Thank you for taking the time to research your options at Shell Point. Life plan communities like ours provide more than just a home. We offer profound peace of mind for you and your family. Here, you’ll be protected from many unexpected healthcare costs, as our continuum of care includes assisted living, memory care, and skilled nursing care – depending on your contract type.

This guide provides a brief overview of how you might finance your move to Shell Point and an important tax deduction to consider. We invite you to schedule a one-on-one meeting so our team can provide more details on the information in this booklet as well as:

• The different contract types available at Shell Point, including refundable options

• Details about entrance fees and monthly fees, including second person fees

• How our financial and medical qualification works

With a community as large as Shell Point, there’s a wealth of residential options to explore across a wide range of price points. Please call (239) 466-1131 or email info@shellpoint.org to book your personalized overview.

We hope to see you on campus soon!

Blessings,

Zach Gurick Director of Sales and Optimal Aging at Shell Point

Most people who move to Shell Point sell their primary home and use the proceeds to fund their entrance fees. Those who rent or don’t have sufficient equity in their home may need to consider other options.

• Selling Your Home (Most Common)

• Bridge Financing

• Retirement Account Withdrawals

• Sale of Securities

• Life Insurance

First, consider these questions: How quickly can I sell my home?

Does my home have enough equity to cover all – or most of – my entrance fee? Will capital gains taxes from the sale of my home limit my available funds? What other funds could I use to offset my entrance fee, if necessary?

Before making any decisions, we strongly recommend that you speak to your financial and tax advisors for personalized guidance. Our Retirement Counselors will be happy to provide you with details that may support their analysis of your options.

Your home may be your most valuable and most treasured financial asset, and it’s typically a primary source of funding for your entrance fee.

Shell Point has created partnerships with other organizations to help sell your home for the best possible price – or to help you move to our campus more quickly. These are optional services, and you’re certainly welcome to use your own real estate agent, realtor, local bank, or credit union.

Shell Point offers complimentary services from Moving Station to connect with you real estate professionals with a proven track record of success in your neighborhood.

For those who want to move to Shell Point quickly, a home equity line of credit for senior living can act as a bridge loan. This often-used tool can help you move now –while giving you the benefit of time to sell your home for the best possible price.

Second Act offers a speedy process that’s customized for senior living consumers. Even if your home is already listed on the market, you can still obtain this Home Equity Line of Credit for Senior Living – something many other banks won’t do.

• Apply for an overall line of credit amount

• Draw what you need to fund your entrance fee and monthly fee at Shell Point

• Make much smaller, interest-only payments on your outstanding balance

• Take time to prepare and sell your home for the highest price

• Pay back your line of credit after you have sold your home

There are many types of retirement accounts, including traditional IRAs, Roth IRAs, and 401(k)s, and you may own more than one. However, making large withdrawals could result in higher income taxes or Medicare surcharges. Qualified tax professionals can help you navigate these complexities and avoid unexpected financial consequences.

• Will a withdrawal from my retirement account move me into a higher tax bracket?

• Are there any penalties associated with these withdrawals?

• Are there better, alternative strategies to fund my Shell Point entrance fee?

Securities can be a significant source of funding for your Shell Point entrance fee, but it’s vital to connect with your financial advisors before making decisions. Selling investments like stocks, mutual funds, or ETFs can result in significant tax consequences, depending on factors such as how long you’ve held the shares, the gain or loss from the sale, and its timing.

For example, if you sell a stock that you’ve held for longer than one year, it’s likely that you’ll pay capital gains tax. If you’ve held the security for less than a year, you’ll pay the short-term capital gains tax, which is equivalent to your income tax rate in the year of sale. This rate could be higher than the long-term capital gains rate, particularly if you still have earned income. However, even the amount of long-term capital gains tax you will pay is based on your adjusted gross income. The long-term capital gains tax ranges from 0% to 20%, depending on your adjusted gross income for the year. Keep in mind that state taxes may also be due.

Consider this scenario for a moment. Suppose you decide to take a withdrawal from your IRA – while also liquidating other securities held outside of an IRA. The IRA withdrawal could put you in a higher ordinary income tax bracket, which might force you to pay a higher capital gains tax rate on the sale of your non-IRA securities. The interplay of these factors can result in unintended consequences. Careful planning is essential.

If you haven’t considered your life insurance policy as a financial asset, it might be an unexpected source of funding for your entrance fee.

Life insurance is most helpful during your high income-earning years – when it was most essential to ensure that your loved one had sufficient funds in your absence. However, as your life circumstances change, you may no longer need this coverage.

If you no longer need life insurance, you might sell it, convert it to an annuity, or create a hybrid policy with long-term care insurance included. Many seniors have a substantial build-up of cash value in their life insurance policy, which allows them to access the cash in a tax-efficient manner.

The most common solution is an all-cash lump-sum payment to the policy owner. The purchaser takes over all future premium obligations and becomes the beneficiary.

A tax-free 1035 exchange of your life insurance policy to an annuity can provide a guaranteed income stream. This may not offset your entrance fee, but it could replace monthly income from other assets you may wish to sell.

Many policies include a rider for long-term care insurance, but hybrid policies may offer more coverage. You may have the option to convert your life insurance policy to a hybrid policy.

If you have a life insurance policy valued at $100,000 or more, you may have the option to retain a portion of your coverage without any future premium payments. Instead of selling your entire policy for a lump-sum payment, you negotiate with the buyer to keep a portion of the policy’s death benefit. The buyer will assume responsibility for paying all future premiums.

Most people are pleasantly surprised to discover the significant tax advantages of moving to Shell Point. As you may already know, the medical expense tax deduction can be a key source of savings.

Since we are a life plan community, Shell Point residents can deduct a portion of their fees as medical expenses – even while living independently. The IRS recognizes this deduction because our contracts allocate a percentage of your fees toward future medical expenses.

This deduction is often available for part of your entrance fee in the first year of residence as well as your ongoing monthly fees. In 2025, the medical tax deduction for Shell Point is 38%.

Living at Shell Point might be more affordable than you realize.

When you move here, you’ll be relieved of multiple expenses associated with home ownership, such as home repairs, maintenance, security, and yard care—to name just a few. These costs add up quickly on an annual basis.

Use this simple worksheet to summarize your current expenses. Compare and contrast those costs with the savings you would enjoy by letting Shell Point handle all these responsibilities and allow you to live stress-free.

As you look into the financial details of making the transition to Shell Point, the numbers are only part of the story. The true value of our community goes beyond math – it’s waking up to a new life filled with opportunities for joy, connection, and positive aging.

Imagine spending your days hitting the links on our championship golf course, exploring your creative side at our Tribby Arts Center, or joining one of the hundreds of clubs and activities that make Shell Point such a vibrant community. With access to state-of-the-art health and wellness facilities, lifelong learning programs, and an active social calendar, every day brings new possibilities.

It’s impossible to put a price tag on the chance to make new friends and live life to the fullest. Let’s talk about what matters most to you. Schedule a one-on-one appointment today to discover how Shell Point can help you embrace a lifestyle that’s as rewarding as it is carefree.

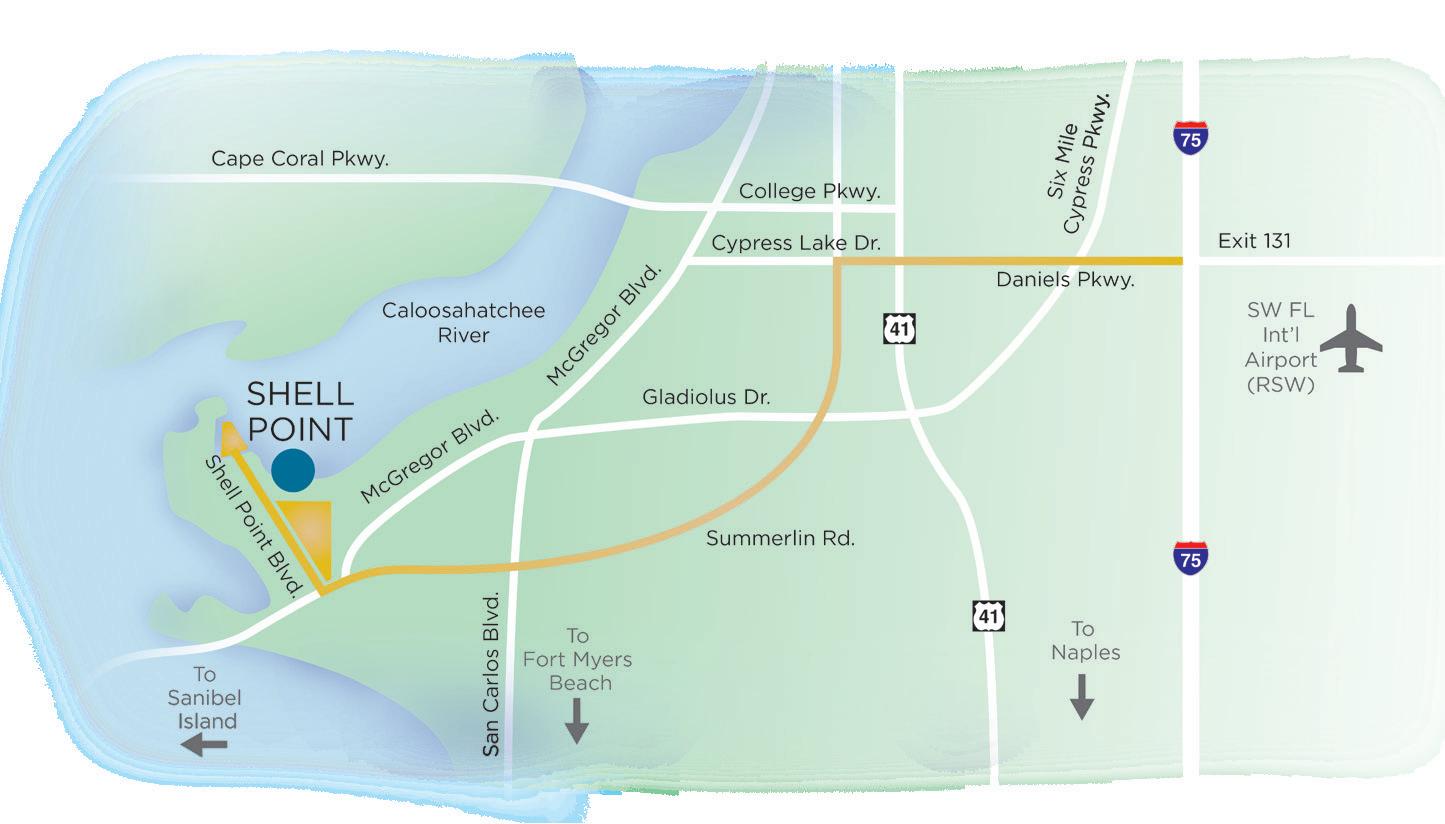

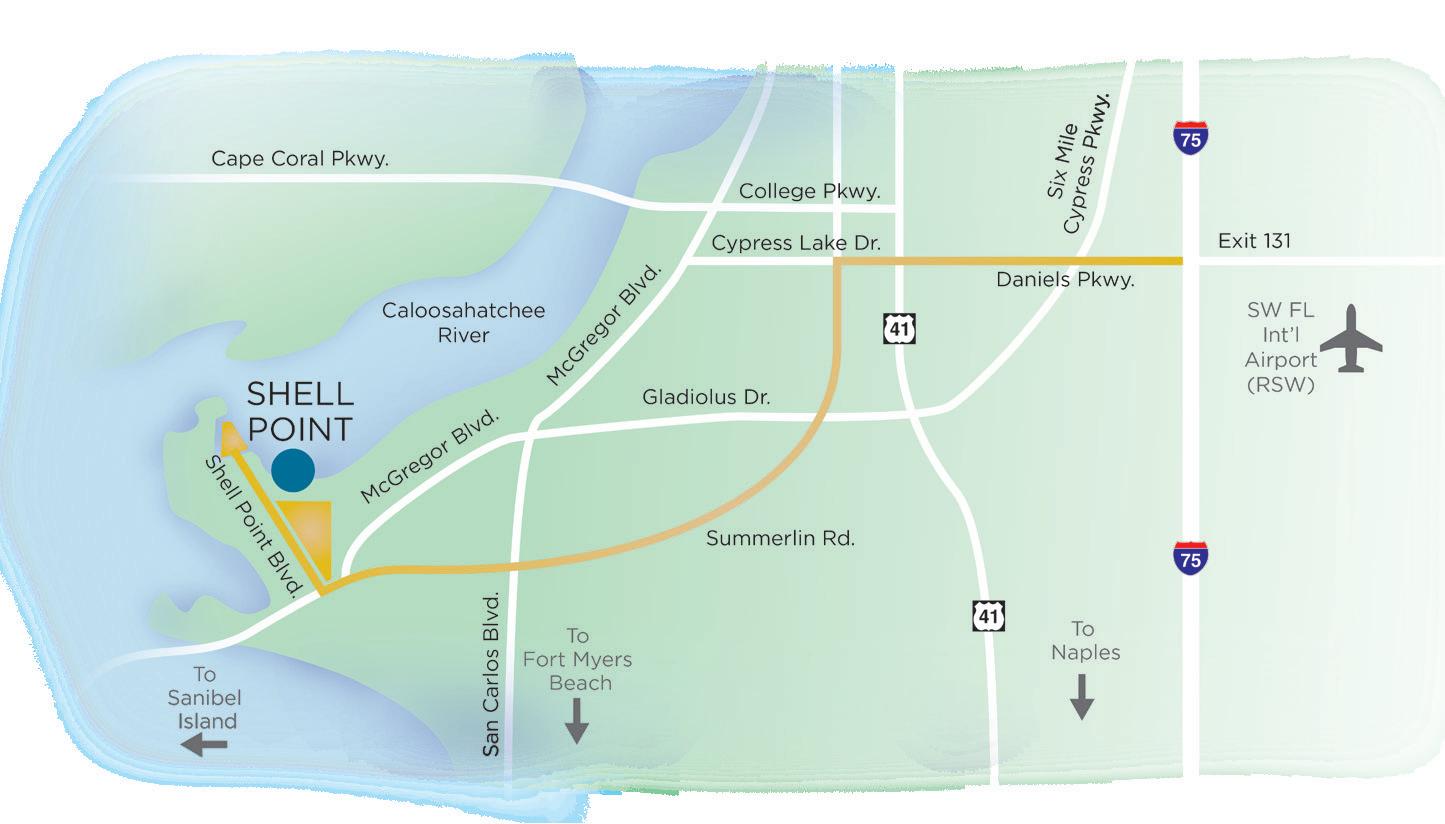

Shell Point is conveniently located in Fort Myers along the Caloosahatchee River. I-75 and the Southwest Florida International Airport provide easy access to other areas of the state and the rest of the country. To visit Shell Point, take the Daniels Parkway exit #131 off I-75 and travel west for 5.5 miles to Summerlin Road. Turn left and travel 8.5 miles to the light at Shell Point Boulevard.