The ICISA INSIDER

Newsletter of the International Credit Insurance & Surety Association (ICISA)

CONTENT FOREWORD

COLUMN

4 | Non-Traditional credit (re-) insurance - exploring the path ahead

Column by Sascha Dear ICISA UPDATES

7 | Update from Committee Chairs

12 | ICISA Members elected a new President

Interview with Benoît des Cressonnières

INSIGHTS

16 | The dark arts of commodities: Assessing risks and claims in trade credit insurance

Insight by Baldev Bhinder

INTERVIEW

19 | AIG Joins ICISA

Interview with Corine Troncy

20 | Member in the spotlight: COSEC

Interview with Vassili Christidis

ANNOUNCEMENTS

1 |

The ICISA INSIDER | How to get a free Subscription? If you would like to be added to the distribution list of The ICISA Insider, please send a message to secretariat@icisa.org Editorial Information | For suggestions and announcements, please contact: Raluca Ezaru (editor) +31 (0)20 625 4115 Raluca.Ezaru@icisa.org Volume 18 | July 2023

Disclaimer

All articles in the ICISA Insider represent solely the opinions of the individual authors, not ICISA, unless otherwise stated. Original articles appearing in the Insider may not be reprinted without the express permission of the author and ICISA. When citing articles, please refer to the title of the article, the author, and the relevant edition of the Insider, including a full url to the article page.

Dear Reader,

Welcome to this Summer Edition of the ICISA Insider!

It’s only a short few weeks since ICISA hosted its second AGM Week. This time we decamped to the beating heart of European institutions in Brussels. Lots of interesting and important topics were discussed throughout the week and you can read the summaries prepared by our Committee Chairs later in the Insider.

During the week spent in Brussels, ICISA changed it’s presidential team after completion of the successful presidency of Kay Scholz, with Benoît des Cressonnières and Jan Mueller being elected as President and Vice-President, respectively. They are sure to put their indelible mark on the association and provide strong leadership to the industry in the coming years. To this end, we asked Benoît what his main objectives are now that he has received his mandate from members. You can read his views on page 12.

Since the beginning of this year, three new members joined our association: AIG, Peak Re and Active Re. It is always pleasing when insurers and reinsurers in our industry see the added value that membership of ICISA brings. At the same time, we hope to continue building a strong community across our membership, wherever they are based throughout the world. This is why we’re keen to give a voice to the newest additions to that community, and you can go to page 19 to read an interview with Corine Troncy from AIG.

Still looking at our members, we included in this edition an interview with Vassili Christidis from COSEC. COSEC has long been the leading player in the Portuguese market and joined ICISA some decades ago. In this article you can read more about what it meant to them being part of ICISA, and what the future holds for them.

While living in a permanently changing world, it is important to be flexible and come up with innovative solutions. In the featured column of this edition (page 4), Sascha Dear of R+V Re talks about the expansion of non-traditional insurance and what some challenges are for insurers. Also in this Insider you will find an article about assessing risks and claims in Trade Credit Insurance industry, written by Baldev Bhinder (page 16).

While the previous six months were busy at our Secretariat, we remain energised after seeing the enthusiasm of our members last month. We’re looking forward even more now to the rest of 2023 (and summer holidays in between of course)! We have Trade Credit Insurance Week ahead of us starting on 2 October, which should not be missed! We strive to once again bring together the significant and relevant to all, members and non-members alike.

We hope you’ll enjoy this edition as much as we enjoyed putting it together.

Happy reading!

Richard Wulff

3 | The ICISA INSIDER | July 2023

Foreword |

Foreword

Column: Non-traditional credit (re-)insuranceexploring the path ahead

Author: Sascha Dear, R+V Re

Author: Sascha Dear, R+V Re

The rich history of credit insurance traces back to the 1600s in England, when the first known credit insurance policy was issued. Over time, it gained popularity with the growth of international trade in the 19th century. The establishment of the German “Hamburg Credit Insurance Association” in 1848 marked a pivotal moment for credit insurance, when the idea quickly spread throughout Europe and North America. Numerous credit insurance companies emerged, offering services to mitigate non-payment risk for their customers. During the 1970s and 1980s, as global trade further expanded, credit insurers extended their coverage to include political risk insurance, safeguarding businesses operating in politically unstable regions. Today, credit insurance is a key component of the global trade finance industry and is used by businesses of all sizes to manage credit risk and protect their balance sheets.

The first credit REinsurance contract was signed in 1892 between the “North British and Mercantile Insurance Company” and the “National Credit Indemnity Company”. This marked the beginning of credit reinsurance as a recognized product in the insurance market. When in the early 20th century global trade flourished, credit reinsurance gained traction due to increased demand. Today, credit reinsurance serves as an essential risk management tool for credit insurers, enabling them to mitigate their risk exposure effectively. The growth of global financial markets and the rise of complex “non-traditional” financial products have further driven the demand for credit reinsurance. Consequently, credit reinsurance has evolved into a mature and highly specialized industry.

In the traditional credit insurance world, which, for historical reasons, is dominated by Surety and (Whole Turnover-) Trade Credit products, we (whenever I use “we” in this article, I refer to both, insurers, and reinsurers) use various credit risk models including Merton, KMV, CreditMetrics, Jarrow and Turnbull, SFAA, among others. These models have been tested and refined across multiple cycles, providing a level of comfort in assessing risks, determining risk appetite, and meeting regulatory capital requirements. And to also provide significant amounts of credit insurance and reinsurance.

So over history, we have adapted to and were able to cope with the then existing challenges. However, the landscape has undergone significant transformation in the past decade. As an example, six years ago, “minor issues” at one of the world’s largest Export Credit Agencies (ECAs) paved the way for Aircraft Financings to land in credit insurance markets, and subsequently, insurers found their way into spaces traditionally occupied by the banking sector. Quickly the banking sector realized that, for them to keep pace with evolving regulations and increasing regulatory capital requirements, the insurance sector can be a quite reliable partner. So, the Holy Grail of “Capital Relief Transactions” found a new home in the non-traditional credit insurance industry. With the broad introduction of Synthetic Risk Transfer (SRT) products into the insurance space in 2019, portfolio-solutions marked the next evolutionary step. Presently, terms like Warehousing Facilities, Net Asset Value-financings, Receivable Finance Portfolios, CLOs, Subscription Line Financings, Capital Call Facilities, NonRecourse-Transactions, Blind Portfolios, Repacks, AssetBased Finance transactions (often accompanied by corresponding swap-facilities), PIK-Financings, “Balthazar”, Diversified Payment Right-Transactions (“DPRs”) and 25-year-Project Financings have transformed into common offerings. And again, insurers and reinsurers are adapting to this expanded spectrum of non-traditional credit insurance products.

Today, these rapid changes coincide with an unprecedented combination of challenges: the COVID pandemic, supplychain disruptions, geopolitical tensions (e.g., Russia/ Ukraine crisis, Taiwan), global inflation coupled with interest rates not witnessed in decades, recession forecasts, cybersecurity concerns, rescue packages for banks, ESG considerations, new accounting principles, etc. Although the impact of COVID on global credit default rates proved less severe than many of us anticipated, the uncertain credit insurance and reinsurance environment is likely to persist for some time.

| 4 July 2023 | The ICISA INSIDER | Column

Column | July 2023 | The ICISA INSIDER 5 |

To keep up with the momentum of expansion of the non-traditional credit insurance space in a constantly evolving world, it is very important to adapt swiftly to these challenges. Which itself presents a challenge due to the scarcity of empirical data available for simulating and stressing PD- (Probability of default) scenarios, when compared to the more traditional products. So, to gain comfort with these new products, we must rely on the expertise and empirical data provided by banks, asset managers, and specialized NFIs (non-financial institutions) & DFIs (development finance institutions), who have been operating in this specialized niche for much longer than we have. Fortunately, there has been a positive shift in transparency, with lenders and brokers being more open to sharing information and models with insurers and reinsurers. This increased collaboration is a significant step forward, but we must further consolidate our efforts to effectively tackle the challenges of tomorrow. It is important to determine our general risk appetite for these types of transactions, which depends on us being comfortable with them. However, how do we become comfortable with something new? It requires us not only to identify but also to create our own models for quantifying the risks associated with “new” products. Additionally, it may be necessary to challenge existing models to ensure they remain effective in this evolving landscape.

The non-traditional credit insurance sector often deals with unique underlying assets, requiring a distinct skill set for analysis. A thorough analysis is crucial, allowing us to be well-prepared for when confronted with unexpected “Black-Swan” events. Full transparency to the lender’s documentation is mandatory, as it enables us to virtually re-underwrite the transactions. When the availability of information is limited due to the existence of nondisclosure agreements (NDA), reaching to the very same conclusions as lenders who use 100% of the information to seek approval from their credit committees, becomes challenging. This becomes particularly important when we are dealing with lenders’ portfolio solutions for capital relive purposes. Lenders use capital relief products to manage and usually reduce their risk-weighted assets (RWAs) by millions, sometimes billions, ultimately freeing up substantial amounts of Tier-capital within a banking corporation. Therefore, it is of paramount importance to approach such figures with the utmost diligence and caution, irrespective of the transaction structure. Please do not get me wrong, there are benefits within such (sometimes even heavily-) structured solutions, but that does not make the underwriting process easier.

While insurers primarily rely on reinsurance to manage their risk exposures, banks have a range of options available, such as secondary market transactions, true-sale arrangements, and securitizations. These options provide additional strategies for effective risk management. Though, it is essential to question whether we are also the most suitable partner for all transactions presented to us? This is particularly relevant considering the growing demand for exclusions such as, among others, RACE-Free (I call it the “Race for RACE”) or War-Exclusions? Attention should be given to the lender’s buying strategy and ultimate retention to assess the level of “skin-in-the-game” and the alignment of interest.

In my opinion the non-traditional credit insurance market will continue to expand its offering and will further grow to accommodate increasing demand from banks. Regulatory bodies are constantly working towards creating a more sustainable and resilient global banking sector, an ongoing endeavour akin to “The Neverending Story” which will fuel this development. The key to success in this dynamic credit environment is to always maintain an open mind, a calm and focused approach, robust models and a welldefined risk appetite. Although risk is inherent, the closer we are sitting together, sharing ideas and collaborate, the more comfortable we will become with underwriting it. … Or not.

As for the future, who knows what it holds? Perhaps we will witness a demand for innovative surety products designed specifically for mining rehabilitation in space colonies? Or heavily structured crypto-currency based supply chain transactions in combination with contractfor-differences perils? While the trajectory of traditionaland non-traditional credit insurance remains uncertain, one thing is certain: we will gather once again to comprehend the particulars of risk to become comfortable with it. After all, taking risks is what we do! And as stated in Martin Scorsese’s “Wolf of Wallstreet”: “Risk is what keeps us young”. However, I would add that fully comprehending the complexities of underlying transactions can sometimes lead to headaches.

In the upcoming edition of the Insider Magazine, Renate Kerpen from DEVK RE accepted the nomination as a columnist.

Don’t miss it!

| 6 July 2023 | The ICISA INSIDER | Column 6 |

Each author of the Insider Column nominates the next writer.

Update Committee Chairs

ICISA has a total of 4 technical committees and a regional committee. In June, the four technical committees met in Brussels, discussing some of the trends in the industry, as well as developments per region, highlights in their companies, and more. In the upcoming pages, the Chairs of each Committee made a short report of their meeting and topics that will be of interest for the industries in the upcoming months.

The ICISA INSIDER | July 2023 Committee Updates |

7 |

Surety Committee

Nils Hoppenworth

Nils Hoppenworth Chair of the Surety Committee

Uncertainty determines a lot in this current economic and business environment. It covers volatilities by all means –i.e. inflation and its impacts on material prices and the interventions of central banks for increasing interest rates to respond to it. In addition, the geopolitical tensions have been followed by impacts on various sectors. In particular, the energy sector finds itself in the midst of a huge transformation as a result of war, but also the longer-term realities of the need to transition to more renewable sources. All these dynamics influence the underwriting of the surety business and bear a lot of challenges as well as opportunities. Overcoming some of the uncertainties of new type of bonds and a distinct language is inevitably important. Therefore the discussions in the Surety Committee during our recent sessions in Brussels focused heavily on terminologies and definitions. The aim of this was to ensure we had a common understanding of basic terms that are widespread in our sector, but which can have different applications and meanings.

But uncertain situations usually come along with a swarm of associated buzzwords. Topics like ESG, Private Equity and impacts of inflation on pricing of the underlying contract, capacities and even on building reserves all generate such content. Finding the real and the impactful from the irrelevant can be a challenge. Once discussions began in the committee, various interpretations of approaches unfolded among participants about how to address the uncertainty and to develop a distinct terminology to promote better understanding within our sector.

Achieving our aims required splitting off into working groups to tackle some more specific topics. This built on some of the discussions initiated at earlier meetings in Helsinki and Amsterdam as well as in the various working groups set up to look at Surety FAQs, the Surety Glossary of Terms, and ultimately, Suretypedia. To get a common understanding, the

ICISA surety committee will also look to share its thoughts with other associations like PASA and SFAA. Greater collaboration and exchange is certainly on the radar.

Another topic of note in Brussels and the world of uncertainty we face was the importance of sound risk assessment of counterparties. Recent history has told us that even among sureties and banks counterparty risk has increased. As a result, a discussion emerged about how our sector could deal with the potential default of a surety or a bank. The key takeaway from this was that in such an event, we must stand together as an industry and ensure a constructive and solution-oriented discussion with regulators and other stakeholders to achieve the best outcome in a bad situation. To get some certainty, more data will likely be required from ICISA members to address some of these issues. This reflects a wider discussion in the Brussels meetings, that to achieve our goals as an association and trade sector, we need to be able to define and explain our viewpoints, and to do this we need solid data. However, as important as these topics are and the necessity of responding to them, solutions will take time and effort.

Together with the committee I will be looking forward to discussing and working with many members on complex topics and get some certainty in the uncertain world in the coming months. We live the transformation. We also must think as an industry how we respond together to the challenges and opportunities of ESG requirements and the principles of transition which sit behind them. Our sector will be challenged with good opportunities where expertise and talent is certainly required. And the Surety Committee and our colleagues in the other ICISA committees are good starting points to find that talent to progress such discussions further.

| 8 July 2023 | The ICISA INSIDER

| Committee Updates

Single Risk Committee

Julian Spiegel

Julian Spiegel Chair of the Single Risk Committee

The Single Risk Committee certainly had much to discuss at our recent annual meeting, which took place in Brussels at the start of June. The last two and a half years have been truly exceptional, with two crises back-to-back; first the Pandemic and then the Russian invasion of Ukraine. Our markets have seen an unprecedented decoupling in the form of low claims activity during periods of adverse macroeconomic trends . At the onset of the Pandemic, governments across the globe came in very forcefully, preventing real economy insolvencies with generous state support schemes.

When markets were hit by the Russian invasion of Ukraine, the impact on our industry turned out (so far) to be manageable. This is true for for multiple reasons. Firstly, and in response to the Russian invasion of Crimea in 2014, our industry had reduced its direct exposure to the region significantly in the years leading up to the current war. Secondly, at the start of the war, corporate balance sheets were in good shape thanks to the preceding Pandemic-related support schemes. Thirdly, credit insurers had done an excellent job cleaning up their portfolios and moving out of lowertier credit risks. There was a consensus at our meeting in Brussels that non-cancellable exposures could still lead to political violence losses in Ukraine and to sanctions-related loss activity in Russia. However, participants felt comfortable that Ukraine-related reserves would remain sufficient.

Going forward, meeting participants expect to see continued stress on sovereign credits caused by high levels of inflation, rising interest rates in advanced economies, and emerging market currency devaluations driving funds from those places to safer havens. Multiple countries, including Ghana, Zambia, and Sri Lanka, are in the process of renegotiating their sovereign debts. Many more countries, especially on the African continent, are on the brink of default. Some of those countries will need to navigate very complex restructurings, reconciling the interests of domestic versus international debtors; of Western debtors versus China; and, of multilaterals versus export credit agencies versus private banks. However, despite this, meeting participants felt that capacity can still be provided, particularly in the

context of sustainable projects of strategic importance and in collaboration with public agencies.

The last few years have seen a true divergence in the business strategies of the various participants in our markets. Risk appetites differ significantly in terms of products, geographical regions, and preferred kinds of insureds. Some underwriters prefer complex products, including portfolio solutions and credit risks related to derivates, that allow them to regionally shift to more secure jurisdictions. Others prefer more traditional and well-tested products, which can still be profitably underwritten even in higher risk jurisdictions.

With the emergence of complex solutions, including SRTs (significant risk transfers), our markets are currently experiencing an inflow of specialized Managing General Agents (MGAs). This trend is underpinned by brokers that are new to our markets targeting the grey areas between insurers and reinsurers in search of new business. Participants also noted that MGAs can provide benefits in the shape of inroads to new markets without the need for significant investment in initial set-up costs, as well as the necessary reputation and relationship building such markets require However, attendees also noted that for long-tenured products, such as CPRI, it was important to see alignment of interests between primary insurers and MGAs. This is because problems may arise for insurers if the MGA does not remain a going concern deeper into the lifespan of the policy, which may then expose insurers to complex risks and challenging run-offs. However, such concerns do not exclude the positive benefits of competition new players bring to the sector.

Overall, meeting participants remain optimistic that profitable pockets in our markets can continue to be serviced with tailor-made business appetites. The Single Risk Committee will continue to provide an informal forum for the exchange of ideas in support of reliable capacity for our insured banks, traders, and corporations and in close collaboration with multilaterals and export credit agencies.

9 | The ICISA INSIDER | July 2023

Committee Updates |

Credit Insurance Committee

Thomas Meyer

Thomas Meyer Chair of Credit Insurance Committee

At the CIC meeting in Brussels, it turned out that on a day-to-day basis, one of the most prominent issues remains the overall geopolitical situation; its developments and implications on the economy; and hence, on credit insurance markets. In this respect, tensions between the West and China, especially regarding the status and outlook of Taiwan, appeared to be at least as important to delegates as the Russian war in Ukraine. More into the details, the rise of inflation and interest rates, expected insolvency developments, and the dealing with sanctions were discussed.

Another area of interest that had not been on the agenda originally is the field of automation, digitization, artificial intelligence and machine learning. This turned out to be important for quite a number of delegates in the longer-run aside from daily business concerns.. Obviously the topic is not new, yet in recent years it was overshadowed by immediate major issues like the Covid19 pandemic and the quickly changing geopolitical scenery. After this lull, it now appears to be to the fore again. The further evolution of new technologies is perceived to be a potential game changer in trade credit insurance, if not a real threat to existing traditional business models over time.

A number of major global long-term developments, also referred to as “megatrends”, the definition and features of which may vary slightly depending on the source, are expected to impact on society and economy and would require some new solutions. Automation and digitization itself is one of those trends, others include the focus on sustainability and the approach to climate change, the rise of China as a global power, or the transformation away from physical goods towards the provision of services (e.g. music and video streaming that has largely replaced CDs, DVDs, etc.).

Credit insurers are faced with the challenge to further automate and digitize their internal processes, e.g. by the introduction of machine learning features to their underwriting setup, in order not only to maintain and improve on efficiency, yet also to keep up with competitors that might come in from a completely different angle, like e.g. tech companies other financial institutions. A rather granular request explicitly mentioned in the CIC in this context addresses the desire for the consistency of data between primary insurers and reinsurers, respectively the ease of data transfer between contractual parties on a large scale. This is something the market has been working on for years yet there still seems quite some way to go. It exemplifies that a lot of work appears to be ahead of credit insurers when it comes to automation and digitization. It also shows that the issue has not been completely overtaken by current affairs, and that credit insurers remain aware of the challenge.

| 10 July 2023 | The ICISA INSIDER

| Committee Updates

Committee of Underwriters

Fabrice Nessi

Fabrice Nessi Chair of the Committee of Underwriters

Last month, during the ICISA AGM Week, our Committee of Underwriters enjoyed a record attendance of 29 representatives from across the ICISA member companies. Beyond the usual European representatives, we had some members from APAC, Latam and North America, which is not always the case. The reason for this large attendance was perhaps the new format of the conference, allowing participation to attend two committees, but I like to think it was also due to some deep interest in the topics that were discussed! As for the agenda, we started with the usual tour de table where everyone presented the current situation in their own country. It was followed by some specific presentations from two external speakers. I would like to specifically thank Raphael Cecchi, Country Risk Analyst at Credendo, for his deep review of the Chinese economic environment, as well as Chandy Smith, Senior Investor Liaison Officer at the Financial Accounting Standards Board (FASB) for their wonderful contributions. We then had three detailed discussions about Fraud, Reverse factoring and the Banking crisis, respectively.

As mentioned by Benoît des Cressonnières at the closing of the AGM, one of the prominent subjects for our industry should be data. And I think the discussion about the new FASB transparency rules on the Supplier Finance Programs is a good example of this challenge, because it could apparently impact the Financial Statements of 20% of the S&P500 for example. This was a real eye-opener for many of us.

I would like to look also to the recent hints of an emerging banking crisis, which has apparently been avoided for the time being. It began in March and the US Treasury and Fed immediately jumped in to calm markets. Regulators moved quickly to back depositors of struggling banks. Banks were able to borrow from the Fed, using their Treasury and MBS as collateral at par value and not much lower market value

(SVB had to incur a EUR 1.8 billion euros loss on its Hold To Maturity portfolio). The idea was obviously to restore confidence in the system, and it worked, as deposits have stabilized. More important, there have been no bankruptcy since First Republic Bank on May 1 and the VIX index and correlations within the SP500 are now at historical low levels. That being said, the economic fallout has just begun. The principal channel through which a banking crisis impacts the economy is through lending standards. The main risk being that banks tighten their underwriting so aggressively that it impairs future investments and operational needs. To date, the impact on loan growth has been muted, banks are still supporting real estate and consumer loans. However, higher delinquency and default rates are being seen and this means banks are starting to reduce their support to commercial and industrial companies. This is a shock, while credit quality had stayed good, in part because of the state support delivered during the Covid pandemic, but also because of record low interest rates. The fear then is that losses could overwhelm small and medium sized banks with thinner capital bases and deposits. It happens that commercial real estate portfolios are owed or financed in majority by these regional banks (80%). It is estimated that $2.5 trillion of debt in this sector will have to be reimbursed or refinanced over next five years ($270 billion this year). Not easy with interest rates that have more than doubled and vacancy rates that are at historical highs. Goldman Sachs estimates that the tightening of underwriting is already having a -0.5-point impact on the US GDP.

Finally, the three bankruptcies that occurred in two months this year, represented $532 billion of assets. This is to be compared to the $526 billion of the 25 banks going bankrupt in 2008… and, do not forget that 297 US banks followed in 09 and 10. So, there was a lot for us to consider. And much more for us to monitor going forward!

11 | The ICISA INSIDER | July 2023

Committee Updates |

ICISA members elected a new President

An interview with Benoît des Cressonnières, newly elected President of ICISA

Benoît joined the Credit Insurance industry over 20 years ago. He started in this industry as CFO of Allianz Trade in Belgium in 1997 and never left since. He always gets enthusiastic about his job and about the industry he joined a while ago with a bit of scepticism. He has represented Allianz Trade in ICISA and joined the Management Committee of ICISA in 2012.

Thanks to his dedication to ICISA, he was elected some weeks ago as President for the upcoming year. I sat with him and asked couple of questions about his views and plans for our organization for the future.

I wish you a pleasant reading!

The Editor

| 12 July 2023 | The ICISA INSIDER

| 12 July 2023 | The ICISA INSIDER | Interview

Tell us something about yourself: how would most of your colleagues describe you and what is one less known thing about you that colleagues and / or business partners don’t usually know about you.

It is always difficult to speak about oneself; the perception others have may be different from what we think.

Generally, I think I am someone passionate about what I am doing in both, professional landscape and my private life. I try to share my relatively long experience in our industry with all our stakeholders – from my team members up to our external business partners, and obviously now within ICISA. And I would be happy to contribute as much as I can to the success of our Association in all its missions to the benefit of the members and the development of our industry across the world. The most important principles in a successful career are ethics, fairness, dialogue and openness.

With so many years in the industry and in my company, I think most of my colleagues and business partners know me well - even sometimes too well (!). When I was still a student, I swore I would never work for an insurance company…but discovering it through the angle of the Trade Credit Insurance & Surety as well as the Reinsurance world made me change my mind. These businesses are so fascinating, with unsuspected variety of opportunities as well as challenges.

How do you feel about being elected as President of ICISA and what made you accept this nomination, and as a Vice-President previously?

I am very proud to represent our important industry and its members. At the same time, it is great to know that I am being helpful to the industry; making it and its benefits even more known. The Trade Credit & Surety business lines, as well as all the related products are key to secure the B2B transactions and the development of projects worldwide. This industry has a real strength and power in ensuring that trade happens safely. For many years I have represented Allianz Trade in the Management Committee of ICISA and felt I could do more for members. I felt that there was a demand for ICISA to adapt to the needs of members, driven by changes in the business environment, the evolution of regulations, the products and the markets we operate in. With the recent changes in the ICISA Secretariat and the appointment of more-or-less a new team, I thought it was the right moment to be part of the change and I was thrilled to offer my experience to support the team in this journey.

What is the main value that ICISA brings to its members?

ICISA could potentially bring a lot of added value to its members by helping them defend their interests around the world, particularly in relation to the ever-growing challenge of regulatory change. At the same time, ICISA can support its members with the development of their activities locally or globally, protecting their own customers in trading safely.

Representing our industry towards the decisionmakers is certainly a key benefit for ICISA members. This also ensures that we are recognized as providing efficient tools to manage trade receivables, allow capital savings to financial industry players, and ease projects’ financing when it is the most necessary in a fast changing world with a lot of uncertainties ahead. ICISA is a valuable platform for sharing best practices, or for example, to support and collaborate on ESG principles that the industry is currently implementing. Last but not least, by collecting data about the industry, ICISA can promote the real value of its members for the economy and can help decisionmakers and regulators to understand better the weight of our industry in worldwide trade and the key benefits we provide in supporting the global economy.

13 | The ICISA INSIDER | July 2023

> > > Interview |

What are your main priorities for ICISA in the upcoming months ?

I always think that ICISA should do so many things, but we need to also look at the financial and human resources we have, therefore we have to select only the most crucial and relevant projects. In my view, there are two extremely important topics which we will pay a lot of attention in the upcoming months.

First is ensuring that ICISA has access to the right industry data from our members. Second is the develop our advocacy activities towards key decisionmakers and make sure ICISA will be consulted before decisions that could have an impact on our industry are taken. And the key principle remains to optimize every Euro spent in driving the actions of ICISA to the benefit of all the members.

During the AGM week you talked a lot about the importance of data for ICISA and for our industry. What is, in your opinion, a reason for which members are reticent to share more information with ICISA?

There is probably a fear that data might be used individually or lead to comparisons between the members. Obviously, this is not at all the purpose of collecting data. ICISA will only use relevant data, which is aggregated, analysed and processed by a neutral third party which will work according to the topics to be presented. While data is key, relevant data for the industry means, inter alia, aggregated exposure, premium, or claims information, which can be divided per

sector, per region or per country to be able to evidence the industry’s role in these categories and others. Within the frame of ICISA, we will of course guarantee to use data in the full respect of the anti-trust rules.

With the risk of repeating myself, access to data will help ICISA in consultations with regulators, being able to highlight our impact in the overall economy and the worldwide trade.

How do you see ICISA’s involvement in offering training and education to junior staff of its members?

Training and education are key pillars for the success of our industry. Indeed, our industry is almost entirely absent from educational curriculums other than the most specific and advanced - even then, there is no guarantee. In the past, members used to organize trainings for their own staff, inviting also some related business parties (i.e. Reinsurance Underwriters), but this has disappeared for many reasons which includes the concentration of our industry in the 90’s, leading to a different competitive landscape.

Ideally, ICISA would have a role in organizing and coordinating trainings for the junior staff of its members. The ideal format needs to be defined in coordination and collaboration with ICISA members, in order to make it cost efficient, attractive and useful, keeping in mind the work and role of STECIS also. Definitely it is an important topic on the agenda of ICISA and concrete actions might be implemented in the next two years to revive the principle of a training program to be offered to the members.

July 2023 | The ICISA INSIDER | Interview | 14

A Guide to Trade Credit Insurance

By the International Credit Insurance & Surety Association

This compact volume is a practical guide for anyone interested in Trade Credit Insurance. The International Credit Insurance & Surety Association (ICISA) presents an approachable but detailed guide written collaboratively by carefully selected industry experts. The guide describes the lifecycle of the credit insurance product, from the initial application stage to the expiration phase of the policy, including practical use aspects for credit managers. The volume offers compact information on the history of trade, the need for protection against trade credit risks, and solutions offered by credit insurance providers. The focus is on short term credit, including whole turnover policies and single risk policies.

Readership

Suitable for anyone interested in Trade Credit Insurance, from credit managers to policymakers.

Importance

• Collaboration of a diverse group of experts from top organisations around the world

• Written in an approachable style, accessible to the non-specialist

• Includes extended glossary of key terminology

• Includes a list of relevant resources for further reading

Content

Foreword; Introduction; Disclaimer; 1.What is trade?; 2. What is trade credit insurance?; 3. Product types; 4. Risk types; 5. Typical set-up of a trade credit insurance contract; 6. Premium, the price for cover; 7. Day-to-day policy management; 8. Buyer risk underwriting in trade credit insurance; 9. Debt collection; 10. Imminent loss and indemnification; 11. Renewal, expiry, termination of a policy; 12. Single risk business; 13. The single risk insurance market: Private and public players; 14. Reinsurance of Trade Credit Insurance; Trade Credit Insurance resources; Glossary of trade credit terminology

About the Author(s) / Editor(s)

The International Credit Insurance & Surety Association (ICISA) brings together the world’s leading companies providing trade credit insurance and surety bonds. ICISA promotes technical excellence, industry innovation and product integrity, as well as addressing business challenges generated by new legislation.

Where to order my copy?

The book can be ordered from Barnes&Noble and Bol.com

15 | The ICISA INSIDER | July 2023

A practical and accessible industry-wide reference on Trade Credit Insurance, written by a team of industry experts.

15 | The ICISA INSIDER | July 2023

The dark arts of commodities trading: assessing risks and claims in trade credit insurance

By Baldev Bhinder

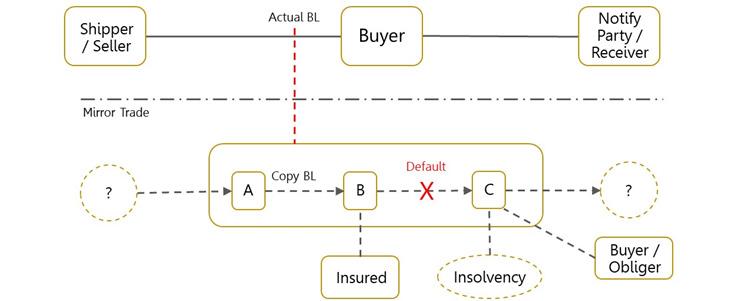

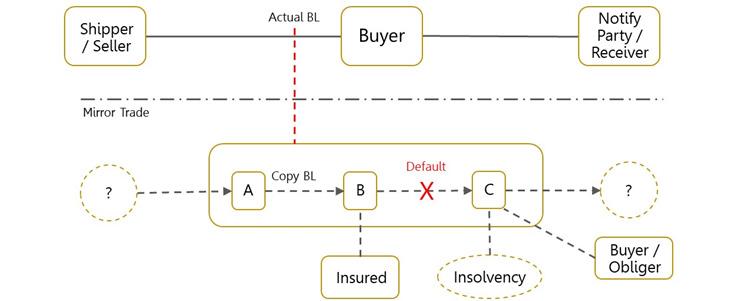

The business of credit insurance does not always sit neatly with the business of commodities financing or trading. Underwriters tasked to provide cover do not have a full understanding over the lifecycle of the trade that may involve commodities being sold forwards, backwards and in circles. A claims manager needs to analyse the nature of the trade against the policy wording. If physical interest in the goods is necessary for cover, then an investigation into the evidence associated with such a trade, including the movement of relevant shipping documents between parties needs to be seen. Fictitious, mirror trades and forged documents are not unheard of in the commodities space even before we dive into synthetic trade structures designed for financial arbitrage.. In that regard, a trade credit policy is not just a non-payment cover – it is predicated on trades involving a physical interest in goods.

Why the obsession with original BLs?

Selling and buying goods typically involves payment in return for goods (e.g., think of your daily purchases in a shop). But international trade involves moving goods on a ship to different destinations. Unlike a shop purchase, the ship as the custodian of the cargo, issues a document known as the bill of lading (“BL”) which has multiple functions including as a receipt of the cargo as well as acting as a document of title. The BLs will list the shipper who loads the goods on the ship (e.g., the exporter) as well as the notify party who needs to be notified when the goods arrive at the destination (e.g., the receiver of the goods). But between the shipper and the receiver, numerous parties may “trade” the goods without physically taking possession of the goods while it moves on the water from one country to another. Only an original BL gives the right of possession to its holder – for negotiable

BLs, the ship is obliged to deliver the cargo to whomever presents the BLs to them, irrespective of whether they are named on the BLs or not. However, since couriering original documents might take days, some parties might agree to buy and sell using photocopy BLs. This is where the danger lies.

For example, it would not be unusual for an underwriter or claims person to be presented with a trade of commodities involving Singapore company A, Hong Kong Buyer B, and Dubai Sub-buyer C involving palm oil that moves from Indonesia to Netherlands. In a claims situation, traders A, B, C are not listed on the BLs but claim to be part of the trade and as proof of that, the insured Trader B, produces a copy of the BL to substantiate their involvement in the trade.

The use of copy BLs are more the exception than norm in trade chains. This is because counterparts need to be confident that their sellers do in fact have good title (typically manifested by the transmission of the original BLs) before paying several millions of dollars for the trade. Copy BLs however carry the danger of giving rise to mirror trades, where a photocopy of a BL can be used to create the appearance of a trade that mirrors the actual trade but involves completely different parties. Unlike an original BL, a copy BL has no real value. Often when we are approached by claims teams to analyse a trade, our primary concern is to connect these trio of parties to the actual physical trade, hence the obsession with who had the actual BL as two parties can’t trade the same goods at the same time. In our investigations focussed on the actual BL, we then discover the actual movement of goods between the actual trading parties.

| 16 July 2023 | The ICISA INSIDER

| Insights

> > >

In this case, Traders A, B and C have created a fiction of a trade using a photocopy BL. This may primarily be for the purpose of obtaining liquidity by creating the appearance of commodities trading and applying it elsewhere. Traders do this because the risk versus reward might appear in their favour. A single cargo of grain, metals or oil in one BL, could be worth anywhere between $5m to $50m. With a photocopying machine, the “trade” could be reproduced 100 times with 100 photocopies of the BL. This may explain how some traders can grow their revenue from $100m to 1 billion in just a few years.

Financial structures dressed up as trade

Multiple financing and mirror trades aren’t particularly sophisticated fraud. But the fact that it happens so often and even slips past experienced trade finance bankers, goes to demonstrate the human fallacy of being seduced by compelling narratives and glitzy balance sheets.

But the dark arts of commodities financing gets more troubling when we look at circular or synthetic trades, loosely described as structured trades. In these structures, parties are no longer concerned with the physical goods and are creating structures to leverage on financial positions –something a trade credit insurance policy might simply not be designed to respond to.

Using the example of copper trades, a voyage between Chile and China could take more than a month. During this period, a trader might seek to “monetize” goods on the water by selling them in a circle back to itself before the ship arrives in China and the goods delivered to the buyer.

Circular trades often raise eyebrows – why would a trader sell goods in a circle and buy it back later in 30 days for a higher price? There are many reasons for creating circular trades but one common denominator is that by putting together a circle, Trader B, Trader C and Trader D have all raised financing on a trade that each never had any physical interest in. More importantly, it becomes a shortcut to increasing their balance sheet without actually doing very much. Circular trades can also sometimes be used as a disguise for a loan between parties, where a trader prepays its “supplier” $100 today through the circle and gets paid $110 in 30 days’ time. The clear risk with circular, synthetic or structured trades is that the parties involved have no interest in the physical trade, and there can be little incentive to verify their actual involvement in the trade, the documents related to the trade such as the original BL or for that matter, even if the trade existed. All that is concerned is that invoices are submitted to each for a fleeting “involvement” in the trade.

17 | The ICISA INSIDER | July 2023

South America Shipper China Receiver Physical Trade Circular Trade: 1 Cargo – 4 Financing Sale Sale Sale Sale Physical Trade Payment: 60 days A B C D Genuine Physical Trade Related/ Connected Party Raising Finance Loan Payment Structure Insights | > > >

Once again, such financial structures wrapped up in the appearance of a trade, does not sit well or at all within a vanilla trade credit policy coverage.

What should underwriters and claims handlers look out for?

It is notoriously difficult to spot dubious trade patterns but a good deal of comfort can be obtained if insureds can legitimately connect their trade directly to the shipper or receiver of the cargo. Ultimately, the familiarity of a trader with the physical operations of trading a particular product and how trade structures are originated will give an insight as to whether such trades might in essence just be financial structures. Most importantly, given the manner in which balance sheets can be inflated in commodities trading, a healthy dose of scepticism might serve underwriters when analysing remarkable growth stories.

For claims handlers, a pro-active approach is critical. Understanding and investigating how the alleged trade fits into the actual physical trade will invariably require insight into the full lifecycle of the BL as well as product knowledge on how that commodity is traded. An inability by an insured to provide prompt responses to requests relating to trade origination, transmission of shipping documents including BLs, proof of payment to suppliers and contemporaneous cover correspondence would, from experience raise serious concerns on the legitimacy of the trade and would warrant closer scrutiny of the transaction.

Baldev Bhinder is the Managing Director of Blackstone & Gold, a specialist commodities and trade law firm based in Singapore. He specializes in trade fraud investigation, asset recovery and litigation. He has helped various insurers in investigating dubious trade claims and has represented insurers in litigation cases. He can be reached at baldevbhinder@blackstonegold. com

| 18 July 2023 | The ICISA INSIDER | 6 18 |

| Insights

AIG joins ICISA

An interview with Corine Troncy

The Editor of ICISA magazine recently spoke with Corine Troncy about AIG, their motivation to join the International Credit Insurance & Surety Association, as well as the topics they wish to explore further within ICISA.

According to Corine, the reason AIG wanted to become a member of ICISA was to stay up to date with market trends and products, as well as the opportunity offered by ICISA, to collaborate with other credit insurers for “the development of the industry”. For Corine, the collaboration between market players through ICISA is important and leads to an improvement in “our clients’ and partners’ experience globally”.

Customers and relationship with customers are a core part of AIG’s mission, which was also highlighted by Corine. She sees ICISA as a platform where insurers can discuss, debate and improve the customer experience through innovations, such as digitalization and to bring new ideas to the table in the form of further automation of underwriting processes.

By joining ICISA, Corine hopes that AIG could benefit can benefit from discussions held around the world by our community of members, while also sharing her and her team’s perspective on these issues, so that everyone can learn and improve from the best practices developed by each other.

When it comes to committees, AIG will be part of: the Asia Committee, Single Risk Committee, Credit Insurance Committee and Committee of Underwriters. Corine explains their decision to join these four committees: “Going forward we would like to be an essential part of industry development as we focus on ease of trading for our clients and business partners.”. AIG is also participating in the Regulatory SubCommittee, which will of course benefit from their presence and input to shape our advocacy agenda going forward.

With AIG’s extensive experience in the industry, particularly as specialists in Excess of Loss (XoL) programs, we are pleased to welcome them as members. We are sure that ICISA members will learn a lot from their perspective on the many questions our industry faces today.

19 | The ICISA INSIDER | July 2023

Interview |

American International Group, Inc. (AIG) is a leading global insurance organization. AIG provides a wide range of property casualty insurance, life insurance, retirement solutions and other financial services to customers in approximately 70 countries and jurisdictions. These diverse offerings include products and services that help businesses and individuals protect their assets, manage risks and provide for retirement security.

AIG has been providing trade credit insurance in multiple countries around the world for more than three decades. They offer local underwriting expertise and policy servicing capabilities virtually anywhere a client’s business operates, including many emerging markets.

Member in the spotlight: COSEC

An interview with Vassili Christidis, CEO of COSEC

What are some highlights in the history of COSEC?

After COSEC´s foundation, in 1969, the company evolved and started to operate in the insurance and surety branch, and in 1975 COSEC was nationalized. A year later, in 1980, COSEC - Companhia de Seguro de Créditos, S.A. statutes were approved. At this time, the Public Investment Bank became the largest shareholder. Some years later, in 2001 the cooperation with the Euler Hermes Group1 starts and in 2007 Euler Hermes becomes COSEC’s shareholder together with BPI, sharing 50% of the credit insurer’s capital.

Over the following years, several awards were given to COSEC by Exame Magazine; by World Finance Insurance Awards; by SIC Notícias. In 2017, COSEC starts the internal innovation program COSEC 2020 and launches Dynamic Guarantee, an innovative online solution for risk classification and coverage. In 2018, the COSEC mobile app is launched, which allows managing Credit Insurance policies anywhere in the world.

COSEC is a leading insurer in Portugal; What do you think makes COSEC stand out? What are particularities of the market in Portugal?

In terms of size, Portugal is a small country - less than 11 million inhabitants - with an economy which, in this postpandemic period, is growing, sometimes above the eurozone average. Industry and services are the two main areas of economic activity, and industry, it should be noted, has a strong internationalisation and export side.1

Footwear, clothing, molds and other components for heavy industry are some of the industries in Portugal that, being exported, benefit from the support of credit insurers. Our solution offers protection, assessment of the customers’ risk situation, and information to help companies improve their credit decisions. In the case of late payment or non-payment, COSEC acts as soon as it is notified, and if uncollectible, it provides compensation. For our clients, this represents a financial guarantee, ensuring that they will receive payment for their credit sales.

We know the market very well and we can proudly say that we have been doing an excellent work for decades. The accompaniment and support we give Portuguese companies, responding with the best solution for their needs, is what makes us the market leader with an increasing market share. This, we believe, is also why many Portuguese companies have a long relationship with us and why new companies talk to us every day to support their activities.

1 Allianz Trade is the trademark used to designate a range of services provided by Euler Hermes

| 20 July 2023 | The ICISA INSIDER

| Insights

COSEC was founded in 1969, initially as the ECA service provider to the Portuguese State. Nowadays, it is the leading Insurer in Portugal in Credit Insurance and Bond Insurance. COSEC has in-depth knowledge of global markets, using important business intelligence systems and offers products to better satisfy its client’s needs. The first solution is the Credit Insurance - Global Offer, which is short-term commercial credit insurance that covers credit sales so that your cash flow is safeguarded, avoiding bad debts. And finally, we have another solution: COSECAllianz Trade World Program. This one is a global credit insurance designed for large companies operating in two or more countries, and it allows global companies to be protected against risks arising from trade credits or political risk situations, while also offering a local debt collection service.

When did COSEC join ICISA and what is most appreciated being part of our association?

COSEC is a member of ICISA as early as the 1970’s. This is a collaboration that makes us very proud, since ICISA comprises the world’s leading Credit and Surety Insurance companies. It is very positive to feel that we are united and that we have the support of an association of this relevance to discuss important topics in this field. We also consider that it is critical to be part of some processes to contribute to the evolution of our operation sector.

21 |

| 16

Insights | The ICISA INSIDER | July 2023

Changes at Credendo & Credendo - Guarantees & Specialty Risks

Credendo – Guarantees & Speciality Risks, the subsidiary of Credendo specialised in, top-up, XOL excess of loss, single risk and surety solutions, has appointed Kerlijne Van Steen, who has served as Head of Single Risk, in the newly created role of Head of Underwriting and Marco Censi, who was the Head of Trade Credit Insurance, takes the lead role of Head of Sales for the credit insurance and surety solutions.

In this new structure, Kerlijne takes the strategic lead of the single risk and surety underwriting to improve efficiency and client experience, while Marco Censi, takes the responsibility to develop and grow the portfolio of credit insurance and surety in the European market.

Kerlijne

Van Steen, Head of Underwriting Company: Credendo

Credendo is pleased to announce the recent appointments of three underwriting specialists to strengthen its Single Risk capabilities.

Joining the branch in Geneva as Senior underwriter, Marine Perrier brings a wealth of knowledge in single risk having worked at Coface Switzerland, and AON Switzerland. Appointed as Underwriter, Kevin Bertrand completes the Single Risk team in Geneva. Prior to Credendo, Kevin had different positions as Credit Risk Underwriter at Allianz Trade, and previously as Coverage Analyst at the CIC. To reinforce the Single risk team in its offices in Vienna, Jakub Lawicki has been appointed Underwriter, after his experience in corporate restructuring at ARP, the Polish Industrial Development Agency, and in risk distribution (CPRI) at ING.

QBE has appointed Gary Payne as Senior Underwriter, Trade Credit

QBE has appointed Gary Payne as Senior Underwriter, Trade Credit to support and grow QBE’s presence in the North of England and Scotland as part of a restructure in the trade credit team supporting new business.

Gary joins from Coface where he was Senior Sales Executive for Trade Credit insurance. In his new role, he will be responsible for all new business with turnover in excess of £35m in the region. He will be based in Manchester and report to Dave Murray, Head of New Business. In addition, as part of the team restructure:

• Jack Staniforth, Underwriter for Trade Credit will be taking on responsibility for all new business enquiries in the South West, Midlands, Northern Ireland and Republic of Ireland.

• Harry Bennion, along with Ruth Copperwheat, will now focus on servicing existing QBE customers in the South.

• Abbie Sandford will continue in role in London and the South East, but with increased responsibility for all new business with turnover in excess of £10m.

• Stephen Watson, will work side by side with Gary Payne servicing £10-35m turnover business in the North of England and Scotland.

| 22 July 2023 | The ICISA INSIDER

ANNOUNCEMENTS July 2023 | The ICISA INSIDER | Announcements

Gary Payne Senior Underwriter Company: QBE

Appointment of Benoît Urbin as Coface country

for the UK and Ireland

Benoît is based in London and reports to Carine Pichon, CEO of Coface in Western Europe. He replaces Frederic Bourgeois who will continue his career outside of Coface Group.

Benoît brings a wealth of experience, having already spent nearly ten years within Coface Group. He has held a variety of senior roles in the company, first in Western Europe within the commercial and underwriting departments, then in North America as Country Manager & Chief Agent of Coface Canada, then Chief Operating Officer for the North America region. Prior to joining Coface, Benoît held an array of executive roles at American Express.

Coface has been active in the UK since 1993 and in Ireland since 2001. It provides companies with credit insurance solutions to protect them from unpaid debts, late payments, political risk, and other losses arising from non-payment for goods or services. Coface also uses its business intelligence database to serve corporates with reliable information on their partners, be they suppliers or clients, and help them evaluate their financial health and minimize the risks.

Alexander Steiner was promoted to the position of Senior Underwriter, Global Credit, Surety & Political Risk Reinsurance. Andrew has worked for AXA XL for over four years, most recently as Underwriter, Global Credit, Surety & Political Risk Reinsurance. Andrew is based in Zurich.

23 | The ICISA INSIDER | July 2023

Benoît Urbin, Country Manager Company: Coface

July 2023 | The ICISA INSIDER | Announcements

Appointment of Alexander Steiner as Senior Underwriter for AXA XL

Alexander Steiner Senior Underwriter Company: AXA XL

manager

24 | The ICISA INSIDER | July 2023 ICISA Members Evert van de Beekstraat 354 1118 CZ Schiphol The Netherlands +31 (0)20 625 4115 secretariat@icisa.org www.icisa.org ICISA Registered Number: 64391736

Author: Sascha Dear, R+V Re

Author: Sascha Dear, R+V Re