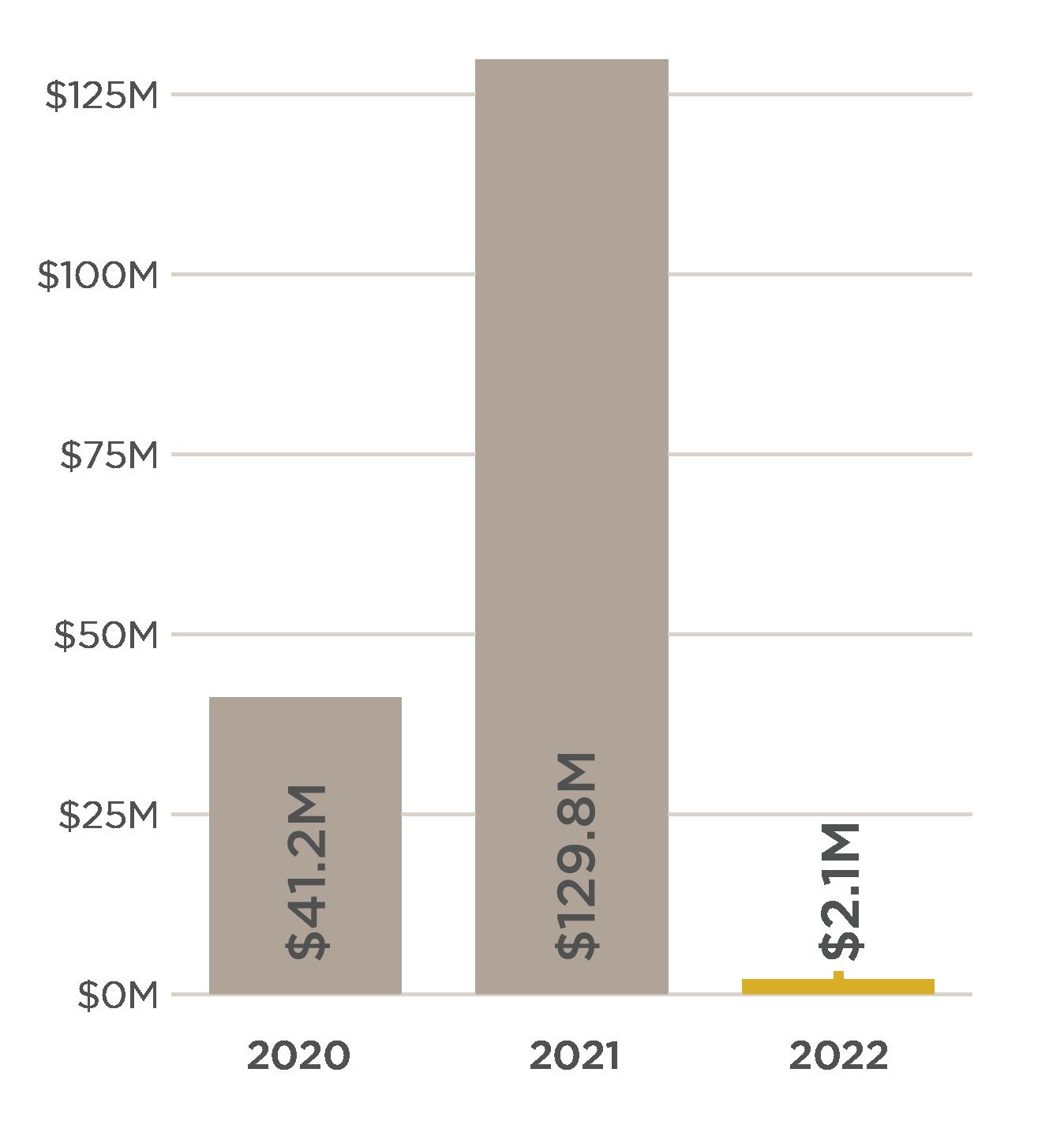

2018 $42,227,000 10 524 $4,222,700 $719 2019 $16,087,000 11 376 $1,462,455 $391

2020 $40,444,000 10 349 $4,044,400 $916 2021 $128,945,000 14 222 $9,210,357 $1,634 2022 $1,744,000 3 57 $581,333 $467

2018 $674,000 2 93 $337,000 $543 2019 $589,500 2 47 $294,750 $625 2020 $735,000 2 129 $367,500 $612 2021 $850,000 2 142 $425,000 $763 2022 $328,449 1 586 $328,449 $733

SALES VOLUME NO OF SALES AVG DAYS ON MARKET AVG SALE AVG PRICE/ SF

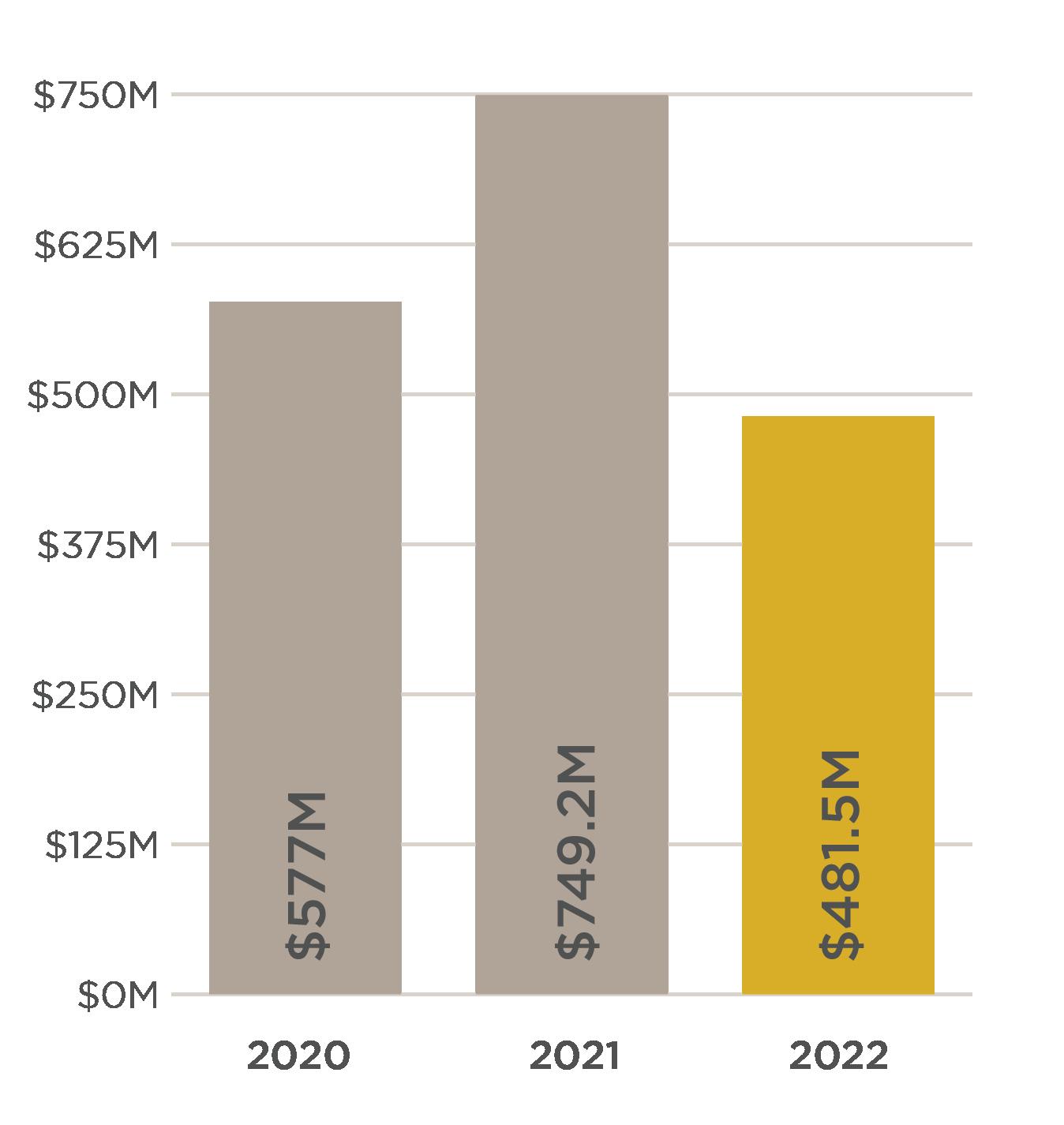

2018 $134,474,266 43 302 $3,127,309 $758 2019 $197,562,570 49 383 $4,031,889 $911 2020 $299,395,787 69 252 $4,339,069 $977 2021 $396,938,545 73 188 $5,437,514 $1,245 2022 $239,754,484 33 180 $7,265,287 $1,598

2018 $135,578,829 156 239 $869,095 $689 2019 $139,538,009 128 271 $1,090,141 $791 2020 $277,619,204 197 237 $1,409,235 $844 2021 $352,230,877 245 136 $1,437,677 $1,009 2022 $241,777,650 114 91 $2,120,857 $1,509

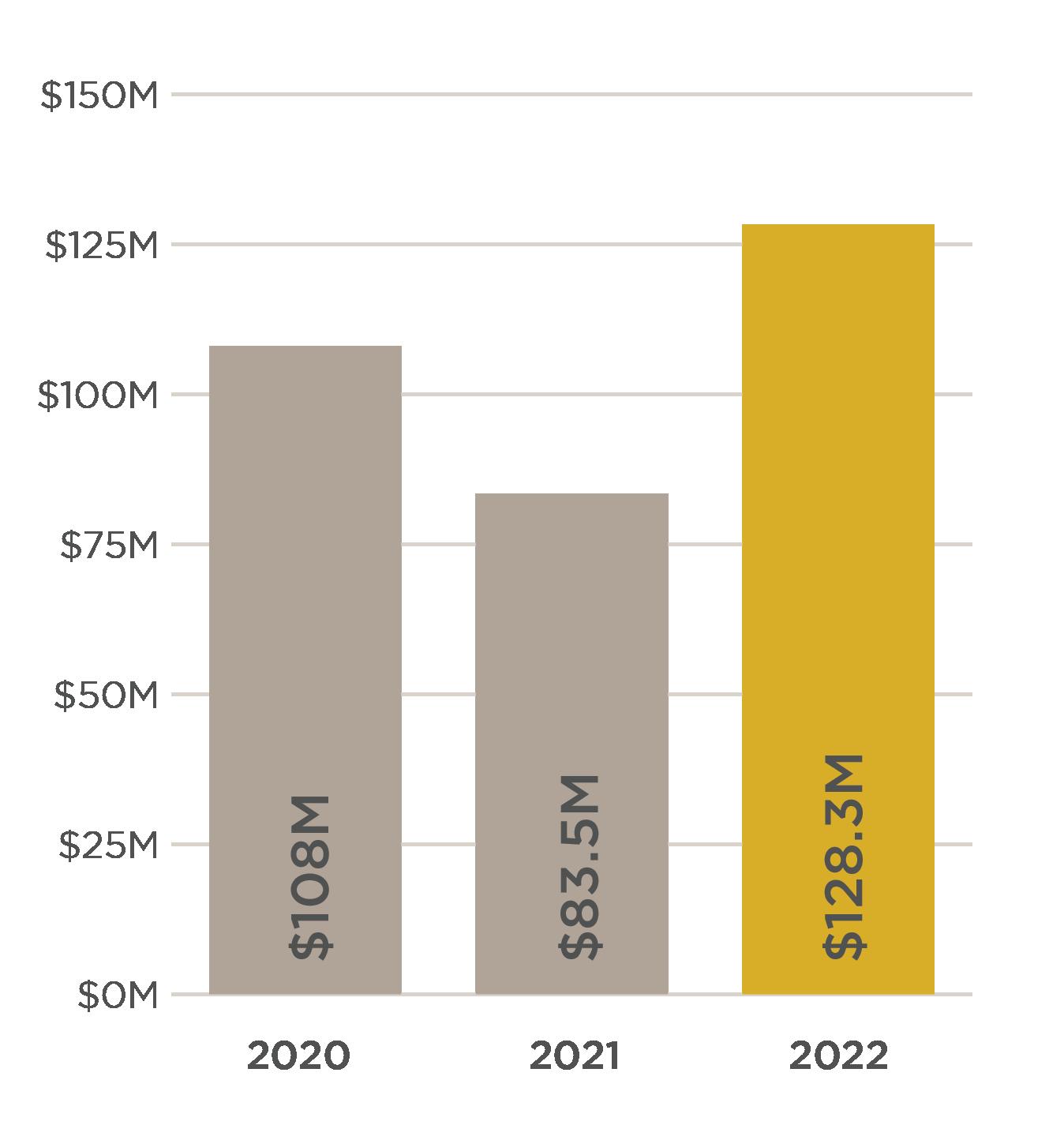

2018 $59,556,800 22 370 $2,707,127 $714 2019 $29,979,000 13 254 $2,306,077 $575 2020 $107,979,999 31 390 $3,483,226 $726 2021 $83,449,250 26 185 $3,209,587 $738 2022 $127,541,150 20 186 $6,377,058 $1,232

2018 $0 0 0 $0 $0 2019 $1,545,000 1 65 $1,545,000 $267 2020 $0 0 0 $0 $0 2021 $0 0 0 $0 $0 2022 $725,000 1 67 $725,000 $1,436

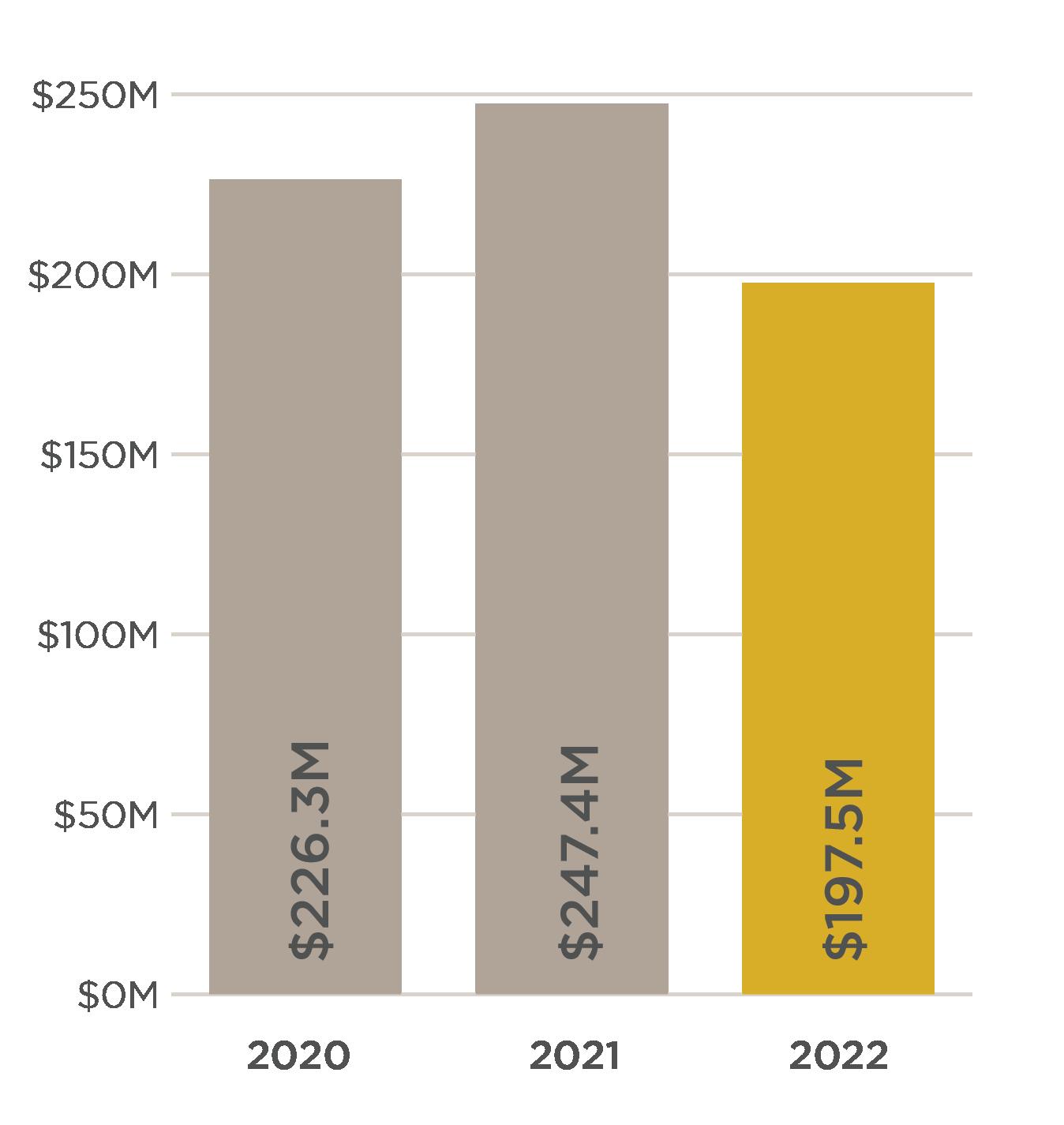

2018 $101,557,669 81 223 $1,253,798 $452 2019 $89,800,209 78 158 $1,151,285 $415 2020 $130,757,993 97 180 $1,348,021 $494 2021 $166,788,415 93 148 $1,793,424 $561 2022 $92,022,500 55 91 $1,673,136 $650

2018 $44,009,815 76 173 $579,077 $433 2019 $57,548,772 89 189 $646,615 $434 2020 $95,570,692 117 173 $816,844 $710 2021 $80,615,200 94 84 $857,609 $932 2022 $105,825,399 88 160 $1,198,749 $738

2018 $93,269,393 103 170 $905,528 $308 2019 $104,525,900 101 186 $1,034,910 $322 2020 $181,516,565 140 156 $1,296,547 $382 2021 $187,470,258 121 97 $1,549,341 $497 2022 $144,265,615 76 129 $1,898,232 $582

2018 $31,234,307 61 151 $512,038 $300 2019 $41,936,276 73 112 $574,470 $317 2020 $44,332,009 73 157 $607,288 $339 2021 $67,120,258 96 139 $699,169 $434 2022 $48,380,309 53 159 $912,836 $505

2018 $5,383,000 10 142 $538,300 $343 2019 $9,400,000 12 178 $783,333 $353 2020 $8,854,500 11 180 $804,955 $346 2021 $21,018,125 23 89 $913,832 $412 2022 $22,158,000 7 203 $3,165,429 $535

2018 $0 0 0 $0 $0 2019 $0 0 0 $0 $0 2020 $162,000 1 318 $162,000 $621 2021 $295,000 1 18 $295,000 $565 2022 $215,000 1 16 $215,000 $824

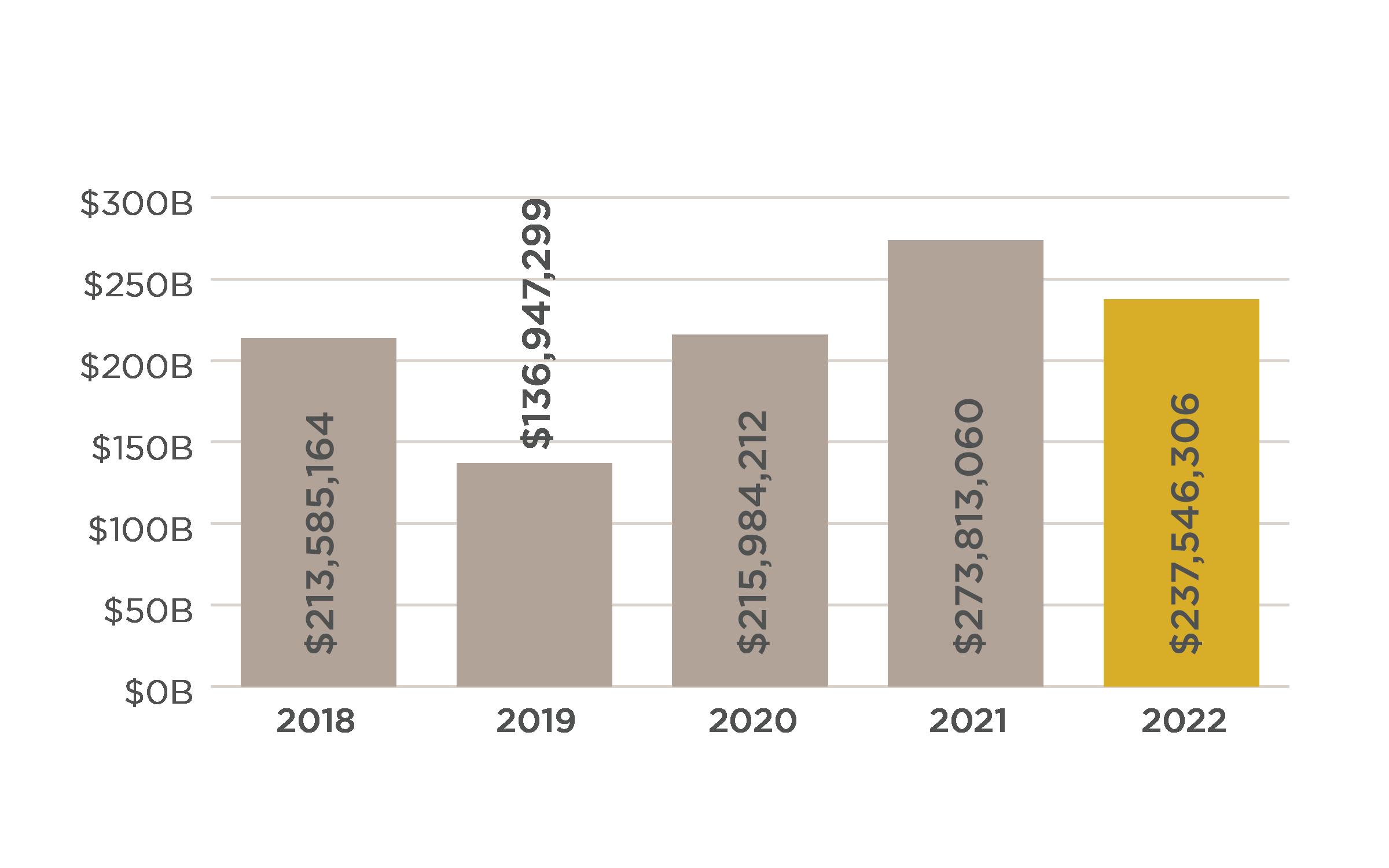

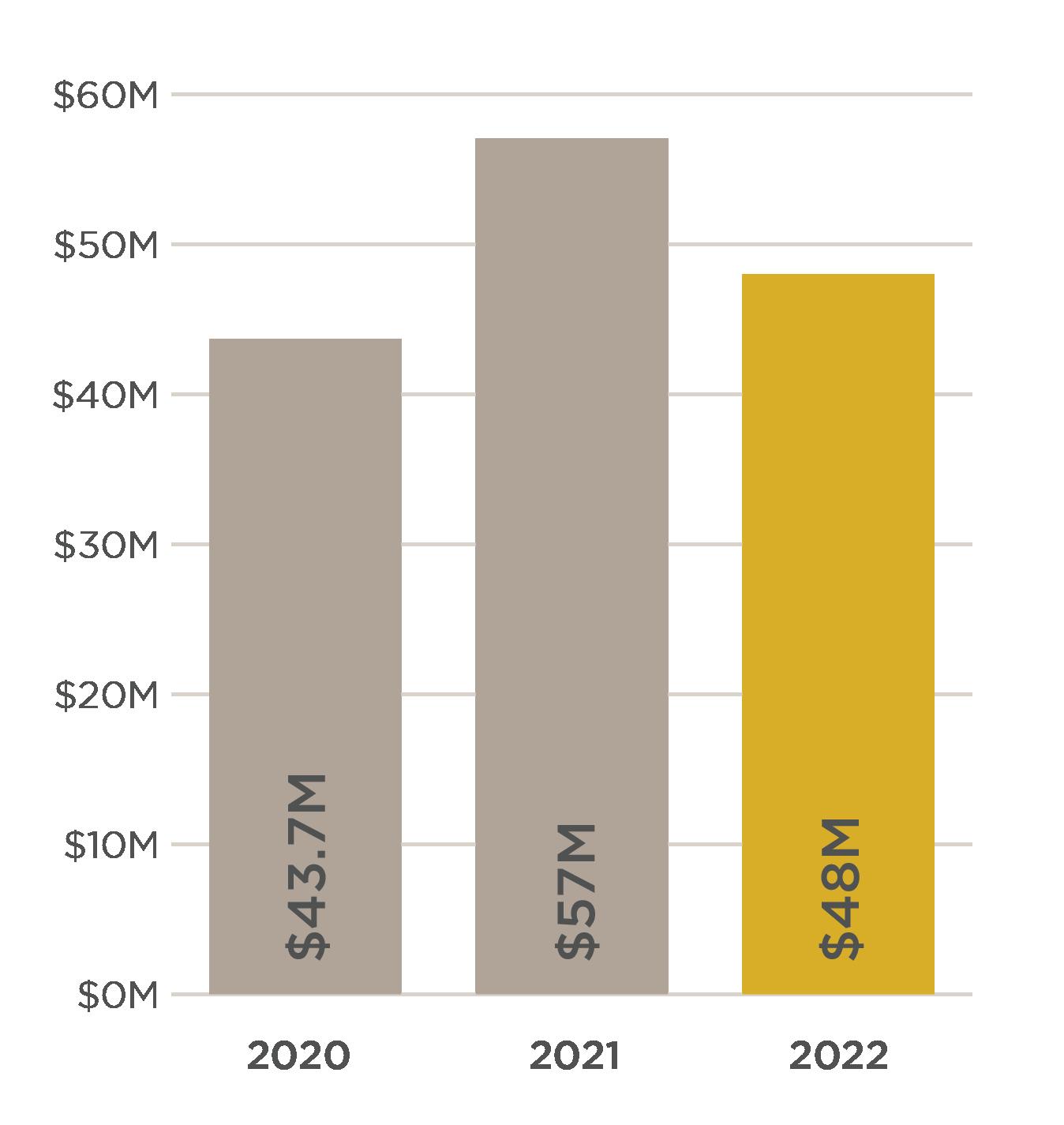

SALES VOLUME

NO OF SALES AVG DAYS ON MARKET AVG SALE AVG PRICE/ SF

2018 $102,910,471 179 111 $574,919 $246 2019 $93,876,810 154 112 $609,590 $244

2020 $154,803,462 230 93 $673,059 $271 2021 $182,944,279 219 86 $835,362 $345 2022 $158,072,534 161 90 $981,817 $395

SALES VOLUME NO OF SALES AVG DAYS ON MARKET AVG SALE AVG PRICE/ SF

2018 $23,509,700 77 85 $305,321 $232 2019 $32,068,149 100 100 $320,681 $252 2020 $26,874,945 81 87 $331,789 $267 2021 $38,292,100 95 80 $403,075 $307 2022 $45,154,120 85 93 $531,225 $363

2018 $42,858,272 103 98 $416,100 $213 2019 $45,138,300 102 111 $442,532 $207 2020 $46,617,300 98 101 $475,687 $237 2021 $61,331,336 105 78 $584,108 $274 2022 $55,971,124 85 83 $658,484 $312

2018 $17,049,510 64 103 $266,399 $193 2019 $21,154,700 72 96 $293,815 $206 2020 $16,695,200 57 97 $292,898 $218 2021 $21,974,563 63 54 $348,803 $259 2022 $20,343,090 51 48 $398,884 $302

SALES VOLUME NO OF SALES AVG DAYS ON MARKET AVG SALE AVG PRICE/ SF

2018 $31,782,835 88 108 $361,169 $192 2019 $31,498,292 83 111 $379,497 185

2020 $38,364,286 82 97 $467,857 $221

2021 $53,377,544 103 85 $518,229 $4,884 2022 $44,097,983 78 91 $565,359 $289

SALES VOLUME NO OF SALES AVG DAYS ON MARKET AVG SALE AVG PRICE/ SF

2018 $5,387,350 23 121 $234,233 $155 2019 $6,027,900 22 93 $273,995 $163

2020 $5,290,800 20 110 $264,540 $179 2021 $3,651,000 11 54 $331,909 $187 2022 $3,895,000 11 59 $354,091 $247

2018 $61,303,845 203 84 $301,989 $170 2019 $60,776,817 186 92 $326,757 $182 2020 $67,189,218 189 82 $355,499 $195 2021 $92,883,316 221 83 $420,286 $235 2022 $73,631,229 154 80 $478,125 $3,248

2018 $9,207,399 52 90 $177,065 $129 2019 $10,608,100 52 90 $204,002 $147 2020 $10,532,450 51 72 $206,519 $189 2021 $22,945,100 86 133 $266,803 $189 2022 $10,395,500 37 111 $280,959 $220