LOST AND FOUND

HOW CHECK-LISTING STOP-LOSS POLICIES HELP MANAGE RISK

Accident

& Health InsuranceWe’ll focus on risk, so you can take care of

HOW CHECK-LISTING STOP-LOSS POLICIES HELP MANAGE RISK

Accident

& Health InsuranceWe’ll focus on risk, so you can take care of

Self-insuring your healthcare benefits can open up new possibilities for your business — affording you greater flexibility in how you manage your healthcare spend. Trust the expert team at QBE to tailor a solution that meets your unique needs.

We offer a range of products for protecting your team and assets:

• Medical Stop Loss

• Captive Medical Stop Loss

• Organ Transplant

• Special Risk Accident

We’ll find the right answers together, so no matter what happens next, you can stay focused on your future.

By Caroline McDonald

By Caroline McDonald

Written By Bruce Shutan

Written By Bruce Shutan

TThere are plenty of do’s and don’ts involved in stop-loss insurance in order to make it as efficient as possible. Whatever steps are followed, there’s no shortage of basic and creative recommendations alike that can be made to achieve the best possible results.

The top priority for any stop-loss contract is that there has to be builtin transparency over the price of care, according to Michael Meloch, president of TPAC Underwriters, Inc.

Although not easily attainable, he believes it’s headed in the right direction thanks in large part to the No Surprises Act and transparency-in-coverage rules. If true transparency came to the marketplace, he believes medical costs would plummet by 30%. “The average bill that gets sent off from a provider is 500% of Medicare,” he laments.

As part of that equation, it’s also critical to know how much all of the entities involved are earning from rebates that should be going to the employer or employees. “Are you charging me a percentage of savings? Are you charging me a PEPM? Are you charging me a percentage of the premium? What are you making off of our plan, Mr. Broker, Mr. Underwriter or Mr. Whoever?” Meloch asks, adding that “there are so many hands in this health care pie. It’s just ridiculous.”

Third-party administrators play a critical gatekeeping role in helping slice up reasonable coverage for self-insured employers. Adam Russo, Esq., CEO of the Phia Group, LLC, says that first and foremost TPAs need to work with preferred stoploss carriers so that they can offer better pricing and actually get claim reimbursements for their selfinsured clients.

He also believes that even if they’re not the ones bringing in the carrier, they should proactively make available a disclaimer document that establishes complete transparency and helps manage expectations.

That effort, for instance, could caution health plan sponsors against expecting reimbursement from a certain carrier based on the result of a third-party claim review. It also would hold the TPA harmless if the carrier in question was chosen and that was indeed the outcome.

“All employers and brokers need to do is actually know what their risk is before they sign the contract,” he explains. “If they did that, TPAs wouldn’t be losing employers due to stop-loss issues. Bottom line is if you tell people ahead of time, ‘if these types of things happen, you’re not going to be reimbursed with that policy,’ and if the group says they’ll still do it, then they can’t get mad at you six months later when they’re not reimbursed. It’s all about the right partnership, total transparency and getting that loyalty back between the TPAs and the stop-loss community.”

The reason Russo is so passionate about employing simple stop-loss checks and balances is that the scenario he describes is one of the top reasons a self-funded group goes back to being fully insured or an administrative-services-only firm wherein none of these conflicts ever arise.

If those employers make a claim, then he says it gets reimbursed in the ASO environment. “But we have more bad policy language out there now than I’ve ever seen in my 20-plus years in the industry,” he observes. “It’s not even close.

“Their definition of experimental and investigational, or a hazardous activities exclusion, might be very different than yours,” Russo continues. “Also, don’t just believe it when you hear plan mirroring. I have seen claims not reimbursed by stoploss carriers even when there is so-called mirroring by them stating the plan didn’t follow the terms of its own plan document and instead the plan followed the network contract. That’s why you have to read the stop-loss policy to see what the actual definitions say and then get real world examples. The biggest issue is probably discretionary authority. There’s language in policies that grant the stop-loss carrier the right to interpret the terms of the plan document independent of the plan administrator’s actual interpretation.”

It’s important to engage the services of a benefits broker who’s knowledgeable about the stop-loss space, can collaborate with the carrier’s underwriting team and make recommendations, notes Andrea McNamara, SVP of technical underwriting for QBE North America.

From locally-focused to national-scale programs, AmeriHealth Administrators offers a full spectrum of third-party administration and business process outsourcing services. Our scalable capabilities service many unique customers, including self-funded employers, Tribal nations, international travelers, and labor organizations.

We offer innovative solutions, insight, and expertise to help you manage your health plan and capabilities, control costs, and support employees’ health.

Visit amerihealth.com/tpa

But a key industry trend is complicating matters. With some experts across the brokerage and consulting community retiring and newer producers not being as familiar with the benefits of unbundling services for selffunded plans, she says losing institutional memory can be daunting.

The fact is that broker partners need to know the stop-loss claims team’s reputation, turnaround time, accuracy of their claim payments and ability to help with cost-containment negotiations, McNamara explains.

Regarding this last point, some carriers are poised to go that extra mile.

“We have a dedicated cost-containment specialist who works out of our claims department,” she reports, as well as a risk management team of registered nurses –most of whom are certified case managers.

Mindful that there could be claims payable under the plan document that aren’t covered under the stop-loss contract, which has narrower language, it’s always good to ensure that the two documents mirror one another, opines Scotty Campbell, senior vice president with Stealth Partner Group, an Amwins Company.

“I think it should be pretty cut and dried that either the claims is payable by the plan or it’s not,” he says. “And if you don’t think it is, then it’s up to the TPA to prove it to us. I like shifting the responsibility to the TPA because you’re paying them to administer this.”

The most common causes of this disconnect include haggling over the definition of experimental medical procedures and medical necessity, as well as usual, customary or reasonable charges.

With the devil lurking in those detail, Campbell cautions that selfinsured plan sponsors can be left holding the bag with hundreds of thousands, if not millions, of dollars owed on claims. Moreover, he notes that lasering high-cost claims can widen any gap between the plan document and stop-loss contract, which also raises a philosophical debate about the merit of this approach.

Rather than laser out these claims, his recommendation is to carve out big-ticket items across the entire continuum of care, which also will avoid arbitrary decision making. “I always want no new lasers with the renewal rate cap whenever I can get it just because there are so many expensive ongoing maintenance medications out there,” Campbell explains.

“If you’re to 300 employee group humming along for a decade spending $3 million a year on health care, then somebody pops up who’s on a million dollar a year orphan drug,” he continues, “that can literally bankrupt your company.”

But that’s not to say there’s no value in lasers, he hastens to add, describing them as “an effective risk-management tool.” With only 20% of covered lives ever even hitting the laser amount – usually because of cancer treatments or transplants – Campbell believes there

are times when it’s worth rolling the dice. “If you take your 50% rate increase, we 100% know you’re going to pay that money no matter what,” he says, “but if we have a laser, you only pay the claim if it happens, and if you do, 100 pennies on the dollar go to pay that claim, whereas if you pay $1 premium, only 75 cents out of $1 goes to pay claims the other 25% is overhead. So I’d rather have the employer keep the money.”

Prudence and good stewardship invariably will be tethered to plan design. For example, a plan that’s steering health plan members toward higher costs will serve as an impediment. “Mayo Clinic is great if I have acute lymphoblastic leukemia, and I’m in Minneapolis,” Meloch says, “but is it the best option if I need knee replacement?” Better choices may involve the Surgery Center of Oklahoma, which made its mark in 1997 as a transparent-priced center of excellence, a facility in the Cayman Islands or elsewhere, he notes.

Another suggestion Campbell makes is having 12 months of a tail for contract periods before or after unscheduled surgeries for an added layer of protection against a worst-case scenario. The underlying plan document 99% of time will allow providers to submit a claim 12 months from the date of service, he says, noting how it’s a standard practice in network agreements that the BUCAHs ink with various facilities. Without a 12-month tail and stop-loss protection, he says there are usually facility claims that are complex and have a big price tag that leaves the client exposed.

The issue recently arose with BlueCross BlueShield of Western

Skyrocketing prices. Administrative challenges. Shock claims. Aging workforces. At Amwins Group Benefits, we’re here to answer the call. We provide solutions to help your clients manage costs and take care of their people. So whether you need a partner for the day-to-day or a problem solver for the complex, our goal is simple: whenever you think of group benefits, you think of us.

We help you win.

The benefits landscape is broad and complex.

New York, which he says served as both the TPA and network for a 100-employee municipality client in rural upstate New York. “They administered this $2 million claim for a hemophiliac baby and auto adjudicated it down to $58,000, then the provider, which does a twice-year audit, realized the problem, submitted it to BlueCross Blue Shield, and they agreed it should be $1.2 million,” he reports.

But by the time that happened, it fell outside the stop-loss contract and was payable on the plan document according to the network agreement that the client signed when they rented

that network. Without the stop loss, he says the city faced bankrupt. While acknowledging the need for technology, Campbell stresses the importance of having a human review and red-flag any questionable high-cost claims.

The way the marketplace is structured raises a larger issue about the degree to which bundled vs. boutique services are the best approach. Bundled service providers whose clear advantage is scale are good if they care about how much it costs the employer and employees, Meloch points out. But he believes those organizations are nearly extinct and the model has become a monopoly as prices continue to rise.

“There’s one large carrier in the South that has $4 billion dollars with a ‘B’ of unallocated surplus,” he says. “That’s not going to premium. That’s not going toward reserves. That’s not going toward anything. Where did that come from? Premiums from employees and employers. These entities have become so large and control a majority of the marketplace that they’re just accumulating premium. At least organizations that are for-profit pay taxes. If I ran a not-for-profit HMO, could I actually make more money? It’s very possible.”

Increased use of specialty drugs, along with cell and gene therapies, to treat the growing number of chronic conditions, comorbidity factors and rare diseases in the U.S. makes due diligence on stop-loss insurance more important than ever before.

Cell and gene therapies are expected to double in the next two years and triple in the next three years after that. In QBE’s 2022 A&H Market Report, the insurer estimates that more than one million people will receive such treatment by the end of 2034.

“The number of drug therapies that cost over $1 million annually is exploding,” McNamara reports, noting how a large segment of the U.S. population is on maintenance drugs for serious chronic illness that are permeating society. Indeed, a recent report by Sun Life found that million-dollar claims per million covered employees rose 15% in the past year and as much as 45% between 2019 and 2022.

Given this backdrop, it’s inconceivable that any self-insured employer would roll the dice by forgoing stop loss, though some large organizations have done so in the past. “When you tally up all your dependent lives, that’s a lot of hooks in the water for cell and gene therapies, and going bare is not a good idea,” she says, cautioning against the prospect of taking on an unlimited risk just to save on the stop-loss premium. As a result, she notes that more large self-insured

employers that have traditionally gone bare are now electing to purchase stop loss to mitigate against the increased severity of these kinds of risks.

A knowledgeable broker would help educate their client to explain that a stop-loss policy is designed to pay for projected claims that are simply unknown. Noting that it’s a small price to pay for peace of mind, McNamara says “that’s what you’re paying them for.”

Bruce Shutan is a Portland, Oregon-based freelance writer who has closely covered the employee benefits industry for more than 30 years.

“You have become a key partner in our company’s attempt to fix what’s broken in our healthcare system.”

- CFO, Commercial Construction Company

“Our clients have grown accustomed to Berkley’s high level of customer service.”

- Broker

“The most significant advancement regarding true cost containment we’ve seen in years.”

- President, Group Captive Member Company

“EmCap has allowed us to take far more control of our health insurance costs than can be done in the fully insured market.”

- President, Group Captive Member Company

“With EmCap, our company has been able to control pricing volatility that we would have faced with traditional Stop Loss.”

- HR Executive, Group Captive Member Company

People are talking about Medical Stop Loss Group Captive solutions from Berkley Accident and Health. Our innovative EmCap® program can help employers with self-funded employee health plans to enjoy greater transparency, control, and stability.

Let’s discuss how we can help your clients reach their goals.

This example is illustrative only and not indicative of actual past or future results. Stop Loss is underwritten by Berkley Life and Health Insurance Company, a member company of W. R. Berkley Corporation and rated A+ (Superior) by A.M. Best, and involves the formation of a group captive insurance program that involves other employers and requires other legal entities. Berkley and its affiliates do not provide tax, legal, or regulatory advice concerning EmCap. You should seek appropriate tax, legal, regulatory, or other counsel regarding the EmCap program, including, but not limited to, counsel in the areas of ERISA, multiple employer welfare arrangements (MEWAs), taxation, and captives. EmCap is not available to all employers or in all states.

Directors & Officers (D&0) insurance is designed to protect the personal assets of company executives and board members from lawsuits for mismanagement and other breaches of responsibility. But it can be very difficult to obtain sufficient coverage in the commercial market and, until recently, very expensive.

If a publicly traded firm needed financial protection for its directors and officers, options were limited to a moderate number of commercial insurance carriers.

More carriers entering the D&O market has caused rates to begin dropping, falling by as much as 14 percent for publicly traded companies in 2022, according to Marsh in its recent Global Insurance Market Index report. This while insurance pricing overall went up 3 percent in the fourth quarter of 2022 and 4 percent in the first quarter of 2023, Marsh said.

Even with lower D&O insurance costs, “We’re still seeing those companies that struggle,” said Donna Weber, senior vice president, Marsh Captive Solutions. “They are having trouble with the cost, getting the limits they want, or even getting coverage at all. Some industries find it prohibitively expensive.” In addition, rates are determined by the insurer – and the market can harden at any time.

Sectors that are struggling include pharmaceutical, cannabis, crypto, aviation and renewable energy. “Industries that are more challenged in the D&O world,” she said.

Side A, the most expensive and hard-to-place coverage, insures a company’s directors and officers when the company cannot reimburse them.

Side B reimburses the company after it has compensated a director or officer.

Side C supplies coverage for the business when it and its directors and officers are named in a securities lawsuit.

Most challenging is coverage for Side A. “It’s an issue of wanting to be able to attract qualified directors,” explained Steve Kinion, captive director at the Oklahoma Insurance Department’s Captive Insurance Division and previously director at the Bureau of Captive and Financial Insurance Products with the Delaware Insurance Department.

While Sides B and C have been insured in the captive market for years, he said, Side A has been more difficult. “Side A is primarily when the shareholders sue, and the corporation is bankrupt,” Kinion said.

All that changed on Feb. 7, 2022, when Delaware amended its corporate law, to allow a company to form a captive insurance company for Side A insurance purposes.

Stephen Taylor, director of the Delaware Captive Insurance Bureau, noted that the Delaware Captive Department is currently “developing guidelines to assist captive managers and applicants with the licensing of captive insurers issuing Side A D&O policies to Delaware corporations.” He added, “We are collaborating with the Delaware Captive Insurance Association in the development of the guidelines.”

Similar legislation will be introduced in the domicile of Oklahoma in 2024, Kinion said. The new law clarifies how companies can use captives for Side A D&O coverage.

Like Delaware’s law, Kinion said, Oklahoma will also prohibit the corporation from indemnifying the officers and directors in the context of shareholder suits, or when the corporation is bankrupt and doesn’t have the funds to indemnify.

“That’s where a third-party insurance company becomes valuable for the officers and directors,” he said. “Because then they can look to that company to pay, for instance, their legal fees in a lawsuit where they are being sued.”

If they are in a state that doesn’t allow that, they must purchase insurance. “In Delaware, the law changed in 2022, stating that the insurance can be purchased from a captive insurance company. That is the difference,” he said.

Weber noted that Delaware’s legislation removed some jurisdictional concerns for writing Side A D&O cover that had previously existed. She said that while captives may not be able to provide the exact coverage as the commercial market, “captives or cells provide another option for companies struggling to purchase coverage.”

As a result, “We are seeing those companies looking into using a captive or a cell facility,” Weber said.

Michael Serricchio, managing director at Marsh Captive Solutions noted, “Captives are obviously a great option.”

Because of this option, “If your D&O is unavailable, you can now do it in a better, more refined, legally governed way in a cell captive,” he said. “By virtue of the fact that we have a decent number of these captives, it has been attractive to companies.”

Since the Delaware corporate law change, with the captive or cell option becoming more feasible, “We currently have 10 cells writing Side A coverage,” Weber said.

There is also added flexibility, as organizations have the option to use their captive for D&O, or “They might buy their primary limit in the commercial market and put some excess either in a captive or a cell captive,” Weber said.

Speaking about the D&O insurance market, Taylor said, “While there is still a soft market, there could be some hardening of the market in the near future, with possible increasing risks to the D&O market in a number of areas.” These include, “rising volume and severity of claims; proposed Securities and Exchange Commission rules on Environmental, Social and Governance (ESG) disclosures; and the challenging economic environment.”

Kinion noted that captives that are being used for Side A are primarily cell captives, “and the cell structure is a good one to use for that purpose. I believe there will be a trend for this coverage, but how much will be up for debate.”

The reason, he said, is that the trend will be dictated by the direction the market takes. “If the D&O market is receptive to offering Side A at competitive prices, companies may feel they don’t need a captive for that.”

If the market hardens again, however, “and it becomes a question of being able to find reasonably priced coverage, and there are exclusions in the coverage, captives will be strongly considered,” he added.

While the insurer trend for D&O pricing appears to be going in a positive direction, “remember where we’re coming from,” Kinion cautioned. “Prices became high and now they’re coming down. So, while they are moderating, look at where they are moderating from.”

Marsh summed it up in its article: “The approved Delaware law is a significant step forward as it allows more companies to consider a wholly owned captive or a “cell” as a partial or complete solution for covering Side A D&O claims. Companies with very high insurance premiums or that are struggling to obtain sufficient capacity in the commercial market may be particularly interested.”

There have been several events that were instrumental in driving up D&O prices, said Steve Kinion, captive director at the Oklahoma Insurance Department’s Captive Insurance Division and previously director at the Bureau of Captive and Financial Insurance Products with the Delaware Insurance Department.

Among them, in 2019 “there was Wells Fargo, that was a $240 million settlement.” This was a fraud scandal when bank employees opened millions of bogus accounts in customers’ names to meet sales goals.

In May of 2023, Wells Fargo agreed to a class-action settlement of $1 billion for misleading investors on the progress of its internal cleanup of the 2019 fraud.

Another was Equifax, which agreed to a global settlement of up to $425 million for a data breach in 2017.

Yet another was Wynn Resorts in 2019, when Steve Wynn was accused of sexual harassment. Wynn Resorts was fined $20 million for failing to investigate sexual conduct claims.

And then there was Bluebell Creameries, which was linked to a number of people being sickened by listeria and three deaths in 2019. The company was ordered by a federal court to pay $17.25 million in criminal penalties.

“Those were all shareholder suits brought against the board, saying they should have been doing their job and overseeing operations,” Kinion explained.

He added, “As the court said to Bluebell, ‘All you do is make ice cream.’ Board members don’t have to be making the ice cream, but they should be aware of the procedures involved.”

Caroline McDonald is an awardwinning journalist who has reported on a wide variety of insurance topics. Her beat has included indepth coverage of risk management and captives.

With participation at the 2023 SIIA Corporate Growth Forum (CGF) exceeding last year’s inaugural event by nearly 25%, the recent CGF in Greenville, SC opened the doors for members to meet directly and pitch investment opportunities with some of the nation’s leading venture capital and private equity firms.

Presentations followed by one-on-one meetings positioned emerging companies serving the self-insurance industry as ripe for immediate and future investment, mergers and acquisitions and growth. With 15+ private equity, investment bankers and investor groups – and a waiting list of others – as well 16 privately-held SIIA companies attending the CGF, the marketplace reflects enthusiasm and active interest for meaningful options.

Is your payments solution delivering more to your bottom line?

Expect more with ECHO®

More connectivity.

More payment accuracy. More to your bottom line.

ECHO offers innovative payment solutions backed by 25+ years of experience you can count on. Learn how we can do more together by contacting us today.

echohealthinc.com

The concept for developing this event germinated several years ago when Mike Ferguson, CEO of SIIA sat down with Orlo “Spike” Dietrich, a longtime supporter of SIIA who joined Ansley Capital Group as an Operating Partner in 2005.

“I have always admired SIIA’S leadership role within the selffunded community and completely supported Mike Ferguson’s vision to align the SIIA member companies with the investor community in a way that is not threatening,” says Dietrich. “From the SIIA membership perspective, working with investors is a complex process, and from personal experience, I can tell you it is very easy to disadvantage yourself, if you have no relevant experience.

The purpose of the CGF is to both introduce the SIIA members to the investor community, and also to provide significant educational content that will serve the SIIA members well when their company begins to explore any type of transaction.”

He emphasizes that SIIA will also demonstrate value to investors since they are being asked to provide sponsorships that enable SIIA to produce this event and spend two and a half days assessing opportunities.

Another ongoing supporter of SIIA who credits the organization for being the basis of the company that he created 10 years ago, Richard Fleder, president and CEO of ELMCRx Solutions, LLC, praises SIIA for providing companies with the opportunity to meet people – whether or not they get an investment.

“I appreciate what SIIA has done for me and encourage member companies, especially those with point solutions, to attend and meet investors that are looking for potential targets to buy – today or tomorrow.” says Fleder. “Emerging companies should start investing in their futures by getting to know these PE and VC firms early on. They might be considered a bit small now

but that doesn’t mean they will be small tomorrow. It takes time, but this is a great place to start the conversation.”

Fleder says that despite high interest rates, deals are getting done, adding, “Every day, companies are being bought and sold and it’s not likely that rates will go down any time soon. Private equity has a lot of capacity or what we term ‘dry powder.’ The term is often used in terms of venture capitalists, where dry powder allows them to invest in opportunities as they arise.”

He is currently focusing on the Pharmacy Benefit Management space, looking for companies of all size, including small size point solutions companies that don’t get enough attention but have roll-up potential.

“This is the best place for us to meet these entities,” he says. “So when Mike Ferguson came to me a few years ago with the concept of organizing this event, I thought it was very relevant to what I’ve done. My appreciation for what SIIA has done for me was my desire to help Mike build up this conference.”

Given the positive feedback from all participants, Ferguson projects even greater support in the years ahead.

“We were pleased to grow attendance at this year’s event by more than 20% compared to last year. Going forward, we

are optimistic that even more members will want to participate as they better understand to value of the educational content being offered as well as the connection opportunities with important sources of capital.”

opened expanded networking opportunities. Schwartz remains fairly optimistic about the financial climate to not only support the emerging companies but to also achieve success in the broader macro environment.

“We support companies in this segment and look forward to helping them achieve long term growth objectives and as well as to raise capital,” says Schwartz. “Our role as a a growth equity investor is to partner with existing management teams, acting as an advisor to support those running day-to-day operations.”

While there are not hard and fast rules as to the size companies that they consider, they usually look at a $35-$40 equity investment.

“We love companies in their earlier stage of maturation and like to help them mature” he adds.

For Grant Jackson, managing general partner of Council Capital since 2009, this event supports their belief that the industry is shifting to self-insurance and there is a pressing need for employers to get more help in managing health costs.

Here’s some fresh perspectives from a return sponsor, Peter Schwartz, vice president, LLR Partners: “We are attending and sponsoring the SIIA CGF for the second year and think there is no better event to extend our relationships and gain exposure to management teams and founders of emerging companies in the employer-sponsored healthcare space. We perceive companies in the self-funded as very interesting opportunities for collaboration and investment.”

He says that generally, the exposure and conversations at the event aligned with his expectations and pointed to significantly increased attendance at the 2023 which

“We want to be in space,” he asserts. “Our goal is to find a hand full of companies that we feel meet the criteria now or in the next few years down the road. My definition of success is to invest in companies that were interested in this conference. We attend all the major SIIA conferences and need to be seen and know what matters to the companies in the industry.”

Jackson says that there are opportunities at this event for investment but hoped there were more companies attending and presenting. He perceives the financial climate to be supportive of these opportunities, adding, “As power shifts toward shorter sales cycles, this will have a positive impact on the market. We are seeking companies with $10-100M enterprise value and are focusing on this self-insured marketplace. We do seek to control deals and have the ability to replace the CEO, but we do not want to operate the business.”

He expresses that hiring talent was tough this past year but ended well at the CEO and all levels, noting,

help those teams grow. This Corporate Growth Forum is right in our sweet spot.”

He points to the 25 members of Frazier’s world class executives in their Center of Excellence (COE) teams that work side by side, arm-in-arm with their portfolio companies.

“If the management team is looking to figure out technology, answer a data question or build a new product in the areas of AI, legal, financing or marketing, they can pull any of the COE team members for help. For companies seeking to add permanent talent to the team, they can partner with our human capital COE team to find the right talent to do that. For us, a growth forum makes a ton of sense. Personally, I’m spending a hundred percent of my time looking at the self-insured employer landscape.”

Emphasizing his firm’s interest in sponsoring the CGF, Brian Poger, who joined Frazier Healthcare Partners in April 2022 as an Executive in Residence on the Growth Buyout team, says, “Frazier is a leader in equity growth focused on the private equity investor. We’ve performed well by partnering with great management teams and surrounding them with an extraordinary talent pool that can

Poger learned about the opportunity to attend the event through the SIIA website and reached out to Mike Ferguson to see if there were opportunities to participate. Anticipating that he would get introductions to two or three potential companies for partnerships, he shares, “We are looking for relationships with dream team executives that perhaps are not immediate opportunities but may be partners in the future. I’m very bullish on the self-insured marketplace and the unique ecosystem of companies that serve this community – including SIIA.”

“We need to consider geography and depending upon the position, it has been easier to recruit talent along the eastern seaboard, while Georgia and Texas proved more difficult.”

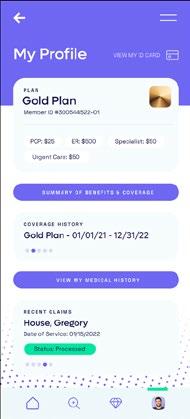

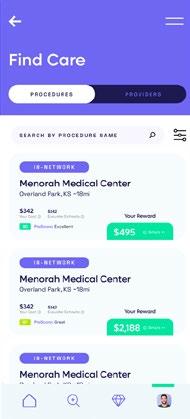

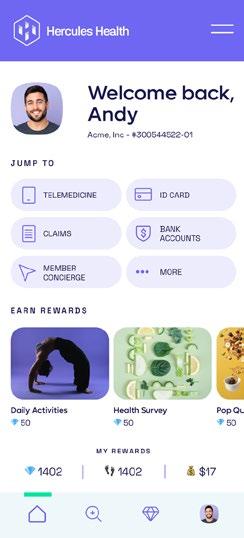

A first-of-its-kind healthcare SuperApp for self-funded plan sponsors that helps members make better decisions around quality medical care delivery, so everyone wins.

The only self-funded healthcare engagement platform of its kind.

Hercules Health rewards habitual app utilization by giving cash incentives earned through intelligent healthcare shopping tied to quality and cost. More app use equals more savings for members and plan sponsors alike.

Hercules Health delivers best-in-class price transparency that is fully compliant with the Transparency in Coverage (TiC) and the No Surprises Act (NSA) rules and regulations.

He anticipates that there will be more companies participating in this Growth Forum during subsequent events and encourages business leaders to make time for a meeting of this type next year. “The CGF iss a great way to sharpen your saw and it’s a great way to meet folks who maybe you think you’ll never need. Maybe you think you’ll never want to take outside capital, but there’s a lot learn from these investors.”

Poger says that as a private equity firm that’s been around for 30+years, Frazier is currently investing out of a $1.5 billion dollar fund, adding, “We like to make investments in profitable

service companies making $10-75 million EBITDA or at least breakeven SaaS companies in the $40-50 million dollar range. I think there’s plenty of capital available to support great companies -venture capital, private equity, debt or whatever you need.”

Frazier doesn’t require a management role for its investments and if there’s a great management team in place, they partner with the current team members. But he also says that they don’t shy away from companies that need management roles, including CEOs.

When Raj Merchant, vice president at New Mountain Capital, was presented with the opportunity to sponsor and attend the CGF, he concluded that this was a unique way to meet with those in the industry that are driving innovation for self-funded employers.

“I wanted to meet with companies that are scaling their solutions, learn more about their growth plans & value proposition, and introduce New Mountain’s platform,” he explains. “CGF is a great way to meet with industry leaders who are addressing the unmet need for holistic cost containment within the ecosystem – the structure of the conference literally lets you shake hands with every attendee.”

GPW offers a unique combination of captive and reinsurance management, accounting, tax compliance, and actuarial services all under one roof, providing clients with efficient and comprehensive service. GPW’s team of experts includes credentialed Actuaries, Certified Public Accountants, and Associates of Captive Insurance.

Learn more at www.gpwa.com

serving the risk management needs of over 3,600 clients.

We know what it’s like to feel FOMA, or Fear Of Missing Anything. So wherever you’re lacking the high-quality claims data you need to write group plans, Curv® fills in the blanks with the industry’s most predictive and trusted risk score, making it easier than ever to identify risks and opportunities.

He says he attends similar conferences but really values this opportunity to have deeper conversations with folks, especially given the curated list of participants.

“CGF is structured in a way that you can have a handful of very deep conversations vs. trying to have numerous shorter conversations. In this structure you can really get into the ‘ins and outs’ of a business’ vision and value proposition, as well as better understand the goals of management teams.”

He continues, “There’s a ton of growth in the self-insured industry, with a number of companies offering innovative solutions to address rising medical costs for segment of employers that have been underserved. We appreciate the opportunity to meet companies that prioritize small-to-mid size employers and provide solutions that generate better health outcomes while also lowering medical costs. Rising medical cost have a disproportionate impact on mid-market employers, and these solutions are critical in today’s environment.”

When asked why his firm chose to attend the SIIA CGF, Harrison Hunter, a managing director at Stone Point Capital, responded, “The conference was a chance to interact with businesses that could be strategically interesting for one of our portfolio companies. Our firm spends a lot of time in the selfinsured employer ecosystem, and we always enjoy getting to interact with earlier stage companies across the ecosystem.”

He said that the event met his expectations for making productive connections that can help their existing portfolio and build relationships for future investments.

“I think that there are opportunities for investment, given our fund’s size,” he continues. ‘Many of the investment opportunities are likely through one of our portfolio companies, although we are quite active so that’s a good outcome for us. We also believe in building relationships that could result in investment down the road.”

He also believes that the financial climate supports these opportunities, noting, “While the current macro environment is difficult, I think that the secular trends within the self-insured ecosystem are strong enough to offset near-term economic headwinds. Our firm is on the larger end of the sponsors, typically

We would like to invite you to share your insight and submit an article to The Self-Insurer! SIIA’s official magazine is distributed in a digital and print format to reach 10,000 readers all over the world.

The Self-Insurer has been delivering information to top-level executives in the self-insurance industry since 1984. Articles or guideline inquires can be submitted to Editor Gretchen Grote at ggrote@ sipconline.net.

The Self-Insurer also has advertising opportunties available. Please contact Shane Byars at sbyars@ sipconline.net for advertising information.

He indicates that the firm is quite active in the ecosystem and has a number of existing investments that could be acquirers of businesses at the conference. They do not seek a management role, rather they back management teams and look to support them through strategic support and capital.

Finally, a noteworthy commentary from Trey Marinello, a Managing Director in Houlihan Lokey’s Healthcare Group whose investment banking experience includes buyside and sell side M&A advisory, capital raising, and strategic advisory services for privately held and publicly traded companies.

“This is an opportunity to help both sides of a deal and drive the best outcome,” he explains. “Our position is running a successful process to arrive at the best terms and treatments. Both sides should walk away equally unhappy!”

Marinello is primarily on the sell side and plays a more advisory role on the buy side.

“This is an event that offers us a better understanding of the ecosystem and an opportunity to knowing the middle market,” says Marinello. “Smaller companies with innovative ideas are usually flexible and need our services to guide them through the processes. Bite size, smaller deals that are often complementary do well in this type of financial environment where there are strategic acquirers. It’s a good time to be a seller.”

Here’s a select group of SIIA member companies that provided their perspectives and enthusiasm for participating in the CGF.

https://www.arcfertility.com/

Ringmaster Technologies’ pharmacy consulting platform presented by its wholly owned subsidiary, “Ringmaster Rx”, is a huge win for Brokers, TPAs, and PBMs (pharmacy benefits managers). Its cloudbased data warehouse integrated with a RFP workflow process gives clients the ability to:

• Solicit, Compare and Award PBM Contracts and Programs

• Perform contract reconciliations & audits in seconds

• Deliver sophisticated analytics and generate value added reports

• Customize their own panel of preferred PBMs

• Efficiently manage cost for their employer groups

G. David Adamson, MD, FRCSC, FACOG, FACSMD, chair and CEO, Advanced Reproductive Care, Inc. (ARC), was excited to share his company’s focus on family benefits, how people think about these services and gaps in needed coverage.

“Employers now realize how important these benefits are for individuals the value to companies who offer the benefits to prospective and current employees,” he explains. “Family forming is a great investment, helping companies to recruit and retain talent. We’ve been helping organizations for 25+ years and have a foothold in the market. Now we are ready scale our business and serve the self insurance marketplace.”

Dr. Adamson expressed his enthusiasm for presenting the ARC business model at the CGF and anticipates that investors will find his approach of great value in helping employers meet the needs of employees who have a fertility issue. The company has grown

Maintaining the status quo is risky —especially when it comes to health plans. A high price doesn’t mean quality of care, and renewing with the same companies that profit from increased fiscal spend year after year won’t improve financial results.

We can help. HPI and EHN are teaming up with local health systems to help our clients:

• Take back control

• Prevent unnecessary care

• Reduce plan spend

• Offer best-in-class providers

• Provide access to dedicated advocates

Helping our clients take back control. hpiTPA.com

organically and is cash flow positive and has no debt, but management is investing profits back into the business to generate growth.

“We have no outside funding at this point but now we are looking for outside funds so that we can grow the company faster,” he says. “Historically, our company has been in the direct-to-consumer market, helping patients with financing and assisting our clinics with administrative services. But we have turned our focus in the last three years to the employer benefit space and this has been a positive change that has led to rapid expansion.

Why wait for better results? Check out our free webinars to learn more.

He says that they are now are ready to reach out and serve many more employers and that’s the reason he came to this meeting, adding, “We’re excited to be here and talk to people who can boost our opportunities for better promotion and deliver patient-centric healthcare with better outcomes at lower cost.”

For 25 years, ARC Fertility has helped people achieve their dream of growing their families. The company has been largely going to employer and broker meetings and is working with some highprofile consultants. The CGF is important as they start looking at the investor space.

https://www.indushealth.com/

Raj Rao, CEO, Indus Health enjoyed the event and found it be a worthwhile investment of his time. Here’s the two things he appreciated most about the CGF:

• Drew an interesting cross-section of industry players with domain expertise in the self-insurance arena

• A wealth of relevant working knowledge about corporate growth and investment to draw from.

IndusHealth serves as a medical travel program administrator for corporate self-insured health

insurance plans that offer their members the choice of traveling outside their home territory to obtain certain elective medical procedures. IndusHealth offers comprehensive personalized travel and treatment programs for Americans desiring care in world-class hospitals as an alternative to what has become oppressively expensive care across the U.S. These inclusive programs begin with an initial physician referral and continue through treatment, recuperation, and return home.

“Unlike large conferences that prove challenging to find and connect with the right people, I didn’t come across anyone that seemed out of place in this context,” says Rao. “It had a relaxed yet energetic feel to be able to exchange ideas and put my knowledge and theories to the test with other innovators, entrepreneurs, investors and domain experts. The sessions and panel discussions provided excellent information and content.”

Rao urges other business leaders providing solutions to self-insured employers to consider leveraging this forum at pretty much any stage of their business growth, adding, “Kudos to you and the SIIA team for your hospitality and pulling off another wonderful event!”

www.paymedix.com

Tom Policelli, CEO, PayMedix, a consumer engagement and healthcare financing platform dedicated to solving the growing problem of high out-of-pocket costs for everyone: providers, patients, and employers, shares his high-level satisfaction with the event.

“What I liked were the one-on-one conversations, which were great discussions with decision-makers and provided a very efficient opportunity to connect. Overall, the intimate nature of the conference allowed for candid discussions. The meeting was very well organized,

and the conversations were specific around the challenges we face in the marketplace.”

By guaranteeing full payments to providers and credit to all patients regardless individual credit history, PayMedix delivers significant savings while increasing access to care and healthcare equity. PayMedix has paid over $5B to providers, has a consumer NPS of 75, and a client retention rate of 94%.

https://scriptsourcing.com/

Gary Becker, CEO, ScriptSourcing says that as a business owner, it’s important to learn from experts and maximize a company’s enterprise value.

“SIIA’s conference was power packed with presenters and panelists which included business owners, attorneys, bankers and investment institutions,” he shares. “The networking was terrific as everyone was willing to share their expertise. Thank you SIIA for putting together such an impactful event.”

ScriptSourcing’s Med Finder makes it easy to search for prescription medications that they are able to source.

People who cannot find a medicine should contact us here to submit a medication request. Please Note: ScriptSourcing does not source generic medications.

ZAKIPOINT HEALTH

https://www.zakipointhealth.

Ramesh Kumar, co-founder and CEO zakipoint Health, characterizes the CGF as an intimate event where participants were engaged and open to discussions throughout the experience.

“The speakers and participants were strategic thinkers, insightful in sharing industry trends, challenges and opportunities,“ says Kumar. “They presented what individual companies need to do to grow or transact.”

zakipoint Health’s mission is to find meaning in healthcare data to bring transparency, direction, and value to people from their healthcare usage and spend. zakipoint Health provides SaaS platform that brings in all the

healthcare data into one place for the employer and the members on the plan to support members for their on-going plan queries, and out of pocket cost estimation, and intelligently steer them to the right places of care at the right time.

Kumar also enjoyed meeting the private equity investors and building relationships with many of them, sharing,

Laura Carabello holds a degree in Journalism from the Newhouse School of Communications at Syracuse University, is a recognized expert in medical travel, and is a widely published writer on healthcare issues. She is a Principal at CPR Strategic Marketing Communications. wwwaves.cpronline.com

“It was a pleasure to chat with investors who understand our space and are happy to help the selffunded industry grow. And biking in Greenville was icing on the cake!”

SIIA Diamond, Gold, and Silver member companies are leaders in the self-insurance/captive insurance marketplace. Provided below are news highlights from these upgraded members. News items should be submitted to membernews@siia.org.

All submissions are subject to editing for brevity. Information about upgraded memberships can be accessed online at www.siia.org.

If you would like to learn more about the benefits of SIIA’s premium memberships, please contact Jennifer Ivy at jivy@siia.org.

Hamilton Square, NJ – Berkley Accident and Health, a Berkley Company, has appointed Rajiv Sood as Vice President and Head of Business Development for the company’s Specialty Accident segment.

Rajiv will be responsible for developing and executing our growth strategy for Specialty Accident, which includes a focus on deepening existing partnerships and identifying and pursuing new market opportunities.

Rajiv joins Berkley Accident and Health with a diverse background that includes prior executive leadership, experience in the insurtech market, and a focus on business development and growth, which makes him an ideal fit for this role.

“Rajiv strengthens our company and positions us well to grow and expand our Specialty Accident segment, which benefits from a robust product portfolio, strong operational capabilities, and a talented team,” said Brad Nieland, President and CEO of Berkley Accident and Health. “He brings a depth of technical skills and a strategic vision for success that will help us to better serve our

clients and capitalize on market opportunities. We are delighted to welcome Rajiv to the Berkley Accident and Health team.”

Rajiv has over thirty years of experience in business development, goto-market strategies, and creating scalable solutions for the accident, health, medical, and other markets. Rajiv resides in the Princeton, New Jersey area.

Hamilton Square, NJ – Travel is on the rise for all types of consumers ranging from conferences to youth sports tournaments, simultaneously raising risk exposures for all groups.

To provide added protection, Berkley Accident and Health, a Berkley Company, has selected Healix International (Healix), an internationally recognized travel assistance leader, to provide emergency medical, security, and travel support services to individuals covered by Berkley Accident and Health travel accident policies.

Assistance services are paired with Berkley’s travel accident products, including Business Travel Accident, Participant Accident, Student Accident insurance and more.

Effective March 1, 2023, travelers have a full range of support provided by Healix at no additional cost. Whether their needs are minor or serious, Healix connects travelers to the necessary medical, travel, behavioral health, or security assistance 24/7/365 from anywhere in the world.

The Healix Travel Oracle mobile app and online portal help give travelers and risk managers an extra layer of support with pre-trip training, emergency alerts, and more.

“We’re pleased to offer these valuable, tangible services from Healix to help travelers be better prepared when something goes awry during their trip, whether it’s lost documentation or a medical emergency,” said Brad Nieland, President and CEO of Berkley Accident and Health. “Our insurance products provide the financial protection that clients need, while Healix delivers the personal care and hands-on support for travelers away from home.”

Charlie Butcher, CEO of Healix, adds, “A face-to-face meeting is a vital part of doing business, and with travel firmly back on the agenda for many organizations, we’re delighted to be working with Berkley Accident and Health to provide the support employees need while

You want unparalleled customer service. Employers need the right stop loss coverage. At Swiss Re Corporate Solutions, we deliver both. We combine cutting-edge risk knowledge with tech-driven solutions and a commitment to put our customers first. We make it easy to do business with us and relentlessly go above and beyond to make stop loss simpler, smarter, faster and better. We’re addressing industry inefficiencies and customer pain points, moving the industry forward – rethinking employer stop loss coverage with you in mind. corporatesolutions.swissre.com/esl

going abroad for work. Traveling in 2023 brings plenty of risks, from the continued risk of coronavirus to the impacts of climate change on weather, to regional geopolitical challenges. Through the Healix services, Berkley Accident and Health clients can provide the tools necessary to reassure and support workers venturing out for business. With the combined support of Berkley Accident and Health and Healix, I am confident employees will receive the best possible support and outcome in the event of a crisis.”

Additional value-adds for clients include a wide range of capabilities, such as:

• Emergency medical and evacuation services

• Security evacuation

• Translation services

• Behavioral health support

• Ground support and protective services

• Pre-trip safety trainings

Travel assistance services are provided by Healix International and are not insured benefits. Berkley Accident and Health, W. R. Berkley Corporation, and its underwriting companies are not affiliated with Healix and are not responsible for nor assume liability for the travel assistance services provided by Healix.

About Healix International

Healix International is a global provider of travel risk management and international medical, security and travel assistance services. Working on behalf of multinationals, governments, NGOs and insurers they look after the welfare of expatriates, travelers, offshore workers and local nationals in every country of the world. Healix provide a comprehensive, integrated range of solutions to help safeguard the health and security of their clients’ employees, providing a single point of contact to access the expertise and help they may need, wherever they are in the world, 24/7. Visit www.healix.com

Hamilton Square, New Jersey – Berkley Accident and Health, a Berkley Company, is proud to announce the recipients of the Risk Achievement of the Year (RAY) Award.

RAY Awards are given to Berkley Accident and Health clients who embrace employee health and wellness and who strive to offer affordable, high-quality health benefits to attract and retain their workers. This year’s winners were announced at the 2023 Berkley Captive Symposium and are based on their health risk management efforts in 2022.

Recipients are selected from the employer/members of Berkley’s Stop Loss Group Captive programs. Group Captive programs are designed to allow small and midsize firms to provide sustainable health benefits and come together to better control their overall health spend. Rather than buy traditional health insurance, these companies self-fund their benefits with Stop Loss protection and then join together to share risk in a Group Captive arrangement.

“Berkley Accident and Health is passionate about helping its clients offer affordable and sustainable health benefits,” said Brad N. Nieland, President and CEO, Berkley Accident and Health. “Because of their outstanding focus on employee wellness and health risk management, RAY Award recipients have taken control of their health care spending – and the results are very impressive.”

RAY Award winners are selected from across a variety of programs in Berkley’s portfolio and have

shown exceptional dedication to health risk management in the previous year.

Winners must demonstrate a strong commitment to the wellbeing of employees and their families and implement programs that help lower health risk factors and show measurable results.

This year, Berkley Accident and Health added a new Platinum award category to recognize a company with continual, sustained achievements.

The 2023 Platinum RAY Award winner is:

Coastal1 Credit Union – Coastal1, a full-service credit union serving Rhode Island and Massachusetts, won the new award for toptier achievement in risk management. Coastal1 won the Platinum RAY Award for its long-term commitment to promoting employee health, helping to reduce health care costs for employees and their families, and continually raising the bar, year after year. Coastal1’s relentless commitment to employee well-being starts at the top, with a leadership team that is willing to invest in programs that make a difference. The company offers cancer care services, specialty Rx management, organ transplant carve-out, EAP, financial counseling, and light care vision to reduce the impact of blue light. It has also trained its HR team in mental health first aid. Last year, it revamped its fitness center with state-of-the-art equipment and expanded it to accommodate on-site classes. All of this has resulted in per member per month health costs that are 5% lower than other health plans, a 16% increase in the employee health and wellness satisfaction score, and a continual reduction in the number of ER visits per year.

The 2023 First Place winners are:

Caring Place Healthcare Group - Caring Place is a family-owned and operated organization of skilled nursing and senior living communities in Ohio. Caring Place offers their employees medical care at a nearby health clinic, along with full annual physicals and biometric screenings. Employees who use the clinic are improving their key biometric measures and showing a 30% decrease in per month health care costs. Overall, Caring Place has seen an almost $300,000 reduction in health care costs over the past three years.

Cheverus High School - Cheverus is a private, Jesuit college preparatory school in Portland, Maine that has implemented several programs to educate employees on strategies to enjoy high-quality, lower-cost health care. They offer wellness biometrics and health coaching, as well as financial incentives to faculty and staff for making health-conscious decisions. These efforts have enabled employees to reduce their health premium contributions by 10% and saved Cheverus an estimated $1 million over five years through its ongoing cost-savings strategies.

Methodist Family Health, Inc. – Methodist Family Health is a nonprofit organization offering a continuum of inpatient and outpatient behavioral care to youth and families. For the past ten years, the organization has hosted annual health fairs and recently launched a new program that takes a holistic view of employee wellness –physical, nutritional, emotional, financial, social, and occupational. Methodist Family Health also uses data analytics to thoughtfully design programs with the most impact. As a result of its independent, pioneering approach to fostering a culture of health among employees, the organization has seen its medical costs trending downward. They

also have not raised employee premiums in 5 years due to their forward-thinking cost containment strategies.

NRP Jones, LLC – NRP Jones is a family-owned manufacturer of hydraulic hose and fittings with locations in Utah and Indiana. In 2022, the company established a near-site health clinic for their employees and leveraged 340(b) pricing to tackle spending on high-cost specialty medications. In 2021, NRP’s employees collectively paid $31,800 for specialty prescriptions, and one year later, in 2022, they collectively paid $13,100 for specialty prescriptions – a cost reduction of more than half.

Ovation Holdings, Inc. – Ovation Holdings provides maintenance, repair, and operations services to customers in the Midwest needing valve, instrumentation, gas detection, and heat trace solutions. In 2020, the company moved from a fully insured health plan and has seen its budgeted health care expenses drop by more than $1 million. From 2020 to 2022, Ovation Holdings have cumulatively saved $2.9 million through its use of Apta Health’s innovative cost-containment program.

United Plate Glass Company, Inc. – United Plate Glass is a major supplier of architectural glass products with multiple facilities in the mid-Atlantic. The company offers its employees a

Staying healthy depends on being proactive. So does spend management. At Vālenz® Health, we believe lowering healthcare costs is driven by the ability to engage early and often in the member’s healthcare journey.

Before a claim even begins, we use data to identify cost, network and plan design opportunities to drive cost containment and improved health outcomes for members. We ensure everyone is aligned. There are no surprises – just reduced costs, better outcomes, and an improved member experience from start to finish.

That’s our promise to you. This is precisely why our customers stay with Valenz, because no one else does what we do.

See how Valenz engages early and often to deliver smarter, better, faster healthcare: visit valenzhealth.com or call (866) 762-4455.

Proud to be a Diamond Member

Proud to be a Diamond Member

choice of two health plans – a traditional PPO and a referencebased pricing plan. United Plate Glass takes a robust approach to wellness, offering a wide range of programming, including health screenings, wellness promotions, educational events, and a wellness fair. The company also implemented diabetes and prescription cost-containment programs that have helped to keep health care costs flat. Since 2018, per employee per year costs have increased by only 0.16%.

Woodard & Curran, Inc.

– Woodard & Curran is an integrated science, engineering, design- build and operations

company specializing in water and environmental projects. Recognizing the connection between mental health and physical health, the company implemented a behavioral health program providing essential mental health support to their employee and their families, resulting in fewer office visits and lower costs from 2021 to 2022. Woodard & Curran also modified its pharmacy plan to encourage employee participation and consumerism and better reflect the cost of high-cost prescriptions.

The 2023 Honorable Mention recipient is:

B & B Manufacturing, Inc. – B&B Manufacturing, which produces and distributes parts for the power transmission and precision mechanical industries, takes a forward-thinking approach to employee health at its headquarters in Indiana. The company implemented a free employee medical clinic, resulting in an increase in employee wellness visits and preventative screenings, even during the challenges of the pandemic. B&B also added cost-containment services for surgical procedures and specialty Rx, which has led to an average annual health care cost per employee that is well below the national average.

At Meritain Health®, our goal is simple—take a creative approach to health care and build industry-leading connections. Whether you're building an employee bene�ts program, researching your member bene�ts or o�ering support to your patients, we're ready to help you do more with your health plan.

Learn more at www.meritain.com.

Follow us:

Berkley Accident and Health is a member of W. R. Berkley Corporation, a Fortune 500 company. Berkley Accident and Health provides an innovative portfolio of accident and health insurance products. It offers four categories of products: Employer Stop Loss, Group Captives, Managed Care (including HMO Reinsurance and Provider Excess), and Specialty Accident. It underwrites Stop Loss coverage through Berkley Life and Health Insurance Company, rated A+ (Superior) by A.M. Best. Visit www.BerkleyAH.com

QBE Re is delighted to announce Jake Birchard as our new hire to QBE Re US Healthcare team.

Jake joins from Aon where he was most recently an Associate Director, Lead Analyst supporting the firm’s health reinsurance clients. He has provided health actuarial and analytics support to insurers, reinsurers, health systems, provider organizations, and employee benefit plan sponsors for over ten years. Jake will be based remotely in Oregon and joined on June 5th 2023.

“Jake has built a strong reputation as a strategic thinker using data to drive decision making and create high impact results. As the Lead Analyst Jake was front line supporting clients with actuarial, financial and analytical decision making.

Having someone of Jake’s knowledge, skill and experience join our team will continue to support the QBE Re Healthcare team in managing our portfolio and driving value for our clients,” says Michael Coghlan, Senior Vice President, Head of US Health Reinsurance.

“Welcoming new talent to the team is always a highlight and I’m delighted to be doing so with Jake. This important hire supports our plans to strategically grow and develop the US Health portfolio. Our broker and cedent contacts in Healthcare will continue to be in excellent hands, and I look forward to announcing further new hires in the future,” said Tim Barber, General Manager North America.

QBE Re was formed to bring together all of QBE’s global reinsurance capabilities, allowing us to provide a consistent, streamlined service to our clients. Today, we offer a range of Property, Casualty, Specialty and Life solutions to customers around the world from our offices in London, Bermuda, Brussels, Dubai, Dublin and New York. Visit www.qbere.com

BEDMINSTER, NJ -- Zelis, a healthcare technology company modernizing the healthcare financial experience for all, announced the launch of its new open access pricing solution. Self-funded employers, which represent 65% of U.S. workers, often struggle to sustain the cost of traditional health plan premiums, and existing solutions are often fragmented and have not delivered a satisfactory experience for members in accessing and navigating care.

To overcome these challenges, third-party administrators need to bring alternative strategies to stabilize claims costs, improve provider accountability related to rising fees, and free patients from network limitations.

Zelis Open Access Pricing is a reference-based pricing (RBP) solution that empowers self-insured employers and third-party administrators to put their members’ experience first while also stabilizing rising healthcare costs.

The new solution allows clients to set maximum reimbursement amounts using pre-defined prices which allows for more predictable cost forecasting.

At the same time, Zelis Open Access Pricing employs a member advocacy team that provides pre-service member education,

navigation support, provider contracting support, balance bill resolution, and legal escalation support to ensure seamless interactions among payers, providers, and members.

The technology-enabled solution includes modeling and analytics, contract management, and performance reporting, as well as a price and provider transparency application to drive member adoption.

“By combining Payer Compass with Zelis, we have joined advanced technology and best-in-class approaches to create this RBP solution to managing rising healthcare claims costs for clients and their members,” said Amanda Eisel, Zelis CEO.

Zelis Open Access Pricing gives members the freedom to choose their preferred healthcare providers, and offers fair, established pricing benchmarks that keep medical expenses under control.

“TPAs and self-funded groups want reference-based pricing for lower claims costs, configurable options, more predictable healthcare cost forecasting, and more,” said Rick Ellsworth, SVP, GM Payer Compass at Zelis. “We are excited to bring to market a fully integrated solution that fits their needs and enhances the experience for their members.”

Zelis is modernizing the healthcare financial experience by providing a connected platform that bridges the gaps and aligns interests across payers, providers, and healthcare consumers. This platform serves more than 700 payers, including the top-5 national health plans, BCBS insurers, regional health plans, TPAs and self-insured employers, and millions of healthcare providers and consumers. Zelis sees across the system to identify, optimize, and solve problems holistically with technology built by healthcare experts – driving real, measurable results for clients. Learn more at Zelis.com and follow us on LinkedIn to get the latest news.

PHOENIX -- AMPS, a pioneer in healthcare cost containment and pharmacy benefit management, announced their partnership with the industry-leading insurtech company, Health in Tech “HIT”.

This strategic partnership delivers innovative and customized saving solution strategies to small levelfunded employer groups looking to make their healthcare dollars go further.

“At Health in Tech, our solutions are designed to give you full autonomy, so you have the power to create whatever products you want. We help you build your system, design specifically for your needs and your market, so you can run with it. Its unique advantage is that the system only takes minutes to produce bindable quotes for small to medium-sized groups,” said Tim Johnson, Chief Executive Officer of Health in Tech. “Combined with AMPS’ consultative and scalable approach, we believe this partnership will have a significant financial impact to both the groups we manage and the members we serve.”

The partnership provides a fully integrated health plan solution that offers all the rewards of being self-funded.

The partnership between AMPS and HIT provides a fully integrated health plan solution that offers an employer all of the bundled solutions of a fully insured plan, yet all the rewards of being selffunded.

“There are many benefits to being self-funded in this current environment, but we also understand that making the transition from a fully insured plan when you are a small group can be daunting,” said Jeff Zavada, Chief Revenue Officer of AMPS. “Through this partnership, we can confidently place these small to midsized groups into a level-funded plan while providing employer groups with the significant savings they so desperately need.”

“We are thrilled to roll out this new strategic partnership which allows us to challenge old assumptions around cost containment solutions,” said Zavada. “By expanding our efficiencies into these smaller markets, we are able to capture a segment of employers who might not know of the cost savings opportunities available outside of traditional PPO networks.”

AMPS and Health In Tech work with Brokers, TPAs, and employer groups to provide a fully integrated solution offering transparency, control, and predictability.

Health in Tech is an industry-leading Insurtech company that delivers disruptive innovation and proprietary technology to reimagine risk, underwriting, and self-funding, making processes better, faster, and more efficient for everyone involved. Visit www.healthintech.com

Advanced Medical Pricing Solutions (AMPS) provides market leading healthcare cost containment services and pharmacy benefit management for self-funded employers, public entities, health plans, TPAs, health sharing organizations and reinsurers. Leveraging 18 years of experience in auditing and pricing medical claims, AMPS delivers “fair for all” pricing both pre-care and post-care. Visit www.amps.com

By supporting people in the moments that matter, we can improve health outcomes and help employers manage costs.

For over 40 years, self-funded employers have trusted Sun Life to help them manage financial risk. But we know that behind every claim is a person facing a health challenge and we are ready to do more to help people navigate complicated healthcare decisions and achieve better health outcomes. Sun Life now offers care navigation and health advocacy services through Health Navigator, to help your employees and their families get the right care at the right time – and help you save money. Let us support you with innovative health and risk solutions for your business. It is time to rethink what you expect from your stop-loss partner.

Ask your Sun Life Stop-Loss Specialist about what is new at Sun Life.

The content on this page is not approved for use in New Mexico. For current financial ratings of underwriting companies by independent rating agencies, visit our corporate website at www.sunlife.com. For more information about Sun Life products, visit www.sunlife.com/us. Stop-Loss policies are underwritten by Sun Life Assurance Company of Canada (Wellesley Hills, MA) in all states except New York, under Policy Form Series 07-SL REV 7-12. In New York, Stop-Loss policies are underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) under Policy Form Series 07-NYSL REV 7-12. Product offerings may not be available in all states and may vary depending on state laws and regulations. © 2023 Sun Life Assurance Company of Canada, Wellesley Hills, MA 02481. All rights reserved. Sun Life and the globe symbol are trademarks of Sun Life Assurance Company of Canada. Visit us at www.sunlife.com/us. BRAD-6503-y SLPC 29427 01/22 (exp. 01/24)

Health In Tech, a leading insurtech company offering self-funded health plans, has announced its partnership with ClaimsBridge for network management services. Through this collaboration, ClaimsBridge will provide Health In Tech with a full range of network solutions, including high-performance networks, direct contracts, and regional provider networks, all powered by the unique and proprietary ClaimsBridge Connect platform.

“The network solutions and direct contracts offered by ClaimsBridge provide best-in-class access and discounts,” said Glenn Hillyer, Chief Growth Officer of Health In Tech. “The ClaimsBridge platform’s fully integrated module enables Health In Tech to offer network solutions that support our expansive growth.”

With the integration of ClaimsBridge’s Connect platform, Health In Tech can provide its clients with unparalleled provider access and discounts. The company’s streamlined underwriting and broker quoting platform, eDIYBS - Do It Yourself Benefit Systems, coupled with ClaimsBridge’s technology solutions, offer a unique franchise for self-funding that is one of the most efficient in the industry.

“We are excited to partner with Health In Tech and provide our technology solutions to enhance their network management capabilities,” said Jeffrey Penn, Vice President of Business Development at ClaimsBridge. “Our platform offers cost containment and technology solutions for payors, and we believe that our partnership will result in significant benefits for Health In Tech’s clients.”

Health In Tech is a leading insurtech company that offers disruptive innovation and proprietary technology to improve and streamline risk, underwriting, and self-funding processes. Contact Glenn Hillyer, Chief Growth Officer, at ghillyer@healthintech.com and visit www.healthintech.com

ClaimsBridge is a leading healthcare technology company that offers various services in the pre-adjudication claims lifecycle, including Clearinghouse, Network Access, Custom provider networks, Reference Based Pricing and Network Hosting. As a SaaS-based company, we provide innovative technology solutions that help over 120 administrators and two million covered lives to achieve best-in-class cost containment results. Our mission is to streamline healthcare operations and improve the overall healthcare experience for payors, providers, and patients alike. Contact Jeffrey Penn, Vice President of Business Development, at jpenn@claimsbridge.com and visit www.claimsbridge.com

Buffalo, NY - Nova Healthcare Administrators, Inc. (Nova) was recently revalidated through the Validation Institute for 2023 in the common chronic condition management category. The validation comes after a thorough data analysis that confirms Nova’s clinical protocols drive measurable improvements in health plan trend.

“This award is important to Nova because its external confirmation of the impact Nova’s programs have for clients and their plan participants,” said Jamie Farrell, Nova’s chief business

and product development officer. “It’s a reflection of the hard work and collaboration of many Nova associates, including our medical management, care navigation, data analytics, and client services teams. Every aspect of Nova’s business aims to take the complex out of a complicated health care system for insurance brokers, our clients, and their members. Within the industry this validation affirms, very simply, that we do what we say we do.”

Nova creates a cost and risk management strategy tailored to our clients’ goals. Our approach includes analyzing medical, behavioral and pharmacy claims, plus operational observations, and clinical data.

Using this data, Nova works with clients to develop strategies that address preventive care, early detection of illness, improving treatment compliance, appropriateness of services, and reducing the cost of necessary care.

Based on 2022 data, Nova has once again achieved below-average admissions and emergency room visits for common chronic diseases (asthma, CAD, CHF, hypertension, COPD, and diabetes), compared to a national benchmark.

Nova’s demographics, claims data, and study design methodology were reviewed, earning Validation Institute’s $25,000 “Credibility Guarantee,” for the outcomes and savings achieved through our chronic condition management program. Nova has received validation through the Validation Institute since 2018.