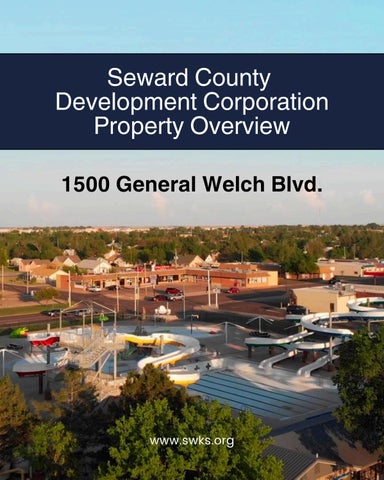

DRONE VIDEO OF LOCATION

DRONE VIDEO OF LOCATION

Seward County

Development Corporation

Eli Svaty

Executive Director

620-655-2036 eli@swks org

City of Liberal Rusty Varnado

City Manager

785-205-9500

rusty.varnado@cityofliberal.org

Economic Development

Seward County

Development Corporation Raquel Arellano Director of Entrepreneurship

925-409-8872

raquel@swks org

Liberal Area

Chamber of Commerce

Rozelle Webb CEO

620-624-3855

raquel@swks org

Administration

Seward County April Warden County Administrator

620-482-5509

awarden@sewardcountyks.org

City of Kismet Rod Lewis Mayor

620=629=0014

rodlewis991@gmail.com

Planning, Zoning, and Building

City of Liberal

Keith Bridenstine

Building and Code Director

620-626-2262

keith.bridenstine@cityofliberal.org

Seward County Albert Gallegos

Planning and Zoning Director

620-626-3394 agallegos@sewardcountyks org

City of Liberal Arlene Rosales

Permit Technician

620-626-2261

arlene.rosales@cityofliberal.org

Seward County Hillary Franco

Permit Technician

620-626-3392

hfranco@sewardcountyks org

PEAK – Promoting Employment across Kansas: $750 application fee

Company retains 95% of the payroll withholding tax of PEAK jobs

Company must provide adequate health insurance coverage for full time employees and pay at least 50% of health insurance premium

PEAK eligible jobs, must meet 100% of the county median wage

Must create a minimum of 10 new PEAK eligible jobs, with in the first 2 years Company must ask for a PEAK proposal, through the business incentive questionnaire, working with the Regional Project Manager, prior to applying for PEAK.

Application and Application fee of $750 must be submitted, before PEAK eligible jobs can be counted.

Non-eligible industries include: gambling, religious, retail trade, educational services, public administration, food services and drinking places, unless applying as an international or national headquarters of administrative/back office facility

HPIP- High Performance Incentive Program: $750 application fee

A tax credit for capital investment, with a 16-year carry-forward, equal to up to 10 percent of the eligible investment that exceeds $ 1 million in Douglas, Johnson, Shawnee and Wyandotte counties; $50,000 in Leavenworth county Exemption from sales tax for eligible capital investments/services

A potential workforce training tax credit up to $50,000 per year on training expenditures above two percent of the company payroll Priority consideration for other assistance programs offered through Commerce, and KMS

Company must complete and submit an HPIP Project Description, prior to the project being committed to Company must pay above average industry wage

Invest in training/skill development equal to 2% of payroll, or participate in a state training program

Company must provide adequate health insurance coverage for full time employees and pay at least 50% of health insurance premium

Non-eligible industries include: agriculture, mining, construction and retailing.

Industries that are not manufacturers, at least 51% of revenue must be generated from sales to Kansas manufacturers, and/or out of state commercial; and/or governmental customers

Grant funds to help offset the costs of training for employees

KIT – training for new employees, hired after the KIT start date

KIR – training for current employees on new processes, technology, equipment; company must have a dollar for dollar match

Positions being trained must be paid an average wage that meets or exceeds the county median wage

Company must provide adequate health insurance coverage for full time employees and pay at least 50% of health insurance premium

Encourage employers to hire job seekers who face the greatest barriers to employment for up to a $2400 federal tax credit per qualified hire.

Available funding: Sponsors can be reimbursed for a portion of the RTI (Related Technical Instruction) per apprentice

Assist Kansas companies with their global market development needs and exporting efforts

Businesses that purchase or expand property for the purpose of: a) manufacturing articles of commerce; b) conducting research and development; or c) storing goods or commodities which are sold or traded in interstate commerce may qualify for property tax abatement with proper approval of the City or County governing body, with final approval from the State Board of Tax Appeals. Certain uses financed by Industrial Revenue Bonds may also qualify for property tax abatements (This has to be approved by the State prior to the issuance).

In Kansas, IRBs are issued by cities, counties and the Kansas Development Finance Authority. Proceeds from the sale of the bonds to private investors are made available to enable creditworthy companies to purchase land and pay the costs of constructing and equipping new facilities or the costs of acquiring, remodeling and expanding existing facilities.

Property owners may petition the City Commission to create a Community Improvement District (CID) for projects exceeding $200,000. Applicants may request special property tax assessments within the district, special sales tax up to 2% within the district or a combination of both. All property owners within the proposed CID must participate in the petition. Upon creation of a CID, revenue generated by these sources is available through a pay-as-you-go account. A CID can exist for a maximum of 22 years.

Tax Increment Financing (TIF) is a real estate redevelopment tool applicable to industrial, commercial, intermodal transportation area and residential projects. TIF uses the increases in real estate tax revenues and local sales tax revenues to retire the bonds sold to finance eligible redevelopment project costs (K.S.A. 121770 et seq.) or to reimburse the developer on a pay-as-you-go basis.

This plan is intended to promote the revitalization and development of certain areas within the City of Liberal in order to protect the public health, safety, and welfare, and improve economic conditions which impair and arrest the sound growth of the community for the residents of the City The City will offer property tax rebates for certain improvements or renovation of the property with the designated areas in accordance with the provisions of K S A 12-17, 114 et seq

The City of Liberal offers development assistance in the form of 50/50 matching grant money for commercial businesses and property owners located within the City of Liberal, Kansas City grants will be for outside façade improvements, parking lot improvements or sidewalk replacement on the exterior of the business