CHANGE SERVICE REQUESTED PRSRT STD U.S. Postage PAID Permit No. 440 Sterling, IL 61081 A FREE PUBLICATION OF

IWhen it comes retirement, it’s important that the numbers add up, but just as important: Doing the math now, which is where a financial planner can help: They’ll make sure you’re in a good place today so you can enjoy tomorrow

f you wanted to sum up retirement planning in one sen- tence, it could be: Start early and save often.

But there’s a lot more to it than that. How do you start? When is “early”? Where should those savings go? There’s a lot of questions to be asked, including some that you might not have even thought of. That’s why one of the questions you should ask is: Where can I find someone to answer those questions?

A retirement financial planner can be a good place to start. They’re trained to ask, and answer, the right questions when it comes to planning for retirement. They can help people figure out when is the best time for putting the time clock behind them and leisure time ahead of them.

It’s a process that involves working with clients to help them understand how markets work, finding ways to make their money work for them, educating them about their options, and getting everything in order so they can be ready for retirement.

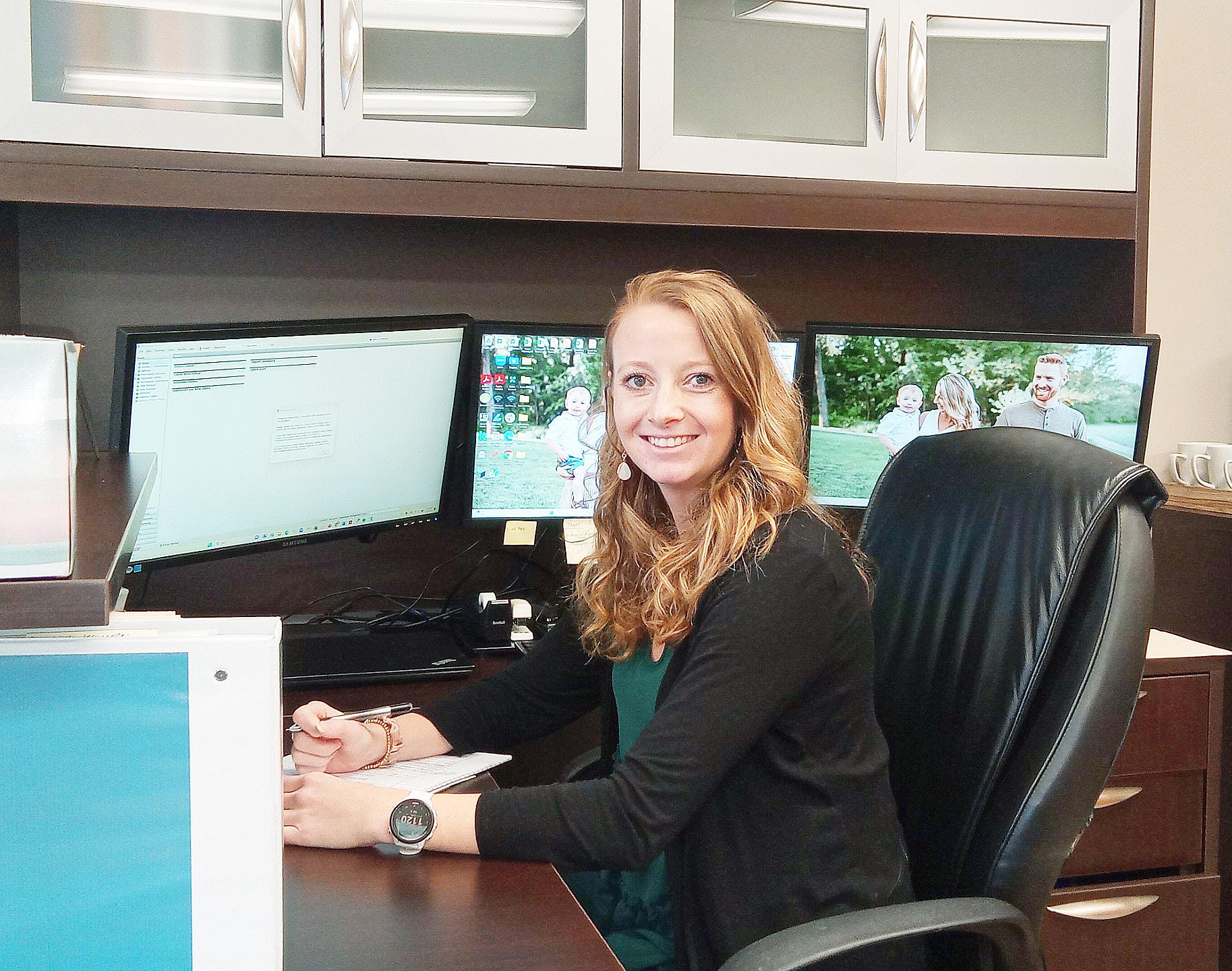

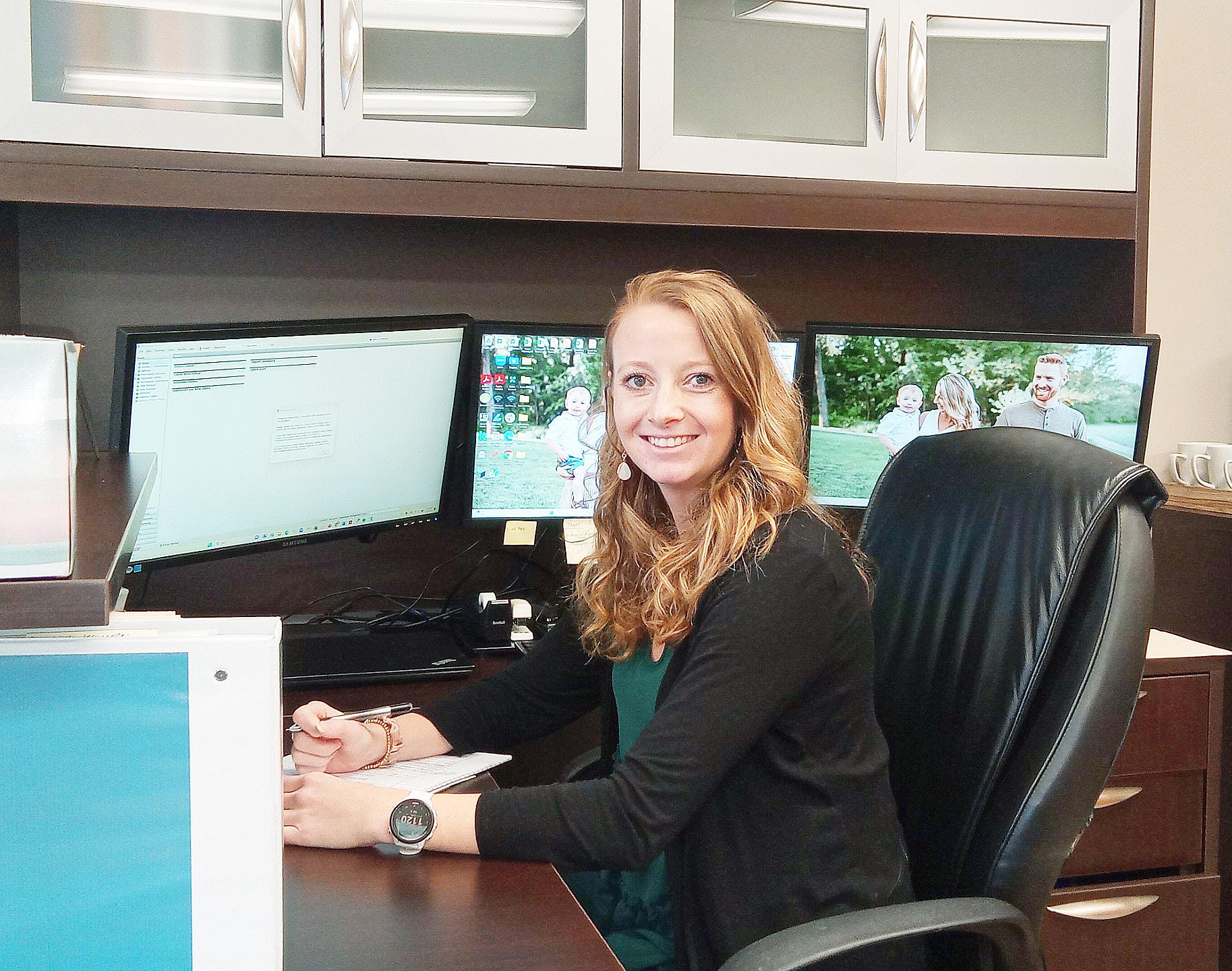

Regan Shipp of Rosemeyer Management Group in Sterling is one of those people, and though she may be in her 20s, she helps clients more than twice her age make financial sense of their affairs so their gold- en years don’t lose their luster due to poor, or lack of, planning.

One of her first pieces of advice: It’s never too early to start thinking about retirement.

The magic number for retirement had long been 65, the age when people could leave the workforce and enjoy their golden years — but that was then. To- day, 65 isn’t necessarily the default age for retirement. Some people are retiring later, and some earlier; it all depends on their financial and life situations.

“Most people start to think about retirement when it gets really close,” Shipp said. “There may be things they could have been doing prior to that, or maybe things that they could have been doing different- ly. Most people probably start saving later in life than what they wished they would have.”

NOW cont’d to pages 3 & 4 2 | A Shaw Media Publication | Sauk Valley Business Journal | Spring 2024

Regan Shipp of Rosemeyer Management Group in Sterling develops wealth management plans for those looking to have a fulfilling retirement. While many people don’t think about retirement until they’re in their 50s, it’s never to early to plan ahead. “Most people start to think about retirement when it gets really close,” Shipp said. “There may be things they could have been doing prior to that, or maybe things that they could have been doing differently.”

CODY CUTTER/CCUTTER@ SHAWMEDIA.COM

815-864-2111 Follow us on social media! @fsbwealthgroup fsbwealthgroup.com Located at First State Bank Shannon-Polo-Lake Carroll

MADE PERSONAL.

WEALTH MANAGEMENT

TIPS for feathering your nest egg

A rise in the cost of living has presented challenges to millions of households. As the cost of everything from food to natural gas to gas has risen, many people have struggled to find ways to save money, especially for their long-term goals like retirement.

The term “nest egg” has long been associated with long-term financial goals like retirement savings or college tuition. But what are individuals to do if short-term costs get in the way of their long-term goals? There’s no magic formula for building a nest egg, but these tips can help anyone grow their savings despite the high cost of living.

Identify a specific, achievable goal. Simply resolving to save “more” without attaching a figure that defines what “more” is can make it hard to build a substantial nest egg. Examine your finances, including what’s coming in each month (i.e., take-home wages) and what has to go out each month (i.e, housing and automotive costs, etc.). Document these expenses and then identify an achievable goal to build your nest egg. If necessary, trim some fat related to monthly expenses that are not necessities so you can redirect funds to your nest egg. Cancel streaming services or cut back on dining out so those funds can be redirected to building a nest egg.

Take advantage of pre-tax opportunities to save. Pretax opportunities to build a nest include retirement vehicles like a 401(k). With these plans, money is deducted from a paycheck before taxes, thus lowering workers’ immediate tax burdens (taxes are paid when funds are withdrawn) and enabling them to save more now. Some employers even match contributions up to a predetermined percentage, so enrolling in plans that offer employer match contributions can be an especially effective way to build a nest egg.

Begin living on a budget, and stick to it. The idea of living on a budget may seem simple, but it’s less common than some may recognize. A 2023 survey from the online financial resource NerdWallet found that 83 percent of the more than 2,000 adults 18 and over who participated acknowledged they overspend. Perhaps more telling is that 84 percent of respondents indicate they have a monthly budget but exceed it anyway. Individuals who want to build a sizable nest egg are urged to work with a financial advisor to devise a monthly budget and then stick to it.

Save for emergencies. A lack of emergency funds can quickly jeopardize a nest egg. Without a somewhat sizable savings account, individuals could be forced to borrow from their retirement accounts in emergency situations. That strategy hurts in more ways than one, as it both reduces the amount in the nest egg and also affects how much the nest egg can grow, as gains are greater when balances are higher. The NerdWallet survey found that 48 percent of respondents want to prioritize emergency savings, and that strategy can be vital to building a nest egg. — Metro News Service

For starters, Shipp recommends that if an employer offers a retirement plan, such as a 401K, enroll in it as early as possible — and preferably a Roth option if it’s available — and sock 15 percent of your paycheck in it. “You’ll be happy you did it,” she said. “With 15 percent, you’ll be on a good track for retirement and it will really set you up for success if you do that.”

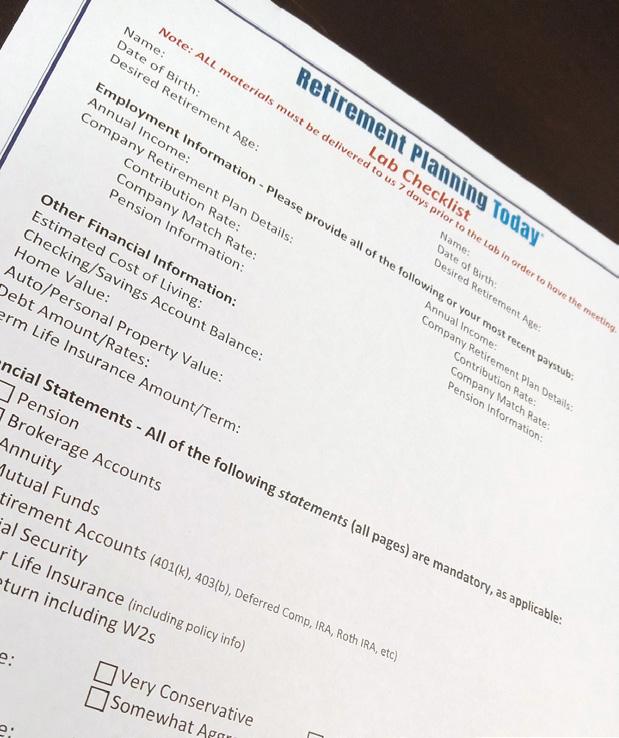

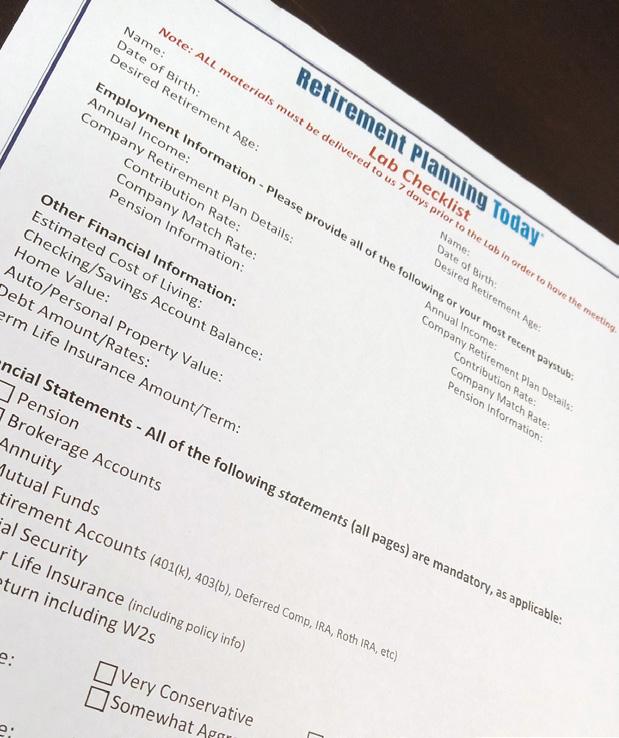

When clients utilize Shipp’s services for retirement planning, she’ll schedule an initial “discovery” meeting where she’ll find out their income, assets, habits, debts and other pertinent information. Once that’s done and a plan is in place, Shipp recommends annual appointments, so clients can review their plans and decide whether any changes need to be made, based on current situations.

“Basically, we want to know everything about them financially,” Shipp said. “I would not be able to make observations or recommendations on their situation with out knowing all of that about them. We’ll make them comfortable with that and send them the checklist.” (at right)

Another important step in the process is preparing for the unex pected and the inevi table, including deter mining beneficiaries. Retirement planners can help clients figure out what will need to be done in case of emer gencies, incapacitations or even death. While establishing wills should be done through an attorney, a financial planner can provide preliminary information that one would need to know when deciding how to distribute their assets once they die.

Regardless of whether people have heirs or not, they still need to get their affairs in order: Assets need to be distributed and beneficiaries need to be decided — whether it’s a person, an organization, or a charity.

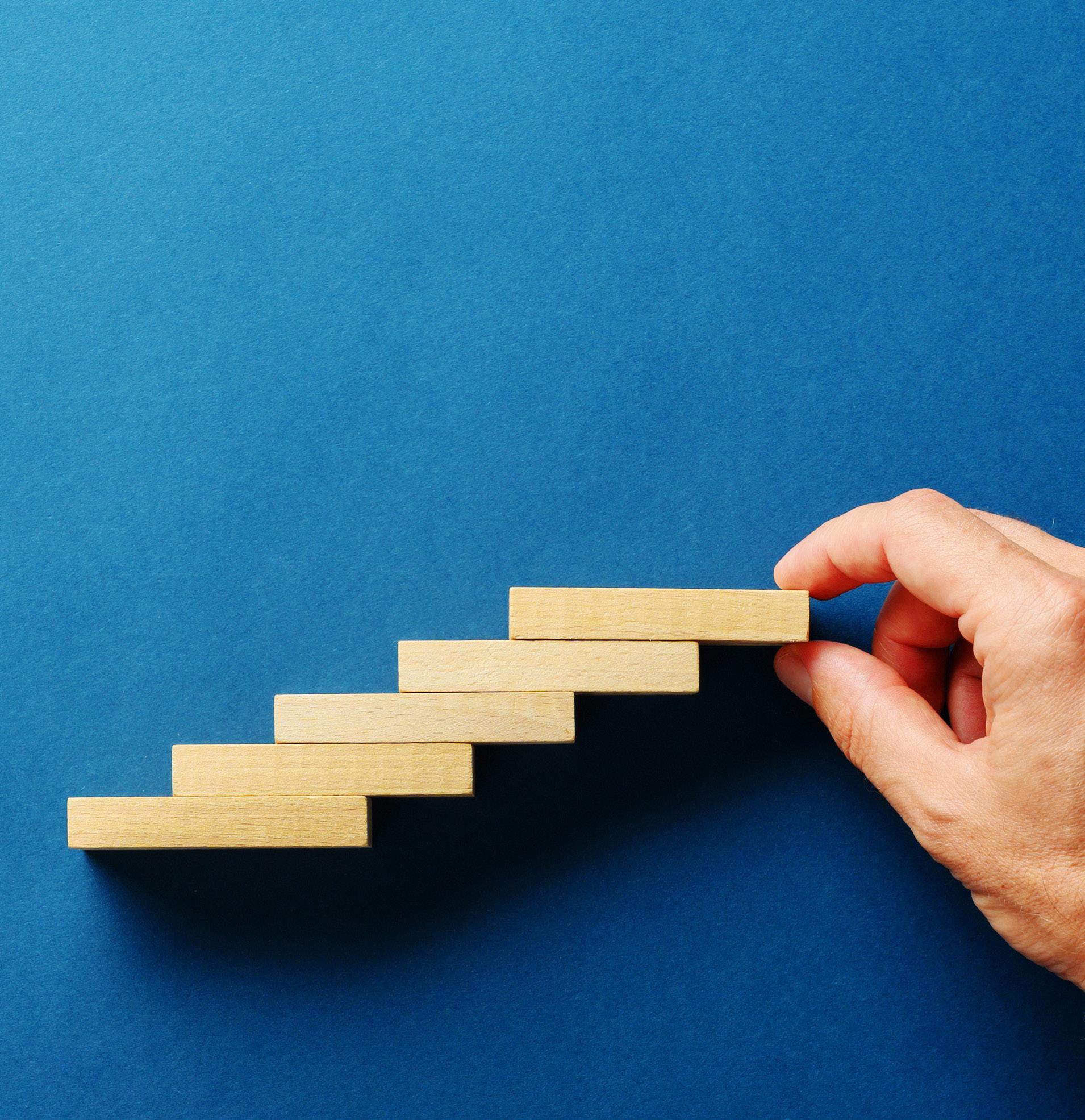

Steps leading to successful retirement planning are helpful in knowing what to do for estate and will planning.

cont’d from page 2 NOW cont’d to page 5

NOW

4 | A Shaw Media Publication | Sauk Valley Business Journal | Spring 2024

“Going through estate planning is determining where your assets are going to go,” Shipp said. “For a young person who doesn’t have a lot of assets, it’s a lot less of a concern than with someone who’s retired and has built up enough assets over the course of their life. Once you start to build up assets, you should probably start to do some of these things.”

While those with families or significant others may find such decisions easier, single people need to think about what will happen when they’re gone.

“A single person who doesn’t do a whole lot maybe won’t feel the need to, but there still are important things. If you own your own home, who do you want your home to go to? If something were to happen to you, and you’re alive but incapacitated, who’s going to make decisions for you? There are things like that which young people that don’t have a lot should be outlining in a will.”

Along with her full-time job with Rosemeyer, Shipp also teaches a community education class on retirement plan-

TIPS for feathering your nest egg

ning three times a year at Sauk Valley Community College in Dixon. The two-night, six-hour course goes over the basics of creating a retirement plan, when to make changes to it, and steps that can be done to get the most out of a plan. The next class is planned for the college’s fall semester.

More info

Regan Shipp at Rosemeyer Management Group can be reached at 815-857-8080 or by appointment at 2002 E. Fifth St,. Suite C, in Sterling. Go to rosemeyermg.com or email info@ rosemeyermg.com for more information.

“People have gotten a lot out of them,” Shipp said. “It’s a crash course on retirement planning. We’ll go through a lot of real-life examples. It’s a lot of information thrown out at once, but they’ll get a lot out of it.”

It’s never too early to think about retirement, and using a financial planner can help allay a person’s fears and concerns about that time when the paychecks stop.

“I think people know that they should have something in place, but they don’t always know what that looks like,” Shipp said. “A lot of people need those nudges to take those steps.” n Cody Cutter can be reached at 815-632-2532 or ccutter@shawmedia.com.

Young adults just starting their careers aren’t always thinking of the day when those careers will come to a close — retirement is a distant goal when it’s 50 years away. However, pushing off retirement savings because it’s not viewed as a necessity now could turn out to be a significant mistake later.

According to Mass Mutual, a Massachusetts-based life insurance and financial services company, the economic disruption caused by the global pandemic pushed retirement to the bottom of many workers’ lists of financial priorities, especially among young professionals. Student loan burdens are another reason why some people delay saving for retirement until they are older.

It’s a challenge that’s not gone unnoticed. A 2019 survey found roughly half of millennial and Generation Z professionals believe they are not saving enough for retirement, a concern made worse by fears that Social Security may not provide the same kind of financial cushion that previous generations had come to expect.

The Social Security Administration’s Board of Trustees estimates that in 2041, based on current law, the Social Security Trust Funds will be depleted since people are living longer and the birth rate is low. The taxes being paid now will not be enough to pay the full benefit amounts scheduled for future retirees.

Young workers need to be proactive and take control of their own retirement savings.

• Experts advise following the general rule of saving at least 10 to 12 percent of your salary when you are in your 20s, including factoring in

any employer match.

• Working for companies that offer defined-contribution plans like a 401(k) or 403(b) can make it easier for young professionals to begin saving for retirement.

• Setting aside a portion of your income early on in retirement savings ensures more years of savings and investments will benefit from decades of compounding.

• Those who contribute to a retirement plan may receive an immediate tax break because the contributions come out of paychecks before taxes are withheld. Many of these plans also offer the advantage of taxdeferred growth. This translates to not being required to pay taxes each year on capital gains, dividends or other yield distributions if the money is not withdrawn before age 59 1/2 . Speak with a financial advisor to learn more about tax-advantaged accounts.

• Investment management firm T. Rowe PriceT. Rowe Price says there are certain benchmarks that can help people save enough money for retirement. By age 30, you should have .5 times the amount of your salary. At age 35, that amount should increase to 1.5 times your salary. These numbers are based on an assumed retirement age of 65 and with a household income growth of 5 percent until age 45 and 3 percent thereafter.

• According to research from Qualtrics, young workers don’t plan on working until they can receive full benefits from Social Security. Twentyfour percent plan to retire early, and 41 percent want to do so by the time they turn 50. That could spark more ambition among younger generations to save for retirement and to save more aggressively.

Even if retirement is many years in the future, young workers need to start saving for retirement early on to be able to retire comfortably.

— Metro News Service

NOW cont’d from page 4

A Shaw Media Publication | Sauk Valley Business Journal | Spring 2024 | 5

When it comes to finding a place to sell clients’ stuff, there’s no place like homes for a family business that rolls out the welcome mat for bargain shoppers, antique hunters, and anyone else looking to buy more stuff of their own

t’s a question just about everyone will face at some point in their life: “What do I do with all of this stuff?”

A Rock Falls business has a bright idea: Let us sell it for you.

Whether you’re a retiree who wants to downsize because you’re ready to move on and move in to a new home, or you’re a family facing the daunting task of dealing with a lifetime of possessions that a loved one left behind, Sauk Valley Estate Sales and Services can help.

If you’ve got a house full of things that need to find a new home, the Bright family — Rick, Amber and Dawn — can help, turning your trinkets and treasures into cash through their family business, Sauk Valley Estate Sales and Services.

For a little more than a decade, the business has helped customers clear out houses and garages by conducting estate sales big and small, from stately estates to more modest homes — but no matter the size, they all have one thing in common: They’re full of stuff.

That’s where owners Dawn and Rick Bright, and their daughter Amber Bright, step in. Organizing, staging, pricing, selling.

Estate sales are often held after someone has passed away, but they’re also a good option for people moving to a new home who have a house full of stuff they don’t want to haul, or those relocating to a senior home or assisted living facility. The sales themselves typically take place over a two-day period, but large estates can go for three days, or stretch out over a few weekends.

SALES cont’d to page 7

6 | A Shaw Media Publication | Sauk Valley Business Journal | Spring 2024

SUBMITTED PHOTO

Most estate sales happen when the weather warms up, and the family will oversee as many as four sales in a month.

The Brights originally started their business as Sauk Valley Auction Center, back when the concept of an estate sale was largely unknown to the area and auctions were the go-to way of selling off a person’s possessions. After just a couple of years, the Brights weren’t quite getting what they had hoped for with the business. That’s when Dawn started thinking about the idea of estate sales. She had known a little about how the sales worked in the larger cities, such as Chicago, and set out to find a way to make them work in the Sauk Valley’s smaller market.

“The Sauk Valley had never been used to an estate sale; it had always been auctions with the hay rack in the front yard, that’s what the area had been used to,” Dawn said. “I told Rick that I would like to go to Chicago and see these things called in-home estate sales and see how those are run. So we made the trip to Chicago, and after I saw all of it, I thought this area needed a company that could come in and do that.”

One of the advantages of using a local estate sale service is that it will have a good eye for items of local interest and can price them accordingly, something that an estate sale coordinator from outside the area may not be able to properly value. Pictured are some items that have turned up at the Brights’ estate sales: a Sterling Warrior trash can and a vintage Prince Castle Multimixer machine.

A Shaw Media Publication | Sauk Valley Business Journal | Spring 2024 | 7

Together We Inspire Wellness Sinnissippi Centers offers a wide variety of behavioral healthcare services for individuals of all ages and for families We’re here when you need us. 800-242-7642 www. sinnissippi.org • Treatment for mental illness • Treatment for substance use • Individual and family counseling • Child and adolescent services • Early childhood mental health • Crisis services • Many other services We bring life to products.TM 25 E. Main St., Amboy, IL 815-857-3691 SM-ST2147870 SALES cont’d from page 6 SALES cont’d

to page 8 SUBMITTEDPHOTOS

There’s not much you won’t find at an estate sale — toys and tools, furniture, housewares, vintage audio equipment, holiday decor and more. With so much for sale, organization plays a big part in an estate sale’s success. Instead of burying stuff in boxes or having people pick through piles, the Brights will set up tables and gather like items together, making it easier for shoppers to find what they’re looking for.

Estate sales, simply put, turn a person’s home into an indoor rummage sale, but instead of just having things for sale that someone chose to haul out of the closet, pretty much everything is up for grabs at an estate sale. From kitsch in the kitchen to garages stuffed with goods — knick-knacks and this-and-that, cars and clothing, tools and toys, furniture and footwear, bits and pieces of local history … whatever a person bought, estate sales customers else can buy.

And unlike an auction, everything’s for sale as soon as the sale starts. No more standing around waiting for an item to come up for auction, no more getting outbid, no more digging through hay racks piled high with stuff.

“The customers can just shop,” Dawn said. “They don’t have to worry about it being like an auction, which can be very time consuming for people. When we had our auctions, we’d have people in the beginning, but if it ran too long, people would lose interest. It just wasn’t working out that well.” With estate sales, “People can come in and buy something, and still have the rest of the weekend.”

SUBMITTEDPHOTOS

Once a sale is planned, the Brights come to the house and organize and price items. If there are items still in the home that the family wants to keep, they’re marked not for for sale (“NFS”). As far as pricing goes, the Brights use a system that differs from some estate sales in larger cities: They go with progressive markdowns.

SALES cont’d from page 7 SALES cont’d to page 9

8 | A Shaw Media Publication | Sauk Valley Business Journal | Spring 2024

Day one is full price up until a certain time, then discounts begin, starting with 10% and growing bigger as the sale progresses. By the second day, the discounts can be deep. But bargain hunters take note: Waiting for something to get marked down can be hit and miss. That item you were hoping to get for a song on the second day may get snapped up by someone before it gets a chance to get marked down. But it’s the thrill of the hunt that keeps people coming back for more — some come back several times throughout the course of the sale to try and snag the best deals.

Some large items, such as vehicles, are still done with a bidding system, with a minimum bid established and people submitting bids throughout the sale.

When they price items, they do so with a variety of factors in mind: how the local economy is going, what the wants and needs are for the area, what styles are trending, what collector items are hot or not, and being able to determine the value of more locally-based items — something that an estate sale coordinator from outside the area may not be able to properly value.

rant in Morrison; that was a two-week, six-day sale of all sorts of restaurant equipment and four floors of antiques and collectibles. The sale attracted hundreds of people and was a high point for the Brights. “We had an amazing crowd, people came from all over to go to that sale,” Dawn said.

Amber has come to enjoy the estate sale model, as opposed to auctions. Her favorite part of the experience is getting ready for the sale, she enjoys getting items organized — with estate sales, presentation an important part of the shopping experience.

“The family will get more doing an estate sale,” Amber said. “Most generally, we’ll sell things by the piece and not by the box like in auctions.”

Getting to meet new people through sales is something that Rick especially enjoys about the job.

More info

Find Sauk Valley Estate Sales and Services on Facebook, email saukvalleyestates@gmail.com or call 815-590-7021 to arrange a sale or for more information. A schedule of sales is updated regularly on its Facebook page.

As for what’s left after the final discount on the last day of the sale, families can ask for the option to have a cleanout sale; customers buy a clean-out ticket and can take out what they please.

“For the most part, the families want the house cleaned out,” Dawn said. “It helps get rid of stuff at the end of the day, it helps the family clean the house out.”

Clients are charged on a commission, depending on the size of the sale.

One of their largest sales to date happened a couple of summers ago with the former Brick House Restau-

“From start to finish, we try to do everything we can to get the house ready for sale for people,” Rick said. “It’s been real interesting doing these sales. We get to meet a lot of people, and I really like that.”

The Brights have enjoyed a growing following among customers over the years, and often run into the same people no matter where the sale is, even if it is in another town. The Brights keep their sales to the Sauk Valley area — Rock Falls, Sterling, Dixon, and surrounding cities such as Morrison, Prophetstown, Lyndon and others not too far from their base of operations.

“I’ve had amazing clients,” Dawn said. “This area just has amazing people that live here. Many people who come to our estates sales will follow us, and that’s how they’ll usually find out when the next sale is.” n Cody Cutter can be reached at 815-632-2532 or ccutter@ shawmedia.com.

A Shaw Media Publication | Sauk Valley Business Journal | Spring 2024 | 9

SALES cont’d from page 8

For decades, people had few choices when it came to deciding where their final resting place would be; it was either in a casket or an urn.

That’s not the case anymore. As technology and customer demand has evolved, so too has the funeral industry, which has found new ways to carry out their clients’ wishes and give the people they’ve left behind more options to honor their loved ones and celebrate their life.

Take cremation for example. Fire isn’t the only choice these days; water is being used, too. Casket choices have also changed, to include other options such as natural wicker. Eco-friendly options — or green funerals — have caught on, too.

The evolution of end-of-life planning is something that funeral directors like Joe McDonald research in order to stay on top of a growing number of options in his industry. McDonald, who has been in the funeral business for nearly 40 years, has owned McDonald Funeral Home in Rock Falls since 1995 (with four more locations throughout the Sauk Valley) and has cremated from his Rock Falls location since 1999.

ROADS cont’d to page 11

10 | A Shaw Media Publication | Sauk Valley Business Journal | Spring 2024

With the advent of new ways to deal with remains, McDonald and his peers have to take a number of considerations into account when deciding what options to offer and help customers make the choice that’s right for them: Is the method simply a passing fad? Is it safe? Is it viable? Is there any local interest?

Joe McDonald

Joe McDonald

“I’ll kind of read up on some of this and try to understand where it’s coming from, and then find out if there’s an actual need for that, or is this a fad — something that somebody started and maybe isn’t going to take hold and not putting a lot of credibility in that,” McDonald said. “Often I’ll have families that will call us and say that they read about something or saw something on television, or through YouTube. We’ll listen to what their questions and concerns are and then try to give them the answers they need.”

One of the options that’s begun to find demand locally is environmentally friendly funerals. Oak Knoll Memorial Park in Sterling offers the burial of cremated ashes — cremains — under a tree with a small plaque near the base; so instead of a grave marker, a person can visit a living reminder of their loved one. Scattering gardens and private family gardens also are on site.

Forest areas have also been utilized as cemetery alternatives. Rock River Memorial Forest in Oregon features areas where ashes can be scattered around trees; families can pick the tree they want to have as their memorial.

ROADS cont’d to page 13

by the numbers

60.5% vs 34.5% Number of people choosing cremation vs. burial, according to 2023 report.

60% Percentage of people who would be interested in exploring “green” funeral options because of their potential environmental benefits, cost savings or for some other reason, up from 55.7% in 2021.

$16.323 billion Annual revenue generated by the funeral industry, according to the latest data (2012) from the U.S. Census Bureau economic census, which also reports that the funeral industry employs 141,002 people and creates $4.7 billion in wages, with nearly 87% of funeral homes family- or privately owned.

53.1% Percentage of people who’ve attended a funeral in a non-traditional location.

31.7% Percentage of people who would prefer to have their cremated remains buried or interred in a cemetery, as opposed to kept in an urn at home, scattered in a sentimental location, split among relatives, kept in a place of worship, or some other option.

Source: National Funeral Directors Association, nfda.org/news/statistics

A Shaw Media Publication | Sauk Valley Business Journal | Spring 2024 | 11 Locally Owned & Managed COMMUNITY IS MORE THAN PART OF OUR NAME PROUDLY SERVING ...

Dixon

Morrison

Rock Falls

Sterling

SM-ST2147818 NLMS #480435

Fulton

ROADS cont’d from page 10

Leave something to those you’ve left behind: less stress

Pre-planning your funeral can help ease anxiety at a glance

The death of a loved is difficult enough to confront, without adding the extra challenge of having to make funeral arrangements. Decisions can be difficult to make during the grieving process, when emotions are elevated and various family members have to come together to make the choices necessary for the funeral.

There also is a financial component to consider. According to Lincoln Heritage Life Insurance Company, the average funeral costs between $7,000 and $12,000, which may or may not include viewing, burial, transport, casket, and other fees. Surviving family members responsible for planning a funeral may be asked to contribute a portion of these expenses if other arrangements have not already been made, which can exacerbate stressful feelings during an already difficult time.

Funeral pre-planning is a good way for people to make a difficult time a little more manageable for their survivors. Funeral homes frequently work hand-in-hand with individuals and families to customize pre-planning packages and facilitate the process. Here’s a look at some benefits of pre-planning a funeral.

EXPLORE YOUR OPTIONS Pre-planning a funeral enables people to consider all of the options without the time constraints of making funeral arrangements right after the passing of a loved one. A knowledgeable staff member at a funeral home can explain the offerings and answer any questions.

STRAIGHTFORWARD PROCESS Unless an person has planned a funeral in the past, there can a lot of unknowns. Funeral homes handle these events every day and can guide families through the process. Most have preplanning kits that include all of the essentials of the process, such as choosing caskets, deciding on prayer cards and designing floral arrangements.

Discover our Digital Banking with customer service that cares.

12 | A Shaw Media Publication | Sauk Valley Business Journal | Spring 2024

SM-ST2140340

AVOID CONFRONTATIONS Working directly with a professional also helps alleviate the burden on family members, who may not agree on arrangements or concur on what they believe would be a loved one’s final wishes. When pre-planning a funeral, individuals can spell out in their own words exactly what they desire and even finance the funeral in advance.

ESTABLISH A PAYMENT PLAN A funeral home staff member can go over the various ways to fund funeral expenses, and may work out a payment schedule to spread out the expense over a period of time. He or she also may explain how funeral prearrangement can be a way to “spend down” assets in a way that protects those monies from look-back periods when determining eligibility for certain assisted living or nursing facilities should that be required in the future.

WORKING WITH RELIGIOUS OFFICIALS Very often a funeral home is a conduit that facilitates all facets of the funeral process. They may reach out to a preferred house of worship to organize a mass or other religious service, and will also contact the cemetery and work with them to secure a plot and deed. This also alleviates pressure down the line on grieving family members who need time to mourn.

— Metro News Service

ROADS cont’d from page 11

Casper Creek Natural Cemetery in Galena, which overlooks the Mississippi River, offers ash scattering around trees, as well as cremains and burials. Caskets and urns are made from non-toxic, biodegradable materials.

One alternative McDonald has been especially curious about lately is the cremation process using a water, commonly referred to as aquamation. The body is placed in a pressurized, heated chamber filled with a water/alkaline solution that breaks down tissue, leaving the bones behind, which are then cremated and placed in an urn. The closest crematory to the Sauk Valley that does this is U.C. Davis-Callahan Funeral Home and Aqua Cremation Center in Morris.

The process is more eco-friendly than traditional cremation, with no carbon emissions from the burning of fossil fuels, and the sterile liquid solution can be disposed of in the wastewater system.

“I’ve been doing some reading on it and have gone to some seminars,” McDonald said. “There have been many people who, while cremation is what they’re looking at, they aren’t looking toward the flames.”

Aqua cremation is legal in 24 states, and has been in Illinois since 2012.

Another method of processing remains, composting, is legal in only four states: Colorado, New York, Vermont and Washington (with California to follow in 2027). That’s when remains are turned into compost, using thermophile microbes to decompose the body in a quicker manner than traditional decomposition. The process reduces both land mass and carbon footprint, and embalming is not required except in rare circumstances.

ROADS cont’d to page 14

A Shaw Media Publication | Sauk Valley Business Journal | Spring 2024 | 13 Specialty Magazines These magazines are totally free and will be sent to you in the mail. To request your F FREE copy, simply call us at (815) 632-2566 or email your requests and address to: knull@saukvalley.com

13

Despite its growing popularity, the composting method is not yet legal in Illinois. A bill in the Illinois General Assembly, HR3158, would allow for its legalization; it was passed by the House, but has idled in the Senate since April 2023.

With a growing number of different ways to deal with remains, and perhaps more to come in the future, it’s important that people plan ahead for their funeral though, admittedly, that can be a sensitive subject deal with — so that their final wishes are honored, and that family members are kept in the loop.

If a person doesn’t make provisions for their funeral, things could get complicated.

ROADS cont’d to page 15

14 | A Shaw Media Publication | Sauk Valley Business Journal | Spring 2024 of the class. With spaces and solutions designed to inspire and connect, HON is paving the way for promising futures every day. head Go to the Check out callsbm.com or contact us at (815) 625-4375 Learn more >

SHAW MEDIA FILE PHOTO

Funeral

2018.

John

Callahan, owner of U.C. Davis-Callahan

Home in Morris, shows off its aqua cremation chamber during an unveiling in

The process is clean enough that it does not require an EPA permit.

ROADS cont’d from page

“Once the person dies, through cremation, it requires several signatures from the surviving family members,” McDonald said. “If someone is in total disagreement with that, we don’t cremate; there’s potential of a liability lawsuit of cremating the remains. Cremation is so critical that we talk about ahead of time, we discuss those things and have those options available so that when it happens, folks are somewhat in agreement in what to do.”

Changes in the way families honor their loved ones with services also has evolved in recent years, mainly due to restrictions at the height of the coronavirus pandemic in 2020-21.

McDonald and other funeral homes had to think of more outside-the-box ways to provide people a way to find closure in the middle of a pandemic, when traditional in-person services were a challenge. Drive-thru visitations were a popular alternative during that time, McDonald said. In other instances, celebrations of life, that typically take place directly after services, were postponed. Even though coronavirus-related restrictions have since been lifted, some families continue to utilize those ways of honoring the deceased.

Cremations rose during the pandemic, maxing out at around 70 percent of arrangements during the height at McDonald Funeral Home, where now about 65 percent choose cremation.

“It’s a change in view on a funeral service and a change in view in how we celebrate life,” McDonald said. “There’s also a cost element to cremation as well, it being less costly than a traditional funeral. There’s a growing number of individuals who don’t believe in seeing the body, who don’t need to see the body again and saw them through the dying process, and who don’t need to go through that as part of their grief recovery. They just want to have the person cremated and have some kind of service afterwards.”

None of us can choose to live forever, but we can choose how our memories will live on, and with the evolution of end-of-life services, more choices are available, not only ensuring that people’s final wishes are granted, but giving the living more ways to honor their loved ones.

“I never thought that when I graduated from college back in 1984 that we would be seeing such a change,” McDonald said. n

Cody Cutter can be reached at 815-632-2532 or ccutter@shawmedia.com.

A Shaw Media Publication | Sauk Valley Business Journal | Spring 2024 | 15 Your Expectations Exceeded. Ordinary Tasks Extraordinary Service www.smbycontractservices.com Dixon, Sterling and Rock Falls 815/626-2511 • 815/288-7211 Email: servicemasterclean@comcast.net Proudly Ser ving Lee, Whiteside, Carroll, Bureau and Ogle Counties 1214 Bataan Road, Dixon, IL 61021 815.625.1000 | RepublicServices.com ©2023 Republic Services, Inc

ROADS cont’d from page 14

Joe McDonald

Joe McDonald