SLIFER REPORT

R E A L E S TA T E M A R K E T

STAY UP TO DATE ALL YEAR LONG

Our teamof market expertsupdatesThe Slifer Report throughout theyear To see thelatest numbersanddiveevendeeper into thereport scanthecode.

Our teamof market expertsupdatesThe Slifer Report throughout theyear To see thelatest numbersanddiveevendeeper into thereport scanthecode.

Greetings from Colorado?s Front Range!

We are home to not one, but two of the U S News and World Report Top 5 Places to Live in the U S The only other state that has more cities in the top 25 (let alone the Top 5) is Florida and guess what- we have more sunny days by over 30%!

As we predicted in early 2022, the real estate market normalized throughout the year and as we prepare for the next market cycle we believe this normalization yields a healthier market and a sign of the return of industry and market fundamentals Here on Colorado?s Front Range, the fundamentals remain strong Predicated on our abundant (and growing) diverse employment base, the opportunities for jobs and job creation continue to be a key factor in living in our Front Range communities Naturally however, the #1 reason people thrive on Colorado?s Front Range is our quality of life. Aside from job opportunities, it?s the safety, quality education and of course our bountiful outdoor and healthy lifestyles We should know, we have been successfully pioneering Colorado communities for more than 60 years. That?s right, Slifer Smith & Frampton recently celebrated our 60th anniversary! It gives us great pride to have been invested in and committed to Colorado, celebrating our Colorado lifestyle since 1962.

A second recent major milestone was welcoming Colorado Landmark, Realtors into the Slifer Smith & Frampton family, an expansion that led to our designation as the #1 Independent Real Estate Brokerage in Colorado, a rally cry that motivates and inspires us Now with five offices across the Front Range and the market leading team of high achieving, community-minded, brokers we are invested in the same vision and innovation of our first 60 years to propel us forward for the next 60.

Here's to Colorado, 2083!

FoundedinVail,1962,thehistoryof Slifer Smith&FramptonReal Estateisoneof hard-wonsuccessand careful stewardshipfor thecommunitiesweserveand call home. Today,we'vegrownacrossthestate,serving four uniquemarketsfromAspento theFront Range,but our passionfor creatingincredible communitiesremainsunwavering It'sjust onereasonwhyweareproud to be Colorado'sleading,independent real estatebrokerage

WepublishTheSlifer Report inall of our markets,so to keepyour finger onthepulse of real estateacrossColorado pleasevisit: SliferSmithAndFrampton.com/Market-Reports

Thereareanumber of factorsthat havecontributed to thestabilityof Colorado'sreal estatemarket andtheconsistent appreciation.Someof thereasonswhyColorado'sreal estatemarket maybemore stablethan other statesinclude:

Strong job market:Colorado'sstrongand diverseeconomyhascontributed to alowunemployment rate,whichinturnhashelped to support thehousingmarket

Population growth: Colorado hasexperienced significant populationgrowth inrecent years,which hashelped to increasedemand for housing andcontributeto risinghomeprices

Limited supply: Colorado hasalimitedsupplyof land for development,whichcan helpto stabilizethe real estatemarket bylimitingthenumber of new homesthat canbebuilt

Desirable location: Colorado isapopular destinationfor touristsandhasahighqualityof life,which canmakeit adesirableplaceto liveand invest inreal estate.

Strong economy: Theoverall strengthof theColorado economy,withrobust job growth anda thrivingbusinessclimate,can helpto support thereal estatemarket andcontributeto stable appreciation

Unlikethehousing crashof 2008/2009,housing isnot thekeyfactor leadingusinto arecessionary environment.That isafundamental economic differentiator fromtheGreat Financial Crisis(GFC). Morespecifically,threekeyvariableshavedramaticallyimproved:

- DuringtheGFC,thehousingmarket cratered byover 45% Webelievethismarket will level off at a30%decline,amaterial 1,500 bpspeak-to-troughimprovement

- Infact,wemayhavealreadyhit that trough If our predictionshold at 30%declinefrom peak-to-trough,inmanymarkets,wearealreadythere Wemayplateautheretemporarilybut alreadyseeing signsof the?bottom?isavastly improved outlook fromtheGFCwherethe depthof bottomwashardto find

- Household liquiditycontinuesto bestrong asbalancesheet positionswill enablebetter purchasingpower asbuyersget off thesidelinesandsellersexpectationsnormalize accordingly

TheUS (and theFront Range) Employment market remainssolid andshowing signsof maintaining that strength,akeyindicator of botheconomic healthand potential buyer pools.

Pictured | Mountain Goat on Mt Blue Sky

Pictured | Mountain Goat on Mt Blue Sky

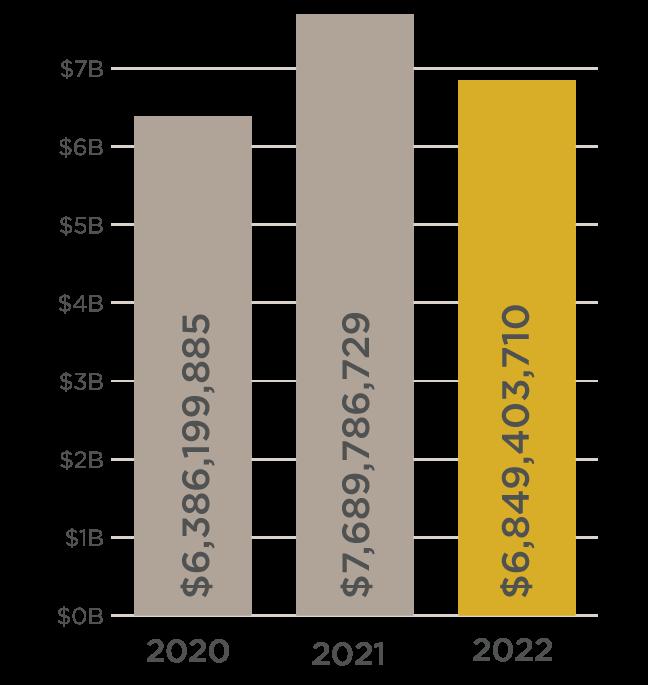

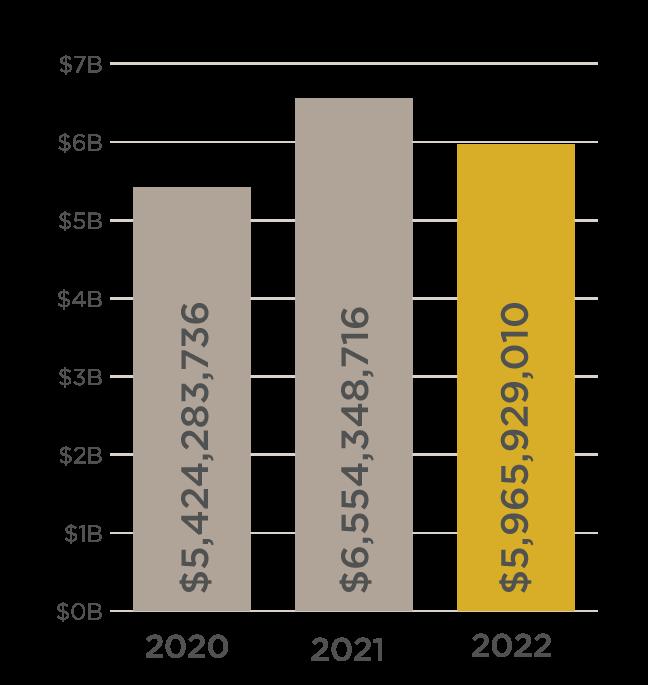

Withstrongeconomic activityacrossthestatenewdevelopment wasakeydriver of growthin2022,andwebelievethe creationof newhigh-qualityhomeswill continueto becritical asColorado settlesinto aneweconomic equilibrium Slifer Smith&Framptonisproudto betheonlybrokerageinColorado withafull divisiondedicatedto bringingnewdevelopmentsto market Our end-to-endservicecontinued to deliver in2022,creatingmorenewhomesinour communitiesthanever before Thisyear thedivisioncelebrated over $1billioninclosed&pendingsalessinceit started in2020

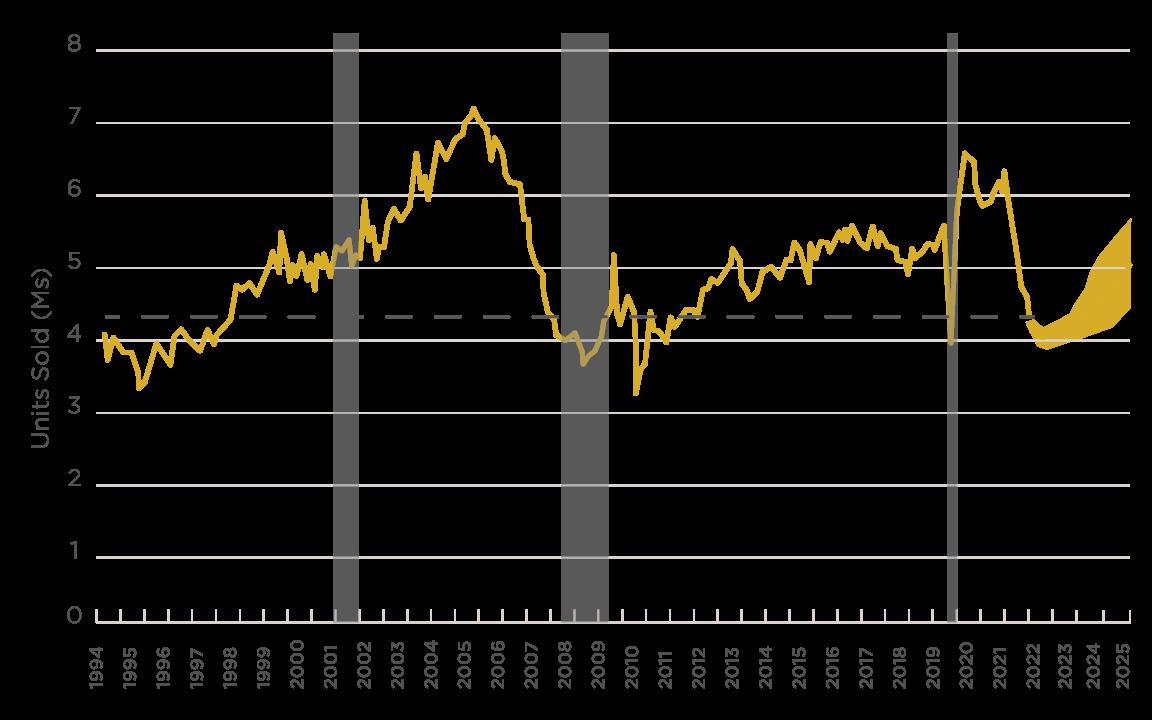

With over 6 million existing home sales in 2021across the US, our industry experienced a near 20-year high Aswepredicted,2022sawthoserarefied salesnumbersreturnto earth with just over 4 million,a30%decline/normalization and morein linewith thelong-term averageof 41million existing home sales dating back to 1968 This market normalization was a result a seriesof industry headwindsthat curbed adecadelong real estatecycleincluding uncertainty linked to thepandemic,aggressivemonetary policy,mounting geopolitical tension and natural disasters right in our own backyard.Not to mention, the home price ?run up?we experienced throughout the cycle combined with once-in-a-generation interest rate increases to cool inflation which caused affordability challengesacrossthenation felt most particularly by first timehomebuyers

Analystssuggest that inflation remainsstructural and not demand induced which seemsto be playing out with the real-time risk of over-tightening policies This market dynamic will encourage many investors to seek inflation hedges which will be a net benefit to real estate Whilewewill meet 2023with continued choppy waters, the housing market will haveasteady and gradual recovery in 2023 and into 2024 stabilizing in line with long-term historical averages before cresting the 5 million existing home sales watermark in 2024. Here on the Front Range, the new official ?Hockey Capital of the US?, we?d welcome a ?hockey stick? recovery (otherwise known as a sharp and steep improvement) but the truth is, there hasn? t been a prolonged ?hockey stick recovery? in over 40 years in our industry tracking and thus wearepreparedfor agood,olefashioned cyclical recovery:measured,steadyandgradual.

Overall, this leads to our clear and present prediction of 2023: People will be doing business and thereisno one better to navigatethesewatersthan thosewho havebeen in thebusiness since1962and successfullysailedthesecyclical seasmanytimesbefore

Real estatehasbeen an organized industryfor well over acentury and thesamefundamentals that drove business then, will drive business now. The most important of those factors is partnering with a professional. 20 years?worth of consecutive, third-party research confirms that now, more than ever, people are looking for qualified partners for the sale and purchase of their homes In fact, the number of homebuyers and sellers partnering with an agent now exceeds 90% Despite countless efforts to disrupt the agent relationship, the fact remains: consumerslikeour product andarehappywith our services Encouragingly,emergingresearch now suggeststhat millennialsuse agentseven more than their parent because it?sconsidered ?smart? Weagree!

May 2023 serve your housing wants and needs in Colorado?s Front Range well.

Pictured | Speer Boulevard

SALES VOLUME

NO OF SALES AVG DAYS ON MARKET AVG SALE MEDIAN SALE

2018 $1,751,730,399 2,435 38 $719,396 $600,000 2019 $1,804,797,750 2,502 38 $721,342 $589,950 2020 $4,996,903,482 6,367 34 $784,813 $636,000 2021 $4,739,161,061 4,716 21 $1,004,911 $783,250 2022 $3,784,506,229 3,526 21 $1,073,314 $842,250

2018 $398,776,558 913 30 $436,776 $375,000 2019 $378,995,025 897 43 $422,514 $370,347 2020 $1,073,820,397 2,287 39 $469,532 $405,000 2021 $1,091,982,278 2,077 30 $525,750 $445,000 2022 $931,817,623 1,508 22 $617,916 $516,033

2018 $486,389,201 917 30 $530,414 $485,900 2019 $602,239,079 1,088 34 $553,529 $508,000

2020 $873,439,420 1,447 27 $603,621 $540,000 2021 $842,886,923 1,200 13 $702,406 $635,000 2022 $697,316,895 913 17 $763,764 $688,000 CONDOMINIUM

2018 $73,552,055 213 21 $345,315 $337,000 2019 $63,874,745 175 29 $364,999 $350,000 2020 $136,429,050 353 27 $386,485 $390,000 2021 $152,395,254 339 16 $449,544 $450,000 2022 $160,518,881 311 23 $516,138 $530,000

POPULATION | 711,463 POPULATION GROWTH | +18 54% SINCE 2010 MEDIAN AGE | 34 6

SALES VOLUME

NO OF SALES AVG DAYS ON MARKET AVG SALE MEDIAN SALE

2018 $4,164,393,794 7,239 21 $605,966 $484,950 2019 $4,498,966,637 7,516 28 $641,843 $502,250

2020 $5,448,702,594 8,263 22 $704,063 $550,000 2021 $6,718,910,900 8,594 13 $760,202 $609,000

2022 $5,791,169,984 6,585 15 $875,817 $675,000

2018 $2,461,578,643 5,658 30 $435,062 $379,950 2019 $2,695,197,464 5,932 37 $454,349 $375,000 2020 $3,015,413,381 6,441 36 $468,159 $415,000 2021 $3,962,478,848 7,519 27 $526,995 $435,000 2022 $3,187,436,516 5,608 20 $568,373 $455,000

SALES VOLUME NO. OF SALES AVG. DAYS ON MARKET AVG. SALE MEDIAN SALE

2018 $3,772,162,541 7,654 23 $492,835 $410,000

2019 $4,071,078,804 8,095 28 $502,913 $420,000

2020 $4,784,819,705 8,799 22 $543,791 $450,000

2021 $5,680,462,559 8,770 11 $647,715 $535,000

2022 $5,032,034,299 7,086 16 $710,137 $597,144

CONDOMINIUM & TOW NHOME

2018 $1,083,244,979 3,900 19 $277,755 $260,000 2019 $1,183,914,406 4,062 29 $291,461 $270,000

2020 $1,313,230,271 4,309 26 $304,765 $282,000

2021 $1,641,156,195 4,740 14 $346,235 $322,950

2022 $1,443,593,459 3,755 13 $384,446 $365,000

SALES VOLUME NO. OF SALES AVG. DAYS ON MARKET AVG. SALE MEDIAN SALE

2018 $3,828,913,484 7,383 25 $518,612 $451,000

2019 $4,023,629,786 7,489 28 $537,272 $472,500

2020 $5,137,097,685 8,724 22 $588,847 $520,000

2021 $6,161,253,950 8,719 12 $706,647 $615,000

2022 $5,377,310,346 6,791 17 $791,829 $680,500

CONDOMINIUM & TOW NHOME

2018 $823,464,377 2,669 17 $308,529 $282,000

2019 $897,109,119 2,787 23 $321,891 $295,000

2020 $1,053,526,857 3,142 20 $335,305 $310,000

2021 $1,208,497,361 3,133 12 $385,732 $363,500

2022 $1,238,562,609 2,753 14 $449,896 $415,000

2018 $2,238,685,597 5,231 44 $427,965 $386,000 2019 $2,468,012,218 5,592 41 $441,347 $396,080 2020 $8,379,326,144 18,141 36 $461,900 $412,500 2021 $8,986,668,632 16,715 21 $537,641 $475,000 2022 $7,843,076,404 12,947 21 $605,783 $535,000 CONDOMINIUM

2018 $191,737,880 643 46 $298,193 $281,000 2019 $199,160,096 656 34 $303,598 $289,900 2020 $954,264,071 2,952 51 $323,260 $305,000 2021 $1,183,059,886 3,190 26 $370,865 $346,000 2022 $1,008,645,811 2,440 23 $413,379 $389,900

2018 $2,639,825,255 6,704 25 $393,769 $370,000

2019 $2,920,710,499 7,197 30 $405,823 $380,000

2020 $3,729,096,207 8,371 22 $445,478 $415,540

2021 $4,223,294,582 8,188 11 $515,791 $484,000

2022 $3,763,264,133 6,484 19 $580,392 $550,000

2018 $488,238,852 1,776 17 $274,909 $272,750

2019 $517,166,995 1,828 27 $282,914 $279,950

2020 $758,214,915 2,467 23 $307,343 $305,000

2021 $829,928,541 2,368 13 $350,477 $350,000

2022 $756,890,525 1,867 16 $405,405 $400,000

SALES VOLUME

NO OF SALES AVG DAYS ON MARKET AVG SALE MEDIAN SALE

2018 $3,715,540,683 6,423 36 $578,474 $500,000 2019 $3,908,061,347 6,682 38 $584,864 $510,000

2020 $4,782,743,464 7,560 32 $632,638 $549,925 2021 $5,799,144,513 7,503 14 $772,910 $651,000

2022 $5,332,963,767 6,193 22 $861,128 $725,300

2018 $409,253,520 1,162 24 $352,198 $328,872 2019 $426,473,680 1,192 35 $357,780 $337,250 2020 $548,834,707 1,474 34 $372,344 $355,000

2021 $616,052,067 1,417 15 $434,758 $422,396 2022 $540,521,149 1,072 19 $504,217 $490,000

As a founding member Slifer Smith & Frampton is proud to fly the Forbes Global Properties flag from Aspen to the Front Range. This powerful, global, network of top-tier independent brokerages gives our agents, and our clients, exclusive access to an invaluable network of the world's finest homes and the agents representing them.

In 20 22 our membership with Forbes Global Properties brought some incredible Front Range homes to a global audience. Here are some of our most notable residences of the year.