The ICISA INSIDER | April 2020 | ARTICLE

By Baldev Bhinder, Managing Director of Blackstone & Gold LLC

dev Bhinder, Managing Director of Blackstone & Gold LLC

Synthetic Trade Finance: Synthetic Trade Finance: 7 Signs to spot a House of Cards 7 Signs to spot a House of Cards

year or so, a high-profile case involving astronomical losses reminds us of the stark reality of the g business. A business that hasEvery long moved pure shipment goods from producer would now be familiar with the cautionary year orbeyond so, a the high-profile case of involving Underwriters d user. A business that is now highly leveraged on liquidity through the creation of synthetic or coverage being sought by traders solely astronomical losses reminds us of the stark reality of tale of insurance mirror trade flows. A businessthe operating on paperAdocuments multiple trading business. business thatthat haslay longsusceptible moved totoobtain financing – a means to an end of accessing ing. Statistics will proudly boast that international trade is valued in the trillions of dollars beyond the pure shipment of goods from producer liquidity. each Banks take an exceeding amount of comfort if a but how much of this sum is synthetic is open to debate. year, leveraged a trading company once to end user. A business that isEvery now highly trade is credit insured, treating the policies akin to guarg revenues in the billions of dollars, topples over and in the post-mortem, we find a antees. bewildering on liquidity through the creation of synthetic or even Insurers, focussed on the credit assessment of of trade documents that have been rolled, flipped or rotated between parties while the mirror trade flows. buyers are too far removed from the transaction to unlying goods are long gone. When the trade is deconstructed by specialist lawyers like myself, derstand questionable signs in the trade flow. Credit intimes what emerges from the smoke is a parallel world of synthetic structures, double financing A business operating on paper documents that lay sussurance and modern trade finance do not sit neatly with udulent documents. ceptible to multiple financing. Statistics will proudly boast

each other. And the shrewd trader knows this.

international trade istale valued in the trillions of dollarsbeing sought by rwriters would now be familiarthat with the cautionary of insurance coverage yearto but of this sum is synthetic is open With an increasingly connected world wiping out arbirs solely to obtain financing – aeach means anhow endmuch of accessing liquidity. Banks take an exceeding to debate. Every year, athe trading company driving trage opportunities on price margins, traders have turned nt of comfort if a trade is credit insured, treating policies akinonce to guarantees. Insurers, thetoo billions of dollars, topples over and in the to to synthetic trades to create liquidity. Passing documents sed on the credit assessment ofrevenues buyers inare far removed from the transaction understand onable signs in the trade flow.post-mortem, Credit insurance anda modern trade not sitfor neatly with we find bewildering flowfinance of trade do docuan easy margin is just the tip of the incentive, the real other. And the shrewd trader knows ments this. that have been rolled, flipped or rotated between reward comes with access to financing and hence liquidparties while the underlying goods are long gone. When

ity for a 60-90 day period. The trader may leverage such

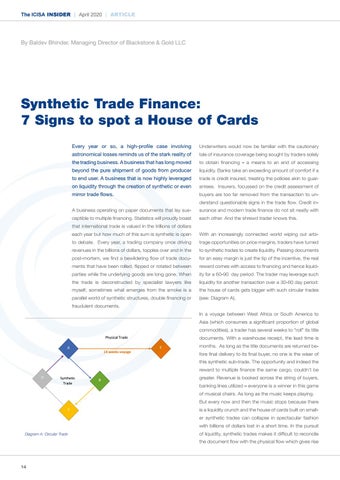

an increasingly connected world wiping out arbitrage opportunities on price margins, traders the trade is deconstructed by specialist lawyers like liquidity for another transaction over a 30-60 day period: turned to synthetic trades to create liquidity. Passing documents for an easy margin is just the myself, sometimes what emerges from the smoke is a the house of cards gets bigger with such circular trades the incentive, the real reward comes with access to financing and hence liquidity for a 60-90 parallel world of synthetic structures, double financing or (see: Diagram A). eriod. The trader may leverage such liquidity for another transaction over a 30-60 day period: fraudulent documents. ouse of cards gets bigger with such circular trades (see: Diagram A). In a voyage between West Africa or South America to

Asia (which consumes a significant proportion of global commodities), a trader has several weeks to “roll” its title Physical Trade A

14 weeks voyage

documents. With a warehouse receipt, the lead time is E

months. As long as the title documents are returned before final delivery to its final buyer, no one is the wiser of this synthetic sub-trade. The opportunity and indeed the reward to multiple finance the same cargo, couldn’t be

D

Synthetic Trade

B

greater. Revenue is booked across the string of buyers, banking lines utilized – everyone is a winner in this game of musical chairs. As long as the music keeps playing. But every now and then the music stops because there

C

is a liquidity crunch and the house of cards built on smaller synthetic trades can collapse in spectacular fashion with billions of dollars lost in a short time. In the pursuit

Diagram A: Circular Trade

Diagram A: Circular Trade

of liquidity, synthetic trades makes it difficult to reconcile the document flow with the physical flow which gives rise

oyage between West Africa or South America to Asia (which consumes a significant proportion bal commodities), a trader has several weeks to “roll” its title documents. With a warehouse 14