Risk-Sharing

There has been an 89% increase in the number of Members since the beginning of the 2002 year. The claims activity has remained relatively stable in both the number of claims (Frequency) and the dollar cost of those claims (Severity). This has been consistent for several reasons. First, the solid underwriting practices that Insurance Benefits uses when adding new members. Second, the claims management and use of rehab nurses that Claims Associates provides. Third, the active loss control programs that are provided by Safety Benefits.

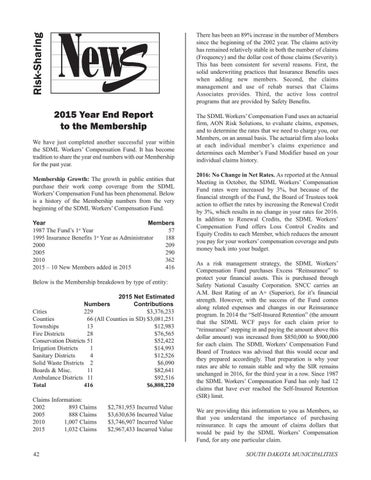

2015 Year End Report to the Membership We have just completed another successful year within the SDML Workers’ Compensation Fund. It has become tradition to share the year end numbers with our Membership for the past year. Membership Growth: The growth in public entities that purchase their work comp coverage from the SDML Workers’ Compensation Fund has been phenomenal. Below is a history of the Membership numbers from the very beginning of the SDML Workers’ Compensation Fund. Year Members 57 1987 The Fund’s 1st Year 1995 Insurance Benefits 1st Year as Administrator 188 2000 209 2005 290 2010 362 2015 – 10 New Members added in 2015 416 Below is the Membership breakdown by type of entity: 2015 Net Estimated Numbers Contributions Cities 229 $3,376,233 Counties 66 (All Counties in SD) $3,081,251 Townships 13 $12,983 Fire Districts 28 $76,565 Conservation Districts 51 $52,422 Irrigation Districts 1 $14,993 Sanitary Districts 4 $12,526 Solid Waste Districts 2 $6,090 Boards & Misc. 11 $82,641 Ambulance Districts 11 $92,516 Total 416 $6,808,220 Claims Information: 2002 893 Claims 2005 888 Claims 2010 1,007 Claims 2015 1,032 Claims

42

$2,781,953 Incurred Value $3,630,636 Incurred Value $3,746,907 Incurred Value $2,967,433 Incurred Value

The SDML Workers’ Compensation Fund uses an actuarial firm, AON Risk Solutions, to evaluate claims, expenses, and to determine the rates that we need to charge you, our Members, on an annual basis. The actuarial firm also looks at each individual member’s claims experience and determines each Member’s Fund Modifier based on your individual claims history. 2016: No Change in Net Rates. As reported at the Annual Meeting in October, the SDML Workers’ Compensation Fund rates were increased by 3%, but because of the financial strength of the Fund, the Board of Trustees took action to offset the rates by increasing the Renewal Credit by 3%, which results in no change in your rates for 2016. In addition to Renewal Credits, the SDML Workers’ Compensation Fund offers Loss Control Credits and Equity Credits to each Member, which reduces the amount you pay for your workers’ compensation coverage and puts money back into your budget. As a risk management strategy, the SDML Workers’ Compensation Fund purchases Excess “Reinsurance” to protect your financial assets. This is purchased through Safety National Casualty Corporation. SNCC carries an A.M. Best Rating of an A+ (Superior), for it’s financial strength. However, with the success of the Fund comes along related expenses and changes in our Reinsurance program. In 2014 the “Self-Insured Retention” (the amount that the SDML WCF pays for each claim prior to “reinsurance” stepping in and paying the amount above this dollar amount) was increased from $850,000 to $900,000 for each claim. The SDML Workers’ Compensation Fund Board of Trustees was advised that this would occur and they prepared accordingly. That preparation is why your rates are able to remain stable and why the SIR remains unchanged in 2016, for the third year in a row. Since 1987 the SDML Workers’ Compensation Fund has only had 12 claims that have ever reached the Self-Insured Retention (SIR) limit. We are providing this information to you as Members, so that you understand the importance of purchasing reinsurance. It caps the amount of claims dollars that would be paid by the SDML Workers’ Compensation Fund, for any one particular claim. SOUTH DAKOTA MUNICIPALITIES