City launches new transitional housing project

By Christina Lee Knauss cknauss@scbiznews.com

The city of Columbia has unveiled a new concept for providing services to chronically unsheltered people in the city.

On Sept. 6, city officials announced the construction of a transitional housing project that will be built on city property at 194 Calhoun St., the location of the former Inclement Weather Center.

The site will now be known as Rapid Shelter Columbia and include 50 sleeping cabins, each designed to accommodate one person, with 40 for men and 10 for women.

The congregate sleeping quarters that already exist at the Calhoun Street site will continue to be used to accommodate overflow population during inclement weather.

Construction for the project will be managed by the city and should begin later this month. The goal is to have the 50 sleeping cabins completed and ready for use by November.

By Christina Lee Knauss cknauss@scbiznews.com

Midtown

at Bullstreet, a new 90-unit attainable housing rental apartment complex, will soon be under construction at the BullStreet District in downtown Columbia.

Midtown at BullStreet will cover approximately two acres located near the recently dedicated Page Ellington Park, a 20-acre city park.

The development will consist of 18 two-bedroom townhouse units and 72 one-, two- and three-bedroom garden-style

units. Onsite amenities will include a community room, computer center, exercise room, playground and gazebo.

Attainable housing is defined as housing that is affordable for people making around an area’s median income. No subsidies are involved.

Connelly Development LLC of Lexington is the developer for the Midtown project. Company President Kevin Connelly has more than 25 years of experience in developing attainable housing in the Carolinas. He is also president of Connelly Builders Inc., general contractor for the

Going public

development.

Parks Player Architecture of Greenville is the development architect, and Civil Engineering of Columbia is providing civil engineering and surveying services.

Completion on Midtown at BullStreet is scheduled for fall 2023.

“Our company is honored to be a part of history to provide much-needed attainable workforce housing at one of the nation’s largest downtown redevelopments,” Connelly said in a news release. the way answers

Pallet, the company that manufactures the sleeping cabins, is based in Everett, Wash., with several staff members who have experienced homelessness in the past. Pallet sleeping cabin projects have been built successfully in places such as Boston and Sonoma County, Calif.

Once completed, Rapid Shelter Columbia will be open year-round, include 24-hour security, on-site case management services and food services.

City officials also announced they will be hiring a new coordinator of homeless services for the city who will work with various programs and services for the homeless population.

Columbia Mayor Daniel Rickenmann and other city officials said the need to find solutions for the homeless crisis has become more urgent in recent months, as the number of chronically unsheltered people in the area has continued to rise.

See RAPID SHELTER,

Midtown BullStreet.

Midtown BullStreet.

INSIDE Upfront 2 SC Biz News Briefs 3 In Focus: Residential Real Estate 13 List: Residential Real Estate Companies 18 Bonus List: Independent Insurance Agencies 19 At Work 21 Viewpoint 23 Pointing

New executive director at Five Points Association. Page 4 Main Street moves Locally owned toy store newest downtown addition. Page 9 Expert

Q&A with president of South Carolina Realtors. Page 14 Foreclosure woes SC has nation’s third-highest foreclosure rate in August. Page 16

Irmo-based Great Southern Homes to become publicly traded company. Page 17 VOLUME 15 NUMBER 13 ■ COLUMBIABUSINESSREPORT.COM SEPTEMBER 26-OCTOBER 9, 2022 ■ $2.25Part of the network

Page 7 New BullStreet development aims to address need HOUSING HELP

at BullStreet, a 90-unit attainable housing development, will soon be underway at

(Rendering/Provided) See MIDTOWN, Page 16

Residential home prices stay strong across SC after interest rate hikes

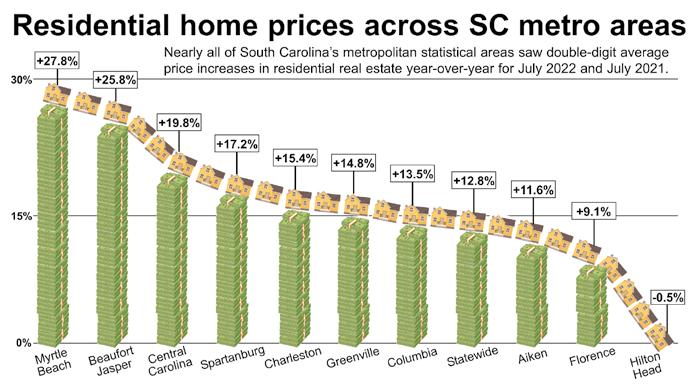

Evenwith three federal interest rate increases this year, South Carolina’s real estate market appears to be robust, year-over-year data from across the state show.

Market reports from multiple listing services and Realtor associations for July show double-digit percentage increases from a year ago in nine of 11 metro areas of the state. Only Hilton Head, one of the highest-priced markets for residential property, saw a 0.50% dip in home prices, data from the Hilton Head Area Association of Realtors indicates.

Five regional markets saw a more than 15% increase from July 2020 to July 2021 in South Carolina, with the Myrtle Beach area reporting the highest increase at 27.8% from one year ago.

Inventory continues to be a factor impacting the housing markets in South Carolina. The amount of time on the market before a sale had fallen in five metro areas, but increased in five others. The longest number of days before a sale occurred in the Columbia area at 130, the Central Carolina Realtors Association reported.

Homes in the Spartanburg area sold the fastest in July at only 10 days, the Spartanburg Association of Realtors said. Spartanburg was closely followed by Charleston at only 14 days until a sale, the Charleston Trident Association of Realtors reported.

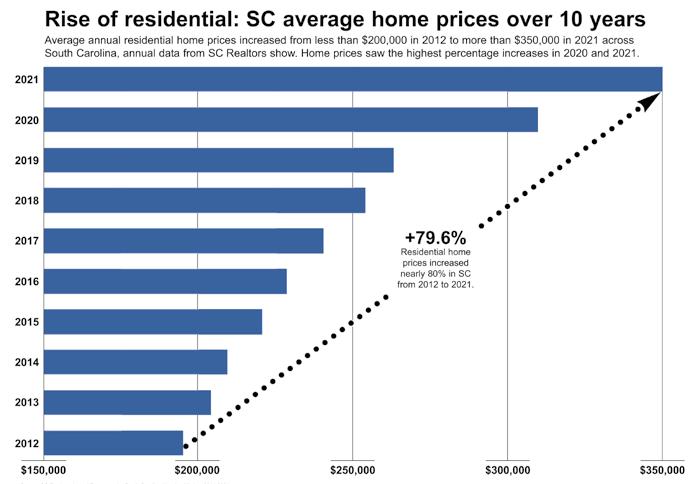

While the last two years have been the strongest real estate market in a decade, data from SC Realtors show, over 10 years, South Carolina has seen an average home price steadily increase.

In 2012, the average home price was just over $194,000. Ten years later, in 2021, the average home price had increased nearly 80% at more than $350,000.

By Andy Owens

Sources: Aiken Association of Realtors, Beaufort-Jasper County Realtors, Charleston Trident MLS, Consolidated MLS, Greater Greenville Association of Realtors, Hilton Head Area Association of Realtors

By Andy Owens

Sources: Aiken Association of Realtors, Beaufort-Jasper County Realtors, Charleston Trident MLS, Consolidated MLS, Greater Greenville Association of Realtors, Hilton Head Area Association of Realtors

“The market in our state is normalizing. Yes, it’s cooling o compared to 2020 and 2021, but it is still a demand-driven market, unlike the late 2000s when we were dealing with a supply-driven market.”

— Cindy Creamer, president, South Carolina Realtors

Upfront FOLLOW US: HEARD IN THE REPORT WEBSITE: @CRBRwww.ColumbiaBusinessReport.com facebook.com/ColumbiaBusinessReport BRIEFS | FACTS | STATEWIDE NEWS

SC Biz News Briefs

Hotel with ties to Clemson coach opens

TheShepherd Hotel has opened its doors in downtown Clemson.

The six-story white brick building at 110 Sloan St., which is located between College Avenue and Sloan Street, features a restaurant called Delish Sisters and a lobby with a grand spiral staircase, according to a news release.

The hotel also includes 67 guest rooms, the Thomas Bar on the third floor, an outdoor terrace and a rooftop event space, according to the release.

The financial investment of the hotel was not disclosed.

Inspired by his daughter, Jamison, who has Down syndrome, hotelier Rick Hayduk had long aspired to operate a hotel and employ individuals with disabilities, the release stated. In 2011, Clemson’s head football coach, Dabo Swinney, introduced Hayduk to Rich Davies, a third-generation real estate developer and involved Clemson alum, the release stated.

The three have come together with the goal of positively impacting the lives of others through creating Shepherd Hotels in collaboration with ClemsonLIFE, a nationally recognized collegiate academic program Clemson University offers to young men and women with intellectual disabilities to prepare them for competitive employment and independent living.

More than 20% of the hotel’s staff comes from ClemsonLIFE. These associates can be found welcoming guests in the hotel lobby, serving in the Delish Sisters restaurant, working in the kitchen, and maintaining guest rooms and public areas.

“We are so excited to welcome the Clemson community to the Shepherd Hotel for a truly remarkable experience,” said Hayduk, co-founder of Shepherd Hotels, in the release. “This is more than a luxury hotel. It is a life-changing opportunity for individuals with special abilities to train and work in the hotel and restaurant while helping them further their skills obtained through the ClemsonLIFE program.

“Our hope is that guests are inspired by our entire team and realize the value, work ethic and heart for hospitality shown by this incredibly special group of people.”

Buying into the mission-oriented vision of the hotel’s founders, several organizations partnered with the founders to help bring the hotel to life, including First Horizon Bank, which supported the project during the hard-hitting financial times surrounding the pandemic, the release stated.

“We are so grateful to our partners whose passion aligns with ours,” said Rich Davies, founder and CEO of Pavilion Development Co. and co-founder of The Shepherd Hotel, in the release. “They have seen the value in creating transformative opportunities to those in our Clemson family who are typically underserved while also stepping up in a tremendous way to bring a best-in-class hospitality experience to our guests.”

CLEMSON GSA Business Report

www.columbiabusinessreport.com 3September 26-October 9, 2022

GSABusinessReport.com With publications in the Upstate, Columbia and Charleston, as well as a statewide magazine, SC Biz News covers the pulse of business across South Carolina. Above are excerpts from our other publications. CharlestonBusiness.com SCBIZmag.com T N Hagan Ave. Huger. When complete, Buyers and renters find uneasy housing market New purpose Nucor Corp. to invest $200M in 5-year span INDUSTRY IN FLUX RUNWAY RUMBLE Aerospace industry shaking up SC SC Ports Authority CEO Barbara Melvin aims to keep moving full speed NEW BOSS detail shop helping restore original Air Force One DETAIL MAN SCBIZNEWS.COM SEPTEMBER/OCTOBER 2022 2022 BEST PLACES TO WORK BIG MONEY: SC BANKS BY DEPOSITS T Shepherd Hotel opens in downtown Clemson INSIDE Up and away Peace Center plans $36M renovation to AMP up the music The 67-room Shepherd Hotel, staffed by memebers of ClemsonLIFE, is now open. (Photo/Provided) OCTOBER 10 EDUCATION & WORKFORCE DEVELOPMENT List: Postgraduate Degree Programs Bonus List: Private Schools Advertising Deadline: September 26 OCTOBER 24 ARCHITECTURE, ENGINEERING AND CONSTRUCTION (AEC) List: General Contractors Advertising Deadline: October 10 NOVEMBER 14 BANKING & FINANCE List: Financial Brokerage Firms Advertising Deadline: October 31 DECEMBER 5 ARCHITECTURE, ENGINEERING AND CONSTRUCTION (AEC) List: Commercial Property Management Cos Advertising Deadline: November 21 For advertising information, call Rick Jenkins at 864.720.1224 Target your market in an upcoming issue of the Columbia Regional Business Report

Jason Thomas, executive editor jthomas@scbiznews.com

• 864.568.7570

Ross Norton, managing editor-content rnorton@scbiznews.com • 864.720.1222

Melinda Waldrop, managing editor-production mwaldrop@scbiznews.com • 803.726.7542

Christina Lee Knauss, sta writer cknauss@scbiznews.com • 803.753.4327

Paige Wills, research specialist pwills@scbiznews.com • 843.849.3125

Steve McDaniel, editor, Custom Publishing Division smcdaniel@scbiznews.com • 843.849.3121

Rick Jenkins, group publisher rjenkins@scbiznews.com • 864.720.1224

Karl Krull, business development director kkrull@scbiznews.com • 843.849.3143

Account Executives

Ryan Downing, senior account executive rdowning@scbiznews.com • 864.720.1221

Amanda Alford, multimedia account executive aalford@bridgetowermedia.com • 864.720.1223

Shannon Pollard, multimedia account executive spollard@scbiznews.com • 843.804.6094

Tony Rossi, multimedia account executive trossi@scbiznews.com • 864.720.1974

Jim Wheeler, multimedia account executive jwheeler@scbiznews.com • 843.849.3104

Events

Kim McManus, events manager kmcmanus@scbiznews.com • 843.849.3116

Lauren Medders, event manager/manufacturing conference lmedders@scbiznews.com

• 864.720.1220

Accounting ar@bridgetowermedia.com Subscription Services service@bridgetowermedia.com

• 877.615.9536

Five Points Association has new leader

By Christina Lee Knauss cknauss@scbiznews.com

TheFive Points Association, a nonprofit organization that oversees efforts to promote and develop the Five Points district in Columbia, has hired Heather McDonald to serve as its new executive director.

As executive director, she will serve as the key advocate for the Five Points district as well as the manager of the association’s daily operations, its board of directors, annual events and more, according to a news release.

“I have always loved Five Points and the energy it carries,” McDonald said. “From working in the district while I was in college at the University of South Carolina, it really feels like I’m coming

home. I believe there is something special brewing in Five Points and I cannot wait to build relationships in this community and work towards the future of this important district.”

McDonald has more than 20 years of experience in business development, marketing and nonprofit management. She has served as a board member for the Contemporaries with the Columbia Museum of Art, president of the board of directors of The Therapy Place and the Time to Give chairperson for Columbia Opportunity Council.

“The leadership and experience McDonald brings to the executive director role will benefit Five Points and the Association,” said Steve Cook, president of the Five Points Association. “Her ability to build consensus among key audiences will allow the

organization to have a true advocate for the area.”

Five Points was founded in 1915 and is one of the most distinctive districts in Columbia. It is currently home to more than 100 businesses, including retailers, restaurants and bars, commercial businesses, living spaces and more.

Founded in 1983, the Five Points Association is the only nonprofit organization to govern the commercial neighborhood district.

“It starts with our community – the district’s businesses, neighbors, students, residents, property owners and tourists,” McDonald said. “All of them are important and need to be heard. I am here to listen and act on the behalf of our great community.”

Reach Christina Lee Knauss at 803-753-4327.

SUBSCRIPTION INFORMATION

Columbia Regional Business Report (USPS 8400) is published monthly except February, March, April, September, October and December which have 2 issues, by SC Biz News.

1612 Marion Street, Suite 301 Columbia, SC 29201-2938

Periodicals postage paid at Columbia, SC.

Mailing address: 1612 Marion Street, Suite 301 Columbia, SC 29201-2938.

Postmaster: Please send address changes to: Subscription Services PO Box 1051 Williamsport, PA 17703-9940

Annual subscribers receive the Business Report including the annual Book of Lists. One year for $67.00; Two years for $97.00; Subscribe, renew, or change your address online at www.columbiabusinessreport.com or call 877-615-9536.

South Carolina’s Media Engine for Economic Growth

Heather McDonald is the new executive director of the Five Points Association, a nonprofit that promotes the downtown business district. (Photo/Provided)

4 www.columbiabusinessreport.com September 26-October 9, 2022 NWS Company LLC A portfolio company of BridgeTower Media

Theentirecontentsofthisnewspaperarecopyright byNWSCompanyLLCwithallrightsreserved.Any reproductionoruseofthecontentwithinthispublicationwithoutpermissionisprohibited.SCBIZandSouth Carolina’s Media Engine for Economic Growth are registeredintheU.S.PatentandTrademarkOffice. ©2022 NWS Company LLC

The Insurance Shop

26-October 9, 2022 www.columbiabusinessreport.com 5September 26-October 9, 2022 Health Plan coverage provided by or through a UnitedHealthcare company. Administrative services provided by United HealthCare Services, Inc., or its affiliates. B2B EI221758005 8/22 ©2022 United HealthCare Services, Inc. All rights Reserved. 22-1758006 Always open for your small business Here’s a fast, easy way to shop for quality health plans for your company. UnitedHealthcare created an online store where you can find: Plus, we now offer level-funding options. It’s easy to explore both level-funded and fully insured plans in the shop. The One-Stop Insurance Shop can really help save you time—something there never seems to be quite enough of in the workday. Stop by and see how convenient shopping for health insurance can be. The shop is open all the time.

One-Stop

Learn more Visit the shop at smallbusiness.uhc.com/plan Instant pricing and plan options Real-time guidance Recommended plans for your business Fast and convenient online shopping 22-UHC_EI-5075_SBS_Columbia.indd 1 8/29/22 5:20 PM

Savannah River lab receives $3M for clean energy research

By Christina Lee Knauss cknauss@scbiznews.com

TheSavannah River National Laboratory has received a $3 million award from the Department of Energy to promote research into developing new clean energy technologies.

The award comes from the DOE’s Office of Science Basic Energy Science program and will be used for research into new pathways for hydrogen storage and production technologies, according to a news release.

The award is part of DOE’s recent announcement that it was awarding $540 million to universities and national laboratories to further research into clean energy technologies and low-carbon manufacturing.

The research at Savannah River will focus on providing greater insight into the surface characteristics that promote the dissociation and recombination of hydrogen on a material surface, as well as the behavior of subsurface hydrogen species.

The objective is to provide an in-depth analysis of the interactions between MXenes, a two-dimensional ceramic material, and hydrogen, the news release said. Researchers will also look at how external stimuli can be used

to fine-tune the interaction.

The collaborative research effort will be led by Patrick Ward, a researcher at Savannah River National Laboratory, Yury Gogotsi of Drexel University, Kah Chun Lau from California State University Northridge and Paul Weiss from the

University of California Los Angeles.

The research is particularly suited to address the DOE’s Hydrogen Shot Initiative, which seeks to reduce the cost of clean hydrogen by 80% to $1 per kilogram in the next decade, and unlock new markets for hydrogen, according to the release.

Savannah River National Laboratory is a DOE multi-program research and development center managed and operated by Battelle Savannah River Alliance LLC.

Reach Christina Lee Knauss at 803-753-4327.

Innovators across state named InnoVision awards finalists

By Jason Thomas jthomas@scbiznews.com

Innovators

from a broad swath of industries across South Carolina have been named finalists for the 2022 InnoVision Awards.

Eighteen organizations in six categories represent an array of sectors, big and small, from across South Carolina’s innovation economy.

The InnoVision Awards honor South Carolina individuals and organizations for impactful innovations under development in South Carolina within the last 18 months, according to an InnoVision Awards news release.

All finalists will be recognized during the InnoVision 2022 Meet the Finalists Series sponsored by the South Carolina Research Authority, according to the release. The series will be held virtually at 4 p.m. on Sept. 20, Sept. 27, and Oct. 4. Each event will feature finalists in two award categories. The series is open to the public and free to those who register in advance at https://www.eventbrite.com/o/innovision-awards-30751864686

InnoVision’s annual awards program will culminate with the virtual Annual Awards Celebration on Nov. 15. During the Awards Celebration, InnoVision will showcase each finalist’s innovation with a video profile, announce the winner in each

award category, and present two special awards: The Ibrahim Janajreh Young Innovator Award and the Dr. Charles Townes Individual Achievement Award.

Here are the finalists:

Technology development (sponsored by SC Tech, an initiative of South Carolina Council on Competitiveness)

• Foresight Data Systems LLC (Columbia)

• Laminaheat LLC (Greer)

• Victory ExoFibres LLC (Central)

Community Sevice

• Digital Drive – South Carolina Broadband Office (Columbia)

• Crisis Intercept Mapping for Service Members, Veterans and their Families (SMVF) Suicide Prevention (Pickens)

• The Sophia Institute (Charleston) Small Business

• Advent Innovations (Columbia)

• ASSET LLC (Columbia)

• Heartbeat Technologies (Mount Pleasant) Education (sponsored by TTI Consumer Power Tools Inc.)

• MedEx Academy – Prisma Health System (Greenville)

• skillsgapp llc (Greenville)

• Sprattronics Learning Lab (Greenville)

Technology Application (sponsored by DartPoints)

• CyCrypt LLC (West Columbia)

• TTI Outdoor Power Equipment Inc. (Anderson)

• Zylo Therapeutics Inc. (Greenville) Sustainability (sponsored by Sonoco)

• Clemson University Environmental Engineering & Earth Science Department (Clemson)

• Performance Enhanced Delivery (Moore)

• VBASE Oil Company (Pendleton)

Reach Jason Thomas at 864-568-7570.

Savannah River National Laboratory has received a $3 million award to promote clean energy research, including new pathways for hydrogen storage. (Photo/File)

6 www.columbiabusinessreport.com September 26-October 9, 2022

The 2022 InnoVision Awards will be presented virtually on Sept. 20, Sept. 27 and Oct. 4. Eighteen organizations in six categories will be recognized. (Photo/File)

He said the increase has resulted in a corresponding increase in calls to law enforcement and other officials about crime, public urination and defecation, panhandling and other issues.

There also has been a rise in the number of homeless people needing help with mental health issues and other services, he said.

“It’s estimated that we have at least 250 chronically unsheltered people right now in the city, and we want to help them have a place to lay their head,” Rickenmann said.

“This is only a step, and not something that will solve all of our problems. Until today, we have not had any options for chronically unsheltered people in Columbia, and now we will.”

Columbia is the first city in the Southeast to launch a temporary housing project like this, Rickenmann said.

The Rapid Shelter will not only be a benefit for its clients but also for businesses downtown and in other regions of the city, said Carl Blackstone, president and CEO of the Columbia Chamber of Commerce.

“This epidemic of homelessness has impacted businesses in the city,” Blackstone said. “It’s not that they (businesses) don’t want to help, but they also need to make a living, and the rise in chronically homeless people on the streets has caused concerns from customers about safety, particularly at night.”

Rapid Shelter will not be available for “walk-up services,” officials said,

FOR YOU

providers and other experts to make sure they are a good fit for the Rapid Shelter.

City Manager Teresa Wilson said Rapid Shelter is the result of months of work and study by a city task force on homelessness. She said the new project is specifically geared to help men and women who, for many different reasons, are not good candidates for traditional homeless shelters.

The cost to build the Pallet cabin community is estimated at $800,000, officials said.

“We have many people living outside downtown and on the perimeter of the city who resist the services that are already in place and who choose to be on the streets,” Wilson said. “It’s been found that this population often does better in housing where they can have a single room to themselves instead of being in congregate housing. This is a way we can offer them housing and services with dignity and compassion.”

Officials haven’t yet determined how long residents would be allowed to stay in the cabins but said the project will be designed as temporary shelter while efforts are made to get clients into permanent housing.

The city will be working over the next few months to hire three full-time staff members to oversee the daily management and operations of Rapid Shelter Columbia.

Reach Christina Lee Knauss at 803-753-4327.

For that quick getaway or last minute trip on the fly, we're here... to get you there. Fly local. Fly . FLIGHTS

meaning unsheltered people can’t simply arrive and get a place to stay. The

residents of the cabins will first have to be screened by local homeless services

RAPID

City of Columbia officials, including Councilwoman Aditi Bussells (at podium), announce the launch of Rapid Shelter Columbia to provide services for the chronically unsheltered. (Photo/Christina Lee Knauss)

Rapid Shelter Columbia will feature 50 sleeping cabins like these manufactured by Pallet. (Photo/Provided)

26-October 9, 2022 www.columbiabusinessreport.com 7September 26-October 9, 2022

aircrafted NONSTOP

SHELTER, from Page 1

8 www.columbiabusinessreport.com September 26-October 9, 2022 2022 | SO UTH CAROLINA MA NUFACTURIN G CONFERENCE AND EX PO GREENVILLE CONVENTION CENTER | GREENVILLE, SC To view the agenda and to register, visit www.scmanufacturingconference.com SAVE THE DATE: NOV. 3 - NOV. 4 Join Manufacturing suppliers and innovators across all industry verticals at South Carolina’s most significant manufacturing event of the year. The 2022 conference will include: • An exhibit hall the equivalent of three football fields • Implementing Industry 4.0 Technology • 2023 Economic Outlook: Auto, Aerospace, Biotech • Women in Manufacturing: Leaders and Influencers • SCMEP Manufacturing Excellence Awards • The South Carolina Manufacturing Extension Partnership (SCMEP) will conduct training courses PRESENTED BY: PRESENTING SPONSORS: For questions about exhibiting or sponsorship opportunities, please contact Rick Jenkins at (864) 720-1224 or rjenkins@scbiznews.com Visit scmanufacturingconference.com for the latest updates.

Locally owned toy store latest addition to Main Street

By Christina Lee Knauss cknauss@scbiznews.com

Anew

toy store is open on Columbia’s Main Street.

Located at 1426 Main St., Perfect Storm Bear Factory is owned by Columbia residents Jenny and Allen Franklin and offers a wide selection of toys, games, puzzles and customizable plush animals. The store is on the street level of the Hub student apartment building.

Perfect Storm held its grand opening event Sept. 9, with city and community officials in attendance.

Owner Jenny Franklin said she comes from a long line of small business entrepreneurs including her father and grandfather and wants to continue the tradition in downtown Columbia. The Franklins

previously ran a seasonal toy shop at Columbiana Centre Mall and decided to bring their concept to a full-time location downtown.

“The wisdom and encouragement of my father and grandfather encouraged me to open the store,” she said. “We hope that our store helps people of all ages to redis-

cover their love for toys and games.”

New stores are a good thing for downtown because they bring back the excitement of “shopping bag retail,” according to Matt Kennell, president and CEO of Main Street District, a downtown marketing and development organization.

“Recently we’ve had a lot of openings in the restaurant and hospitality sector, and now it’s good to see new retail stores coming into the area,” Kennell said. “There’s something about real, shopping bag-retail that gets people excited and really creates a buzz for our city and downtown.”

Perfect Storm Bear Factory is open 10 a.m. to 7 p.m., Monday through Friday, 9 a.m. to 7 p.m. Saturday and from 1 to 6 p.m. by appointment only on Sunday.

Reach Christina Lee Knauss at 803-753-4327.

SCEDA taps new executive director, management group

By Jason Thomas jthomas@scbiznews.com

The South Carolina Economic Developers’ Association has named a new executive director and an agency to lead the statewide organization.

Beacon Association Management will lead SCEDA in day-to-day operations

including the execution of large events and coordinating membership meetings, according to a SCEDA news release. In addition, it will guide the board through strategic planning, and provide comprehensive metrics and reports to evaluate and continue the planning process for the future, the release stated.

Also, Katie Koon, CEO of Beacon Association Management, will serve as

the new executive director of SCEDA, according to the release.

Koon replaces Andrea “Andi” Rawl. In June, the S.C. Manufacturers Alliance hired Lexington-native Rawl as executive director of the S.C. Automotive Council.

Five team members will work closely with SCEDA in support of Koon, who has experience serving as executive director for various trade and professional

associations, the release stated. Those experiences include leading Community College Business Officers, the South Carolina Aviation Association and the South Carolina Association of Heating and Air Conditioning Contractors.

She holds the Certified Association Executive credential, awarded by the American Society of Association Executives.

Perfect Storm Bear Factory, located at 1426 Main St., celebrated its grand opening Sept. 9. (Photo/Provided)

Perfect Storm Bear Factory, located at 1426 Main St., celebrated its grand opening Sept. 9. (Photo/Provided)

26-October 9, 2022 www.columbiabusinessreport.com 9September 26-October 9, 2022

Trusted Trusted partners who want to see Columbia thrive as much as you do. We are NAI Columbia. NAIColumbia.com

Peace Center ready to turn up the volume

By Ross Norton rnorton@scbiznews.com

The Peace Center has plans to make Greenville a bigger dot on the map of music cities.

Peace Center President and CEO Megan Riegel on Sept. 13 unveiled a major renovation project designed to diversify Greenville’s live music scene by diversifying possible venues for musical artists and music fans. Called AMP, for A Music Project, the plan calls for a new purpose for three buildings on the Peace Center campus that will include a flat floor music club, an intimate listening room, a podcast and recording studio, and artist dorms.

The intent of the $36 million project is to deliver a larger variety of live music options in Greenville. By repurposing what the Peace Center considered underused real estate and providing new mission-centric programming, the venue can continue to meet the needs of the community and help Greenville become a more vibrant music town, Riegel said.

The project brings more than music, though. A just-completed study by the University of South Carolina places the annual economic impact of the Peace Center, which attracts about 350,000 people each year, at $80 million, Riegel said.

“We’re excited that we’re in this place for great entertainment, but the reality is we’re great for the community, too,” she said. “So what we’re getting ready to do is make another significant investment in the community which is going to ratchet that economic impact up even further.”

The most visible addition will be two new venues for live music: one is an intimate café-style setting for small audiences and the other is a three-tier flat-floor music venue to attract the acts and the fans who prefer the up-close, standing-room experience.

“Believe it or not there are some acts that do not want to play the concert hall, right? They want to be in a room with a mosh pit. They want to be in a room where people are on their feet and having a good ol’ time,” Riegel said at a press event. “Different artists thrive in different spaces and so what we’ve created is this variety of spaces to serve a variety of artists and a variety of audiences.”

She said the public for years has told her Greenville needs more spaces for those performances.

“We’ve listened carefully to what our community says it wants regarding live entertainment,” Riegel said in the announcement. “These new venues will complete the circle of our live music scene and attract a whole new range of artists and visitors to Green-

ville. People have been waiting for this for a long time.”

She said AMP is an important step in fulfilling the Peace Center’s vision to build the local music scene, create connections and expand the reach of the performing arts in the South.

Once complete, the project will effectively achieve the Peace Center’s longstanding goal of realizing a fully-functioning, 10-venue arts and entertainment campus by or before 2030.

Building designs for AMP were developed by Greenville architecture firm Craig Gaulden Davis with landscape design from the Greenville studio of MKSK. Craig Gaulden Davis designed the original Peace Center campus that opened in 1990 and has extensive renovation design experience with historic buildings, a primary reason they were chosen for AMP, the news release said.

Construction is expected to begin in February 2023 and be completed by late 2024. The five projects that make up AMP are:

The Mockingbird

A nod to Nashville’s famed Bluebird Café, The Mockingbird will be a listening room inside the historic Gullick and Markley buildings on Main Street next to the Gunter Theatre. It is described as “a casual, intimate, lounge-like setting (that) will create a space for artists and their audiences to connect in close, personal ways.”

The main entrance will face Main Street with the listening room on the street level. The interior is designed to blend modern elements with tradition-

al features, such as exposed brick walls, punched tin ceiling panels and hardwood floors. Except for new windows and doors, minimal exterior renovations are planned, the release said. The existing tan brick of the Gullick and red brick of the Markley will remain largely untouched, ensuring both buildings retain their historic character and charm.

Artist Dorms

The space directly above The Mockingbird will become a three-bedroom suite for the use of artists performing at any Peace Center venue. The artist dorms will accommodate performers who want a bit of privacy from their public life on the road or a convenient place to stay before or after their gig. This fully furnished, 3-bed/3.5-bath suite will feature modern baths, a living area and kitchen with views of Main Street and the Reedy River.

The Studio

The space next to the artist dorms will be turned into a professional podcast and recording studio. Managed and operated by the Peace Center, the studio will be available for booking by artists who want high quality, professional recording, mixing, editing and related audio services. It also provides the Peace Center opportunities to produce original content, the release said.

Wyche Landscape Design

A final element of the AMP program is to elevate the Wyche outdoor event space with distinctive environmental landscaping.

“Using natural foliage and re-rout-

ing pathways leading to and from the open-air structure, the Wyche will take new root in a garden-like setting,” the release said. “Designed as an extension of beautiful Falls Park just a stone’s throw away, a river terrace running the length of the Wyche will provide pedestrians an attractive walkway overlooking the banks of the Reedy River. ADA-compliant semi-circular paths will provide easy access into either side of the building with subtle landscape lighting to illuminate the way and create a peaceful ambiance.”

The Peace Center is a six-acre campus downtown that consists of the 2,115-seat Peace Concert Hall, 400-seat Gunter Theatre, an outdoor amphitheater and a number of event spaces including the iconic Wyche building and the Huguenot Mill. The expansion will mean an undetermined number of new jobs, Riegel said. The Peace Center currently has 48 full-time employees.

Coach Music Factory

The historic Coach Factory flanking the east side of the Peace Amphitheater will be repurposed into a threetiered, standing room live music club for national and local acts. Peace Center operators say the club will feature a broad group of musical genres such as hip hop, indie rock, country, jam bands, Americana and more. The Coach Music Factory will have a club vibe to satisfy serious live music lovers, and the size, acoustics, lighting and other technical aspects that today’s professional touring musicians demand, the news release stated. It will be similar to The Orange Peel in Asheville and the Fillmore in Charlotte.

The Mockingbird name is a nod to the famous Bluebird Cafe in Nashville. The exterior of the building will be largely unchanged. (Image/Craig Gaulden Davis)

10 www.columbiabusinessreport.com September 26-October 9, 2022

Industry veteran new COO at Optus Bank

By Christina Lee Knauss cknauss@scbiznews.com

Benita

Lefft is the new COO for Columbia-based Optus Bank. She comes to Optus with more than 30 years of banking experience, including a long career at Wells Fargo, according to a news release.

At Wells Fargo, she served as COO, senior vice president and head of the middle market credit services division, area city executive e-market place director, and community banking state Community Reinvestment Act officer.

Lefft

Lefft

“I am honored to join Optus Bank as COO and excited to leverage my experience to further advance the bank’s mission to transform opportunities into wealth,” Lefft said in a statement.

“I am passionate about the role that minority depository institutions play to impact the lives of the underserved in the markets we serve.”

Lefft is a native of South Caroli-

na and a graduate of the University of South Carolina and University of Dayton. Her community service includes serving as president of the Rock Hill chapter of Alpha Kappa Alpha Sorority Inc. and treasurer of the Pearls of Service Foundation. She has also served on the board of directors for Discovery Place and the Palmetto Richland Cancer Center.

“Benita is the right executive leader at the right time to help us enter the next chapter of our growth and success,” said Dominik Mjartan, president and CEO of Optus Bank. “Over the last five years,

we’ve grown more than 650%, recently closed a $100 million capital raise and built a foundation for continued exponential growth of our community impact. Benita’s mission focus and track record of executive leadership is what we need to fulfi ll our commitment to help our customers and communities build generational wealth.”

Optus Bank, founded in 1921 as Victory Savings Bank, is a federally designated minority depository institution and a U.S. Treasury-certified Community Development Financial Institution.

NRC renews Westinghouse Columbia fuel facility operation license

By Christina Lee Knauss cknauss@scbiznews.com

Nuclear Regulatory Commission has renewed the operating license for the Westinghouse Columbia Fuel Fabrication Facility in Hopkins. The renewed license authorizes the facility to continue operations through Sept. 12, 2062.

The Columbia facility produces nuclear fuel for use in commercial nuclear power reactors. The license was first issued by the Atomic Energy

Commission in 1969 and was last renewed by the NRC in 2007.

The renewal follows completion of safety and environmental reviews by NRC staff. Their final environmental impact statement, published July 29, described “small” impacts on most resources and “small to moderate” impacts on groundwater and waste generation during decommissioning.

The final safety evaluation report was published July 29 and will be available through the NRC’s webpage on the Westinghouse facility.

The NRC safety review concluded Westinghouse’s programs are adequate to ensure safe operation of the facility for the license’s 40-year period. The staff did not identify safety risks or new processes or technologies that might introduce new safety concerns. Staff also considered the company’s safety performance and efforts to mitigate onsite contamination, with oversight by South Carolina, before renewing the license.

Reach Christina Lee Knauss at 803-753-4327.

The review concluded Westinghouse’s programs are adequate to ensure operation of the facility for the license’s 40-year period.

26-October 9, 2022 www.columbiabusinessreport.com 11September 26-October 9, 2022 Davis)

2022 Join SC Biz News in Columbia for a fast-paced countdown revealing the top 20 small and top 20 large high-growth companies in South Carolina. October 6, 2022 5:30 p.m. - 8:30 p.m. • DoubleTree by Hilton Columbia For sponsorship information, contact Rick Jenkins at 864.720.1224 or rjenkins@scbiznews.com Presented By: Sponsored By: Tickets: bit.ly/scbiz22roar20tix

The

NRC safety

12 www.columbiabusinessreport.com September 26-October 9, 2022 For Advertising Inquiries Rick Jenkins at 864-720-1224 or rjenkins@scbiznews.com PUBLICATION DATE: December 19, 2022 ADVERTISING DEADLINE: November 28, 2022 The Book of Lists is an indispensable guide that includes up-to-date information on hundreds of companies in the Midlands. Distributed to area chambers of commerce, economic development offices, commercial real estate firms, and readers of the Business Report. Put 12 months of marketing exposure to work for you! The definitive resource guide for business professionals in the Midlands.

INDUSTRY IN FLUX

Buyers and renters finding uneasy housing market

By Christina lee Knauss cknauss@scbiznews.com

Theseasons are changing in South Carolina and so are conditions on the residential real estate market, with recent statistics suggesting it is no longer exactly a buyer’s or seller’s market in many regions of the state.

For buyers, home prices remain high while interest rates on mortgages are going up as the Federal Reserve has raised rates in an effort to slow inflation.

Meawhile, unlike this time last year, sellers are not seeing their homes get

snapped up as quickly in some parts of the state, with the amount of available inventory slowly rising in some areas while the number of buyers decreases, experts say.

At the same time, many renters are having a hard time finding available and affordable space because of a lack of available rental units, and builders aren’t rushing to build new ones in some markets because of high building costs and difficulty finding property.

“It’s harder to buy and harder to rent right now than it was last year,” said John Smith, president of the Central Carolina Realtors Association. “That is something we’re seeing in the Mid-

lands and also what we’re hearing from people in Greenville and Charleston as well. The market for sellers is still good, but some sellers are pulling back because the demand has dropped. In many cases, they’re not getting the prices for their home that they got back in March and April of this year.”

Prices for a new single-family home in the greater Columbia area continue to remain high, with the median sales price in the Columbia market at $276,790, according to an August market report from the S.C. Association of Realtors. That’s up from an average price of $274,818 in July, and 20.3% higher than the median price in

August 2021.

This follows a statewide trend, according to statistics compiled by the association, which indicate that median sales prices jumped 19.7% in the second quarter and 17.6% in July alone.

While they might get more for their home, it is taking sellers a longer time to make that sale.

Sellers in the Columbia area are facing a slightly longer wait times to sell their homes, with average days on the market rising to 22 days in August from 21 in July, according to statistics

New at Piper Glen, a Great Southern Homes development in Pendleton. Across South Carolina, home prices remain high while interest rates continue to rise, creating a market with longer wait times for options, and inventory is not increasing. (Photo/Ross Norton)

New at Piper Glen, a Great Southern Homes development in Pendleton. Across South Carolina, home prices remain high while interest rates continue to rise, creating a market with longer wait times for options, and inventory is not increasing. (Photo/Ross Norton)

26-October 9, 2022In Focus RESIDENTIAL REAL ESTATE LISTS: Residential Real Estate Firms, Page 18 | BONUS: Independent Insurance Companies, Pages 19-20

homes are built

sellers and a decreasing number of buyers. Renters are also having trouble finding affordable

See RRE, Page 15

SC Realtors take on challenging times

A conversation with Cindy Creamer, president of South Carolina Realtors

Staff Report

From the time we first heard the word “coronavirus,” the real estate market responded first by coming to a complete (although brief) stop, then taking off like a rocket before calming down somewhat. And now we have the uncertainty associated with rising interest rates. Would you call this thrill ride exhausting or exhilarating?

From the start of the pandemic, Realtors were working with local, state and national officials to make sure the business of real estate, the transaction of real property, was still able to take place. Many states shut down their economy for weeks, even months. We worked with our local officials to make sure deed recording offices had the capacity to record deeds and mortgages. We worked with Gov. Henry McMaster and his team to ensure that real estate was declared as essential to the economy.

Realtors know that in times of crisis, even a global pandemic, homeownership, the transfer of real property and basic shelter is essential to the public good. These last two years have been stressful, but the one thing that makes the hard work worthwhile is that Realtors have been the trusted advisers that have helped thousands of homeowners navigate this robust and challenging market.

Where do you think the South Carolina market is now and what does it need to be healthy moving forward?

The market in our state is normalizing. Yes, it’s cooling off compared to 2020 and 2021, but it is still a demand-driven market, unlike the late 2000s when we were dealing with a supply-driven market. I believe we need more inventory at various price points, especially on the first-time buyer side.

Working class families are being squeezed by the three-eyed (I) monster — inflation, interest rates and inventory. Our National Association of Realtors reports that a typical home is almost 50% more expensive than just a year ago when you factor in the 3 I’s. Until interest rates stabilize and inventory increases to a five-six month level (instead of a two-three month level).

What needs to happen to keep a robust real estate market robust?

The obvious answer is to keep the three I’s in check — grow the economy to keep inflation in check, stabilize interest rates and increase inventory. The other answer isn’t so obvious — our local and state leaders have to continue to focus on making South Carolina the best state to live, work and play in the country. Our strong industry, tourism and economic growth has not happened by accident — we have to continue to lead

and SC Realtors will continue to advocate for economic growth that enhances the quality of life of our citizens.

It appears that the inventory numbers are up from a year ago when buyers were sometimes making desperate offers. Are they?

Inventory numbers are up from a year ago but let’s look at the numbers from the last few years for a better perspective.

According to SC REALTOR market reports, we ended 2018 with a four-month inventory supply level, 2019 was 3.6 months, 2020 was 1.9 months, 2021 was 1.3 months and, as of the end of July in 2022, we’re at 1.9 months. While the data shows a 46% increase in inventory from a year ago, as you can see South Carolina is still well below historical averages and remarkably below the industry recognized six months of inventory (which most economists say is the average supply for a normal market). We haven’t seen six months of inventory since 2014.

Is the potential for more interest rate hikes pushing potential buyers to take action?

The Federal Reserve indicated again on Aug. 9 that they will likely increase interest rates again, but it is not necessarily bad news. We’ve seen over the last few months that the mortgage rates don’t follow the interest rates on a point-by-point basis.

I don’t think the fear of future mortgage rates increases will cause buyers to act, we’ve seen that bump already and buyers that need to buy will buy, but their buying power will be decreased.

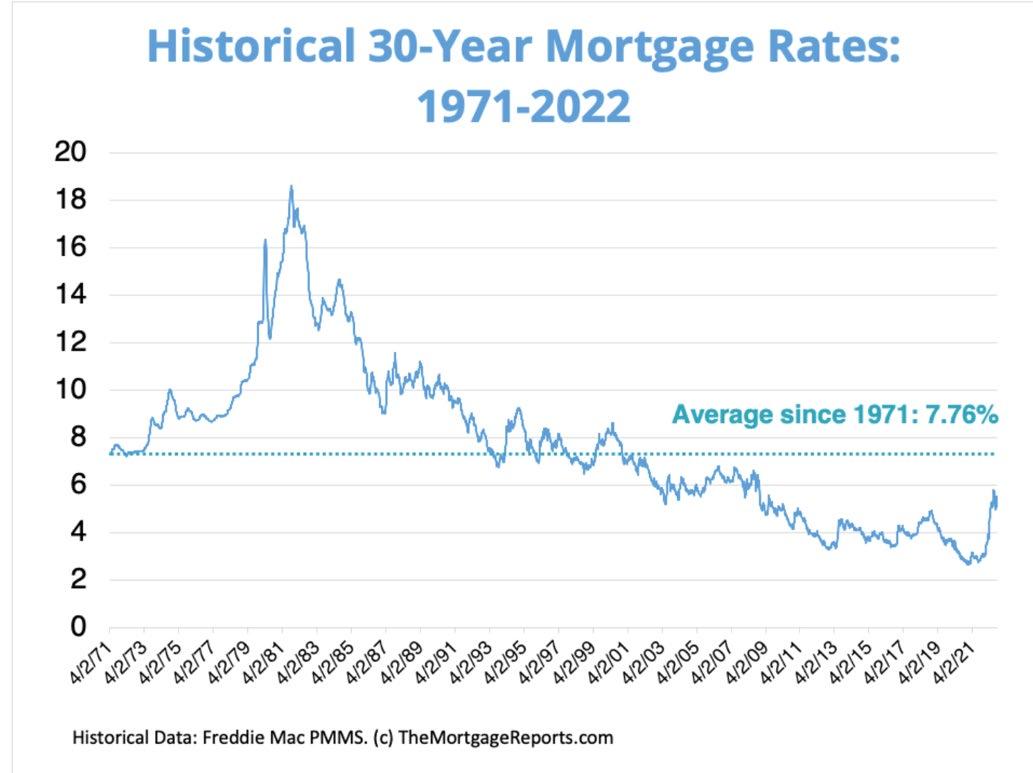

Have the low rates of recent years spoiled us into thinking 6% is outrageous? How long ago was 6% a pretty desirable interest rate?

I agree that we have become comfortable with historic low interest rates. The 50-year average is just below 8%. The market reacts and adapts as interest rates change.

Remember, properties sold even when mortgages were over 16% in the early 1980s.

The fact remains, however, that mortgages have almost doubled in the past year.

Do home buyers wait for market opportunities or do most buyers take action regardless of market conditions such as inventory and interest rates?

Life events require the transaction of real property — new job transfer, marriage, divorce, births, deaths, retirement, etc.

Most buyers buy when life events require them to buy. Investors try to take advantage of market conditions for the best returns, but the majority of buyers are dealing with transitional, emotional events in their life which makes working with a trusted adviser, their local Realtor, even more important.

What is the most significant challenge facing the residential real

estate industry right now?

We’ve talked about the inventory levels being low but that doesn’t do justice to the problems it has caused in our local communities.

All the factors we’ve talked about have led to escalating home prices, which has squeezed working class homeowners and homebuyers.

For many of our communities, those that serve our communities (police, teachers, first responders, etc.) cannot afford to live in the community they serve. They are forced into long commutes which puts stress on our infrastructure and exacerbates urban sprawl (traffic, congestion, etc.) We’ve got to find solutions to address workforce housing because it is already affecting our small businesses.

What do you wish everyone knew about residential real estate?

Not as easy as it looks!

Why should someone use a professional — an agent or Realtor — when buying or selling a residence?

Buying a home, whether it’s your first

home or your retirement home, can be a very emotional process.

Throw in all the other market factors we’ve discussed and you can see how difficult buying or selling a home can be in any market.

Realtors are members of the National Association of Realtors, who are bound and held accountable by a code of ethics while helping their clients and customers navigate one of the most complicated and important transactions they will make in their lifetime.

When you work with a Realtor you work with a professional committed to safeguarding the rights of home buyers and sellers.

Through local, state and national advocacy efforts, Realtors seek to preserve, protect and advance property rights for all.

Realtors adhere to a standard that requires equal professional service, because all properties should be open and feel welcome to all.

That’s the Realtor difference.

Cindy Creamer is president of the South Carolina Realtors. She is an agent with Dunes Real Estate in Hilton Head.

While the real estate market is cooling off compared to last year, experts say the demand-drive market is normalizing, though inflation, interest rates and inventory remain concerns. (Photo/File)

Creamer

14 www.columbiabusinessreport.com September 26-October 9, 2022IN FOCUS: RESIDENTIAL REAL ESTATE

from the Consolidated Multiple Listings Service, which covers listings in the Columbia metropolitan area.

The supply of inventory in the region also was at 1.6 months, the same as in July but a 45.5% increase over July 2021, according to the CMLS report.

Buyers in the region are facing challenges both because of the sales price increases and rising interest rates, the report indicates. For August, the Columbia region’s housing affordability index fell to 86, which means the median household income is 86% of what is necessary to qualify to buy a median-priced home under interest rates. In August 2021, the index was 103, a 12-month decline of 16.6%.

“With the rise in interest rates and inflation, some of the buyers have dropped out of the market,” Smith said.

Meanwhile, the amount of new housing starts around the state is dropping because builders are facing dramatic increases in construction costs, brought on both by inflation and lingering supply chain problems.

Renters are also facing an uphill battle statewide as the number of available rental units shrinks, driving prices up.

The shortage and high cost of rentals is especially hard on lower-income renters, according to the new “Out of Reach Report” released in late July by the National Low Income Housing Coalition.

According to the report, South Carolina is No. 28 in the nation for highest housing costs relative to income. The report shows that a minimum wage worker making $7.25 an hour would have to work 91 hours a week to afford a modest one-bedroom rental home. According to the report, the state’s average housing wage is $19.30 an hour, which is the amount someone needs to earn to afford an average two-bedroom apartment at fair market rate without paying more than 30% of income for housing.

According to Rentcafe.com, a nationwide apartment search website, the average monthly rental rate in the Columbia area is currently $1,321, with the highest average being downtown at $2,013 and the lowest in some of the perimeter neighborhoods at $985.

Smith said the rise in rental rates is continuing because of a high demand for rental properties and a growing shortage of available land to build additional rental properties. The increasing number of renters comes both because of more people moving to the state as

well as prospective home buyers forced to remain in rental properties because of a lack of affordable or available inventory.

“Builders are having challenges finding places to build multi-family properties for rentals,” he said. “There’s a challenge in finding vacant lots where cities and towns also have ordinances that allow that type of building.”

Builders interested in putting up rental units are also facing the ongoing challenge of higher supply costs when and if they do secure land where rentals can be built, Smith said.

“It’s a double-edged sword with a shortage of availability of good places to build coupled with builders’ inability to build affordably,” he said.

While the real estate markets continue to sort themselves out, Smith said those looking to buy homes in the future can follow some old-fashioned advice that stands up no matter what market trends are: save as much money as possible for a down payment, show prospective lenders good credit, and find a good local real estate agent.

“Continue to improve your credit as much as you can and try to work with a Realtor who is knowledgeable about a particular market you’re interested in,” Smith said. “Also make sure you’re on the Realtor’s watch list for properties that come available so that if you get pre-approved by a lender and you find something you like, you can be ready to go on a sale right then.”

Illustration/File

Illustration/File

26-October 9, 2022 www.columbiabusinessreport.com 15September 26-October 9, 2022 IN FOCUS: RESIDENTIAL REAL ESTATE

RRE, from Page 13

IT’S TIME TO BINGE BUSINESS Subscribe to SCBIZtv and stay in tune with what’s happening across South Carolina. https://www.youtube.com/scbiztv With nearly 150 videos (and counting), our YouTube channel features a wide variety of businessrelated content. Our playlists have something for everyone. What’s New and What’s Hot! Check out our new content as well as our trending videos on this ever-changing playlist. Coffee With This ongoing video series features business executives sharing insight about their business, the industry in which they work and the community in which they live. Coping with COVID Explore the impact the coronavirus is having on our daily lives, both at home and at the office. Recognition Events With events like Women of Influence in the Upstate, Icons and Phenoms in the Midlands and Health Care Heroes in the Lowcountry, SC Biz News honors the movers and shakers across the state.

“Our years of experience in providing various types of housing have prepared us to help meet the city’s need for more attainable housing while providing our residents with a quality lifestyle experience.”

Midtown will benefit BullStreet because it will expand the variety of housing price points available in the development, said Chandler Cox, BullStreet project manager for master developer Hughes Development Corp.

“We’re really excited to have Kevin and the team at Connelly Builders working on a project at BullStreet. They’ve done a number of projects across the state and have a great reputation for quality work,” Cox said.

“We were approached by Kevin and his

team when they were looking at possible sites, and their vision for adding attainable housing to this district was something we have also always wanted to do at BullStreet.

“This will round out the offerings and round out the overall vision for BullStreet.”

Columbia city officials said the addition of attainable housing to the BullStreet mix is crucial for the future development of the city.

Housing choices that accommodate a broad range of incomes are needed more than ever in the Midlands and statewide because more people are struggling with both a continuing rise in rents and home prices, according to Bonita Shropshire, executive director of S.C. Housing.

“The COVID-19 pandemic was the tipping point for many families strug-

gling through financial hardships to stay in their homes, and it also exposed what we already knew — there is not enough affordable housing to meet the growing demand in our state,” Shropshire said.

While attainable housing is different from affordable housing because it does not require subsidies, the availability of apartments at this price point will be helpful to many workers who are struggling with the high cost of rent, according to statistics from S.C. Housing.

A 2021 Housing Needs Assessment Report published by the agency found that more than 140,000 renter households statewide regularly experience severe cost burden, meaning that they spend more than half their gross income on rent.

The report also found that in 40 of 46 counties statewide, average renters can’t

find a basic two-bedroom apartment without overextending their budget.

Columbia city officials said the addition of attainable housing to the BullStreet mix is crucial for the future development of the city.

“Attainable housing at the BullStreet District helps the city meet one of our most pressing needs because it helps keep workers in Columbia to benefit our workforce,” said Columbia Mayor Daniel Rickenmann.

“Workers are leaving Columbia because the cost of housing is too high. Having attainable housing in one of our most high-profile developments is good for our city and our workforce and addresses a critical need.”

Reach SC Biz News staff writer Christina Lee Knauss at 803-753-4327.

SC has nation’s 3rd-highest foreclosure rate in August

By Jason Thomas jthomas@scbiznews.com

SouthCarolina was among the states with the highest foreclosure rates during the month of August, according to a new report.

ATTOM, a curator of real estate data nationwide for land and property data, released its August 2022 U.S. Foreclosure Market Report earlier this month.

Data shows there were a total of 34,501 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — up 14% from a month ago and up 118% from a year ago, according to a news release from ATTOM.

Nationwide, one in every 4,072 housing units had a foreclosure filing in August 2022. States with the highest foreclosure rates were Illinois (one in every 1,926 housing units with a foreclosure filing); Delaware (one in every 2,387 housing units); South Carolina (one in every 2,417 housing units); New Jersey (one in every 2,441 housing units); and Florida (one in every

2,950 housing units).

Lenders started the foreclosure process on 23,952 U.S. properties in August 2022, up 12% from last month and up 187% from a year ago, according to the report.

“Two years after the onset of the COVID-19 pandemic, and after massive government intervention and mortgage industry efforts to prevent defaults, foreclosure starts have almost returned to 2019 levels,” said Rick Sharga, executive

vice president of market intelligence at ATTOM, in the release. “August foreclosure starts were at 86% of the number of foreclosure starts in August 2019, but it’s important to remember that even then, foreclosure activity was relatively low compared to historical averages.”

Among the 223 metropolitan statistical areas with a population of at least 200,000, those with the highest foreclosure rates in August 2022 were Peoria, Ill. (one in every

869 housing units with a foreclosure filing); Jacksonville, N.C. (one in every 968 housing units); Bakersfield, Calif. (one in every 1,454 housing units); South Bend, Ind. (one in every 1,478 housing units); and Rockford, Ill. (one in every 1,496 housing units).

Lenders repossessed 3,938 U.S. properties through completed foreclosures (REOs) in August 2022, up 28% from last month and up 59 percent from last year.

“Repossessions are likely to continue running below pre-pandemic levels for several reasons, most importantly that over 90% of borrowers in foreclosure have positive equity in their homes and would benefit from selling these properties at a profit rather than risk losing everything to a foreclosure auction or lender repossession,” Sharga said in the release.

Those states that had the greatest number of REOs in April 2022, included: Illinois (493 REOs); New York (337 REOs); Michigan (326 REOs); Pennsylvania (260 REOs); and California (189 REOs).

Reach Jason Thomas at 864-568-7570.

Charleston company acquires Harbison multifamily property

By Christina Lee Knauss cknauss@scbiznews.com

Charleston-based

Beach Real Estate Funds LLC, an affiliate of The Beach Co., has acquired Waters Edge at Harbison, a 240-unit garden style multifamily community in the Harbison area.

“Columbia is a market in which The Beach Co. has owned and operated communities for over three decades,” said Leonard Way, BREF’s senior vice president and fund manager, in a news release.

“BREF is excited to close out our flagship acquisition fund with the purchase

of Waters Edge, further expanding The Beach Co.’s footprint in our state’s capital and building upon our southeast portfolio.”

Built in 1996, Waters Edge at Harbison offers one-, two- and three-bedroom floorplans in 10 residential buildings on 14 acres. Residents have ample space and connectivity to the lake and area’s trail systems. Floorplans range from 715- to 1,350-square-feet with an average unit size of 1,025-square-feet.

“Current ownership did a great job preparing the asset for the next phase of improvements, particularly the unit interiors,” Ward McCarthy, asset management

Leonard Way, Senior vice president and fund manager, Beach Real Estate Funds LLC

manager at BREF, said in the release.

The company plans to renovate unit interiors with updates including stainless

steel appliances and granite and quartz countertops,

This transaction represents the final acquisition for the Beach Investment Fund, providing investors with a diverse portfolio spread across high-growth markets in the Southeast. Northmarq’s John Currin, Andrea Howard and Jeff Glen facilitated the sale on behalf of the seller. Connor Locke and Cliff Ayers placed the debt on behalf of Walker and Dunlop’s Coleman-Butler team. BREF’s Darby Parker and Niko LeVigne facilitated the acquisition on behalf of the buyer.

Reach Christina Lee Knauss at 803-753-4327.

Photo/File

“Columbia is a market in which The Beach Co. has owned and operated communities for over three decades.”

16 www.columbiabusinessreport.com September 26-October 9, 2022IN FOCUS: RESIDENTIAL REAL ESTATE

MIDTOWN, from Page 1

apartment budget. the addithe Bullfuture develBullStreet one of our it helps benefit our Mayor DanColumbia too high. one of developments is workforce and Christina Lee

Great Southern Homes to become public company

By Ross Norton rnorton@scbiznews.com

One of the most highly visible homebuilders in the state is going public.

Great Southern Homes of Irmo, with building projects — most of them large housing developments — throughout South Carolina and some in Georgia, announced Sept. 12 that it has entered an agreement with DiamondHead Holdings Corp., a special purpose acquisition company.

The transaction values the combined company at a pro forma enterprise value of approximately $572 million, as of Dec. 31 of this year.

When the transaction is completed, Great Southern Homes will become a publicly traded company, and DiamondHead Holdings Corp. will be renamed United Homes Group Inc., according to a news release. DiamondHead is expected to remain listed on the Nasdaq Capital Market and is expected to trade under the new ticker symbol “UHG.”

GSH is one of the largest homebuilders in the Southeast. The company builds homes focused on the entry level buyers and those moving up for the first time, the company says.

GSH plans to employ a capital-efficient “land-light” operating model that it expects to generate higher returns with lower cyclical risk compared to traditional homebuilding operating models, the news release said. The land-light approach allows the company to control land supply primarily through lot option contracts versus carrying lot inventory on-balance sheet. Through organic growth, GSH has become the 25th ranked starter-home builder and the 41st ranked single-family detached home builder in the United States, respectively, based on 2021 home closings, according to Pro Builder’s 2022 Housing Giants Report.

DiamondHead is a special purpose acquisition company led by Co-CEO and Chairman David Hamamoto, who was the founder and chairman of the previously publicly-traded NorthStar real estate related companies: NorthStar Realty Finance Corp., NorthStar Asset Management Group Inc. and NorthStar Realty Europe Corp. He was a former partner at Goldman, Sachs & Co. and the co-founder of its Real Estate Principal Investment Group and Whitehall funds.

DiamondHead is co-sponsored by Antara Capital, an event-driven hedge fund founded by Himanshu Gulati.

Founded by Michael Nieri, Great Southern Homes and its predecessors have have built more than 11,000 homes.

Population growth and single-family starts in the company’s Georgia and S.C. markets have outpaced the national average since 2017, the news release

pointed out.

“For over 20 years I have worked to build GSH into the leading Southeast homebuilder it is today,” Nieri said in the news release. “I am excited for the next chapter for GSH, where through the combination of my operational expertise with David Hamamoto’s public company and capital markets experience, we plan to grow UHG into a national homebuilder. Our growth plans include both continued organic expansion as well as becoming a merger partner of choice for smaller regional homebuilders located in high-growth markets. Additionally, we are building out a programmatic, institutional build-to-rent platform, where our current product set and geographic footprint are well positioned to meet the demands of the strong and growing rental market for single family homes.”

Hamamoto said the company will help alleviate a shortage of homes.

“We believe there continues to be a massive undersupply of single-family homes in the U.S., especially in starter and first move-up products which will result in significant demand for the foreseeable future,” he said in the release. “In addition, as Michael mentioned, we believe there are extremely compelling opportunities to generate accretive growth through M&A as well as a programmatic build-to-rent platform.”

As part of the transaction, all of GSH’s existing shareholders will roll 100% of their shares into shares of the combined company and, assuming no redemptions from DHHC public shareholders, will hold approximately 51% of the shares of the combined company on closing, the release said.

Assuming no redemptions from DHHC shareholders, the transaction will deliver approximately $320 million

in cash proceeds, net of estimated transaction costs, to the combined company including a $25 million commitment to purchase and not redeem DHHC public shares from the DHHC sponsor group, including Hamamoto and Antara Capital, the news release predicted.

The boards of directors of GSH and DHHC have approved the transaction. The transaction is expected to close during the first quarter of 2023.

BTIG LLC is acting as exclusive sellside adviser to Great Southern Homes. Nelson Mullins Riley & Scarborough LLP is acting as counsel.

Zelman Partners is acting as exclusive mergers and acquisition adviser to DiamondHead. Sullivan & Cromwell LLP is acting as counsel to DHHC.

Additional information about the proposed transaction, including an investor presentation, will be available online

Piper Glen is one of three Great Southern Homes communities under construction on S.C. Highway 187 in Pendleton. (Photo/Ross Norton)

26-October 9, 2022 www.columbiabusinessreport.com 17September 26-October 9, 2022 IN FOCUS: RESIDENTIAL REAL ESTATE

Home 2615 Devine St. Columbia, SC 29205

Resource 200 N. Lake Lexington SC 29072

Jeff Cook Real Estate 206 N. Church St. Lexington, SC 29072

Asset Realty Inc. 140 Wildewood Park Drive, Suite B Columbia, SC 29223

Wolfe & Taylor Inc. 1216 Pickens St. Columbia, SC 29201

Disharoon Homes LLC 1528 Legrand Road Columbia SC 29223

Mac's Real Estate Ser vices Inc. 556 McCarter Trail Lexington, SC 29073

Turner Properties 3790 Fernandina Road, Suite 105 Columbia, SC 29210

Berkshire Hathaway HomeSer vices Midlands Real Estate 2720 Devine St. Columbia SC 29205

803-771-2424 www.homeadvantagerealty.com jill@homeadvantagerealty.com

803-758-4444 www.resourcecolumbia.com info@resourcecolumbia.com

803-291-4428 www.jeffcookrealestate.com info@jeffcookrealestate.com

803-865-7340 www.assetrealtyinc.net www.assetrealtyinc.net

803-771-4567 www.wolfeandtaylor.com info@wolfeandtaylor.com

803-786-8978 www.disharoonhomes.com info@disharoonhomes.com

803-394-7009 www.macsres.com benbr ysonmcc@gmail.com

803-407-8522 www.turnerproperties.com info@turnerproperties.com

803-409-0830 www.bhhsmidlands.com bhanna@bhhsmidlands.com

Lou Redbord, Laura Rittenberg 1970 $1,340,356,000 4,447 660 7

Jill R. Moylan 1990 $159,630,500 561 111 4

Dustin Johns, Tara Johns 2008 $150,000,000 473 28 1

Kris McDonagh 2017

$46,482,242 181 20 1

Natashi Johnson 1996 $27,996,376 133 25 1

C. Steve Taylor 1945 $20,101,482 129 16 1

Fan S. Disharoon 2003

Benjamin B. McCarter 2016

Chris Turner 2008

Brenda Hanna 2006

$8,000,000 50 4 1

$7,865,684 34 5 1

$1,889,000 15 1 1

$1,365,034 198 32 1

Researched by Paige Wills

18 www.columbiabusinessreport.com September 26-October 9, 2022IN FOCUS: RESIDENTIAL REAL ESTATE 2022 | SOUTH CAROLINA MA NUFACTURING CONFERENCE AND EX PO GREENVILLE CONVENTION CENTER | GREENVILLE, SC To view the agenda and to register, visit www.scmanufacturingconference.com SAVE THE DATE: NOV. 3 - NOV. 4 • An exhibit hall the equivalent of three football fields • Implementing Industry 4.0 Technology • 2023 Economic Outlook: Auto, Aerospace, Biotech • Women in Manufacturing: Leaders and Influencers • SCMEP Manufacturing Excellence Awards • The South Carolina Manufacturing Extension Partnership (SCMEP) will conduct training courses PRESENTED BY: For questions about exhibiting or sponsorship opportunities, please contact Rick Jenkins at rjenkins@scbiznews. com or call (864) 720-1224 Visit scmanufacturingconference.com for the latest updates. Join Manufacturing suppliers and innovators across all industry verticals at South Carolina’s most significant manufacturing event of the year. The 2022 conference will include: PRESENTING SPONSORS: Residential Real Estate Companies Ranked by $ Value of Residential Sales in 2021 in the Columbia Area Company Phone / Website / Email Top Local Official(s) / Year Founded 2021 Sales Volume / Transactions Residential Agents / Midlands Offices Coldwell Banker Realty 1711 Ger vais St. Columbia, SC 29201 803-799-8035 www.coldwellbankerhomes.com marketing@cbcarolinas.com

Advantage Realty LLC

Realty Group

Drive

Because of space constraints, sometimes only the top-ranked companies are published in the print edition. Although ever y effort is made to ensure accuracy, errors sometimes occur. Email additions or corrections to research@scbiznews.com.

Independent Insurance Agencies

Acentria Insurance

3231 Sunset Blvd., Suite B West Columbia, SC 29169 803-399-7604 www.acentria.com

Adams Eaddy & Associates 2230 Devine St. Columbia, SC 29205 803-254-9404 www.adamseaddy.com

Affordable Insurance Group 6168 St. Andrews Road Columbia, SC 29212 803-798-4499

www.affordableinsgrp.com

All Mobile Insurance Services 108 N. Lake Drive, Suite A Lexington, SC 29072 803-359-0399

AssuredPartners of South Carolina LLC 501 Huger St. Columbia, SC 29021 803-732-0060 www.assuredpartners.com

Bailout Insurance Group LLC 1030 St. Andrews Road, Suite B Columbia, SC 29210 803-848-9669

Batesburg Insurance Agency Inc. 657 W. Columbia Ave. Batesburg, SC 29006 803-532-3864 www.batesburginsuranceagency.com

Bevco Insurance 15 Boulware Road Lugoff, SC 29078 803-438-1055 www.bevcoinsurance.com

Brabham Griffin Insurance 1612 Marion St., Suite 101 Columbia, SC 29201 803-744-2255 www.brabhamgriffin.com

Brazell Insurance Group 2 Office Park Court, Suite 102A Columbia, SC 29223 803-451-0013 www.brazellinsurance.com

The Burgess Agency LLC 115 Broad St. Sumter, SC 29150 803-667-4600

C.L. Thaxton Insurance Group 2313 N. Broad St. Camden, SC 29020 803-432-1453 www.thaxtoninsurancegroup.com

Capital Carolina Homes 1847 Augusta Highway Lexington, SC 29072 803-951-1900 www.lexingtondiscounthomes.com

Carolina Insurance Group of SC 141 Charter Oak Road Lexington, SC 29072 803-951-3351 www.carolinainsgroup.com

The Carter Insurance Group LLC 4727 Sunset Blvd., Suite A Lexington, SC 29072 803-520-5260

Choice Flood Insurance 9 Natchez Court Columbia, SC 29229 803-730-8626 www.choicefloodinsurance.com

Chris Bagwell Insurance LLC 4768 Sunset Blvd. Lexington, SC 29072 803-600-1641

Clyburn & Sellers Insurance 2001 W. Dekalb St. Camden, SC 29020 803-432-9045 www.clyburnllc.com

Conley Insurance Group 5140 Sunset Blvd., Suite B Lexington, SC 29072 803-755-0543

Creech Roddey Watson Insurance 25 E. Calhoun St. Sumter, SC 29150 803-775-1168 www.crwins.com

Davenport Insurance Solutions LLC 9367 Two Notch Road, Suite 218 Columbia, SC 29223 803-699-1947 www.davenport-insurance.com

Dixon Blackwood Insurance Agency 4248 Broad St. Ext. Sumter, SC 29154 803-494-8880

First South Insurance Agency Inc. 107 Brookside Parkway Lexington, SC 29072 803-359-0142 www.fsia.net

Gardner Associates Inc. 4400 St. Andrews Road, Suite C Columbia, SC 29210 803-708-3775

GMM Insurance Inc. 115 Library Hill Lane, Suite A Lexington, SC 29072 803-739-2345 www.gmminsurance.com

Griffin Insurance Agency LLC 261 Broad St., Suite A5 Sumter, SC 29150 803-373-0840 www.griffinins.net

H&H Insurance Brokers 17 River Bottom Road Irmo, SC 29063 772-538-5070 www.handhinsurancebrokersofsc. com

Hibbits Insurance 562 Summers Ave. Orangeburg, SC 29115 803-534-1184 www.hibbitsinsurance.com

Hub International 1330 Lady St. Columbia, SC 29201 803-799-5533 www.hubinternational.com

Independent Choice Insurance P.O. Box 4509 Leesville, SC 29070 803-532-9286

Independent Insurance Brokers & Associates LLC 7554 Woodrow St. Irmo, SC 29063 803-749-8210 www.scinb.com

Insurance Office of America 7001 St. Andrews Road, Suite H378 Columbia, SC 29212 803-996-4850 www.ioausa.com

Irmo Insurance Agency Inc. 1345 Lake Murray Blvd. Irmo, SC 29063 803-781-4700 www.irmoinsuranceagency.com

ISU-Sadler & Co. 3014 Devine St., Suite 200 Columbia, SC 29205 803-254-6311 www.sadlerco.com

Jesse T. Reese Inc. 2014 Assembly St. Columbia, SC 29201 803-799-9206 www.jessetreese.com

Jones Benefits LLC

709 W. Dekalb St. Camden, SC 29020 803-713-1499

Keisler Insurance Group 3132 Carlisle St. Columbia, SC 29205 803-521-0807 www.keislerinsurance.com

Klosterman Insurance Agency LLC 22 Office Park Court Columbia, SC 29223 803-736-6161

www.klostermaninsuranceagency. com

Kuhn Insurance Group 510 E. Main St. Lexington, SC 29072 803-636-2214 www.kuhninsurancegroup.com

Livingston Insurance Agency 100 Ninth St. West Columbia, SC 29169 803-791-1120

www.livingstoninsurancesc.com