2025 - 2026 Health and Wellness Benefits

Active, regular part-time and full-time employees working a minimum of 30 hours per week are eligible for the benefits outlined in this booklet on the first of the month following 30 days of employment. You may also enroll eligible dependents in certain benefits.

• Your spouse;

• Your same-sex or opposite-sex domestic partner;

• Your dependent children up to age 26 (regardless of marital status), including a biological child, stepchild, a legally adopted child, a child placed for adoption, or a child for whom you or your spouse are the legal guardians;

• Your unmarried children age 26 or older who are mentally or physically disabled and who rely on you for support and care; and/or

• Children of a same-sex or opposite-sex domestic partner relationship, up to age 26 (regardless of marital status).

If you are nearing retirement age, please be sure to carefully consider your options for health coverage after employment. Resources are available through www.medicare.gov, or 800-633-4227, and www.ssa.gov/retire (Social Security) or 800-772-1213. Your current health insurance company will also have information about how to continue services through Medicare once you are eligible. The State of California offers free assistance with understanding your Medicare options through HICAP www.cahealthcareadvocates.org or 800-424-0222.

If you (and/or your dependents) have Medicare or will become eligible for Medicare in the next 12 months, a Federal law gives you more choices about your prescription drug coverage. Please see page 35 for more details.

Sequoia Living provides access to high-quality, comprehensive care. The plans differ largely in the way the cost of care is structured and in the strategies you can use to control your expenses:

Let you choose care inside or outside the plan network you selected, but you will incur a higher out-of-pocket cost for service if you use out of network providers.

Offer a comprehensive, convenient approach, but require that you seek care within the HMO network.

We know you want the best benefit coverage with the fewest obstacles between you and your healthcare. With 3 different medical plan options, you choose what is best for you and your family.

This plan offers an all-in-one approach to healthcare, with predictable copays and no deductibles. Preventive care is covered at 100%.

Under the Kaiser Permanente HMO, you and your covered dependents must receive all care and prescriptions from Kaiser physicians at Kaiser Permanente facilities. Except for emergencies, coverage is not available at non-Kaiser facilities.

You must call Kaiser immediately (or as soon as possible) after you are admitted to a non-Kaiser hospital for emergency services.

The Health Net PPO plan is a traditional plan that gives you the greatest flexibility, combined with lower costs when you choose a provider within its broad national network. Choosing health professionals who participate in the Health Net PPO network keep your costs lower and eliminate paperwork. How the plan works:

• It is recommended, although not required, that you choose a primary care physician (PCP) to serve as your personal doctor and help coordinate all your healthcare needs. Referrals are not necessary to see specialists in the PPO network. Just choose a participating doctor and make an appointment.

• Visit any licensed physician inside or outside the network. You will pay more when you get care outside the network. Either way, most routine services require a copay or coinsurance, and may involve meeting an annual deductible as well. Preventive care is paid at 100% in network.

• All outpatient surgeries and hospital stays require pre-treatment authorization. Network doctors may take care of this for you. If you go to a non-network provider and do not obtain pre-treatment authorization, you may be subject to a non-compliance penalty, and services determined not to be medically necessary may not be covered.

Like the Kaiser HMO above, this Health Maintenance Organization (HMO) plan offers an all-in-one approach to healthcare, with predictable copays and deductibles that make managing your life, your health, and your budget simpler. An HMO typically covers only in-network care except in lifethreatening emergencies.

When you enroll, you choose a primary care physician who can provide routine care as well as referrals to a broad network of specialists and facilities. You and your family members do not have to select the same PCP.

For most services you pay a flat copay amount, rather than a percentage of the cost. Preventive care is covered at no cost to you. Please keep in mind the following:

• You must live or work within 30 miles of your PCP

• If your PCP withdraws from the network, you must choose a new PCP. If you do not select a PCP, one will be assigned to you based on your home address.

Group health plans are required to provide you with an easy-to-understand summary about a health plan’s benefits and coverage so that you can better evaluate your choices.

The SBC form also includes details, called “coverage examples,” which are comparison tools that allow you to see what the plan would generally cover in two common medical situations. The SBC’s standardized and easy to understand information about health plan benefits and coverage allows you to more easily make “apples to apples” comparisons between our insurance options.

You are encouraged to read and explore the SBC’s and Uniform Glossary available for your medical plans posted on the eFlex for Benefits portal and our intranet site, My Sequoia Living. Hard copies available on request from your HR Department.

Important Terms

Coinsurance

The amount you pay for covered services after you pay the deductible. For example, if your plan has coinsurance of 20% and you have already paid the deductible, the plan pays 80% of the costs and you pay 20%.

Copay

The amount you pay up-front for your visit.

Covered services

Those services deemed by your plan to be medically necessary for the care and treatment of an injury or illness.

Deductible

The amount you pay before the plan starts to pay. For example, a PPO plan requires a $1,000 deductible for an individual using in-network services. This means you pay the first $1,000 in medical care you use (please note, the deductible is not applicable to all services).

Formulary

A list that contains the approved medications that are part of your prescription drug plan.

Generic

An FDA-approved drug, composed of virtually the same chemical formula as a brand-name drug.

Out-of-pocket maximum

The most you will pay for covered medical expenses in a year. Once you reach your out-of-pocket maximum, the plan pays 100% of your covered medical expenses for the balance of the year.

Explanation of benefits (EOB)

It’s not a bill, but a statement sent by your health insurance company to explain what medical treatments and/or services were paid for on your behalf.

Out-of-Network services are subject to a Calendar Year deductible and maximum reimbursable charge limitations. Payments made to health care professionals not participating in Health Net PPO network are determined based on the lesser of: the health care professional's normal charge for a similar service or supply, or a percentage of a fee schedule developed by Health Net that is based on a

the

or supply, or the amount charged for that service health care professionals in the

Sequoia Living offers a competitive PPO dental plan to help you maintain your oral health. If you choose to use a dentist that is not part of the network, your benefit will be based on the Usual and Customary (U&C) allowance for the dental procedure performed. You will be responsible for the charges over the Usual and Customary allowance, in addition to your portion of the coinsurance.

Network providers will submit claims on your behalf directly to Delta Dental. However, if you receive services through non-network providers, you may be required to submit your own claims.

Does not apply to

Sequoia Living’s vision plan gives you the freedom to see any provider. Keep in mind, however, that you can save a significant amount if you choose a network provider plus they’ll handle all the paperwork for you.

With Flexible Spending Accounts (FSA) you can use pre-tax dollars to pay for certain allowed expenses. There are two different plans:

Plan description Used for eligible out-of-pocket healthcare costs.

Eligible expenses

• Unreimbursed health related costs

• Prescription medications

Ineligible expenses

• Cosmetic surgery

• Non-prescription medication

• Life insurance premiums

Complete list of eligible and ineligible expenses www.irs.gov/publications/p502

Eligible FSA products

Annual contribution limit

$3,300

Used for eligible dependent care expenses for children under the age of 13 or dependent adults. You and your spouse must both work or be a full-time student in order to participate.

• Childcare at a day camp

• Nursery school or by a private sitter

• Cost of care at a licensed daycare

• Before or after-school care

• Eldercare

• Education expenses

• Transportation expenses for childcare

• Overnight camp expenses

https://www.irs.gov/pub/irspdf/p503.pdf

$5,000 (or $2,500, if you and your spouse file separate income tax returns)

Your eligible expenses should be incurred between April 1, 2025 – March 31, 2026 April 1, 2025 – March 31, 2026

What happens to account funds at the end of the year

Sequoia Living’s FSA plan has a 2 1/2-month grace period. This gives you until June 15, 2026 to incur claims for the 4/1/2025 – 3/31/2026 plan year. This applies to both Health Care and Dependent Care FSA. Consult your plan summary for more details.

Submit claim by September 30, 2026 September 30, 2026

You determine your annual contribution amount and which accounts you wish to contribute to. Your contributions are then taken out of your pay in equal amounts each pay period before taxes are deducted. You and your tax-qualified dependents incur eligible expenses. You use your FSA Debit Card to pay for healthcare and/or dependent care expenses at participating locations or file a claim online, via fax, or mail for reimbursement. Your reimbursements are paid to you tax-free.

The FSA plan administrator, Chard Snyder, will help you manage your accounts and claims processing. You can access your account online at www.chard-snyder.com customer.

If you terminate from Sequoia Living before the plan year ends, your contributions will cease. However, you may still submit receipts for reimbursement for any eligible expenses incurred up to your date of termination. Expenses must be submitted by September 30, 2026.

For the Health Care FSA, if you have a positive balance, you may be eligible to continue participation through COBRA on an after-tax basis. You will receive information in your COBRA election notice.

Commuting to work each day can be expensive, so we work with Commuter Benefits to help you save money on your commuting costs.

Does

A commuter account allows you to set aside pre-tax dollars for mass transit and parking expenses associated with your daily commute to work. There are two types of commuter accounts: mass transit and parking. You have the option to enroll in one or both accounts. You choose a monthly election amount, up to $325 for mass transit expenses and $325 for parking expenses. The money is placed in your account via payroll deduction and then used to pay for eligible commuting expenses.

Why should I enroll in a commuter account?

If you take public transportation to work or pay for parking, you’ll want to take advantage of the savings these plans offer. Money contributed to a commuter account is free from federal and state taxes and remains tax-free when it is spent on eligible expenses. On average, participants enjoy a 30% tax savings on their annual contribution. This means you could be saving up to $1,000 per year on commuter expenses!

Qualifying expenses

Commuter funds can cover costs for:

• Bus, ferry, train, subway tickets and passes

• Vanpool fees when there are six or more adult passengers

• Parking expenses, including parking at or near your place of work or at the location from which you take mass transit to get to work

Non-qualifying expenses

Commuter qualifying expenses do not cover expenses such as bridge tolls, mileage, or fuel. For details of non-qualifying expenses, contact commuter benefits customer service at 888.235.9223

Monday – Friday, 8am – 8pm EST.

Company Information

Company Information: Sequoia Living, Inc

Company ID: 9788

Cut Off date: 10th of the month

Helpful hints

• Send an email to Payroll@sequoialiving.org or call 415-351-3609 to request enrollment into the program.

• You must have funds in your commuter account before you can spend them.

• You can change your election amount or terminate plan participation at any time. Changes requested by the 10th of the month will be effective the first of the following month.

• Save your receipts when you spend your commuter account dollars. You may need itemized invoices to verify the eligibility of expenses.

• The easiest way to manage your account is online at myaccount.edenredbenefits.com Any unused funds that remain in your account at the end of the year will be carried over into the next plan year, if you continue to participate in the plan.

• To see how much you could save, check out our savings calculator at: edenredbenefits.com/foremployees/#employee-calculator

Sequoia Living provides Basic Term Life and Accidental Death & Dismemberment (AD&D) coverage to you at no cost through Reliance Standard.

Note: The cost of any coverage exceeding $50,000 is considered “imputed income” by the IRS. Imputed income will be reported on your W-2 form as part of your taxable income. If you wish to avoid imputed income, you may waive coverage over $50,000.

In addition to the basic coverage, you can purchase additional Life and Accidental Death & Dismemberment (AD&D) under Sequoia Living group policy through Reliance Standard. If you elect Voluntary Life Insurance for yourself, you can elect Voluntary Life Insurance for your spouse/domestic partner and/or child(ren).

$10,000 increments up to $500,000 maximum.

*Guarantee Issue Amount is $100,000.

$5,000 increments not to exceed 50% of employee amount, or $250,000 maximum.

*Guarantee Issue Amount is $25,000.

Birth to age 20 (26 if full time student): $5,000 increments, not to exceed $10,000.

*Guarantee Issue Amount is $10,000.

Important Note: This benefit will be funded by the employee with post-tax dollars to generate a nontaxable benefit.

Guarantee Issue Amount: If you elect Voluntary Life Insurance in excess of the guarantee issue amount, satisfactory evidence of insurability must be approved by Reliance Standard. If you do not elect Voluntary Life insurance when it is first made available to you and elect to add the coverage at another time, the entire amount elected will require satisfactory evidence of insurability.

Voluntary Life and AD&D Monthly Rates

To calculate monthly cost of coverage, use this formula

All employees over age 18 may voluntarily participate in the 403(b) program. Ascensus is Sequoia Living’s 403(b) plan administrator. You can build your own retirement account using pre-tax dollars through payroll, which also lessens your taxable income each year. You may invest your contributions in a diverse selection of investment options. You have access to Merrill Lynch Financial Investment Advisors at no cost to you. See summary plan description for details. You can enroll in or access your account at secure.ascensus.com Current employees who have a previous TSA plan with Equitable (formerly AXA) or Symetra may transfer their funds to the current 403(b) plan with Ascensus. Contact Human Resources for details.

After working for one year and 1,000 hours, Sequoia Living makes a discretionary contribution of 4% of your eligible earnings to your account in the 403(b) (Defined Contribution Plan). You do not have to contribute to the 403(b) (Defined Contribution Plan) to receive this contribution, although you are highly encouraged to do so. Employer contributions are vested after three years of service. For details, see the 403(b) Summary Plan Description

Employees who desire residence in a Sequoia Living Continuing Care Retirement Community may apply a credit of $500 for each year of service towards the entrance fee. Any current or former employees who meet the service plus age and admission requirements associated with any prospective resident application may contact the Chief People Officer for additional information.

On April 1, 2022, the Pension Plan (Defined Benefit Plan) was frozen to new entrants and accruals. If you were hired after March 1, 2021, you will not participate in the Pension Plan (Defined Benefit Plan) at all. If you are currently a participant in the Pension Plan (Defined Benefit Plan), any compensation you earned and any service you performed for Sequoia Living, Inc. after March 31, 2022 will not count toward the amount of your benefit under the Pension Plan (Defined Benefit Plan).

With your employer benefits, you now have a place to turn for everything about your money – at no cost to you. Northstar takes a personalized approach to helping you with your finances.

Work 1-on-1 with a CERTIFIED FINANCIAL PLANNER via chat or video call to get advice on your financial priorities.

You’ll get a personalized, step-by-step action plan that balances your expenses with your short- and longterm goals.

Create a realistic budget based on your income, expenses, and goals, plus work toward savings goals, retirement, and more.

Learn which employer benefits are relevant to you and your goals, plus get help choosing different types of insurance, perks, and more.

Learn how to adjust your financial plan whether you’re a new graduate, new to a job, buying a home, starting a family, retiring, and more.

Topics you can talk to Northstar about

• Paying off debt

• Saving for retirement

• Selecting your benefits

• Financially supporting family members

• Paying for education

• Saving for buying

• Understanding taxes

• Making insurance decisions

• Managing windfalls

• Investment advice

• Family planning

• Paying for Medicare

• And more

Sometimes balancing work and family creates issues that are hard to handle on your own. Sometimes you just need help with the logistics of a busy life. Or maybe all you need is a trustworthy referral. Whatever issue you might face – job stress, family life, childcare, school issues, and even pet care – the Life Assistance Program offers free, confidential assistance at no cost to you.

You, your spouse or domestic partner, dependents, parents and parents-in-law can use this program. Just call the toll-free phone number to speak to a counselor or set up a face-to-face assessment. Coverage includes up to eight sessions per person, per incident, each year.

Services include:

• Work and life matters

• Lifestyle and management

• Dependent care and care giving

• Education

• Legal and financial

More Information

For more information or to get help:

• Call (877) 240-6863

• Visit www.HealthAdvocate.com/sequoialiving Client Code: B7RXXWX

Benefit eligible employees earn PTO based on continuous length of service and can accrue up to two times the annual amount. (Vacation and Sick for union employees per Collective Bargaining Agreement).

Sequoia Living recognizes 8 paid holidays per year.

Eligible employees on an approved Leave of Absence for their own illness, injury, or Kin Care can utilize accrued Salary Continuation. In coordination with State Disability (SDI) or temporary disability benefits, they will receive a percentage of their pay, not exceeding 100% of their regular salary, for a maximum of 180 days.

Part-time and Full-time employees will be granted up to five days off, 3 days paid time off and 2 days unpaid time off, upon request, in the event of a death within their immediate family.

Part-time and Full-time employees will be granted up to 5 paid days upon request, if a funeral occurs 500 or more miles from the employee’s residence. If employee is unable to travel to a funeral, the employee may request bereavement leave for 2 days paid and 3 days unpaid, upon request.

Casual employees will be granted up to 5 days of unpaid time off, upon request, in the event of a death within their immediate family.

Sequoia Living has a Scholarship Program sponsored by the Sequoia Living Foundation that provides you with an opportunity to improve your skills in current or future work-related areas. The program assists employees in pursuing specific, approved courses and educational programs. To be eligible, you must have one year of employment and may be reimbursed for a portion of tuition costs, enrollment fees, and costs for books for courses taken at a recognized educational institution.

Sequoia Living appreciates the important role you play in caring for and serving our residents and clients. We recognize outstanding service, significant contributions beyond normal job responsibilities, and significant years of service as well, as delivery and demonstration of the Sequoia Living Culture Values.

Sequoia Living has an Emergency Relief Fund to help Sequoia Living employees who have completed their Introductory Period and are experiencing a financial crisis (for example, a fire in your home). Grant applications are available through your Manager and are awarded by the Senior Services of Northern California (SSNC), supporting the Sequoia Living Foundation. As an employee, you may help your fellow employees by making contributions to The Emergency Relief Fund.

In most cases, you may only make changes to your benefits during Open Enrollment. However, if you have a “qualified life event,” you may make changes to certain benefits, as defined by the plan documents, related to that event.

Your marriage

Your divorce or legal separation

Birth, adoption or placement for adoption of an eligible child

Death of your spouse or covered child

A change in your children’s eligibility for benefits

Change in your or your spouse’s work status that affects benefits eligibility

Becoming eligible for Medicare or Medicaid during the year

A significant change in your or your spouse’s health coverage attributable to your spouse’s employment

Becoming eligible for domestic partner status in accordance with Sequoia Living’s Domestic Partner policy

The coverage change you make must be consistent with your qualifying event. You may be required to provide proof of the status change, such as a birth certificate or marriage license. To ensure enrollment, all forms must be submitted to the Human Resources Department within 30 days of the event.

The first of the month following notification date (Exception: Changes made due to the birth or adoption of a child are effective on the date of birth or adoption.)

Last day of the month (most plans) For specific details, see your Summary Plan Description (SPD).

Under certain circumstances, and at your expense, you and your enrolled dependents can choose to continue coverage under your health and welfare plans including the healthcare flexible spending account, beyond the time coverage would have ordinarily ended. You may elect continuation of coverage for yourself and your dependents if you lose coverage under the plan because of one of the following qualifying events:

• Termination (for reasons other than gross misconduct)

• Reduction in employment hours

• Retirement

In addition, continuation of coverage may be available to your eligible dependents in the event of:

• Your death

• You and your spouse divorce or legally separate

• A covered child ceases to be an eligible dependent

If you experience a COBRA qualifying event, you will receive a COBRA election notice from our COBRA administrator with information regarding your cost and instructions on how to apply for COBRA continuation.

If you and your spouse legally separate or divorce or your covered child ceases to be an eligible dependent, you must notify Sequoia Living within 60 days of the event.

Please read this notice carefully and keep it where you can find it. This notice has information about your current prescription drug coverage with Sequoia Living and about your options under Medicare’s prescription drug coverage. This information can help you decide whether or not you want to join a Medicare drug plan. If you are considering joining, you should compare your current coverage, including which drugs are covered at what cost, with the coverage and costs of the plans offering Medicare prescription drug coverage in your area. Information about where you can get help to make decisions about your prescription drug coverage is at the end of this notice.

There are two important things you need to know about your current coverage and Medicare’s prescription drug coverage:

1. Medicare prescription drug coverage became available in 2006 to everyone with Medicare. You can get this coverage if you join a Medicare Prescription Drug Plan or join a Medicare Advantage Plan (like an HMO or PPO) that offers prescription drug coverage. All Medicare drug plans provide at least a standard level of coverage set by Medicare. Some plans may also offer more coverage for a higher monthly premium.

2. Sequoia Living has determined that the prescription drug coverage offered by the Sequoia Living Health and Welfare Plan is, on average for all plan participants, expected to pay out as much as standard Medicare prescription drug coverage pays and is therefore considered Creditable Coverage. Because your existing coverage is Creditable Coverage, you can keep this coverage and not pay a higher premium (a penalty) if you later decide to join a Medicare drug plan.

You can join a Medicare drug plan when you first become eligible for Medicare and each year from October 15th to December 7th.

However, if you lose your current creditable prescription drug coverage, through no fault of your own, you will also be eligible for a two (2) month Special Enrollment Period (SEP) to join a Medicare drug plan.

If you decide to join a Medicare drug plan, your current Sequoia Living coverage may be affected.

If you do decide to join a Medicare drug plan and drop your current Sequoia Living coverage, be aware that you and your dependents will not be able to get this coverage back until the plan’s next open enrollment period.

When Will You Pay A Higher Premium (Penalty) To Join A Medicare Drug Plan?

You should also know that if you drop or lose your current coverage with Sequoia Living and don’t join a Medicare drug plan within 63 continuous days after your current coverage ends, you may pay a higher premium (a penalty) to join a Medicare drug plan later.

If you go 63 continuous days or longer without creditable prescription drug coverage, your monthly premium may go up by at least 1% of the Medicare base beneficiary premium per month for every month that you did not have that coverage. For example, if you go nineteen months without creditable coverage, your premium may consistently be at least 19% higher than the Medicare base beneficiary premium. You may have to pay this higher premium (a penalty) as long as you have Medicare prescription drug coverage. In addition, you may have to wait until the following October to join.

For More Information About This Notice Or Your Current Prescription Drug Coverage…

Contact the number listed below for further information. NOTE: You’ll get this notice each year. You will also get it before the next period you can join a Medicare drug plan, and if this coverage through Sequoia Living changes. You also may request a copy of this notice at any time.

For More Information About Your Options Under Medicare Prescription Drug Coverage…

More detailed information about Medicare plans that offer prescription drug coverage is in the “Medicare & You” handbook. You’ll get a copy of the handbook in the mail every year from Medicare. You may also be contacted directly by Medicare drug plans.

For more information about Medicare prescription drug coverage:

• Visit www.medicare.gov

• Call your State Health Insurance Assistance Program (see the inside back cover of your copy of the “Medicare & You” handbook for their telephone number) for personalized help

• Call 1-800-MEDICARE (1-800-633-4227). TTY users should call 1-877-486-2048.

If you have limited income and resources, extra help paying for Medicare prescription drug coverage is available. For information about this extra help, visit Social Security on the web at www.socialsecurity.gov, or call them at 1-800-772-1213 (TTY 1-800-325-0778).

Remember: Keep this Creditable Coverage notice. If you decide to join one of the Medicare drug plans, you may be required to provide a copy of this notice when you join to show whether or not you have maintained creditable coverage and, therefore, whether or not you are required to pay a higher premium (a penalty).

For more information, contact the HR Department.

Premium Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP)

If you or your children are eligible for Medicaid or CHIP and you’re eligible for health coverage from your employer, your state may have a premium assistance program that can help pay for coverage, using funds from their Medicaid or CHIP programs. If you or your children aren’t eligible for Medicaid or CHIP, you won’t be eligible for these premium assistance programs, but you may be able to buy individual insurance coverage through the Health Insurance Marketplace. For more information, visit www.healthcare.gov

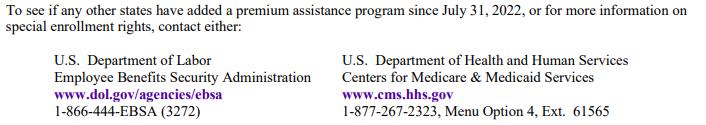

If you or your dependents are already enrolled in Medicaid or CHIP and you live in a State listed below, contact your State Medicaid or CHIP office to find out if premium assistance is available.

If you or your dependents are NOT currently enrolled in Medicaid or CHIP, and you think you or any of your dependents might be eligible for either of these programs, contact your State Medicaid or CHIP office or dial 1-877-KIDS NOW or www.insurekidsnow.gov to find out how to apply. If you qualify, ask your state if it has a program that might help you pay the premiums for an employersponsored plan.

If you or your dependents are eligible for premium assistance under Medicaid or CHIP, as well as eligible under your employer plan, your employer must allow you to enroll in your employer plan if you aren’t already enrolled. This is called a “special enrollment” opportunity, and you must request coverage within 60 days of being determined eligible for premium assistance. If you have questions about enrolling in your employer plan, contact the Department of Labor at www.askebsa.dol.gov or call 1-866-444-EBSA (3272).

If you live in one of the following states, you may be eligible for assistance paying your employer health plan premiums. The following list of states is current as of January 31, 2022. Contact your State for more information on eligibility –

Website: http://myalhipp.com/ Phone: 1-855-692-5447

The AK Health Insurance Premium Payment Program

Website: http://myakhipp.com/ Phone: 1-866-251-4861

Email: CustomerService@MyAKHIPP.com

Medicaid Eligibility: https://health.alaska.gov/dpa/Pages/default.aspx

Website: Health Insurance Premium Payment (HIPP) Program

http://dhcs.ca.gov/hipp Phone: 916-445-8322

Fax: 916-440-5676

Email: hipp@dhcs.ca.gov

Health First Colorado Website: https://www.healthfirstcolorado.com/

Health First Colorado Member Contact Center: 1-800-221-3943/ State Relay 711

(Colorado’s

CHP+: https://www.colorado.gov/pacific/hcpf/childhealth- plan-plus

CHP+ Customer Service: 1-800-359-1991/ State Relay 711

Health Insurance Buy-In Program (HIBI): https://www.colorado.gov/pacific/hcpf/health-insurancebuy-program

HIBI Customer Service: 1-855-692-6442 ARKANSAS-Medicaid

Website: http://myarhipp.com/ Phone: 1-855-MyARHIPP (855-692-7447)

Website: https://www.flmedicaidtplrecovery.com/flmedicaidtplrecove ry.com/hipp/index.html

Phone: 1-877-357-3268

GA HIPP Website: https://medicaid.georgia.gov/healthinsurance-premium-payment-program-hipp Phone: 678-564-1162, Press 1

GA CHIPRA Website: https://medicaid.georgia.gov/programs/thirdparty- liability/childrens-health-insuranceprogram- reauthorization-act-2009-chipra Phone: (678) 564-1162, Press 2

Healthy Indiana Plan for low-income adults 19-64

Website: http://www.in.gov/fssa/hip/ Phone: 1-877-438-4479

All other Medicaid Website: https://www.in.gov/medicaid/ Phone 1-800-457-4584

Medicaid Website:

https://dhs.iowa.gov/ime/members

Medicaid Phone: 1-800-338-8366

Hawki Website: http://dhs.iowa.gov/Hawki

Hawki Phone: 1-800-257-8563

HIPP Website:

https://dhs.iowa.gov/ime/members/medicaid-a-toz/hipp HIPP Phone: 1-888-346-9562

Website: https://www.kancare.ks.gov/ Phone: 1-800-792-4884

Kentucky Integrated Health Insurance Premium Payment Program (KI-HIPP) Website: https://chfs.ky.gov/agencies/dms/member/Pages/kihipp.aspx

Phone: 1-855-459-6328

Email: KIHIPP.PROGRAM@ky.gov

KCHIP Website: https://kidshealth.ky.gov/Pages/ index.aspx Phone: 1-877-524-4718

Kentucky Medicaid Website: https://chfs.ky.gov

Website: www.medicaid.la.gov or www.ldh.la.gov/lahipp

Phone: 1-888-342-6207 (Medicaid hotline) or 1-855-618-5488 (LaHIPP)

Website: https://www.mass.gov/masshealth/pa Phone: 1-800-862-4840

TTY: (617) 886-8102

Website: https://mn.gov/dhs/people-we-serve/children-andfamilies/health-care/health-care-programs/programsand- services/other-insurance.jsp Phone: 1-800-657-3739

Website: http://www.dss.mo.gov/mhd/participants/pages/hipp.htm Phone: 573-751-2005

Website: http://dphhs.mt.gov/MontanaHealthcarePrograms/HIP P Phone: 1-800-694-3084

Email: HHSHIPPProgram@mt.gov

Website: http://www.ACCESSNebraska.ne.gov Phone: 1-855-632-7633 Lincoln: 402-473-7000 Omaha: 402-595-1178

Medicaid Website: http://dhcfp.nv.gov

Medicaid Phone: 1-800-992-0900

Enrollment Website:

https://www.maine.gov/dhhs/ofi/applicationsforms Phone: 1-800-442-6003

TTY: Maine relay 711

Private Health Insurance Premium Webpage: https://www.maine.gov/dhhs/ofi/applicationsforms Phone: -800-977-6740. TTY: Maine relay 711

Medicaid Website: http://www.state.nj.us/humanservices/ dmahs/clients/medicaid/ Medicaid Phone: 609-631-2392

CHIP Website: http://www.njfamilycare.org/index.html CHIP Phone: 1-800-701-0710

Website: https://www.dhhs.nh.gov/programsservices/medicaid/health-insurance-premium-program Phone: 603-271-5218

Toll free number for the HIPP program: 1-800-852-3345, ext 5218

Website: http://dss.sd.gov Phone: 1-888-828-0059

NEW YORK-Medicaid TEXAS-Medicaid

Website: https://www.health.ny.gov/health_care/medicaid/ Phone: 1-800-541-2831

NORTH CAROLINA-Medicaid

Website: https://medicaid.ncdhhs.gov/ Phone: 919-855-4100

NORTH DAKOTA-Medicaid

Website: http://www.nd.gov/dhs/services/medicalserv/medicai d/ Phone: 1-844-854-4825

OKLAHOMA-Medicaid and CHIP

Website: http://www.insureoklahoma.org

Phone: 1-888-365-3742

OREGON-Medicaid

Website: http://healthcare.oregon.gov/Pages/index.aspx http://www.oregonhealthcare.gov/index-es.html

Phone: 1-800-699-9075

PENNSYLVANIA-Medicaid

Website: https://www.dhs.pa.gov/Services/Assistance/Pages/HIPP - Program.aspx

Phone: 1-800-692-7462

Website: https://www.hhs.texas.gov/ser vices/health/medicaidchip/medicaid-chipmembers/chip Phone: 1-800-440-0493

UTAH-Medicaid and CHIP

Medicaid Website: https://medicaid.utah.gov/ CHIP Website: http://health.utah.gov/chip Phone: 1-877-543-7669

VERMONT-Medicaid

Website: http://www.greenmountaincare.org/ Phone: 1-800-250-8427

VIRGINIA-Medicaid and CHIP

Website: https://www.coverva.org/en/famis-select https://www.coverva.org/en/hipp

Medicaid Phone: 1-800-432-5924

CHIP Phone: 1-800-432-5924

WASHINGTON-Medicaid

Website: https://www.hca.wa.gov/ Phone: 1-800-562-3022

WEST VIRGINIA-Medicaid and CHIP

Website: https://dhhr.wv.gov/b ms/

http://mywvhipp.com/

Medicaid Phone: 304-558-1700

CHIP Toll-free phone: 1-855-MyWVHIPP (1-855-699-8447)

Website: http://www.eohhs.ri.gov/ Phone: 1-855-697-4347, or 401-462-0311 (Direct RIte Share Line)

Website: https://www.dhs.wisconsin.gov/badgercareplus/index.htm

Phone: 1-800-362-3002

Website: https://www.scdhhs.gov Phone: 1-888-549-0820

Website: https://health.wyo.gov/healthcarefin/medicaid/programsand- eligibility/ Phone: 1-800-251-1269

Women's Health and Cancer Rights Act (WHCRA)

If you have had or are going to have a mastectomy, you may be entitled to certain benefits under the Women’s Health and Cancer Rights Act of 1998 (WHCRA). For individuals receiving mastectomy-related benefits, coverage will be provided in a manner determined in consultation with the attending physician and patient, for:

• Reconstruction of the breast on which the mastectomy has been performed;

• Surgery and reconstruction of the other breast to produce a symmetrical appearance; and

• Prostheses and physical complications for all stages of a mastectomy, including Lymphedemas (swelling associated with the removal of lymph nodes).

These benefits may be subject to annual deductibles and coinsurance provisions that are appropriate and consistent with other benefits under your plan or coverage. If you would like more information on WHCRA benefits, contact the HR Department.

If you are declining enrollment for yourself or your dependents (including your spouse) because of other health insurance coverage or group health plan coverage, you may be able to enroll yourself and your dependents in this plan if you or your dependents lose eligibility for that other coverage (or if the employer stops contributing toward your or your dependents’ other coverage). However, you must request enrollment within 30 days after your or your dependents’ other coverage ends (or after the employer stops contributing toward the other coverage)

In addition, if you have a new dependent as a result of marriage, birth, adoption, or placement for adoption, you may be able to enroll yourself and your dependents However, you must request enrollment within 30 days after the marriage, birth, adoption, or placement for adoption

To request special enrollment or obtain more information, contact the HR Department.

If a qualifying benefit option under a group health plan maintained by the employer generally requires or allows the designation of a primary care provider, the covered individual has the right to designate any primary care provider who participates in the Plan’s network and who is available to accept the covered individual. Until the covered individual makes this designation, the Plan may designate a primary care provider for him or her For children, the covered employee or spouse may designate a pediatrician as the primary care provider For information on how to select a primary care provider, and for a list of the participating primary care providers, contact the HR Department.

For any qualifying benefit option, covered individuals do not need prior authorization from the group health plan or from any other person (including a primary care provider) in order to obtain access to obstetrical or gynecological care from a health care professional in the Plan’s network who specializes in obstetrics or gynecology The health care professional, however, may be required to comply with certain procedures, including obtaining prior authorization for certain services, following a pre-approved treatment plan, or procedures for making referrals For a list of participating health care professionals who specialize in obstetrics or gynecology, contact the HR Department

The information contained in this document is proprietary and confidential to Sequoia Living.

No part of this document may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying and recording, for any purposes without the express written permission of Sequoia Living.

This document is subject to change without notice. Sequoia Living does not warrant that the material contained in this document is error - free. If you find any problems with this document, please report them to Sequoia Living Human Resources, in writing.

Sequoia Living reserves the right to terminate, suspend, withdraw, or modify the benefits described in this document, in whole or in part, at any time. No statement in this or any other document, and no oral representation, should be construed as a waiver of this right.

This is not a legal document. Please refer to the summary plan descriptions for detailed information. This document is not intended to cover every option detail. Complete details are in the legal documents, contracts, and administrative policies that govern benefit operation and administration.

If there should ever be any differences between the summaries in this handbook and these legal documents, contract, policies, the documents contracts and policies will be the final authority.