INTRODUCING :

INTRODUCING :

MADE IN THE USA

TOGETHER WE STAND. TOGETHER WE GIVE BACK.

Introducing Red Cat Premium Cabernet Sauvignon, proudly made in the USA. This special release supports our new Veteran Outreach Initiative, with a portion of proceeds from every bottle going directly to Veteran Support Organizations. Raise a glass in honor of those who served.

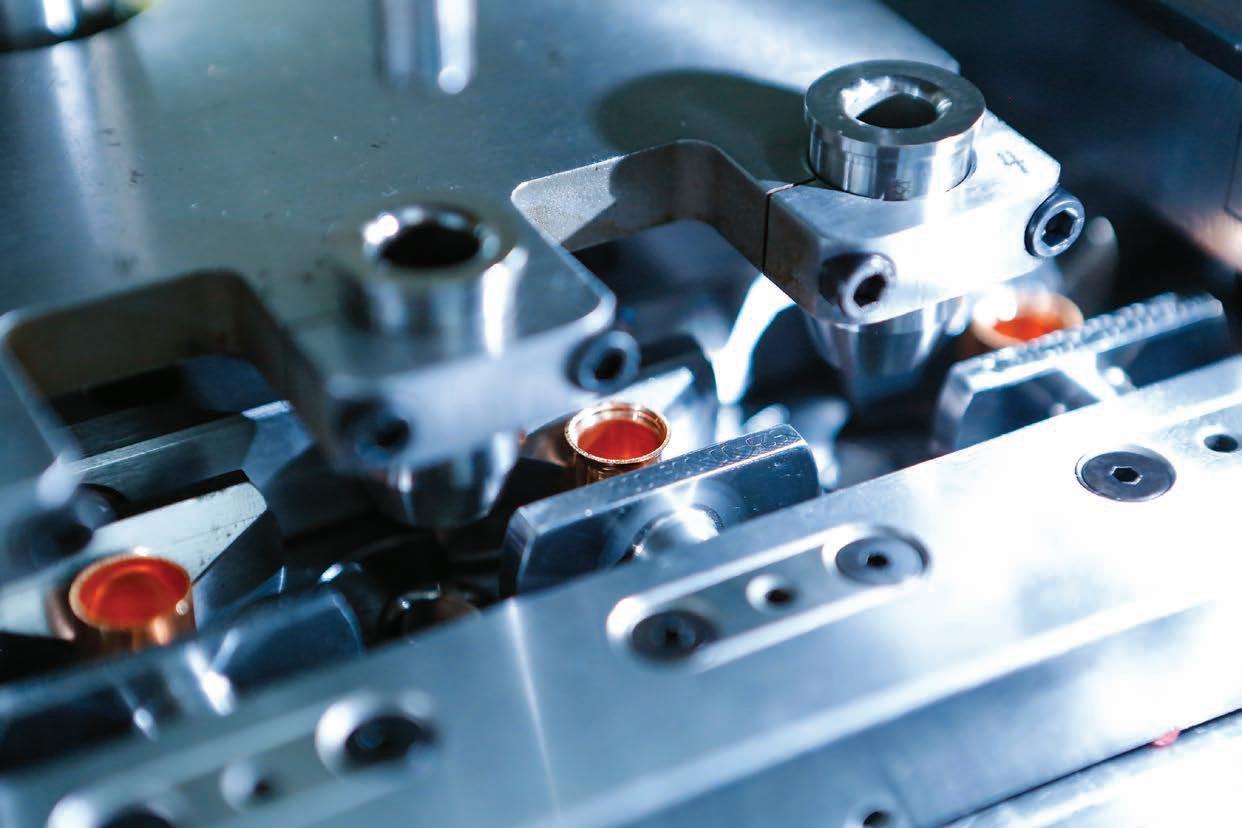

For firearms manufacturers, thermal management, durability, and weight are crucial factors in overall barrel performance. Composite Heat Release technology uses a patent-pending combination of ceramic and carbon fiber reinforced composite materials, which are custom formulated and applied to manufacturer-supplied barrel blanks. The end result: barrels that weigh less, heat slower, and cool faster than traditional steel or carbon-wrapped steel barrels.

At Avient, we don’t make barrels, we make your barrels better.

Curious about Composite Heat Release? Find out more at avient.com/shooting-sports or call 1.844.4AVIENT.

While new firearms deliver razor-thin margins around 12%, used guns represent retailers’ biggest profit opportunity — but only if they can price them correctly. Smart retailers using advanced pricing technology are achieving profit margins up to 54% on used inventory, while those relying on outdated methods struggle to break even.

Gun store owners face a constant juggling act: ATF compliance, inventory management, customer service, and somehow finding time to research fair prices for used firearms that walk through their doors. Most retailers spend hours flipping through outdated blue books or scrolling through online listings, often settling for educated guesses that either leave money on the table or create slow-moving inventory that kills cash flow.

With used guns having no fixed wholesale cost, every pricing decision directly impacts the bottom line. Yet few retailers have time to become expert appraisers on every make and model that enters their store.

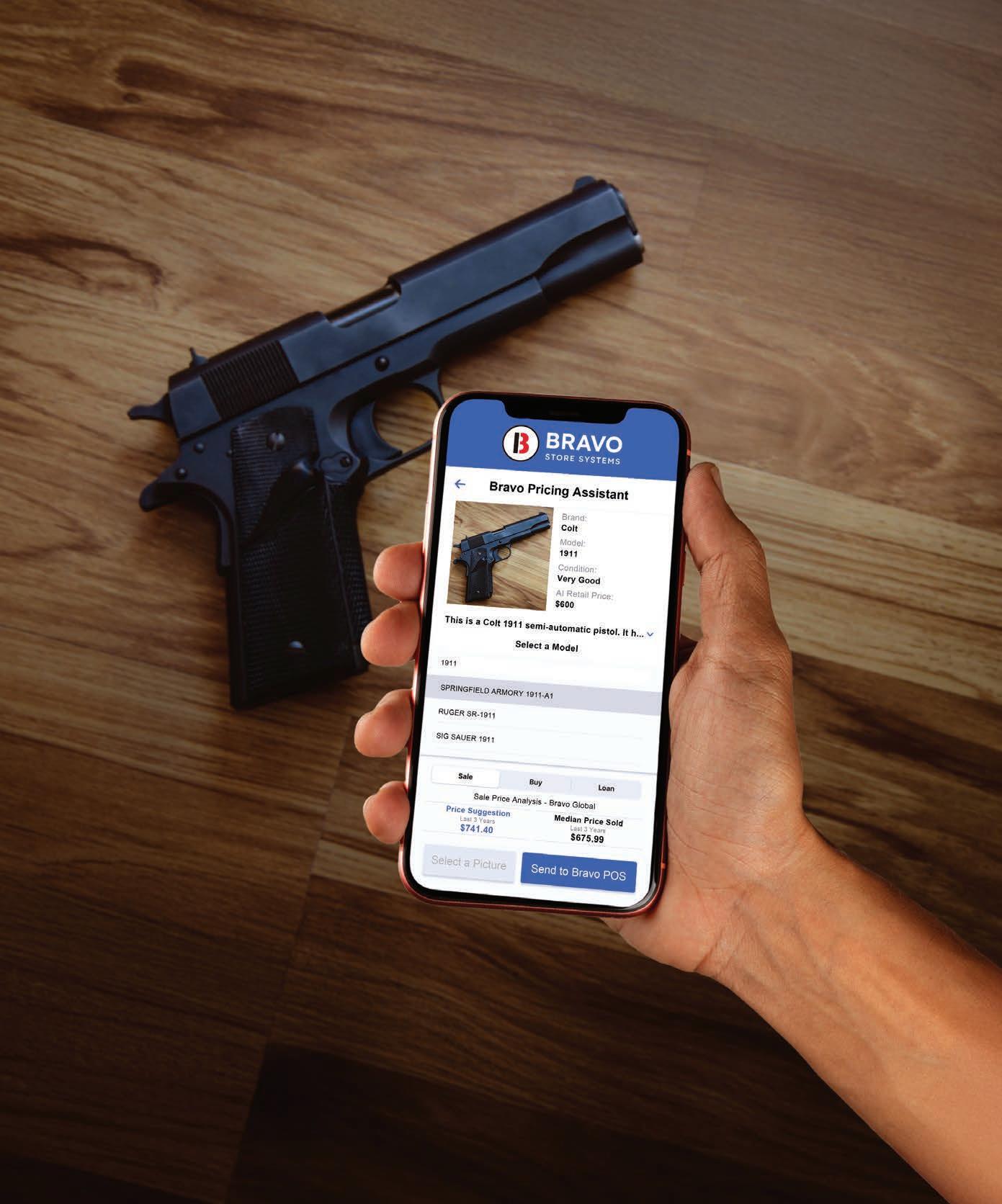

Bravo Shopkeeper Plus includes the AI Estimator, powered by Bravo Intelligence, representing first-tomarket technology specifically designed for firearms retail operations. Store owners simply photograph any firearm and instantly receive:

• Instant Item Identif ication: Revolutionary image recognition technology accurately identif ies firearms with detailed descriptions.

• Market-Based Pricing: Real-time pricing recommendations based on current market conditions, not outdated reference books.

• Condition Detection: AAdvanced technology detects scratches, wear patterns, and condition issues affecting value.

• Smar t Buying Decisions: Make informed purchasing decisions in seconds rather than minutes.

Bravo customers report spending 75% less time on pricing decisions while achieving profit margins up to 54% on used firearms. Instead of second-guessing whether a particular Glock is worth $450 or $500, retailers know within seconds — freeing them to focus on customers and compliance instead of research. The difference lies in accurate, instant pricing, powered by Bravo Intelligence, and based on real market conditions and precise condition assessment. When retailers can confidently identify a firearm’s true value and condition, they can price optimally — high enough to maximize profit, competitive enough to move inventory quickly.

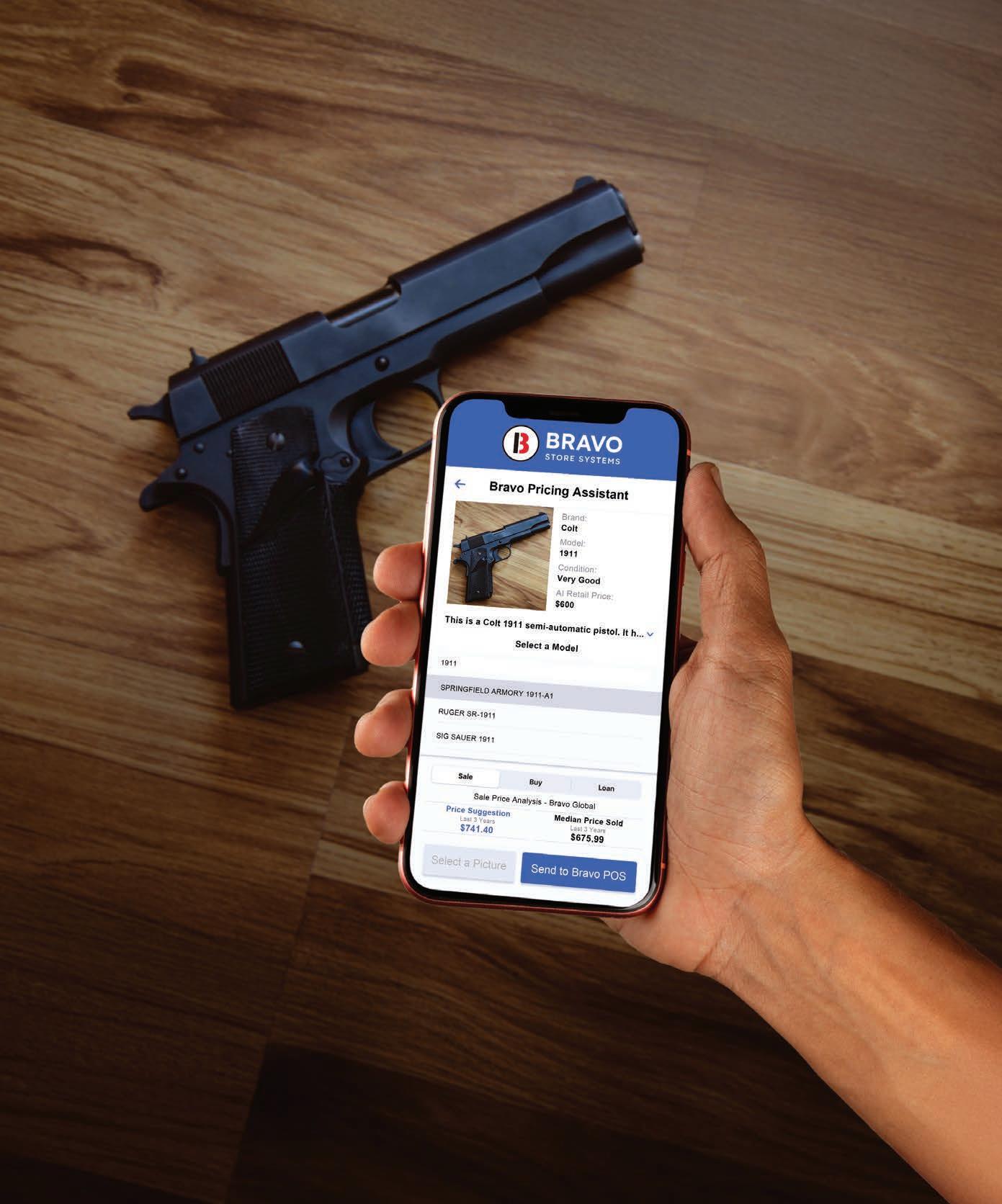

The AI Estimator is built directly into Bravo

Shopkeeper Plus, part of Bravo’s all in one Point of Sale system designed specifically for FFLs. While competitors force retailers to manage separate vendors for ATF compliance, inventory management, and point of sale, Bravo delivers everything as one all-in-one solution.

When ATF auditors arrive or systems fail, retailers work with one team that understands their entire operation. This eliminates finger pointing between vendors, compliance gaps between disconnected systems, and the risk of losing an FFL over integration failures.

In an industry where regulatory compliance can determine business survival, retailers cannot afford to trust their operations to cobbled-together systems from different vendors. One missed sync between inventory and compliance systems could cost everything a business owner has built.

Bravo’s all-in-one platform ensures pricing, inventory tracking, and ATF reporting work together flawlessly because they were designed together from day one.

Time equals money in retail operations. Every minute spent researching prices represents time not serving customers or growing the business. Every underpriced gun means profit walking out the door. Every overpriced piece ties up cash on shelves.

Smart retailers are already using technology to work more efficiently — achieving the kind of used gun profit margins that transform their bottom line.

Bravo Store Systems has been serves SMB customers with purpose-built software solutions designed specifically for the firearms industry. The company understands that running a gun store means juggling complex regulations, tight margins, and demanding customers while trying to grow a profitable business.

Bravo builds software that solves the real problems gun store owners face daily - from instant pricing decisions to seamless compliance reporting — creating solutions that actually work for SMBs.

The future of profitable used gun retail has arrived, built on working smarter rather than harder.

Retailers interested in optimizing used gun profits can visit bravostoresystems.com or stop by booth 536 at RangeRetailer this July.

Secure storage helps prevent accidents, suicide and theft. A cable lock, gun case, lock box or full-size safe can prevent unwanted access of your firearm in your home or vehicle.

Don’t wait. Prioritize safety now. Visit GunStorageCheck.org .

Gun safety is a priority all year long.

Gun Storage Check Week® is your reminder.

SEPTEMBER 1-7

Conceived nearly a century ago, the M1 Garand remains in demand.

Gen. George S. Patton famously called the M1 Garand “the best battle implement ever devised.” Guy Sagi would agree. He says in his article (page 36) on this American archetype, ”The M1 Garand’s performance during World War II is legendary. Whether in the forests of Europe, deserts of Africa, or sands of the Pacific, it delivered and quickly gained the confidence of combat troops.”

You may ask, rightly, what’s this got to do with my business? As it turns out, plenty. The rifle, originally conceived nearly a century ago, still attracts attention—and not just from grizzled veterans who shouldered it in battle. Peter Mathiesen, who writes “What’s Selling Where” for SHOT Business, spurred my interest when he reported in a recent edition that two retailers noticed renewed interest in the rifle. In fact, one told him the interest in the M1 Garand was at “an all-time high.”

And interest isn’t limited solely to used models. Springfield Armory, primary suppliers of M1s and related models, reports sales of new guns are robust. Mike Humphries, media relations manager at Springfield Armory, says, “Demand for the M1A in its numerous forms is consistently strong, and that is one of the many reasons it has been around since the launch of the company.”

Sagi also notes there is a thriving aftermarket for custom parts, including triggers, polymer stocks, and other components. Part of this demand is fueled by local and national M1 competitions. All of which is to say, this design has a lot of life left in it.

You may never have heard of D&M Holding, but you soon will (see page 24). Global demand for reliable supplies of ammunition, primers, and powder is soaring as a matter national security,

and D&M is working nonstop to support the U.S., NATO countries, and other friendly foreign governments. The brainchild of Dan Powers, former CEO of SIG Sauer’s ammunition manufacturing facility in Arkansas, D&M specializes in greenfield projects (i.e., a new undertaking that starts from scratch on undeveloped land or without any preexisting infrastructure or systems), often for companies and countries that have never before been in the ammunition, primer, or propellant business. D&M’s turnkey factories include solutions for ammunition production, primer production, as well as propellant production for everything from small-caliber ammunition to artillery. The company handles all aspects of the project, from site planning and floor planning to equipment manufacture and installation, as well as what Powers calls the “the secret sauce,” the transfer of knowhow. But what impresses me most is the ability of Powers to attract—and keep— a talented and dedicated team. That’s a rare ability these days—and it recalls an observation a talented CEO made years ago to me when I asked him to explain his company’s success: “I hire good people and then get out of their way.” Words to live by.

EDITORIAL & CREATIVE EDITOR w SLATON L. WHITE

GROUP MANAGING EDITOR w HILARY DYER ART DIRECTOR w TOD MOLINA

ADVERTISING

SALES TEAM w DON HARRIS w TOBY SHAW w BRAD BISNETTE

COLE PUBLISHING ADMINISTRATION

PRESIDENT, COLE PUBLISHING w JEFF BRUSS PRESIDENT, GRAND VIEW OUTDOORS w DERRICK NAWROCKI

NSSF ADMINISTRATION

PRESIDENT & CEO w JOSEPH H. BARTOZZI

SENIOR VICE PRESIDENT & CCO w CHRIS DOLNACK

VICE PRESIDENT, MARKETING w BILL DUNN

SENIOR VICE PRESIDENT FOR GOVERNMENT & PUBLIC AFFAIRS, ASSISTANT SECRETARY & GENERAL COUNSEL w LAWRENCE G. KEANE

VICE PRESIDENT, HUMAN RESOURCES w LISA DAVIS

VICE PRESIDENT & CFO w JOHN SMITH

MANAGING DIRECTOR, MEMBER SERVICES w JOHN MCNAMARA

SHOT BUSINESS (ISSN 1081-8618, USPS 25801) is published bimonthly by COLE Publishing, 415 E Wall St, Eagle River, WI 54521. Periodicals postage is paid at Eagle River, WI.

POSTMASTER: Send address changes to SHOT BUSINESS, PO Box 2707, Eagle River, WI 54521. All rights reserved. Contents may not be printed or otherwise reproduced without written permission of COLE Publishing. Periodicals postage pending at Eagle River, WI 54521 and at additional mailing offices.

COLE Publishing is not responsible for researching or investigating the accuracy of the contents of stories published in this magazine. Readers are advised that the use of the information contained within this magazine is with the understanding that it is at their own risk. COLE Publishing assumes no liability for this information or its use. COLE Publishing assumes no responsibility for unsolicited editorial, photography, and art submissions. In addition, no Terms and Conditions agreements are recognized by COLE Publishing unless signed and returned by the Editor.

POSTMASTER: Send address changes to: SHOT BUSINESS P.O. BOX 220, THREE LAKES, WI 54562.

ADVERTISING: Advertising inquiries should be emailed to shotbusiness@colepublishing.com. No responsibility will be assumed for unsolicited materials. SHOT BUSINESS is a registered trademark of NSSF. Contents copyright ©2025 by NSSF. All rights reserved. Reproduction in whole or part is prohibited unless expressly authorized by publisher.

MEMBER/SUBSCRIBER SERVICES: membership@nssf.org

Olin Corporation has completed the previously announced acquisition of the small-caliber ammunition assets of AMMO, Inc. The assets, employees, and ammunition business are now part of Olin’s Winchester Ammunition business, including the brass shell case capabilities and a newly constructed,

world-class, 185,000-square-foot production facility located in Manitowoc, Wisconsin. The facility and its skilled employees complement Winchester’s existing production capabilities, enabling greater specialization and broader participation across a variety of high-margin specialty calibers.

Funded from available liquidity, this transaction is expected to be immediately accretive to Olin’s shareholders, delivering incremental expected firstyear adjusted EBITDA of $10 to $15 million, including synergies realization, leveraging Winchester’s industry-leading economies of scale, raw material sourcing, and the company’s projectile, primer, and loading capabilities. Once fully integrated, this acquisition is expected to yield adjusted EBITDA of $40 million per year with full realization of synergies.

“During our recent Investor Day, we committed to our capital allocation framework,” says Ken

Lane, Olin’s president and CEO. “Like the White Flyer acquisition in 2023, this acquisition furthers Winchester’s strategy to identify and secure small, bolt-on opportunities that are highly strategic and immediately accretive to Olin. By year three, we expect to have paid one-and-a-half times adjusted EBITDA for these world-class assets.”

Brett Flaugher, president of Winchester Ammunition, says, “The specialization of the Manitowoc facility will expand our reach into higher-value commercial, as well as international military and law enforcement, calibers while deepening our near full integration across the ammunition value chain. This shift enables our larger legacy plants to focus on high-volume products and growing our cost advantage.” winchester.com

In conjunction with the sale, AMMO is beginning a formal rebranding process, including

↑ By acquiring the small-caliber ammo assets of AMMO, Inc. Olin-Winchester can now reach cost-effectively into new markets.

a corporate name change to Outdoor Holding Company, to better reflect its e-commerce identity and broader vision in the outdoor lifestyle and sporting goods sectors. GunBroker, which had been a component of AMMO, Inc., will remain with the new entity. It is the largest online marketplace dedicated to firearms, hunting, shooting, and related products. Third-party sellers list items on the site and federal and state laws govern the sale of firearms and other restricted items. Ownership policies and regulations are followed using licensed firearms dealers as transfer agents. Launched in 1999, the GunBroker. com website is an informative, secure, and safe way to buy and sell firearms, ammunition, shooting accessories, and outdoor gear online. GunBroker promotes responsible ownership of guns and firearms. gunbroker.com

The Model 1854 lever action is now chambered in .45-70 Govt. Smith & Wesson first introduced the series in a paired synthetic black polymer and stainless-steel finish, as well as an Armornite and walnut furniture combination, across several pistol calibers, including .44 Rem. Mag, .45 Colt, and .357 Magnum.

These rifles have a 6+1 capacity, a forged 416 stainless-steel receiver, and 20-inch 410 stainless-steel barrel and include an 11/16-24 thread pattern for suppressor use. Their large loop lever is constructed for smooth operation, allowing for quicker follow-up shots, while the flat trigger design allows for consistent finger placement.

The Model 1854 .45-70 rifles come equipped with several out-of-the-box features such as a 5¾-inch Picatinny base for optics mounting, an adjustable XS Sights ghost ring rear sight, a gold bead front sight, and a fixed magazine tube. The forend on the stainless-steel model offers three M-LOK compatible slots for the user’s preferred accessories and both variants incorporate mounts for the addition of a sling. SRP: $1,499.

smith-wesson.com

Lately, there has been a surge of speculation about rising ammunition prices, driven by new U.S. tariffs and concerns about international supply chains. Dan Wolgin, CEO of Ammunition Depot, thinks it best put those fears to rest. “At Ammunition Depot, we don’t foresee any meaningful effects in the near future from the tariffs. Here’s why.”

The U.S. ammo supply chain is largely domestic. “Most of our ammunition inventory comes from American manufacturers,” Wolgin says. “That means we’re largely insulated from international trade disruptions. While tariffs may impact some imported goods, they have little to no bearing on the bulk of the U.S. ammunition market, for three key reasons: ammunition component materials like brass, lead, and powder are largely sourced and processed domestically; ammunition is loaded and manufactured here in the U.S.; and foreign ammunition is only a small percentage of our sales.”

Wolgin notes that while some headlines are causing anxiety, tariffs don’t move the needle for the core of the industry. “There are two current factors, neither of which is driving prices,” he says. “Antimony is a marginal component, a hardening agent used in bullet cores, but, as of December 2024, it is no longer being exported by China. Keep in mind that, on average, it makes up less than two percent of bullet composition. The U.S. can import it from Australia, Bolivia, and Turkey.”

This shift happened before the current tariff situation and is not driving pricing pressure today.

Smokeless powder, however, is a concern. “There has been a domestic shortage of smokeless powder for over two years,” he says. “It’s not an import issue, as most powder is produced in the U.S., but it could impact prices if the supply tightens further.”

He does note that prices for smokeless powder have recently risen by about 15 percent this year, but ammo prices haven’t moved, thanks to careful inventory management and domestic sourcing. “Bottom line: it’s a known factor, but it hasn’t driven price increases yet,” he says.

And though manufacturers have tried to raise prices, they haven’t stuck. “Ammo producers have made several attempts over the past two years to raise

prices,” Wolgin says. “But in every instance, the market has rejected those increases. Unless there’s a real, sustained shift in cost structures (which hasn’t happened yet), price hikes are unlikely to take hold. For the last year ammo prices have gone lower, not higher.”

To Wolgin, the real threat is panic buying. “The only real risk to price stability is consumer-driven panic buying. If fear over tariffs or other rumors triggers a run on ammo, it could lead to short-term shortages and price spikes. That’s not supply-chain driven, it’s behavioral economics at play.”

His advice for consumers: Stay calm; stay informed; and buy smart.

“Despite international tension and economic noise, the American ammo market remains strong, stable, and domestic,” Wolgin says. “At Ammunition Depot, we’re monitoring the landscape closely, and we see no legitimate reason to expect a rise in prices driven by tariffs or supply chain issues. So no, you don’t need to be tariffied.”

Ammunitiondepot.com

FALCO Holsters has relaunched its customer-favorite G122 Sling Bag with a hidden upgrade that enhances functionality, improves draw performance, and adds storage space. The update was based on feedback and recommendations from customers. Known for its comfortable, discreet design and cross-body access, the G122 Sling Bag is a trusted choice for anyone who prefers off-body carry or simply finds themselves in situations where belt holsters aren’t practical. Its low-profile silhouette blends seamlessly into civilian environments, aided by a variety of color options, while still allowing quick firearm access in dynamic scenarios such as hiking, biking, commuting, or traveling.

Thanks to its versatile design and anti-slip lining, the G122 can also be worn as a fanny pack. It features three compartments for everyday essentials and a dedicated firearm compartment with a nylon pull cord for fast access.

“At FALCO, we constantly refine our designs to improve the daily carry experience of our customers,” says Robert Kovac, CEO of FALCO Holsters. “Sometimes that means upgrading a proven concealed carry bag, and other times it means developing entirely new innovations such as our carbon-fiber or 3D-printed holsters. In every case, the goal is the same: to bring practical value to the people who trust us with their protection. That’s why we listened, refined, and relaunched the G122 with purpose, and without increasing the cost.” SRP: $129.95. falcoholsters.com

Savage Arms has added a new component to its popular line of AccuCan suppressors. The AC30 B.O.B. (Back Over Barrel) suppressor is the perfect option for shooters looking to enhance balance and reduce overall firearm length while shooting suppressed. The B.O.B. design partially encloses the barrel, allowing for more internal volume and minimizing the increase of overall rifle length. These modifications improve sound suppression and reduce point-of-impact shift, leading to better accuracy.

“The AC30 B.O.B. is a great addition to our suppressor line that gives hunters and shooters performance advantages and options,” says Beth Shimanski, director of marketing at Savage Arms. “This design and option is attractive to a wide variety of hunters, as it provides a significant reduction in noise, is more compact, rated for all .30 caliber options, and also reduces felt recoil. Competitive shooters will enjoy similar benefits of reduced noise and recoil, without sacrificing maneuverability.”

At a weight of only 13.7 ounces and fully serviceable in the field, the new AccuCan is perfect for backcountry hunting or all-day shooting excursions. Capable of shooting any .30 caliber cartridge up to .300 Winchester Magnum, it is compatible with a wide variety of firearms, including most Savage firearms with factory-installed Proof Research barrels.

A standout feature of the AC30 B.O.B. is the revolutionary MonoKore design. This approach

allows the suppressor to reduce both flash and recoil, giving shooters a more enjoyable and

accurate experience at the range or in the field. SRP: $999. savagearms.com

by S laton l . W hite

Waterfowl hunters these days benefit from a host of innovative loads. That is a welcome development, but the variety of choices can make heads spin—for hunters and retailers alike. A hunter’s ammo menu includes steel, bismuth, tungsten, and TSS (tungsten super shot), each of which offers specific performance benefits. But these non-toxic loads come with sticker shock, because dense nontoxic metals, such as bismuth and tungsten, have higher commodity prices, which do make for a more expensive product. Turkey hunters, who on a good day will take one shot only, can justify the cost of a TSS turkey load, which could be as high as $10 per shell. Waterfowlers, however, expect to shoot a lot more, and at $10 per shell, a day in the blind can become prohibitively expensive.

That’s where a product called “stacked loads” comes into play. Basically, it’s a form of modern alchemy where ammo manufacturers mix pellet sizes and materials to create high-performing shotgun loads for waterfowlers. But just what are these loads?

“A stacked (duplex) load is when you have two different shot sizes in the same shotshell,” says Ronald Evans, Remington shotshell product line manager. “The smaller pellet size, such as No. 4, is most of the time nearest the powder or the bottom of the load; the larger pellets, such as size BB, sit at the top. In most cases, we see improved performance in patterns and effective ranges. Smaller shot delivers denser patterns at close range while the larger shot is effective at longer ranges. This type of load also works well when more than one species of waterfowl is being hunted. If a hunter is chasing ducks, but geese are in the area, he could use a BB and No. 4 load for both birds.”

Stacked loads can also comprise different metals. “We will use stacked loads to maximize pattern density and/or increase down-range energy,” says Scott Turner, HEVI-Shot shotshell product line manager. “When dealing with non-toxic materials, we are limited to TSS (18 grams per cubic centimeter), HEVI-Shot tungsten (12.0g/cc), bismuth (9.6g/ cc), and steel (7.8g/cc). The higher the density, the higher the material cost. By stacking different materials, we are able to tailor a good balance of cost and performance for the consumer.”

Turner also points out a feature of HEVI-Shot that retailers should bear in mind. “HEVI-Shot is known for its density,” he says. “By using denser products, we are able to reduce the size of the pellets for the same down-range energy. For example, if you shoot a size 3 steel pellet, you can shoot a size 6 HEVI-Shot tungsten pellet or a size 4 bismuth. That

way, a hunter can put more lethal pellets on target. That’s why our HEVI-Shot X-treme comes in size No. 1 (steel) and size No. 4 (tungsten). There are two other combinations as well.”

And though stacked steel loads are generally less expensive, retailers should note manufacturers consider them to be premium products. “Non-toxic stacked loads that use steel and either bismuth or a tungsten metal are referred to as a premium or highperforming product and offer performance advantages, such as improved wad systems, over traditional steel loads,” says Joshua Vickers, Federal shotshell product line manager. “In the case of Federal’s new Ultra Steel, which offers steel stacked loads (BB and 2, 2 and 4, and 3 and 5), we have found that by stacking two different steel shot sizes coupled with our FLITECONTROL Flex wad, we were able to notably increase pattern densities in a 15-inch circle at 40 yards, making for a more lethal load.”

Here is a selection of stacked loads that retailers should consider stocking.

Black Cloud TSS (12- and 20-gauge): 60 percent HEAVYWEIGHT TSS and 40 percent steel FLITESTOPPER pellets in No. 3 (steel) and No. 9 (TSS) or BB; Ultra Steel: a fifty-fifty mix of all-steel payloads in either 3 and 5, 2 and 4, and 2 and BB in 3-inch 12-gauge. New in 2025 will be 3.5-inch 12-gauge loads in 2 and 4 or 2 and BB. In addition, there will also be a 3.5-inch 10-gauge load in 2 and BB or 1 and BBB. federalpremium.com

HEVI-Metal Xtreme: 30 percent tungsten and 70 percent steel in mixed sizes 3 (steel) and 6 (tungsten), 1 and 4, or 2 and BB. New for 2025, HEVI-Steel Layered (12- and 20-gauge) consists of payloads of 100-percent steel in different sizes, such as 3 and 5, 2 and 4, or 2 and BB. hevishot.com

Nitro Steel Duplex currently comes in four 12-gauge configurations: 2 and 4, 6 and 2, 4 and BB, and 2 and BB. In 2025, Nitro Steel Duplex will introduce three new 20-gauge SKUs in 4 and 6, 2 and 6, or 2 and 4. remington.com

For decades, the lever-action rifle has been synonymous with the Old West, hunting, and classic Americana. But in recent years these rifles have experienced a resurgence—not just among collectors and hunters, but also in tactical and survival scenarios. Once considered obsolete in the face of semi-automatic platforms, lever guns are proving their worth in the modern era, particularly in states with restrictive firearm laws and among those seeking a versatile, powerful alternative for defensive use.

Lever-action rifles offer several tactical advantages that make them a viable option for today’s shooters. Unlike modern sporting rifles, lever guns often bypass many restrictive state regulations due to their traditional design. This makes them an attractive choice for those living in states with magazinecapacity limits or bans on semi-automatic rifles.

Beyond the legal considerations, lever-action rifles offer lightweight, maneuverable, and fast-handling capabilities. Their slim profile makes them easy to carry and store, and their cycling speed—while not as fast as a semi-auto—is quicker than many assume. With practice, a skilled shooter can deliver rapid follow-up shots with surprising efficiency.

Big Horn Armory has taken the concept of a tactical lever gun to the next level with the Model

89 Black Thunder and the Model 89 White Lightning. These rifles blend the heritage of the lever action with modern features that make them highly effective for tactical applications. Chambered in .500 S&W, the Black Thunder and White Lightning deliver significant stopping power, making them formidable choices for personal defense, hunting, and law-enforcement applications.

Constructed from precision-machined stainless steel with a black nitride or laminate gray finish, these rifles are also built to withstand harsh environments.

Fiocchi of America, a global leader in defensive, target, and hunting ammunition, is proud to welcome Kiersten Sales to the Pro Staff Team. Sales is a dedicated sporting clays competitor with an impressive list of accomplishments, including 2025 Florida Challenge: Main Lady Champion; and 2023 National Championship, FITASC: Ladies Champion.

“I love to compete and have a deep desire to be the best I can be,” says Sales. “I began playing tennis at three years old and added volleyball and gymnastics by age ten. My brother started shooting clay targets with the SCTP team at Quail Creek Plantation in Okeechobee, Florida, and my competitive nature drew me to this sport, which requires a high level of self-discipline. Soon, I was hooked on breaking clays. My seven years in the SCTP program brought me many hard-fought successes. The work ethic and self-motivation required were the catalysts for my desire to succeed. I started shooting NSCA events and earned a spot in Master Class at age 14. This

sport truly rewards your efforts; I have recently completed the NSCA Level 1 Instructors Course, and I aspire to give back as a mentor and coach. My goal is to reach my full potential and earn a spot on the USA Sporting Clays Team. I am excited to excel and push myself to the highest levels this sport has to offer. I look forward to traveling around the nation, making new friends, aligning myself with companies and products I believe in, and seeing just how far I can go.”

Sales has selected Fiocchi’s White Rinos and Little Rinos as her competition shell.

“We are thrilled to add Kiersten to our team. She is a very accomplished and well-rounded young lady,” says Holly Hammond, Fiocchi’s marketing manager. “I believe her long list of achievements is just the beginning of her competitive career. We welcome her to the Fiocchi family.” fiocchiusa.com

Tactical enhancements, such as M-LOK attachment points, threaded barrels for suppressors, and integrated rail systems make these rifles adaptable to modern accessories, including optics, lights, and lasers.

Whether navigating legal restrictions, looking for a powerful truck gun, or simply embracing the reliability of a lever-action rifle in a tactical setup, these firearms stand out as a modern solution with timeless performance.

Bighornarmory.com

Henry Repeating Arms, a leader in leveraction rifle production, has created a new R&D initiative—Special Products Division—focused on forward-thinking. The first product out the door is the the HUSH Series, a new line of suppressoroptimized lever-action rifles. This release marks a significant expansion in Henry’s modern firearm offerings with a platform purpose-built to deliver the optimal solution for suppressed shooting and hunting without compromising weight and balance.

Lever-action rifles have long been celebrated for their inherent balance, reliability, fast follow-up shots, and more recently, their innate suppressibility due to a closed action. The HUSH Series builds on those strengths by dramatically reducing the weight forward of the receiver, ensuring the rifle’s natural point of balance is preserved even with a suppressor mounted. These refinements define Henry’s Ultimate Suppressor Host (HUSH)—offering a quieter, smarter, and more capable solution for modern hunters and shooting enthusiasts.

“Suppressor use is growing rapidly, and for good reason,” says Andy Wickstrom, president of Henry Repeating Arms. “It protects hearing, minimizes recoil, reduces game spooking, and improves the

overall experience when out at the range. With the SPD’s HUSH Series, we deliver the best possible platform for running suppressed without compromise.”

Key features across the series include matchgrade 416R stainless-steel barrels encased in a tension-wrapped carbon-fiber sleeve, manufactured in

partnership with BSF Barrels of Devalue, Wisconsin; lightweight, skeletonized aluminum forearms featuring M-LOK accessory slots, designed in collaboration with TAPCO; a checkered, lightweight, matte dark gray American hardwood laminate stock with a rubber recoil pad; receiver-mounted forged carbon-fiber Picatinny rail for optics mounting; and a threaded muzzle for suppressor use.

“With the HUSH Series, our engineering team started with a clean slate and a clear objective: design the ideal suppressor host from the ground up,” says Nick Chappell, vice president of engineering at Henry Repeating Arms. “Every design decision, from the carbon-fiber tension-wrapped barrel to the aluminum forearm and forged carbon optics rail, was made to reduce weight, enhance balance, and maximize performance. This is the most technically advanced lever-action ever produced, and we’re just getting started.”

The HUSH Series will be available in five popular calibers: .45 Colt, .357 Magnum/. 38 Special, .44 Magnum/.44 Special, .30-30 Win., and .45-70 Gov’t. SRP: $1,999. henryusa.com

Our purpose is to advocate for the industry and your business. Help us keep both strong.

NSSF® — The Firearm Industry Trade Association, constantly works on behalf of every one of its thousands of members to strengthen our industry. We provide unparalleled education resources, in-depth market research, compliance consultations with industry pros and other tools to help any size firearm business thrive.

Membership dues support our e orts that support your business.

JOIN A COMMUNITY OF LIKE-MINDED BUSINESSES THAT ARE COMMITTED TO THE FUTURE OF THE SHOOTING AND HUNTING INDUSTRY.

Enhancing a company’s brand presence and market growth requires adhering to a well-executed strategic plan.

eprolight, a division of the SK Group, is the premier manufacturer and global supplier of top-grade electro-optical and optical sights; self-illuminated sights for pistols, shotguns, and rifles; and night vision devices and thermal sights. As director of marketing at Meprolight USA, Eric Suarez has spent the last four years leading strategic initiatives that have significantly enhanced the company’s brand presence and market growth.

With a distinguished career in the United States Marine Corps, specifically within Special Operations, Suarez brings a wealth of experience in high-pressure environments and leadership to his role. After retiring from military service in 2016, he transitioned into the firearms industry, leveraging his tactical expertise and strategic vision to drive marketing efforts that support Meprolight’s mission of providing cutting-edge optical solutions for military, law enforcement, and civilian markets. His passion for supporting today’s warfighter is a driving force behind his work, ensuring that every initiative aligns with the needs of those who rely on the highest-quality gear in the field.

SHOT Business: What do you see as the biggest challenges facing the industry in the next five years?

Eric Suarez: In the next five years, the outdoor and firearms industry will face several key challenges. One of the most significant will be navigating the evolving regulatory landscape. As governments increasingly introduce (or rescind) new laws and restrictions, businesses will need to stay agile to ensure compliance without compromising product availability or innovation. Additionally, the growing concern over safety and

responsible gun ownership will require companies to develop and promote solutions prioritizing education and training. Adapting to changing consumer behaviors, particularly with the rise of e-commerce and digital engagement, will be essential for businesses to stay competitive and relevant in an ever-evolving market. Our industry has a very wide demographic. With that, we cannot focus on one segment without affecting another, so balance is key. In the end I believe a great company is one that can adapt and make sound decisions in a timely manner. Those that can will succeed; those that are stuck in the old ways will probably struggle.

SB: What opportunities do you see?

ES: In the next five years, sales and marketing within the firearms and outdoor industry will see exciting opportunities. One of the most prominent will be the ability to leverage digital marketing and e-commerce to reach a broader, more diverse audience while gaining marketing data and analytics. As more consumers turn to online shopping, brands will tap into targeted advertising, social media campaigns, and influencer partnerships to increase brand awareness and drive direct sales. Another significant opportunity lies in personalized marketing, where datadriven insights allow companies to tailor their messaging and offers to specific customer segments. Creating a community through brand-driven experiences—such as events, strategic partnerships, and outdoor experiences—will provide valuable opportunities to engage with customers on a deeper level and foster brand loyalty.

SB: When you get up in the morning, what gets you excited about working in the industry?

ES: My work at Meprolight and within the firearms industry is deeply rooted in my military background and my commitment to supporting the needs of the warfighter. Having served myself, I understand the critical importance of reliable, high-performance equipment in high-stakes environments. My experience drives me to ensure we deliver products that meet the exacting standards required by military and law enforcement agencies around the world. It’s humbling to know that many of our employees and their families still serve, and that our company’s core purpose is to be a global supplier of mission-critical solutions for military and law enforcement agencies. This sense of duty and connection to those on the front lines fuels my passion for this industry, and it’s why I’m dedicated to ensuring we continue to develop the best products possible for those who rely on them most.

SB: How will you meet the expectations of your customers?

ES: We stay ahead of our competitors by focusing on continuous innovation, customer centricity, and building strong relationships within the industry. By closely monitoring market trends, regulatory changes, and consumer preferences, we ensure that our product offerings remain relevant and ahead of the curve. We prioritize developing high-quality, unique products that offer real-world solutions, including accessories and mounting systems enhancing the functionality of our core products. In addition, we place a strong emphasis on customer education and support (blogs, YouTube videos, and constant updates of our data on our website), ensuring that our clients are not just purchasing products, but are also empowered with the knowledge to use them responsibly and effectively. Leveraging advanced digital marketing strategies, strong online engagement, and personalized experiences also allows us to directly connect with our audience to build brand loyalty and advocacy. By staying agile, innovative, and customer focused, we position ourselves to lead the market rather than follow it.

SB: In a very competitive world, how does Meprolight stay ahead of the pack?

ES: Staying ahead of the pack requires constant innovation, a deep understanding of the market, and commitment to excellence. While it’s true that we’ve been behind in the pistol optic and magnified optic space in the past, we’ve used that as an opportunity to not only fill those gaps but also disrupt the industry over the last 14 months with our new product offerings. We’ve launched a wide array of products that are not just “me too” but are crafted with the

Meprolight riflescopes feature intuitive and lockable windage and elevation turrets.

goal of delivering the best performance at competitive, affordable prices. By listening to our customers, understanding their real-world needs, and continually pushing the boundaries of product design and performance, we’re building a brand that’s not only innovative but also trusted by professionals worldwide. This commitment to quality, affordability, and disruption is what sets us apart and keeps us ahead of the competition.

SB: Optics technology in your sector (LE/MIL/ OEM) seems to be evolving quickly, driven by the demands of LE professionals and warfighters around the globe. How does Meprolight take advantage of this?

ES: Meprolight takes full advantage of the rapid evolution in optics technology by staying agile and closely connected to the needs of law enforcement professionals and military personnel worldwide.

Recognizing that these users operate in highly demanding environments, the company prioritizes continuous innovation and development of optics systems that integrate the latest advancements in technology. This involves closely monitoring emerging trends—such as advancements in night vision, lasing, rifle/pistol trends, and enhanced durability— to ensure that our products remain at the cutting edge of performance and reliability. Our strong emphasis on R&D allows us to rapidly incorporate these technological advancements into the product lineup, ensuring we deliver optics solutions that meet the evolving needs of our customers.

We also capitalize on our close partnerships with military and law enforcement agencies, using their real-world feedback to inform the development of new products. By understanding the specific challenges faced by these professionals, such as low-light conditions or high-stress environments, we can design optics that not only meet current demands but are also adaptable to future operational requirements.

SB: Meprolight was founded in 1990 as the primary red dot sight, sighting system, and battle optic

supplier to the Israel Defense Force (IDF). Does that heritage give the company a competitive advantage these days? If so, how does Meprolight employ that advantage on an everyday basis?

ES: Meprolight’s heritage as the primary supplier of red dot sights, sighting systems, and battle optics to the Israel Defense Force (IDF) undoubtedly gives the company a significant competitive advantage in the market today. This legacy is built on years of close collaboration with one of the most advanced military forces globally, providing us with invaluable insights into the rigorous demands of military and tactical applications. The IDF’s high standards and our role in fulfilling them have helped the company develop robust, reliable, and innovative products, positioning them as a trusted name in optics for both military and civilian markets, both globally and domestically.

SB: Meprolight’s vision statement says, “We are always looking to supply consumer communities with ‘tomorrow’s needs’ by continuing our long tradition of providing state-of-the-art solutions for any day or night conditions.” To do this, it seems you need to be able to see a bit into the future. How does the company do this?

ES: Meprolight’s ability to foresee and meet “tomorrow’s needs” is largely driven by its deep commitment to innovation, advanced research, and a proactive approach to understanding evolving market demands. By continuously investing in R&D, the company stays at the forefront of emerging technologies in optics, ensuring that it not only meets the current needs of military and civilian markets but also anticipates future trends.

Additionally, we leverage our extensive experience in high-stakes environments, such as military operations, where anticipating future needs is crucial. The company integrates this real-world expertise into its product development cycle, using feedback and data from field testing to refine and innovate its offerings. Meprolight.com

As an IS 9001-2015 processor and stocking distributor of Special Bar Quality (SBQ) steel, Summit has the ability to produce, stock, and cut steel to suit its customers’ needs. The company can provide Gun Barrel Quality steel of all grades and sizes and produce custom blanks.

Summit Steel supplies manufacturers with a vital component of any firearm.

Just like the strength of any building lies in the quality of its foundation, the reliability and longevity of any firearm begins with the quality of the steel it’s built around. This concept is nothing new to the largest gun manufacturers in the world. And for nearly a decade, many of those manufacturers have turned to Summit Steel for the steel components that make up the foundations of all the firearms they manufacture.

It isn’t just the quality and the workmanship of the steel that has given Summit Steel such a solid reputation in the industry; it’s the quality of the

company. And for Summit Steel, that begins and ends with family.

Ross Bushman, CEO of Summit Steel, founded the company in 1985, but that certainly wasn’t his first foray in the steel business.

“My father started in the scrap metal business with his dad,” Bushman says. “My dad took over the company, and I started working with him right out of high school.”

When his father was forced to close the business because of unfavorable economic conditions, Bushman struck out on his own. He took out a second mortgage on his house and founded Summit Steel.

With his knowledge of the steel industry, Bushman slowly began growing his fledgling company. And while he had a very diversified customer portfolio from the beginning, it didn’t include the firearms industry.

“I hadn’t even considered the firearms industry,” he says. “Neither had my dad. I don’t know what we were thinking.”

That all changed 20 years ago when Bushman’s son, Jason, who is now president of Summit Steel, joined the family business. Since then, Summit Steel has grown beyond anything Ross had imagined.

“When I first started the business, we were mostly brokering and bringing in the steel that our customers needed,” Bushman says. “When my son joined me, that’s when things really started to kick into high gear.”

Once they set their sights on the firearms industry, it didn’t take long for manufacturers to recognize the benefits of working with Summit. As an IS 9001-2015 processor and stocking distributor of Special Bar Quality (SBQ) steel, Summit has the ability to produce, stock, and cut steel to suit its customers’ needs. They can provide Gun Barrel Quality steel of all grades and sizes and produce custom blanks. From chamfering, heat-treating, and cold finish steel, Summit has become the one-

stop shop for many of the major firearms manufacturers in the country.

The increase in business that resulted from working with the firearms industry also helped shape an expanded business model that allowed Summit Steel to better serve its customers.

“Instead of just brokering, we built a warehouse so we could maintain an inventory of the kind of steel our customers use on a regular basis. That way we have it readily available whenever they needed it,” Bushman says. “That also allowed us to provide for other customers’ needs as well.”

Summit currently has several warehouses and a production saw-cutting facility with plans to build another facility in the near future. This will not only allow them to store more steel, but more types of steel for different uses within the firearms industry as well as across other industries such as oil and gas, military, transportation, and infrastructure.

The warehoused stock also gives Summit the ability to respond rapidly to its customers’ changing needs. So when a manufacturer decides to do a quick run on a popular firearm, Summit Steel can get them the steel they need when they need it instead of having to wait weeks to give customers

Consumers may not know the source of the steel in the barrel of a rifle, but firearm manufacturers appreciate the quality of Summit’s Gun Barrel quality steel as well as custom blanks.

the steel that meets their exact specifications. And where that steel comes from is just as important to Bushman as what they do with it once it arrives.

“The stainless steel we stock is from a mill preferred by most manufacturers,” he says. “All our regular alloys and carbon stock we buy from U.S. mills. We buy as much from domestic mills as we can. That’s important to our customers and it’s important to us.”

Being able to get the manufacturers the steel they want, when they want it, is one of the reasons that Summit Steel has such a solid reputation in the industry. But it isn’t the only reason.

“We’re a close-knit family operation and we create our business on relationships,” Bushman says. “We recognize our customers’ needs and we meet those needs. We get the job done, and they appreciate that because that’s how they do business, too.” ammomachineryshop.com

with solid accuracy in mind. Quick and simple on its own. Quiet and efficient when suppressed. The Davidson’s Exclusive Ruger American Ranch Camo is ready to put in a good day’s work.

by Brad Fitzpatrick

If your customers are looking for new big-game, waterfowl, target, or self — defense loads, they'll find them all — and more this year.

Never willing to settle for the same old cartridges, propellants, and projectiles, ammo brands are forever improving upon their products, and that results in better options and improved performance for hunters, shooters, and LE professionals. This year a number of noteworthy new ammunition products are debuting, and these include everything from lead-free hunting and target shotshells to new defensive handgun ammunition and several new cartridges. Perhaps the most noteworthy of these is the launch of a brand-new rimfire round from Winchester that is set to take on the oldest established cartridge in existence, the .22 LR. But regardless of your favorite platform or shooting application, there are new loads to get excited about on this list.

For 2025, APEX Ammunition is adding a 3-inch 20-gauge load to their popular TSS/S3 family of blended waterfowl ammo. The new 20-gauge load combines ⅞-ounce of premium No. 2 steel with ¼-ounce of No. 7.5 TSS. This blended load offers maximum versatility and value by combining steel shot, which is affordable and highly effective for close shots over decoys, with TSS pellets that are extremely dense and carry more energy at extended ranges than non-toxic pellets. TSS pellets have a density of 18.3 g/cc, which is 56 percent denser than lead, and this allows companies like APEX to add smaller No. 7.5 TSS pellets to their blended loads, filling out the pattern while still retaining outstanding downrange energy and improving penetration thanks to the smaller surface area of TSS pellets. The steel pellets in this load are zinc-coated to reduce friction and improve patterning.

APEX TSS/S3 waterfowl ammunition is loaded with their tungsten-grade wads, and these blended loads offer the benefits of both steel and TSS shot, making them a great option for serious waterfowlers.

apexammunition.com

This year CCI’s Blazer is adding hollow point options to the affordable Blazer Brass line of training ammunition. Four new Brass HP options—9mm 115-grain JHP, .40 S&W 180-grain JHP, 10mm Auto 180-grain JHP, and .45 ACP 230-grain JHP— round out the company’s line of FMJ brass ammunition and offer an affordable and reliable training option with improved terminal performance over traditional FMJs. The new Brass HP loads will be sold in 50-count boxes and come with reloadable brass cases.

CCI has a reputation for offering some of the most reliable, accurate, and innovative rimfire products on the market each year, and for 2025 they’re adding a couple of new products to their lineup, including Suppressor MAX .22 LR ammunition. With a muzzle velocity of 970 fps, Suppressor MAX is safe for use in suppressors and yet it will reliably cycle semi-auto .22 pistols and rifles. The 45-grain segmenting hollow point provides excellent terminal performance at low velocities, and that will make this new CCI load extremely appealing to anyone who runs a can on their rimfires. CCI is also offering a new .22 WMR load specifically designed for personal defense, Uppercut .22 WMR. This .22 WMR load features a 40-grain hollow point bullet that is engineered to offer the optimal blend of penetration and expansion, providing the best possible performance from .22 WMR handguns, but it will also work in .22 WMR rifles. The .22 WMR is certainly on the light side for personal defense, but having the right bullet like CCI’s Uppercut makes a major difference in downrange performance.

cci-ammunition.com

Federal has been offering ammunition for hunters, shooters, and law enforcement professionals for over a century, and this year they’re adding a new .44 Remington Magnum load to their HST line of personal-defense ammunition. These 240-grain HST loads offer more energy than 10mm Auto, .357 Magnum, and .44 Special loads yet they produce less recoil than Federal’s full-power .44 Magnum hunting and beardefense loads. In addition to premium HST bullets, these rounds come loaded with quality propellants and primers and feature nickel-plated cases.

Other new additions to Federal’s handgun ammunition lineup include the addition of .45 Colt and .32 H&R Magnum Hydra-Shok Deep offerings. Both loads come with nickel-plated cases and sealed primers, and both are designed to balance bullet expansion and penetration. The .45 Colt load comes with 210-grain HSD JHP bullets while the .32 H&R Magnum features 80-grain HSD JHP bullets. Also new this year for .32 H&R Magnum fans is Federal’s 85-grain American Eagle JSP practice load, an ideal choice for those who carry a .32 H&R revolver, and a light, affordable practice load for .327 Federal revolvers. Handgun hunters will be happy to hear that Federal is offering a new 10mm Power-Shok load with 200-grain JHP ammunition, a load that is suitable for a variety of game, including deer and hogs.

Perhaps the biggest news this year from Federal, though, is the launch of their new 7mm Backcountry hunting cartridge. There are plenty of 7mm cartridges currently available, but because the 7mm Backcountry utilizes a Peak Allow steel case, chamber pressure can be increased to levels well above what could be sustained using brass cases. The result is increased performance, especially with shorter barrels. With 170-grain bullets, the 7mm Backcountry achieves roughly 3,000 fps from a 20-inch barrel, which is about 150 fps faster than a 7mm PRC from a barrel of the same length. The Peak Alloy steel is far better than the cheap steel alloys used in imported ammunition, and Federal nickel plates the cases for durability and smooth cycling. Because the cartridge diameter is smaller, it will fit one additional round in the magazine compared to other modern 7mm cartridges. Because it works well in rifles with relatively short barrels, the 7mm Backcountry is well-suited for use with suppressors.

Federal will also offer 7mm Backcountry ammunition loaded with 155-grain Terminal Ascent bullets as well as 168-grain Barnes LRX bullets, 175-grain Fusion Tipped, and a whopping 195grain Berger Elite Hunter bullet with a G1 ballistic coefficient of .755.

Though the 7mm Backcountry is certainly big news, it’s hardly the only new rifle ammunition available from Federal this year. There’s a new 6mm ARC load available in the Gold Medal target line this year, and that round is loaded with an 108-grain Berger boat tail bullet with a very high BC. There are also some exciting cartridge additions coming to the Terminal Ascent, Barnes TSX, and Barnes LRX ammunition lines this year as well, and Federal is adding a new .22 LR load to their HammerDown family. The new 40-grain .22 LR Hammer down ammunition features a copper-plated hollow-point bullet that is designed to operate flawlessly in .22 lever guns and offers lethal downrange performance on small game.

Federal has been driving shotshell design and development for decades, and this year the company is offering a long list of new and innovative shotshell products. Most notable, perhaps, is their Master Class line of sporting clay shotshells. Designed specifically to improve your score at clay games, these shells offer a new Podium design wad that is optimized for use in Federal’s straight-wall hull. These shells feature a new, stylish look and feature premium wads, hulls, shot, and other components that are suitable for high-level sporting clay and FITASC shoots. Six 12-gauge loads (four 1-ounce, two 1⅛-ounce) will be available initially, but you can expect the Master Class family to continue to expand over the coming years. Also new from Federal is their 16-gauge BLACK CLOUD load that comes with a blended ⅞-ounce load of premium zinc-plated steel and Flitestopper shot (60/40, respectively) and Flitecontrol wads. For those who like to hit their birds with the heaviest steel payloads possible, Federal is also adding a 3½-inch 12-gauge and 3½-inch 10-gauge loads to their Ultra Steel line. Both will come with 1½-ounce loads, and there are blended 10- and 12-gauge loads available as well. There are new HEVI-Bismuth loads available in 16 and 28 gauge this year, and fans of the 28-gauge will be happy to hear that in addition to the HEVI-Bismuth load Federal will also be offering a Heavyweight TSS 28-gauge load as well as a 28-gauge Rob Roberts 28-gauge Custom Shop TSS turkey load. federalpremium.com

HEVI-Shot is offering some new additions to their line of hard-hitting turkey loads for 2025. First up is HEVI-Bismuth Turkey, which is being offered in both 12- and 20-gauge loads. This ammunition mixes both No. 4 and No. 5 HEVI-Bismuth shot for a lethal non-toxic load. There are four HEVI-13 Turkey loads making a comeback this year, all of which are loaded with HEVI-Shot’s 12 g/cc tungsten pellets, which offer 20 percent more knockdown power than comparably sized lead pellets. HEVI-13 Turkey will be available in 12-gauge or 20-gauge 3-inch loads this year, and shooters can select loads with either No. 6 or No. 7 tungsten. There’s a new addition to the company’s Magnum Blend Turkey loads: for 2025 HEVI-Shot is adding a 28-gauge 2¾-inch Magnum Blend offering that features 15 16 ounce ounce of blended Nos. 5, 6, and 7 1⁄ 2 g/ cc tungsten pellets. There are also two new 2¾-inch 28-gauge turkey loads joining the HEVI-18 Turkey lineup this year, one with 1 1⁄16 ounces of No. 7 shot and the other with 1 1 16 ounces of No. 9 shot.

In addition to HEVI-Shot’s new turkey loads they’re also offering HEVI-Hitter Waterfowl loads this year that offer 20 percent tungsten pellets over 80 percent steel pellets. These layered loads are available in 12, 16, 20, and 28 gauge and combine the affordability and short-range effectiveness of steel pellets with the heavier (12 g/cc) punch of tungsten. There are four new HEVI-Steel layered offerings this year, including 12-gauge 2xBB and 2x4 and 20-gauge 2x4 and 3x5. Also new is a 1 1⁄ 8-ounce HEVISteel 16-gauge 2¾-inch load that is available in 2, 4, 6, and BB. There’s also a new 16-gauge, 2¾-inch load in the HEVI-Metal Longer Range lineup that also comes with 1⅛-ounce payloads. Lastly from HEVI-Shot are new 100 packs of popular HEVI-Steel and HEVI-Hammer loads in both 12 and 20 gauge. hevishot.com

The big news from Hornady is the .338 ARC (Advanced Rifle Cartridge). This unique round was designed to function in AR-15 rifles. The 307-grain SUB-X bullet at 1,050 fps offers 1.6 times more energy than the .300 Blackout subsonic for improved terminal performance. There’s also a 175-grain HP that offers a muzzle velocity of 2,075 fps. With an overall length of 2.260 inches, this cartridge will function flawlessly in AR-15 rifles and is also a great option for lightweight micro bolt-action guns. Hornady designed the .338 ARC to be cleaner than other subsonic rounds, and it functions with a 1:8 twist barrel for both supersonic and subsonic loads. It is also engineered to provide reliable subsonic and supersonic operation with the same gas settings.

Also new this year is Backcountry Defense handgun ammunition, which is designed to offer threat-stopping straight-line penetration against large, dangerous predators. The heart of this ammunition is Hornady’s new DGH (Dangerous Game Handgun) bullet that features a protected point design that locks the core to the jacket for straight-line penetration without deflection— key features when selecting a bear-stopping bullet. Because it uses a heavyfor-caliber jacketed bullet instead of a hard cast bullet there’s no lead smoke for improved awareness and faster follow-ups. Seven new Backcountry Defense loads are offered this year, ranging from a 138-grain 9mm+P load to a 500-grain .500 S&W Magnum.

Hornady is also expanding their existing ammunition lines this year as well. The popular .22 ARC cartridge will now be available loaded with a 70-grain CX monolithic bullet as well as an 80-grain ELD-X hunting bullet. A bit of good news for fans of the 6mm GT as well: factory ammunition will be available for this cartridge from Hornady starting in 2025. Hornady.com

Nosler is taking aim at America’s most popular big-game animal with the launch of their new Whitetail Country centerfire rifle ammunition. Whitetail Country is available in a variety of popular cartridges like .270 Winchester, .30-30, .308 Winchester, and .30-06, and there are also two straight-wall offerings: .350 Legend and .45-70. The .350 Legend and .45-70 loads feature Nosler’s straight-wall jacketed soft point lead-core bullets which are engineered to expand reliably at extended ranges, and the bullet’s ogive is optimized for reliable feeding. Non straight-wall cartridges come with Nosler’s Solid Base jacketed lead core bullets that offer an accuracyenhancing boat-tailed bullet profile and offer consistent, reliable performance at a variety of ranges. This American-made ammunition is optimized for whitetails and comes loaded in high-quality brass with superb propellants for a very affordable price point. nolser.com

Remington has continued to expand their classic Core-Lokt line of hunting ammunition, and for 2025 the company is offering Core-Lokt Tipped Lever Gun ammunition. Building on the rugged and time-tested Core-Lokt design, these bullets are optimized for lever-action rifles and feature a flat polymer tip. Ballistic coefficients are also improved for better downrange performance. For example, Remington’s 180grain Core-Lokt Tipped bullet features a BC of .212, which is considerably better than the soft-point 180-grain .360 Buckhammer load that offers a BC of .163. This translates to better downrange performance with flatter trajectories, more energy, and less wind drift. Six new Core-Lokt Tipped Lever Gun loads are available for 2025: .30-30 Winchester 150-grain, .35 Remington 200-grain, .45-70 300-grain, .444 Marlin 240-grain, .32 Winchester Special 170-grain, and .360 Buckhammer 180-grain.

There are other new additions to the Remington Core-Lokt family this year, too: Remington is working with Bill Wilson of Wilson Combat and adding an 150-grain Core-Lokt .300 Ham’r load, along with 400 Legend. Also new for 2025 is a .300 Remington Ultra Magnum 180-grain load to their Core-Lokt Tipped line.

Remington’s new shotgun products include their Premier Royal Flush line of upland hunting ammunition. These loads feature plated lead shot for consistent patterns. With shot sizes ranging from No. 4 to No. 6, you can find the right load for hunting everything from preserve birds to wild-flushing late-season roosters. Also new this year is Remington Duck Club, an economical steel load available in both 12and 20-gauge offerings that’s ideal for a variety of situations.

Fans of steel shot should also check out Remington’s new Nitro Steel Duplex 20 gauge. Available in three different 3-inch, 1-ounce loads, Nitro Steel Duplex comes with a blend of 2x4, 2x6, or 4x6 shot, making it a versatile, affordable non-toxic load for your sub-gauge duck gun.

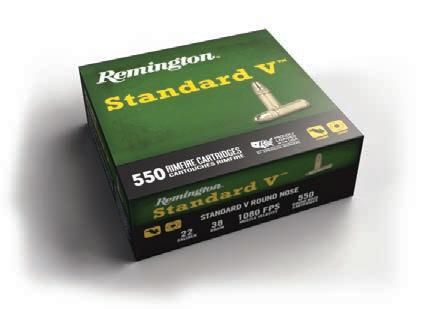

Remington’s rimfire line is extending in 2025 with the introduction of Wheelgun 22, a 39-grain truncated-cone lead .22 LR bullet optimized for use in revolvers. Wheelgun 22 is low velocity and low noise, making it the optimal choice for plinking. Remington is also releasing Standard V, a 38-grain lead roundnose .22 LR bullet made for the economical shooter. Also new for 2025 is Remington’s revamp of the .22 Short. These will be offered in both a 29-grain plated round nose and a 27-grain plated hollow point. All of these new loads, as well as the existing offerings from Remington, will include new technological advances and can be identified by the “R” head stamp.

remington.com

Winchester is changing the rimfire game with the launch of their new 21 Sharp, and in doing so they’re taking on the oldest and most popular cartridge available today—the .22 LR. The .22 LR has been popular since the 1800s, and it’s estimated that there are around 2.5 billion rounds of .22 LR produced annually. However, despite its popularity and longevity the .22 LR is not without its issues. Foremost among those is the use of a heeled bullet that restricts bullet design. Faced with the option to change the .22 LR cartridge or bullet, Winchester wisely opted to redesign the bullet profile to eliminate the need for a heeled bullet. The new .210-inch .21 Sharp bullet can be loaded into .22 LR-sized cases. This offers Winchester the flexibility to use a wider variety of bullet designs than are available with the .22 LR. Winchester will initially offer four .21 Sharp offerings: a 34-grain JHP, a 37-grain copper-plated lead bullet, a 42-grain FMJ, and a 25-grain lead-free Copper Matrix bullet. The Copper Matrix is groundbreaking because it offers a rimfire option in areas where lead ammunition is banned. Velocities range from 1,300 fps for the 42-grain FMJ to around 1,750 for the 25-grain Copper Matrix bullet, and that translates into excellent terminal performance on small game. Winchester claims that the 34-grain bullet expands to an average of 173 percent of its original size while retaining 99 percent of its original weight and penetrating nearly three feet of gelatin. All of which means it performs appreciably better than the .22 LR. The design requires nothing more than a barrel swap to change .22 LR rifles to .21 Sharp, and the ability to use new, modern, and easy-to-manufacture bullets could potentially help mitigate periodic rimfire ammunition shortages that have plagued shooters.

Also new from Winchester is Last Call, a brand-new waterfowl load that utilizes 18 g/cc TSS shot for improved lethality on ducks and geese. TSS will be available in 12-, 20-, and 28-gauge offerings as well as .410.

Because it utilizes high-density TSS pellets, Last Call ammunition is loaded with pellets that are smaller in diameter (No. 5 to No. 9), and this allows for more pellets per shot. TSS’s incredibly high density makes it lethal on birds, reducing cripples and resulting in cleaner, faster kills. winchester.com

A new ammunition entity is making its mark in America and abroad.

by Slaton L. White

Industrial powerhouse is a muchoverused term, but when considering the world-wide reach of D&M Holding Co., it is a completely apt description of the company’s importance to the ammunition industry. Founded in 2018 by Dan Powers, former president of the SIG Sauer Ammunition division, and James Jones, a defense industry executive, D&M Holding Company, Inc. is an ammunition and energetics engineering group based in Tampa, Florida, and Cabot, Arkansas.

The group specializes in greenfield projects (i.e., a new undertaking that starts from scratch on undeveloped land or without any pre-existing infrastructure or systems), often for companies and countries that have never before been in the ammunition, primer, or propellant business. Global demand for reliable supplies of ammunition, primers, and powder is soaring as a matter national security, and D&M is working nonstop to support the U.S., NATO countries, and other friendly foreign governments.

D&M specializes in design and manufacture of equipment for the ammunition and energetics industry and in the development of turnkey factories for government and commercial customers

worldwide. D&M’s turnkey factories include solutions for ammunition production, primer production, as well as propellant production for everything from small-caliber ammunition to artillery. D&M services include all aspects of the project from site planning and floor planning to equipment manufacture and installation, as well as the secret sauce, the transfer of know-how. D&M offers intensive training to its clients and 24/7 support.

Under the leadership of president and CEO Dan Powers, along with business partners B.J. Rogers and James Jones, D&M has become a name spoken everywhere as the one company that you can count on to finish a factory and make it run, period.

“D&M is unique in that we are the only company in the industry that offers solutions for all ammunition components, including ammunition factories, primer factories, and propellant factories. We have no competitor that does all three,” Powers says.

Powers and his team have built ammunition factories in the United States and Ukraine with more in the works globally. Some current projects include: Canada (building plants to produce nitrocellulose, single-base and double-base powders, primers, and ammunition components), Ukraine (currently the company has two ammunition projects and a primer project in the works), Eastern

Europe (building a single-base powder plant for a southeastern European country with other projects in the works), and the United States (D&M Holding is expanding its own White River Energetics primer facility in Arkansas to include a propellant factory, laboratories for R&D, and a training center).

Given the success of SIG Sauer’s ammo division, it’s fair to ask why Powers left to strike out on his own. His decision to leave SIG was molded by that very success.

“When I was at SIG Sauer, there were a lot of articles written about me and the SIG ammunition division, and as time passed, I realized there was much more I could do beyond SIG Sauer,” he says. “As a result of this exposure, I started receiving calls from all over the world when word got out that I had left SIG—calls from private companies and governments—asking me to help improve their current ammunition facilities and/or build new ones for them.”

“James Jones and I spent two years traveling all over the world visiting factories, meeting with potential customers, and listening to their needs. It was clear that parts of our industry were underserved and, in some cases, untouched, and we saw an opportunity to fill the gap. This intensive information gathering process, combined with my expe-

rience at SIG, helped us develop our business model, which continues to guide our innovation and drive our growth.”

“Today the services D&M provides are much needed worldwide, and we are working nonstop to support NATO countries and other friendly foreign governments in their efforts to ensure adequate ammunition supplies for their troops.”

D&M’s first big stand-alone project was building out a multi-million-dollar ammunition facility in Ukraine. D&M won a competitive contract with the government of Ukraine to build the new ammunition factory after the country’s existing factory was lost during the initial Russian invasion of 2014. Ukraine needed a modern factory that could produce multiple calibers, including both NATO and Russian standards, and D&M offered the best solution.

D&M had delivered all the equipment and was in the process of installation when the U.S. government told the team to leave because the invasion was imminent.

“We were on one of the last flights out of Kyiv before Russia invaded on February 24, 2022,” says James Jones, vice president of business development of D&M.

When it was clear the Russian advance to Kyiv was stalled, D&M hired a security firm and began making plans to return to Ukraine. Against U.S. government advice due to safety concerns, Powers and a team of D&M employee volunteers quietly crossed the border and finished commissioning the factory,

which now produces ammunition 24/7 for the Ukrainian Armed Forces.

The successful completion of the factory put D&M on the map and has been a success story touted by both the governments of Ukraine and the U.S. D&M has since signed agreements for multiple projects in Ukraine, including ammunition and primer production.

↑ Ammo in a D&M sealing machine. The process is designed to protect cartridges from moisture, chemical exposure, and environmental degradation, thus ensuring dependable performance even in the most demanding conditions.

“D&M’s initial focus was on manufacturing of the machinery, but the COVID pandemic forced us to vertically integrate quickly to meet delivery deadlines. We were forced into making our own tooling because suppliers were so backlogged. D&M could not honor its contracts without faster access to necessary tooling,” says B.J. Rogers, vice president of operations for D&M.

As a result, D&M began making its own parts and tooling, such as carbide dies and punches, to get the job done. That now allows D&M to develop new caliber solutions quickly without the standard 90-day delay in tooling.

This started the progression of D&M adding capabilities and capacity throughout the company, which has included expanding its machine shop and fabrication shop, as well as the acquisition of two additional companies with more acquisitions planned. D&M has also added divisions and specialties over the years. Power’s strong industry relationships could ensure D&M customers had powder, but primers were an issue. So, D&M created White River Energetics, LLC, and started making primers. In the past 18 months, D&M has created an energetics division capable of producing powder plants as well. These plants allow D&M to supply industry partners with the products they need while also providing a training ground for their clients.

D&M built WRE to supply customers with primers and is currently expanding the primer business and building a new powder factory there. “We are expanding our primer facility at White River

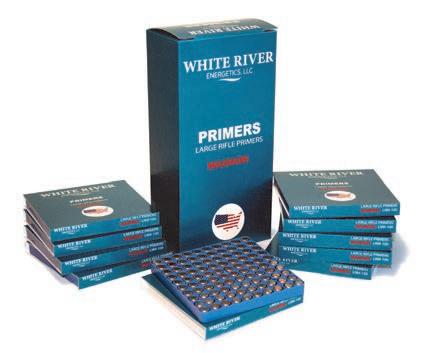

↑ White River Energetics (WRE) was created to supply customers with primers. The company is currently undergoing expansion.

Energetics and building a propellant factory there due to increasing demand worldwide. Currently, there is a worldwide shortage of smokeless propellant that is affecting munitions availability globally. This will be the first propellant factory to be built in the United States in over 50 years and is an important step to ensure that D&M customers have a steady source of powder in the years ahead,” Powers says.

WRE currently makes around 800 million primers a year; around 600 million of those go to OEM customer here in the U.S. for small and large caliber pistol and rifle ammunition. Some of these are sold by distributors to dealers.

By mid 2026, primer production will increase to around 1.2 to 1.4 billion primers, with many more going to the consumer. D&M intends to sell direct to box stores and work with select distributors.

Building a primer manufacturing facility takes a lot of time and money and is an inherently dangerous endeavor, as there is always risk when

↑ These large rifle primers are packaged and now ready for delivery to customers.

Many innovators work their magic by themselves, but you don’t truly build a winning operation without assembling a team that shares your vision and work ethic. Dan Powers has assembled a team of some of the best and brightest professionals in the industry. His secret? Identifying those in the industry that want to, as he says, “build and teach.”

“Dan has a knack for finding the diamonds in the industry and convincing people to follow him, and we all do,” says vice president Leslie Weber. Powers also gives his team room to achieve whatever goals have been set. “He never asks us to bend to what he wants; he just asks us what we need to succeed, gives it to us, and lets us be creative,” says B. J. Rogers, owner and vice president of operations.

The executive team at D&M includes:

*Dan Powers, owner, president, and CEO of D&M. Powers has been a pioneer for all his 25 years in the ammunition industry. Interestingly, he started his career as an accountant. As luck (or fate) would have it, a friend talked him into going with him to a gun show years ago where he saw a guy selling bags of ammunition. His interest was sparked, and the rest is history. Powers became an early innovator in frangible ammunition as the owner of Precision Ammunition before selling the company to RUAG, the then Swissgovernment-owned defense conglomerate. He stayed on as the president of RUAG USA, managing U.S. operations and consulting on modernization at other RUAG-owned ammunition companies in Europe. After leaving RUAG, Powers developed the business plan for SIG Sauer’s ammunition division and built the division from scratch, starting in Kentucky before moving the factory to Little Rock, Arkansas. The division was based on the coveted SIG V-Crown cartridge, which is Power’s patent and legacy.

* B.J. Rogers, owner and vice president of operations. Rogers spent his 15 years in the ammunition industry at Remington, where he was a ballistics engineer before becoming Remington’s centerfire engineering manager and later at SIG Sauer as the ammunition division plant manager and as director of operations.

* James Jones, owner and vice president of business development. Jones is a 20-year defense industry executive. Much of his career was spent with Goldbelt Wolf, LLC, a defense contracting company that represented U.S. defense companies and ammunition manufacturers in international contracts. Jones has represented nearly every major U.S. defense company and has worked in over 50 countries.

* Don Pile, senior chemist. Pile spent 22 years at Remington in various positions as an explosives engineer and research chemist and holds multiple primer technology patents, especially for military primers. Powers recruited him to SIG Sauer, where he worked as chief chemist for several years before Powers again recruited him to join D&M Holding Company in 2020. Pile is one of the best-known primer chemists in the world.

* Jason Lawhon, vice president of energetics. Lawhon spent 32 years at St. Marks Powder, the largest propellant manufacturer in the world, where he held many positions as a chemical engineer and in business development. He is one of the few people in the world with experience in so many aspects of the powder business. When Lawhon decided to retire from St. Marks, Powers convinced him to join D&M, travel the world, and help to reimagine and reinvent legacy propellant systems.